Form FWP Citigroup Global Markets Filed by: Citigroup Global Markets Holdings Inc.

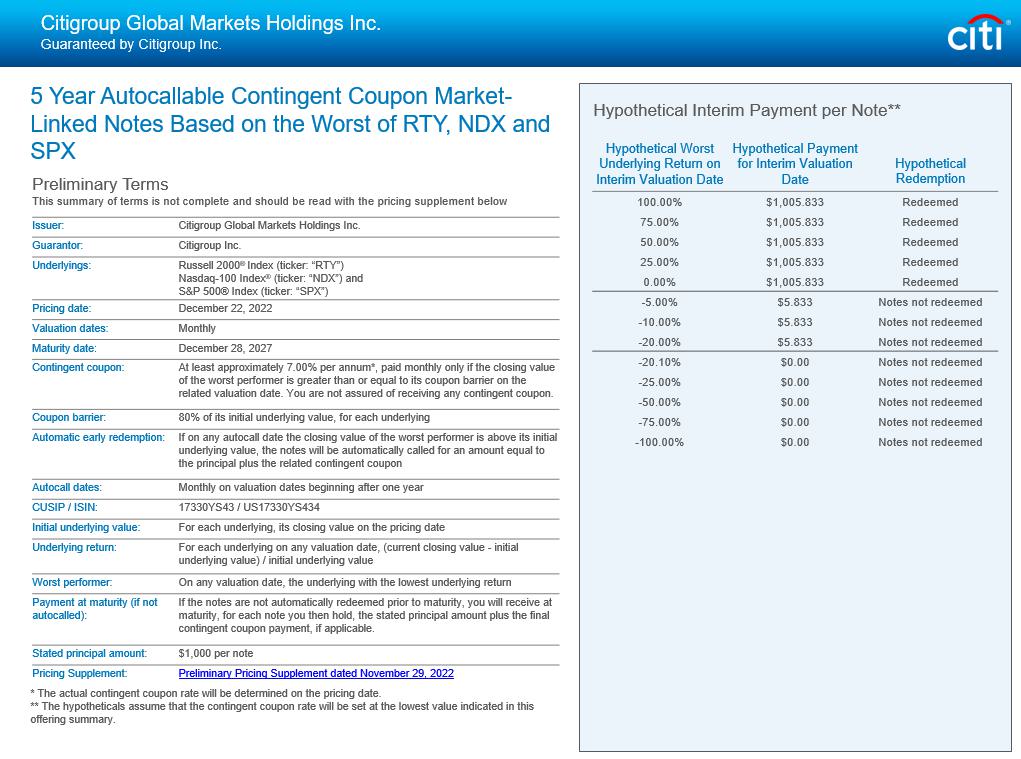

Preliminary Terms This summary of terms is not complete and should be read with the pricing supplement below Issuer: Citigroup Global Markets Holdings Inc. Guarantor: Citigroup Inc. Underlyings: Russell 2000 ® Index (ticker: “ RTY ”) Nasdaq - 100 Index ® (ticker: “ NDX ”) and S&P 500® Index (ticker: “SPX”) Pricing date: December 22, 2022 Valuation dates: Monthly Maturity date: December 28, 2027 Contingent coupon: At least approximately 7.00 % per annum*, paid monthly only if the closing value of the worst performer is greater than or equal to its coupon barrier on the related valuation date. You are not assured of receiving any contingent coupon. Coupon barrier: 80% of its initial underlying value, f or each underlying Automatic early redemption: If on any autocall date the closing value of the worst performer is above its initial underlying value, the notes will be automatically called for an amount equal to the principal plus the related contingent coupon Autocall dates: Monthly on valuation dates beginning after one year CUSIP / ISIN: 17330YS43 / US17330YS434 Initial underlying value: For each underlying, its closing value on the pricing date Underlying return: For each underlying on any valuation date, (current closing value - initial underlying value) / initial underlying value Worst performer: On any valuation date, the underlying with the lowest underlying return Payment at maturity (if not autocalled): If the notes are not automatically redeemed prior to maturity, you will receive at maturity, for each note you then hold, the stated principal amount plus the final contingent coupon payment, if applicable. Stated principal amount: $1,000 per note Pricing Supplement: Preliminary Pricing Supplement dated November 29, 2022 Citigroup Global Markets Holdings Inc. Guaranteed by Citigroup Inc. 5 Year Autocallable Contingent Coupon Market - Linked Notes Based on the Worst of RTY , NDX and SPX Hypothetical Interim Payment per Note** Hypothetical Worst Underlying Return on Interim Valuation Date Hypothetical Payment for Interim Valuation Date Hypothetical Redemption 100.00% $1,005.833 Redeemed 75.00% $1,005.833 Redeemed 50.00% $1,005.833 Redeemed 25.00% $1,005.833 Redeemed 0.00% $1,005.833 Redeemed - 5.00% $5.833 Notes not redeemed - 10.00% $5.833 Notes not redeemed - 20.00% $5.833 Notes not redeemed - 20.10% $0.00 Notes not redeemed - 25.00% $0.00 Notes not redeemed - 50.00% $0.00 Notes not redeemed - 75.00% $0.00 Notes not redeemed - 100.00% $0.00 Notes not redeemed * The actual contingent coupon rate will be determined on the pricing date. ** The hypotheticals assume that the contingent coupon rate will be set at the lowest value indicated in this offering summary.

Selected Risk Considerations • Although the notes provide for the repayment of the stated principal amount at maturity, you may nevertheless suffer a loss on your investment in real value terms if you do not receive one or more, or any contingent coupon payments. • You will not receive any contingent coupon following any valuation date on which the closing value of the worst performer on that valuation date is less than its coupon barrier. • The return on the notes depends solely on the performance of the worst performer. As a result, t he notes are subject to the risks of each of the underlyings and will be negatively affected if any one performs poorly. • You will not benefit in any way from the performance of any better performing underlying. • You will be subject to risks relating to the relationship among the underlyings . The less correlated the underlyings , the more likely it is that any one of the underlyings will perform poorly over the term of the notes. All that is necessary for the notes to perform poorly is for one of the underlyings to perform poorly. • The notes may be automatically redeemed prior to maturity, limiting your opportunity to receive contingent coupons if the worst performer performs in a way that would otherwise be favorable. • The notes do not offer any upside exposure to any underlying. • The notes are particularly sensitive to the volatility of the closing values of the underlyings on or near the valuation dates. • The notes are unsecured debt securities and are subject to the credit risk of Citigroup Global Markets Holdings Inc. and Citigroup Inc. If Citigroup Global Markets Holdings Inc. defaults on its obligations under the notes and Citigroup Inc. defaults on its guarantee obligations, you may not receive anything owed to you under the notes. • The notes will not be listed on any securities exchange and you may not be able to sell them prior to maturity. • The estimated value of the notes on the pricing date will be less than the issue price. For more information about the estimated value of the notes, see the accompanying preliminary pricing supplement. • The value of the notes prior to maturity will fluctuate based on many unpredictable factors. • The Russell 2000 ® Index is subject to risks associated with small capitalization stocks. • The issuer and its affiliates may have conflicts of interest with you. • The U.S. federal tax consequences of an investment in the notes are unclear. The above summary of selected risks does not describe all of the risks associated with an investment in the notes. You should read the accompanying preliminary pricing supplement and product supplement for a more complete description of risks relating to the notes. Additional Information Citigroup Global Markets Holdings Inc. and Citigroup Inc. have filed registration statements (including the accompanying preliminary pricing supplement, product supplement, underlying supplement, prospectus supplement and prospectus) with the Securities and Exchange Commission (“SEC”) for the offering to which this communication relates. Before you invest, you should read the accompanying preliminary pricing supplement, product supplement, underlying supplement, prospectus supplement and prospectus in those registration statements (File Nos. 333 - 255302 and 333 - 255302 - 03) and the other documents Citigroup Global Markets Holdings Inc. and Citigroup Inc. have filed with the SEC for more complete information about Citigro up Global Markets Holdings Inc., Citigroup Inc. and this offering. You may obtain these documents without cost by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, you can request these documents by calling toll - free 1 - 800 - 831 - 9146. Filed pursuant to Rule 433 This offering summary does not contain all of the material information an investor should consider before investing in the notes. This offering summary is not for distribution in isolation and must be read together with the accompanying preliminary pricing supplement and the other documents referred to therein, which can be accessed via the link on the first page. Citigroup Global Markets Holdings Inc. Guaranteed by Citigroup Inc.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Spotify (SPOT) jumps 10% as Q1 revenue, gross margins beat Street's estimates

- Citi updates its outlook for Lucid stock. Here's where it expects LCID shares to trade

- KLA Corporation (KLAC) PT Raised to $725 at Citi

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

CitiSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share