Form DFRN14A New York City REIT, Inc. Filed by: Comrit Investments 1, LP

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of The

Securities Exchange Act of 1934

(Amendment No. 1)

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under § 240.14a-12 |

New York City REIT, Inc.

(Name of Registrant as Specified in Its Charter)

COMRIT INVESTMENTS 1, LP

COMRIT INVESTMENTS LTD.

I.B.I. INVESTMENT HOUSE LTD

ZIV SAPIR

SHARON STERN

EREZ SHACHAM

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials: | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

| (1) | Amount previously paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

2022 ANNUAL MEETING OF STOCKHOLDERS

OF

NEW YORK CITY REIT, INC.

SUPPLEMENT DATED MAY 18, 2022

TO THE PROXY STATEMENT

OF

COMRIT INVESTMENTS 1, LP

DATED

APRIL 8, 2022

PLEASE SIGN, DATE AND MAIL THE ENCLOSED WHITE PROXY CARD TODAY

Comrit Investments 1, LP (“Comrit Investments 1”), Comrit Investments LTD (“Comrit Manager”), I.B.I. Investment House Ltd (“I.B.I.”), and Ziv Sapir (collectively, “Comrit” or “we”), participants in this solicitation, beneficially own in the aggregate approximately 2% of the outstanding shares of Class A Common Stock, par value $0.01 per share (the “Common Stock”), of New York City REIT, Inc., a Maryland corporation (“NYC REIT” or the “Company”). Sharon Stern (“Ms. Stern” or the “Nominee”), another participant in this solicitation, does not own any securities of the Company. Erez Shacham, another participant in this solicitation, beneficially owns 86 shares of the Common Stock.

We are seeking to elect one nominee to the Company’s Board of Directors (the “Board”) because we believe the Board would benefit from the insight of a new and independent member to ensure that the interests of the common stockholders, the true owners of NYC REIT, are appropriately represented in the boardroom. We have nominated a director who has a strong, relevant background and who is committed to demanding accountability to all stockholders and fully exploring all opportunities to unlock stockholder value.

Comrit filed its definitive proxy statement for the Annual Meeting with the Securities and Exchange Commission (the “SEC”) on April 8, 2022 (the “Definitive Proxy Statement”). The Company filed its definitive proxy statement for its 2022 Annual Meeting of Stockholders (including any adjournments or postponements thereof and any meeting which may be called in lieu thereof, the “Annual Meeting”) on April 15, 2022. This Proxy Supplement discloses certain information about the Annual Meeting included in the Company’s definitive proxy statement that had not been publicly available at the time we filed our Definitive Proxy Statement.

This Proxy Supplement is dated May 18, 2022, and is first being furnished to stockholders on or about May 18, 2022. This Proxy Supplement should be read in conjunction with the Definitive Proxy Statement. Defined terms used but not defined below have the meanings ascribed to them in the Definitive Proxy Statement. Except as updated or supplemented by this Proxy Supplement, all information set forth in the Definitive Proxy Statement remains unchanged and should be considered in casting your vote at the Annual Meeting.

For the reasons set forth in the Definitive Proxy Statement, we are seeking your support to elect Comrit’s director nominee, Sharon Stern, as a Class II director to hold office until the 2025 Annual Meeting of Stockholders and until her successor has been duly elected and qualified (the “Nominee”), to the Board at the Annual Meeting.

The Annual Meeting will be held on Tuesday, May 31, 2022 at the offices of Paul, Weiss, Rifkind, Wharton & Garrison LLP located at 1285 Avenue of the Americas, New York, NY 10019, commencing at 8:00 a.m. Eastern Time. The Company has set the close of business on May 3, 2022 as the record date for determining stockholders entitled to notice of and to vote at the Annual Meeting (the “Record Date”). Stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. The Company has not yet provided the number of shares of the Company’s Common Stock that were issued and outstanding as of the Record Date. According to the Company’s Quarterly Report on Form 10-Q filed with the SEC on May 13, 2022, 13,565,570 shares of the Company’s Common Stock were issued and outstanding as of May 9, 2022.

1

IF YOU HAVE SUBMITTED A WHITE PROXY CARD AND ARE A STOCKHOLDER AS OF THE RECORD DATE AND YOU DO NOT WISH TO CHANGE YOUR VOTE, THEN YOU DO NOT HAVE TO TAKE ANY FURTHER ACTION AND YOU DO NOT NEED TO SUBMIT THE ENCLOSED WHITE PROXY CARD. YOU SHOULD DISREGARD AND DISCARD, AND NOT VOTE, ANY GOLD PROXY CARD YOU RECEIVE FROM THE COMPANY. ONLY YOUR LAST DATED PROXY CARD WILL COUNT.

OTHER SUPPLEMENTAL DISCLOSURES

Stockholder Proposals

According to the Company’s definitive proxy statement, pursuant to Rule 14a-8 of the Exchange Act, the Company must receive stockholder proposals submitted pursuant to such Rule, in writing by December 16, 2022, to consider them for inclusion in the Company’s proxy materials for the 2023 Annual Meeting. For any proposal that is not submitted for inclusion in the Company’s proxy statement, but is instead sought to be presented directly at the 2023 Annual Meeting, the Company’s secretary must receive written notice of the proposal at the Company’s principal executive offices during the period beginning on November 16, 2022 and ending at 5:00 p.m. Eastern Time, on December 16, 2022.

Additional Participant Information

The Nominee, Comrit Investments 1, Comrit Manager, I.B.I., Ziv Sapir, Sharon Stern and Erez Shacham are participants in this solicitation. The principal business of Comrit Investments 1 is serving as a private investment fund. Comrit Manager manages the business and affairs of Comrit Investments 1. I.B.I. is an Israeli public company traded on the Tel Aviv Stock Exchange. Ziv Sapir is the Managing Partner and the CEO of Comrit Investments 1 and the CEO of Comrit Manager. Mr. Sapir is a citizen of Israel. The Nominee, Ms. Stern, is currently President of Eastmore Management and Metro Investments. Ms. Stern is a citizen of Canada. Mr. Shacham is currently CEO of NY Stone New Jersey and NY Stone Manhattan. Mr. Shacham is a citizen of the United States.

The address of the principal office of each of Comrit Investments 1, Comrit Manager, I.B.I., and Mr. Sapir is 9 A’had Ha’am Street, Floor 28th, Shalom Tower, Tel Aviv, Israel 6129109. The address of the principal office of the Nominee is 1822 Ste. Catherine W., Suite 100, Montreal, Quebec H3H 1M1. The address of the principal office of Mr. Shacham is 30 W. 21st Street, New York, New York 10010.

As of the date hereof, Comrit Investments 1 beneficially owns 267,520 shares of Common Stock. Comrit Manager, as the general partner of Comrit Investments 1, may be deemed the beneficial owner of the 267,520 shares owned by Comrit Investments 1. Mr. Sapir, as the investment manager of Comrit Manager, may be deemed the beneficial owner of the 267,520 shares owned by Comrit Investments 1. I.B.I, as the majority owner of Comrit Manager, may be deemed the beneficial owner of the 267,520 shares owned by Comrit Investments 1. Mr. Sapir, as the owner of the shares of Comrit Manager not owned by I.B.I., may be deemed the beneficial owner of the 267,520 shares owned by Comrit Investments 1. As of the date hereof, Mr. Stern does not own of record or beneficially any securities of the Company. As of the date hereof, Mr. Shacham beneficially owns 86 shares of Common Stock. For information regarding transactions in securities of the Company during the past two years by each participant, please see Schedule II.

Each participant in this solicitation, if deemed to be a member of a “group” with the other participants for the purposes of Section 13(d)(3) of the Exchange Act, may be deemed to beneficially own the 267,520 shares of Common Stock owned by Comrit Investments 1. Each participant in this solicitation disclaims beneficial ownership of the shares of Common Stock owned by Comrit Investments 1 except to the extent of their pecuniary interest therein. During the past two years, the participants in this solicitation have not purchased or sold any securities of the Company.

The shares of Common Stock owned directly by Comrit Investments 1 were purchased with working capital (which may, at any given time, include margin loans made by brokerage firms in the ordinary course of business).

Except as set forth in this Proxy Statement (including the Schedules hereto), (i) during the past 10 years, no participant in this solicitation has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no participant in this solicitation directly or indirectly beneficially owns any securities of the Company; (iii) no participant in this solicitation owns any securities of the Company which are owned of record but not beneficially; (iv) no participant in this solicitation has purchased or sold any securities of the Company during the past two years; (v) no part of the purchase price or market value of the securities of the Company owned by any participant in this solicitation is represented by funds borrowed or otherwise obtained for the purpose of acquiring or holding such securities; (vi) no participant in this solicitation is, or within the past year was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies; (vii) no associate of any participant in this solicitation owns beneficially, directly or indirectly, any securities of the Company; (viii) no participant in this solicitation owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company; (ix) no participant in this solicitation or any of his or its associates was a party to any transaction, or series of similar transactions, since the beginning of the Company’s last fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000; (x) no participant in this solicitation or any of his or its associates has any arrangement or understanding with any person with respect to any future employment by the Company or its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may be a party; and (xi) no participant in this solicitation has a substantial interest, direct or indirect, by securities holdings or otherwise, in any matter to be acted on at the Annual Meeting.

There are no material proceedings to which any participant in this solicitation or any of his or her or its associates is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries. With respect to the Nominee, none of the events enumerated in Item 401(f)(1)-(8) of Regulation S-K of the Exchange Act occurred during the past 10 years.

THIS SOLICITATION IS BEING MADE BY COMRIT AND NOT ON BEHALF OF THE BOARD OF DIRECTORS OR MANAGEMENT OF THE COMPANY. COMRIT URGES YOU TO SIGN, DATE AND RETURN THE WHITE PROXY CARD IN FAVOR OF THE ELECTION OF THE NOMINEE. IF YOU HAVE ALREADY SENT A GOLD PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED IN OUR DEFINITIVE PROXY STATEMENT BY SIGNING, DATING, AND RETURNING THE ENCLOSED WHITE PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

2

IMPORTANT

Your vote is important, no matter how few shares of Common Stock you own. Comrit urges you to sign, date, and return the enclosed WHITE proxy card today to vote FOR the election of our Nominee and in accordance with Comrit’s recommendations on the other proposals on the agenda for the Annual Meeting.

| • | If your shares of Common Stock are registered in your own name, please sign and date the enclosed WHITE proxy card and return it to Comrit, c/o Saratoga Proxy Consulting, LLC (“Saratoga”) in the enclosed postage-paid envelope today. Stockholders also have the following two options for authorizing a proxy to vote shares registered in their name: |

| • | Via the Internet at www.cesvote.com at any time prior to 11:59 p.m. (Eastern Time) on May 30, 2022, and follow the instructions provided on the WHITE proxy card; or |

| • | By telephone, by calling 1(888) 693-8683 at any time prior to 11:59 p.m. (Eastern Time) on May 30, 2022, and follow the instructions provided on the WHITE proxy card. |

| • | If your shares of Common Stock are held in a brokerage account or bank, you are considered the beneficial owner of the shares of Common Stock, and your broker or bank will be forwarding these proxy materials, a WHITE proxy card, and a voting form. As a beneficial owner, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your shares of Common Stock on your behalf without your instructions. As a beneficial owner, you may vote the shares at the Annual Meeting only if you obtain a legal proxy from the broker or bank giving you the rights to vote the shares. |

| • | Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the voting form provided by your broker or bank for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed WHITE proxy card. |

| • | You may vote your shares at the Annual Meeting. Even if you plan to attend the Annual Meeting, we recommend that you submit your WHITE proxy card by mail by the applicable deadline so that your vote will be counted if you later decide not to attend the Annual Meeting. |

Since only your latest dated proxy card will count, we urge you to not return the gold proxy card you receive from the Company. Remember, you can vote for our Nominee only on our WHITE proxy card. So please make certain that the latest dated proxy card you return is the WHITE proxy card.

If you have any questions, require assistance in voting your WHITE proxy card, or need additional copies of Comrit’s proxy materials, please contact Saratoga at the phone numbers or email address listed below.

Saratoga Proxy Consulting LLC

520 8th Avenue, 14th Floor

New York, NY 10018

(212) 257-1311

Stockholders Call Toll Free at: (888) 368-0379

Email: [email protected]

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting—This Proxy Statement and our WHITE proxy card are available at

https://rebuildnycreit.com/

3

IMPORTANT

Tell your Board what you think! Your vote is important. No matter how many shares of Common Stock you own, please give Comrit your proxy FOR the election of the Nominee and in accordance with Comrit’s recommendations on the other proposals on the agenda for the Annual Meeting by taking three steps:

| • | SIGNING the enclosed WHITE proxy card; |

| • | DATING the enclosed WHITE proxy card; and |

| • | MAILING the enclosed WHITE proxy card TODAY in the envelope provided (no postage is required if mailed in the United States). |

Stockholders also have the following two options for authorizing a proxy to vote shares registered in their name:

| • | Via the Internet at www.cesvote.com at any time prior to 11:59 p.m. (Eastern Time) on May 30, 2022, and follow the instructions provided on the WHITE proxy card; or |

| • | By telephone, by calling 1(888) 693-8683 at any time prior to 11:59 p.m. (Eastern Time) on May 30, 2022, and follow the instructions provided on the WHITE proxy card. |

You may vote your shares at the Annual Meeting, however, even if you plan to attend the Annual Meeting, we recommend that you submit your WHITE proxy card by mail by the applicable deadline so that your vote will still be counted if you later decide not to attend the Annual Meeting. If any of your shares of Common Stock are held in the name of a brokerage firm, bank, bank nominee or other institution, only it can vote such shares of Common Stock and only upon receipt of your specific instructions. Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the voting form provided by your broker or custodian for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed WHITE proxy card.

If you have any questions, require assistance in voting your WHITE proxy card, or need additional copies of Comrit’s proxy materials, please contact Saratoga at the phone numbers or email address listed below.

Saratoga Proxy Consulting LLC

520 8th Avenue, 14th Floor

New York, NY 10018

(212) 257-1311

Stockholders Call Toll Free at: (888) 368-0379

Email: [email protected]

SCHEDULE I

The following table is reprinted from the Company’s definitive proxy statement filed with the Securities and Exchange Commission on April 15, 2022.

STOCK OWNERSHIP BY DIRECTORS, OFFICERS AND CERTAIN STOCKHOLDERS

The following table sets forth information regarding the beneficial ownership of shares of Common Stock as of April 13, 2022, in each case including shares of Common Stock which may be acquired by such persons within 60 days, by:

| • | each person known by the Company to be the beneficial owner of more than 5% of its outstanding shares of Common Stock based solely upon the amounts and percentages contained in the public filings of such persons; |

| • | each of the Company’s named executive officers and directors; and |

| • | all of the Company’s executive officers and directors as a group. |

| Common Stock | ||||||||

| Beneficial Owner(1) |

Number of Shares Beneficially Owned |

Percent of Class |

||||||

| Bellevue Capital Partners, LLC(2) |

1,353,661 | 10.1 | % | |||||

| Morgan Stanley and Morgan Stanley Smith Barney LLC(3) |

1,229,576 | 9.2 | % | |||||

| Edward M. Weil, Jr.(4) |

12,210 | * | ||||||

| Christopher J. Masterson |

— | — | ||||||

| Elizabeth K. Tuppeny(5) |

22,936 | * | ||||||

| Lee M. Elman(5) |

13,590 | * | ||||||

| Abby M. Wenzel(5) |

20,845 | * | ||||||

| All directors and executive officers as a group (five persons) |

69,581 | * | ||||||

| * | Less than 1%. |

| (1) | Unless otherwise indicated, the business address of each individual or entity listed in the table is 650 Fifth Avenue, 30th Floor, New York, New York 10019. Unless otherwise indicated, the individual or entity listed has sole voting and investment power over the shares listed. |

| (2) | Includes the shares beneficially owned by its managing member and excludes the shares beneficially owned by Mr. Weil. The business address of Bellevue Capital Partners, LLC and its managing member is 222 Bellevue Avenue, Newport, Rhode Island 02840. Bellevue Capital Partners, LLC and its sole managing member share voting and dispositive power over 1,353,661 shares. The information contained herein with respect to Bellevue Capital Partners, LLC is based solely on the Amendment No. 3 to the Schedule 13D filed by Bellevue Capital Partners, LLC with the SEC on April 4, 2022 and the Form 3 and Form 4 filed by Bellevue Capital Partners, LLC with the SEC on April 13, 2022. |

| (3) | The business address of Morgan Stanley and Morgan Stanley Smith Barney LLC is 1585 Broadway, New York, New York 10036. Each of Morgan Stanley and Morgan Stanley Smith Barney LLC has no sole voting power over shares, no shared voting power over shares, no sole dispositive power over shares and has shared dispositive power over 1,229,576 shares. The information contained herein with respect to Morgan Stanley and Morgan Stanley Smith Barney LLC is based solely on the Schedule 13G filed by Morgan Stanley and Morgan Stanley Smith Barney LLC with the SEC on February 11, 2022. |

| (4) | Mr. Weil, our executive chairman, chief executive officer, president and secretary, is also the chief executive officer of AR Global. While Mr. Weil has a non-controlling interest in the parent of AR Global, Mr. Weil does not have direct or indirect voting or investment power over any shares that AR Global or the parent of AR Global may own and Mr. Weil disclaims beneficial ownership of such shares. Accordingly, the shares included as beneficially owned by Mr. Weil do not include the 127,666 shares of Common Stock that are directly or indirectly beneficially owned by AR Global or the 56,091 shares of Common Stock that are directly or indirectly beneficially owned by the parent of AR Global. |

| (5) | Includes approximately 8,391 unvested restricted shares of Common Stock. |

SCHEDULE II

TRANSACTIONS IN SECURITIES OF THE COMPANY

DURING THE PAST TWO YEARS

COMRIT INVESTMENTS 1, LP

None.

COMRIT INVESTMENTS LTD

None.

I.B.I. INVESTMENT HOUSE LTD.

None.

ZIV SAPIR

None.

SHARON STERN

None.

EREZ SHACHAM

| Nature of Transaction | Amount of Securities Purchased/(Sold) | Date of Purchase/Sale | ||

| Purchase | 86 | 4/29/2022 |

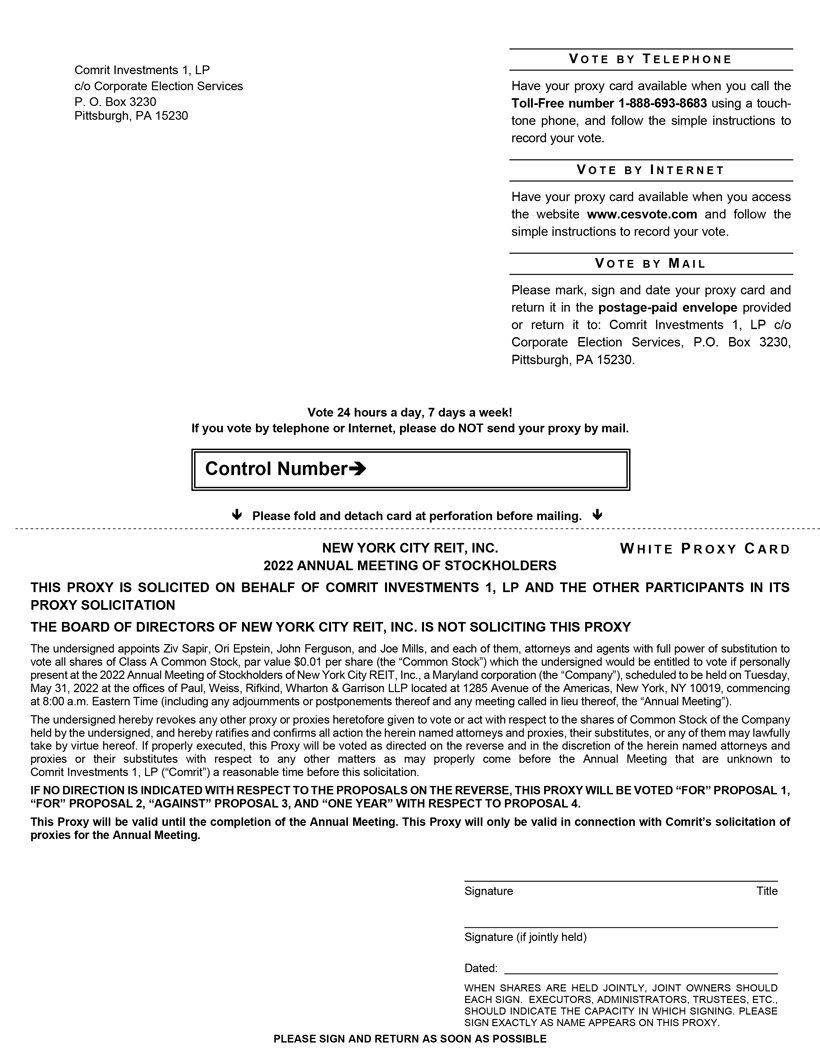

Comrit Investments 1, LP V OT E B Y T E L E P H O N E c/o Corporate Election Services Have your proxy card available when you call the P. O. Box 3230 Toll-Free number 1-888-693-8683 using a touch- Pittsburgh, PA 15230 tone phone, and follow the simple instructions to record your vote. V OT E B Y I N T E R N E T Have your proxy card available when you access the website www.cesvote.com and follow the simple instructions to record your vote. V OT E B Y M A I L Please mark, sign and date your proxy card and return it in the postage-paid envelope provided or return it to: Comrit Investments 1, LP c/o Corporate Election Services, P.O. Box 3230, Pittsburgh, PA 15230. Vote 24 hours a day, 7 days a week! If you vote by telephone or Internet, please do NOT send your proxy by mail. Control Number  Please fold and detach card at perforation before mailing.  NEW YORK CITY REIT, INC. W HIT E P R O X Y C A R D 2022 ANNUAL MEETING OF STOCKHOLDERS THIS PROXY IS SOLICITED ON BEHALF OF COMRIT INVESTMENTS 1, LP AND THE OTHER PARTICIPANTS IN ITS PROXY SOLICITATION THE BOARD OF DIRECTORS OF NEW YORK CITY REIT, INC. IS NOT SOLICITING THIS PROXY The undersigned appoints Ziv Sapir, Ori Epstein, John Ferguson, and Joe Mills, and each of them, attorneys and agents with full power of substitution to vote all shares of Class A Common Stock, par value $0.01 per share (the “Common Stock”) which the undersigned would be entitled to vote if personally present at the 2022 Annual Meeting of Stockholders of New York City REIT, Inc., a Maryland corporation (the “Company”), scheduled to be held on Tuesday, May 31, 2022 at the offices of Paul, Weiss, Rifkind, Wharton & Garrison LLP located at 1285 Avenue of the Americas, New York, NY 10019, commencing at 8:00 a.m. Eastern Time (including any adjournments or postponements thereof and any meeting called in lieu thereof, the “Annual Meeting”). The undersigned hereby revokes any other proxy or proxies heretofore given to vote or act with respect to the shares of Common Stock of the Company held by the undersigned, and hereby ratifies and confirms all action the herein named attorneys and proxies, their substitutes, or any of them may lawfully take by virtue hereof. If properly executed, this Proxy will be voted as directed on the reverse and in the discretion of the herein named attorneys and proxies or their substitutes with respect to any other matters as may properly come before the Annual Meeting that are unknown to Comrit Investments 1, LP (“Comrit”) a reasonable time before this solicitation. IF NO DIRECTION IS INDICATED WITH RESPECT TO THE PROPOSALS ON THE REVERSE, THIS PROXY WILL BE VOTED “FOR” PROPOSAL 1, “FOR” PROPOSAL 2, “AGAINST” PROPOSAL 3, AND “ONE YEAR” WITH RESPECT TO PROPOSAL 4. This Proxy will be valid until the completion of the Annual Meeting. This Proxy will only be valid in connection with Comrit’s solicitation of proxies for the Annual Meeting. Signature Title Signature (if jointly held) Dated: WHEN SHARES ARE HELD JOINTLY, JOINT OWNERS SHOULD EACH SIGN. EXECUTORS, ADMINISTRATORS, TRUSTEES, ETC., SHOULD INDICATE THE CAPACITY IN WHICH SIGNING. PLEASE SIGN EXACTLY AS NAME APPEARS ON THIS PROXY. PLEASE SIGN AND RETURN AS SOON AS POSSIBLE

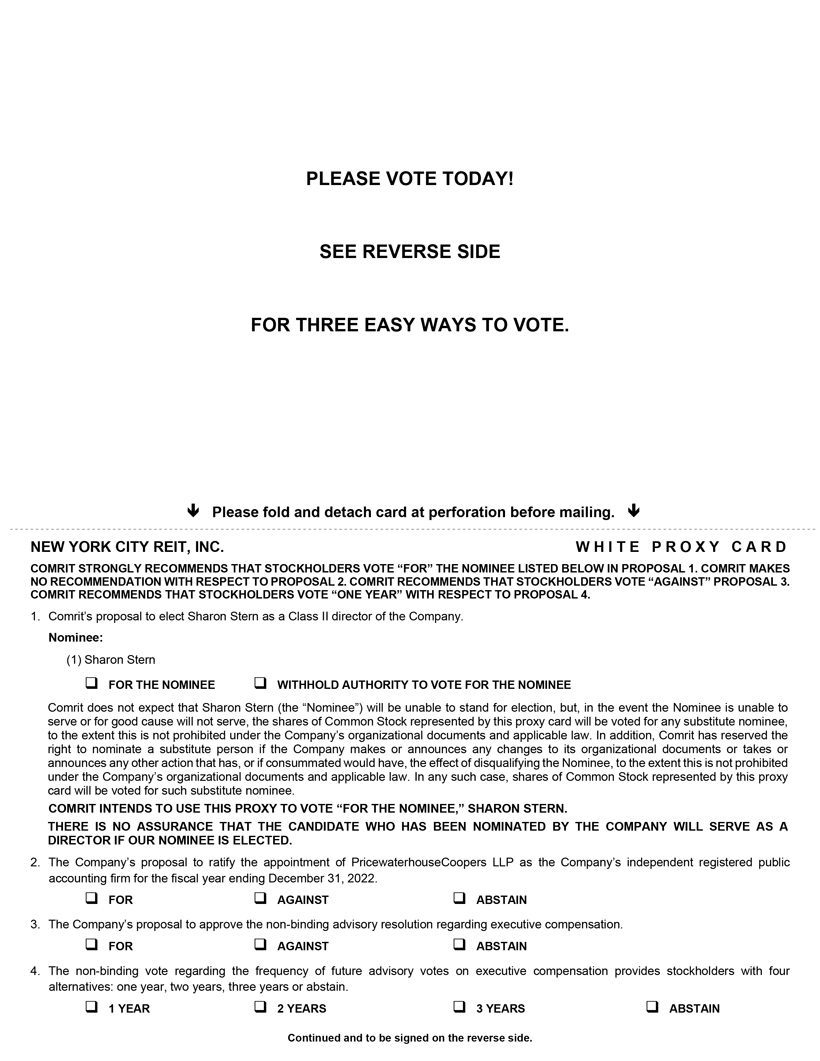

PLEASE VOTE TODAY! SEE REVERSE SIDE FOR THREE EASY WAYS TO VOTE.  Please fold and detach card at perforation before mailing.  NEW YORK CITY REIT, INC. W H I T E P R O X Y C A R D COMRIT STRONGLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE NOMINEE LISTED BELOW IN PROPOSAL 1. COMRIT MAKES NO RECOMMENDATION WITH RESPECT TO PROPOSAL 2. COMRIT RECOMMENDS THAT STOCKHOLDERS VOTE “AGAINST” PROPOSAL 3. COMRIT RECOMMENDS THAT STOCKHOLDERS VOTE “ONE YEAR” WITH RESPECT TO PROPOSAL 4. 1. Comrit’s proposal to elect Sharon Stern as a Class II director of the Company. Nominee: (1) Sharon Stern FOR THE NOMINEE WITHHOLD AUTHORITY TO VOTE FOR THE NOMINEE Comrit does not expect that Sharon Stern (the “Nominee”) will be unable to stand for election, but, in the event the Nominee is unable to serve or for good cause will not serve, the shares of Common Stock represented by this proxy card will be voted for any substitute nominee, to the extent this is not prohibited under the Company’s organizational documents and applicable law. In addition, Comrit has reserved the right to nominate a substitute person if the Company makes or announces any changes to its organizational documents or takes or announces any other action that has, or if consummated would have, the effect of disqualifying the Nominee, to the extent this is not prohibited under the Company’s organizational documents and applicable law. In any such case, shares of Common Stock represented by this proxy card will be voted for such substitute nominee. COMRIT INTENDS TO USE THIS PROXY TO VOTE “FOR THE NOMINEE,” SHARON STERN. THERE IS NO ASSURANCE THAT THE CANDIDATE WHO HAS BEEN NOMINATED BY THE COMPANY WILL SERVE AS A DIRECTOR IF OUR NOMINEE IS ELECTED. 2. The Company’s proposal to ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022. FOR AGAINST ABSTAIN 3. The Company’s proposal to approve the non-binding advisory resolution regarding executive compensation. FOR AGAINST ABSTAIN 4. The non-binding vote regarding the frequency of future advisory votes on executive compensation provides stockholders with four alternatives: one year, two years, three years or abstain. 1 YEAR 2 YEARS 3 YEARS ABSTAIN Continued and to be signed on the reverse side.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- American Strategic Investment Co. Announces Release Date for First Quarter Results

- ROSEN, A TOP RANKED LAW FIRM, Encourages CI&T Inc Investors to Inquire About Securities Class Action Investigation – CINT

- RUM Reports Annual Financial Results with Increased Net Comprehensive Income for the Year Ended December 31, 2023

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share