Form FWP ICZOOM Group Inc. Filed by: ICZOOM Group Inc.

ICZOOM Group Inc. Investor Presentation September 2021 Issuer Free Writing Prospectus Dated September 23, 2021 Filed Pursuant to Rule 433 Relating to Preliminary Prospectus Dated September 17, 2021 Registration Statement No. 333-259012

Forward-Looking Statements

This presentation includes statements that are, or may be deemed, “forward-looking statements”. In some cases these forward-looking statements can be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “anticipates,” “expects, ”“plans,”“ intends,” “may,” “could,” “might,” “will,” “should,” “approximately,” “potential,” or in each case, their negative or other variations thereon or comparable terminology, although not all forward-looking statements contain these words. They appear in a number of places throughout this presentation and include statements regarding our intentions, beliefs, projections, outlook, analyses or current expectations on our goals and strategies; our future business development, financial condition and results of operations; expected changes in our revenues, costs or expenditures; our expectations regarding demand for and market acceptance of our services; competition in our industry; and government policies and regulations relating to our industry as stated herein.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events, competitive dynamics, and regulatory developments and depend on the economic circumstances that may or may not occur in the future or may occur on longer or shorter timelines than anticipated. Although we believe that we have a reasonable basis for each forward-looking statement contained in this presentation, we caution you that forward-looking statements are not guarantees of future performance and that our actual results of operation, financial condition and liquidity, and the development of the industry in which we operate may differ materially from the forward-looking statements contained in this presentation as a result of, among other factors, the factors referenced in the “Risk Factors” section of the prospectus contained in the registration statement on Form F-1 (File No. 333-259012) initially filed with the Securities and Exchange Commission (the “SEC”) on August 23, 2021 as amended thereafter, for our proposed initial public offering (the “Registration Statement”). In addition, even if our results of operations, financial conditions and liquidity, and the development of the industries in which we operate are consistent with the forward-looking statements contained in this presentation, they may not be predictive of results or developments in future periods. Any forward-looking statement that we make in this presentation speaks only as of the date of such statement, and we undertake no obligation to update or revise publicly any of the forward-looking statements after the date hereof to conform the statements to actual results or changed expectations except as required by applicable law.

This investor presentation provides basic information about the company and the offering. Because it is only a summary, this document does not cover all the information that should be considered before investing. You should read carefully the factors described in the “Risk Factors” section of the prospectus contained in the Registration Statement to better understand the risks and uncertainties inherent in our businesses and any forward-looking statements.

Free Writing Prospectus Statement

This free writing prospectus relates to the proposed initial public offering of Class A ordinary shares of ICZOOM Group Inc. (the “Company”), which are being registered on the Registration Statement and should be read together with the preliminary prospectus included in the Registration Statement filed by the Company with the SEC for the offering to which this presentation relates and may be accessed through the following web link:

https://www.sec.gov/Archives/edgar/data/0001854572/000119312521275308/d155173df1a.htm

The Company has filed the Registration Statement (including a preliminary prospectus) with the SEC for the proposed offering to which this communication relates. The Registration Statement has not yet become effective. Before you invest, you should read the prospectus in the Registration Statement (including the risk factors described therein) and other documents we have filed with the SEC in their entirety for more complete information about us and the proposed offering. You may get these documents for free by visiting EDGAR on the SEC web site at http://www.sec.gov.

Alternatively, we or the representative of the underwriters will arrange to send you the prospectus if you contact Prime Number Capital LLC, via email: [email protected] and standard mail at 1129 Northern Blvd., Suite 404, Manhasset, New York, 11030 or contact ICZOOM Group Inc., via email: [email protected].

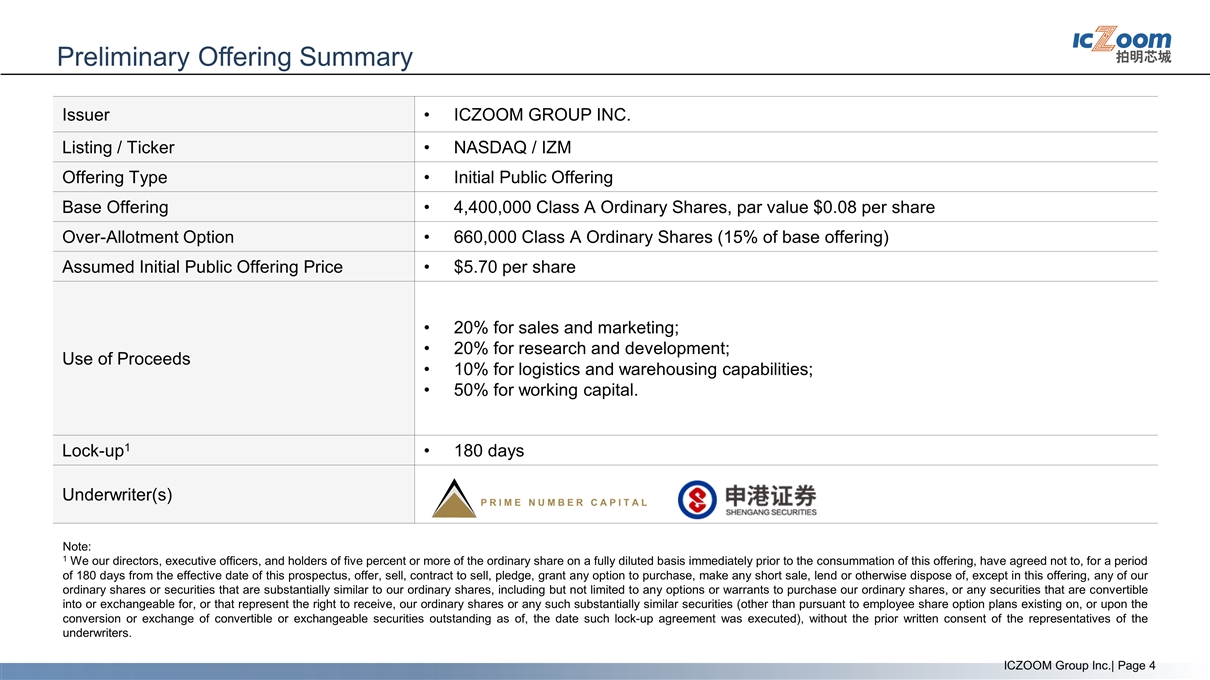

Preliminary Offering Summary Issuer ICZOOM GROUP INC. Listing / Ticker NASDAQ / IZM Offering Type Initial Public Offering Base Offering 4,400,000 Class A Ordinary Shares, par value $0.08 per share Over-Allotment Option 660,000 Class A Ordinary Shares (15% of base offering) Assumed Initial Public Offering Price $5.70 per share Use of Proceeds 20% for sales and marketing; 20% for research and development; 10% for logistics and warehousing capabilities; 50% for working capital. Lock-up1 180 days Underwriter(s) Note: 1 We our directors, executive officers, and holders of five percent or more of the ordinary share on a fully diluted basis immediately prior to the consummation of this offering, have agreed not to, for a period of 180 days from the effective date of this prospectus, offer, sell, contract to sell, pledge, grant any option to purchase, make any short sale, lend or otherwise dispose of, except in this offering, any of our ordinary shares or securities that are substantially similar to our ordinary shares, including but not limited to any options or warrants to purchase our ordinary shares, or any securities that are convertible into or exchangeable for, or that represent the right to receive, our ordinary shares or any such substantially similar securities (other than pursuant to employee share option plans existing on, or upon the conversion or exchange of convertible or exchangeable securities outstanding as of, the date such lock-up agreement was executed), without the prior written consent of the representatives of the underwriters. Ostin Technology Group | Page ICZOOM Group Inc.| Page

Table of Contents Company Overview Industry Overview Investment Highlights Growth Strategies Financials 6 11 13 18 20 ICZOOM Group Inc.| Page

We are a B2B e-commerce trading platform primarily engaged in sales of electronic component products Company Overview Industry Overview Investment Highlights Growth Strategies Financials Implementation of Real-Time Transaction Information Captures changes of offering prices and updates Anonymous Product Offering Collects, optimizes, and presents product offering information Software-as-a-service (“SaaS”) Solution Enables customers to optimize orders One-Stop Platform Lower Cost Higher Efficiency ICZOOM Group Inc.| Page

Company Overview Industry Overview Investment Highlights Growth Strategies Financials One-stop Customs Clearance 1 Customized Service 2 Enterprise Level Hierarchical Customer Management 3 7 Temporary Warehousing 4 Logistic Service 5 6 Supply Chain Coordination Custom Qualification Our value-added services And more… ICZOOM Group Inc.| Page

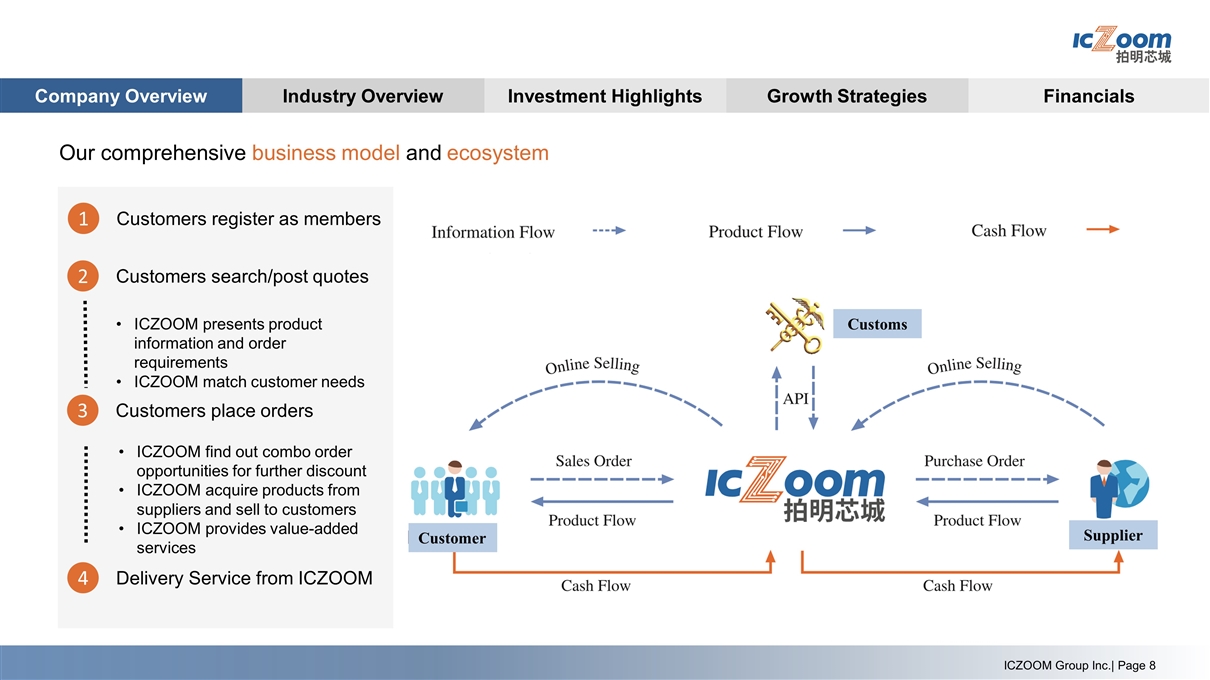

Company Overview Industry Overview Investment Highlights Growth Strategies Financials Our comprehensive business model and ecosystem 1 Customers register as members 2 Customers search/post quotes 3 Customers place orders ICZOOM presents product information and order requirements ICZOOM match customer needs ICZOOM find out combo order opportunities for further discount ICZOOM acquire products from suppliers and sell to customers ICZOOM provides value-added services 4 Delivery Service from ICZOOM ICZOOM Group Inc.| Page Customer Customs Supplier

Global market layout and customer network Company Overview Industry Overview Investment Highlights Growth Strategies Financials 835 Suppliers Global Customer Network Distributors from Overseas 3,670 brands in multiple electronic industry subdivisions Small and medium-sized enterprises in the PRC Generated revenue from a total of 866 customers and 749 customers for the past two fiscal years (2019-2020) 3,670 619 Accumulated suppliers in 2019 619 Offering data of 25+ million stock- keeping units 25M+ Manufactures in China Short inventory turnover period of 3.64 days and 3.92 days as of June 30, 2020 and 2019 749 866 ICZOOM Group Inc.| Page

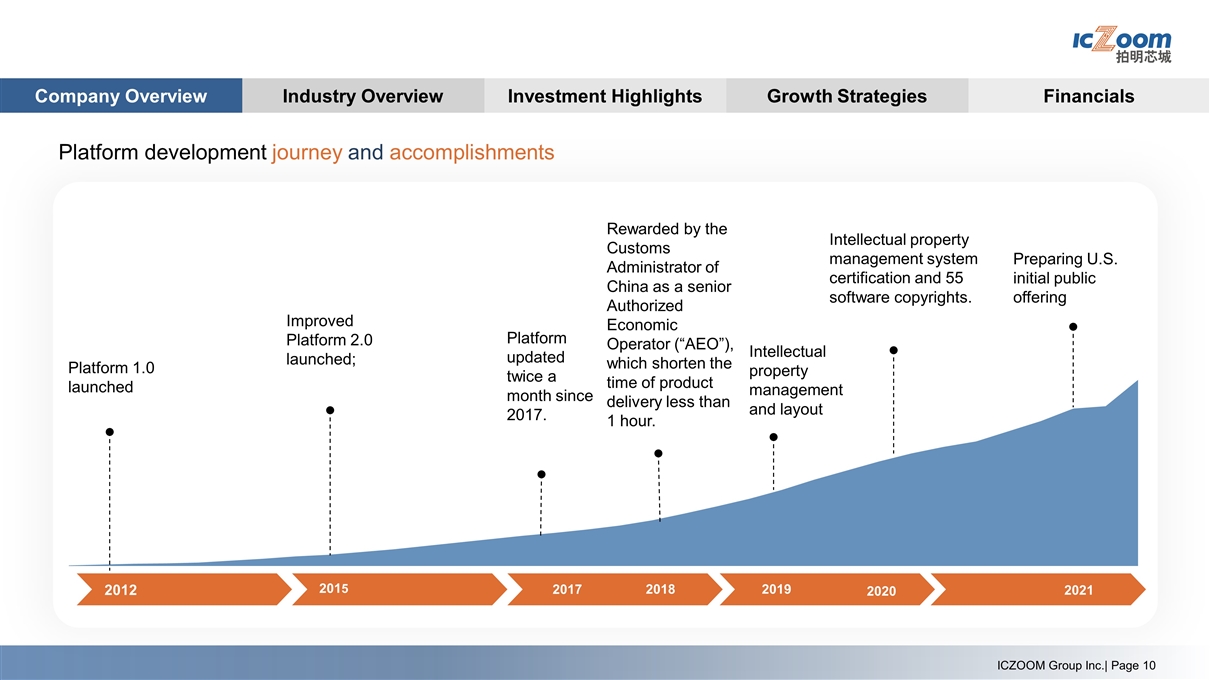

2012 2015 2017 2018 Platform 1.0 launched Improved Platform 2.0 launched; Platform updated twice a month since 2017. Preparing U.S. initial public offering Intellectual property management and layout Company Overview Industry Overview Investment Highlights Growth Strategies Financials Platform development journey and accomplishments ICZOOM Group Inc.| Page Rewarded by the Customs Administrator of China as a senior Authorized Economic Operator (“AEO”), which shorten the time of product delivery less than 1 hour. 2020 2019 2021 Intellectual property management system certification and 55 software copyrights.

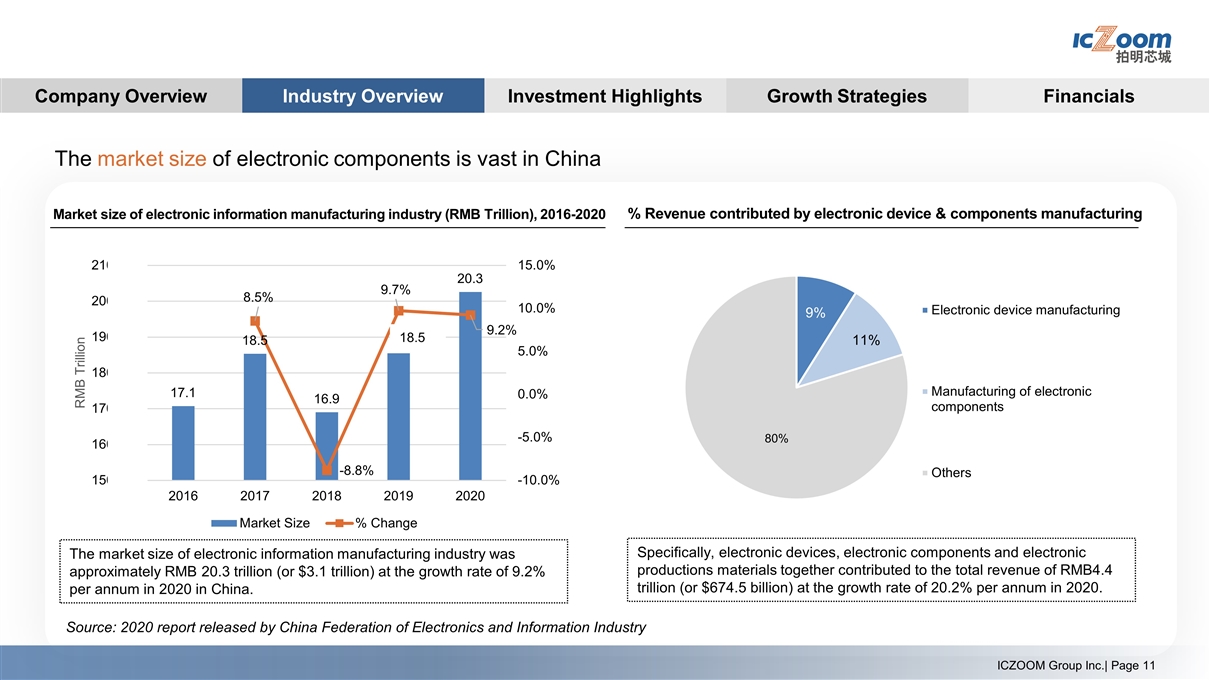

Company Overview Industry Overview Investment Highlights Growth Strategies Financials The market size of electronic components is vast in China Market size of electronic information manufacturing industry (RMB Trillion), 2016-2020 The market size of electronic information manufacturing industry was approximately RMB 20.3 trillion (or $3.1 trillion) at the growth rate of 9.2% per annum in 2020 in China. Specifically, electronic devices, electronic components and electronic productions materials together contributed to the total revenue of RMB4.4 trillion (or $674.5 billion) at the growth rate of 20.2% per annum in 2020. ICZOOM Group Inc.| Page Source: 2020 report released by China Federation of Electronics and Information Industry % Revenue contributed by electronic device & components manufacturing

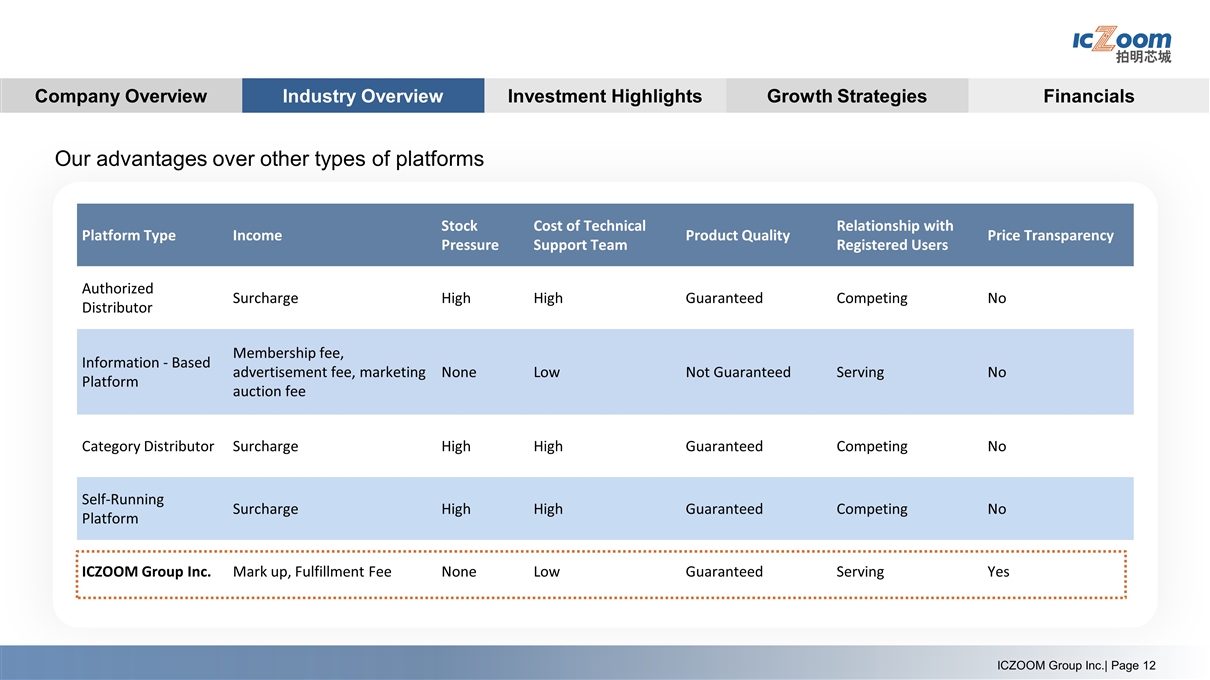

Company Overview Industry Overview Investment Highlights Growth Strategies Financials Platform Type Income Stock Pressure Cost of Technical Support Team Product Quality Relationship with Registered Users Price Transparency Authorized Distributor Surcharge High High Guaranteed Competing No Information - Based Platform Membership fee, advertisement fee, marketing auction fee None Low Not Guaranteed Serving No Category Distributor Surcharge High High Guaranteed Competing No Self-Running Platform Surcharge High High Guaranteed Competing No ICZOOM Group Inc. Mark up, Fulfillment Fee None Low Guaranteed Serving Yes ICZOOM Group Inc.| Page Our advantages over other types of platforms

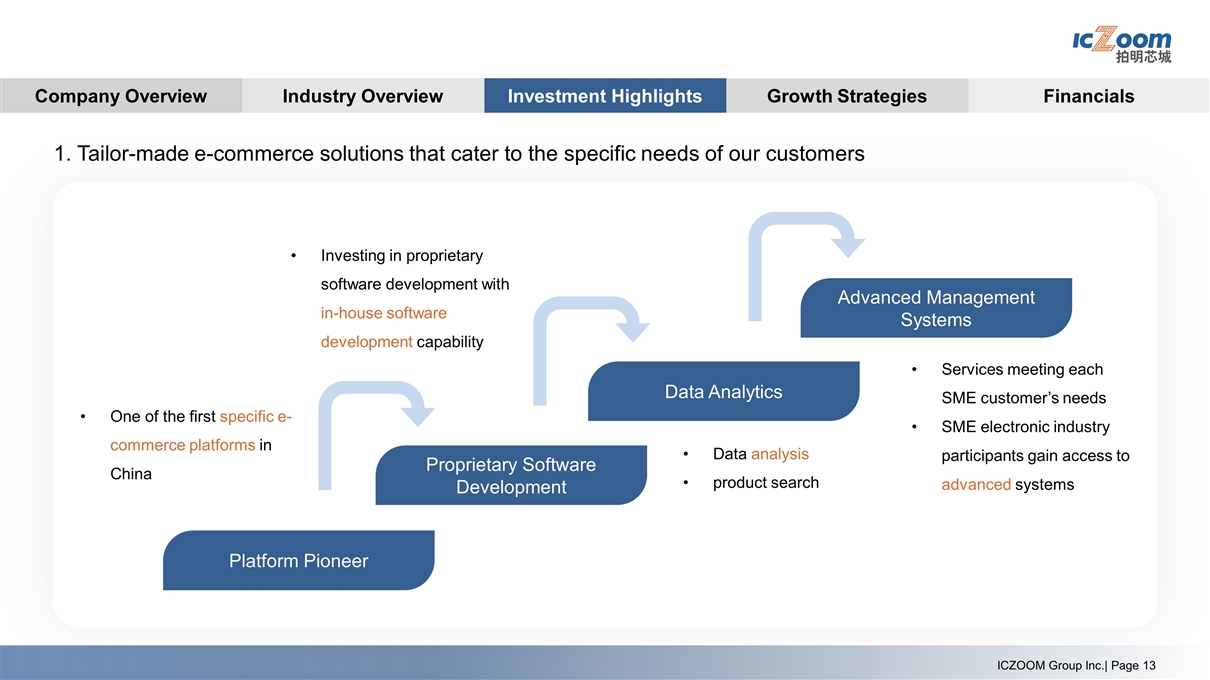

Investing in proprietary software development with in-house software development capability One of the first specific e-commerce platforms in China Platform Pioneer Proprietary Software Development Data Analytics Advanced Management Systems Services meeting each SME customer’s needs SME electronic industry participants gain access to advanced systems Data analysis product search Company Overview Industry Overview Investment Highlights Growth Strategies Financials 1. Tailor-made e-commerce solutions that cater to the specific needs of our customers ICZOOM Group Inc.| Page

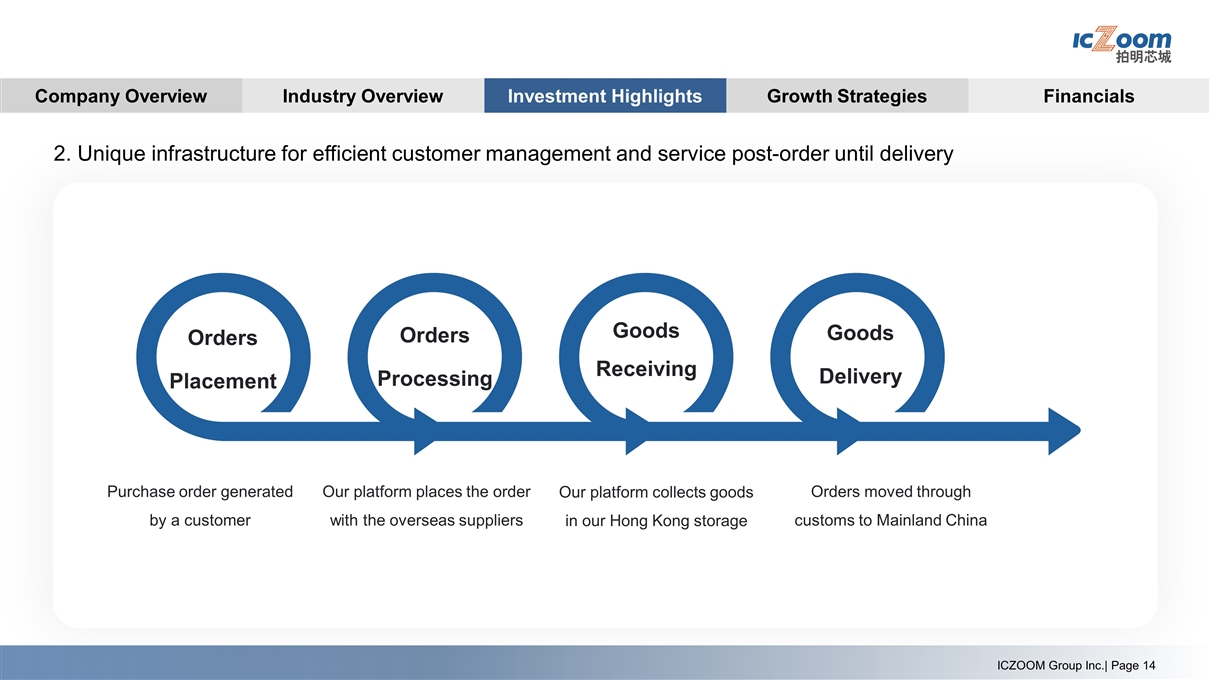

Company Overview Industry Overview Investment Highlights Growth Strategies Financials 2. Unique infrastructure for efficient customer management and service post-order until delivery Orders Placement Orders Processing Goods Delivery Goods Receiving Our platform places the order with the overseas suppliers Our platform collects goods in our Hong Kong storage Orders moved through customs to Mainland China Purchase order generated by a customer ICZOOM Group Inc.| Page

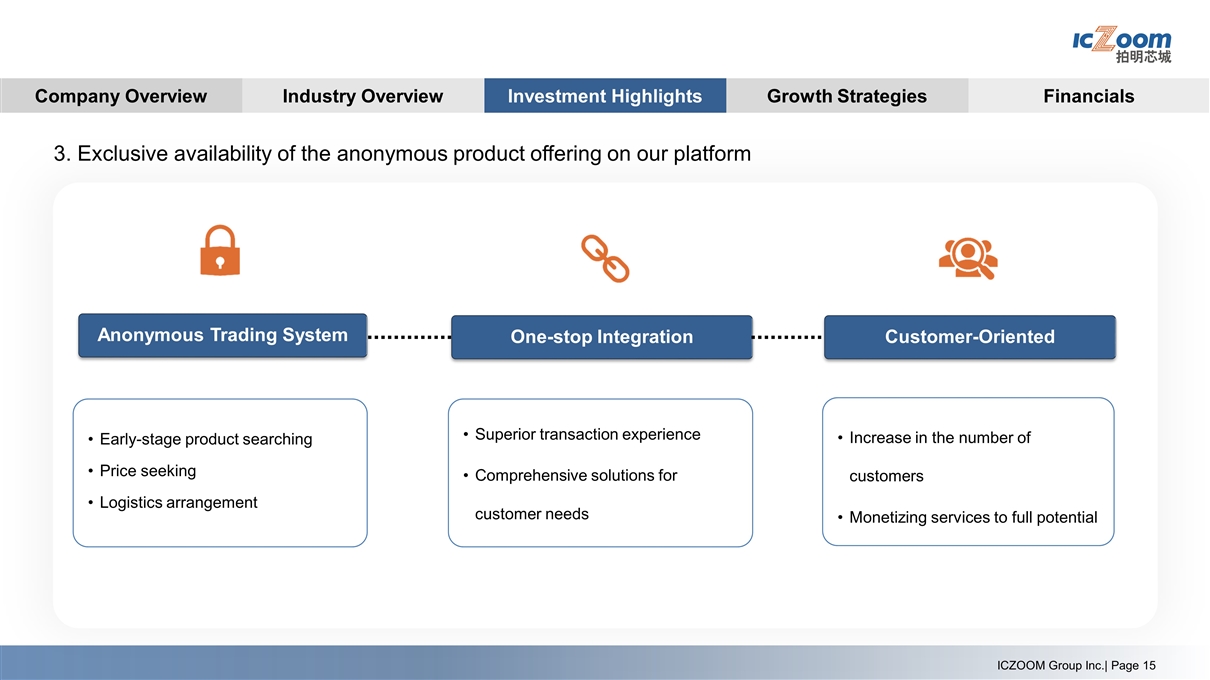

Company Overview Industry Overview Investment Highlights Growth Strategies Financials 3. Exclusive availability of the anonymous product offering on our platform Anonymous Trading System One-stop Integration Customer-Oriented Early-stage product searching Price seeking Logistics arrangement Superior transaction experience Comprehensive solutions for customer needs Increase in the number of customers Monetizing services to full potential ICZOOM Group Inc.| Page

Company Overview Industry Overview Investment Highlights Growth Strategies Financials 4. Visionary founders, experienced management team and strong corporate culture 9 management team members supporting co-founders 16+ years average experience in electronics, e-commerce, and big data analytics for each member Strong management fosters the development of an ecosystem serving China’s electronics industry Lei Xia– Co-Founder& CEO Former president of SinoHub Former first sales manager of Arrow Electronics Shanghai Pioneered an innovative business model Captured an outstanding market position in our industry Duanrong Liu – Co-Founder & COO Former manager of Dragon (Hong Kong) Electronics Executive MBA from Tsinghua University Qiang He – CFO Former auditor of PricewaterhouseCoopers Zhongtian LLP CPA of China and CPA of North Dakota, US ICZOOM Group Inc.| Page

Company Overview Industry Overview Investment Highlights Growth Strategies Financials 5. Independent Directors’ Expertise in the Industries Enhance Our Corporate Governance Wei Xia - Independent Director Nominee Served in a variety of roles as an analytic consultant of Wells Fargo Bank, a marketing analyst of Washington Mutual Bank, and a financial analyst of JPMorgan Chase Former director of finance at SinoHub, Inc Master’s degree from Georgia State University Qi (Jeff) He – Independent Director Nominee COO of HiFiBiO (HK) Limited Former CFO of Harbour BioMed Former executive VP of ShangPharma Co., Ltd. MBA degree from Emory University Tianshi (Stanley) Yang – Independent Director Nominee CFO of TD Holdings, Inc. (NASDAQ: GLG) Former financial dept. director of Meten International Education Group Ltd (NASDAQ: METX) Former investment director of China First Capital Group (HKEX:01269) Master’s degree from Brandeis University ICZOOM Group Inc.| Page Note: The three nominees will serve as the independent directors of the Company upon the effectiveness of this prospectus

Company Overview Industry Overview Investment Highlights Growth Strategies Financials 1. Continue to invest in information engine to support business 2. Further develop and expand solutions on e-commerce platform Extensive industry data Enhanced data storage and integration Boosted data processing efficiency Optimized data analytics algorithms Strengthen our cooperation with large distributors Generate incremental revenues Grow storage and customs clearing services Offer financing solutions to more customers ICZOOM Group Inc.| Page

Company Overview Industry Overview Investment Highlights Growth Strategies Financials 3. Strengthen technology capabilities and enrich SaaS suite 4. Expand marketing and sales by strengthening cooperation with large suppliers Generate incremental revenues by providing more flexible order execution services 1 2 3 Anonymous Auction Real time price information SaaS Specialized and focuses on electronic components transactions ICZOOM Group Inc.| Page Streamlined integration services More SMEs More vendors

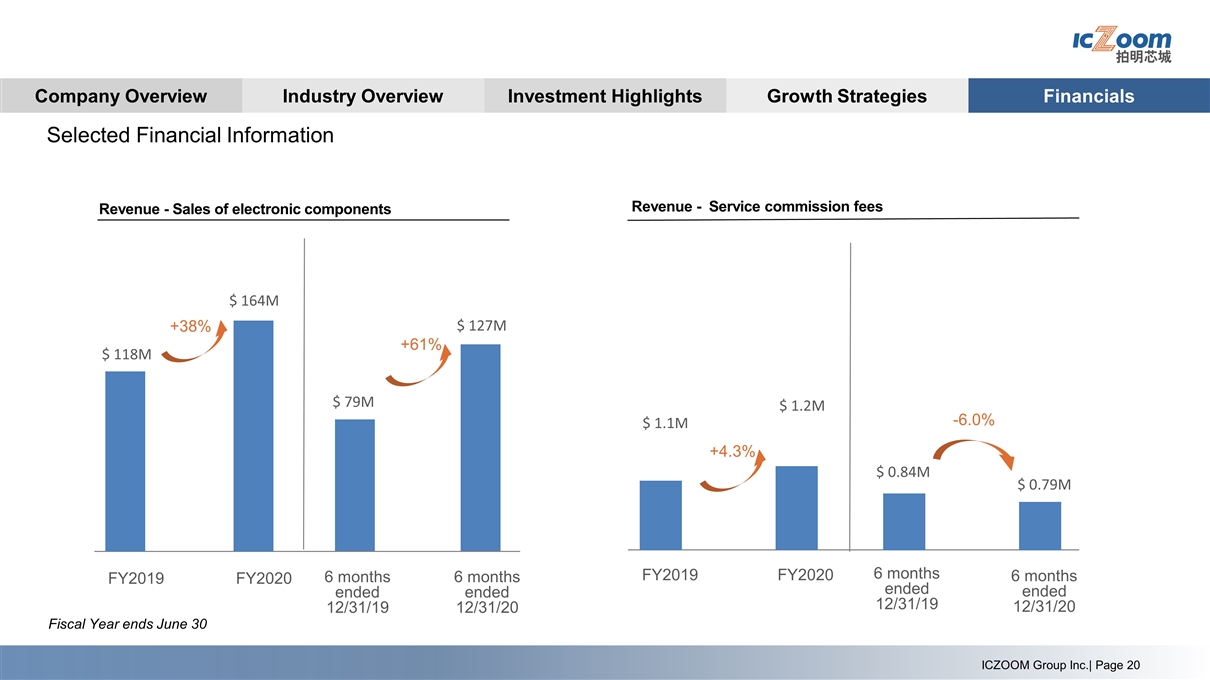

Company Overview Industry Overview Investment Highlights Growth Strategies Financials Selected Financial Information Revenue - Sales of electronic components Revenue - Service commission fees ICZOOM Group Inc.| Page FY2019 $ 118M $ 164M +38% $ 79M $ 127M +61% FY2020 6 months ended 12/31/19 6 months ended 12/31/20 FY2019 $ 1.1M $ 1.2M +4.3% $ 0.84M $ 0.79M -6.0% FY2020 6 months ended 12/31/19 6 months ended 12/31/20 Fiscal Year ends June 30

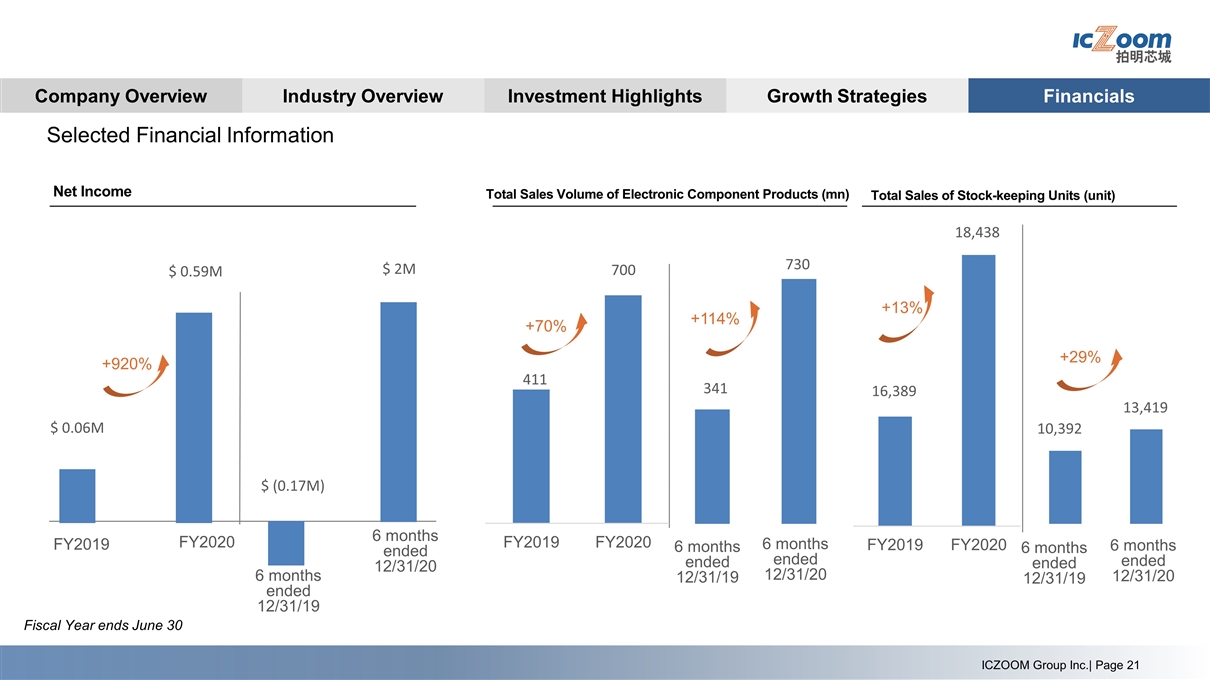

Company Overview Industry Overview Investment Highlights Growth Strategies Financials Selected Financial Information ICZOOM Group Inc.| Page Net Income FY2019 $ 0.06M $ 0.59M +920% $ (0.17M) $ 2M FY2020 6 months ended 12/31/19 6 months ended 12/31/20 Fiscal Year ends June 30 Total Sales Volume of Electronic Component Products (mn) Total Sales of Stock-keeping Units (unit) 6 months ended 12/31/19 6 months ended 12/31/19 6 months ended 12/31/20 6 months ended 12/31/20 730 341 700 411 13,419 10,392 18,438 16,389 +70% +114% +13% +29%

THANKS At Company Iris Zhang Investor Relations Director Email: [email protected] Phone: +86 13823769603 Investor Relations Janice Wang EverGreen Consulting Inc. Email: [email protected] Phone: +1 571-464-9470 +86 13811768559 Underwriter Frank Wang Prime Number Capital Email: [email protected] Phone: +86 15221989673

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Veolia: Combined Shareholders’ General Meeting, April 25, 2024

- Marie Brizard Wine & Spirits: Q1 2024 revenues

- Digital Therapeutics Market Size Worth USD 44.13 billion by 2031, to Grow at a CAGR of 31.02% | As per SNS Insider

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share