Form FWP BARCLAYS BANK PLC Filed by: BARCLAYS BANK PLC

Filed Pursuant to Rule 433

Registration No. 333-265158

Fact Sheet | June 7, 2023

|

|

Trailblazer Notes

|

|

Issuer:

Barclays Bank PLC

Tenor:

Approximately 30 months

Reference Asset:

The BXIITBZ5 (Bloomberg ticker: 'BXIITBZ5 <US Equity>') (the 'Index'). Please see the accompanying Pricing Supplement for more information on the Index and its calculation, composition and methodology.

CUSIP / ISIN:

06745MGL6/ US06745MGL63

Upside Leverage Factor:

3.25

Initial Value:

The Closing Value of the Reference Asset on the Initial Valuation Date

Final Value:

The Closing Value of the Reference Asset on the Final Valuation Date

Index Fee and Costs:

The Reference Asset includes an index fee of 0.85% per annum. Please see the Pricing Supplement for more information on the fees and costs embedded in the Reference Asset and associated with investing in the notes.

Initial Valuation Date:

June 30, 2023

Issue Date:

July 06, 2023

Final Valuation Date:

December 30, 2025

Maturity Date:

January 5, 2026

|

Selected Structure Definitions

|

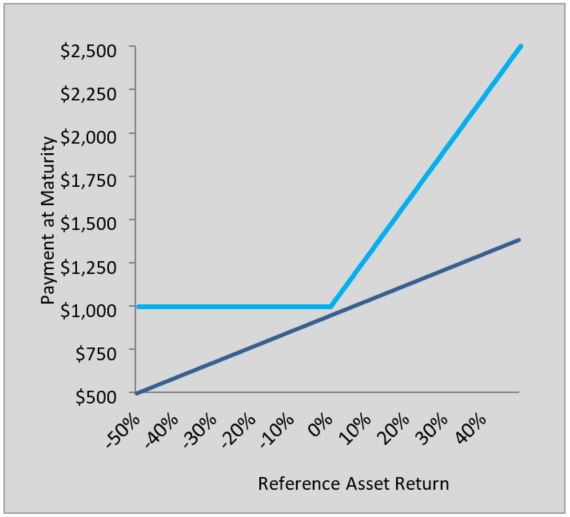

Payment at Maturity:

If you hold the notes to maturity, you will receive on the Maturity Date a cash payment per $1,000 principal amount of notes equal to:

●

If the Final Value is greater than the Initial Value, you will receive an amount per$1,000 principal amount note calculated as follows:

$1,000 + ($1,000 x Reference Asset Return x Upside Leverage Factor)

●

If the Final Value is less than or equal to the Initial Value, you will receive a payment of $1,000 per $1,000 principal amount note

|

Reference Asset Return: The performance of the Reference Asset from the Initial Value to the Final Value All terms that are not defined in this fact sheet shall have the meanings set forth in the accompanying preliminary pricing supplement dated May 31, 2023 (the 'Pricing Supplement'). All terms set forth or defined herein, including all prices, levels, values and dates, are subject to adjustment as described in the accompanying Pricing Supplement. In the event that any of the terms set forth or defined in this fact sheet conflict with the terms as described in the accompanying Pricing Supplement, the terms described in the accompanying Pricing Supplement shall control.

The notes are not suitable for all investors. You should read carefully the accompanying Pricing Supplement (together with all documents incorporated by reference therein) for more information on the risks associated with investing in the notes.

Any payment, including any payment at maturity, is not guaranteed by any third party and is subject to both the creditworthiness of the Issuer and the exercise of any U.K. Bail-in Power, as further described in the accompanying Pricing Supplement.

|

Hypothetical Payment at Maturity ƚ

|

|

Reference Asset Return

|

Payment at Maturity ƚ

|

Total Return on

Notes ƚ

|

|

40.00%

|

$2,300.00

|

130.00%

|

|

30.00%

|

$1,975.00

|

97.50%

|

|

20.00%

|

$1,650.00

|

65.00%

|

|

10.00%

|

$1,325.00

|

32.50%

|

|

5.00%

|

$1,162.50

|

16.25%

|

|

0.00%

|

$1,000.00

|

0.00%

|

|

-10.00%

|

$1,000.00

|

0.00%

|

|

-15.00%

|

$1,000.00

|

0.00%

|

|

-20.00%

|

$1,000.00

|

0.00%

|

|

-25.00%

|

$1,000.00

|

0.00%

|

|

-30.00%

|

$1,000.00

|

0.00%

|

|

-50.00%

|

$1,000.00

|

0.00%

|

|

-100.00%

|

$1,000.00

|

0.00%

|

|

ƚAssuming that the Upside Leverage Factor will be set at 3.25

|

Fact Sheet | June 7, 2023

Trailblazer Notes

|

Summary Characteristics of the Notes

|

Summary Risk Considerations

|

|

Commissions—Barclays Capital Inc. will receive commissions from the Issuer of up to $10.00 per $1,000 principal amount. Please see the accompanying Pricing Supplement for additional information about selling concessions, commissions and fees.

Estimated Value Lower Than Issue Price—Our estimated value of the notes on the Initial Valuation

Date is expected to be between $920.00 and $967.60 per note. Please see “Additional Information Regarding Our Estimated Value Of The Notes” in the accompanying Pricing Supplement for more information.

Your Return on the Notes Is Limited to the Payment at Maturity--You will not receive any interest or coupon payments on the notes or any other payments aside from the Payment at Maturity. If the Final Value is less than or equal to the Initial Value, your Payment at Maturity will be limited to the principal amount of your notes. The return at maturity of the principal amount of your notes plus any amount in excess thereof may not compensate you for any loss in value due to inflation and other factors relating to the value of money over time. Any payment on the notes, including the repayment of principal, is subject to the credit risk of Barclays Bank PLC.

Any Payment on the Notes Will Be Determined Based on the Closing Value of the Reference Asset on the Dates Specified — Any payment on the notes will be determined based on the Closing Values of the Reference Asset on the dates specified. You will not benefit from any more favorable value of the Index determined at any other time.

|

Credit of Issuer—The notes are senior unsecured debt obligations of the Issuer and are not, either directly or indirectly, an obligation of any third party. In the event the Issuer were to default on its obligations, you may not receive any amounts owed to you, including any payment at maturity under the terms of the notes.

U.K. Bail-In Power—Each holder of notes acknowledges, accepts, and agrees to be bound by, and consents to the exercise of, any U.K. Bail-in Power by the relevant U.K. resolution authority, which may be exercised so as to result in you losing all or a part of the value of your investment in the notes or receiving a different security from the notes that is worth significantly less than the notes. Please see “Consent to U.K. Bail-In Power” in the accompanying Pricing Supplement for more information.

Historical Performance—The historical performance of the Reference Asset is not an indication of the future performance of the Index over the term of the notes.

Conflict of Interest—In connection with our normal business activities and in connection with hedging our obligations under the notes, we and our affiliates play a variety of roles in connection with the notes, including acting as calculation agent and as a market-maker for the notes. In each of these roles, our and our affiliates’ economic interests may be adverse to your interests as an investor in the notes.

Lack of Liquidity—The notes will not be listed on any securities exchange. There may be no secondary market for the notes or, if there is a secondary market, there may be insufficient liquidity to allow you to sell the notes easily.

Tax Treatment—Significant aspects of the tax treatment of the notes are uncertain. You should consult your tax advisor about your tax situation.

|

In addition to the summary risks and characteristics of the notes discussed under the headings above, you should carefully consider the risks discussed under the heading “Selected Risk Considerations” in the accompanying Pricing Supplement and under the heading “Risk Factors” in the accompanying prospectus supplement.

Other Information

This fact sheet is a general summary of the terms and conditions of this offering of notes. The Issuer has filed a registration statement (including a prospectus) with the U.S. Securities and Exchange Commission (the “SEC”) for this offering of notes. Before you invest, you should read carefully the full description of the terms and conditions of, and risks associated with investing in, the notes contained in the Pricing Supplement as well as the information contained in the accompanying prospectus supplement and prospectus that are incorporated by reference in the Pricing Supplement. The Pricing Supplement, as filed with the SEC, is available at the following hyperlink:

https://www.creativeservices.barclays/docs/200007927/06745MGL6.pdf

You may access the prospectus supplement and prospectus that are incorporated by reference in the Pricing Supplement by clicking on the respective hyperlink for each document included in the Pricing Supplement under the heading “Additional Documents Related To The Offering Of The Notes,” or by requesting such documents from the Issuer or any underwriter or dealer participating in this offering. We strongly advise you to carefully read these documents before investing in the notes.

You may revoke your offer to purchase the notes at any time prior to the Initial Valuation Date. We reserve the right to change the terms of, or reject any offer to purchase, the notes prior to the Initial Valuation Date. In the event of any changes to the terms of the notes, we will notify you and you will be asked to accept such changes in connection with your purchase of the notes. You may choose to reject such changes, in which case we may reject your offer to purchase the notes.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Village Farms (VFF) Announces Management Additions

- As Tesla CEO Elon Musk is increasingly levering himself to Texas, Barclays weighs in

- Blackstone (BX) to Acquire Tropical Smoothie Cafe

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

BarclaysSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share