Form FWP Citigroup Commercial Filed by: CITIGROUP COMMERCIAL MORTGAGE SECURITIES INC

| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-262701-02 | ||

The information in this free writing prospectus is preliminary and may be supplemented or changed. This free writing prospectus is not an offering to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

THIS

FREE WRITING PROSPECTUS, DATED [MAY 31, 2022]

MAY BE AMENDED OR SUPPLEMENTED PRIOR TO TIME OF SALE

CGCMT 2022-GC48

The depositor has filed a registration statement (including a prospectus) with the SEC (SEC File No. 333- 262701) for the offering to which this free writing prospectus relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor, Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co, LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

The securities to which these collateral materials (“Materials”) relate will be described in greater detail in the prospectus expected to be dated in May 2022 (the “Preliminary Prospectus”) that will be included as part of our registration statement. The Preliminary Prospectus will contain material information that is not contained in these Materials (including, without limitation, a summary of risks associated with an investment in the offered securities under the heading “Summary of Risk Factors” and a detailed discussion of such risks under the heading “Risk Factors”).

These Materials are preliminary and subject to change. The information in these Materials supersedes all prior such information delivered to you and will be superseded by any subsequent information delivered prior to the time of sale.

Neither these materials nor anything contained in these materials shall form the basis for any contract or commitment whatsoever. These Materials are not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

The information contained in these Materials may not pertain to any securities that will actually be sold. The information contained in these Materials may be based on assumptions regarding market conditions and other matters as reflected in these Materials. We make no representations regarding the reasonableness of such assumptions or the likelihood that any of such assumptions will coincide with actual market conditions or events, and these Materials should not be relied upon for such purposes. We and our affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of these Materials may, from time to time, have long or short positions in, and buy or sell, the securities mentioned in these Materials or derivatives thereof (including options). Information contained in these Materials is current as of the date appearing on these Materials only.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of the email communication to which this free writing prospectus is attached relating to (1) these Materials not constituting an offer (or a solicitation of an offer), (2) no representation being made that these Materials are accurate or complete and that these Materials may not be updated or (3) these Materials possibly being confidential, are, in each case, not applicable to these Materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these Materials having been sent via Bloomberg or another system.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

2

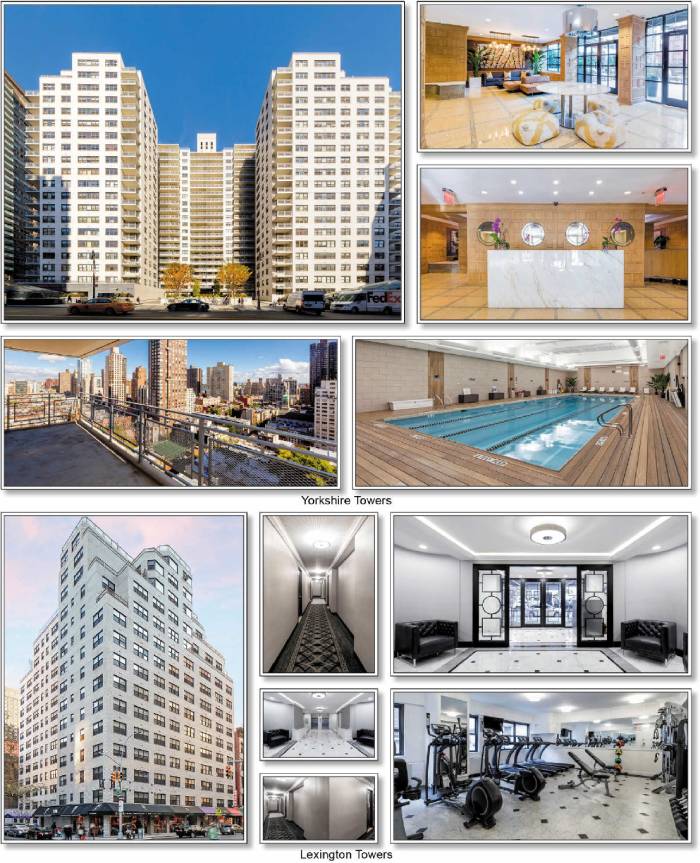

loan #1: Yorkshire & Lexington Towers

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

3

loan #1: Yorkshire & Lexington Towers

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

4

loan #1: Yorkshire & Lexington Towers

| Mortgaged Property Information | Mortgage Loan Information | |||||||||||||

| Number of Mortgaged Properties | 2 | Loan Seller(3) | BMO, SMC, CREFI | |||||||||||

| Location (City / State) | New York, New York | Cut-off Date Balance(4) | $60,000,000 | |||||||||||

| Property Type | Multifamily | Cut-off Date Balance per Unit(2) | $393,564.36 | |||||||||||

| Size (Units) | 808 | Percentage of Initial Pool Balance | 9.5% | |||||||||||

| Total Occupancy as of 3/1/2022 | 96.4% | Number of Related Mortgage Loans | None | |||||||||||

| Owned Occupancy as of 3/1/2022 | 96.4% | Type of Security | Fee | |||||||||||

| Year Built / Latest Renovation | Various / Various | Mortgage Rate | 3.04000% | |||||||||||

| Appraised Value | $954,000,000 | Original Term to Maturity (Months) | 60 | |||||||||||

| Appraisal Date | 1/20/2022 | Original Amortization Term (Months) | NAP | |||||||||||

| Borrower Sponsors | Meyer Chetrit and The Gluck Family Trust | Original Interest Only Period (Months) | 60 | |||||||||||

| U/A/D July 16, 2009 | First Payment Date | 7/6/2022 | ||||||||||||

| Property Management | Jumeaux Management LLC | Maturity Date | 6/6/2027 | |||||||||||

| Underwritten Revenues | $51,394,888 | |||||||||||||

| Underwritten Expenses | $16,019,126 | Escrows(5) | ||||||||||||

| Underwritten Net Operating Income (NOI)(1) | $35,375,762 | Upfront | Monthly | |||||||||||

| Underwritten Net Cash Flow (NCF)(1) | $35,375,762 | Taxes | $5,390,917 | $898,486 | ||||||||||

| Cut-off Date LTV Ratio(2) | 33.3% | Insurance | $367,868 | Springing | ||||||||||

| Maturity Date LTV Ratio(2) | 33.3% | Replacement Reserves | $1,100,000 | $0 | ||||||||||

| DSCR Based on Underwritten NOI / NCF(1)(2) | 3.61x / 3.61x | TI / LC | $1,000,000 | $0 | ||||||||||

| Debt Yield Based on Underwritten NOI / NCF(1)(2) | 11.1% / 11.1% | Other(6) | $12,400,000 | Springing | ||||||||||

| Sources and Uses | ||||||||||||||

| Sources | $ | % | Uses | $ | % | |||||||||

| Senior Loan Amount | $318,000,000 | 44.5% | Loan Payoff | $545,268,671 | 76.4% | |||||||||

| Subordinate Loan Amount | 221,500,000 | 31.0 | Closing Costs | 93,214,219 | 13.1 | |||||||||

| Mezzanine Loan Amount | 174,500,000 | 24.4 | Principal Equity Distribution | 55,258,325 | 7.7 | |||||||||

| Reserves | 20,258,785 | 2.8 | ||||||||||||

| Total Sources | $714,000,000 | 100.0% | Total Uses | $714,000,000 | 100.0% | |||||||||

| (1) | The Underwritten NOI and Underwritten NCF includes disbursements from a Supplemental Income Reserve (as defined below) of $5,226,004. See “Escrows” section below. |

| (2) | Calculated based on the aggregate outstanding principal balance as of the Cut-off Date of the Yorkshire & Lexington Towers Senior Loan (as defined below). The Yorkshire & Lexington Towers Senior Loan Underwritten DSCR Based on Underwritten NOI / NCF excluding credit for the upfront Supplemental Income Reserve are 3.08x and 3.08x, respectively. The Yorkshire & Lexington Towers Senior Loan Underwritten Debt Yield Based on Underwritten NOI / NCF excluding credit for the upfront Supplemental Income Reserve are 9.5% and 9.5%, respectively. For additional information regarding the loan-to-value ratio, debt service coverage ratio and debt yield based on the Yorkshire & Lexington Towers Whole Loan (as defined below) and the Yorkshire & Lexington Towers Total Debt (as defined below), see “Current Mezzanine Indebtedness” below. |

| (3) | The Yorkshire & Lexington Towers Mortgage Loan (as defined below) was co-originated by Bank of Montreal, SMC and CREFI. See “—The Mortgage Loan” below. |

| (4) | The Yorkshire & Lexington Towers Mortgage Loan is part of the Yorkshire & Lexington Towers Whole Loan which is comprised of eighteen senior pari passu promissory notes and two junior pari passu promissory notes with an aggregate original balance of $539,500,000. See “—The Mortgage Loan” below. |

| (5) | See “Escrows” section below. |

| (6) | Upfront other reserves include a $6,500,000 unit upgrade reserve and a $5,900,000 Supplemental Income Reserve. See “Escrows” section below. |

| ■ | The Mortgage Loan. The mortgage loan (the “Yorkshire & Lexington Towers Mortgage Loan”) is part of a whole loan (the “Yorkshire & Lexington Towers Whole Loan") evidenced by twenty notes comprising (i) eighteen senior pari passu notes (collectively the “Yorkshire & Lexington Towers Senior Pari Passu Notes”, and the portion of the Yorkshire & Lexington Towers Whole Loan evidenced by eighteen senior pari passu notes, the “Yorkshire & Lexington Towers Senior Loan”) with an aggregate outstanding principal balance as of the Cut-off Date of $318,000,000, and (ii) two junior notes (the "Yorkshire & Lexington Towers Trust Subordinate Companion Notes", and the portion of the Whole Loan evidenced by such two junior notes, “Yorkshire & Lexington Towers Trust Subordinate Companion Loan”) with an aggregate outstanding principal balance as of the Cut-off Date of $221,500,000. The Yorkshire & Lexington Towers Trust Subordinate Companion Notes are subordinate to the Yorkshire & Lexington Towers Senior Pari Passu Notes as and to the extent described in “Description of the Mortgage Pool—The Whole Loans—The Yorkshire & Lexington Towers Pari-Passu AB Whole Loan" in the Preliminary Prospectus. The aggregate outstanding principal balance as of the Cut-off Date of the Yorkshire & Lexington Towers Whole Loan is $539,500,000. The Yorkshire & Lexington Towers Whole Loan is secured by a first mortgage encumbering the borrowers’ fee simple interest in two multifamily properties totaling 808 units located in New York City (collectively, the “Yorkshire & Lexington Towers Properties”). The Yorkshire & Lexington Towers Senior Loan was originated by Bank of Montreal (“BMO”), Starwood Mortgage Capital LLC (“SMC”), and Citi Real Estate Funding Inc. (“CREFI”) on May 12, 2022, and the Yorkshire & Lexington Towers Trust Subordinate Companion Loan was originated by BMO and CREFI on May 12, 2022. The Yorkshire & Lexington Towers Whole Loan has an interest rate of 3.04000% per annum. The proceeds of the Yorkshire & Lexington Towers Whole Loan were used to refinance the Yorkshire & Lexington Towers Properties, fund upfront reserves, pay origination costs and return equity to the borrower sponsors. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

5

loan #1: Yorkshire & Lexington Towers

The Yorkshire & Lexington Towers Whole Loan had an initial term of 60 months and has a remaining term of 60 months as of the Cut-off Date. The Yorkshire & Lexington Towers Whole Loan requires payments of interest only for the entire term of the Yorkshire & Lexington Towers Whole Loan. The stated maturity date of the Yorkshire & Lexington Towers Whole Loan is the payment date in June 2027. Defeasance of the Yorkshire & Lexington Towers Whole Loan is permitted at any time after the date that is earlier of (i) July 6, 2025 and (ii) the date that is two years from the closing date of the securitization that includes the last note to be securitized.

Only the Yorkshire & Lexington Towers Mortgage Loan will be included in the mortgage pool for the CGCMT 2022-GC48 securitization trust, representing approximately 9.5% of the Initial Pool Balance. The Yorkshire & Lexington Towers Subordinate Companion Loan will be contributed to the CGCMT 2022-GC48 securitization trust, but will not be included in the mortgage pool. Payments allocated to the Yorkshire & Lexington Towers Subordinate Companion Loan will be paid only to the holders of the Yorkshire & Lexington Towers loan-specific certificates as described in “Description of the Mortgage Pool—The Whole Loans—The Yorkshire & Lexington Towers Pari-Passu AB Whole Loan” in the Preliminary Prospectus.

The Yorkshire & Lexington Towers Mortgage Loan is evidenced by three Yorkshire & Lexington Towers Senior Pari Passu Notes designated as Note A-4, Note A-9 and Note A-11 with an aggregate outstanding principal balance as of the Cut-off Date of $60,000,000. The remaining Yorkshire & Lexington Towers Senior Pari Passu Notes are currently held by BMO, SMC and CREFI and are expected to be contributed to one or more other securitization trusts. Prior to the occurrence of a “control appraisal period” with respect to the Yorkshire & Lexington Towers Whole Loan, the holder of the Yorkshire & Lexington Towers Trust Subordinate Companion Note designated as Note B-1 (i.e., the CGCMT 2022-GC48 securitization trust, which rights will be exercisable by the designated class of holders of the series of loan-specific certificates that will be backed by the Yorkshire & Lexington Towers Trust Subordinate Companion Loan) will be the controlling noteholder. Following the occurrence and during the continuance of such “control appraisal period” with respect to the Yorkshire & Lexington Towers Trust Whole Loan, the holder of the Yorkshire & Lexington Towers Senior Pari Passu Note designated as Note A-4 (i.e., the CGCMT 2022-GC48 securitization trust, which rights will be exercisable by the controlling class representative for the CGCMT 2022-GC48 pooled mortgage loans securitization transaction) will be the controlling noteholder. See “Description of the Mortgage Pool—The Whole Loans—The Yorkshire & Lexington Towers Pari-Passu AB Whole Loan” and “Pooling and Servicing Agreement” in the Preliminary Prospectus.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

6

loan #1: Yorkshire & Lexington Towers

The table below summarizes the promissory notes that comprise the Yorkshire & Lexington Towers Whole Loan. The relationship between the holders of the Yorkshire & Lexington Towers Whole Loan is governed by a co-lender agreement as described under “Description of the Mortgage Pool— The Whole Loans—The Yorkshire & Lexington Towers Pari-Passu AB Whole Loan” in the Preliminary Prospectus.

Whole Loan Summary | ||||

| Note | Original Balance | Cut-off Date Balance | Note Holder(s)/Securitization Trust | Controlling Piece |

| A-1(1) | $25,000,000 | $25,000,000 | BMO | No |

| A-2(1) | 25,000,000 | 25,000,000 | Starwood Mortgage Funding II LLC | No |

| A-3(1) | 25,000,000 | 25,000,000 | CREFI | No |

| A-4 | 20,000,000 | 20,000,000 | BMO/CGCMT 2022-GC48 | No |

| A-5(1) | 20,000,000 | 20,000,000 | Starwood Mortgage Funding II LLC | No |

| A-6(1) | 20,000,000 | 20,000,000 | CREFI | No |

| A-7(1) | 20,000,000 | 20,000,000 | BMO | No |

| A-8(1) | 20,000,000 | 20,000,000 | Starwood Mortgage Funding II LLC | No |

| A-9 | 20,000,000 | 20,000,000 | CREFI/CGCMT 2022-GC48 | No |

| A-10(1) | 20,000,000 | 20,000,000 | BMO | No |

A-11

|

20,000,000

|

20,000,000

|

Starwood Mortgage Funding II LLC/CGCMT 2022-GC48 | No

|

| A-12(1) | 20,000,000 | 20,000,000 | CREFI | No |

| A-13(1) | 10,000,000 | 10,000,000 | BMO | No |

| A-14(1) | 10,000,000 | 10,000,000 | Starwood Mortgage Funding II LLC | No |

| A-15(1) | 10,000,000 | 10,000,000 | CREFI | No |

| A-16(1) | 12,000,000 | 12,000,000 | BMO | No |

| A-17(1) | 10,000,000 | 10,000,000 | Starwood Mortgage Funding II LLC | No |

| A-18(1) | 11,000,000 | 11,000,000 | CREFI | No |

| Total Senior Notes | $318,000,000 | $318,000,000 | ||

| B-1 | $147,666,667 | $147,666,667 | BMO/CGCMT 2022-GC48 (Loan Specific) | Yes(2) |

| B-2 | $73,833,333 | $73,833,333 | CREFI/CGCMT 2022-GC48 (Loan Specific) | Yes(2) |

| Whole Loan | $539,500,000 | $539,500,000 | ||

| (1) | Expected to be contributed to one or more future securitization(s). |

| (2) | Following the occurrence and during the continuance of a “control appraisal period” with respect to the Yorkshire & Lexington Towers Whole Loan, Note A-4 will be the controlling note, and the controlling class representative of the CGCMT 2022-GC48 pooled mortgage loans securitization will be entitled to exercise the related control rights. See “Description of the Mortgage Pool—The Whole Loans—The Yorkshire & Lexington Towers Pari-Passu AB Whole Loan” in the Preliminary Prospectus. |

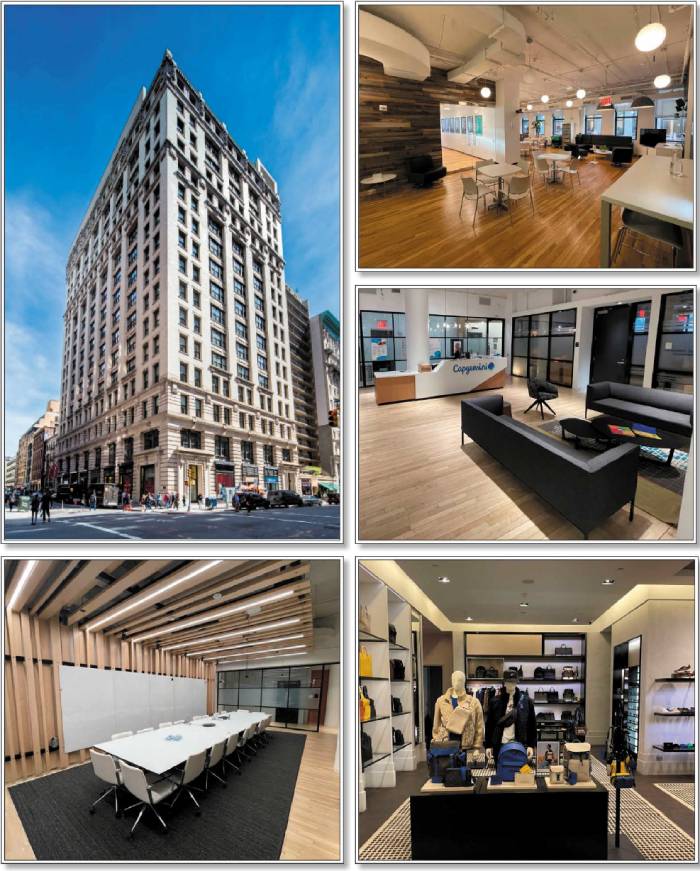

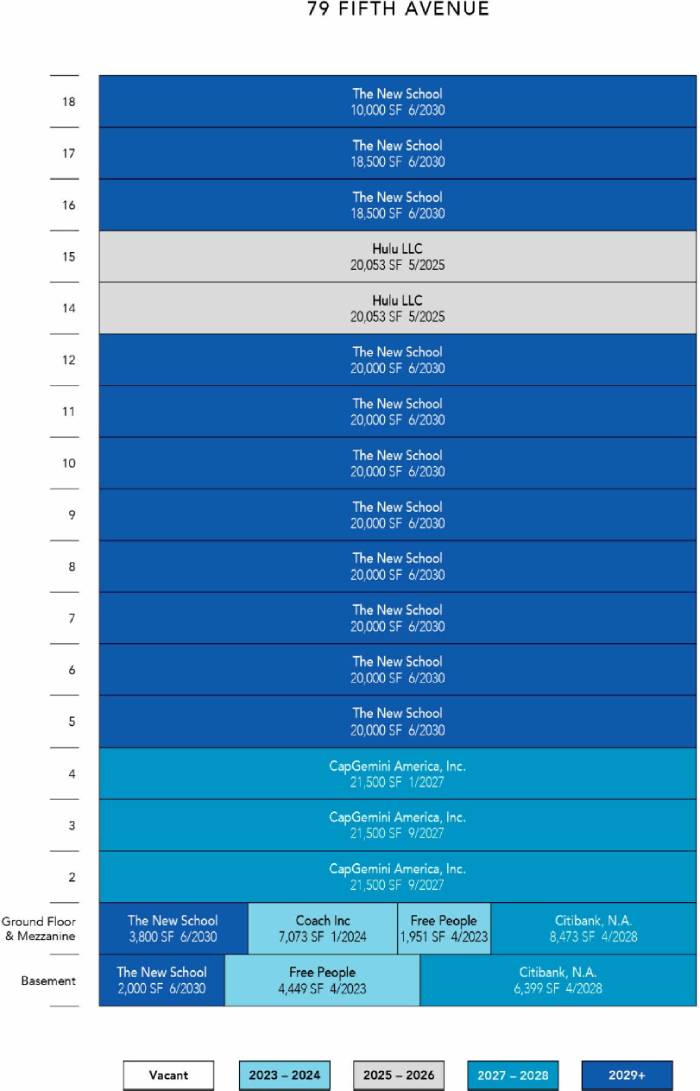

| ■ | The Mortgaged Properties. The Yorkshire & Lexington Towers Properties consist of (i) a multifamily building comprised of 681 residential units totaling 615,641 SF, a 33,000 SF parking garage with 168 parking spaces and six commercial and retail units totaling 29,451 SF (the “Yorkshire Towers Property”) and (ii) a multifamily building comprised of 127 residential units totaling 115,188 SF, a 8,886 SF parking garage with 36 parking spaces and six commercial and retail units totaling 9,998 SF (the “Lexington Towers Property”). The Yorkshire & Lexington Towers Properties have 808 residential units totaling 730,829 SF, 204 parking spaces totaling 41,886 SF and 12 commercial and retail units totaling 39,449 SF. The commercial tenants (excluding City Parking) at the Yorkshire & Lexington Towers Properties have a remaining weighted average lease term of 6.1 years. The Yorkshire & Lexington Towers Properties are located in the Upper East Side neighborhood and are located approximately 200 feet from the Lexington Avenue/East 86th Street subway station with access to the 4, 5, and 6 subway lines. |

The Yorkshire Towers Property and the Lexington Towers Property were built in 1964 and 1963, respectively and the residential portion of the Yorkshire & Lexington Towers Properties features a range of studio, one-, two-, three-, and four-bedroom units. Of the 808 residential units, 305 of the units are rent stabilized. The Yorkshire & Lexington Towers Properties’ residential units all feature hardwood flooring, full kitchen appliances, and many units include a private balcony. Bathrooms feature marble flooring in the renovated units and vinyl tile in the unrenovated units. Renovated units feature marble countertop kitchens, stainless steel appliances, including a refrigerator, dishwasher, microwave, and gas-fired stove and oven, and washer and dryer. Community spaces include 24-hour attended lobby lounge, health club and fitness center, children’s playroom, and outdoor seating area.

The largest tenant at the Yorkshire Towers Property by underwritten base rent, CVS Pharmacy (“CVS”), occupies 15,813 SF (19.4% of the total commercial NRA, 58.1% of the total UW Commercial Base Rent) with a lease expiration of January 31, 2033. CVS is a consumer retail and health solutions company with over 9,900 locations in 49 states, the District of Columbia and Puerto Rico. CVS has over 300,000 employees in the United States, 40,000 of which are pharmacists, physicians, nurses, and nurse practitioners. The remaining 65,522 SF of

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

7

loan #1: Yorkshire & Lexington Towers

commercial space at the Yorkshire & Lexington Towers Properties is 98.3% occupied by 10 tenants (79.2% of the total NRA, 41.9% of the total UW Commercial Base Rent).

The following table presents certain information relating to the Yorkshire & Lexington Towers Properties:

|

Property Name |

City |

Year

Built / |

Units(2) |

% of |

Allocated |

% of |

Appraised |

% of |

| Yorkshire Towers | New York | 1964 / 2014, 2022 | 681 | 84.3% | $464,286,688 | 86.1% | $821,000,000 | 86.1% |

|

Lexington Towers |

New York | 1963 / 2014 |

127 |

15.7% |

75,213,312 |

13.9 |

133,000,000 |

13.9 |

| Total | 808 | 100.0% | $539,500,000 | 100.0% | $954,000,000 | 100.0% |

| (1) | Source: Appraisals. |

| (2) | Based on the underwritten rent roll dated March 1, 2022. The Yorkshire Towers Property has 681 residential units and six commercial and retail units, and the Lexington Towers Property has 127 residential units and six commercial units. |

| ■ | Borrower Sponsors’ Renovation Plan. The information set forth below regarding the borrower sponsors’ renovation plans reflects forward-looking statements and certain projections provided by the borrower sponsors, assuming, among other things, that the borrowers will complete certain projected renovations by December 1, 2024 and that all of the newly renovated and currently unoccupied units will be leased at current market rate rent and all of the currently occupied units will continue to be leased at the current contractual rent. We cannot assure you that such assumptions and projections provided by the borrower sponsors will materialize in the future as expected or at all. |

The borrower sponsors have identified 311 units that will be renovated, which consists of 283 units that are projected to receive a light renovation and 28 units that are projected to receive a major renovation. The 28 major renovation units will be combined into 13 units post-renovation. Of the 28 units projected to receive major renovations, 16 units are rent-stabilized, all of which are currently vacant. Major renovations will feature the combination of two or three units into one larger unit or a significant floor plan alteration, and are expected to take approximately four to six months to complete. Light renovation units will feature aesthetic and systems upgrades, such as new appliances, countertops, removal of carpeting and lighting upgrades. The borrowers deposited $6,500,000 into a unit upgrade reserve with the lender at the time of origination of the Yorkshire & Lexington Towers Whole Loan, to be disbursed to pay or reimburse borrowers for unit renovation costs pursuant to the Yorkshire & Lexington Towers Whole Loan documents.

The major renovation units are projected to receive an average renovation of $37,143 per unit and are anticipated to increase rent from $53.20 per SF in-place to $82.67 per SF. The borrower sponsors have executed 41 major renovations to date, which have been combined into a total of 23 units. These major renovations have achieved average annual rent increases from $32.93 per SF to $75.37 per SF.

The light renovation units are projected to receive an average renovation of $19,382 per unit and are anticipated to increase rent from $62.01 per SF in-place to $82.79 per SF. The borrower sponsors have executed 16 light renovations to date. These light renovations have achieved average annual rent increases from $50.33 per SF to $82.04 per SF.

The following tables present certain information relating to the as-is and post-renovation residential unit mixes at the Yorkshire & Lexington Towers Properties based on certain assumptions, including the assumptions described above:

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

8

loan #1: Yorkshire & Lexington Towers

| Yorkshire Towers Property As-Is Market Rate Unit Mix(1) |

|

Unit Type |

# of Units |

% of Total |

Average

SF |

Monthly

Average |

Monthly |

Monthly |

Monthly |

| Studio | 63 | 14.3% | 547 | $3,100 | $5.67 | $3,121 | $5.52 |

| One Bedroom | 244 | 55.2 | 778 | $4,301 | $5.53 | $4,319 | $5.50 |

| Two Bedroom | 81 | 18.3 | 1,152 | $6,122 | $5.31 | $6,355 | $5.31 |

| Three Bedroom | 53 | 12.0 | 1,299 | $7,707 | $5.93 | $7,682 | $5.91 |

| Four Bedroom | 1 | 0.2 | 2,087 | $12,995 | $6.23 | $12,995 | $6.23 |

|

Total / Wtd. Avg. |

442 |

100.0% |

879 |

$4,891 |

$5.56 |

$4,941 |

$5.54 |

| (1) | Based on the underwritten rent roll dated March 1, 2022. |

| (2) | Source: Appraisal. |

|

Lexington Towers Property As-Is Market Rate Unit Mix(1) |

|

Unit Type |

# of Units |

% of Total |

Average

SF |

Monthly

Average |

Monthly |

Monthly |

Monthly |

| Studio | 10 | 16.4% | 619 | $3,270 | $5.29 | $3,270 | $5.29 |

| One Bedroom | 33 | 54.1 | 776 | $4,306 | $5.55 | $4,286 | $5.53 |

| Two Bedroom | 10 | 16.4 | 1,045 | $6,339 | $6.06 | $6,287 | $6.01 |

| Three Bedroom | 6 | 9.8 | 1,392 | $8,823 | $6.34 | $8,823 | $6.34 |

| Four Bedroom | 2 | 3.3 | 1,889 | $13,123 | $6.95 | $12,935 | $6.85 |

|

Total / Wtd. Avg. |

61 |

100.0% |

892 |

$5,203 |

$5.83 |

$5,192 |

$5.81 |

| (1) | Based on the underwritten rent roll dated March 1, 2022. |

| (2) | Source: Appraisal. |

Yorkshire Towers Property As-Is Rent Stabilized Unit Mix(1) |

|

Unit Type |

# of Units |

% of Total |

Average

SF |

Monthly

Average |

Monthly |

Monthly |

Monthly |

| Studio | 31 | 13.0% | 545 | $1,915 | $3.51 | $2,370 | $3.52 |

| One Bedroom | 116 | 48.5 | 792 | $1,980 | $2.50 | $2,182 | $2.49 |

| Two Bedroom | 81 | 33.9 | 1,230 | $2,916 | $2.37 | $2,989 | $2.36 |

| Three Bedroom | 8 | 3.3 | 1,638 | $3,714 | $2.27 | $3,714 | $2.27 |

| Four Bedroom | 3 | 1.3 | 1,859 | $12,167 | $6.55 | $12,167 | $6.55 |

|

Total / Wtd. Avg. |

239 |

100.0% |

950 |

$2,475 |

$2.60 |

$2,710 |

$2.59 |

| (1) | Based on the underwritten rent roll dated March 1, 2022. |

| (2) | Source: Appraisal. |

Lexington Towers Property As-Is Rent Stabilized Unit Mix(1) |

|

Unit Type |

# of Units |

% of Total |

Average

SF |

Monthly

Average |

Monthly |

Monthly |

Monthly |

| Studio | 19 | 28.8% | 660 | $1,923 | $2.91 | $2,056 | $2.97 |

| One Bedroom | 31 | 47.0 | 830 | $2,033 | $2.45 | $2,014 | $2.43 |

| Two Bedroom | 11 | 16.7 | 1,254 | $3,591 | $2.86 | $3,589 | $2.86 |

| Three Bedroom | 3 | 4.5 | 1,536 | $9,564 | $6.23 | $3,128 | $2.32 |

| Four Bedroom | 2 | 3.0 | 2,055 | $19,750 | $9.61 | NAV | NAV |

|

Total / Wtd. Avg. |

66 |

100.0% |

921 |

$3,140 |

$3.41 |

$2,500 |

$2.66 |

| (1) | Based on the underwritten rent roll dated March 1, 2022. |

| (2) | Source: Appraisal. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

9

loan #1: Yorkshire & Lexington Towers

| Yorkshire Towers Property Projected Post-Renovation Market Rate Unit Mix(1)(2) |

|

Unit Type |

# of Units |

% of Total |

Average

SF |

Monthly

Average |

Monthly |

Monthly |

Monthly |

| Studio | 61 | 14.1% | 547 | $3,489 | $6.38 | $3,121 | $5.52 |

| One Bedroom | 240 | 55.6 | 778 | $5,108 | $6.57 | $4,319 | $5.50 |

| Two Bedroom | 77 | 17.8 | 1,148 | $7,784 | $6.78 | $6,355 | $5.31 |

| Three Bedroom | 53 | 12.3 | 1,299 | $8,582 | $6.60 | $7,682 | $5.91 |

| Four Bedroom | 1 | 0.2 | 2,087 | $12,995 | $6.23 | $12,995 | $6.23 |

|

Total / Wtd. Avg. |

432 |

100.0% |

878 |

$5,801 |

$6.61 |

$4,941 |

$5.54 |

| (1) | Based on the underwritten rent roll dated March 1, 2022. |

| (2) | Based on the assumption that (i) the Yorkshire Towers Property will achieve stabilization in February 2025 and (ii) all of the newly renovated and currently unoccupied units will be leased at current market rate rent and all of the currently occupied units will continue to be leased at the current contractual rent. |

| (3) | Source: Appraisal. |

| Lexington Towers Property Projected Post-Renovation Market Rate Unit Mix(1)(2) |

|

Unit Type |

# of Units |

% of Total |

Average

SF |

Monthly

Average |

Monthly |

Monthly |

Monthly |

| Studio | 10 | 16.7% | 619 | $4,309 | $6.97 | $3,270 | $5.29 |

| One Bedroom | 32 | 53.3 | 775 | $5,347 | $6.90 | $4,286 | $5.53 |

| Two Bedroom | 10 | 16.7 | 1,045 | $7,072 | $6.77 | $6,287 | $6.01 |

| Three Bedroom | 6 | 10.0 | 1,392 | $9,101 | $6.54 | $8,823 | $6.34 |

| Four Bedroom | 2 | 3.3 | 1,889 | $12,935 | $6.85 | $12,935 | $6.85 |

|

Total / Wtd. Avg. |

60 |

100.0% |

893 |

$6,090 |

$6.82 |

$5,192 |

$5.81 |

| (1) | Based on the underwritten rent roll dated March 1, 2022. |

| (2) | Based on the assumption that (i) the Lexington Towers Property will achieve stabilization in February 2024 and (ii) all of the newly renovated and currently unoccupied units will be leased at current market rate rent and all of the currently occupied units will continue to be leased at the current contractual rent. |

| (3) | Source: Appraisal. |

Yorkshire Towers Property Projected Post-Renovation Rent Stabilized Unit Mix(1)(2)

|

Unit Type |

# of Units |

% of Total |

Average

SF |

Monthly

Average |

Monthly

|

Monthly

|

Monthly

|

| Studio | 27 | 11.50% | 544 | $1,925 | $3.54 | $2,370 | $3.52 |

| One Bedroom | 106 | 45.1 | 793 | $1,976 | $2.49 | $2,182 | $2.49 |

| Two Bedroom | 85 | 36.2 | 1,246 | $3,371 | $2.71 | $2,989 | $2.36 |

| Three Bedroom | 12 | 5.1 | 1,729 | $6,858 | $3.97 | $3,714 | $2.27 |

|

Four Bedroom |

5 |

2.1 |

2,167 |

$14,531 |

$6.71 |

$12,167 |

$6.55 |

| Total / Wtd. Avg. | 235 | 100.0% | 1005 | $2,991 | $2.97 | $2,710 | $2.59 |

| (1) | Based on the underwritten rent roll dated March 1, 2022. |

| (2) | Based on the assumption that (i) the Yorkshire Towers Property will achieve stabilization in February 2025 and (ii) all of the newly renovated and currently unoccupied units will be leased at current market rate rent and all of the currently occupied units will continue to be leased at the current contractual rent. |

| (3) | Source: Appraisal. |

|

Lexington Towers Property Projected Post-Renovation Rent Stabilized Unit Mix(1)(2)

|

|

Unit Type |

# of Units |

% of Total |

Average

SF |

Monthly

Average |

Monthly |

Monthly |

Monthly |

| Studio | 18 | 27.3% | 655 | $1,898 | $2.90 | $2,056 | $2.97 |

| One Bedroom | 31 | 47.0 | 830 | $2,014 | $2.42 | $2,014 | $2.43 |

| Two Bedroom | 12 | 18.2 | 1,281 | $4,225 | $3.30 | $3,589 | $2.86 |

| Three Bedroom | 3 | 4.5 | 1,536 | $8,828 | $5.75 | $3,128 | $2.32 |

| Four Bedroom | 2 | 3.0 | 2,055 | $14,728 | $7.17 | NAV | NAV |

|

Total / Wtd. Avg. |

66 |

100.0% |

934 |

$3,079 |

$3.30 |

$2,500 |

$2.66 |

| (1) | Based on the underwritten rent roll dated March 1, 2022. |

| (2) | Based on the assumption that (i) the Lexington Towers Property will achieve stabilization in February 2024 and (ii) all of the newly renovated and currently unoccupied units will be leased at current market rate rent and all of the currently occupied units will continue to be leased at the current contractual rent. |

| (3) | Source: Appraisal. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

10

loan #1: Yorkshire & Lexington Towers

| ■ | COVID-19 Update. The first debt service payment for the Yorkshire & Lexington Towers Whole Loan is scheduled for July 2022. As of May 12, 2022, the Yorkshire & Lexington Towers Whole Loan is not subject to any forbearance, modification or debt service relief request. |

The following table presents certain information relating to historical leasing of the residential units at the Yorkshire & Lexington Towers Properties:

Historical and Current Multifamily Occupancy %

12/31/2019(1) |

12/31/2020(1) |

12/31/2021(1) |

As of 3/1/2022(2) |

| 94.7% | 81.2% | 94.7% | 96.4% |

| (1) | Historical occupancies are as of December 31 of each respective year and are based on information obtained from the borrowers’ occupancy report dated January 22, 2022. |

| (2) | Based on the underwritten rent roll dated March 1, 2022. |

| ■ | Operating History and Underwritten Net Cash Flow. The following table presents certain information relating to the historical operating performance and Underwritten Net Cash Flow at the Yorkshire & Lexington Towers Properties: |

Cash Flow Analysis

|

2019 |

2020 |

2021 |

TTM 2/28/2022 |

Underwritten |

Underwritten $ per Unit | |

| Base Rent - Residential | $34,429,262 | $32,908,021 | $33,023,336 | $34,184,092 | $39,497,416 | $48,882.94 |

| Base Rent - Commercial |

6,197,568 |

5,981,339 |

5,764,022 |

5,810,592 |

6,984,828 |

$8,644.59 |

| Gross Potential Rent(1) | $40,626,830 | $38,889,360 | $38,787,358 | $39,994,684 | $46,482,244 | $57,527.53 |

| Total Reimbursements | 297,713 | 410,419 | 284,498 | 324,797 | 327,568 | $405.41 |

| Supplemental Income Reserve | 0 | 0 | 0 | 0 | 5,226,004 | $6,467.83 |

| Other Income(2) |

702,657 |

863,978 |

694,304 |

675,664 |

675,664 |

$836.22 |

| Net Rental Income | $41,627,200 | $40,163,756 | $39,766,160 | $40,995,144 | $52,711,480 | $65,236.98 |

| Total Vacancy & Credit Loss |

(99,272) |

(35,705) |

0 |

0 |

(1,316,592) |

($1,629.45) |

| Effective Gross Income | $41,527,928 | $40,128,052 | $39,766,160 | $40,995,144 | $51,394,888 | $63,607.53 |

| Real Estate Taxes | 8,345,869 | 9,104,352 | 9,749,387 | 9,839,080 | 10,057,294 | $12,447.15 |

| Insurance | 368,159 | 430,452 | 468,680 | 473,667 | 497,141 | $615.27 |

| Management Fee | 830,559 | 802,561 | 794,408 | 819,903 | 924,637 | $1,144.35 |

| Other Operating Expenses(3) |

4,639,527 |

4,172,737 |

4,499,404 |

4,540,054 |

4,540,054 |

$5,618.88 |

| Total Expenses | $14,184,113 | $14,510,102 | $15,511,878 | $15,672,705 | $16,019,126 | $19,825.65 |

| Net Operating Income(4) |

$27,343,815 |

$25,617,949 |

$24,254,281 |

$25,322,439 |

$35,375,762 |

$43,781.88 |

| Replacement Reserves(5) | 0 | 0 | 0 | 0 | 0 | $0.00 |

| TI/LC(5) |

0 |

0 |

0 |

0 |

0 |

$0.00 |

| Net Cash Flow(4) | $27,343,815 | $25,617,949 | $24,254,281 | $25,322,439 | $35,375,762 | $43,781.88 |

| Occupancy(6) | 94.7% | 81.2% | 94.7% | 96.4% | 97.2% | |

| NOI Debt Yield (7) | 8.6% | 8.1% | 7.6% | 8.0% | 11.1% | |

| NCF DSCR (7) | 2.79x | 2.61x | 2.47x | 2.58x | 3.61x |

| (1) | Includes straight line average rent through loan maturity for CVS. |

| (2) | Other Income includes items such as miscellaneous operating income. |

| (3) | Other Operating Expenses includes items such as utilities, repairs and maintenance, administrative, and payroll and benefits. |

| (4) | The Underwritten Net Operating Income and Underwritten Net Cash Flow includes disbursements from a Supplemental Income Reserve of $5,226,004. The Underwritten NOI is greater than TTM 2/28/2022 Net Operating Income due in part to (i) the borrower sponsors recently renovating 57 units, which has increased rents at the Yorkshire & Lexington Towers Properties, (ii) underwritten straight-lined rent for CVS and (iii) disbursements from the Supplemental Income Reserve. Please refer to “Escrows” below. |

| (5) | The borrower sponsors funded five years’ worth of Replacement Reserves and TI/LC at origination. |

| (6) | Underwritten occupancy is based on the economic occupancy. TTM 2/28/2022 occupancy is based on the underwritten rent roll dated March 1, 2022. Historical occupancies through 2021 are based on information obtained from the borrowers’ occupancy report dated January 22, 2022. |

| (7) | Calculated based on the aggregate outstanding principal balance as of the Cut-off Date of the Yorkshire & Lexington Towers Senior Loan. The Yorkshire & Lexington Towers Senior Loan Underwritten NOI Debt Yield, excluding credit for the upfront Supplemental Income Reserve is 9.5%. The Yorkshire & Lexington Towers Senior Loan Underwritten NCF DSCR excluding credit for the upfront Supplemental Income Reserve is 3.08x. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

11

loan #1: Yorkshire & Lexington Towers

| ■ | Appraisal. According to the appraisals, the Yorkshire & Lexington Towers Properties have an aggregate “as is” appraised value of $954,000,000 as of January 20, 2022 and have an aggregate “as stabilized” appraised value of $1,057,000,000 with an anticipated stabilization date of February 1, 2024 for the Lexington Towers Property and an anticipated stabilization date of February 1, 2025 for the Yorkshire Towers Property. The individual “as is” appraised values for the Yorkshire Towers Property and the Lexington Towers Property are $821,000,000 and $133,000,000, respectively. The individual “as-stabilized” appraised values for the Yorkshire Towers Property and the Lexington Towers Property are $909,000,000 and $148,000,000, respectively. |

| ■ | Environmental Matters. According to the Phase I environmental assessments dated January 19, 2022, and February 3, 2022, there was no evidence of any recognized environmental concerns at the Yorkshire & Lexington Towers Properties. The Phase I environmental assessment, however, did acknowledge historical environmental concerns at the Yorkshire Towers property. See “Description of the Mortgage Pool—Mortgage Pool Characteristics—Environmental Considerations” in the Preliminary Prospectus. |

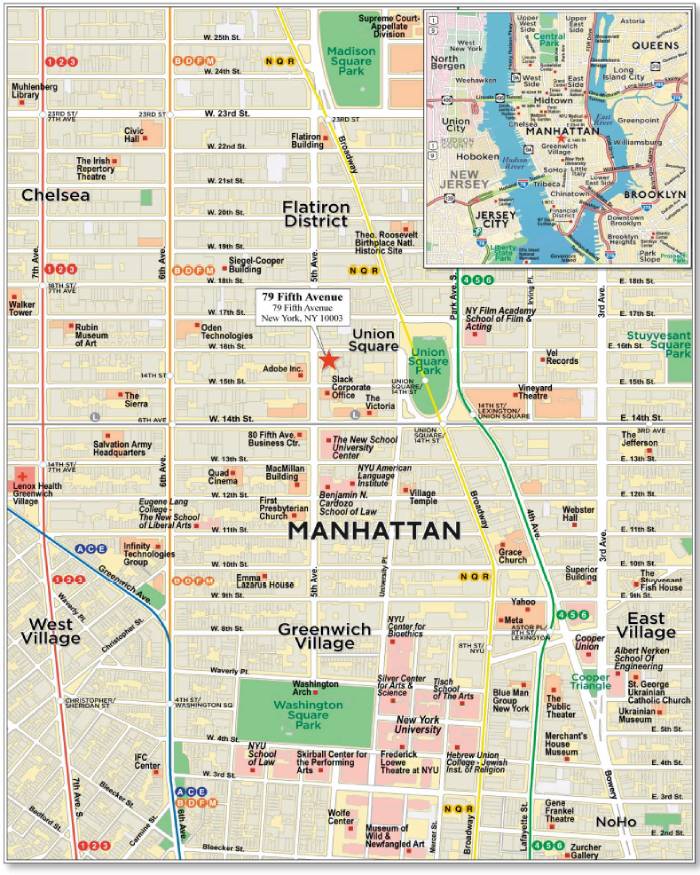

| ■ | Market Overview and Competition. The Yorkshire & Lexington Towers Properties are located in New York, New York, within the New York-Newark-Jersey City, NY-NJ-PA Metropolitan Statistical Area. According to the appraisal, the unemployment rate from 2011 through 2021 in New York City increased at an annual rate of 0.3% and is expected to decrease at an average annual rate of 4.7% between 2022 and 2026. The estimated 2021 median annual household income in New York City was $68,261. The leading industries are education and health, professional and business, government, trade, and transportation and utilities. The largest employer in New York City is Northwell Health, which employs 68,088 people. The Yorkshire & Lexington Towers Properties are located on the southeast corner of Lexington Avenue and East 88th Street. The Upper East Side is generally considered the area that extends from East 59th to East 110th Streets, east of Central Park and Fifth Avenue to the East River. The Upper East Side is known for its many art galleries such as the Metropolitan Museum of Art, and Hunter College of the City University of New York which occupies several modern high-rise buildings at 68th Street and Lexington Avenue. The largest institutions of higher learning on the East Side are along York Avenue and the FDR Drive, including Rockefeller University and the Cornell Medical Center. The Yorkshire & Lexington Towers Properties benefits from its proximity to Fifth Avenue, which forms the eastern border of Central Park, as well as Madison Avenue, which is dense with prime retail and commercial space. |

The Yorkshire & Lexington Towers Properties are situated in the Upper East Side multifamily submarket. According to CoStar, as of February 2022, the Upper East Side – Multifamily submarket had an overall vacancy rate of 2.0%, with net absorption totaling 17 units. The vacancy rate decreased 2.2% over the past 12 months. Rental rates increased by 3.1% for the past 12 months and ended at $4,096 per unit per month. A total of 46 units at the Yorkshire & Lexington Towers Properties are still under construction as of the end of the first quarter of 2022.

According to the appraisals, the 2021 population for New York City was approximately 8,305,600 and is forecasted to grow to approximately 8,317,700 in 2022, and approximately 8,335,900 in 2026.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

12

loan #1: Yorkshire & Lexington Towers

The following table presents seven comparable multifamily rental properties to the Yorkshire & Lexington Towers Properties.

Summary of Comparable Multifamily Properties(1)

| Property Name / Address | Year Built | No. of Units |

Unit Mix |

Avg. Unit SF | Avg. Market Rent Per Month |

Occupancy |

|

Yorkshire & Lexington Towers 305 East 86th Street and 160 |

1963-1964 | 808(2) | Studio(2) | 570(2) | $2,673(2) | 96.4%(2) |

| 1 Bed(2) | 786(2) | $3,539(2) | ||||

| 2 Bed(2) | 1,187(2) | $4,555(2) | ||||

| 3 Bed(2) | 1,356(2) | $7,395(2) | ||||

| 4 Bed(2) | 1,944(2) | $14,405(2) | ||||

|

The Serrano 1735 York Avenue, NY |

1986 | 263 | 1 Bed | 650 | $4,501 | 92.6% |

| 2 Bed | NAV | $7,201 | ||||

| 3 Bed | NAV | $8,878 | ||||

|

Ventura 240 East 86th Street, NY |

1999 | 246 | Studio | 508 | $3,734 | 98.4% |

| 1 Bed | 751 | $4,652 | ||||

| 2 Bed | 967 | $6,380 | ||||

| 3 Bed | 1,293 | $8,921 | ||||

|

The Lucerne 350 East 79th Street, NY |

1989 | 219 | 1 Bed | 659 | $4,617 | 98.6% |

| 2 Bed | 906 | $7,134 | ||||

| 3 Bed | NAV | $11,878 | ||||

| 4 Bed | NAV | $17,975 | ||||

|

The Colorado 201 East 86th Street, NY |

1987 | 173 | Studio | 547 | $3,953 | 99.6% |

| 1 Bed | 667 | $4,595 | ||||

| 2 Bed | 937 | $6,675 | ||||

| 3 Bed | 1,254 | $9,938 | ||||

| 4 Bed | 1,940 | $15,473 | ||||

|

The Strathmore 400 East 84th Street, NY |

1996 | 179 | 1 Bed | 714 | $4,168 | 99.2% |

| 2 Bed | 1,166 | $6,926 | ||||

| 3 Bed | 1,611 | $11,217 | ||||

| 4 Bed | NAV | $17,520 | ||||

|

One Carnegie Hill 215 East 96th Street, NY |

2005 | 455 | Studio | 484 | $3,355 | 99.6% |

| 1 Bed | 636 | $4,141 | ||||

| 2 Bed | 879 | $6,248 | ||||

| 3 Bed | 1,239 | $8,318 | ||||

| 4 Bed | 1,350 | $10,625 | ||||

|

CONVIVIUM 515 East 86th Street, NY |

2020 | 140 | Studio | 638 | $4,300 | 98.6% |

| 1 Bed | 741 | $5,474 | ||||

| 2 Bed | 1,138 | $7,523 | ||||

| 3 Bed | 1,369 | $9,750 | ||||

| (1) | Source: Appraisals. |

| (2) | Based on the underwritten rent roll dated March 1, 2022. Avg. Market Rent Per Month reflects average monthly in-place rents for occupied units. |

The following table presents five comparable retail leases for the Yorkshire & Lexington Towers Properties.

Summary of Comparable Retail Leases(1)

Property Name |

Tenant Name |

Tenant Leased Space (SF) |

Lease Sign Date |

Lease Term (months) |

Base Rent Per SF |

| Yorkshire Towers | CVS Pharmacy | 15,813(2) | May 2017(2) | 189(2) | $252.37(2) |

| 201 East 86th Street | Lululemon | 6,565 | Q4 2021 | 120 | $240.00 |

| 1523 Second Avenue | NY Allergy and Asthma | 4,488 | Q4 2021 | 144 | $100.00 |

| 1503 Third Avenue | Cohen’s Fashion Optical | 3,200 | Q3 2021 | 120 | $175.00 |

| 1592 Third Avenue | Marathon Coffee | 400 | Q3 2021 | 120 | $90.00 |

| 207 East 84th Street | Glosslab | 1,340 | Q2 2021 | 120 | $116.00 |

| (1) | Source: Appraisals. |

| (2) | Based on the underwritten rent roll dated March 1, 2022. |

| ■ | The Borrowers. The borrowers under the Yorkshire & Lexington Towers Mortgage Loan are CF E 88 LLC, SM E 88 LLC, CF E 86 LLC, SM E 86 LLC and LSG E 86 LLC, each a single-purpose Delaware limited liability company with two independent directors. Legal counsel to the borrowers delivered a non-consolidation opinion in connection with the origination of the Yorkshire & Lexington Towers Whole Loan. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

13

loan #1: Yorkshire & Lexington Towers

The Yorkshire Towers Property is 100% owned by CF E 86 LLC, SM E 86 LLC and LSG E 86 LLC, as tenants in common (collectively, the “86th Street Borrowers”) and the Lexington Towers Property is 100% owned by CF E 88 LLC and SM E 88 LLC, as tenants in common (collectively, the “88th Street Borrowers”, and together with the 86th Street Borrowers, the “Y&L Tower Borrowers”).

CF E 86 LLC owns a 58.75% tenant-in-common interest in the Yorkshire Towers Property, and is is 100% indirectly owned by Meyer Chetrit and three family members of Meyer Chetrit. CF E 88 LLC owns a 58.75% tenant-in-common interest in the Lexington Towers Property, and is 100% indirectly owned by Meyer Chetrit and three family members of Meyer Chetrit (CF E 86 LLC and CF E 88 LLC, collectively, the “Chetrit Borrower”). SM E 86 LLC and LSG E 86 LLC each own a tenant-in-common interest, and in the aggregate own a 41.25% tenant-in-common interest, in the Yorkshire Towers Property, and are each indirectly majority owned by The Gluck Family Trust U/A/D July 16, 2009. SM E 88 LLC owns a 41.25% tenant-in-common interest in the Lexington Towers Property, and is indirectly majority owned by The Gluck Family Trust U/A/D July 16, 2009 (SM E 88 LLC, SME E 86 LLC and LSG E 86 LLC, collectively, the “Stellar Borrower”).

The 86th Street Borrowers are currently controlled by CFSM E 86 Manager LLC, a Delaware limited liability company, which is a non-member manager of each 86th Street Borrower (the “86th Manager”). The 88th Street Borrowers are currently controlled by CFSM E 88 Manager LLC, a Delaware limited liability company, which is a non-member manager of each 88th Street Borrower (the “88th Manager”, and together with the 86th Manager, the “Y&L Tower Managers”). Both the 86 Manager and the 88th Manager are jointly controlled by Meyer Chetrit and the Amended and Restated 2013 LG Revocable Trust. Meyer Chetrit and the Gluck Family Trust U/A/D July 16, 2009 are the borrower sponsors and non-recourse carveout guarantors for the Yorkshire & Lexington Towers Whole Loan.

Meyer Chetrit is one of the controllers of The Chetrit Group. The Chetrit Group is an experienced, privately held New York City real estate development firm controlled by two brothers: Joseph and Meyer Chetrit. The Chetrit Group, which is headquartered in Manhattan, has ownership interests in over 14 million square feet of commercial and residential real estate across the United States, including New York, Chicago, Miami, and Los Angeles, as well as internationally.

Laurence Gluck is the founder of Stellar Management, a real estate development and management firm founded in 1985. Based in New York City, Stellar Management owns and manages a portfolio of over 13,000 apartments in 100 buildings located across New York City and over three million square feet of office space. Prior to founding Stellar Management, Laurence Gluck served as a real estate attorney at Proskauer, Rose, Goetz & Mendelsohn and later as a partner at Dreyer & Traub. Laurence Gluck also formerly served as a member of the Board of Governors of the Real Estate Board of New York.

| ■ | Escrows. At origination of the Yorkshire & Lexington Towers Whole Loan, the borrowers deposited approximately (i) $5,390,917 into a real estate tax reserve account, (ii) $367,868 into an insurance premiums reserve account, (iii) $1,100,000 into a replacement reserve account, (iv) $1,000,000 into a tenant improvement and leasing commissions reserve account, (v) $6,500,000 into a unit upgrade reserve account, and (vi) $5,900,000 into a supplemental income reserve account (such account, the “Supplemental Income Reserve”). |

Tax Reserve. The borrowers are required to deposit into a real estate tax reserve, on a monthly basis, 1/12 of the taxes that the lender estimates will be payable over the next-ensuing 12-month period (initially estimated to be approximately $898,486).

Insurance Reserve. The borrowers are required to deposit into an insurance reserve, on a monthly basis, 1/12 of the amount which will be sufficient to pay the insurance premiums due for the renewal of coverage afforded by such policies; provided, however, such insurance reserve has been conditionally waived so long as (i) no event of default under the Yorkshire & Lexington Towers Whole Loan is continuing and (ii) the borrowers maintain a blanket policy meeting the requirements of the Yorkshire & Lexington Towers Mortgage Whole Loan documents.

Supplemental Income Reserve. Unless and until the Yorkshire & Lexington Towers Properties (excluding the amount on deposit in the Supplemental Income Reserve) achieve a 5.0% “transient” Yorkshire & Lexington Towers Total Debt debt yield (calculated on the basis of annualized net cash flow for a three month period ending with the most recently completed month), the lender may require the borrowers to make additional supplemental reserve deposits if and to the extent the lender determines, in its reasonable discretion on a quarterly basis on and after

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

14

loan #1: Yorkshire & Lexington Towers

May 6, 2023, that additional supplemental income reserve deposits are required in order to achieve (when the additional deposit and all other deposits in the supplemental income reserve account are added to net cash flow for the Yorkshire & Lexington Towers Properties) a 5.0% transient Yorkshire & Lexington Total Debt debt yield for the following 12, 9, 6 or 3 months (such applicable 12, 9, 6 or 3- month period depending on the quarter with respect to which such determination by the lender is made). The guarantors provided a related carry guaranty (the “Carry Guaranty”) of certain carry costs, including real estate taxes, insurance premiums, debt service and operating expenses, for the period until the Yorkshire & Lexington Towers Properties achieve a 5.0% transient debt yield (excluding the amount on deposit in the Supplemental Income Reserve). The obligations of the guarantors under such Carry Guaranty are limited to the additional supplemental income reserve deposit amount as and when due.

So long as no event of default under the Yorkshire & Lexington Towers Whole Loan is continuing, on each payment date, the lender is required to transfer the Monthly Supplemental Income Reserve Disbursement Amount (as defined below) from the Supplemental Income Reserve to the cash management account. Such funds deposited into the cash management account will be required to be applied with all other funds then on deposit in the cash management account in the order of priority set forth in the Yorkshire & Lexington Towers Whole Loan documents, as described under “ —Lockbox and Cash Management” below. So long as no event of default under the Yorkshire & Lexington Towers Whole Loan is continuing, upon such time as the lender has reasonably determined that the Yorkshire & Lexington Towers Properties (excluding the amount on deposit in the Supplemental Income Reserve) have achieved a 5.0% “transient” Yorkshire & Lexington Towers Total Debt debt yield (calculated on the basis of annualized net cash flow for a three month period ending with the most recently completed month), then upon the borrowers’ written request, all of the funds in the Supplemental Income Reserve will be required to be disbursed to the borrowers; provided, however, if a Cash Trap Period (as defined below) is then continuing, then such funds will not be disbursed to the borrowers, and such funds will instead be deposited into the excess cash reserve account, to be applied in accordance with the terms of the Yorkshire & Lexington Towers Whole Loan documents.

“Monthly Supplemental Income Reserve Disbursement Amount” means 1/12 of (x) the initial Supplemental Income Reserve deposit with respect to the first 12 payment dates occurring during the term of the Yorkshire & Lexington Towers Whole Loan, and (y) each Supplemental Income Reserve additional deposit amount with respect to the 12 payment dates following the date that the borrowers are required to deposit such Supplemental Income Reserve additional deposit amount pursuant to the terms of the Yorkshire & Lexington Towers Whole Loan documents; provided that, if at any time the lender reassesses the Supplemental Income Reserve additional deposit amount in accordance with the terms of the Yorkshire & Lexington Towers Whole Loan documents, the Monthly Supplemental Income Reserve Disbursement Amount will be required to be adjusted so that all of funds in the Supplemental Income Reserve will be disbursed in equal monthly installments ending on such Supplemental Income Reserve reassessment date (i.e., so that there will be no funds in the Supplemental Income Reserve on deposit on such Supplemental Income Reserve reassessment date.

| ■ | Lockbox and Cash Management. The Yorkshire & Lexington Towers Mortgage Loan is structured with a hard lockbox for commercial tenants and a soft lockbox for residential tenants, and in place cash management. The borrowers are required to deposit all rents collected from residential tenants into the lockbox account within three days of receipt. The borrowers are required to deliver a tenant direction letter to commercial tenants to deposit all rents directly to the lockbox account. The borrowers are required to cause all amounts deposited into the lockbox account to be transferred on each business day to a cash management account controlled by the lender. So long as no event of default under the Yorkshire & Lexington Towers Whole Loan is continuing, on each monthly payment date all funds on the deposit in the cash management account (including any Monthly Supplemental Income Reserve Disbursement Amount deposited into the cash management account) will be applied to (i) fund any required insurance and tax reserve amount, (ii) pay deposit account bank fees, (iii) make monthly debt service payments on the Yorkshire & Lexington Towers Whole Loan, (iv) pay other amounts payable to the lender under the Yorkshire & Lexington Towers Whole Loan documents, (v) pay certain operating expenses reflected in the approved annual budget or otherwise approved by lender and (vi) make debt service payments on the mezzanine loans, in that order. After such application of funds in the cash management account, if a Cash Trap Period is continuing, the remaining funds will be deposited in the excess cash reserve account, and if no Cash Trap Period is continuing, such remaining funds will be released to the borrowers. The balance of any funds from time to time held in the excess cash reserve account will be released to the borrowers in the event the related Cash Trap Period ends. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

15

loan #1: Yorkshire & Lexington Towers

A “Cash Trap Period” means a period (A) commencing upon the earliest to occur of (i) an event of default; (ii) any bankruptcy action of the borrowers, principal, guarantor or manager has occurred; (iii) the failure by the borrowers, after stabilization (i.e., until a Yorkshire & Lexington Towers Total Debt debt yield of at least 5.0% has been achieved (without taking into account any disbursement of Supplemental Income Reserve funds) for one calendar quarter, provided no event of default then exists), to maintain a Yorkshire & Lexington Towers Total Debt debt yield of at least 4.25%; or (iv) a Yorkshire & Lexington Towers Mezzanine Loans (as defined below) default and (B) will be cured upon (a) with respect to clause (i) above, the lender accepts a cure of the event of default; (b) in the case of a bankruptcy action by or against manager only, the borrowers provide a qualified replacement manager as defined in the Yorkshire & Lexington Towers Properties Whole Loan documents; (c) with respect to clause (iii) above, the Yorkshire & Lexington Towers Total Debt debt yield is equal to or greater than 4.75% for one calendar quarter; or (d) with respect to clause (iv) above, the Yorkshire & Lexington Towers Mezzanine Loans lender accepts a cure of the Yorkshire & Lexington Towers Mezzanine Loans default.

| ■ | Property Management. The Yorkshire & Lexington Towers Properties are managed by Jumeaux Management LLC, an affiliate of the borrower sponsors. Under the Yorkshire & Lexington Towers Properties Whole Loan documents, the lender may require the borrowers to terminate any management agreement and replace the applicable property manager if: (i) an event of default under the Yorkshire & Lexington Towers Properties Whole Loan documents exists, (ii) the property manager becomes insolvent or a debtor in any bankruptcy or insolvency proceeding, (iii) there exists a material default by the property manager under the management agreement beyond all applicable notice and cure periods, (iv) 50% or more of the direct or indirect ownership interest in the property manager has changed or control of manager has changed, in each event from what it was at origination of the Yorkshire & Lexington Towers Whole Loan, (v) the property manager has engaged in gross negligence, fraud, willful misconduct or misappropriation of funds, or (vi) an event occurs that will give rise to the right of the borrowers to terminate the management agreement. Provided that no event of default is occurring under the Yorkshire & Lexington Towers Properties Whole Loan documents, the borrowers may, terminate the management agreement and replace the property manager with a qualified manager as set forth in the Yorkshire & Lexington Towers Properties Whole Loan documents (which requirements include a rating agency confirmation and, if an affiliate of the borrowers, an updated non-consolidation opinion). |

| ■ | Current Subordinate Debt Indebtedness. The Yorkshire & Lexington Towers Properties also secure the Yorkshire & Lexington Towers Trust Subordinate Companion Loan, which has an aggregate Cut-off Date principal balance of $221,500,000. The Yorkshire & Lexington Towers Trust Subordinate Companion Loan accrues interest at 3.04000% per annum. The Yorkshire & Lexington Towers Senior Loan is senior in right of payment to the Yorkshire & Lexington Towers Trust Subordinate Companion Loan. The Yorkshire & Lexington Towers Subordinate Companion Loan will be contributed to the CGCMT 2022-GC48 securitization trust, but will not be included in the mortgage pool. Payments allocated to the Yorkshire & Lexington Towers Subordinate Companion Loan will be paid only to the holders of the Yorkshire & Lexington Towers loan-specific certificates as described in “Description of the Mortgage Pool—The Whole Loans—The Yorkshire & Lexington Towers Pari-Passu AB Whole Loan” in the Preliminary Prospectus. |

| ■ | Current Mezzanine Indebtedness. Concurrently with the funding of the Yorkshire & Lexington Towers Whole Loan, BMO and Citigroup Global Markets Realty Corp. (“CGMRC”), co-originated a mezzanine A loan in the amount of $80,000,000 to be secured by the mezzanine A borrower’s interests in the borrowers, as collateral for the mezzanine A loan (the “Mezzanine A Loan”). The Mezzanine A Loan is coterminous with the Yorkshire & Lexington Towers Whole Loan. The Mezzanine A Loan accrues interest at a rate of 5.80000% per annum and requires interest-only payments until its maturity date. |

Concurrently with the funding of the Yorkshire & Lexington Towers Whole Loan, BMO and CGMRC, co-originated a mezzanine B loan in the amount of $23,100,000 to be secured by the mezzanine B borrower’s interests in the borrower, as collateral for the mezzanine B loan (the “Mezzanine B Loan”). The Mezzanine B Loan is coterminous with the Yorkshire & Lexington Towers Whole Loan. The Mezzanine B Loan accrues interest at a rate of 7.14000% per annum and requires interest-only payments until its maturity date.

Concurrently with the funding of the Yorkshire & Lexington Towers Whole Loan, BMO and CGMRC, co-originated a mezzanine C loan in the amount of $25,000,000 to be secured by the mezzanine C borrower’s interests in the borrowers, as collateral for the mezzanine C loan (the “Mezzanine C Loan”). The Mezzanine C Loan is coterminous

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

16

loan #1: Yorkshire & Lexington Towers

with the Yorkshire & Lexington Towers Whole Loan. The Mezzanine C Loan accrues interest at a rate of 8.00000% per annum and requires interest-only payments until its maturity date.

Concurrently with the funding of the Yorkshire & Lexington Towers Whole Loan, BMO and CGMRC, co-originated a mezzanine D loan in the amount of $46,400,000 to be secured by the mezzanine D borrower’s interests in the borrowers, as collateral for the mezzanine D loan (the “Mezzanine D Loan”, collectively with the Mezzanine A Loan, the Mezzanine B Loan and the Mezzanine C Loan, the “Yorkshire & Lexington Towers Mezzanine Loans,” and collectively with the Yorkshire & Lexington Towers Whole Loan, the “Yorkshire & Lexington Towers Total Debt”). The Mezzanine D Loan is coterminous with the Yorkshire & Lexington Towers Whole Loan. The Mezzanine D Loan accrues interest at a rate of 9.46185345% per annum and requires interest-only payments until its maturity date.

It is expected that BMO and CGMRC will transfer their respective interests in the Mezzanine A Loan, Mezzanine B Loan, Mezzanine C Loan and Mezzanine D Loan to an unaffiliated third party on or prior to the closing of the CGCMT 2022-GC48 securitization.

Based on the Yorkshire & Lexington Towers Total Debt Cut-off Date outstanding principal balance of $714,000,000, the Cut-off Date LTV Ratio, Maturity Date LTV Ratio, DSCR Based on Underwritten NCF and Debt Yield Based on Underwritten NOI are illustrated below. See "Description of the Mortgage Pool—Additional Indebtedness—Existing Mezzanine Debt” in the Preliminary Prospectus.

Financial Information

Yorkshire

& Lexington |

Yorkshire

& Lexington |

Yorkshire

& Lexington | |

| Cut-off Date Balance | $318,000,000 | $539,500,000 | $714,000,000 |

| Cut-off Date LTV Ratio(1) | 33.3% | 56.6% | 74.8% |

| Maturity Date LTV Ratio(1) | 33.3% | 56.6% | 74.8% |

| DSCR Based on Underwritten NCF(2)(3) | 3.61x | 2.13x | 1.20x |

| Debt Yield Based on Underwritten NOI(2)(3) | 11.1% | 6.6% | 5.0% |

| (1) | Based on the aggregate as-is appraised value of $954,000,000 as of January 20, 2022. |

| (2) | The Underwritten NCF and Underwritten NOI include disbursements from a Supplemental Income Reserve of $5,226,004. Please refer to “Escrows” above. |

| (3) | The Yorkshire & Lexington Towers Senior Loan DSCR Based on Underwritten NCF, Yorkshire & Lexington Towers Whole Loan DSCR Based on Underwritten NCF, and the Yorkshire & Lexington Towers Total Debt DSCR Based on Underwritten NCF excluding credit for the upfront Supplemental Income Reserve are 3.08x, 1.81x and 1.02x, respectively. The Yorkshire & Lexington Towers Senior Loan Debt Yield Based on Underwritten NOI, Yorkshire & Lexington Towers Whole Loan Debt Yield Based on Underwritten NOI, and Yorkshire & Lexington Towers Total Debt Debt Yield Based on Underwritten NOI excluding credit for the upfront Supplemental Income Reserve are 9.5%, 5.6% and 4.2%, respectively. Please refer to “Escrows and Reserves” below. |

| ■ | Permitted Future Mezzanine or Subordinate Secured Indebtedness. Not Permitted. |

| ■ | Release of Collateral. Not Permitted. |

| ■ | Terrorism Insurance. The Yorkshire & Lexington Towers Whole Loan documents require that the “all-risk” insurance policy required to be maintained by the borrowers provides coverage for terrorism in an amount equal to the full replacement cost of the Yorkshire & Lexington Towers Properties, plus business interruption coverage in an amount equal to 100% of the projected loss to net profit for the Yorkshire & Lexington Towers Properties until the completion of restoration or the expiration of 24 months. See “Risk Factors—Risks Relating to the Mortgage Loans—Terrorism Insurance May Not Be Available for All Mortgaged Properties” in the Preliminary Prospectus. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

17

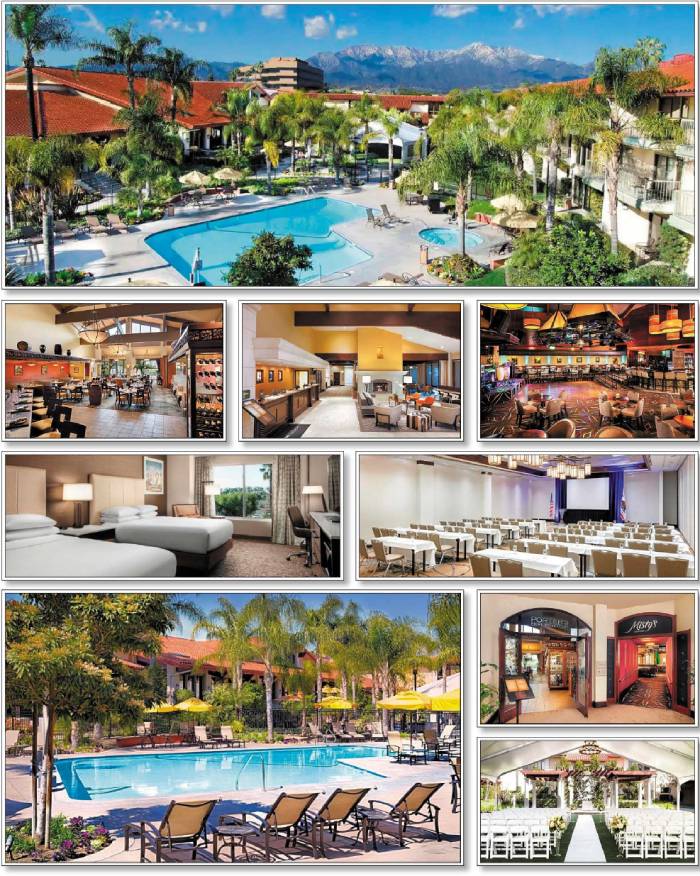

Loan #2: Cliffs hotel and spa

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

18

Loan #2: Cliffs hotel and spa