Form N-CSR Capitol Series Trust For: Apr 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number: 811-22895 |

Capitol Series Trust

(Exact name of registrant as specified in charter)

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Address of principal executive offices) (Zip code)

Zachary P. Richmond

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

| Registrant’s telephone number, including area code: | 513-587-3400 |

| Date of fiscal year end: | April 30 |

| Date of reporting period: | April 30, 2022 |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) |

PORTFOLIO

THERMOSTAT

FUND

Canterbury

Portfolio Thermostat Fund

Institutional Shares – CAPTX

Annual Report

April 30, 2022

Canterbury Investment Management, LLC

23 East Cedar Street

Zionsville, Indiana 46077

(844) 838-2121

| Portfolio Managers’ Letter to Our Shareholders (Unaudited) |

| April 30, 2022 |

What is the Ultimate Objective for Investing?

As another fiscal year for the Canterbury Portfolio Thermostat Fund (CAPTX or “the Fund”) comes to a close, we like to remind our readers and shareholders of the goal of all long-term investors. We think there are many reasons why people choose to invest in liquid financial securities, but for most individuals, the long-term investors, it boils down to becoming and then remaining financially independent throughout the course of their lives.

The bottom line is people work their whole lives, building and saving for retirement. When they begin their career, most people do not have many financial assets. Over time, as they earn and save, assets accumulate, and their investment portfolios begin to compound. As earnings increase, and the years before retirement lessen, larger contributions to portfolios are made. Before they know it, many investors have built up substantial assets. It is these accumulated assets that will allow them to remain financially independent as work lives come to close and the doors to retirement, the best years yet, open.

If there is one question that has plagued the long-term investor since the inception of traded markets, it is “how can I avoid the substantial declines that come from bear markets?” Bear markets, which are characterized by volatile, large drawdowns, often cause investors to see many years of savings and earnings wiped away. A large decline in an investor’s early years of saving does not have the same impact as a bear market during the years leading up to retirement, or during retirement. A bear market during one’s later years can ultimately hinder the ability to remain financially independent.

Successful investing over the long-term is not about buying, holding, and hoping that the markets do not go down. Over the course of a lifetime, there will be many bear markets. During the 1990s, the markets experienced a substantial rise. Then, over the next decade from 2000 to 2010, the markets saw two fifty percent decline. Now, for the last ten plus years, the markets have yet again risen. What will the next decade bring?

Market Commentary April 2021 – April 2022

At this time last year, we were discussing the trading anomaly caused by the Coronavirus pandemic. Time flies. It feels like the short-lived market event took place many years ago, not just two. Markets are counterintuitive in that they will often do what investors least expect, when they least expect it. The sharp decline that took place in March/April of 2020 seemingly came out of nowhere. All the same, the sharp rally that began in late April of 2020 came when most investors could not feel worse about the markets. The market’s rise continued into 2021, even as negative news events kept sweeping the headlines. The markets generally went up, on low volatility.

1

For most of the calendar year 2021, market indexes, particularly large cap securities like those found in the S&P 500, rose. At Canterbury, we use our own volatility index, the Canterbury Volatility Index (CVI). It works similar to temperature in that anything below a CVI reading of CVI 75 is considered “low and stable.” From April 2021 through the end of the calendar year, the S&P 500 experienced low and stable volatility. It had tight fluctuations, often lulling investors to sleep. The market was heading upward, on small and incremental movements.

Although the markets were going up, there were still problems below the surface of the markets. Coming out of the pandemic, the sector that saw the most benefit was technology. Technology-related stocks, which make up more than 40% of the S&P 500, experienced some of the lowest declines during the March 2020 trading anomaly, and some of the largest rallies off the market lows. As a result, those technology-related stocks continued to grow their position in the market’s weightings. These stocks make up the largest allocation in the S&P 500 that they have since the early days of 2000, prior to the technology bubble and crash. In other words, the markets go as technology goes.

Beginning in the early weeks of 2022, we began to see a dramatic shift in the market environment. While volatility was low in 2021, it began to increase in the early days of January 2022. Sector leadership began to rotate away from technology and into more traditionally “defensive” market sectors like consumer staples and utilities. One of the smallest sectors, energy, saw and continues to see a substantial increase as the price of gas climbs higher. Technology was no longer leading the markets upward, and due to its large allocation, started leading the markets in the opposite direction.

By late February, the volatility of technology stocks had risen high enough to turn our “Market State” indicators bearish for the Nasdaq (a technology-heavy index). One month later, The S&P 500 followed suit. We have stated previously that the market environment seen in 2020 was a trading anomaly, characterized by a sharp decline and equally sharp rally over the course of a few months. The decline in the markets we have seen in the first few months of 2022 is not a trading anomaly. This is a bear market.

Bearish Stocks, Bearish Bonds

Investors know the importance of limiting risk. After all, in order to get the benefits of long-term compounding, portfolios need to limit declines during bear markets. That is the purpose of portfolio diversification. Investors diversify across a few asset classes, usually some blend of stocks and bonds. The theory is that when stocks are volatile and declining, the portfolio’s decline is being partially offset by a rise in bonds.

Currently, the S&P 500’s structure looks similar to what it was back at the turn of the century. Now, in a similar fashion, technology-related stocks are dragging the market index down. There is one large difference today, however, when it comes to what the average portfolio has experienced. Back in the early 2000s, while the stock market declined, bonds generally rose and offset some of the losses that investors experienced.

2

Today, not only have stocks declined in the first few months of 2022, but bonds have also seen sharp drawdowns. Through the end of April, twenty-year treasury bonds were down close to -20% for the year. From their peak in August of 2020, twenty-year treasury bonds have fallen by -30%. In other words, bonds have done very little to offset risks in the last two years. Traditional methods of diversification has not worked for today’s market environment. The conservative investors, the ones who generally have a balanced allocation of both stocks and bonds, is experiencing some of the highest volatility they have felt in their portfolios since the financial crisis of 2008/2009—and it is still happening.

The Canterbury Portfolio Thermostat Fund (CAPTX)

The Canterbury Portfolio Thermostat Fund (the “Fund”) is an evolution in adaptive, ETF portfolio management. The Fund is an adaptive portfolio management process designed to create stability across all market environments. Its goal is to compound returns through maintaining low volatility in both bull markets and bear markets. The Fund uses a comprehensive system to adjust its holdings, asset allocation, and diversification based on today’s broad market environment.

Fund Commentary April 2021 – April 2022

Make no mistake about it, the volatility that we have seen in the early months of 2022 has the makings of a classic bear market. There has been a dramatic shift that has occurred in the market’s environment over the past year. So far, the Fund (CAPTX) has been successful in navigating the changing, dynamic markets.

From April 2021 through the end of the calendar year, the markets saw low and decreasing volatility. As a result, the Fund held a broad range of equities and a few alternatives. These holdings were reflective of the low volatility environment. Earlier in this write-up, we referenced the Canterbury Volatility Index (CVI). In mid-June 2021, the volatility of the S&P 500 was CVI 61. As a reminder, volatility below CVI 75 is considered low and stable. CAPTX held recognizable positions in market sectors such as technology, communications, health care, financials; international indexes like the EAFE (Europe, Asia, Far East); style indexes like S&P 500 Value and Dividend Payers; and alternatives such as Canada Dollar, Inverse 20-year treasuries, and Real Estate. As a result, the Fund’s volatility, measured by the Canterbury Volatility Index, was around CVI 50. Again, this volatility level is considered low and stable.

Maintaining Low Volatility

As market environments shift, the goal of the Fund is to maintain consistent and low volatility, regardless of the changing markets. The S&P 500 reached a low volatility level of CVI 47 in September 2021. Since then, through the end of April 2022, the volatility of the market index had more than doubled to CVI 119, well above that low and stable CVI 75 level. In May, volatility continues to rise. Because of the changing market environment, the structure of the Fund looks vastly different than it did ten months ago. As volatility in the markets began to increase, the Fund rotated

3

its positions. Through the end of April 2022, the Fund held more “defensive” sectors such as Utilities, Energy, Food & Beverages; and took alternative positions such as Gold, Inverse Emerging Markets, Inverse Financials, and Inverse Russell 2000.

As of April 29th, 2022, CAPTX’s volatility level measured CVI 52. In other words, even though the volatility of the markets had more than doubled, the volatility of the Fund remained relatively the same. Through the employment of non-correlated ETFs (Exchange-Traded-Funds) ranging across several sectors and asset classes, the Fund was able to maintain consistently low volatility in an environment characterized by high and increasing volatility. Year-to-date, through the end of April 2022, CAPTX was down a marginal -3.73%, while the Nasdaq technology index (ETF: QQQ) had fallen -22%; the S&P 500 was down -14%; and twenty-year treasury bonds (ETF: TLT) were down -17% for the year.

The Plan Moving Forward

The current market environment has many of the characteristics of a classic bear market. Volatility is high and continues to climb, the market segment (technology stocks) that led the markets for last several years is now leading the market’s decline, and “outlier” trading days (a day beyond a +/-1.50% move) are occurring once every three days, on average. The climb in volatility is a bear market characteristic. Additionally, bonds are struggling as interest rates climb. If both of these trends continue, the conservative, balanced portfolios will begin to feel even more risky than they do right now.

The Canterbury Portfolio Thermostat Fund has made the necessary adjustments to maintain stability, regardless of the external market’s swing from a low volatility bull market to a highly erratic bear market. The plan from here is to turn a negative situation into a positive outcome and use the market’s volatility to the Fund’s advantage, by limiting portfolio declines and adapting portfolio allocations to combat the swings of the markets, in both directions.

CAPTX was built for this volatile type of market environment. We know that long-term investors want and need compounded returns. We also know that a bear market can cause years of savings and compounding to be wiped out in a short amount of time, only to take investors many years to recover. The goal of the Fund is to limit the large declines and volatility that the market brings and create stability during market environments that are full of instability.

Tom Hardin & Brandon Bischof

4

Investment Results (Unaudited)

Average Annual Total Returns(a) as of April 30, 2022

| Since | ||||

| Inception | ||||

| One Year | Three Year | Five Year | (8/2/16) | |

| Canterbury Portfolio Thermostat Fund, Institutional Shares | -1.10% | 3.79% | 3.84% | 4.37% |

| MSCI World Index (b) | -3.10% | 10.95% | 10.74% | 11.48% |

| Expense Ratios(c) | ||||

| Institutional | ||||

| Shares | ||||

| Total Annual Operating Expenses | 2.32% | |||

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Canterbury Portfolio Thermostat Fund (the “Fund”) distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (844) 838-2121.

| (a) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Fund’s returns reflect any fee reductions during the applicable periods and exclude the redemption fee. If such fee reductions had not occurred, the quoted performance would have been lower. |

| (b) | The MSCI World Index is an unmanaged free float-adjusted market capitalization index that is designed to measure global developed market equity performance. Currently, the MSCI World Index consists of the following 23 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. The performance of the index is expressed in terms of U.S. dollars, and does not reflect the deduction of fees or taxes with a mutual fund. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| (c) | The expense ratio is from the Fund’s prospectus dated August 27, 2021 and amended September 15, 2021. The Institutional Shares expense ratio does not correlate to the corresponding ratio of expenses to average net assets included in the financial highlights section of this report, which reflects the operating expenses of the Fund and does not include acquired fund fees and expenses. Additional information pertaining to the Fund’s expense ratios as of April 30, 2022, can be found in the financial highlights. |

Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

The Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

5

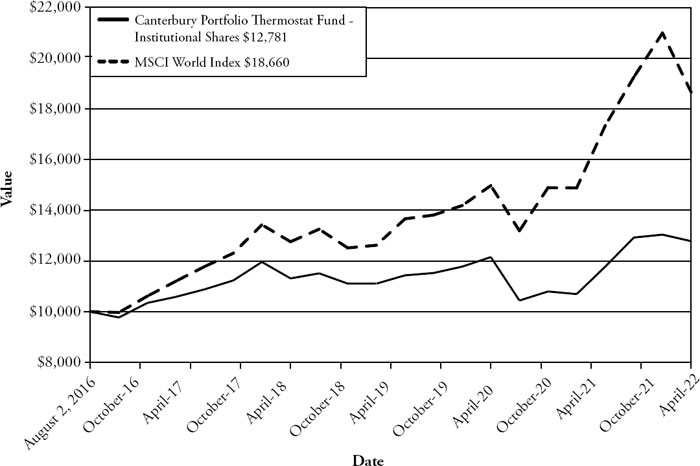

Investment Results (Unaudited) (continued)

Comparison

of the Growth of a $10,000 Investment in the Canterbury Portfolio

Thermostat Fund - Institutional Shares, and the MSCI World Index.

The chart above assumes an initial investment of $10,000 made on August 2, 2016 (commencement of operations) and held through April 30, 2022. THE FUND’S RETURNS REPRESENT PAST PERFORMANCE AND DO NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of the Fund’s shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call (844) 838-2121. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

6

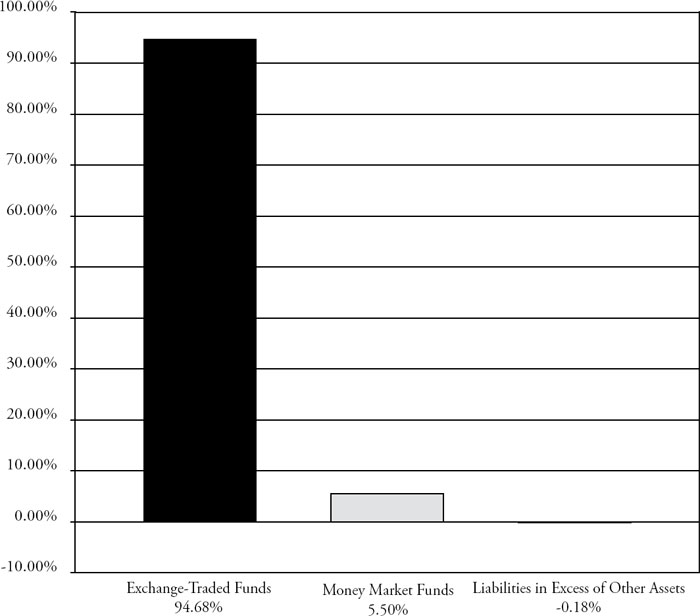

| Portfolio Illustration (Unaudited) |

| April 30, 2022 |

The following chart gives a visual breakdown of the Fund’s holdings as a percentage of net assets.

Availability of Portfolio Schedule (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the SEC’s website at http://www.sec.gov and on the Fund’s website at http://www.canterburyfunds.com.

7

| Canterbury Portfolio Thermostat Fund |

| Schedule of Investments |

| April 30, 2022 |

| Fair | ||||||||

| Shares | Value | |||||||

| EXCHANGE-TRADED FUNDS — 94.68% | ||||||||

| Energy Select Sector SPDR® Fund | 14,890 | $ | 1,118,984 | |||||

| Health Care Select Sector SPDR® Fund | 11,365 | 1,480,746 | ||||||

| Invesco Dynamic Food & Beverage ETF | 29,070 | 1,357,860 | ||||||

| Invesco International Dividend Achievers ETF | 68,880 | 1,266,014 | ||||||

| Invesco S&P 500® Equal Weight ETF | 10,100 | 1,489,244 | ||||||

| iShares MSCI Global Agriculture Producers ETF | 30,455 | 1,386,312 | ||||||

| ProShares Short Financials(a) | 106,575 | 1,360,963 | ||||||

| ProShares Short MSCI Emerging Markets(a) | 103,155 | 1,472,022 | ||||||

| ProShares Short Russell 2000(a) | 57,215 | 1,395,474 | ||||||

| SPDR® Gold Minishares Trust(a) | 34,290 | 1,291,704 | ||||||

| SPDR® Portfolio S&P 500® Value ETF | 36,235 | 1,438,530 | ||||||

| SPDR® S&P Aerospace & Defense ETF | 10,920 | 1,228,609 | ||||||

| SPDR® S&P Dividend ETF | 11,900 | 1,475,838 | ||||||

| Technology Select Sector SPDR® Fund | 9,265 | 1,310,256 | ||||||

| Utilities Select Sector SPDR® Fund | 18,745 | 1,335,769 | ||||||

| Total Exchange-Traded Funds (Cost $19,862,027) | 20,408,325 | |||||||

| MONEY MARKET FUNDS — 5.50% | ||||||||

| Morgan Stanley Institutional Liquidity Government Portfolio, Institutional Class, 0.30%(b) | 1,186,233 | 1,186,233 | ||||||

| Total Money Market Funds (Cost $1,186,233) | 1,186,233 | |||||||

| Total Investments — 100.18% (Cost $21,048,260) | 21,594,558 | |||||||

| Liabilities in Excess of Other Assets — (0.18)% | (39,759 | ) | ||||||

| NET ASSETS — 100.00% | $ | 21,554,799 | ||||||

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of April 30, 2022. |

ETF - Exchange-Traded Fund

SPDR - Standard & Poor’s Depositary Receipt

See accompanying notes which are an integral part of these financial statements.

8

| Canterbury Portfolio Thermostat Fund |

| Statement of Assets and Liabilities |

| April 30, 2022 |

| Assets | ||||

| Investments in securities at fair value (cost $21,048,260) | $ | 21,594,558 | ||

| Dividends receivable | 336 | |||

| Prepaid expenses | 20,270 | |||

| Total Assets | 21,615,164 | |||

| Liabilities | ||||

| Payable for fund shares redeemed | 15,782 | |||

| Payable to Adviser | 16,536 | |||

| Payable to Administrator | 6,958 | |||

| Payable to trustees | 3 | |||

| Payable to auditors | 15,875 | |||

| Other accrued expenses | 5,211 | |||

| Total Liabilities | 60,365 | |||

| Net Assets | $ | 21,554,799 | ||

| Net Assets consist of: | ||||

| Paid-in capital | 21,406,177 | |||

| Accumulated earnings | 148,622 | |||

| Net Assets | $ | 21,554,799 | ||

| Institutional Shares | ||||

| Shares outstanding (unlimited number of shares authorized, no par value) | 1,986,687 | |||

| Net asset value, offering and redemption price per share(a) | $ | 10.85 |

| (a) | Subject to certain exceptions, a 2.00% redemption fee is imposed upon shares redeemed within 60 calendar days of their purchase. |

See accompanying notes which are an integral part of these financial statements.

9

| Canterbury Portfolio Thermostat Fund |

| Statement of Operations |

| For the year ended April 30, 2022 |

| Investment Income | ||||

| Dividend income | $ | 321,951 | ||

| Total investment income | 321,951 | |||

| Expenses | ||||

| Adviser | 174,457 | |||

| Registration | 31,848 | |||

| Administration | 30,000 | |||

| Fund accounting | 27,500 | |||

| Legal | 20,833 | |||

| Transfer agent | 20,000 | |||

| Audit and tax preparation | 16,135 | |||

| Trustee | 13,499 | |||

| Printing | 8,974 | |||

| Compliance Services | 6,241 | |||

| Custodian | 5,000 | |||

| Insurance | 3,737 | |||

| Interest expense | 250 | |||

| Miscellaneous | 25,511 | |||

| Total expenses | 383,985 | |||

| Net investment loss | (62,034 | ) | ||

| Net Realized and Change in Unrealized Gain (Loss) on Investments | ||||

| Net realized gain on investment securities transactions | 432,607 | |||

| Net change in unrealized depreciation of investment securities | (697,306 | ) | ||

| Net realized and change in unrealized loss on investments | (264,699 | ) | ||

| Net decrease in net assets resulting from operations | $ | (326,733 | ) |

See accompanying notes which are an integral part of these financial statements.

10

| Canterbury Portfolio Thermostat Fund |

| Statements of Changes in Net Assets |

| For the | For the | |||||||

| Year Ended | Year Ended | |||||||

| April 30, 2022 | April 30, 2021 | |||||||

| Increase (Decrease) in Net Assets due to: | ||||||||

| Operations | ||||||||

| Net investment loss | $ | (62,034 | ) | $ | (161,762 | ) | ||

| Net realized gain on investment securities transactions | 432,607 | 3,362,319 | ||||||

| Net change in unrealized appreciation (depreciation) of investment securities | (697,306 | ) | 1,308,599 | |||||

| Net increase (decrease) in net assets resulting from operations | (326,733 | ) | 4,509,156 | |||||

| Distributions to Shareholders from Earnings | ||||||||

| Institutional Shares | (2,045,796 | ) | (10,860 | ) | ||||

| Total distributions | (2,045,796 | ) | (10,860 | ) | ||||

| Capital Transactions - Institutional Shares | ||||||||

| Proceeds from shares sold | 11,221,271 | 4,095,903 | ||||||

| Reinvestment of distributions | 2,045,796 | 10,860 | ||||||

| Amount paid for shares redeemed | (6,934,354 | ) | (18,357,443 | ) | ||||

| Proceeds from redemption fees(a) | 28,919 | 14,758 | ||||||

| Total Capital Transactions - Institutional Shares | 6,361,632 | (14,235,922 | ) | |||||

| Total Increase (Decrease) in Net Assets | 3,989,103 | (9,737,626 | ) | |||||

| Net Assets | ||||||||

| Beginning of year | $ | 17,565,696 | $ | 27,303,322 | ||||

| End of year | $ | 21,554,799 | $ | 17,565,696 | ||||

| Share Transactions - Institutional Shares | ||||||||

| Shares sold | 955,502 | 378,204 | ||||||

| Shares issued in reinvestment of distributions | 181,687 | 1,081 | ||||||

| Shares redeemed | (567,321 | ) | (1,686,876 | ) | ||||

| Total Share Transactions- Institutional Shares | 569,868 | (1,307,591 | ) | |||||

| (a) | Subject to certain exceptions, a 2.00% redemption fee is imposed upon shares redeemed within 60 calendar days of their purchase. |

See accompanying notes which are an integral part of these financial statements.

11

| Canterbury Portfolio Thermostat Fund - Institutional Shares |

| Financial Highlights |

| (For a share outstanding during each year) |

| For the | For the | For the | For the | For the | ||||||||||||||||

| Year Ended | Year Ended | Year Ended | Year Ended | Year Ended | ||||||||||||||||

| April 30, | April 30, | April 30, | April 30, | April 30, | ||||||||||||||||

| 2022 | 2021 | 2020 | 2019 | 2018 | ||||||||||||||||

| Selected Per Share Data | ||||||||||||||||||||

| Net asset value, beginning of year | $ | 12.40 | $ | 10.02 | $ | 11.11 | $ | 11.15 | $ | 10.54 | ||||||||||

| Income from investment operations: | ||||||||||||||||||||

| Net investment income (loss) | (0.02 | ) | (0.12 | ) | 0.05 | 0.03 | 0.06 | |||||||||||||

| Net realized and unrealized gain (loss) on investments | (0.08 | ) | 2.49 | (1.01 | ) | 0.06 | 0.65 | |||||||||||||

| Total from investment operations | (0.10 | ) | 2.37 | (0.96 | ) | 0.09 | 0.71 | |||||||||||||

| Less distributions to shareholders from: | ||||||||||||||||||||

| Net investment income | — | — | (a) | (0.05 | ) | (0.03 | ) | (0.07 | ) | |||||||||||

| Net realized gains | (1.47 | ) | — | (0.08 | ) | (0.12 | ) | (0.04 | ) | |||||||||||

| Return of capital | — | — | (0.01 | ) | — | — | ||||||||||||||

| Total from distributions | (1.47 | ) | — | (a) | (0.14 | ) | (0.15 | ) | (0.11 | ) | ||||||||||

| Paid-in capital from redemption fees | 0.02 | 0.01 | 0.01 | 0.02 | 0.01 | |||||||||||||||

| Net asset value, end of year | $ | 10.85 | $ | 12.40 | $ | 10.02 | $ | 11.11 | $ | 11.15 | ||||||||||

| Total Return(b) | (1.10 | )% | 23.80 | % | (8.69 | )% | 1.07 | % | 6.85 | % | ||||||||||

| Ratios and Supplemental Data: | ||||||||||||||||||||

| Net assets, end of year (000 omitted) | $ | 21,555 | $ | 17,566 | $ | 27,303 | $ | 29,153 | $ | 35,051 | ||||||||||

| Ratio of expenses to average net assets before expense waiver | 1.98 | % | 1.86 | % | 1.61 | % | 1.53 | % | 1.73 | % | ||||||||||

| Ratio of expenses to average net assets after expense waiver | 1.98 | % | 1.69 | % | 1.30 | % | 1.30 | % | 1.30 | % | ||||||||||

| Ratio of net investment income (loss) to average net assets after expense waiver | (0.32 | )% | (0.72 | )% | 0.51 | % | 0.25 | % | 0.54 | % | ||||||||||

| Portfolio turnover rate | 234 | % | 160 | % | 206 | % | 185 | % | 116 | % | ||||||||||

| (a) | Rounds to less than $0.005 per share. |

| (b) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. Excludes redemption fees. |

See accompanying notes which are an integral part of these financial statements.

12

| Canterbury Portfolio Thermostat Fund |

| Notes to the Financial Statements |

| April 30, 2022 |

NOTE 1. ORGANIZATION

The Canterbury Portfolio Thermostat Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as a diversified series of Capitol Series Trust (the “Trust”) on December 17, 2015. The Trust is an open-end investment company established under the laws of Ohio by an Agreement and Declaration of Trust dated September 18, 2013 (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees of the Trust (the “Board”) to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund is one of a series of funds currently authorized by the Board. The Fund’s investment adviser is Canterbury Investment Management, LLC (the “Adviser”). The investment objective of the Fund is to seek long-term risk-adjusted growth. The Fund attempts to achieve its investment objective utilizing broadly diversified liquid securities traded on major exchanges, primarily exchange-traded funds (“ETFs”). The Fund’s portfolio is structured primarily as a “fund of funds.” The Fund will invest in any debt, equity, and alternative security deemed appropriate and necessary to improve the portfolio’s composition, exposure to which is obtained through the use of ETFs.

The Fund currently offers one class of shares, Institutional Shares. The Fund’s Investor Shares have been approved by the Board, but are not yet available for purchase and are not being offered at this time. The Fund’s Institutional Shares commenced operations on August 2, 2016. Each share represents an equal proportionate interest in the assets and liabilities belonging to the Fund and is entitled to such dividends and distributions out of income belonging to the Fund as are declared by the Board. Both share classes impose a 2.00% redemption fee on shares redeemed within 60 days of purchase.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”, including Accounting Standards Update 2013-08. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

13

| Canterbury Portfolio Thermostat Fund |

| Notes to the Financial Statements (continued) |

| April 30, 2022 |

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net realized capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

The Fund recognizes tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the previous three tax year ends and the interim tax period since then, as applicable) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements and does not expect this to change over the next twelve months. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the period, the Fund did not incur any interest or penalties.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or another appropriate basis (as determined by the Board).

Security Transactions and Related Income – Throughout the reporting period, security transactions are accounted for no later than one business day following the trade date. For financial reporting purposes, security transactions are accounted for on trade date on the last business day of the reporting period. The specific identification method is used for determining gains or losses for financial statements and income tax purposes. Dividend income is recorded on the ex-dividend date.

Dividends and Distributions – The Fund intends to distribute its net investment income and net realized long-term and short-term capital gains, if any, at least annually. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the period from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified among the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value (“NAV”) per share of the Fund.

14

| Canterbury Portfolio Thermostat Fund |

| Notes to the Financial Statements (continued) |

| April 30, 2022 |

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

The Fund values its portfolio securities at fair value as of the close of regular trading on the New York Stock Exchange (“NYSE”) (normally 4:00 p.m. Eastern time) on each business day the NYSE is open for business. Fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained and available from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| ● | Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date |

| ● | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ● | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy which is reported is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

In computing the NAV of the Fund, fair value is based on market valuations with respect to portfolio securities for which market quotations are readily available. Pursuant to Board approved policies, the Fund relies on independent third-party pricing services to provide the current market value of securities. Those pricing services value equity securities, including exchange-traded funds, exchange-

15

| Canterbury Portfolio Thermostat Fund |

| Notes to the Financial Statements (continued) |

| April 30, 2022 |

traded notes, closed-end funds and preferred stocks, traded on a securities exchange at the last reported sales price on the principal exchange. Equity securities quoted by NASDAQ are valued at the NASDAQ Official Closing Price. If there is no reported sale on the principal exchange, equity securities are valued at the mean between the most recent quoted bid and asked price. When using market quotations or close prices provided by the pricing service and when the market is considered active, the security will be classified as a Level 1 security. Investments in open-end mutual funds, including money market mutual funds, are generally priced at the ending NAV provided by the pricing service of the funds and are generally categorized as Level 1 securities.

In the event that market quotations are not readily available, the Adviser determines that the market quotation or the price provided by the pricing service does not accurately reflect the current fair value, such securities are valued as determined in good faith by the Trust’s Valuation Committee, based on recommendations from a pricing committee comprised of certain officers of the Trust, certain employees of the Fund’s administrator, and representatives of the Adviser (together the “Pricing Review Committee”). These securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.

In accordance with the Trust’s Portfolio Valuation Procedures, the Pricing Review Committee, in making its recommendations with the Adviser’s participation, is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single standard exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of an issue of securities being valued pursuant to the Trust’s Fair Value Guidelines would be the amount which the Fund might reasonably expect to receive for them upon their current sale. Methods which are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market prices of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Fair value pricing is permitted if, in accordance with the Trust’s Portfolio Valuation Procedures, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before the Fund’s NAV calculation that may affect a security’s value, or other data calls into question the reliability of market quotations.

16

| Canterbury Portfolio Thermostat Fund |

| Notes to the Financial Statements (continued) |

| April 30, 2022 |

The following is a summary of the inputs used to value the Fund’s investments as of April 30, 2022:

| Valuation Inputs | ||||||||||||||||

| Assets | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Exchange-Traded Funds | $ | 20,408,325 | $ | — | $ | — | $ | 20,408,325 | ||||||||

| Money Market Funds | 1,186,233 | — | — | 1,186,233 | ||||||||||||

| Total | $ | 21,594,558 | $ | — | $ | — | $ | 21,594,558 | ||||||||

The Fund did not hold any investments at the end of the reporting period for which significant unobservable inputs (Level 3) were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period.

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES

Under the terms of the investment advisory agreement (the “Agreement”), the Adviser manages the Fund’s investments subject to approval of the Board. As compensation for its management services, the Fund is obligated to pay the Adviser a fee computed and accrued daily and paid monthly at an annual rate of 0.90% of the Fund’s average daily net assets. For the fiscal year ended April 30, 2022, the Adviser earned fees of $174,457 from the Fund. At April 30, 2022, the Fund owed the Adviser $16,536.

The Trust retains Ultimus Fund Solutions, LLC (the “Administrator”) to provide the Fund with administration, accounting, transfer agent and compliance services, including all regulatory reporting. For the fiscal year ended April 30, 2022, the Administrator earned fees of $30,000 for administration services, $27,500 for fund accounting services, $6,241 for compliance services and $20,000 for transfer agent services. At April 30, 2022, the Fund owed the Administrator $6,958 for such services.

The Board supervises the business activities of the Trust. Each Trustee serves as a Trustee for the lifetime of the Trust or until the earlier of his or her retirement as a Trustee at age 78 (which may be extended for up to two years in an emeritus non-voting capacity at the pleasure and request of the Board), or until he/she dies, resigns, or is removed, whichever is sooner. “Independent Trustees,” meaning those Trustees who are not “interested persons” of the Trust, as defined in the 1940 Act, as amended, have each received an annual retainer of $1,000 per Fund and $500 per Fund for each quarterly in-person Board meeting. Effective April 1, 2022, the annual retainer increased to $1,500 per Fund. In addition, each Independent Trustee may be compensated for preparation related to and participation in any special meetings of the Board and/or any Committee of the Board, with such compensation determined on a case-by-case basis based on the length and complexity of the meeting. The Trust also reimburses Trustees for out-of-pocket expense incurred in conjunction with attendance at Board meetings.

17

| Canterbury Portfolio Thermostat Fund |

| Notes to the Financial Statements (continued) |

| April 30, 2022 |

The officers and one trustee of the Trust are employees of the Administrator. Ultimus Fund Distributors, LLC (the “Distributor”) acts as the principal distributor of the Fund’s shares. The Distributor is a wholly-owned subsidiary of the Administrator.

NOTE 5. PURCHASES AND SALES OF SECURITIES

For the fiscal year ended April 30, 2022, purchases and sales of investment securities, other than short-term investments, were $45,235,778 and $41,430,769, respectively.

There were no purchases or sales of long-term U.S. government obligations during the fiscal year ended April 30, 2022.

NOTE 6. FEDERAL TAX INFORMATION

At April 30, 2022, the net unrealized appreciation (depreciation) and tax cost of investments for tax purposes was as follows:

| Gross unrealized appreciation | $ | 923,488 | ||

| Gross unrealized depreciation | (376,802 | ) | ||

| Net unrealized appreciation/(depreciation) on investments | $ | 546,686 | ||

| Tax cost of investments | $ | 21,047,872 |

The tax character of distributions paid for the fiscal years ended April 30, 2022 and April 30, 2021 were as follows:

| 2022 | 2021 | |||||||

| Distributions paid from: | ||||||||

| Ordinary income | $ | 696,626 | $ | — | ||||

| Long-term capital gains | 1,349,170 | 10,860 | ||||||

| Total distributions paid | $ | 2,045,796 | $ | 10,860 | ||||

At April 30, 2022, the components of accumulated earnings (deficit) on a tax basis were as follows:

| Accumulated capital and other losses | $ | (398,064 | ) | |

| Unrealized appreciation on investments | 546,686 | |||

| Total accumulated earnings | $ | 148,622 |

Under current tax law, net investment losses after December 31 and capital losses realized after October 31 of the Fund’s fiscal year may be deferred and treated as occurring on the first business day of the following fiscal year for tax purposes. The Fund had post October losses of $398,064.

18

| Canterbury Portfolio Thermostat Fund |

| Notes to the Financial Statements (continued) |

| April 30, 2022 |

NOTE 7. INVESTMENT IN OTHER INVESTMENT COMPANIES

The Fund may invest a significant portion of its assets in shares of one or more investment companies, including ETFs, open-end mutual funds and money market mutual funds. The Fund will incur additional indirect expenses (acquired fund fees and expenses) to the extent it invests in shares of other investment companies. As of April 30, 2022, the Fund had 94.68% of the value of its net assets invested in ETFs. The financial statements of these ETFs and open-end mutual funds can be found at www.sec.gov.

NOTE 8. COMMITMENTS AND CONTIGENCIES

The Trust indemnifies its officers and Trustees for certain liabilities that may arise from their performance of their duties to the Trust or the Fund. Additionally, in the normal course of business, the Trust enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

NOTE 9. SUBSEQUENT EVENTS

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date at which these financial statements were issued. Based upon this evaluation, management has determined there were no items requiring adjustment of the financial statements or additional disclosure.

19

| Report of Independent Registered Public Accounting Firm |

To the Shareholders and the Board of Trustees of Canterbury Portfolio Thermostat Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Canterbury Portfolio Thermostat Fund (the “Fund”) (one of the funds constituting Capitol Series Trust (the “Trust”)), including the schedule of investments, as of April 30, 2022, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund (one of the funds constituting Capitol Series Trust) at April 30, 2022, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and its financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Trust’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Trust is not required to have, nor were we engaged to perform, an audit of Trust’s internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Trust’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of April 30, 2022, by correspondence with the custodian and brokers. Our audits also included evaluating the

20

| Report of Independent Registered Public Accounting Firm (continued) |

accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more Capitol Series Trust investment companies since 2017.

Cincinnati, Ohio

June 24, 2022

21

| Summary of Fund Expenses (Unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction and (2) ongoing costs, including management fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from November 1, 2021 through April 30, 2022.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table below is useful in comparing ongoing costs only and will not help you determine the relative costs of owning different funds. In addition, if transaction costs were included, your costs would have been higher.

| Beginning | Ending | Expenses | ||||||||

| Account | Account | Paid | Annualized | |||||||

| Value | Value | During | Expense | |||||||

| November 1, 2021 | April 30, 2022 | Period(a) | Ratio | |||||||

| Canterbury Portfolio Thermostat Fund | ||||||||||

| Institutional Class | Actual | $1,000.00 | $980.30 | $9.55 | 1.94% | |||||

| Hypothetical(b) | $1,000.00 | $1,015.15 | $9.71 | 1.94% | ||||||

| (a) | Expenses are equal to the Fund’s annualized expense ratios, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| (b) | Hypothetical assumes 5% annual return before expenses. |

22

| Additional Federal Income Tax Information (Unaudited) |

The Form 1099-DIV you receive in January 2023 will show the tax status of all distributions paid to your account in calendar year 2022. Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in the Fund. As required by the Internal Revenue Code and/or regulations, shareholders must be notified regarding the status of qualified dividend income for individuals and the dividends received deduction for corporations.

Qualified Dividend Income. The Fund designates approximately 0% or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for a reduced tax rate.

Qualified Business Income. The Fund designates approximately 0% of its ordinary income dividends, or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified business income.

Dividends Received Deduction. Corporate shareholders are generally entitled to take the dividends received deduction on the portion of the Fund’s dividend distribution that qualifies under tax law. For the Fund’s calendar year 2022 ordinary income dividends, 0% qualifies for the corporate dividends received deduction.

For the year ended April 30, 2022, the Fund designated $1,349,170 as long-term capital gain distributions.

23

| Trustees and Officers (Unaudited) |

The Board supervises the business activities of the Trust and is responsible for protecting the interests of shareholders. The Chairman of the Board is Walter B. Grimm, who is an Independent Trustee of the Trust.

Each Trustee serves as a Trustee for the lifetime of the Trust or until the earlier of his or her retirement as a Trustee at age 78, death, resignation or removal. Officers are re-elected annually by the Board. The address of each Trustee and officer is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246.

As of the date of this report, the Trustees oversee the operations of 13 series.

Interested Trustee Background. The following table provides information regarding the Interested Trustee.

Name,

(Age), |

Principal

Occupation During Past 5 Years |

| David

James* Birth Year: 1970 TRUSTEE Began Serving: March 2021 |

Principal Occupation(s): Executive Vice President and Chief Legal and Risk Officer of Ultimus Fund Solutions, LLC (2018 to present).

Previous Position(s): Managing Director and Senior Managing Counsel, State Street Bank and Trust Company (2009 to 2018). |

| * | Mr. James is considered an “interested person” of the Trust within the meaning of Section 2(a)(19) of the 1940 Act because of his relationship with the Trust’s administrator, transfer agent, and distributors. |

Independent Trustee Background. The following table provides information regarding the Independent Trustees.

| Name,

(Age), Position with Trust, Term of Position with Trust |

Principal

Occupation During Past 5 Years and Other Directorships |

| Walter

B. Grimm Birth Year: 1945 TRUSTEE AND CHAIR Began Serving: November 2013 |

Principal Occupation(s): President, Leigh Management Group, LLC (consulting firm) (October 2005 to present); and President, Leigh Investments, Inc. (1988 to present) Board member, Boys & Girls Club of Coachella (2018 to present). |

| Lori

Kaiser Birth Year: 1963 TRUSTEE Began Serving: July 2018 |

Principal Occupation(s): Founder and CEO, Kaiser Consulting since 1992. |

| Janet

Smith Meeks Birth Year: 1955 TRUSTEE Began Serving: July 2018 |

Principal Occupation(s):Co-Founder and CEO, Healthcare Alignment Advisors, LLC (consulting company) since August 2015.

Previous Position(s):President and Chief Operating Officer, Mount Carmel St. Ann’s Hospital (2006 to 2015). |

24

| Trustees and Officers (Unaudited) (continued) |

Name, (Age), Position with Trust, Term of Position with Trust |

Principal

Occupation During Past 5 Years |

| Mary

M. Madick Birth Year: 1958 TRUSTEE Began Serving: November 2013 |

Principal Occupation(s): President, US Health Holdings (2020 to present).

Previous Position(s): President (2019 to 2020) and Chief Operating Officer (2018 to 2019), Dignity Health Managed Services Organization; Chief Operating Officer, Pennsylvania Health and Wellness (fully owned subsidiary of Centene Corporation) (2016 to 2018); Vice President, Gateway Heath (2015 to 2016). |

Officers. The following table provides information regarding the Officers.

Name,

(Age), |

Principal

Occupation During Past 5 Years |

| Matthew

J. Miller Birth Year: 1976 PRESIDENT and CHIEF EXECUTIVE OFFICER Began Serving: September 2013 (as VP); September 2018 (as President) |

Principal Occupation(s): Assistant Vice President, Relationship Management, Ultimus Fund Solutions, LLC (December 2015 to present); Vice President, Valued Advisers Trust (December 2011 to present).

Previous Position(s): Vice President, Relationship Management, Huntington Asset Services, Inc. (n/k/a Ultimus Asset Services, LLC) (2008 to December 2015).

|

Zachary

P. Richmond

|

Principal Occupation(s): Vice President, Director of Financial Administration for Ultimus Fund Solutions, LLC (February 2019 to present).

Previous Position(s): Assistant Vice President, Associate Director of Financial Administration for Ultimus Fund Solutions, LLC (December 2015 to February 2019). |

| Martin

R. Dean Birth Year: 1963 CHIEF COMPLIANCE OFFICER Began Serving: May 2019 |

Principal Occupation(s): Senior Vice President, Head of Fund Compliance, Ultimus Fund Solutions, LLC (January 2016 to present). |

| Paul

Leone Birth Year: 1963 SECRETARY Began Serving: June 2021 |

Principal Occupation(s): Vice President and Senior Counsel, Ultimus Fund Solutions, LLC (2020 to present).

Previous Position(s):Managing Director, Leone Law Office, P.C. (2019 to 2020); and served in the roles of Senior Counsel - Distribution and Senior Counsel - Compliance, Empower Retirement/Great-West Life & Annuity Ins. Co. (2015 to 2019). |

Stephen

Preston |

Principal Occupation(s):Chief Compliance Officer, Ultimus Fund Distributors, LLC (June 2011 to present).

Previous Position(s):Chief Compliance Officer, Ultimus Fund Solutions, LLC (June 2011 to August 2019). |

25

| Approval of Investment Advisory Agreement (Unaudited) |

At a quarterly meeting of the Board of Trustees of Capitol Series Trust (“Trust”) held on December 8 and 9, 2021, the Trust’s Board of Trustees (“Board”), including all of the Trustees who are not “interested persons” of the Trust (“Independent Trustees”) as that term is defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (the “1940 Act”), considered and approved the renewal of the Investment Advisory Agreement (“Investment Advisory Agreement”) for an additional one-year period between the Trust and Canterbury Investment Management, LLC (“Canterbury”) with respect to the Canterbury Portfolio Thermostat Fund (the “Canterbury Fund” or the “Fund”), a series of the Trust.

Prior to the meeting, the Trustees received and considered information from Canterbury and the Trust’s administrator designed to provide the Trustees with the information necessary to evaluate the terms of the proposed renewal of the Investment Advisory Agreement between the Trust and Canterbury, including, but not limited to: Canterbury’s responses to counsel’s initial due diligence letter requesting information relevant to the approval of the Investment Advisory Agreement:, Canterbury’s responses to counsel’s supplemental requests for additional information; and peer group comparative expense and performance data provided by Broadridge (collectively, the “Support Materials”). The Trustees noted the completeness of the Support Materials that Canterbury provided, and reviewed such Support Materials at various times with Canterbury, Trust management, and counsel to the Independent Trustees. The Trustees also noted the discussions that had taken place with representatives of Canterbury, and considered additional information that Canterbury had provided regarding its services to the Canterbury Fund, including but not limited to: information regarding Canterbury’s investment philosophy and investment strategy; Canterbury’s development of innovations in investor tools; the firm’s investment in internal resources to support and promote the Canterbury Fund; the firm’s compliance culture; compensation of portfolio managers; trading practices; liability insurance; Canterbury’s financial statements; Canterbury’s profitability with respect to the Canterbury Fund; Canterbury’s marketing and distribution plans for the Fund; and other benefits that Canterbury derives from its relationship with the Fund. This information, together with information provided to and reviewed by the Board concerning Canterbury and the Canterbury Fund since the Fund’s inception, formed the primary, but not exclusive, basis for the Board’s determinations.

Before voting to approve the renewal of the Investment Advisory Agreement, the Trustees reviewed the terms of Investment Advisory Agreement, as well as the Support Materials, with Trust management and with counsel to the Independent Trustees. The Trustees also received, reviewed and discussed a memorandum from such counsel delineating each Trustee’s duty of care and duty of loyalty obligations and application of the fiduciary duty standards of Section 36(b) of the 1940 Act, all of which govern their consideration of the renewal of the Investment Advisory Agreement. In addition, the memorandum described the various factors that the U.S. Securities and Exchange Commission (“SEC”) and U.S. Courts over the years have suggested are appropriate for trustee consideration in

26

| Approval of Investment Advisory Agreement (Unaudited) (Continued) |

the advisory agreement approval and renewal process, including the factors outlined in Gartenberg v. Merrill Lynch Asset Management Inc., 694 F.2d 923, 928 (2d Cir. 1982); cert. denied sub. nom. and Andre v. Merrill Lynch Ready Assets Trust, Inc., 461 U.S. 906 (1983).

In determining whether to approve the renewal of the Investment Advisory Agreement, the Trustees considered all factors they believed relevant with respect to the Canterbury Fund, including the following: (1) the nature, extent, and quality of the services to be provided by Canterbury; (2) the cost of the services to be provided and the profits to be realized by Canterbury from services rendered to the Trust and the Fund; (3) comparative fee and expense data for the Canterbury Fund and other investment companies with similar investment objectives; (4) the extent to which economies of scale would be realized as the Canterbury Fund grows and whether the proposed advisory fee for the Fund reflects these economies of scale for the Fund’s benefit; and (5) other financial benefits to Canterbury resulting from services to be rendered to the Canterbury Fund. In their deliberations, the Trustees did not identify any particular information that was all-important or controlling.

After having received and reviewed the Support Materials, as well as investment performance, compliance, operating, and distribution reports of the Canterbury Fund on a quarterly basis since the Fund’s inception, and having noted Canterbury’s presentation and the additional discussions with representatives of Canterbury that had occurred at various times, the Trustees determined that they had all of the information they deemed reasonably necessary to make an informed decision concerning the approval of the renewal of the Investment Advisory Agreement. The Trustees discussed the facts and factors relevant to the approval of the Investment Advisory Agreement, which incorporated and reflected their knowledge of Canterbury’s services provided to the Canterbury Fund. Based upon the Support Materials, Canterbury’s presentation and discussions with representatives of Canterbury, and performance, compliance, fee and expense and distribution information received on a quarterly basis since the Fund’s inception, the Board concluded that the overall arrangements between the Trust and Canterbury as set forth in the Investment Advisory Agreement are fair and reasonable in light of the services that Canterbury performs, the investment advisory fees that the Canterbury Fund pays, and such other matters as the Trustees considered relevant in the exercise of their reasonable business judgment. The material factors and conclusions that formed the basis of the Trustees’ determination to approve the continuation of the Investment Advisory Agreement are summarized below.

Nature, Extent and Quality of Services Provided. The Trustees considered the scope of services that Canterbury provides under the Investment Advisory Agreement, noting that such services include but are not limited to the following: (1) investing the Canterbury Fund’s assets consistent with the Fund’s investment objective and investment policies; (2) determining the portfolio securities to be purchased, sold or otherwise disposed of and the timing of such transactions; (3) voting all proxies with respect to the Fund’s portfolio securities; (4) maintaining the required books and records for transactions that Canterbury effects on behalf of the Fund; (5) selecting broker-dealers to execute orders on

27

| Approval of Investment Advisory Agreement (Unaudited) (Continued) |

behalf of the Canterbury Fund; (6) performing compliance services on behalf of the Canterbury Fund; and (7) engaging in marketing activities. The Trustees noted no changes to the services that Canterbury provides to the Canterbury Fund under the terms of the Investment Advisory Agreement. The Trustees considered Canterbury’s capitalization and its assets under management. The Trustees further considered the investment philosophy and investment industry experience of the portfolio managers, and noted the proprietary software and research algorithm developed by Canterbury and utilized to manage the Fund’s portfolio in accordance with its investment strategy. The Trustees also noted the Canterbury Fund’s performance compared to its benchmark index, including the fact that the Fund had underperformed its benchmark index for the one-, three- and six-month, one-, three- and five-year, and since inception periods ended September 30, 2021. The Trustees also considered the Canterbury Fund’s performance compared to the Tactical Allocation Morningstar category and the custom Broadridge peer group, which was a subset of the Morningstar category with filters applied for actively managed, unaffiliated fund-of-funds and net assets. The Trustees noted that the Canterbury Fund underperformed the median of the Tactical Allocation Morningstar category for the one-, three-, and five-year and since inception periods ended September 30, 2021. With respect to the custom Broadridge peer group, the Trustees noted that the Canterbury Fund also underperformed the median of this peer group for the one-, three-, and five-year and since inception periods ended September 30, 2021. The Board further noted its discussions with representatives of Canterbury regarding management of the Canterbury Fund’s adaptive portfolio strategy, performance of the Canterbury Fund and historical success in limiting drawdowns during normal bull market corrections. Based upon the foregoing, the Trustees concluded that they are satisfied with the nature, extent and quality of services that Canterbury provides to the Canterbury Fund under the Investment Advisory Agreement.

Cost of Advisory Services and Profitability. The Trustees considered the annual management fee that the Canterbury Fund pays to Canterbury under the Investment Advisory Agreement, as well as Canterbury’s profitability from the services that it renders to the Fund, noting the said services were slightly unprofitable during the last fiscal year and were projected to be slightly profitable in the current fiscal year. The Trustees noted that, while a Rule 12b-1 Distribution Plan had been approved on behalf of the Investor Shares of the Canterbury Fund, Investor Shares were not currently offered for purchase. The Trustees also considered Canterbury’s commitment with respect to the Canterbury Fund and the growth of assets in the Fund over time.

Comparative Fee and Expense Data. The Trustees noted that the Canterbury Fund’s management fee was equal to the Morningstar category median and higher than the Morningstar category average, and the Canterbury Fund’s management fee was lower than both the median and average for the Broadridge custom peer group. The Trustees then noted that the Canterbury Fund’s gross and net total expense ratios were above the median and average gross and net total expense ratios reported for

28

| Approval of Investment Advisory Agreement (Unaudited) (Continued) |

the same Morningstar peer group category. With regard to the custom Broadridge peer group, the Trustees noted that the Canterbury Fund’s gross total expense ratio was higher than the average and the median gross total expense ratios reported for the peer group and that the Canterbury Fund’s net total expense ratio was also above the median and the average net total expense ratios reported for the peer group. They further considered the fees paid by Canterbury’s separately managed accounts and sub-advisory relationships to other accounts with similar investment objectives and strategies to that of the Fund, noting the differences in the services provided to these accounts compared to the services provided to the Canterbury Fund. In particular, they noted that Canterbury has additional responsibilities with respect to the Canterbury Fund, including compliance, reporting and operational responsibilities. While recognizing that it is difficult to compare advisory fees because the scope of advisory services provided may vary from one investment adviser to another, or from one investment product to another, the Trustees concluded that Canterbury’s advisory fee continues to be reasonable.

Economies of Scale. The Trustees considered whether the Canterbury Fund may benefit from any economies of scale, but did not find that any material economies exist at this time. The Trustees also noted Canterbury’s view that due to the Canterbury Fund’s low net asset total and Canterbury’s current unprofitability with respect to the Fund, fee breakpoints are not necessary or appropriate at this time.

Other Benefits. The Trustees noted that Canterbury does not utilize soft dollar arrangements with respect to portfolio transactions and does not use affiliated brokers to execute the Canterbury Fund’s portfolio transactions. The Trustees noted that Canterbury had confirmed that there were no economic or other benefits to the Adviser associated with the selection or use of any particular ETF providers for the Fund’s portfolio. The Trustees concluded that all things considered, Canterbury does not receive material additional financial benefits from services rendered to the Canterbury Fund.

Other Considerations. The Trustees also considered potential conflicts for Canterbury with respect to relationships forged with ETF providers. The Trustees noted that both they and Counsel have discussed with representatives of Canterbury their duty of loyalty relative to the selection of ETF providers and the conflicts that could develop relative to any relationship that Canterbury may form with a specific ETF provider. Based on the assurances and representations from Canterbury, the Trustees concluded that no conflict of interest currently exists that could adversely impact the Canterbury Fund.

29

| FACTS | WHAT DOES CANTERBURY PORTFOLIO THERMOSTAT FUND (THE “FUND”) DO WITH YOUR PERSONAL INFORMATION? |

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include:

■ Social Security number

■ account balances and account transactions

■ transaction or loss history and purchase history

■ checking account information and wire transfer instructions

When you are no longer our customer, we continue to share your information as described in this notice. |

| How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons the Fund chooses to share; and whether you can limit this sharing. |

| Reasons we can share your personal information | Does the Fund share? |

| For

our everyday business purposes— such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus |

Yes |

| For

our marketing purposes— to offer our products and services to you |

No |

| For joint marketing with other financial companies | No |

| For

our affiliates’ everyday business purposes— information about your transactions and experiences |

No |

| For

our affiliates’ everyday business purposes— information about your creditworthiness |

No |

| For nonaffiliates to market to you | No |

| Questions? | Call (844) 838-2121 |

30

| Who we are | |

| Who is providing this notice? | Canterbury Portfolio Thermostat Fund |

| Ultimus Fund Distributors, LLC (Distributor) | |

| Ultimus Fund Solutions, LLC (Administrator) | |

| What we do | |

| How does the Fund protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. Our service providers are held accountable for adhering to strict policies and procedures to prevent any misuse of your nonpublic personal information. |

| How does the Fund collect my personal information? | We collect your personal information, for example, when you

■ open an account or deposit money

■ buy securities from us or sell securities to us

■ make deposits or withdrawals from your account or provide account information

■ give us your account information

■ make a wire transfer

■ tell us who receives the money

■ tell us where to send the money

■ show your government-issued ID

■ show your driver’s license |

| Why can’t I limit all sharing? | Federal law gives you the right to limit only

■ sharing for affiliates’ everyday business purposes — information about your creditworthiness

■ affiliates from using your information to market to you

■ sharing for nonaffiliates to market to you

State laws and individual companies may give you additional rights to limit sharing. |

| Definitions | |

| Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies.

■ Canterbury Investment Management, LLC, the investment adviser to the Fund, could be deemed to be an affiliate. |

| Nonaffiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies.

■ The Fund does not share your personal information with nonaffiliates so they can market to you. |

| Joint marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you.

■ The Fund doesn’t jointly market. |

31

This page is intentionally left blank.

This page is intentionally left blank.

OTHER INFORMATION (UNAUDITED)