Form N-CSR Advisors' Inner Circle For: Sep 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-22920

The Advisors’ Inner Circle Fund III

(Exact name of registrant as specified in charter)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip code)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s telephone number, including area code: (877) 446-3863

Date of fiscal year end: September 30, 2022

Date of reporting period: September 30, 2022

Item 1. Reports to Stockholders.

A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR § 270.30e-1), is attached hereto.

The Advisors’ Inner Circle Fund III

First Foundation Fixed Income Fund

First Foundation Total Return Fund

| ANNUAL REPORT | SEPTEMBER 30, 2022 |

|

Investment Adviser: Brookmont Capital Management, LLC

|

| THE ADVISORS’ INNER CIRCLE FUND III | BROOKMONT FUNDS | |

| SEPTEMBER 30, 2022 | ||

| 1 | ||||

| 7 | ||||

| 26 | ||||

| 28 | ||||

| 29 | ||||

| 33 | ||||

| 37 | ||||

| 59 | ||||

| 60 | ||||

| Trustees and Officers of the Advisors’ Inner Circle Fund III |

62 | |||

| 70 | ||||

| 74 | ||||

The Funds file their complete schedule of investments with the US Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT (Form N-Q for filings prior to March 31, 2020). The Funds’ Form N-Q and N-PORT are available on the SEC’s website at https://www.sec.gov, and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Funds use to determine how to vote proxies relating to Fund securities, as well as information relating to how a Fund voted proxies relating to fund securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-800-838-0191 and (ii) on the SEC’s website at https://www.sec.gov.

| THE ADVISORS’ INNER CIRCLE FUND III | FIRST FOUNDATION | |

| FIXED INCOME FUND | ||

| SEPTEMBER 30, 2022 | ||

| (Unaudited) |

For the twelve-month period ended September 30, 2022, the First Foundation Fixed Income Fund (the “Fund”) returned -13.79% for Class A shares (without load) and -13.59% for Class Y shares. The Fund’s benchmark, the Bloomberg US Aggregate Bond Index, returned -14.60%, and the Fund’s Morningstar peer group, the Intermediate Core-Plus Bond Category, returned -14.56% over the same period.

The outperformance over the past twelve months was primarily driven by the Fund’s exposure to credit risk and underweight exposure to longer-duration securities. The Fund had a duration of 5.8 years versus 6.8 years for the index to begin the year.

Manager’s Discussion

Throughout 2022, the Federal Reserve (Fed) has moved aggressively in its attempts to rein in inflation by raising interest rates and shrinking its balance sheet. In September, the Fed moved 75bp, taking the Fed funds rate to 3.0 – 3.25%. That is over a 300bp move in the federal funds rate in just over six months. The Fed’s strategy has been to get rates back to a neutral level as fast as possible and embrace restrictive monetary policy for as long as necessary, based on how the economic and labor markets evolve.

After a year of highly aggressive monetary policy, many fixed-income sectors are pricing at compelling levels. Treasury yields have hit decade highs as the financial markets price in a nearly 5% fed funds rate within the next six months. With fixed-income yields at decade highs and treasury yields over 4% across the curve, income opportunities abound in our markets. With core CPI at a 40-year high and the unemployment rate at a 50-year low, the market dynamics within the U.S. should continue to pressure the Fed to stay aggressive with monetary policy. As such, fixed-income markets will remain volatile, and we currently prefer the “higher quality, greater liquidity” theme within markets. Thus, while we remain diligent in our search for attractive risk-adjusted returns, we believe patience and protection are in order and will be rewarded and afford attractive entry points to be exploited in the future.

1

| THE ADVISORS’ INNER CIRCLE FUND III | FIRST FOUNDATION | |

| FIXED INCOME FUND | ||

| SEPTEMBER 30, 2022 | ||

| (Unaudited) |

|

AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED SEPTEMBER 30, 2022* | ||||||||||

| One Year Return |

Three Year Return |

Five Year Return |

Ten Year Return |

Annualized Inception to Date* | ||||||

| First Foundation Fixed Income Fund, Class A Shares (with load)** | -17.44% | -3.41% | -0.87% | 0.63% | 3.74% | |||||

| First Foundation Fixed Income Fund, Class A Shares (without load)** | -13.79% | -2.00% | 0.00% | 1.07% | 3.90% | |||||

| First Foundation Fixed Income Fund, Class Y Shares | -13.59% | -1.75% | 0.24% | 1.33% | 4.15% | |||||

| Bloomberg U.S. Aggregate Bond Index |

-14.60% | -3.26% | -0.27% | 0.89% | 4.34% | |||||

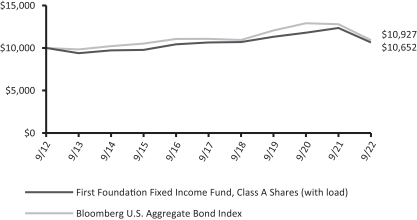

Growth of a $10,000 Investment

* Inception date of the Fund is November 29, 1993.

** Refers to the individual maximum sales charge of 4.25%.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost.

Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower.

Please note that one cannot invest directly in an unmanaged index. There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and

2

| THE ADVISORS’ INNER CIRCLE FUND III | FIRST FOUNDATION | |

| FIXED INCOME FUND | ||

| SEPTEMBER 30, 2022 | ||

| (Unaudited) |

allocations are subject to change because it is actively managed and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on page 6.

3

| THE ADVISORS’ INNER CIRCLE FUND III | FIRST FOUNDATION | |

| TOTAL RETURN FUND | ||

| SEPTEMBER 30, 2022 | ||

| (Unaudited) |

Performance Review

For the twelve-month period ended September 30, 2022, the First Foundation Total Return Fund (the “Fund”) returned -4.98% for Class Y shares and -5.20% for the Class A shares (without load). The Fund’s benchmarks, the Bloomberg U.S. Aggregate Bond Index and the S&P 500 Index, returned -14.60% and -15.47% respectively, over the same period.

Manager’s Discussion

The Fund seeks to maximize total return by investing primarily in a combination of U.S. and International equity and debt securities. We utilize an active approach to asset allocation and hold concentrated positions. Our valuation discipline across asset classes and independent insights ensures that each investment candidate is evaluated from varying perspectives and ideas compete for capital.

During a weak period in the last twelve months ending September 30, both the stock and bond market were down 15%. The simultaneous pain in both bond and equity indexes led to little benefit to diversification for those indexes. We were relieved to have captured only one third of the downside of the broad security markets during this time.

With the mainline investment markets offering few places to hide, we were pleased to be a relatively safe port in the storm. Versus our Morningstar Moderate Index we use to evaluate ourselves we are now the 1st percentile manager through September 30th on a year-to- date, 2nd percentile over one year and 1st percentile on a 3 year basis. Over the past 5 years we are in the 11th percentile, and we believe our since inception numbers (7.5 years) to be better than 95% of our peers. Being willing to express our view in an independent manner has led us away from the major equity and bond index weights which we also believe to be superior from a risk standpoint.

The Fund has not made any significant changes over the past year except to increase our weightings in “ballast” companies that are lower beta than the average equity and to recycle our investible real asset equities. Our large position in low duration bonds has proved fruitful during our management tenure especially in the past 12 months as it has preserved our ability to dynamically allocate capital.

|

AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED SEPTEMBER 30, 2022* | ||||||||||

| One Year Return |

Three Year Return |

Five Year Return |

Ten Year Return |

Annualized Inception to Date* | ||||||

| First Foundation Total Return Fund, Class A Shares (with load)** | -10.65% | 6.35% | 4.11% | 5.75% | 6.50% | |||||

| First Foundation Total Return Fund, Class A Shares (without load)** |

-5.20% | 8.47% | 5.35% | 6.38% | 6.72% | |||||

| First Foundation Total Return Fund, Class Y Shares |

-4.98% | 8.75% | 5.61% | 6.64% | 6.92% | |||||

| S&P 500 Index |

-15.47% | 8.16% | 9.24% | 11.70% | 9.45% | |||||

| Bloomberg U.S. Aggregate Bond Index |

-14.60% | -3.26% | -0.27% | 0.89% | 4.34% | |||||

4

| THE ADVISORS’ INNER CIRCLE FUND III | FIRST FOUNDATION | |

| TOTAL RETURN FUND | ||

| SEPTEMBER 30, 2022 | ||

| (Unaudited) |

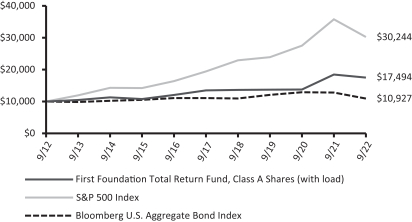

Growth of a $10,000 Investment

* Inception date of the Fund is February 22, 1993.

** Refers to the individual maximum sales charge of 5.75%.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost.

Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower.

Please note that one cannot invest directly in an unmanaged index. There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change because it is actively managed and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on page 6.

5

| THE ADVISORS’ INNER CIRCLE FUND III | FIRST FOUNDATION | |

| TOTAL RETURN FUND | ||

| SEPTEMBER 30, 2022 | ||

| (Unaudited) |

Definition of the Comparative Index

Bloomberg U.S. Aggregate Bond Index is a market capitalization-weighted index that measures the performance of high-quality, fixed- income securities across the government, corporate, mortgage-backed, asset-backed, and commercial mortgage- backed markets.

S&P 500 Index is an unmanaged, market-weighted index that consists of approximately 500 of the largest publicly-traded U.S. companies and is considered representative of the broad U.S. stock market.

6

| THE ADVISORS’ INNER CIRCLE FUND III | FIRST FOUNDATION | |

| FIXED INCOME FUND | ||

| SEPTEMBER 30, 2022 | ||

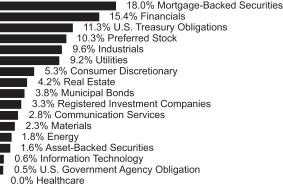

†Percentages are based on total investments.

| Principal Amount ($) |

Value ($) | |||||||

| Corporate Obligations — 50.6% |

| |||||||

| COMMUNICATION SERVICES — 2.8% |

| |||||||

| Netflix |

||||||||

| 4.88%, 04/15/28 |

750,000 | 701,936 | ||||||

| 4.88%, 06/15/30 (a) |

750,000 | 685,378 | ||||||

| ROBLOX |

||||||||

| 3.88%, 05/01/30 (a) |

2,000,000 | 1,627,740 | ||||||

| |

||||||||

| 3.88%, 12/15/27 (a) |

1,000,000 | 937,725 | ||||||

| Warner Media |

||||||||

| 5.35%, 12/15/43 |

168,000 | 131,838 | ||||||

|

|

|

|||||||

| 4,084,617 | ||||||||

|

|

|

|||||||

| CONSUMER DISCRETIONARY — 5.3% |

| |||||||

| Ford Motor Credit |

||||||||

| 3.38%, 11/13/25 |

750,000 | 662,630 | ||||||

| Las Vegas Sands |

||||||||

| 3.20%, 08/08/24 |

1,500,000 | 1,413,989 | ||||||

| 3.90%, 08/08/29 |

2,410,000 | 1,992,535 | ||||||

| Marriott International |

||||||||

| 3.50%, 10/15/32 |

1,000,000 | 804,222 | ||||||

| 4.00%, 04/15/28 |

3,250,000 | 2,942,862 | ||||||

|

|

|

|||||||

| 7,816,238 | ||||||||

|

|

|

|||||||

The accompanying notes are an integral part of the financial statements.

7

| THE ADVISORS’ INNER CIRCLE FUND III | FIRST FOUNDATION | |

| FIXED INCOME FUND | ||

| SEPTEMBER 30, 2022 | ||

| Principal Amount ($) |

Value ($) | |||||||

| Corporate Obligations (continued) |

| |||||||

| ENERGY — 1.7% |

| |||||||

| BP Capital Markets |

||||||||

| US Treas Yield Curve Rate T Note Const Mat 5 Yr + 4.398%, 4.88% (b)(c) |

1,725,000 | 1,483,500 | ||||||

| Energy Transfer |

||||||||

| 6.50%, 02/01/42 |

259,000 | 241,031 | ||||||

| Plains All American Pipeline |

||||||||

| ICE LIBOR USD 3 Month + 4.110%, 6.13% (b)(c) |

1,000,000 | 815,112 | ||||||

|

|

|

|||||||

| 2,539,643 | ||||||||

|

|

|

|||||||

| FINANCIALS — 15.2% |

| |||||||

| Arbor Realty Trust |

||||||||

| 4.50%, 03/15/27 |

1,750,000 | 1,470,557 | ||||||

| Athene Holding |

||||||||

| 3.50%, 01/15/31 |

2,000,000 | 1,601,733 | ||||||

| Bank of America |

||||||||

| ICE LIBOR USD 3 Month + 3.898%, 6.10% (b)(c) |

1,750,000 | 1,677,568 | ||||||

| ICE LIBOR USD 3 Month + 4.553%, 6.30% (b)(c) |

500,000 | 491,150 | ||||||

| Bank of New York Mellon |

||||||||

| US Treas Yield Curve Rate T Note Const Mat 5 Yr + 4.358%, 4.70% (b)(c) |

1,000,000 | 957,500 | ||||||

| Charles Schwab |

||||||||

| US Treas Yield Curve Rate T Note Const Mat 5 Yr + 4.971%, 5.38% (b)(c) |

1,400,000 | 1,361,500 | ||||||

| Everest Reinsurance Holdings |

||||||||

| ICE LIBOR USD 3 Month + 2.385%, 5.29%, 05/15/37 (b) |

1,500,000 | 1,210,109 | ||||||

| Independent Bank Group |

||||||||

| ICE LIBOR USD 3 Month + 2.830%, 5.00%, 12/31/27 (b) |

500,000 | 497,910 | ||||||

| JPMorgan Chase & Co |

||||||||

| ICE LIBOR USD 3 Month + 3.470%, 6.28% (b)(c) |

245,000 | 244,996 | ||||||

| ICE LIBOR USD 3 Month + 3.780%, 6.75% (b)(c) |

3,000,000 | 2,972,778 | ||||||

| Lincoln National |

||||||||

| ICE LIBOR USD 3 Month + 2.040%, 4.75%, 04/20/67 (b) |

400,000 | 267,880 | ||||||

| M&T Bank |

||||||||

| 4.00%, 07/15/24 |

250,000 | 246,473 | ||||||

| Oaktree Specialty Lending |

||||||||

| 2.70%, 01/15/27 |

400,000 | 336,817 | ||||||

| 3.50%, 02/25/25 |

2,750,000 | 2,612,377 | ||||||

| PNC Financial Services Group |

||||||||

| US Treas Yield Curve Rate T Note Const Mat 5 Yr + 3.238%, 6.20% (b)(c) |

150,000 | 141,750 | ||||||

| Prudential Financial, Inc. |

||||||||

| ICE LIBOR USD 3 Month + 3.920%, 5.63%, 06/15/43 (b) |

895,000 | 881,808 | ||||||

The accompanying notes are an integral part of the financial statements.

8

| THE ADVISORS’ INNER CIRCLE FUND III | FIRST FOUNDATION | |

| FIXED INCOME FUND | ||

| SEPTEMBER 30, 2022 | ||

| Principal Amount ($) |

Value ($) | |||||||

| Corporate Obligations (continued) |

| |||||||

| FINANCIALS (continued) |

| |||||||

| Rocket Mortgage |

||||||||

| 2.88%, 10/15/26 (a) |

2,000,000 | 1,640,000 | ||||||

| State Street |

||||||||

| ICE LIBOR USD 3 Month + 1.000%, 4.29%, 06/15/47 (b) |

750,000 | 573,633 | ||||||

| Truist Financial |

||||||||

| US Treas Yield Curve Rate T Note Const Mat 5 Yr + 4.605%, 4.95% (b)(c) |

1,650,000 | 1,585,304 | ||||||

| UBS AG |

||||||||

| 5.13%, 05/15/24 |

500,000 | 487,433 | ||||||

| United Wholesale Mortgage |

||||||||

| 5.50%, 04/15/29 (a) |

500,000 | 380,000 | ||||||

| Wells Fargo |

||||||||

| ICE LIBOR USD 3 Month + 0.500%, 3.01%, 01/15/27 (b) |

795,000 | 743,772 | ||||||

|

|

|

|||||||

| 22,383,048 | ||||||||

|

|

|

|||||||

| HEALTHCARE — 0.0% |

| |||||||

| CVS Pass-Through Trust |

||||||||

| 6.04%, 12/10/28 |

42,159 | 41,866 | ||||||

| Endo Finance |

||||||||

| 5.38%, 01/15/23 (a)(d) |

187,000 | 10,285 | ||||||

|

|

|

|||||||

| 52,151 | ||||||||

|

|

|

|||||||

| INDUSTRIALS — 9.6% |

| |||||||

| BNSF Funding Trust I |

||||||||

| ICE LIBOR USD 3 Month + 2.350%, 6.61%, 12/15/55 (b) |

1,554,000 | 1,454,566 | ||||||

| Boeing |

||||||||

| 3.25%, 03/01/28 to 02/01/35 (e) |

2,125,000 | 1,739,986 | ||||||

| 3.45%, 11/01/28 |

2,150,000 | 1,852,150 | ||||||

| 3.60%, 05/01/34 |

750,000 | 562,174 | ||||||

| 3.63%, 02/01/31 |

1,000,000 | 830,049 | ||||||

| General Electric |

||||||||

| ICE LIBOR USD 3 Month + 3.330%, 6.62% (b)(c) |

1,495,000 | 1,398,099 | ||||||

| General Electric MTN |

||||||||

| ICE LIBOR USD 3 Month + 0.300%, 2.81%, 05/13/24 (b) |

750,000 | 734,690 | ||||||

| Southwest Airlines |

||||||||

| 2.63%, 02/10/30 |

1,000,000 | 802,171 | ||||||

| 3.45%, 11/16/27 |

200,000 | 180,559 | ||||||

| 7.38%, 03/01/27 |

3,100,000 | 3,285,718 | ||||||

| Uber Technologies |

||||||||

| 4.50%, 08/15/29 (a) |

1,000,000 | 840,625 | ||||||

| 6.25%, 01/15/28 (a) |

500,000 | 465,000 | ||||||

|

|

|

|||||||

| 14,145,787 | ||||||||

|

|

|

|||||||

The accompanying notes are an integral part of the financial statements.

9

| THE ADVISORS’ INNER CIRCLE FUND III | FIRST FOUNDATION | |

| FIXED INCOME FUND | ||

| SEPTEMBER 30, 2022 | ||

| Principal Amount ($) |

Value ($) | |||||||

| Corporate Obligations (continued) |

| |||||||

| INFORMATION TECHNOLOGY — 0.6% |

| |||||||

| Fiserv |

||||||||

| 3.50%, 07/01/29 |

1,000,000 | 870,039 | ||||||

|

|

|

|||||||

| MATERIALS — 2.3% |

| |||||||

| Ball |

||||||||

| 2.88%, 08/15/30 |

2,250,000 | 1,726,751 | ||||||

| 4.88%, 03/15/26 |

1,750,000 | 1,660,243 | ||||||

|

|

|

|||||||

| 3,386,994 | ||||||||

|

|

|

|||||||

| REAL ESTATE — 3.9% |

| |||||||

| Brookfield Property |

||||||||

| 5.75%, 05/15/26 (a) |

250,000 | 226,004 | ||||||

| Federal Realty Investment Trust |

||||||||

| 3.50%, 06/01/30 |

2,500,000 | 2,128,283 | ||||||

| Phillips Edison Grocery Center Operating Partnership I |

||||||||

| 2.63%, 11/15/31 |

1,000,000 | 725,986 | ||||||

| Regency Centers |

||||||||

| 2.95%, 09/15/29 |

750,000 | 622,030 | ||||||

| Retail Opportunity Investments Partnership |

||||||||

| 4.00%, 12/15/24 |

850,000 | 813,196 | ||||||

| Rexford Industrial Realty |

||||||||

| 2.13%, 12/01/30 |

1,500,000 | 1,145,291 | ||||||

|

|

|

|||||||

| 5,660,790 | ||||||||

|

|

|

|||||||

| UTILITIES — 9.2% |

| |||||||

| Duke Energy |

||||||||

| US Treas Yield Curve Rate T Note Const Mat 5 Yr + 3.388%, 4.88% (b)(c) |

1,500,000 | 1,344,364 | ||||||

| Edison International |

||||||||

| 4.13%, 03/15/28 |

2,550,000 | 2,274,971 | ||||||

| US Treas Yield Curve Rate T Note Const Mat 5 Yr + 4.698%, 5.38% (b)(c) |

2,125,000 | 1,747,812 | ||||||

| Pacific Gas and Electric |

||||||||

| 2.50%, 02/01/31 |

4,250,000 | 3,092,521 | ||||||

| 3.50%, 08/01/50 |

3,000,000 | 1,825,683 | ||||||

| 4.95%, 07/01/50 |

1,500,000 | 1,097,890 | ||||||

| PacifiCorp |

||||||||

| 6.25%, 10/15/37 |

42,000 | 42,980 | ||||||

| Southern California Edison |

||||||||

| 3.90%, 12/01/41 |

15,000 | 10,911 | ||||||

| WEC Energy Group, Inc. |

||||||||

| ICE LIBOR USD 3 Month + 2.113%, 5.02%, 05/15/67 (b) |

2,560,000 | 2,124,800 | ||||||

|

|

|

|||||||

| 13,561,932 | ||||||||

|

|

|

|||||||

| Total Corporate Obligations |

||||||||

| (Cost $88,147,726) |

74,501,239 | |||||||

|

|

|

|||||||

The accompanying notes are an integral part of the financial statements.

10

| THE ADVISORS’ INNER CIRCLE FUND III | FIRST FOUNDATION | |

| FIXED INCOME FUND | ||

| SEPTEMBER 30, 2022 | ||

| Principal Amount ($) |

Value ($) | |||||||

| Mortgage-Backed Securities — 18.0% |

| |||||||

| AGENCY MORTGAGE-BACKED SECURITIES — 17.0% |

| |||||||

| FHLMC |

||||||||

| 4.00%, 05/01/44 |

402,290 | 381,125 | ||||||

| 5.00%, 06/01/41 |

74,251 | 74,680 | ||||||

| FHLMC Multifamily Structured Pass-Through Certificates, Series K735, Class AM |

||||||||

| 2.46%, 05/25/26 |

2,000,000 | 1,841,575 | ||||||

| FNMA, Series 2010-16, Class PA |

||||||||

| 4.50%, 02/25/40 |

26,304 | 25,777 | ||||||

| FNMA, Series 2019-M12, Class A2 |

||||||||

| 2.89%, 06/25/29 (b) |

1,500,000 | 1,357,591 | ||||||

| FNMA |

||||||||

| 3.00%, 02/01/43 to 06/01/43 (e) |

1,666,540 | 1,492,450 | ||||||

| 3.50%, 11/01/42 to 02/01/43 (e) |

716,360 | 661,428 | ||||||

| 4.00%, 01/01/41 to 03/01/44 (e) |

529,319 | 502,995 | ||||||

| 4.50%, 10/01/39 to 04/01/41 (e) |

683,810 | 668,918 | ||||||

| 5.00%, 06/01/41 |

88,608 | 89,018 | ||||||

| FNMA, Series 2016-104, Class QA |

||||||||

| 3.00%, 11/25/43 |

163,295 | 159,248 | ||||||

| FRESB Mortgage Trust, Series 2018-SB52, Class A10F |

||||||||

| 3.48%, 06/25/28 (b) |

2,104,164 | 1,992,120 | ||||||

| FRESB Mortgage Trust, Series 2019-SB63, Class A10H |

||||||||

| 2.89%, 03/25/39 (b) |

581,386 | 531,474 | ||||||

| FRESB Mortgage Trust, Series 2019-SB60, Class A10F |

||||||||

| 3.31%, 01/25/29 (b) |

757,696 | 708,960 | ||||||

| FRESB Mortgage Trust, Series 2018-SB53, Class A10F |

||||||||

| 3.66%, 06/25/28 (b) |

1,556,814 | 1,484,386 | ||||||

| FRESB Mortgage Trust, Series 2019-SB62, Class A10F |

||||||||

| 3.07%, 03/25/29 (b) |

1,562,043 | 1,438,135 | ||||||

| FRESB Mortgage Trust, Series 2017-SB42, Class A10F |

||||||||

| 2.96%, 10/25/27 (b) |

986,375 | 909,845 | ||||||

| GNMA, Series 2012-83, Class AK |

||||||||

| 3.20%, 12/16/53 (b) |

587,282 | 533,203 | ||||||

| GNMA, Series 2018-129, Class AG |

||||||||

| 3.10%, 05/16/59 |

127,466 | 125,946 | ||||||

| GNMA, Series 2018-3, Class AG |

||||||||

| 2.50%, 10/16/58 |

223,360 | 198,471 | ||||||

| GNMA, Series 2017-24, Class A |

||||||||

| 2.25%, 09/16/44 |

145,886 | 140,548 | ||||||

| GNMA, Series 2018-156, Class AD |

||||||||

| 3.25%, 08/16/59 (b) |

350,077 | 328,159 | ||||||

| GNMA, Series 2018-68, Class B |

||||||||

| 3.00%, 02/16/59 (b) |

1,000,000 | 864,785 | ||||||

| GNMA, Series 2020-8, Class AH |

||||||||

| 2.55%, 01/16/62 |

1,316,938 | 1,147,975 | ||||||

The accompanying notes are an integral part of the financial statements.

11

| THE ADVISORS’ INNER CIRCLE FUND III | FIRST FOUNDATION | |

| FIXED INCOME FUND | ||

| SEPTEMBER 30, 2022 | ||

| Principal Amount ($) |

Value ($) | |||||||

| Mortgage-Backed Securities (continued) |

| |||||||

| AGENCY MORTGAGE-BACKED SECURITIES (continued) |

| |||||||

| GNMA, Series 2017-46, Class A |

||||||||

| 2.50%, 11/16/57 |

373,470 | 324,580 | ||||||

| GNMA, Series 2017-106, Class AC |

||||||||

| 2.60%, 04/16/51 |

286,676 | 263,637 | ||||||

| GNMA |

||||||||

| 3.50%, 05/20/43 |

467,866 | 435,453 | ||||||

| 4.00%, 01/20/41 to 04/20/43 (e) |

446,281 | 424,863 | ||||||

| GNMA, Series 2019-2, Class AE |

||||||||

| 3.25%, 03/16/59 |

843,684 | 795,236 | ||||||

| GNMA, Series 2019-55, Class AH |

||||||||

| 3.15%, 03/16/61 (b) |

778,691 | 694,934 | ||||||

| GNMA, Series 2017-70, Class AE |

||||||||

| 2.60%, 10/16/58 |

813,127 | 716,459 | ||||||

| GNMA, Series 2017-69, Class AS |

||||||||

| 2.75%, 02/16/58 |

724,715 | 670,185 | ||||||

| GNMA, Series 2020-3, Class AH |

||||||||

| 2.50%, 02/16/62 |

1,010,392 | 879,894 | ||||||

| GNMA, Series 2012-100, Class BA |

||||||||

| 2.60%, 08/16/52 (b) |

2,500,000 | 2,135,403 | ||||||

|

|

|

|||||||

| 24,999,456 | ||||||||

|

|

|

|||||||

| NON-AGENCY MORTGAGE-BACKED SECURITIES — 1.0% |

| |||||||

| Commercial Mortgage Trust, Series 2013-LC13, Class AM |

||||||||

| 4.56%, 08/10/46 (a)(b) |

100,000 | 98,649 | ||||||

| Commercial Mortgage Trust, Series 2014-CR14, Class AM |

||||||||

| 4.53%, 02/10/47 (b) |

120,000 | 117,783 | ||||||

| GS Mortgage Securities Trust, Series 2014-GC20, Class AS |

||||||||

| 4.26%, 04/10/47 |

105,000 | 102,165 | ||||||

| JPMBB Commercial Mortgage Securities Trust, Series 2013-C17, Class C |

||||||||

| 5.05%, 01/15/47 (b) |

153,000 | 146,960 | ||||||

| JPMBB Commercial Mortgage Securities Trust, Series 2014-C18, Class C |

||||||||

| 4.95%, 02/15/47 (b) |

100,000 | 91,892 | ||||||

| Morgan Stanley Bank of America Merrill Lynch Trust, Series 2013-C10, Class AS |

||||||||

| 4.21%, 07/15/46 (b) |

210,000 | 206,699 | ||||||

| Morgan Stanley Bank of America Merrill Lynch Trust, Series 2013-C10, Class C |

||||||||

| 4.21%, 07/15/46 (b) |

191,000 | 172,277 | ||||||

|

WFRBS Commercial Mortgage Trust, Series 2014-LC14, Class AS |

||||||||

| 4.35%, 03/15/47 (b) |

263,000 | 256,799 | ||||||

The accompanying notes are an integral part of the financial statements.

12

| THE ADVISORS’ INNER CIRCLE FUND III | FIRST FOUNDATION | |

| FIXED INCOME FUND | ||

| SEPTEMBER 30, 2022 | ||

| Principal Amount ($)/Shares |

Value ($) | |||||||

| Mortgage-Backed Securities (continued) |

| |||||||

| NON-AGENCY MORTGAGE-BACKED SECURITIES (continued) |

| |||||||

| WFRBS Commercial Mortgage Trust, Series 2013-C17, Class AS |

||||||||

| 4.26%, 12/15/46 |

115,000 | 112,704 | ||||||

| WFRBS Commercial Mortgage Trust, Series 2014-C19, Class B |

||||||||

| 4.72%, 03/15/47 (b) |

140,000 | 135,044 | ||||||

|

|

|

|||||||

| 1,440,972 | ||||||||

|

|

|

|||||||

| Total Mortgage-Backed Securities |

||||||||

| (Cost $29,024,322) |

26,440,428 | |||||||

|

|

|

|||||||

| U.S. Treasury Obligations — 11.2% |

| |||||||

| U.S. Treasury Bill |

||||||||

| 2.46%, 10/11/2022 (f) |

3,000,000 | 2,998,367 | ||||||

| U.S. Treasury Bonds |

||||||||

| 1.13%, 5/15/2040 to 8/15/2040 (e) |

5,500,000 | 3,420,566 | ||||||

| 1.25%, 5/15/2050 |

500,000 | 279,844 | ||||||

| 2.25%, 8/15/2046 |

1,000,000 | 720,078 | ||||||

| U.S. Treasury Notes |

||||||||

| 0.38%, 7/31/2027 |

800,000 | 671,656 | ||||||

| 0.63%, 10/15/2024 to 8/15/2030 (e) |

6,000,000 | 5,040,400 | ||||||

| 1.25%, 11/30/2026 |

2,000,000 | 1,779,766 | ||||||

| 1.38%, 11/15/2031 |

2,000,000 | 1,625,000 | ||||||

|

|

|

|||||||

| Total U.S. Treasury Obligations |

||||||||

| (Cost $19,547,827) |

16,535,677 | |||||||

|

|

|

|||||||

| Preferred Stock — 10.3% |

| |||||||

| COMMUNICATION SERVICES — 2.6% |

| |||||||

| Qwest Corp. 6.50%, 09/01/2056 |

55,790 | 1,264,201 | ||||||

| Qwest Corp. 6.75%, 06/15/2057 |

45,187 | 1,039,301 | ||||||

| Telephone and Data Systems 6.00% (c) |

80,000 | 1,488,000 | ||||||

|

|

|

|||||||

| 3,791,502 | ||||||||

|

|

|

|||||||

| ENERGY — 1.5% |

| |||||||

| Enbridge 6.38%, 04/15/2078 (b) |

10,022 | 237,221 | ||||||

| Energy Transfer 7.63% (b)(c) |

53,750 | 1,229,262 | ||||||

| Energy Transfer 7.38% (b)(c) |

32,862 | 718,035 | ||||||

| Energy Transfer 7.60% (b)(c) |

1,394 | 33,721 | ||||||

|

|

|

|||||||

| 2,218,239 | ||||||||

|

|

|

|||||||

The accompanying notes are an integral part of the financial statements.

13

| THE ADVISORS’ INNER CIRCLE FUND III | FIRST FOUNDATION | |

| FIXED INCOME FUND | ||

| SEPTEMBER 30, 2022 | ||

| Shares/ Principal Amount ($) |

Value ($) | |||||||

| Preferred Stock (continued) |

| |||||||

| FINANCIALS — 3.7% |

| |||||||

| Arbor Realty Trust, REIT 6.38% (c) |

34,000 | 660,960 | ||||||

| Athene Holding 6.38% (b)(c) |

5,929 | 149,529 | ||||||

| B Riley Financial 5.00%, 12/31/2026 |

80,000 | 1,796,800 | ||||||

| B. Riley Financial 6.00%, 01/31/2028 |

40,000 | 908,400 | ||||||

| B. Riley Financial 6.75%, 05/31/2024 |

8,892 | 219,633 | ||||||

| Ellington Financial, REIT 6.25% (b)(c) |

80,000 | 1,337,600 | ||||||

| RiverNorth DoubleLine Strategic Opportunity Fund I 4.38% (c) |

21,000 | 388,920 | ||||||

|

|

|

|||||||

| 5,461,842 | ||||||||

|

|

|

|||||||

| REAL ESTATE — 1.5% |

| |||||||

| Brookfield Property Partners 6.50% (c) |

20,600 | 390,782 | ||||||

| CTO Realty Growth, REIT 6.38% (c) |

80,000 | 1,756,800 | ||||||

|

|

|

|||||||

| 2,147,582 | ||||||||

|

|

|

|||||||

| UTILITIES — 1.0% |

| |||||||

| SCE Trust III 5.75% (b)(c) |

61,167 | 1,260,652 | ||||||

| SCE Trust VI 5.00% (c) |

12,348 | 228,932 | ||||||

|

|

|

|||||||

| 1,489,584 | ||||||||

|

|

|

|||||||

| Total Preferred Stock |

||||||||

| (Cost $17,366,002) |

15,108,749 | |||||||

|

|

|

|||||||

| Municipal Bonds — 3.8% |

| |||||||

| CALIFORNIA — 0.3% |

| |||||||

| San Francisco City & County Redevelopment Financing Authority TA |

||||||||

| 8.26%, 08/01/29 |

300,000 | 343,275 | ||||||

|

|

|

|||||||

| KENTUCKY — 0.5% |

| |||||||

| Clark County School District Finance Corp RB |

||||||||

| Insured: ST INTERCEPT |

||||||||

| 5.20%, 06/01/26 |

750,000 | 764,891 | ||||||

|

|

|

|||||||

| MARYLAND — 0.3% |

| |||||||

| Maryland Economic Development RB |

||||||||

| 3.70%, 06/01/25 |

500,000 | 478,535 | ||||||

|

|

|

|||||||

| MICHIGAN — 0.9% |

| |||||||

| Belding Area Schools GO |

||||||||

| Insured: Q-SBLF |

||||||||

| 6.50%, 05/01/25 |

750,000 | 751,134 | ||||||

| Comstock Park Public Schools GO |

||||||||

| Insured: Q-SBLF |

||||||||

| 6.30%, 05/01/26 |

635,000 | 635,686 | ||||||

|

|

|

|||||||

| 1,386,820 | ||||||||

|

|

|

|||||||

The accompanying notes are an integral part of the financial statements.

14

| THE ADVISORS’ INNER CIRCLE FUND III | FIRST FOUNDATION | |

| FIXED INCOME FUND | ||

| SEPTEMBER 30, 2022 | ||

| Principal Amount ($)/Shares |

Value ($) | |||||||

| Municipal Bonds (continued) |

| |||||||

| NEW YORK — 0.7% |

| |||||||

| New York & New Jersey Port Authority RB |

||||||||

| 4.46%, 10/01/62 |

320,000 | 279,583 | ||||||

| New York State Dormitory Authority RB |

||||||||

| 5.00%, 01/01/24 (g) |

720,000 | 725,877 | ||||||

|

|

|

|||||||

| 1,005,460 | ||||||||

|

|

|

|||||||

| NORTH DAKOTA — 0.6% |

| |||||||

| Kindred Public School District No. 2 GO |

||||||||

| 6.00%, 08/01/27 |

750,000 | 789,444 | ||||||

|

|

|

|||||||

| WASHINGTON — 0.5% |

| |||||||

| Washington Higher Education Facilities Authority RB |

||||||||

| 4.27%, 10/01/22 |

750,000 | 750,000 | ||||||

|

|

|

|||||||

| Total Municipal Bonds |

||||||||

| (Cost $5,579,949) |

5,518,425 | |||||||

|

|

|

|||||||

| Registered Investment Companies — 3.3% |

| |||||||

| Ares Dynamic Credit Allocation Fund |

7,808 | 91,744 | ||||||

| DoubleLine Income Solutions Fund |

99,865 | 1,078,542 | ||||||

| DoubleLine Opportunistic Credit Fund |

6,295 | 90,963 | ||||||

| PGIM High Yield Bond Fund |

25,596 | 295,378 | ||||||

| PIMCO Dynamic Income Fund |

34,714 | 672,766 | ||||||

| PIMCO Dynamic Income Opportunities Fund |

134,944 | 1,779,911 | ||||||

| RiverNorth DoubleLine Strategic Opportunity Fund |

97,148 | 893,762 | ||||||

|

|

|

|||||||

| Total Registered Investment Companies |

4,903,066 | |||||||

|

|

|

|||||||

| Asset-Backed Securities — 1.6% |

| |||||||

| SBA Small Business Investment Company, Series 2018-10B, Class 1 |

||||||||

| 3.55%, 9/10/2028 |

985,280 | 926,424 | ||||||

| SBA Small Business Investment Company, Series 2018-10A, Class 1 |

||||||||

| 3.19%, 3/10/2028 |

671,377 | 633,397 | ||||||

| Small Business Administration, Series 2018-20H, Class 1 |

||||||||

| 3.58%, 8/1/2038 |

895,531 | 847,747 | ||||||

|

|

|

|||||||

| Total Asset-Backed Securities |

2,407,568 | |||||||

|

|

|

|||||||

The accompanying notes are an integral part of the financial statements.

15

| THE ADVISORS’ INNER CIRCLE FUND III | FIRST FOUNDATION | |

| FIXED INCOME FUND | ||

| SEPTEMBER 30, 2022 | ||

| Principal Amount ($)/Shares |

Value ($) | |||||||

| U.S. Government Agency Obligation — 0.5% |

| |||||||

| FHLMC MTN |

||||||||

| 2.00%, 10/29/2040 |

1,000,000 | 663,116 | ||||||

|

|

|

|||||||

| Total U.S. Government Agency Obligations |

663,116 | |||||||

|

|

|

|||||||

| Common Stock — 0.4% |

| |||||||

| ENERGY — 0.1% |

| |||||||

| Unit Corp (h) |

2,231 | 118,846 | ||||||

|

|

|

|||||||

| REAL ESTATE — 0.3% |

| |||||||

| Creative Media & Community Trust, REIT |

69,150 | 441,868 | ||||||

| Orion Office Inc, REIT |

726 | 6,356 | ||||||

|

|

|

|||||||

| 448,224 | ||||||||

|

|

|

|||||||

| Total Common Stock |

567,070 | |||||||

|

|

|

|||||||

| Total Investments - 99.7% |

146,645,338 | |||||||

|

|

|

|||||||

| (Cost $170,667,545) |

||||||||

| Other Assets & Liabilities, Net - 0.3% |

499,759 | |||||||

|

|

|

|||||||

| Net Assets - 100.0% |

147,145,097 | |||||||

|

|

|

|||||||

| (a) | Securities exempt from registration under Rule 144A of the 1933 Act. These securities may only be resold in transactions exempt from registration to qualified institutional buyers. The Board has determined these investments to be liquid. At September 30, 2022, these securities amounted to $6,911,406 or 4.7% of Net Assets of the Fund. |

| (b) | Variable or floating rate security. The rate shown is the effective interest rate as of period end. The rates on certain securities are not based on published reference rates and spreads and are either determined by the issuer or agent based on current market conditions; by using a formula based on the rates of underlying loans; or by adjusting periodically based on prevailing interest rates. |

| (c) | Perpetual security with no stated maturity date. |

| (d) | The issuer is, or is in danger of being, in default of its payment obligation. |

| (e) | Securities are grouped by coupon and represent a range of maturities. |

| (f) | Interest rate represents the security’s effective yield at the time of purchase. |

| (g) | Escrowed to Maturity |

| (h) | Non-income producing security. |

The accompanying notes are an integral part of the financial statements.

16

| THE ADVISORS’ INNER CIRCLE FUND III | FIRST FOUNDATION | |

| FIXED INCOME FUND | ||

| SEPTEMBER 30, 2022 | ||

FHLMC — Federal Home Loan Mortgage Corporation

FNMA — Federal National Mortgage Association

FRESB — Freddie Mac Small Balance Mortgage Trust

GNMA — Government National Mortgage Association

GO — General Obligation

ICE — Intercontinental Exchange

LIBOR — London Interbank Offered Rate

MTN — Medium Term Note

REIT — Real Estate Investment Trust

RB — Revenue Bond

TA — Tax Allocation

USD — U.S. Dollar

The following is a summary of the inputs used as of September 30, 2022 in valuing the Fund’s investments carried at value:

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Corporate Obligations |

$ | — | $ | 74,501,239 | $ | — | $ | 74,501,239 | ||||||||

| Mortgage-Backed Securities |

— | 26,440,428 | — | 26,440,428 | ||||||||||||

| U.S. Treasury Obligations |

13,537,310 | 2,998,367 | — | 16,535,677 | ||||||||||||

| Preferred Stock |

15,108,749 | — | — | 15,108,749 | ||||||||||||

| Municipal Bonds |

— | 5,518,425 | — | 5,518,425 | ||||||||||||

| Registered Investment Companies |

4,903,066 | — | — | 4,903,066 | ||||||||||||

| Asset-Backed Securities |

— | 2,407,568 | — | 2,407,568 | ||||||||||||

| U.S. Government Agency Obligation |

— | 663,116 | — | 663,116 | ||||||||||||

| Common Stock |

567,070 | — | — | 567,070 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments in Securities |

$ | 34,116,195 | $ | 112,529,143 | $ | — | $ | 146,645,338 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Amounts designated as “—” are $0 or have been rounded to $0.

For more information on valuation inputs, see Note 2 – Significant Accounting Policies in the Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

17

| THE ADVISORS’ INNER CIRCLE FUND III | FIRST FOUNDATION | |

| TOTAL RETURN FUND | ||

| SEPTEMBER 30, 2022 |

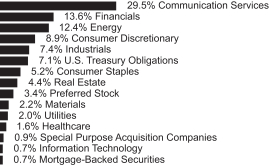

| SECTOR WEIGHTINGS (Unaudited)† |

†Percentages are based on total investments.

| Shares | Value ($) | |||||||

| Common Stock — 43.5% |

| |||||||

| COMMUNICATION SERVICES — 13.3% |

| |||||||

| Activision Blizzard |

29,750 | 2,211,615 | ||||||

| Alphabet, Inc., Class A (a) |

11,620 | 1,111,453 | ||||||

| Alphabet, Inc., Class C (a) |

3,860 | 371,139 | ||||||

| Liberty Media Corp.-Liberty Formula One, Class A (a) |

73,750 | 3,873,350 | ||||||

| Madison Square Garden Entertainment (a) |

77,882 | 3,433,817 | ||||||

| Walt Disney Co. (a) |

14,250 | 1,344,203 | ||||||

|

|

|

|||||||

| 12,345,577 | ||||||||

|

|

|

|||||||

| CONSUMER DISCRETIONARY — 5.2% |

| |||||||

| Amazon.com, Inc. (a) |

8,450 | 954,850 | ||||||

| Domino’s Pizza |

1,375 | 426,525 | ||||||

| MGM Resorts International |

51,500 | 1,530,580 | ||||||

| Tandy Leather Factory (a) |

524,514 | 1,914,476 | ||||||

|

|

|

|||||||

| 4,826,431 | ||||||||

|

|

|

|||||||

| CONSUMER STAPLES — 2.9% |

| |||||||

| Altria Group |

24,400 | 985,272 | ||||||

| Philip Morris International, Inc. |

20,900 | 1,734,909 | ||||||

|

|

|

|||||||

| 2,720,181 | ||||||||

|

|

|

|||||||

| ENERGY — 9.2% |

| |||||||

| Texas Pacific Land |

4,370 | 7,766,495 | ||||||

| Unit Corp (a) |

14,335 | 763,626 | ||||||

| Windrock |

23 | 12,880 | ||||||

|

|

|

|||||||

| 8,543,001 | ||||||||

|

|

|

|||||||

The accompanying notes are an integral part of the financial statements.

18

| THE ADVISORS’ INNER CIRCLE FUND III | FIRST FOUNDATION | |

| TOTAL RETURN FUND | ||

| SEPTEMBER 30, 2022 |

| Shares | Value ($) | |||||||

| Common Stock (continued) |

| |||||||

| FINANCIALS — 5.1% |

| |||||||

| Aon, Class A |

3,015 | 807,628 | ||||||

| Berkshire Hathaway, Inc., Class B (a) |

5,055 | 1,349,786 | ||||||

| JPMorgan Chase |

20,025 | 2,092,613 | ||||||

| PNC Financial Services Group |

3,000 | 448,260 | ||||||

|

|

|

|||||||

| 4,698,287 | ||||||||

|

|

|

|||||||

| HEALTHCARE — 1.5% |

| |||||||

| Edwards Lifesciences Corp. (a) |

6,000 | 495,780 | ||||||

| HCA Healthcare, Inc. |

2,775 | 510,017 | ||||||

| Laboratory Corp of America Holdings |

2,000 | 409,620 | ||||||

|

|

|

|||||||

| 1,415,417 | ||||||||

|

|

|

|||||||

| INDUSTRIALS — 0.5% |

| |||||||

| Honeywell International |

2,790 | 465,846 | ||||||

|

|

|

|||||||

| INFORMATION TECHNOLOGY — 0.5% |

| |||||||

| Broadcom, Inc. |

970 | 430,690 | ||||||

|

|

|

|||||||

| MATERIALS — 1.8% |

| |||||||

| Compass Minerals International, Inc. |

18,206 | 701,477 | ||||||

| Keweenaw Land Association Ltd. |

52,595 | 928,302 | ||||||

|

|

|

|||||||

| 1,629,779 | ||||||||

|

|

|

|||||||

| REAL ESTATE — 3.5% |

| |||||||

| Creative Media & Community Trust, REIT |

234,895 | 1,500,979 | ||||||

| CTO Realty Growth, REIT |

74,634 | 1,398,641 | ||||||

| Equity LifeStyle Properties, REIT |

4,755 | 298,804 | ||||||

|

|

|

|||||||

| 3,198,424 | ||||||||

|

|

|

|||||||

| Total Common Stock (Cost $39,681,526) |

40,273,633 | |||||||

|

|

|

|||||||

| Foreign Common Stock — 32.2% |

| |||||||

| CANADA — 6.4% |

| |||||||

| Brookfield Asset Management, Inc., Class A |

53,368 | 2,182,218 | ||||||

| Canadian Pacific Railway |

21,300 | 1,421,136 | ||||||

| GreenFirst Forest Products (a) |

336,500 | 391,834 | ||||||

| PrairieSky Royalty Ltd. |

152,235 | 1,973,222 | ||||||

|

|

|

|||||||

| 5,968,410 | ||||||||

|

|

|

|||||||

| FRANCE — 18.5% |

| |||||||

| Bollore SA |

1,239,539 | 5,734,008 | ||||||

| Cie de L’Odet |

3,617 | 4,082,001 | ||||||

| Cie du Cambodge |

1 | 5,388 | ||||||

The accompanying notes are an integral part of the financial statements.

19

| THE ADVISORS’ INNER CIRCLE FUND III | FIRST FOUNDATION | |

| TOTAL RETURN FUND | ||

| SEPTEMBER 30, 2022 |

| Shares/ Principal Amount ($) |

Value ($) | |||||||

| Foreign Common Stock (continued) |

| |||||||

| FRANCE (continued) |

| |||||||

| Financiere Moncey |

1 | 5,290 | ||||||

| Lagardere |

126,239 | 1,874,842 | ||||||

| LVMH Moet Hennessy Louis Vuitton ADR |

7,150 | 840,125 | ||||||

| Societe Industrielle et Financiere de l’Artois |

1 | 4,291 | ||||||

| Vivendi SA |

553,390 | 4,321,860 | ||||||

| Vivendi SA ADR |

35,800 | 275,302 | ||||||

|

|

|

|||||||

| 17,143,107 | ||||||||

|

|

|

|||||||

| JAPAN — 1.0% |

| |||||||

| Nintendo Co, Ltd. |

16,000 | 647,097 | ||||||

| Nintendo Co, Ltd. ADR |

5,250 | 267,592 | ||||||

|

|

|

|||||||

| 914,689 | ||||||||

|

|

|

|||||||

| MEXICO — 2.2% |

| |||||||

| Becle |

1,152,214 | 2,035,965 | ||||||

|

|

|

|||||||

| NETHERLANDS — 4.1% |

| |||||||

| EXOR |

62,850 | 3,823,569 | ||||||

|

|

|

|||||||

| Total Foreign Common Stock |

29,885,740 | |||||||

|

|

|

|||||||

| Corporate Obligations — 11.1% |

| |||||||

| COMMUNICATION SERVICES — 1.6% |

||||||||

| iHeartCommunications, Inc. |

||||||||

| 6.38%, 05/01/26 |

545 | 506 | ||||||

| 8.38%, 05/01/27 |

132 | 111 | ||||||

| Lumen Technologies |

||||||||

| 7.50%, 04/01/24 |

722,000 | 743,660 | ||||||

| Sky |

||||||||

| 3.13%, 11/26/22 (b) |

770,000 | 768,736 | ||||||

|

|

|

|||||||

| 1,513,013 | ||||||||

|

|

|

|||||||

| CONSUMER DISCRETIONARY — 2.7% |

||||||||

| 7-Eleven |

||||||||

| 0.63%, 02/10/23 (b) |

795,000 | 783,588 | ||||||

| eBay |

||||||||

| 2.75%, 01/30/23 |

1,042,000 | 1,035,673 | ||||||

| Hyundai Capital America |

||||||||

| 1.15%, 11/10/22 (b) |

270,000 | 269,017 | ||||||

| 5.75%, 04/06/23 (b) |

215,000 | 215,632 | ||||||

The accompanying notes are an integral part of the financial statements.

20

| THE ADVISORS’ INNER CIRCLE FUND III | FIRST FOUNDATION | |

| TOTAL RETURN FUND | ||

| SEPTEMBER 30, 2022 |

| Principal Amount ($) |

Value ($) | |||||||

| Corporate Obligations (continued) |

| |||||||

| CONSUMER DISCRETIONARY (continued) |

| |||||||

| Toll Brothers Finance |

||||||||

| 4.38%, 04/15/23 |

182,000 | 181,035 | ||||||

|

|

|

|||||||

| 2,484,945 | ||||||||

|

|

|

|||||||

| ENERGY — 0.9% |

| |||||||

| Kinder Morgan, Inc. |

||||||||

| 5.63%, 11/15/23 (b) |

42,000 | 42,015 | ||||||

| Schlumberger Finance Canada |

||||||||

| 2.65%, 11/20/22 (b) |

70,000 | 69,953 | ||||||

| Southern Natural Gas |

||||||||

| 0.63%, 04/28/23 (b) |

59,000 | 57,382 | ||||||

| Texas Eastern Transmission |

||||||||

| 2.80%, 10/15/22 (b) |

575,000 | 574,668 | ||||||

| Williams |

||||||||

| 3.70%, 01/15/23 |

59,000 | 58,957 | ||||||

|

|

|

|||||||

| 802,975 | ||||||||

|

|

|

|||||||

| FINANCIALS — 1.9% |

| |||||||

| Bank of America |

||||||||

| ICE LIBOR USD 3 Month + 4.174%, 6.50% (c)(d) |

340,000 | 333,609 | ||||||

| Charles Schwab |

||||||||

| 2.65%, 01/25/23 |

201,000 | 200,242 | ||||||

| ICE LIBOR USD 3 Month + 4.820%, 7.60% (c)(d) |

100,000 | 100,083 | ||||||

| JPMorgan Chase & Co |

||||||||

| ICE LIBOR USD 3 Month + 3.470%, 6.28% (c)(d) |

181,000 | 180,998 | ||||||

| MUFG Union Bank |

||||||||

| 2.10%, 12/09/22 |

260,000 | 258,738 | ||||||

| Prudential Financial, Inc. |

||||||||

| ICE LIBOR USD 3 Month + 3.920%, |

500,000 | 492,630 | ||||||

| Swiss Re Treasury US |

||||||||

| 2.88%, 12/06/22 (b) |

200,000 | 199,632 | ||||||

|

|

|

|||||||

| 1,765,932 | ||||||||

|

|

|

|||||||

| HEALTHCARE — 0.0% |

| |||||||

| Allergan, Inc. |

||||||||

| 2.80%, 03/15/23 |

61,000 | 60,259 | ||||||

|

|

|

|||||||

| INDUSTRIALS — 0.9% |

| |||||||

| Air Lease |

||||||||

| 2.25%, 01/15/23 |

861,000 | 853,746 | ||||||

|

|

|

|||||||

| INFORMATION TECHNOLOGY — 0.2% |

| |||||||

| Hewlett Packard Enterprise |

||||||||

| 2.25%, 04/01/23 |

202,000 | 199,679 | ||||||

|

|

|

|||||||

The accompanying notes are an integral part of the financial statements.

21

| THE ADVISORS’ INNER CIRCLE FUND III | FIRST FOUNDATION | |

| TOTAL RETURN FUND | ||

| SEPTEMBER 30, 2022 |

| Principal ($)/Shares |

Value ($) | |||||||

| Corporate Obligations (continued) |

| |||||||

| REAL ESTATE — 0.9% |

| |||||||

| American Tower |

||||||||

| 3.00%, 06/15/23 |

26,000 | 25,665 | ||||||

| 3.50%, 01/31/23 |

782,000 | 779,552 | ||||||

|

|

|

|||||||

| 805,217 | ||||||||

|

|

|

|||||||

| UTILITIES — 2.0% |

| |||||||

| Dominion Energy |

||||||||

| 2.45%, 01/15/23 (b) |

300,000 | 298,315 | ||||||

| Duke Energy Carolinas |

||||||||

| 2.50%, 03/15/23 |

480,000 | 476,201 | ||||||

| Edison International |

||||||||

| 3.13%, 11/15/22 |

226,000 | 225,604 | ||||||

| Public Service Enterprise Group |

||||||||

| 2.65%, 11/15/22 |

425,000 | 424,334 | ||||||

| Virginia Electric and Power |

||||||||

| 2.75%, 03/15/23 |

200,000 | 198,008 | ||||||

| WEC Energy Group, Inc. |

||||||||

| ICE LIBOR USD 3 Month + 2.113%, |

250,000 | 207,500 | ||||||

|

|

|

|||||||

| 1,829,962 | ||||||||

|

|

|

|||||||

| Total Corporate Obligations |

||||||||

| (Cost $10,447,552) |

10,315,728 | |||||||

|

|

|

|||||||

| U.S. Treasury Obligations — 7.0% |

| |||||||

| U.S. Treasury Bills |

||||||||

| 2.98%, 12/8/2022 (e) |

1,000,000 | 994,589 | ||||||

| 3.33%, 3/2/2023 (e) |

1,000,000 | 984,632 | ||||||

| U.S. Treasury Notes |

||||||||

| 0.25%, 4/15/2023 |

2,000,000 | 1,961,172 | ||||||

| 0.38%, 4/15/2024 |

2,000,000 | 1,883,047 | ||||||

| 1.88%, 2/15/2032 |

825,000 | 699,058 | ||||||

|

|

|

|||||||

| Total U.S. Treasury Obligations |

6,522,498 | |||||||

|

|

|

|||||||

| Preferred Stock — 3.3% |

| |||||||

| COMMUNICATION SERVICES — 0.7% |

| |||||||

| Liberty Broadband 7.00% (d) |

4,499 | 112,126 | ||||||

| Telephone and Data Systems 6.00% (d) |

27,000 | 502,200 | ||||||

|

|

|

|||||||

| 614,326 | ||||||||

|

|

|

|||||||

The accompanying notes are an integral part of the financial statements.

22

| THE ADVISORS’ INNER CIRCLE FUND III | FIRST FOUNDATION | |

| TOTAL RETURN FUND | ||

| SEPTEMBER 30, 2022 |

| Shares/ Principal Amount ($) |

Value ($) | |||||||

| Preferred Stock (continued) |

| |||||||

| ENERGY — 0.2% |

| |||||||

| Energy Transfer 7.38% (c)(d) |

9,850 | 215,223 | ||||||

|

|

|

|||||||

| FINANCIALS — 0.9% |

| |||||||

| Bank of America 7.25% (a)(d) |

635 | 744,855 | ||||||

| RiverNorth DoubleLine Strategic Opportunity Fund I 4.38% (d) |

4,000 | 74,080 | ||||||

| Wells Fargo 5.85% (c)(d) |

3,200 | 71,840 | ||||||

|

|

|

|||||||

| 890,775 | ||||||||

|

|

|

|||||||

| REAL ESTATE — 1.5% |

| |||||||

| CTO Realty Growth, REIT 6.38% (d) |

56,847 | 1,248,360 | ||||||

| Equity Commonwealth, REIT 6.50% (a)(d) |

4,000 | 104,680 | ||||||

| Rexford Industrial Realty, REIT 5.88% (d) |

900 | 20,916 | ||||||

|

|

|

|||||||

| 1,373,956 | ||||||||

|

|

|

|||||||

| Total Preferred Stock |

3,094,280 | |||||||

|

|

|

|||||||

| Special Purpose Acquisition Companies — 0.9% |

| |||||||

| Liberty Media Acquisition, Class A (a) |

80,200 | 797,188 | ||||||

| Pershing Square Tontine (a) |

42,443 | — | ||||||

|

|

|

|||||||

| 797,188 | ||||||||

|

|

|

|||||||

| Total Special Purpose Acquisition Companies |

797,188 | |||||||

|

|

|

|||||||

| Mortgage-Backed Securities — 0.7% |

| |||||||

| AGENCY MORTGAGE-BACKED SECURITIES — 0.6% |

| |||||||

| FHLMC |

23,480 | 23,615 | ||||||

| FNMA |

215,696 | 193,168 | ||||||

| 3.50%, 11/01/42 to 02/01/43 (f) |

96,842 | 89,390 | ||||||

| 4.00%, 02/01/44 |

25,276 | 24,013 | ||||||

| 4.50%, 02/01/40 to 01/01/41 (f) |

48,607 | 47,644 | ||||||

| 5.00%, 06/01/41 |

28,020 | 28,150 | ||||||

| FNMA, Series 2012-93, Class SW |

16,702 | 1,815 | ||||||

| FNMA, Series 2004-354, Class 1 |

1,683 | 1,475 | ||||||

| GNMA |

||||||||

| 3.00%, 04/20/43 to 06/20/43 (f) |

40,401 | 36,319 | ||||||

| 3.50%, 05/20/43 |

41,682 | 38,795 | ||||||

The accompanying notes are an integral part of the financial statements.

23

| THE ADVISORS’ INNER CIRCLE FUND III | FIRST FOUNDATION | |

| TOTAL RETURN FUND | ||

| SEPTEMBER 30, 2022 |

| Principal Amount ($) |

Value ($) | |||||||

| Mortgage-Backed Securities (continued) |

| |||||||

| AGENCY MORTGAGE-BACKED SECURITIES (continued) |

| |||||||

| 4.00%, 01/20/41 to 04/20/43 (f) |

46,338 | 44,177 | ||||||

| 4.50%, 05/20/40 to 03/20/41 (f) |

16,118 | 15,927 | ||||||

|

|

|

|||||||

| 544,488 | ||||||||

|

|

|

|||||||

| NON-AGENCY MORTGAGE-BACKED SECURITIES — 0.1% |

| |||||||

| JPMBB Commercial Mortgage Securities Trust, Series 2013-C17,

Class C |

60,000 | 57,631 | ||||||

| WFRBS Commercial Mortgage Trust, Series 2014-LC14, Class AS |

40,000 | 39,057 | ||||||

|

|

|

|||||||

| 96,688 | ||||||||

|

|

|

|||||||

| Total Mortgage-Backed Securities |

641,176 | |||||||

|

|

|

|||||||

| Total Investments - 98.7% |

91,530,243 | |||||||

|

|

|

|||||||

| (Cost $95,040,940) |

||||||||

| Other Assets & Liabilities, Net - 1.3% |

1,223,072 | |||||||

|

|

|

|||||||

| Net Assets - 100.0% |

92,753,315 | |||||||

|

|

|

|||||||

| (a) | Non-income producing security. |

| (b) | Securities exempt from registration under Rule 144A of the 1933 Act. These securities may only be resold in transactions exempt from registration to qualified institutional buyers. The Board has determined these investments to be liquid. At September 30, 2022, these securities amounted to $3,278,938 or 3.5% of Net Assets of the Fund. |

| (c) | Variable or floating rate security. The rate shown is the effective interest rate as of period end. The rates on certain securities are not based on published reference rates and spreads and are either determined by the issuer or agent based on current market conditions; by using a formula based on the rates of underlying loans; or by adjusting periodically based on prevailing interest rates. |

| (d) | Perpetual security with no stated maturity date. |

| (e) | Interest rate represents the security’s effective yield at the time of purchase. |

| (f) | Securities are grouped by coupon and represent a range of maturities. |

| (g) | Interest only security (“IO”). These types of securities represent the right to receive the monthly interest payments on an underlying pool of mortgages. Payments of principal on the pool reduce the value of the “interest only” holding. |

| (h) | Principal only security (“PO”). These types of securities represent the right to receive the monthly principal payments on an underlying pool of mortgages. No payments of interest on the pool are passed through to the “principal only” holder. |

The accompanying notes are an integral part of the financial statements.

24

| THE ADVISORS’ INNER CIRCLE FUND III | FIRST FOUNDATION | |

| TOTAL RETURN FUND | ||

| SEPTEMBER 30, 2022 |

ADR — American Depositary Receipt

FHLMC — Federal Home Loan Mortgage Corporation

FNMA — Federal National Mortgage Association

GNMA — Government National Mortgage Association

ICE — Intercontinental Exchange

LIBOR — London Interbank Offered Rate

Ltd. — Limited

REIT — Real Estate Investment Trust

USD — U.S. Dollar

The following is a summary of the inputs used as of September 30, 2022 in valuing the Fund’s investments carried at value:

| Investments in Securities | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stock |

$ | 39,345,331 | $ | 928,302 | $ | — | $ | 40,273,633 | ||||||||

| Foreign Common Stock |

29,885,740 | — | — | 29,885,740 | ||||||||||||

| Corporate Obligations |

— | 10,315,728 | — | 10,315,728 | ||||||||||||

| U.S. Treasury Obligations |

— | 6,522,498 | — | 6,522,498 | ||||||||||||

| Preferred Stock |

3,094,280 | — | — | 3,094,280 | ||||||||||||

| Special Purpose Acquisition Companies |

797,188 | — | — | 797,188 | ||||||||||||

| Mortgage-Backed Securities |

— | 641,176 | — | 641,176 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments in Securities |

$ | 73,122,539 | $ | 18,407,704 | $ | — | $ | 91,530,243 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Amounts designated as “—” are $0 or have been rounded to $0.

For more information on valuation inputs, see Note 2 – Significant Accounting Policies in the Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

25

| THE ADVISORS’ INNER CIRCLE FUND III | BROOKMONT FUNDS | |

| SEPTEMBER 30, 2022 | ||

| STATEMENTS OF ASSETS AND LIABILITIES | ||

| First Foundation Fixed Income Fund |

First Foundation Total Return Fund |

|||||||

| Assets |

||||||||

| Investments, at value (Cost $170,667,545 and $95,040,940) |

$ | 146,645,338 | $ | 91,530,243 | ||||

| Cash equivalents (Note 2) |

– | 1,474,187 | ||||||

| Foreign tax reclaim receivable |

– | 204,847 | ||||||

| Receivable for: |

||||||||

| Investments sold |

– | 645,082 | ||||||

| Dividends and interest |

1,043,085 | 220,845 | ||||||

| Prepaid expenses and other assets |

10,326 | 9,722 | ||||||

|

|

|

|

|

|||||

| Total assets |

147,698,749 | 94,084,926 | ||||||

|

|

|

|

|

|||||

| Liabilities: |

||||||||

| Payable for: |

||||||||

| Fund shares redeemed |

149,135 | 1,183 | ||||||

| Transfer agent fees |

74,395 | 46,056 | ||||||

| Distribution and shareholder servicing fees |

43,570 | 11,038 | ||||||

| Investment advisory fees payable |

37,462 | 40,757 | ||||||

| Audit fees |

35,815 | 27,185 | ||||||

| Income distribution payable |

22,122 | – | ||||||

| Payable due to administrator |

14,974 | 9,775 | ||||||

| Trustees fees |

5,306 | 3,423 | ||||||

| CCO fees payable |

2,158 | 1,392 | ||||||

| Investments purchased |

– | 991,287 | ||||||

| Foreign currency payable, at value (Proceeds $- and $198,720) |

– | 175,498 | ||||||

| Due to custodian |

133,107 | – | ||||||

| Accrued expenses and other liabilities |

35,608 | 24,017 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

553,652 | 1,331,611 | ||||||

|

|

|

|

|

|||||

| Net Assets |

$ | 147,145,097 | $ | 92,753,315 | ||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of the financial statements.

26

| THE ADVISORS’ INNER CIRCLE FUND III | BROOKMONT FUNDS | |

| SEPTEMBER 30, 2022 | ||

| STATEMENTS OF ASSETS AND LIABILITIES | ||

| First Foundation Fixed Income Fund |

First Foundation Total Return Fund |

|||||||

| Net Assets Consist of: |

||||||||

| Paid-in capital |

$ | 172,544,244 | $ | 87,039,996 | ||||

| Total distributable earnings (accumulated loss) |

(25,399,147) | 5,713,319 | ||||||

|

|

|

|

|

|||||

| Net Assets |

$ | 147,145,097 | $ | 92,753,315 | ||||

|

|

|

|

|

|||||

| Class A: |

||||||||

| Net assets |

$ | 55,515,610 | $ | 33,456,420 | ||||

| Shares outstanding (no par value; unlimited shares authorized) |

4,988,471 | 1,336,813 | ||||||

| Net asset value per share(a)(b) |

$ | 11.13 | $ | 25.03 | ||||

|

|

|

|

|

|||||

| Maximum offering price per share(c) |

$ | 11.62 | $ | 26.56 | ||||

|

|

|

|

|

|||||

| Class Y: |

||||||||

| Net assets |

$ | 91,629,487 | $ | 59,296,895 | ||||

| Shares outstanding (no par value; unlimited shares authorized) |

8,240,919 | 2,322,041 | ||||||

| Net asset value, offering and redemption price per share |

$ | 11.12 | $ | 25.54 | ||||

|

|

|

|

|

|||||

(a) Redemption price per share is equal to net asset value per share less any applicable contingent deferred sales charge (“CDSC”).

(b) Purchases without an initial sales charge of $1,000,000 or more are subject to a 0.50% CDSC if redeemed within one year of purchase.

(c) The sales charge is 4.25% for the Fixed Income Fund and 5.75% for the Total Return Fund. On sales of $1,000,000 or more, there is no sales charge and therefore the offering will be lower.

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

27

| THE ADVISORS’ INNER CIRCLE FUND III | BROOKMONT FUNDS | |

| FOR THE YEAR ENDED | ||

| SEPTEMBER 30, 2022 | ||

| STATEMENTS OF OPERATIONS | ||

| First Foundation Fixed Income Fund |

First Foundation Total Return Fund |

|||||||

| Investment Income: |

||||||||

| Dividends |

$ | 1,799,001 | $ | 4,629,065 | ||||

| Interest |

5,514,133 | 267,196 | ||||||

| Less: Foreign taxes withheld |

– | (267,390) | ||||||

|

|

|

|

|

|||||

| Total income |

7,313,134 | 4,628,871 | ||||||

|

|

|

|

|

|||||

| Expenses: |

||||||||

| Investment advisory fees |

537,764 | 475,294 | ||||||

| Administration fees |

211,864 | 112,451 | ||||||

| Distribution and shareholder service fees: |

||||||||

| Class A Shares |

162,907 | 96,293 | ||||||

| Transfer agent fees |

231,339 | 148,653 | ||||||

| Legal fees |

65,186 | 32,929 | ||||||

| Registration fees |

49,671 | 45,455 | ||||||

| Audit fees |

36,294 | 33,706 | ||||||

| Trustees fees |

– | 12,161 | ||||||

| Reports to shareholders |

46,397 | 26,519 | ||||||

| Chief compliance officer fees |

8,124 | 5,782 | ||||||

| Custodian/wire agent fees |

3,934 | 12,382 | ||||||

| Other |

54,589 | 22,163 | ||||||

|

|

|

|

|

|||||

| Total operating expenses |

1,408,069 | 1,023,788 | ||||||

| Less: |

||||||||

| Fees Paid Indirectly |

(4,933) | (3,038) | ||||||

|

|

|

|

|

|||||

| Net operating expenses |

1,403,136 | 1,020,750 | ||||||

|

|

|

|

|

|||||

| Net investment income |

5,909,998 | 3,608,121 | ||||||

|

|

|

|

|

|||||

| Realized gain (loss) on: |

||||||||

| Investments in securities |

(1,460,694) | 3,177,948 | ||||||

| Foreign currency related transactions |

– | 18,593 | ||||||

| Reimbursement from affiliate(1) |

310,750 | – | ||||||

|

|

|

|

|

|||||

| Net realized gain (loss) |

(1,149,944) | 3,196,541 | ||||||

|

|

|

|

|

|||||

| Net Change in Unrealized Appreciation (Depreciation) on: |

||||||||

| Investments in securities |

(30,657,303) | (12,681,406) | ||||||

| Foreign currency related translations |

– | 14,671 | ||||||

|

|

|

|

|

|||||

| Net change in unrealized depreciation |

(30,657,303) | (12,666,735) | ||||||

|

|

|

|

|

|||||

| Net realized and unrealized loss |

(31,807,247) | (9,470,194) | ||||||

|

|

|

|

|

|||||

| Total decrease in net assets resulting from operations |

$ | (25,897,249) | $ | (5,862,073) | ||||

|

|

|

|

|

|||||

(1) See Note 3 in Notes to Financial Statements.

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

28

| THE ADVISORS’ INNER CIRCLE FUND III | FIRST FOUNDATION | |

| FIXED INCOME FUND | ||

| STATEMENTS OF CHANGES IN NET ASSETS | ||

| Year Ended September 30, 2022 |

Year Ended September 30, 2021(1) |

|||||||

| Increase (Decrease) in Net Assets |

||||||||

| Operations: |

||||||||

| Net investment income |

$ | 5,909,998 | $ | 5,807,242 | ||||

| Net realized gain (loss) |

(1,460,694 | ) | 1,096,938 | |||||

| Reimbursement from affiliate(2) |

310,750 | — | ||||||

| Net change in unrealized appreciation (depreciation) |

(30,657,303 | ) | 2,577,438 | |||||

|

|

|

|

|

|||||

| Net increase (decrease) resulting from operations |

(25,897,249 | ) | 9,481,618 | |||||

|

|

|

|

|

|||||

| Distributions: |

||||||||

| Class A Shares |

(2,125,082 | ) | (3,155,161 | ) | ||||

| Class Y Shares |

(3,981,390 | ) | (4,991,270 | ) | ||||

| Return of capital: |

||||||||

| Class A Shares |

— | (110,119 | ) | |||||

| Class Y Shares |

— | (167,310 | ) | |||||

|

|

|

|

|

|||||

| Net decrease resulting from distributions |

(6,106,472 | ) | (8,423,860 | ) | ||||

|

|

|

|

|

|||||

| Net increase (decrease) in net assets from operations and distributions |

(32,003,721 | ) | 1,057,758 | |||||

|

|

|

|

|

|||||

| Capital Share transactions:(3) |

||||||||

| Class A Shares |

||||||||

| Issued |

147,215 | 812,193 | ||||||

| Reinvestment of Distributions |

1,916,026 | 2,944,606 | ||||||

| Redeemed |

(10,138,724 | ) | (11,353,144 | ) | ||||

|

|

|

|

|

|||||

| Net decrease from Class A share transactions |

(8,075,483 | ) | (7,596,345 | ) | ||||

|

|

|

|

|

|||||

| Class C Shares(4) |

||||||||

| Issued |

— | 30 | ||||||

| Reinvestment of Distributions |

— | 3,364 | ||||||

| Redeemed |

— | (1,772,881 | ) | |||||

|

|

|

|

|

|||||

| Net decrease from Class C share transactions |

— | (1,769,487 | ) | |||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of the financial statements.

29

| THE ADVISORS’ INNER CIRCLE FUND III | FIRST FOUNDATION | |

| FIXED INCOME FUND | ||

| Year Ended September 30, 2022 |

Year Ended September 30, 2021(1) |

|||||||

| Class Y Shares |

||||||||

| Issued |

$ | 14,540,345 | $ | 25,810,990 | ||||

| Reinvestment of Distributions |

3,920,137 | 5,062,941 | ||||||

| Redeemed |

(30,607,739 | ) | (22,102,037 | ) | ||||

|

|

|

|

|

|||||

| Net increase (decrease) from Class Y share transactions |

(12,147,257 | ) | 8,771,894 | |||||

|

|

|

|

|

|||||

| Total increase (decrease) in net assets |

(52,226,461 | ) | 463,820 | |||||

|

|

|

|

|

|||||

| Net Assets |

||||||||

| Beginning of year |

199,371,558 | 198,907,738 | ||||||

|

|

|

|

|

|||||

| End of year |

$ | 147,145,097 | $ | 199,371,558 | ||||

|

|

|

|

|

|||||

(1) On January 11, 2021, the Highland Fixed Income Fund (the “Fixed Income Predecessor Fund”) was reorganized into the First Foundation Fixed Income Fund (the “Fixed Income Fund”). Class A and Class Y shares of the Fixed Income Predecessor Fund were exchanged on a tax-free basis for Class A and Class Y shares of the Fixed Income Fund. Information presented prior to January 11, 2021 is that of the Fixed Income Predecessor Fund. See Note 1 in Notes to Financial Statements.

(2) See Note 3 in Notes to Financial Statements.

(3) For share transactions, see Note 6 in Notes to Financial Statements.

(4) On November 16, 2020, Class C Shares of the Fixed Income Predecessor Fund were converted to Class Y Shares of the Fixed Income Predecessor Fund, and the Class C Shares were terminated. See Note 1 in Notes to Financial Statements.

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying notes are an integral part of the financial statements.

30

| THE ADVISORS’ INNER CIRCLE FUND III | FIRST FOUNDATION | |

| TOTAL RETURN FUND | ||

| STATEMENTS OF CHANGES IN NET ASSETS | ||

| Year Ended September 30, 2022 |

Year Ended September 30, 2021(1) |

|||||||

| Increase (Decrease) in Net Assets |

||||||||

| Operations: |

||||||||

| Net investment income |

$ | 3,608,121 | $ | 1,722,086 | ||||

| Net realized gain |

3,196,541 | 10,870,102 | ||||||

| Net change in unrealized appreciation (depreciation) |

(12,666,735 | ) | 8,719,000 | |||||

|

|

|

|

|

|||||

| Net increase (decrease) resulting from operations |

(5,862,073 | ) | 21,311,188 | |||||

|

|

|

|

|

|||||

| Distributions: |

||||||||

| Class A Shares |

(5,493,365 | ) | (324,066 | ) | ||||

| Class Y Shares |

(6,905,918 | ) | (352,574 | ) | ||||

|

|

|

|

|

|||||

| Net decrease resulting from distributions |

(12,399,283 | ) | (676,640 | ) | ||||

|

|

|

|

|

|||||

| Net increase (decrease) in net assets from operations and distributions |

(18,261,356 | ) | 20,634,548 | |||||

|

|

|

|

|

|||||

| Capital Share transactions:(2) |

||||||||

| Class A Shares |

||||||||

| Issued |

387,433 | 659,915 | ||||||

| Reinvestment of Distributions |

5,200,902 | 306,898 | ||||||

| Redeemed |

(5,379,063 | ) | (6,632,116 | ) | ||||

|

|

|

|

|

|||||

| Net increase (decrease) from Class A share transactions |

209,272 | (5,665,303 | ) | |||||

|

|

|

|

|

|||||

| Class C Shares(3) |

||||||||

| Issued |

— | 441 | ||||||

| Redeemed |

— | (2,179,380 | ) | |||||

|

|

|

|

|

|||||

| Net decrease from Class C share transactions |

— | (2,178,939 | ) | |||||

|

|

|

|

|

|||||

| Class Y Shares |

||||||||

| Issued |

26,665,299 | 15,277,244 | ||||||

| Reinvestment of Distributions |

6,799,972 | 344,048 | ||||||

| Redeemed |

(10,621,088 | ) | (7,806,485 | ) | ||||

|

|

|

|

|

|||||

| Net increase from Class Y share transactions |

22,844,183 | 7,814,807 | ||||||

|

|

|

|

|

|||||

| Total increase in net assets |

4,792,099 | 20,605,113 | ||||||

|

|

|

|

|

|||||

| Net Assets |

||||||||

| Beginning of year |

87,961,216 | 67,356,103 | ||||||

|

|

|

|

|

|||||

| End of year |

$ | 92,753,315 | $ | 87,961,216 | ||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of the financial statements.

31

| THE ADVISORS’ INNER CIRCLE FUND III | FIRST FOUNDATION | |

| TOTAL RETURN FUND | ||