Form N-6 RIVERSOURCE OF NEW YORK

Table of Contents

| THE SECURITIES ACT OF 1933 | [ ] | |

| Post-Effective Amendment No. (File No. ) | [ ] |

| THE INVESTMENT COMPANY ACT OF 1940 | [ ] | |

| Amendment No. 101 (File No. 811-05213) | [x] |

Depositor’s Telephone Number, including Area Code:

(800) 541-2251

Minneapolis, MN 55474

Table of Contents

| Issued by: | RiverSource Life Insurance Co. of New York (RiverSource Life of NY) |

| 20 Madison

Avenue Extension Albany, NY 12203 Telephone: 1-800-541-2251 Website address: riversource.com/lifeinsurance RiverSource of New York Account 8 | |

| Service Center: | RiverSource Life Insurance Co. of New York |

| 70500

Ameriprise Financial Center Minneapolis, MN 55474 Telephone: 1-800-541-2251 Website address: riversource.com/lifeinsurance |

| • | A Fixed Account to which we credit interest. |

| • | Indexed Accounts to which we credit interest. |

| • | Subaccounts that invest in underlying Funds. |

| • | Are NOT deposits or obligations of a bank or financial institution; |

| • | Are NOT insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency; and |

| • | Are subject to risks including loss of the amount you invested and the policy ending without value. |

|

|

53 |

|

|

53 |

|

|

53 |

|

|

56 |

|

|

56 |

|

|

58 |

|

|

60 |

|

|

61 |

|

|

61 |

|

|

61 |

|

|

62 |

|

|

63 |

|

|

72 |

| FEES AND EXPENSES | Location in Statutory Prospectus | |||

| Charges for Early Withdrawals | If you surrender your policy for its full Cash Surrender Value, or the policy Lapses, during the first ten years and for ten years after requesting an increase in the Specified Amount, you will incur a Surrender Charge. The Surrender Charges are set based on various factors such as the Insureds’ Insurance Ages (or Attained Insurance Ages at the time of a requested increase in the Specified Amount), Risk Classifications, genders and the number of years the policy has been in force (or for the number of years from the effective date of an increase in Specified Amount). The Surrender Charges are shown under the Policy Data page of your policy. | Fee Tables | ||

| Transaction Charges | In addition to Surrender Charges, you may also incur charges on other transactions, such as a premium expense charge, partial Surrender Charge, express mail fee, electronic fund transfer fee, and fees imposed when exercising your rights under certain riders and benefits under the policy. If you take a loan against the policy, you will be charged a loan interest rate on any outstanding balance until the loan is paid off. | Fee Tables | ||

| Ongoing Fees and Expenses (annual charges) | In

addition to Surrender Charges and transaction charges, an investment in the policy is subject to certain ongoing fees and expenses, including fees and expenses covering the cost of insurance under the policy and the cost of certain optional

benefits available under the policy. Such fees and expenses are set based on various factors such as the Insureds’ Risk Classifications, Issue Ages, genders and the number of years the policy is in force. You should review the rates, fees and

charges under the Policy Data page of your policy. You will also bear expenses associated with the Funds offered under the policy, as shown in the following table: |

Fee Tables | ||

| Annual Fee | Minimum | Maximum | ||

| Underlying

Fund options (Funds fees and expenses)(1) |

0.26% | 4.14% | ||

| (1) As a percentage of fund assets. | ||||

| RISKS | ||||

| Risk of Loss | You can lose money by investing in this policy including loss of principal. | Principal Risks | ||

| Not a Short-Term Investment | The

policy is a long-term investment that is primarily intended to provide a death benefit that we pay to the Beneficiary upon the last surviving Insured’s death. The policy is not suitable as a short-term investment and may not be appropriate for an investor who needs ready access to cash. Your policy has little or no Cash Surrender Value in the early policy years. During early policy years the Cash Surrender Value may be less than the premiums you pay for the policy. Your ability to take partial surrenders is limited. You cannot take partial surrenders during the first policy year. |

Principal Risks | ||

| RISKS | Location

in Statutory Prospectus | |||

| Risks Associated with Investment Options | •

You can lose cash value due to adverse investment experience. There is no minimum guaranteed cash value under the Subaccounts of the Variable Account. • If the death benefit is option 2, the death benefit could decrease from the death benefit on the previous Valuation Date due to adverse investment experience. • Your policy could Lapse due to adverse investment experience if the No-Lapse Guarantee is not in effect and you do not pay the premiums needed to maintain coverage. • Each investment option (including the Fixed Account and the Indexed Accounts) has its own unique risks. • You should review the investment options before making an investment decision. |

Principal

Risks The Variable Account and the Funds | ||

| Insurance Company Risks | An

investment in the policy is subject to the risks related to us. Any obligations (including under the Fixed Account and the Indexed Accounts) or guarantees and benefits of the policy that exceed the assets of the Variable Account are subject to our

claims-paying ability. If we experience financial distress, we may not be able to meet our obligations to you. More information about RiverSource Life of NY, including our financial strength ratings, is available by contacting us at

1-800-541-2251. Additional information regarding the financial strength of RiverSource Life of NY can be accessed at: strengthandsoundness.com. |

Principal

Risks The General Account | ||

| Policy Lapse | Insufficient premium payments, fees and expenses, poor investment performance, full and partial surrenders, and unpaid loans or loan interest may cause the policy to Lapse. There is a cost associated with reinstating a Lapsed policy. Death benefits will not be paid if the policy has Lapsed. | Keeping the Policy in Force | ||

| RESTRICTIONS | ||||

| Investment Options | •

We reserve any right to limit transfers of value from a Subaccount to one or more Subaccounts or to the Fixed Account to five per policy year, and we may suspend or modify this transfer privilege at any time with any necessary approval of the

Securities and Exchange Commission. • Your transfers among the Subaccounts are subject to policies designed to deter market timing. • The minimum transfer amount from an investment option is $50, if automated, and $250 by mail or telephone. • On the youngest Insured’s Attained Insurance Age 120 anniversary, any Policy Value in the Subaccounts will be transferred to the Fixed Account and may not be transferred to any Indexed Account. • You may only transfer between Subaccounts and the Fixed Account on a Policy Anniversary, unless you automate such transfers. • Restrictions into and out of the Indexed Accounts apply. • We reserve the right to close, merge or substitute Funds as investment options. We also reserve the right, upon notification to you, to close or restrict any Funds. We will obtain any necessary approval of the Securities and Exchange Commission. • We generally limit premium payments in excess of $1,000,000. |

Transfers

Among the Fixed Account, Indexed Accounts and Subaccounts Substitution of Investments Optional Benefits — Investment Allocation Restrictions for Certain Benefit Riders | ||

| Optional Benefits | •

Certain restrictions and limitations apply under the policy’s optional benefits. • Certain optional benefits are only available at policy issuance. |

Additional Information About Standard Benefits (Other than Standard Benefits) | ||

| TAXES | Location

in Statutory Prospectus | |||

| Tax Implications | •

You should consult with a tax professional to determine the tax implications of an investment in and payments received under the policy. • If your policy is a modified endowment contract, you may have to pay a tax penalty if you take a withdrawal before age 59½. |

Taxes | ||

| CONFLICTS OF INTEREST | ||||

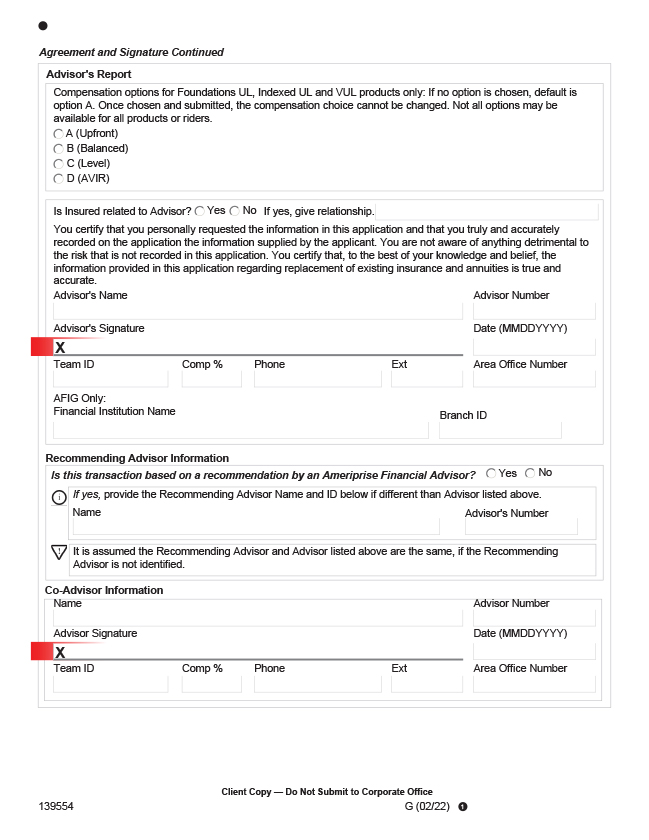

| Investment Professional Compensation | In

general, we pay selling firms and their sales representatives compensation for selling the policy. In addition to commissions, we may, in order to promote sales of the policies, pay or provide selling firms with other promotional incentives in cash, credit or other compensation. These promotional incentives or reimbursements may be calculated as a percentage of the selling firm’s aggregate, net or anticipated sales and/or total assets attributable to sales of the policy, and/or may be a fixed dollar amount. Selling firms and their sales representatives may have a financial incentive to recommend the policy over another investment. |

Distribution of the Policy | ||

| Exchanges | If you already own an insurance policy, some financial representatives may have a financial incentive to offer you a new policy in place of one you already own. You should only exchange an existing policy if you determine, after comparing the features, fees and risks of both policies, that it is better for you to purchase the new policy rather than continue to own your existing policy. | For additional information, see 1035 exchanges under Other Tax Considerations | ||

| • | A Fixed Account, |

| • | Indexed Accounts, or |

| • | Subaccounts that invest in underlying Funds. |

| • | Flexibility. The policy is designed to be flexible. While the at least one of the Insureds are living, you, as the Owner of the policy, may exercise all of the rights and options described in the policy. You may, within limits, (1) change the amount of insurance, (2) borrow or withdraw amounts you have invested, (3) choose when and how much you invest, (4) choose whether your Policy Value or premium will be added to the Specified Amount when determining proceeds payable to the Beneficiary upon the last surviving Insured’s death, and (5) add or delete certain other optional benefits that we make available by rider to your policy, as permitted. |

| • | Accessing Your Money. At any time while the policy is in force, you may fully surrender your policy in return for its Cash Surrender Value. A full surrender will terminate your policy and it cannot be reinstated. At any time after the first policy year, you may partially surrender your policy’s Cash Surrender Value. A partial surrender must be at least $500. Partial surrenders will also reduce your Policy Value and death benefit and will increase your risk of Lapse. Full surrenders may be subject to Surrender Charges and partial surrenders are subject to surrender processing fees. |

| • | Death Benefit Options. You must choose between death benefit Option 1, Option 2 or Option 3 at the time of your application. After choosing a death benefit option, you may change it at any time prior to the youngest Insured’s Attained Insurance Age 120. |

| • | Death Benefit Option 1: Provides for a death benefit that is equal to the greater of (a) the Specified Amount and (b) a percentage of Policy Value. |

| • | Death Benefit Option 2: Provides for a death benefit that is equal to the greater of (a) the Specified Amount plus the Policy Value and (b) a percentage of Policy Value. |

| • | Death Benefit Option 3: Provides for a death benefit that is equal to the greater of (a) the lesser of (i) the Specified Amount plus premiums paid, less partial surrenders and any partial surrender fees, or (ii) the Death Benefit Option 3 Limit shown in your Policy Data pages; and (b) a percentage of Policy Value. |

| • | Loans. You may take a loan from your policy at any time. The maximum amount of a new loan you may take is 90% of the Cash Surrender Value. The minimum loan you may take is $500. When you take a loan, we remove from your investment options an amount equal to your loan and hold that part of your Policy Value in the Fixed Account as loan collateral. We charge interest on your loan. The loan collateral does not participate in the investment performance of the Subaccounts, nor does it receive indexed interest. Taking a loan may have adverse tax consequences, will reduce the death benefit, and will increase your risk of Lapse. |

| • | Tax Treatment. The policy is designed to afford the tax treatment of a qualifying life insurance policy under federal law. Generally, under federal tax law, the death benefit under a qualifying life insurance policy is excludable from the gross income of the Beneficiary. In addition, under a qualifying life insurance policy, cash value builds up on a tax deferred basis and transfers of cash value among the available investment options under the policy may be made income tax free. The tax treatment of policy loans and distributions may vary depending on whether the policy is a modified endowment contract. Neither distributions nor loans from a policy that is not a modified endowment contract are subject to the 10% penalty tax. |

| • | Optional Benefit Riders: The policy offers additional benefits, or “riders,” that provide you with supplemental benefits under the policy at an additional cost. . These riders, which are only available at policy issue, include: |

| • | Rider that provides a partial waiver of the Surrender Charge upon a full surrender (i.e., Accounting Value Increase Rider). |

| • | Policy Split Option Rider that permits a policy to be split into two individual permanent plans of life insurance then offered by us for exchange (i.e., Policy Split Option Rider). |

| • | Rider that provides an additional, pre-set death benefit if the last surviving Insured dies during the first four years of a policy (i.e., Four-Year Term Rider). |

| • | Additional “Standard” Riders, Features and Services. Additional riders, features and services under the policy are summarized below. There are no additional charges associated with these features and services. |

| • | Automated Transfers. This feature allows you to automatically transfer Policy Value from either a Subaccount or the Fixed Account to one or more Subaccounts and the Indexed Accounts on a regular basis. Via automated transfers you can take advantage of a dollar cost averaging strategy where you invest in one or more Subaccounts on a regular basis, for example monthly, instead of investing a large amount at one point in time. This systematic approach can help you benefit from fluctuations in Accumulation Unit values caused by the fluctuations in the value of the underlying Fund. |

| • | Asset Rebalancing. The automatic rebalancing feature automatically rebalances your Policy Value in the Subaccounts to correspond to your premium allocation designation. Asset rebalancing does not count towards the number of free transfers per policy year. |

| • | No-Lapse Guarantee. Guarantees the policy will remain in force over the No-Lapse Guarantee Period even if the Cash Surrender Value is insufficient to pay the monthly deduction. This feature is in effect so long as certain requirements are met. |

| • | Riders that help prevent your policy from Lapsing (i.e., Overloan Protection Benefit). |

| • | Policy Value Credit. We may periodically apply a credit to your Policy Value. |

| CHARGE | WHEN CHARGE IS DEDUCTED | AMOUNT DEDUCTED | |||

| Maximum Sales Charge Imposed on Premiums (Load)(a) | When you pay premium. | 6% of each premium payment. | |||

| Premium Taxes | When you pay premium as part of the premium expense charge. | A portion of the premium expense charge is used to pay state premium taxes imposed on us by state and governmental subdivisions. See discussion under “Premium Expense Charge.” | |||

| Maximum Deferred Sales Charge (Load)(b) | When you surrender your policy for its full Cash Surrender Value, or the policy Lapses, during the first ten years and for ten years after requesting an increase in the Specified Amount. | Rate per $1,000 of initial Specified Amount: | |||

| Minimum: $7.3347 — Female, Standard NonTobacco, Insurance Age 20; Male, Standard NonTobacco, Insurance Age 85. | |||||

| Maximum: $36.8476– Female, Standard Tobacco, Insurance Age 68; Male, Standard Tobacco, Insurance Age 68. | |||||

| Representative Insured: $18.4595– Female, Super Preferred, Nontobacco, Age 55; Male, Standard Nontobacco, Insurance Age 55. | |||||

| Other Surrender Fees(c) | When you surrender part of the value of your policy. | The lesser of: | |||

| • $25; or | |||||

| • 2% of the amount surrendered. | |||||

| Transfer Fees | N/A | N/A | |||

| Fees for Express Mail and Electronic Fund Transfers of Loan or Surrender Proceeds | When you take a loan or surrender and Proceeds are sent by express mail or electronic fund transfer. | • $30 — United States. | |||

| • $35 — International. | |||||

| Interest Rate on Loans | Charged daily and due at the end of the policy year. | • 3% for policy years 1-10; | |||

| • 1.00% for policy years 11+ | |||||

| Overloan Protection Benefit (OPB) | Upon exercise of the benefit. | 3% of the Policy Value | |||

| Policy Split Option Rider (PSO) | Upon exercise of the benefit. | $250 | |||

| (a) | We call this the premium expense charge in other places in this prospectus. |

| (b) | We call this a Surrender Charge in other places in this prospectus, and it is level for the first five policy years and then it decreases monthly until it reaches $0 at the end of year 10. This charge varies based on individual characteristics. The charges shown in the table may not be representative of the charge you will pay. For information about the charge you would pay, contact your sales representative or RiverSource Life of NY at the address or telephone number shown on the first page of this prospectus. |

| (c) | We call this the partial Surrender Charge in other places in this prospectus. |

| CHARGE | WHEN CHARGE IS DEDUCTED | AMOUNT DEDUCTED |

| Policy Fee | $10 per month for initial Specified Amounts below $2,000,000. | |

| Cost of Insurance Charge(a) | Monthly. | Monthly rate per $1,000 of Net Amount at Risk: |

| Minimum: $0.00000— Female, Super Preferred, Nontobacco Insurance Age 20; Female, Super Preferred, Nontobacco, Insurance Age 20; Duration 1. | ||

| Maximum: $49.01164— Male, Standard Tobacco, Insurance Age 85; Male, Standard Tobacco, Insurance Age 85, Duration 35. | ||

| Representative Insured: $0.00001– Female, Super Preferred, Nontobacco, Insurance Age 55; Male, Standard, Nontobacco, Age 55: Duration 1. | ||

| Administrative Charge(a) | Monthly. | Rate per $1,000 of initial Specified Amount: |

| Minimum: $0.064— Female, Super Preferred Nontobacco, Insurance Age 20; Female, Super Preferred Nontobacco, Insurance Age 20; Durations 1-10. | ||

| Maximum: $1.672; Male, Standard Tobacco, Age 85; Male, Standard Tobacco, Insurance Age 85; Durations 1-10 | ||

| Representative Insured: Female, Super Preferred Nontobacco, Age 55; Male, Standard Nontobacco, Insurance Age 55. | ||

| Current: $0.274 per month, Durations 1-10. | ||

| Indexed Account Charge(b) | Monthly. | Annual rate of 0.60% applied monthly. |

| Mortality and Expense Risk Charge | Monthly. | Annual rate of 0.00% applied monthly to the Variable Account Value. |

| Optional Benefit Charges: | ||

| (a) | This charge varies based on individual characteristics. The charges shown in the table may not be representative of the charge you will pay. For information about the charge you would pay, contact your sales representative or RiverSource Life of NY at the address or telephone number shown on the first page of this prospectus. |

| (b) | The Indexed Account charge is equal to the sum of the charges for all Indexed Accounts. The charge for an Indexed Account is equal to the current Indexed Account charge for that Indexed Account multiplied by the sum of the Segment values corresponding to that Indexed Account as of the Monthly Date. |

| CHARGE | WHEN CHARGE IS DEDUCTED | AMOUNT DEDUCTED |

| Accounting Value Increase Rider (AVIR)(a) | Monthly. | Monthly rate per $1,000 of Specified Amount: |

| Minimum: $0.0329 — Female, Nontobacco, Insurance Age 85; Male Nontobacco, Insurance Age 85. | ||

| Maximum: $0.0475 — Female, Nontobacco, Insurance Ages 35-55; Male Nontobacco, Insurance Ages 35-55. | ||

| Representative Insured: $0.0475 — Female, Nontobacco, Age 55; Male, Nontobacco, Insurance Age 55. | ||

| Four-Year Term Insurance Rider (FYT)(a)(b) | Monthly. | Monthly rate per $1,000 of Net Amount at Risk: |

| Minimum: $0.00000 — Female, Super Preferred, Nontobacco, Insurance Age 20; Female, Super Preferred, Nontobacco, Insurance Age 20, Duration 1. | ||

| Maximum: $2.46005 — Male, Standard Tobacco, Insurance Age 85; Male, Standard Tobacco, Insurance Age 85; Duration 4. | ||

| Representative Insured: $0.00001 – Female, Super Preferred Nontobacco, Insurance Age 55; Male, Standard Nontobacco, Age 55; Duration 1. | ||

| (a) | This charge varies based on individual characteristics. The charges shown in the table may not be representative of the charge you will pay. For information about the charge you would pay, contact your sales representative or RiverSource Life of NY at the address or telephone number shown on the first page of this prospectus. |

| (b) | This rider will terminate if one of the following circumstances occurs: (1) four-year Anniversary date shown in the policy; or (2) if the PSO rider is exercised. |

| Total Annual Fund Expenses | Minimum(%) | Maximum(%) |

| (expenses deducted from the fund assets, including management fees, distribution and/or service (12b-1) fees and other expenses) | 0.26 | 4.14 |

| Policy Risk | What It Means |

| Risks of Poor Investment Performance | If you direct your Net Premiums or transfer your Policy’s Value to a Subaccount that drops in value: |

| • You can lose cash values due to adverse investment experience. There is no minimum guaranteed cash value under the Subaccounts of the Variable Account. | |

| • If the death benefit option is option 2, the death benefit could decrease from the death benefit on the previous Valuation Date due to adverse investment experience (but at no time will it be less than the Specified Amount). | |

| • Your policy could Lapse due to adverse investment experience if the NLG is in not effect and you do not pay the premiums needed to maintain coverage. | |

| The Policy is Unsuitable as a Short-term Savings Vehicle | The policy is a long-term investment that provides a death benefit that we pay to the Beneficiary upon the last surviving Insured’s death. |

| The policy is not suitable as a short-term investment. Your policy has little or no Cash Surrender Value in the early policy years. Surrender Charges apply to this policy for the first ten years. A new schedule of Surrender Charges will apply for ten years after an increase in the Specified Amount. Surrender Charges can significantly reduce Policy Values. During early policy years the Cash Surrender Value may be less than the premiums you pay for the policy. | |

| Your ability to take partial surrenders is limited. You cannot take partial surrenders during the first policy year. | |

| Risks of Policy Lapse | If you do not pay the premiums needed to maintain coverage: |

| • We will not pay a death benefit if your policy Lapses. | |

| • Also, the Lapse may have adverse tax consequences. (See “Tax Risk.”) | |

| Your policy may Lapse due to Surrender Charges. | |

| • Surrender Charges affect the surrender value, which is a measure we use to determine whether your policy will enter a grace period (and possibly Lapse, which may have adverse tax consequences, see “Tax Risk”). A partial surrender will reduce the Policy Value and the death benefit and may terminate the NLG. | |

| If you take a loan against your policy. | |

| • Taking a loan increases the risk of: | |

| — policy Lapse (which may have adverse tax consequences, see “Tax Risk”); | |

| — a permanent reduction of Policy Value; | |

| — reducing the death benefit. | |

| • Taking a loan may also terminate the NLG. | |

| Your policy can Lapse due to poor investment performance. | |

| Policy Risk | What It Means |

| • Your policy could Lapse due to adverse investment experience if the NLG is not in effect and you do not pay the premiums needed to maintain coverage. | |

| • The Lapse may have adverse tax consequences (See “Tax Risk”). | |

| Exchange/Replacement Risk | You exchange or replace another policy to buy this one. |

| • You may pay Surrender Charges on the old policy. | |

| • The new policy has Surrender Charges, which may extend beyond those in the old policy. | |

| • The new policy’s Surrender Charges may be higher than the Surrender Charges in old policy. | |

| • You may be subject to new incontestability and suicide periods on the new policy. | |

| • You may be in a higher insurance risk rating category in the new policy which may increase the cost of the policy. | |

| • If a partial surrender is taken prior to the exchange, you may have adverse tax consequences. | |

| • The exchange may have adverse tax consequences. (See “Tax Risk.”) | |

| You use cash values or dividends from another policy to buy this one, without fully surrendering the other policy. | |

| • If you borrow from another policy to buy this one, the loan reduces the death benefit on the other policy. If you fail to repay the loan and accrued interest, you could lose the other coverage and you may be subject to income tax if the policy Lapses or is surrendered with a loan against it. You may have adverse tax consequences. (See “Tax Risk.”) | |

| • If you surrender cash value from another policy to buy this one, you could lose coverage on the other policy. Also, the surrender may be subject to income tax. You may have adverse tax consequences. (See “Tax Risk.”) | |

| Limitations on Access to Cash Value Through Withdrawals | Your

ability to take partial surrenders is limited. You cannot take partial surrenders during the first policy year. |

| Possibility of Adverse Tax Consequences | A policy may be classified as a “modified endowment contract” (MEC) for federal income tax purposes when issued. If a policy is not a MEC when issued, certain changes you make to the policy may cause it to become a MEC. |

| • Any taxable earnings come out first on surrenders or loans from a MEC policy or an assignment or pledge of a MEC policy. Investment in the policy comes out second. Federal income tax on these earnings will apply. State and local income taxes may also apply. If you are under age 59½, a 10% penalty tax may also apply to these earnings. | |

| If you exchange or replace another policy to buy this one. | |

| • If you replace the old policy and it is not part of an exchange under Section 1035 of the Code, there may be adverse tax consequences if the total Policy Value (before reductions for outstanding loans, if any) exceeds your investment in the old policy. | |

| Policy Risk | What It Means |

| • If you replace the old policy as part of an exchange under Section 1035 of the Code and there is a loan on the old policy, there may be adverse tax consequences if the total Policy Value (before reductions for the outstanding loan) exceeds your investment in the old policy. | |

| • The new policy may be or may become a MEC even if the old policy was not a MEC. See discussion under “Modified Endowment Contracts”. | |

| • The exchange may require a portion of the cash value of the old policy to be distributed in order to qualify the new policy as a life insurance policy for federal tax purposes. | |

| If your policy Lapses or is fully surrendered with an outstanding policy loan, you may experience a significant tax cost. | |

| • You will be taxed on any earnings in the policy. Generally, a policy has earnings to the extent the cash value plus any outstanding loans exceeds the investment in the contract. | |

| • For non-MEC policies, it could be the case that a policy with a relatively small existing cash value could have significant as yet untaxed earnings that will be taxed upon Lapse or surrender of the policy. | |

| • For MEC policies, earnings are the remaining earnings (any earnings that have not been previously taxed) in the policy, which could be a significant amount depending on the policy. | |

| The investments in the Subaccount are not adequately diversified. | |

| • If a policy fails to qualify as a life insurance policy because it is not adequately diversified, the policyholder must include in gross income the “income on the contract” (as defined in Section 7702(g) of the Code). | |

| Congress may change how a life insurance policy is taxed at any time. | |

| The interpretation of current tax law is subject to change by the Internal Revenue Service (IRS) or the courts at any time. | |

| • You could lose any or all of the specific federal income tax attributes and benefits of a life insurance policy including tax-deferred accrual of cash values and income tax free death benefits. | |

| • For non-MEC policies you could lose your ability to take non-taxable distributions or loans from the policy. | |

| • Typically, changes of this type are prospective only, but some or all of the attributes could be affected. | |

| The IRS may determine that you are the Owner of the Fund shares held by our Variable Account. | |

| • You may be taxed on the income of each Subaccount to the extent of your interest in the Subaccount. | |

| Fund Risks | A comprehensive discussion of the risks of each Fund in which the Subaccounts invest may be found in each Fund’s prospectus. Please refer to the prospectuses for the Funds for more information. The investment advisers cannot guarantee that the Funds will meet their investment objectives. |

| Policy Risk | What It Means |

| Market Risk | Variable life insurance is a complex vehicle that is subject to market risk, including the potential loss of principal invested. |

| • You may experience loss in Policy Value due to factors that affect the overall performance of the financial markets. | |

| Financial Strength and Claims Paying Ability Risk | All insurance benefits, including the death benefit, and all guarantees, including those related to the Fixed Account and Indexed Accounts, are general account obligations that are subject to the financial strength and claims paying ability of RiverSource of New York. |

| Effects of COVID-19 Pandemic | The coronavirus disease 2019 (“COVID-19”) public health crisis presents ongoing significant economic and societal disruption, and has driven significant volatility in the equity and interest rate markets. Any periods of continued high market volatility, and your individual circumstances (e.g., your selected allocations and the timing of any purchase payments, transfers, or withdrawals), will affect values under your policy. As part of how we maintain our strong financial strength and claims-paying ability, we continue to reserve amounts for our contractual obligations in accordance with significant state solvency regulations. The extent to which the COVID-19 pandemic may impact financial markets, investment performance under your policy, and our financial strength and claims-paying ability will depend on future developments, which are highly uncertain and cannot be estimated, including the scope and duration of the pandemic and actions taken by governmental authorities, market participants, and other third parties in response to the pandemic. |

| We have implemented comprehensive strategies to address the operating environment spurred by the pandemic. To promote the safety and security of our employees and to assure the continuity of our business operations, we have implemented a work from home protocol for virtually all of our employee population, restricted business travel, and provided resources for complying with the guidance from the World Health Organization, the U.S. Centers for Disease Control and government authorities. We have been satisfying elevated customer service volumes and our operations teams have continued to operate successfully and without disruptions in service. Our pandemic strategy is flexible and scalable and takes into consideration that a pandemic could be widespread and may occur in multiple waves, affecting different communities at different times with varying levels of severity. We cannot, however, predict the impact that natural or man-made disasters and catastrophes, including the COVID-19 pandemic, may have over near- or longer-term periods. | |

| Cyber Security and Systems Integrity | Increasingly, businesses are dependent on the continuity, security, and effective operation of various technology systems. The nature of our business depends on the continued effective operation of our systems and those of our business partners. This dependence makes us susceptible to operational and information security risks from cyber-attacks. |

| These risks may include the following: | |

| Policy Risk | What It Means |

| • the corruption or destruction of data; | |

| • theft, misuse or dissemination of data to the public, including your information we hold; and | |

| • denial of service attacks on our website or other forms of attacks on our systems and the software and hardware we use to run them. | |

| These attacks and their consequences can negatively impact your policy, your privacy, your ability to conduct transactions on your policy, or your ability to receive timely service from us. There can be no assurance that we, the underlying Funds in your policy, or our other business partners will avoid losses affecting your policy due to any successful cyber-attacks or information security breaches. | |

| Conflict of Interest Risks Related to Certain Funds Advised by Columbia Management | We are an affiliate of Ameriprise Financial, Inc., which is the parent company of Columbia Management Investment Advisers, LLC (Columbia Management). Columbia Management acts as investment adviser to several Fund of funds, including managed volatility Funds. As such, it retains full discretion over the investment activities and investment decisions of the Funds. These Funds invest in other registered mutual funds. In providing investment advisory services for the Funds and the underlying funds in which those Funds respectively invest, Columbia Management is, together with its affiliates, including us, subject to competing interests that may influence its decisions. These competing interests typically arise because Columbia Management or one of its affiliates serves as the investment adviser to the underlying Funds and may provide other services in connection with such underlying Funds, and because the compensation we and our affiliates receive for providing these investment advisory and other services varies depending on the underlying Fund. |

| Managed Volatility Funds’ Risks | Managed volatility Funds employ a strategy designed to reduce overall volatility and downside risk. These Funds may also be used in conjunction with guaranteed living benefit riders we offer with various annuity contracts. Conflicts may arise because the manner in which these Funds and their strategies are executed by Columbia Management are expected to benefit us by reducing our financial risk and expense in offering guaranteed living benefit riders. Managed volatility Funds employ a strategy to reduce overall volatility and downside risk when markets are declining and market volatility is high. A successful strategy may result in less gain in your Policy Value during rising markets with higher volatility when compared to Funds not employing a managed volatility strategy. Although an investment in the managed volatility Funds may mitigate declines in your Policy Value due to declining equity markets, the Funds’ investment strategies may also curb or decrease your Policy Value during periods of positive performance by the equity markets. There is no guarantee that any of the Funds’ strategies will be successful. Costs associated with running a managed volatility strategy may also adversely impact the performance of managed volatility Funds. |

| • | providing the insurance benefits of the policy; |

| • | issuing the policy; |

| • | administering the policy; |

| • | assuming certain risks in connection with the policy; and |

| • | distributing the policy. |

| Lapse

or surrender at beginning of year |

Maximum

Surrender Charge |

| 1 | $27,689.23 |

| 2 | 27,689.23 |

| 3 | 27,689.23 |

| 4 | 27,689.23 |

| 5 | 27,689.23 |

| 6 | 27,227.12 |

| 7 | 21,688.81 |

| 8 | 16,151.66 |

| 9 | 10,613.35 |

| 10 | 5,076.20 |

| 11 | 0.00 |

| • | you do not specify the accounts from which you want us to take the monthly deduction; or |

| • | the value in the Fixed Account or any Subaccount is insufficient to pay the portion of the monthly deduction you have specified. |

| 1. | Cost of Insurance: primarily, this is the cost of providing the death benefit under your policy. It depends on: |

| • | the amount of the death benefit; |

| • | the Policy Value; and |

| • | the cost of insurance rate. |

| “a” | is the monthly cost of insurance rate based on the each Insured’s Insurance Age, duration, sex and Risk Classification. Generally, the cost of insurance rate will increase as the Attained Insurance Age of each of the Insureds increases. |

| We set the rates based on our expectations of mortality, future investment earnings, persistency and expenses. Our current monthly cost of insurance rates are less than the maximum monthly cost of insurance rates guaranteed in the policy. We reserve the right to change rates from time to time; any change will apply to all individuals of the same Risk Classification. However, rates will not exceed the guaranteed maximum monthly cost of insurance rates shown in your policy. All rates are based on the 2017 Commissioners Standard Ordinary (CSO) Smoker and Nonsmoker Mortality Tables, Age Nearest Birthday. | |

| “b” | is the death benefit on the Monthly Date divided by 1.0008295381 (which reduces our Net Amount at Risk, solely for computing the cost of insurance, by taking into account assumed monthly earnings at an annual rate of 1%). |

| “c” | is the Policy Value on the Monthly Date. At this point, the Policy Value has been reduced by the administrative charge, mortality and expense risk charge, the policy fee and any charges for optional riders. |

| “d” | is any flat extra insurance charges we assess as a result of special underwriting considerations. |

| (a) × (b) | where: |

| 12 |

| • | Mortality risk — the risk that the cost of insurance charge will be insufficient to meet actual claims. |

| • | Expense risk — the risk that the policy fee, administrative charge and the Surrender Charge (described above) may be insufficient to cover the cost of administering the policy. |

| CHARGE | WHEN CHARGE IS DEDUCTED | AMOUNT DEDUCTED |

| Policy Split Option Rider (PSO) | Upon exercise of the Rider. | $250 |

| Overloan Protection Benefit (OPB) | Upon exercise of benefit. | 3% of the Policy Value. |

| Four-Year Term Insurance Rider (FYT)(a),(b) | Monthly. | Monthly rate per $1,000 of the cost of insurance amount: |

| Minimum: $0.00000 — Female, Super Preferred, Nontobacco, Insurance Age 20; Female, Super Preferred, Nontobacco, Insurance Age 20, Duration 1. | ||

| Maximum: $2.3592616 — Male, Standard Tobacco, Insurance Age 85; Male, Standard Tobacco, Insurance Age 85; Duration 4. | ||

| Representative Insured: $0.0000147 – Female, Super Preferred Nontobacco, Insurance Age 55; Male, Standard Nontobacco, Age 55; Duration 1. | ||

| Accounting Value Increase Rider (AVIR)(a) | Monthly. | Monthly rate per $1,000 of Specified Amount: |

| Minimum: $0.0329 — Female, Nontobacco, Insurance, Age 85; Male Nontobacco, Insurance Age 85. | ||

| Maximum: $0.0475 — Female, Nontobacco, Insurance Ages 35-55; Male Nontobacco, Insurance Ages 35-55. | ||

| Representative Insured: $0.0475 — Female, Nontobacco, Age 55; Male, Nontobacco, Insurance Age 55. | ||

| (a) | This charge varies based on individual characteristics. The charges shown in the table may not be representative of the charge you will pay. For information about the charge you would pay, contact your sales representative or RiverSource of New York at the address or telephone number shown on the first page of this prospectus. |

| (b) | This rider will terminate if one of the following circumstances occurs: (1) four-year Anniversary date shown in the policy; or (2) if the PSO rider is exercised. |

| • | Surrender Charges; |

| • | cost of optional insurance benefits; |

| • | policy fees; |

| • | administrative charges; |

| • | mortality and expense risk charges; |

| • | Indexed Account charges; |

| • | cost of insurance charges; and |

| • | annual operating expenses of the Funds, including management fees and other expenses. |

| • | diluting the value of an investment in an underlying Fund in which a Subaccount invests; |

| • | increasing the transaction costs and expenses of an underlying Fund in which a Subaccount invests; and |

| • | preventing the investment adviser(s) of an underlying Fund in which a Subaccount invests from fully investing the assets of the Fund in accordance with the Fund’s investment objectives. |

| • | requiring transfer requests to be submitted only by first-class U.S. mail; |

| • | not accepting hand-delivered transfer requests or requests made by overnight mail; |

| • | not accepting telephone or electronic transfer requests; |

| • | requiring a minimum time period between each transfer; |

| • | not accepting transfer requests of an agent acting under power of attorney; |

| • | limiting the dollar amount that you may transfer at any one time; |

| • | suspending the transfer privilege; or |

| • | modifying instructions under an automated transfer program to exclude a restricted Fund if you do not provide new instructions. |

| • | Each Fund may restrict or refuse trading activity that the Fund determines, in its sole discretion, represents market timing. |

| • | Even if we determine that your transfer activity does not constitute market timing under the market timing policies described above which we apply to transfers you make under the policy, it is possible that the underlying Fund’s market timing policies and procedures, including instructions we receive from a Fund, may require us to reject your transfer request. For example, while we will attempt to execute transfers permitted under any asset allocation, dollar-cost averaging or asset rebalancing program that may be described in this prospectus, we cannot guarantee that an underlying Fund’s market timing policies and procedures will do so. Orders we place to purchase Fund shares for the Variable Account are subject to acceptance by the Fund. We reserve the right to reject without prior notice to you any transfer request if the Fund does not accept our order. |

| • | Each underlying Fund is responsible for its own market timing policy, and we cannot guarantee that we will be able to implement specific market timing policies and procedures that a Fund has adopted. As a result, a Fund’s returns might be adversely affected, and a Fund might terminate our right to offer its shares through the Variable Account. |

| • | Funds that are available as investment options under the policy may also be offered to other intermediaries who are eligible to purchase and hold shares of the Fund, including without limitation, separate accounts of other insurance companies and certain retirement plans. Even if we are able to implement a Fund’s market timing policies, we cannot guarantee that other intermediaries purchasing that same Fund’s shares will do so, and the returns of that Fund could be adversely affected as a result. |

| • | You must make transfers from the Fixed Account and any subaccounts during a 30-day period starting on a Policy Anniversary, except for automated transfers, which can be set up for monthly, quarterly or semiannual transfer periods. If the amount in the Fixed Account is less than $100, the entire amount can be transferred at any time. |

| • | If we receive your request to transfer amounts from the Fixed Account within 30 days before the Policy Anniversary, the transfer will become effective on the anniversary. |

| • | If we receive your request on or within 30 days after the Policy Anniversary, the transfer will be effective on the day we receive it. |

| • | We will not accept requests for transfers from the Fixed Account at any other time. |

| • | If you have made a transfer from the Fixed Account to one or more Subaccounts, you may not make a transfer from those Subaccounts back to the Fixed Account until the next Policy Anniversary. |

| • | For mail and telephone transfers — $250 or the entire Subaccount balance, whichever is less. |

| • | For automated transfers — $50. |

| • | For mail and telephone transfers — $250 or the entire Fixed Account balance minus any outstanding Indebtedness, whichever is less. |

| • | For automated transfers — $50. |

| • | no transfers from the Fixed Account or Subaccounts to any Indexed Account will be allowed; and |

| • | Indexed Account premium allocation percentages will change to allocate all premium and loan repayments to the Fixed Account. |

| • | from an Indexed Account Segment prior to Segment maturity, except transfers due to policy loans taken or interest charged on Indebtedness; |

| • | from the Fixed Account or any Subaccount to any Indexed Account when the policy is in a transfer restriction period; |

| • | from the Fixed Account to any Subaccount or Indexed Account after the youngest Insured’s Attained Insurance Age 120 anniversary. |

| • | Only one automated transfer arrangement can be in effect at any time. |

| • | You may transfer all or part of the value of a Subaccount to one or more of the other Subaccounts, one or more of the Indexed Accounts and/or to the Fixed Account. |

| • | You may transfer all or part of the Fixed Account Value, minus Indebtedness, to one or more of the Subaccounts and/or one or more of the Indexed Accounts. |

| • | Either the Fixed Account or one or more of the Subaccounts can be used as the source of Funds for any automated transfer arrangement. The Indexed Accounts may not be used as the source of Funds for any automated transfer arrangement. |

| • | You can start or stop this service by written or phone request. You must allow seven days for us to change any instructions that are currently in place. |

| • | The minimum transfer amount is $50. |

| • | You cannot make automated transfers from the Fixed Account to one or more Subaccounts in an amount that, if continued, would deplete the Fixed Account within 12 months. There is no such restriction on automated transfer arrangements that transfer value from the Fixed Account to one or more of the Indexed Accounts only. |

| • | If your policy has entered a transfer restriction period that will last for 12 months, during this period transfers from the Fixed Account or the Subaccounts to any Indexed Account will not be allowed. Any automated transfer arrangement that moves money to an Indexed Account will be terminated. Premiums and loan repayments allocated to an Indexed Account during this period will be redirected to the Fixed Account. |

| • | If you made a transfer from the Fixed Account to one or more Subaccounts, you may not make a transfer from those Subaccounts back to the Fixed Account until the next Policy Anniversary. |

| • | If you submit your automated transfer request with an application for a policy, automated transfers will not take effect until the policy is issued. |

| • | The balance in any account from which you make an automated transfer must be sufficient to satisfy your instructions. If not, we will stop the automated arrangement. |

| • | Automated transfers are subject to all other policy provisions and terms including provisions relating to the transfer of money between the Fixed Account and the Subaccounts. (Exception: The maximum number of transfers per year provision does not apply to automated transfers.) |

| • | You may make automated transfers by choosing a schedule we provide. |

| By

investing an equal number of dollars each month… |

Month | Amount

Invested |

Accumulation

Unit Value |

Number

of Units Purchased | |

| Jan | $ 100 | $ 20 | 5.00 | ||

| Feb | 100 | 18 | 5.56 | ||

| you

automatically buy more units when the per unit market price is low… |

Mar | 100 | 17 | 5.88 | |

| → | Apr | 100 | 15 | 6.67 | |

| May | 100 | 16 | 6.25 | ||

| June | 100 | 18 | 5.56 | ||

| July | 100 | 17 | 5.88 | ||

| and

fewer units when the per unit market price is high. |

Aug | 100 | 19 | 5.26 | |

| → | Sept | 100 | 21 | 4.76 | |

| Oct | 100 | 20 | 5.00 |

| • | Investment objectives: The investment managers and advisers cannot guarantee that the Funds will meet their investment objectives. Please read the Funds’ prospectuses for facts you should know before investing. These prospectuses are available by contacting us at the address or telephone number on the first page of this prospectus. |

| • | Fund name and management: A Fund underlying your policy in which a Subaccount invests may have a name, portfolio manager, objectives, strategies and characteristics that are the same or substantially similar to those of a publicly-traded retail mutual fund. Despite these similarities, an underlying Fund is not the same as any publicly-traded retail mutual fund. Each underlying Fund will have its own unique portfolio holdings, fees, operating expenses and operating results. The results of each underlying Fund may differ significantly from any publicly-traded retail mutual fund. |

| • | Eligible purchasers: All Funds are available to serve as the underlying investments for variable annuities and variable life insurance policies. The Funds are not available to the public (see “Fund name and management” above). Some Funds also are available to serve as investment options for tax-deferred retirement plans. It is possible that in the future for tax, regulatory or other reasons, it may be disadvantageous for variable annuity accounts and variable life insurance accounts and/or tax-deferred retirement plans to invest in the available Funds simultaneously. Although we and the Fund providers do not currently foresee any such disadvantages, the boards of directors or trustees of each Fund will monitor events in order to identify any material conflicts between annuity owners, policy owners and tax-deferred retirement plans and to determine what action, if any, should be taken in response to a conflict. If a board were to conclude that it should establish separate funds for the variable annuity, variable life insurance and tax-deferred retirement plan accounts, you would not bear any expenses associated with establishing separate funds. Please refer to the Funds’ prospectuses for risk disclosure regarding simultaneous investments by variable annuity, variable life insurance and tax-deferred retirement plan accounts. Each Fund intends to comply with the diversification requirements under Section 817(h) of the Code. |

| • | Funds available under the policy: We seek to provide a broad array of underlying Funds taking into account the fees and charges imposed by each Fund and the policy charges we impose. We select the underlying Funds in which the Subaccounts initially invest and when there is a substitution (see “Substitution of Investments”). We also make all decisions regarding which Funds to retain in a policy, which Funds to add to a policy and which Funds will no longer be offered in a policy. In making these decisions, we may consider various objective and subjective factors. Objective factors include, but are not limited to, Fund performance, Fund expenses, classes of Fund shares available, size of the Fund, and investment objectives and investing style of the Fund. Subjective factors include, but are not limited to, investment sub-styles and process, management skill and history at other funds, and portfolio concentration and sector weightings. We also consider the levels and types of revenue, including but not limited to expense payments |

| and non-cash compensation that a Fund, its distributor, investment adviser, subadviser, transfer agent or their affiliates pay us and our affiliates. This revenue includes, but is not limited to compensation for administrative services provided with respect to the Fund and support of marketing expenses incurred with respect to the Fund. | |

| • | Money market Fund yield: In low interest rate environments, money market Fund yields may decrease to a level where the deduction of fees and charges associated with your policy could result in negative net performance. |

| • | Risks and conflicts of interest with certain Funds advised by Columbia Management: We are an affiliate of Ameriprise Financial, Inc., which is the parent company of Columbia Management Investment Advisers, LLC (Columbia Management). Columbia Management acts as investment adviser to several Fund of funds, including managed volatility Funds. As such, it retains full discretion over the investment activities and investment decisions of the Funds. These Funds invest in other registered mutual funds. In providing investment advisory services for the Funds and the underlying funds in which those Funds respectively invest, Columbia Management is, together with its affiliates, including us, subject to competing interests that may influence its decisions. These competing interests typically arise because Columbia Management or one of its affiliates serves as the investment adviser to the underlying Funds and may provide other services in connection with such underlying Funds, and because the compensation we and our affiliates receive for providing these investment advisory and other services varies depending on the underlying Fund. |

| • | Volatility and volatility management risk with the managed volatility funds: These Funds invest in other registered mutual funds. In addition, managed volatility Funds employ a strategy designed to reduce overall volatility and downside risk. These types of Funds are available under the policies and one or more of these Funds may be offered in other variable annuity and variable life insurance products offered by us. These Funds may also be used in conjunction with guaranteed living benefit riders we offer with various annuity contracts. |

| Conflicts may arise because the manner in which these Funds and their strategies are executed by Columbia Management are expected to benefit us by reducing our financial risk and expense in offering guaranteed living benefit riders. Managed volatility Funds employ a strategy to reduce overall volatility and downside risk when markets are declining and market volatility is high. A successful strategy may result in less gain in your Policy Value during rising markets with higher volatility when compared to Funds not employing a managed volatility strategy. Although an investment in the managed volatility Funds may mitigate declines in your Policy Value due to declining equity markets, the Funds’ investment strategies may also curb or decrease your Policy Value during periods of positive performance by the equity markets. There is no guarantee that any of the Funds’ strategies will be successful. Costs associated with running a managed volatility strategy may also adversely impact the performance of managed volatility Funds. | |

| While Columbia Management is the investment adviser to the managed volatility Funds, it provides no investment advice to you as whether an allocation to the Funds is appropriate for you. You must decide whether an investment in these Funds is right for you. Additional information on the Funds, including risks and conflicts of interest, is included in their respective prospectuses. Columbia Management advised Fund of funds and managed volatility Funds and their investment objectives are listed in the table below. | |

| • | Revenue we receive from the Funds and potential conflicts of interest: |

| Expenses We May Incur on Behalf of the Funds | |

| When a Subaccount invests in a Fund, the Fund holds a single account in the name of the Variable Account. As such, the Variable Account is actually the shareholder of the Fund. We, through our Variable Account, aggregate the transactions of numerous policy Owners and submit net purchase and redemption requests to the Funds on a daily basis. In addition, we track individual policy Owner transactions and provide confirmations, periodic statements, and other required mailings. These costs would normally be borne by the Fund, but we incur them instead. | |

| A complete list of why we may receive this revenue, as well as sources of revenue, is described in detail below. | |

| Payments the Funds May Make to Us | |

| We or our affiliates may receive from each of the Funds, or their affiliates, compensation including but not limited to expense payments. These payments are designed in part to compensate us for the expenses we may incur on behalf of the Funds. In addition to these payments, the Funds may compensate us for wholesaling activities or to participate in educational or marketing seminars sponsored by the Funds. | |

| The amount, type, and manner in which the revenue from these sources is computed vary by Fund. | |

| Conflicts of Interest These Payments May Create | |

| When we determined the charges to impose under the policies, we took into account anticipated payments from the Funds. If we had not taken into account these anticipated payments, the charges under the policies would have been higher. Additionally, the amount of payment we receive from a Fund or its affiliate may create an incentive for us to include that Fund as an investment option and may influence our decision regarding which Funds to include in the Variable Account as Subaccount options for policy Owners. Funds that offer lower payments or no payments may also have corresponding expense structures that are lower, resulting in decreased overall fees and expenses to shareholders. |

| We offer Funds managed by our affiliates Columbia Management and Columbia Wanger Asset Management, LLC (Columbia Wanger). We have additional financial incentive to offer our affiliated Funds because additional assets held by them generally results in added revenue to us and our parent company, Ameriprise Financial, Inc. Additionally, employees of Ameriprise Financial, Inc. and its affiliates, including our employees, may be separately incented to include the affiliated Funds in the products, as employee compensation and business unit operating goals at all levels are tied to the success of the company. Currently, revenue received from our affiliated Funds comprises the greatest amount and percentage of revenue we derive from payments made by the Funds. | |

| The Amount of Payments We Receive from the Funds | |

| We or our affiliates receive revenue which ranges up to 0.65% of the average daily net assets invested in various Funds offered through this and other variable life insurance and annuity contracts we and our affiliates issue. | |

| Why revenues are paid to us: In accordance with applicable laws, regulations and the terms of the agreements under which such revenue is paid, we or our affiliates may receive revenue from the Funds, including but not limited to expense payments and non-cash compensation, for various purposes: |

| • | Training and educating sales representatives who sell the policies. |

| • | Granting access to our employees whose job it is to promote sales of the policies by authorized selling firms and their sales representatives, and granting access to sales representatives of our affiliated selling firms. |

| • | Activities or services we or our affiliates provide that assist in the promotion and distribution of the policies including promoting the Funds available under the policies to policy Owners, authorized selling firms and sales representatives. |

| • | Providing sub-transfer agency and shareholder servicing to policy Owners. |

| • | Promoting, including and/or retaining the Fund’s investment portfolios as underlying investment options in the policies. |

| • | Furnishing personal services to policy Owners, including education of policy Owners regarding the Funds, answering routine inquiries regarding a Fund, maintaining accounts or providing such other services eligible for service fees as defined under the rules of the Financial Industry Regulatory Authority (FINRA). |

| • | Subaccounting services, transaction processing, recordkeeping and administration. |

| • | Assets of the Fund’s adviser, subadviser, transfer agent, distributor or an affiliate of these. The revenue resulting from these sources may be based either on a percentage of average daily net assets of the Fund or on the actual cost of certain services we provide with respect to the Fund. We may receive this revenue either in the form of a cash payment or it may be allocated to us. |

| • | Assets of the Fund’s adviser, subadviser, transfer agent, distributor or an affiliate of these. The revenue resulting from these sources may be based either on a percentage of average daily net assets of the Fund or on the actual cost of certain services we provide with respect to the Fund. We receive this revenue in the form of a cash payment. |

| • | laws or regulations change; |

| • | the existing Funds become unavailable; or |

| • | in our judgment, the Funds no longer are suitable (or are no longer the most suitable) for the Subaccounts. |

| • | add new Subaccounts; |

| • | combine any two or more Subaccounts; |

| • | transfer assets to and from the Subaccounts or the Variable Account; and |

| • | eliminate or close any Subaccounts. |

| • | cease offering any Subaccount; |

| • | add or remove Variable Accounts; |

| • | combine the assets of the Variable Account with the assets of any of our other separate accounts; |

| • | register or deregister the Variable Account; |

| • | operate the Variable Account as a management investment company, unit investment trust, or any other form permitted under securities or other law; |

| • | run the Variable Account under the direction of a committee, board, or other group; or |

| • | make any changes required by the Investment Company Act of 1940, other federal securities laws or state insurance laws. |

| Assumptions | |

| Segment Growth Cap: | 7% |

| Segment Floor: | 0% |

| Segment Participation Rate: | 100% |

| Average Segment Value: | $5,000 |

| Starting S&P 500 Index value: | 1,000 |

| Ending S&P 500 Index value: | 1,200 |

| ( | 1200 | –1 | ) | = | 20% |

| 1000 |

| a) | 20% (Index Growth Rate) x 100% (Segment Participation Rate) = 20% |

| b) | Segment Growth Cap of 7%, but not less than Segment Floor of 0% |

| Starting S&P 500 Index value: | 1,000 |

| Ending S&P 500 Index value: | 900 |

| ( | 900 | –1 | ) | = | -10% |

| 1000 |

| a) | -10% (Index Growth Rate) x 100% (Segment Participation Rate) = -10% |

| b) | Segment Growth Cap of 7%, but not less than Segment Floor of 0% |

| Starting S&P 500 Index value: | 1,000 |

| Ending S&P 500 Index value: | 1,050 |

| ( | 1050 | –1 | ) | = | 5% |

| 1000 |

| a) | 5% (Index Growth Rate) x 100% (Segment Participation Rate) = 5% |

| b) | Segment Growth Cap of 7%, but not less than floor of 0% |

| • | select a Specified Amount of insurance; |

| • | select a death benefit option; |

| • | designate a Beneficiary; and |

| • | state how premiums are to be allocated among the Fixed Account, the Indexed Accounts and the Subaccounts. |

The two tests are:

| • | The date we mail the policy from our Service Center. |

| • | The Policy Date (only if the policy is issued in force). |

| • | The date your sales representative delivers the policy to you as evidenced by our policy delivery receipt, which you must sign and date. |

| • | the Specified Amount; |

| • | the Insureds’ genders; |

| • | the Insureds’ issue ages; |

| • | the Insureds’ Risk Classifications; |

| • | premium frequency; and |

| • | the death benefit option. |

| • | the sum of your Net Premiums, transfer amounts (including loan transfers), Segment maturity reallocations, and any applicable policy value credit allocated to the Fixed Account; plus |

| • | interest credited; minus |

| • | the sum of amounts surrendered (including any applicable Surrender Charges) and amounts transferred out of the Fixed Account (including loan transfers); minus |

| • | any portion of the monthly deduction for the coming month that is allocated to the Fixed Account. |

| • | the sum of your Net Premiums, Segment maturity reallocations, and any applicable policy value credit allocated to the Indexed Account; plus |

| • | indexed interest credited; minus |

| • | the sum of amounts surrendered (including any applicable Surrender Charges) and amounts transferred out (due to loans taken and interest charged on Indebtedness), Segment maturity reallocations allocated to the Fixed Account, any Subaccounts, or another Indexed Account; minus |

| • | any portion of the monthly deduction for the coming month that is allocated to the Indexed Account. |

| • | adding the Fund’s current net asset value per share, plus the per share amount of any dividend or capital gain distributions, to obtain a current adjusted net asset value per share; then |

| • | dividing that sum by the previous adjusted net asset value per share. |

| • | additional Net Premiums allocated to the Subaccounts; |

| • | any applicable policy value credit allocated to the Subaccounts; |

| • | transfers into or out of the Subaccounts; |

| • | amounts transferred from Indexed Accounts at Segment maturity; |

| • | partial surrenders and partial surrender fees; |

| • | Surrender Charges; and |

| • | monthly deductions. |

| • | changes in underlying Fund net asset value; |

| • | Fund dividends distributed to the Subaccounts; |

| • | Fund capital gains or losses; and |

| • | Fund operating expenses. |

| • | the Interim Accounts, proportionally, based on the Interim Account values until exhausted; then |

| • | the Segments of the Indexed Accounts starting with the most recently opened Segment(s); then |

| • | the next most recently opened Segment(s), and will continue in this manner until the amount required to satisfy the deduction has been met. |

| • | the sum of premiums paid; minus |

| • | partial surrenders; minus |

| • | outstanding Indebtedness; equals or exceeds |

| • | the NLG Premiums due since the Policy Date. |

| • | a written request; |

| • | evidence satisfactory to us that both Insureds (or the last surviving Insured) remain insurable and due proof that the first death occurred before the date of Lapse; |

| • | payment of the premium we specify; and |

| • | payment or reinstatement of any Indebtedness. |

| • | the Specified Amount; or |

| • | a percentage of the Policy Value. The percentage is designed to ensure that the policy meets the provisions of federal tax law, which require a minimum death benefit in relation to Policy Value for your policy to qualify as life insurance. |

Attained Insurance Age 120, the death benefit amount is the greater of the following as determined on the Death Benefit Valuation Date:

| • | the Policy Value plus the Specified Amount; or |

| • | a percentage of Policy Value. The percentage is designed to ensure that the policy meets the provisions of federal tax law, which require a minimum death benefit in relation to Policy Value for your policy to qualify as life insurance. |

| 1. | the lesser of: |

| • | the Specified Amount plus premiums paid, less partial surrenders and any partial surrender fees; or |

| • | the Death Benefit Option 3 Limit shown under Policy Data; or |

| 2. | a percentage of the Policy Value. The percentage is designed to ensure the policy meets the provisions of federal tax law, which require a minimum death benefit in relation to the Policy Value for your policy to qualify as life insurance. |

| Example | Option 1 | Option 2 | Option 3 |

| Specified Amount | $100,000 | $100,000 | $100,000 |

| Policy Value | $ 5,000 | $ 5,000 | $ 5,000 |

| Premiums paid | $ 4,000 | $ 4,000 | $ 4,000 |

| Death benefit | $100,000 | $105,000 | $104,000 |

| Policy Value increases to | $ 8,000 | $ 8,000 | $ 8,000 |

| Death benefit | $100,000 | $108,000 | $104,000 |

| Policy Value decreases to | $ 3,000 | $ 3,000 | $ 3,000 |

| Death benefit | $100,000 | $103,000 | $104,000 |

Attained Insurance Age 120 anniversary, the death benefit amount will be the greater of:

| • | the death benefit on the youngest Insured’s Attained Insurance Age 120 anniversary, minus any partial surrenders and partial surrender fees occurring after the youngest Insured’s Attained Insurance Age 120 anniversary; or |

| • | the Policy Value on the date of death of the last surviving Insured. |

Attained Insurance Age 120 anniversary, you may make a written request to change the death benefit option once per policy year. A change in the death benefit option also will change the Specified Amount. You do not need to provide additional evidence of insurability.

| • | Monthly deduction because the cost of insurance charges depends upon the Specified Amount. |

| • | Charges for certain optional insurance benefits. |

| • | Your monthly deduction will increase because the cost of insurance charge depends upon the Specified Amount. |

| • | Charges for certain optional insurance benefits may increase. |

| • | The NLG premiums will increase. |

| • | The administrative charge will increase. |

| • | The Surrender Charge will increase. A new schedule of Surrender Charges will apply to the amount of any increase in the Specified Amount. |

| • | Only one decrease per policy year is allowed. |

| • | We reserve the right to limit any decrease to the extent necessary to qualify the policy as life insurance under the Code. |

| • | After the decrease, the Specified Amount may not be less than the minimum amount shown in the policy. The minimum amounts shown in the policy are: |

| • | In policy years 2-5, the Specified Amount remaining after the decrease may not be less than 75% of the initial Specified Amount. |

| • | In policy years 6 -10, the Specified Amount remaining after the decrease may not be less than 50% of the initial Specified Amount. |

| • | In policy years 11-15, the Specified Amount remaining after the decrease may not be less than 25% of the initial Specified Amount. |

| • | In policy years 16+, the Specified Amount remaining after the decrease must be at least $1,000. |

| Maximum reduction in initial Specified Amount in policy year 10: | $100,000 X .50 = | $ 50,000 |

| Maximum reduction in increase in Specified Amount during the fourth policy year of increase: | $100,000 X .25 = | +25,000 |

| Maximum permitted reduction in current Specified Amount: | $ 75,000 | |

| Current Specified Amount before reduction: | $ 200,000 | |

| Minus maximum permitted reduction in current Specified Amount: | –75,000 | |

| Specified Amount after reduction | $ 125,000 |

| • | Your monthly deduction will decrease because the cost of insurance charge depends upon the Specified Amount. |

| • | Charges for certain optional insurance benefits may decrease. |

| • | The NLG premiums will decrease. |

| • | The administrative charge will not change. |

| • | The Surrender Charge will not change. |

| • | First from the initial Specified Amount when the policy was issued, and |

| • | Then from the increases successively following the initial Specified Amount. |

| • | the Policy Value on the date of death; plus |

| • | the amount of insurance that would have been purchased by the cost of insurance deducted for the policy month during which death occurred, if that cost had been calculated using rates for the correct age and sex; minus |

| • | the amount of any outstanding Indebtedness on the date of death. |

| Name | Purpose | Is

the Benefit Standard or Optional |

Brief Description of Restrictions / Limitations |

| Four-Year Term Insurance Rider (FYT) | FYT provides a Specified Amount of insurance. The FYT death benefit is paid if both Insureds die during the first four policy years. | Optional | •

FYT is only available at issue. • FYT automatically terminates on the four-year Policy Anniversary of the policy. • FYT is not available if either Insured is uninsurable. |

| Policy Split Option Rider (PSO) | PSO permits a policy to be split into two individual permanent plans of life insurance then offered by us for exchange, one on the life of each Insured. | Optional | •

PSO is only available at issue. • PSO is not available for Insureds in certain Risk Classifications. • Both Insureds must be between Insurance Ages 20 - 75. • If the policy and this rider are still in force at the oldest Insureds’ 80th insurance anniversary, this rider will automatically terminate. |

| Overloan Protection Benefit (OPB) | Protects the policy from Lapsing as a result of the loan balance exceeding the Policy Value when certain conditions are met. | Standard | •

OPB can only be exercised if the death benefit option 1 is in effect. • The policy must be in force for at least 15 years before the OPB can be exercised. • The policy may not be in the grace period to exercise the OPB. |

| Accounting Value Increase Rider (AVIR) | If the policy is fully surrendered while the policy is in force and prior to the expiration date of the rider, we will waive a portion of the Surrender Charge. | Optional | •

This rider is available at time of application only with small business owners. • The waiver does not apply to any Surrender Charge due to increases in Specified Amount, or to partial surrenders. • Surrender Charges will not be waived if the policy is being surrendered in exchange for a new insurance policy or contract. |

| Paid Up Insurance Option | You may request that we use the Cash Surrender Value of the policy to purchase an amount of paid-up insurance prior to the youngest Insured’s Attained Insurance Age 120. | Optional | •

When the Paid-Up Insurance option is elected, you will forfeit all rights to make future premium payments and all riders will terminate. • The paid-up insurance policy’s death benefit amount, minus its Cash Surrender Value, cannot be greater than your current policy’s death benefit, minus its Policy Value (both as of the date of the paid-up insurance policy’s purchase). |

| 1. | The month and date on or next following receipt of your written request for coverage to end; or |

| 2. | The four-year Policy Anniversary, as shown under Policy Data; or |

| 3. | The date the policy terminates. |

| 1. | divorce of the Insureds; or |

| 2. | the federal tax law is changed resulting in removal of the unlimited marital deduction or reduces by at least 50% the level of the estate taxes payable on death; or |

| 3. | there is a dissolution of a business partnership between the Insureds; or |

| 4. | there is a dissolution of a business conducted or owned by the Insureds. |

| • | The amount waived is a percentage of the Surrender Charge that would apply to the initial Specified Amount. |

| • | The waiver does not apply to any Surrender Charge due to increases in Specified Amount, or to partial surrenders. |

| • | Surrender Charges will not be waived if the policy is being surrendered in exchange for a new insurance policy or contract. |

| • | The policy has been in force for at least 15 years; and |

| • | The youngest Insured’s Attained Insurance Age is at least 75 but not greater than 95; and |

| • | Policy Indebtedness must be greater than the Specified Amount and greater than or equal to the Indebtedness percentage shown under Policy Data; and |

| • | The Cash Surrender Value is sufficient to pay the exercise charge; and |

| • | The death benefit option in effect is option 1; and |

| • | The policy has not yet entered the grace period; and |

| • | The policy is not a modified endowment contract, as defined by Section 7702A of the Internal Revenue Code, and exercising the benefit does not cause the policy to become a modified endowment contract; and |

| • | No current or future distributions will be required from the policy to maintain its qualification for treatment as a life insurance policy under the Internal Revenue Code; and |

| • | The sum of partial surrenders taken to date are greater than or equal to the amount that can be withdrawn from the policy without creating adverse tax consequences. |

| 1. | Premium payments are no longer accepted; however, loan repayments will be accepted. |

| 2. | Monthly deductions will no longer be taken. |

| 3. | Partial surrenders will no longer be available. |