Form FWP BofA Finance LLC Filed by: BofA Finance LLC

|

BofA Finance LLC

Fully and Unconditionally Guaranteed by Bank of America Corporation

Market Linked Securities

|

|

|

Issuer:

|

BofA Finance LLC (“BofA Finance”)

|

|

Guarantor:

|

Bank of America Corporation (“BAC” or the “Guarantor”)

|

|

Term:

|

Approximately 3 years (unless earlier called)

|

|

Underlyings:

|

The SPDR® S&P® Regional Banking ETF (Bloomberg symbol: “KRE”), Russell 2000® Index (Bloomberg symbol: “RTY”) and Nasdaq-100 Index® (Bloomberg symbol: “NDX”). The SPDR® S&P® Regional Banking ETF is sometimes referred to herein as the “Fund.” The Russell 2000® Index and the Nasdaq-100 Index® are sometimes collectively referred to herein as the “Indices” and individually as an “Index.”

|

|

Pricing Date:

|

December 17, 2021*

|

|

Issue Date:

|

December 22, 2021*

|

|

Denominations:

|

$1,000 and any integral multiple of $1,000. References in the pricing supplement to a “Security” are to a Security with a principal amount of $1,000.

|

|

Contingent Coupon Payments:

|

See “How Contingent Coupon Payments are calculated” on page 2

|

|

Contingent Coupon Rate:

|

[8.50%-9.50%] per annum, which equals [2.125% - 2.375%] per quarter, to be determined on the Pricing Date

|

|

Automatic Call:

|

See “How to determine if the Securities will be automatically called” on page 2

|

|

Observation Dates:

|

Quarterly, on the 17th day of each March, June, September and December, commencing March 2022 and ending September 2024, and the Valuation Date*. We refer to December 17, 2024* as the “Valuation Date.”

|

|

Redemption Amount:

|

See “How the Redemption Amount is calculated” on page 2

|

|

Maturity Date:

|

December 20, 2024*

|

|

Lowest Performing Underlying

|

See “How the Lowest Performing Underlying is determined” on page 2

|

|

Starting Value:

|

For each Underlying, its closing value on the Pricing Date

|

|

Ending Value:

|

For each Underlying, its closing value on the Valuation Date

|

|

Coupon Barrier:

|

With respect to the SPDR® S&P® Regional Banking ETF:$ , which is equal to 70% of its Starting Value.

With respect to the Russell 2000® Index: , which is equal to 70% of its Starting Value.

With respect to the Nasdaq-100 Index®: , which is equal to 70% of its Starting Value.

|

|

Threshold Value:

|

With respect to the SPDR® S&P® Regional Banking ETF:$ , which is equal to 70% of its Starting Value.

With respect to the Russell 2000® Index: , which is equal to 70% of its Starting Value.

With respect to the Nasdaq-100 Index®: , which is equal to 70% of its Starting Value.

|

|

Calculation Agent:

|

BofA Securities, Inc. (“BofAS”), an affiliate of BofA Finance

|

|

Underwriting Discount:

|

2.125%; dealers, including those using the trade name Wells Fargo Advisors (WFA), may receive a selling concession of 1.50% and WFA will receive a distribution expense fee of 0.075%. In addition, in respect of certain Securities sold in this offering, BofAS or its affiliates may pay a fee of up to $1.50 per Security to selected securities dealers in consideration for marketing and other services in connection with the distribution of the Securities to other securities dealers.

|

|

CUSIP:

|

09709UWN4

|

|

●

|

Linked to the lowest performing of the SPDR® S&P® Regional Banking ETF, the Russell 2000® Index and the Nasdaq-100 Index®

|

|

●

|

Unlike ordinary debt securities, the Securities do not provide for fixed payments of interest, do not repay a fixed amount of principal on the Maturity Date and are subject to potential automatic call prior to the Maturity Date upon the terms described below. Whether the Securities pay a Contingent Coupon, whether the Securities are automatically called prior to the Maturity Date and, if they are not automatically called, whether you are repaid the principal amount of your Securities on the Maturity Date will depend in each case on the closing value of the Lowest Performing Underlying on the relevant Observation Date. The Lowest Performing Underlying on any Observation Date is the Underlying that has the lowest closing value on that Observation Date as a percentage of its Starting Value

|

|

●

|

Contingent Coupon. The Securities will pay a Contingent Coupon Payment on a quarterly basis until the earlier of the Maturity Date or automatic call if, and only if, the closing value of the Lowest Performing Underlying on the Observation Date for that quarter is greater than or equal to its Coupon Barrier. However, if the closing value of the Lowest Performing Underlying on an Observation Date is less than its Coupon Barrier, you will not receive any Contingent Coupon Payment for the relevant quarter. If the closing value of the Lowest Performing Underlying is less than its Coupon Barrier on every Observation Date, you will not receive any Contingent Coupon Payments throughout the entire term of the Securities. The Coupon Barrier for each Underlying is equal to 70% of its Starting Value. The Contingent Coupon Rate will be determined on the Pricing Date and will be within the range of 8.50% to 9.50% per annum

|

|

●

|

Automatic Call. If the closing value of the Lowest Performing Underlying on any of the quarterly Observation Dates from June 2022 to September 2024, inclusive, is greater than or equal to its Starting Value, we will automatically call the Securities for the principal amount plus a final Contingent Coupon Payment

|

|

●

|

Potential Loss of Principal. If the Securities are not automatically called prior to the Maturity Date, you will receive the principal amount on the Maturity Date if, and only if, the closing value of the Lowest Performing Underlying on the Valuation Date is greater than or equal to its Threshold Value. If the closing value of the Lowest Performing Underlying on the Valuation Date is less than its Threshold Value, you will lose more than 30%, and possibly all, of the principal amount of your Securities. The Threshold Value for each Underlying is equal to 70% of its Starting Value

|

|

●

|

If the Securities are not automatically called prior to the Maturity Date, you will have full downside exposure to the Lowest Performing Underlying from its Starting Value if its closing value on the Valuation Date is less than its Threshold Value, but you will not participate in any appreciation of any Underlying and will not receive any dividends on shares of the Fund or the securities held by or included in any Underlying

|

|

●

|

Your return on the Securities will depend solely on the performance of the Underlying that is the Lowest Performing Underlying on each Observation Date. You will not benefit in any way from the performance of the better performing Underlyings. Therefore, you will be adversely affected if any Underlying performs poorly, even if the other Underlyings perform favorably

|

|

●

|

All payments on the Securities are subject to the credit risk of BofA Finance LLC, as issuer and Bank of America Corporation, as guarantor, and you will have no ability to pursue shares of the Fund or any securities held by or included in any Underlying for payment; if BofA Finance LLC, as issuer, and Bank of America Corporation, as guarantor, default on their obligations, you could lose some or all of your investment

|

|

●

|

No exchange listing; designed to be held to maturity

|

The initial estimated value of the Securities as of the pricing date is expected to be between $910.00 and $960.00 per Security, which is less than the public offering price. The actual value of your Securities at any time will reflect many factors and cannot be predicted with accuracy. See “Risk Factors” beginning on page PS-9 of the accompanying preliminary pricing supplement and “Structuring the Securities” on page PS-35 of the accompanying preliminary pricing supplement for additional information.

| ●

|

If the Ending Value of the Lowest Performing Underlying on the Valuation Date is greater than or equal to its Threshold Value: $1,000; or

|

| ●

|

If the Ending Value of the Lowest Performing Underlying on the Valuation Date is less than its Threshold Value:

|

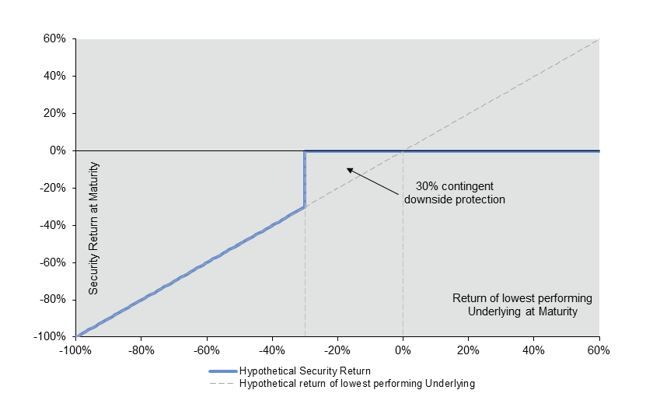

Hypothetical Payout Profile

If the Securities are automatically called: If the Securities are automatically called prior to maturity, you will receive the principal amount of your Securities plus a final Contingent Coupon Payment on the Call Settlement Date. In the event the Securities are automatically called, your total return on the Securities will equal any Contingent Coupon Payments received prior to the Call Settlement Date and the Contingent Coupon Payment received on the Call Settlement Date.

If the Securities are not automatically called:

If the Securities are not automatically called prior to maturity, the following table illustrates, for a range of hypothetical performance factors of the Lowest Performing Underlying on the Valuation Date, the hypothetical Redemption Amount payable at maturity per Security (excluding the final Contingent Coupon Payment, if any). The performance factor of the Lowest Performing Underlying on the Valuation Date is its Ending Value expressed as a percentage of its Starting Value (i.e., its Ending Value divided by its Starting Value).

|

Hypothetical performance factor of Lowest Performing Underlying on Valuation Date

|

Hypothetical Redemption Amount per Security

|

|

175.00%

|

$1,000.00

|

|

160.00%

|

$1,000.00

|

|

150.00%

|

$1,000.00

|

|

140.00%

|

$1,000.00

|

|

130.00%

|

$1,000.00

|

|

120.00%

|

$1,000.00

|

|

110.00%

|

$1,000.00

|

|

100.00%

|

$1,000.00

|

|

90.00%

|

$1,000.00

|

|

80.00%

|

$1,000.00

|

|

70.00%

|

$1,000.00

|

|

69.00%

|

$690.00

|

|

60.00%

|

$600.00

|

|

50.00%

|

$500.00

|

|

40.00%

|

$400.00

|

|

30.00%

|

$300.00

|

|

25.00%

|

$250.00

|

| ●

|

Your investment may result in a loss; there is no guaranteed return of principal.

|

| ●

|

Your return on the Securities is limited to the return represented by the Contingent Coupon Payments, if any, over the term of the Securities.

|

| ●

|

The Securities are subject to a potential automatic call, which would limit your ability to receive the Contingent Coupon Payments over the full term of the Securities.

|

| ●

|

You may not receive any Contingent Coupon Payments.

|

| ●

|

Because the Securities are linked to the lowest performing (and not the average performance) of the Underlyings, you may not receive any return on the Securities and may lose a significant portion or all of your principal amount even if the closing value of one Underlying is always greater than or equal to its Coupon Barrier or Threshold Value, as applicable.

|

| ●

|

Higher Contingent Coupon Rates are associated with greater risk.

|

| ●

|

Your return on the Securities may be less than the yield on a conventional debt security of comparable maturity.

|

| ●

|

The Contingent Coupon Payment, payment upon automatic call or Redemption Amount, as applicable, will not reflect the values of the Underlyings other than on the Observation Dates.

|

| ●

|

Any payment on the Securities is subject to the credit risk of BofA Finance, as issuer, and BAC, as Guarantor, and actual or perceived changes in BofA Finance or the Guarantor’s creditworthiness are expected to affect the value of the Securities.

|

| ●

|

We are a finance subsidiary and, as such, have no independent assets, operations or revenues.

|

| ●

|

The public offering price you pay for the Securities will exceed their initial estimated value.

|

| ●

|

The initial estimated value does not represent a minimum or maximum price at which BofA Finance, BAC, BofAS or any of our other affiliates or WFS or its affiliates would be willing to purchase your Securities in any secondary market (if any exists) at any time.

|

| ●

|

BofA Finance cannot assure you that a trading market for your Securities will ever develop or be maintained.

|

| ●

|

The Securities are not designed to be short-term trading instruments, and if you attempt to sell the Securities prior to maturity, their market value, if any, will be affected by various factors that interrelate in complex ways, and their market value may be less than the principal amount.

|

| ●

|

Trading and hedging activities by BofA Finance, the Guarantor and any of our other affiliates, including BofAS, and WFS and its affiliates, may create conflicts of interest with you and may affect your return on the Securities and their market value.

|

| ●

|

There may be potential conflicts of interest involving the calculation agent, which is an affiliate of ours.

|

| ●

|

The Securities are subject to risks associated with the banking industry.

|

| ●

|

The stocks held by the KRE are concentrated in one sector.

|

| ●

|

The anti-dilution adjustments will be limited.

|

| ●

|

The performance of the KRE may not correlate with the performance of its underlying index as well as the net asset value per share of the KRE, especially during periods of market volatility.

|

| ●

|

The publisher of an Index or the sponsor or investment advisor of the Fund may adjust the applicable Underlying in a way that affects its values, and the publisher, sponsor or investment advisor has no obligation to consider your interests.

|

| ●

|

The Securities are subject to risks associated with small-size capitalization companies.

|

| ●

|

An Investment In The Securities Is Subject To Risks Associated With Investing In Non-U.S. Companies.

|

| ●

|

The U.S. federal income tax consequences of an investment in the Securities are uncertain, and may be adverse to a holder of the Securities.

|

Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo Finance LLC and Wells Fargo & Company.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- FirstEnergy Corp. (FE) PT Raised to $35 at BofA Securities

- Geopolitical shocks should be bought, not sold - BofA

- Dominion Resources, Inc. (D) PT Raised to $43 at BofA Securities

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share