Form F-3 VIQ Solutions Inc.

As filed with the Securities and Exchange Commission on August 15, 2022

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

VIQ SOLUTIONS INC.

(Exact name of Registrant as specified in its charter)

Not applicable

(Translation of Registrant’s name into English)

| Ontario | Not Applicable | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number (if applicable)) |

5915 Airport Road

Suite 700

Mississauga, Ontario L4V 1T1 Canada

(905) 948-8266

(Address and telephone number of Registrant’s principal executive offices)

C T Corporation System

1015 15th Street N.W., Suite 1000

Washington, D.C., 20005

Telephone: (202) 572-3133

(Name, address, and telephone number of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

Sebastien Paré 5915 Airport Road Suite 700 Mississauga, Ontario L4V 1T1 Canada Telephone: (905) 948-8266

|

Rob Condon Dentons US LLP 1221 Avenue of the Americas New York, New York 10020 Telephone: (212) 768-6839 |

Ora Wexler Dentons Canada LLP 77 King Street West, Suite 400 Toronto, Ontario M5K 0A1 Canada Telephone: (416) 863-4516 |

Approximate date of commencement of proposed sale of the securities to the public:

From time to time after the effective date of this Registration Statement

If only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company x

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

PART I

INFORMATION REQUIRED IN PROSPECTUS

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED AUGUST 15, 2022

Preliminary Prospectus

VIQ SOLUTIONS INC.

7,103,704 COMMON SHARES

This Prospectus relates to the resale by the selling shareholders identified herein of up to 7,103,704 common shares (the “Common Shares”) of VIQ Solutions Inc. (the “Company”). The Common Shares being offered for resale include up to (i) 3,551,852 Common Shares, and (iii) 3,551,852 Common Shares issuable upon the exercise of warrants of the Company (the “Warrants”), that were initially issued pursuant to the Securities Purchase Agreement dated as of July 18, 2022 (the “Securities Purchase Agreement”), by and between the Company and the selling shareholders.

We are not selling any Common Shares and will not receive any proceeds from the sale of the Common Shares under this Prospectus. Upon the exercise of the Warrants, however, we will receive the applicable exercise price of the Warrants.

The selling shareholders may, from time to time, sell, transfer or otherwise dispose of any or all of the Common Shares being registered or interests in the Common Shares being registered on any stock exchange, market or trading facility on which our Common Shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices. Prices may vary from purchaser to purchaser during the period of distribution. See “Plan of Distribution.” This Prospectus has not been filed in respect of, and will not qualify, any distribution of the Common Shares being registered in any of the provinces or territories of Canada at any time. We will not receive any of the proceeds from the sale or other disposition of the Common Shares by the selling shareholders. The net proceeds received from the sale or other disposition of the Common Shares by the selling shareholders, if any, is unknown to us.

We may amend or supplement this Prospectus from time to time by filing amendments or supplements as required. You should read the entire Prospectus, including the additional information described under the heading “Incorporation of Certain Information by Reference,” and any amendments or supplements carefully before you make your investment decision.

The Common Shares are traded on the Nasdaq Capital Market (“Nasdaq”) and the Toronto Stock Exchange (“TSX”) under the symbol “VQS.” On August 12, 2022, the closing price of the Common Shares was US$1.00 per share on the Nasdaq and CDN$1.31 per share on the TSX. You are urged to obtain current market quotations for the Common Shares.

We have prepared this Prospectus in accordance with United States disclosure requirements. Our financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board, as adopted by the International Accounting Standards Board (“IASB”), and thus may not be comparable to financial statements of United States companies.

The enforcement by investors of civil liabilities under United States federal securities laws may be affected adversely by the fact that the Company is incorporated and governed under the laws of the Province of Ontario, Canada, that a number of our officers and directors are residents of countries other than the United States, and a substantial portion of our assets and some of said persons are located outside the United States.

We are an “emerging growth company” as defined by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and, as such, we have elected to comply with certain reduced public company reporting requirements for this Prospectus and future filings. Please see “Prospectus Summary—Implications of Being an Emerging Growth Company.”

No underwriter has been involved in the preparation of this Prospectus nor has any underwriter performed any review of the contents of this Prospectus.

Investing in the Common Shares involves a high degree of risk. Prospective purchasers of the Common Shares should carefully consider all the information in this Prospectus and in the documents incorporated by reference in this Prospectus. See “Risk Factors” beginning on page 6 of this Prospectus.

Neither the Securities and Exchange Commission (the “SEC”), the Canadian Securities Administrators nor any state or other foreign securities commission has approved or disapproved of these securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus is , 2022.

TABLE OF CONTENTS

You should rely only on the information contained in or incorporated by reference into this Prospectus or any prospectus supplement. References to this “Prospectus” include documents incorporated by reference herein. See “Incorporation of Certain Information By Reference.” The information in or incorporated by reference into this Prospectus is current only as of its date. We have not authorized anyone to provide you with information that is different. This document may only be used where it is legal to offer these securities.

Neither we nor the selling shareholders have authorized anyone to provide you with additional information or information different from that contained in this Prospectus filed with the SEC, in any supplement to this Prospectus filed with the SEC, in any free writing prospectus filed with the SEC, or in the documents described under the heading “Incorporation of Certain Information by Reference.” We and the selling shareholders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The selling shareholders are offering to sell, and seeking offers to buy, Common Shares only in jurisdictions where offers and sales are permitted. The information contained in this Prospectus is accurate only as of the date of this Prospectus, regardless of the time of delivery of this Prospectus or any sale of Common Shares. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: Neither we nor the selling shareholders have done anything that would permit this offering or possession or distribution of this Prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this Prospectus must inform themselves about, and observe any restrictions relating to, the offering of the Common Shares and the distribution of this Prospectus outside the United States.

This Prospectus may be supplemented from time to time by one or more prospectus supplements. Such prospectus supplement may also add, update or change information contained in this Prospectus. If there is any inconsistency between the information in this Prospectus and the applicable prospectus supplement, you must rely on the information in the prospectus supplement. You should carefully read both this Prospectus and any applicable prospectus supplement together with additional information described under the heading “Where You Can Find Additional Information” before deciding to invest in any Common Shares being offered.

To the extent there is a conflict between the information contained in this Prospectus, on the one hand, and the information contained in any document incorporated by reference filed with the SEC before the date of this Prospectus, on the other hand, you should rely on the information in this Prospectus. If any statement in a document incorporated by reference is inconsistent with a statement in another document incorporated by reference having a later date, the statement in the document having the later date modifies or supersedes the earlier statement.

Our audited consolidated financial statements have been prepared in accordance with IFRS as issued by the IASB. Our fiscal year is the 12-month period ending December 31. Amounts stated herein and in the documents incorporated by reference herein are in Canadian dollars, unless otherwise indicated. All references to “$” and “CDN$” are to Canadian dollars. All references to “US$” are to United States dollars. Certain totals, subtotals and percentages throughout this report may not reconcile due to rounding.

All references in this Prospectus to “VIQ” the “Company,” “we,” “us” and “our” refer to VIQ Solutions Inc. and its consolidated subsidiaries, except where the context otherwise requires.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Prospectus and the documents incorporated herein by reference contain forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those discussed in the forward-looking statements. The statements contained in, or incorporated by reference in, this Prospectus that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements are often identified by the use of words such as, but not limited to, “anticipate,” “believe,” “can,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “seek,” “should,” “strategy,” “target,” “will,” “would” and similar expressions or variations intended to identify forward-looking statements. These statements are based on the beliefs and assumptions of our management based on information currently available to management. Such forward-looking statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking statements.

1

Factors that could cause or contribute to such differences include, but are not limited to, (i) those included in our Annual Report on Form 20-F for the fiscal year ended December 31, 2021 (the “Annual Report”), (ii) those contained in this Prospectus and in our other SEC reports described under “Risk Factors,” (iii) those described elsewhere in this Prospectus, and (iv) other factors that we may publicly disclose from time to time. Furthermore, such forward-looking statements speak only as of the date made. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements.

The following summary highlights selected information contained elsewhere in this Prospectus and in the documents incorporated by reference in this Prospectus, and does not contain all of the information that you need to consider in making your investment decision. We urge you to read this entire Prospectus, including the more detailed consolidated financial statements, notes to the consolidated financial statements and other information incorporated by reference from our other filings with the SEC. Investing in our securities involves substantial risks. Therefore, carefully consider the risk factors set forth in this Prospectus and in our most recent filings with the SEC including the Annual Report and reports on Form 6-K, as well as other information in this Prospectus and any prospectus supplements and the documents incorporated by reference herein or therein, before purchasing our securities. Each of the risk factors could adversely affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our securities.

Overview of the Company

VIQ combines artificial intelligence (AI)-driven voice and video capture technology and services to securely manage digital content in the most rigid security environments, including governments, courts, insurance, law enforcement, media content, news and conferencing. VIQ’s products and services help cybersecurity focused entities securely speed the capture, creation, and management of large volumes of information, preserve the unique value of the spoken word and video image, and deliver meaningful data that they can utilize.

VIQ offers its clients a technology services stack comprised of six core software solutions: MobileMic Pro, CaptureProTM, NetScribe, First Draft, Editing Services and aiAssist, that are integrated to create a seamless, end to end digital platform, as outlined further below.

VIQ spent the last three years integrating its entire product portfolio into a modern, secured, cloud-based, scalable ecosystem. Through this established commercial platform, VIQ ingests multi-media content across its markets and delivers immediate value to customers in the form of high-quality evidentiary documentation. The effective aggregation of customer information in the platform, which may appear as a by-product, is in fact a valuable asset that is to be monetized. The Company’s first AI-driven use of this information was aimed at improving the efficiency of the verbatim transcription process by delivering a progressively better first draft. In turn, this capability enabled the delivery of First Draft, a service where a machine-generated version of a multi speakers recording is presented to the user, all the while, feeding back into the system the quality-controlled version of the documents we delivered, refining our linguistic and industry specific corpus models, and progressively enhancing the outcome of our services, in a virtuous circle.

VIQ operates worldwide with a network of partners including security integrators, audio-video specialists, and hardware and data storage suppliers. The Company’s revenue is strategically segmented both by geography and industry markets: Approximately 57% of its recent revenue has been from customers located in the United States, 27% from Australia and a growing 4% from Canada, Europe, Middle East and Africa.

2

VIQ’s solutions serve a growing customer base across a variety of vertical and horizontal markets, the primary of which are as follows:

· 61% of revenue is in legal (courts);

· 11% in criminal justice (including Law Enforcement);

· 13% in insurance; and

· 15% in media, corporate finance, government and medical.

VIQ delivers its products and services to clients primarily through a network of resellers and integrators, as well as through direct sales, offering a variety of deployment methodologies and business models to meet customer demand including software, SaaS and managed services.

Looking ahead, VIQ intends on utilizing this content to extend the scope of solutions that it offers and to expand the value of the content it collects. To that end, VIQ’s ML-driven AI engine selection process drives the platform to serve emerging needs and unlocks the additional value in the data stream. VIQ takes advantage of all available technologies to accelerate its strategy, as the system is designed intentionally to integrate both VIQ’s internal intellectual property and external applications.

VIQ’s vision is to create an environment where it can cultivate the relationships with its customers through a portfolio of value-added complementary services.

VIQ is transitioning its technology services offerings towards a SaaS revenue model, in which clients are charged recurring monthly fees based on a number of variables. Given the size, nature, and visibility of its sales pipeline, VIQ anticipates this SaaS option will continue to gain traction in the markets in which VIQ’s software is offered.

For a further description of the Company and its business, see the section entitled “Information on the Company” in the Annual Report, which is incorporated by reference in this Prospectus.

Recent Developments

See the interim condensed consolidated financial statements for the three and six months ended June 30, 2022, and our management discussion and analysis, included as exhibits to our Form 6-K, furnished with the SEC on August 11, 2022, as well as information included in our other Form 6-Ks incorporated by reference herein.

Corporate Information

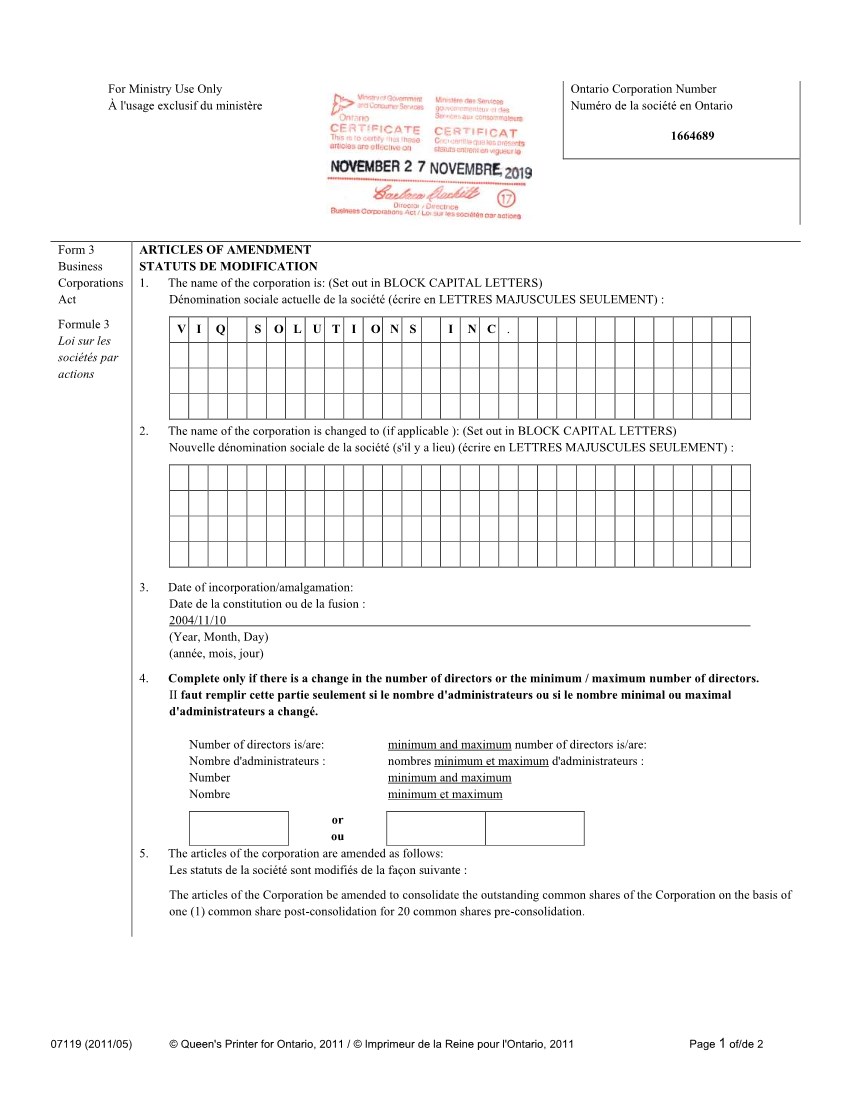

VIQ was incorporated pursuant to the Business Corporations Act (Alberta) on November 10, 2004 and was continued under the Business Corporations Act (Ontario), on April 14, 2017. The Company’s head and registered offices are located at 5915 Airport Road, Suite 700, Mississauga, Ontario, Canada L4V 1T1, and its telephone number is (905) 948-8266.

Implications of Being an Emerging Growth Company

As a company with less than US$1.07 billion in revenue during our last fiscal year, we qualify as an “emerging growth company,” as defined in the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include an exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002 and, to the extent that we no longer qualify as a foreign private issuer, (i) reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and (ii) exemptions from the requirements of holding a non-binding advisory vote on executive compensation, including golden parachute compensation.

We may take advantage of these provisions for up to five years from the initial public offering of the Common Shares in the United States or such earlier time that we are no longer an emerging growth company. We will cease to be an emerging growth company upon the earliest of the following:

| ■ | the last day of the first fiscal year in which our annual revenues were at least US$1.07 billion; |

| ■ | the last day of the fiscal year following the fifth anniversary of the initial public offering of the Common Shares in the United States; |

3

| ■ | the date on which we have issued more than US$1 billion of non-convertible debt securities over a three year period; and |

| ■ | the last day of the fiscal year during which we meet the following conditions: (i) the worldwide market value of our common equity securities held by non-affiliates as of our most recently completed second fiscal quarter is at least US$700 million, (ii) we have been subject to U.S. public company reporting requirements for at least 12 months and (iii) we have filed at least one annual report as a U.S. public company. |

Implications of Being a Foreign Private Issuer

We are also considered a “foreign private issuer” under U.S. securities laws. In our capacity as a foreign private issuer, we are exempt from certain rules under the Exchange Act, that impose certain disclosure obligations and procedural requirements for proxy solicitations under Section 14 of the Exchange Act. In addition, our officers, directors and principal shareholders are exempt from the reporting and “short-swing” profit recovery provisions of Section 16 of the Exchange Act and the rules under the Exchange Act with respect to their purchases and sales of our securities. Moreover, we are not required to file periodic reports and financial statements with the SEC as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act. In addition, we are not required to comply with Regulation FD, which restricts the selective disclosure of material information.

Both foreign private issuers and emerging growth companies are also exempt from certain more stringent executive compensation disclosure rules for public companies in the United States under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. Even if we no longer qualify as an emerging growth company, so long as we remain a foreign private issuer, we will continue to be exempt from such compensation disclosures.

We may take advantage of these exemptions until such time as we are no longer a foreign private issuer. We will remain a foreign private issuer until such time that more than 50% of our outstanding voting securities are held by U.S. residents and any of the following three circumstances applies: (1) the majority of our executive officers or directors are U.S. citizens or residents; (2) more than 50% of our assets are located in the United States; or (3) our business is administered principally in the United States.

PRIVATE PLACEMENT OF COMMON SHARES AND WARRANTS

On July 18, 2022, the Company entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”) with Armistice Capital Master Fund Ltd. (“Armistice Master Fund”), Special Situations Fund III QP, L.P. (“SSFQP”), Special Situations Cayman Fund, L.P. (“Cayman”), Special Situations Technology Fund, L.P. (“TECH”), and Special Situations Technology Fund II, L.P. (“TECH II”), also referred to herein as the selling shareholders. Pursuant to the Securities Purchase Agreement, the selling shareholders purchased an aggregate of 3,551,852 Common Shares and Warrants to purchase up to an aggregate of 3,551,852 Common Shares in a private placement which closed on July 21, 2022 (the “Private Placement”), at a combined purchase price of US$1.35, resulting in total gross proceeds of approximately US$4.8 million before deducting placement agent commissions and other offering expenses. In connection with the Private Placement, A.G.P./Alliance Global Partners, as placement agent was paid a cash fee of US$311,675, equal to 6.5% of the gross proceeds of the Private Placement, and was reimbursed for reasonable accountable legal expenses incurred in connection with the Private Placement in the amount of US$50,000 and for non-accountable expenses in the amount of US$15,000.

In connection with the Securities Purchase Agreement, the Company and each selling shareholder entered into a registration rights agreement, dated July 21, 2022 (each, a “Registration Rights Agreement”). Pursuant to the Registration Rights Agreement, the Company agreed to prepare and file a registration statement on Form F-3 to provide for the resale of the Common Shares held by selling shareholders and the Common Shares issuable upon exercise of the Warrants held by the selling shareholders. This Prospectus is a part of the registration statement filed pursuant to that obligation. The Private Placement was conducted pursuant to an exemption from the registration requirements of the Securities Act, under Section 4(a)(2) thereof and/or Rule 506 of Regulation D promulgated thereunder.

4

| Common shares offered by the selling shareholders | 7,103,704 Common Shares, including 3,551,852 Common Shares issuable upon exercise of the Warrants. |

| Common shares to be outstanding after this offering | 37,067,099 Common Shares (including 3,551,852 Common Shares issuable upon exercise of the Warrants). |

| Use of proceeds | The selling shareholders will receive all of the net proceeds from the sale of the Common Shares in this offering. We will not receive any proceeds from the sale of Common Shares in this offering. We will, however, bear the costs incurred in connection with the registration of these Common Shares and, upon a cash exercise of the Warrants, we will receive the exercise price of the Warrants. |

| Risk factors | See “Risk Factors” beginning on page 6 and the other information included in this Prospectus and incorporated by reference for a discussion of factors you should carefully consider before deciding to invest in our common shares. |

| Nasdaq trading symbol for the Common Shares: | “VQS”. |

The number of Common Shares that will be outstanding immediately after this offering is based on 33,515,247 Common Shares outstanding as of August 10, 2022 and assumes the full exercise of the Warrants described above. There is no guarantee that the Warrants will be exercised for Common Shares. The number of Common Shares that will be outstanding immediately after this offering does not include:

| • | 771,767 stock options outstanding with a weighted average exercise price per Common Share of CAD $2.89 expiring between 2023 and 2025 under the Company’s legacy stock option plan; | ||

| • | 579,563 stock options outstanding with a weighted average exercise price per Common Share of CAD $2.45 expiring 2031 under the Omnibus Equity Incentive Plan; | ||

| • | 66,667 deferred share units outstanding with an average exercise price per Common Share of CAD $1.20 with no expiry date; | ||

| • | 330,279 restricted share units outstanding expiring 2031 and selective units with no expiry dates under the Omnibus Equity Incentive Plan; | ||

| • | 195,000 performance share units with no expiry dates; and | ||

| • | 2,117,647 warrants at an exercise price of $5.00 expiring 2026. |

5

Investing in our securities involves a high degree of risk. You should carefully review the risks and uncertainties described under the heading “Risk Factors” contained in this Prospectus and any related free writing prospectus, and in the Annual Report and reports on Form 6-K as updated by our subsequent filings, which are incorporated by reference into this Prospectus, before deciding whether to purchase any of the securities being registered pursuant to the registration statement of which this Prospectus is a part. Each of the risk factors could adversely affect our business, results of operations, financial condition and cash flows, as well as adversely affect the value of an investment in our securities, and the occurrence of any of these risks might cause you to lose all or part of your investment. Additional risks not presently known to us or that we currently believe are immaterial may also significantly impair our business operations.

Risks Related to the Offering and the Common Shares

The Company has a history of operating losses and negative cash flows and may never achieve consistent profitability, which may adversely affect its ability to continue as a going concern.

During the years ended December 31, 2021 and 2020 and the six months ended June 30, 2022, the Company sustained net losses from operations. During the years ended December 31, 2021 and 2020, the Company had negative cash flow from operating activities. To the extent that the Company experiences negative cash flow from operating activities in any future period, the Company may use all or a portion of the proceeds raised through the Private Placement, as well as cash on-hand and additional financial resources, to fund such negative cash flow.

The Company may not have sufficient cash flow to adequately satisfy its liquidity requirements in the future. Failure to adequately satisfy the Company’s liquidity requirements may have a material adverse effect on the business, results of operations and financial position, and may adversely affect its ability to continue as a going concern. If the Company does not become consistently profitable, its accumulated deficit will grow larger, its cash balances will decline and the Company will require additional financing to continue operations. Any such financing may not be accessible on acceptable terms, if at all. If the Company cannot generate sufficient cash or obtain additional financing, the Company may be required to downsize its business or discontinue operations altogether.

If additional funds are raised through further issuances of equity securities, existing shareholders (including prospective investors) could suffer significant dilution, and any new equity securities issued could have rights, preferences and privileges superior to those of holders of Common Shares. Any debt financing secured in the future could involve restrictive covenants relating to the Company’s capital raising activities and other financial and operational matters, which may make it more difficult for the Company to obtain additional capital and to pursue business opportunities, including potential acquisitions.

Investment in the Common Shares is speculative and involves a high degree of risk. You may lose your entire investment.

There is no guarantee that the Common Shares will earn any positive return in the short term or long term. A holding of Common Shares is speculative and involves a high degree of risk and should be undertaken only by holders whose financial resources are sufficient to enable them to assume such risks and who have no need for immediate liquidity in their investment. A holding of Common Shares is appropriate only for holders who have the capacity to absorb a loss of some or all of their holdings.

The Company will not receive any of the proceeds from the sale of Common Shares in this offering, so your purchase of Common Shares will not directly benefit the Company.

The selling shareholders will receive all of the net proceeds from the sale of Common Shares this offering. We will not receive any proceeds from the sale of Common Shares in this offering, so we will not directly benefit from your purchase of Common Shares. We will, however, bear the costs incurred in connection with the registration of these Common Shares. Upon a cash the exercise of the Warrants, we will receive the exercise price of the Warrants.

6

There is no assurance of a liquid trading market for the Common Shares in the future.

Purchasers of Common Shares in this offering may be unable to sell significant quantities of Common Shares into the public trading markets at all or without a significant reduction in the price of their Common Shares. There may not be sufficient liquidity of the Common Shares on any trading market. Additionally, the Company may not continue to meet the listing requirements of the TSX or Nasdaq or be able to achieve listing on any other public listing exchange. If the Common Shares are no longer listed on the TSX or Nasdaq, the trading price of the Common Shares is likely to drop and it would be more difficult for you to sell your Common Shares.

The market price for the Common Shares may be volatile and subject to wide fluctuations in response to numerous factors, many of which are beyond the Company’s control.

We have experienced and expect to continue to experience volatility and wide fluctuations in the market price of the Common Shares. The factors which may contribute to market price fluctuations of the Common Shares include the following:

| • | actual or anticipated fluctuations in the Company’s quarterly results of operations; | |

| • | recommendations by securities research analysts; | |

| • | changes in the economic performance or market valuations of companies in the industry in which the Company operates; | |

| • | addition or departure of the Company’s executive officers and other key personnel; | |

| • | release or expiration of transfer restrictions on outstanding Common Shares; | |

| • | sales or perceived or anticipated sales of additional Common Shares; | |

| • | operating and financial performance that vary from the expectations of management, securities analysts and investors; | |

| • | regulatory changes affecting the Company’s industry generally and its business and operations; | |

| • | announcements of developments and other material events by the Company or its competitors; | |

| • | fluctuations to the costs of vital production materials and services; | |

| • | changes in global financial markets and global economies and general market conditions, such as interest rates and price volatility; | |

| • | significant acquisitions or business combinations, strategic partnerships, joint ventures or capital commitments by or involving the Company or its competitors; | |

| • | operating and share price performance of other companies that investors deem comparable to the Company, or from a lack of market comparable companies; and | |

| • | news reports relating to trends, concerns, technological or competitive developments, regulatory changes and other related issues in the Company’s industry or target markets. |

The Company may be unable to procure sufficient capital to fund its operations.

Should the Company’s costs and expenses prove to be greater than currently anticipated, or should the Company change its current business plan in a manner that will increase or accelerate its anticipated costs and expenses, the depletion of its working capital would be accelerated. To the extent it becomes necessary to raise additional cash in the future as its current cash and working capital resources are depleted, the Company will seek to raise it through the public or private sale of assets, debt or equity securities, the procurement of advances on contracts, debt financing or short-term loans, or a combination of the foregoing. The Company may also seek to satisfy indebtedness without any cash outlay through the private issuance of debt or equity securities. The Company may not be able to secure the additional cash or working capital it may require to continue its operations. Failure by the Company to obtain additional cash or working capital on acceptable terms, on a timely basis and in sufficient amounts to fund its operations, or to make other satisfactory arrangements, may cause the Company to delay or indefinitely postpone certain of its activities, including potential acquisitions, or to reduce or delay capital expenditures, or cause the Company to sell material assets, seek additional capital (if available) or seek compromise arrangements with its creditors. The foregoing could materially and adversely impact the business, operations, financial condition and results of operations of the Company.

7

Your ownership interest will be diluted and our stock price could decline when we issue additional Common Shares.

We expect to issue from time to time in the future additional Common Shares or securities convertible into, or exercisable or exchangeable for, Common Shares in connection with possible financings, acquisitions, equity incentives for employees or otherwise. Any such issuance could result in substantial dilution to existing shareholders and cause the trading price of the Common Shares to decline.

We have never paid cash dividends and investors should not expect us to do so in the foreseeable future.

The Company has never declared or paid cash dividends on the Common Shares. We intend to retain future earnings, if any, to finance the operation, development, and expansion of our business. We do not anticipate paying cash dividends on the Common Shares in the foreseeable future. Payment of future cash dividends, if any, will be at the discretion of the board of directors of the Company and will depend on our financial condition, results of operations, capital requirements, business prospects, any contractual restrictions and other factors that the board of directors considers relevant.

If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, our share price and trading volume could decline.

The trading market for the Common Shares will depend in part on the research and reports that securities or industry analysts publish about us or our business, which research and reports are not and would not be subject to our control. We currently receive research coverage by securities analysts, but industry analysts that currently cover us may cease to do so. If industry analysts cease coverage of our company, the trading price for the Common Shares could be materially and adversely impacted. In the event we obtain securities analyst coverage, if one or more of the analysts who cover us downgrade the Common Shares or publish inaccurate or unfavorable research about our business, our share price may be materially and adversely impacted. If one or more of these analysts cease coverage of our company or fail to publish reports on us regularly, demand for our shares could decrease, which might cause our share price and trading volume to decline.

A decline in the price of the Common Shares could affect our ability to raise any required working capital and adversely impact our operations.

A decline in the price of the Common Shares could result in a reduction in the liquidity of the Common Shares and a reduction in our ability to raise any required capital for our operations. Because we intend to fund the Company in the future primarily through the sale of equity securities, and our continued operations. A reduction in our ability to raise equity capital in the future may have a material adverse effect upon our business plan and operations. If our share price declines, we may not be able to raise additional capital or generate funds from operations sufficient to meet our obligations.

The proceeds from the sale or other disposition of Common Shares covered by this Prospectus are solely for the account of the selling shareholders. Accordingly, we will not receive any proceeds from the sale or other disposition of such Common Shares, and the net proceeds received from the sale or other disposition of such Common Shares by the selling shareholders, if any, is unknown. We will, however, bear the costs incurred in connection with the registration of these Common Shares and, upon the exercise of the Warrants, we will receive the exercise price of the Warrants. If all of the Warrants sold in the Private Placement were to be exercised in cash at the current exercise price of US$1.39 per Common Share, we would receive additional gross proceeds of approximately US$4.9 million. We cannot predict when or if the Warrants will be exercised. It is possible that the Warrants may expire and may never be exercised.

8

CAPITALIZATION AND INDEBTEDNESS

The following table sets forth our capitalization and indebtedness as of June 30, 2022, and as adjusted to give pro forma effect to the Private Placement completed on July 21, 2022. This table should be read in conjunction with our interim condensed consolidated financial statements for the six month period ended June 30, 2022, which are incorporated by reference into this Prospectus.

| As of June 30, 2022 | ||||||||

| Actual (Unaudited) | Pro Forma as adjusted to give effect to the Private Placement | |||||||

| Cash and cash equivalents | 3,491,907 | 7,723,443 | ||||||

| Total debt | 8,837,019 | 8,837,019 | ||||||

| Stockholders’ equity | 72,317,239 | 76,717,239 | ||||||

| Common Shares, no par value, unlimited shares authorized, 29,963,395 shares issued and outstanding as of June 30, 2022, 33,515,247 shares issued and outstanding, as adjusted, as of June 30, 2022 | ||||||||

| Additional paid-in capital | 5,243,008 | 5,243,008 | ||||||

| Contributed surplus | 38,021 | 38,021 | ||||||

| Accumulated deficit | (60,226,993 | ) | (60,226,993 | ) | ||||

| Total stockholders’ equity | 17,371,275 | 21,771,275 | ||||||

| Total capitalization | 26,208,294 | 30,608,294 | ||||||

Any changes to our capitalization will be set forth in a prospectus supplement or in a report on Form 6-K subsequently furnished with the SEC and specifically incorporated herein by reference. Because we will not be receiving any proceeds pursuant to the sale of any Common Shares by the selling shareholders, our capitalization will not be adjusted to reflect such sales.

The Company’s authorized share capital consists of an unlimited number of Common Shares .

As at August 10, 2022 there were (i) 33,515,247 Common Shares issued and outstanding, (ii) 771,767 stock options outstanding with a weighted average exercise price per Common Share of CAD $2.89 expiring between 2023 and 2025 under the Company’s legacy stock option plan; (iii) 579,563 stock options outstanding with a weighted average exercise price per Common Share of CAD $2.45 expiring 2031 under the Omnibus Equity Incentive Plan; (iv) 66,667 deferred share units outstanding with an average exercise price per Common Share of CAD $1.20 with no expiry date; (v) 330,279 restricted share units outstanding expiring 2031 and selective units with no expiry dates under the Omnibus Equity Incentive Plan; (vi) 195,000 performance share units with no expiry dates’ (vii) 2,117,647 warrants at an exercise price of $5.00 expiring 2026; and (viii) 3,551,852 warrants at an exercise price of $1.39 expiring July 21, 2027.

9

Common Shares

The holders of Common Shares are entitled to vote at all meetings of the shareholders of the Company either in person or by proxy. The holders of Common Shares are also entitled to dividends, if and when declared by the Board, and the distribution of the residual assets of the Company in the event of a dissolution of the Company. Any dividend unclaimed after a period of six years from the date on which it has been declared to be payable will be forfeited and revert to the Company.

All Common Shares rank equally as to all benefits which might accrue to the holders thereof, including the right to receive dividends, voting powers, and participation in assets and in all other respects, on liquidation, dissolution or winding-up of the Company, whether voluntary or involuntary, or any other disposition of the assets of the Company among its shareholders for the purpose of winding up its affairs after the Company has paid out its liabilities. The Common Shares are not subject to any call or assessment rights, any pre-emptive rights, any conversion or any exchange rights. The Common Shares are not subject to any redemption, retraction, purchase for cancellation, surrender, sinking or purchase fund provisions. Additionally, the Common Shares are not subject to any provisions permitting or restricting the issuance of additional securities and any other material restrictions or any provisions requiring a securityholder to contribute additional capital to the Company.

Warrants

In the Private Placement that closed on July 21, 2022, Warrants to purchase up to 3,551,852 Common Shares were issued. The Warrants have an exercise price of US$1.39 per Common Share, are exercisable any time after January 21, 2023 and will expire on July 21, 2027.

To date, we have not paid any dividends on the Common Shares. We do not intend to pay dividends on any of the Common Shares in the foreseeable future. In addition, we are restricted from paying dividends pursuant to certain solvency tests prescribed under the Business Corporations Act (Ontario) and in the future may be subject to contractual restrictions on the payment of dividends under certain debt instruments that we enter into. Any future payment of dividends also will depend upon our financial requirements to fund further growth, our financial condition and other factors which our board of directors may consider in the circumstances.

Purchasers of Common Shares being offered pursuant to this Prospectus may suffer immediate and substantial dilution in the net tangible book value per Common Share. Dilution in net tangible book value per share represents the difference between the amount per share paid by purchasers and the net tangible book value per share of Common Shares immediately after a purchase. The amount of dilution experienced by each purchaser of Common Shares under this Prospectus will vary, because the selling shareholders who offer and sell Common Shares covered by this Prospectus may do so at various times, at prices and at terms then prevailing or at prices related to the then current market price, or in negotiated transactions. Accordingly, the amount paid per share by each purchaser and the net tangible book value per share at the time of purchase cannot be determined at this time. Therefore, we have not included in this Prospectus information about the dilution (if any) to the public arising from these sales. See Risk Factors – “Your ownership interest will be diluted and our stock price could decline when we issue additional Common Shares.”

10

We are registering the Common Shares previously issued in the Private Placement that closed on July 21, 2022 and the Common Shares issuable upon exercise of the Warrants in the Private Placement to permit the resale of these Common Shares by the selling shareholders from time to time after the date of this Prospectus. We will not receive any of the proceeds from the sale by the selling shareholders of the Common Shares. Upon the cash exercise of the Warrants, however, we will receive the exercise price of the Warrants. We will bear all fees and expenses incident to our obligation to register the Common Shares, except for any applicable underwriting fees, discounts, selling commissions and stock transfer taxes.

Each selling shareholder and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their Common Shares covered hereby on the Nasdaq or any other stock exchange, market or trading facility on which the Common Shares are traded or in private transactions, in all cases, in compliance with applicable laws. These sales may be at fixed or negotiated prices. A selling shareholder may use any one or more of the following methods when selling Common Shares, in any case, in compliance with applicable laws:

| · | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; | |

| · | block trades in which the broker-dealer will attempt to sell the Common Shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; | |

| · | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; | |

| · | an exchange distribution in accordance with the rules of the applicable exchange; | |

| · | privately negotiated transactions; | |

| · | settlement of short sales; | |

| · | in transactions through broker-dealers that agree with the selling shareholders to sell a specified number of such Common Shares at a stipulated price per security; | |

| · | through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; | |

| · | a combination of any such methods of sale; or | |

| · | any other method permitted pursuant to applicable law. |

The selling shareholders may also sell Common Shares under Rule 144 or any other exemption from registration under the Securities Act, if available, rather than under this Prospectus, and in any event, in compliance with applicable laws.

Broker-dealers engaged by the selling shareholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling shareholders (or, if any broker-dealer acts as agent for the purchaser of Common Shares, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with applicable laws including FINRA Rule 2121; and in the case of a principal transaction a markup or markdown in compliance with FINRA Rule 2121.

In connection with the sale of the Common Shares or interests therein, the selling shareholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the Common Shares in the course of hedging the positions they assume. The selling shareholders may also sell Common Shares short and deliver these Common Shares to close out their short positions, or loan or pledge the Common Shares to broker-dealers that in turn may sell these Common Shares. The selling shareholders may also enter into option or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other financial institution of Common Shares offered by this Prospectus, which common shares such broker-dealer or other financial institution may resell pursuant to this Prospectus (as supplemented or amended to reflect such transaction).

The selling shareholders and any broker-dealers or agents that are involved in selling the Common Shares may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the Common Shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. Each selling shareholder has informed the Company that it does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute the Common Shares.

11

The Company has agreed to indemnify the selling shareholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We agreed to keep this Prospectus effective until the earlier of (i) the date on which the Common Shares may be resold by the selling shareholders without registration and without regard to any volume or manner-of-sale limitations by reason of Rule 144, without the requirement for the Company to be in compliance with the current public information under Rule 144 under the Securities Act or any other rule of similar effect, or (ii) all of the common shares have been sold pursuant to this Prospectus or Rule 144 under the Securities Act or any other rule of similar effect. The resale securities will be sold only through registered or licensed brokers or dealers if required under applicable securities laws, including applicable state securities laws. In addition, in certain states, the resale securities covered hereby may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market making activities with respect to the Common Shares for the applicable restricted period, as defined in Regulation M under the Exchange Act, prior to the commencement of the distribution. In addition, the selling shareholders will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the Common Shares by the selling shareholders or any other person. We will make copies of this Prospectus available to the selling shareholders and have informed them of the need to deliver a copy of this Prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under the Securities Act).

Once sold under the registration statement of which this Prospectus forms a part, the Common Shares will generally be freely tradable in the United States in the hands of persons other than our affiliates.

The Common Shares being offered by the selling shareholders are those previously issued to the selling shareholders in the Private Placement that closed on July 21, 2022, and those issuable to the selling shareholders, upon exercise of the Warrants issued in the Private Placement. For additional information regarding the issuances of those Common Shares and Warrants, see “Private Placement of Common Shares and Warrants” above. We are registering the Common Shares in order to permit the selling shareholders to offer such shares for resale from time to time. Except for the ownership of the Common Shares and the Warrants, the selling shareholders have not had any material relationship with us within the past three years.

The table below lists the selling shareholders and other information regarding the beneficial ownership of the Common Shares by each of the selling shareholders. The second column lists the number of Common Shares beneficially owned by each selling shareholder, based on its ownership of the Common Shares and warrants, as of August 10, 2022, assuming exercise of all Warrants held by the selling shareholders on that date, without regard to any limitations on exercise.

The third column lists the Common Shares being offered by this Prospectus by the selling shareholders.

In accordance with the terms of the Registration Rights Agreements, this Prospectus generally covers the resale of the (i) sum of the number of Common Shares issued to the selling shareholders in the Private Placement described above and (ii) the maximum number of Common Shares issuable upon exercise of the related Warrants, determined as if the outstanding Warrants were exercised in full as of the trading day immediately preceding the date the registration statement of which this Prospectus forms a part was initially filed with the SEC, each as of the trading day immediately preceding the applicable date of determination and all subject to adjustment as provided in the registration right agreement, without regard to any limitations on the exercise of the Warrants. The fourth column assumes the sale of all of the Common Shares offered by the selling shareholders pursuant to this Prospectus.

12

Under the terms of the Warrants, a selling shareholder may not exercise the Warrants to the extent such exercise would cause such selling shareholder, together with its affiliates and attribution parties, to beneficially own a number of Common Shares which would exceed, at the direction of the selling shareholder, 4.99% or 9.99%, of our then outstanding Common Shares following such exercise, excluding for purposes of such determination of Common Shares issuable upon exercise of such Warrants which have not been exercised. The number of Common Shares in the columns below do not reflect this limitation. The selling shareholders may sell all, some or none of their Common Shares in this offering. See "Plan of Distribution."

| Name of Selling Shareholder | Number of Common Shares Beneficially Owned Prior to the Offering(1) | Percentage of Common Shares Beneficially Owned Prior to the Offering(1) | Number of Common Shares Registered for Sale Hereby(1) | Number of Common Shares Beneficially Owned After the Offering(1) | Percentage of Common Shares Beneficially Owned After the Offering(1) | ||||||||||||||||

| Armistice Capital Master Fund Ltd. (2) | 4,174,293 | (3) | 12.45 | % | (4 | ) | 3,703,704 | (3) | 470,589 | 1.4 | % | ||||||||||

| Special Situations Fund III, QP, L.P. (5) | 2,779,325 | (6) | 8.29 | % | 1,882,046 | (6) | 897,279 | 2.68 | % | ||||||||||||

| Special Situations Cayman Fund, L.P. (7) | 848,418 | (8) | 2.53 | % | 559,202 | (8) | 289,216 | * | |||||||||||||

| Special Situations Technology Fund, L.P. (9) | 218,725 | (10) | * | 151,022 | (10) | 67,703 | * | ||||||||||||||

| Special Situations Technology Fund II, L.P. (11) | 1,196,858 | (12) | 3.57 | % | 807,730 | (12) | 389,128 | 1.16 | % | ||||||||||||

* Less than one percent.

| 1) | This table is based upon information supplied by the selling shareholders, which information may not be accurate as of the date hereof. We have determined beneficial ownership in accordance with the rules of the SEC. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the selling shareholders named in the table above have sole voting and investment power with respect to all Common Shares that they beneficially own, subject to applicable community property laws. Applicable percentages are based on 33,515,247 shares outstanding on August 10, 2022, adjusted as required by rules promulgated by the SEC. |

| 2) | The Common Shares are directly held by Armistice Capital Master Fund Ltd. (the “Master Fund”), a Cayman Islands exempted company, and may be deemed to be indirectly beneficially owned by Armistice Capital, LLC (“Armistice”), as the investment manager of the Master Fund; and (ii) Steven Boyd, as the Managing Member of Armistice Capital. Armistice and Steven Boyd disclaim beneficial ownership of the reported securities except to the extent of their respective pecuniary interest therein. The address of the Master Fund is c/o Armistice Capital, LLC, 510 Madison Avenue, 7th Floor, New York, NY 10022. |

| 3) | Includes 1,851,852 Common Shares and Warrants to purchase up to 1,851,852 common shares, both of which the Master Fund purchased in the Private Placement. The Warrants are subject to a 4.99% beneficial ownership limitation that prohibits the Master Fund from exercising any portion of them if, following such exercise, the Master Fund’s ownership of our Common Shares would exceed 4.99% of the total amount of our outstanding stock. |

| 4) | Does not take into account the application of the beneficial ownership limitation described in footnote 3. |

| 5) | MGP Limited Partnership is the general partner of SSFQP. David Greenhouse and Adam Stettner are the managing members of MGP Limited Partnership. The address of MGP Limited Partnership is Special Situations Fund III, QP, L.P., 527 Madison Avenue, Suite 2600, New York, NY 10022. |

| 6) | Includes 941,023 Common Shares and Warrants to purchase up to 941,023 Common Shares held by SSFQP that were purchased in the Private Placement. |

| 7) | SSCayman LLC is the general partner of Cayman. David Greenhouse and Adam Stettner are the managing members of SS Cayman LLC. The address of SSCayman LLC is c/o Special Situations Cayman Fund, L.P., 527 Madison Avenue, Suite 2600, New York, NY 10022. |

| 8) | Includes 279,601 Common Shares and Warrants to purchase up to 279,601 Common Shares held by Cayman that were purchased in the Private Placement. |

13

| 9) | SST Advisers LLC is the general partner of TECH. David Greenhouse and Adam Stettner are the managing members of SST Advisers LLC. The address of SST Advisers LLC is c/o Special Situations Technology Fund, L.P., 527 Madison Avenue, Suite 2600, New York, NY 10022. |

| 10) | Includes 75,511 Common Shares and Warrants to purchase up to 75,511 Common Shares held by TECH that were purchased in the Private Placement. |

| 11) | SST Advisers LLC is the general partner of TECH II. David Greenhouse and Adam Stettner are the managing members of SST Advisers LLC. The address of SST Advisers LLC is c/o Special Situations Technology Fund II, L.P., 527 Madison Avenue, Suite 2600, New York, NY 10022. |

| 12) | Includes 403,865 Common Shares and Warrants to purchase up to 403,865 Common Shares held by TECH II that were purchased in the Private Placement. |

Certain Canadian and United States legal matters relating to this offering will be passed upon for us by Dentons Canada LLP as to matters relating to Canadian law and by Dentons US LLP as to matters relating to United States law.

The consolidated financial statements of the Company as of December 31, 2021 and December 31, 2020 and for the years ended December 31, 2021 and December 31, 2020 appearing in the Annual Report and incorporated herein by reference, have been audited by KPMG LLP, independent registered public accounting firm, as set forth in its report thereon.

The consolidated financial statements of the Company as of December 31, 2019 and for the year ended December 31, 2019 appearing in the Company’s Annual Report, have been audited by MNP LLP, independent registered public accounting firm, as set forth in its report thereon.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

This Prospectus is part of a registration statement we filed with the SEC. This Prospectus does not contain all of the information set forth in the registration statement and the exhibits to the registration statement. For further information with respect to us and the securities being offered under this Prospectus, we refer you to the registration statement and the exhibits and schedules filed as a part of the registration statement. You should rely only on the information contained in this prospectus or incorporated by reference. We have not authorized anyone else to provide you with different information. The securities are not being offered in any jurisdiction where the offer is not permitted. You should not assume that the information in this Prospectus is accurate as of any date other than the date on the front page of this Prospectus, regardless of the time of delivery of this Prospectus or any sale of the securities offered by this Prospectus.

We are subject to the information requirements of the Exchange Act relating to foreign private issuers and applicable Canadian securities legislation and, in accordance therewith, file reports and other information with the SEC and securities regulatory authorities in Canada. Investors may read and download documents we have filed with the SEC’s Electronic Data Gathering and Retrieval system at www.sec.gov. The reports and information we file in Canada are available to the public free of charge on SEDAR at www.sedar.com.

The Company makes available free of charge its annual and current reports and other information upon request. To request such materials, please contact the Corporate Secretary at the following address or telephone number: VIQ Solutions Inc., 5915 Airport Road, Suite 700 Mississauga, Ontario L4V 1T1 Canada, Attention: Corporate Secretary; (905) 948-8266. Exhibits to the documents will not be sent, unless those exhibits have specifically been incorporated by reference in this Prospectus.

14

The Company maintains its website at https://viqsolutions.com. The Company’s website and the information contained therein or connected thereto are not incorporated into this Prospectus or the registration statement of which this Prospectus forms a part.

The following table sets forth the expenses (other than underwriting discounts and commissions or agency fees and other items constituting underwriters’ or agents’ compensation, if any) expected to be incurred by us in connection with the offering of securities registered under this registration statement as well as the securities offered and sold in the Private Placement.

| Amount To Be Paid |

|||||

| SEC registration fee | US$ | 790.22 | |||

| Legal fees and expenses | US$ | 145,125 | |||

| Accounting fees and expenses | US$ | 20,207 | |||

| Miscellaneous | US$ | 20,690 | |||

| Total | US$ | 186,812.22 | |||

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

Information has been incorporated by reference in this Prospectus from documents filed with, or furnished to, the SEC. Copies of the documents incorporated herein by reference may be obtained on request without charge upon written or oral request from our Corporate Secretary at 5915 Airport Road, Suite 700, Mississauga, Ontario L4V 1T1 Canada (telephone (905) 948-8266). Copies of these documents are also available through the Internet on the SEC’s Electronic Data Gathering and Retrieval System, which can be accessed online at www.sec.gov and at our website at https://viqsolutions.com.

The following documents, which we filed or furnished with the SEC, as applicable, are specifically incorporated by reference into, and form an integral part of, this Prospectus:

| (a) | The Company’s Annual Report on Form 20-F dated May 2, 2022 for the year ended December 31, 2021 filed with the SEC on May 2, 2022; |

| (c) | The management’s discussion and analysis of the Company for the three-months ended March 31, 2022 and 2021, included as Exhibit 99.3 to the Form 6-K furnished to the SEC on May 11, 2022; |

| (f) | The Company’s Current Report on Form 6-K furnished to the SEC on July 21, 2022; and |

All documents filed by us pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, and any document of the type referred to in the preceding paragraph, subsequent to the date of this Prospectus and prior to the termination of the offering of the securities offered by this Prospectus are incorporated by reference into this Prospectus and form part of this Prospectus from the date of filing or furnishing of these documents. We may incorporate by reference into this Prospectus any Form 6-K that is submitted to the SEC after the date of the filing of the registration statement of which this Prospectus forms a part and before the date of termination of this offering. Any such Form 6-K that we intend to so incorporate shall state in such form that it is being incorporated by reference into this Prospectus. The documents incorporated or deemed to be incorporated herein by reference contain meaningful and material information relating to us, and the readers should review all information contained in this Prospectus and the documents incorporated or deemed to be incorporated herein by reference.

15

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for the purposes of this Prospectus, to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any statement so modified or superseded shall not constitute a part of this Prospectus, except as so modified or superseded. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of such a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made.

INDEMNIFICATION FOR SECURITIES ACT

LIABILITIES

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or person controlling the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act, and will be governed by the final adjudication of such issue.

There are no governmental laws, decrees, regulations or other legislation, including foreign exchange controls, in Canada which may affect the export or import of capital or that may affect the remittance of dividends, interest or other payments to non-resident holders of the Company’s securities. Any remittances of dividends to United States residents, however, are subject to a withholding tax pursuant to the Income Tax Act (Canada). Such withholding tax may be reduced pursuant to the terms of an applicable tax treaty between Canada and the non-resident holder’s jurisdiction of residence. See “Certain Income Tax Considerations – Certain Canadian Federal Income Tax Considerations – Taxation of Dividends.”

CERTAIN INCOME TAX CONSIDERATIONS

Material income tax consequences relating to the purchase, ownership and disposition of the common shares offered by this Prospectus are summarized below. You are urged to consult your own tax advisors prior to any acquisition of our securities.

Certain Canadian Federal Income Tax Considerations

Subject to the limitations and qualifications stated herein, the following is, as of the date of this Prospectus, a fair summary of certain of the principal Canadian federal income tax considerations generally applicable under the Income Tax Act (Canada) and the regulations promulgated thereunder (collectively, the “Tax Act”) to a purchaser who acquires, as beneficial owner, Common Shares from the selling shareholders pursuant to this Prospectus and who, for purposes of the Tax Act and at all relevant times: (i) deals at arm’s length with the Company and the selling shareholders; (ii) is not affiliated with the Company or the selling shareholders, and (iii) acquires and holds the Common Shares as capital property. A holder who meets all of the foregoing requirements is referred to as a “Holder” in this summary, and this summary only addresses such Holders. Generally, the Common Shares will be considered to be capital property to a Holder provided that the Holder does not use or hold the Common Shares in the course of carrying on a business and such Holder has not acquired such Common Shares in one or more transactions considered to be an adventure or concern in the nature of trade.

16

This summary is applicable to a Holder who, for the purposes of the Tax Act and any applicable tax treaty or convention and at all relevant times: (i) is not resident or deemed to be resident in Canada, (ii) does not use or hold (and is not deemed to use or hold) the Common Shares in connection with a business carried on in Canada, and (iii) is not a “foreign affiliate”, as defined in the Tax Act, of a taxpayer resident in Canada (a “Non-Resident Holder”), and this portion of the summary only addresses such Non-Resident Holders. This part of the summary is not applicable to a Non-Resident Holder that is an insurer that carries on, or is deemed to carry on, an insurance business in Canada and elsewhere or that is an “authorized foreign bank” (as defined in the Tax Act). Such Non-Resident Holders should consult their own tax advisors.

This summary is based on the facts set out in this Prospectus, the provisions of the Tax Act in force as of the date hereof, and the administrative policies and assessing practices of the Canada Revenue Agency (the “CRA”) published in writing by the CRA and publicly available prior to the date hereof. This summary takes into account all specific proposals to amend the Tax Act publicly announced by or on behalf of the Minister of Finance (Canada) prior to the date hereof (the “Tax Proposals”) and assumes that the Tax Proposals will be enacted in the form proposed, although no assurance can be given that the Tax Proposals will be enacted in their current form or at all. This summary does not otherwise take into account or anticipate any changes in law or in the administrative policies or assessing practices of the CRA, whether by way of judicial, legislative or governmental decision or action. This summary is not exhaustive of all possible Canadian federal income tax considerations, and does not take into account other federal or any provincial, territorial or foreign income tax legislation or considerations, which may differ materially from those described in this summary.

This summary is of a general nature only and is not, and is not intended to be, and should not be construed to be, legal or tax advice to any particular Non-Resident Holder, and no representations concerning the tax consequences to any particular Non-Resident Holder are made. The tax consequences of acquiring, holding and disposing of Common Shares will vary according to the Non-Resident Holder’s particular circumstances. Non-Resident Holders should consult their own tax advisors regarding the tax considerations applicable to them having regard to their particular circumstances.

In general, for purposes of the Tax Act, all amounts relating to the acquisition, holding or disposition of the Common Shares must be converted into Canadian dollars based on the applicable exchange rate quoted by the Bank of Canada for the relevant day or such other rate of exchange that is acceptable to the CRA.

Taxation of Dividends

Dividends paid or credited or deemed to be paid or credited by the Company to a Non-Resident Holder will generally be subject to Canadian withholding tax at the rate of 25%, subject to any reduction in the rate of such withholding to which the Non-Resident Holder is entitled under an applicable income tax treaty between Canada and the country where the Non-Resident Holder is resident. For example, under the Canada-United States Tax Convention (1980), as amended (the “Canada-U.S. Treaty”), the withholding tax rate in respect of a dividend paid to a Non-Resident Holder who is the beneficial owner of the dividend and is resident in the United States for purposes of, and entitled to full benefits under, the Canada-U.S. Treaty, is generally reduced to 15%. The Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (the “MLI”), of which Canada is a signatory, affects many of Canada’s bilateral tax treaties, including the ability to claim benefits thereunder. The MLI does not apply to the Canada-U.S. Treaty. Non-Resident Holders are urged to consult their own tax advisors to determine their entitlement to relief under an applicable income tax treaty or convention.

17

Disposition of Common Shares

A Non-Resident Holder will generally not be subject to tax under the Tax Act in respect of any capital gain realized on a disposition or deemed disposition of common shares unless such shares are “taxable Canadian property” of the Non-Resident Holder at the time of disposition and the Non-Resident Holder and the capital gain is not exempt from tax in Canada under the terms of an applicable income tax treaty between Canada and the country in which the Non-Resident Holder is resident.