Form N-CSR ADVISORS SERIES TRUST For: Sep 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07959

Advisors Series Trust

(Exact name of registrant as specified in charter)

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

(Address of principal executive offices) (Zip code)

Jeffrey T. Rauman, President/Chief Executive Officer

Advisors Series Trust

c/o U.S. Bancorp Fund Services, LLC

777 East Wisconsin Avenue, 5th Floor

Milwaukee, WI 53202

(Name and address of agent for service)

(Name and address of agent for service)

(626) 914-7363

Registrant's telephone number, including area code

Date of fiscal year end: September 30, 2021

Date of reporting period: September 30, 2021

Item 1. Reports to Stockholders.

(a) [Insert full text of semi-annual or annual report here]

Scharf Fund

Institutional Class – LOGIX

Retail Class – LOGRX

Scharf Multi-Asset Opportunity Fund

Institutional Class – LOGOX

Retail Class – LOGBX

Scharf Global Opportunity Fund

Retail Class – WRLDX

Scharf Alpha Opportunity Fund

Retail Class – HEDJX

ANNUAL REPORT

September 30, 2021

Scharf Investments, LLC

(This Page Intentionally Left Blank.)

SCHARF FUNDS

TABLE OF CONTENTS

|

Letter from the President

|

2

|

|

To Our Shareholders

|

6

|

|

Investment Highlights

|

9

|

|

Expense Examples

|

15

|

|

Sector Allocation of Portfolio Assets

|

17

|

|

Schedules of Investments

|

21

|

|

Statements of Assets and Liabilities

|

38

|

|

Statements of Operations

|

40

|

|

Statements of Changes in Net Assets

|

42

|

|

Statement of Cash Flows

|

48

|

|

Financial Highlights

|

49

|

|

Notes to Financial Statements

|

55

|

|

Report of Independent Registered Public Accounting Firm

|

74

|

|

Notice to Shareholders

|

76

|

|

Information about Trustees and Officers

|

78

|

|

Householding

|

82

|

|

Privacy Notice

|

83

|

SCHARF FUNDS

Letter from the President

Dear Fellow Shareholders,

We have believed since early spring that the speed and magnitude of the economic recovery places us further along the market cycle than most investors appreciate. Historically, when the economic

recovery growth rate peaks, stock leadership transfers from cyclicals who benefit early in the cycle to more defensive stocks who offer superior earning sustainability throughout the cycle. Leading economic indicators like the 10-year treasury yield,

the ISM Manufacturing PMI index and upwards earnings estimates revisions all peaked in April. If past is prologue, the rotation into quality stocks is just beginning this cycle and likely to last for a while.

Meanwhile, U.S. equity markets continue to set new highs, powered by an increasingly narrow group of stocks. Currently, just 30% of S&P 500 stocks are trading above their 50-day moving averages.

This is highly unusual. Setting aside the cognitive dissonance-inducing earnings impacts from the pandemic and subsequent recovery, stocks continue to look expensive vs. their long-term earnings power. The cyclically-adjusted price earnings (CAPE)

ratio averages the trailing 10 years of S&P 500 earnings, adjusted for inflation, and compares it to current market levels. The S&P 500’s CAPE ratio is currently 36x, a figure near its historical peak of 44x in December 1999, and well over

twice the long-term average of 17x. S&P 500 margins may also be peaking. Labor, materials, transportation and even tax rate inflationary pressures pose risks to current margin levels.

So, against the backdrop of a peaking U.S. market with peak corporate profit margins and a potential rotation into defensive stocks, we have high conviction in our portfolio’s positioning. Our exacting

investment discipline, one we have followed since inception, emphasizes high quality companies trading at compelling discounts to fair value. We seek to buy stocks with 30%+ plus upside to our price targets and limited downside if our investment

thesis proves incorrect. We use this upside vs. downside calculus to create a stock’s Favorability Ratio. Leaving our own projections aside and using consensus earnings and the historical median high and low P/Es for

2

SCHARF FUNDS

stocks, the Scharf portfolio Favorability Ratio is 3.34 vs. 0.45 for the S&P 500. The Scharf portfolio also sports a top quartile Earnings Predictability, a figure that measures the volatility of a

company’s earnings for the prior 32 quarters against 1,700 stocks in the Value Line universe. The higher the earnings predictability, the better a company can be expected to perform when the economy slows.

Despite expensive market indices, we are finding attractive opportunities within defensive areas like health care (e.g., CVS and Centene), communication services (e.g., broadband providers Charter and

Comcast), insurance (e.g., strong underwriters and capital allocators Berkshire Hathaway and Markel) and business services/software (e.g., Cognizant and Fiserv). All of these examples have multiples that are several turns less than relevant peers,

the market or fair value, yet generally have superior earnings quality, prospects and capital returns.

Higher Inflation

As we have mentioned elsewhere, the threat of extended inflation is not factored into U.S. equity prices. That’s not a good setup for many risk assets either. With the Producer Price Index (PPI) at 8.3%

and the Consumer Price Index (CPI) at 5.3% vs. a 10-Year TIPS/Treasury breakeven rate of 2.37%, investors clearly believe inflation is transitory. However, the Fed has been surprised at the extended nature of elevated prices. At first, Fed Chairman

Powell cited base effect issues as the cause, but since the Fed’s Jackson Hole meeting, he has admitted that supply chain issues are driving prices and these constraints are likely to last into 2022.

There are several companies in the Scharf Portfolio that we believe should fare well should inflation take root. These include companies with pricing power or who own long-term, irreplaceable fixed

assets. Software companies like Microsoft and Oracle offer deeply integrated and mission critical software solutions, increasingly via cloud subscriptions with annual fee increases to corporate clients around the world. Kansas City Southern owns

6,700 miles of railroad track in the U.S. and Mexico. CVS Health and Centene reprice health insurance annually. Unilever and Heineken, owners of strong brands such as Ben & Jerry’s and the namesake beer brand, can navigate inflation via price

increases. Insurance companies Berkshire Hathaway and Markel will benefit should higher inflation bring on high interest rates since they will be able to invest consumer premiums in bonds with higher yields. A well-diversified, high-quality portfolio

of companies should help mitigate the threat of inflation.

The Path Forward

If one thing is certain, it’s that the markets do not like uncertainty. Market headwinds include questions around Federal Reserve policy and interest rates, uncertainty in Washington D.C. over the

infrastructure bill, inflation, and ongoing concerns over COVID-19 and potential variants. We believe it’s best to stay the course and keep focused on company fundamentals. We remain focused on executing our time-tested

3

SCHARF FUNDS

investment strategy of investing in attractively priced, quality companies with both predictable earnings and compelling favorability ratios. We believe history has shown that this is a proven way to

build wealth over the long term.

I sincerely hope that you, your families and those closest to you are healthy and well. Thank you for your continued trust and confidence in Scharf Investments and the Scharf Funds. My team and I

welcome your comments and the opportunity to respond to your questions. Please don’t hesitate to reach out to us.

Best regards,

Brian Krawez, CFA

President and Portfolio Manager

November 1, 2021

Active investing has higher management fees because of the manager’s increased level of involvement while passive investing has lower management and operating fees. Investing in both

actively and passively managed mutual funds involves risk and principal loss is possible. Both actively and passively managed mutual funds generally have daily liquidity. There are no guarantees regarding the performance of actively and passively

managed mutual funds. Actively managed mutual funds may have higher portfolio turnover than passively managed funds. Excessive turnover can limit returns and can incur capital gains.

Mutual fund investing involves risk. Principal loss is possible. The Funds may invest in securities representing equity or debt. These securities may be issued by small- and

medium-sized companies, which involve additional risks such as limited liquidity and greater volatility. The Funds may invest in foreign securities which involve greater volatility, political, economic and currency risks, and differences in

accounting methods. These risks are greater for emerging markets. The Funds may invest in exchange-traded funds (“ETFs”) or mutual funds, the risks of owning either generally reflecting the risks of owning the underlying securities held by the ETF or

mutual fund. The Funds follow an investment style that favors relatively low valuations. Investment in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment in

lower-rated, non-rated and distressed securities presents a greater risk of loss to principal and interest than higher-rated securities. The Scharf Alpha Opportunity Fund may make short sales of securities, which involves the risk that losses may

exceed the original amount invested. The Scharf Alpha Opportunity Fund may use leverage which may exaggerate the effect of any increase or decrease in the value of portfolio securities or the net asset value of the Fund, and money borrowed will be

subject to interest costs.

Forward earnings and EPS Growth are not measures of the Funds’ future performance.

4

SCHARF FUNDS

Terms and Definitions:

The S&P 500® Index

is a broad-based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general.

The S&P 500® Growth

Index is a market-capitalization-weighted index developed by Standard and Poor’s consisting of those stocks within the S&P 500 Index that exhibit strong growth characteristics.

The S&P 500® Value Index

is a market-capitalization-weighted index developed by Standard and Poor’s consisting of those stocks within the S&P 500 Index that exhibit strong value characteristics.

The Lipper Balanced Funds Index is an index of open-end mutual funds whose primary objective is to conserve principal by maintaining at all times a balanced

portfolio of both equities and bonds.

The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market,

including Treasuries, government related and corporate securities.

The MSCI All Country World Index (Net) is a broad measure of stock performance throughout the world, with the exception of U.S. based companies.

The HFRX Equity Hedge Index encompasses various equity hedge strategies, also known as long/short equity, that combine core long holdings of equities with short

sales of stock, stock indices, related derivatives, or other financial instruments related to the equity markets.

Price to Earnings Ratio (P/E) is a valuation of a company’s current share price compared to its per-share earnings.

Producer Price Index (PPI) measures the average changes in prices received by domestic producers for their output.

Consumer Price Index (CPI) measures the weighted average market basket of consumer goods and services purchased by households.

Treasury Inflation-Protected Securities (TIPS) is a bond that offsets the effects of rising prices by adjusting its principal value as inflation rises.

You cannot invest directly in an index.

The information provided herein represents the opinion of the Funds’ manager, is subject to change at any time, is not guaranteed and should not be considered investment advice.

The Funds’ holdings and sector allocations are subject to change at any time and should not be considered recommendations to buy and sell any security. Please refer to the Schedule of Investments in

this report for a complete list of Fund holdings.

Must be preceded or accompanied by a prospectus.

5

SCHARF FUNDS

TO OUR SHAREHOLDERS

|

PERFORMANCE AS OF 9/30/2021

|

||||||

|

SCHARF FUND

|

||||||

|

|

Since

|

Since

|

||||

|

|

6

|

One

|

Three

|

Five

|

Inception

|

Inception

|

|

Cumulative:

|

Months

|

Year

|

Year

|

Year

|

12/30/11

|

1/28/15

|

|

Scharf Fund – Institutional Class

|

4.88%

|

23.43%

|

43.61%

|

70.68%

|

210.31%

|

N/A

|

|

Scharf Fund – Retail Class

|

4.73%

|

23.08%

|

42.43%

|

68.28%

|

N/A

|

80.73%

|

|

S&P 500® Index

|

9.18%

|

30.00%

|

56.07%

|

118.26%

|

316.63%

|

145.15%

|

|

(with dividends reinvested)

|

||||||

|

Annualized:

|

||||||

|

Scharf Fund – Institutional Class

|

—

|

—

|

12.82%

|

11.28%

|

12.31%

|

N/A

|

|

Scharf Fund – Retail Class

|

—

|

—

|

12.51%

|

10.97%

|

N/A

|

9.28%

|

|

S&P 500® Index

|

—

|

—

|

15.99%

|

16.90%

|

15.76%

|

14.39%

|

|

(with dividends reinvested)

|

||||||

|

SCHARF MULTI-ASSET OPPORTUNITY FUND

|

||||||

|

|

Since

|

Since

|

||||

|

|

6

|

One

|

Three

|

Five

|

Inception

|

Inception

|

|

Cumulative:

|

Months

|

Year

|

Year

|

Year

|

12/31/12

|

1/21/16

|

|

Scharf Multi-Asset Opportunity

|

||||||

|

Fund – Institutional Class

|

3.95%

|

16.46%

|

35.69%

|

54.27%

|

117.13%

|

N/A

|

|

Scharf Multi-Asset Opportunity

|

||||||

|

Fund – Retail Class

|

3.82%

|

16.18%

|

34.67%

|

52.29%

|

N/A

|

68.02%

|

|

Lipper Balanced Funds Index

|

2.78%

|

18.69%

|

35.68%

|

60.88%

|

112.84%

|

80.95%

|

|

(with dividends reinvested)

|

||||||

|

Bloomberg U.S.

|

||||||

|

Aggregate Bond Index

|

1.88%

|

-0.90%

|

16.94%

|

15.61%

|

27.68%

|

21.20%

|

|

S&P 500® Index

|

||||||

|

(with dividends reinvested)

|

9.18%

|

30.00%

|

56.07%

|

118.26%

|

259.15%

|

157.15%

|

|

Annualized:

|

||||||

|

Scharf Multi-Asset Opportunity

|

||||||

|

Fund – Institutional Class

|

—

|

—

|

10.71%

|

9.06%

|

9.27%

|

N/A

|

|

Scharf Multi-Asset Opportunity

|

||||||

|

Fund – Retail Class

|

—

|

—

|

10.43%

|

8.78%

|

N/A

|

9.54%

|

|

Lipper Balanced Funds Index

|

—

|

—

|

10.71%

|

9.98%

|

9.02%

|

10.98%

|

|

(with dividends reinvested)

|

||||||

|

Bloomberg U.S.

|

||||||

|

Aggregate Bond Index

|

—

|

—

|

5.36%

|

2.94%

|

2.83%

|

3.44%

|

|

S&P 500® Index

|

||||||

|

(with dividends reinvested)

|

—

|

—

|

15.99%

|

16.90%

|

15.74%

|

18.05%

|

6

SCHARF FUNDS

|

SCHARF GLOBAL OPPORTUNITY FUND

|

|||||

|

|

Since

|

||||

|

|

6

|

One

|

Three

|

Five

|

Inception

|

|

Cumulative:

|

Months

|

Year

|

Year

|

Year

|

10/14/14

|

|

Scharf Global Opportunity Fund

|

3.90%

|

26.33%

|

43.27%

|

79.43%

|

110.77%

|

|

MSCI All Country World Index (Net)

|

6.26%

|

27.44%

|

42.69%

|

85.84%

|

103.82%

|

|

Annualized:

|

|||||

|

Scharf Global Opportunity Fund

|

—

|

—

|

12.73%

|

12.40%

|

11.30%

|

|

MSCI All Country World Index (Net)

|

—

|

—

|

12.58%

|

13.20%

|

10.77%

|

|

SCHARF ALPHA OPPORTUNITY FUND

|

|||||

|

|

Since

|

||||

|

|

6

|

One

|

Three

|

Five

|

Inception

|

|

Cumulative:

|

Months

|

Year

|

Year

|

Year

|

12/31/15

|

|

Scharf Alpha Opportunity Fund

|

-0.08%

|

8.56%

|

8.60%

|

8.49%

|

10.84%

|

|

HFRX Equity Hedge Index

|

6.42%

|

17.74%

|

15.64%

|

27.03%

|

26.15%

|

|

Bloomberg U.S.

|

|||||

|

Aggregate Bond Index

|

1.88%

|

-0.90%

|

16.94%

|

15.61%

|

22.31%

|

|

S&P 500® Index

|

9.18%

|

30.00%

|

56.07%

|

118.26%

|

135.37%

|

|

(with dividends reinvested)

|

|||||

|

Annualized:

|

|||||

|

Scharf Alpha Opportunity Fund

|

—

|

—

|

2.79%

|

1.64%

|

1.81%

|

|

HFRX Equity Hedge Index

|

—

|

—

|

4.96%

|

4.90%

|

4.12%

|

|

Bloomberg U.S.

|

|||||

|

Aggregate Bond Index

|

—

|

—

|

5.36%

|

2.94%

|

3.56%

|

|

S&P 500® Index

|

—

|

—

|

15.99%

|

16.90%

|

16.05%

|

|

(with dividends reinvested)

|

|||||

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so

that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained

by calling 1-866-572-4273.

The gross expense ratios, as of the Funds’ registration statement dated January 28, 2021, for the Scharf Fund Institutional Class, Scharf Fund Retail Class, Scharf Multi-Asset Opportunity Fund

Institutional Class, Scharf Multi-Asset Opportunity Fund Retail Class, Scharf Global Opportunity Fund, and Scharf Alpha Opportunity Fund are 0.98%, 1.23%, 1.51%, 1.76%, 2.13%, and 3.40%, respectively. The net expense ratios, as of the Funds’

registration statement dated January 28, 2021, for the Scharf Fund Institutional Class, Scharf Fund Retail Class, Scharf Multi-Asset Opportunity Fund Institutional Class, Scharf Multi-Asset Opportunity Fund Retail Class, Scharf Global Opportunity

Fund, and Scharf Alpha Opportunity Fund represent the percentages paid by investors and are 0.89%, 1.14%, 1.00%, 1.25%, 0.90%, and 1.99%, respectively, after fee waivers and expense reimbursements, including acquired fund fees and expenses, interest,

taxes and extraordinary expenses. Scharf Investments, LLC (the “Adviser”), the Funds’ investment adviser, has contractually agreed to waive fees through January 27, 2022 for the Scharf Fund, Scharf Multi-Asset Opportunity Fund, Scharf Global

Opportunity Fund, and Scharf Alpha Opportunity Fund. The Scharf Fund charges a 2.00% redemption fee on redemptions or exchanges of fund shares that are made within 60 days of

7

SCHARF FUNDS

purchase. The Scharf Multi-Asset Opportunity Fund, Scharf Global Opportunity Fund, and Scharf Alpha Opportunity Fund charge a 2.00% redemption fee on redemptions or exchanges of fund shares that are

made within 15 days of purchase. Had a redemption fee been included, returns would be lower.

For the fiscal year ended September 30, 2021, the Scharf Funds mutual funds performed as follows:

Scharf Fund Institutional Class and Retail Class returned 23.43% and 23.08%, respectively, compared to the 30.00% return for the S&P 500® Index (“S&P 500”). The key contributors to relative performance for the period were Valvoline, Inc., CVS Health Corp., and Baidu, Inc. – ADR. The key detractors from

relative performance were Progressive Corp., Berkshire Hathaway, Inc. – Class B, and Lockheed Martin Corp.

Scharf Multi-Asset Opportunity Fund Institutional Class and Retail Class returned 16.46% and 16.18%, respectively, compared to the 18.69% return for the Lipper

Balanced Funds Index, -0.90% return for the Bloomberg U.S. Aggregate Bond Index, and 30.00% return for the S&P 500. The key contributors to relative performance for the period were CVS Health Corp., Valvoline, Inc., and Baidu, Inc. – ADR. The key

detractors from relative performance were Progressive Corp., Berkshire Hathaway, Inc. – Class B, and Lockheed Martin Corp.

Scharf Global Opportunity Fund returned 26.33% compared to the 27.44% return for the MSCI All Country World Index (Net). The key contributors to relative

performance for the period were Grupo Televisa S.A.B. – ADR, Baidu Inc. – ADR, and Porsche Automobil Holding SE. The key detractors from relative performance were Barrick Gold Corp., Lockheed Martin Corp., and Novartis AG – ADR.

Scharf Alpha Opportunity Fund returned 8.56% compared to the 17.74% return for the HFRX Equity Hedge Index, -0.90% return for the Bloomberg U.S. Aggregate Bond

Index, and 30.00% return for the S&P 500. The key contributors to relative performance for the period were Valvoline, Inc., CVS Health Corp., and Baidu, Inc. – ADR. The key detractors from relative performance were Progressive Corp., Berkshire

Hathaway, Inc. – Class B, and Lockheed Martin Corp.

8

SCHARF FUNDS

Comparison of the change in value of a hypothetical $1,000,000 investment

in the Scharf Fund – Institutional Class vs. the S&P 500® Index

Average Annual Total Return for the Periods Ended 9/30/2021:

|

Since

|

Since

|

|||

|

Inception

|

Inception

|

|||

|

1 year

|

5 year

|

(12/30/11)

|

(1/28/15)

|

|

|

Scharf Fund – Institutional Class1

|

23.43%

|

11.28%

|

12.31%

|

—

|

|

Scharf Fund – Retail Class2

|

23.08%

|

10.97%

|

—

|

9.28%

|

|

S&P 500® Index

|

30.00%

|

16.90%

|

15.76%

|

14.39%

|

Performance data quoted on this page represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so

that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by

calling 1–866–572–4273 (1–866–5SCHARF).

Returns reflect reinvestment of dividends and capital gains distributions. Fee waivers are in effect. In the absence of fee waivers, returns would be reduced. The performance data and graph do not

reflect the deduction of taxes that a shareholder would pay on dividends, capital gains distributions, or redemption of Fund shares. The performance data and graph do not reflect the 2.00% redemption fee imposed on shares held 60 days or less.

Indices do not incur expenses and are not available for investment.

The S&P 500® Index is an unmanaged capitalization-weighted index of 500 stocks designed to represent the broad

domestic economy.

|

1

|

Institutional Class commenced operations on December 30, 2011.

|

|

2

|

Retail Class commenced operations on January 28, 2015.

|

9

SCHARF MULTI-ASSET OPPORTUNITY FUND

Comparison of the change in value of a hypothetical $5,000,000 investment in

the Scharf Multi-Asset Opportunity Fund – Institutional Class vs.

the Lipper Balanced Funds Index, the S&P 500® Index,

and the Bloomberg U.S. Aggregate Bond Index

Average Annual Total Return for the Periods Ended 9/30/2021:

|

Since

|

Since

|

|||

|

Inception

|

Inception

|

|||

|

1 year

|

5 year

|

(12/31/12)

|

(1/21/16)

|

|

|

Scharf Multi–Asset Opportunity

|

||||

|

Fund – Institutional Class1

|

16.46%

|

9.06%

|

9.27%

|

—

|

|

Scharf Multi–Asset Opportunity

|

||||

|

Fund – Retail Class2

|

16.18%

|

8.78%

|

—

|

9.54%

|

|

S&P 500® Index

|

30.00%

|

16.90%

|

15.74%

|

18.05%

|

|

Bloomberg U.S.

|

||||

|

Aggregate Bond Index

|

-0.90%

|

2.94%

|

2.83%

|

3.44%

|

|

Lipper Balanced Funds Index

|

18.69%

|

9.98%

|

9.02%

|

10.98%

|

Performance data quoted on this page represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so

that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by

calling 1–866–572–4273 (1–866–5SCHARF).

Returns reflect reinvestment of dividends and capital gains distributions. Fee waivers are in effect. In the absence of fee waivers, returns would be reduced. The performance data and graph do not

reflect the deduction of taxes that a shareholder

10

SCHARF MULTI-ASSET OPPORTUNITY FUND

would pay on dividends, capital gains distributions, or redemption of Fund shares. The performance data and graph do not reflect the 2.00% redemption fee imposed on shares held 15 days or less. Indices

do not incur expenses and are not available for investment.

The S&P 500® Index is an unmanaged capitalization-weighted index of 500 stocks designed to represent the broad

domestic economy.

The Lipper Balanced Funds Index is an equally weighted index of the 30 largest U.S. balanced funds.

The Bloomberg U.S. Aggregate Bond Index is a broad based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government related

and corporate securities.

|

1

|

The Fund commenced operations on December 31, 2012.

|

|

2

|

The Fund commenced operations on January 21, 2016.

|

11

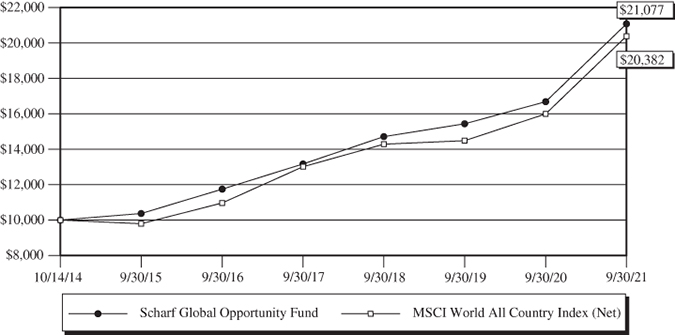

SCHARF GLOBAL OPPORTUNITY FUND

Comparison of the change in value of a hypothetical $10,000 investment in the

Scharf Global Opportunity Fund vs. the MSCI World All Country Index (Net).

Average Annual Total Return for the Periods Ended 9/30/2021:

|

1 year

|

5 year

|

Since Inception1

|

|

|

Scharf Global Opportunity Fund

|

26.33%

|

12.40%

|

11.30%

|

|

MSCI World All Cap Country Index (Net)

|

27.44%

|

13.20%

|

10.77%

|

Performance data quoted on this page represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so

that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by

calling 1–866–572–4273 (1–866–5SCHARF).

Returns reflect reinvestment of dividends and capital gains distributions. Fee waivers are in effect. In the absence of fee waivers, returns would be reduced. The performance data and graph do not

reflect the deduction of taxes that a shareholder would pay on dividends, capital gains distributions, or redemption of Fund shares. The performance data and graph do not reflect the 2.00% redemption fee imposed on shares held 15 days or less.

Indices do not incur expenses and are not available for investment.

The MSCI World All Country Index (Net) captures large and mid cap representation across 23 Developed Markets (DM) and 23 Emerging Markets (EM) countries. Net total return indexes reinvest dividends

after the deduction of withholding taxes, using a tax rate applicable to non–resident institutional investors who do not benefit from double taxation treaties.

|

1

|

The Fund commenced operations on October 14, 2014.

|

12

SCHARF Alpha OPPORTUNITY FUND

Comparison of the change in value of a hypothetical $10,000 investment in

the Scharf Alpha Opportunity Fund vs. the HFRX Equity Hedge Index,

S&P 500® Index, and the Bloomberg U.S. Aggregate Bond Index.

Average Annual Total Return for the Periods Ended 9/30/2021:

|

1 year

|

5 year

|

Since Inception1

|

|

|

Scharf Alpha Opportunity Fund

|

8.56%

|

1.64%

|

1.81%

|

|

HFRX Equity Hedge Index

|

17.74%

|

4.90%

|

4.12%

|

|

Bloomberg U.S. Aggregate Bond Index

|

-0.90%

|

2.94%

|

3.56%

|

|

S&P 500® Index

|

30.00%

|

16.90%

|

16.05%

|

Performance data quoted on this page represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so

that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by

calling 1–866–572–4273 (1–866–5SCHARF).

Returns reflect reinvestment of dividends and capital gains distributions. Fee waivers are in effect. In the absence of fee waivers, returns would be reduced. The performance data and graph do not

reflect the deduction of taxes that a shareholder would pay on dividends, capital gains distributions, or redemption of Fund shares. The performance data and graph do not reflect the 2.00% redemption fee imposed on shares held 15 days or less.

Indices do not incur expenses and are not available for investment.

The HFRX Equity Hedge Index encompasses various equity hedge strategies, also known as long/short equity, that combine core long holdings of equities with short

13

SCHARF Alpha OPPORTUNITY FUND

sales of stock, stock indices, related derivatives, or other financial instruments related to the equity markets.

The S&P 500® Index is an unmanaged capitalization–weighted index of 500 stocks designed to represent the broad

domestic economy.

The Bloomberg U.S. Aggregate Bond Index is a broad based benchmark that measures the investment grade, U.S. dollar–denominated, fixed–rate taxable bond market, including Treasuries, government related

and corporate securities.

|

1

|

The Fund commenced operations on December 31, 2015.

|

14

SCHARF FUNDS

EXPENSE EXAMPLES at September 30, 2021 (Unaudited)

Shareholders in mutual funds generally incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, redemption fees, and exchange fees; and (2) ongoing costs,

including management fees, distribution and/or service fees, and other fund expenses. The Scharf Fund, Scharf Multi–Asset Opportunity Fund, Scharf Global Opportunity Fund, and the Scharf Alpha Opportunity Fund are

no–load mutual funds. These Examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on

an investment of $1,000 invested in each Fund at the beginning of the period and held for the entire period (4/1/21-9/30/21).

Actual Expenses

The first line of each table below provides information about actual account values and actual expenses, with actual net expenses being limited. Although the Funds charge no sales load or transaction

fees, you will be assessed fees for outgoing wire transfers, returned checks, and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. The Examples below include, but are not limited to,

management fees, fund accounting, custody and transfer agent fees. You may use the information in the first line of the tables, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account

value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period’’ to estimate the expenses you paid on your account

during this period.

Hypothetical Example for Comparison Purposes

The second line of each table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratio and an assumed rate of return of 5% per year

before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the

ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the tables are

meant to highlight your ongoing costs only and will not help you determine the relative total costs of owning different funds, as they may charge transaction costs, such as sales charges (loads), redemption fees, or exchange fees.

15

SCHARF FUNDS

EXPENSE EXAMPLES at September 30, 2021 (Unaudited), Continued

|

Beginning

|

Ending

|

Expenses Paid

|

Annualized

|

|

|

Account Value

|

Account Value

|

During Period*

|

Expense

|

|

|

Scharf Fund

|

4/1/21

|

9/30/21

|

4/1/21-9/30/21

|

Ratio*

|

|

Institutional Class

|

||||

|

Actual

|

$1,000.00

|

$1,048.80

|

$4.42

|

0.86%

|

|

Hypothetical (5% return

|

||||

|

before expenses)

|

$1,000.00

|

$1,020.76

|

$4.36

|

0.86%

|

|

Retail Class

|

||||

|

Actual

|

$1,000.00

|

$1,047.30

|

$5.85

|

1.14%

|

|

Hypothetical (5% return

|

||||

|

before expenses)

|

$1,000.00

|

$1,019.35

|

$5.77

|

1.14%

|

|

Beginning

|

Ending

|

Expenses Paid

|

Annualized

|

|

|

Scharf Multi-Asset

|

Account Value

|

Account Value

|

During Period*

|

Expense

|

|

Opportunity Fund

|

4/1/21

|

9/30/21

|

4/1/21-9/30/21

|

Ratio*

|

|

Institutional Class

|

||||

|

Actual

|

$1,000.00

|

$1,039.50

|

$4.96

|

0.97%

|

|

Hypothetical (5% return

|

||||

|

before expenses)

|

$1,000.00

|

$1,020.21

|

$4.91

|

0.97%

|

|

Retail Class

|

||||

|

Actual

|

$1,000.00

|

$1,038.20

|

$6.28

|

1.23%

|

|

Hypothetical (5% return

|

||||

|

before expenses)

|

$1,000.00

|

$1,018.90

|

$6.23

|

1.23%

|

|

Beginning

|

Ending

|

Expenses Paid

|

Annualized

|

|

|

Scharf Global

|

Account Value

|

Account Value

|

During Period*

|

Expense

|

|

Opportunity Fund

|

4/1/21

|

9/30/21

|

4/1/21-9/30/21

|

Ratio*

|

|

Retail Class

|

||||

|

Actual

|

$1,000.00

|

$1,039.00

|

$3.83

|

0.75%

|

|

Hypothetical (5% return

|

||||

|

before expenses)

|

$1,000.00

|

$1,021.31

|

$3.80

|

0.75%

|

|

Beginning

|

Ending

|

Expenses Paid

|

Annualized

|

|

|

Scharf Alpha

|

Account Value

|

Account Value

|

During Period*

|

Expense

|

|

Opportunity Fund

|

4/1/21

|

9/30/21

|

4/1/21-9/30/21

|

Ratio*

|

|

Retail Class

|

||||

|

Actual(1)

|

$1,000.00

|

$ 999.20

|

$9.17

|

1.83%

|

|

Hypothetical (5% return

|

||||

|

before expenses)(1)

|

$1,000.00

|

$1,015.89

|

$9.25

|

1.83%

|

|

(1)

|

Excluding interest expense and dividends on short positions, your actual expenses would be $4.36 and your hypothetical expenses would be $4.41.

|

|

|

*

|

Expenses are equal to the Fund’s annualized expense ratio of each class, multiplied by the average account value over the period, multiplied by 183 (days in most recent fiscal half-year)/365

days to reflect the one-half year expense.

|

16

SCHARF FUND

SECTOR ALLOCATION OF PORTFOLIO ASSETS at September 30, 2021 (Unaudited)

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and

Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

17

SCHARF MULTI-ASSET OPPORTUNITY FUND

SECTOR ALLOCATION OF PORTFOLIO ASSETS at September 30, 2021 (Unaudited)

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and

Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

18

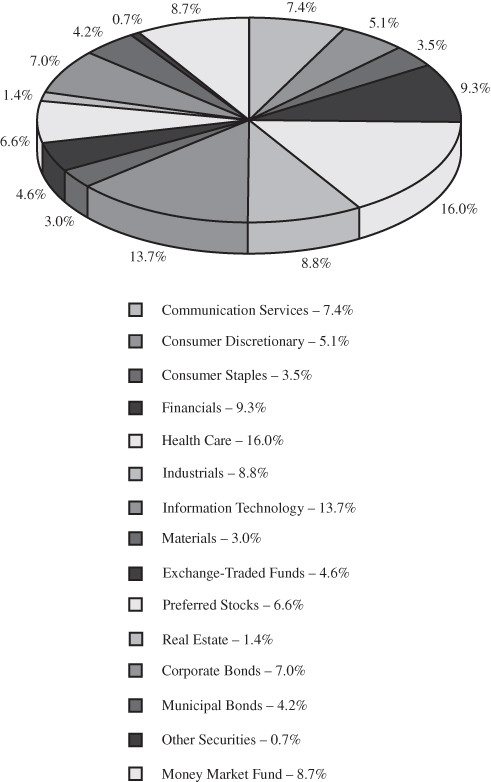

SCHARF GLOBAL OPPORTUNITY FUND

SECTOR ALLOCATION OF PORTFOLIO ASSETS at September 30, 2021 (Unaudited)

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and

Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

19

SCHARF Alpha OPPORTUNITY FUND

SECTOR ALLOCATION OF PORTFOLIO ASSETS at September 30, 2021 (Unaudited)

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and

Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

20

SCHARF FUND

SCHEDULE OF INVESTMENTS at September 30, 2021

|

Shares

|

COMMON STOCKS – 92.58%

|

Value

|

|||||

|

Aerospace and Defense – 3.68%

|

|||||||

|

42,695

|

Lockheed Martin Corp.

|

$

|

14,734,044

|

||||

|

Beverages – 2.29%

|

|||||||

|

87,835

|

Heineken N.V. (b)

|

9,177,247

|

|||||

|

Building Products – 3.85%

|

|||||||

|

277,355

|

Masco Corp.

|

15,407,070

|

|||||

|

Chemicals – 4.23%

|

|||||||

|

543,210

|

Valvoline, Inc.

|

16,937,288

|

|||||

|

Commercial Services & Supplies – 1.94%

|

|||||||

|

206,476

|

Herman Miller, Inc.

|

7,775,886

|

|||||

|

Construction & Engineering – 1.30%

|

|||||||

|

39,215

|

Jacobs Engineering Group, Inc.

|

5,197,164

|

|||||

|

Diversified Financial Services – 6.03%

|

|||||||

|

88,524

|

Berkshire Hathaway, Inc. – Class B (a)

|

24,161,741

|

|||||

|

Health Care Providers & Services – 14.79%

|

|||||||

|

238,875

|

Centene Corp. (a)

|

14,884,301

|

|||||

|

232,695

|

CVS Health Corp.

|

19,746,497

|

|||||

|

100,715

|

McKesson Corp.

|

20,080,557

|

|||||

|

31,393

|

Quest Diagnostics, Inc.

|

4,561,717

|

|||||

|

59,273,072

|

|||||||

|

Insurance – 7.17%

|

|||||||

|

15,343

|

Markel Corp. (a)

|

18,336,880

|

|||||

|

114,790

|

Progressive Corp.

|

10,375,868

|

|||||

|

28,712,748

|

|||||||

|

Interactive Media & Services – 1.51%

|

|||||||

|

39,465

|

Baidu, Inc. – ADR (a)

|

6,067,744

|

|||||

|

IT Services – 7.13%

|

|||||||

|

177,180

|

Cognizant Technology Solutions Corp. – Class A

|

13,148,528

|

|||||

|

141,950

|

Fiserv, Inc. (a)

|

15,401,575

|

|||||

|

28,550,103

|

|||||||

|

Media – 9.25%

|

|||||||

|

359,150

|

Comcast Corp. – Class A

|

20,087,259

|

|||||

|

98,355

|

Liberty Broadband Corp. (a)

|

16,985,909

|

|||||

|

37,073,168

|

|||||||

The accompanying notes are an integral part of these financial statements.

21

SCHARF FUND

SCHEDULE OF INVESTMENTS at September 30, 2021, Continued

|

Shares

|

COMMON STOCKS – 92.58%, Continued

|

Value

|

|||||

|

Personal Products – 2.60%

|

|||||||

|

192,345

|

Unilever plc – ADR

|

$

|

10,428,946

|

||||

|

Pharmaceuticals – 7.83%

|

|||||||

|

105,095

|

AstraZeneca plc – ADR

|

6,312,006

|

|||||

|

85,029

|

Johnson & Johnson

|

13,732,183

|

|||||

|

138,640

|

Novartis AG – ADR

|

11,337,979

|

|||||

|

31,382,168

|

|||||||

|

Road & Rail – 1.47%

|

|||||||

|

21,732

|

Kansas City Southern

|

5,881,548

|

|||||

|

Software – 12.42%

|

|||||||

|

111,385

|

Microsoft Corp.

|

31,401,659

|

|||||

|

210,660

|

Oracle Corp.

|

18,354,806

|

|||||

|

49,756,465

|

|||||||

|

Specialty Retail – 5.09%

|

|||||||

|

97,556

|

Advance Auto Parts, Inc.

|

20,378,473

|

|||||

|

TOTAL COMMON STOCKS

|

|||||||

|

(Cost $261,796,927)

|

370,894,875

|

||||||

|

PREFERRED STOCK – 3.45%

|

|||||||

|

Technology Hardware,

|

|||||||

|

Storage & Peripherals – 3.45%

|

|||||||

|

234,960

|

Samsung Electronics Co., Ltd. (b)

|

13,811,838

|

|||||

|

TOTAL PREFERRED STOCK

|

|||||||

|

(Cost $3,804,584)

|

13,811,838

|

||||||

The accompanying notes are an integral part of these financial statements.

22

SCHARF FUND

SCHEDULE OF INVESTMENTS at September 30, 2021, Continued

|

Shares

|

MONEY MARKET FUND – 3.84%

|

Value

|

|||||

|

15,385,061

|

First American Treasury Obligations

|

||||||

|

Fund, Class Z, 0.01% (c)

|

$

|

15,385,061

|

|||||

|

TOTAL MONEY MARKET FUND

|

|||||||

|

(Cost $15,385,061)

|

15,385,061

|

||||||

|

Total Investments in Securities

|

|||||||

|

(Cost $280,986,572) – 99.87%

|

400,091,774

|

||||||

|

Other Assets in Excess of Liabilities – 0.13%

|

524,398

|

||||||

|

TOTAL NET ASSETS – 100.00%

|

$

|

400,616,172

|

|||||

|

ADR

|

American Depository Receipt

|

|

(a)

|

Non–income producing security.

|

|

(b)

|

Foreign issuer.

|

|

(c)

|

Rate shown is the 7–day annualized yield as of September 30, 2021.

|

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and

Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

23

SCHARF MULTI-ASSET OPPORTUNITY FUND

SCHEDULE OF INVESTMENTS at September 30, 2021

|

Shares

|

COMMON STOCKS – 66.57%

|

Value

|

|||||

|

Aerospace and Defense – 2.51%

|

|||||||

|

3,675

|

Lockheed Martin Corp.

|

$

|

1,268,242

|

||||

|

Beverages – 1.68%

|

|||||||

|

8,150

|

Heineken N.V. (b)

|

851,535

|

|||||

|

Building Products – 2.75%

|

|||||||

|

25,035

|

Masco Corp.

|

1,390,694

|

|||||

|

Chemicals – 2.98%

|

|||||||

|

48,245

|

Valvoline, Inc.

|

1,504,279

|

|||||

|

Commercial Services & Supplies – 1.39%

|

|||||||

|

18,680

|

Herman Miller, Inc.

|

703,489

|

|||||

|

Construction & Engineering – 0.93%

|

|||||||

|

3,549

|

Jacobs Engineering Group, Inc.

|

470,349

|

|||||

|

Diversified Financial Services – 4.32%

|

|||||||

|

7,999

|

Berkshire Hathaway, Inc. – Class B (a)

|

2,183,247

|

|||||

|

Health Care Providers & Services – 10.47%

|

|||||||

|

21,492

|

Centene Corp. (a)

|

1,339,166

|

|||||

|

20,908

|

CVS Health Corp.

|

1,774,253

|

|||||

|

8,883

|

McKesson Corp.

|

1,771,093

|

|||||

|

2,815

|

Quest Diagnostics, Inc.

|

409,048

|

|||||

|

5,293,560

|

|||||||

|

Hotels, Restaurants & Leisure – 1.33%

|

|||||||

|

126,300

|

Domino’s Pizza Group plc (b)

|

674,240

|

|||||

|

Insurance – 4.99%

|

|||||||

|

1,392

|

Markel Corp. (a)

|

1,663,621

|

|||||

|

9,489

|

Progressive Corp.

|

857,711

|

|||||

|

2,521,332

|

|||||||

|

Interactive Media & Services – 0.94%

|

|||||||

|

3,080

|

Baidu, Inc. – ADR (a)

|

473,550

|

|||||

|

IT Services – 5.09%

|

|||||||

|

15,486

|

Cognizant Technology Solutions Corp. – Class A

|

1,149,216

|

|||||

|

13,129

|

Fiserv, Inc. (a)

|

1,424,496

|

|||||

|

2,573,712

|

|||||||

The accompanying notes are an integral part of these financial statements.

24

SCHARF MULTI-ASSET OPPORTUNITY FUND

SCHEDULE OF INVESTMENTS at September 30, 2021, Continued

|

Shares/

|

|||||||

|

Principal

|

|||||||

|

Amount

|

COMMON STOCKS – 66.57%, Continued

|

Value

|

|||||

|

Media – 6.42%

|

|||||||

|

31,101

|

Comcast Corp. – Class A

|

$

|

1,739,479

|

||||

|

8,714

|

Liberty Broadband Corp. (a)

|

1,504,908

|

|||||

|

3,244,387

|

|||||||

|

Personal Products – 1.78%

|

|||||||

|

16,569

|

Unilever plc – ADR

|

898,371

|

|||||

|

Pharmaceuticals – 5.50%

|

|||||||

|

9,721

|

AstraZeneca plc – ADR

|

583,843

|

|||||

|

7,230

|

Johnson & Johnson

|

1,167,645

|

|||||

|

12,565

|

Novartis AG – ADR

|

1,027,566

|

|||||

|

2,779,054

|

|||||||

|

Road & Rail – 1.15%

|

|||||||

|

2,147

|

Kansas City Southern

|

581,064

|

|||||

|

Software – 8.60%

|

|||||||

|

9,850

|

Microsoft Corp.

|

2,776,912

|

|||||

|

18,038

|

Oracle Corp.

|

1,571,651

|

|||||

|

4,348,563

|

|||||||

|

Specialty Retail – 3.74%

|

|||||||

|

9,040

|

Advance Auto Parts, Inc.

|

1,888,366

|

|||||

|

TOTAL COMMON STOCKS

|

|||||||

|

(Cost $23,466,632)

|

33,648,034

|

||||||

|

PREFERRED STOCKS – 6.62%

|

|||||||

|

Capital Markets – 1.54%

|

|||||||

|

$

|

700,000

|

Charles Schwab Corp. – Series G, 5.375%

|

779,625

|

||||

|

Closed–End Fund – 2.01%

|

|||||||

|

38,400

|

Gabelli Equity Trust, Inc. – Series K, 5.00%

|

1,015,681

|

|||||

|

Technology Hardware,

|

|||||||

|

Storage & Peripherals – 3.07%

|

|||||||

|

26,435

|

Samsung Electronics Co., Ltd. 3.59% (b)

|

1,553,949

|

|||||

|

TOTAL PREFERRED STOCKS

|

|||||||

|

(Cost $2,166,669)

|

3,349,255

|

||||||

The accompanying notes are an integral part of these financial statements.

25

SCHARF MULTI-ASSET OPPORTUNITY FUND

SCHEDULE OF INVESTMENTS at September 30, 2021, Continued

|

Shares

|

REIT – 1.45%

|

Value

|

|||||

|

Equity Real Estate

|

|||||||

|

Investment Trust (REIT) – 1.45%

|

|||||||

|

11,250

|

Realty Income Corp.

|

$

|

729,675

|

||||

|

TOTAL REIT

|

|||||||

|

(Cost $735,778)

|

729,675

|

||||||

|

EXCHANGE-TRADED FUNDS – 4.61%

|

|||||||

|

52,929

|

iShares Silver Trust (a)

|

1,086,103

|

|||||

|

7,558

|

SPDR Gold Shares (a)

|

1,241,175

|

|||||

|

TOTAL EXCHANGE–TRADED FUNDS

|

|||||||

|

(Cost $1,961,065)

|

2,327,278

|

||||||

|

Principal

|

|||||||

|

Amount

|

CORPORATE BONDS – 7.04%

|

||||||

|

Beverages – 0.16%

|

|||||||

|

Keurig Dr. Pepper, Inc.

|

|||||||

|

$

|

76,000

|

4.057%, 5/25/2023

|

80,335

|

||||

|

Biotechnology – 0.30%

|

|||||||

|

AbbVie, Inc.

|

|||||||

|

150,000

|

2.30%, 11/21/2022 (d)

|

153,104

|

|||||

|

Chemicals – 0.11%

|

|||||||

|

DuPont de Nemours, Inc.

|

|||||||

|

50,000

|

4.205%, 11/15/2023

|

53,699

|

|||||

|

Computer and Electronic

|

|||||||

|

Product Manufacturing – 0.19%

|

|||||||

|

Digital Equipment Corp.

|

|||||||

|

89,000

|

7.75%, 4/1/2023

|

96,430

|

|||||

|

Entertainment – 0.34%

|

|||||||

|

Walt Disney Co.

|

|||||||

|

150,000

|

8.875%, 4/26/2023

|

169,884

|

|||||

|

Health Care Providers & Services – 0.30%

|

|||||||

|

McKesson Corp.

|

|||||||

|

150,000

|

2.70%, 12/15/2022

|

153,300

|

|||||

The accompanying notes are an integral part of these financial statements.

26

SCHARF MULTI-ASSET OPPORTUNITY FUND

SCHEDULE OF INVESTMENTS at September 30, 2021, Continued

|

Principal

|

|||||||

|

Amount

|

CORPORATE BONDS – 7.04%, Continued

|

Value

|

|||||

|

Internet & Direct Marketing Retail – 0.64%

|

|||||||

|

Amazon.com, Inc.

|

|||||||

|

$

|

150,000

|

5.20%, 12/3/2025

|

$

|

174,417

|

|||

|

eBay, Inc.

|

|||||||

|

150,000

|

2.60%, 7/15/2022

|

151,860

|

|||||

|

326,277

|

|||||||

|

IT Services – 0.36%

|

|||||||

|

International Business Machines Corp.

|

|||||||

|

150,000

|

7.00%, 10/30/2025

|

184,717

|

|||||

|

Life Sciences Tools & Services – 0.33%

|

|||||||

|

Thermo Fisher Scientific, Inc.

|

|||||||

|

150,000

|

4.133%, 3/25/2025

|

165,038

|

|||||

|

Petroleum and Coal

|

|||||||

|

Products Manufacturing – 1.15%

|

|||||||

|

Murphy Oil USA, Inc.

|

|||||||

|

557,000

|

5.625%, 5/1/2027

|

583,006

|

|||||

|

Pharmaceutical and

|

|||||||

|

Medicine Manufacturing – 0.34%

|

|||||||

|

Wyeth LLC

|

|||||||

|

150,000

|

6.45%, 2/1/2024

|

170,095

|

|||||

|

Road & Rail – 0.54%

|

|||||||

|

Bestfoods, Inc.

|

|||||||

|

150,000

|

7.25%, 12/15/2026

|

194,681

|

|||||

|

Burlington Northern Santa Fe LLC

|

|||||||

|

75,000

|

3.05%, 9/1/2022

|

76,421

|

|||||

|

271,102

|

|||||||

|

Securities and Commodity Contracts

|

|||||||

|

Intermediation and Brokerage – 1.96%

|

|||||||

|

Goldman Sachs Group, Inc.

|

|||||||

|

1,001,000

|

4.00%, (3 Month LIBOR + 0.7675%), 6/1/2043 (c)

|

990,205

|

|||||

|

Specialty Retail – 0.32%

|

|||||||

|

Advance Auto Parts, Inc.

|

|||||||

|

150,000

|

4.50%, 12/1/2023

|

160,359

|

|||||

|

TOTAL CORPORATE BONDS

|

|||||||

|

(Cost $3,254,709)

|

3,557,551

|

||||||

The accompanying notes are an integral part of these financial statements.

27

SCHARF MULTI-ASSET OPPORTUNITY FUND

SCHEDULE OF INVESTMENTS at September 30, 2021, Continued

|

Principal

|

|||||||

|

Amount

|

MUNICIPAL BONDS – 4.20%

|

Value

|

|||||

|

California Health Facilities Financing Authority,

|

|||||||

|

Revenue Bonds, Chinese Hospital Association

|

|||||||

|

$

|

10,000

|

3.00%, 6/1/2024, Series 2012

|

$

|

10,167

|

|||

|

California Health Facilities Financing Authority,

|

|||||||

|

Revenue Bonds, Persons with

|

|||||||

|

Developmental Disabilities

|

|||||||

|

145,000

|

7.875%, 2/1/2026, Series 2011B

|

145,745

|

|||||

|

California State, General Obligation,

|

|||||||

|

Highway Safety, Traffic Reduction,

|

|||||||

|

Air Quality and Port Security Bonds

|

|||||||

|

90,000

|

6.509%, 4/1/2039, Series 2009B

|

90,175

|

|||||

|

California State, General Obligation, Various Purpose

|

|||||||

|

370,000

|

6.65%, 3/1/2022, Series 2010

|

379,780

|

|||||

|

City of New York, General Obligation,

|

|||||||

|

Build America Bonds

|

|||||||

|

75,000

|

5.887%, 12/1/2024

|

86,281

|

|||||

|

35,000

|

5.424%, 3/1/2025

|

40,006

|

|||||

|

Commonwealth of Massachusetts,

|

|||||||

|

Build America Bonds

|

|||||||

|

110,000

|

4.20%, 12/1/2021

|

110,698

|

|||||

|

Dana Point California Community

|

|||||||

|

Facilities Taxable – Series B

|

|||||||

|

120,000

|

1.017%, 9/1/2022

|

120,257

|

|||||

|

San Francisco Bay Area Toll Authority,

|

|||||||

|

Revenue Bonds

|

|||||||

|

100,000

|

2.128%, 4/1/2022

|

100,979

|

|||||

|

100,000

|

2.234%, 4/1/2023

|

102,923

|

|||||

|

75,000

|

6.793%, 4/1/2030

|

92,338

|

|||||

|

Santa Clara Valley Transportation Authority,

|

|||||||

|

Sales Tax Revenue, Build America Bonds

|

|||||||

|

75,000

|

4.899%, 4/1/2022

|

76,691

|

|||||

|

State of California, Build America Bonds

|

|||||||

|

35,000

|

5.70%, 11/1/2021

|

35,147

|

|||||

|

15,000

|

4.988%, 4/1/2039

|

15,975

|

|||||

|

State of Connecticut, Build America Bonds

|

|||||||

|

240,000

|

5.20%, 12/1/2022

|

253,619

|

|||||

|

25,000

|

5.30%, 12/1/2023

|

27,552

|

|||||

The accompanying notes are an integral part of these financial statements.

28

SCHARF MULTI-ASSET OPPORTUNITY FUND

SCHEDULE OF INVESTMENTS at September 30, 2021, Continued

|

Principal

|

|||||||

|

Amount

|

MUNICIPAL BONDS – 4.20%, Continued

|

Value

|

|||||

|

State of Georgia, School Construction Bonds

|

|||||||

|

$

|

15,000

|

4.35%, 2/1/2029

|

$

|

15,655

|

|||

|

State of Hawaii, Build America Bonds, Taxable

|

|||||||

|

25,000

|

5.10%, 2/1/2024

|

27,613

|

|||||

|

State of Oregon, General Obligation,

|

|||||||

|

Board of Higher Educations – Taxable

|

|||||||

|

5,000

|

5.742%, 8/1/2024

|

5,481

|

|||||

|

Toledo City School District, General

|

|||||||

|

Obligation Bond, Taxable

|

|||||||

|

225,000

|

5.00%, 12/1/2024

|

254,083

|

|||||

|

University of California, Build America Bonds

|

|||||||

|

100,000

|

6.296%, 5/15/2050

|

130,625

|

|||||

|

TOTAL MUNICIPAL BONDS

|

|||||||

|

(Cost $2,092,063)

|

2,121,790

|

||||||

|

OTHER SECURITIES – 0.74%

|

|||||||

|

Independent Power and Renewable

|

|||||||

|

Electricity Producers – 0.74%

|

|||||||

|

13,475

|

Tennessee Valley Authority, Series D,

|

||||||

|

PAARS, Power Bond

|

373,797

|

||||||

|

2.134%, (reset annually @ CMT 30 year index average

|

|||||||

|

+ 94 bps if lower than current rate), 6/1/2028 (c)

|

|||||||

|

TOTAL OTHER SECURITIES

|

|||||||

|

(Cost $344,147)

|

373,797

|

||||||

The accompanying notes are an integral part of these financial statements.

29

SCHARF MULTI-ASSET OPPORTUNITY FUND

SCHEDULE OF INVESTMENTS at September 30, 2021, Continued

|

Shares

|

MONEY MARKET FUND – 8.66%

|

||||||

|

4,378,126

|

First American Treasury Obligations

|

||||||

|

Fund, Class Z, 0.01% (e)

|

$

|

4,378,126

|

|||||

|

TOTAL MONEY MARKET FUND

|

|||||||

|

(Cost $4,378,126)

|

4,378,126

|

||||||

|

Total Investments in Securities

|

|||||||

|

(Cost $38,399,189) – 99.89%

|

50,485,506

|

||||||

|

Other Assets in Excess of Liabilities – 0.11%

|

57,075

|

||||||

|

TOTAL NET ASSETS – 100.00%

|

$

|

50,542,581

|

|||||

|

ADR

|

American Depository Receipt

|

|

CMT

|

Constant Maturity

|

|

LIBOR

|

London Interbank Offered Rate

|

|

(a)

|

Non–income producing security.

|

|

(b)

|

Foreign issuer.

|

|

(c)

|

Variable rate security. Rate shown reflects the rate in effect as of September 30, 2021.

|

|

(d)

|

Security purchased within the terms of a private placement memorandum, exempt from registration under Rule 144A of the Securities Act of 1933, as amended, and may be sold only to dealers in the

program or other “qualified institutional buyers.” As of September 30, 2021, the value of these investments was $153,104 or 0.30% of total net assets.

|

|

(e)

|

Rate shown is the 7–day annualized yield as of September 30, 2021.

|

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and

Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

30

SCHARF GLOBAL OPPORTUNITY FUND

SCHEDULE OF INVESTMENTS at September 30, 2021

|

Shares

|

COMMON STOCKS – 91.09%

|

Value

|

|||||

|

Aerospace and Defense – 3.57%

|

|||||||

|

2,653

|

Lockheed Martin Corp.

|

$

|

915,550

|

||||

|

Auto Components – 0.17%

|

|||||||

|

10,108

|

Nexen Corp. (b)

|

43,027

|

|||||

|

Automobiles – 3.26%

|

|||||||

|

84,399

|

Porsche Automobil Holding SE – ADR

|

834,706

|

|||||

|

Beverages – 1.61%

|

|||||||

|

3,958

|

Heineken N.V. (b)

|

413,543

|

|||||

|

Building Products – 1.96%

|

|||||||

|

9,026

|

Masco Corp.

|

501,394

|

|||||

|

Chemicals – 1.84%

|

|||||||

|

15,120

|

Valvoline, Inc.

|

471,442

|

|||||

|

Commercial Services & Supplies – 1.95%

|

|||||||

|

13,300

|

Herman Miller, Inc.

|

500,878

|

|||||

|

Diversified Financial Services – 3.81%

|

|||||||

|

3,577

|

Berkshire Hathaway, Inc. – Class B (a)

|

976,306

|

|||||

|

Health Care Providers & Services – 13.43%

|

|||||||

|

16,453

|

Centene Corp. (a)

|

1,025,187

|

|||||

|

16,299

|

CVS Health Corp.

|

1,383,133

|

|||||

|

5,190

|

McKesson Corp.

|

1,034,782

|

|||||

|

3,443,102

|

|||||||

|

Hotels, Restaurants & Leisure – 3.84%

|

|||||||

|

184,655

|

Domino’s Pizza Group plc (b)

|

985,762

|

|||||

|

Household Durables – 3.49%

|

|||||||

|

8,094

|

Sony Corp. – ADR (a)

|

895,035

|

|||||

|

Insurance – 6.35%

|

|||||||

|

46,890

|

AIA Group, Ltd. (b)

|

541,804

|

|||||

|

908

|

Markel Corp. (a)

|

1,085,178

|

|||||

|

1,626,982

|

|||||||

|

Interactive Media & Services – 6.31%

|

|||||||

|

6,622

|

Baidu, Inc. – ADR (a)

|

1,018,133

|

|||||

|

10,135

|

Tencent Holdings, Ltd. (b)

|

600,706

|

|||||

|

1,618,839

|

|||||||

The accompanying notes are an integral part of these financial statements.

31

SCHARF GLOBAL OPPORTUNITY FUND

SCHEDULE OF INVESTMENTS at September 30, 2021, Continued

|

Shares

|

COMMON STOCKS – 91.09%, Continued

|

Value

|

|||||

|

IT Services – 5.12%

|

|||||||

|

7,750

|

Cognizant Technology Solutions Corp. – Class A

|

$

|

575,128

|

||||

|

6,800

|

Fiserv, Inc. (a)

|

737,800

|

|||||

|

1,312,928

|

|||||||

|

Media – 11.73%

|

|||||||

|

15,637

|

Comcast Corp. – Class A

|

874,577

|

|||||

|

120,414

|

Grupo Televisa S.A.B. – ADR

|

1,322,146

|

|||||

|

4,703

|

Liberty Broadband Corp. – Class C (a)

|

812,208

|

|||||

|

3,008,931

|

|||||||

|

Metals & Mining – 3.18%

|

|||||||

|

45,128

|

Barrick Gold Corp. – ADR (b)

|

814,560

|

|||||

|

Personal Products – 2.69%

|

|||||||

|

12,744

|

Unilever plc – ADR

|

690,980

|

|||||

|

Pharmaceuticals – 7.65%

|

|||||||

|

9,488

|

AstraZeneca plc – ADR

|

569,849

|

|||||

|

2,849

|

Johnson & Johnson

|

460,113

|

|||||

|

11,402

|

Novartis AG – ADR

|

932,456

|

|||||

|

1,962,418

|

|||||||

|

Software – 5.09%

|

|||||||

|

1,882

|

Microsoft Corp.

|

530,574

|

|||||

|

8,894

|

Oracle Corp.

|

774,934

|

|||||

|

1,305,508

|

|||||||

|

Specialty Retail – 4.04%

|

|||||||

|

4,955

|

Advance Auto Parts, Inc.

|

1,035,050

|

|||||

|

TOTAL COMMON STOCKS

|

|||||||

|

(Cost $19,015,510)

|

23,356,941

|

||||||

|

PREFERRED STOCKS – 7.14%

|

|||||||

|

Auto Components – 0.38%

|

|||||||

|

14,157

|

Nexen Corp., 3.02% (b)

|

42,029

|

|||||

|

19,025

|

Nexen Tire Corp., 3.72% (b)

|

56,882

|

|||||

|

98,911

|

|||||||

|

Capital Markets – 0.40%

|

|||||||

|

1,800

|

Korea Investment Holdings Co., Ltd., 4.74% (b)

|

101,554

|

|||||

The accompanying notes are an integral part of these financial statements.

32

SCHARF GLOBAL OPPORTUNITY FUND

SCHEDULE OF INVESTMENTS at September 30, 2021, Continued

|

Shares

|

PREFERRED STOCKS – 7.14%, Continued

|

Value

|

|||||

|

Containers & Packaging – 0.06%

|

|||||||

|

5,450

|

NPC, 4.53% (b)

|

$

|

14,569

|

||||

|

Personal Products – 0.26%

|

|||||||

|

1,870

|

AMOREPACIFIC Group, 1.07% (b)

|

30,561

|

|||||

|

65

|

LG Household & Health Care, Ltd., 1.60% (b)

|

35,245

|

|||||

|

65,806

|

|||||||

|

Technology Hardware,

|

|||||||

|

Storage & Peripherals – 6.04%

|

|||||||

|

26,375

|

Samsung Electronics Co., Ltd., 3.59% (b)

|

1,550,422

|

|||||

|

TOTAL PREFERRED STOCKS

|

|||||||

|

(Cost $814,766)

|

1,831,262

|

||||||

|

MONEY MARKET FUND – 3.17%

|

|||||||

|

813,508

|

First American Treasury Obligations

|

||||||

|

Fund, Class Z, 0.01% (c)

|

813,508

|

||||||

|

TOTAL MONEY MARKET FUND

|

|||||||

|

(Cost $813,508)

|

813,508

|

||||||

|

Total Investments in Securities

|

|||||||

|

(Cost $20,643,784) – 101.40%

|

26,001,711

|

||||||

|

Liabilities in Excess of Other Assets – (1.40)%

|