Form N-CSR CONESTOGA FUNDS For: Sep 30

| OMB APPROVAL |

|

OMB Number: 3235-0570

Expires: July 31, 2022

Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-21120 |

| Conestoga Funds |

| (Exact name of registrant as specified in charter) |

| 550 E. Swedesford Road, Suite 120 Wayne, PA | 19087 |

| (Address of principal executive offices) | (Zip code) |

| Conestoga Capital Advisors 550 E. Swedesford Road, Suite 120 Wayne, PA 19087 |

| (Name and address of agent for service) |

| With Copy To: |

| Josh Deringer, Esq. |

| Faegre Drinker Biddle & Reath LLP |

| One Logan Square, Suite 2000 |

| Philadelphia, PA 19103 |

| Registrant's telephone number, including area code: | (800) 320-7790 |

| Date of fiscal year end: | September 30 | |

| Date of reporting period: | September 30, 2021 |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles. A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public.

A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) |

Conestoga Funds

SMALL CAP FUND

SMID CAP FUND

MID CAP FUND

M a n a g e d B y

ANNUAL REPORT

September 30, 2021

CONESTOGA FUNDS |

|

November 18, 2021

Dear Fellow Shareholders of the Conestoga Funds,

The Conestoga Funds fiscal year ended September 30, 2021, has been marked by the continued economic recovery from COVID-19. The global economy has slowly begun to re-open, with some setbacks as cases of the virus surge regionally. Equity markets moved mostly higher over the fiscal year on the strength of corporate earnings and low interest rates. Many major equity indices hit all-time highs during the Summer of 2021.

We are pleased to report that each of the Conestoga Funds outperformed their respective benchmarks during the Funds’ fiscal year. As the Managers describe in their letter that follows, a return to favor for high-quality companies and positive stock selection effects generated excess returns for each of the Funds. Importantly, and consistent with our expectations, the Funds’ outperformance has been driven by limiting downside return during the market’s declines.

This report includes our first report on the Conestoga Mid Cap Fund. We launched the Conestoga Mid Cap Fund on June 29, 2021, with initial funding from members of Conestoga Capital Advisors and our Funds’ Board of Trustees. We are excited to offer the mutual fund as a complement to our over ten-year track record of separate account management.

Also, we are excited to report that the Conestoga Funds will add a new fund later this year. The Conestoga Micro Cap Fund will focus on companies that are smaller and/or earlier-stage growth than those that would be candidates for our Small Cap Fund. We look forward to communicating more on the Micro Cap Fund in our future letters.

On behalf of my fellow trustees of the Conestoga Funds and my partners at Conestoga Capital Advisors, thank you for your continued investment in our Conestoga Funds.

Sincerely,

Robert M. Mitchell.

Robert M. Mitchell

Chairman and Chief Executive Officer

The Conestoga Funds

1

CONESTOGA FUNDS |

|

Dear Fellow Shareholders,

Market Review

Equity markets continued to move higher over the Conestoga Funds’ fiscal year ended September 30, 2021. Market participants watched closely for signs that the global economy would continue to rebound from the impact of COVID-19. The Federal Reserve communicated that its programs to support the economy would be “tapered” down in the quarters ahead and interest rates would likely rise in 2022. Expectations for a temporary spike in inflation are extending longer than expected, and supply chain bottlenecks and labor shortages persist across many sectors of the economy.

The above factors contributed to a rotation away from the companies that have benefited from the economic recovery since mid-2020. In the second half of the Funds’ fiscal year, this aided Conestoga as higher-quality companies (those expected to have more sustainable earnings growth, lower leverage, and higher returns on equity) generally outperformed lower-quality companies (unprofitable and highly levered). We expect the Conestoga Funds to outperform during more volatile and/or down markets, and we are pleased to report the Funds met these expectations over the recent quarters and trailing one-year period.

Markets face several uncertain challenges as 2021 comes to a close and 2022 comes into view. COVID-19 appears to be easing and vaccination rates are rising globally. This should support the continued re-opening of global economies, but any resurgence of COVID-19 cases could temper growth. We expect inflation to be less temporary than forecast, which may also introduce volatility into the market if interest rates rise, supply chain issues persist, and corporate earnings are impacted. Earnings comparisons in the year ahead will be more challenging given the higher base of current earnings against which future earnings will likely be judged, and the current high equity market valuations could be tested. Persistent political challenges surrounding spending packages, tax proposals and debt limits creates additional negative crosscurrents for investment markets.

Readers will note that we have added our recently launched Conestoga Mid Cap Fund (“Mid Cap Fund”) to this Annual Report. Our Mid Cap Fund began operations on June 29, 2021 and holds several “graduates” from our Conestoga Small Cap Fund (“Small Cap Fund”) and Conestoga SMid Cap Fund (“SMid Cap Fund”). Following the additions of investment team members Derek Johnston in 2015 and Ted Chang in 2020 – both of whom are co-portfolio managers on the Conestoga Mid Cap Fund – we believe we are well prepared to manage the Mid Cap Fund and we look forward to introducing the Fund to clients, advisors, and institutional consultants.

2

Returns for the Small Cap Fund, the SMid Cap Fund and the Mid Cap Fund for the periods through September 30, 2021, are below:

|

3Q |

YTD |

1 |

3 |

5 |

10 |

Since |

Conestoga Small Cap Fund (Investors Class) |

3.99% |

10.63% |

37.70% |

13.56% |

19.62% |

17.36% |

13.34% |

Russell 2000 Growth Index |

-5.65% |

2.82% |

33.27% |

11.70% |

15.34% |

15.74% |

12.16% |

|

3Q |

YTD |

1 |

3 |

5 |

|

Since |

Conestoga SMid Cap Fund (Investors Class) |

3.51% |

13.28% |

35.09% |

15.89% |

21.54% |

13.43% |

|

Russell 2500 Growth Index |

-3.53% |

4.84% |

31.98% |

16.01% |

18.21% |

13.25% |

|

3Q |

|

|

|

|

|

Since |

Conestoga Mid Cap Fund (Investors Class) |

4.04% |

3.10% |

|||||

Russell Mid Cap Growth Index |

-0.76% |

-1.20% |

* |

Note – All periods longer than one-year are annualized |

SMALL CAP FUND PERFORMANCE REVIEW

The Conestoga Small Cap Fund Investors Class rose 37.70% net of fees for the twelve months ended September 30, 2021, versus the Russell 2000 Growth Index return of 33.27%. Sector allocation accounted for a significant portion of the outperformance while stock selection also added to relative return. (Note: Conestoga’s sector allocations are driven by the bottom-up stock selection process, not a top-down sector view.)

Sector allocation was strongest within the Health Care, Industrials and Technology sectors, the three heaviest weighted sectors of the portfolio. Within Health Care, the portfolio’s biotech weight was significantly less than the Russell 2000 Growth Index’s weight. The biotech industry within the benchmark was up only 8.9% during the twelve-month period, and the underweight in the industry significantly enhanced the portfolio’s relative return. Within Industrials, the overweight of electronic equipment (Helios Technologies, Inc. (HLIO)), the construction industry (Construction Partners, Inc. (ROAD)) and the engineering and contracting services industry (Exponent, Inc. (EXPO)) were sources of positive relative return. The Small Cap Fund’s overweight of Technology (up 47%), which outperformed the broader benchmark, also enhanced our relative return over the last twelve months.

3

From a stock selection perspective, the portfolio had positive stock selection in seven out of the nine sectors (where we have exposure). As mentioned above, stock selection was strongest within the Health Care sector. A significant portion of the positive stock selection came from medical equipment companies (Cantel Medical Corp. (CMD) and Repligen Corporation (RGEN)) as well as health care services holdings (Omnicell Inc. (OMCL)). Stock selection within Consumer Discretionary, Basic Materials, Utilities and Real Estate were solid over the last twelve months ended September 30, 2021.

We added eight new stocks to the Small Cap Fund during the fiscal year ended September 30, 2021. Within Technology, we added Brooks Automation Inc. (BRKS), Shutterstock Inc. (SSTK), Simulations Plus (SLP), Vertex Inc. (VERX), and Workiva Inc. (WK). In Health Care, we added CareDX Inc. (CDNA) and Vericel Corp. (VCEL). In Industrials, we added Hillman Solutions Corp. (HLMN).

We also removed eight companies from the Small Cap Fund. Three companies were the target of mergers or acquisitions and were sold as a result: Cantel Medical Corp. (CMD), Five9 Inc. (FIVN) and RealPage Inc. (RP). Long-time holding Bio-Techne Corp. (TECH) was sold as its market capitalization rose. ACI Worldwide Inc. (ACIW), Bottomline Technologies (EPAY), Ligand Pharmaceuticals Inc. (LGND). and Proto Labs Inc. (PRLB) were sold on fundamental concerns.

SMID CAP FUND PERFORMANCE REVIEW

The Conestoga SMid Cap Fund Investors Class rose 35.09% net-of-fees for the year ended September 30, 2021, versus the Russell 2500 Growth Index return of 31.98%. We were pleased to observe that the portfolio generated returns consistent with our expectations. During the “up period” from March 2020 through mid-first quarter 2021, the SMid Cap Fund lagged as lower-quality companies propelled the market higher. As volatility increased and the market pulled back from its highs in mid-February 2021, the SMid Cap Fund performed better on a relative basis. The market favored high-quality stocks in the third quarter, 2021, during which the SMid Cap Fund outperformed the benchmark by a wider margin.

As with the Small Cap Fund above, sector allocation accounted for a significant portion of the outperformance while stock selection also added to relative return. Sector allocation was strongest within the Industrials, Health Care, and Consumer Staples sectors. Within Health Care, portfolio’s biotech weight was significantly less than the Russell 2500 Growth Index’s weight. The biotech industry was up only 12.3% for the twelve-month period, and the underweight in the industry significantly enhanced the portfolio’s relative return.

Within Industrials, the overweight in machinery (Generac Holdings, Inc. (GNRC)), the construction industry (Construction Partners, Inc. (ROAD)) and the engineering and contracting services industry (Exponent, Inc. (EXPO)) were sources of positive relative return. The SMid Cap Fund’s lack of exposure to the Consumer Staples sector which underperformed the broader benchmark, also enhanced our relative return over the last twelve months.

From a stock selection perspective, the portfolio had positive stock selection in five out of the seven sectors (where we have exposure). As mentioned above, stock selection was strongest within the Health Care sector. A significant portion of the positive stock selection

4

came from Omnicell, Inc. (OMCL), Repligen Corp (RGEN), and Bio-Techne Corp. (TECH). Stock selection within Consumer Discretionary, Basic Materials, Utilities, Technology and Real Estate were solid over the last twelve months ended September 30, 2021.

Conestoga added nine new companies to the SMid Cap Fund during the fiscal year ended September 30, 2021. Within Technology, we added Avalara Inc. (AVLR), Five9 Inc. (FIVN), Lightspeed Commerce Inc. (LSPD), Novanta Inc. (NOVT), Q2 Holdings Inc. (QTWO), and Workiva Inc. (WK). In Health Care, we added CareDX Inc. (CDNA) and Definitive Healthcare Corp. (DH) and within Industrials, we added Hillman Solutions Corp. (HLMN.)

Eight stocks were removed from the SMid Cap Fund during the fiscal year ended September 30, 2021. Five9 Inc. (FIVN) and RealPage Inc. (RP) were sold after the announcement of acquisitions. Of note, the acquisition of Five9 Inc. by Zoom Communications Inc. (ZM) was not completed and, as a result, we repurchased Five9 Inc. into the SMid Cap Fund in early October 2021. ACI Worldwide, Inc. (ACIW), Bottomline Technologies Inc. (EPAY), Ligand Pharmaceuticals Inc. (LGND), and Pluralsight Inc. (PS) were sold on fundamental concerns to fund purchases in higher conviction holdings. Ansys Inc. (ANSS) and Copart Inc. (CPRT) were sold as their market capitalizations rose to higher levels.

MID CAP FUND PERFORMANCE REVIEW

The Conestoga Mid Cap Fund was launched on June 29, 2021. We are happy to report that the Mid Cap Fund got off to a good start, rising 3.10% from inception through September 30, 2021. This compares to the Russell Mid Cap Growth Index decline of -1.20% over the same period. The Mid Cap Fund benefited from the return to “high quality” factor leadership that was prevalent in the equity market over the summer of 2021. Profitable companies as measured by Return on Invested Capital (ROIC) and operating earnings before interest, taxes, depreciation and amortization (EBITDA) margins significantly outperformed high beta, non-earning companies.

In the Technology sector, strong stock selection was the primary driver of excess returns. Performance was broad-based as seven of the ten holdings within the sector generated positive returns with Fortinet Inc. (FTNT), Gartner Inc. (IT), and Lightspeed Commerce Inc. (LSPD) being the largest gainers. FTNT traded higher following an earnings report that saw revenue and billings accelerate to multi-year highs. Shares of IT were also up for the quarter as sales and earnings exceeded expectations.

Health Care generated positive stock selection effects led by West Pharmaceuticals Inc. (WST), Align Technology Inc. (ALGN), and Bio-Techne Corp. (TECH). WST continues to benefit from strength in its core, pre-pandemic business as well as outperformance in COVID-19 vaccine revenue. The portfolio also received a boost from its lack of exposure to the underperforming biotechnology industry.

Broad-based gains were seen in Consumer Discretionary with five of the seven names in the sector generating positive returns for the quarter ended September 30, 2021. Copart Inc. (CPRT), Tractor Supply Company (TSCO) and Rollins Inc. (ROL) were the largest contributors to relative gains. Vehicle salvage auctioneer CPRT continues to benefit from double-digit pricing, buoyed by a shortage of vehicles, which led to a top- and bottom-line beat during the most recent quarter.

5

There were also a few names that detracted from returns, most notably Coupa Software Inc. (COUP), Graco Inc. (GGG) and Veeva Systems Inc. (VEEV). While financial results for COUP were solid, beating consensus estimates handily, there has been debate around the organic growth of the business and billings guidance. Shares of GGG drifted lower in September 2021 as various industrial companies warned about supply chain shortages and rising input costs. VEEV’s stock price was relatively weak due to concerns sales force reductions in the pharmaceutical industry, which could lower the company’s growth prospects.

CONESTOGA CAPITAL ADVISORS, LLC FIRM UPDATE

Conestoga Capital Advisors, LLC (“Conestoga”) celebrated its 20th anniversary on July 1, 2021. From our initial base of $80 million in client assets and a two- and one-half-year track record, we have grown to a firm of over $8 billion in assets. We very sincerely thank those Fund shareholders, clients, consultants, and advisors who have placed their confidence in our team and our investment approach over the past two decades!

As of September 30, 2021, Conestoga’s total assets were $8.5 billion, an all-time high for the firm. The breakdown of assets across the four primary investment strategies was:

● Small Cap Growth: |

$6.9 billion |

● SMid Cap Growth: |

$1.5 billion |

● Micro Cap Growth: |

$55.9 million |

● Mid Cap Growth: |

$27.0 million |

Conestoga is not actively pursuing new Small Cap Growth separate account placements and the Small Cap Fund remains in soft-close. The Small Cap Fund experienced net inflows over the fiscal year ended September 30, 2021 of $183 million. We are primarily focused on growing the assets of our SMid Cap Fund and SMid Cap Growth separate account strategy. Over the twelve months ended September 30, 2021, the SMid Cap Fund experienced net inflows of $89 million.

Conestoga has filed to create a Micro Cap mutual fund, which we expect to launch in December 2021. We look forward to introducing this strategy to prospective investors. Conestoga has managed a Micro Cap limited partnership since 2018 and a separate account since 2019. We expect to more actively market the Mid Cap Fund and Micro Cap Fund in the year ahead.

In August of 2021, Conestoga continued our program of expanding ownership across the firm. This year. we transitioned ownership to eight partners. Twelve of our fourteen members are owners of Conestoga.

Lastly, after working remotely since March of 2020, Conestoga began to return to the office in June 2021. Any team member that was fully vaccinated was invited to return. On a typical day, more than half of our staff now works in the office. We continue to monitor local developments and will adjust our work plans as warranted.

6

On behalf of all the members of Conestoga, we thank you for your investment in the Funds.

Sincerely,

Robert M. Mitchell |

Joseph F. Monahan |

Derek S. Johnston |

Ted Chang |

7

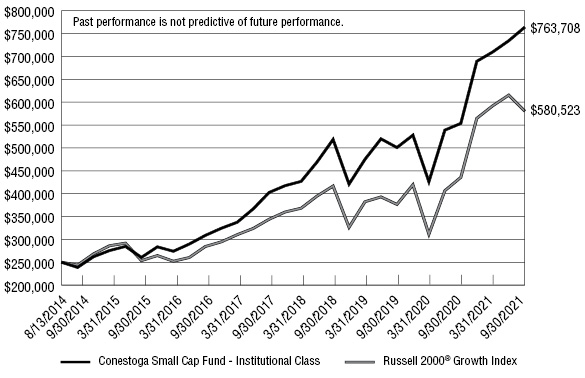

CONESTOGA SMALL CAP FUND - INSTITUTIONAL CLASS |

Comparison of the Change in Value of a $250,000 Investment in

Conestoga Small Cap Fund – Institutional Class (since inception on 08/13/2014) versus the Russell 2000® Growth Index

Average Annual Total Returns for the Periods Ended September 30, 2021 |

|||||

1 Year |

3 Years |

5 Years |

Since |

||

Conestoga Small Cap Fund - Institutional Class |

37.96% |

13.79% |

19.86% |

16.95% |

|

Russell 2000® Growth Index |

33.27% |

11.70% |

15.34% |

12.54% |

|

The Fund’s past performance does not predict its future performance. The graph and table shown above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares but does reflect the reinvestment of all dividends and distributions. The Fund’s benchmark, the Russell 2000® Growth Index, measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000® companies with higher price-to-value ratios and higher forecasted growth values. The Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities in the Russell 3000® Index based on a combination of their market capitalization and current index membership.

8

CONESTOGA SMALL CAP FUND - INVESTORS CLASS |

10 Year Comparison of the Change in Value of a $10,000

Investment in Conestoga Small Cap Fund – Investors Class

versus the Russell 2000® Growth Index

Average Annual Total Returns for the Periods Ended September 30, 2021 |

|||||||

1 Year |

3 Years |

5 Years |

10 Years |

15 Years |

Since |

||

Conestoga Small Cap Fund - Investors Class |

37.70% |

13.56% |

19.62% |

17.36% |

12.57% |

13.34% |

|

Russell 2000® Growth Index |

33.27% |

11.70% |

15.34% |

15.74% |

10.59% |

12.16% |

|

The Fund’s past performance does not predict its future performance. The graph and table shown above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares but does reflect the reinvestment of all dividends and distributions. The Fund’s benchmark, the Russell 2000® Growth Index, measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000® companies with higher price-to-value ratios and higher forecasted growth values. The Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities in the Russell 3000® Index based on a combination of their market capitalization and current index membership.

9

CONESTOGA SMID CAP FUND - INSTITUTIONAL CLASS |

Comparison of the Change in Value of a $250,000 Investment in

Conestoga SMid Cap Fund – Institutional Class (since inception on 12/15/2014) versus the Russell 2500® Growth Index

Average Annual Total Returns for the Periods Ended September 30, 2021 |

|||||

1 Year |

3 Years |

5 Years |

Since |

||

Conestoga SMid Cap Fund - Institutional Class |

35.46% |

16.16% |

21.83% |

17.59% |

|

Russell 2500® Growth Index |

31.98% |

16.01% |

18.21% |

15.02% |

|

The Fund’s past performance does not predict its future performance. The graph and table shown above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares but does reflect the reinvestment of all dividends and distributions. The Fund’s benchmark, the Russell 2500® Growth Index, measures the performance of the small- to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500® companies with higher growth earnings potential as defined by Russell’s leading style methodology. The Russell 2500® Index measures the performance of the small- to mid-cap segment of the U.S. equity universe, commonly referred to as “smid” cap. The Russell 2500® Index is a subset of the Russell 3000® Index. It includes approximately 2500 of the smallest securities in the Russell 3000® Index based on a combination of their market capitalization and current index membership.

10

CONESTOGA SMID CAP FUND - INVESTORS CLASS |

Comparison of the Change in Value of a $10,000 Investment in

Conestoga SMid Cap Fund – Investors Class (since inception on 01/21/2014) versus the Russell 2500® Growth Index

Average Annual Total Returns for the Periods Ended September 30, 2021 |

|||||

1 Year |

3 Years |

5 Years |

Since |

||

Conestoga SMid Cap Fund - Investors Class |

35.09% |

15.89% |

21.54% |

13.43% |

|

Russell 2500® Growth Index |

31.98% |

16.01% |

18.21% |

13.25% |

|

The Fund’s past performance does not predict its future performance. The graph and table shown above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares but does reflect the reinvestment of all dividends and distributions. The Fund’s benchmark, the Russell 2500® Growth Index, measures the performance of the small- to mid-cap growth segment of the U.S. equity universe. It includes those Russell 2500® companies with higher growth earnings potential as defined by Russell’s leading style methodology. The Russell 2500® Index measures the performance of the small- to mid-cap segment of the U.S. equity universe, commonly referred to as “smid” cap. The Russell 2500® Index is a subset of the Russell 3000® Index. It includes approximately 2500 of the smallest securities in the Russell 3000® Index based on a combination of their market capitalization and current index membership.

11

CONESTOGA MID CAP FUND - INSTITUTIONAL CLASS |

Comparison of the Change in Value of a $250,000 Investment in

Conestoga Mid Cap Fund – Institutional Class (since inception on 6/29/2021)

versus the Russell Midcap® Growth Index

Total Returns for the Period Ended September 30, 2021 |

|||||

Since |

|||||

Conestoga Mid Cap Fund - Institutional Class |

3.20% |

||||

Russell Midcap® Growth Index |

(1.20%) |

||||

The Fund’s past performance does not predict its future performance. The graph and table shown above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares but does reflect the reinvestment of all dividends and distributions. The Fund’s benchmark, the Russell Midcap® Growth Index, measures the performance of the mid-cap growth segment of the U.S. equity universe. It includes those Russell Midcap® Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell Midcap® Growth Index is constructed to provide a comprehensive and unbiased barometer of the mid-cap growth market. The index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true mid-cap growth market.

12

CONESTOGA MID CAP FUND - INVESTORS CLASS |

Comparison of the Change in Value of a $10,000 Investment in

Conestoga Mid Cap Fund – Investors Class (since inception on 6/29/2021)

versus the Russell Midcap® Growth Index

Total Returns for the Period Ended September 30, 2021 |

|||||

Since |

|||||

Conestoga Mid Cap Fund - Investors Class |

3.10% |

||||

Russell Midcap® Growth Index |

(1.20%) |

||||

The Fund’s past performance does not predict its future performance. The graph and table shown above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares but does reflect the reinvestment of all dividends and distributions. The Fund’s benchmark, the Russell Midcap® Growth Index, measures the performance of the mid-cap growth segment of the U.S. equity universe. It includes those Russell Midcap® Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell Midcap® Growth Index is constructed to provide a comprehensive and unbiased barometer of the mid-cap growth market. The index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true mid-cap growth market.

13

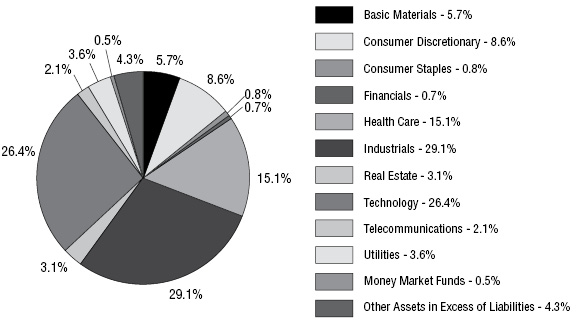

CONESTOGA SMALL CAP FUND |

Diversification*

(% of Net Assets)

Top Ten Equity Holdings

Security Description |

% of Net Assets |

|

SPS Commerce, Inc. |

4.2% |

|

Casella Waste Systems, Inc. - Class A |

3.6% |

|

Descartes Systems Group, Inc. (The) |

3.5% |

|

Fox Factory Holding Corporation |

3.5% |

|

Repligen Corporation |

3.4% |

|

SiteOne Landscape Supply, Inc. |

3.4% |

|

Exponent, Inc. |

3.1% |

|

FirstService Corporation |

3.1% |

|

Paylocity Holding Corporation |

3.1% |

|

Omnicell, Inc. |

2.9% |

* |

Industry categories represent the industry assigned at the time of purchase. See Note 7 of the Notes to Financial Statements. |

14

CONESTOGA SMALL CAP FUND |

||||||||

COMMON STOCKS — 95.2% |

Shares |

Value |

||||||

Basic Materials — 5.7% |

||||||||

Metal Fabricating — 3.5% |

||||||||

Omega Flex, Inc. |

374,370 | $ | 53,418,855 | |||||

RBC Bearings, Inc. (a) |

471,550 | 100,062,910 | ||||||

| 153,481,765 | ||||||||

Specialty Chemicals — 2.2% |

||||||||

Balchem Corporation |

639,435 | 92,762,835 | ||||||

Consumer Discretionary — 8.6% |

||||||||

Auto Parts — 0.8% |

||||||||

Dorman Products, Inc. (a) |

390,464 | 36,965,227 | ||||||

Education Services — 0.9% |

||||||||

Grand Canyon Education, Inc. (a) |

445,655 | 39,199,814 | ||||||

Home Improvement Retailers — 3.4% |

||||||||

SiteOne Landscape Supply, Inc. (a) |

740,530 | 147,713,519 | ||||||

Recreational Products — 3.5% |

||||||||

Fox Factory Holding Corporation (a) |

1,039,513 | 150,251,209 | ||||||

Consumer Staples — 0.8% |

||||||||

Nondurable Household Products — 0.8% |

||||||||

WD-40 Company |

160,293 | 37,104,624 | ||||||

Financials — 0.7% |

||||||||

Financial Data Providers — 0.7% |

||||||||

Computer Services, Inc. |

521,251 | 30,753,809 | ||||||

Health Care — 15.1% |

||||||||

Biotechnology — 1.2% |

||||||||

Vericel Corporation (a) |

1,074,015 | 52,411,932 | ||||||

Health Care Management Services — 0.4% |

||||||||

National Research Corporation |

433,399 | 18,276,436 | ||||||

Health Care Services — 2.9% |

||||||||

Omnicell, Inc. (a) |

859,855 | 127,628,278 | ||||||

15

CONESTOGA SMALL CAP FUND |

||||||||

COMMON STOCKS — 95.2% (Continued) |

Shares |

Value |

||||||

Health Care — 15.1% (Continued) |

||||||||

Medical Equipment — 5.8% |

||||||||

CareDx, Inc. (a) |

534,864 | $ | 33,894,332 | |||||

LeMaitre Vascular, Inc. (b) |

1,274,721 | 67,674,938 | ||||||

Repligen Corporation (a) |

514,735 | 148,753,268 | ||||||

| 250,322,538 | ||||||||

Medical Supplies — 4.8% |

||||||||

Merit Medical Systems, Inc. (a) |

1,490,395 | 107,010,361 | ||||||

Neogen Corporation (a) |

2,316,272 | 100,595,693 | ||||||

| 207,606,054 | ||||||||

Industrials — 29.1% |

||||||||

Building Materials: Other — 5.8% |

||||||||

Hillman Solutions Corporation (a) |

4,957,850 | 59,147,150 | ||||||

Simpson Manufacturing Company, Inc. |

866,415 | 92,680,412 | ||||||

Trex Company, Inc. (a) |

978,485 | 99,736,976 | ||||||

| 251,564,538 | ||||||||

Building: Climate Control — 1.8% |

||||||||

AAON, Inc. |

1,210,050 | 79,064,667 | ||||||

Construction — 2.4% |

||||||||

Construction Partners, Inc. - Class A (a)(b) |

3,117,891 | 104,044,023 | ||||||

Defense — 4.0% |

||||||||

Axon Enterprise, Inc. (a) |

573,110 | 100,305,712 | ||||||

Mercury Systems, Inc. (a) |

1,551,523 | 73,573,221 | ||||||

| 173,878,933 | ||||||||

Diversified Industrials — 1.1% |

||||||||

ESCO Technologies, Inc. |

646,005 | 49,742,385 | ||||||

Electronic Equipment: Control & Filter — 2.0% |

||||||||

Helios Technologies, Inc. |

1,068,207 | 87,710,477 | ||||||

Electronic Equipment: Gauges & Meters — 2.4% |

||||||||

Mesa Laboratories, Inc. (b) |

354,081 | 107,059,931 | ||||||

Engineering & Contracting Services — 3.1% |

||||||||

Exponent, Inc. |

1,196,555 | 135,390,198 | ||||||

Machinery: Construction & Handling — 1.0% |

||||||||

Douglas Dynamics, Inc. (b) |

1,224,465 | 44,448,079 | ||||||

16

CONESTOGA SMALL CAP FUND |

||||||||

COMMON STOCKS — 95.2% (Continued) |

Shares |

Value |

||||||

Industrials — 29.1% (Continued) |

||||||||

Machinery: Industrial — 2.4% |

||||||||

EVI Industries, Inc. (a) |

519,322 | $ | 14,125,558 | |||||

John Bean Technologies Corporation |

631,180 | 88,712,349 | ||||||

| 102,837,907 | ||||||||

Professional Business Support Services — 3.1% |

||||||||

Paylocity Holding Corporation (a) |

476,745 | 133,679,298 | ||||||

Real Estate — 3.1% |

||||||||

Real Estate Services — 3.1% |

||||||||

FirstService Corporation |

748,560 | 135,100,109 | ||||||

Technology — 26.4% |

||||||||

Computer Services — 1.4% |

||||||||

Workiva, Inc. (a) |

443,300 | 62,487,568 | ||||||

Consumer Digital Services — 0.8% |

||||||||

Shutterstock, Inc. |

320,805 | 36,353,623 | ||||||

Electronic Components — 1.3% |

||||||||

Rogers Corporation (a) |

295,960 | 55,190,621 | ||||||

Production Technology Equipment — 4.6% |

||||||||

Brooks Automation, Inc. |

827,000 | 84,643,450 | ||||||

Novanta, Inc. (a) |

731,020 | 112,942,590 | ||||||

| 197,586,040 | ||||||||

Software — 18.3% |

||||||||

Altair Engineering, Inc. - Class A (a) |

1,453,555 | 100,208,082 | ||||||

BlackLine, Inc. (a) |

953,840 | 112,610,350 | ||||||

Descartes Systems Group, Inc. (The) (a) |

1,851,846 | 150,481,006 | ||||||

Model N, Inc. (a)(b) |

2,553,844 | 85,553,774 | ||||||

PROS Holdings, Inc. (a) |

1,436,840 | 50,979,083 | ||||||

Q2 Holdings, Inc. (a) |

600,640 | 48,135,289 | ||||||

Simulations Plus, Inc. |

905,596 | 35,771,042 | ||||||

SPS Commerce, Inc. (a) |

1,123,580 | 181,244,690 | ||||||

Vertex, Inc. - Class A (a) |

1,682,790 | 32,343,224 | ||||||

| 797,326,540 | ||||||||

Telecommunications — 2.1% |

||||||||

Telecommunications Equipment — 2.1% |

||||||||

Vocera Communications, Inc. (a)(b) |

2,004,504 | 91,726,103 | ||||||

17

CONESTOGA SMALL CAP FUND |

||||||||

COMMON STOCKS — 95.2% (Continued) |

Shares |

Value |

||||||

Utilities — 3.6% |

||||||||

Waste & Disposal Services — 3.6% |

||||||||

Casella Waste Systems, Inc. - Class A (a) |

2,045,385 | $ | 155,326,537 | |||||

Total Common Stocks (Cost $2,153,519,264) |

$ | 4,144,995,617 | ||||||

|

||||||||

MONEY MARKET FUNDS — 0.5% |

Shares |

Value |

||||||

Fidelity Investments Treasury Only Portfolio - Institutional Shares, 0.01% (c) (Cost $20,857,171) |

20,857,171 | $ | 20,857,171 | |||||

Total Investments at Value — 95.7% (Cost $2,174,376,435) |

$ | 4,165,852,788 | ||||||

Other Assets in Excess of Liabilities — 4.3% |

188,570,334 | |||||||

Net Assets — 100.0% |

$ | 4,354,423,122 | ||||||

(a) |

Non-income producing security. |

(b) |

The Fund owned 5% or more of the company’s outstanding voting shares thereby making the company an affiliate of the Fund as that term is defined in the Investment Company Act of 1940 (Note 5). |

(c) |

The rate shown is the 7-day effective yield as of September 30, 2021. |

Schedule of Investments uses the Russell ICB Industry and Sector classification. |

|

See accompanying notes to financial statements. |

|

18

CONESTOGA SMID CAP FUND |

Diversification*

(% of Net Assets)

Top Ten Equity Holdings

Security Description |

% of Net Assets |

|

Casella Waste Systems, Inc. - Class A |

3.9% |

|

Exponent, Inc. |

3.4% |

|

Omnicell, Inc. |

3.4% |

|

Repligen Corporation |

3.3% |

|

West Pharmaceutical Services, Inc. |

3.1% |

|

Bio-Techne Corporation |

3.0% |

|

Pool Corporation |

2.8% |

|

Descartes Systems Group, Inc. (The) |

2.7% |

|

FirstService Corporation |

2.6% |

|

SPS Commerce, Inc. |

2.5% |

* |

Industry categories represent the industry assigned at the time of purchase. See Note 7 of the Notes to Financial Statements. |

19

CONESTOGA SMID CAP FUND |

||||||||

COMMON STOCKS — 95.0% |

Shares |

Value |

||||||

Basic Materials — 3.2% |

||||||||

Metal Fabricating — 2.1% |

||||||||

RBC Bearings, Inc. (a) |

40,916 | $ | 8,682,375 | |||||

Specialty Chemicals — 1.1% |

||||||||

Balchem Corporation |

33,375 | 4,841,711 | ||||||

Consumer Discretionary — 15.2% |

||||||||

Consumer Services: Miscellaneous — 4.0% |

||||||||

IAA, Inc. (a) |

118,665 | 6,475,549 | ||||||

Rollins, Inc. |

289,937 | 10,243,474 | ||||||

| 16,719,023 | ||||||||

Education Services — 2.8% |

||||||||

Bright Horizons Family Solutions, Inc. (a) |

65,620 | 9,148,740 | ||||||

Grand Canyon Education, Inc. (a) |

28,395 | 2,497,624 | ||||||

| 11,646,364 | ||||||||

Home Improvement Retailers — 2.5% |

||||||||

SiteOne Landscape Supply, Inc. (a) |

52,145 | 10,401,363 | ||||||

Hotels & Motels — 2.0% |

||||||||

Vail Resorts, Inc. (a) |

25,620 | 8,558,361 | ||||||

Recreational Products — 2.8% |

||||||||

Pool Corporation |

27,370 | 11,889,802 | ||||||

Recreational Vehicles & Boats — 1.1% |

||||||||

LCI Industries |

34,625 | 4,661,564 | ||||||

Health Care — 20.4% |

||||||||

Health Care Services — 5.0% |

||||||||

Definitive Healthcare Corporation (a) |

37,795 | 1,618,760 | ||||||

Health Catalyst, Inc. (a) |

101,205 | 5,061,262 | ||||||

Omnicell, Inc. (a) |

96,035 | 14,254,475 | ||||||

| 20,934,497 | ||||||||

Medical Equipment — 4.1% |

||||||||

CareDx, Inc. (a) |

56,314 | 3,568,618 | ||||||

Repligen Corporation (a) |

47,980 | 13,865,740 | ||||||

| 17,434,358 | ||||||||

20

CONESTOGA SMID CAP FUND |

||||||||

COMMON STOCKS — 95.0% (Continued) |

Shares |

Value |

||||||

Health Care — 20.4% (Continued) |

||||||||

Medical Supplies — 11.3% |

||||||||

Bio-Techne Corporation |

26,070 | $ | 12,632,740 | |||||

Merit Medical Systems, Inc. (a) |

96,038 | 6,895,528 | ||||||

Neogen Corporation (a) |

160,086 | 6,952,535 | ||||||

Teleflex, Inc. |

21,265 | 8,007,336 | ||||||

West Pharmaceutical Services, Inc. |

31,019 | 13,168,806 | ||||||

| 47,656,945 | ||||||||

Industrials — 30.5% |

||||||||

Aerospace — 1.6% |

||||||||

HEICO Corporation - Class A |

55,755 | 6,603,065 | ||||||

Building Materials: Other — 6.2% |

||||||||

Hillman Solutions Corporation (a) |

368,010 | 4,390,359 | ||||||

Simpson Manufacturing Company, Inc. |

45,915 | 4,911,528 | ||||||

Trex Company, Inc. (a) |

94,090 | 9,590,594 | ||||||

Watsco, Inc. |

27,130 | 7,179,141 | ||||||

| 26,071,622 | ||||||||

Construction — 2.2% |

||||||||

Construction Partners, Inc. - Class A (a) |

283,765 | 9,469,238 | ||||||

Containers & Packaging — 1.1% |

||||||||

AptarGroup, Inc. |

40,130 | 4,789,515 | ||||||

Defense — 4.0% |

||||||||

Axon Enterprise, Inc. (a) |

56,545 | 9,896,506 | ||||||

Mercury Systems, Inc. (a) |

145,825 | 6,915,022 | ||||||

| 16,811,528 | ||||||||

Electronic Equipment: Gauges & Meters — 1.8% |

||||||||

Cognex Corporation |

94,785 | 7,603,653 | ||||||

Engineering & Contracting Services — 3.4% |

||||||||

Exponent, Inc. |

127,405 | 14,415,876 | ||||||

Machinery: Construction & Handling — 1.1% |

||||||||

Douglas Dynamics, Inc. |

127,557 | 4,630,319 | ||||||

Machinery: Engines — 1.8% |

||||||||

Generac Holdings, Inc. (a) |

18,400 | 7,519,528 | ||||||

21

CONESTOGA SMID CAP FUND |

||||||||

COMMON STOCKS — 95.0% (Continued) |

Shares |

Value |

||||||

Industrials — 30.5% (Continued) |

||||||||

Machinery: Industrial — 2.2% |

||||||||

EVI Industries, Inc. (a) |

82,850 | $ | 2,253,520 | |||||

John Bean Technologies Corporation |

48,605 | 6,831,433 | ||||||

| 9,084,953 | ||||||||

Machinery: Specialty — 1.8% |

||||||||

Graco, Inc. |

109,540 | 7,664,514 | ||||||

Professional Business Support Services — 1.3% |

||||||||

Fair Isaac Corporation (a) |

13,970 | 5,559,082 | ||||||

Transaction Processing Services — 2.0% |

||||||||

Jack Henry & Associates, Inc. |

52,320 | 8,583,619 | ||||||

Real Estate — 2.6% |

||||||||

Real Estate Services — 2.6% |

||||||||

FirstService Corporation |

60,510 | 10,920,845 | ||||||

Technology — 19.2% |

||||||||

Computer Services — 5.4% |

||||||||

Gartner, Inc. (a) |

25,670 | 7,800,600 | ||||||

Tyler Technologies, Inc. (a) |

19,830 | 9,095,030 | ||||||

Workiva, Inc. (a) |

40,115 | 5,654,610 | ||||||

| 22,550,240 | ||||||||

Production Technology Equipment — 1.1% |

||||||||

Novanta, Inc. (a) |

30,600 | 4,727,700 | ||||||

Software — 12.7% |

||||||||

Altair Engineering, Inc. - Class A (a) |

82,570 | 5,692,376 | ||||||

Avalara, Inc. (a) |

38,455 | 6,720,780 | ||||||

Descartes Systems Group, Inc. (The) (a) |

141,875 | 11,528,763 | ||||||

Guidewire Software, Inc. (a) |

65,745 | 7,815,108 | ||||||

Lightspeed Commerce, Inc. (a) |

68,765 | 6,631,009 | ||||||

Q2 Holdings, Inc. (a) |

60,265 | 4,829,637 | ||||||

SPS Commerce, Inc. (a) |

65,084 | 10,498,700 | ||||||

| 53,716,373 | ||||||||

22

CONESTOGA SMID CAP FUND |

||||||||

COMMON STOCKS — 95.0% (Continued) |

Shares |

Value |

||||||

Utilities — 3.9% |

||||||||

Waste & Disposal Services — 3.9% |

||||||||

Casella Waste Systems, Inc. - Class A (a) |

217,875 | $ | 16,545,427 | |||||

Total Investments at Value — 95.0% (Cost $253,040,216) |

400,693,460 | |||||||

Other Assets in Excess of Liabilities — 5.0% |

20,973,717 | |||||||

Net Assets — 100.0% |

$ | 421,667,177 | ||||||

(a) |

Non-income producing security. |

Schedule of Investments uses the Russell ICB Industry and Sector classification. |

|

See accompanying notes to financial statements. |

|

23

CONESTOGA MID CAP FUND |

Diversification*

(% of Net Assets)

Top Ten Equity Holdings

Security Description |

% of Net Assets |

|

West Pharmaceutical Services, Inc. |

5.8% |

|

Copart, Inc. |

5.2% |

|

Fortinet, Inc. |

4.1% |

|

Bio-Techne Corporation |

3.9% |

|

CoStar Group, Inc. |

3.9% |

|

Align Technology, Inc. |

3.8% |

|

ANSYS, Inc. |

3.4% |

|

Pool Corporation |

3.2% |

|

Gartner, Inc. |

3.2% |

|

Verisk Analytics, Inc. |

3.2% |

* |

Industry categories represent the industry assigned at the time of purchase. See Note 7 of the Notes to Financial Statements. |

24

CONESTOGA MID CAP FUND |

||||||||

COMMON STOCKS — 98.5% |

Shares |

Value |

||||||

Basic Materials — 1.5% |

||||||||

Metal Fabricating — 1.5% |

||||||||

Fastenal Company |

495 | $ | 25,547 | |||||

Consumer Discretionary — 18.7% |

||||||||

Consumer Services: Miscellaneous — 8.1% |

||||||||

Copart, Inc. (a) |

655 | 90,863 | ||||||

Rollins, Inc. |

1,395 | 49,285 | ||||||

| 140,148 | ||||||||

Education Services — 2.1% |

||||||||

Bright Horizons Family Solutions, Inc. (a) |

265 | 36,946 | ||||||

Hotels & Motels — 2.6% |

||||||||

Vail Resorts, Inc. (a) |

135 | 45,097 | ||||||

Recreational Products — 3.2% |

||||||||

Pool Corporation |

130 | 56,473 | ||||||

Specialty Retail — 2.7% |

||||||||

Tractor Supply Company |

230 | 46,600 | ||||||

Financials — 2.5% |

||||||||

Financial Data Providers — 2.5% |

||||||||

FactSet Research Systems, Inc. |

110 | 43,426 | ||||||

Health Care — 25.8% |

||||||||

Health Care Services — 3.0% |

||||||||

Veeva Systems, Inc. - Class A (a) |

180 | 51,871 | ||||||

Medical Equipment — 6.5% |

||||||||

IDEXX Laboratories, Inc. (a) |

90 | 55,971 | ||||||

Masimo Corporation (a) |

105 | 28,425 | ||||||

STERIS plc |

140 | 28,599 | ||||||

| 112,995 | ||||||||

Medical Supplies — 16.3% |

||||||||

Align Technology, Inc. (a) |

100 | 66,543 | ||||||

Bio-Techne Corporation |

140 | 67,839 | ||||||

Teleflex, Inc. |

130 | 48,952 | ||||||

West Pharmaceutical Services, Inc. |

235 | 99,766 | ||||||

| 283,100 | ||||||||

25

CONESTOGA MID CAP FUND |

||||||||

COMMON STOCKS — 98.5% (Continued) |

Shares |

Value |

||||||

Industrials — 18.8% |

||||||||

Aerospace — 3.0% |

||||||||

HEICO Corporation - Class A |

435 | $ | 51,517 | |||||

Containers & Packaging — 2.0% |

||||||||

Ball Corporation |

390 | 35,088 | ||||||

Electronic Equipment: Gauges & Meters — 1.5% |

||||||||

Cognex Corporation |

320 | 25,670 | ||||||

Electronic Equipment: Pollution Control — 1.6% |

||||||||

Xylem, Inc. |

225 | 27,828 | ||||||

Machinery: Specialty — 2.6% |

||||||||

Graco, Inc. |

635 | 44,431 | ||||||

Professional Business Support Services — 5.2% |

||||||||

TransUnion |

310 | 34,816 | ||||||

Verisk Analytics, Inc. |

280 | 56,076 | ||||||

| 90,892 | ||||||||

Transaction Processing Services — 2.9% |

||||||||

Jack Henry & Associates, Inc. |

310 | 50,859 | ||||||

Real Estate — 3.9% |

||||||||

Real Estate Services — 3.9% |

||||||||

CoStar Group, Inc. (a) |

785 | 67,557 | ||||||

Technology — 24.6% |

||||||||

Computer Services — 5.9% |

||||||||

Gartner, Inc. (a) |

185 | 56,218 | ||||||

Tyler Technologies, Inc. (a) |

100 | 45,865 | ||||||

| 102,083 | ||||||||

Software — 18.7% |

||||||||

ANSYS, Inc. (a) |

175 | 59,579 | ||||||

Avalara, Inc. (a) |

195 | 34,080 | ||||||

Coupa Software, Inc. (a) |

125 | 27,398 | ||||||

Fortinet, Inc. (a) |

245 | 71,549 | ||||||

Guidewire Software, Inc. (a) |

275 | 32,689 | ||||||

Lightspeed Commerce, Inc. (a) |

355 | 34,233 | ||||||

Qualtrics International, Inc. - Class A (a) |

745 | 31,841 | ||||||

Roper Technologies, Inc. |

75 | 33,460 | ||||||

| 324,829 | ||||||||

26

CONESTOGA MID CAP FUND |

||||||||

COMMON STOCKS — 98.5% (Continued) |

Shares |

Value |

||||||

Utilities — 2.7% |

||||||||

Waste & Disposal Services — 2.7% |

||||||||

Waste Connections, Inc. |

365 | $ | 45,964 | |||||

Total Investments at Value — 98.5% (Cost $1,671,900) |

$ | 1,708,921 | ||||||

Other Assets in Excess of Liabilities — 1.5% |

26,096 | |||||||

Net Assets — 100.0% |

$ | 1,735,017 | ||||||

(a) |

Non-income producing security. |

Schedule of Investments uses the Russell ICB Industry and Sector classification. |

|

See accompanying notes to financial statements. |

|

27

CONESTOGA FUNDS |

||||||||||||

|

Conestoga |

Conestoga |

Conestoga |

|||||||||

ASSETS |

||||||||||||

Investments in unaffiliated securities, at cost |

$ | 1,848,128,819 | $ | 253,040,216 | $ | 1,671,900 | ||||||

Investments in affiliated securities, at cost |

326,247,616 | — | — | |||||||||

Total investments, at cost |

$ | 2,174,376,435 | $ | 253,040,216 | $ | 1,671,900 | ||||||

Investments in unaffiliated securities, at value (Note 2) |

$ | 3,665,345,940 | $ | 400,693,460 | $ | 1,708,921 | ||||||

Investments in affiliated securities, at value (Notes 2 & 5) |

500,506,848 | — | — | |||||||||

Total investments, at value |

4,165,852,788 | 400,693,460 | 1,708,921 | |||||||||

Cash (Note 2) |

207,034,410 | 22,240,799 | 49,117 | |||||||||

Receivable due from Adviser (Note 4) |

— | — | 17,506 | |||||||||

Receivable for capital shares sold |

2,041,608 | 330,819 | 200 | |||||||||

Receivable for investment securities sold |

2,198,206 | — | — | |||||||||

Dividends and interest receivable |

334,362 | 9,512 | — | |||||||||

Other assets |

52,023 | 21,242 | 794 | |||||||||

Total assets |

4,377,513,397 | 423,295,832 | 1,776,538 | |||||||||

LIABILITIES |

||||||||||||

Payable for capital shares redeemed |

2,215,548 | 384,570 | — | |||||||||

Payable for investment securities purchased |

17,385,747 | 870,037 | — | |||||||||

Payable to Adviser (Note 4) |

3,006,015 | 229,413 | — | |||||||||

Accrued distribution fees (Note 4) |

147,878 | — | 342 | |||||||||

Accrued Trustees’ fees (Note 4) |

46,575 | 46,575 | 491 | |||||||||

Payable to administrator (Note 4) |

53,135 | 11,165 | 4,265 | |||||||||

Other accrued expenses |

235,377 | 86,895 | 36,423 | |||||||||

Total liabilities |

23,090,275 | 1,628,655 | 41,521 | |||||||||

NET ASSETS |

$ | 4,354,423,122 | $ | 421,667,177 | $ | 1,735,017 | ||||||

NET ASSETS CONSIST OF: |

||||||||||||

Paid-in capital |

$ | 2,185,678,773 | $ | 278,061,452 | $ | 1,700,258 | ||||||

Accumulated earnings |

2,168,744,349 | 143,605,725 | 34,759 | |||||||||

NET ASSETS |

$ | 4,354,423,122 | $ | 421,667,177 | $ | 1,735,017 | ||||||

NET ASSET VALUE PER SHARE: |

||||||||||||

INSTITUTIONAL CLASS |

||||||||||||

Net assets applicable to Institutional Class |

$ | 3,385,943,013 | $ | 357,478,568 | $ | 1,168,253 | ||||||

Institutional Class shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) |

38,838,223 | 13,681,564 | 113,238 | |||||||||

Net asset value, offering price and redemption price per share (Note 2) |

$ | 87.18 | $ | 26.13 | $ | 10.32 | ||||||

INVESTORS CLASS |

||||||||||||

Net assets applicable to Investors Class |

$ | 968,480,109 | $ | 64,188,609 | $ | 566,764 | ||||||

Investors Class shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) |

11,284,279 | 2,499,826 | 54,975 | |||||||||

Net asset value, offering price and redemption price per share (Note 2) |

$ | 85.83 | $ | 25.68 | $ | 10.31 | ||||||

See accompanying notes to financial statements. |

28

CONESTOGA FUNDS |

||||||||||||

|

Conestoga |

Conestoga |

Conestoga |

|||||||||

INVESTMENT INCOME |

||||||||||||

Dividend income from unaffiliated investments |

$ | 5,833,924 | $ | 1,295,167 | $ | 1,291 | ||||||

Dividend income from affiliated investments (Note 5) |

2,607,157 | — | — | |||||||||

Foreign withholding taxes on dividends |

(79,711 | ) | (6,002 | ) | (10 | ) | ||||||

Interest |

10,581 | 1,078 | 2 | |||||||||

Total investment income |

8,371,951 | 1,290,243 | 1,283 | |||||||||

EXPENSES |

||||||||||||

Investment advisory fees (Note 4) |

35,662,430 | 2,890,168 | 3,298 | |||||||||

Distribution fees - Investors Class (Note 4) |

2,392,397 | 149,999 | 342 | |||||||||

Shareholder Servicing Fees (Note 4) |

||||||||||||

Institutional Class |

1,446,100 | 227,867 | 276 | |||||||||

Investors Class |

478,787 | 30,000 | 68 | |||||||||

Transfer agent fees (Note 4) |

359,331 | 35,973 | 3,067 | |||||||||

Trustees’ fees and expenses (Note 4) |

193,079 | 187,169 | 491 | |||||||||

Fund accounting fees (Note 4) |

274,475 | 85,091 | 9,242 | |||||||||

Legal fees |

143,693 | 144,939 | 26,981 | |||||||||

Custody and bank service fees |

201,225 | 28,379 | 1,478 | |||||||||

Registration and filing fees |

150,489 | 68,618 | 4,000 | |||||||||

Postage and supplies |

85,601 | 13,156 | 380 | |||||||||

Audit and tax services fees |

17,460 | 15,460 | 9,900 | |||||||||

Insurance expense |

31,652 | 2,515 | — | |||||||||

Printing of shareholder reports |

13,262 | 4,573 | 120 | |||||||||

Administration fees (Note 4) |

3,000 | 3,000 | 768 | |||||||||

Organizational costs (Note 1) |

— | — | 4,324 | |||||||||

Other expenses |

23,052 | 17,148 | 3,825 | |||||||||

Total expenses |

41,476,033 | 3,904,055 | 68,560 | |||||||||

Fee reductions and expense reimbursements by the Adviser (Note 4) |

(3,899,668 | ) | (863,983 | ) | (64,920 | ) | ||||||

Net expenses |

37,576,365 | 3,040,072 | 3,640 | |||||||||

NET INVESTMENT LOSS |

$ | (29,204,414 | ) | $ | (1,749,829 | ) | $ | (2,357 | ) | |||

(a) |

Represents the period from commencement of operations (June 29, 2021) through September 30, 2021. |

29

CONESTOGA FUNDS |

||||||||||||

|

Conestoga |

Conestoga |

Conestoga |

|||||||||

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS |

||||||||||||

Net realized gains from unaffiliated investments |

$ | 235,876,394 | $ | 7,623,945 | $ | 95 | ||||||

Net realized losses from affiliated investments (Note 5) |

(6,440,761 | ) | — | — | ||||||||

Net change in unrealized appreciation (depreciation) on unaffiliated investments |

839,781,987 | 87,198,122 | 37,021 | |||||||||

Net change in unrealized appreciation (depreciation) on affiliated investments (Note 5) |

122,320,113 | — | — | |||||||||

NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS |

1,191,537,733 | 94,822,067 | 37,116 | |||||||||

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS |

$ | 1,162,333,319 | $ | 93,072,238 | $ | 34,759 | ||||||

(a) |

Represents the period from commencement of operations (June 29, 2021) through September 30, 2021. |

See accompanying notes to financial statements. |

|

30

CONESTOGA SMALL CAP FUND |

||||||||

|

Year Ended |

Year Ended |

||||||

FROM OPERATIONS |

||||||||

Net investment loss |

$ | (29,204,414 | ) | $ | (16,568,661 | ) | ||

Net realized gains (losses) from investments |

229,435,633 | (12,405,801 | ) | |||||

Net realized gains from in-kind redemptions |

— | 62,786,700 | ||||||

Net change in unrealized appreciation (depreciation) on investments |

962,102,100 | 253,323,708 | ||||||

Net increase in net assets resulting from operations |

1,162,333,319 | 287,135,946 | ||||||

DISTRIBUTIONS TO SHAREHOLDERS (Note 2) |

||||||||

Institutional Class |

— | (38,621,836 | ) | |||||

Investors Class |

— | (18,459,611 | ) | |||||

Decrease in net assets from distributions to shareholders |

— | (57,081,447 | ) | |||||

CAPITAL SHARE TRANSACTIONS (Note 6) |

||||||||

Institutional Class |

||||||||

Proceeds from shares sold |

783,876,197 | 807,652,870 | ||||||

Reinvestment of distributions to shareholders |

— | 28,194,336 | ||||||

Payments for shares redeemed |

(470,707,498 | ) | (555,771,590 | ) | ||||

Net increase in Institutional Class net assets from capital share transactions |

313,168,699 | 280,075,616 | ||||||

Investors Class |

||||||||

Proceeds from shares sold |

118,468,533 | 128,087,873 | ||||||

Reinvestment of distributions to shareholders |

— | 16,437,261 | ||||||

Payments for shares redeemed |

(248,225,990 | ) | (255,964,837 | ) | ||||

Net decrease in Investors Class net assets from capital share transactions |

(129,757,457 | ) | (111,439,703 | ) | ||||

TOTAL INCREASE IN NET ASSETS |

1,345,744,561 | 398,690,412 | ||||||

|

||||||||

NET ASSETS |

||||||||

Beginning of year |

3,008,678,561 | 2,609,988,149 | ||||||

End of year |

$ | 4,354,423,122 | $ | 3,008,678,561 | ||||

See accompanying notes to financial statements. |

31

CONESTOGA SMID CAP FUND |

||||||||

|

Year Ended |

Year Ended |

||||||

FROM OPERATIONS |

||||||||

Net investment loss |

$ | (1,749,829 | ) | $ | (696,766 | ) | ||

Net realized gains (losses) from investments |

7,623,945 | (9,706,211 | ) | |||||

Net change in unrealized appreciation (depreciation) on investments |

87,198,122 | 40,201,692 | ||||||

Net increase in net assets resulting from operations |

93,072,238 | 29,798,715 | ||||||

DISTRIBUTIONS TO SHAREHOLDERS (Note 2) |

||||||||

Institutional Class |

— | (1,206,661 | ) | |||||

Investors Class |

— | (630,211 | ) | |||||

Decrease in net assets from distributions to shareholders |

— | (1,836,872 | ) | |||||

CAPITAL SHARE TRANSACTIONS (Note 6) |

||||||||

Institutional Class |

||||||||

Proceeds from shares sold |

144,722,264 | 120,337,652 | ||||||

Reinvestment of distributions to shareholders |

— | 1,092,700 | ||||||

Payments for shares redeemed |

(51,920,798 | ) | (36,710,977 | ) | ||||

Net increase in Institutional Class net assets from capital share transactions |

92,801,466 | 84,719,375 | ||||||

Investors Class |

||||||||

Proceeds from shares sold |

15,006,418 | 24,293,664 | ||||||

Reinvestment of distributions to shareholders |

— | 564,960 | ||||||

Payments for shares redeemed |

(18,625,647 | ) | (22,363,356 | ) | ||||

Net increase (decrease) in Investors Class net assets from capital share transactions |

(3,619,229 | ) | 2,495,268 | |||||

TOTAL INCREASE IN NET ASSETS |

182,254,475 | 115,176,486 | ||||||

NET ASSETS |

||||||||

Beginning of year |

239,412,702 | 124,236,216 | ||||||

End of year |

$ | 421,667,177 | $ | 239,412,702 | ||||

See accompanying notes to financial statements. |

32

CONESTOGA MID CAP FUND |

||||

|

Period Ended |

|||

FROM OPERATIONS |

||||

Net investment loss |

$ | (2,357 | ) | |

Net realized gains from investments |

95 | |||

Net change in unrealized appreciation (depreciation) on investments |

37,021 | |||

Net increase in net assets resulting from operations |

34,759 | |||

CAPITAL SHARE TRANSACTIONS (Note 6) |

||||

Institutional Class |

||||

Proceeds from shares sold |

1,145,200 | |||

Investors Class |

||||

Proceeds from shares sold |

614,658 | |||

Payments for shares redeemed |

(59,600 | ) | ||

Net increase in Investors Class net assets from capital share transactions |

555,058 | |||

TOTAL INCREASE IN NET ASSETS |

1,735,017 | |||

NET ASSETS |

||||

Beginning of period |

— | |||

End of period |

$ | 1,735,017 | ||

(a) |

Represents the period from commencement of operations (June 29, 2021) through September 30, 2021. |

See accompanying notes to financial statements. |

|

33

CONESTOGA SMALL CAP FUND |

||||||||||||||||||||

Per Share Data for a Share Outstanding Throughout Each Year: |

||||||||||||||||||||

|

Year |

Year |

Year |

Year |

Year |

|||||||||||||||

Net asset value at beginning of year |

$ | 63.19 | $ | 58.40 | $ | 61.27 | $ | 50.29 | $ | 39.01 | ||||||||||

Income (loss) from investment operations: |

||||||||||||||||||||

Net investment loss (a) |

(0.56 | ) | (0.33 | ) | (0.23 | ) | (0.19 | ) | (0.12 | ) | ||||||||||

Net realized and unrealized gains (losses) on investments |

24.55 | 6.39 | (1.93 | ) | 13.93 | 11.88 | ||||||||||||||

Total from investment operations |

23.99 | 6.06 | (2.16 | ) | 13.74 | 11.76 | ||||||||||||||

Less distributions from net realized gains |

— | (1.27 | ) | (0.71 | ) | (2.76 | ) | (0.48 | ) | |||||||||||

Net asset value at end of year |

$ | 87.18 | $ | 63.19 | $ | 58.40 | $ | 61.27 | $ | 50.29 | ||||||||||

Total return (b) |

37.96 | % | 10.53 | % | (3.39 | %) | 28.75 | % | 30.43 | % | ||||||||||

Net assets at end of year (000,000’s) |

$ | 3,386 | $ | 2,204 | $ | 1,752 | $ | 1,648 | $ | 607 | ||||||||||

Ratios/supplementary data: |

||||||||||||||||||||

Ratio of total expenses to average net assets |

0.98 | % | 1.00 | % | 0.99 | % | 0.99 | % | 1.02 | % | ||||||||||

Ratio of net expenses to average net assets (c) |

0.90 | % | 0.90 | % | 0.90 | % | 0.90 | % | 0.90 | % | ||||||||||

Ratio of net investment loss to average net assets (c) |

(0.69 | %) | (0.56 | %) | (0.41 | %) | (0.37 | %) | (0.28 | %) | ||||||||||

Portfolio turnover rate |

19 | % | 22 | % | 26 | % | 9 | % | 24 | % | ||||||||||

(a) |

Per share net investment loss has been determined on the basis of average number of shares outstanding during the period. |

(b) |

Total return is a measure of the change in value of an investment in the Fund over the periods covered. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. The total returns would be lower if the Adviser had not reduced advisory fees and/or reimbursed expenses (Note 4). |

(c) |

Ratio was determined after advisory fee reductions and/or expense reimbursements (Note 4). |

See accompanying notes to financial statements. |

|

34

CONESTOGA SMALL CAP FUND |

||||||||||||||||||||

Per Share Data for a Share Outstanding Throughout Each Year: |

||||||||||||||||||||

|

Year |

Year |

Year |

Year |

Year |

|||||||||||||||

Net asset value at beginning of year |

$ | 62.33 | $ | 57.74 | $ | 60.70 | $ | 49.95 | $ | 38.83 | ||||||||||

Income (loss) from investment operations: |

||||||||||||||||||||

Net investment loss (a) |

(0.70 | ) | (0.44 | ) | (0.33 | ) | (0.30 | ) | (0.20 | ) | ||||||||||

Net realized and unrealized gains (losses) on investments |

24.20 | 6.30 | (1.92 | ) | 13.81 | 11.80 | ||||||||||||||

Total from investment operations |

23.50 | 5.86 | (2.25 | ) | 13.51 | 11.60 | ||||||||||||||

Less distributions from net realized gains |

— | (1.27 | ) | (0.71 | ) | (2.76 | ) | (0.48 | ) | |||||||||||

Net asset value at end of year |

$ | 85.83 | $ | 62.33 | $ | 57.74 | $ | 60.70 | $ | 49.95 | ||||||||||

Total return (b) |

37.70 | % | 10.30 | % | (3.57 | %) | 28.47 | % | 30.16 | % | ||||||||||

Net assets at end of year (000,000’s) |

$ | 968 | $ | 805 | $ | 858 | $ | 1,033 | $ | 702 | ||||||||||

Ratios/supplementary data: |

||||||||||||||||||||

Ratio of total expenses to average net assets |

1.25 | % | 1.28 | % | 1.27 | % | 1.29 | % | 1.34 | % | ||||||||||

Ratio of net expenses to average net assets (c) |

1.10 | % | 1.10 | % | 1.10 | % | 1.10 | % | 1.10 | % | ||||||||||

Ratio of net investment loss to average net assets (c) |

(0.89 | %) | (0.75 | %) | (0.60 | %) | (0.56 | %) | (0.48 | %) | ||||||||||

Portfolio turnover rate |

19 | % | 22 | % | 26 | % | 9 | % | 24 | % | ||||||||||

(a) |

Per share net investment loss has been determined on the basis of average number of shares outstanding during the period. |

(b) |

Total return is a measure of the change in value of an investment in the Fund over the periods covered. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. The total returns would be lower if the Adviser had not reduced advisory fees and/or reimbursed expenses (Note 4). |

(c) |

Ratio was determined after advisory fee reductions and/or expense reimbursements (Note 4). |

See accompanying notes to financial statements. |

|

35

CONESTOGA SMID CAP FUND |

||||||||||||||||||||

Per Share Data for a Share Outstanding Throughout Each Year: |

||||||||||||||||||||

|

Year |

Year |

Year |

Year |

Year |

|||||||||||||||

Net asset value at beginning of year |

$ | 19.29 | $ | 17.18 | $ | 17.05 | $ | 12.80 | $ | 9.99 | ||||||||||

Income (loss) from investment operations: |

||||||||||||||||||||

Net investment loss (a) |

(0.11 | ) | (0.06 | ) | (0.03 | ) | (0.06 | ) | (0.05 | ) | ||||||||||

Net realized and unrealized gains on investments |

6.95 | 2.40 | 0.30 | 4.35 | 2.86 | |||||||||||||||

Total from investment operations |

6.84 | 2.34 | 0.27 | 4.29 | 2.81 | |||||||||||||||

Less distributions from net realized gains |

— | (0.23 | ) | (0.14 | ) | (0.04 | ) | — | ||||||||||||

Net asset value at end of year |

$ | 26.13 | $ | 19.29 | $ | 17.18 | $ | 17.05 | $ | 12.80 | ||||||||||

Total return (b) |

35.46 | % | 13.76 | % | 1.72 | % | 33.64 | % | 28.13 | % | ||||||||||

Net assets at end of year (000’s) |

$ | 357,479 | $ | 188,836 | $ | 80,814 | $ | 45,210 | $ | 21,653 | ||||||||||

Ratios/supplementary data: |

||||||||||||||||||||

Ratio of total expenses to average net assets |

1.10 | % | 1.26 | % | 1.39 | % | 1.62 | % | 2.11 | % | ||||||||||

Ratio of net expenses to average net assets (c)(d) |

0.85 | % | 0.85 | % | 0.85 | % | 0.86 | % | 0.96 | % | ||||||||||

Ratio of net investment loss to average net assets (c) |

(0.47 | %) | (0.34 | %) | (0.20 | %) | (0.37 | %) | (0.47 | %) | ||||||||||

Portfolio turnover rate |

17 | % | 11 | % | 37 | % | 8 | % | 24 | % | ||||||||||

(a) |

Per share net investment loss has been determined on the basis of average number of shares outstanding during the period. |

(b) |

Total return is a measure of the change in value of an investment in the Fund over the periods covered. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. The total returns would be lower if the Adviser had not reduced advisory fees and/or reimbursed expenses (Note 4). |

(c) |

Ratio was determined after advisory fee reductions and/or expense reimbursements (Note 4). |

(d) |

Effective January 31, 2018, the Adviser has agreed to reduce its advisory fees and reimburse other expenses in order to limit annual operating expenses to 0.85% of the average daily net assets allocable to Institutional Class Shares. Between January 31, 2017 and January 31, 2018, the expense limitation had been 0.90%. Prior to January 31, 2017, the expense limitation had been 1.10%. |

See accompanying notes to financial statements. |

|

36

CONESTOGA SMID CAP FUND |

||||||||||||||||||||

Per Share Data for a Share Outstanding Throughout Each Year: |

||||||||||||||||||||

|

Year |

Year |

Year |

Year |

Year |

|||||||||||||||

Net asset value at beginning of year |

$ | 19.01 | $ | 16.97 | $ | 16.88 | $ | 12.71 | $ | 9.94 | ||||||||||

Income (loss) from investment operations: |

||||||||||||||||||||

Net investment loss (a) |

(0.17 | ) | (0.10 | ) | (0.07 | ) | (0.09 | ) | (0.08 | ) | ||||||||||

Net realized and unrealized gains on investments |

6.84 | 2.37 | 0.30 | 4.30 | 2.85 | |||||||||||||||

Total from investment operations |

6.67 | 2.27 | 0.23 | 4.21 | 2.77 | |||||||||||||||

Less distributions from net realized gains |

— | (0.23 | ) | (0.14 | ) | (0.04 | ) | — | ||||||||||||

Net asset value at end of year |

$ | 25.68 | $ | 19.01 | $ | 16.97 | $ | 16.88 | $ | 12.71 | ||||||||||

Total return (b) |

35.09 | % | 13.52 | % | 1.50 | % | 33.25 | % | 27.87 | % | ||||||||||

Net assets at end of year (000’s) |

$ | 64,189 | $ | 50,577 | $ | 43,422 | $ | 38,680 | $ | 3,388 | ||||||||||

Ratios/supplementary data: |

||||||||||||||||||||

Ratio of total expenses to average net assets |

1.36 | % | 1.51 | % | 1.64 | % | 1.95 | % | 3.04 | % | ||||||||||

Ratio of net expenses to average net assets (c)(d) |

1.10 | % | 1.10 | % | 1.10 | % | 1.10 | % | 1.20 | % | ||||||||||

Ratio of net investment loss to average net assets (c) |

(0.71 | %) | (0.57 | %) | (0.45 | %) | (0.62 | %) | (0.73 | %) | ||||||||||

Portfolio turnover rate |

17 | % | 11 | % | 37 | % | 8 | % | 24 | % | ||||||||||

(a) |

Per share net investment loss has been determined on the basis of average number of shares outstanding during the period. |

(b) |

Total return is a measure of the change in value of an investment in the Fund over the periods covered. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. The total returns would be lower if the Adviser had not reduced advisory fees and/or reimbursed expenses (Note 4). |

(c) |

Ratio was determined after advisory fee reductions and/or expense reimbursements (Note 4). |

(d) |

Effective January 31, 2018, the Adviser has agreed to reduce its advisory fees and reimburse other expenses in order to limit annual operating expenses to 1.10% of the average daily net assets allocable to Investors Class Shares. Between January 31, 2017 and January 31, 2018, the expense limitation had been 1.15%. Prior to January 31, 2017, the expense limitation had been 1.35%. |

See accompanying notes to financial statements. |

|

37

CONESTOGA MID CAP FUND |

||||

Per Share Data for a Share Outstanding Throughout the Period: |

||||

|

Period |

|||

Net asset value at beginning of period |

$ | 10.00 | ||

Income (loss) from investment operations: |

||||

Net investment loss (b) |

(0.01 | ) | ||

Net realized and unrealized gains on investments |

0.33 | |||

Total from investment operations |

0.32 | |||

Net asset value at end of period |

$ | 10.32 | ||

Total return (c) |

3.20 | %(d) | ||

Net assets at end of period (000’s) |

$ | 1,168 | ||

Ratios/supplementary data: |

||||

Ratio of total expenses to average net assets |

16.18 | %(e) | ||

Ratio of net expenses to average net assets (f) |

0.80 | %(e) | ||

Ratio of net investment loss to average net assets (f) |

(0.50 | %)(e) | ||

Portfolio turnover rate |

1 | %(d) | ||

(a) |

Represents the period from the commencement of operations (June 29, 2021) through September 30, 2021. |

(b) |

Per share net investment loss has been determined on the basis of average number of shares outstanding during the period. |

(c) |

Total return is a measure of the change in value of an investment in the Fund over the period covered. The return shown does not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. The total return would be lower if the Adviser had not reduced advisory fees and/or reimbursed expenses (Note 4). |

(d) |

Not annualized. |

(e) |

Annualized. |

(f) |

Ratio was determined after advisory fee reductions and/or expense reimbursements (Note 4). |

See accompanying notes to financial statements. |

|

38

CONESTOGA MID CAP FUND |

||||

Per Share Data for a Share Outstanding Throughout the Period: |

||||

|

Period |

|||

Net asset value at beginning of period |

$ | 10.00 | ||

Income (loss) from investment operations: |

||||

Net investment loss (b) |

(0.02 | ) | ||

Net realized and unrealized gains on investments |

0.33 | |||

Total from investment operations |

0.31 | |||

Net asset value at end of period |

$ | 10.31 | ||

Total return (c) |

3.10 | %(d) | ||

Net assets at end of period (000’s) |

$ | 567 | ||

Ratios/supplementary data: |

||||

Ratio of total expenses to average net assets |

17.54 | %(e) | ||

Ratio of net expenses to average net assets (f) |

1.05 | %(e) | ||

Ratio of net investment loss to average net assets (f) |

(0.73 | %)(e) | ||

Portfolio turnover rate |

1 | %(d) | ||

(a) |

Represents the period from the commencement of operations (June 29, 2021) through September 30, 2021. |

(b) |

Per share net investment loss has been determined on the basis of average number of shares outstanding during the period. |

(c) |

Total return is a measure of the change in value of an investment in the Fund over the period covered. The return shown does not reflect the deduction of taxes a shareholder would pay on Fund distributions, if any, or the redemption of Fund shares. The total return would be lower if the Adviser had not reduced advisory fees and/or reimbursed expenses (Note 4). |

(d) |

Not annualized. |

(e) |

Annualized. |

(f) |

Ratio was determined after advisory fee reductions and/or expense reimbursements (Note 4). |

See accompanying notes to financial statements. |

|

39

CONESTOGA FUNDS

NOTES TO FINANCIAL STATEMENTS

September 30, 2021

1. Organization

Conestoga Funds (the “Trust”) was organized as a Delaware statutory trust on February 5, 2002. The Trust consists of three series, the Conestoga Small Cap Fund (the “Small Cap Fund”), the Conestoga SMid Cap Fund (the “SMid Cap Fund”), and the Conestoga Mid Cap Fund (the “Mid Cap Fund”) (individually, a “Fund” and collectively, the “Funds”). The Trust is registered as an open-end diversified management investment company of the series type under the Investment Company Act of 1940, as amended (the “1940 Act”). Each Fund’s investment objective is to achieve long-term growth of capital. Each Fund currently offers two classes of shares, Institutional Class and Investors Class. The Mid Cap Fund commenced operations on June 29, 2021.

Each Fund’s two classes of shares represent interests in the same portfolio of investments, and have the same rights, but the share classes differ primarily in the expenses to which they are subject and have differing investment minimums. Institutional Class shares are sold without any sales loads or distribution fees but are subject to a shareholder servicing fee of up to 0.10% of the average daily net assets allocable to Institutional Class shares and require a $250,000 initial investment. Investors Class shares are sold without any sales loads but are subject to a distribution fee of up to 0.25% and a shareholder servicing fee of up to 0.25% of the average daily net assets allocable to Investors Class shares and require a $2,500 initial investment. The Board of Trustees of the Trust (the “Board”) has determined to limit the shareholder servicing fees paid by Investors Class shares of each Fund to 0.05% of the average daily net assets allocable to Investors Class shares until at least September 30, 2022.