Form N-CSR BAILLIE GIFFORD FUNDS For: Apr 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10145

Baillie Gifford Funds

(Exact name of registrant as specified in charter)

1 Greenside Row

Edinburgh, Scotland, UK, EH1 3AN

(Address of principal executive offices) (Zip code)

Gareth Griffiths

1 Greenside Row

Edinburgh, Scotland, UK, EH1 3AN

(Name and address of agent for service)

Registrant's telephone number, including area code: 011-44-131-275-2000

Date of fiscal year end: April 30

Date of reporting period: April 30, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) | The Report to Shareholders is attached herewith. |

BAILLIE GIFFORD FUNDS

Baillie Gifford Multi Asset Fund

Annual Report

April 30, 2022

Index

|

Page Number |

|||||||

|

01 |

Management Discussion |

||||||

|

03 |

Fund Expenses |

||||||

|

05 |

Industry Diversification Table |

||||||

|

06 |

Portfolio of Investments |

||||||

|

17 |

Financial Statements |

||||||

|

21 |

Financial Highlights |

||||||

|

23 |

Notes to Financial Statements |

||||||

|

35 |

Report of Independent Registered Public Accounting Firm |

||||||

|

Supplemental Information |

|||||||

|

36 |

Federal Income Tax Information |

||||||

|

37 |

Management of the Trust |

||||||

Scenic view of Bostadh Beach and Luskentyre Beach in Summer, Isle of Harris, Scotland

Source: © Markus Keller/Shutterstock

This report is intended for shareholders of Baillie Gifford Multi Asset Fund (the "Fund") and may not be used as sales literature unless preceded or accompanied by a current prospectus for the Fund.

The statements and views expressed in this report are as of this report's period end and are subject to change at any time. All investments entail risk, including the possible loss of principal.

Management Discussion (unaudited)

Annual Report April 30, 2022

Baillie Gifford Multi Asset Fund

Market Conditions and Review of Performance during the 12 months ended April 30, 2022

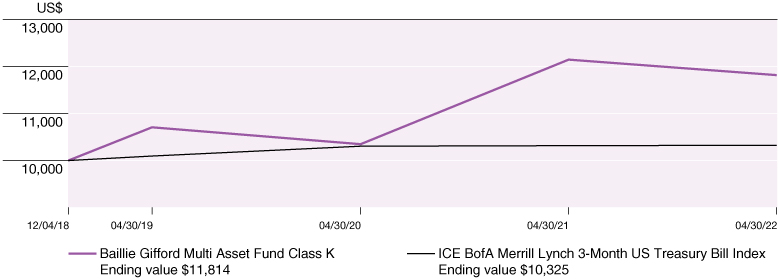

In the 12 months ended April 30, 2022, Baillie Gifford Multi Asset Fund's performance was negative (-2.71% for Class K shares), meaning it underperformed its benchmark, which returned 0.08% over the same period.

During the spring of 2021, economies continued to reopen as COVID-19 vaccines were rolled out across the world and, reinforced by supportive economic policies and low inflation, the subsequent positive sentiment across investment markets was generally a good thing for most asset classes. However, investment markets have had a much more challenging start to 2022, reacting initially to heightened short-term inflation data and then more recently to the war in Ukraine. The Fund has not been immune from recent volatility and much of the strong growth generated during the 2021 calendar year has been given back.

Across all asset classes in which the Fund invests, listed growth equities was the worst performing asset class over the reporting period, as rising central bank interest rates impacted the outlook for future global growth prospects. In conjunction with this, rising U.S. inflation has contributed to a broad sell off in technology stocks, and continued Chinese lockdowns in response to the COVID-19 pandemic have impacted supply chains. Both of these developments have had negative effects on the Fund and equity markets more generally.

Infrastructure holdings were the single biggest positive contributor to returns during the reporting period, as governments globally pledged to increase their renewable energy commitments. We believe elevated energy prices experienced in many regions globally should serve to increase both the viability of these renewable energy commitments and the push for greater international energy independence in the future.

Another asset class that contributed positively to performance was real estate, with investments in logistics and distribution assets being particularly beneficial. These assets are capitalising on what we believe is the ongoing shift to e-commerce and the need for increased warehousing space to meet the need for rising inventory levels. The portfolio's commodities investments were a

notable performer over the period, as our exposure to rare earth miners contributed positively against a favourable backdrop for their use in renewable technologies.

From a broader investment and outlook perspective, while we remain sensitive to shorter-term swings in market sentiment, our focus remains on taking advantage of what we believe are longer-term trends. The portfolio invests in a number of broader themes — which include the Rise of Asia, the Green Revolution and Technological Innovation — while we also maintain a generally positive view on economies reopening as COVID-19 restrictions are lifted. These themes appear across a broad range of asset classes including listed equities, infrastructure and real estate. Indeed, on a medium-term view, we believe that: the abrupt change in geopolitical relations following Russia's invasion of Ukraine only strengthens the case for Europe seeking energy independence; wage inflation is increasing the attraction and adoption of automation and other disruptive activities; and supply chain disruption only prompts greater inventories and demand for the logistics companies that store them. As a result we believe there remain many interesting growth opportunities for Multi Asset investors.

And while we consistently seek to capture this optimism, the portfolio is designed to protect against potential longer-term downswings via a refined allocation to more defensively orientated investments, alongside the inherent diversification of the portfolio.

Investment Strategies used to manage the Fund

The investment strategy remains largely unchanged from 12 months ago. Baillie Gifford Multi Asset Fund offers actively managed exposure to a broad range of different asset classes through the convenience of a single portfolio. Our investment approach combines a top-down, macroeconomic view with bottom-up research, as described in the Fund's prospectus. The portfolio managers take an active, flexible approach to asset allocation, adjusting the mix of asset classes in response to long- and short-term opportunities in an effort to reduce overall volatility and/or increase returns. The portfolio managers make allocation decisions across asset classes primarily based on an analysis of the long-term expected returns, correlations and risk.

01

Management Discussion (unaudited)

Annual Report April 30, 2022

Fund Performance for periods ended 04/30/22 (Average Annual Total Returns)

|

One Year |

% p.a. Since Inception (December 4, 2018) |

||||||||||

|

Baillie Gifford Multi Asset Fund Class K |

-2.71 |

% |

5.02 |

% |

|||||||

|

Baillie Gifford Multi Asset Fund Institutional Class |

-2.80 |

% |

5.01 |

% |

|||||||

|

ICE BofA Merrill Lynch 3-Month US Treasury Bill Index |

0.08 |

% |

0.94 |

% |

|||||||

The returns are provided for all shares classes that had shares outstanding as of April 30, 2022. Additional year-over-year returns for each class are available in the Financial Highlights section.

Comparison of the change in value of $10,000 investment in the Fund's Class K share and the index

Past performance does not predict future performance. The graph and the table above do not reflect the deduction of taxes that a shareholder would pay on the Fund distributions or redemption of Fund shares.

02

Fund Expenses (unaudited)

Annual Report April 30, 2022

As a shareholder of Baillie Gifford Multi Asset Fund (the "Fund") you incur two types of costs: (1) transactional costs and (2) ongoing costs, including advisory fees, administration and supervisory fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from November 1, 2021 to April 30, 2022.

Actual Expenses

The first line of each table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide the account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During the Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of each table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund's actual return.

The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5%hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table labeled "Hypothetical (5% return before expenses)" is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

03

Fund Expenses (unaudited)

Annual Report April 30, 2022

|

Beginning Account Value November 1, 2021 |

Ending Account Value April 30, 2022 |

Annualized Expense Ratios Based on the Period November 1, 2021 to April 30, 2022 |

Expenses Paid During Period* |

||||||||||||||||

|

Baillie Gifford Multi Asset Fund — Class K |

|||||||||||||||||||

|

Actual |

$ |

1,000 |

$ |

930.80 |

0.32 |

% |

$ |

1.53 |

|||||||||||

|

Hypothetical (5% return before expenses) |

$ |

1,000 |

$ |

1,023.21 |

0.32 |

% |

$ |

1.61 |

|||||||||||

|

Baillie Gifford Multi Asset Fund — Institutional Class |

|||||||||||||||||||

|

Actual |

$ |

1,000 |

$ |

930.70 |

0.35 |

% |

$ |

1.68 |

|||||||||||

|

Hypothetical (5% return before expenses) |

$ |

1,000 |

$ |

1,023.06 |

0.35 |

% |

$ |

1.76 |

|||||||||||

* Unless otherwise indicated, expenses are calculated using the Fund's annualized expense ratio, multiplied by the average account value for the period, multiplied by 181/365 (to reflect the six-month period).

Expenses are calculated using the annualized expense ratio for the Fund, which represents the ongoing expenses as a percentage of net assets for the year ended April 30, 2022. Expenses are calculated by multiplying the annualized expense ratio by the average account value for the period; then multiplying the result by the number of days in the

most recent fiscal half-year; and then dividing that result by the number of days in the calendar year. Expense ratios for the most recent fiscal year may differ from expense ratios based on the one-year data in the financial highlights.

04

Industry Diversification Table (unaudited)

Annual Report April 30, 2022

April 30, 2022

Baillie Gifford Multi Asset Fund

|

Value |

% of Total Net Assets |

||||||||||

|

Advertising |

$ |

34,945 |

0.3 |

% |

|||||||

|

Airlines |

58,664 |

0.4 |

|||||||||

|

Asset Backed Securities |

455,165 |

3.3 |

|||||||||

|

Auto Parts & Equipment |

18,576 |

0.1 |

|||||||||

|

Banks |

603,303 |

4.4 |

|||||||||

|

Building Materials |

82,125 |

0.6 |

|||||||||

|

Commercial Services |

51,524 |

0.4 |

|||||||||

|

Computers |

19,580 |

0.2 |

|||||||||

|

Diversified Financial Services |

618,620 |

4.5 |

|||||||||

|

Electric |

1,635,183 |

11.9 |

|||||||||

|

Electrical Components and Equipment |

282,954 |

2.1 |

|||||||||

|

Electronics |

56,715 |

0.4 |

|||||||||

|

Energy-Alternate Sources |

106,215 |

0.8 |

|||||||||

|

Engineering & Construction |

38,744 |

0.3 |

|||||||||

|

Entertainment |

43,322 |

0.3 |

|||||||||

|

Food |

104,513 |

0.8 |

|||||||||

|

Gas |

70,412 |

0.5 |

|||||||||

|

Internet |

54,645 |

0.4 |

|||||||||

|

Investment Companies |

336,389 |

2.5 |

|||||||||

|

Leisure Time |

42,985 |

0.3 |

|||||||||

|

Lodging |

128,538 |

0.9 |

|||||||||

|

Media |

14,226 |

0.1 |

|||||||||

|

Mining |

803,883 |

5.8 |

|||||||||

|

Pooled Investment Vehicles |

3,956,076 |

28.9 |

|||||||||

|

Real Estate |

153,443 |

1.2 |

|||||||||

|

REITS |

1,192,524 |

8.7 |

|||||||||

|

Retail |

76,288 |

0.6 |

|||||||||

|

Sovereign |

1,371,378 |

10.1 |

|||||||||

|

Telecommunications |

63,105 |

0.4 |

|||||||||

|

Toys/Games/Hobbies |

18,631 |

0.2 |

|||||||||

|

Total Value of Investments |

12,492,671 |

91.4 |

|||||||||

|

Other assets less liabilities |

1,171,932 |

8.6 |

|||||||||

|

Net Assets |

$ |

13,664,603 |

100.0 |

% |

|||||||

The table above is based on Bloomberg Industry Group classifications. For compliance monitoring purposes, sub-industry classifications are used which results in less concentration across industry sectors.

05

Portfolio of Investments

Annual Report April 30, 2022

April 30, 2022

Baillie Gifford Multi Asset Fund

|

Shares/Principal |

Value |

||||||||||

|

COMMON STOCKS — 30.2% |

|||||||||||

|

AUSTRALIA — 2.6% |

|||||||||||

|

BHP Group Ltd. |

1,089 |

$ |

36,495 |

||||||||

| Lynas Rare Earths Ltd. * |

25,295 |

158,730 |

|||||||||

|

Newcrest Mining Ltd. |

6,510 |

122,254 |

|||||||||

|

Rio Tinto PLC |

624 |

44,089 |

|||||||||

|

361,568 |

|||||||||||

|

CANADA — 1.6% |

|||||||||||

|

First Majestic Silver Corp. |

6,160 |

63,631 |

|||||||||

|

Hydro One Ltd. |

2,647 |

71,561 |

|||||||||

|

Pan American Silver Corp. |

3,090 |

76,539 |

|||||||||

|

211,731 |

|||||||||||

|

CHINA — 1.7% |

|||||||||||

|

China Longyuan Power Group Corp., Ltd., Class H |

50,000 |

96,441 |

|||||||||

|

China Yangtze Power Co., Ltd., Class A |

29,800 |

102,433 |

|||||||||

|

Xinyi Energy Holdings Ltd. |

64,000 |

34,234 |

|||||||||

|

233,108 |

|||||||||||

|

DENMARK — 1.4% |

|||||||||||

| NKT A/S * |

1,190 |

56,715 |

|||||||||

|

Orsted AS |

1,257 |

139,062 |

|||||||||

|

195,777 |

|||||||||||

|

FRANCE — 1.3% |

|||||||||||

| JCDecaux SA * |

1,667 |

34,945 |

|||||||||

|

Nexans SA |

1,526 |

139,000 |

|||||||||

|

173,945 |

|||||||||||

|

GERMANY — 0.3% |

|||||||||||

| Fraport AG Frankfurt Airport Services Worldwide * |

725 |

38,744 |

|||||||||

|

IRELAND — 0.5% |

|||||||||||

|

CRH PLC |

986 |

39,264 |

|||||||||

| Ryanair Holdings PLC ADR * |

369 |

32,221 |

|||||||||

|

71,485 |

|||||||||||

The accompanying notes are an integral part of the financial statements.

06

Portfolio of Investments

Annual Report April 30, 2022

April 30, 2022

Baillie Gifford Multi Asset Fund

|

Shares/Principal |

Value |

||||||||||

|

ITALY — 3.1% |

|||||||||||

|

Italgas SpA |

10,875 |

$ |

70,412 |

||||||||

|

Prysmian SpA |

4,426 |

143,955 |

|||||||||

|

Terna — Rete Elettrica Nazionale |

25,374 |

206,953 |

|||||||||

|

421,320 |

|||||||||||

|

MACAU — 0.6% |

|||||||||||

|

Galaxy Entertainment Group Ltd. |

8,000 |

45,649 |

|||||||||

| Sands China Ltd. * |

16,400 |

36,149 |

|||||||||

|

81,798 |

|||||||||||

|

NETHERLANDS — 0.4% |

|||||||||||

|

CTP NV |

3,483 |

49,315 |

|||||||||

|

SPAIN — 3.9% |

|||||||||||

|

EDP Renovaveis SA |

5,847 |

138,382 |

|||||||||

|

Iberdrola SA |

16,157 |

185,657 |

|||||||||

|

Red Electrica Corp. SA |

6,965 |

140,235 |

|||||||||

| Siemens Gamesa Renewable Energy SA * |

4,519 |

71,981 |

|||||||||

|

536,255 |

|||||||||||

|

SWITZERLAND — 0.4% |

|||||||||||

| Dufry AG * |

710 |

28,260 |

|||||||||

| Wizz Air Holdings PLC * |

676 |

26,443 |

|||||||||

|

54,703 |

|||||||||||

|

UNITED KINGDOM — 1.9% |

|||||||||||

|

Ashtead Group PLC |

332 |

17,167 |

|||||||||

|

Greggs PLC |

867 |

25,296 |

|||||||||

|

Hays PLC |

22,370 |

34,357 |

|||||||||

|

Octopus Renewables Infrastructure Trust PLC |

51,357 |

74,726 |

|||||||||

| SSP Group PLC * |

20,148 |

59,469 |

|||||||||

| Whitbread PLC * |

1,339 |

46,740 |

|||||||||

|

257,755 |

|||||||||||

|

UNITED STATES — 10.5% |

|||||||||||

|

Ares Capital Corp. |

5,875 |

119,086 |

|||||||||

|

Avangrid, Inc. |

1,436 |

63,687 |

|||||||||

| Booking Holdings, Inc. * |

19 |

41,996 |

|||||||||

|

Brookfield Renewable Corp., Class A |

2,799 |

100,484 |

|||||||||

The accompanying notes are an integral part of the financial statements.

07

Portfolio of Investments

Annual Report April 30, 2022

April 30, 2022

Baillie Gifford Multi Asset Fund

|

Shares/Principal |

Value |

||||||||||

| CBRE Group, Inc., Class A * |

574 |

$ |

47,665 |

||||||||

|

Consolidated Edison, Inc. |

1,863 |

172,775 |

|||||||||

|

Eversource Energy |

1,573 |

137,480 |

|||||||||

|

FirstCash Holdings, Inc. |

602 |

48,027 |

|||||||||

|

Golub Capital BDC, Inc. |

4,585 |

68,408 |

|||||||||

|

Hecla Mining Co. |

12,775 |

66,558 |

|||||||||

| Howard Hughes Corp. (The) * |

563 |

56,463 |

|||||||||

| Lyft, Inc., Class A * |

388 |

12,649 |

|||||||||

|

Martin Marietta Materials, Inc. |

121 |

42,861 |

|||||||||

| MP Materials Corp. * |

2,430 |

92,437 |

|||||||||

|

Newmont Corp. |

1,965 |

143,150 |

|||||||||

|

NextEra Energy, Inc. |

878 |

62,355 |

|||||||||

| Royal Caribbean Cruises Ltd. * |

553 |

42,985 |

|||||||||

| Six Flags Entertainment Corp. * |

1,132 |

43,322 |

|||||||||

|

Sixth Street Specialty Lending, Inc. |

3,320 |

74,169 |

|||||||||

|

1,436,557 |

|||||||||||

|

Total Common Stocks |

|||||||||||

|

(cost $4,054,444) |

4,124,061 |

||||||||||

|

POOLED INVESTMENT VEHICLES — 28.9% |

|||||||||||

|

GUERNSEY — 3.9% |

|||||||||||

|

International Public Partnerships Ltd. |

33,991 |

71,213 |

|||||||||

|

Pershing Square Holdings Ltd. |

1,307 |

44,842 |

|||||||||

|

Renewables Infrastructure Group Ltd. (The) |

94,226 |

159,954 |

|||||||||

|

Sequoia Economic Infrastructure Income Fund Ltd. |

90,580 |

112,087 |

|||||||||

|

TwentyFour Income Fund Ltd. |

110,359 |

149,873 |

|||||||||

|

537,969 |

|||||||||||

|

IRELAND — 3.2% |

|||||||||||

|

Aspect Core Trend Fund, Class A |

3,484 |

439,391 |

|||||||||

|

LUXEMBOURG — 0.3% |

|||||||||||

|

BBGI Global Infrastructure SA |

19,266 |

41,042 |

|||||||||

|

UNITED KINGDOM — 2.5% |

|||||||||||

|

3i Infrastructure PLC |

15,192 |

66,866 |

|||||||||

|

Greencoat UK Wind PLC |

102,076 |

204,720 |

|||||||||

|

HICL Infrastructure PLC |

30,427 |

67,493 |

|||||||||

|

339,079 |

|||||||||||

The accompanying notes are an integral part of the financial statements.

08

Portfolio of Investments

Annual Report April 30, 2022

April 30, 2022

Baillie Gifford Multi Asset Fund

|

Shares/Principal |

Value |

||||||||||

|

UNITED STATES — 19.0% |

|||||||||||

|

Baillie Gifford Emerging Markets Equities Fund, Class K (1) |

22,778 |

$ |

442,342 |

||||||||

|

Baillie Gifford International Alpha Fund, Class K (1) |

63,332 |

749,848 |

|||||||||

|

Baillie Gifford U.S. Equity Growth Fund, Class K (1) |

26,989 |

523,592 |

|||||||||

|

Credit Suisse Managed Futures Strategy Fund, Class I |

27,474 |

323,374 |

|||||||||

|

KraneShares Asia Pacific High Income Bond ETF |

19,100 |

559,439 |

|||||||||

|

2,598,595 |

|||||||||||

|

Total Pooled Investment Vehicles |

|||||||||||

|

(cost $3,861,534) |

3,956,076 |

||||||||||

|

STRUCTURED NOTES — 8.8% |

|||||||||||

|

SWITZERLAND — 4.3% |

|||||||||||

|

Credit Suisse AG, Zero cpn., 10/31/22 (2) |

737 |

585,403 |

|||||||||

|

UNITED STATES — 4.5% |

|||||||||||

|

Goldman Sachs International, Zero cpn., 07/13/51 (3) |

422 |

351,817 |

|||||||||

|

Goldman Sachs International, Zero cpn., 08/12/51 (4) |

263 |

266,803 |

|||||||||

|

618,620 |

|||||||||||

|

Total Structured Notes |

|||||||||||

|

(cost $1,422,000) |

1,204,023 |

||||||||||

|

REAL ESTATE INVESTMENT TRUSTS — 8.7% |

|||||||||||

|

UNITED KINGDOM — 3.2% |

|||||||||||

|

LondonMetric Property PLC |

16,826 |

56,870 |

|||||||||

|

Segro PLC |

8,070 |

135,109 |

|||||||||

|

Target Healthcare REIT PLC |

24,165 |

33,728 |

|||||||||

|

Tritax Big Box REIT PLC |

44,685 |

136,408 |

|||||||||

|

UK Commercial Property REIT Ltd. |

72,126 |

79,468 |

|||||||||

|

441,583 |

|||||||||||

The accompanying notes are an integral part of the financial statements.

09

Portfolio of Investments

Annual Report April 30, 2022

April 30, 2022

Baillie Gifford Multi Asset Fund

|

Shares/Principal |

Value |

||||||||||

|

UNITED STATES — 5.5% |

|||||||||||

|

Duke Realty Corp. |

3,740 |

$ |

204,765 |

||||||||

|

First Industrial Realty Trust, Inc. |

2,703 |

156,774 |

|||||||||

|

Prologis, Inc. |

1,034 |

165,740 |

|||||||||

|

Rexford Industrial Realty, Inc. |

2,866 |

223,662 |

|||||||||

|

750,941 |

|||||||||||

|

Total Real Estate Investment Trusts |

|||||||||||

|

(cost $999,037) |

1,192,524 |

||||||||||

|

FOREIGN GOVERNMENT BONDS — 7.8% |

|||||||||||

|

BRAZIL — 0.2% |

|||||||||||

|

Brazil Letras do Tesouro Nacional, Series LTN, Zero cpn., 01/01/24 |

BRL |

162,000 |

26,871 |

||||||||

|

CHILE — 0.3% |

|||||||||||

|

Bonos de la Tesoreria de la Republica en pesos, 5.00%, 03/01/35 |

CLP |

35,000,000 |

35,382 |

||||||||

|

CHINA — 1.9% |

|||||||||||

|

China Government Bond, Series INBK, 3.39%, 03/16/50 |

CNY |

1,740,000 |

263,211 |

||||||||

|

EGYPT — 0.2% |

|||||||||||

|

Egypt Government Bond, Series 7YR, 14.41%, 07/07/27 |

EGP |

601,000 |

31,630 |

||||||||

|

INDONESIA — 0.4% |

|||||||||||

|

Indonesia Treasury Bond, Series FR58, 8.25%, 06/15/32 |

IDR |

769,000,000 |

57,353 |

||||||||

|

IVORY COAST (COTE D'IVOIRE) — 0.7% |

|||||||||||

|

Ivory Coast Government International Bond, 5.25%, 03/22/30 |

EUR |

100,000 |

94,321 |

||||||||

|

MALAYSIA — 0.2% |

|||||||||||

|

Malaysia Government Bond, Series 0413, 3.84%, 04/15/33 |

MYR |

128,000 |

27,141 |

||||||||

|

PERU — 0.3% |

|||||||||||

|

Peru Government Bond, 6.90%, 08/12/37 |

PEN |

97,000 |

22,359 |

||||||||

|

Peruvian Government International Bond, 8.75%, 11/21/33 |

14,000 |

18,593 |

|||||||||

|

40,952 |

|||||||||||

The accompanying notes are an integral part of the financial statements.

10

Portfolio of Investments

Annual Report April 30, 2022

April 30, 2022

Baillie Gifford Multi Asset Fund

|

Shares/Principal |

Value |

||||||||||

|

ROMANIA — 0.3% |

|||||||||||

|

Romania Government Bond, Series 15Y, 3.65%, 09/24/31 |

RON |

135,000 |

$ |

21,939 |

|||||||

|

Romanian Government International Bond, 1.75%, 07/13/30 |

EUR |

20,000 |

16,643 |

||||||||

|

38,582 |

|||||||||||

|

SOUTH AFRICA — 0.4% |

|||||||||||

|

Republic of South Africa Government Bond, Series R209, 6.25%, 03/31/36 |

ZAR |

1,153,000 |

49,712 |

||||||||

|

UKRAINE — 0.5% |

|||||||||||

|

Ukraine Government Bond, 15.84%, 02/26/25 (5) |

UAH |

1,498,000 |

0 |

||||||||

|

Ukraine Government International Bond, Series GDP, 1.26%, 05/31/40 (6) |

252,000 |

72,369 |

|||||||||

|

72,369 |

|||||||||||

|

UNITED STATES — 2.1% |

|||||||||||

|

U.S. Treasury Bond, 2.38%, 05/15/51 |

USD |

62,000 |

54,584 |

||||||||

|

U.S. Treasury Bond, 2.00%, 08/15/51 |

70,000 |

56,558 |

|||||||||

|

U.S. Treasury Bond, 1.88%, 11/15/51 |

70,000 |

54,907 |

|||||||||

|

U.S. Treasury Bond, 2.25%, 02/15/52 |

130,000 |

111,617 |

|||||||||

|

277,666 |

|||||||||||

|

URUGUAY — 0.3% |

|||||||||||

|

Uruguay Government International Bond, 4.38%, 12/15/28 |

UYU |

1,570,406 |

45,099 |

||||||||

|

Total Foreign Government Bonds |

|||||||||||

|

(cost $1,373,389) |

1,060,289 |

||||||||||

|

COLLATERALIZED LOAN OBLIGATIONS — 3.3% |

|||||||||||

|

IRELAND — 3.3% |

|||||||||||

|

Fair Oaks Senior CLO Investments 2021-1 DAC, Zero cpn., 11/30/26 (8) |

4,347 |

455,165 |

|||||||||

|

Total Collateralized Loan Obligations |

|||||||||||

|

(cost $492,158) |

455,165 |

||||||||||

|

TREASURY BILLS — 1.6% |

|||||||||||

|

UNITED STATES — 1.6% |

|||||||||||

|

U.S. Treasury Bill, 08/25/22 (7) |

USD |

222,000 |

221,261 |

||||||||

|

Total Treasury Bills |

|||||||||||

|

(cost $221,535) |

221,261 |

||||||||||

The accompanying notes are an integral part of the financial statements.

11

Portfolio of Investments

Annual Report April 30, 2022

April 30, 2022

Baillie Gifford Multi Asset Fund

|

Shares/Principal |

Value |

||||||||||

|

CORPORATE BONDS — 1.4% |

|||||||||||

|

CANADA — 0.1% |

|||||||||||

|

Bell Canada, Series MTN, 4.75%, 09/29/44 |

CAD |

21,000 |

$ |

15,245 |

|||||||

|

FRANCE — 0.3% |

|||||||||||

|

Electricite de France SA, 6.95%, 01/26/39 |

USD |

15,000 |

17,678 |

||||||||

|

Orange SA, 9.00%, 03/01/31 |

13,000 |

17,125 |

|||||||||

|

34,803 |

|||||||||||

|

UNITED KINGDOM — 0.1% |

|||||||||||

|

Tesco PLC, Series EMTN, 5.50%, 01/13/33 |

GBP |

14,000 |

19,748 |

||||||||

|

UNITED STATES — 0.9% |

|||||||||||

|

Aptiv PLC, 4.35%, 03/15/29 |

USD |

19,000 |

18,576 |

||||||||

|

AT&T, Inc., 3.50%, 09/15/53 |

18,000 |

14,092 |

|||||||||

|

Citigroup, Inc., 8.13%, 07/15/39 |

13,000 |

17,900 |

|||||||||

|

Corning, Inc., 5.45%, 11/15/79 |

17,000 |

16,643 |

|||||||||

|

Dell International LLC / EMC Corp., 5.30%, 10/01/29 |

19,000 |

19,580 |

|||||||||

|

Hasbro, Inc., 6.35%, 03/15/40 |

17,000 |

18,631 |

|||||||||

|

Walt Disney Co. (The), 6.15%, 02/15/41 |

12,000 |

14,226 |

|||||||||

|

119,648 |

|||||||||||

|

Total Corporate Bonds |

|||||||||||

|

(cost $212,681) |

189,444 |

||||||||||

|

INFLATION INDEXED BONDS — 0.7% |

|||||||||||

|

BRAZIL — 0.3% |

|||||||||||

|

Brazil Notas do Tesouro Nacional Serie B, Series NTNB, 6.00%, 05/15/27 |

BRL |

204,313 |

42,427 |

||||||||

|

MEXICO — 0.4% |

|||||||||||

|

Mexican Udibonos, Series S, 4.00%, 11/30/28 |

MXN |

969,576 |

47,401 |

||||||||

|

Total Inflation Indexed Bonds |

|||||||||||

|

(cost $95,806) |

89,828 |

||||||||||

|

TOTAL INVESTMENTS — 91.4% |

|||||||||||

|

(cost $12,732,584) |

$ |

12,492,671 |

|||||||||

|

Other assets less liabilities — 8.6% |

1,171,932 |

||||||||||

|

NET ASSETS — 100.0% |

$ |

13,664,603 |

|||||||||

The accompanying notes are an integral part of the financial statements.

12

Portfolio of Investments

Annual Report April 30, 2022

April 30, 2022

Baillie Gifford Multi Asset Fund

* Non-income producing security.

(1) Affiliated Fund.

(2) ETF-linked certificate which tracks the Xtrackers Harvest CSI 500 China A-Shares Small Cap ETF as the reference price. Value correlates to changes in this reference price.

(3) Index-linked note which tracks the Volatility Curve US Series 1 Total Return Strategy as the reference price. Value correlates to changes in this reference price.

(4) Index-linked note which tracks the USD 10-20 Year Long Volatility Index Total Return Strategy as the reference price. Value correlates to changes in this reference price.

(5) Investment was valued at nil due to a decision made by Baillie Gifford Overseas Limited (the "Manager") based on there being no trading available in this security.

(6) Adjustable rate security with an interest rate that is not based on a published reference index and spread. The rate is based on the structure of the agreement and current market conditions.

(7) Security issued on a discount basis with no stated coupon rate. Income is recognized through the accretion of discount.

(8) Investment was valued using significant unobservable inputs.

This report classifies issuers geographically by their country of risk. For compliance monitoring purposes, the Manager retains discretion to consider a number of factors in determining where a particular issuer is located, as described in further detail in the Fund's prospectus.

A summary of the Fund's investments in affiliated funds during the year ended April 30, 2022 is as follows:

Affiliated Fund Holdings

|

Shares at April 30, 2021 |

Value at April 30, 2021 |

Purchases Cost |

Sales Proceeds |

Net Realized Gain/ (Loss) |

Net Change in Unrealized Appreciation/ (Depreciation) |

Shares at April 30, 2022 |

Value at April 30, 2022 |

Income Distributions |

Long Term Capital Gain Distributions |

||||||||||||||||||||||||||||||||||

|

Baillie Gifford Emerging Markets Equities Fund, Class K |

30,265 |

$ |

864,974 |

$ |

162,522 |

$ |

(337,150 |

) |

$ |

26,956 |

$ |

(274,960 |

) |

22,778 |

$ |

442,342 |

$ |

10,525 |

$ |

10,910 |

|||||||||||||||||||||||

|

Baillie Gifford International Alpha Fund, Class K |

109,775 |

1,913,385 |

136,089 |

(736,709 |

) |

26,311 |

(589,228 |

) |

63,332 |

749,848 |

20,533 |

115,557 |

|||||||||||||||||||||||||||||||

|

Baillie Gifford U.S. Equity Growth Fund, Class K |

37,844 |

1,591,352 |

394,367 |

(680,011 |

) |

45,190 |

(827,306 |

) |

26,989 |

523,592 |

34,072 |

101,102 |

|||||||||||||||||||||||||||||||

|

177,884 |

$ |

4,369,711 |

$ |

692,978 |

$ |

(1,753,870 |

) |

$ |

98,457 |

$ |

(1,691,494 |

) |

113,099 |

$ |

1,715,782 |

$ |

65,130 |

$ |

227,569 |

||||||||||||||||||||||||

For more information on the affiliated fund holdings, please refer to Note B.

The accompanying notes are an integral part of the financial statements.

13

Portfolio of Investments

Annual Report April 30, 2022

April 30, 2022

Baillie Gifford Multi Asset Fund

Open forward foreign currency contracts outstanding at April 30, 2022:

| Counterparty |

Settlement Date |

Currency To Deliver |

Currency To Receive |

Unrealized Appreciation |

Unrealized Depreciation |

||||||||||||||||||

|

HSBC Securities (USA) Inc. |

5/11/2022 |

AUD |

476,000 |

USD |

353,986 |

$ |

17,594 |

$ |

— |

||||||||||||||

|

HSBC Securities (USA) Inc. |

5/11/2022 |

CAD |

1,076,800 |

USD |

852,886 |

14,693 |

— |

||||||||||||||||

|

HSBC Securities (USA) Inc. |

5/11/2022 |

CHF |

727,700 |

USD |

780,436 |

31,915 |

— |

||||||||||||||||

|

HSBC Securities (USA) Inc. |

5/11/2022 |

EUR |

556,000 |

USD |

602,021 |

15,162 |

— |

||||||||||||||||

|

HSBC Securities (USA) Inc. |

5/11/2022 |

EUR |

2,788,370 |

USD |

3,032,076 |

88,951 |

— |

||||||||||||||||

|

HSBC Securities (USA) Inc. |

5/11/2022 |

GBP |

2,086,790 |

USD |

2,720,771 |

96,759 |

— |

||||||||||||||||

|

HSBC Securities (USA) Inc. |

5/11/2022 |

JPY |

33,000,000 |

USD |

256,980 |

2,593 |

— |

||||||||||||||||

|

HSBC Securities (USA) Inc. |

5/11/2022 |

NOK |

3,750,000 |

USD |

428,456 |

28,636 |

— |

||||||||||||||||

|

HSBC Securities (USA) Inc. |

5/11/2022 |

NZD |

513,000 |

USD |

350,850 |

19,651 |

— |

||||||||||||||||

|

HSBC Securities (USA) Inc. |

5/11/2022 |

USD |

66,487 |

AUD |

91,000 |

— |

(2,176 |

) |

|||||||||||||||

|

HSBC Securities (USA) Inc. |

5/11/2022 |

USD |

552,878 |

EUR |

509,000 |

— |

(15,629 |

) |

|||||||||||||||

|

HSBC Securities (USA) Inc. |

5/11/2022 |

USD |

196,445 |

GBP |

153,000 |

— |

(4,057 |

) |

|||||||||||||||

|

HSBC Securities (USA) Inc. |

5/11/2022 |

USD |

1,070,166 |

JPY |

134,341,200 |

— |

(34,573 |

) |

|||||||||||||||

|

HSBC Securities (USA) Inc. |

5/11/2022 |

USD |

140,896 |

NOK |

1,260,000 |

— |

(6,556 |

) |

|||||||||||||||

|

HSBC Securities (USA) Inc. |

5/11/2022 |

USD |

64,706 |

NZD |

97,000 |

— |

(2,082 |

) |

|||||||||||||||

|

HSBC Securities (USA) Inc. |

5/11/2022 |

USD |

270,168 |

ZAR |

4,195,000 |

— |

(4,915 |

) |

|||||||||||||||

|

HSBC Securities (USA) Inc. |

5/11/2022 |

ZAR |

4,195,000 |

USD |

286,663 |

21,410 |

— |

||||||||||||||||

|

HSBC Securities (USA) Inc. |

5/12/2022 |

CNY |

840,000 |

USD |

132,165 |

5,085 |

— |

||||||||||||||||

|

HSBC Securities (USA) Inc. |

5/12/2022 |

USD |

131,097 |

CNY |

840,000 |

— |

(4,018 |

) |

|||||||||||||||

|

HSBC Securities (USA) Inc. |

5/19/2022 |

BRL |

1,014,000 |

USD |

214,885 |

11,158 |

— |

||||||||||||||||

|

HSBC Securities (USA) Inc. |

5/19/2022 |

PHP |

26,800,000 |

USD |

517,175 |

6,455 |

— |

||||||||||||||||

|

HSBC Securities (USA) Inc. |

5/19/2022 |

USD |

384,807 |

BRL |

2,020,000 |

21,040 |

— |

||||||||||||||||

|

HSBC Securities (USA) Inc. |

5/19/2022 |

USD |

233,343 |

PHP |

12,000,000 |

— |

(4,662 |

) |

|||||||||||||||

|

HSBC Securities (USA) Inc. |

6/9/2022 |

USD |

142,476 |

ZAR |

2,100,000 |

— |

(10,123 |

) |

|||||||||||||||

|

HSBC Securities (USA) Inc. |

6/9/2022 |

ZAR |

5,454,000 |

USD |

348,621 |

4,881 |

— |

||||||||||||||||

|

HSBC Securities (USA) Inc. |

6/16/2022 |

EUR |

330,000 |

USD |

371,022 |

22,076 |

— |

||||||||||||||||

|

HSBC Securities (USA) Inc. |

6/16/2022 |

ILS |

318,000 |

USD |

99,309 |

3,822 |

— |

||||||||||||||||

|

HSBC Securities (USA) Inc. |

6/16/2022 |

USD |

75,589 |

EUR |

69,000 |

— |

(2,627 |

) |

|||||||||||||||

|

HSBC Securities (USA) Inc. |

6/16/2022 |

USD |

376,141 |

ILS |

1,237,600 |

— |

(4,521 |

) |

|||||||||||||||

|

HSBC Securities (USA) Inc. |

7/21/2022 |

EUR |

67,000 |

USD |

70,829 |

— |

(162 |

) |

|||||||||||||||

|

HSBC Securities (USA) Inc. |

7/21/2022 |

THB |

9,560,000 |

USD |

285,333 |

5,705 |

— |

||||||||||||||||

|

HSBC Securities (USA) Inc. |

7/21/2022 |

USD |

138,233 |

JPY |

17,680,000 |

— |

(1,498 |

) |

|||||||||||||||

|

HSBC Securities (USA) Inc. |

7/21/2022 |

USD |

516,182 |

THB |

16,760,000 |

— |

(25,955 |

) |

|||||||||||||||

|

HSBC Securities (USA) Inc. |

7/28/2022 |

CAD |

462,000 |

USD |

370,598 |

11,102 |

— |

||||||||||||||||

|

HSBC Securities (USA) Inc. |

7/28/2022 |

COP |

844,000,000 |

USD |

214,569 |

4,559 |

— |

||||||||||||||||

|

HSBC Securities (USA) Inc. |

7/28/2022 |

EUR |

173,760 |

USD |

197,986 |

13,788 |

— |

||||||||||||||||

|

HSBC Securities (USA) Inc. |

7/28/2022 |

INR |

16,100,000 |

USD |

208,166 |

— |

(80 |

) |

|||||||||||||||

The accompanying notes are an integral part of the financial statements.

14

Portfolio of Investments

Annual Report April 30, 2022

April 30, 2022

Baillie Gifford Multi Asset Fund

|

Counterparty |

Settlement Date |

Currency To Deliver |

Currency To Receive |

Unrealized Appreciation |

Unrealized Depreciation |

||||||||||||||||||

|

Barclays Bank PLC |

7/28/2022 |

TRY |

1,100,000 |

USD |

69,455 |

$ |

357 |

$ |

— |

||||||||||||||

|

HSBC Securities (USA) Inc. |

7/28/2022 |

USD |

79,626 |

BRL |

400,000 |

— |

(942 |

) |

|||||||||||||||

|

HSBC Securities (USA) Inc. |

7/28/2022 |

USD |

863,436 |

CAD |

1,084,000 |

— |

(19,943 |

) |

|||||||||||||||

|

HSBC Securities (USA) Inc. |

7/28/2022 |

USD |

70,513 |

EUR |

64,200 |

— |

(2,457 |

) |

|||||||||||||||

|

HSBC Securities (USA) Inc. |

8/18/2022 |

CLP |

149,000,000 |

USD |

185,115 |

14,058 |

— |

||||||||||||||||

|

HSBC Securities (USA) Inc. |

8/18/2022 |

USD |

468,140 |

CLP |

391,000,000 |

— |

(19,258 |

) |

|||||||||||||||

|

Total unrealized appreciation (depreciation) |

$ |

461,450 |

$ |

(166,234 |

) |

||||||||||||||||||

|

Net unrealized appreciation (depreciation) |

$ |

295,216 |

|||||||||||||||||||||

ADR — American Depositary Receipt

CLO — Collateralized Loan Obligation

ETF — Exchange Traded Fund

FRN — Floating Rate Note

MTN — Medium Term Note

REIT — Real Estate Investment Trust

Currency Abbreviations:

AUD — Australian Dollar

BRL — Brazilian Real

CAD — Canadian Dollar

CHF — Swiss Franc

CLP — Chilean Peso

CNY — Chinese Yuan

COP — Colombian Peso

EGP — Egyptian Pound

EUR — Euro

GBP — Great Britain Pound

IDR — Indonesian Rupiah

ILS — Israeli Shekel

INR — Indian Rupee

JPY — Japanese Yen

MXN — Mexican Peso

MYR — Malaysian Ringgit

NOK — Norwegian Krone

NZD — New Zealand Dollar

PEN — Peruvian Nuevo Sol

PHP — Philippine Peso

RON — Romanian New Leu

THB — Thai Baht

UAH — Ukrainian hryvnia

UYU — Uruguayan peso

ZAR — South African Rand

The accompanying notes are an integral part of the financial statements.

15

Portfolio of Investments

Annual Report April 30, 2022

April 30, 2022

Baillie Gifford Multi Asset Fund

Fair Value Measurement

The following is a summary of the inputs used as of April 30, 2022 in valuing the Fund's investments carried at fair value:

|

Investments in Securities(1) |

Level 1 |

Level 2 |

Level 3 |

Total |

|||||||||||||||

|

Assets: |

|||||||||||||||||||

|

Common Stocks |

$ |

1,680,509 |

$ |

2,443,552 |

$ |

— |

$ |

4,124,061 |

|||||||||||

|

Pooled Investment Vehicles |

3,347,813 |

608,263 |

— |

3,956,076 |

|||||||||||||||

|

Structured Notes |

— |

1,204,023 |

— |

1,204,023 |

|||||||||||||||

|

Real Estate Investment Trusts |

750,941 |

441,583 |

— |

1,192,524 |

|||||||||||||||

|

Foreign Government Bonds |

— |

1,060,289 |

— |

1,060,289 |

|||||||||||||||

|

Collateralized Loan Obligations |

— |

— |

455,165 |

455,165 |

|||||||||||||||

|

Treasury Bills |

— |

221,261 |

— |

221,261 |

|||||||||||||||

|

Corporate Bonds |

— |

189,444 |

— |

189,444 |

|||||||||||||||

|

Inflation Indexed Bonds |

— |

89,828 |

— |

89,828 |

|||||||||||||||

|

Total Investments in Securities |

$ |

5,779,263 |

$ |

6,258,243 |

$ |

455,165 |

$ |

12,492,671 |

|||||||||||

|

Other Financial Instruments(2) |

|||||||||||||||||||

|

Forward Foreign Currency Contracts |

— |

461,450 |

— |

461,450 |

|||||||||||||||

|

Total Investments in Securities and Other Financial Instruments |

$ |

5,779,263 |

$ |

6,719,693 |

$ |

455,165 |

$ |

12,954,121 |

|||||||||||

|

Liabilities: |

|||||||||||||||||||

|

Other Financial Instruments(2) |

|||||||||||||||||||

|

Forward Foreign Currency Contracts |

— |

(166,234 |

) |

— |

(166,234 |

) |

|||||||||||||

|

Total Other Financial Instruments |

$ |

— |

$ |

(166,234 |

) |

$ |

— |

$ |

(166,234 |

) |

|||||||||

(1) A complete listing of investments and additional information regarding the industry classification and geographical location of these investments is disclosed in the Portfolio of Investments.

(2) Reflects the unrealized appreciation (depreciation) of the instruments.

See Note A for a description of the inputs used in the fair value hierarchy above.

The following is a reconciliation of the Fund's Level 3 investments for which significant unobservable inputs were used in determining value:

|

Balance at April 30, 2021 |

$ |

— |

|||||

|

Purchases |

775,208 |

||||||

|

Sales |

(269,713 |

) |

|||||

|

Realized gain (loss) |

(13,337 |

) |

|||||

|

Change in unrealized gain (loss) |

(36,993 |

) |

|||||

|

Transfers into Level 3 |

— |

||||||

|

Transfers out of Level 3 |

— |

||||||

|

Balance at April 30, 2022 |

$ |

455,165 |

* |

||||

|

Change in unrealized gain (loss) related to Investments still held at April 30, 2022. |

$ |

(36,993 |

) |

||||

* The ongoing conflict in Russia and Ukraine has led to significant disruption and volatility in the global stock market. This led to certain securities held in Russian rubles and Ukrainian hryvnia becoming untradeable, such as the Ukraine Government Bond held by the Fund. As a result of this, the Manager made the decision to value this bond at nil, at which point this was transferred out of Level 2 into Level 3.

Fair Oaks Senior CLO Investments 2021-1 DAC is a weekly priced instrument held by the Fund for which the trustee-quoted NAV is a significant unobservable input.

The accompanying notes are an integral part of the financial statements.

16

Statement of Assets and Liabilities

Annual Report April 30, 2022

April 30, 2022

Baillie Gifford Multi Asset Fund

|

ASSETS |

|||||||

|

Investments, at value (cost $11,016,670) |

$ |

10,776,889 |

|||||

|

Investments in affiliated funds, at value (cost $1,715,914) |

1,715,782 |

||||||

|

Cash |

1,137,183 |

||||||

|

Deposit with broker for futures contracts |

35,478 |

||||||

|

Foreign cash, at value (cost $4,835) |

4,900 |

||||||

|

Unrealized appreciation on forward foreign currency contracts |

461,450 |

||||||

|

Due from Investment Advisor |

82,494 |

||||||

|

Receivable for investments sold |

66,211 |

||||||

|

Interest receivable |

14,395 |

||||||

|

Dividends receivable |

10,543 |

||||||

|

Tax reclaims receivable |

3,223 |

||||||

|

Prepaid assets |

18,500 |

||||||

|

Total Assets |

14,327,048 |

||||||

|

LIABILITIES |

|||||||

|

Advisory fee payable |

6,174 |

||||||

|

Deposit from broker for forward foreign currency contracts |

330,000 |

||||||

|

Unrealized depreciation on forward foreign currency contracts |

166,234 |

||||||

|

Payable for investment purchased |

22,632 |

||||||

|

Administration & Supervisory fee payable |

13,119 |

||||||

|

Accrued expenses |

124,286 |

||||||

|

Total Liabilities |

662,445 |

||||||

|

NET ASSETS |

$ |

13,664,603 |

|||||

|

COMPOSITION OF NET ASSETS |

|||||||

|

Paid-in capital |

$ |

12,310,406 |

|||||

|

Total distributable earnings |

1,354,197 |

||||||

|

$ |

13,664,603 |

||||||

|

NET ASSET VALUE, PER SHARE |

|||||||

| Class K ($5,953,885 / 576,785 shares outstanding), unlimited authorized, no par value |

$ |

10.32 |

|||||

| Institutional Class ($7,710,718 / 746,965 shares outstanding), unlimited authorized, no par value |

$ |

10.32 |

|||||

The accompanying notes are an integral part of the financial statements.

17

Statement of Operations

Annual Report April 30, 2022

For the Year Ended April 30, 2022

Baillie Gifford Multi Asset Fund

|

INVESTMENT INCOME |

|||||||

|

Dividends (net of foreign withholding taxes of $26,024) |

$ |

416,001 |

|||||

|

Income from affiliated funds |

65,130 |

||||||

|

Interest |

159,430 |

||||||

|

Total Investment Income |

640,561 |

||||||

|

EXPENSES |

|||||||

|

Advisory fee, net of Temporary Advisory Fee Waiver (Note B) |

20,105 |

||||||

|

Administration & Supervisory fee — Class K shares (Note B) |

29,782 |

||||||

|

Administration & Supervisory fee — Institutional Class shares (Note B) |

12,942 |

||||||

|

Transfer agency |

33,706 |

||||||

|

Sub-transfer agency — Institutional Class shares |

1,383 |

||||||

|

Legal |

136,849 |

||||||

|

Fund accounting |

119,128 |

||||||

|

Clearing fees |

42,158 |

||||||

|

Professional fees |

38,642 |

||||||

|

Printing fees |

29,180 |

||||||

|

Custody |

21,003 |

||||||

|

Registration fees |

13,956 |

||||||

|

Trustees' fees |

666 |

||||||

|

Commitment fees |

256 |

||||||

|

Miscellaneous |

5,107 |

||||||

|

Total Expenses |

504,863 |

||||||

|

Fees waived/expenses reimbursed |

(402,954 |

) |

|||||

|

Affiliated fund fees waived/expenses reimbursed |

(21,288 |

) |

|||||

|

Total Expenses after waiver |

80,621 |

||||||

|

Net Investment Income |

559,940 |

||||||

|

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS, FUTURES, AND FOREIGN CURRENCY TRANSACTIONS |

|||||||

|

Net realized gain (loss) from: |

|||||||

|

Investments |

1,401,110 |

||||||

|

Investments in affiliated funds |

98,457 |

||||||

|

Long Term Capital gains distributions from affiliated funds |

227,569 |

||||||

|

Futures |

91,789 |

||||||

|

Forward foreign currency contracts |

624,733 |

||||||

|

Foreign currency transactions |

(13,914 |

) |

|||||

|

2,429,744 |

|||||||

The accompanying notes are an integral part of the financial statements.

18

Statement of Operations

Annual Report April 30, 2022

|

Net change in unrealized appreciation (depreciation) on: |

|||||||

|

Investments |

$ |

(1,950,997 |

) |

||||

|

Investments in affiliated funds |

(1,691,494 |

) |

|||||

|

Futures |

(8,619 |

) |

|||||

|

Forward foreign currency contracts |

528,420 |

||||||

|

Translation of net assets and liabilities denominated in foreign currencies |

(645 |

) |

|||||

|

(3,123,335 |

) |

||||||

|

Net realized and unrealized loss |

(693,591 |

) |

|||||

|

NET DECREASE IN NET ASSETS FROM OPERATIONS |

$ |

(133,651 |

) |

||||

The accompanying notes are an integral part of the financial statements.

19

Statements of Changes in Net Assets

Annual Report April 30, 2022

Baillie Gifford Multi Asset Fund

|

For the Year Ended April 30, 2022 |

For the Year Ended April 30, 2021 |

||||||||||

|

INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS |

|||||||||||

|

Net investment income |

$ |

559,940 |

$ |

438,684 |

|||||||

|

Net realized gain (loss) |

2,429,744 |

(568,234 |

) |

||||||||

|

Net change in unrealized appreciation (depreciation) |

(3,123,335 |

) |

3,723,471 |

||||||||

|

Net increase (decrease) in net assets from operations |

(133,651 |

) |

3,593,921 |

||||||||

|

DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS FROM: |

|||||||||||

|

Distributable earnings |

|||||||||||

|

Class K |

(1,114,541 |

) |

(84,965 |

) |

|||||||

|

Institutional Class |

(463,476 |

) |

(26,961 |

) |

|||||||

|

Total Distributions to Shareholders |

(1,578,017 |

) |

(111,926 |

) |

|||||||

|

TRANSACTIONS IN SHARES OF BENEFICIAL INTEREST |

|||||||||||

|

Net proceeds from shares subscribed: |

|||||||||||

|

Class K |

47,669 |

10,000,000 |

|||||||||

|

Institutional Class |

1,321,726 |

716,420 |

|||||||||

|

Dividends reinvested: |

|||||||||||

|

Class K |

1,114,541 |

84,965 |

|||||||||

|

Institutional Class |

463,476 |

26,961 |

|||||||||

|

Cost of shares redeemed: |

|||||||||||

|

Class K |

(12,076,856 |

) |

— |

||||||||

|

Institutional Class |

(150,134 |

) |

— |

||||||||

|

Increase (Decrease) in Net Assets from Transactions in Shares of Beneficial Interest |

(9,279,578 |

) |

10,828,346 |

||||||||

|

Total Increase (Decrease) in Net Assets |

(10,991,246 |

) |

14,310,341 |

||||||||

|

NET ASSETS |

|||||||||||

|

Beginning of year |

24,655,849 |

10,345,508 |

|||||||||

|

End of year |

$ |

13,664,603 |

$ |

24,655,849 |

|||||||

The accompanying notes are an integral part of the financial statements.

20

Financial Highlights

Annual Report April 30, 2022

Baillie Gifford Multi Asset Fund

Selected data for a Class K share outstanding throughout each period

|

For the Year Ended April 30, 2022 |

For the Year Ended April 30, 2021 |

For the Year Ended April 30, 2020 |

For the Period December 4, 2018(a) through April 30, 2019 |

||||||||||||||||

|

Net asset value, beginning of period |

$ |

11.27 |

$ |

9.65 |

$ |

10.66 |

$ |

10.00 |

|||||||||||

|

From Investment Operations |

|||||||||||||||||||

|

Net investment income(b) |

0.26 |

0.20 |

0.24 |

0.13 |

|||||||||||||||

|

Net realized and unrealized gain (loss) on investments and foreign currency |

(0.51 |

) |

1.47 |

(0.54 |

) |

0.57 |

|||||||||||||

|

Net increase (decrease) in net asset value from investment operations |

(0.25 |

) |

1.67 |

(0.30 |

) |

0.70 |

|||||||||||||

|

Dividends and Distributions to Shareholders |

|||||||||||||||||||

|

From net investment income |

(0.14 |

) |

(0.05 |

) |

(0.55 |

) |

(0.04 |

) |

|||||||||||

|

From net realized gain on investments |

(0.56 |

) |

— |

(0.16 |

) |

— |

|||||||||||||

|

Total Dividends and Distributions |

(0.70 |

) |

(0.05 |

) |

(0.71 |

) |

(0.04 |

) |

|||||||||||

|

Net asset value, end of period |

$ |

10.32 |

$ |

11.27 |

$ |

9.65 |

$ |

10.66 |

|||||||||||

|

Total Return |

|||||||||||||||||||

|

Total return based on net asset value(c) |

(2.71 |

)% |

17.35 |

% |

(3.35 |

)% |

7.06 |

% |

|||||||||||

|

Ratios/Supplemental Data |

|||||||||||||||||||

|

Net assets, end of period (000's omitted) |

$ |

5,954 |

$ |

17,873 |

$ |

5,173 |

$ |

5,351 |

|||||||||||

|

Ratio of net expenses to average net assets, after affiliated fund waiver but before waiver under expense limitation agreement(d)(e) |

1.92 |

% |

2.14 |

% |

4.65 |

% |

3.02 |

%* | |||||||||||

|

Ratio of net expenses to average net assets, after affiliated fund waiver and waiver under expense limitation agreement(d) |

0.32 |

% |

0.29 |

% |

0.56 |

% |

0.55 |

%* | |||||||||||

|

Ratio of net investment income to average net assets |

2.28 |

% |

1.91 |

% |

2.29 |

% |

3.08 |

%* | |||||||||||

|

Portfolio turnover rate(f) |

67 |

% |

58 |

% |

59 |

% |

14 |

% |

|||||||||||

* Annualized.

(a) Commencement of investment operations.

(b) Calculated based upon average shares outstanding during the period.

(c) Total investment return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions, if any, at net asset value during the period, and redemption on the last day of the period. Total return is not annualized for periods less than one year.

(d) Does not include the expenses of non-affiliated pooled investment vehicles in which the Fund invests.

(e) This figure represents the gross expenses of the Fund less any waiver in relation to management fees paid on assets invested in affiliated funds (refer to Note B for further details).

(f) Portfolio turnover rate calculated at the Fund level.

The accompanying notes are an integral part of the financial statements.

21

Financial Highlights

Annual Report April 30, 2022

Baillie Gifford Multi Asset Fund

Selected data for an Institutional Class share outstanding throughout each period

|

For the Year Ended April 30, 2022 |

For the Year Ended April 30, 2021 |

For the Year Ended April 30, 2020 |

For the Period December 4, 2018(a) through April 30, 2019 |

||||||||||||||||

|

Net asset value, beginning of period |

$ |

11.28 |

$ |

9.65 |

$ |

10.66 |

$ |

10.00 |

|||||||||||

|

From Investment Operations |

|||||||||||||||||||

|

Net investment income(b) |

0.24 |

0.21 |

0.24 |

0.13 |

|||||||||||||||

|

Net realized and unrealized gain (loss) on investments and foreign currency |

(0.50 |

) |

1.47 |

(0.54 |

) |

0.57 |

|||||||||||||

|

Net increase (decrease) in net asset value from investment operations |

(0.26 |

) |

1.68 |

(0.30 |

) |

0.70 |

|||||||||||||

|

Dividends and Distributions to Shareholders |

|||||||||||||||||||

|

From net investment income |

(0.14 |

) |

(0.05 |

) |

(0.55 |

) |

(0.04 |

) |

|||||||||||

|

From net realized gain on investments |

(0.56 |

) |

— |

(0.16 |

) |

— |

|||||||||||||

|

Total Dividends and Distributions |

(0.70 |

) |

(0.05 |

) |

(0.71 |

) |

(0.04 |

) |

|||||||||||

|

Net asset value, end of period |

$ |

10.32 |

$ |

11.28 |

$ |

9.65 |

$ |

10.66 |

|||||||||||

|

Total Return |

|||||||||||||||||||

|

Total return based on net asset value(c) |

(2.80 |

)% |

17.42 |

% |

(3.35 |

)% |

7.06 |

% |

|||||||||||

|

Ratios/Supplemental Data |

|||||||||||||||||||

|

Net assets, end of period (000's omitted) |

$ |

7,711 |

$ |

6,783 |

$ |

5,173 |

$ |

5,350 |

|||||||||||

|

Ratio of net expenses to average net assets, after affiliated fund waiver but before waiver under expense limitation agreement(d)(e) |

1.94 |

% |

2.13 |

%(f) |

4.65 |

% |

3.02 |

%* | |||||||||||

|

Ratio of net expenses to average net assets, after affiliated fund waiver and waiver under expense limitation agreement(d) |

0.34 |

% |

0.29 |

% |

0.56 |

% |

0.55 |

%* | |||||||||||

|

Ratio of net investment income to average net assets |

2.10 |

% |

1.99 |

% |

2.29 |

% |

3.08 |

%* | |||||||||||

|

Portfolio turnover rate(g) |

67 |

% |

58 |

% |

59 |

% |

14 |

% |

|||||||||||

* Annualized.

(a) Commencement of investment operations.

(b) Calculated based upon average shares outstanding during the period.

(c) Total investment return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions, if any, at net asset value during the period, and redemption on the last day of the period. Total return is not annualized for periods less than one year.

(d) Does not include the expenses of non-affiliated pooled investment vehicles in which the Fund invests.

(e) This figure represents the gross expenses of the Fund less any waiver in relation to management fees paid on assets invested in affiliated funds (refer to Note B for further details).

(f) Institutional Class had a lower ratio than Class K due to rounding.

(g) Portfolio turnover rate calculated at the Fund level.

The accompanying notes are an integral part of the financial statements.

22

Notes to Financial Statements

Annual Report April 30, 2022

Note A — Organization and Accounting Policies

The Fund is a diversified series of Baillie Gifford Funds (the "Trust"). The Trust includes other series that are not included in this report. The investment objective of the Fund is to seek long-term capital growth at lower volatility than is typically associated with equity markets. For information on the specific investment strategies of the Fund and a description of each share class, please refer to the Fund's prospectus. The Trust is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the "1940 Act"). The Trust was organized on June 21, 2000 as a Massachusetts business trust under the laws of Massachusetts. The Trust operates pursuant to the Second Amended and Restated Agreement and Declaration of Trust dated February 27, 2017, as amended from time to time.

As of April 30, 2022, the Fund offers Class K and Institutional Class shares.

The Fund is an investment company that applies the accounting and reporting guidance issued in Topic 946 by the U.S. Financial Accounting Standards Board. The financial statements of the Fund have been prepared in conformity with generally accepted accounting principles in the United States of America ("GAAP"). Management is required to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

The following is a summary of significant accounting policies followed by the Fund:

Valuation of Investments

Investments for which there are readily available market quotations are valued at market value. Equity securities listed on a securities exchange, market or automated quotation system (including equity securities traded over the counter) for which quotations are readily available, are valued at the last quoted trade price on the primary exchange or market (foreign or domestic) on which they are most actively traded on the date of valuation (or at approximately 4:00 p.m. Eastern Time if a security's primary exchange is normally open at that time), or, if there

is no such reported sale on the date of valuation, at the most recent quoted bid price.

Fixed income securities including corporate bonds, inflation indexed bonds, foreign government bonds and sovereign debts are normally valued on the basis of quotes obtained from brokers and dealers or independent pricing services or sources. Independent pricing services typically use information provided by market makers or estimates of market values obtained from yield data relating to investments or securities with similar characteristics. The service providers' internal models use inputs that are observable such as, among other things, issuer details, interest rates, yield curves, prepayment speeds, credit risks/spreads, default rates and quoted prices for similar assets. Securities that use similar valuation techniques and inputs as described above are categorized as Level 2 within the fair value hierarchy. Certain short-term debt obligations maturing within 60 days or less may be valued at their amortized cost unless Baillie Gifford Overseas Limited (the "Manager") determines that amortized cost does not represent fair value. These securities are classified as Level 2 securities.

Investments in pooled investment vehicles are valued at the most recent published NAV for each investee fund. Where the most recent published NAV for an investee fund was determined at a time, or in the case of a non-daily priced fund, a date, other than the pricing point of the Fund, the price may be subject to fair value adjustment as determined by the Manager. At April 30, 2022, there were no fair value adjustments required on investments in pooled investment vehicles not listed on an exchange.

Investments in structured securities are valued daily from an independent pricing source based on quotes received from the counterparty. Certain derivatives are centrally cleared or trade in the over-the-counter market. The Fund's pricing services use various techniques including industry standard option pricing models and proprietary discounted cash flow models to determine the fair value of those instruments. The Fund's net benefit or obligation under the derivative contract, as measured by the fair value of the contract, is included in net assets.

The Fund invests in futures contracts which are valued at the closing settlement price established each day by the board of the exchange on which they are traded.

The Fund invests in forward foreign exchange contracts which are valued based on closing exchange rates from each respective foreign market.

The Fund may enter into swap agreements which are valued by independent third-party pricing agents based upon the specific terms of each agreement.

23

Notes to Financial Statements

Annual Report April 30, 2022

The Fund may invest in collateralized loan obligations which are normally valued on the basis of quotes obtained from brokers and dealers or independent pricing services.

A collateralized loan obligation ("CLO") is a security backed by a pool of debt, often corporate loans with low credit ratings. The investor receives scheduled debt payments from the underlying loans but assumes most of the risk in the event that borrowers default.

The Fund invests in Structured Notes. These are hybrid instruments which combine both debt and other characteristics into a single note form. Structured Note values are linked to the performance of an underlying index or strategy and are unsecured debt obligations of an issuer which may not be publicly listed or traded on an exchange. Structured Notes are valued daily, based on a price calculated by the issuer. Realized gain and loss and change in unrealized appreciation and depreciation on these notes for the reporting period are included in the Statement of Operations.

Other securities for which current market quotations are not readily available (or for which quotations are not believed to be reliable due to market changes that occur after the most recent available quotations are obtained, or for any other reason) and all other assets are valued at their fair value as determined in good faith by the Manager, pursuant to procedures approved by the Board of Trustees of the Trust (the "Board"). The actual calculations may be made by persons acting pursuant to the direction of the Board or by pricing services.

Generally, trading in foreign securities markets is substantially completed each day at various times prior to close of regular trading on the New York Stock Exchange. Occasionally, events affecting the value of equity securities of non-U.S. issuers not traded on a U.S. exchange may occur between the completion of substantial trading of such securities for the day and the close of regular trading on the New York Stock Exchange, and such events may not be reflected in the computation of the Fund's net asset value. If events materially affecting the value of the Fund's portfolio securities occur during such period, then these securities will be valued at their fair value as determined in good faith by the Manager, pursuant to procedures approved by the Board. The Fund utilizes a third party pricing service for all equity securities, except those traded on Canadian, Latin American, or U.S. exchanges, subject to certain minimum confidence levels, which applies a fair value adjustment that seeks to reflect changes in such securities' market prices since the close of the market on which the securities are traded. To the extent that securities are valued using this service, the securities will be

classified as Level 2 securities in the fair value measurement framework described below.

The Fund may invest in bonds issued by governments of both developed and emerging market economies.

These may be denominated in the currency of the issuing country, or some other currency such as U.S. dollars.

Fair Value Measurement