Form N-CSR Advisors' Inner Circle For: Sep 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-22920

The Advisors’ Inner Circle Fund III

(Exact name of registrant as specified in charter)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip code)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s telephone number, including area code: (877) 446-3863

Date of fiscal year end: September 30, 2022

Date of reporting period: September 30, 2022

Item 1. Reports to Stockholders.

A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR § 270.30e-1), is attached hereto.

THE ADVISORS’ INNER CIRCLE FUND III

Redwheel Global Emerging Equity Fund

(Formerly, RWC Global Emerging Equity Fund)

| ANNUAL REPORT | SEPTEMBER 30, 2022 |

|

Investment Adviser:

RWC Asset Advisors (US) LLC

|

| THE ADVISORS’ INNER CIRCLE FUND III | REDWHEEL GLOBAL EMERGING EQUITY FUND SEPTEMBER 30, 2022

|

| 1 | ||||

| 4 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 14 | ||||

| 26 | ||||

| Trustees and Officers of The Advisors’ Inner Circle Fund III |

28 | |||

| 36 | ||||

| 38 | ||||

| 41 | ||||

The Fund files its complete schedule of investments with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q or as an exhibit to its reports on Form N-PORT within sixty days after period end. The Fund’s Form N-Q and Form N-PORT reports are available on the Commission’s website at https://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to Fund securities, as well as information relating to how a Fund voted proxies relating to fund securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-855-RWC-FUND; and (ii) on the Commission’s website at https://www.sec.gov.

| THE ADVISORS’ INNER CIRCLE FUND III | REDWHEEL GLOBAL EMERGING EQUITY FUND SEPTEMBER 30, 2022

|

| LETTER TO SHAREHOLDERS (Unaudited) |

Dear Shareholders:

Emerging Markets fell significantly during the 12-month period ending on 30 September 2022. During the period, inflation began surging on the back of supply and labor shortages and higher commodity prices. This resulted in aggressive rate hikes by many central banks aimed at bringing down inflation. The tightening cycle has led to a stronger dollar and weaker global liquidity backdrop. Market sentiment was also impacted by recessionary fears and geopolitical concerns during the period.

Over the 12-month period, the Redwheel Global Emerging Equity Fund fell by -31.37% and the MSCI Emerging Markets Index decreased by -28.11%. In Asia, China fell by -35.4% amidst regulatory challenges, continued COVID-19 lockdowns, and weakness in the property sector. However, recent activity data revealed stronger readings in industrial production, retails sales and infrastructure investment. South Korea and Taiwan fell by -40.7% and -30.5%, respectively. Both countries suffered on the back of softening demand for tech hardware and semiconductors. India fell by -9.9% as inflationary pressures grew amidst higher energy and commodity prices. In EMEA, Russia was expelled from the index on 9 March 2022 following the invasion of Ukraine. The United Arab Emirates and Saudi Arabia increased by +5.1% and +1.9%, respectively. Both countries were supported by an elevated price of oil. In LatAm, Brazil rose by +4.3% due to higher commodity prices and an earlier tightening cycle than other regions in the world. Recently, a second-round dispute between former president Lula and incumbent Jair Bolsonaro was confirmed.

The Fund’s overweight in the materials sector was a relative outperformer during the period. Sociedad Química y Minera (SQM) and Saudi Arabian Mining Company (MA’ADEN) increased by +79.7% and +66.8%, respectively. SQM benefitted from elevated lithium pricing. MA’ADEN increased on the back of higher phosphate and aluminum pricing as well as robust production volumes. In Brazil, Petrobras rose by +18.5% as the company continues to pay strong dividends. There were single stock contributors to the Fund’s performance in China. Pinduoduo and GoodWe Power increased by +78.2% and +25.1%, respectively. Pinduoduo benefitted as it strengthened its ‘value-for-money’ proposition and agricultural product offerings, making it a go-to site for factory/farm direct sales and white label products. GoodWe Power increased on the back of robust inverter demand.

The Fund’s exposure to China was a detractor during the period as Sunac China, Bilibili, and Geely Automobile fell by -77.1%, -74.0%, and -68.3%, respectively. We are optimistic on China going forward as we anticipate that the government will prioritize economic growth. Although volatility may continue, we expect that the market will refocus on company fundamentals. Our exposure to tech hardware and semiconductor-related companies resulted in relative underperformance in the information technology sector. MediaTek and Taiwan Semiconductor Manufacturing Company fell by -42.2% and -34.5%, respectively. Both companies suffered from lower demand in consumer electronics which negatively impacted investor sentiment. Looking ahead, we expect that the outlook for tech hardware and semiconductors will improve as the supply/demand imbalance resolves through inventory digestion. The Fund’s exposure to Russia was also a detractor during the 12-month period. Following Russia invading Ukraine and subsequent sanctions from the West, we eliminated our exposure to Russian equities. Our current view is that Russian securities are generally un-investable given prevailing circumstances.

Despite recent macroeconomic headwinds, we believe that the outlook for Emerging Markets is strong as the macroeconomic backdrop improves across many Emerging Market countries. Going forward, we

1

| THE ADVISORS’ INNER CIRCLE FUND III | REDWHEEL GLOBAL EMERGING EQUITY FUND SEPTEMBER 30, 2022

|

anticipate that fiscal and current accounts will continue to recover in many Emerging Market countries. In addition, many Emerging Market central banks are ahead of the curve in normalizing rates and removing monetary stimulus as their economies recover. We anticipate that early normalizations will prevent further corrections or aggressive reactions to global economic conditions. Emerging Markets are well positioned to benefit from strong growth and macro improvements over the next 12 months.

Definition of the Comparative Index

MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets.

The material represents the Adviser’s assessment of the portfolio and market environment at a specific point in time and should not be relied upon by the reader as research or investment advice regarding any stock.

Past performance is not a guarantee of future results. Investing involves risk, including possible loss of principal. International investments may involve risk of capital loss from unfavourable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume.

2

| THE ADVISORS’ INNER CIRCLE FUND III | REDWHEEL GLOBAL EMERGING EQUITY FUND SEPTEMBER 30, 2022

|

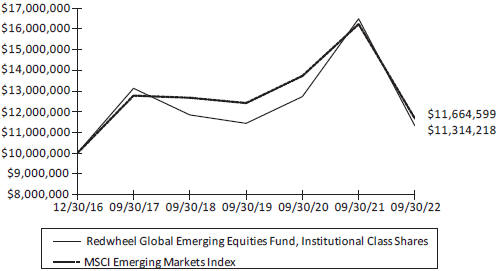

Comparison of Change in the Value of a $10,000,000 Investment in the Redwheel Global Emerging Equity Fund, Institutional Shares versus the MSCI Emerging Markets Index.

|

AVERAGE ANNUAL TOTAL RETURN FOR THE PERIODS ENDED

SEPTEMBER 30, 2022*

| ||||||||

| One Year | Three Year | Five Years |

Annualized Inception to Date* | |||||

| Institutional Class shares |

-31.37% | -0.36% | -2.93% | 2.17% | ||||

| Class I shares† |

-31.43% | -0.44% | -3.03% | -2.85% | ||||

| MSCI Emerging Markets Index |

-28.11% | -2.07% | -1.81% | 2.71% | ||||

* The Redwheel Global Emerging Equity Fund commenced operations on December 30, 2016.

† The graph is based on Institutional Class Shares only. Returns for Class I Shares are substantially similar to those of the Institutional Class Shares and differ only to the extent that Class I Shares have higher total annual fund operating expenses than Institutional Class Shares.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, may be worth less than its original cost. The Fund’s performance assumes the reinvestment of dividends and capital gains. Index returns assume reinvestment of dividends and, unlike a fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

High short-term performance from a limited number of the Fund’s holdings is unusual, and investors should not expect such performance to be continued over the long term.

There are no assurances that the Fund will meet its stated objectives. The Fund’s holdings and allocations are subject to change because it is actively managed and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of the comparative index on page 2.

3

| THE ADVISORS’ INNER CIRCLE FUND III | REDWHEEL GLOBAL EMERGING EQUITY FUND SEPTEMBER 30, 2022

|

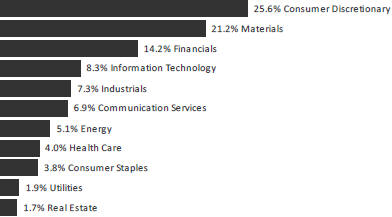

| SECTOR WEIGHTINGS (Unaudited)†: |

† Percentages based on total investments.

|

COMMON STOCK — 95.3% |

||||||||

| Shares | Value | |||||||

| Brazil — 7.5% |

||||||||

| Centrais Eletricas Brasileiras |

329,900 | $ | 2,627,563 | |||||

| Hapvida Participacoes e Investimentos |

3,621,602 | 5,088,730 | ||||||

| MercadoLibre * |

4,321 | 3,576,837 | ||||||

| Rumo |

444,800 | 1,525,470 | ||||||

|

|

|

| ||||||

| 12,818,600 | ||||||||

|

|

|

| ||||||

| Burkina Faso — 1.1% |

||||||||

| Endeavour Mining |

79,995 | 1,450,811 | ||||||

| Endeavour Mining |

24,319 | 450,965 | ||||||

|

|

|

| ||||||

| 1,901,776 | ||||||||

|

|

|

| ||||||

| Canada — 2.7% |

||||||||

| Ivanhoe Mines, Cl A * |

720,614 | 4,662,318 | ||||||

|

|

|

| ||||||

| Chile — 2.5% |

||||||||

| Sociedad Quimica y Minera de Chile ADR |

47,803 | 4,338,122 | ||||||

|

|

|

| ||||||

| China — 36.3% |

||||||||

| Alibaba Group Holding * |

316,500 | 3,158,360 | ||||||

| Alibaba Group Holding ADR * |

25,946 | 2,075,421 | ||||||

| Baidu, Cl A * |

251,350 | 3,700,056 | ||||||

| CALB * |

286,300 | 1,385,928 | ||||||

| China Resources Power Holdings |

460,000 | 710,305 | ||||||

| Fujian Sunner Development, Cl A |

1,123,333 | 3,059,874 | ||||||

| Full Truck Alliance ADR * |

269,900 | 1,767,845 | ||||||

| Geely Automobile Holdings |

2,550,000 | 3,489,541 | ||||||

The accompanying notes are an integral part of the financial statements.

4

| THE ADVISORS’ INNER CIRCLE FUND III | REDWHEEL GLOBAL EMERGING EQUITY FUND SEPTEMBER 30, 2022

|

| COMMON STOCK — continued |

||||||||

| Shares | Value | |||||||

| China — (continued) |

||||||||

| JD.com, Cl A |

71,102 | $ | 1,793,717 | |||||

| JD.com ADR |

34,768 | 1,748,831 | ||||||

| Jiangsu GoodWe Power Supply Technology, Cl A |

87,633 | 3,475,545 | ||||||

| Kuaishou Technology, Cl B * |

685,700 | 4,398,043 | ||||||

| Li Auto ADR * |

44,426 | 1,022,242 | ||||||

| Li Auto, Cl A * |

230,800 | 2,658,333 | ||||||

| Lizhong Sitong Light Alloys Group, Cl A |

412,600 | 1,496,290 | ||||||

| Meituan, Cl B * |

282,600 | 5,939,062 | ||||||

| Muyuan Foods, Cl A |

248,900 | 1,911,037 | ||||||

| Ningbo Ronbay New Energy Technology, Cl A |

133,248 | 1,567,529 | ||||||

| Pinduoduo ADR * |

134,242 | 8,400,864 | ||||||

| QuakeSafe Technologies, Cl A |

256,366 | 1,724,269 | ||||||

| Shandong Head Group, Cl A |

204,300 | 811,845 | ||||||

| Shenzhen Senior Technology Material, Cl A |

888,757 | 2,493,089 | ||||||

| Silergy |

33,000 | 430,384 | ||||||

| Tencent Holdings |

37,795 | 1,276,535 | ||||||

| Tianqi Lithium * |

100,400 | 876,113 | ||||||

| Wens Foodstuffs Group |

372,500 | 1,075,734 | ||||||

|

|

|

| ||||||

| 62,446,792 | ||||||||

|

|

|

| ||||||

| Ghana — 1.5% |

||||||||

| Kosmos Energy * |

278,288 | 1,438,749 | ||||||

| Tullow Oil * |

2,568,023 | 1,206,485 | ||||||

|

|

|

| ||||||

| 2,645,234 | ||||||||

|

|

|

| ||||||

| Greece — 0.7% |

||||||||

| Eurobank Ergasias Services and Holdings * |

1,405,872 | 1,173,023 | ||||||

|

|

|

| ||||||

| India — 13.7% |

||||||||

| ICICI Bank |

668,521 | 7,018,975 | ||||||

| Indian Hotels, Cl A |

416,920 | 1,685,898 | ||||||

| InterGlobe Aviation * |

139,039 | 3,154,129 | ||||||

| Maruti Suzuki India |

38,841 | 4,192,756 | ||||||

| Reliance Industries |

144,758 | 4,201,178 | ||||||

| State Bank of India |

516,762 | 3,346,579 | ||||||

|

|

|

| ||||||

| 23,599,515 | ||||||||

|

|

|

| ||||||

| Indonesia — 1.9% |

||||||||

| Bank Mandiri Persero |

1,399,200 | 859,166 | ||||||

| Bank Rakyat Indonesia Persero |

7,877,400 | 2,305,499 | ||||||

|

|

|

| ||||||

| 3,164,665 | ||||||||

|

|

|

| ||||||

| Mexico — 1.3% |

||||||||

| Cemex ADR * |

624,226 | 2,141,095 | ||||||

|

|

|

| ||||||

The accompanying notes are an integral part of the financial statements.

5

| THE ADVISORS’ INNER CIRCLE FUND III | REDWHEEL GLOBAL EMERGING EQUITY FUND SEPTEMBER 30, 2022

|

| COMMON STOCK — continued |

||||||||

| Shares | Value | |||||||

| Philippines — 0.5% |

||||||||

| Ayala Land |

942,000 | $ | 365,725 | |||||

| Monde Nissin |

2,583,700 | 535,720 | ||||||

|

|

|

| ||||||

| 901,445 | ||||||||

|

|

|

| ||||||

| Russia — –% |

||||||||

| Rosneft Oil PJSC (A) |

292,949 | — | ||||||

|

|

|

| ||||||

| Saudi Arabia — 4.1% |

||||||||

| Saudi Arabian Oil |

202,675 | 1,929,463 | ||||||

| Saudi National Bank |

308,369 | 5,145,286 | ||||||

|

|

|

| ||||||

| 7,074,749 | ||||||||

|

|

|

| ||||||

| South Africa — 3.6% |

||||||||

| Gold Fields ADR |

531,719 | 4,301,607 | ||||||

| MTN Group |

282,789 | 1,879,076 | ||||||

|

|

|

| ||||||

| 6,180,683 | ||||||||

|

|

|

| ||||||

| South Korea — 6.6% |

||||||||

| Doosan Fuel Cell * |

55,713 | 1,099,131 | ||||||

| HYBE * |

4,827 | 448,597 | ||||||

| Kia |

55,589 | 2,766,776 | ||||||

| Samsung Biologics * |

2,978 | 1,666,995 | ||||||

| SK Hynix |

92,406 | 5,285,644 | ||||||

|

|

|

| ||||||

| 11,267,143 | ||||||||

|

|

|

| ||||||

| Taiwan — 4.9% |

||||||||

| Globalwafers |

42,000 | 479,070 | ||||||

| MediaTek |

150,660 | 2,599,851 | ||||||

| Taiwan Semiconductor Manufacturing ADR |

35,096 | 2,406,182 | ||||||

| Taiwan Semiconductor Manufacturing |

220,304 | 2,920,216 | ||||||

|

|

|

| ||||||

| 8,405,319 | ||||||||

|

|

|

| ||||||

| United Arab Emirates — 0.7% |

||||||||

| Aldar Properties PJSC |

1,085,028 | 1,238,640 | ||||||

|

|

|

| ||||||

| Vietnam — 1.6% |

||||||||

| Hoa Phat Group JSC |

1,628,819 | 1,435,623 | ||||||

| Vincom Retail JSC * |

1,135,393 | 1,324,309 | ||||||

|

|

|

| ||||||

| 2,759,932 | ||||||||

|

|

|

| ||||||

| Zambia — 4.1% |

||||||||

| First Quantum Minerals |

413,985 | 7,065,208 | ||||||

|

|

|

| ||||||

| TOTAL COMMON STOCK |

163,784,259 | |||||||

|

|

|

| ||||||

The accompanying notes are an integral part of the financial statements.

6

| THE ADVISORS’ INNER CIRCLE FUND III | REDWHEEL GLOBAL EMERGING EQUITY FUND SEPTEMBER 30, 2022

|

| PREFERRED STOCK — 4.4% |

||||||||

| Shares | Value | |||||||

| Brazil — 2.5% |

||||||||

| Banco Bradesco (B) |

1,179,107 | $ | 4,325,038 | |||||

|

|

|

| ||||||

| Chile — 1.9% |

||||||||

| Sociedad Quimica y Minera de Chile, Cl B (B) |

34,238 | 3,220,306 | ||||||

|

|

|

| ||||||

| TOTAL PREFERRED STOCK |

7,545,344 | |||||||

|

|

|

| ||||||

| TOTAL INVESTMENTS— 99.7% |

$ | 171,329,603 | ||||||

|

|

|

| ||||||

Percentages are based on Net Assets of $171,854,896.

| * | Non-income producing security. |

| (A) | Level 3 security in accordance with fair value hierarchy. |

| (B) | There is currently no rate available. |

| ADR | American Depositary Receipt | |

| Cl | Class | |

| JSC | Joint Stock Company | |

| PJSC | Public Joint Stock Company |

The accompanying notes are an integral part of the financial statements.

7

| THE ADVISORS’ INNER CIRCLE FUND III | REDWHEEL GLOBAL EMERGING EQUITY FUND SEPTEMBER 30, 2022

|

The following is a summary of the level of inputs used as of September 30, 2022, in valuing the Fund’s investments carried at value:

| Investments in Securities | Level 1 | Level 2 | Level 3† | Total | ||||||||||||||||

| Common Stock |

||||||||||||||||||||

| Brazil |

$ | 12,818,600 | $ | — | $ | — | $ | 12,818,600 | ||||||||||||

| Burkina Faso |

450,965 | 1,450,811 | — | 1,901,776 | ||||||||||||||||

| Canada |

4,662,318 | — | — | 4,662,318 | ||||||||||||||||

| Chile |

4,338,122 | — | — | 4,338,122 | ||||||||||||||||

| China |

17,277,244 | 45,169,548 | — | 62,446,792 | ||||||||||||||||

| Ghana |

1,438,749 | 1,206,485 | — | 2,645,234 | ||||||||||||||||

| Greece |

— | 1,173,023 | — | 1,173,023 | ||||||||||||||||

| India |

— | 23,599,515 | — | 23,599,515 | ||||||||||||||||

| Indonesia |

— | 3,164,665 | — | 3,164,665 | ||||||||||||||||

| Mexico |

2,141,095 | — | — | 2,141,095 | ||||||||||||||||

| Philippines |

— | 901,445 | — | 901,445 | ||||||||||||||||

| Russia |

— | — | — | ^ | — | |||||||||||||||

| Saudi Arabia |

— | 7,074,749 | — | 7,074,749 | ||||||||||||||||

| South Africa |

4,301,607 | 1,879,076 | — | 6,180,683 | ||||||||||||||||

| South Korea |

— | 11,267,143 | — | 11,267,143 | ||||||||||||||||

| Taiwan |

2,406,182 | 5,999,137 | — | 8,405,319 | ||||||||||||||||

| United Arab Emirates |

— | 1,238,640 | — | 1,238,640 | ||||||||||||||||

| Vietnam |

— | 2,759,932 | — | 2,759,932 | ||||||||||||||||

| Zambia |

7,065,208 | — | — | 7,065,208 | ||||||||||||||||

|

|

|

|||||||||||||||||||

| Total Common Stock |

56,900,090 | 106,884,169 | — | 163,784,259 | ||||||||||||||||

|

|

|

|||||||||||||||||||

| Preferred Stock |

||||||||||||||||||||

| Brazil |

4,325,038 | — | — | 4,325,038 | ||||||||||||||||

| Chile |

3,220,306 | — | — | 3,220,306 | ||||||||||||||||

|

|

|

|||||||||||||||||||

| Total Preferred Stock |

7,545,344 | — | — | 7,545,344 | ||||||||||||||||

|

|

|

|||||||||||||||||||

| Total Investments in Securities |

$ | 64,445,434 | $ | 106,884,169 | $ | — | $ | 171,329,603 | ||||||||||||

|

|

|

|||||||||||||||||||

† A reconciliation of Level 3 investments is presented when the fund has a significant amount of Level 3 investments at the end of the period in relation to net assets. Management has concluded that Level 3 investments are not material in relation to net assets.

^ Includes Securities in which the fair value is $0 or has been rounded to $0.

For more information on valuation inputs see Note 2 Significant Accounting Policies in the Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

8

| THE ADVISORS’ INNER CIRCLE FUND III | REDWHEEL GLOBAL EMERGING EQUITY FUND SEPTEMBER 30, 2022

|

| STATEMENT OF ASSETS AND LIABILITIES | ||||

| Assets: |

||||

| Investments, at Value (Cost $181,626,553) |

$ | 171,329,603 | ||

| Cash |

1,515,182 | |||

| Foreign Currency, at Value (Cost $102,592) |

102,333 | |||

| Receivable for Capital Shares Sold |

700,000 | |||

| Receivable for Investment Securities Sold |

191,584 | |||

| Dividend and Interest Receivable |

129,902 | |||

| Reclaim Receivable |

33,952 | |||

| Other Prepaid Expenses |

22,268 | |||

|

|

|

|||

| Total Assets |

174,024,824 | |||

|

|

|

|||

| Liabilities: |

||||

| Payable for Investment Securities Purchased |

1,412,604 | |||

| Accrued Foreign Capital Gains Tax on Appreciated Securities |

362,541 | |||

| Payable to Investment Adviser |

138,509 | |||

| Payable for Capital Shares Redeemed |

123,168 | |||

| Payable to Administrator |

18,468 | |||

| Shareholder Servicing Fees Payable |

5,031 | |||

| Chief Compliance Officer Fees Payable |

1,881 | |||

| Payable to Trustees |

330 | |||

| Other Accrued Expenses and Other Payables |

107,396 | |||

|

|

|

|||

| Total Liabilities |

2,169,928 | |||

|

|

|

|||

| Net Assets |

$ | 171,854,896 | ||

|

|

|

|||

| Net Assets Consist of: |

||||

| Paid-in Capital |

$ | 243,339,905 | ||

| Total Accumulated Losses |

(71,485,009) | |||

|

|

|

|||

| Net Assets |

$ | 171,854,896 | ||

|

|

|

|||

| Institutional Class Shares: |

||||

| Net Assets |

$ | 49,429,348 | ||

| Outstanding Shares of beneficial interest (unlimited authorization — no par value) |

5,198,107 | |||

| Net Asset Value, Offering and Redemption Price Per Share |

$ | 9.51 | ||

|

|

|

|||

| Class I Shares: |

||||

| Net Assets |

122,425,548 | |||

| Outstanding Shares of beneficial interest (unlimited authorization — no par value) |

12,902,042 | |||

| Net Asset Value, Offering and Redemption Price Per Share |

$ | 9.49 | ||

|

|

|

|||

The accompanying notes are an integral part of the financial statements.

9

| THE ADVISORS’ INNER CIRCLE FUND III | REDWHEEL GLOBAL EMERGING EQUITY FUND FOR THE YEAR ENDED SEPTEMBER 30, 2022

|

| STATEMENT OF OPERATIONS | ||||

| Investment Income: |

||||

| Dividends |

$ | 8,694,487 | ||

| Interest |

5,346 | |||

| Less: Foreign Taxes Withheld |

(644,619 | ) | ||

|

|

|

| ||

| Total Investment Income |

8,055,214 | |||

|

|

|

| ||

| Expenses: |

||||

| Investment Advisory Fees (Note 5) |

2,262,733 | |||

| Administration Fees (Note 4) |

298,054 | |||

| Shareholder Serving Fees, Class I Shares (Note 4) |

174,500 | |||

| Trustees’ Fees |

20,673 | |||

| Chief Compliance Officer Fees (Note 3) |

7,816 | |||

| Custodian Fees (Note 4) |

175,333 | |||

| Transfer Agent Fees (Note 4) |

83,053 | |||

| Professional Fees |

70,541 | |||

| Registration and Filing Fees |

39,078 | |||

| Printing Fees |

22,340 | |||

| Other Expenses |

56,015 | |||

|

|

|

| ||

| Total Expenses |

3,210,136 | |||

|

|

|

| ||

| Less: |

||||

| Net Recovery of Investment Advisory Fees Previously Waived (Note 5) |

24,905 | |||

|

|

|

| ||

| Net Expenses |

3,235,041 | |||

|

|

|

| ||

| Net Investment Income |

4,820,173 | |||

|

|

|

| ||

| Net Realized Gain (Loss) on: |

||||

| Investments |

(51,449,517 | ) | ||

| Foreign Currency Transactions |

(339,483 | ) | ||

|

|

|

| ||

| Net Realized Loss |

(51,789,000 | ) | ||

|

|

|

| ||

| Net Change in Unrealized Appreciation (Depreciation) on: |

||||

| Investments |

(42,325,813 | ) | ||

| Foreign Capital Gains Tax on Appreciated Securities |

833,697 | |||

| Foreign Currency Transactions and Translation of Other Assets and Liabilities Denominated in Foreign Currencies |

(7,381 | ) | ||

|

|

|

| ||

| Net Change in Unrealized Appreciation (Depreciation) |

(41,499,497 | ) | ||

|

|

|

| ||

| Net Realized and Unrealized Loss on Investments, Foreign Capital Gains Tax on Appreciated Securities, and Foreign Currency Transactions and Translation of Other Assets and Liabilities Denominated in Foreign Currencies |

(93,288,497 | ) | ||

|

|

|

| ||

| Net Decrease in Net Assets Resulting from Operations |

$ | (88,468,324 | ) | |

|

|

|

| ||

The accompanying notes are an integral part of the financial statements.

10

| THE ADVISORS’ INNER CIRCLE FUND III | REDWHEEL GLOBAL EMERGING EQUITY FUND

|

| STATEMENT OF CHANGES IN NET ASSETS |

| Year Ended September 30, 2022 |

Year Ended September 30, 2021 | |||||||||||

| Operations: |

||||||||||||

| Net Investment Income |

$ | 4,820,173 | $ | 403,600 | ||||||||

| Net Realized Gain (Loss) on Investments and Foreign Currency |

||||||||||||

| Transactions |

(51,789,000 | ) | 53,230,427 | |||||||||

| Net Change in Unrealized Depreciation on Investments, Foreign Capital Gains Tax on Appreciated Securities, Foreign Currency Transactions and Translation of Other Assets and Liabilities Denominated in Foreign Currencies |

(41,499,497 | ) | (1,522,478 | ) | ||||||||

|

|

|

|

|

|

| |||||||

| Net Increase (Decrease) in Net Assets Resulting From Operations |

(88,468,324 | ) | 52,111,549 | |||||||||

|

|

|

|

|

|

| |||||||

| Distributions: |

||||||||||||

| Institutional Class Shares |

(8,678,789 | ) | (114,177 | ) | ||||||||

| Class I Shares |

(28,860,207 | ) | (368,857 | ) | ||||||||

|

|

|

|

|

|

| |||||||

| Total Distributions |

(37,538,996 | ) | (483,034 | ) | ||||||||

|

|

|

|

|

|

| |||||||

| Capital Share Transactions:(1) |

||||||||||||

| Institutional Class Shares |

||||||||||||

| Issued |

13,123,726 | 18,546,328 | ||||||||||

| Reinvestment of Distributions |

6,506,878 | 114,177 | ||||||||||

| Redeemed |

(2,413,804 | ) | (5,358,429 | ) | ||||||||

|

|

|

|

|

|

| |||||||

| Net Institutional Class Shares Transactions |

17,216,800 | 13,302,076 | ||||||||||

|

|

|

|

|

|

| |||||||

| Class I Shares |

||||||||||||

| Issued |

106,986,066 | 143,480,104 | ||||||||||

| Reinvestment of Distributions |

28,027,077 | 355,177 | ||||||||||

| Redeemed |

(159,426,690 | ) | (92,830,142 | ) | ||||||||

|

|

|

|

|

|

| |||||||

| Net Class I Shares Transactions |

(24,413,547 | ) | 51,005,139 | |||||||||

|

|

|

|

|

|

| |||||||

| Net Increase (Decrease) in Net Assets From Capital Share Transactions |

(7,196,747 | ) | 64,307,215 | |||||||||

|

|

|

|

|

|

| |||||||

| Total Increase (Decrease) in Net Assets |

(133,204,067 | ) | 115,935,730 | |||||||||

|

|

|

|

|

|

| |||||||

| Net Assets: |

||||||||||||

| Beginning of Year |

305,058,963 | 189,123,233 | ||||||||||

|

|

|

|

|

|

| |||||||

| End of Year |

$ | 171,854,896 | $ | 305,058,963 | ||||||||

|

|

|

|

|

|

| |||||||

| (1) | For share transactions, see Note 7 in the Notes to Financial Statements. |

The accompanying notes are an integral part of the financial statements.

11

| THE ADVISORS’ INNER CIRCLE FUND III | REDWHEEL GLOBAL EMERGING EQUITY FUND

|

| FINANCIAL HIGHLIGHTS |

Selected Per Share Data & Ratios

For a Share Outstanding Throughout the Year

| Institutional Class Shares |

||||||||||||||||||||

| Year Ended September 30, 2022 |

Year Ended September 30, 2021 |

Year Ended September 30, 2020 |

Year Ended September 30, 2019 |

Year Ended September 30, 2018 |

||||||||||||||||

| Net Asset Value, Beginning of Year |

$ | 16.10 | $ | 12.46 | $ | 11.25 | $ | 11.67 | $ | 13.13 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (Loss) from Investment Operations: |

||||||||||||||||||||

| Net Investment Income (Loss)* |

0.23 | 0.04 | (0.03) | 0.07 | 0.02 | |||||||||||||||

| Net Realized and Unrealized Gain (Loss) |

(4.63) | 3.64 | 1.30 | (0.48) | (1.28) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total from Investment Operations |

(4.40) | 3.68 | 1.27 | (0.41) | (1.26) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Dividends and Distributions: |

||||||||||||||||||||

| Net Investment Income |

(0.31) | (0.04) | (0.06) | (0.01) | (0.05) | |||||||||||||||

| Capital Gains |

(1.88) | — | — | — | (0.15) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Dividends and Distributions |

(2.19) | (0.04) | (0.06) | (0.01) | (0.20) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Asset Value, End of Year |

$ | 9.51 | $ | 16.10 | $ | 12.46 | $ | 11.25 | $ | 11.67 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Return† |

(31.37)% | 29.52% | 11.29% | (3.46)% | (9.77)% | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Ratios and Supplemental Data |

||||||||||||||||||||

| Net Assets, End of Year(Thousands) |

$ | 49,429 | $ | 61,658 | $ | 38,174 | $ | 37,682 | $ | 43,464 | ||||||||||

| Ratio of Expenses to Average Net Assets (Including Waivers and Reimbursements) |

1.22%(1) | 1.25%(1) | 1.25% | 1.25% | 1.25% | |||||||||||||||

| Ratio of Expenses to Average Net Assets (Excluding Waivers and Reimbursements) |

1.21% | 1.20% | 1.26% | 1.29% | 1.33% | |||||||||||||||

| Ratio of Net Investment Income (Loss) to Average Net Assets |

1.87% | 0.24% | (0.30)% | 0.58% | 0.17% | |||||||||||||||

| Portfolio Turnover Rate |

136% | 122% | 139% | 106% | 91% | |||||||||||||||

| * | Per share calculations were performed using average shares for the period. |

Total return is for the period indicated and has not been annualized. Returns shown do not reflect the

| † | deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Ratio includes previously waived advisory fees recaptured. The net expense ratio would have been lower |

| (1) | absent the impact of the recaptured fees. |

The accompanying notes are an integral part of the financial statements.

12

| THE ADVISORS’ INNER CIRCLE FUND III | REDWHEEL GLOBAL EMERGING EQUITY FUND

|

| FINANCIAL HIGHLIGHTS |

Selected Per Share Data & Ratios

For a Share Outstanding Throughout the Year

| Class I Shares |

||||||||||||||||||||

| Year Ended September 30, 2022 |

Year Ended September 30, 2021 |

Year Ended September 30, 2020 |

Year Ended September 30, 2019 |

Year Ended September 30, 2018 |

||||||||||||||||

| Net Asset Value, Beginning of Year |

$ | 16.07 | $ | 12.44 | $ | 11.23 | $ | 11.65 | $ | 13.13 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (Loss) from Investment Operations: |

||||||||||||||||||||

| Net Investment Income (Loss)* |

0.25 | 0.02 | (0.05) | 0.06 | 0.01 | |||||||||||||||

| Net Realized and Unrealized Gain (Loss) |

(4.65) | 3.64 | 1.31 | (0.47) | (1.29) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total from Investment Operations |

(4.40) | 3.66 | 1.26 | (0.41) | (1.28) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Dividends and Distributions: |

||||||||||||||||||||

| Net Investment Income |

(0.30) | (0.03) | (0.05) | (0.01) | (0.05) | |||||||||||||||

| Capital Gains |

(1.88) | — | — | — | (0.15) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Dividends and Distributions |

(2.18) | (0.03) | (0.05) | (0.01) | (0.20) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Asset Value, End of Year |

$ | 9.49 | $ | 16.07 | $ | 12.44 | $ | 11.23 | $ | 11.65 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Return† |

(31.43)% | 29.41% | 11.24% | (3.54)% | (9.96)% | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Ratios and Supplemental Data |

||||||||||||||||||||

| Net Assets, End of Year(Thousands) |

$ | 122,426 | $ | 243,401 | $ | 150,949 | $ | 104,992 | $ | 101,839 | ||||||||||

| Ratio of Expenses to Average Net Assets (Including Waivers and Reimbursements) |

1.31%(1) | 1.34%(1) | 1.34% | 1.34% | 1.33% | |||||||||||||||

| Ratio of Expenses to Average Net Assets (Excluding Waivers and Reimbursements) |

1.30% | 1.29% | 1.36% | 1.38% | 1.41% | |||||||||||||||

| Ratio of Net Investment Income (Loss) to Average Net Assets |

1.93% | 0.13% | (0.40)% | 0.57% | 0.05% | |||||||||||||||

| Portfolio Turnover Rate |

136% | 122% | 139% | 106% | 91% | |||||||||||||||

| * | Per share calculations were performed using average shares for the period. |

Total return is for the period indicated and has not been annualized. Returns shown do not reflect the

| † | deductions of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Ratio includes previously waived advisory fees recaptured. The net expense ratio would have been lower |

| (1) | absent the impact of the recaptured fees. |

The accompanying notes are an integral part of the financial statements.

13

| THE ADVISORS’ INNER CIRCLE FUND III | REDWHEEL GLOBAL EMERGING EQUITY FUND SEPTEMBER 30, 2022

|

| NOTES TO FINANCIAL STATEMENTS |

1. Organization:

The Advisors’ Inner Circle Fund III (the “Trust”) is organized as a Delaware statutory trust under a Declaration of Trust dated December 4, 2013. The Trust is registered under the Investment Company Act of 1940, as amended, as an open-end management investment company with 65 funds. The financial statements herein are those of the Redwheel Global Emerging Equity Fund (the “Fund”). The investment objective of the Fund is to seek long-term capital appreciation. The Fund is classified as a diversified investment company. RWC Asset Advisors (US) LLC serves as the Fund’s investment adviser (the “Adviser”). The Fund currently offers Class N Shares, Class I Shares and Institutional Class Shares. The Fund commenced operations on December 30, 2016. As of September 30, 2022, only Class I and the Institutional Class have outstanding shares. The financial statements of the remaining funds of the Trust are presented separately. The assets of each fund are segregated, and a shareholder’s interest is limited to the fund in which shares are held.

Effective February 21, 2022, the Fund’s name changed from the “RWC Global Emerging Equity Fund” to the “Redwheel Global Emerging Equity Fund.”

2. Significant Accounting Policies:

The following are significant accounting policies, which are consistently followed in the preparation of the financial statements of the Fund. The Fund is an investment company that applies the accounting and reporting guidance issued in Topic 946 by the U.S. Financial Accounting Standards Board (“FASB”).

Use of Estimates — The preparation of financial statements in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) requires management to make estimates and assumptions that affect the fair value of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates and such differences could be material.

Security Valuation — Securities listed on a securities exchange, market or automated quotation system for which quotations are readily available (except for securities traded on NASDAQ), including securities traded over the counter, are valued at the last quoted sale price on an exchange or market (foreign or domestic) on which they are traded or, if there is no such reported sale on the valuation date, at the most recent quoted bid price. For securities traded on NASDAQ, the NASDAQ official closing price will be used. The prices for foreign securities are reported in local currency and converted to U.S. dollars using currency exchange rates. Prices for most securities held in the Fund are provided daily by recognized independent pricing agents. If a security price cannot be obtained from an independent, third-party pricing agent, the Fund seeks to obtain a bid price from at least one independent broker.

Securities for which market prices are not “readily available” are required to be fair valued under the 1940 Act.

In December 2020, the SEC adopted Rule 2a-5 under the 1940 Act, establishing requirements to determine fair value in good faith for purposes of the 1940 Act. The rule permits fund boards to designate a fund’s investment adviser to perform fair-value determinations, subject to board oversight and certain other conditions. The rule also defines when market quotations are “readily

14

| THE ADVISORS’ INNER CIRCLE FUND III | REDWHEEL GLOBAL EMERGING EQUITY FUND SEPTEMBER 30, 2022

|

available” for purposes of the 1940 Act and requires a fund to fair value a portfolio investment when a market quotation is not readily available. The SEC also adopted new Rule 31a-4 under the 1940 Act, which sets forth recordkeeping requirements associated with fair-value determinations. The compliance date for Rule 2a-5 and Rule 31a-4 was September 8, 2022.

Effective September 8, 2022, and pursuant to the requirements of Rule 2a-5, the Trust’s Board of Trustees designated the Adviser as the Board’s valuation designee to perform fair-value determinations for the Fund through a Fair Value Committee established by the Adviser and approved new Adviser Fair Value Procedures for the Fund. Prior to September 8, 2022, fair-value determinations were performed in accordance with the Trust’s Fair Value Procedures established by the Fund’s Board of Trustees and were implemented through a Fair Value Committee designated by the Board.

Some of the more common reasons that may necessitate that a security be valued using Fair Value Procedures include: the security’s trading has been halted or suspended; the security has been de-listed from a national exchange; the security’s primary trading market is temporarily closed at a time when under normal conditions it would be open; the security has not been traded for an extended period of time; the security’s primary pricing source is not able or willing to provide a price; or trading of the security is subject to local government imposed restrictions. When a security is valued in accordance with the Fair Value Procedures, the Committee will determine the value after taking into consideration relevant information reasonably available to the Committee.

For securities that principally trade on a foreign market or exchange, a significant gap in time can exist between the time of a particular security’s last trade and the time at which the Fund calculates its net asset value. The closing prices of such securities may no longer reflect their market value at the time the Fund calculates its net asset value if an event that could materially affect the value of those securities (a “Significant Event”) has occurred between the time of the security’s last close and the time that the Fund calculates net asset value. A Significant Event may relate to a single issuer or to an entire market sector. If the Adviser of the Fund becomes aware of a Significant Event that has occurred with respect to a security or group of securities after the closing of the exchange or market on which the security or securities principally trade, but before the time at which the Fund calculates its net asset value, it may request that a Committee meeting be called.

The Fund uses Intercontinental Exchange Data Pricing & Reference Data, LLC. (“ICE”) as a third party fair valuation vendor. ICE provides a fair value for foreign securities in the Fund based on certain factors and methodologies (involving, generally, tracking valuation correlations between the U.S. market and each non-U.S. security) applied by ICE in the event that there is a movement in the U.S. market that exceeds a specific threshold established by the Committee. The Committee establishes a “confidence interval” which is used to determine the level of correlation between the value of a foreign security and movements in the U.S. market before a particular security is fair valued when the threshold is exceeded. In the event that the threshold established by the Committee is exceeded on a specific day, the Fund values its non-U.S. securities that exceed the applicable “confidence interval” based upon the fair values provided by ICE. In such event, it is not necessary to hold a Committee meeting. In the event that the Adviser believes that the fair values provided by ICE are not reliable, the Adviser contacts SEI Investments Global Fund Services (the “Administrator”) and may request that a meeting of the Committee be held.

15

| THE ADVISORS’ INNER CIRCLE FUND III | REDWHEEL GLOBAL EMERGING EQUITY FUND SEPTEMBER 30, 2022

|

If a local market in which the Fund owns securities is closed for one or more days, the Fund shall value all securities held in that corresponding currency based on the fair value prices provided by ICE using the predetermined confidence interval discussed above.

In accordance with U.S. GAAP, the Fund discloses fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy are described below:

| ● | Level 1 — Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

| ● | Level 2 — Other significant observable inputs (includes quoted prices for similar securities, interest rates, prepayment speeds, credit risk, referenced indices, quoted prices in inactive markets, adjusted quoted prices in active markets, adjusted quoted prices on foreign equity securities that were adjusted in accordance with pricing procedures approved by the Board, etc.); and |

| ● | Level 3 — Prices, inputs modeling techniques which are both significant to the fair value measurement and unobservable (supported by little or no market activity). |

Investments are classified within the level of the lowest significant input considered in determining fair value. Investments classified within Level 3 whose fair value measurement considers several inputs may include Level 1 or Level 2 inputs as components of the overall fair value measurement.

Federal Income Taxes — It is the Fund’s intention to qualify as a regulated investment company for Federal income tax purposes by complying with the appropriate provisions of Subchapter M of the Internal Revenue Code of 1986, as amended. Accordingly, no provisions for Federal income taxes have been made in the financial statements.

The Fund evaluates tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether it is “more-likely than-not” (i.e., greater than 50-percent) that each tax position will be sustained upon examination by a taxing authority based on the technical merits of the position. Tax positions not deemed to meet the more-likely-than-not threshold are recorded as a tax benefit or expense in the current year. The Fund did not record any tax provision in the current period. However, management’s conclusions regarding tax positions taken may be subject to review and adjustment at a later date based on factors including, but not limited to, examination by tax authorities (i.e., from commencement of operations, as applicable), on-going analysis of and changes to tax laws, regulations and interpretations thereof.

As of and during the year ended September 30, 2022, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the year, the Fund did not incur any significant interest or penalties.

Foreign Taxes — The Fund may be subject to taxes imposed by countries in which it invests. Such taxes are generally based on either income or gains earned or repatriated. The Fund accrues and

16

| THE ADVISORS’ INNER CIRCLE FUND III | REDWHEEL GLOBAL EMERGING EQUITY FUND SEPTEMBER 30, 2022

|

applies such taxes to net investment income, net realized gains and net unrealized gains as income and/or capital gains are earned. The Fund has accrued foreign capital gain tax in the amount of $362,541 presented on the Statement of Assets and Liabilities.

Security Transactions and Investment Income — Security transactions are accounted for on trade date. Costs used in determining realized gains and losses on the sale of investment securities are based on the specific identification method. Dividend income and expense are recorded on the ex-dividend date. Interest income is recognized on the accrual basis from settlement date. Certain dividends from foreign securities will be recorded as soon as the Fund is informed of the dividend if such information is obtained subsequent to the ex-dividend date.

Foreign Currency Translation — The books and records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars on the date of valuation. The Fund does not isolate that portion of realized or unrealized gains and losses resulting from changes in the foreign exchange rate from fluctuations arising from changes in the market prices of the securities. These gains and losses are included in net realized and unrealized gains and losses on investments on the Statement of Operations. Net realized and unrealized gains and losses on foreign currency transactions represent net foreign exchange gains or losses from foreign currency exchange contracts, disposition of foreign currencies, currency gains or losses realized between trade and settlement dates on securities transactions and the difference between the amount of the investment income and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid.

Cash — Idle cash may be swept into various time deposit accounts and is classified as cash on the Statement of Assets and Liabilities. The Fund maintains cash in bank deposit accounts which, at times, may exceed United States federally insured limits. Amounts invested are available on the same business day.

Expenses — Most expenses of the Trust can be directly attributed to a particular fund. Expenses which cannot be directly attributed to a particular fund are apportioned among the funds of the Trust based on the number of funds and/or relative net assets.

Dividends and Distributions to Shareholders — The Fund distributes substantially all of its net investment income annually. Any net realized capital gains are distributed annually. All distributions are recorded on ex-dividend date.

Equity-Linked Warrants — The Fund may invest in equity-linked and index-linked warrants. Equity-linked warrants provide a way for investors to access markets where entry is difficult or costly. A Fund purchases the equity-linked and index-linked warrants from a broker, who in turn is expected to purchase shares in the local market and issue a call warrant hedged on the underlying holdings. If the Fund exercises its call and closes its position, the shares are expected to be sold and the warrant redeemed with the proceeds. Each warrant typically represents one share of the underlying stock or basket of stocks representing the index. Therefore, the price, performance and liquidity of the warrant are all linked to the underlying stock or index, less transaction costs. Equity-linked warrants are generally valued at the closing price of the underlying securities, then adjusted for stock dividends declared by the underlying securities. In addition to the market risk related to the underlying holdings, the Fund bears additional counterparty risk with respect to the issuing broker. A Fund may also purchase warrants, issued by banks and other financial

17

| THE ADVISORS’ INNER CIRCLE FUND III | REDWHEEL GLOBAL EMERGING EQUITY FUND SEPTEMBER 30, 2022

|

institutions, whose values are based on the values from time to time of one or more securities indices.

Forward Foreign Currency Contracts — The Fund may enter into forward foreign currency contracts as hedges against either specific transactions, fund positions or anticipated fund positions. The Fund may also engage in currency transactions to enhance the Fund’s returns. All commitments are “marked-to-market” daily at the applicable foreign exchange rate, and any resulting unrealized gains or losses are recorded currently. The Fund realizes gains and losses at the time forward contracts are extinguished. Unrealized gains or losses on outstanding positions in forward foreign currency contracts held at the close of the period are recognized as ordinary income or loss for Federal income tax purposes. The Fund could be exposed to risk if the counterparties to the contracts are unable to meet the terms of the contract and from unanticipated movements in the value of a foreign currency relative to the U.S. dollar. Finally, the risk exists that losses could exceed amounts disclosed on the Statements of Assets and Liabilities. There were no open forward foreign currency contracts as of September 30, 2022.

Classes — Class specific expenses are borne by that class of shares. Income, realized and unrealized gains (losses), and non-class specific expenses are allocated to the respective class on the basis of relative daily net assets.

3. Transactions with Affiliates:

Certain officers of the Trust are also employees of the Administrator, a wholly owned subsidiary of SEI Investments Company, and/or SEI Investments Distribution Co. (the “Distributor”). Such officers are paid no fees by the Trust, other than the Chief Compliance Officer (“CCO”) as described below, for serving as officers of the Trust.

The services provided by the CCO and his staff are paid for by the Trust as incurred. The services include regulatory oversight of the Trust’s advisors and service providers as required by SEC regulations. The CCO’s services and fees have been approved by and are reviewed by the Board. For the year ended September 30, 2022, the fund was allocated CCO fees totaling $7,816.

4. Administration, Distribution, Shareholder Servicing, Custodian and Transfer Agent Agreements:

The Fund and the Administrator are parties to an Administration Agreement under which the Administrator provides administration services to the Fund. For these services, the Administrator is paid an asset based fee, which will vary depending on the number of share classes and the average daily net assets of the Fund. For the year ended September 30, 2022, the Fund paid $298,054 for these services.

The Fund has adopted the Distribution Plan (the “Plan”) for the Class N Shares. Under the Plan, the Distributor, or third parties that enter into agreements with the Distributor, may receive up to 0.25% of the Fund’s average daily net assets attributable to Class N Shares. Under the Plan, the Distributor may make payments pursuant to written agreements to financial institutions and intermediaries such as banks, savings and loan associations and insurance companies including, without limit, investment counselors, broker-dealers and the Distributor’s affiliates and subsidiaries (collectively, “Agents”) as compensation for services and reimbursement of expenses incurred in connection with distribution assistance. The Plan is characterized as a compensation plan since the distribution fee will be paid to the Distributor without regard to the distribution expenses incurred by the Distributor or the amount

18

| THE ADVISORS’ INNER CIRCLE FUND III | REDWHEEL GLOBAL EMERGING EQUITY FUND SEPTEMBER 30, 2022

|

of payments made to other financial institutions and intermediaries. The Trust intends to operate the Plan in accordance with its terms and with the Financial Industry Regulatory Authority (“FINRA”) rules concerning sales charges. For the year ended September 30, 2022, no such fees were incurred.

The Fund has adopted a shareholder servicing plan (the “Service Plan”) under which a shareholder servicing fee of up to 0.15% of average daily net assets of the Class N Shares and 0.09% of average daily net assets of Class I Shares of the Fund will be paid to other service providers. Certain brokers, dealers, banks, trust companies and other financial representatives receive compensation from the Fund for providing a variety of services, including record keeping and transaction processing. Such fees are based on the assets of the Fund that are serviced by the financial representative. Such fees are paid by the Fund to the extent that the number of accounts serviced by the financial representative multiplied by the account fee charged by the Fund’s transfer agent would not exceed the amount that would have been charged had the accounts serviced by the financial representative been registered directly through the transfer agent. All fees in excess of this calculated amount are paid by the Adviser. For the year ended September 30, 2022, the Fund paid $174,500 for these services.

Brown Brothers Harriman & Co. acts as custodian (the “Custodian”) for the Fund. The Custodian plays no role in determining the investment policies of the Fund or which securities are to be purchased or sold by the Fund. For the year ended September 30, 2022, the Fund paid $175,333 for these services.

DST Systems, Inc., serves as the transfer agent and dividend disbursing agent for the Fund under a transfer agency agreement with the Trust. For the year ended September 30, 2022, the Fund paid $83,053 for these services.

5. Investment Advisory Agreement:

Under the terms of an investment advisory agreement, the Adviser provides investment advisory services to the Fund at a fee computed daily at an annual rate of 0.90% of the Fund’s average daily net assets. As of September 30, 2022, the fees for these services were $2,262,733.

The Adviser has contractually agreed to reduce fees and reimburse expenses to the extent necessary to keep total annual fund operating expenses after fee reductions and/or expense reimbursements (excluding interest, taxes, brokerage commissions and other costs and expenses relating to the securities that are purchased and sold by the Fund, distribution fees, shareholder servicing fees, other expenditures which are capitalized in accordance with generally accepted accounting principles, acquired fund fee expenses and non-routine expenses) from exceeding 1.25% of the average daily net assets of each of the Fund’s share classes until January 29, 2023 (the “Expense Limitation”). The Adviser may recover all or a portion of its fee reductions or expense reimbursements, up to the expense cap in place at the time the expenses were waived, within a three-year period from the year in which it reduced its fee or reimbursed expenses if the Fund’s total annual fund operating expenses are below the Expense Limitation. This agreement may be terminated by the Board for any reason at any time, or by the Adviser, upon ninety (90) days’ prior written notice to the Trust, effective as of the close of business on January 29, 2023. As of September 30, 2022, there are no remaining fees available to be recaptured. The amount recovered in the year ended September 30, 2022, was $24,905.

6. Investment Transactions:

For the year ended September 30, 2022, the Fund made purchases of $339,780,464 and sales of $377,357,165 in investment securities other than long-term U.S. Government and short-term securities. There were no purchases or sales of long-term U.S. Government securities.

19

| THE ADVISORS’ INNER CIRCLE FUND III | REDWHEEL GLOBAL EMERGING EQUITY FUND SEPTEMBER 30, 2022

|

7. Capital Share Transactions:

Capital share transactions were as follows:

| Year | Year | |||||||||||

| Ended | Ended | |||||||||||

| September 30, | September 30, | |||||||||||

| 2022 | 2021 | |||||||||||

| Institutional Class Shares |

||||||||||||

| Issued |

1,097,472 | 1,086,853 | ||||||||||

| Reinvestment of Distributions |

472,145 | 6,845 | ||||||||||

| Redeemed |

(201,111 | ) | (326,589 | ) | ||||||||

|

|

|

|

|

|

| |||||||

| Total Institutional Class Shares Transactions |

1,368,506 | 767,109 | ||||||||||

|

|

|

|

|

|

| |||||||

| Class I Shares |

||||||||||||

| Issued |

8,448,889 | 8,367,066 | ||||||||||

| Reinvestment of Distributions |

2,038,828 | 21,319 | ||||||||||

| Redeemed |

(12,732,950 | ) | (5,371,969 | ) | ||||||||

|

|

|

|

|

|

| |||||||

| Total Class I Shares Transactions |

(2,245,233 | ) | 3,016,416 | |||||||||

|

|

|

|

|

|

| |||||||

| Net Increase (Decrease) in Shares Outstanding From Share Transactions |

(876,727 | ) | 3,783,525 | |||||||||

|

|

|

|

|

|

| |||||||

8. Federal Tax Information:

It is the Fund’s intention to continue to qualify as a regulated investment company for Federal income tax purposes and distribute all of its taxable income (including net capital gains). Accordingly, no provision for Federal income taxes is required.

Reclassification of Components of Net Assets — The timing and characterization of certain income and capital gain distributions are determined annually in accordance with Federal tax regulations which may differ from accounting principles generally accepted in the United States. As a result, net investment income (loss) and net realized gain (loss) on investment transactions for the reporting period may differ from distributions during such period. These book/tax differences may be temporary or permanent in nature. The permanent differences primarily consist of reclassification of distributions, foreign currency translations and investments in Passive Foreign Investment Company (“PFICs”).

The tax character of dividends and distributions paid during the years or year ended September 30, 2022 and 2021 were as follows:

| Long-Term Capital | ||||||||||||

| Ordinary Income | Gain | Total | ||||||||||

| 2022 |

$ | 25,639,329 | $ | 11,899,667 | $ | 37,538,996 | ||||||

| 2021 |

483,034 | — | 483,034 | |||||||||

20

| THE ADVISORS’ INNER CIRCLE FUND III | REDWHEEL GLOBAL EMERGING EQUITY FUND SEPTEMBER 30, 2022

|

As of September 30, 2022, the components of Accumulated Losses on a tax basis were as follows:

| Undistributed Ordinary Income |

$ | 814,050 | ||

| Capital Loss Carryforwards |

(934,134 | ) | ||

| Post October Capital Losses Deferred |

(46,919,958 | ) | ||

| Unrealized Depreciation |

(24,444,963 | ) | ||

| Other Temporary Differences |

(4 | ) | ||

|

|

|

| ||

| Total Accumulated Losses |

$ | (71,485,009 | ) | |

|

|

|

|

Post October capital losses represent capital losses realized on investment transactions from November 1, 2021 through September 30, 2022, that, in accordance with Federal income tax regulations, the Funds may elect to defer and treat as having arisen in the following fiscal year.

For taxable years beginning after December 22, 2010, a Registered Investment Company within the meaning of the 1940 Act (“RIC”) is permitted to carry forward net capital losses to offset capital gains realized in later years, and the losses carried forward retain their original character as either long-term or short-term losses. Losses carried forward under these provisions are as follows:

| Short-Term | Long-Term | |||||||||||||

| Loss |

Loss | Total | ||||||||||||

| $934,134 |

$– | $934,134 | ||||||||||||

For Federal income tax purposes the difference between Federal tax cost and book cost primarily relates to wash sales, capital gains tax and PFIC Mark to Market which cannot be used for Federal income tax purposes in the current year and have been deferred for use in future years. The Federal tax cost and aggregate gross unrealized appreciation and depreciation for the investments held (including foreign currency) by the Fund at September 30, 2022, were as follows:

| Aggregate Gross | Aggregate Gross | |||||||||||||

| Unrealized | Unrealized | Net Unrealized | ||||||||||||

| Federal Tax Cost | Appreciation | Depreciation | Depreciation | |||||||||||

| $195,766,837 | $17,110,227 | $(41,555,190) | $(24,444,963) | |||||||||||

9. Concentration of Shareholders:

At September 30, 2022, the percentage of total shares outstanding, held by shareholders owning 10% or greater of the aggregate total shares outstanding, for each share class, which are comprised of individual shareholders and omnibus accounts that are held on behalf of various individual shareholders was as follows:

| No. of | % | |||

| Shareholders | Ownership | |||

| Institutional Class Shares |

3 | 73% | ||

| Class I Shares |

1 | 41% |

21

| THE ADVISORS’ INNER CIRCLE FUND III | REDWHEEL GLOBAL EMERGING EQUITY FUND SEPTEMBER 30, 2022

|

10. Concentration of Risks:

As with all management investment companies, a shareholder of the Fund is subject to the risk that his or her investment could lose money. The Fund is subject to the principal risks noted below, any of which may adversely affect the Fund’s net asset value (“NAV”) and ability to meet its investment objective.

Equity Risk – Since it purchases equity securities, the Fund is subject to the risk that stock prices may fall over short or extended periods of time. Historically, the equity market has moved in cycles, and the value of the Fund’s securities may fluctuate from day to day. Individual companies may report poor results or be negatively affected by industry and/or economic trends and developments. The prices of securities issued by such companies may suffer a decline in response. These factors contribute to price volatility, which is the principal risk of investing in the Fund.

In addition, the impact of any epidemic, pandemic or natural disaster, or widespread fear that such events may occur, could negatively affect the global economy, as well as the economies of individual countries, the financial performance of individual companies and sectors, and the markets in general in significant and unforeseen ways. Any such impact could adversely affect the prices and liquidity of the securities and other instruments in which the Fund invests, which in turn could negatively impact the Fund’s performance and cause losses on your investment in the Fund.

Foreign Company Risk – Investing in foreign companies, including direct investments and investments through depositary receipts, poses additional risks since political and economic events unique to a country or region will affect those markets and their issuers. These risks will not necessarily affect the U.S. economy or similar issuers located in the United States. Securities of foreign companies may not be registered with the U.S. Securities and Exchange Commission (the “SEC”) and foreign companies are generally not subject to the regulatory controls imposed on U.S. issuers and, as a consequence, there is generally less publicly available information about foreign securities than is available about domestic securities. Income from foreign securities owned by the Fund may be reduced by a withholding tax at the source, which tax would reduce income received from the securities comprising the portfolio. Foreign securities may also be more difficult to value than securities of U.S. issuers. While depositary receipts provide an alternative to directly purchasing the underlying foreign securities in their respective national markets and currencies, investments in depositary receipts continue to be subject to many of the risks associated with investing directly in foreign securities.

Emerging and Frontier Markets Securities Risk – The Fund’s investments in emerging or frontier markets securities are considered speculative and subject to heightened risks in addition to the general risks of investing in foreign securities. Unlike more established markets, emerging and frontier markets may have governments that are less stable, markets that are less liquid and economies that are less developed. In addition, the securities markets of emerging and frontier market countries may consist of companies with smaller market capitalizations and may suffer periods of relative illiquidity; significant price volatility; restrictions on foreign investment; and possible restrictions on repatriation of investment income and capital. Furthermore, foreign investors may be required to register the proceeds of sales, and future economic or political crises could lead to price controls, forced mergers, expropriation or confiscatory taxation, seizure, nationalization or creation of government monopolies.

Foreign Currency Risk – As a result of the Fund’s investments in securities denominated in, and/or receiving revenues in, foreign currencies, the Fund will be subject to currency risk. Currency risk is the risk that foreign currencies will decline in value relative to the U.S. dollar or, in the case of hedged positions, that the U.S. dollar will decline in value relative to the currency hedged. In either event, the dollar value of an investment in the Fund would be adversely affected.

22

| THE ADVISORS’ INNER CIRCLE FUND III | REDWHEEL GLOBAL EMERGING EQUITY FUND SEPTEMBER 30, 2022

|

Geographic Focus Risk – To the extent that it focuses its investments in a particular country or geographic region, the Fund may be more susceptible to economic, political, regulatory or other events or conditions affecting issuers and countries within that country or geographic region. As a result, the Fund may be subject to greater price volatility and risk of loss than a fund holding more geographically diverse investments.

Risk of Investing in China – The Chinese economy is generally considered an emerging market and can be significantly affected by economic and political conditions and policy in China and surrounding Asian countries. A relatively small number of Chinese companies represents a large portion of China’s total market and thus may be more sensitive to adverse political or economic circumstances and market movements. The economy of China differs, often unfavorably, from the U.S. economy in such respects as structure, general development, government involvement, wealth distribution, rate of inflation, growth rate, allocation of resources and capital reinvestment, among others. Under China’s political and economic system, the central government has historically exercised substantial control over virtually every sector of the Chinese economy through administrative regulation and/or state ownership. In addition, expropriation, including nationalization, confiscatory taxation, political, economic or social instability or other developments could adversely affect and significantly diminish the values of the Chinese companies in which the Fund invests.

Small and Mid-Capitalization Company Risk – The small- and mid-capitalization companies in which the Fund may invest may be more vulnerable to adverse business or economic events than larger, more established companies. In particular, investments in these small and medium-sized companies may pose additional risks, including liquidity risk, because these companies may have limited product lines, markets and financial resources, and may depend upon a relatively small management group. Therefore, small- and mid-capitalization stocks may be more volatile than those of larger companies. These securities may be traded over-the-counter or listed on an exchange.

Private Placements Risk – Investment in privately placed securities may be less liquid than investments in publicly traded securities. Although these securities may be resold in privately negotiated transactions, the prices realized from these sales could be less than those originally paid by the Fund or less than what may be considered the fair value of such securities. Further, companies whose securities are not publicly traded may not be subject to the disclosure and other investor protection requirements that might be applicable if their securities were publicly traded.

Rights and Warrants Risk – Investments in rights or warrants involve the risk of loss of the purchase value of a right or warrant if the right to subscribe to additional shares is not exercised prior to the right’s or warrant’s expiration. Also, the purchase of rights and/or warrants involves the risk that the effective price paid for the right and/or warrant added to the subscription price of the underlying security may exceed the market price of the underlying security in instances such as those where there is no movement in the price of the underlying security.

Risks of Investing in Other Investment Companies – To the extent that the Fund invests in other investment companies, such as open-end funds, closed-end funds and ETFs, the Fund will be subject to substantially the same risks as those associated with the direct ownership of the securities held by such other investment companies. As a shareholder of another investment company, the Fund relies on that investment company to achieve its investment objective. If the investment company fails to achieve its objective, the value of the Fund’s investment could decline, which could adversely affect the Fund’s performance. By investing in another investment company, Fund shareholders indirectly bear the Fund’s proportionate share of the fees and expenses of the other investment company, in

23

| THE ADVISORS’ INNER CIRCLE FUND III | REDWHEEL GLOBAL EMERGING EQUITY FUND SEPTEMBER 30, 2022

|

addition to the fees and expenses that Fund shareholders directly bear in connection with the Fund’s own operations.

Because ETFs and certain closed-end funds are listed on national stock exchanges and are traded like stocks listed on an exchange, their shares potentially may trade at a discount or premium. Investments in ETFs and certain closed-end funds are also subject to brokerage and other trading costs, which could result in greater expenses to the Fund. In addition, because the value of ETF and certain closed-end fund shares depends on the demand in the market, the Adviser may not be able to liquidate the Fund’s holdings at the most optimal time, which could adversely affect Fund performance.

Liquidity Risk – Certain securities may be difficult or impossible to sell at the time and the price that the Fund would like. The Fund may have to accept a lower price to sell a security, sell other securities to raise cash, or give up an investment opportunity, any of which could have a negative effect on Fund management or performance.

Investment Style Risk – The Fund pursues a “growth style” of investing, meaning that the Fund invests in equity securities of companies that the Adviser believes will have above-average rates of earnings growth and which, therefore, may experience above-average increases in stock prices. Over time, a growth investing style may go in and out of favor, causing the Fund to sometimes underperform other equity funds that use differing investing styles.

Convertible Securities Risk – The value of a convertible security is influenced by changes in interest rates (with investment value declining as interest rates increase and increasing as interest rates decline) and the credit standing of the issuer. The price of a convertible security will also normally vary in some proportion to changes in the price of the underlying common stock because of the conversion or exercise feature.