Form N-CSR ADVISORS SERIES TRUST For: Sep 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07959

Advisors Series Trust

(Exact name of registrant as specified in charter)

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

(Address of principal executive offices) (Zip code)

Jeffrey T. Rauman, President/Chief Executive Officer

Advisors Series Trust

c/o U.S. Bancorp Fund Services, LLC

777 East Wisconsin Avenue, 5th Floor

Milwaukee, WI 53202

(Name and address of agent for service)

(Name and address of agent for service)

(626) 914-7363

Registrant's telephone number, including area code

Date of fiscal year end: September 30, 2022

Date of reporting period: September 30, 2022

Item 1. Reports to Stockholders.

(a)

|

Annual Report

September 30, 2022

|

Poplar Forest Funds

Poplar Forest Partners Fund

Class A (PFPFX)

Class I (IPFPX)

Poplar Forest Cornerstone Fund

Investor Class (IPFCX)

POPLAR FOREST FUNDS

TABLE OF CONTENTS

|

Performance

|

1

|

|

Letter to Partner

|

2

|

|

Sector Allocation of Portfolio Assets

|

12

|

|

Expense Example

|

14

|

|

Investment Highlights

|

16

|

|

Schedules of Investments

|

19

|

|

Statements of Assets and Liabilities

|

26

|

|

Statements of Operations

|

28

|

|

Statements of Changes in Net Assets

|

29

|

|

Financial Highlights

|

31

|

|

Notes to Financial Statements

|

34

|

|

Report of Independent Registered Public Accounting Firm

|

45

|

|

Notice to Shareholders

|

47

|

|

Information about Trustees and Officers

|

48

|

|

Householding

|

52

|

|

Privacy Notice

|

53

|

POPLAR FOREST FUNDS

Performance of each Fund class for the 1-, 3-, 5-, 10-year and since inception periods as of September 30, 2022, is as follows:

|

*

|

The 60/40 blended index comprises 60% S&P 500® Index and 40% Bloomberg U.S. Aggregate

Bond Index.

|

|

|

**

|

Returns for periods greater than 1 year have been annualized.

|

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so

that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained

by calling 1-877-522-8860. Performance for Class A shares with load reflects a maximum 5.00% sales charge. Class A shares without load do not take into account any sales charges which would reduce performance.

As of the Funds’ most recently filed registration statement, the Partners Fund Class A shares gross expense ratio is 1.31%; net expense ratio is 1.20% and is applicable to investors.

The Partners Fund Institutional Class shares gross expense ratio is 1.06%; net expense ratio is 0.95% and is applicable to investors. The Cornerstone Fund gross expense ratio is 1.53%; net expense ratio is 0.90% and is applicable to investors. The

Adviser has contractually agreed to the fee waiver through at least January 27, 2023.

1

POPLAR FOREST FUNDS

Portfolio Manager Commentary

Dear Partner,

With COVID having become endemic, 2022 was the year we all dared to take much-delayed summer vacations. For me, that meant heading to the beach in North Carolina. You may wonder: doesn’t he live in

California? I do, and while I’ve surely enjoyed many an hour looking out at the Pacific, the view of the Atlantic from the Carolina coast feels like heaven to me. When I was a kid, our family vacation was most often a week or two in a rented condo in

Myrtle Beach, S.C. - and I loved just about every minute of it: body surfing and beach walks, hours at the arcade and all the fresh shrimp we could eat.

The only things I don’t remember fondly were the occasional hurricane warnings. When the warnings came, we’d nervously watch the news each evening for reports on the path of storms that might be headed

our way. Those storms usually stayed out at sea and our vacations were uninterrupted, but in 1998, the first time I’d taken my own kids to Myrtle Beach, our family was forced to evacuate in advance of Hurricane Bonnie. The weather looked almost

placid as we packed to leave, but 24 hours later, Bonnie came ashore as a category 2 storm that killed several people and caused a half billion dollars of damage.

Hurricane season in the Atlantic typically runs from June to November. According to the National Weather Service, a hurricane is a “tropical cyclone with maximum sustained winds of 74 mph (64 knots) or

higher.” These cyclones are created when masses of warm air collide with cool air over warm ocean water. Warm water and warm air are key ingredients, but it is that collision with cooler air that produces the wind, rain and thunderstorms that make

hurricanes so destructive.

I’ve been thinking about hurricanes lately as I’ve been evaluating the potential impact of a recession on our portfolio. Just as hurricanes can cause damage to coastal property, recessions can harm

investor portfolios as a shrinking economy sends corporate profits lower. With memories of the Category 5 calamity of the Global Financial Crisis (the “GFC” in 2008-09), it is no wonder that the risk of recession is top of mind for many investors

today.

First and foremost, I do not believe that we are currently in a recession; quite the contrary – the economy is as warm as the water in the tropics. Corporate margins are robust and earnings have

continued to grow. The employment picture is rosy with low initial claims for unemployment and roughly two job openings for every one person looking for work. Basically, fiscal stimulus and accommodative monetary policy did such a good job offsetting

COVID-induced weakness that strong demand has overwhelmed more limited supply. The result: unacceptably high inflation.

While inflation has probably peaked, we are living in a supply constrained world and I suspect inflation will be stickier than central bankers want. Importantly,

the decade after the Global Financial Crisis was a time of excess supply, and central bankers around the world kept interest rates artificially low to stimulate demand. Investment strategies that worked well in the

aftermath of the GFC seem less likely to work well in coming years – in particular, and as we’ve seen so far in 2022, investment approaches that favor long duration (high P/E) growth stocks may fare poorly in a time of increasing interest

rates. If, as I suspect, it takes more time than desired for inflation to fall to levels consistent with the U.S. Federal Reserve’s (the “Fed’s”) definition of price

2

POPLAR FOREST FUNDS

stability (2% inflation), then we may be living with structurally higher interest rates for years. Value stocks may do particularly well in this environment. The

Fed has made clear that they will use monetary policy to cool the economy to combat inflation. Just as cool air colliding with warm air over tropical waters produces hurricanes, the collision of increasingly chilly monetary policy and a warm economy

could create an economic storm with the potential to turn into a hurricane.

Storm Watch

According to the National Oceanic and Atmospheric Administration, typically 10 tropical storms form each year in the Atlantic Ocean, the Caribbean Sea, and the Gulf of Mexico. Roughly six of these

storms grow into hurricanes, but the majority stay at sea. In an average three-year period, only two major hurricanes will strike the U.S. coastline between Texas and Maine. While the 2022 hurricane season had been relatively mild, in just the last

two weeks, Hurricane Fiona caused extensive damage in Puerto Rico and Canada while Hurricane Ian has wreaked havoc in Florida and the Carolina coast. Our thoughts and prayers are with all of those who have been affected by these destructive storms.

Recessions are rarer than hurricanes – over the last 40 years, we’ve only had four. While I am hopeful that the growing economic storm clouds will fizzle out over the proverbial ocean, at Poplar Forest,

we think it is prudent to plan for something more severe. Fed Chairman Powell seems intent on convincing the market that he can whip inflation, and an aggressive Fed could turn a relatively harmless tropical storm into an economic hurricane. As you

can see below, recessionary economic activity (highlighted in grey) reduces companies’ revenues and profits. If there is a recession in 2023, earnings estimates may decline by 20% or more for the S&P 500® Index (“S&P 500”). We have already seen some diminution in estimates during September and we expect more when companies report third quarter earnings in the next few weeks. While stocks don’t

currently look particularly expensive when compared to current consensus expectations for earnings, if those expectations are reduced by 20% or more, then the price-to-earnings ratio on the S&P 500 could increase from the fairly reasonable

current level of 16x to a more expensive 20x or more.

Source: Intrinsic Research

3

POPLAR FOREST FUNDS

Like meteorologists watching for signs of dangerous storms, we are monitoring various indicators for signals of economic trouble. While the economy looks mostly sunny today, the extended forecast is

more worrisome as measured by the Conference Board’s Index of Leading Economic Indicators (the “LEI”). The ten components of the LEI for the U.S. include:

|

1.

|

Average weekly hours in manufacturing;

|

|

|

2.

|

Average weekly initial claims for unemployment insurance;

|

|

|

3.

|

Manufacturers’ new orders for consumer goods and materials;

|

|

|

4.

|

ISM® Index of New Orders;

|

|

|

5.

|

Manufacturers’ new orders for nondefense capital goods excluding aircraft orders;

|

|

|

6.

|

Building permits for new private housing units;

|

|

|

7.

|

S&P 500® Index of Stock Prices;

|

|

|

8.

|

Leading Credit Index™;

|

|

|

9.

|

Interest rate spread (10-year Treasury bonds less federal funds rate);

|

|

|

10.

|

Average consumer expectations for business conditions.

|

This collection of macroeconomic variables has historically done a very good job of forecasting the direction of the economy; earnings for the S&P 500 have historically followed a similar pattern.

As the Conference Board said in its recent release: the “U.S. LEI continued to decline signaling a contraction in economic activity may be imminent.”

Source: The Conference Board

I believe the most helpful leading indicator is the difference (the “spread”) between yields on 10-year Treasury Bonds and the Federal Funds rate. As you can see below, in the past, this indicator has

fallen well below zero in advance of recessions. Despite the Fed’s decision to raise rates by 0.75% (to 3.00-3.25%) at its last meeting, this yield spread is currently still well above zero with 10-year Treasury bonds now yielding 3.75%. While risks

are growing, increasing long-term interest rates are a sign that the Fed has not yet moved far enough to actually trigger a recession. We will be watching closely to see where long-term rates go as the Fed continues to raise short-term rates

(potentially to 4.5% or more in 2023).

4

POPLAR FOREST FUNDS

In terms of recession signaling, the danger generally comes when long-term interest rates stop going up alongside short-term rates and the yield curve inverts

(when short-term interest rates become materially higher than long-term rates). One exception to this rule of thumb was in 1998; the yield curve inverted, and although economic conditions worsened dramatically in emerging markets, a U.S. recession

was avoided. The S&P 500 declined 19.3% during a 45 day stretch in 1998, but stock prices quickly recovered and moved higher as the tech bubble continued to inflate in 1999.

Trying to Reason with Hurricane Season

There is no guarantee that restrictive monetary policy will create a recession. And even if it does, it is important to remember that monetary policy works with a lag that has historically averaged

about a year – that means we may be looking at mid-2023 before the threatening winds really pick up. At this point, in our multi-year projections for the businesses in which we are invested, we are assuming that we will have to live through a

Category 1 or 2 storm (a mild recession) sometime in 2023. I hope this will prove to be an overly conservative assumption, but given the clouds we see on the horizon, it seems prudent to be conservative right now.

As long-term owners of businesses, we don’t turn and run just because a storm might come. Storms come and go and, over time, the market has continued to move to new highs. However, this is not a time

for risky investments; we want to make sure that the companies in our portfolio can survive a potential economic hurricane. We focus on the absolute value of businesses (low valuations are like homeowners’ insurance). We avoid speculation (we don’t

build on the sand). We focus on businesses with strong balance sheets and consistent free cash flow (it’s important to be resting on a strong foundation when the wind starts howling). We focus on idiosyncratic opportunities (where we’re not merely

dependent on the weather staying sunny). We have avoided housing and autos (industries where a storm seems most likely to come ashore). We have been holding a bit of extra cash (the equivalent of bottled water and flashlight batteries in case the

power goes out). Our cash reserves are currently around 5% of

5

POPLAR FOREST FUNDS

assets; if we get really concerned that a Category 5 storm is coming, we may take cash to 20-25% of our portfolios if we don’t find great investment opportunities as short-term oriented investors head

for higher ground.

Furthermore, I’ve lived through enough cycles to know that people sometimes panic when they hear a dire weather forecast. We have identified a list of companies we’d like to invest in; if someone wants

to sell us their beautiful beach house at a 50% discount to what we think its worth, we may buy it – especially if we believe the foundation is strong.

The Forecast – Partly Cloudy with a Chance of Thunderstorms

While I’m generally an optimistic person, I came into this year with a defensive mindset. That approach has served us relatively well in this volatile period. Like Bill Murray’s character in the 1980

comedy classic Caddyshack said, about impending rain, while “I don’t think the heavy stuff’s going to come down for a while,” I do think a conservative posture continues to make sense given the Fed’s attitude on battling inflation. One of the longest

standing admonitions in the investment business is: “Don’t fight the Fed.” History suggests that when the Fed is raising interest rates, it is prudent to plan for inclement weather, and that’s just what we’ve done.

Historically, value investing has been particularly helpful in managing bear markets. While this wasn’t the case when the Housing Bubble burst, it definitely was when the Tech Bubble popped. I continue to believe that we are in the midst of an investment cycle that resembles the late 1990s/early 2000s period. If I’m right, value stocks will have several more years of outperformance and our focus on absolute

value may prove particularly rewarding. As someone who invests alongside each of you, I continue to be excited about the long-term prospects of our portfolio of companies with solid balance sheets, ample free cash flow, and robust

idiosyncratic opportunities. While our companies are projected to grow earnings faster than the S&P 500 over the next few years, they are valued at less than 9x estimated 2023 earnings while the S&P 500 is

valued at 15x. Though there are a few clouds on the horizon, our portfolio continues to look like an incredible bargain to me.

We will continue to watch the skies for signs of trouble and believe we have a solid plan for navigating whatever weather comes our way.

J. Dale Harvey

Founder, CIO and Portfolio Manager

6

POPLAR FOREST FUNDS

Partners Fund Portfolio Review

The Partners Fund Institutional Class shares produced a return of -5.43% while Class A shares (no load) produced an -5.68% return for the fiscal year ended September 30, 2022. This compared to a return

of -15.47% for the S&P 500 and -11.36% for the Russell 1000 Value Index.

Relative to the S&P 500, the portfolio’s top contributing sectors to performance over this fiscal period were Healthcare, Energy and Consumer Discretionary. The bottom contributing sectors were

Industrials, Financials and Consumer Staples. Overall, positive performance came from both stock selection and sector allocation.

At the security level, the Fund’s top detractors from overall performance were Ally Financial, MillerKnoll, Citigroup, FedEx and AT&T. Offsetting this was positive contribution from top contributors

Chevron, Murphy Oil, Dollar Tree, CVS Health and National Fuel Gas.

Market Outlook

Economic activity is slowing, but the economy is still growing. The employment picture is very healthy. This strength is driving the Fed to increase interest rates in hopes of cooling things down, but

monetary policy works with a lag. The Fed’s aggressive actions have flattened the yield curve, with inversion in parts of the curve.

An inverted yield curve has historically been an early indicator of economic softness. While many investors talk about the spread between two-year treasuries and their ten-year siblings, as was

previously discussed, we have found that the spread between the Fed Funds rate and the ten-year treasury to be a better indicator of recession risk. This rate spread is included in the Conference Board’s index of Leading Economic Indicators for good

reason, in our opinion.

At present, the spread between the ten-year and Fed Funds has narrowed considerably, but it is still positive. This suggests to us that recession risk is growing, but that a recession is still at least

a few quarters in front of us. That said, for at least the last six months, our earnings and free cash flow forecasts have been based on an assumption that we will have to live through at least a mild 2023 recession. While we hope the Fed can avert a

recession, we think it is prudent to plan conservatively and as such, we are focused on companies that have already “taken their medicine” on weakening demand, pricing, and margins. Conversely, we see risks for companies selling relatively

undifferentiated products whose stock prices embed expectations for continued price gains and margin expansion in 2023-24. Management teams will be developing their 2023 business plans in the next few months and we foresee the potential for high

magnitude margin disappointments if pricing assumptions don’t accurately reflect the risk of deteriorating unit demand trends. Caution may be warranted for companies whose valuations don’t compensate investors for the risk of falling unit demand,

weakening prices, and rising inventory-to-sales ratios.

Portfolio Changes and Positioning

At the start of the Fund’s fiscal year, we were seeing signs that the economy was quite strong. Government stimulus had lifted consumer’s balance sheets. Also, pandemic impacted supply chains were

taking longer to correct which created a supply/demand imbalance. The Fed’s highly accommodative interest rate policy seemed inappropriate

7

POPLAR FOREST FUNDS

and suggested economic risk was building as inflation needed to be tamed. Against this backdrop, we positioned the portfolio to be slightly more defensive than we might otherwise be as cyclical names no

longer offered the same risk/reward tradeoff. In our view, investors didn’t share our concern about a potentially slowing economy. By March 2022, investors’ perception had shifted as it became clear the Fed needed to act aggressively to combat

inflation. Now, most investors are keenly aware of the potential for a recession and the opportunities appear to be more balanced between economically sensitive and defensive businesses. We are focusing on those companies with solid balance sheets,

ample free cash flow, and robust idiosyncratic opportunities where we believe the risk/reward is favorable despite macro trends.

Cornerstone Fund Portfolio Review

The Cornerstone Fund produced a -5.60% return. This compares to a -14.85% return for a 60/40 blend of the S&P 500 and the Bloomberg U.S. Aggregate Bond Index for the fiscal year ended September 30,

2022.

At the security level, the Fund benefitted from top contributing equity investments Chevron, Dollar Tree, Murphy Oil, National Fuel Gas and United Therapeutics. The top detracting equity investments

were MillerKnoll, Ally Financial, Citigroup, FedEx and AT&T.

While the overlap between the equities owned in the Cornerstone and Partners Funds is high, the Cornerstone Fund remains far more defensive with roughly 10% in cash and equivalents and roughly 28% in

fixed income investments. With interest rates returning to more normal levels, we have increased our exposure to fixed income securities year over year and the Fund’s asset allocation is closer to a neutral level. Within the bond portfolio, we

continue to be relatively balanced in our exposure to corporate and treasury and/or agency issues. Our duration remains a bit lower than neutral as we worry that there are still potential rate increases coming.

We remain focused on trying to manage downside risk while also striving to protect our investors’ long-term purchasing power. Our equities currently account for approximately 62% of the Fund which

compares to 73% on September 30, 2021. The draw-down in 2022’s weak stock market environment was less than that of the Partners Fund.

As we look ahead, we believe our portfolio is well positioned to generate solid inflation-adjusted returns. The Fund remains focused on high quality companies that are trading at what we believe are

discounted valuations, while our bond selections continue to emphasize our goal of capital preservation.

Disclosures

Must be preceded or accompanied by a prospectus.

Mutual fund investing involves risk. Principal loss is possible. The Funds may invest in debt securities which typically decrease in value when interest rates rise. This risk is

usually greater for longer-term debt securities. The Funds may invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater in emerging

markets. Investing in small and medium sized companies may involve greater risk than investing in larger, more established companies because small and medium capitalization companies can be subject to greater share price volatility. The Funds may

invest in

8

POPLAR FOREST FUNDS

options, which may be subject to greater fluctuations in value than an investment in the underlying securities. When the Cornerstone Fund invests in other funds and ETFs an investor

will indirectly bear the principal risks and its share of the fees and expenses of the underlying funds. Investments in asset-backed and mortgage-backed securities involve additional risks such as credit risk, prepayment risk, possible illiquidity

and default, and increased susceptibility to adverse economic developments. Diversification does not assure a profit, nor does it protect against a loss in a declining market.

Value stocks typically are less volatile than growth stocks; however, value stocks have a lower expected growth rate in earnings and sales.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice. Fund holdings and sector allocations are subject to change and should not be

considered recommendations to buy or sell any security.

Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security. For a complete list of holdings, please refer to the

schedule of investments in this report.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Poplar Forest Capital LLC is the adviser to the Poplar Forest Funds which are distributed by Quasar Distributors, LLC.

Partners Fund Top Ten Equity Holdings and Percentage Weights as of 9/30/22:

|

Chevron

|

5.02

|

%

|

||

|

AmerisourceBergen

|

4.73

|

|||

|

Allstate

|

4.64

|

|||

|

United Therapeutics

|

4.53

|

|||

|

Wells Fargo

|

4.38

|

|||

|

CVS Health

|

4.36

|

|||

|

National Fuel Gas

|

4.34

|

|||

|

Equitable Holdings

|

4.30

|

|||

|

Dollar Tree

|

4.01

|

|||

|

International Business Machines

|

3.99

|

Cornerstone Fund Top Ten Equity Holdings and Percentage Weights as of 9/30/22:

|

United Therapeutics

|

2.82

|

%

|

||

|

Las Vegas Sands

|

2.51

|

|||

|

Perrigo Co.

|

2.51

|

|||

|

Conagra Brands

|

2.45

|

|||

|

Allstate

|

2.43

|

|||

|

AmerisourceBergen

|

2.41

|

|||

|

Equitable Holdings

|

2.40

|

|||

|

CVS Health

|

2.34

|

|||

|

Curtiss Wright

|

2.34

|

|||

|

International Business Machines

|

2.32

|

The S&P 500® Index: is a market-value weighted index consisting of 500 stocks chosen for market size, liquidity, and

industry group representation. The Index is unmanaged.

9

POPLAR FOREST FUNDS

The Russell 1000® Value index: measures the performance of the Russell 1000’s value segment, which is defined to include

firms whose share prices have lower price/book ratios and lower expected long/term mean earnings growth rates.

The Bloomberg U.S. Aggregate Bond Index: is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries,

government-related and corporate securities, mortgage-backed securities, asset-backed securities and commercial mortgage-backed securities.

Blended index: (also known as a blended benchmark) is a combination of two or more indices in varying percentages. To take a simple example, if an investor’s assets are allocated to 60% stocks and 40%

bonds, the portfolio’s performance might be best measured against a blended benchmark consisting of 60% in a stock index (e.g. S&P 500® index) and 40% in a bond

index (e.g. Bloomberg U.S. Aggregate Bond Index).

The Consumer Price Index (CPI): is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. The annual percentage change in a

CPI is used as a measure of inflation.

It is not possible to invest directly in an index.

Index performance is not indicative of a fund’s performance. Past performance does not guarantee future results. Earnings growth is not a measure of the Fund’s future performance.

Earnings Growth: The annual rate of growth of earnings typically measured as Earnings Per Share Growth.

Free Cash Flow: Is equal to the after-tax net income of a company plus depreciation and amortization less capital expenditures.

Inflation: Is a quantitative measure of the rate at which the average price level of a basket of selected goods and services in an economy increases over a period of time. Often expressed as a

percentage, inflation indicates a decrease in the purchasing power of a nation’s currency.

Price/Earnings (P/E) Ratio: Is a common tool for comparing the prices of different common stocks and is calculated by dividing the earnings per share into the current market price of a stock.

Yield Curve: Is a line that compares the yield of bonds of equal quality but different maturity dates. In general, bonds with longer maturity dates offer higher yields than bonds with shorter maturity

dates, thus producing an upward sloping yield curve.

Bear Market: A period marked with falling stock prices. In a bear market, investor confidence is extremely low. Many investors opt to sell off their stocks during a bear market for fear of further

losses.

Dividend Yield: Represents the trailing 12-month dividend yield aggregating all income distributions per share over the past year, divided by the period ending fund or stock share price. It does not

reflect capital gains distributions.

Earnings Per Share (EPS): is the net income of a company divided by the total number of shares it has outstanding.

10

POPLAR FOREST FUNDS

Index Fund: Is a type of mutual fund with a portfolio constructed to match or track the components of a market index, such as the Standard & Poor’s 500 Index (S&P 500).

Passive investing: Is an investment strategy to maximize returns by minimizing buying and selling. Index investing in one common passive investing strategy whereby investors purchase a representative

benchmark, such as the S&P 500 Index, and hold it over a long-time horizon.

11

POPLAR FOREST PARTNERS FUND

SECTOR ALLOCATION OF PORTFOLIO ASSETS at September 30, 2022 (Unaudited)

Percentages represent market value as a percentage of total investments.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and

Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

12

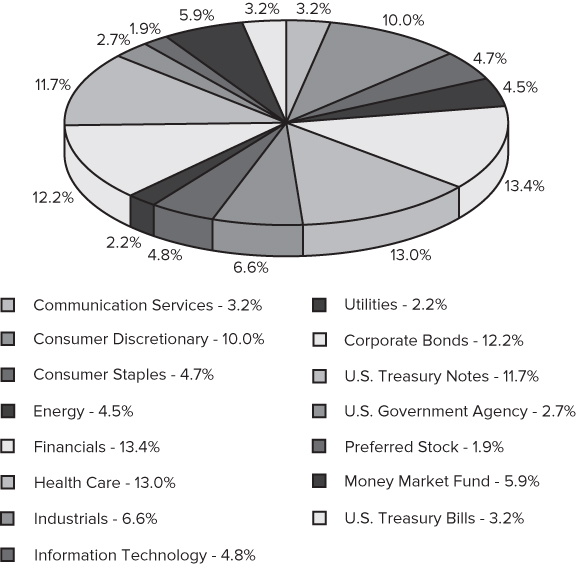

POPLAR FOREST CORNERSTONE FUND

SECTOR ALLOCATION OF PORTFOLIO ASSETS at September 30, 2022 (Unaudited)

Percentages represent market value as a percentage of total investments.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and

Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

13

POPLAR FOREST FUNDS

EXPENSE EXAMPLE at September 30, 2022 (Unaudited)

As a shareholder of a mutual fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, redemption fees, and exchange fees, and (2) ongoing costs,

including management fees, distribution and/or service fees, and other fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of

investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (4/1/22 – 9/30/22).

Actual Expenses

For each class of each Fund, two lines are presented in the tables below, with the first line providing information about actual account values and actual expenses. You will be assessed fees for

outgoing wire transfers, returned checks, and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. The Example below includes, but is not limited to, management fees, 12b-1 fees, fund

accounting, custody and transfer agent fees. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account

value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class of each Fund, the second line provides information about hypothetical account values and hypothetical expenses based on the respective Fund’s actual expense ratio and an assumed rate of

return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this

information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the

expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the tables for each class of each

Fund is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

14

POPLAR FOREST FUNDS

EXPENSE EXAMPLE at September 30, 2022 (Unaudited), Continued

|

Beginning

|

Ending

|

Expenses Paid

|

Annualized

|

|

|

Account Value

|

Account Value

|

During Period

|

Expense

|

|

|

4/1/22

|

9/30/22

|

4/1/22 – 9/30/22

|

Ratio*

|

|

|

Poplar Forest Partners Fund

|

||||

|

Class A Shares

|

||||

|

Actual

|

$1,000.00

|

$ 848.60

|

$5.56

|

1.20%

|

|

Hypothetical (5% return

|

||||

|

before expenses)

|

$1,000.00

|

$1,019.05

|

$6.07

|

1.20%

|

|

Institutional Class Shares

|

||||

|

Actual

|

$1,000.00

|

$ 849.90

|

$4.41

|

0.95%

|

|

Hypothetical (5% return

|

||||

|

before expenses)

|

$1,000.00

|

$1,020.31

|

$4.81

|

0.95%

|

|

Beginning

|

Ending

|

Expenses Paid

|

Annualized

|

|

|

Account Value

|

Account Value

|

During Period

|

Expense

|

|

|

4/1/22

|

9/30/22

|

4/1/22 – 9/30/22

|

Ratio*

|

|

|

Poplar Forest Cornerstone Fund

|

||||

|

Investor Class Shares

|

||||

|

Actual

|

$1,000.00

|

$ 876.10

|

$4.23

|

0.90%

|

|

Hypothetical (5% return

|

||||

|

before expenses)

|

$1,000.00

|

$1,020.56

|

$4.56

|

0.90%

|

|

*

|

Expenses are equal to the annualized expense ratio of each class, multiplied by the average account value over the period, multiplied by 183 (days in most recent fiscal half-year) / 365 days to

reflect the one-half year expense.

|

15

POPLAR FOREST PARTNERS FUND

Comparison of the change in value of a $100,000 investment in the

Poplar Forest Partners Fund – Institutional Class Shares vs

the S&P 500® Index and the Russell 1000®

Value Index

|

Average Annual Total Return:

|

1 Year

|

5 Year

|

10 Year

|

|

Poplar Forest Partners Fund –

|

|||

|

Institutional Class Shares

|

-5.43%

|

4.91%

|

9.85%

|

|

Poplar Forest Partners Fund –

|

|||

|

Class A Shares (with sales load)

|

-10.40%

|

3.58%

|

9.02%

|

|

Poplar Forest Partners Fund –

|

|||

|

Class A Shares (without sales load)

|

-5.68%

|

4.65%

|

9.58%

|

|

S&P 500® Index

|

-15.47%

|

9.24%

|

11.70%

|

|

Russell 1000® Value Index

|

-11.36%

|

5.29%

|

9.17%

|

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s

shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling

1-877-522-8860.

Returns reflect the reinvestment of dividends and capital gain distributions. Fee waivers are in effect. In the absence of fee waivers, returns would be reduced. Class A shares may be subject to a

5.00% front-end sales load. The performance data and graph do not reflect the deduction of taxes that a shareholder may pay on dividends, capital gain distributions, or redemption of Fund shares. This chart does not imply any future performance.

Indices do not incur expenses and are not available for investment.

The S&P 500® Index is a market-value weighted index consisting of 500 stocks chosen for market size, liquidity, and

industry group representation.

The Russell 1000® Value Index is a measure of the performance of the Russell 1000’s value segment, which is defined to

include firms whose share prices have lower price/book ratios and lower expected long/term mean earnings growth rates.

16

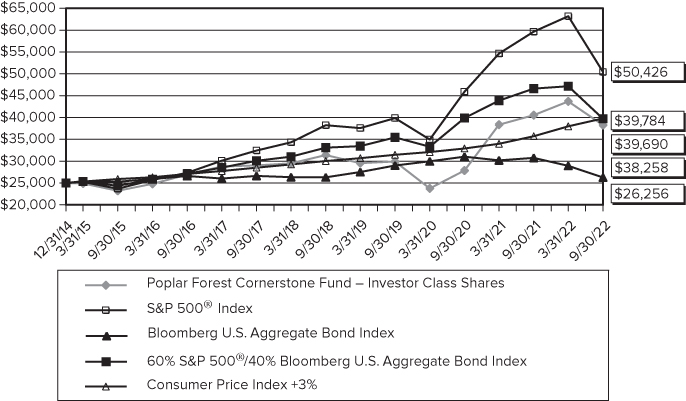

POPLAR FOREST CORNERSTONE FUND

Comparison of the change in value of $25,000 investment in the

Poplar Forest Cornerstone Fund – Investor Class Shares vs.

the S&P 500® Index, the Bloomberg U.S. Aggregate Bond Index,

the Blended Index and the Consumer Price Index +3%

|

Since

|

|||

|

Average Annual Total Return:

|

1 Year

|

5 Year

|

Inception1

|

|

Poplar Forest Cornerstone Fund –

|

|||

|

Investor Class Shares

|

-5.60%

|

5.68%

|

5.65%

|

|

S&P 500® Index

|

-15.47%

|

9.24%

|

9.48%

|

|

Bloomberg U.S. Aggregate Bond Index

|

-14.60%

|

-0.27%

|

0.63%

|

|

60% S&P 500®/ 40% U.S. Aggregate Bond Index

|

-14.85%

|

5.70%

|

6.15%

|

|

Consumer Price Index +3%

|

11.43%

|

6.86%

|

6.15%

|

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so

that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained

by calling 1-877-522-8860.

Returns reflect the reinvestment of dividends and capital gain distributions. Fee waivers are in effect. In the absence of fee waivers, returns would be reduced. The performance data and graph do not

reflect the deduction of taxes that a shareholder may pay on dividends, capital gain distributions, or redemption of Fund shares. This chart does not imply any future performance. Indices do not incur expenses and are not available for investment.

The S&P 500® Index is a market-value weighted index consisting of 500 stocks chosen for market size, liquidity, and

industry group representation.

17

POPLAR FOREST CORNERSTONE FUND

The Bloomberg U.S. Aggregate Bond Index is a broad based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable market, including Treasuries, government related and

corporate securities.

The blended index is a 60% S&P 500® Index and 40% Bloomberg U.S. Aggregate Bond Index blend.

Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. The annual percentage change in a CPI

is used as a measure of inflation. The CPI +3% is a measure defined as an objective in the Fund’s prospectus.

|

1

|

The Fund commenced operations on December 31, 2014.

|

18

POPLAR FOREST PARTNERS FUND

SCHEDULE OF INVESTMENTS at September 30, 2022

|

Shares

|

COMMON STOCKS – 95.1%

|

Value

|

|||||

|

Aerospace & Defense – 2.5%

|

|||||||

|

53,500

|

Curtiss-Wright Corp.

|

$

|

7,445,060

|

||||

|

Air Freight & Logistics – 2.5%

|

|||||||

|

50,700

|

FedEx Corp.

|

7,527,429

|

|||||

|

Banks – 7.3%

|

|||||||

|

211,000

|

Citigroup, Inc.

|

8,792,370

|

|||||

|

327,000

|

Wells Fargo & Co.

|

13,151,940

|

|||||

|

21,944,310

|

|||||||

|

Biotechnology – 4.5%

|

|||||||

|

65,000

|

United Therapeutics Corp. (b)

|

13,609,700

|

|||||

|

Commercial Services & Supplies – 1.1%

|

|||||||

|

217,000

|

MillerKnoll, Inc.

|

3,385,200

|

|||||

|

Consumer Finance – 2.7%

|

|||||||

|

296,000

|

Ally Financial, Inc.

|

8,237,680

|

|||||

|

Diversified Financial Services – 4.3%

|

|||||||

|

490,000

|

Equitable Holdings, Inc.

|

12,911,500

|

|||||

|

Diversified Telecommunication Services – 3.9%

|

|||||||

|

763,000

|

AT&T, Inc.

|

11,704,420

|

|||||

|

Entertainment – 1.0%

|

|||||||

|

249,000

|

Warner Bros. Discovery, Inc. (b)

|

2,863,500

|

|||||

|

Food Products – 3.1%

|

|||||||

|

284,000

|

Conagra Brands, Inc.

|

9,266,920

|

|||||

|

Gas Utilities – 4.4%

|

|||||||

|

212,000

|

National Fuel Gas Co.

|

13,048,600

|

|||||

|

Health Care Providers & Services – 9.1%

|

|||||||

|

105,000

|

AmerisourceBergen Corp.

|

14,209,650

|

|||||

|

137,500

|

CVS Health Corp.

|

13,113,375

|

|||||

|

27,323,025

|

|||||||

|

Hotels, Restaurants & Leisure – 3.2%

|

|||||||

|

257,000

|

Las Vegas Sands Corp. (b)

|

9,642,640

|

|||||

|

Household Durables – 1.7%

|

|||||||

|

360,000

|

Newell Brands, Inc.

|

5,000,400

|

|||||

|

Insurance – 8.6%

|

|||||||

|

112,000

|

Allstate Corp.

|

13,947,360

|

|||||

|

250,500

|

American International Group, Inc.

|

11,893,740

|

|||||

|

25,841,100

|

|||||||

|

IT Services – 6.2%

|

|||||||

|

264,000

|

DXC Technology Co. (b)

|

6,462,720

|

|||||

|

100,800

|

International Business Machines Corp.

|

11,976,048

|

|||||

|

18,438,768

|

|||||||

The accompanying notes are an integral part of these financial statements.

19

POPLAR FOREST PARTNERS FUND

SCHEDULE OF INVESTMENTS at September 30, 2022, Continued

|

Shares

|

Value

|

||||||

|

Machinery – 1.7%

|

|||||||

|

468,000

|

CNH Industrial NV (a)

|

$

|

5,227,560

|

||||

|

Multi-line Retail – 4.0%

|

|||||||

|

88,500

|

Dollar Tree, Inc. (b)

|

12,044,850

|

|||||

|

Oil, Gas & Consumable Fuels – 8.1%

|

|||||||

|

105,000

|

Chevron Corp.

|

15,085,350

|

|||||

|

260,000

|

Murphy Oil Corp.

|

9,144,200

|

|||||

|

24,229,550

|

|||||||

|

Pharmaceuticals – 7.2%

|

|||||||

|

135,000

|

Merck & Co., Inc.

|

11,626,200

|

|||||

|

276,000

|

Perrigo Co. PLC (a)

|

9,842,160

|

|||||

|

21,468,360

|

|||||||

|

Specialty Retail – 3.0%

|

|||||||

|

57,500

|

Advance Auto Parts, Inc.

|

8,989,550

|

|||||

|

Textiles, Apparel & Luxury Goods – 2.3%

|

|||||||

|

240,000

|

Tapestry, Inc.

|

6,823,200

|

|||||

|

Tobacco – 2.7%

|

|||||||

|

99,000

|

Philip Morris International, Inc.

|

8,217,990

|

|||||

|

TOTAL COMMON STOCKS

|

|||||||

|

(Cost $245,092,997)

|

285,191,312

|

||||||

|

MONEY MARKET FUND – 4.9%

|

|||||||

|

14,644,960

|

Morgan Stanley Institutional Liquidity Funds –

|

||||||

|

Treasury Portfolio – Institutional Class, 2.768% (c)

|

14,644,960

|

||||||

|

TOTAL MONEY MARKET FUND

|

|||||||

|

(Cost $14,644,960)

|

14,644,960

|

||||||

|

Total Investments in Securities

|

|||||||

|

(Cost $259,737,957) – 100.0%

|

299,836,272

|

||||||

|

Other Assets in Excess of Liabilities – 0.0%

|

16,351

|

||||||

|

NET ASSETS – 100.0%

|

$

|

299,852,623

|

|||||

|

(a)

|

U.S. traded security of a foreign issuer.

|

|

(b)

|

Non-income producing security.

|

|

(c)

|

Rate shown is the 7-day annualized yield at September 30, 2022.

|

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and

Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

20

POPLAR FOREST CORNERSTONE FUND

SCHEDULE OF INVESTMENTS at September 30, 2022

|

Shares

|

COMMON STOCKS – 65.6%

|

Value

|

|||||

|

Aerospace & Defense – 2.5%

|

|||||||

|

5,000

|

Curtiss-Wright Corp.

|

$

|

695,800

|

||||

|

Air Freight & Logistics – 1.8%

|

|||||||

|

3,350

|

FedEx Corp.

|

497,375

|

|||||

|

Banks – 4.4%

|

|||||||

|

16,300

|

Citigroup, Inc.

|

679,221

|

|||||

|

14,200

|

Wells Fargo & Co.

|

571,124

|

|||||

|

1,250,345

|

|||||||

|

Biotechnology – 3.0%

|

|||||||

|

4,000

|

United Therapeutics Corp. (a)

|

837,520

|

|||||

|

Commercial Services & Supplies – 1.1%

|

|||||||

|

20,100

|

MillerKnoll, Inc.

|

313,560

|

|||||

|

Consumer Finance – 1.8%

|

|||||||

|

18,000

|

Ally Financial, Inc.

|

500,940

|

|||||

|

Diversified Financial Services – 3.2%

|

|||||||

|

4,021

|

Apollo Global Management, Inc.

|

186,976

|

|||||

|

27,100

|

Equitable Holdings, Inc.

|

714,085

|

|||||

|

901,061

|

|||||||

|

Diversified Telecommunication Services – 2.4%

|

|||||||

|

44,100

|

AT&T, Inc.

|

676,494

|

|||||

|

Entertainment – 1.0%

|

|||||||

|

24,000

|

Warner Bros. Discovery, Inc. (a)

|

276,000

|

|||||

|

Food Products – 2.6%

|

|||||||

|

22,300

|

Conagra Brands, Inc.

|

727,649

|

|||||

|

Gas Utilities – 2.3%

|

|||||||

|

10,700

|

National Fuel Gas Co.

|

658,585

|

|||||

|

Health Care Providers & Services – 6.0%

|

|||||||

|

5,300

|

AmerisourceBergen Corp.

|

717,249

|

|||||

|

7,300

|

CVS Health Corp.

|

696,201

|

|||||

|

600

|

Elevance Health, Inc.

|

272,544

|

|||||

|

1,685,994

|

|||||||

|

Hotels, Restaurants & Leisure – 2.7%

|

|||||||

|

19,900

|

Las Vegas Sands Corp. (a)

|

746,648

|

|||||

|

Household Durables – 1.4%

|

|||||||

|

29,000

|

Newell Brands, Inc.

|

402,810

|

|||||

|

Insurance – 4.7%

|

|||||||

|

5,800

|

Allstate Corp.

|

722,274

|

|||||

|

12,400

|

American International Group, Inc.

|

588,752

|

|||||

|

1,311,026

|

|||||||

The accompanying notes are an integral part of these financial statements.

21

POPLAR FOREST CORNERSTONE FUND

SCHEDULE OF INVESTMENTS at September 30, 2022, Continued

|

Shares

|

Value

|

||||||

|

IT Services – 4.1%

|

|||||||

|

19,500

|

DXC Technology Co. (a)

|

$

|

477,360

|

||||

|

5,800

|

International Business Machines Corp.

|

689,098

|

|||||

|

1,166,458

|

|||||||

|

Machinery – 1.6%

|

|||||||

|

39,600

|

CNH Industrial NV (c)

|

442,332

|

|||||

|

Multi-line Retail – 2.4%

|

|||||||

|

4,900

|

Dollar Tree, Inc. (a)

|

666,890

|

|||||

|

Oil, Gas & Consumable Fuels – 4.7%

|

|||||||

|

4,600

|

Chevron Corp.

|

660,882

|

|||||

|

18,900

|

Murphy Oil Corp.

|

664,713

|

|||||

|

1,325,595

|

|||||||

|

Pharmaceuticals – 4.7%

|

|||||||

|

6,600

|

Merck & Co., Inc.

|

568,392

|

|||||

|

20,900

|

Perrigo Co. PLC (c)

|

745,294

|

|||||

|

1,313,686

|

|||||||

|

Software – 0.9%

|

|||||||

|

2,500

|

VMware, Inc.

|

266,150

|

|||||

|

Specialty Retail – 1.8%

|

|||||||

|

3,200

|

Advance Auto Parts, Inc.

|

500,288

|

|||||

|

Textiles, Apparel & Luxury Goods – 2.2%

|

|||||||

|

22,300

|

Tapestry, Inc.

|

633,989

|

|||||

|

Tobacco – 2.3%

|

|||||||

|

7,800

|

Philip Morris International, Inc.

|

647,478

|

|||||

|

TOTAL COMMON STOCKS

|

|||||||

|

(Cost $16,680,218)

|

18,444,673

|

||||||

|

Principal

|

|||||||

|

Amount

|

CORPORATE BONDS – 12.8%

|

||||||

|

Banks – 2.4%

|

|||||||

|

Citizens Financial Group, Inc.

|

|||||||

|

$

|

700,000

|

3.750%, 7/1/24

|

676,473

|

||||

|

Food Products – 2.5%

|

|||||||

|

McCormick & Company, Inc.

|

|||||||

|

715,000

|

3.500%, 9/1/23

|

705,990

|

|||||

|

Gas Utilities – 2.5%

|

|||||||

|

National Fuel Gas Co.

|

|||||||

|

800,000

|

3.950%, 9/15/27

|

711,035

|

|||||

|

Professional Services – 2.7%

|

|||||||

|

Equifax, Inc.

|

|||||||

|

750,000

|

3.300%, 12/15/22

|

749,728

|

|||||

The accompanying notes are an integral part of these financial statements.

22

POPLAR FOREST CORNERSTONE FUND

SCHEDULE OF INVESTMENTS at September 30, 2022, Continued

|

Principal

|

|||||||

|

Amount

|

Value

|

||||||

|

Specialty Retail – 2.7%

|

|||||||

|

Dick’s Sporting Goods, Inc.

|

|||||||

|

$

|

1,000,000

|

3.150%, 1/15/32

|

$

|

762,733

|

|||

|

TOTAL CORPORATE BONDS

|

|||||||

|

(Cost $3,731,614)

|

3,605,959

|

||||||

|

U.S. TREASURY NOTES – 12.3%

|

|||||||

|

U.S. Treasury Floating Rate Note

|

|||||||

|

650,000

|

3.346%, (USBMMY3M + 0.049%), 1/31/23 (d)

|

650,644

|

|||||

|

U.S. Treasury Note TIPS

|

|||||||

|

873,432

|

0.125%, 7/15/24

|

843,795

|

|||||

|

868,695

|

0.250%, 7/15/29

|

783,264

|

|||||

|

U.S. Treasury Notes

|

|||||||

|

310,000

|

0.500%, 11/30/23

|

296,807

|

|||||

|

145,000

|

0.750%, 12/31/23

|

138,860

|

|||||

|

165,000

|

0.875%, 1/31/24

|

157,688

|

|||||

|

165,000

|

1.500%, 2/29/24

|

158,735

|

|||||

|

145,000

|

2.250%, 3/31/24

|

140,707

|

|||||

|

300,000

|

2.625%, 4/15/25

|

288,222

|

|||||

|

TOTAL U.S. TREASURY NOTES

|

|||||||

|

(Cost $3,622,420)

|

3,458,722

|

||||||

|

U.S. GOVERNMENT AGENCY – 2.9%

|

|||||||

|

Federal Home Loan Banks

|

|||||||

|

800,000

|

4.000%, 9/30/27

|

800,918

|

|||||

|

TOTAL U.S. GOVERNMENT AGENCY

|

|||||||

|

(Cost $800,000)

|

800,918

|

||||||

|

PREFERRED STOCK – 2.0%

|

|||||||

|

Consumer Finance – 2.0%

|

|||||||

|

700,000

|

Ally Financial, Inc. – Series B, 4.70%

|

548,121

|

|||||

|

TOTAL PREFERRED STOCK

|

|||||||

|

(Cost $713,347)

|

548,121

|

||||||

|

SHORT-TERM INVESTMENTS – 9.6%

|

|||||||

|

Money Market Fund – 6.2%

|

|||||||

|

1,745,760

|

Morgan Stanley Institutional Liquidity Funds –

|

||||||

|

Treasury Portfolio – Institutional Class, 2.768% (b)

|

1,745,760

|

||||||

The accompanying notes are an integral part of these financial statements.

23

POPLAR FOREST CORNERSTONE FUND

SCHEDULE OF INVESTMENTS at September 30, 2022, Continued

|

Principal

|

|||||||

|

Amount

|

Value

|

||||||

|

U.S. Treasury Bills – 3.4%

|

|||||||

|

$

|

175,000

|

0.090%, 10/6/22 (e)

|

$

|

174,966

|

|||

|

175,000

|

0.160%, 11/3/22 (e)

|

174,600

|

|||||

|

155,000

|

0.240%, 12/1/22% (e)

|

154,267

|

|||||

|

145,000

|

0.39%, 12/29/22 (e)

|

143,880

|

|||||

|

165,000

|

1.145%, 2/23/23 (e)

|

162,693

|

|||||

|

145,000

|

1.590%, 3/23/23 (e)

|

142,481

|

|||||

|

952,887

|

|||||||

|

TOTAL SHORT-TERM INVESTMENTS

|

|||||||

|

(Cost $2,703,660)

|

2,698,647

|

||||||

|

Total Investments in Securities

|

|||||||

|

(Cost $28,251,259) – 105.2%

|

29,557,040

|

||||||

|

Liabilities in Excess of Other Assets – (5.2)%

|

(1,450,512

|

)

|

|||||

|

NET ASSETS – 100.0%

|

$

|

28,106,528

|

|||||

TIPS – Treasury Inflation Protected Securities

USBMMY3M – U.S. Treasury 3 Month Bill Money Market Fund

|

(a)

|

Non-income producing security.

|

|

(b)

|

Rate shown is the 7-day annualized yield at September 30, 2022.

|

|

(c)

|

U.S. traded security of a foreign issuer.

|

|

(d)

|

Variable or floating rate security based on a reference index and spread. The rate reported is the rate in effect as of September 30, 2022.

|

|

(e)

|

Rate shown is the discount rate at September 30, 2022.

|

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and

Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

24

(This Page Intentionally Left Blank.)

25

POPLAR FOREST FUNDS

STATEMENTS OF ASSETS AND LIABILITIES at September 30, 2022

|

Poplar Forest

|

Poplar Forest

|

|||||||

|

Partners Fund

|

Cornerstone Fund

|

|||||||

|

ASSETS

|

||||||||

|

Investments in securities, at value (identified cost

|

||||||||

|

$259,737,957 and $28,251,259, respectively)

|

$

|

299,836,272

|

$

|

29,557,040

|

||||

|

Receivables

|

||||||||

|

Fund shares issued

|

71,713

|

54,000

|

||||||

|

Dividends and interest

|

550,615

|

74,723

|

||||||

|

Prepaid expenses

|

25,213

|

2,826

|

||||||

|

Total assets

|

300,483,813

|

29,688,589

|

||||||

|

LIABILITIES

|

||||||||

|

Payables

|

||||||||

|

Investments purchased

|

—

|

1,519,316

|

||||||

|

Fund shares redeemed

|

285,753

|

8,812

|

||||||

|

Due to Adviser

|

195,346

|

6,028

|

||||||

|

12b-1 fees

|

22,497

|

—

|

||||||

|

Custody fees

|

6,871

|

1,394

|

||||||

|

Administration and fund accounting fees

|

50,326

|

16,461

|

||||||

|

Transfer agent fees and expenses

|

34,585

|

3,675

|

||||||

|

Audit fees

|

22,500

|

20,997

|

||||||

|

Chief Compliance Officer fee

|

2,083

|

2,082

|

||||||

|

Trustee fees and expenses

|

401

|

629

|

||||||

|

Accrued expenses

|

10,828

|

2,667

|

||||||

|

Total liabilities

|

631,190

|

1,582,061

|

||||||

|

NET ASSETS

|

$

|

299,852,623

|

$

|

28,106,528

|

||||

The accompanying notes are an integral part of these financial statements.

26

POPLAR FOREST FUNDS

STATEMENTS OF ASSETS AND LIABILITIES at September 30, 2022, Continued

|

Poplar Forest

|

Poplar Forest

|

|||||||

|

Partners Fund

|

Cornerstone Fund

|

|||||||

|

CALCULATION OF NET ASSET VALUE PER SHARE

|

||||||||

|

Class A Shares

|

||||||||

|

Net assets applicable to shares outstanding

|

$

|

23,387,444

|

$

|

—

|

||||

|

Shares issued and outstanding [unlimited number

|

||||||||

|

of shares (par value $0.01) authorized]

|

507,599

|

—

|

||||||

|

Net asset value and redemption price per share

|

$

|

46.07

|

$

|

—

|

||||

|

Maximum offering price per share (Net asset value

|

||||||||

|

per share divided by 95.00%)

|

$

|

48.49

|

$

|

—

|

||||

|

Investor Class Shares

|

||||||||

|

Net assets applicable to shares outstanding

|

$

|

—

|

$

|

28,106,528

|

||||

|

Shares issued and outstanding [unlimited number

|

||||||||

|

of shares (par value $0.01) authorized]

|

—

|

1,037,914

|

||||||

|

Net asset value, offering and redemption price per share

|

$

|

—

|

$

|

27.08

|

||||

|

Institutional Class Shares

|

||||||||

|

Net assets applicable to shares outstanding

|

$

|

276,465,179

|

$

|

—

|

||||

|

Shares issued and outstanding [unlimited number

|

||||||||

|

of shares (par value $0.01) authorized]

|

5,989,920

|

—

|

||||||

|

Net asset value, offering and redemption price per share

|

$

|

46.16

|

$

|

—

|

||||

|

COMPONENTS OF NET ASSETS

|

||||||||

|

Paid-in capital

|

$

|

240,063,644

|

$

|

24,269,379

|

||||

|

Total distributable earnings

|

59,788,979

|

3,837,149

|

||||||

|

Net assets

|

$

|

299,852,623

|

$

|

28,106,528

|

||||

The accompanying notes are an integral part of these financial statements.

27

POPLAR FOREST FUNDS

STATEMENTS OF OPERATIONS For the Year Ended September 30, 2022

|

Poplar Forest

|

Poplar Forest

|

|||||||

|

Partners Fund

|

Cornerstone Fund

|

|||||||

|

INVESTMENT INCOME

|

||||||||

|

Income

|

||||||||

|

Dividends

|

$

|

8,350,397

|

$

|

549,156

|

||||

|

Interest

|

72,407

|

281,638

|

||||||

|

Total Income

|

8,422,804

|

830,794

|

||||||

|

Expenses

|

||||||||

|

Advisory fees (Note 4)

|

2,800,746

|

249,837

|

||||||

|

Administration and fund accounting fees (Note 4)

|

297,977

|

97,742

|

||||||

|

Transfer agent fees and expenses (Note 4)

|

137,053

|

19,079

|

||||||

|

Sub-transfer agent fees (Note 4)

|

81,075

|

856

|

||||||

|

12b-1 fees – Class A shares (Note 5)

|

68,333

|

—

|

||||||

|

Registration fees

|

37,622

|

8,301

|

||||||

|

Custody fees (Note 4)

|

38,716

|

6,501

|

||||||

|

Audit fees

|

22,500

|

19,997

|

||||||

|

Printing and mailing expense

|

17,357

|

5,256

|

||||||

|

Trustees fees and expenses

|

13,843

|

14,070

|

||||||

|

Chief Compliance Officer fee (Note 4)

|

12,500

|

12,499

|

||||||

|

Legal fees

|

6,592

|

6,755

|

||||||

|

Insurance expense

|

6,181

|

2,569

|

||||||

|

Miscellaneous

|

26,762

|

6,387

|

||||||

|

Total expenses

|

3,567,257

|

449,849

|

||||||

|

Less: Advisory fees waived (Note 4)

|

(295,589

|

)

|

(168,783

|

)

|

||||

|

Net expenses

|

3,271,668

|

281,066

|

||||||

|

Net investment income

|

5,151,136

|

549,728

|

||||||

|

REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS

|

||||||||

|

Net realized gain from investments

|

21,976,629

|

2,183,894

|

||||||

|

Net change in unrealized appreciation on investments

|

(45,477,946

|

)

|

(4,474,030

|

)

|

||||

|

Net realized and unrealized loss on investments

|

(23,501,317

|

)

|

(2,290,136

|

)

|

||||

|

Net Decrease in Net Assets Resulting from Operations

|

$

|

(18,350,181

|

)

|

$

|

(1,740,408

|

)

|

||

The accompanying notes are an integral part of these financial statements.

28

POPLAR FOREST PARTNERS FUND

STATEMENTS OF CHANGES IN NET ASSETS

|

Year Ended

|

Year Ended

|

|||||||

|

September 30, 2022

|

September 30, 2021

|

|||||||

|

NET INCREASE/(DECREASE) IN NET ASSETS FROM:

|

||||||||

|

OPERATIONS

|

||||||||

|

Net investment income

|

$

|

5,151,136

|

$

|

4,885,897

|

||||

|

Net realized gain from investments

|

21,976,629

|

39,388,544

|

||||||

|

Net change in unrealized appreciation/

|

||||||||

|

(depreciation) on investments

|

(45,477,946

|

)

|

78,809,934

|

|||||

|

Net increase/(decrease) in net assets

|

||||||||

|

resulting from operations

|

(18,350,181

|

)

|

123,084,375

|

|||||

|

DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS

|

||||||||

|

Net dividends and distributions to shareholders —

|

||||||||

|

Class A Shares

|

(3,177,349

|

)

|

(415,085

|

)

|

||||

|

Net dividends and distributions to shareholders —

|

||||||||

|

Institutional Class Shares

|

(38,843,292

|

)

|

(5,476,997

|

)

|

||||

|

Total dividends and distributions to shareholders

|

(42,020,641

|

)

|

(5,892,082

|

)

|

||||

|

CAPITAL SHARE TRANSACTIONS

|

||||||||

|

Net increase/(decrease) in net assets derived

|

||||||||

|

from net change in outstanding shares (a)

|

46,622,960

|

(13,007,866

|

)

|

|||||

|

Total increase/(decrease) in net assets

|

(13,747,862

|

)

|

104,184,427

|

|||||

|

NET ASSETS

|

||||||||

|

Beginning of year

|

313,600,485

|

209,416,058

|

||||||

|

End of year

|

$

|

299,852,623

|

$

|

313,600,485

|

||||

|

(a)

|

A summary of share transactions is as follows:

|

|

Year Ended

|

Year Ended

|

||||||||||||||||

|

September 30, 2022

|

September 30, 2021

|

||||||||||||||||

|

Class A Shares

|

Shares

|

Paid-in Capital

|

Shares

|

Paid-in Capital

|

|||||||||||||

|

Shares sold

|

123,157

|

$

|

6,537,843

|

25,420

|

$

|

1,304,406

|

|||||||||||

|

Shares issued on

|

|||||||||||||||||

|

reinvestments of distributions

|

53,592

|

2,723,003

|

8,381

|

359,307

|

|||||||||||||

|

Shares redeemed

|

(99,674

|

)

|

(5,070,147

|

)

|

(75,059

|

)

|

(3,502,736

|

)

|

|||||||||

|

Net increase/(decrease)

|

77,075

|

$

|

4,190,699

|

(41,258

|

)

|

$

|

(1,839,023

|

)

|

|||||||||

|

Year Ended

|

Year Ended

|

||||||||||||||||

|

September 30, 2022

|

September 30, 2021

|

||||||||||||||||

|

Institutional Class Shares

|

Shares

|

Paid-in Capital

|

Shares

|

Paid-in Capital

|

|||||||||||||

|

Shares sold

|

1,418,632

|

$

|

75,102,907

|

761,086

|

$

|

38,036,211

|

|||||||||||

|

Shares issued on

|

|||||||||||||||||

|

reinvestments of distributions

|

561,705

|

28,529,000

|

95,132

|

4,077,349

|

|||||||||||||

|

Shares redeemed

|

(1,153,787

|

)

|

(61,199,646

|

)

|

(1,080,237

|

)

|

(53,282,403

|

)

|

|||||||||

|

Net increase/(decrease)

|

826,550

|

$

|

42,432,261

|

(224,019

|

)

|

$

|

(11,168,843

|

)

|

|||||||||

The accompanying notes are an integral part of these financial statements.

29

POPLAR FOREST CORNERSTONE FUND

STATEMENTS OF CHANGES IN NET ASSETS

|

Year Ended

|

Year Ended

|

|||||||

|

September 30, 2022

|

September 30, 2021

|

|||||||

|

NET INCREASE/(DECREASE) IN NET ASSETS FROM:

|

||||||||

|

OPERATIONS

|

||||||||

|

Net investment income

|

$

|

549,728

|

$

|

548,438

|

||||

|

Net realized gain from investments

|

2,183,894

|

2,924,392

|

||||||

|

Net change in unrealized appreciation/

|

||||||||

|

(depreciation) on investments

|

(4,474,030

|

)

|

5,994,523

|

|||||

|

Net increase/(decrease) in net assets

|

||||||||

|

resulting from operations

|

(1,740,408

|

)

|

9,467,353

|

|||||

|

DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS

|

||||||||

|

Net dividends and distributions to shareholders —

|

||||||||

|

Investor Class Shares

|

(3,563,788

|

)

|

(472,669

|

)

|

||||

|

Total dividends and distributions to shareholders

|

(3,563,788

|

)

|

(472,669

|

)

|

||||

|

CAPITAL SHARE TRANSACTIONS

|

||||||||

|

Net increase/(decrease) in net assets derived

|

||||||||

|

from net change in outstanding shares (a)

|

3,967,318

|

(2,174,853

|

)

|

|||||

|

Total increase/(decrease) in net assets

|

(1,336,878

|

)

|

6,819,831

|

|||||

|

NET ASSETS

|

||||||||