Form N-14 WANGER ADVISORS TRUST

Table of Contents

As filed with the Securities and Exchange Commission on February 3, 2023

Securities Act File No. [ ]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

| THE SECURITIES ACT OF 1933 | ☒ | |||||

| Pre-Effective Amendment No. | ☐ | |||||

| Post-Effective Amendment No. | ☐ |

WANGER ADVISORS TRUST

(Exact Name of Registrant as Specified in Charter)

71 S. Wacker, Suite 2500

Chicago, Illinois 60606

Telephone number: 312.634.9200

| Ryan C. Larrenaga, Esq. c/o Columbia Management Investment Advisers, LLC 290 Congress Street Boston, Massachusetts 02210 |

Stephen Kusmierczak Daniel J. Beckman Columbia Acorn Trust 71 S. Wacker, Suite 2500 Chicago, Illinois 60606 |

Mary C. Moynihan Perkins Coie LLP 700 13th Street, N.W., Suite 800 Washington, D.C. 20005 |

(Name and Address of Agents for Service)

TITLE OF SECURITIES BEING REGISTERED:

Shares of Wanger Acorn, a series of the Registrant.

Approximate Date of Proposed Public Offering: As soon as practicable after the effective date of this Registration Statement.

No filing fee is required because an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Wanger Advisors Trust

Wanger Select

INFORMATION STATEMENT/PROSPECTUS

February 10, 2023

Columbia Wanger Asset Management, LLC (“Columbia Wanger”) and Columbia Management Investment Advisers, LLC (together with Columbia Wanger, the “Investment Managers”) have recommended the reorganization of two mutual funds managed by Columbia Wanger as anticipated in connection with the changes made effective May 1, 2022, to align the principal investment strategies, primary performance benchmarks, portfolio management and advisory fees of Columbia Wanger’s domestic mutual fund strategies (the “Domestic Repositioning”). As part of this initiative, the board of trustees (the “Board”) of Wanger Select (the “Target Fund”) and Wanger Acorn (formerly known as Wanger USA) (the “Acquiring Fund”) approved the Domestic Repositioning and has approved a Proposal to reorganize the Target Fund into the Acquiring Fund. The Target Fund and the Acquiring Fund are each referred to individually as a “Fund” and collectively as the “Funds.” No shareholder approval is required to effect the reorganization of the Target Fund into the Acquiring Fund (a “Reorganization”), which is scheduled to be completed on or about April 24, 2023.

This is a brief overview of the Reorganization of the Target Fund. We encourage you to read the full text of the enclosed Information Statement/Prospectus to obtain detailed information with respect to the Reorganization for the Target Fund. THE FUND IS NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND A PROXY TO THE FUND WITH RESPECT TO THE REORGANIZATION.

The Target Fund and the Acquiring Fund are owned of record by (i) sub-accounts of separate accounts of insurance companies (each, a “Participating Insurance Company”) established to fund benefits under variable annuity contracts and variable life insurance policies (each a “Contract,” and the holders thereof, “Contract Owners”) issued by Participating Insurance Companies and/or (ii) qualified pension and retirement plans (“Qualified Plans”) and other qualified institutional investors under relevant U.S. federal income tax rules, as authorized by Columbia Management Investment Distributors, Inc. Depending on the context, references to “you” or “your” herein refer either to a Contract Owner, the Participating Insurance Company, Qualified Plans or other qualified investors. References to a Fund “shareholder” refer only to (i) the separate accounts of Participating Insurance Companies invested in the Fund on behalf of Contracts, not Contract Owners, and (ii) Qualified Plans and other qualified investors, not participants in Qualified Plans.

Q: What information is included in the Information Statement/Prospectus?

The enclosed Information Statement/Prospectus provides information about the Reorganization of the Target Fund, and information about the shares that you will receive as a result of the Reorganization. Although the Information Statement/Prospectus includes information that you should review and keep for future reference, it is not a solicitation of a proxy from you.

Q: What is a fund reorganization?

A fund reorganization involves one fund transferring all of its assets and liabilities to another fund in exchange for shares of such fund. Once completed, shareholders of the fund being reorganized will hold shares of the acquiring fund.

Q: Do I need to take any action in connection with the Reorganization?

No. In accordance with the Fund’s Agreement and Declaration of Trust and applicable state and U.S. federal law (including Rule 17a-8 under the Investment Company Act of 1940), the Reorganization may be effected without the approval of shareholders of a Fund. Your shares will automatically be converted into shares of the Acquiring Fund on the date of the completion of the Reorganization of the Fund. You will receive written confirmation that this change has taken place. No certificates for shares will be issued in connection with the Reorganization. The aggregate net asset value (the “NAV”) of the Acquiring Fund shares you receive in the Reorganization will be equal to the aggregate NAV of the shares you own in the Target Fund immediately prior to the Reorganization. If you sell your shares or are otherwise no longer a shareholder of the Target Fund as of the closing, this transaction will not impact you.

Q: Which fund is being reorganized?

The Information Statement/Prospectus provides information about the Reorganization of the Target Fund into the Acquiring Fund, as noted in the table below:

| Target Fund |

Acquiring Fund | |||

| Wanger Select | g | Wanger Acorn |

Table of Contents

Q: Why did the Investment Managers propose the Reorganization?

The Investment Managers proposed the Reorganization as anticipated in connection with the changes made effective May 1, 2022, to align the Target Fund’s principal investment strategies, portfolio management and advisory fees with those of the Acquiring Fund. This included a significant increase in the normal number of portfolio holdings of the Target Fund, as the Target Fund discontinued its prior practice of investing in a limited number of companies (generally 20-40). Further, the Reorganization of the Target Fund into the Acquiring Fund will enable shareholders of the Target Fund to invest in a larger, potentially more efficient portfolio while continuing to pursue the same investment objective. As noted below, it is expected that following the Reorganization, the expenses borne by Target Fund shareholders as shareholders of the Acquiring Fund will be lower than the expenses they currently bear as shareholders of the Target Fund. See “Will there be any changes to my fees and expenses as a result of the Reorganization?” below.

Q: Why did the Board approve the Reorganization?

Among the Board’s considerations in approving the Reorganization were the following: (i) the Reorganization of the Target Fund into the Acquiring Fund will enable shareholders of the Target Fund to invest in a larger, potentially more efficient portfolio while continuing to pursue the same investment objective; (ii) the operating expenses that shareholders of the Target Fund will experience as shareholders of the Acquiring Fund after the Reorganization are expected to, on a net basis, decrease; (iii) the similar historical performance of the Target Fund and the Acquiring Fund, the current and historic higher asset levels of the Acquiring Fund, and the 98% current portfolio overlap of the Target Fund and Acquiring Fund; (iv) the minimal, if any, brokerage transaction costs associated with any portfolio repositioning before and after the closing of the Reorganization; and (v) alternatives to the Reorganization, including liquidation, the unlikelihood that the Target Fund would maintain sufficient size to ensure its continued economic viability absent the Reorganization, and the Acquiring Fund’s better relative prospects for attracting additional assets after the Reorganization. For more information about the Board’s considerations in approving the Reorganization, and conclusion that the Reorganization is in the best interests of the Funds, see the section of the Information Statement/Prospectus entitled “Section B—Additional Information About the Reorganization—Board Considerations.”

Q: Will the portfolio manager or investment manager of my fund change as a result of the Reorganization?

The Funds have the same investment manager and portfolio managers. The portfolio managers of the Acquiring Fund will continue to manage the Acquiring Fund following the Reorganization. Columbia Wanger will continue to serve as the investment manager to the Acquiring Fund following the Reorganization. Information about the portfolio managers who will manage the Acquiring Fund following the Reorganization is included in the section of the Information Statement/Prospectus entitled “Section C –Additional Information Applicable to the Acquiring Fund.”

Q: Will there be any changes to my Contract as a result of the Reorganization? Can I make a transfer before or after the Reorganization?

The Reorganization will not alter Contract Owners’ rights under their Contracts. The Reorganization will not cause any fees or charges under Contracts to be greater after the Reorganization than before it.

Information about Contract Owners’ ability to transfer their investments is included in the section of the Information Statement/Prospectus entitled “Section A—Information About the Reorganization—Summary— How the Reorganization Will Work.”

Q: What are the costs of the Reorganization?

No significant costs are expected to be borne by the Target Fund or the Acquiring Fund in connection with the Reorganization. The Agreement and Plan of Reorganization (the “Agreement”) provides that the Investment Managers will bear all Reorganization-related costs other than brokerage and other portfolio transaction costs, if any, whether or not the Reorganization is consummated.

-2-

Table of Contents

Q: Will there be any costs associated with portfolio repositioning?

Yes, but they are expected to be minimal, if any, because there is currently 98% portfolio overlap between the Target Fund and the Acquiring Fund. If the Reorganization had occurred as of December 31, 2022, it is estimated that approximately 0% of the Target Fund’s investment portfolio would have been sold by the Acquiring Fund and the Acquiring Fund would have borne approximately $0 in transaction costs. The actual transaction costs, if any, will vary based on the degree of portfolio overlap between the Target Fund and the Acquiring Fund at the time of the Reorganization and on market conditions at the time of sale, if any. Repositioning costs are described in more detail in the section of the Information Statement/Prospectus entitled “Section A – Reorganization – Synopsis – Comparison of Fees and Expenses – Portfolio Turnover” with respect to the Reorganization.

Q: What are the U.S. federal income tax consequences of the Reorganization?

The Reorganization is expected to qualify as a tax-free reorganization for U.S. federal income tax purposes. The Reorganization will not be a taxable event for federal income tax purposes for Contract Owners regardless of the tax status of the Reorganization, provided that the Contracts qualify to be treated as life insurance contracts under Section 7702(a) of the Internal Revenue Code of 1986, as amended (the “Code”) or annuity contracts under Section 72 of the Code. In addition, the Reorganization, whether or not treated as tax-free for U.S. federal income tax purposes, is not expected to be a taxable event for Qualified Plans or other qualified investors that hold shares in tax-advantaged accounts. For more information see the section of the Information Statement/Prospectus entitled “Section B – Additional Information About the Reorganization – U.S. Federal Income Tax Status of the Reorganization.” A portion of the portfolio assets of the Target Fund may be sold by the Acquiring Fund following the Reorganization. Any such sales will cause the Acquiring Fund to incur transaction costs. Shareholders and Contract Owners should consult their own tax advisors about the potential tax consequences of the Reorganization to them, including foreign, state and local income taxes. For a description of the tax consequences of investing in Contracts, Contract Owners should consult the prospectus or other information provided by the Participating Insurance Company regarding their Contracts.

Q: Will there be any changes to my fees and expenses as a result of the Reorganization?

Yes. It is expected that, following the Reorganization, the expenses borne by Target Fund shareholders as shareholders of the Acquiring Fund will be lower than the expenses they currently bear. Columbia Wanger has contractually agreed, effective upon closing of the Reorganization, to waive fees and reimburse certain expenses of the Acquiring Fund, through April 30, 2025, so that ordinary operating expenses (excluding transaction costs and certain other investment-related expenses, interest and fees on borrowings and expenses associated with the Fund’s investment in other investment companies, if any) do not exceed the annual rates of 0.95%. This arrangement may only be amended or terminated with approval from the Board and Columbia Wanger. There is no guarantee that Columbia Wanger will continue to limit the Acquiring Fund’s operating expenses beyond April 30, 2025, and the Acquiring Fund’s operating expenses could increase after this expiration date. The Reorganization costs expected to be borne by shareholders are limited to brokerage and other portfolio transaction costs and are expected to be minimal, if any. See Information Statement/Prospectus under “Section A – Information About the Reorganization – Synopsis – Comparison of Fees and Expenses.”

-3-

Table of Contents

Q: Whom should I call if I have questions?

If you have questions about the Reorganization described in the Information Statement/Prospectus, please call Computershare Fund Services, toll free at (866) 963-6125. Shareholders of the Target Fund for which the Reorganization is effected, within 60 days following the completion of its fiscal year or half year, may call (800) 345-6611 to request, at no charge, a copy of the Target Fund’s final report to shareholders for that period.

-4-

Table of Contents

February 10, 2023

Dear Contract Owner or Shareholder,

As Co-Presidents of Wanger Select (the “Target Fund”), we are writing to provide important information about the reorganization that will affect your investment in the Target Fund. As previously communicated in a supplement to the Target Fund’s prospectus and statement of additional information, Columbia Wanger Asset Management, LLC (“Columbia Wanger”) and Columbia Management Investment Advisers, LLC (together with Columbia Wanger, the “Investment Managers”) proposed to the board of trustees (the “Board”) of the Target Fund and Wanger Acorn (formerly known as Wanger USA) (the “Acquiring Fund”) a reorganization of the of Target Fund (the “Reorganization”), and the Board unanimously approved the Reorganization.

The enclosed Information Statement/Prospectus provides information about the Reorganization of the Target Fund into the Acquiring Fund, another fund managed by Columbia Wanger. Under the Agreement and Plan of Reorganization, the Target Fund will transfer all of its assets to the Acquiring Fund, as indicated below, in exchange for shares of the Acquiring Fund and the assumption by the Acquiring Fund of all the liabilities of the Target Fund. The Reorganization is scheduled to close on or about April 24, 2023.

The table below shows the Target Fund and the Acquiring Fund for the Reorganization:

| Target Fund |

Acquiring Fund | |||

| Wanger Select |

g |

Wanger Acorn |

The Investment Managers proposed the Reorganization as anticipated in connection with the changes made effective May 1, 2022, to align the principal investment strategies, primary performance benchmarks, portfolio management and advisory fees of Columbia Wanger’s domestic mutual fund strategies, as approved by the Board (the “Domestic Repositioning”). The Reorganization of the Target Fund into the Acquiring Fund will enable shareholders of the Target Fund to invest in a larger, potentially more efficient portfolio while continuing to pursue the same investment objective.

NO ACTION ON YOUR PART IS REQUIRED TO EFFECT THE REORGANIZATION. Your shares will automatically be converted into shares of the Acquiring Fund on the date of the completion of the Reorganization for the Target Fund. We are not asking you for a proxy and you are requested not to send us a proxy.

Please carefully read the enclosed Information Statement/Prospectus, as it discusses the Reorganization in more detail. Information about your ability to transfer your investment is included in the section of the Information Statement/Prospectus entitled “Section A—Information About the Reorganization—Summary—How the Reorganization Will Work.” If you transfer your investment or sell your shares of the Target Fund as of the closing date, this transaction will not impact you. If you have questions, please call Computershare Fund Services, toll free at (866) 963-6125.

Sincerely,

Stephen Kusmierczak,

Co-President, Wanger Advisors Trust

Daniel J. Beckman,

Co-President, Wanger Advisors Trust

Table of Contents

Wanger Advisors Trust

Wanger Select

(the “Target Fund”)

INFORMATION STATEMENT/PROSPECTUS

Dated February 10, 2023

This document is an information statement for the Target Fund and a prospectus for the Acquiring Fund (as defined below). The mailing address and telephone number of the Target Fund and the Acquiring Fund (each, a “Fund” and collectively, the “Funds”) is c/o Columbia Management Investment Services Corp., P.O. Box 219104, Kansas City MO 64121-9104 and 800-345-6611. The principal offices of the Funds are located at 71 S. Wacker, Suite 2500 Chicago, Illinois 60606. This Information Statement/Prospectus contains information you should know about the reorganization (the “Reorganization”), with respect to the Target Fund, as indicated below. You should read this document carefully and retain it for future reference.

This Information Statement/Prospectus is being mailed on or about February 17, 2023.

NO SHAREHOLDER VOTE WILL BE TAKEN WITH RESPECT TO THE MATTERS DESCRIBED IN THIS INFORMATION STATEMENT/PROSPECTUS. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY. In accordance with the Fund’s Agreement and Declaration of Trust and applicable state and U.S. federal law (including Rule 17a-8 under the Investment Company Act of 1940 (the “1940 Act”)), the Reorganization has been approved by the board of trustees of Wanger Advisors Trust and will be effected without the approval of shareholders.

Each of the Funds is a registered open-end management investment company (or a series thereof).

The Target Fund and the Acquiring Fund are owned of record by (i) sub-accounts of separate accounts (of insurance companies (each, a “Participating Insurance Company”) established to fund benefits under variable annuity contracts and variable life insurance policies (each a “Contract,” and the holders thereof, “Contract Owners”) issued by Participating Insurance Companies and/or (ii) qualified pension and retirement plans (“Qualified Plans”) and other qualified institutional investors under relevant U.S. federal income tax rules, as authorized by Columbia Management Investment Distributors, Inc. Depending on the context, references to “you” or “your” herein refer either to a Contract Owner, the Participating Insurance Company, Qualified Plans or other qualified investors. References to a Fund “shareholder” refer only to (i) the separate accounts of Participating Insurance Companies invested in the Fund on behalf of Contracts, not Contract Owners, and (ii) Qualified Plans and other qualified investors, not participants in Qualified Plans.

Where to Get More Information

The following documents have been filed with the Securities and Exchange Commission (the “SEC”) and are incorporated into this Information Statement/Prospectus by reference:

| (1) | the Statement of Additional Information of the Acquiring Fund relating to the Reorganization (the “Reorganization SAI”), dated February 10, 2023; |

| (2) | the following materials of Wanger Advisors Trust (SEC file nos. 033-83548 and 811-08748): |

| • |

| • |

| • |

| • |

| • |

Table of Contents

For a free copy of any of the documents listed above and/or to ask questions about this Information Statement/Prospectus, please call Computershare Fund Services, toll free at (866) 963-6125 or go to https://www.proxy-direct.com/MeetingDocuments/33085/WangerSelectFund-InformationStatement.pdf.

Each of the Funds is subject to the information requirements of the Securities Exchange Act of 1934, as amended, and the 1940 Act, and files reports, proxy materials and other information with the SEC. Copies of these reports, proxy materials and other information may be obtained, after paying a duplicating fee, by electronic request at [email protected], or by writing to the Public Reference Branch of the SEC Office of Consumer Affairs and Information Services, 100 F Street, N.E., Washington, D.C. 20549-0102. In addition, copies of these documents may be viewed online or downloaded from the SEC’s website at www.sec.gov.

Please note that investments in the Funds are not bank deposits, are not federally insured, are not guaranteed by any bank or government agency and may lose value. There is no assurance that any Fund will achieve its investment objectives.

AS WITH ALL MUTUAL FUNDS, THE SEC HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED ON THE ADEQUACY OF THIS INFORMATION STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

-2-

Table of Contents

| Page | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| Synopsis of Reorganization: Comparison of Wanger Select and Wanger Acorn |

4 | |||

| Comparison of the Target Fund and the Acquiring Fund - Significant Considerations |

4 | |||

| 4 | ||||

| 7 | ||||

| 9 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 20 | ||||

| 21 | ||||

| Section C — Additional Information Applicable to the Acquiring Fund |

25 | |||

| Exhibit A — Ownership of Fund Shares and Financial Highlights |

A-1 | |||

| A-1 | ||||

| A-2 | ||||

-i-

Table of Contents

SECTION A — INFORMATION ABOUT THE REORGANIZATION

The following information describes the reorganization (the “Reorganization”) of Wanger Select (the “Target Fund”) into Wanger Acorn (formerly known as Wanger USA) (the “Acquiring Fund”). The Target Fund and the Acquiring Fund are each referred to individually as a “Fund” and collectively as the “Funds.”

Columbia Wanger Asset Management, LLC (“Columbia Wanger”) and Columbia Management Investment Advisers, LLC (Columbia Management) (together with Columbia Wanger, the “Investment Managers”) have recommended the reorganization of two mutual funds managed by Columbia Wanger as anticipated in connection with the changes made effective May 1, 2022, to align the principal investment strategies, primary performance benchmarks, portfolio management and advisory fees of Columbia Wanger’s domestic mutual fund strategies (the “Domestic Repositioning”). The board of trustees of the Target Fund and the Acquiring Fund (the “Board”) approved the Domestic Repositioning and as part of the initiative has approved a proposal to reorganize the Target Fund into the Acquiring Fund. The Reorganization is scheduled to close on or about April 24, 2023.

This Information Statement/Prospectus provides information about the Reorganization of the Target Fund into the Acquiring Fund. The following is a summary of the Reorganization. More complete information appears later in this Information Statement/Prospectus. You should carefully read the entire Information Statement/Prospectus and the exhibits because they contain details that are not included in this summary.

How The Reorganization Will Work

| • | Pursuant to an Agreement and Plan of Reorganization (the “Agreement”), the Target Fund will transfer all of its assets to the Acquiring Fund in exchange for shares of the Acquiring Fund (“Acquisition Shares”) and the Acquiring Fund’s assumption of all obligations and liabilities of the Target Fund. Immediately after the closing, the Target Fund will liquidate and distribute pro rata to shareholders of record of its shares the Acquisition Shares received by the Target Fund. |

| • | The Acquiring Fund will issue Acquisition Shares with an aggregate net asset value equal to the aggregate value of the assets that it receives from the Target Fund, net of liabilities and any expenses of the Reorganization payable by the Target Fund. Acquisition Shares of the Acquiring Fund will be distributed to the shareholders of the Target Fund in proportion to their holdings of the Target Fund. While the aggregate net asset value of your shares will not change as a result of the Reorganization, the number of shares you hold may differ based on each Fund’s net asset value. |

| • | The Investment Managers will bear all Reorganization-related costs other than brokerage and other portfolio transaction costs, if any, whether or not the Reorganization is consummated, in accordance with the Agreement. A portion of the portfolio assets of |

-1-

Table of Contents

| the Target Fund may be sold by the Acquiring Fund after the Reorganization. Any such sales could cause the Acquiring Fund to incur transaction costs. However, brokerage and portfolio transaction costs are expected to be minimal, if any, as there is currently 98% portfolio overlap between the Target Fund and the Acquiring Fund. See the section of the Information Statement/Prospectus entitled “Section A – Information About the Reorganization – Synopsis – Comparison of Fees and Expenses – Portfolio Turnover” with respect to the Reorganization. |

| • | The Reorganization is expected to qualify as a tax-free reorganization for U.S. federal income tax purposes. The Reorganization will not be a taxable event for federal income tax purposes for Contract Owners regardless of the tax status of the Reorganization, provided that the Contracts qualify to be treated as life insurance contracts under Section 7702(a) of the Internal Revenue Code of 1986, as amended (the “Code”) or annuity contracts under Section 72 of the Code. In addition, the Reorganization, whether or not treated as tax-free for U.S. federal income tax purposes, is not expected to be a taxable event for Qualified Plans and other qualified investors that hold shares in tax-advantaged accounts. For more information see the section of this Information Statement/Prospectus entitled “Section B – Additional Information About the Reorganization – U.S. Federal Income Tax Status of the Reorganization.” Shareholders and Contract Owners should consult their own tax advisors about the potential tax consequences of the Reorganization to them, including potential foreign, state and local income taxes. For a description of the tax consequences of investing in Contracts, Contract Owners should consult the prospectus or other information provided by the Participating Insurance Company regarding their Contracts. |

| • | At least 45 days prior to the close of the Reorganization (scheduled on or about April 24, 2023), Contract Owners with values invested in the Target Fund will be informed by their Participating Insurance Company of the Reorganization and the fact that they may, prior to the Reorganization, transfer their values out of the sub-account invested in the Target Fund and into any other investment option under the Contract without any fees or charges (and without the transfer counting as a transfer for purposes of any limit on the number of free transfers or any limit on the number of transfers under the Contract). |

| • | After the Reorganization is completed, Target Fund shareholders will be shareholders of the Acquiring Fund and the Target Fund will be dissolved. |

| • | Shortly after the close of the Reorganization (scheduled on or about April 24, 2023), each Participating Insurance Company will notify Contract Owners whose values were transferred pursuant to the Reorganization of the right to transfer those values out of the sub-account invested in the Acquiring Fund and into any other investment option under the Contract without fees or charges (and without the transfer counting as a transfer for purposes of any limit on the number of free transfers or any limit on the number of transfers under the Contract) within 60 days after the close of the Reorganization. |

U.S. Federal Income Tax Consequences

The Reorganization is expected to qualify as a tax-free reorganization for U.S. federal income tax purposes and will not take place unless the Target Fund and the Acquiring Fund receive a satisfactory opinion of tax counsel substantially to the effect that the Reorganization will qualify as a tax-free reorganization, as described in more detail in the section entitled “Section B – Additional Information About the Reorganization – U.S. Federal Income Tax Status of the Reorganization.” Accordingly, no gain or loss is expected to be recognized by the Target Fund, Shareholders or Contract Owners as a direct result of the Reorganization. For Shareholders in the Reorganization, the aggregate tax basis in Acquisition Shares is expected to carry over from the shareholders’ Target Fund shares, and the holding period in the Acquisition Shares is expected to include the shareholders’ holding period in the Target Fund shares.

The Reorganization will not be a taxable event for Contract Owners for U.S. federal income tax purposes regardless of the tax status of the Reorganization, provided that the Contracts qualify to be treated as life insurance contracts under Section 7702(a) of the Code or annuity contracts under Section 72 of the Code. In addition, the Reorganization, whether or not treated as tax-free for U.S. federal income tax purposes, is not expected to be a taxable event for Qualified Plans and other qualified investors that hold shares in tax-advantaged accounts. For more information about the U.S. federal income tax consequences of the Reorganization, see the section entitled “Section B – Additional Information About the Reorganization – U.S. Federal Income Tax Status of the Reorganization.”

-2-

Table of Contents

Shareholders and Contract Owners should consult their own tax advisors about the potential tax consequences of the Reorganization to them, including foreign, state and local income taxes. For a description of the tax consequences of investing in Contracts, Contract Owners should consult the prospectus or other information provided by the Participating Insurance Company regarding their Contracts.

For more information about the U.S. federal income tax consequences of the Reorganization, see the section entitled “Section B – Additional Information About the Reorganization – U.S. Federal Income Tax Status of the Reorganization.” For more information regarding repositioning costs, see the section captioned “portfolio turnover” within the synopsis for the Reorganization.

No significant costs are expected to be borne by the Target Fund or the Acquiring Fund in connection with the Reorganization, as set forth below. The Agreement provides that the Investment Managers will bear all Reorganization-related costs other than brokerage and other portfolio transaction costs, if any, whether or not the Reorganization is consummated. Brokerage and other portfolio transaction costs are expected to be minimal, if any, as there is currently 98% portfolio overlap between the Target Fund and the Acquiring Fund. The Investment Managers are expected to bear approximately $168,000 in Reorganization-related costs. See “Section A – Information About the Reorganization – Synopsis – Comparison of Fees and Expenses.”

-3-

Table of Contents

SYNOPSIS OF THE REORGANIZATION: COMPARISON OF WANGER SELECT AND WANGER ACORN

Comparison of the Target Fund and the Acquiring Fund - Significant Considerations

The Target Fund and the Acquiring Fund:

| • | Have the same investment objective, the same investment strategies and substantially similar investment policies with which they pursue their investment objective, as discussed in more detail below. |

| • | Have the same risk profile, with identical principal risks associated with investments in the Acquiring Fund and the Target Fund; these risks include active management risk, market risk, small- and mid-cap securities risk, issuer risk, growth securities risk, liquidity and trading volume risk, sector risk, foreign securities risk, and emerging market securities risk, as discussed in more detail below. |

| • | Have the same policies for buying and selling shares and the same distribution and exchange rights. Please see “Section C – Additional Information Applicable to the Acquiring Funds” for a description of these policies for the Acquiring Fund. |

| • | Have the same fiscal year end, December 31. |

| • | Are structured as series of the same open-end management investment company organized as a Massachusetts business trust. Please see Appendix B to this Information Statement/Prospectus for more information regarding the rights of shareholders. |

| • | Have the same investment manager – Columbia Wanger. |

Comparison of Fees and Expenses

The following tables describe the fees and expenses that you may pay if you buy, hold and sell shares of a Fund. The purpose of the tables below is to assist you in understanding the various costs and expenses of investing in the Fund. The tables do not reflect any fees or expenses imposed by your Contract or Qualified Plan, which are disclosed in your separate Contract prospectus or Qualified Plan disclosure documents. If the additional fees or expenses were reflected, the expenses set forth below would be higher.

The information in the table reflects the fees and expenses for each Fund for the annual period ended December 31, 2022 (annualized) and the pro forma projected expenses for the twelve months ended December 31, 2022 for the combined Fund following the Reorganization.

Actual fees and expenses of the combined Fund will be based on the Fund’s asset levels following the Reorganization. The assets of the Funds will vary based on market conditions, redemptions and other factors.

-4-

Table of Contents

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| Wanger Select (Current) | ||||

| Management fees(a) |

0.74 | % | ||

| Distribution and/or service (12b-1) fees |

0.00 | % | ||

| Other expenses |

0.39 | % | ||

| Total annual Fund operating expenses |

1.13 | % | ||

| Less: Fee waivers and/or expense reimbursements(b) |

(0.18 | )% | ||

| Total annual Fund operating expenses after fee waivers and/or expense reimbursements |

0.95 | % | ||

| Wanger Acorn (Current) |

||||

| Management fees(a) |

0.74 | % | ||

| Distribution and/or service (12b-1) fees |

0.00 | % | ||

| Other expenses |

0.22 | % | ||

| Total annual Fund operating expenses |

0.96 | % | ||

| Wanger Acorn (Pro Forma) |

||||

| Management fees(a) |

0.74 | % | ||

| Distribution and/or service (12b-1) fees |

0.00 | % | ||

| Other expenses |

0.22 | % | ||

| Total annual Fund operating expenses |

0.96 | % | ||

| Less: Fee waivers and/or expense reimbursements(c) |

(0.01 | )% | ||

| Total annual Fund operating expenses after fee waivers and/or expense reimbursements |

0.95 | % | ||

| (a) | Management fees have been restated to reflect the current management fee rate. |

| (b) | Columbia Wanger has contractually agreed, effective May 1, 2022, to waive fees and reimburse certain expenses of the Target Fund, through April 30, 2023, so that ordinary operating expenses (excluding transaction costs and certain other investment-related expenses, interest and fees on borrowings and expenses associated with the Target Fund’s investment in other investment companies, if any), do not exceed the annual rate of 0.95%. This arrangement may only be amended or terminated with approval from the Board and Columbia Wanger. |

| (c) | Columbia Wanger has contractually agreed, effective upon closing of the Reorganization, to waive fees and reimburse certain expenses of the Acquiring Fund, through April 30, 2025, so that ordinary operating expenses (excluding transaction costs and certain other investment-related expenses, interest and fees on borrowings and expenses associated with the Fund’s investment in other investment companies, if any) do not exceed the annual rate of 0.95%. This arrangement may only be amended or terminated with approval from the Board and Columbia Wanger. There is no guarantee that Columbia Wanger will continue to limit the Acquiring Fund’s operating expenses beyond April 30, 2025, and the Acquiring Fund’s operating expenses could increase after this expiration date. |

-5-

Table of Contents

Expense examples: These examples are intended to help you compare the cost of investing in each Fund with the cost of investing in other mutual funds. These examples assume that you invest $10,000 in the applicable Fund for the time periods indicated and then redeem or sell all of your shares at the end of those periods, both under the current arrangements and, for the Acquiring Fund, assuming completion of the Reorganization. These examples also assume that your investment has a 5% return each year and that each Fund’s operating expenses remain the same. These examples include a contractual fee waiver/expense reimbursement arrangement only for the Acquiring Fund (Pro Forma) and only the period indicated in the Fund’s Annual Fund Operating Expenses table. These examples do not reflect any fees and expenses that apply to your Contract or Qualified Plan. Inclusion of these charges would increase expenses for all periods shown. Although your actual costs may be higher or lower, based on the assumptions listed above, your costs would be:

| Wanger Select (Current) | 1 Year | 3 Years | 5 Years | 10 Years | ||||||||||||

| Shares (whether or not redeemed) |

$ | 115 | $ | 359 | $ | 622 | $ | 1,375 | ||||||||

| Wanger Acorn (Current) | ||||||||||||||||

| Shares (whether or not redeemed) |

$ | 98 | $ | 306 | $ | 531 | $ | 1,178 | ||||||||

| Wanger Acorn (Pro Forma) | ||||||||||||||||

| Shares (whether or not redeemed) |

$ | 97 | $ | 304 | $ | 529 | $ | 1,176 | ||||||||

-6-

Table of Contents

Portfolio Turnover. Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. Those costs, which are not reflected in annual Fund operating expenses or in the expense examples, affect a Fund’s performance. During the most recent fiscal year, each Fund’s portfolio turnover rate was the following percentage of the average value of the Fund’s portfolio:

| Fund |

Percentage of the Average Value of the Fund’s Portfolio |

|||

| Wanger Select |

119 | % | ||

| Wanger Acorn |

70 | % | ||

The Target Fund’s and the Acquiring Fund’s portfolio turnover rate for the fiscal year ended December 31, 2022 are expected to stay the same or increase from their respective portfolio turnover rates for the fiscal year ended December 31, 2022. The Target Fund’s portfolio turnover rate for the fiscal year ended December 31, 2022 is expected to be impacted by the discontinuation, effective May 1, 2022, of the Target Fund’s former practice of investing in a limited number of companies (generally 20-40). The Acquiring Fund’s portfolio turnover rate for the fiscal year ended December 31, 2022, is expected to be impacted by the changes, effective May 1, 2022, to the market capitalization range of the companies in which the Acquiring Fund invests a majority of its assets. There is no material additional portfolio turnover impact expected following completion of the Reorganization. As of December 31, 2022, there was 98% portfolio overlap between the Target Fund and the Acquiring Fund. If the Reorganization had occurred as of December 31, 2022, it is estimated that approximately 0% of the Target Fund’s investment portfolio would have been sold. It is estimated that such portfolio repositioning would have resulted in brokerage commissions or other transaction costs of $0 (0% of combined assets). The actual transaction costs, if any, will vary based on the degree of portfolio overlap between the Target Fund and the Acquiring Fund at the time of the Reorganization.

The above information is presented for informational purposes as of a specific point in time in the past. Actual market prices, capital gains and transaction costs, if any, will depend on market conditions at the time of sale, if any, and may vary from the information shown.

Comparison of Investment Objectives and Principal Investment Strategies, and Non-Fundamental Investment Policies

The investment objectives and principal investment strategies of the Target Fund and the Acquiring Fund are set forth in the table below. Each Fund’s investment objective and non-fundamental investment policies (including its principal and additional investment strategies) can be changed by the Board without shareholder approval. There is no assurance that a Fund’s investment objective will be achieved.

The Funds have the same investment objective to seek long-term capital appreciation and they have the same principal investment strategies.

-7-

Table of Contents

| Wanger Select |

Wanger Acorn | |||

| Investment Objective | The Fund seeks long-term capital appreciation. | The Fund seeks long-term capital appreciation. | ||

| Principal Investment Strategy | Under normal circumstances, the Fund invests a majority of its net assets in the common stock of small- and mid-sized companies with market capitalizations generally in the range of market capitalizations in the Russell 2500 Growth Index, the Fund’s benchmark, (the Index) at the time of purchase (between $21.5 million and $30 billion as of March 31, 2022). The market capitalization range and composition of companies in the Index are subject to change. As such, the size of the companies in which the Fund invests may change. The Fund determines a company’s market capitalization at the time of investment. As long as a majority of its net assets are invested in companies within the Index, the Fund may continue to hold and make new investments in a security even if the company’s market capitalization grows beyond the market capitalization of the largest company within the Index or falls below the market capitalization of the smallest company within the Index. | Under normal circumstances, the Fund invests a majority of its net assets in the common stock of small- and mid-sized companies with market capitalizations generally in the range of market capitalizations in the Russell 2500 Growth Index, the Fund’s benchmark, (the Index) at the time of purchase (between $21.5 million and $30 billion as of March 31, 2022). The market capitalization range and composition of companies in the Index are subject to change. As such, the size of the companies in which the Fund invests may change. The Fund determines a company’s market capitalization at the time of investment. As long as a majority of its net assets are invested in companies within the Index, the Fund may continue to hold and make new investments in a security even if the company’s market capitalization grows beyond the market capitalization of the largest company within the Index or falls below the market capitalization of the smallest company within the Index. | ||

| Diversification | The Fund is diversified. | The Fund is diversified. | ||

| Foreign Investments | The Fund invests the majority of its assets in U.S. companies, but also may invest up to 33% of its total assets in foreign companies in developed markets (for example, Japan, Canada and the United Kingdom) and in emerging markets (for example, China, India and Brazil). | The Fund invests the majority of its assets in U.S. companies, but also may invest up to 33% of its total assets in foreign companies in developed markets (for example, Japan, Canada and the United Kingdom) and in emerging markets (for example, China, India and Brazil). | ||

| Pledge Assets | The Fund may not pledge, mortgage or hypothecate its assets, except as may be necessary in connection with permitted borrowings or in connection with short sales, options, futures and options on futures. | The Fund may not pledge, mortgage or hypothecate its assets, except as may be necessary in connection with permitted borrowings or in connection with short sales, options, futures and options on futures. | ||

| Short Sales | The Fund may not sell securities short or maintain a short position. | The Fund may not sell securities short or maintain a short position. | ||

| Invest for control | The Fund may not invest in companies for the purpose of management or the exercise of control. | The Fund may not invest in companies for the purpose of management or the exercise of control. |

Additional Information About the Funds’ Principal Investment Strategies

For both Funds, Columbia Wanger believes that stocks of small- and mid-sized companies, which generally are not as well known by financial analysts as larger companies, may offer higher return potential than stocks of larger companies. In pursuit of each Fund’s objective, the portfolio managers take advantage of the research and stock-picking capabilities of Columbia Wanger. Columbia Wanger from time to time emphasizes one or more sectors in selecting the Fund’s investments, including the consumer discretionary, health care, and information technology sectors. Columbia Wanger typically seeks companies with:

| • | A strong business franchise that offers growth potential. |

| • | Products and services in which the company has a competitive advantage. |

-8-

Table of Contents

| • | A stock price Columbia Wanger believes is reasonable relative to the assets and earning power of the company. |

Columbia Wanger may sell a portfolio holding if the security reaches Columbia Wanger’s price target, if the company has a deterioration of fundamentals, such as failing to meet key operating benchmarks, or if Columbia Wanger believes other securities are more attractive. Columbia Wanger also may sell a portfolio holding to fund redemptions.

Comparison of Fundamental Investment Policies

Each Fund has adopted certain fundamental investment restrictions. As described in the section of the Information Statement/Prospectus entitled “Section B – Additional Information About the Reorganization – Board Considerations,” one of the factors considered by the Board in approving the Reorganization was that the fundamental investment restrictions of the Target Fund and Acquiring Fund did not differ materially. The fundamental investment restrictions (i.e., those which may not be changed without shareholder approval) are listed below.

The fundamental investment restrictions cannot be changed without the consent of the holders of a majority of the outstanding shares of the applicable Fund. The term “majority of the outstanding shares” means the vote of (i) 67% or more of a Fund’s shares present at a meeting, if more than 50% of the outstanding shares of the Fund are present or represented by proxy, or (ii) more than 50% of a Fund’s outstanding shares, whichever is less.

| Wanger Select |

Wanger Acorn | |||

| Issuer diversification | The Fund may not acquire securities of any one issuer which at the time of investment (a) represent more than 10% of the voting securities of the issuer or (b) have a value greater than 10% of the value of the outstanding securities of the issuer.

With respect to 50% of its total assets, the Fund may not purchase the securities of any issuer (other than cash items and U.S. Government securities and securities of other investment companies) if such purchase would cause the Fund’s holdings of that issuer to exceed more than 5% of the Fund’s total assets.

As permitted by this fundamental policy, the Fund became diversified effective January 31, 2012, and may not resume operating in a non-diversified manner without first obtaining shareholder approval. Accordingly, with respect to 75% of its assets, the Fund may not invest more than 5% of its assets in any one issuer. |

The Fund may not acquire securities of any one issuer which at the time of investment (a) represent more than 10% of the voting securities of the issuer or (b) have a value greater than 10% of the value of the outstanding securities of the issuer.

With respect to 75% of the value of the Fund’s total assets, the Fund may not invest more than 5% of its assets (valued at time of investment) in securities of any one issuer, except in government obligations. | ||

| Concentrate in any one industry | The Fund may not invest more than 25% of its total assets in the securities of companies in a single industry (excluding U.S. Government securities). | The Fund may not invest more than 25% of its assets (valued at time of investment) in securities of companies in any one industry |

-9-

Table of Contents

| Wanger Select |

Wanger Acorn | |||

| Loans | The Fund may not make loans, but this restriction shall not prevent the Fund from (a) investing in debt securities, (b) investing in repurchase agreements, or (c) lending its portfolio securities, provided that it may not lend securities if, as a result, the aggregate value of all securities loaned would exceed 33% of its total assets (taken at market value at the time of such loan). | The Fund may not make loans, but this restriction shall not prevent the Fund from (a) buying a part of an issue of bonds, debentures, or other obligations that are publicly distributed, or from investing up to an aggregate of 15% of its total assets (taken at market value at the time of each purchase) in parts of issues of bonds, debentures or other obligations of a type privately placed with financial institutions, (b) investing in repurchase agreements, or (c) lending portfolio securities, provided that it may not lend securities if, as a result, the aggregate value of all securities loaned would exceed 33% of its total assets (taken at market value at the time of such loan). | ||

| Borrow money | The Fund may not borrow money except (a) from banks for temporary or emergency purposes in amounts not exceeding 33% of the value of the Fund’s assets at the time of borrowing, and (b) in connection with transactions in options and in securities index futures. | The Fund may not borrow money except (a) from banks for temporary or emergency purposes in amounts not exceeding 33% of the value of the Fund’s assets at the time of borrowing, and (b) in connection with transactions in options and in securities index futures. | ||

| Act as an underwriter | The Fund may not underwrite the distribution of securities of other issuers; however, the Fund may acquire “restricted” securities which, in the event of a resale, might be required to be registered under the 1933 Act on the ground that the Fund could be regarded as an underwriter as defined by that act with respect to such resale. | The Fund may not underwrite the distribution of securities of other issuers; however, the Fund may acquire “restricted” securities which, in the event of a resale, might be required to be registered under the 1933 Act on the ground that the Fund could be regarded as an underwriter as defined by that act with respect to such resale; but the Fund will limit its total investment in restricted securities and in other securities for which there is no ready market, including repurchase agreements maturing in more than seven days, to not more than 15% of its net assets at the time of acquisition. | ||

| Buy or sell real estate | The Fund may not purchase and sell real estate or interests in real estate, although it may invest in marketable securities of enterprises which invest in real estate or interests in real estate. | The Fund may not purchase and sell real estate or interests in real estate, although it may invest in marketable securities of enterprises which invest in real estate or interests in real estate. |

-10-

Table of Contents

| Wanger Select |

Wanger Acorn | |||

| Buy or sell commodities | The Fund may not purchase and sell commodities or commodity contracts, except that it may enter into (a) futures and options on futures and (b) foreign currency contracts. | The Fund may not purchase and sell commodities or commodity contracts, except that it may enter into (a) futures and options on futures and (b) forward contracts. | ||

| Margin purchases | The Fund may not make margin purchases of securities, except for use of such short-term credits as are needed for clearance of transactions and except in connection with transactions in options, futures and options on futures. | The Fund may not make margin purchases of securities, except for use of such short-term credits as are needed for clearance of transactions and except in connection with transactions in options, futures and options on futures. | ||

| Issue senior securities | The Fund may not issue any senior security except to the extent permitted under the 1940 Act. | The Fund may not issue any senior security except to the extent permitted under the 1940 Act. |

A comparison of the principal risks of investing in the Target Fund and the Acquiring Fund is provided under “Comparison of Principal Risks” below.

The principal risks associated with investments in the Acquiring Fund and the Target Fund are identical. The actual risks of investing in each Fund depend on the securities held in each Fund’s portfolio and on market conditions, both of which change over time. The Acquiring Fund is subject to the principal risks described in “Section C – Additional Information Applicable to the Acquiring Fund” below. The Target Fund is subject to each of the principal risks of the Acquiring Fund.

-11-

Table of Contents

The following table provides a comparison of the types of principal investment risks associated with an investment in each Fund:

| Principal Investment Risks |

Wanger Select | Wanger Acorn | ||||||

| Active Management Risk |

X | X | ||||||

| Market Risk |

X | X | ||||||

| Small- and Mid-Cap Company Securities Risk |

X | X | ||||||

| Issuer Risk |

X | X | ||||||

| Growth Securities Risk |

X | X | ||||||

| Liquidity and Trading Volume Risk |

X | X | ||||||

| Sector Risk |

X | X | ||||||

| Consumer Discretionary Sector Risk |

X | X | ||||||

| Health Care Sector Risk |

X | X | ||||||

| Information Technology Sector Risk |

X | X | ||||||

| Foreign Securities Risk |

X | X | ||||||

| Emerging Market Securities Risk |

X | X | ||||||

Comparison of Management of the Funds

Columbia Wanger serves as investment manager for each of the Target Fund and Acquiring Fund. Both Funds obtain investment management services from Columbia Wanger according to terms of advisory agreements that are identical. The table below shows the current contractual management fee schedule for each Fund.

| Wanger Select and Wanger Acorn |

||||

| Assets |

Fee | |||

| Up to $700 million |

0.740 | % | ||

| $700 million to $2 billion |

0.690 | % | ||

| $2 billion to $6 billion |

0.640 | % | ||

| $6 billion and over |

0.630 | % | ||

Each Fund is governed by the same Board, which is responsible for overseeing the Fund’s policies and activities. For a listing of the members comprising the Funds’ Board, please refer to the Statement of Additional Information for the Funds.

The Funds have the same portfolio management teams. “Section C – Additional Information Applicable to the Acquiring Fund” below describes the professional history of the portfolio managers of the Funds. The Statement of Additional Information of each Fund provides additional information about portfolio manager compensation, other accounts managed and ownership of each Fund’s shares.

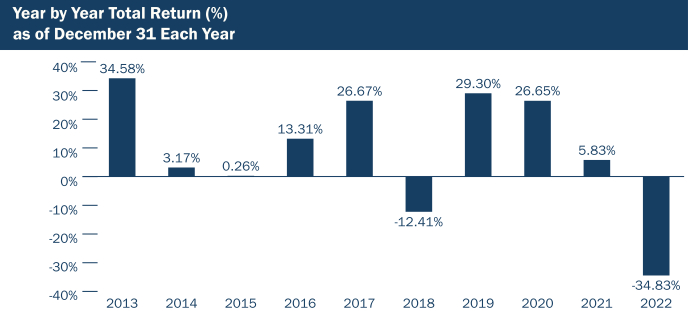

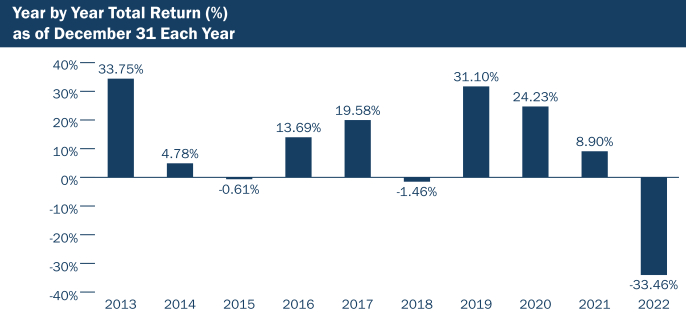

The following bar charts and tables show some of the risks of investing in the Funds. The bar charts show how each Fund’s performance has varied for each full calendar year shown. The table below the bar chart compares each Fund’s returns for the periods shown with a broad measure of market performance.

The Target Fund’s performance prior to May 1, 2022 reflects returns achieved pursuant to a strategy that included investing in a limited number of companies (generally 20-40). If the Fund’s current strategies had been in place for the prior periods, results shown would have been different.

The Acquiring Fund’s performance prior to May 1, 2022 reflects returns achieved pursuant to a strategy with a different market capitalization limit on the companies in which the Target Fund invests a majority of its assets. If the Target Fund’s current strategies had been in place for the prior periods, results shown would have been different.

Effective May 1, 2022, the Acquiring Fund compares its performance to that of the Russell 2500 Growth Index (the New Index). Prior to this date, the Fund compared its performance to that of the Russell 2000 Growth Index (the Former Index). The Acquiring Fund changed its primary benchmark in connection with changes to its principal investment strategies that became effective May 1, 2022. The Investment Manager believes that the New Index provides a more appropriate comparison than the Former Index for investors measuring the Fund’s relative performance. Information on the Former Index will be shown for a one-year transition period.

The returns shown do not reflect any fees and expenses imposed under your Contract or Qualified Plan and would be lower if they did.

Past performance (before taxes) is no guarantee of how a Fund will perform in the future. Updated performance information can be obtained by calling toll-free 800.345.6611 or visiting columbiathreadneedleus.com.

-12-

Table of Contents

Wanger Select

SHARE PERFORMANCE

(based on calendar years)

During the periods shown in the bar chart, the highest return for a calendar quarter was 27.52% (2nd Quarter 2020) and the lowest return for a calendar quarter was -24.18 (2nd Quarter 2022).

-13-

Table of Contents

Average Annual Total Returns (for periods ended December 31, 2022)

| Share Class Inception Date |

1 Year | 5 Years | 10 Years | |||||||||||||

| 02/01/1999 | ||||||||||||||||

| Returns before taxes |

-34.83% | -0.22% | 7.05% | |||||||||||||

| Russell 2500 Growth Index |

||||||||||||||||

| (reflects no deduction for fees, expenses or taxes) |

-26.21% | 5.97% | 10.62% | |||||||||||||

Wanger Acorn

SHARE PERFORMANCE

(based on calendar years)

During the periods shown in the bar chart, the highest return for a calendar quarter was 26.59% (2nd Quarter 2020) and the lowest return for a calendar quarter was -27.04% (1st Quarter 2020).

-14-

Table of Contents

Average Annual Total Returns (for periods ended December 31, 2022)

| Share Class Inception Date |

1 Year | 5 Years | 10 Years | |||||||||||||

| Returns before taxes |

05/03/1995 | -33.46% | 3.06% | 8.21% | ||||||||||||

| Russell 2500 Growth Index |

||||||||||||||||

| (reflects no deductions for fees, expenses or taxes) |

-26.21% | 5.97% | 10.62% | |||||||||||||

| Russell 2000 Growth Index | ||||||||||||||||

| (reflects no deductions for fees, expenses or taxes) |

-26.36% | 3.51% | 9.20% | |||||||||||||

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Funds through a broker-dealer or other financial intermediary (such as an insurance company), the Funds and its related companies – including the Investment Manager, Columbia Management Investment Distributors, Inc. (the “Distributor”) and Columbia Management Investment Services Corp. (the “Transfer Agent”) – may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your financial advisor to recommend the fund over another investment. These potential conflicts of interest may be heightened with respect to broker-dealers owned by Ameriprise Financial, Inc. and/or its affiliates. Ask your financial advisor or visit your financial intermediary’s website for more information.

-15-

Table of Contents

SECTION B — ADDITIONAL INFORMATION ABOUT THE REORGANIZATION

The Board has approved the Agreement. While Contract Owners and Shareholders are encouraged to review the Agreement, which has been filed with the SEC as an exhibit to the registration statement of which this Information Statement/Prospectus is a part, the following is a summary of certain terms of the Agreement:

| • | The Reorganization is expected to occur in the second quarter of 2023, subject to receipt of any necessary regulatory approvals and satisfaction of any other conditions to closing. However, following such approvals, the Reorganization may happen at any time agreed to by the applicable Target Fund and Acquiring Fund. |

| • | The Target Fund will transfer all of its assets to the Acquiring Fund and, in exchange, the Acquiring Fund will assume all the Target Fund’s obligations and liabilities and will issue Acquisition Shares to the Target Fund. The value of the Target Fund’s assets, as well as the number of Acquisition Shares to be issued to the Target Fund, will be determined in accordance with the Agreement. The Acquisition Shares will have an aggregate net asset value equal to the value of the assets received from the Target Fund, net of liabilities and costs of the Reorganization payable by the Target Fund. Such costs are limited to brokerage and other portfolio transaction costs, which are expected to be minimal, if any. Immediately after the closing, the Target Fund will liquidate and distribute pro rata to its shareholders of record the Acquisition Shares received by the Target Fund. |

| • | As a result, shareholders of the Target Fund will become shareholders of the Acquiring Fund. |

| • | The value of the net assets of the Target Fund and the Acquisition Shares will be computed as of the close of regular trading on the New York Stock Exchange on the business day immediately preceding the closing date of the Reorganization. |

Conditions to Closing the Reorganization

The completion of the Reorganization is subject to certain conditions described in the Agreement, including among others:

| • | The Target Fund shall have declared and paid a dividend or dividends that, together with all previous dividends, shall have the effect of distributing all of the Target investment company taxable income (computed without regard to the deduction for dividends paid), net tax-exempt income and net realized capital gains, if any, to the shareholders of the Target Fund for all taxable periods ending on or before the closing date of the Reorganization, (after reduction for any available capital loss carryforwards and excluding any net capital gains on which the Target Fund paid U.S. federal income tax). |

| • | The Target Fund and the Acquiring Fund will have received any approvals, consents or exemptions from the SEC or any other regulatory body necessary to carry out the Reorganization. |

| • | A registration statement on Form N-14 relating to the Reorganization will have been filed with the SEC and become effective. |

| • | The Target Fund and the Acquiring Fund will have received a satisfactory opinion of tax counsel to the effect that, as described in more detail below in the section entitled “U.S. Federal Income Tax Status of the Reorganization,” shareholders of the Target Fund will not recognize gain or loss for U.S. federal income tax purposes upon the exchange of their Target Fund shares for the Acquisition Shares of the Acquiring Fund in connection with the Reorganization and the Target Fund will not recognize gain or loss as a direct result of the Reorganization. This condition may not be waived under the Agreement. |

Termination of the Agreement and Plan of Reorganization

The Agreement and the transactions contemplated by it may be terminated with respect to any Reorganization by mutual agreement of the Target Fund and the Acquiring Fund at any time prior to the closing

-16-

Table of Contents

thereof, or by either the Target Fund or the Acquiring Fund in the event of a material breach of the Agreement by the other Fund or a failure of any condition precedent to the terminating Fund’s obligations under the Agreement. In the event of a termination of the Reorganization, the Investment Manager will bear all costs associated with the Reorganization.

Each Fund is a series of Wanger Advisors Trust, a Massachusetts business trust, and is governed by the same Agreement and Declaration of Trust (“Declaration of Trust”) and Bylaws. Accordingly, shareholder rights are identical in all respects. See Appendix B hereto for a complete description of the Declaration of Trust and Bylaws of the Funds.

U.S. Federal Income Tax Status of the Reorganization

As long as the Contracts qualify to be treated as life insurance contracts under Section 7702(a) of the Code or annuity contracts under Section 72 of the Code, the Reorganization, whether or not treated as tax-free for U.S. federal income tax purposes, will not create any tax liability for Contract Owners. The Fund is required to comply with Section 817(h) of the Code and the regulations thereunder, which impose “diversification” requirements on the Fund. The Fund intends to comply with the diversification requirements. If the Fund does not satisfy the Section 817(h) requirements, income on the variable annuity contracts could become currently taxable to the Contract Owners.

In addition, the Reorganization, whether or not treated as tax-free for U.S. federal income tax purposes, is not expected to be a taxable event for Qualified Plans and other qualified investors that hold shares in tax-advantaged accounts. Persons investing through such accounts should consult their tax advisors to determine the precise effect of a Reorganization in light of their particular tax situation.

The Reorganization is intended to qualify for U.S. federal income tax purposes as a tax-free reorganization under section 368(a) of the Code. As a condition to the closing of the Reorganization, the Target Fund and Acquiring Fund will receive an opinion from Perkins Coie, LLP substantially to the effect that, on the basis of existing provisions of the Code, U.S. Treasury regulations issued thereunder, current administrative rules, pronouncements and court decisions, and certain representations, qualifications and assumptions with respect to the Reorganization, for U.S. federal income tax purposes:

| • | The transfer by the Target Fund of all its assets to the Acquiring Fund solely in exchange for Acquisition Shares and the assumption by the Acquiring Fund of all the liabilities of the Target Fund, immediately followed by the pro rata distribution of all the Acquisition Shares so received by the Target Fund to the Target Fund’s shareholders of record in complete liquidation of the Target Fund and the termination of the Target Fund promptly thereafter, will constitute a “reorganization” within the meaning of section 368(a)(1) of the Code, and the Target Fund and the Acquiring Fund will each be “a party to a reorganization” within the meaning of section 368(b) of the Code, with respect to the Reorganization. |

| • | No gain or loss will be recognized by the Acquiring Fund upon the receipt of all the assets of the Target Fund solely in exchange for Acquisition Shares and the assumption by the Acquiring Fund of all the liabilities of the Target Fund. |

| • | No gain or loss will be recognized by the Target Fund upon the transfer of all its assets to the Acquiring Fund solely in exchange for Acquisition Shares and the assumption by the Acquiring Fund of all the liabilities of the Target Fund or upon the distribution (whether actual or constructive) of the Acquisition Shares so received to the Target Fund’s shareholders solely in exchange for such shareholders’ shares of the Target Fund in complete liquidation of the Target Fund. |

| • | No gain or loss will be recognized by the Target Fund’s shareholders upon the exchange, pursuant to the Agreement, of all their shares of the Target Fund solely for Acquisition Shares. |

| • | The aggregate basis of the Acquisition Shares received by the Target Fund shareholder pursuant to the Agreement will be the same as the aggregate basis of the Target Fund shares exchanged therefor by such shareholder. |

| • | The holding period of the Acquisition Shares received by the Target Fund shareholder in the Reorganization will include the period during which the shares of the Target Fund exchanged therefor were held by such shareholder, provided such Target Fund shares were held as capital assets at the effective time of the Reorganization. |

| • | The basis of the assets of the Target Fund received by the Acquiring Fund will be the same as the basis of such assets in the hands of the Target Fund immediately before the effective time of the Reorganization. |

-17-

Table of Contents

| • | The holding period of the assets of the Target Fund received by the Acquiring Fund will include the period during which such assets were held by the Target Fund. |

| • | The Acquiring Fund will succeed to and take into account the items of the Target Fund described in section 381(c) of the Code, subject to the conditions and limitations specified in sections 381, 382, 383 and 384 of the Code and the regulations thereunder. |

The opinion will assume that Contracts and the Participating Insurance Company issuing them are properly structured under the insurance company provisions of section 817(d) of the Code, and the ownership of shares in the Funds and access to the Funds satisfies the requirements of Treasury Regulations section 1.817-5(f) and will be based on customary assumptions, and certain factual certifications made by the officers of the Target Fund and the Acquiring Fund, but cannot be free from doubt.

No opinion will be expressed as to (a) the effect of the Reorganization on the Target Fund, the Acquiring Fund or any Target Fund shareholder with respect to any asset (including without limitation any stock held in a passive foreign investment company as defined in section 1297(a) of the Code) as to which any unrealized gain or loss is required to be recognized under federal income tax principles (i) at the end of a taxable year or on the termination thereof, or (ii) upon the transfer of such asset regardless of whether such transfer would otherwise be a non-taxable transaction under the Code or (b) any other federal tax issues (except those set forth above) and any state, local or foreign tax issues of any kind.

No private letter ruling will be sought from the Internal Revenue Service (the “IRS”) with respect to the federal income tax consequences of the Reorganization. Opinions of counsel are not binding upon the IRS or the courts, and are not guarantees of the tax results, and do not preclude the IRS from adopting or taking a contrary position, which may be sustained by a court. If the Reorganization were consummated but the IRS or the courts determine that the Reorganization did not qualify as a tax-free reorganization under the Code, the Target Fund would recognize gain or loss on the transfer of its assets to the Acquiring Fund and each shareholder of the Target Fund would recognize a taxable gain or loss for federal income tax purposes equal to the difference between its tax basis in its Target Fund shares and the fair market value of the Acquisition Shares it received. Shareholders and Contract Owners should consult their tax advisors regarding the effect, if any, of the Reorganization in light of their individual circumstances. For a description of the tax consequences of investing in Contracts, Contract Owners should consult the prospectus or other information provided by the Participating Insurance Company regarding their Contracts.

A portion of the portfolio assets of the Target Fund may be sold by the Acquiring Fund after the Reorganization. However, brokerage and portfolio transaction costs are expected to be minimal, if any, as there is currently 98% portfolio overlap between the Target Fund and the Acquiring Fund. Any gains recognized in any such sale on a net basis, after reduction by any available losses as appropriate, will be distributed to shareholders during or with respect to the year of sale. Further, the Reorganization will end the tax year of the Target Fund, and will therefore accelerate any distributions to shareholders from the Target Fund for its short tax year ending on the date of the Reorganization.

More generally, prior to the closing of the Reorganization, the Target Fund will declare and pay a distribution to its shareholders, which, together with all previous distributions, will have the effect of distributing to its shareholders all of its investment company taxable income (computed without regard to the deduction for dividends paid), net tax-exempt income, if any, and realized net capital gains (after reduction for available capital loss carryforwards and excluding certain capital gain on which the Target Fund paid U.S. federal income tax), if any, through the closing of the Reorganization. The Target Fund may similarly distribute its investment income and gains to its shareholders.

Contract Owners who choose to redeem or exchange their investments by surrendering their Contracts or initiating a partial withdrawal may be subject to taxes and a penalty. For a description of the tax consequences of investing in Contracts, Contract Owners should consult the prospectus or other information provided by the Participating Insurance Company regarding their Contracts.

Although it is not expected to affect Contract Owners or Qualified Plans and other qualified investors that hold shares in tax-advantaged accounts, each of the Target Fund and the Acquiring Fund may lose the benefit of certain tax losses that could have been used to offset or defer future gains of the combined Fund, and the combined Fund will have tax attributes that reflect a blending of the tax attributes of each Fund at the time of the Reorganization.

A Fund’s ability to carry forward capital losses and to use them to offset future gains may be limited as a result of the Reorganization. First, a Fund’s “pre-acquisition losses” (including capital loss carryforwards, net current-year capital losses, and unrealized losses that exceed certain thresholds) may become unavailable to offset gains of the Acquiring Fund after the Reorganization to the extent such pre-acquisition losses exceed an

-18-

Table of Contents

annual limitation amount. Second, one Fund’s pre-acquisition losses cannot be used to offset gains in another Fund that are unrealized (“built in”) at the time of the Reorganization and that exceed certain thresholds (“non-de minimis built-in gains”) for five tax years. Third, the Target Fund’s loss carryforwards, as limited under the previous two rules, are permitted to offset only that portion of the gains of the Acquiring Fund for the taxable year of the Reorganization that is equal to the portion of the Acquiring Fund’s taxable year that follows the date of the Reorganization (prorated according to number of days). Therefore, in certain circumstances, shareholders of a Fund may pay U.S. federal income tax sooner, or pay more U.S. federal income tax, than they would have had the Reorganization not occurred.

As of December 31, 2022, each of the Target Fund and the Acquiring Fund had no net realized or unrealized losses. As of December 31, 2022, the Target Fund had year-to-date net realized losses equal to about 41% of net assets and net unrealized losses equal to about 12% of net assets. As of December 31, 2022, the Acquiring Fund had year-to-date net realized losses equal to about 22% of net assets and net unrealized losses equal to about 0% of net assets.

As of December 31, 2022, the Target Fund had $27,672,074 in capital loss carryforwards and the Acquiring Fund had $91,688,224 in capital loss carryforwards. It is estimated that the Target Fund’s capital loss carryforwards can be fully utilized by the Acquiring Fund within approximately 14 years of the Reorganization to offset future capital gains.