Form DFAN14A KANSAS CITY SOUTHERN Filed by: CANADIAN PACIFIC RAILWAY LTD/CN

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☒ | Soliciting Material under §240.14a-12 | |

KANSAS CITY SOUTHERN

(Name of Registrant as Specified In Its Charter)

CANADIAN PACIFIC RAILWAY LIMITED

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Canadian Pacific Proxy Statement

in Opposition to

CN Merger

CONFIDENTIAL

August 3, 2021

Legends

FORWARD LOOKING STATEMENTS AND INFORMATION

This presentation includes certain forward-looking statements and forward looking information (collectively, FLI). FLI is typically identified by words such as

“anticipate”, “expect”, “project”, “estimate”, “forecast”, “plan”, “intend”, “target”, “believe”, “likely” and similar words suggesting future

outcomes or statements regarding an outlook. All statements other than statements of historical fact may be FLI. Although we believe that the FLI is reasonable based on the information available today and processes used to prepare it, such

statements are not guarantees of future performance and you are cautioned against placing undue reliance on FLI. By its nature, FLI involves a variety of assumptions, which are based upon factors that may be difficult to predict and that may involve

known and unknown risks and uncertainties and other factors which may cause actual results, levels of activity and achievements to differ materially from those expressed or implied by these FLI, including, but not limited to, the following: changes

in business strategies and strategic opportunities; estimated future dividends; financial strength and flexibility; debt and equity market conditions, including the ability to access capital markets on favourable terms or at all; cost of debt and

equity capital; potential changes in the CP share price; the ability of management of CP, its subsidiaries and affiliates to execute key priorities; general North American and global social, economic, political, credit and business conditions; risks

associated with agricultural production such as weather conditions and insect populations; the availability and price of energy commodities; the effects of competition and pricing pressures, including competition from other rail carriers, trucking

companies and maritime shippers in Canada and the U.S.; North American and global economic growth; industry capacity; shifts in market demand; changes in commodity prices and commodity demand; uncertainty surrounding timing and volumes of

commodities being shipped via CP; inflation; geopolitical instability; changes in laws, regulations and government policies, including regulation of rates; changes in taxes and tax rates; potential increases in maintenance and operating costs;

changes in fuel prices; disruption in fuel supplies; uncertainties of investigations, proceedings or other types of claims and litigation; compliance with environmental regulations; labour disputes; changes in labour costs and labour difficulties;

risks and liabilities arising from derailments; transportation of dangerous goods; timing of completion of capital and maintenance projects; sufficiency of CP’s budgeted capital expenditures in carrying out CP’s business plan; services and

infrastructure; the satisfaction by third parties of their obligations to CP; currency and interest rate fluctuations; exchange rates; effects of changes in market conditions and discount rates on the financial position of pension plans and

investments; trade restrictions or other changes to international trade arrangements; the effects of current and future multinational trade agreements on the level of trade among Canada and the U.S.; climate change and the market and regulatory

responses to climate change; anticipated in-service dates; success of hedging activities; operational performance and reliability; regulatory and legislative decisions and actions; public opinion; various

events that could disrupt operations, including severe weather, such as droughts, floods, avalanches and earthquakes, and cybersecurity attacks, as well as security threats and governmental response to them, and technological changes; acts of

terrorism, war or other acts of violence or crime or risk of such activities; insurance coverage limitations; and the pandemic created by the outbreak of COVID-19 and resulting effects on CP’s business,

operating results, cash flows and/or financial condition, as well as resulting effects on economic conditions, the demand environment for logistics requirements and energy prices, restrictions imposed by public health authorities or governments,

fiscal and monetary policy responses by governments and financial institutions, and disruptions to global supply chains.

We caution that the foregoing list of

factors is not exhaustive and is made as of the date hereof. Additional information about these and other assumptions, risks and uncertainties can be found in reports and filings by CP with Canadian and U.S. securities regulators. Reference should

be made to “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Forward-Looking Statements” in CP’s annual and interim reports on Form 10-K and 10-Q. Due to the interdependencies and correlation of these factors, as well as other factors, the impact of any one assumption, risk or uncertainty on FLI cannot be

determined with certainty.

Except to the extent required by law, we assume no obligation to publicly update or revise any FLI, whether as a result of new

information, future events or otherwise. All FLI in this presentation is expressly qualified in its entirety by these cautionary statements.

ADDITIONAL INFORMATION

ABOUT THE TRANSACTION AND WHERE TO FIND IT

Canadian Pacific Railway Limited (“CPRL”), together with the other participants named in this communication

(collectively, “CP”), has filed a preliminary proxy statement and accompanying BLUE proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes of the shareholders of Kansas City Southern, a

Delaware corporation (“KCS”), against the proposal to adopt the Agreement and Plan of Merger, dated as of May 21, 2021 (the “CN Merger Agreement”), by and among Canadian National Railway Company, a Canadian corporation

(“CN”), Brooklyn Merger Sub, Inc., a Delaware corporation and a direct wholly owned subsidiary of CN, and KCS. The definitive proxy statement will be sent to the shareholders of KCS once it becomes available.

INVESTORS AND SHAREHOLDERS OF KCS ARE URGED TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT

KCS, CP, THE TRANSACTIONS CONTEMPLATED BY THE CN MERGER AGREEMENT AND RELATED MATTERS AND DEVELOPMENTS. THE PROXY STATEMENT AND SUCH OTHER PROXY MATERIALS, WHEN FILED WITH THE SEC, WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT

WWW.SEC.GOV. IN ADDITION, INVESTORS AND SHAREHOLDERS WILL BE ABLE TO OBTAIN FREE COPIES OF THE PROXY STATEMENT AND OTHER MATERIALS FILED WITH THE SEC ONLINE AT INVESTOR.CPR.CA, OR UPON REQUEST TO CP’S PROXY SOLICITOR, INNISFREE M&A

INCORPORATED, AT (212) 750-5833 OR TOLL-FREE AT (877) 456-3442.

PARTICIPANTS IN THE

SOLICITATION OF PROXIES

The participants in the proxy solicitation are anticipated to be CPRL, Isabelle Courville, Edward R. Hamberger, Matthew H. Paull, Keith E.

Creel, Nadeem S. Velani and John K. Brooks. As of the date of this communication, none of CPRL, Ms. Courville, Mr. Hamberger, Mr. Velani or Mr. Brooks are the beneficial owner of any shares of common stock, par value $0.01 per

share, or 4% noncumulative preferred stock, par value $25.00 per share, of KCS (collectively, the “Shares”). Mr. Paull is the beneficial owner of 34 Shares, and Mr. Creel is the beneficial owner of seven Shares. Information about

CPRL’s directors and executive officers may be found in its 2021 Management Proxy Circular, dated March 10, 2021, as well as its 2020 Annual Report on Form 10-K filed with the SEC and applicable

securities regulators in Canada on February 18, 2021, available free of charge on its website at investor.cpr.ca and at www.sedar.com and www.sec.gov.

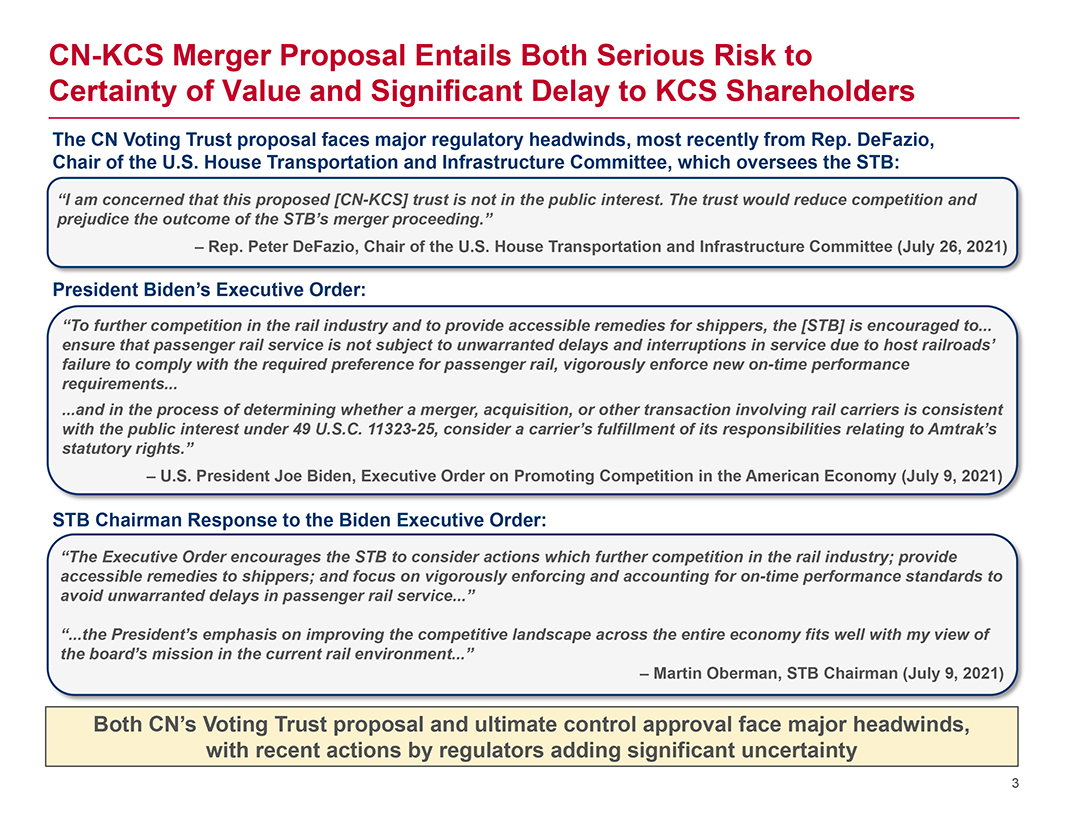

CN-KCS Merger Proposal Entails Both Serious Risk to Certainty of Value and Significant Delay to

KCS Shareholders

The CN Voting Trust proposal faces major regulatory headwinds, most recently from Rep. DeFazio, Chair of the U.S. House Transportation and

Infrastructure Committee, which oversees the STB:

“I am concerned that this proposed [CN-KCS] trust is not in the

public interest. The trust would reduce competition and prejudice the outcome of the STB’s merger proceeding.”

– Rep. Peter DeFazio, Chair of the

U.S. House Transportation and Infrastructure Committee (July 26, 2021)

President Biden’s Executive Order:

“To further competition in the rail industry and to provide accessible remedies for shippers, the [STB] is encouraged to ensure that passenger rail service is not subject to

unwarranted delays and interruptions in service due to host railroads’ failure to comply with the required preference for passenger rail, vigorously enforce new on-time performance requirements ...and in

the process of determining whether a merger, acquisition, or other transaction involving rail carriers is consistent with the public interest under 49 U.S.C. 11323-25, consider a carrier’s fulfillment of

its responsibilities relating to Amtrak’s statutory rights.”

– U.S. President Joe Biden, Executive Order on Promoting Competition in the American

Economy (July 9, 2021)

STB Chairman Response to the Biden Executive Order:

“The Executive Order encourages the STB to consider actions which further competition in the rail industry; provide accessible remedies to shippers; and focus

on vigorously enforcing and accounting for on-time performance standards to avoid unwarranted delays in passenger rail service...”

“...the President’s emphasis on improving the competitive landscape across the entire economy fits well with my view of the board’s mission in the current rail

environment...”

– Martin Oberman, STB Chairman (July 9, 2021)

Both

CN’s Voting Trust proposal and ultimate control approval face major headwinds, with recent actions by regulators adding significant uncertainty

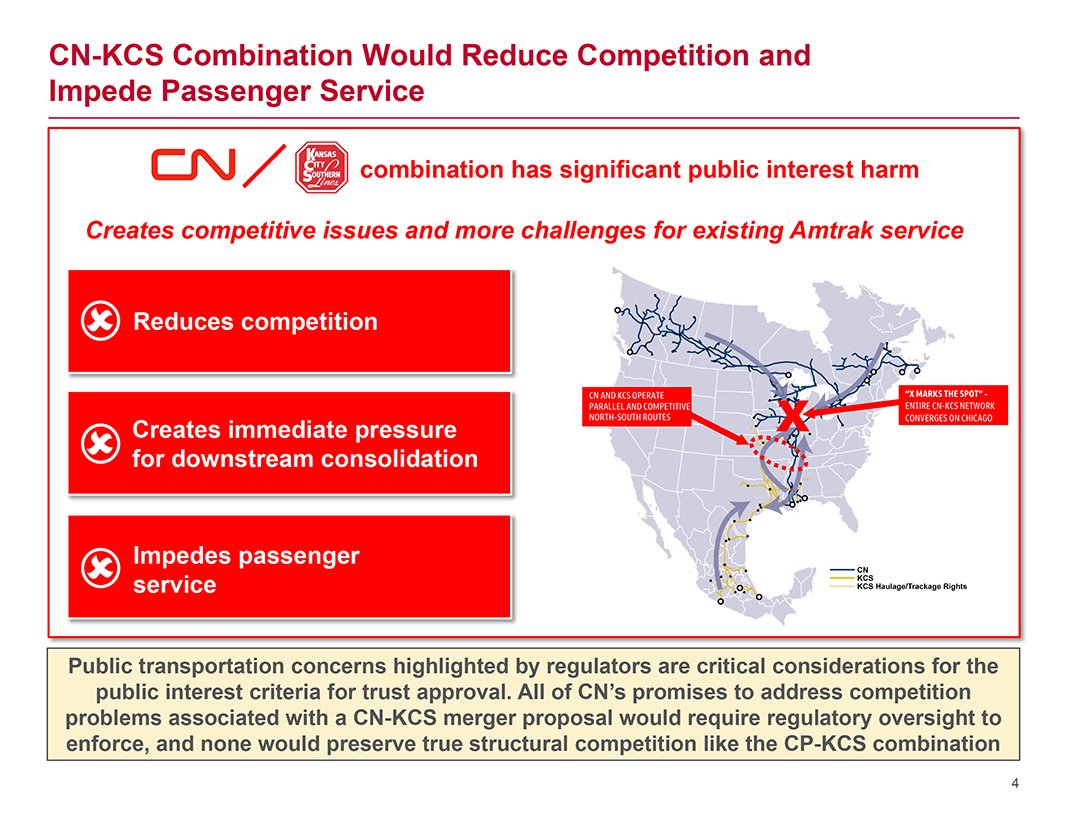

CN-KCS Combination Would Reduce Competition and Impede Passenger Service

combination has significant public interest harm

Creates competitive issues and more

challenges for existing Amtrak service

Reduces competition

Creates immediate

pressure for downstreaconsolidation

Impedes passenger service

CN AND KCS

OPERATE PARALLEL AND COMPETITIVE NORTH-SOUTH ROUTES

“X MARKS THE SPOT” -

ENTIRE CN-KCS NETWORK CONVERGES ON CHICAGO

-CN

-KCS

-KCS Haulage/Trackage Rights

Public transportation concerns highlighted by regulators are critical considerations for the public interest criteria for trust approval. All of CN’s promises to address

competition problems associated with a CN-KCS merger proposal would require regulatory oversight to enforce, and none would preserve true structural competition like the

CP-KCS combination

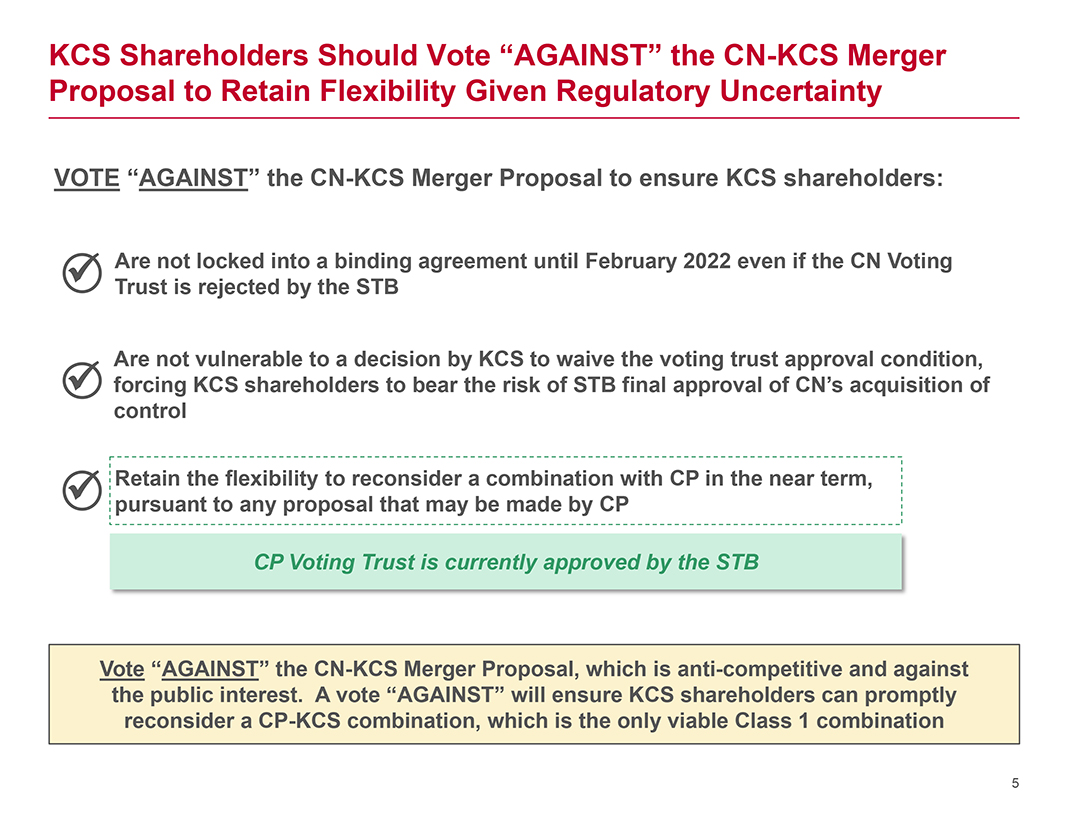

KCS Shareholders Should Vote “AGAINST” the CN-KCS Merger Proposal to Retain

Flexibility Given Regulatory Uncertainty

VOTE “AGAINST” the CN-KCS Merger Proposal to ensure KCS shareholders:

 Are not locked into a binding agreement until February 2022 even if the CN Voting Trust is rejected by the STB

Are not vulnerable to a decision by KCS to waive the voting trust approval condition, forcing KCS shareholders to bear the risk of STB final approval of CN’s acquisition of

control

 Retain the flexibility to reconsider a combination with CP in the near term, pursuant to any proposal that may be made by CP

CP Voting Trust is currently approved by the STB

Vote “AGAINST” the CN-KCS Merger Proposal, which is anti-competitive and against the public interest. A vote “AGAINST” will ensure KCS shareholders can promptly reconsider a CP-KCS

combination, which is the only viable Class 1 combination

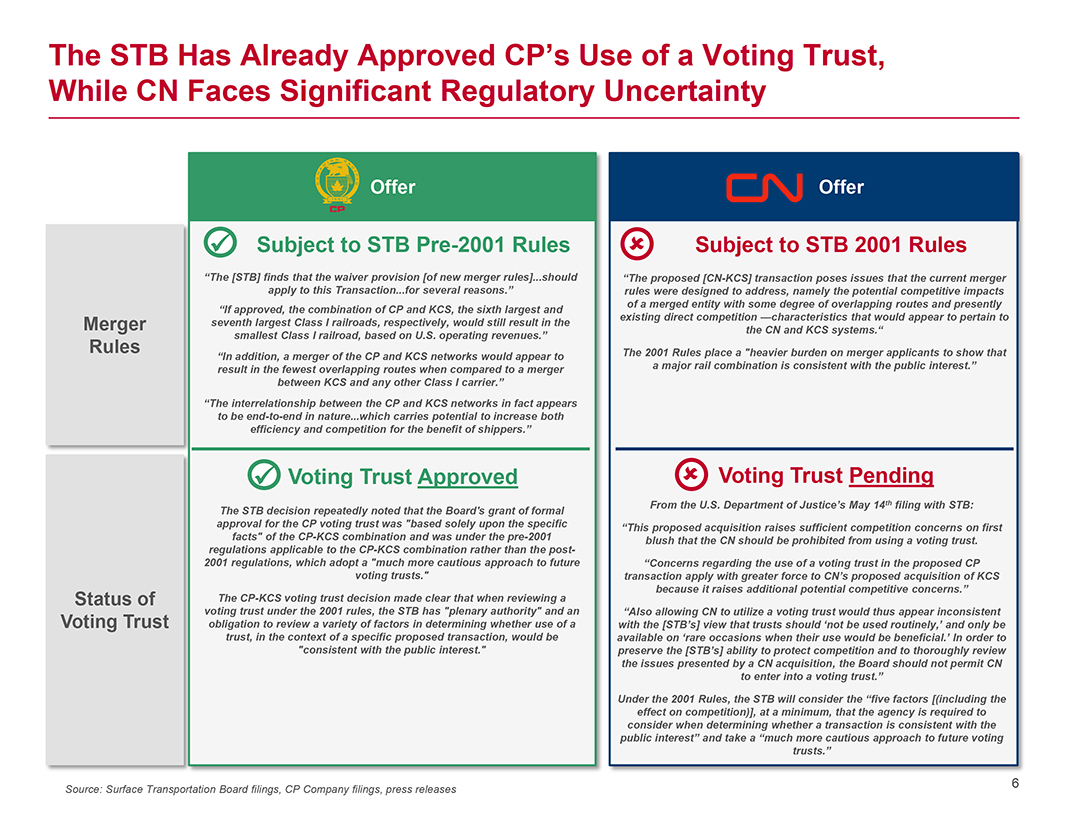

The STB Has Already Approved CP’s Use of a Voting Trust, While CN Faces Significant Regulatory Uncertainty

Offer

 Subject to STB Pre-2001 Rules

“The [STB] finds that the waiver provision [of new merger rules] should

apply to this Transaction for several reasons.”

“If approved, the

combination of CP and KCS, the sixth largest and

seventh largest Class I railroads, respectively, would still result in the

smallest Class I railroad, based on U.S. operating revenues.”

“In addition, a merger

of the CP and KCS networks would appear to

result in the fewest overlapping routes when compared to a merger

between KCS and any other Class I carrier.”

“The interrelationship between the CP

and KCS networks in fact appears

to be end-to-end in nature which carries potential

to increase both

efficiency and competition for the benefit of shippers.”

Merger Rules

 Voting Trust Approved

The STB decision repeatedly noted that the Board’s grant of formal

approval for the CP

voting trust was “based solely upon the specific

facts” of the CP-KCS combination and was under the pre-2001

regulations applicable to the CP-KCS combination rather than the post-

2001 regulations, which adopt a “much more cautious approach to future

voting trusts.”

The CP-KCS

voting trust decision made clear that when reviewing a

voting trust under the 2001 rules, the STB has “plenary authority” and an

obligation to review a variety of factors in determining whether use of a

trust, in the

context of a specific proposed transaction, would be

“consistent with the public interest.”

Status of Voting Trust

Offer

 Subject to STB 2001 Rules

“The proposed [CN-KCS] transaction poses issues that the current merger

rules were designed to address, namely the potential competitive

impacts

of a merged entity with some degree of overlapping routes and presently

existing direct competition —characteristics that would appear to pertain to

the CN and KCS systems.“

The 2001 Rules place a “heavier burden on merger applicants

to show that

a major rail combination is consistent with the public interest.”

 Voting Trust Pending

From the U.S. Department of Justice’s May 14th

filing with STB:

“This proposed acquisition raises sufficient competition concerns on first

blush that the CN should be prohibited from using a voting trust.

“Concerns regarding the

use of a voting trust in the proposed CP

transaction apply with greater force to CN’s proposed acquisition of KCS

because it raises additional potential competitive concerns.”

“Also allowing CN to

utilize a voting trust would thus appear inconsistent

with the [STB’s] view that trusts should ‘not be used routinely,’ and only be

available on ‘rare occasions when their use would be beneficial.’ In order to

preserve the [STB’s] ability to protect competition and to thoroughly review

the issues presented by a CN acquisition, the Board should not permit CN

to enter into a

voting trust.”

Under the 2001 Rules, the STB will consider the “five factors [(including the

effect on competition)], at a minimum, that the agency is required to

consider when

determining whether a transaction is consistent with the

public interest” and take a “much more cautious approach to future voting

trusts.”

Source: Surface Transportation Board filings, CP Company filings, press releases

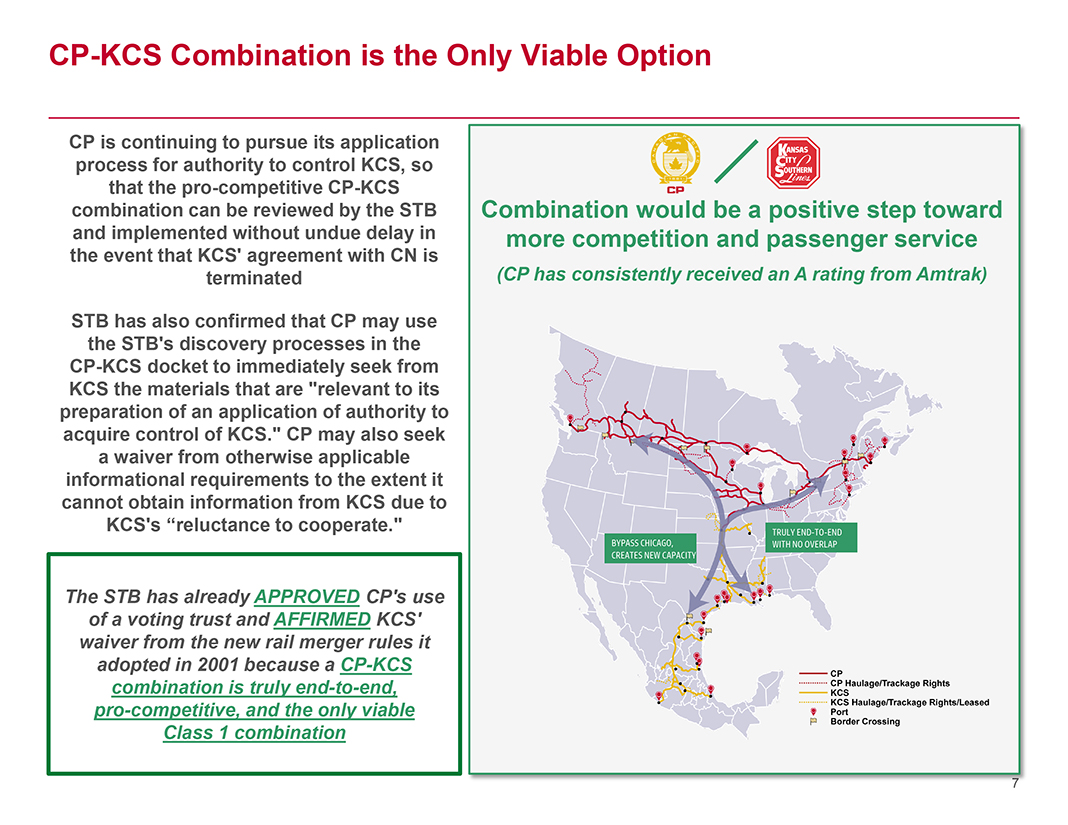

CP-KCS Combination is the Only Viable Option

CP is continuing to pursue its application process for authority to control KCS, so that the pro-competitive

CP-KCS combination can be reviewed by the STB and implemented without undue delay in the event that KCS’ agreement with CN is terminated

STB has also confirmed that CP may use the STB’s discovery processes in the CP-KCS docket to immediately seek from KCS the materials

that are “relevant to its preparation of an application of authority to acquire control of KCS.” CP may also seek a waiver from otherwise applicable informational requirements to the extent it cannot obtain information from KCS due to

KCS’s “reluctance to cooperate.”

The STB has already APPROVED CP’s use of a voting trust and AFFIRMED KCS’ waiver from the new rail merger

rules it adopted in 2001 because a CP-KCS combination is truly end-to-end,

pro-competitive, and the only viable Class 1 combination

Combination would be a positive step toward more competition

and passenger service

(CP has consistently received an A rating from Amtrak)

BYPASS CHICAGO, CREATES NEW CAPACITY

TRULY END-TO-END WITH NO OVERLAP

7

CP-KCS is a Compelling Strategic Combination and the Only Viable Class 1 Combination

Combination offers significant benefits to rail shippers and the supply chain

KCS shareholders benefit from clear path to closing

Clear Path to Closing

with the Voting Trust Already Approved by STB

Creates the First U.S.-Mexico-Canada Rail Network which is Truly End-to-End and Pro-Competitive with No Overlap

Well Positioned for Growth,

Bringing Together Two Railroads with Highest 3-Year Revenue CAGR

Significant Annualized Synergies that KCS Shareholders

Would Participate in Through Meaningful Ownership

CP’s Leading Management Team has Consistently Outperformed CN and Delivered on Guidance

8

Appendix A – CN’s Voting Trust Likely Will Not Be Approved

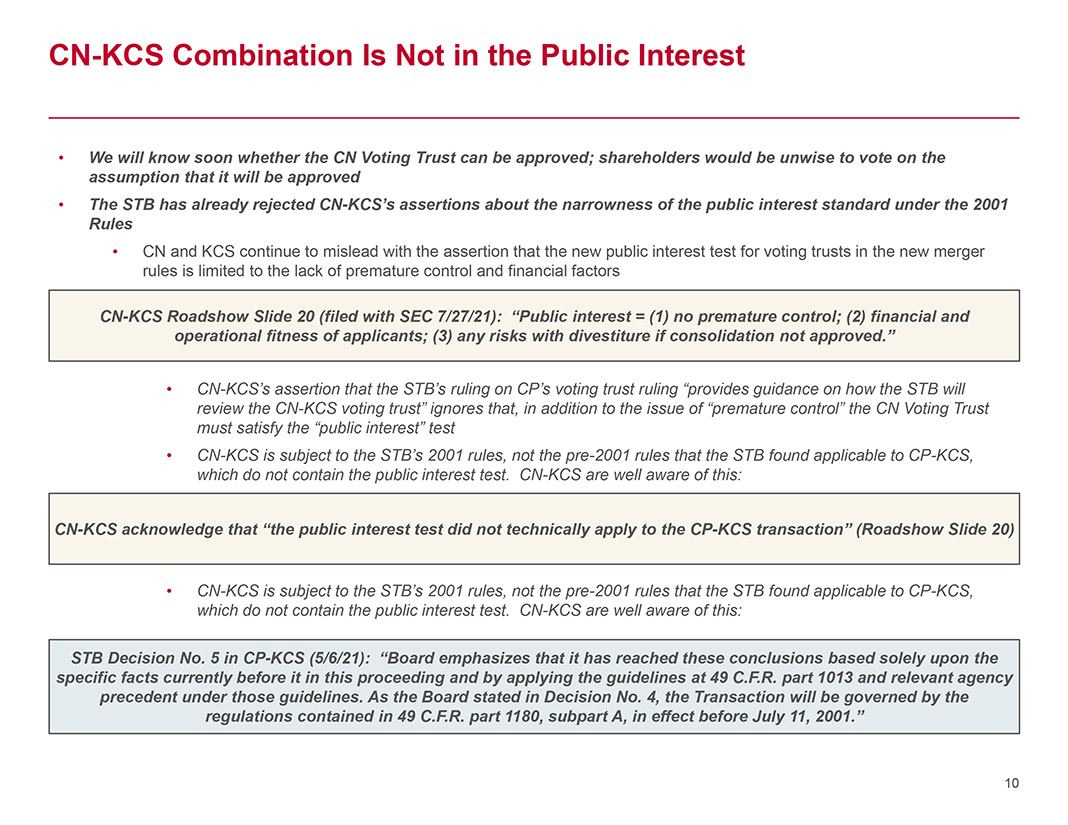

CN-KCS Combination Is Not in the Public Interest

• We will know soon whether the CN Voting Trust can be approved; shareholders would be unwise to vote on the assumption that it will be approved

• The STB has already rejected CN-KCS’s assertions about the narrowness of the public interest standard under the 2001 Rules

• CN and KCS continue to mislead with the assertion that the new public interest test for voting trusts in the new merger rules is limited to the lack of

premature control and financial factors

CN-KCS Roadshow Slide 20 (filed with SEC 7/27/21): “Public interest = (1) no

premature control; (2) financial and operational fitness of applicants; (3) any risks with divestiture if consolidation not approved.”

•

CN-KCS’s assertion that the STB’s ruling on CP’s voting trust ruling “provides guidance on how the STB will review the CN-KCS voting trust” ignores that, in addition to the issue of

“premature control” the CN Voting Trust must satisfy the “public interest” test

• CN-KCS is subject to the STB’s 2001 rules, not the pre-2001 rules that the STB found applicable to CP-KCS, which do not contain the public interest test. CN-KCS are well aware of this:

CN-KCS acknowledge that “the public interest test did not technically apply to the

CP-KCS transaction” (Roadshow Slide 20)

• CN-KCS is subject to the

STB’s 2001 rules, not the pre-2001 rules that the STB found applicable to CP-KCS, which do not contain the public interest test.

CN-KCS are well aware of this:

STB Decision No. 5 in CP-KCS (5/6/21):

“Board emphasizes that it has reached these conclusions based solely upon the specific facts currently before it in this proceeding and by applying the guidelines at 49 C.F.R. part 1013 and relevant agency precedent under those guidelines. As

the Board stated in Decision No. 4, the Transaction will be governed by the regulations contained in 49 C.F.R. part 1180, subpart A, in effect before July 11, 2001.”

10

Public Interest Standard (Cont’d)

• In

the CN-KCS proceeding the STB explained that the public interest standard applicable to the approval of CN’s Voting Trust is far broader than CN-KCS claim:

STB Decision No. 3 in CN-KCS (5/17/21): “financial integrity … one of five factors, at a minimum, that the

agency is required to consider when determining whether a transaction is ‘consistent with the public interest.’”

• Decision No. 3 also

makes clear that the standard for approval under the 2001 rules is far more onerous than under the pre-2001 standards

STB

Decision No. 3 in CN-KCS:

“voting trusts … should not be used routinely, but rather should be available only

for those rare occasions when their use would be beneficial” “use of a voting trust is a privilege, not a right” “the Board expects to take a more cautious approach to a voting trust here” “ whether the proposed use of

a voting trust in a potential CN-KCS transaction is ‘consistent with the public interest’ would be informed by argument on both the potential benefits and costs of such use”

• STB Chairman Oberman emphasized the breadth of the public interest test in public comments shortly after Decision No. 3

Chairman Oberman (Wolfe, 5/25/21):

“we laid out in that decision as best we could the

factors and the details that will be relevant and will be analyzed by us in connection with the voting trust” “when you are considering the public interest, there are not two different public interests. There are issues involving –

the factors are laid out: competition, public interest, health of the network generally, all of those issues are relevant to all of these considerations”

11

Even if the Public Interest Test Were as Narrow as CN Claims, CN’s Trust Would Flunk the Test

• CN acknowledges that financial risks are a relevant factor

• Yet CN’s voting

trust papers fail to address the financial implications – in terms of pressure to raise rates or cut back on investment – posed by the $11+ billion in debt CN would incur as soon as the Trust was formed, and might never be able to recoup

• CN did not give appropriate consideration to the implications of an economic downside scenario, in which the revenues relied upon to repay debt would be

reduced

• CN did not analyze the implications of a potential need to dispose of KCS out of trust in a spinoff transaction that does not yield any sale

proceeds

12

CN and KCS Fail to Address the Other Prongs of the Public Interest Test Focused on Impact on Competition for CN’s Voting Trust

• STB has signaled that this is an important factor: CN-KCS Decision No. 3 cited DOJ comments emphasizing that

competitive harm could arise during the Trust period

STB Decision No. 3 in CN-KCS: quoted DOJ comment that

“threats to competition would be present immediately after the CN voting trust is consummated”

• Biden Executive Order tells agencies like the STB

to give weight to DOJ’s views

Exec. Order Sec. 3(c)(ii): “[STB] encouraged to coordinate their efforts, as appropriate and consistent with applicable

law, with respect to: … in the case of major transactions, soliciting and giving significant consideration to the views of the Attorney General

• The

history of CN-KCS’s misrepresentations about the nature of their transaction betray a realization that CN-KCS will in fact harm competition as soon as the Voting

Trust is formed

• CN started out saying it was a true end to end transaction –it wasn’t

CN (Ruest) (Bernstein, 6/3/21): “combination is a true end-to-end merger”

• Ultimately forced to acknowledge that there was head-to-head competition; proposed to divest

Baton Rouge—New Orleans line and then proclaimed that this addressed all competitive issues AGAIN ignoring other points of overlap and parallel corridors

CP-KCS Roadshow Slide 10: “divestiture … would result in zero overlap”

• But the divestiture cannot protect

competition during the Voting Trust period, because it would only occur, if at all, after the STB approved CN-KCS control at the end of 2022 at the earliest

• As a result, all we have are CN’s promises that it will preserve CN and KCS competition during the Trust Period – the mere fact that CN must make them promise

shows that there is in fact competition to preserve

CN Reply (7/6/21): “Mr. Ruest also emphasizes … CN’s commitments to ensuring robust

competition during the trust period” CN (Finn) (TD, 5/5/21): STB “should realize that these two railways [compete] today and … will continue to compete during the voting trust period”

• In addition, the facts show that CN’s zero overlap claim is false.

•

CP’s economist Robert Majure explained in detail the parallel route structure and the potential harm to geographic competition in CP’s Voting Trust Comments

• CN and KCS have acknowledged that their parallel north-south lines are in fact “alternative” competing North-South routes

KCS (Ottensmeyer) (Bernstein, 6/3/21): KCS and CN routes to the Gulf are “multiple routes that could be used alternatively”

13

CN has Repeatedly Taken an Unduly Narrow View of the

Rail-to-Rail Competition that the STB will Seek to Protect

CN has repeatedly acted

as if the only relevant competitive issues are “2-to-1” direct served shippers (which it says it will remedy with its proposed divestiture)

CN Voting Trust Motion, Ruest V.S. (5/26/21): “CN would propose solutions for the very limited number of customers that are served only by CN and KCS (so called 2-to-1 customers)”

The STB has a different view, which includes corridor competition

and competition

2001 Rules: “additional consolidation in the industry is also likely to result in a number of anticompetitive effects. such as loss of

geographic competition. that are increasingly difficult to remedy directly or proportionately” STB in CN/WC in 2001: inquiring whether there are “rail corridors in which CN and WC compete” or any “expected reduction in geographic

competition” in addition to whether there are “ 2-to-1 or 3-to-2 shippers”

CP’s economist, Robert Majure, showed that there are over 300 shippers served by both CN and KCS, and that CN-KCS

would reduce the number of independent rail routes from 3-to-2 or 2-to-1 in more than 60

different BEA-to-BEA corridors

14

CN’s Proposed Divestiture is Illusory

Although CN calls its proposal a “divestiture,” it is not really a transfer of the rights that KCS has today given that CN will retain trackage rights to

operate over the entire line and serve every shipper on the line

CN Voting Trust Motion (5/26/21): “CN-KCS will retain

local and overhead trackage rights over the line”

Appears highly unlikely that any buyer would:

(a) be a viable competitor given CN-KCS’s service everywhere on the divested lines;

(b) have the resources to invest in the line (including its many bridges); or

(c) be a real

competitor with the incentive and ability to replace KCS’s role in reaching distant markets – e.g., via KCS-CP routes via Kansas City

15

There is No Realistic Prospect for an Appeal to Overturn a Negative Ruling by the STB on CN’s Trust

CN’s disdain for the STB’s authority over voting trusts is longstanding, but its narrow view of the STB’s authority has consistently been rejected

CN in EP 582 (11/17/00): argued that use of voting trusts was “outside the Board’s public interest jurisdiction”

The STB squarely rejected CN’s view in 2001:

STB in EP 582 (6/11/01) (adopting 2001

Rules): “CN questions our … authority …, but that power is inherent in our statutory authority over rail mergers”

The courts of appeals have

emphasized the STB’s plenary and exclusive authority in the area of railroad mergers, and its extensive discretion in this arena.

U.S. Supreme Court:

“wisdom and experience of the expert agency, not of the courts, must determine whether the proposed consolidation is consistent with the public interest”

For example, the courts affirmed the STB’s complete moratorium on Class I merger applications as within the STB’s discretion

D.C. Circuit: STB discretion with respect to rail mergers flows from “Board’s ‘special cognizance’ over the railroad industry”

16

Appendix B—Uncertainty Surrounds Ultimate Approval of CN Control of KCS

Ultimate Approval of CN Control of KCS Remains Highly Uncertain

The 2001 Rules fundamentally changed the STB’s approach to proposed mergers, shifting the presumption to one disfavoring further consolidation, especially where competition

would be reduced

STB in EP 582 (10/3/00) (proposing new rules): New rules mark a “paradigm shift in our review of major mergers”

STB’s decision applying the 2001 Rules to CN noted that a CN-KCS combination, unlike a

CP-KCS combination, poses the concerns that motivated adoption of the 2001 Rules

STB Decision No. 3 in CN-KCS: “proposed transaction poses issues that the current merger rules were designed to address, namely

the potential competitive impacts of a merged entity with some degree of overlapping routes and presently existing direct competition—characteristics that would appear to pertain to the CN and KCS systems.”

Under the 2001 Rules, CN must not merely preserve existing options, but “enhance competition”

CN’s transaction would reduce competition, and at minimum require STB to enforce numerous “commitments” aimed at addressing the fundamental structural change caused

by the transaction – the elimination of parallel and overlapping routes

CN’s “open gateway” pledge is not an offsetting competitive

enhancement”

KCS touts this as a “major commitment” (Roadshow Slide 26), but it is in fact no different than what every merging party has committed

to even in Minor and Significant cases since 2000, including CN three separate times: WC (in 2001), DMIR (in 2004), and EJE (in 2008)

STB in 2001 CN/WC case (a

Minor merger): Applicants “pledge to ‘keep all existing active gateways affected by the Transaction open on commercially reasonable terms.’ … We will hold applicants to this representation.”

This merely preserves competition, it does not add anything new

18

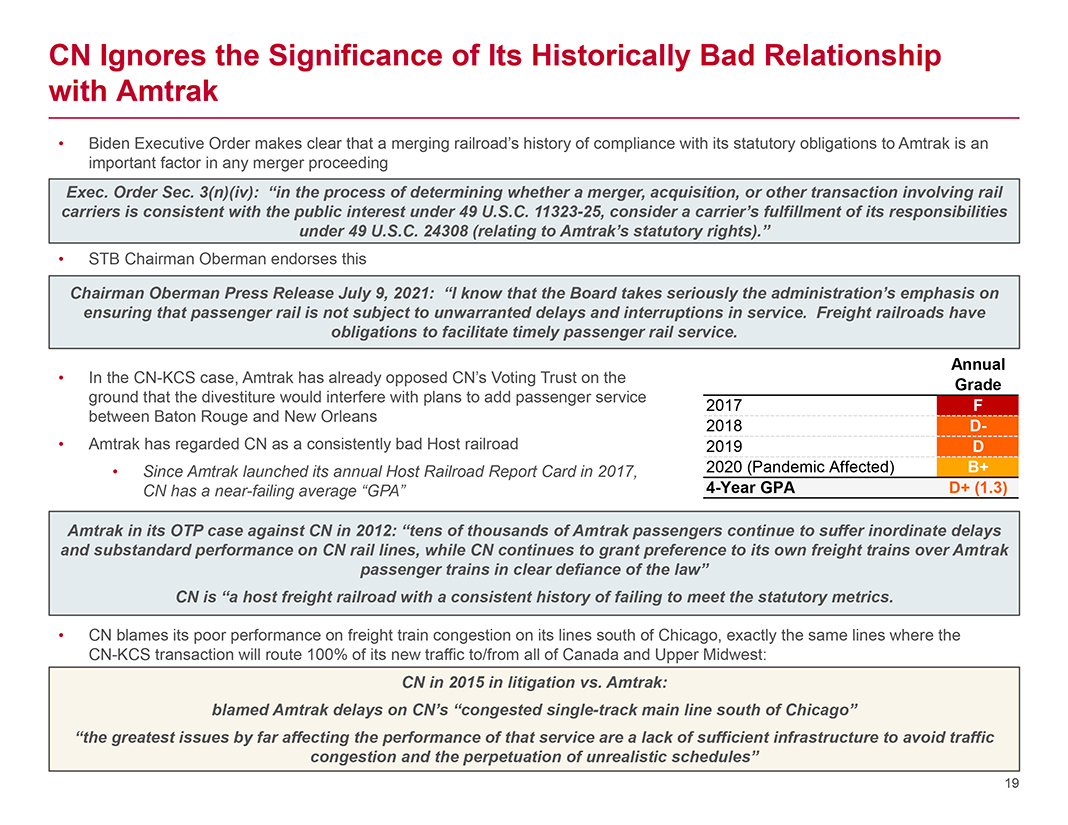

CN Ignores the Significance of Its Historically Bad Relationship with Amtrak

Biden Executive Order makes clear that a merging railroad’s history of compliance with its statutory obligations to Amtrak is an important factor in any merger proceeding

Exec. Order Sec. 3(n)(iv): “in the process of determining whether a merger, acquisition, or other transaction involving rail carriers is consistent with the

public interest under 49 U.S.C. 11323-25, consider a carrier’s fulfillment of its responsibilities under 49 U.S.C. 24308 (relating to Amtrak’s statutory rights).”

STB Chairman Oberman endorses this

Chairman Oberman Press Release July 9, 2021: “I

know that the Board takes seriously the administration’s emphasis on ensuring that passenger rail is not subject to unwarranted delays and interruptions in service. Freight railroads have obligations to

facilitate timely passenger rail service.

In the

CN-KCS case, Amtrak has already opposed CN’s Voting Trust on the ground that the divestiture would interfere with plans to add passenger service between Baton Rouge and New Orleans

Amtrak has regarded CN as a consistently bad Host railroad

Since Amtrak launched its annual

Host Railroad Report Card in 2017, CN has a near-failing average “GPA”

Annual Grade

2017 F 2018 D-2019 D 2020 (Pandemic Affected) B+ 4-Year GPA D+ (1.3)

Amtrak in its OTP case against CN in 2012: “tens of thousands of Amtrak passengers continue to suffer inordinate delays and substandard performance on CN rail lines, while CN

continues to grant preference to its own freight trains over Amtrak passenger trains in clear defiance of the law” CN is “a host freight railroad with a consistent history of failing to meet the statutory metrics.

CN blames its poor performance on freight train congestion on its lines south of Chicago, exactly the same lines where the CN-KCS

transaction will route 100% of its new traffic to/from all of Canada and Upper Midwest:

CN in 2015 in litigation vs. Amtrak: blamed Amtrak delays on CN’s

“congested single-track main line south of Chicago”

“the greatest issues by far affecting the performance of that service are a lack of sufficient

infrastructure to avoid traffic congestion and the perpetuation of unrealistic schedules”

19

A CN-KCS Combination Poses Numerous Other Serious Public Interest Concerns

It extinguishes the possibility of CP-KCS combination, which injects new competition and investment in North-South rail corridors,

intensifying competition with larger Class I railroads like UP, BNSF and CN – without any need for remedies or STB enforcement of commitments.

It sparks

potential further “downstream” consolidation

It leads to a downgrading of KCS’s Shreveport-Kansas City mainline, which would degrade existing CP-KCS routing options and reduce rail capacity rather than expanding it

KCS (Ottensmeyer) (Bernstein 6/3/21) and CN (Ruest) (UBS

6/8/21): Shreveport-Kansas

City line would be a “less attractive route” and become a “redundancy line” in

CN-KCS system

20

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Umicore secures € 499 million in sustainability-linked private debt placement

- AKVA group ASA: Invitation – presentation of the Q1 2024 financial results

- Albion Technology & General VCT PLC: Annual Financial Report

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share