Form DEFC14A AVALARA, INC. Filed by: Altair US, LLC

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant ¨

Filed by a Party other than the Registrant þ

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Under Rule 14a-12 |

Avalara, Inc.

(Name of Registrant as Specified In Its Charter)

Altair US, LLC

Richard H. Bailey

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| þ | No fee required. |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

| Avalara, Inc. SHAREHOLDERS: WE NEED YOUR HELP TO PROTECT THE VALUE OF YOUR INVESTMENT BY VOTING AGAINST THE PROPOSED MERGER |

ALTAIR US, LLC

September 30, 2022

Dear Fellow Avalara Shareholders:

The attached proxy statement and the enclosed GOLD proxy card are being furnished to you, the shareholders of Avalara, Inc., a Washington corporation (“Avalara” or the “Company”), in connection with the solicitation of proxies by Altair US, LLC for use at the special meeting of shareholders of Avalara and at any adjournments or postponements thereof (the “Special Meeting”), relating to the proposed acquisition of Avalara (the “Merger”) by affiliates of Vista Equity Partners Management, LLC. In connection with the proposed Merger, Avalara entered into an Agreement and Plan of Merger, dated as of August 8, 2022 (the “Merger Agreement”), with Lava Intermediate, Inc., a Delaware corporation (“Parent”), and Lava Merger Sub, Inc., a Washington corporation and wholly owned subsidiary of Parent (“Merger Sub”). Pursuant to and subject to the terms and conditions of the merger agreement, Merger Sub will be merged with and into Avalara and Avalara will survive the merger as a direct or indirect wholly owned subsidiary of Parent.

Pursuant to the attached proxy statement, we are soliciting proxies from holders of shares of Avalara’s common stock to vote AGAINST adopting the Merger Agreement.

According to the Company, you will be able to attend the Special Meeting by visiting www.cesonlineservices.com/avlr22_vm. To participate in the Special Meeting, you must pre-register at www.cesonlineservices.com/avlr22_vm by 9:00 a.m., Eastern Time on Thursday, October 13, 2022. You will not be able to attend the Special Meeting in person.

We recommend that you carefully consider the information contained in the attached proxy statement and then support our efforts by signing, dating and returning the enclosed GOLD proxy card today, or by voting against adopting the Merger Agreement via the internet or telephone.

If you have already voted for management’s proposals relating to the Merger on the white proxy card, you have every right to change your vote by signing, dating and returning a later dated proxy card or by voting via the internet or telephone.

If you have any questions or require any assistance with your vote, please contact MacKenzie Partners, Inc. (“MacKenzie Partners”), which is assisting us, at their address and toll-free number listed below.

Thank you for your support,

Altair US, LLC

|

MacKenzie Partners, Inc. 1407 Broadway, 27th Floor New York, New York 10018

Stockholders Call Toll Free: 1-800-322-2885 E-mail: [email protected] |

SPECIAL MEETING OF SHAREHOLDERS OF

avalara, Inc.

255 South King Street, Suite 1800

Seattle, WA 98104

__________________________

PROXY STATEMENT

OF

ALTAIR US, LLC

PLEASE USE THE ENCLOSED GOLD PROXY CARD TO VOTE BY TELEPHONE OR INTERNET TODAY.

ALTERNATIVELY, YOU MAY SIGN, DATE AND RETURN THE ENCLOSED GOLD PROXY CARD BY MAIL.

Altair US, LLC (“Altair” or “we”) is a pre-IPO angel investor in, and one of the largest shareholders of, Avalara, Inc. (“Avalara” or the “Company”). We are writing to our fellow shareholders in connection with the proposed acquisition of Avalara (the “Merger”) by affiliates of Vista Equity Partners Management, LLC (“Vista”). In connection with the proposed Merger, Avalara entered into an Agreement and Plan of Merger, dated as of August 8, 2022 (the “Merger Agreement”), with Lava Intermediate, Inc., a Delaware corporation (“Parent”), and Lava Merger Sub, Inc., a Washington corporation and wholly owned subsidiary of Parent (“Merger Sub”). Pursuant to and subject to the terms and conditions of the merger agreement, Merger Sub will be merged with and into Avalara and Avalara will survive the merger as a direct or indirect wholly owned subsidiary of Parent. The Board of Directors of Avalara (the “Board”) has scheduled a special meeting of shareholders for the purpose of adopting the Merger Agreement (the “Special Meeting”). The Special Meeting is scheduled to be a virtual meeting held as a live audio webcast via the internet at www.cesonlineservices.com/avlr22_vm on October 14, 2022, at 9:00 a.m., Eastern Time. To participate in the Special Meeting, you must pre-register at www.cesonlineservices.com/avlr22_vm by 9:00 a.m., Eastern Time on Thursday, October 13, 2022. You will not be able to attend the Special Meeting in person.

As set forth more fully in this Proxy Statement, we oppose the Merger and urge fellow shareholders to vote AGAINST the adoption of the Merger Agreement because we believe the proposed Merger (i) significantly undervalues the Company and (ii) was negotiated and agreed to at an inopportune time during this depressed and volatile period in the capital markets and global economy and following an inappropriately limited and severely flawed sale process. On a forward EBITDA basis, the proposed Merger price would be a substantial discount to the Company’s historical valuation.[1] We therefore believe that the Merger is not in the best interests of shareholders and are soliciting proxies from the shareholders of Avalara to vote AGAINST the following Merger proposals (the “Merger Proposals”):

| Proposal | Our Recommendation | |||

| 1. | Avalara’s proposal to adopt the Merger Agreement (the “Merger Agreement Proposal”). | AGAINST | ||

| 2. | Avalara’s proposal to approve, on a non-binding, advisory basis, the compensation that may be paid or become payable by Avalara to its named executive officers in connection with the Merger (the “Compensation Proposal”). | AGAINST | ||

| 3. | Avalara’s proposal to approve any adjournment of the Special Meeting to a later date or dates, if necessary or appropriate, to solicit additional proxies if there are insufficient votes to approve the Merger Agreement Proposal or to ensure that any supplement or amendment to the accompanying proxy statement is timely provided to Avalara shareholders (the “Adjournment Proposal”). | AGAINST | ||

| To transact any other business that properly comes before the Special Meeting, including any postponement or adjournment thereof. | ||||

_____________________________

[1] Throughout Avalara’s time as a public company, it has traded at a median enterprise value multiple to the next-twelve months projected revenue of 12.9x. Since the beginning of 2020, when the Company’s growth accelerated due to pandemic-driven shifts in customer demand patterns, it has traded at an even higher multiple: 16.5x the next twelve-months forecasted revenue. The proposed transaction is valued at just 8.1x forecasted revenue, a substantial discount to the Company’s historical valuation.

Avalara has set the record date for determining shareholders entitled to notice of and to vote at the Special Meeting as September 8, 2022 (the “Record Date”). Only shareholders of record at the close of business on the Record Date will be entitled to vote at the Special Meeting. As of the Record Date, there were 88,557,882 shares of Avalara common stock, par value $0.0001 per share (“Common Stock”) outstanding and entitled to vote at the Special Meeting according to the Company’s definitive proxy statement filed with the Securities and Exchange Commission (the “SEC”) on September 12, 2022 (the “Company’s Proxy Statement”).

As of the close of business on September 29, 2022, the Participants (as defined in Annex I) beneficially owned 850,892 shares of Common Stock.

We intend to vote our shares AGAINST Avalara’s Merger Proposals.

We urge you to sign, date and return the GOLD proxy card voting “AGAINST” Avalara’s Merger Proposals.

This Proxy Statement and GOLD proxy card are first being mailed or given to the Company’s shareholders on or about September 30, 2022.

This Proxy Solicitation is being made by Altair and Richard H. Bailey, the Manager of Altair, and not on behalf of the Board or management of the Company or any other third party. We are not aware of any other matters to be brought before the Special Meeting other than as described herein. Should other matters be brought before the Special Meeting, the persons named as proxies in the enclosed GOLD proxy card will vote on such matters in their discretion.

If you have already voted using the Company’s white proxy card, you have every right to change your vote by using the GOLD proxy card to vote again by telephone or Internet or by telephone by following the instructions on the GOLD proxy card. Alternatively, you may sign, date and return the enclosed GOLD proxy card in the postage-paid envelope provided. Only the latest validly executed proxy that you submit will be counted; any proxy may be revoked at any time prior to its exercise at the Special Meeting by following the instructions under “Can I change my vote or revoke my proxy?” in the Questions and Answers section.

For instructions on how to vote and other information about the proxy materials, see the Questions and Answers section starting on page 11.

|

YOUR VOTE IS IMPORTANT We urge you to submit your vote using the GOLD proxy card via Internet or by telephone as soon as possible. For additional instructions for each of these voting options, please refer to the enclosed GOLD proxy card. |

If you have any questions or require any assistance with voting your shares, please contact MacKenzie Partners, toll free at 1-800-322-2885 or email at [email protected].

PROPOSAL 1: MERGER AGREEMENT PROPOSAL |

You are being asked by Avalara to adopt the Merger Agreement. It is a condition to the consummation of the Merger that Avalara’s shareholders adopt the Merger Agreement. For the reasons discussed below, we oppose the Merger and the adoption of the Merger Agreement. To that end, we are soliciting your proxy to vote AGAINST Proposal 1.

We recommend that you demonstrate your opposition to the proposed Merger and send a message to the Board that the proposed Merger is not in the best interest of Avalara’s shareholders by using the enclosed GOLD proxy to vote by telephone or internet today. Alternatively, you may sign, date and return the enclosed GOLD proxy card by mail.

Reasons to Vote Against Adopting the Merger Agreement:

We believe strongly in Avalara’s opportunity to create significantly more value for shareholders. Tax compliance is critical for all businesses, but despite increasing complexity and risk of exposure, many businesses continue to calculate taxes and file returns manually. We believe Avalara, by providing simple, automated transactional tax solutions in a market with limited competition, has a clear and long runway to continue to compound growth for many years, regardless of macroeconomic conditions. Avalara, in our view, is a fundamentally sound business, with a resilient business model, strong partnerships with leading companies and a compelling opportunity to be a part of every transaction in the world.[2]

As Ross Tennenbaum, Avalara’s Chief Financial Officer, said this May:

“We’re addressing a large, low-penetrated market where we are a leader in the space, with competitive moats and a differentiated business strategy. We are positioning to capture a leader share of our market opportunity.”[3]

And again, as recently as June 28, Mr. Tennenbaum expressed great enthusiasm for the prospects of Avalara:

“We remain in the early days of penetration in a big market and still believe we are a growth story where we can sustain strong growth for a number of years as we build a multibillion-dollar revenue company. We also believe we can do that with significant margin improvement.”[4]

Avalara’s leadership team has taken great pains to explain that despite the difficult global economic environment, Avalara is positioned to succeed, stating that the Company is “a long and strong growth compounder and well-positioned to grow in good and in challenging times.”[5]

It is dumbfounding to us that the Board would have chosen now to sell the Company. The management team has expressed confidence in the future, despite an uncertain macroeconomic environment that would surely cause any potential buyer to pause. Meanwhile, capital markets are volatile, private equity funds are proceeding very cautiously and the debt financing market for large buyouts, like that of Avalara, limits the ability of private equity firms to pay reasonable multiples. On top of this, the Company is on the verge of achieving operating profitability for the first time,[6] which we believe will make it more attractive to a larger and different set of buyers. In light of these circumstances, this was simply the wrong time for the Board to look for a buyer for Avalara in our opinion.

_____________________________

[2] CEO Scott McFarlane, Avalara 2022 Analyst Day, June 28, 2022 (“First, we have a clear and unified vision to be part of every transaction in the world. And I am more confident than ever we can achieve this vision.”).

[3] CFO Ross Tennenbaum, Q1 2022 Earnings Call, May 6, 2022.

[4] CFO Ross Tennenbaum, Avalara 2022 Analyst Day, June 28, 2022.

[5] CEO Scott McFarlane, Q1 2022 Earnings Call, May 6, 2022.

[6] See Avalara Preliminary Proxy Statement, filed with the SEC on August 24, 2022, at 64, which shows Non-GAAP Operating Income at break-even in 2022 and $52 million in 2023, with Non-GAAP Operating Income projected to approximately double in each of the subsequent two years.

The Timing Is Wrong

Only one party made a final proposal to buy Avalara, despite the fact that Avalara is a company with very attractive long-term fundamentals and a “competitive moat.”[7] This unfortunate and suboptimal outcome was the result, in our view, of a poorly timed and flawed sale process.

Macroeconomic factors like rising interest rates, inflation, supply chain disruptions and concerns over consumer spending have created significant economic dislocation and uncertainty in 2022. Avalara has certainly not been immune to these challenges. During the first quarter of 2022, sales and marketing capacity constraints led to slower than expected growth in new bookings and upsell bookings, and the Company’s international business faced some weakness attributable to a decrease in contract pricing with a large marketplace partner.

At the same time, volatile capital markets have lowered equity valuations and made financing of large buyout transactions difficult. The Russell 3000 was down 20% during the first half of 2022, its worst start to the year ever.[8] For technology companies, these issues have been compounded by the normalization of growth and post-pandemic demand, rattling investor confidence in the sector. Not surprisingly, Avalara’s stock price was down approximately 23% during the first quarter of 2022 given these economic uncertainties and the “risk off” capital markets environment.

While Avalara’s share price declined as investors pulled back from higher-risk assets, there were no signs that the Company’s long-term prospects were fundamentally impaired. As noted above, in May and June, the Company’s executive officers continued to express great confidence in the Company’s prospects and batted away concerns that the economic slowdown would have much impact on the Company in the mid- to longer-term. Notably, on the May earnings call, for example, Mr. Tennenbaum said that Avalara’s broad customer diversity helps “insulate the [Company] from shock to e-commerce and the broader economy” and that its international business remains “a huge opportunity and green space” going forward.[9]

The Company’s projections also reflect management’s confidence that the short-term economic disruptions would have only a marginal impact on the mid- and long-term prospects of the business. While the Company’s “May Projections” forecasted a Non-GAAP Operating Loss of $11 million in 2022 and Non-GAAP Operating Income of $55 million in 2023, the Company’s updated “July Projections” show the Company breaking even in 2022 (an improvement) and a Non-GAAP Operating income of $52 million in 2023.[10]

Faced with uncertain economic times – but ones the executive team was confident the Company would weather successfully[11] – a depressed stock market and a volatile financing market, it is incomprehensible to us that the Board would have thought the timing was optimal to maximize the value of the Company in a sale.

We believe there was no imperative for the Board to undertake a sale process amid a temporarily strained economic environment coupled with inhospitable financing markets.

By July, as proposals for Avalara were due under the Board’s process, high-yield corporate bond spreads to treasury yields had widened more than 200 basis points from January, significantly affecting the availability of financing and the cost of debt for any buyout. Notably, the number of announced private equity buyouts in the $5 billion to $10 billion range in Q2 was down more than 40% from a year earlier[12] because of the turmoil in the economy and financing markets.[13]

_____________________________

[7] CFO Ross Tennenbaum, Q1 2022 Earnings Call, May 6, 2022.

[8] Source: FactSet.

[9] Avalara Q1 2022 Earnings Call, May 5, 2022.

[10] Avalara Preliminary Proxy Statement, filed with the SEC on August 24, 2022, at 63-64.

[11] In May, the Board approved mid-term projections indicating that Avalara could achieve operating profitability as soon as 2023 for the first time. See Avalara Preliminary Proxy Statement, filed with the SEC on August 24, 2022 at page 63.

[12] Source: Bloomberg.

[13] Source: Aaron Kirchfeld and Michelle F. Davis, “Dealmakers Buckle Up as Records Give Way to Ruptures in M&A,” Bloomberg, June 30, 2022 (“Buyout firms, whose spending had been trending up year-on-year as recently as May, are all of a sudden finding it harder to secure the leveraged loans required to get big deals done.”).

We believe the Board’s timing for conducting the once-and-only sale of Avalara impacted the number of proposals and the competitive nature of the “auction.” Several potentially interested parties withdrew from the process, specifically citing unfavorable market conditions[14] and an uncertain macroeconomic environment.[15] Even Vista itself did not initially submit a proposal due in part to difficulty securing financing because of the “deterioration in the financial markets”[16] and then came back with a lower indication of interest than what it had originally proposed, in part because of “the deterioration in the financial markets.”[17]

The Sale Process Was Flawed

Having launched a sale process in the middle of market turmoil, we believe the Board should have expected that no bidder would provide an indication of interest that matched the Board’s view of intrinsic value. That is exactly what happened. In fact, no bidder was even able to submit a final bid on the Board’s timeline because of the lack of certainty regarding Avalara’s near-term business outlook and the inability to finance an attractive proposal.

When the deadline for making proposals came and went without the Company receiving any final proposals, the Board on July 16 rightly “decided to terminate the potential sale process.”[18] That was the smartest thing this Board did during this “sale” process.

Unfortunately, it was not a decision that lasted.

Instead, the Board appears to have eagerly re-engaged with Vista when Vista came back to the table with a price that was almost 10% below its initial indication of interest. The Board’s engagement on that basis signaled to Vista, in our view, the Company’s unusual eagerness to complete a deal. Vista from then on, in our opinion, had the upper hand and was able to negotiate a deal very much in its favor.

And while this unusual negotiating move – agreeing to re-engage with a bidder at a significantly lower price to accommodate temporary financial market dislocation – may have been the most obvious and egregious process flaw that irreparably tainted the sale process, it certainly was not the only one in our view.

From the start, the Company’s financial advisor, Goldman Sachs, appears to have failed to conduct a robust sale process. It initiated contact with just three potential buyers. The few other firms in the process had all been engaging with the Company for several months about providing growth capital for the Company’s promising international expansion opportunities. Later, when a rumor of a sales process appeared in the media, and Goldman fielded additional in-bound interest from “a variety of parties,”[19] Goldman appeared to pay little attention to those potential buyers and sources of financing; in fact, as far as we can tell from reviewing the Company’s public disclosures, no substantive discussions took place with any of these parties.

The Board’s process, it appears based on its disclosures was to interact with the limited number of firms that had indicated some interest in a transaction with the Company in March and April, and to make outbound phone calls to just three additional firms. We believe this process was woefully inadequate, especially in the face of challenging market conditions. Compounding this process that we regard as deficient was the Board’s willingness to accept a “no-shop” provision, severely limiting the Company’s ability to solicit or encourage other proposals once the deal was announced.

It appears to us that Vista may have been the preferred buyer all along. Goldman has longstanding ties to Vista, after all, including by earning more than $80 million[20] in fees during the last two years from Vista and its affiliates and portfolio companies. It is also not lost on us that Avalara director Marcela Martin serves on a board of a Vista-controlled company with four Vista professionals, including the Vista partner that was responsible for the Avalara deal. And Avalara director Rajeev Singh has also served on the board of a company that Vista acquired.

_____________________________

[14] Avalara Preliminary Proxy Statement, filed with the SEC on August 24, 2022, at 39 (“Party G informed Goldman Sachs that they had determined not to explore a potential transaction involving Avalara because of challenging market conditions,” while “Party C informed members of Avalara’s senior management that they would not submit an indication of interest because of market conditions…”).

[15] Id. at 41.

[16] Id.

[17] Id. at 49.

[18] Id. at 41.

[19] Id. at 40.

[20] Id. at 60.

However, whether Vista was the preferred party all along, or not, it should have been obvious to this Board in our opinion that, between Goldman’s lucrative relationship with Vista and its outsized success fee for this transaction, Goldman had extraordinary financial incentives to recommend a transaction and that nearly any available transaction would be good enough.

The egregious conflicts of interest that incentivized management and Goldman to advocate for the transaction raise serious and troubling questions as to whether the Board followed a reasonable and prudent process. Avalara management stands to receive a $60 million payday as a result of the deal[21] (not including the $2.7 million the non-employee directors will receive[22]). Two of the Company’s directors are serving or have served on the boards of Vista affiliates. Goldman has a close working relationship with Vista and its affiliates, for which it received approximately $80 million in fees over the past two years (not including another $43 million from Vista equity holders and their affiliates[23]), and stands to receive $70 million contingent upon closing of the transaction[24] (plus a net gain of an estimated $5 million with respect to capped call transactions[25]). These conflicts of interest and the absence of truly independent financial advice, in our view, made for a biased and flawed process which, unsurprisingly, led to a great deal for Vista and Goldman but a disappointing outcome for Avalara shareholders.

The Board could very easily have obtained a second opinion from an independent financial advisor – a firm without a strong financial incentive for getting a deal done or maintaining a mutually beneficial relationship with the would-be buyer. So, why didn’t the Board engage a second, unconflicted financial advisor to objectively review the timing, process and terms of this important transaction? We suspect the Board was concerned that any such independent financial advisor would question the suboptimal timing and flawed approach used by the Board and Goldman to arrive at the deal.

The Price Is Inadequate

The Board’s unexplained haste to sell the Company could perhaps be excused had what we regard as an ill-designed and poorly executed sale process nevertheless maximized value for Avalara shareholders. The negotiated transaction, at $93.50 per share, falls far short in our view.

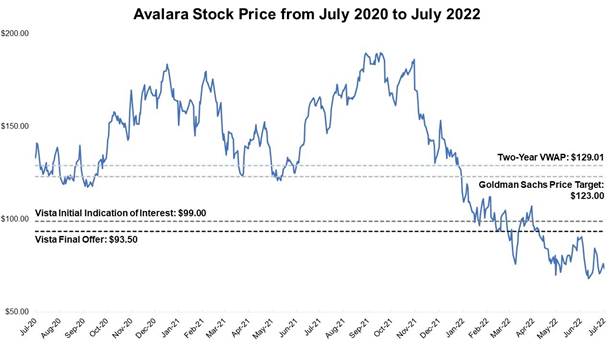

1 Source: FactSet. (NYSE: AVLR) Data as of July 6, 2022, the last trading day prior to media reports speculating on the proposed merger. “Vista Initial Indication of Interest” calculated as the midpoint of the range of $97.00 and $101.00 per share of Avalara common stock as disclosed on page 39 of Avalara’s Preliminary Proxy Statement.

_____________________________

[21] Id. at 68.

[22] Id. at 68.

[23] Id. at 60.

[24] Id. at 62.

[25] Id. at 62.

Several sell-side analysts and the investors they cover[26] openly expressed doubt about the deal price:

| · | “Given Avalara’s leading position in the large and underpenetrated market for tax compliance automation software, our initial view is that the proposed transaction price is somewhat underwhelming.” (William Blair, August 8, 2022) |

| · | “We do wonder if they could do better than the current implied valuation… [We] wouldn’t be surprised [if] a modestly higher price is ultimately achieved for shareholders.” (Needham) |

| · | “There has been a lack of enthusiasm from our investor conversations this morning… We believe the [near-term] outlook likely pushed the needle towards taking a deal at a multiple that could prove conservative over the [long-term] and may have been a bit lower than what some investors were hoping for.” (Evercore ISI) |

| · | “[W]e are a little surprised at AVLR’s willingness to sell at $93.50 given its recently laid out medium-term targets ($250 million of FCF by CY 25) and an aspirational goal of reaching $3 billion in revenue.” (Raymond James) |

In addition to analyst and investor sentiment, there are five objective measures of value that all suggest the deal price is inadequate and that a fair deal would be priced well over $110 per share:

| 1. | Analyst price targets. Prior to the announcement of

the transaction, sell-side analysts had a mean price target for Avalara of more than $117 per share. Price targets had been at or above

$100 since June 2019, when the Company’s LTM revenue was less than half of what it is today. The day before the deal was announced,

Goldman’s own analyst covering Avalara had a price target of $123 per share (a 32% premium over the deal price). Typically,

change-in-control transactions occur above the median sell-side price targets. Among the comparable transactions selected by Goldman for

its fairness opinion, for example, the deal price represented an average of a 15% premium[27] to the mean target price the

day before the announcement of the transaction.[28] For Avalara, the transaction value represented a 20% discount to

the mean sell-side price target. |

| 2. | Historical valuation multiples. Throughout

Avalara’s time as a public company, it has traded at a median enterprise value multiple to the next twelve-months projected

revenue of 12.9x. Since the beginning of 2020, when the Company’s growth accelerated due to pandemic-driven shifts in customer

demand patterns, it has traded at an even higher multiple: 16.5x the next twelve-months forecasted revenue. The proposed transaction

is valued at just 8.1x forecasted revenue, a substantial discount to the Company’s historical valuation. |

| 3. | Indications of interest from private equity firms before the dramatic increase in financing costs. Members of Avalara’s senior management team began receiving inbound interest from private equity firms in March and April 2022. During that time, Avalara was trading at or above $90 per share. Even a modest sale premium of 25% – which is in-line with comparable transactions and which the private equity firms were likely prepared to pay, otherwise they would not have reached out – would put a transaction price for Avalara well above $110 per share.[29] |

| 4. | Premiums in a bear market. Avalara’s total shareholder return during the one-year period prior to the transaction announcement was -44%, compared to an average of +19% for the comparable transactions examined by Goldman.[30] One should expect companies trading at near-term highs would receive smaller premiums, not larger ones, than companies that have traded down in a risk-off market environment. And yet, the premium offered for Avalara is lower than the median of the premiums in the comparable deals. |

_____________________________

[26] Permission to use analyst quotes neither sought nor obtained.

[27] Source: FactSet. Data refers to weighted average based on disclosed transaction value.

[28] Source: FactSet and Company filings. Comparable transactions refer to those in the “Selected Transactions Analysis” of the Company’s financial advisor and include Ping Identity (Thoma Bravo), Zendesk (Permira & H&F), SailPoint (Thoma Bravo), Datto (Kaseya / Insight), Anaplan (Thoma Bravo), Mandiant (Google), Medallia (Thoma Bravo), Proofpoint (Thoma Bravo), Pluralsight (Vista), Slack (Salesforce), Tableau (Salesforce), Ultimate Software (Hellman & Friedman), Apptio (Vista), SendGrid (Twilio), Adaptive Insights (Workday), MuleSoft (Salesforce), Netsuite (Oracle), Demandware (Salesforce), Marketo (Vista), Cvent (Vista), Solarwinds (Thoma Bravo), Concur (SAP) and Sourcefire (Cisco).

[29] Source. FactSet. See supra at Footnote 35 for a list of comparable transactions.

[30] Source: FactSet. Data refers to weighted average based on disclosed transaction value.

| 5. | Premiums to an adjusted unaffected price. Goldman’s fairness opinion claims the “undisturbed” price of Avalara’s shares was the closing price on July 6, the day before rumors of a buyout surfaced. And perhaps Avalara’s stock rallied thereafter in part because of the deal rumor. But, from July 6 to August 5 – the last trading day before the announcement of the transaction – the comparable public companies[31] traded up during the widespread market rally of July (that surely would have also increased Avalara’s stock price) by an average of 13%.[32] Avalara would likely have matched this performance even in the absence of the deal rumor. And so, we estimate that the Company’s true “undisturbed” price (July 5 plus peer company returns) is $83.15 per share, not the $73.54 used by Goldman. Applying the median one-day premium of comparable transactions[33] to the true undisturbed price yields a price for Avalara of over $103 per share. |

Conclusion

We are proud to have owned Avalara for nearly twenty years. And based on the Company’s strong competitive position and promising future, we are perfectly content to continue to own Avalara as an independent entity for years to come. We understand there has been a deceleration in revenue growth for the first time in Avalara’s history as a public company. But the Company’s modestly slower revenue growth over one or two quarters is not a fundamental business issue, nor do we believe that it will persist.

The Board, in the face of this macroeconomic adversity unrelated to the market for tax compliance software, should have insisted that the Company execute through the economic trough, with a plan to emerge stronger and create value in the future. If the Company is to be sold, it should be sold from a position of strength, in a robust financing market and only after a well-run, competitive process. This is not that time in our view.

The proposed transaction appears to us to be the product of bad timing and a flawed process. The price in our view reflects pessimism and transient market dynamics and not the Company’s intrinsic value. We are convinced that, in the near-term, Avalara can deliver value to shareholders far in excess of the $93.50 per share that Vista is offering, and in the longer-term, Avalara can compound that value as it executes its profitable growth strategy.

Shareholders Should Vote AGAINST the Merger

In our view, there is no reason to sell the Company now, and certainly not at this price. We therefore urge all shareholders to join us in voting AGAINST the Merger on the GOLD proxy card.

Vote Required.

According to the Company’s Proxy Statement, the approval of the Merger Agreement Proposal requires the affirmative vote of the holders of a majority of all of the issued and outstanding shares of Common Stock entitled to vote at the Company’s Special Meeting. An abstention vote will have the same effect as if the shareholder voted “AGAINST” the Merger Agreement Proposal. Nevertheless, we urge shareholders to vote “AGAINST” the Merger Agreement Proposal to make sure their voices are heard and that there can be no doubt that the Company’s shareholders stand in opposition to the Merger.

We urge you to vote today using our GOLD proxy card. If you have already voted using the Company’s white proxy card, you have every right to change your vote by using the enclosed GOLD proxy card to vote again by telephone or by Internet. In light of ongoing delays in the postal system, we encourage all shareholders to submit their proxies electronically. If you do not have access to a touch-tone phone or Internet, please sign, date and return the enclosed GOLD proxy card in the postage-paid envelope provided. Only the latest validly executed proxy that you submit will be counted; any proxy may be revoked at any time prior to its exercise at the Special Meeting by following the instructions under “Can I change my vote or revoke my proxy?” If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor, MacKenzie Partners, toll free at 1-800-322-2885 or email at [email protected].

|

We Recommend a Vote AGAINST the Merger Agreement Proposal on the GOLD proxy card.

|

_____________________________

[31] “Comparable public companies” refer to those in the “Selected Public Company Comparables Analysis” of the Company’s financial advisor and include Alteryx, BigCommerce Holdings, BlackLine, Coupa Software, Datadog, Elastic, HubSpot, MongoDB, Okta, PagerDuty, Paylocity, Shopify, Smartsheet and Zscaler.

[32] Source: FactSet. Data from July 6, 2022 to August 5, 2022. Data refers to weighted average based on market value at the beginning of the measurement period.

[33] See supra at Footnote 35 for a list of comparable transactions.

| PROPOSAL 2: COMPENSATION PROPOSAL |

You are being asked by Avalara to approve, on a non-binding, advisory basis, the compensation that may be paid or become payable by Avalara to its named executive officers in connection with the Merger. We refer you to the Company’s Proxy Statement for a description of such compensation. As required by Section 14A of the Exchange Act, Avalara is asking its shareholders to vote on the approval of the following resolution:

“RESOLVED, that the compensation that may be paid or become payable to Avalara’s named executive officers in connection with the merger, as disclosed [in the Company’s Proxy Statement] under “The Merger—Interests of Avalara’s Executive Officers and Directors in the Merger—Quantification of Potential Merger-Related Payments to Named Executive Officers,” as reflected in the table captioned “Golden Parachute Compensation,” the associated footnotes and narrative discussion, is hereby APPROVED.”

Approval of the Compensation Proposal requires that the number of votes cast “FOR” the proposal exceeds the number of votes “AGAINST” the proposal at the Special Meeting. For the reasons discussed above in “REASONS TO VOTE AGAINST ADOPTING THE MERGER AGREEMENT”, we oppose the proposed Merger. To that end, we are soliciting your proxy to vote AGAINST Proposal 2. Shareholders should note, however, that the Compensation Proposal is advisory in nature, and the results of that vote will not affect the compensation that would, or may, be payable to the named executive officers in connection with the merger.

Altair recommends that you vote AGAINST the Compensation Proposal.

Vote Required.

According to the Company’s Proxy Statement, the approval of the Compensation Proposal requires that the number of votes cast “FOR” the proposal exceeds the number of votes “AGAINST” the proposal at the Special Meeting. An abstention vote will have no effect on the approval of the Compensation Proposal. Assuming a quorum is present, if you hold your shares in “street name,” the failure to instruct your bank, broker, or other nominee on how to vote your shares of Avalara common stock will have no effect on the outcome of the named executive officer merger-related compensation advisory proposal because such shares are not deemed present and entitled to vote on the matter under Washington law.

Therefore, we urge shareholders to vote “AGAINST” the Compensation Proposal to make sure their voices are heard and let the Company know that the Company’s shareholders stand in opposition to the Merger.

|

We Recommend a Vote AGAINST the Compensation Proposal on the GOLD proxy card. |

| PROPOSAL 3: ADJOURNMENT PROPOSAL |

You are being asked by Avalara to approve the adjournment of the Special Meeting, if necessary or appropriate, to solicit additional proxies if there are not sufficient votes to approve the Merger Agreement Proposal. If a quorum is present, approval of the Adjournment Proposal requires that the number of votes cast “FOR” the proposal exceeds the number of votes “AGAINST” the proposal at the Special Meeting; whereas, if a quorum is not present, the shareholders holding a majority in voting power of the outstanding shares of Avalara common stock, present in person at the virtual Special Meeting or by proxy and entitled to vote at the Special Meeting, may adjourn the Special Meeting to another place, date, or time. For the reasons discussed above in “REASONS TO VOTE AGAINST ADOPTING THE MERGER AGREEMENT”, we oppose the proposed Merger. To that end, we are soliciting your proxy to vote AGAINST Proposal 3.

Altair recommends that you vote AGAINST the Adjournment Proposal.

Vote Required.

According to the Company’s Proxy Statement, the approval of the Adjournment Proposal requires that the number of votes cast “FOR” the proposal exceeds the number of votes “AGAINST” the proposal at the Special Meeting if a quorum is present at the Special Meeting, or the affirmative vote of the voting power of the shares of common stock present at the Special Meeting or represented by proxy at the Special Meeting and entitled to vote on the Adjournment Proposal if a quorum is not present. Therefore, if a quorum is present, an abstention vote will have no effect on the approval of the Adjournment Proposal, while an abstention vote will have the same effect as if the shareholder voted “AGAINST” the Adjournment Proposal if a quorum is not present. Assuming a quorum is present, if you hold your shares in “street name,” the failure to instruct your bank, broker, or other nominee on how to vote your shares of Avalara common stock will have no effect on the outcome of the adjournment proposal because such shares are not deemed present and entitled to vote on the matter under Washington law. Nevertheless, we urge shareholders to vote “AGAINST” the Adjournment Proposal to make sure their voices are heard and that there can be no doubt that the Company’s shareholders stand in opposition to the Merger.

|

We Recommend a Vote AGAINST the Adjournment Proposal on the GOLD proxy card. |

| QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE SPECIAL MEETING |

Who is entitled to vote?

Only holders of the Company’s voting stock at the close of business on the Record Date (September 8, 2022) are entitled to notice of and to vote at the Special Meeting. Shareholders who sold shares before the Record Date (or acquire them without voting rights after the Record Date) may not vote such shares. Shareholders of record on the Record Date will retain their voting rights in connection with the Special Meeting even if they sell such shares after the Record Date (unless they also transfer their voting rights as of the Record Date).

How do I vote my shares?

Shares held in record name. If your shares are registered in your own name, please vote today via Internet or telephone by following the directions on the enclosed GOLD proxy card or by signing, dating and returning the enclosed GOLD proxy card in the postage-paid envelope provided. Execution and delivery of a proxy by a record holder of shares will be presumed to be a proxy with respect to all shares held by such record holder unless the proxy specifies otherwise.

Shares beneficially owned or held in “street” name. If you hold your shares in “street” name with a broker, bank, dealer, trust company or other nominee, only that nominee can exercise the right to vote with respect to the shares that you beneficially own through such nominee and only upon receipt of your specific instructions. Accordingly, it is critical that you promptly give instructions to your broker, bank, dealer, trust company or other nominee to vote AGAINST the Merger Proposals. Please follow the instructions to vote provided on the enclosed GOLD proxy card. If your broker, bank, dealer, trust company, or other nominee provides for proxy instructions to be delivered to them by telephone or Internet, instructions will be included on the enclosed GOLD voting instruction form.

Note: Shares represented by properly executed GOLD proxy cards will be voted at the Special Meeting as marked and, in the absence of specific instructions, “AGAINST” the Merger Proposals.

How should I vote on each proposal?

We recommend that you vote your shares on the GOLD proxy card as follows:

“AGAINST” the Merger Agreement Proposal (Proposal 1)

“AGAINST” the Compensation Proposal (Proposal 2); and

“AGAINST” the Adjournment Proposal (Proposal 3).

How many shares must be present to hold the Special Meeting?

According to the Company’s Proxy Statement, the holders of a majority of the voting power of Avalara’s capital stock issued and outstanding and entitled to vote, present in person or represented by proxy, will constitute a quorum at the Special Meeting. According to the Company’s Proxy Statement, abstentions (shares for which proxies have been received but for which the holders have abstained from voting) and broker non-votes, if any, which are described below, will be included in the calculation of the number of Shares present at the meeting for purposes of determining whether a quorum has been met. Altair does not expect any broker non-votes at the Special Meeting because the rules applicable to banks, brokers and other nominees only provide such nominees with discretionary authority to vote on proposals that are considered routine, whereas each of the proposals to be presented at the Special Meeting is considered non-routine.

What are “broker non-votes” and what effect do they have on the proposals?

Under applicable stock exchange rules, all of the proposals in this Proxy Statement are non-routine matters, so there can be no broker non-votes at the Special Meeting. A broker non-vote occurs when shares held by a bank, broker, trust, or other nominee are represented at a meeting, but the bank, broker, trust, or other nominee has not received voting instructions from the beneficial owner and does not have the discretion to direct the voting of the shares on a particular proposal, but has discretionary voting power on other proposals at such meeting. Accordingly, if your shares are held in “street name,” your bank, broker, trust, or other nominee will NOT be able to vote your shares of Common Stock on any of the proposals, and your shares will not be counted as present in determining the presence of a quorum, unless you have properly instructed your bank, broker, trust, or other nominee on how to vote. Because the proposal to approve the Merger Agreement requires the affirmative vote of a majority of the outstanding shares of Common Stock, the failure to provide your bank, broker, trust, or other nominee with voting instructions will have the same effect as a vote “AGAINST” the proposal to approve the merger agreement. Because the approval of each of the Compensation Proposal and the Adjournment Proposal requires that the number of votes cast “FOR” the proposal at the Special Meeting exceeds the number of votes “AGAINST” the proposal, and because your bank, broker, trust or other nominee does not have discretionary authority to vote on either proposal, the failure to provide your bank, broker, trust, or other nominee with voting instructions will have no effect on approval of each such proposal.

What should I do if I receive a proxy card from the Company?

You may receive proxy solicitation materials from the Company, including a merger proxy statement and white proxy card. We are not responsible for the accuracy of any information contained in any proxy solicitation materials used by the Company or any other statements that it may otherwise make.

We recommend that you discard any white proxy card or solicitation materials that may be sent to you by the Company. If you have already voted using the Company’s white proxy card, you have every right to change your vote by using the enclosed GOLD proxy card to vote via Internet or by telephone by following the instructions on the GOLD proxy card or by signing, dating and returning the enclosed GOLD proxy card in the postage-paid envelope provided. Only the latest-dated validly executed proxy that you submit will be counted; any proxy may be revoked at any time prior to its exercise at the Special Meeting by following the instructions below under “Can I change my vote or revoke my proxy?” If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor, MacKenzie Partners, toll free at 1-800-322-2885 or via email at [email protected].

Can I change my vote or revoke my proxy?

If you are the shareholder of record, you may change your proxy instructions or revoke your proxy at any time before your proxy is voted at the Special Meeting. Proxies may be revoked by any of the following actions:

| · | returning a later-dated proxy either by voting by telephone or Internet by following the instructions on the enclosed GOLD proxy card or by signing, dating and returning the enclosed GOLD proxy card in the postage-paid envelope provided (the latest dated proxy is the only one that counts); |

| · | delivering a written revocation to the secretary of the Company (Although a revocation is effective if delivered to the Company, we request that either the original or a copy of any revocation be mailed to [email protected]); or |

| · | registering for and attending the Special Meeting and voting thereat (although virtual attendance at the Special Meeting will not, by itself, revoke a proxy). |

If your shares are held in a brokerage account by a broker, bank or other nominee, you should follow the instructions provided by your broker, bank or other nominee. There is no physical location for the special meeting. If you virtually attend the Special Meeting and you beneficially own shares but are not the record owner, your mere attendance at the Special Meeting WILL NOT be sufficient to revoke any previously submitted proxy card. You must provide written authority from the record owner to vote your shares held in its name at the meeting in the form of a “legal proxy” issued in your name from the bank, broker or other nominee that holds your shares. If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor, MacKenzie Partners, toll free at 1-800-322-2885 or via email at [email protected].

IF YOU HAVE ALREADY VOTED USING THE COMPANY’S WHITE PROXY CARD, WE URGE YOU TO REVOKE IT BY VOTING AGAINST THE MERGER ON THE GOLD PROXY CARD.

Who is making this Proxy Solicitation and who is paying for it?

The solicitation of proxies pursuant to this Proxy Solicitation is being made by the Participants named on Annex I hereto. Proxies may be solicited by mail, facsimile, telephone, Internet, in person and by advertisements. The Participants will solicit proxies from individuals, brokers, banks, bank nominees and other institutional holders. Altair has requested banks, brokerage houses and other custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial owners of the shares they hold of record. Altair will reimburse these record holders for their reasonable out-of-pocket expenses in so doing.

Altair has retained MacKenzie Partners to provide solicitation and advisory services in connection with this solicitation. MacKenzie Partners will be paid a fee up to $75,000 plus additional fees and expenses to be agreed upon based upon the campaign services provided. In addition, Altair will reimburse MacKenzie Partners for its reasonable out-of-pocket expenses and will indemnify MacKenzie Partners against certain liabilities and expenses, including certain liabilities under the federal securities laws. MacKenzie Partners will solicit proxies from individuals, brokers, banks, bank nominees and other institutional holders. It is anticipated that MacKenzie Partners will employ up to 25 persons to solicit the Company’s shareholders as part of this solicitation. MacKenzie Partners does not believe that any of its directors, officers, employees, affiliates or controlling persons, if any, is a “participant” in this Proxy Solicitation.

The costs related to this Proxy Solicitation will be borne by Altair. Costs of this Proxy Solicitation are currently estimated to be approximately $400,000. The actual amount could be higher or lower depending on the facts and circumstances arising in connection with the solicitation. We estimate that through the date hereof, Altair’s expenses in connection with this Proxy Solicitation are approximately $245,000. If successful, Altair may seek reimbursement of these costs from the Company. In the event that Altair decides to seek reimbursement of its expenses, Altair does not intend to submit the matter to a vote of the Company’s shareholders. The Board would be required to evaluate the requested reimbursement consistent with its fiduciary duties to the Company and its shareholders. Costs related to the solicitation of proxies include expenditures for attorneys, public relations and other advisors, solicitors, printing, advertising, postage, transportation and other costs incidental to the solicitation.

What is Householding of Proxy Materials?

The SEC has adopted rules that permit companies and intermediaries (such as brokers and banks) to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more shareholders sharing the same address by delivering a single proxy statement addressed to those shareholders.

Once you have received notice from your bank or broker that it will be householding communications to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate proxy statement and annual report, please notify your bank or broker and direct your request to Avalara, Inc., 255 South King Street, Suite 1800, Seattle, Washington 98104. Shareholders who currently receive multiple copies of this Proxy Statement at their address and would like to request householding of their communications should contact their bank or broker.

Because Altair has initiated a contested proxy solicitation, we understand that banks and brokers with account holders who are shareholders of the Company will not be householding our proxy materials.

Where can I find additional information concerning Avalara and the Merger?

Pursuant to Rule 14a-5(c) promulgated under the Securities Exchange Act of 1934 (the “Exchange Act”), we have omitted from this proxy statement certain disclosure required by applicable law to be included in the Company’s Proxy Statement in connection with the Special Meeting. Such disclosure includes:

| · | a summary term sheet of the Merger; |

| · | the terms of the Merger Agreement and the Merger and related transactions; |

| · | any reports, opinions and/or appraisals received by Avalara in connection with the Merger; |

| · | past contacts, transactions and negotiations by and among the parties to the Merger and their respective affiliates and advisors; |

| · | federal and state regulatory requirements that must be complied with and approvals that must be obtained in connection with the Merger; |

| · | security ownership of certain beneficial owners and management of Avalara, including 5% owners; |

| · | the trading prices of Avalara’s stock over time; |

| · | the establishment of a quorum; |

| · | the compensation paid and payable to Avalara’s directors and executive officers; |

| · | the requirements for the submission of shareholder proposals to be considered for inclusion in Avalara’s proxy statement for the 2022 annual meeting of shareholders; and |

| · | appraisal rights and dissenters’ rights. |

We take no responsibility for the accuracy or completeness of information contained in the Company’s Proxy Statement. Except as otherwise noted herein, the information in this proxy statement concerning the Company has been taken from or is based upon documents and records on file with the SEC and other publicly available information.

This proxy statement and all other solicitation materials in connection with this Proxy Solicitation will be available free of charge, pursuant to SEC rules, on the SEC’s website at https://www.sec.gov.

| CONCLUSION |

We urge you to carefully consider the information contained in this proxy statement and then support our efforts by signing, dating, and returning the enclosed GOLD proxy card today to vote AGAINST the Merger Proposals.

Thank you for your support,

ALTAIR US, LLC

September 30, 2022

ANNEX I: INFORMATION ON THE PARTICIPANTS

This Proxy Solicitation is being made by Altair US, LLC, a Delaware limited liability company (“Altair”), and Richard H. Bailey (“Mr. Bailey” and together with Altair, the “Participants,” and each referred to individually as a “Participant”).

As of the close of business on September 29, 2022, the Participants may be deemed to beneficially own 850,892 shares of Common Stock.

The address of the business office for each of Altair and Mr. Bailey is c/o Frank R. Bailey, III, Attorney at Law, 50 Old Courthouse Square, Suite 404, Santa Rosa, CA 95404. The principal business of (i) Altair is to serve as a private family investment office; and (iii) Mr. Bailey is to serve as Chairman of Pacific Beachcomber, S.C.

A number of the shares of Common Stock held by Altair are held by the investment funds managed by Altair in commingled margin accounts, which may extend margin credit to Altair from time to time, subject to applicable federal margin regulations, stock exchange rules and credit policies. In such instances, the positions held in the margin accounts are pledged as collateral security for the repayment of debit balances in the account. The margin accounts bear interest at a rate based upon market levels from time to time in effect. Because other securities are held in the margin accounts, it is not possible to determine the amounts, if any, of margin used to purchase the shares of Common Stock reported herein.

Except as set forth in this Proxy Statement (including the Annexes), (i)

during the past ten years, none of the Participants have been convicted in a criminal proceeding (excluding traffic violations or similar

misdemeanors); (ii) none of the Participants in this proxy solicitation directly or indirectly beneficially own any securities of the

Company; (iii) none of the Participants own any securities of the Company which are owned of record but not beneficially; (iv) none of

the Participants have purchased or sold any securities of the Company during the past two years; (v) no part of the purchase price or

market value of the securities of the Company owned by any of the Participants is represented by funds borrowed or otherwise obtained

for the purpose of acquiring or holding such securities; (vi) none of the Participants are, or within the past year were, a party to any

contract, arrangements or understandings with any person with respect to any securities of the Company, including, but not limited to,

joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits

or the giving or withholding of proxies; (vii) no associate of any of the Participants owns beneficially, directly or indirectly, any

securities of the Company; (viii) none of the Participants own beneficially, directly or indirectly, any securities of any parent or subsidiary

of the Company; (ix) none of the Participants or any of their associates were a party to any transaction, or series of similar transactions,

since the beginning of the Company’s last fiscal year, or is a party to any currently proposed transaction, or series of similar

transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000;

(x) none of the Participants or any of their associates have any arrangement or understanding with any person with respect to any future

employment by the Company or its affiliates, or with respect to any future transactions to which the Company or any of its affiliates

will or may be a party; and (xi) no person, including any of the Participants, has a substantial interest, direct or indirect, by security

holdings or otherwise in any matter to be acted on as set forth in this Proxy Statement. There are no material proceedings to which any

of the Participants or any of their associates is a party adverse to the Company or any of its subsidiaries or has a material interest

adverse to the Company or any of its subsidiaries.

Transactions by the Participants with respect to the Company’s securities

The following tables set forth all transactions effected during the past two years by Altair with respect to securities of the Company. The shares of Common Stock reported herein are held in either cash accounts or margin accounts in the ordinary course of business. Unless otherwise indicated, all transactions were effected on the open market.

Common Stock:

| Trade Date | Amount Acquired (Sold) |

| 10/27/2020 | (2,500) |

| 10/29/2020 | (2,500) |

| 11/11/2020 | (2,500) |

| 11/20/2020 | (4,500) |

IMPORTANT

Tell your Board what you think! YOUR VOTE IS VERY IMPORTANT, no matter how many or how few shares you own. Please give us your proxy to vote “AGAINST” Avalara’s Merger Proposals by using one of the four options below:

| o | Voting via Internet by following the easy instructions on the enclosed GOLD proxy card, or voting instruction form; |

| o | Voting by telephone using the toll-free number listed on the enclosed GOLD proxy card or voting instruction form and following the easy voice prompts; |

| o | In light of ongoing delays with the postal system, we encourage all shareholders to vote electronically. If you do not have access to a touch-tone phone or Internet, you may sign, date and return the enclosed GOLD proxy card or voting instruction form in the postage-paid envelope provided; or |

| o | Registering for and virtually attending the Special Meeting and voting thereat. |

If any of your shares are held in the name of a broker, bank, bank nominee, or other institution, they can only vote your shares upon receipt of your specific instructions. Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by Internet. You may also vote by signing, dating and returning the enclosed GOLD voting form in the postage-paid envelope provided.

After submitting your vote using the enclosed GOLD proxy card, we urge you to NOT SIGN OR RETURN AVALARA’S WHITE PROXY CARD because only your latest dated proxy card will be counted.

If you have previously signed and returned a white proxy card to Avalara, you have every right to change your vote. Only your latest dated proxy card will count. You may revoke any proxy card already sent to Avalara by voting by telephone or Internet following the instructions on the enclosed GOLD proxy card or signing, dating and returning the enclosed GOLD proxy card in the postage-paid envelope provided. Any proxy may be revoked at any time prior to the Special Meeting by delivering a written notice of revocation to the Company, by delivering or a later dated proxy for the Special Meeting or by virtually voting at the Special Meeting after registering. Virtual attendance at the Special Meeting will not in and of itself constitute a revocation.

If you have any questions concerning this proxy statement, would like to request additional copies of this proxy

statement, or need help voting your shares, please contact our proxy solicitor:

MacKenzie Partners, Inc.

1407 Broadway, 27th Floor

New York, New York 10018

Stockholders Call Toll Free: 1-800-322-2885

E-mail: [email protected]

FORM OF GOLD PROXY CARD

Avalara, Inc.

Proxy Card for Special Meeting of Shareholders (the “Special Meeting”)

THIS PROXY SOLICITATION IS BEING MADE BY Altair US, LLC AND Richard h. bailey (“ALTAIR”, “WE” OR “US”), AND NOT BY THE BOARD OF DIRECTORS OR MANAGEMENT OF AVALARA, INC.

The undersigned appoints Robert Marese and Eleazer Klein, and each of them, attorneys and agents with full power of substitution to vote all shares of common stock of Avalara, Inc., a Washington corporation (the “Company”), that the undersigned would be entitled to vote at the Special Meeting of shareholders of the Company scheduled to be held virtually at www.cesonlineservices.com/avlr22_vm on October 14, 2022, at 9:00 a.m., Eastern Time, including at any rescheduling, adjournments or postponements thereof, with all powers that the undersigned would possess if personally present, upon and in respect of the instructions indicated herein, with discretionary authority as to any and all other matters that may properly come before the meeting or any adjournment, postponement or substitution thereof that are unknown to Altair a reasonable time before this solicitation.

The undersigned hereby revokes any other proxy or proxies heretofore given to vote or act with respect to said shares, and hereby ratifies and confirms all action the herein named attorneys and proxies, their substitutes, or any of them may lawfully take by virtue hereof. This proxy will be valid until the sooner of one year from the date indicated on the reverse side and the completion of the Special Meeting (including any adjournments, rescheduling or postponements thereof).

If the proxy card is signed and returned, it will be voted in accordance with your instructions. If the proxy card is signed and returned unmarked and/or you do not specify how the proxy should be voted, this proxy will be voted “AGAINST” Proposals 1, 2 and 3 and at the discretion of the proxy holders with respect to such other matters as may properly come before the meeting or any adjournments or postponements thereof to the extent authorized by Rule 14a-4(c) under the Securities Exchange Act of 1934, as amended. None of the matters currently intended to be acted upon pursuant to this proxy are conditioned on the approval of other matters.

Please take a moment now to vote your

shares of Avalara, Inc.

for the upcoming Special Meeting of Stockholders.

|

VOTE BY INTERNET Please access https://www.proxyvotenow.com/ALVR (please note you must type an “s” after “http”). Then, simply follow the easy instructions on the voting site. You will be required to provide the unique Control Number printed below. |

|

|

VOTE BY TELEPHONE Please call toll-free from the U.S. or Canada at (855) 457-2571, on a touch-tone telephone. If outside the U.S. or Canada, call +1 (575) 215-3394. Then, simply follow the easy voice prompts. You will be required to provide the unique Control Number printed below.

|

You may vote by telephone or Internet 24 hours a day, 7 days a week.

Your internet or telephone vote authorizes the named proxies to vote your shares in the same manner as if you marked, signed and returned your GOLD proxy card.

| CONTROL NUMBER : |

|

|

VOTE BY MAIL Please complete, sign, date and return the proxy card in the envelope provided to: Altair US, LLC, c/o MacKenzie Partners, Inc., 1407 Broadway, 27th Floor, New York, New York 10018.

|

▼ TO VOTE BY MAIL, PLEASE DETACH THE CARD HERE AND SIGN, DATE RETURN IN THE POSTAGE-PAID ENVELOPE PROVIDED ▼

------------------------------------------------------------------------------------------------------------------------------------------------------------------

INSTRUCTIONS: FILL IN VOTING BOXES “n” IN BLACK OR BLUE INK

Altair recommends that you vote “AGAINST” each of the Proposals:

| FOR | AGAINST | ABSTAIN | |

| Proposal 1 – Avalara’s Merger Agreement Proposal | ¨ | ¨ | ¨ |

| Proposal 2 - Avalara’s Compensation Proposal | ¨ | ¨ | ¨ |

| Proposal 3 – Avalara’s Adjournment Proposal | ¨ | ¨ | ¨ |

| Signature (Capacity) | Date | |

| Signature (Joint Owner) (Capacity/Title) | Date | |

| NOTE: Please sign exactly as your name(s) appear(s) on stock certificates or on the label affixed hereto. When signing as attorney, executor, administrator or other fiduciary, please give full title as such. Joint owners must each sign personally. ALL HOLDERS MUST SIGN. If a corporation or partnership, please sign in full corporate or partnership name by an authorized officer and give full title as such. | ||

PLEASE SIGN, DATE AND PROMPTLY RETURN THIS PROXY CARD IN THE ENCLOSED RETURN ENVELOPE THAT IS POSTAGE PREPAID IF MAILED IN THE UNITED STATES.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Press Release for Early Warning Report Filed Pursuant to NI 62-103

- SPACEMOBILE ALERT: Bragar Eagel & Squire, P.C. Announces that a Class Action Lawsuit Has Been Filed Against AST SpaceMobile, Inc. and Encourages Investors to Contact the Firm

- UPDATE: LifeWallet Announces a Comprehensive Settlement with a Group of Affiliated Property & Casualty Insurers

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share