Form F-1/A Polyrizon Ltd.

As filed with the Securities and Exchange Commission on February 3, 2023.

Registration No. 333-266745

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 4

TO

FORM

F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Polyrizon

Ltd.

(Exact name of Registrant as specified in its charter)

Not

Applicable

(Translation of Registrant’s name into English)

| State of Israel | 2834 | Not Applicable | ||

| (State or other jurisdiction

of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

5 Ha-Tidhar Street Raanana, 4366507, Israel Tel: +972-9-93740333 |

Puglisi & Associates 850 Library Ave., Suite 204 Newark, DE 19711 Tel: (302) 738-6680 | |

| (Address, including zip code, and telephone number, | (Name, address, including zip code, and telephone | |

| including area code, of registrant’s principal executive offices) | number, including area code, of agent for service) |

| Copies to: | ||||

David Huberman, Esq. |

Keren

Arad-Leibovitz, Adv. Keren Law Firm 5th Floor, Toyota Tower (A) 65 Yigal Alon Street Tel Aviv, Israel Tel: +972.544.275177 |

Darrin

M. Ocasio, Esq. Avital Perlman, Esq. Sichenzia Ross Ference LLP 1185 Avenue of the Americas, 31st Floor New York, NY 10036 Tel: 212.930.9700 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date hereof.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards † provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Registration Statement contains two prospectuses, as set forth below.

| ● | Public Offering Prospectus. A prospectus to be used for the initial public offering of up to 1,350,000 units, or Units, each consisting of one ordinary share, or Ordinary Share, and three warrants, each to purchase one Ordinary Share, or each a Warrant, and up to 1,350,000 pre-funded units, or Pre-Funded Units, each consisting of one pre-funded warrant to purchase one Ordinary Share and three Warrants, each to purchase one Ordinary Share, of the registrant (the “Public Offering Prospectus”) through the underwriter named in the Underwriting section of the Public Offering Prospectus. |

| ● | Resale Prospectus. A prospectus to be used for the potential resale by the Selling Shareholders of up to 1,858,803 Ordinary Shares of the registrant held by them and/or issuable to them, collectively, that are not being sold pursuant to the Public Offering Prospectus (the “Resale Prospectus”). |

The Resale Prospectus is substantively identical to the Public Offering Prospectus, except for the following principal points:

| ● | they contain different front covers; |

| ● | all references in the Public Offering Prospectus to “this offering” will be changed to “the IPO,” defined as the underwritten initial public offering of our Units, in the Resale Prospectus; |

| ● | all references in the Public Offering Prospectus to “underwriter” will be changed to “underwriter of the IPO” in the Resale Prospectus; |

| ● | they contain different “Use of Proceeds” sections; |

| ● | they contain different “Summary — The Offering” sections; |

| ● | the section “Shares Eligible For Future Sale — Selling Shareholders Resale Prospectus” from the Public Offering Prospectus is deleted from the Resale Prospectus; |

| ● | the “Underwriting” section from the Public Offering Prospectus is deleted from the Resale Prospectus and a “Plan of Distribution” section is inserted in its place; |

| ● | the “Legal Matters” section in the Resale Prospectus deletes the reference to counsel for the underwriter; and |

| ● | they contain different back covers. |

The Registrant has included in this Registration Statement a set of alternate pages after the back cover page of the Public Offering Prospectus (the “Alternate Pages”) to reflect the foregoing differences in the Resale Prospectus as compared to the Public Offering Prospectus. The Public Offering Prospectus will exclude the Alternate Pages and will be used for the public offering by the registrant. The Resale Prospectus will be substantively identical to the Public Offering Prospectus except for the addition or substitution of the Alternate Pages and will be used for the resale offering by the Selling Shareholders of the balance of their Ordinary Shares that are not being sold pursuant to the Public Offering Prospectus.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, | DATED FEBRUARY 3, 2023 |

1,350,000 Units

Each Consisting of One Ordinary Share

and Three Warrants, each to Purchase One Ordinary Share

1,350,000 Pre-Funded Units Each Consisting

of

One Pre-Funded Warrant to Purchase One Ordinary Share and

Three Warrants, Each to Purchase One Ordinary Share

Polyrizon Ltd.

This is the initial public offering of Polyrizon Ltd. We are offering 1,350,000 units, or Units, each consisting of one of our ordinary shares, no par value per share, or Ordinary Shares, and three warrants, each to purchase one of our Ordinary Shares, or each, a Warrant. We anticipate that the initial public offering price per Unit will be between $5.20 and $7.20 and the assumed exercise price of each Warrant included in the Unit will be $5.825 (based on an assumed public offering price of $6.20 per Unit, the midpoint of the price range of the Units) per Ordinary Share (with such exercise price equal to the public offering price per Unit less $0.125 per Warrant included in the Unit). The Units have no stand-alone rights and will not be certificated or issued as stand-alone securities. The Ordinary Shares and Warrants are immediately separable and will be issued separately in this offering. The Warrants offered hereby will be immediately exercisable on the date of issuance and will expire five years from the date of issuance.

We are also offering to those purchasers, if any, whose purchase of Units in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% of our outstanding Ordinary Shares immediately following the consummation of this offering, the opportunity to purchase, if they so choose, up to 1,350,000 pre-funded units, or, each, a Pre-Funded Unit, in lieu of the Units that would otherwise result in ownership in excess of 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding Ordinary Shares, with each Pre-Funded Unit consisting of a pre-funded warrant to purchase one Ordinary Share and three Warrants, each to purchase one Ordinary Share. The purchase price of each Pre-Funded Unit will equal the price per Unit, minus $0.001, and the exercise price of each Pre-Funded Warrant included in the Pre-Funded Unit will be $0.001 per Ordinary Share. The Pre-Funded Units have no stand-alone rights and will not be certificated or issued as stand-alone securities. The Pre-Funded Warrants and Warrants are immediately separable and will be issued separately in this offering. There can be no assurance that we will sell any of the Pre-Funded Units being offered. The Pre-Funded Warrants offered hereby will be immediately exercisable and may be exercised at any time until exercised in full.

For each Pre-Funded Unit we sell, the number of Units we are offering will be decreased on a one-for-one basis. Because we will issue three Warrants as part of each Unit or Pre-Funded Unit, the number of Warrants sold in this offering will not change as a result of a change in the mix of the Units and Pre-Funded Units sold.

We have applied to list our Ordinary Shares and our Warrants on The Nasdaq Capital Market, or Nasdaq, under the symbol “PLRZ” and “PLRZW”, respectively. It is a condition to the closing of this offering that our Ordinary Shares and Warrants shall have been approved for listing on Nasdaq. We do not intend to apply to list the Pre-Funded Warrants on any securities exchange or other nationally recognized trading system.

We are both an emerging growth company, as defined in the Jumpstart Our Business Startups Act of 2012 (or the JOBS Act), and a “foreign private issuer,” as defined under the U.S. federal securities law and are subject to reduced public company reporting requirements. See “Prospectus Summary – Implications of Being an Emerging Growth Company and Foreign Private Issuer” for additional information.

In addition, we have registered an aggregate of 1,858,803 Ordinary Shares for resale by certain shareholders, or the Selling Shareholders, by means of a separate prospectus. Other than certain affiliates of the registrant that have entered into lock-up agreements with the underwriter, the Selling Shareholders are not subject to any lock-up or leakage agreements and have the right to sell the shares being registered hereby at any time. We will pay the expenses associated with the sale of the Ordinary Shares by the Selling Shareholders pursuant to this prospectus. Our registration of the Ordinary Shares by the Selling Shareholders covered by this prospectus does not mean that the Selling Shareholders will issue, offer or sell, as applicable, any of the Ordinary Shares. The Selling Shareholders may offer and sell the Ordinary Shares covered by this prospectus in a number of different ways and at varying prices. We provide more information in the section entitled “Plan of Distribution.”

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 14.

Neither the Securities and Exchange Commission (or the SEC) nor any state or other foreign securities commission has approved nor disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Unit | Per Pre-Funded Unit | Total | ||||||||||

| Public offering price | $ | $ | $ | |||||||||

| Underwriting discounts and commissions (1) | $ | $ | $ | |||||||||

| Proceeds to us (before expenses) (2) | $ | $ | $ |

| (1) | Does not include a non-accountable expense allowance equal to 1.0% of the initial public offering price payable to the underwriter. In addition, we have agreed to issue warrants to the underwriter, or the Underwriter Warrants, in an amount equal to 6% of the aggregate number of Ordinary Shares sold in this offering, but excluding the shares sold through the exercise of the over-allotment option). See the section titled “Underwriting” beginning on page 146 of this prospectus for additional disclosure regarding underwriter compensation and offering expenses. |

| (2) | Does not include proceeds from the exercise of the Warrants or Underwriter Warrants or Pre-Funded Warrants in cash, if any. |

We have granted the underwriter an option to purchase from us, up to an additional 202,500 Ordinary Shares and/or up to an additional 607,500 Warrants and/or up to an additional 202,500 Pre-Funded Warrants, within 45 days from the date of this prospectus to cover over-allotments, if any. The purchase price to be paid per additional Ordinary Share or Pre-Funded Warrant will be equal to the public offering price of one Unit or Pre-Funded Unit (less the $0.01 purchase price allocated to each Warrant), as applicable, less the underwriting discounts and commissions. The underwriter may exercise the over-allotment option with respect to the Ordinary Shares, Pre-Funded Warrants or Warrants only, or any combination thereof. If the underwriter exercises the option in full, the total underwriting discounts and commissions and management fees payable will be $770,040 and the total proceeds to us, before expenses, will be $8,855,460.

The underwriter expects to deliver the Ordinary Shares on or about , 2023.

Sole Book-Running Manager

Aegis Capital Corp.

The date of this prospectus is , 2023.

TABLE OF CONTENTS

i

Neither we, the Selling Shareholders nor the underwriter have authorized anyone to provide you with information that is different from that contained in this prospectus, any amendment or supplement to this prospectus, or in any free writing prospectus we may authorize to be delivered or made available to you. Neither we, the Selling Shareholders nor the underwriter take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We, the Selling Shareholders and the underwriter are offering to sell Ordinary Shares and seeking offers to purchase Ordinary Shares only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date on the front of this prospectus, regardless of the time of delivery of this prospectus or any sale of Ordinary Shares. Our business, financial condition, results of operations and prospects may have changed since the date on the front cover of this prospectus.

Through and including , 2023 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

Neither we, the Selling Shareholders nor any of the underwriter have taken any action to permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

Capture and Contain and Trap and Target are trademarks of ours that we use in this prospectus. This prospectus also includes trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, our trademarks and tradenames referred to in this prospectus often appear without the ® or ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or the right of the applicable licensor to our trademark and tradenames.

The terms “shekel,” “Israeli shekel” and “NIS” refer to New Israeli Shekels, the lawful currency of the State of Israel, and the terms “dollar,” “U.S. dollar” or “$” refer to United States dollars, the lawful currency of the United States of America. All references to “shares” in this prospectus refer to Ordinary Shares of Polyrizon Ltd., no par value per share.

On September 29, 2022, the Company effected (i) a reverse stock split of our issued and outstanding shares at a ratio of one-for-8.80, pursuant to which holders of our shares received one Ordinary Share for every 8.80 Ordinary Shares held, (ii) cancelled the par value of our Ordinary Shares and Preferred Shares, and (iii) increased its authorized share capital to 19,752,250 Ordinary Shares. Unless the context expressly dictates otherwise, all references to share and per share amounts referred to herein reflect the reverse stock split.

On December 19, 2022, following shareholder approval at an extraordinary general shareholders meeting, the Company effected the issuance of 858,148 bonus shares (equivalent to a forward share split at a ratio of 1.25-for-1), or the Forward Share Split. The authorized share capital of the Company was increased to facilitate the Forward Share Split. Unless the context expressly dictates otherwise, all references to share and per share amounts referred to herein reflect the Forward Share Split.

MARKET, INDUSTRY AND OTHER DATA

This prospectus contains estimates, projections and other information concerning our industry, our business, and the markets for our product candidates. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. Unless otherwise expressly stated, we obtained this industry, business, market and other data from our own internal estimates and research as well as from reports, research surveys, studies and similar data prepared by market research firms and other third parties, industry, medical and general publications, government data and similar sources.

In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Special Note Regarding Forward-Looking Statements.”

ii

This summary highlights selected information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before deciding to invest in our securities, you should read this entire prospectus carefully, including the sections of this prospectus entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the related notes included elsewhere in this prospectus. Unless the context otherwise requires, references in this prospectus to the “company,” “Polyrizon,” “we,” “us,” “our” and other similar designations refer to Polyrizon Ltd.

Company Overview

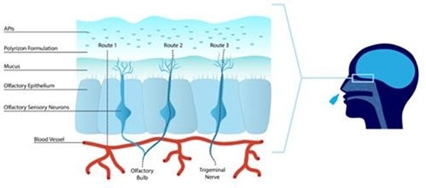

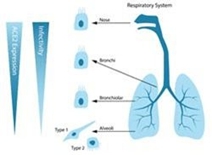

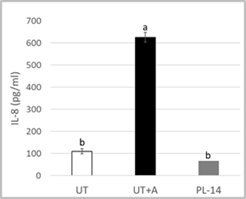

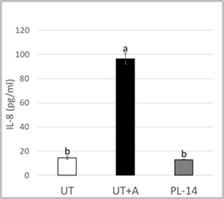

We are a development stage biotech company specializing in the development of innovative medical device hydrogels delivered in the form of nasal sprays, which form a thin hydrogel-based shield containment barrier in the nasal cavity that can provide a barrier against viruses and allergens from contacting the nasal epithelial tissue. Our proprietary Capture and Contain TM, or C&C, hydrogel technology, comprised of a mixture of naturally occurring building blocks, is delivered in the form of nasal sprays, and potentially functions as a “biological mask” with a thin shield containment barrier in the nasal cavity. We are further developing certain aspects of our C&C hydrogel technology such as the bioadhesion and prolonged retention at the nasal deposition site for intranasal delivery of drugs. We refer to our additional technology, which is in an earlier stage of pre-clinical development, that is focused on nasal delivery of active pharmaceutical ingredients, or APIs, as Trap and Target ™, or T&T.

Our Product Candidates

Our nasal hydrogels have been designed to serve as a non-invasive and fast-acting system. The hydrogels are formulated as an innovative mixture of mucoadhesive polymers (e.g., sodium alginate) which are Generally Recognized as Safe, or GRAS, by the Federal Drug Administration, or the FDA. Our mucoadhesive polymers derived from seaweed polysaccharides possess promising features as they are renewable, biodegradable, biocompatible, and environment friendly. The formulated hydrogel is sprayed into the nose to create a physical barrier with long-lasting adhesion to the mucosal membranes. Our polymers have an atomic mass much higher than the upper cell penetration limit, the polymers will simply lay on top of the cells and act as a physical barrier to viruses and allergens from contacting the nasal epithelial tissue, as opposed to penetrating the cells and causing a chemical reaction. Therefore, the C&C product candidates are not expected to be considered as drugs by the FDA but as medical devices.

Our leading technologies are C&C and T&T. The C&C technology is a containment barrier against a wide range of allergen particulates and viruses.

PL-14 – Nasal Allergies Blocker

| o | We expect our PL-14 C&C technology medical device product candidate, or our PL-14 product candidate, to be regulated as a Class II medical device by the FDA under its 510(k) pathway. |

| o | Our PL-14 product candidate is scheduled to initiate preclinical safety trials in the third quarter of 2023. In addition, pivotal clinical trial on our PL-14 product candidate is expected to commence in the second quarter of 2024, following which we plan to submit a 510(k) application for FDA clearance. |

| o | For our PL-14 technology product candidate, we will pursue the 510(k) pathway which requires a manufacturer to demonstrate substantial equivalence to an FDA-cleared device (i.e., predicate device) to a subject device (i.e., our product candidate). This process for clearing our device with the FDA entails performing a medical device analysis of the product candidates (e.g., PL-14 product candidate) description, operational principle, potential accessories and proposed intended use, for the purpose of identifying a predicate device that has already been cleared by the FDA. Through this review, we found three possible predicate devices for establishing substantial equivalence, Alzair Allergy Blocker (510(k) Number: K170848), or Alzair, NASAL EASE ALLERGY BLOCKER (510(k) Number: K132520), or Nasalease, and Bentrio Allergy Blocker (510(k) Number: K213114), or Bentrio. There is no guarantee that our PL-14 product candidate will advance in the FDA 510(k) process at the same rate as the aforementioned predicate devices or will reach commercialization. |

1

| o | The estimated timeline for obtaining 510(k) clearance for our PL-14 product candidate is based on the estimated time needed for the following activities: (i) GMP manufacturing of our clinical trial materials, which usually requires 9-12 months; (ii) biocompatibility preclinical studies, which usually requires 3-6 months (although these studies may be performed concurrently with the GMP manufacturing mentioned above); (iii) clinical trials, which usually requires 6-12 months; and (iv) FDA submission and clearance, which usually requires 3-12 months. Regarding FDA submission and clearance, generally 510(k) applicants can expect submission acceptance review decisions within 15 calendar days, substantive review decisions within 60 days, and final decisions within 90 days. However, the FDA’s time of review does not include time on “hold”, which includes any time spent by us responding to any FDA information requests, meaning that the total timeframe of the review process could take longer than anticipated. In the case of our predicate devices for our PL-14 product candidate, Alzai, Nasalese, and Bentrio, the FDA submission and clearance process took 86 and 140 days, respectively. For additional information, please see “Business – FDA clearance plan for our C&C product candidates.” |

PL-15 – COVID-19 and PL-16 – Influenza Blockers

| o | We expect our PL-15 C&C technology medical device product candidate, or our PL-15 product candidate, and our PL-16 C&C technology medical device product candidate, or our PL-16 product candidate, which provide a barrier to COVID-19 and influenza from contacting the nasal epithelial tissue, respectively, to be regulated as a Class II medical device under a De Novo Classification request. For the clinical studies planned for PL-15 & PL-16 which will include human subjects; the Investigational Device Exemptions (IDE) regulation describes three types of device studies: significant risk (SR), nonsignificant risk (NSR), and exempt studies. During the first quarter following the closing of this offering, the company intends to schedule a pre-submission meeting with the FDA to determine the IDE regulation type of device studies for PL-15 & PL-16. Our proposed 12-month interval from the scheduled FDA pre-sub meeting to the planned IDE clinical trial initiation should provide ample time to fulfill the necessary tasks for the IDE filing, such as 1) reporting previous studies to support the IDE, 2) preparing IDE required design and manufacturing control documentation, 3) conducting bench and biocompatibility tests to support safety of the device prior to starting the a human study, and 4) obtaining clinical protocol and ethics committee approvals as well as FDA IDE approval to start the clinical trial. Once IDE has been initiated, Polyrizon will comply with FDA Guidance “Changes or Modifications During the Conduct of a Clinical Investigation”, 2001. |

| o | Our PL-15 product candidate is scheduled to initiate preclinical safety trials in the third quarter of 2023, subject to securing additional financing, feasibility clinical trials in the first quarter of 2025 and pivotal clinical trials in the second quarter of 2025. Following these trials, we plan to submit De Novo Classification requests for each product candidate. Our PL-16 product candidate is schedules to initiate preclinical safety trials in the third quarter of 2023, feasibility clinical trials in the second quarter of 2024 and, subject to securing additional financing, pivotal clinical trials in the first quarter of 2025. Following these trials, we plan to submit De Novo Classification requests for each product candidate. |

| o | Upon a review similar to the one performed for our PL-14 product candidate, we found that there were no potential predicate devices in the FDA’s database matching the proposed intended uses of our PL-15 and PL-16 product candidates. Because of this, we will pursue a De Novo Classification request for each product candidate. This pathway involves demonstrating that the product candidates provide a reasonable assurance of safety and effectiveness. During the first quarter following the closing of this offering, we intend to submit a Q-submission (Pre-submission) for each product candidate and request a pre-submission meeting with FDA’s Center for Devices and Radiological Health, or CDRH, to confirm the potential for this regulatory path. For more information, please see “Business – Our Product Candidates – The determination process for the C&C product candidates as a Class II medical devices.” |

| o | The estimated timeline for marketing authorization via De Novo Classification grant for our PL-15 and PL-16 product candidates is based on taking similar steps as the steps described above for obtaining 510(k) clearance for our PL-14 product candidate. We estimate a longer period of time for the entire grant process for each of these product candidates due to possibly extended clinical trials requested by the FDA and also due to a longer review timeframe. For additional information, please see “Business – FDA clearance plan for our C&C product candidates.” |

In the event the FDA does not agree with our regulatory assessments regarding the C&C product candidates (510(k) for our PL-14 product candidate, and Class II De Novo pathway for our PL-15 and PL-16 product candidates), it may require us to go through a lengthier, more rigorous examination than we had expected (such as Premarket approval, or PMA, which is the FDA process of scientific and regulatory review to evaluate the safety and effectiveness of Class III medical devices. If we are required to pursue a PMA, the introduction of our product candidates into the market could be delayed significantly. For more information, please see “Risks Related to the Discovery, Development and Clinical Testing of Product Candidates.”

Trap and Target ™ Product Candidates

In contrast to our C&C product candidates, the hydrogel in our T&T product candidates is formulated differently in order to provide for sustained release of the API. The content of the hydrogel (quantity and quality) in the T&T product candidates is formulated differently than the content of C&C product candidates, and therefore enable different functions: physical barrier for the C&C product candidates and API sustained release for the T&T product candidates. It is through these differences that we rationalize the different regulatory treatment of our C&C and T&T product candidates.

2

The T&T platform technology is designed to allow a long residence time and an intimate contact with the mucosal tissue for a targeted delivery of medicines. We expect that our T&T platform product candidates will be regulated as a combination-product consisting of a nasal sprayer and formulation consisting of a hydrogel and a generic API, which we intend to pursue under the FDA’s 505(b)(2) pathway. We aim to conduct feasibility studies for our T&T platform product candidates with corticosteroids, benzodiazepines and naloxone, beginning in the second quarter of 2023 through the second quarter of 2024. Pre-clinical studies will follow and are expected to begin in the second quarter of 2024. Phase I clinical trials for each of the three product candidates of the T&T technology are planned for the fourth quarter of 2025, subject to securing additional financing.

People

Our leadership team has a vast industry experience. Each of our executive management team has over 15 years (on average) of experience in life science companies, which includes extensive work history in the area of research and development of medical devices, pharmaceutical and other drug compounds. Our board of directors have similar experience in the life sciences industry as well as strong financial background that is derived from their roles as executives of publicly-traded companies and having educational backgrounds in finance, business, tax and accounting. We believe that these aforementioned practical and educational experiences of our group will strongly contribute to a successful path from clinical development, regulatory approvals and commercialization of our product candidates. In addition, our management is supported by our Scientific Advisory Board which is an advisory panel of professors with expertise in drug delivery systems, chemistry and pharmaceuticals.

Market Opportunities

We believe that our technologies have the potential to provide solutions to a broad range of unmet needs in the healthcare market. With our C&C technology, we aim to introduce solutions to address common medical and public health challenges, such as allergic rhinitis and nasal viral infections, including COVID-19.

With our T&T technology, we aim to address challenges in the markets of: allergic and non-allergic rhinitis by local intranasal delivery of corticosteroids; for systemic delivery of central nervous system, or CNS, related drugs for the growing markets of combatting opioid overdose using intranasal naloxone, and benzodiazepines for seizure clusters.

Recent Developments

SciSparc Collaboration

On May 30, 2022, we entered into a collaboration agreement with SciSparc Ltd., or SciSparc (Nasdaq: SPRC), a specialty clinical-stage pharmaceutical company focusing on the development of therapies to treat disorders of the central nervous system. As part of the collaboration, we will work with SciSparc to develop a unique technology for the treatment of pain, based on SciSparc's SCI-160 platform and our T&T platform technology.

The

collaboration shall be in effect for an unlimited period of time until terminated. Under the collaboration agreement, SciSparc will pay

development fees to us of up to a total of $2,550,000 subject to the completion of certain milestones. To date, no payments have been

made pursuant to the collaboration. In addition, SciSparc will pay us a royalty fees in an amount equal to 3.25% of

net income actually received on products developed under the collaboration and sold by SciSparc, and will also pay a 35% royalty fee

on income actually received from any sublicensee of SciSparc who sells the products. The agreement can be terminated at any time by either

party with prior written notice of at least 60 days and may also be terminated by either party within 7 days as a result of certain breaches

of the agreement. Certain clauses under the agreement, including the royalty clause and the license clause shall withstand the termination

of the agreement.

3

NurExone Collaboration

On July 18, 2022, we signed a collaboration agreement with NurExone Biologic Inc., or NurExone, pursuant to which we will use our T&T platform technology to develop formulations, conduct analytical development and produce technical batches of a tailored intranasal delivery system. The intranasal system is being designed for delivery of NurExone’s ExoTherapy to patients with traumatic spinal cord injuries and may also be relevant to other indications through intranasal exosome delivery. The collaboration shall be in effect for an unlimited period of time until terminated by either party. The agreement may be terminated at any time by either party upon delivering prior written notice of at least 90 days, and may also be terminated by either party within 7 days as a result of certain breaches of the agreement. Certain clauses under the agreement, including the royalty clause and the license clause shall withstand the termination of the agreement.

Pursuant to the collaboration agreement, NurExone will pay the costs of the formulation development in an estimated amount of $220,000 in three installments, subject to certain development milestones. We expect to be able to perform a biological efficacy study of the intranasal system within three quarters. NurExone shall pay development fees to us of up to a total of $3,350,000 subject to the completion of certain milestones, including the payment of an aggregate of $500,000 upon successful completion of a Phase 2 clinical trial. To date, we have received approximately $76,000 pursuant to the collaboration agreement. Moreover, NurExone shall pay the following royalties based on any product sales resulting from the collaboration agreement: (i) a 2.25% royalty for sales of products by NurExone that generate an income between $50,000 and $2,500,000, (ii) a 2.75% royalty for sales of products by Nurexone that generate an income between $2,500,000 and $10,000,000, and (iii) a 3.25% royalty for sales of products by NurExone that generate an income greater than $10,000,000. Any products sold by a sublicensee of Nurexone will be subject to a 35% royalty fee. In advanced stages of the collaboration, we may assist NurExone with regulatory submissions for the United States and Europe. Manufacturing and marketing rights for formulations under the collaboration agreement are exclusive to NurExone.

Recent Financing

In addition, in January 2022, June 2022 and August 2022, we signed Simple Agreements for Future Equity, or the 2022 SAFEs, with several existing investors of the Company, or the SAFE Investors for an aggregate amount of approximately $719,000. Pursuant to the terms of the 2022 SAFEs, upon consummation of a Qualified Equity Financing (which is defined as at least $300,000 aggregate proceeds), we will issue to each SAFE Investor the number of most senior class of shares issued in the Qualified Equity Financing equal to the Investment Amount divided by the discount price (which is defined as the lowest price per SAFE share sold in the Equity Financing discounted by to 20%). In addition, the right to receive SAFE shares shall also include the right to receive warrants or other convertible instruments granted to the investors in the Equity Financing, if granted. The 2022 SAFEs provide that, immediately prior to the closing of an initial public offering of the Company, the number of ordinary shares issuable to each SAFE Investor is equal to the purchase amount of each 2022 SAFE divided by the price per share determined by the Company and the underwriter in the initial public offering. The 2022 SAFEs will automatically expire and terminate upon the earliest to occur of either (i) the issuance of SAFE shares pursuant to (A) a Qualified Equity Financing, (B) an optional conversion in a financing that is not a Qualified Equity Financing, (C) a change of control of the Company, (D) a public offering or (E) a mandatory conversion if the Investment Amount has not been converted prior to July 31, 2023 and (ii) the payment, or setting aside for payment, of amounts due to the SAFE Investors following a dissolution event, excluding a change of control, of the Company. Accordingly, upon the closing of this offering, in addition to issuing to each SAFE Investor Ordinary Shares, we will also issue to each SAFE Investor three SAFE Warrants, each to purchase one Ordinary Share at an exercise price of $5.825 (based on an assumed public offering price of $6.20 per Unit, the midpoint of the price range of the Units) per Ordinary Share (with such exercise price equal to the public offering price per Unit less $0.125 per Warrant included in the Unit), or the SAFE Warrants. Upon the completion of this offering, we expect to issue Ordinary Shares upon the automatic conversion of the SAFEs.

Corporate Information

We are an Israeli corporation based in Israel near Raanana, and were incorporated in January 2005. Our principal executive offices are located at 5 Ha-Tidhar Street, Raanana, 4366507, Israel. Our telephone number is +972-9-93740333. Our website address is www.polyrizon-biotech.com. The information contained on our website and available through our website is not incorporated by reference into and should not be considered a part of this prospectus, and the reference to our website in this prospectus is an inactive textual reference only.

4

Summary of Risks Associated with our Business

Our business is subject to a number of risks of which you should be aware before a decision to invest in our Ordinary Shares. You should carefully consider all the information set forth in this prospectus and, in particular, should evaluate the specific factors set forth in the sections titled “Risk Factors” before deciding whether to invest in our Ordinary Shares. Among these important risks are, but not limited to, the following:

Risks Related to Our Financial Condition and Capital Requirements

| ● | We have incurred significant losses since our inception. We anticipate that we will continue to incur significant losses for the foreseeable future. We have never generated any revenue from product candidates sales and may never be profitable. | |

| ● | We expect that we will need to raise substantial additional funding, which may not be available on acceptable terms, or at all. Failure to obtain funding on acceptable terms and on a timely basis may require us to curtail, delay or discontinue our product candidates development efforts or other operations. |

Risks Related to the Discovery, Development and Clinical Testing of Product Candidates

| ● | We depend on enrollment of patients in our upcoming clinical trials in order to continue development of our product candidates. | |

| ● | We may not receive, or may be delayed in receiving, the necessary clearances or approvals for our product candidates, failure to timely obtain necessary clearances or approvals would adversely affect our ability to grow our business. |

| ● | We do not plan to conduct a pre-submission meeting with the FDA’s CDRH to confirm the potential for the Class II medical device path under a de novo classification request for our PL-15 and PL-16 products until after the completion of this initial public offering. If we are denied submission under the de novo pathway, it may require us to go through a different pathway, such as a PMA pathway, which may result in a lengthier approval process for our devices. |

| ● | Legislative or regulatory reforms in the United States or the European Union may make it more difficult and costly for us to obtain regulatory clearances or approvals for our product candidates or to manufacture, market or distribute our product candidates after clearance or approval is obtained. | |

| ● | We are heavily dependent on the success of our C&C product candidates. |

| ● | Regulatory approval processes of the FDA, EMA and comparable foreign regulatory authorities are lengthy, time-consuming and unpredictable, if we are unable to obtain regulatory clearances, grants and approvals, our business may fail. |

| ● | If the FDA does not conclude that our T&T platform product candidate satisfies the requirements under Section 505(b)(2) of the Federal Food, Drug and Cosmetic Act, or FFDCA, or Section 505(b)(2), or if we are unable to utilize the hybrid application pathway in the European Union, or if the requirements are not as we expect, the approval pathway for our T&T platform product candidates will likely take significantly longer, cost significantly more and entail significantly greater complications and risks than anticipated, and in either case may not be successful. | |

| ● | Our C&C and T&T technologies are novel technologies, which makes it difficult to accurately and reliably predict the time and cost of development and regulatory approval. | |

| ● | As an organization, we have not previously conducted pivotal clinical trials, and we may be unable to do so for any product candidates we may develop, including our T&T platform product candidates. |

| ● | We may find it difficult to enroll patients in our clinical trials due to various reasons, including possible disruption due to the COVID-19 pandemic, which could delay or prevent us from proceeding with such trials. | |

| ● | Our product candidates and the administration of our product candidates may cause undesirable side effects or have other properties that could delay or prevent their regulatory approval. | |

| ● | We may be subject, directly or indirectly, to U.S. federal and state healthcare fraud and abuse laws, false claims laws, physician payment transparency laws and health information privacy and security laws. If we are unable to comply, or have not fully complied, with such laws, we could face substantial penalties. | |

| ● | We face intense competition in an environment of rapid technological change, which may adversely affect our financial condition and our ability to successfully market or commercialize our product candidates. | |

| ● | The misuse or off-label use of our product candidates may harm our reputation in the marketplace, result in injuries that lead to product candidates liability suits or result in costly investigations, fines or sanctions by regulatory bodies if we are deemed to have engaged in the promotion of these uses, any of which could be costly to our business. |

5

Risks Related to our Reliance on Third Parties

| ● | We will rely on third parties to conduct certain elements of our preclinical studies and clinical trials and perform other tasks for us. If these third parties do not successfully carry out their contractual duties, meet expected deadlines or comply with regulatory requirements, we may not be able to obtain regulatory approval for or commercialize our product candidates. |

| ● | Independent clinical investigators and contract research organizations, or CROs, that we will engage to conduct our clinical trials may not devote sufficient time or attention to our clinical trials or be able to repeat their past success. |

| ● | We rely on third parties to manufacture the raw materials that we use to create our product candidates. Our business could be harmed if existing and prospective third parties fail to provide us with sufficient quantities of these materials and product candidates or fail to do so at acceptable quality levels or prices. |

Risks Related to Our Intellectual Property

| ● | If we are unable to obtain and maintain effective patent rights for our product candidates or any future product candidates, we may not be able to compete effectively in our markets. If we are unable to protect the confidentiality of our trade secrets or know-how, such proprietary information may be used by others to compete against us. |

| ● | Changes in patent policy and national intellectual property laws could increase the uncertainties and costs surrounding the prosecution of our patent applications and the enforcement or defense of any issued patents. |

| ● | We may be involved in lawsuits to protect or enforce our intellectual property, which could be expensive, time consuming and unsuccessful. |

| ● | We may be subject to claims that our employees, consultants, or independent contractors have wrongfully used or disclosed confidential information of third parties or that our employees have wrongfully used or disclosed alleged trade secrets of their former employers, and we may be subject to claims challenging the inventorship of our intellectual property. |

Risks Related to Our Business Operations

| ● | Our business, operations and financial performance have been and may continue to be impacted by the COVID-19 pandemic. |

| ● | We will need to expand our organization, and we may experience difficulties in managing this growth, which could disrupt our operations. |

| ● | Due to our limited resources and access to capital, we must, and have in the past decided to, prioritize development of certain product candidates over other potential candidates. These decisions may prove to have been wrong and may adversely affect our revenues. |

| ● | We may not be successful in our efforts to identify, discover or license additional product candidates. |

| ● | Our employees and independent contractors may engage in misconduct or other improper activities, including noncompliance with regulatory standards and requirements. |

| ● | Under applicable employment laws, we may not be able to enforce covenants not to compete and therefore may be unable to prevent our competitors from benefiting from the expertise of some of our former employees. |

6

Risks Related to Commercialization of Our Product Candidates

| ● | We currently have no marketing and sales organization. If we are unable to establish marketing and sales capabilities, or enter into agreements with third parties to market and sell our product candidates, we may be unable to generate any product candidates revenue. |

| ● | We are subject to significant regulatory oversight with respect to manufacturing our product candidates. Delays in establishing and obtaining regulatory approval of our manufacturing process may delay or disrupt our product candidates development and commercialization efforts. |

| ● | If we receive marketing approval for our product candidates, sales will be limited unless the product candidates achieves broad market acceptance. |

| ● | It may be difficult for us to profitably sell our product candidates if coverage and reimbursement for these product candidates is limited by government authorities and/or third-party payor policies. |

| ● | Our business entails a significant risk of clinical trial and/or product candidates liability and our ability to obtain sufficient insurance coverage could have a material effect on our business, financial condition, results of operations or prospects. |

Risks Related to this Offering and Ownership of Our Securities

| ● | Our executive officers, directors and principal shareholders will maintain the ability to exert significant control over matters submitted to our shareholders for approval. |

| ● | If we are determined to be a passive foreign investment company, or PFIC, U.S. taxpayers would be subject to certain adverse U.S. federal income tax rules. |

7

| ● | If a United States person is treated as owning at least 10% of our shares, such holder may be subject to adverse U.S. federal income tax consequences. |

| ● | As a foreign private issuer, we intend to follow certain home country corporate practices instead of Nasdaq requirements, and we will not be subject to certain U.S. securities laws. |

| ● | We are an emerging growth company and the reduced disclosure requirements applicable to emerging growth companies may make our Ordinary Shares less attractive to investors. |

| ● | Certain recent initial public offerings of companies with public floats comparable to the anticipated public float of Polyrizon have experienced extreme volatility that was seemingly unrelated to the underlying performance of the respective company. |

Risks Related to Israeli Law and Our Operations in Israel

| ● | Our headquarters and other significant operations are located in Israel, and, therefore, our results may be adversely affected by political, economic and military instability in Israel. |

| ● | It may be difficult to enforce a judgment of a U.S. court against us and our executive officers and directors in Israel, to assert U.S. securities laws claims in Israel or to serve process on us. |

| ● | Your rights and responsibilities as a shareholder will be governed in key respects by Israeli laws, which differs from U.S. companies. |

Implications of Being an “Emerging Growth Company” and a Foreign Private Issuer

Emerging Growth Company

As a company with less than $1.07 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. In particular, as an emerging growth company, we:

| ● | may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations disclosure in our initial registration statement; |

| ● | are not required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives, which is commonly referred to as “compensation discussion and analysis”; |

| ● | are not required to obtain a non-binding advisory vote from our shareholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on frequency” and “say-on-golden-parachute” votes); |

| ● | will not be required to conduct an evaluation of our internal control over financial reporting; |

| ● | are exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and chief executive officer pay ratio disclosure; and |

| ● | an exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002. |

8

We may take advantage of these provisions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company upon the earlier to occur of: (1) the last day of the fiscal year in which we have total annual gross revenues of $1.07 billion or more; (2) the date on which we have issued more than $1.0 billion in nonconvertible debt during the previous three years; or (3) the date on which we are deemed to be a large accelerated filer under the rules of the Securities and Exchange Commission, or the SEC. We may choose to take advantage of some but not all of these reduced burdens, and therefore the information that we provide holders of our Ordinary Shares may be different than the information you might receive from other public companies in which you hold equity. In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards applicable to public companies. We have elected to take advantage of the extended transition period to comply with new or revised accounting standards and to adopt certain of the reduced disclosure requirements available to emerging growth companies. As a result of the accounting standards election, we will not be subject to the same implementation timing for new or revised accounting standards as other public companies that are not emerging growth companies which may make comparison of our financials to those of other public companies more difficult. In addition, the information that we provide in this prospectus may be different than the information you may receive from other public companies in which you hold equity interests.

Foreign Private Issuer

Upon consummation of this offering, we will report under the Securities Exchange Act of 1934, as amended, or the Exchange Act, as a non-U.S. company with foreign private issuer status. Even after we no longer qualify as an emerging growth company, as long as we continue to qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

| ● | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations with respect to a security registered under the Exchange Act; |

| ● | the sections of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and |

| ● | the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial statements and other specified information, and current reports on Form 8-K upon the occurrence of specified significant events. |

We will be required to file an annual report on Form 20-F within four months of the end of each fiscal year. In addition, we intend to publish our results on a quarterly basis through press releases, distributed pursuant to the rules and regulations of the Nasdaq Stock Exchange. Press releases relating to financial results and material events will also be furnished to the SEC on Form 6-K. However, the information we are required to file with or furnish to the SEC will be less extensive and less timely compared to that required to be filed with the SEC by U.S. domestic issuers. As a result, you may not be afforded the same protections or information, which would be made available to you, were you investing in a U.S. domestic issuer.

We may take advantage of these exemptions until such time as we are no longer a foreign private issuer. We would cease to be a foreign private issuer at such time as more than 50% of our outstanding voting securities are held by U.S. residents and any of the following three circumstances applies: (i) the majority of our executive officers or directors are U.S. citizens or residents; (ii) more than 50% of our assets are located in the United States; or (iii) our business is administered principally in the United States.

Both foreign private issuers and emerging growth companies are also exempt from certain more stringent executive compensation disclosure rules. Thus, even if we no longer qualify as an emerging growth company, but remain a foreign private issuer, we will continue to be exempt from the more stringent compensation disclosures required of companies that are neither an emerging growth company nor a foreign private issuer.

9

THE OFFERING

| Ordinary Shares currently issued and outstanding | 4,311,359 Ordinary Shares | |

| Units offered by us | 1,350,000 Units (based on an assumed public offering price of $6.20 per Unit, the midpoint of the range set forth on the cover page of this prospectus), each consisting of one Ordinary Share and three Warrants, each to purchase one Ordinary Share. The Units have no stand-alone rights and will not be certificated or issued as stand-alone securities. The Ordinary Shares and Warrants are immediately separable and will be issued separately in this offering. | |

| Pre-Funded Units offered by us | We are also offering to those purchasers, if any, whose purchase of Units in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% of our outstanding Ordinary Shares immediately following the consummation of this offering, Pre-Funded Units, each consisting of one Pre-Funded Warrant to purchase one Ordinary Share and three Warrants, each to purchase one Ordinary Share. The Pre-Funded Units have no stand-alone rights and will not be certificated or issued as stand-alone securities. The Pre-Funded Warrants and Warrants are immediately separable and will be issued separately in this offering. For each Pre-Funded Unit we sell, the number of Units we are offering will be decreased on a one-for-one basis. Because we will issue three Warrants as part of each Unit or Pre-Funded Unit, the number of Warrants sold in this offering will not change as a result of a change in the mix of the Units and Pre-Funded Units sold.

The purpose of the Pre-funded Warrants is to enable investors that may have restrictions on their ability to beneficially own more than 4.99% (or, upon election of the holder, 9.99%) of our outstanding Ordinary Shares following the consummation of this offering the opportunity to make an investment in the Company without triggering their ownership restrictions, by receiving Pre-funded Warrants in lieu of our Ordinary Shares which would result in such ownership of more than 4.99% (or 9.99%), and receive the ability to exercise their option to purchase the shares underlying the Pre-funded Warrants at such nominal price at a later date. For each Pre-funded Unit we sell, the number of Units we are offering will be decreased on a one-for-one basis. Therefore, if we sell all 1,350,000 Units that we are offering, no Pre-funded Units will be sold. The use of proceeds and other applicable disclosures assumes that the maximum number of Units are sold (and therefore no Pre-funded Units are sold) and/or that if any Pre-funded Units are sold, they are immediately exercised so that the maximum number of Ordinary Shares are issued, resulting in the full 1,350,000 Ordinary Shares being issued. |

10

| Warrants | Each Warrant will have an exercise price of $5.825 (based on an assumed public offering price of $6.20 per Unit, the midpoint of the price range of the Units) per Ordinary Share (with such exercise price equal to the public offering price per Unit less $0.125 per Warrant included in the Unit), will be immediately exercisable and will expire five years from the date of issuance. | |

Subject to certain exemptions outlined in the Warrant, for a period until two years from the date of issuance of the Warrant, if the Company shall sell, enter into an agreement to sell, or grant any option to purchase, or sell, enter into an agreement to sell, or grant any right to reprice, or otherwise dispose of or issue (or announce any offer, sale, grant or any option to purchase or other disposition) any Ordinary Shares or convertible security, at an effective price per share less than the exercise price of the Warrant then in effect, or a Dilutive Issuance, the exercise price of the Warrant shall be reduced to equal the effective price per share in such Dilutive Issuance; provided, however, that in no event shall the exercise price of the Warrant be reduced to an exercise price lower than 50% of the exercise price of the Warrants on the issuance date, or the Initial Exercise Price.

On the date that is 90 calendar days immediately following the initial issuance date of the Warrants, the exercise price of the Warrants will adjust to be equal to the Reset Price (as defined below), provided that such value is less than the exercise price in effect on that date. The Reset Price means such number equal to the greater of (a) 50% of the initial exercise price (as adjusted for share splits, share dividends, recapitalizations and similar events pursuant to Section 3(a) of the Warrants) of the Warrants on the issuance date or (b) 100% of the lowest volume weighted average price per Ordinary Share occurring during the 90 calendar days following the issuance date of the Warrants.

The lowest Reset Price is $2.9125, which is 50% of assumed exercise price, based on an assumed public offering price of $6.20 per Unit, the midpoint of the price range of the Units, per Ordinary Share.

To better understand the terms of the Warrants, you should carefully read the “Description of the Securities We are Offering” section of this prospectus. You should also read the form of Warrant, which is filed as an exhibit to the registration statement of which this prospectus forms a part. | ||

| Pre-Funded Warrants | Each Pre-Funded Warrant will be immediately exercisable at an exercise price of $0.001 per Ordinary Share and may be exercised at any time until exercised in full. To better understand the terms of the Pre-Funded Warrants, you should carefully read the “Description of the Securities We are Offering” section of this prospectus. You should also read the form of Pre-Funded Warrant, which is filed as an exhibit to the registration statement of which this prospectus forms a part. | |

| Ordinary Shares offered by the Selling Shareholders | An aggregate of 1,858,803 Ordinary Shares. | |

| Ordinary Shares to be issued and outstanding after this offering | 5,661,359 Ordinary Shares (assuming no exercise of the Underwriter Warrants and excluding 4,050,000 Ordinary Shares issuable upon exercise of the Warrants, and no sale of any Pre-Funded Units), or 5,863,859 Ordinary Shares if the underwriter exercises in full the over-allotment option to purchase additional Ordinary Shares. | |

| Over-allotment option | We have granted the underwriter an option to purchase from us, up to an additional 202,500 Ordinary Shares and/or up to an additional 607,500 Warrants and/or up to an additional 202,500 Pre-Funded Warrants, within 45 days from the date of this prospectus to cover over-allotments, if any. The purchase price to be paid per additional Ordinary Share or Pre-Funded Warrant will be equal to the public offering price of one Unit or Pre-Funded Unit (less the $0.01 purchase price allocated to each Warrant), as applicable, less the underwriting discounts and commissions. The underwriter may exercise the over-allotment option with respect to the Ordinary Shares, Pre-Funded Warrants or Warrants only, or any combination thereof. | |

| Underwriter Warrants | We will issue to the underwriter the Underwriter Warrants to purchase up to 81,000 Ordinary Shares. The Underwriter Warrants will have an exercise price of 125% of the per Unit public offering price, will be exercisable on the date of issuance and will expire five years from the effective date of the registration statement of which this prospectus forms a part. For additional information regarding our arrangement with the underwriter, please see “Underwriting.” |

| Lock-Up Agreements | Our directors, executive officers, and any other holder(s) of five percent (5%) or more of the outstanding shares have agreed with the underwriter not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our Ordinary Shares or securities convertible into Ordinary Shares for a period of 180 days from the closing of this offering. |

11

| Use of proceeds | We expect to receive approximately $7.01 million in net proceeds from the sale of securities offered by us in this offering (approximately $8.16 million if the underwriter exercises its over-allotment option in full), based upon an assumed public offering price of $6.20 per Unit, which is the midpoint of the price range set forth on the cover page of this prospectus, and after deducting the underwriting discounts and commissions and estimated offering expenses payable by us.

We currently expect to use the net proceeds from this offering for the following purposes:

● approximately 2.50 million to complete the preclinical and clinical development and submit a 510(k) application to the FDA for our PL-14, PL-15 and PL-16 product candidates;

● approximately $0.50 million to complete in vitro feasibility as well as preclinical studies of corticosteroid, benzodiazepine, and naloxone for our T&T platform technology product candidates ; and

● the remainder for working capital and general corporate purposes and possible future acquisitions.

The amounts and schedule of our actual expenditures will depend on multiple factors. As a result, our management will have broad discretion in the application of the net proceeds of this offering.

We will not receive any proceeds from the sale of Ordinary Shares by the Selling Shareholders. | |

| Risk factors | Investing in our securities involves a high degree of risk. You should read the “Risk Factors” section starting on page 14 of this prospectus for a discussion of factors to consider carefully before deciding to invest in the Ordinary Shares. | |

| Nasdaq Capital Market symbol: | We have applied to list the Ordinary Shares and our Warrants on Nasdaq under the symbol “PLRZ” and “PLRZW”, respectively. No assurance can be given that our application will be approved or that a trading market will develop. |

The number of the Ordinary Shares to be issued and outstanding immediately after this offering as shown above assumes that all of the Ordinary Shares offered hereby are sold, and is based on 4,311,359 Ordinary Shares issued and outstanding as of the date of this prospectus. This number excludes:

| ● | 209,327 Ordinary Shares issuable upon the exercise of options to directors, employees and consultants under our incentive option plan outstanding as of such date, with exercise price at a range of $0.2282 -$0.3808 per share, of which 175,631 were vested as of such date (including 33,417 options which vests upon the completion of this offering); and |

| ● | such number of Ordinary Shares issuable upon the exercise of options representing 2.5% of the Company’s post-initial public offering issued and outstanding shares which shall vest and become exercisable over a total period of three years commencing on the grant date on a monthly basis in equal installments which will be granted to Company’s Chief Executive Officer subsequent to the completion of this offering. |

| ● | 29,350 options to purchase 29,350 Ordinary Shares of the Company in consideration for NIS 0.352 per option, the options will vest and become exercisable over a period of eleven (11) months commencing on the grant date, on a monthly basis in equal instalments which will be granted to Company’s Chief R&D Officer, or CRDO, subsequent to the completion of this offering. |

| ● | 258,065 Ordinary Shares issuable upon the exercise of options issued to one of the Company’s shareholders, at an exercise price of $7.75 (125% of the price per Unit in this offering). The option expires 3 years after the date of a successful completion of this offering. |

| ● | 347,880 Ordinary Shares issuable upon the exercise of SAFE Warrants (defined below) at an exercise price of $5.825. |

| ● | 290,673 Ordinary Shares reserved for future issuance under our incentive option plan. |

Unless otherwise indicated, all information in this prospectus assumes or gives effect to:

| ● | no exercise of the underwriter’s over-allotment option; |

| ● | no exercise of the Warrants, Pre-Funded Warrants or the Underwriter Warrants; |

| ● | the issuance of 115,962 Ordinary Shares upon the automatic conversion of a Simple Agreement for Future Equity, or SAFE, investment in the amount of approximately $719,000, upon the completion of this offering at an assumed conversion price equal to $6.20, the midpoint of the price range set forth on the cover page of this prospectus; |

| ● | the issuance of 311,457 Ordinary Shares upon the automatic conversion of the 311,457 Preferred Shares issued and outstanding as of the date hereof, which will automatically convert upon the completion of this offering; | |

| ● | a 1-for-8.80 reverse stock split effected on September 29, 2022; and | |

| ● | the Forward Share Split. |

See “Description of Share Capital and Governing Documents” for additional information.

12

The following table summarizes our financial data. We have derived the following statements of comprehensive loss data for the years ended December 31, 2021 and 2020 and for the six-month ended June 30, 2022 and 2021 and the balance sheet data as of June 30, 2022 from our audited financial statements as of December 31, 2021 and from our condensed financial statements as of June 30, 2022 included elsewhere in this prospectus. Such financial statements have been prepared in accordance with U.S. GAAP. Our historical results are not necessarily indicative of the results that may be expected in the future, and our results for any interim period are not necessarily indicative of results that may be expected for any full year. The following summary financial data should be read in conjunction with “Selected Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited financial statements and related notes included elsewhere in this prospectus.

| For the Six Months Ended June 30, | For the Years Ended December 31, | |||||||||||||||

| (U.S. dollars in thousands except share and per share data) | 2022 | 2021 | 2021 | 2020 | ||||||||||||

| Statement of Operations: | ||||||||||||||||

| Research and Development Expenses | $ | 247 | 90 | $ | 245 | 38 | ||||||||||

| General and Administrative Expenses | 325 | 61 | 458 | 34 | ||||||||||||

| Operating Loss | 572 | 151 | 703 | 72 | ||||||||||||

| Financing Expenses, net | 20 | 2 | 8 | 1 | ||||||||||||

| Net Loss and Comprehensive Loss | 592 | 153 | 711 | 73 | ||||||||||||

| Basic and Diluted Net Loss per Share | $ | 0.16 | 0.13 | $ | 0.36 | 0.20 | ||||||||||

| Weighted average number of shares outstanding used in computing basic and diluted net loss per share | 3,883,940 | 1,345,052 | 2,103,915 | 587,063 | ||||||||||||

| (in thousands of USD) | As of June 30, 2022 | |||||||||||

| Pro Forma | ||||||||||||

| Actual | Pro Forma(1) | As Adjusted(2) | ||||||||||

| Balance Sheet Data: | ||||||||||||

| Cash and cash equivalents | $ | 195 | $ | 460 | $ | 7,470 | ||||||

| Other current assets | $ | 34 | $ | 34 | $ | 34 | ||||||

| Deferred offering costs | $ | 390 | $ | 390 | $ | - | ||||||

| Property and equipment, net | $ | 18 | $ | 18 | $ | 18 | ||||||

| Total assets | $ | 637 | $ | 902 | $ | 7,522 | ||||||

| Employees and payroll related liabilities | $ | 27 | $ | 27 | $ | 27 | ||||||

| Accrued expenses and other payables | $ | 152 | $ | 152 | $ | 122 | ||||||

| Derivative warrant liability | $ | 512 | $ | 512 | $ | 512 | ||||||

| SAFE | $ | 452 | $ | - | $ | - | ||||||

| Total current liabilities | $ | 1,143 | $ | 691 | $ | 661 | ||||||

| Temporary equity | $ | 248 | $ | - | $ | - | ||||||

| Ordinary shares | $ | - | $ | - | $ | - | ||||||

| Additional paid-in capital | $ | 1,980 | $ | 2,945 | $ | 9,595 | ||||||

| Accumulated deficit | $ | (2,734 | ) | $ | (2,734 | ) | $ | (2,734 | ) | |||

| Total shareholders’ equity | $ | (754 | ) | $ | 211 | $ | 6,861 | |||||

| Total liabilities, temporary equity and shareholders’ deficit | $ | 637 | $ | 902 | $ | 7,522 | ||||||

| (1) | Pro Forma data gives effect to the following events as if each event had occurred on or before June 30, 2022: (i) the conversion of 311,457 preferred shares into 311,457 Ordinary Shares; (ii) the issuance of 115,962 Ordinary Shares pursuant to the 2022 SAFEs (defined below), based on an assumed offering price of $6.20 per Ordinary Share, which is the midpoint of the price range set forth on the cover page of this prospectus; (iii) a 1-for-8.80 reverse stock split effected on September 29, 2022; and (iv) the Forward Share Split. |

| (2) | Pro Forma as Adjusted data gives additional effect to the sale of 1,350,000 Units in this offering at an initial public offering price of $6.20 per Unit, which is the midpoint of the price range set forth on the cover page of this prospectus, after deducting underwriting discounts and commissions and estimated offering expenses payable by us, as if the sale had occurred on June 30, 2022. |

The as adjusted information discussed above is illustrative only and will be adjusted based on the actual initial public offering price and other terms of our initial public offering determined at pricing. Each $1.00 increase (decrease) in the assumed initial public offering price of $6.20 per Unit, which is the midpoint of the price range set forth on the cover page of this prospectus, would increase (decrease) the pro forma as adjusted amount of each of cash, cash equivalents and short-term deposits, total assets and shareholders’ equity (deficiency) by $1.2 million, assuming that the number of Units offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, each increase (decrease) of 1.0 million Units offered by us at the assumed initial public offering price would increase (decrease) each of cash, cash equivalents and short-term deposits, total assets and shareholders’ equity (deficiency) by $5.6 million.

13

Investing in our Securities involves a high degree of risk. You should carefully consider the risks and uncertainties described below, in addition to the other information set forth in this prospectus, including the financial statements and the related notes included elsewhere in this prospectus, before purchasing our Ordinary Shares or Warrants. If any of the following risks actually occurs, our business, financial condition, cash flows and results of operations could be negatively impacted. In that case, the trading price of our Ordinary Shares or Warrants would likely decline and you might lose all or part of your investment.

Risks Related to Our Financial Condition and Capital Requirements

We have incurred significant losses since our inception. We anticipate that we will continue to incur significant losses for the foreseeable future, and we may never achieve or maintain profitability.

We are a development stage biotech company. We have incurred operating losses since our inception, including operating losses of $572,000 and $151,000 for the six months ended June 30, 2022 and June 30, 2021, respectively. As of June 30, 2022, we had an accumulated deficit of $2.7 million. We have devoted substantially all of our financial resources to designing and developing our C&C product candidates, including preclinical studies and clinical development and providing general and administrative support for these operations. We expect that our expenses and operating losses will increase for the foreseeable future as we continue clinical development of our C&C product candidates to provide a barrier against allergens, influenza and COVID-19 from contacting the nasal epithelial tissue and develop other product candidates using our T&T platform technology for nasal delivery of APIs. Our ability to ultimately achieve revenues and profitability is dependent upon our ability to successfully complete the development of our C&C product candidates and any future product candidates, obtain necessary regulatory approvals for and successfully manufacture, market and commercialize our product candidates.

We anticipate that our expenses will increase substantially based on a number of factors, including to the extent that we:

| ● | Begin our planned clinical trial of our C&C product candidates in the second quarter of 2024; | |

| ● | seek regulatory and marketing approvals for any product candidates that successfully complete clinical trials; | |

| ● | advance our preclinical and research and development programs; | |

| ● | identify, assess, acquire, license and/or develop other product candidates; | |

| ● | manufacture current good manufacturing practices, or cGMP, material for clinical trials or potential commercial sales; | |

| ● | establish a sales, marketing and distribution infrastructure to commercialize any product candidates for which we may obtain marketing approval; | |

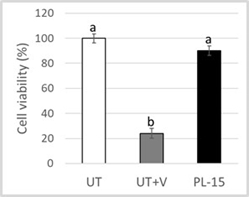

| ● | hire personnel and invest in additional infrastructure to support our operations as a public company and expand our product candidates development; | |