Form N-CSR BlackRock Hedge Fund For: Mar 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-23626

| Name of Fund: | BlackRock Hedge Fund Guided Portfolio Solution |

| Fund Address: | 100 Bellevue Parkway, Wilmington, DE 19809 |

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Hedge Fund Guided Portfolio Solution, 50 Hudson Yards, New York, NY 10001

Registrant’s telephone number, including area code: (800) 882-0052, Option 4

Date of fiscal year end: 3/31/2023

Date of reporting period: 3/31/2023

Item 1 – Report to Stockholders

(a) The Report to Shareholders is attached herewith.

|

MARCH 31, 2023 |

| 2023 Annual Report | ||

BlackRock Hedge Fund Guided Portfolio Solution

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

Dear Shareholder,

Significant economic headwinds emerged during the 12-month reporting period ended March 31, 2023, as investors navigated changing economic conditions and volatile markets. The U.S. economy shrank in the first half of 2022 before returning to modest growth in the second half of the year, marking a shift to a more challenging post-reopening economic environment. Changes in consumer spending patterns and a tight labor market led to elevated inflation, which reached a 40-year high before beginning to moderate.

Equity prices fell as interest rates rose, particularly during the first half of the reporting period. Both large- and small-capitalization U.S. stocks declined, although equities began to recover in the second half of the period as inflation eased and economic growth resumed. Emerging market stocks and international equities from developed markets declined overall, pressured by rising interest rates and volatile commodities prices.

The 10-year U.S. Treasury yield rose during the reporting period, driving its price down, as investors reacted to fluctuating inflation data and attempted to anticipate its impact on future interest rate changes. The corporate bond market also faced inflationary headwinds, and higher interest rates led to rising borrowing costs for corporate issuers.

The U.S. Federal Reserve (the “Fed”), acknowledging that inflation has been more persistent than expected, raised interest rates eight times. Furthermore, the Fed wound down its bond-buying programs and accelerated the reduction of its balance sheet.

Restricted labor supply kept inflation elevated even as other inflation drivers, such as goods prices and energy costs, moderated. While economic growth slowed in the last year, we believe that taming inflation requires a more substantial decline that lowers demand to a level more in line with the economy’s productive capacity. Although the Fed has decelerated the pace of interest rate hikes, we believe that it still seems determined to get inflation back to target. With this in mind, we believe the possibility of a U.S. recession in the near-term is high, but the dimming economic outlook has not yet been fully reflected in current market prices. We believe investors should expect a period of higher volatility as markets adjust to the new economic reality and policymakers attempt to adapt to rapidly changing conditions. Turmoil in the banking sector late in the period highlighted the potential for the knock-on effects of substantially higher interest rates to disrupt markets with little warning.

While we favor an overweight to equities in the long term, we prefer an underweight stance on equities overall in the near term. Expectations for corporate earnings remain elevated, which seems inconsistent with the possibility of a recession. Nevertheless, we are overweight on emerging market stocks as we believe a weakening U.S. dollar provides a supportive backdrop. We also see long-term opportunities in credit, where we believe that valuations are appealing and higher yields provide attractive income, although we are neutral on credit in the near term, as we’re concerned about tightening credit and financial conditions. However, we believe there are still some strong opportunities for a six- to twelve-month horizon, particularly short-term U.S. Treasuries, global inflation-linked bonds, and emerging market bonds denominated in local currency.

Overall, our view is that investors need to think globally, position themselves to be prepared for a decarbonizing economy, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| Total Returns as of March 31, 2023 | ||||

| 6-Month | 12-Month | |||

| U.S. large cap equities (S&P 500® Index)

|

15.62% | (7.73)% | ||

| U.S. small cap equities (Russell 2000® Index)

|

9.14 | (11.61) | ||

| International equities (MSCI Europe, Australasia, Far East Index)

|

27.27 | (1.38) | ||

| Emerging market equities (MSCI Emerging Markets Index)

|

14.04 | (10.70) | ||

| 3-month Treasury bills (ICE BofA 3-Month U.S. Treasury Bill Index)

|

1.93 | 2.52 | ||

| U.S. Treasury securities (ICE BofA 10-Year U.S. Treasury Index)

|

4.38 | (6.90) | ||

| U.S. investment grade bonds (Bloomberg U.S. Aggregate Bond Index)

|

4.89 | (4.78) | ||

| Tax-exempt municipal bonds (Bloomberg Municipal Bond Index)

|

7.00 | 0.26 | ||

| U.S. high yield bonds (Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index)

|

7.88 | (3.35) | ||

| Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | ||||

| 2 | T H I S P A G E I S N O T P A R T O F Y O U R F U N D R E P O R T |

| Page

|

||||

| 2 | ||||

| Annual Report: |

||||

| 4 | ||||

| 5 | ||||

| 8 | ||||

| Disclosure of Expenses for Continuously Offered Closed-End Funds |

8 | |||

| Financial Statements: |

||||

| 9 | ||||

| 11 | ||||

| 12 | ||||

| 13 | ||||

| 14 | ||||

| 15 | ||||

| 17 | ||||

| 25 | ||||

| 26 | ||||

| 27 | ||||

| 31 | ||||

| 3 |

| The Benefits and Risks of Leveraging | BlackRock Hedge Fund Guided Portfolio Solution |

The Fund may utilize leverage to seek to enhance the distribution rate on, and net asset value (“NAV”) of, its common shares (“Common Shares”). However, there is no guarantee that these objectives can be achieved in all interest rate environments.

In general, the concept of leveraging is based on the premise that the financing cost of leverage, which is based on short-term interest rates, is normally lower than the income earned by the Fund on its longer-term portfolio investments purchased with the proceeds from leverage. To the extent that the total assets of the Fund (including the assets obtained from leverage) are invested in higher-yielding portfolio investments, the Fund’s shareholders benefit from the incremental net income. The interest earned on securities purchased with the proceeds from leverage (after paying the leverage costs) is paid to shareholders in the form of dividends, and the value of these portfolio holdings (less the leverage liability) is reflected in the per share NAV.

To illustrate these concepts, assume the Fund’s capitalization is $100 million and it utilizes leverage for an additional $30 million, creating a total value of $130 million available for investment in longer-term income securities. If prevailing short-term interest rates are 3% and longer-term interest rates are 6%, the yield curve has a strongly positive slope. In this case, the Fund’s financing costs on the $30 million of proceeds obtained from leverage are based on the lower short-term interest rates. At the same time, the securities purchased by the Fund with the proceeds from leverage earn income based on longer-term interest rates. In this case, the Fund’s financing cost of leverage is significantly lower than the income earned on the Fund’s longer-term investments acquired from such leverage proceeds, and therefore the holders of Common Shares (“Common Shareholders”) are the beneficiaries of the incremental net income.

However, in order to benefit shareholders, the return on assets purchased with leverage proceeds must exceed the ongoing costs associated with the leverage. If interest and other costs of leverage exceed the Fund’s return on assets purchased with leverage proceeds, income to shareholders is lower than if the Fund had not used leverage. Furthermore, the value of the Fund’s portfolio investments generally varies inversely with the direction of long-term interest rates, although other factors can influence the value of portfolio investments. In contrast, the amount of the Fund’s obligations under its respective leverage arrangement generally does not fluctuate in relation to interest rates. As a result, changes in interest rates can influence the Fund’s NAVs positively or negatively. Changes in the future direction of interest rates are very difficult to predict accurately, and there is no assurance that the Fund’s intended leveraging strategy will be successful.

The use of leverage also generally causes greater changes in the Fund’s NAV, market price and dividend rates than comparable portfolios without leverage. In a declining market, leverage is likely to cause a greater decline in the NAV and market price of the Fund’s shares than if the Fund were not leveraged. In addition, the Fund may be required to sell portfolio securities at inopportune times or at distressed values in order to comply with regulatory requirements applicable to the use of leverage or as required by the terms of leverage instruments, which may cause the Fund to incur losses. The use of leverage may limit the Fund’s ability to invest in certain types of securities or use certain types of hedging strategies. The Fund incurs expenses in connection with the use of leverage, all of which are borne by shareholders and may reduce income to the shareholders. Moreover, to the extent the calculation of the Fund’s investment advisory fees includes assets purchased with the proceeds of leverage, the investment advisory fees payable to the Fund’s investment adviser will be higher than if the Fund did not use leverage.

The Fund may utilize leverage through a credit facility as described in the Notes to Financial Statements, if applicable.

Under the Investment Company Act of 1940, as amended (the “1940 Act”), the Fund is permitted to borrow money (including through the use of TOB Trusts) or issue debt securities up to 33 1/3% of its total managed assets. The Fund may voluntarily elect to limit its leverage to less than the maximum amount permitted under the 1940 Act. In addition, the Fund may also be subject to certain asset coverage, leverage or portfolio composition requirements imposed by its credit facility, which may be more stringent than those imposed by the 1940 Act.

| 4 | 2 0 2 3 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Fund Summary as of March 31, 2023 | BlackRock Hedge Fund Guided Portfolio Solution |

Investment Objective

BlackRock Hedge Fund Guided Portfolio Solution’s (the “Fund”) investment objective is to seek, over time, absolute and risk-adjusted returns that exhibit low volatility and low-to-moderate correlation to global equity and fixed income markets, while preserving capital. The Fund seeks to achieve its investment objective by allocating the Fund’s assets to private investment vehicles commonly referred to as “hedge funds” (“Portfolio Funds”) that are managed by third-party investment management firms that are not affiliated with the Fund’s investment adviser.

The Fund’s common shares are not listed on any securities exchange. The Fund is designed for long-term investors, and an investment in the common shares, unlike an investment in a traditional listed closed-end fund, should be considered illiquid.

No assurance can be given that the Fund’s investment objective will be achieved.

Net Asset Value Per Share Summary

| 03/31/23 | 03/31/22 | Change | High | Low | ||||||||||||||||

| Net Asset Value — Class I | $ | 10.03 | $ | 10.14 | (1.08 | )% | $ | 10.18 | $ | 9.90 | ||||||||||

| Net Asset Value — Class A | 9.97 | 10.11 | (1.38 | ) | 10.15 | 9.87 | ||||||||||||||

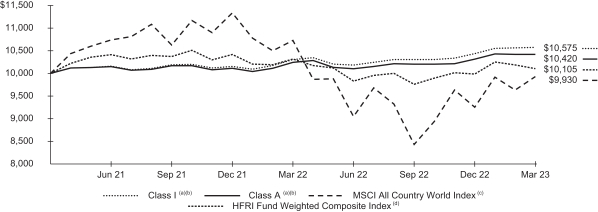

GROWTH OF $10,000 INVESTMENT

The Fund commenced operations on March 31, 2021.

| (a) | Assuming maximum sales charges, if any, transaction costs and other operating expenses, including investment advisory fees. |

| (b) | The Fund has adopted a policy to invest, under normal circumstances, at least 80% of the value of its net assets, plus the amount of any borrowings for investment purposes, in Portfolio Funds. |

| (c) | An index that captures large- and mid-cap representation across certain developed markets and certain emerging markets. |

| (d) | A global, equal-weighted index of single-manager funds that report to Hedge Fund Research Database. |

| Average Annual Total Returns(a) | ||||||||

| 1 Year | Since Inception(b) |

|||||||

| Class I | 2.60 | % | 2.83% | |||||

| Class A | 1.71 | 2.08 | ||||||

| HFRI Fund Weighted Composite Index(c) | (2.05 | ) | 0.52 | |||||

| MSCI All Country World Index®(d) | (7.44 | ) | (0.35) | |||||

(a) See “About Fund Performance” for a detailed description of share classes and how performance was calculated for certain share classes.

(b) The Fund commenced operations on March 31, 2021.

(c) A global, equal-weighted index of single-manager funds that report to Hedge Fund Research Database.

(d) An index that captures large- and mid-cap representation across certain developed markets and certain emerging markets.

Past performance is not an indication of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

The Fund is presenting the performance of one or more indices for informational purposes only. The Fund is actively managed and does not seek to track or replicate the performance of any index. The index performance shown is not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance.

| F U N D S U M M A R Y |

5 |

| Fund Summary as of March 31, 2023 (continued) | BlackRock Hedge Fund Guided Portfolio Solution |

Portfolio Management Commentary

Investment Strategies

The Fund invests in portfolios of hedge funds as a means to gain exposure to various types of investment strategies in four primary hedge fund strategies, including Equity Hedge, Event-Driven, Relative Value and Macro. The following descriptions are not intended to be complete explanations of the strategies described or a list of all possible investment strategies or methods that may be used by the Fund.

Equity Hedge strategies maintain positions both long and short, normally with a primary focus on equity securities and equity derivatives. A wide variety of investment processes can be employed to arrive at an investment decision, including both quantitative and fundamental techniques.

Event-Driven strategies generally maintain positions in companies currently or prospectively involved in a wide variety of corporate transactions, including, but not limited to, mergers, restructurings, financial distress, tender offers, shareholder buybacks, debt exchanges, security issuances or other capital structure adjustments.

Relative Value strategies maintain positions where the investment thesis is predicated on the realization of a valuation discrepancy in the relationship between multiple securities. These strategies employ a variety of fundamental and quantitative techniques.

Macro strategies employ a broad range of strategies where the investment process is predicated on movements in underlying economic variables and the impact of these movements on equity, fixed income, hard currency and commodity markets.

What factors influenced performance?

The Fund’s exposure to Macro strategies made the largest contribution to positive performance during the period and benefited from price volatility across the energy complex and interest rate yield curves. Relative Value strategies overall added to performance, with positive contribution from credit-related strategies and quantitative strategies offset by modestly negative contribution from volatility arbitrage strategies. Event-Driven strategies were mixed, notably in merger arbitrage, given spread widening resulting from equity volatility and deal-specific developments. Equity Hedge strategies were the largest detractors from performance over the period given a challenging backdrop in equity markets globally.

Describe recent portfolio activity.

On June 1, 2022, the Fund made one new allocation to Drakewood Prospect Fund Ltd.

On September 1, 2022, the Fund made one new allocation to Atlas Enhanced Fund, Ltd.

Over the period, the Fund fully redeemed from Pelham Long/Short Fund, Ltd. and Rose Grove Offshore Fund I, Ltd., and initiated a full redemption from Segantii Asia-Pacific Equity Multi-Strategy Fund, expected to complete by May 2023.

In aggregate, the Fund’s position changes over the period resulted in increased exposure to Equity Hedge strategies, decreased exposure to Relative Value and Event-Driven strategies, and slight changes in Macro strategies. Cash balance in the portfolio was higher at the end of the period.

Describe portfolio positioning at period end.

At period end, the Fund held broad exposure across different hedge fund strategies. For purposes of financial reporting, the underlying hedge funds are categorized based on their primary underlying strategy exposure. In this regard, the categories of investment strategies as a percentage of the Fund’s long term investments are 29% Equity Hedge, 24% Macro, 17% Event-Driven and 17% Relative Value. Cash as a percentage of the Fund’s investments was 13% at period end. Cash is held in the portfolio for deployment in new and existing positions and to comply with regulations. The Fund’s cash position had no material impact to Fund performance during the period.

| 6 | 2 0 2 3 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Fund Summary as of March 31, 2023 (continued) | BlackRock Hedge Fund Guided Portfolio Solution |

Portfolio Information

TEN LARGEST HOLDINGS

|

|

||||

| Security | Percent of Net Assets |

|||

|

|

||||

| Atlas Enhanced Fund, Ltd. |

8.9% | |||

| Pentwater Event Fund, Ltd. |

8.5% | |||

| One William Street Capital Offshore Fund, Ltd. |

8.2 | |||

| Stratus Feeder, Ltd. |

7.9 | |||

| Voleon Composition International Fund, Ltd. |

6.3 | |||

| Manticore Fund (Cayman) Ltd. |

4.8 | |||

| Polar Multi-Strategy Fund |

4.4 | |||

| East One Commodity Fund Limited |

4.4 | |||

| Schonfeld Strategic Partners Offshore Fund, Ltd. |

4.4 | |||

| Kadensa Fund |

4.3 | |||

|

|

||||

SECTOR ALLOCATION

|

|

||||

| Sector(a) | Percent of

|

|||

|

|

||||

| Equity Hedge |

28.7% | |||

| Macro |

24.5 | |||

| Event-Driven |

17.0 | |||

| Relative Value |

16.9 | |||

| Short-Term Securities |

10.4 | |||

| Other Assets Less Liabilities |

2.5 | |||

|

|

||||

| (a) | For Fund compliance purposes, the Fund’s sector classifications refer to one or more of the sector sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. |

| F U N D S U M M A R Y | 7 |

| About Fund Performance | BlackRock Hedge Fund Guided Portfolio Solution |

Class I Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to certain eligible investors.

Class A Shares are not subject to any sales charge. These shares are subject to an ongoing distribution fee and shareholder servicing fee of 0.75% per year.

Past performance is not an indication of future results. Financial markets have experienced extreme volatility and trading in many instruments has been disrupted. These circumstances may continue for an extended period of time, and may continue to affect adversely the value and liquidity of the Fund’s investments. As a result, current performance may be lower or higher than the performance data quoted. Refer to blackrock.com to obtain performance data current to the most recent month-end. Performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Figures shown in the performance table(s) assume reinvestment of all distributions, if any, at net asset value (“NAV”) on the ex-dividend date or payable date, as applicable. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Distributions paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders.

BlackRock Advisors, LLC (the “Manager”), the Fund’s investment adviser, has contractually and/or voluntarily agreed to waive and/or reimburse a portion of the Fund’s expenses. Without such waiver(s) and/or reimbursement(s), the Fund’s performance would have been lower. With respect to the Fund’s voluntary waiver(s), if any, the Manager is under no obligation to waive and/or reimburse or to continue waiving and/or reimbursing its fees and such voluntary waiver(s) may be reduced or discontinued at any time. With respect to the Fund’s contractual waiver(s), if any, the Manager is under no obligation to continue waiving and/or reimbursing its fees after the applicable termination date of such agreement. See the Notes to Financial Statements for additional information on waivers and/or reimbursements.

Disclosure of Expenses for Continuously Offered Closed-End Funds

Shareholders of the Fund may incur the following charges: (a) transactional expenses, including early withdrawal fees; and (b) operating expenses, including investment advisory fees, and other fund expenses. The example below (which is based on a hypothetical investment of $1,000 invested at the beginning of the period and held through the end of the period) is intended to assist shareholders both in calculating expenses based on an investment in the Fund and in comparing these expenses with similar costs of investing in other funds.

The expense example provides information about actual account values and actual expenses. Annualized expense ratios reflect contractual and voluntary fee waivers, if any. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their Fund and share class under the heading entitled “Expenses Paid During the Period.”

The expense example also provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in the Fund and other funds, compare the 5% hypothetical example with the 5% hypothetical examples that appear in shareholder reports of other funds.

The expenses shown in the expense example are intended to highlight shareholders’ ongoing costs only and do not reflect transactional expenses, such as sales charges, if any. Therefore, the hypothetical example is useful in comparing ongoing expenses only and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

| Actual | Hypothetical 5% Return | |||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||

| |

Beginning Account Value (10/01/22) |

|

Ending Account Value (03/31/23) |

|

|

Expenses Paid During the Period |

(a) |

|

Beginning Account Value (10/01/22) |

|

|

Ending Account Value (03/31/23) |

|

|

Expenses Paid During the Period |

(a) |

|

Annualized Expense Ratio |

| |||||||||||||

| Class I |

$ | 1,000.00 | $ | 1,026.00 | $ | 6.21 | $ | 1,000.00 | $ | 1,003.34 | $ | 6.14 | 1.23 | % | ||||||||||||||||||

| Class A |

|

1,000.00

|

|

|

1,021.20

|

|

|

10.88

|

|

|

1,000.00

|

|

|

992.87

|

|

|

10.73

|

|

|

2.16

|

| |||||||||||

| (a) | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period shown). |

| 8 | 2 0 2 3 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| March 31, 2023 |

BlackRock Hedge Fund Guided Portfolio Solution (Percentages shown are based on Net Assets) |

| Portfolio Funds(a)(b) | First Acquisition Date |

Cost | Value | %of Net Assets |

||||||||||||

|

|

||||||||||||||||

| Equity Hedge |

||||||||||||||||

| Atlas Enhanced Fund, Ltd |

09/01/22 | $ | 7,300,000 | $ | 7,540,811 | 8.9 | % | |||||||||

| Kadensa Fund |

04/01/21 | 3,687,500 | 3,598,413 | 4.3 | % | |||||||||||

| Manticore Fund (Cayman) Ltd. |

04/01/21 | 4,112,500 | 4,016,396 | 4.8 | % | |||||||||||

| Schonfeld Strategic Partners Offshore Fund, Ltd. |

01/01/22 | 3,600,000 | 3,686,646 | 4.4 | % | |||||||||||

| Voleon Composition International Fund, Ltd. |

04/01/21 | 4,653,483 | 5,277,779 | 6.3 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total Equity Hedge |

23,353,483 | 24,120,045 | 28.7 | % | ||||||||||||

| Event-Driven |

||||||||||||||||

| MY Asian Opportunities Unit Trust |

05/01/21 | 3,766,075 | 3,512,113 | 4.2 | % | |||||||||||

| Nekton Global Fund Ltd. |

10/01/21 | 3,437,242 | 3,555,648 | 4.2 | % | |||||||||||

| Pentwater Event Fund, Ltd. |

04/01/21 | 6,425,000 | 7,155,621 | 8.5 | % | |||||||||||

| Segantii Asia-Pacific Equity Multi-Strategy Fund |

11/01/21 | 50,352 | 52,353 | 0.1 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total Event-Driven |

13,678,669 | 14,275,735 | 17.0 | % | ||||||||||||

| Macro |

||||||||||||||||

| Crabel Fund SPC, Ltd. |

04/01/21 | 3,162,500 | 3,429,305 | 4.1 | % | |||||||||||

| Drakewood Prospect Fund Ltd. |

06/01/22 | 3,550,000 | 3,471,019 | 4.1 | % | |||||||||||

| East One Commodity Fund Limited |

05/01/21 | 2,987,500 | 3,715,882 | 4.4 | % | |||||||||||

| Stratus Feeder, Ltd. |

04/01/21 | 4,834,500 | 6,632,708 | 7.9 | % | |||||||||||

| Systematica Alternative Markets Fund Ltd. |

05/01/21 | 3,087,500 | 3,372,340 | 4.0 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total Macro |

17,622,000 | 20,621,254 | 24.5 | % | ||||||||||||

| Relative Value |

||||||||||||||||

| One William Street Capital Offshore Fund, Ltd. |

04/01/21 | 6,250,000 | 6,882,838 | 8.2 | % | |||||||||||

| Parallax Offshore Investors Fund, Ltd. |

04/01/21 | 3,468,187 | 3,597,573 | 4.3 | % | |||||||||||

| Polar Multi-Strategy Fund |

04/01/21 | 3,601,771 | 3,728,703 | 4.4 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total Relative Value |

13,319,958 | 14,209,114 | 16.9 | % | ||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total Portfolio Funds |

67,974,110 | 73,226,148 | 87.1 | % | ||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Security | Shares | Cost | Value | %of Net Assets |

||||||||||||

|

|

||||||||||||||||

| Short-Term Securities |

||||||||||||||||

| Money Market Funds |

||||||||||||||||

| BlackRock Liquidity Funds, T-Fund, Institutional Class, 4.70%(c)(d) |

8,745,590 | 8,745,590 | 8,745,590 | 10.4 | % | |||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total Short-Term Securities |

8,745,590 | 8,745,590 | 10.4 | % | ||||||||||||

|

|

||||||||||||||||

| Total Investments |

$ | 76,719,700 | 81,971,738 | 97.5 | % | |||||||||||

|

|

|

|||||||||||||||

| Other Assets Less Liabilities |

2,083,048 | 2.5 | % | |||||||||||||

|

|

|

|

|

|||||||||||||

| Net Assets |

$ | 84,054,786 | 100.0 | % | ||||||||||||

|

|

|

|

|

|||||||||||||

| (a) | Non-income producing security. |

| (b) | Restricted security as to resale, excluding 144A securities. The Fund held restricted securities with a current value of $73,226,148, representing 87.1% of its net assets as of period end, and an original cost of $67,974,110. |

| (c) | Affiliate of the Fund. |

| (d) | Annualized 7-day yield as of period end. |

Affiliates

Investments in issuers considered to be affiliate(s) of the Fund during the year ended March 31, 2023 for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows:

|

|

||||||||||||||||||||||||||||||||||||

| Affiliated Issuer | Value at 03/31/22 |

Purchases at Cost |

Proceeds from Sale |

Net Realized Gain (Loss) |

Change in Unrealized Appreciation (Depreciation) |

Value at 03/31/23 |

Shares Held at 03/31/23 |

Income | Capital Gain Distributions from Underlying Funds |

|||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||

| BlackRock Liquidity Funds, T-Fund, Institutional Class |

$ | 4,721,908 | $ | 4,023,682 | (a) | $ | — | $ | — | $ | — | $ | 8,745,590 | 8,745,590 | $ | 191,614 | $ | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

(a) Represents net amount purchased (sold).

|

S C H E D U L E O F I N V E S T M E N T S |

9 |

| Schedule of Investments (continued) March 31, 2023 |

BlackRock Hedge Fund Guided Portfolio Solution |

Fair Value Hierarchy as of Period End

Various inputs are used in determining the fair value of financial instruments. For a description of the input levels and information about the Fund’s policy regarding valuation of financial instruments, refer to the Notes to Financial Statements.

The following table summarizes the Fund’s financial instruments categorized in the fair value hierarchy. The breakdown of the Fund’s financial instruments into major categories is disclosed in the Schedule of Investments above.

| Level 1

|

Level 2

|

Level 3

|

Total

|

|||||||||||||

| Assets |

||||||||||||||||

| Investments |

||||||||||||||||

| Short-Term Securities |

||||||||||||||||

| Money Market Funds |

$ | 8,745,590 | $ | — | $ | — | $ | 8,745,590 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Investments valued at NAV(a) |

73,226,148 | |||||||||||||||

|

|

|

|||||||||||||||

| $ | 81,971,738 | |||||||||||||||

|

|

|

|||||||||||||||

| (a) | Certain investments of the Fund were fair valued using NAV as a practical expedient as no quoted market value is available and therefore have been excluded from the fair value hierarchy. |

See notes to financial statements.

| 10 | 2 0 2 3 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Statement of Assets and Liabilities

March 31, 2023

| BlackRock Hedge Fund Guided Portfolio Solution |

||||

| ASSETS |

||||

| Investments, at value — unaffiliated(a) |

$ | 73,226,148 | ||

| Investments, at value — affiliated(b) |

8,745,590 | |||

| Investments in Portfolio Funds paid in advance |

7,250,000 | |||

| Investments in Portfolio Funds sold receivable |

996,920 | |||

| Receivables: |

||||

| Dividends — affiliated |

44,837 | |||

| From the Manager |

1,719 | |||

|

|

|

|||

| Total assets |

90,265,214 | |||

|

|

|

|||

| LIABILITIES |

||||

| Capital contributions received in advance |

4,275,000 | |||

| Repurchase offer payable |

1,403,100 | |||

| Payables: |

||||

| Administration fees |

50,000 | |||

| Investment advisory fees |

113,238 | |||

| Other accrued expenses |

263,089 | |||

| Service and distribution fees |

106,001 | |||

|

|

|

|||

| Total liabilities |

6,210,428 | |||

|

|

|

|||

| NET ASSETS |

$ | 84,054,786 | ||

|

|

|

|||

| NET ASSETS CONSIST OF: |

||||

| Paid-in capital |

$ | 84,307,607 | ||

| Accumulated loss |

(252,821 | ) | ||

|

|

|

|||

| NET ASSETS |

$ | 84,054,786 | ||

|

|

|

|||

| NET ASSET VALUE |

||||

| Class I | ||||

| Net assets |

$ | 26,547,071 | ||

|

|

|

|||

| Shares outstanding |

2,646,919 | |||

|

|

|

|||

| Net asset value |

$ | 10.03 | ||

|

|

|

|||

| Class A | ||||

| Net assets |

$ | 57,507,715 | ||

|

|

|

|||

| Shares outstanding |

5,767,381 | |||

|

|

|

|||

| Net asset value |

$ | 9.97 | ||

|

|

|

|||

| (a) Investments, at cost — unaffiliated |

$ | 67,974,110 | ||

| (b) Investments, at cost — affiliated |

$ | 8,745,590 | ||

See notes to financial statements.

|

F I N A N C I A L S T A T E M E N T S |

11 |

Year Ended March 31, 2023

| BlackRock Hedge Fund Guided Portfolio Solution |

||||

| INVESTMENT INCOME |

||||

| Dividends — affiliated |

$ | 191,614 | ||

| Other income — unaffiliated |

13,164 | |||

|

|

|

|||

| Total investment income |

204,778 | |||

|

|

|

|||

| EXPENSES |

||||

| Investment advisory |

391,021 | |||

| Service and distribution — class specific |

359,349 | |||

| Professional |

340,417 | |||

| Administration |

175,000 | |||

| Transfer agent — class specific |

53,083 | |||

| Custodian |

39,839 | |||

| Accounting services |

21,563 | |||

| Trustees and Officer |

3,565 | |||

| Registration |

2,880 | |||

| Miscellaneous |

48,656 | |||

|

|

|

|||

| Total expenses |

1,435,373 | |||

| Less: |

||||

| Fees waived and/or reimbursed by the Manager |

(28,651 | ) | ||

| Transfer agent fees waived and/or reimbursed — class specific |

(53,083 | ) | ||

|

|

|

|||

| Total expenses after fees waived and/or reimbursed |

1,353,639 | |||

|

|

|

|||

| Net investment loss |

(1,148,861 | ) | ||

|

|

|

|||

| REALIZED AND UNREALIZED GAIN (LOSS) |

||||

| Net realized gain (loss) from: |

||||

| Investments — unaffiliated |

(848,204 | ) | ||

|

|

|

|||

| (848,204 | ) | |||

|

|

|

|||

| Net change in unrealized appreciation (depreciation) on: |

||||

| Investments — unaffiliated |

3,709,128 | |||

|

|

|

|||

| Net realized and unrealized gain |

2,860,924 | |||

|

|

|

|||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS |

$ | 1,712,063 | ||

|

|

|

|||

See notes to financial statements.

| 12 | 2 0 2 3 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Statements of Changes in Net Assets

| BlackRock Hedge Fund Guided Portfolio Solution | ||||||||

| Year Ended 03/31/23 |

Year Ended 03/31/22 |

|||||||

| INCREASE (DECREASE) IN NET ASSETS |

||||||||

| OPERATIONS |

||||||||

| Net investment loss |

$ | (1,148,861 | ) | $ | (726,669 | ) | ||

| Net realized gain (loss) |

(848,204 | ) | 259,220 | |||||

| Net change in unrealized appreciation (depreciation) |

3,709,128 | 1,542,910 | ||||||

|

|

|

|

|

|||||

| Net increase in net assets resulting from operations |

1,712,063 | 1,075,461 | ||||||

|

|

|

|

|

|||||

| DISTRIBUTIONS TO SHAREHOLDERS |

||||||||

| Class A |

(1,652,445 | ) | (398,502 | ) | ||||

| Class I |

(888,253 | ) | (286,621 | ) | ||||

|

|

|

|

|

|||||

| Decrease in net assets resulting from distributions to shareholders |

(2,540,698 | ) | (685,123 | ) | ||||

|

|

|

|

|

|||||

| CAPITAL SHARE TRANSACTIONS |

||||||||

| Proceeds from issuance of capital shares (net of change in capital contributions received in advance) |

29,870,000 | 53,803,500 | ||||||

| Reinvestment of distributions |

2,528,683 | 306,079 | ||||||

| Repurchase of shares resulting from tender offers |

(2,090,597 | ) | (24,582 | ) | ||||

|

|

|

|

|

|||||

| Net increase in net assets derived from capital share transactions |

30,308,086 | 54,084,997 | ||||||

|

|

|

|

|

|||||

| NET ASSETS |

||||||||

| Total increase in net assets |

29,479,451 | 54,475,335 | ||||||

| Beginning of year |

54,575,335 | 100,000 | ||||||

|

|

|

|

|

|||||

| End of year |

$ | 84,054,786 | $ | 54,575,335 | ||||

|

|

|

|

|

|||||

See notes to financial statements.

|

F I N A N C I A L S T A T E M E N T S |

13 |

Year Ended March 31, 2023

| BlackRock Hedge Fund |

||||

| CASH PROVIDED BY (USED FOR) OPERATING ACTIVITIES |

||||

| Net increase in net assets resulting from operations |

$ | 1,712,063 | ||

| Adjustments to reconcile net increase in net assets resulting from operations to net cash used for operating activities: |

||||

| Proceeds from sales of long-term investments |

8,779,194 | |||

| Purchases of long-term investments |

(29,638,164 | ) | ||

| Net proceeds from sales of short-term securities |

(4,023,682 | ) | ||

| Net realized gain on investments |

848,204 | |||

| Net unrealized (appreciation) depreciation on investments |

(3,709,128 | ) | ||

| (Increase) Decrease in Assets: |

||||

| Investments in Portfolio Funds paid in advance |

(6,350,000 | ) | ||

| Receivables: |

||||

| Dividends — affiliated |

(44,457 | ) | ||

| From the Manager |

362,476 | |||

| Prepaid expenses |

181 | |||

| Increase (Decrease) in Liabilities: |

||||

| Payables: |

||||

| Administration fees |

12,500 | |||

| Investment advisory fees |

113,238 | |||

| Service and distribution fees |

(8,495 | ) | ||

| Other accrued expenses |

84,040 | |||

|

|

|

|||

| Net cash used for operating activities |

(31,862,030 | ) | ||

|

|

|

|||

| CASH PROVIDED BY (USED FOR) FINANCING ACTIVITIES |

||||

| Proceeds from issuance of capital shares (net of change in capital contributions received in advance) |

32,564,000 | |||

| Payments on shares repurchased |

(689,955 | ) | ||

| Cash dividends paid to shareholders |

(12,015 | ) | ||

|

|

|

|||

| Net cash provided by financing activities |

31,862,030 | |||

|

|

|

|||

| CASH |

||||

| Net decrease in restricted and unrestricted cash |

— | |||

| Restricted and unrestricted cash at beginning of year |

— | |||

|

|

|

|||

| Restricted and unrestricted cash at end of year |

$ | — | ||

|

|

|

|||

| NON-CASH FINANCING ACTIVITIES |

||||

| Capital shares issued in reinvested dividends and distributions |

$ | 2,528,683 | ||

|

|

|

|||

See notes to financial statements.

| 14 | 2 0 2 3 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

(For a share outstanding throughout each period)

| BlackRock Hedge Fund Guided Portfolio Solution | ||||||||

| Class I | ||||||||

| Year Ended 03/31/23 |

Year Ended 03/31/22(a) |

|||||||

| Net asset value, beginning of year |

$ | 10.14 | $ | 10.00 | ||||

|

|

|

|

|

|||||

| Net investment loss(b) |

(0.11 | ) | (0.15 | ) | ||||

| Net realized and unrealized gain |

0.37 | 0.45 | ||||||

|

|

|

|

|

|||||

| Net increase from investment operations |

0.26 | 0.30 | ||||||

|

|

|

|

|

|||||

| Distributions from net investment income |

(0.37 | ) | (0.16 | ) | ||||

|

|

|

|

|

|||||

| Net asset value, end of year |

$ | 10.03 | $ | 10.14 | ||||

|

|

|

|

|

|||||

| Total Return(c) |

||||||||

| Based on net asset value |

2.60 | % | 3.06 | % | ||||

|

|

|

|

|

|||||

| Ratios to Average Net Assets(d) |

||||||||

| Total expenses |

1.43 | % | 3.27 | % | ||||

|

|

|

|

|

|||||

| Total expenses after fees waived and/or reimbursed |

1.34 | % | 1.45 | % | ||||

|

|

|

|

|

|||||

| Net investment loss |

(1.06 | )% | (1.44 | )% | ||||

|

|

|

|

|

|||||

| Supplemental Data |

||||||||

| Net assets, end of year (000) |

$ | 26,547 | $ | 19,831 | ||||

|

|

|

|

|

|||||

| Portfolio turnover rate |

14 | % | 9 | % | ||||

|

|

|

|

|

|||||

| (a) | Commenced operations on March 31, 2021. |

| (b) | Based on average shares outstanding. |

| (c) | Where applicable, assumes the reinvestment of distributions. The Fund is a continuously offered closed-end fund, the Shares of which are offered at net asset value. No secondary market for the Fund’s Shares exists. |

| (d) | Excludes fees and expenses incurred indirectly as a result of investments in underlying funds. |

See notes to financial statements.

|

F I N A N C I A L H I G H L I G H T S |

15 |

Financial Highlights (continued)

(For a share outstanding throughout each period)

| BlackRock Hedge Fund Guided Portfolio Solution (continued) | ||||||||

| Class A | ||||||||

| Year Ended 03/31/23 |

Year Ended 03/31/22(a) |

|||||||

| Net asset value, beginning of year |

$ | 10.11 | $ | 10.00 | ||||

|

|

|

|

|

|||||

| Net investment loss(b) |

(0.19 | ) | (0.22 | ) | ||||

| Net realized and unrealized gain |

0.36 | 0.46 | ||||||

|

|

|

|

|

|||||

| Net increase from investment operations |

0.17 | 0.24 | ||||||

|

|

|

|

|

|||||

| Distributions from net investment income |

(0.31 | ) | (0.13 | ) | ||||

|

|

|

|

|

|||||

| Net asset value, end of year |

$ | 9.97 | $ | 10.11 | ||||

|

|

|

|

|

|||||

| Total Return(c) |

||||||||

| Based on net asset value |

1.71 | % | 2.45 | % | ||||

|

|

|

|

|

|||||

| Ratios to Average Net Assets(d) |

||||||||

| Total expenses |

2.31 | % | 3.75 | % | ||||

|

|

|

|

|

|||||

| Total expenses after fees waived and/or reimbursed |

2.19 | % | 2.16 | % | ||||

|

|

|

|

|

|||||

| Net investment loss |

(1.89 | )% | (2.15 | )% | ||||

|

|

|

|

|

|||||

| Supplemental Data |

||||||||

| Net assets, end of year (000) |

$ | 57,508 | $ | 34,744 | ||||

|

|

|

|

|

|||||

| Portfolio turnover rate |

14 | % | 9 | % | ||||

|

|

|

|

|

|||||

| (a) | Commenced operations on March 31, 2021. |

| (b) | Based on average shares outstanding. |

| (c) | Where applicable, assumes the reinvestment of distributions. The Fund is a continuously offered closed-end fund, the Shares of which are offered at net asset value. No secondary market for the Fund’s Shares exists. |

| (d) | Excludes fees and expenses incurred indirectly as a result of investments in underlying funds. |

See notes to financial statements.

| 16 | 2 0 2 3 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| 1. | ORGANIZATION |

BlackRock Hedge Fund Guided Portfolio Solution (the “Fund”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end management investment company. The Fund is organized as a Delaware statutory trust. The Fund engages in a continuous offering of shares. The Fund may from time to time offer to repurchase shares from shareholders in accordance with written tenders by shareholders at those times, in those amounts, and on such terms and conditions as the Board of Trustees of the Fund (the “Board”) may determine in its sole discretion. The Fund calculates the net asset value (“NAV”) per share of the applicable class of the Fund as of the close of business on the last business day of each calendar month, and at such other times as the Board may determine. The Fund’s shares are offered for sale as of the first business day of each calendar month (the “Subscription Date”) at a price equal to the Fund’s NAV per share determined as of the close of business on the last business day of the calendar month preceding the Subscription Date, except that the Fund may offer shares more or less frequently as determined by the Board. The price of the shares during the Fund’s continuous offering will fluctuate over time with the NAV of the shares.

The Fund offers two classes of shares designated as Class I Shares and Class A Shares. Both classes of shares have identical voting, dividend, liquidation and other rights and will be subject to the same terms and conditions, except that Class A Shares bear expenses related to the shareholder servicing and distribution of such shares.

The Fund, together with certain other registered investment companies advised by BlackRock Advisors, LLC (the “Manager”) or its affiliates, is included in a complex of funds referred to as the BlackRock Fixed-Income Complex.

2. SIGNIFICANT ACCOUNTING POLICIES

The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”), which may require management to make estimates and assumptions that affect the reported amounts of assets and liabilities in the financial statements, disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. The Fund is considered an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies. Below is a summary of significant accounting policies:

Investment Transactions and Income Recognition: For financial reporting purposes, investment transactions are recorded on the dates the transactions are executed. Realized gains and losses on investment transactions are determined using the specific identification method. Dividend income and capital gain distributions, if any, are recorded on the ex-dividend dates. Non-cash dividends, if any, are recorded on the ex-dividend dates at fair value. Dividends from foreign securities where the ex-dividend dates may have passed are subsequently recorded when the Fund is informed of the ex-dividend dates. Under the applicable foreign tax laws, a withholding tax at various rates may be imposed on capital gains, dividends and interest. Income, expenses and realized and unrealized gains and losses are allocated daily to each class based on its relative net assets.

Distributions: Distributions from net investment income are declared annually and paid annually. Distributions of capital gains are recorded on the ex-dividend dates and made at least annually. The character and timing of distributions are determined in accordance with U.S. federal income tax regulations, which may differ from U.S. GAAP.

Deferred Compensation Plan: Under the Deferred Compensation Plan (the “Plan”) approved by the Board of Trustees of the Fund (the “Board”), the trustees who are not “interested persons” of the Fund, as defined in the 1940 Act (“Independent Trustees”), may defer a portion of their annual complex-wide compensation. Deferred amounts earn an approximate return as though equivalent dollar amounts had been invested in common shares of certain funds in the BlackRock Fixed-Income Complex selected by the Independent Trustees. This has the same economic effect for the Independent Trustees as if the Independent Trustees had invested the deferred amounts directly in certain funds in the BlackRock Fixed-Income Complex.

The Plan is not funded and obligations thereunder represent general unsecured claims against the general assets of the Fund, as applicable. Deferred compensation liabilities, if any, are included in the Trustees’ and Officer’s fees payable in the Statement of Assets and Liabilities and will remain as a liability of the Fund until such amounts are distributed in accordance with the Plan.

Net appreciation (depreciation) in the value of participants’ deferral accounts is allocated among the participating funds in the BlackRock Fixed Income Complex and reflected as Trustee and Officer expense on the Statement of Operations. The Trustee and Officer expense may be negative as a result of a decrease in value of the deferred accounts.

Indemnifications: In the normal course of business, the Fund enters into contracts that contain a variety of representations that provide general indemnification. The Fund’s maximum exposure under these arrangements is unknown because it involves future potential claims against the Fund, which cannot be predicted with any certainty.

Other: Expenses directly related to the Fund or its classes are charged to the Fund or the applicable class. Expenses directly related to the Fund and other shared expenses prorated to the Fund are allocated daily to each class based on its relative net assets or other appropriate methods. Other operating expenses shared by several funds, including other funds managed by the Manager, are prorated among those funds on the basis of relative net assets or other appropriate methods.

The Fund has an arrangement with its custodian whereby credits are earned on uninvested cash balances, which could be used to reduce custody fees and/or overdraft charges. The Fund may incur charges on certain uninvested cash balances and overdrafts, subject to certain conditions.

3. INVESTMENT VALUATION AND FAIR VALUE MEASUREMENTS

Investment Valuation Policies: The Fund’s investments are valued at fair value (also referred to as “market value” within the financial statements) each day that the Fund is open for business and, for financial reporting purposes, as of the report date. U.S. GAAP defines fair value as the price a fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. The Board of each Fund has approved the designation of each Fund’s Manager as the valuation designee for the Fund. The Fund determines the fair values of its financial instruments using various independent dealers or pricing services under the Manager’s

| N O T E S T O F I N A N C I A L S T A T E M E N T S |

17 |

Notes to Financial Statements (continued)

policies. If a security’s market price is not readily available or does not otherwise accurately represent the fair value of the security, the security will be valued in accordance with the Manager’s policies and procedures as reflecting fair value. The Manager has formed a committee (the “Valuation Committee”) to develop pricing policies and procedures and to oversee the pricing function for all financial instruments, with assistance from other BlackRock pricing committees.

In valuing interests in Portfolio Funds, the Manager, under the supervision of the Board, considers all relevant information to determine the price that the Fund might reasonably expect to receive from the current sale (or redemption in the case of a Portfolio Fund whose interests carry redemption rights) of the interest in the Portfolio Fund in an arm’s-length transaction. In general, the Manager will rely primarily on any actual or estimated (as applicable) unaudited values provided by the Portfolio Fund manager to the extent such unaudited values are received in a timely fashion and are believed to be the most reliable and relevant indication of the value of interests in such Portfolio Fund. It is anticipated that these unaudited values will be prepared in accordance with U.S. GAAP and will, in effect, be the fair value of each Portfolio Fund’s assets, less such Portfolio Fund’s liabilities (the net asset value). In some cases, estimated unaudited values are provided before final unaudited values. The Manager will rely primarily on such estimated unaudited values or final unaudited values, to the extent they are the most reliable and relevant indication of value of interests in the Portfolio Funds. The Manager will give weight to such valuations and any other factors and considerations set forth in the Valuation Procedures as deemed appropriate in each case. In general, the Manager will, prior to investing in any Portfolio Fund, and periodically thereafter, assess such Portfolio Fund’s valuation policies and procedures for appropriateness in light of the Fund’s obligation to fair value its assets under the 1940 Act and pursuant to U.S. GAAP for investment companies and will assess the overall reasonableness of the information provided by such Portfolio Fund. As part of this assessment, the Manager may also evaluate, among other things, a Portfolio Fund’s practices in respect of creating “side pockets” and such Portfolio Fund’s valuation policies and procedures in respect of any such “side pockets.” The Manager will also review any other information available to it, including reports by independent auditors, fund administrators, if any, and/or other third parties.

In instances where unaudited estimated or final values may not be available, or where such unaudited estimated or final values are determined not to be the most reliable and relevant indication of value of an interest in a Portfolio Fund (as further discussed below), additional factors that may be relevant in determining the value of an interest in a Portfolio Fund, in addition to those other factors and considerations set forth in the Valuation Procedures, include (1) changes in the valuation of hedge fund indices, (2) publicly available information regarding a Portfolio Fund’s underlying portfolio companies or investments, (3) the price at which recent subscriptions and redemptions of such Portfolio Fund interests were offered, (4) relevant news and other sources, (5) significant market events and (6) information provided to the Manager or the Fund by a Portfolio Fund, or the failure to provide such information as agreed to in the Portfolio Fund’s offering materials or other agreements with the Fund.

In circumstances where, taking into account the factors and considerations set forth above and in the Valuation Procedures, the Manager has reason to believe that a value provided by a Portfolio Fund is not the most reliable and relevant indication of the value of an interest in the Portfolio Fund, the Manager may adjust such reported value to reflect the fair value of the interest in the Portfolio Fund. Likewise, in circumstances where a Portfolio Fund does not provide a valuation as contemplated above, the factors and considerations set forth above and in the Valuation Procedures may be the only indicators of the value of an interest in a Portfolio Fund and the Manager will use such factors, together with other valuation methodologies set forth in the Valuation Procedures that may be relevant, to estimate the fair value of its interest in a Portfolio Fund. In circumstances where the Manager determines to adjust the values reported by Portfolio Funds, or in circumstances where the Portfolio Funds do not provide valuations as contemplated above (such circumstances being collectively referred to as “Adjusted Fair Values”), such valuations will be subject to review and approval by the Valuation Committee or its delegate as outlined in the Valuation Procedures. The Board reviews fair value determinations at its regularly scheduled meetings and also reviews the Valuation Procedures on a regular basis.

Fair Value Inputs and Methodologies: The following methods and inputs are used to establish the fair value of the Fund’s assets and liabilities:

| · | Investments in open-end U.S. mutual funds (including money market funds) are valued at that day’s published NAV. |

Fair Value Hierarchy: Various inputs are used in determining the fair value of financial instruments. These inputs to valuation techniques are categorized into a fair value hierarchy consisting of three broad levels for financial reporting purposes as follows:

| · | Level 1 – Unadjusted price quotations in active markets/exchanges for identical assets or liabilities that the Fund has the ability to access; |

| · | Level 2 – Other observable inputs (including, but not limited to, quoted prices for similar assets or liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market–corroborated inputs); and |

| · | Level 3 – Unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Valuation Committee’s assumptions used in determining the fair value of financial instruments). |

The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the fair value hierarchy classification is determined based on the lowest level input that is significant to the fair value measurement in its entirety. Investments classified within Level 3 have significant unobservable inputs used by the Valuation Committee in determining the price for Fair Valued Investments. Level 3 investments include equity or debt issued by privately held companies or funds that may not have a secondary market and/or may have a limited number of investors. The categorization of a value determined for financial instruments is based on the pricing transparency of the financial instruments and is not necessarily an indication of the risks associated with investing in those securities.

As of March 31, 2023, certain investments of the Fund were fair valued using NAV as the practical expedient as no quoted market value is available and therefore have been excluded from the fair value hierarchy.

| 18 | 2 0 2 3 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Notes to Financial Statements (continued)

| 4. | INVESTMENTS IN PORTFOLIO FUNDS |

Information reflecting the Fund’s investments in Portfolio Funds as of March 31, 2023 is summarized below.

| Investment | Value | % of Fund’s Net Assets |

Primary Geographic Locations |

Redemptions Permitted |

||||||||||||

|

|

||||||||||||||||

| Equity Hedge |

||||||||||||||||

| Atlas Enhanced Fund, Ltd. |

$ | 7,540,811 | 8.9 | % | North America | Quarterly | ||||||||||

| Kadensa Fund |

3,598,413 | 4.3 | |

Developed Asia Pacific, Emerging Markets, North America |

|

Quarterly | ||||||||||

| Manticore Fund (Cayman) Ltd. |

4,016,396 | 4.8 | |

Developed Asia Pacific, Emerging Markets, North America, Western Europe |

|

Monthly | ||||||||||

| Schonfeld Strategic Partners Offshore Fund, Ltd. |

3,686,646 | 4.4 | |

Developed Asia Pacific, Emerging Markets, North America, Western Europe |

|

Monthly | ||||||||||

| Voleon Composition International Fund, Ltd. |

5,277,779 | 6.3 | |

North America, Western Europe |

|

Monthly | ||||||||||

| Event-Driven |

||||||||||||||||

| MY Asian Opportunities Unit Trust |

3,512,113 | 4.2 | North America | Quarterly | ||||||||||||

| Nekton Global Fund Ltd. |

3,555,648 | 4.2 | |

Developed Asia Pacific, Emerging Markets, North America, Western Europe |

|

Quarterly | ||||||||||

| Pentwater Event Fund, Ltd. |

7,155,621 | 8.5 | |

Emerging Markets, North America, Western Europe |

|

Monthly | ||||||||||

| Segantii Asia-Pacific Equity Multi-Strategy Fund |

52,353 | 0.1 | |

Developed Asia Pacific, Emerging Markets, North America |

|

Monthly | ||||||||||

| Macro |

||||||||||||||||

| Crabel Fund SPC, Ltd. |

3,429,305 | 4.1 | |

Developed Asia Pacific, Emerging Markets, North America, Western Europe |

|

Monthly | ||||||||||

| Drakewood Prospect Fund Ltd. |

3,471,019 | 4.1 | North America | Monthly | ||||||||||||

| East One Commodity Fund Limited |

3,715,882 | 4.4 | |

Emerging Markets, North America, Western Europe |

|

Monthly | ||||||||||

| Stratus Feeder, Ltd. |

6,632,708 | 7.9 | |

Developed Asia Pacific, Emerging Markets, North America, Western Europe |

|

Monthly | ||||||||||

| Systematica Alternative Markets Fund Ltd. |

3,372,340 | 4.0 | |

Developed Asia Pacific, Emerging Markets, North America, Western Europe |

|

Monthly | ||||||||||

| Relative Value |

||||||||||||||||

| One William Street Capital Offshore Fund, Ltd. |

6,882,838 | 8.2 | North America | Quarterly | ||||||||||||

| Parallax Offshore Investors Fund, Ltd. |

3,597,573 | 4.3 | |

Developed Asia Pacific, North America, Western Europe |

|

Quarterly | ||||||||||

| Polar Multi-Strategy Fund |

3,728,703 | 4.4 | |

Developed Asia Pacific, Emerging Markets, North America, Western Europe |

|

Monthly | ||||||||||

| $ | 73,226,148 | 87.1 | % | |||||||||||||

|

|

|

|

|

|||||||||||||

| N O T E S T O F I N A N C I A L S T A T E M E N T S |

19 |

Notes to Financial Statements (continued)

| Major Category | Fair Value | Illiquid Investments(a) |

Gates(b) | Lock-ups(c) | Redemption Frequency(d) |

Redemption Notice Period(d) |

||||||||||||||||||

| Equity Hedge(e) |

$ | 24,120,045 | $ | — | $ | 1,955,010 | $ | 11,301,455 | Quarterly, Monthly | 5-65 days | ||||||||||||||

| Event-Driven(f) |

14,275,735 | — | 1,788,905 | — | Quarterly, Monthly | 60-90 days | ||||||||||||||||||

| Macro(g) |

20,621,254 | — | — | 7,145,187 | Monthly | 5-60 days | ||||||||||||||||||

| Relative Value(h) |

14,209,114 | — | 1,720,710 | 10,480,411 | Quarterly, Monthly | 45-90 days | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| $ | 73,226,148 | $ | — | $ | 5,464,625 | $ | 28,927,053 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| (a) | Represents private investment funds that cannot be voluntarily redeemed by the Fund at any time. This includes: (i) private investment funds that are liquidating and making distribution payments as their underlying assets are sold, (ii) suspended redemptions/withdrawals, and (iii) side pocket holdings. These types of investments may be realized within 1 to 3 years from March 31, 2023, depending on the specific investment and market conditions. This does not include private investment funds with gates and lockups, which are noted above. |

| (b) | Represents the portion of the Portfolio Funds for which there are investor level gates, which are not otherwise included as illiquid investments. |

| (c) | Represents investments that cannot be redeemed without a fee due to a lock-up provision, which are not otherwise included as illiquid investments or investments with gates. The lock-up period for these investments is 6 to 36 months at March 31, 2023. |

| (d) | Redemption frequency and redemption notice period reflect general redemption terms, and exclude liquidity restrictions noted above. |

| (e) | Equity Hedge strategies maintain positions both long and short, normally with a primary focus on equity securities and equity derivatives. A wide variety of investment processes can be employed to arrive at an investment decision, including both quantitative and fundamental techniques. The application of the Valuation Procedures to investments in this category did not result in any Adjusted Fair Values as of March 31, 2023. The fair values of the investments in this category have been estimated based on the net asset values provided by management of the Portfolio Funds. |

| (f) | Event-Driven strategies concentrate on companies that are subject to corporate events such as mergers, acquisitions, restructurings, spin-offs, shareholder activism or other special situations that alter a company’s financial structure or operating strategy. The intended goal of these strategies is to profit when the price of a security changes to reflect more accurately the likelihood and potential impact of the occurrence, or nonoccurrence, of the event. The application of the Valuation Procedures to investments in this category did not result in any Adjusted Fair Values as of March 31, 2023. The fair values of the investments in this category have been estimated based on the net asset values provided by management of the Portfolio Funds. |

| (g) | Macro strategies employ a broad range of strategies where the investment process is predicated on movements in underlying economic variables and the impact of these movements on equity, fixed income, hard currency and commodity markets. The application of the Valuation Procedures to investments in this category did not result in any Adjusted Fair Values as of March 31, 2023. The fair values of the investments in this category have been estimated based on the net asset values provided by management of the Portfolio Funds. |

| (h) | Relative Value strategies seek to profit from the mispricing of financial instruments relative to each other or historical norms. These strategies utilize quantitative and qualitative analyses to identify securities or spreads between securities that deviate from their theoretical fair value and/or historical norms. The application of the Valuation Procedures to investments in this category did not result in any Adjusted Fair Values as of March 31, 2023. The fair values of the investments in this category have been estimated based on the net asset values provided by management of the Portfolio Funds. |

| 5. | INVESTMENT ADVISORY AGREEMENT AND OTHER TRANSACTIONS WITH AFFILIATES |

Investment Advisory: The Fund entered into an Investment Advisory Agreement with the Manager, the Fund’s investment adviser and an indirect, wholly-owned subsidiary of BlackRock, Inc. (“BlackRock”), to provide investment advisory and administrative services. The Manager is responsible for the management of the Fund’s portfolio and provides the personnel, facilities, equipment and certain other services necessary to the operations of the Fund.

For such services, the Fund pays the Manager a monthly fee at an annual rate equal to 0.55% of the average monthly value of the Fund’s net assets.

Service and Distribution Fees: The Fund has entered into a Distribution Agreement (the “Distribution Agreement”) with BlackRock Investments, LLC (the “Distributor”), an affiliate of the Manager, to provide for distribution of the common shares. The Distribution Agreement provides that the Distributor will sell, and will appoint financial intermediaries to sell, common shares on behalf of the Fund on a reasonable efforts basis. The Fund has adopted a distribution and servicing plan (the “Distribution and Servicing Plan”) with respect to certain classes of the common shares and in doing so has voluntarily complied with Rule 12b-1 under the 1940 Act, as if the Fund were an open-end investment company, and will be subject to an ongoing distribution fee and shareholder servicing fee (together, the “Distribution and Servicing Fee”) in respect of the classes of common shares paying such Distribution and Servicing Fee. The maximum annual rates at which the Distribution and Servicing Fees may be paid under the Distribution and Servicing Plan (calculated as a percentage of the Fund’s monthly net assets attributable to the classes of common shares paying such Distribution and Servicing Fee) is 0.75% for Class A Shares. Class I Shares are not subject to a distribution fee or shareholder servicing fee.

For the year ended March 31, 2023, the class specific service and distribution fees borne directly by Class A Shares amounted to $359,349.

Transfer Agent: Pursuant to written agreements, certain financial intermediaries, some of which may be affiliates, provide the Fund with sub-accounting, recordkeeping, sub-transfer agency and other administrative services with respect to servicing of underlying investor accounts. For these services, these entities receive an asset-based fee or an annual fee per shareholder account, which will vary depending on share class and/or net assets. For the year ended March 31, 2023, the Fund did not pay any amounts to affiliates in return for these services.

In addition, the Fund pays the transfer agent, which is not an affiliate, a fee for the issuance, transfer and redemption of shares and the opening and maintenance of shareholder accounts, which is included in transfer agent in the Statement of Operations.

| 20 | 2 0 2 3 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Notes to Financial Statements (continued)

For the year ended March 31, 2023, the following table shows the class specific transfer agent fees borne directly by each share class of the Fund:

| Class Name | Total | |||

| Class I |

$ | 10,300 | ||

| Class A |

42,783 | |||

|

|

|

|||

| 53,083 |

Expense Limitations, Waivers and Reimbursements: The Manager contractually agreed to waive its investment advisory fees by the amount of investment advisory fees the Fund pays to the Manager indirectly through its investment in affiliated money market funds (the “affiliated money market fund waiver”) through June 30, 2024. The contractual agreement may be terminated upon 90 days’ notice by a majority of the Independent Trustees, or by a vote of a majority of the outstanding voting securities of the Fund. This amount is included in fees waived and/or reimbursed by the Manager in the Statements of Operations. For year ended March 31, 2023, the amount waived was $4,837.

The Manager contractually agreed to waive its investment advisory fee with respect to any portion of the Fund’s assets invested in affiliated equity and fixed-income mutual funds and affiliated exchange-traded funds that have a contractual management fee through June 30, 2024. The agreement can be renewed for annual periods thereafter, and may be terminated on 90 days’ notice, each subject to approval by a majority of the Funds’ Independent Trustees. For the year ended March 31, 2023, there were no fees waived by the Manager pursuant to this arrangement.

The Manager contractually agreed to waive and/or reimburse certain operating and other expenses of the Fund in order to limit certain expenses to 0.80% of the Fund’s average monthly value of the net assets of each share class (“expense limitation”). This expense limitation excludes the investment advisory fee, service and distribution fees, interest expense, portfolio transaction, sub-accounting, record keeping, other administrative services and other investment-related costs (including acquired fund fees and expenses, commitment fees on leverage, prime broker fees and dividend expense) and certain other fund expenses, which constitute extraordinary expenses not incurred in the ordinary course of the Fund’s business. The Manager has agreed not to reduce or discontinue the contractual expense limitations through June 30, 2024. This amount is included in fees waived and/or reimbursed by the Manager in the Statements of Operations. For the year ended March 31, 2023, the Manager waived $23,814 pursuant to this arrangement.

In addition, these amounts waived and/or reimbursed by the Manager are included in transfer agent fees waived and/or reimbursed — class specific in the Statement of Operations. For the year ended March 31, 2023, class specific expense waivers and/or reimbursements are as follows:

| Class Name | Total | |||

| Class I |

$ | 10,300 | ||

| Class A |

42,783 | |||

|

|

|

|||

| 53,083 |

With respect to the contractual expense limitation, if during the Fund’s fiscal year the operating expenses of a share class, that at any time during the prior two fiscal years received a waiver and/or reimbursement from the Manager, are less than the current expense limitation for that share class, the Manager is entitled to be reimbursed by such share class up to the lesser of: (a) the amount of fees waived and/or expenses reimbursed during those prior two fiscal years under the agreement and (b) an amount not to exceed either the current expense limitation of that share class or the expense limitation of the share class in effect at the time that the share class received the applicable waiver and/or reimbursement, provided that:

| (1) | the Fund has more than $50 million in assets for the fiscal year, and |

| (2) | the Manager or an affiliate continues to serve as the Fund’s investment adviser or administrator. |

This repayment applies only to the contractual expense limitation on net expenses and does not apply to the contractual advisory fee waiver described above or any voluntary waivers that may be in effect from time to time. Effective April 1, 2028, the repayment arrangement between the Fund and the Manager pursuant to which such Fund may be required to repay amounts waived and/or reimbursed under the Fund’s contractual caps on net expenses will be terminated.

As of March 31, 2023, the fund level and class specific waivers and/or reimbursements subject to possible future recoupment under the expense limitation agreement are as follows:

| Fund Level/Share Class | Expiring March 31, | |||||||

| 2024 | 2025 | |||||||

| Fund Level |

$ | 563,342 | $ | 23,814 | ||||

| Class I |

2,817 | 10,300 | ||||||

| Class A |

13,666 | 42,783 | ||||||