Form DEFA14A Yellowstone Acquisition

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 3, 2021 (August 1, 2021)

|

YELLOWSTONE ACQUISITION COMPANY |

||

|

(Exact name of registrant as specified in its Charter) |

||

|

Delaware |

001-39648 |

85-2732947 |

|

(State or other jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification Number) |

|

1601 Dodge Street, Suite 3300 Omaha, Nebraska 68102 (Address and telephone number of principal executive offices, including zip code) |

||

|

(402) 225-6511 (Registrant's telephone number, including area code) |

||

|

Not Applicable (Former name or address, if changed since last report) |

||

Securities registered under Section 12(b) of the Exchange Act:

|

Title of Class |

Trading Symbol |

Name of Exchange on Which Registered |

|

Units, each consisting of one share of Class A common stock, $0.0001 par value, and one-half of one redeemable warrant |

YSACU |

The Nasdaq Stock Market LLC |

|

Class A common stock, $0.0001 par value included as part of the units |

YSAC |

The Nasdaq Stock Market LLC |

|

Warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share |

YSACW |

The Nasdaq Stock Market LLC |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of Registrant under any of the following provisions (see General Instruction A.2. below):

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

☒ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

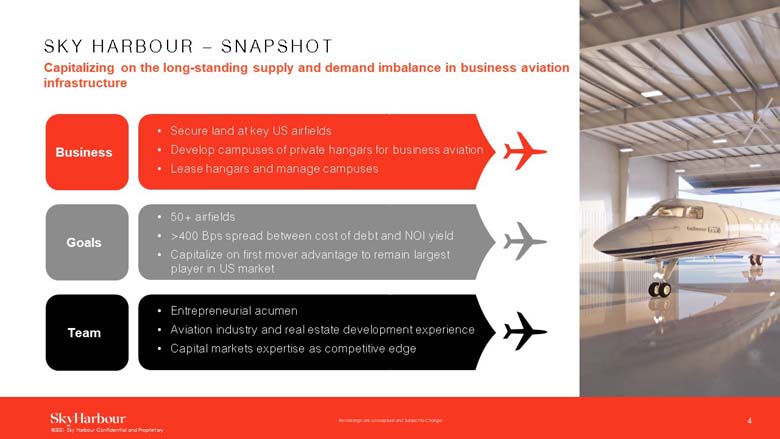

On August 1, 2021, Sky Harbour LLC (“Sky”), a Delaware limited liability company and Yellowstone Acquisition Company (“Yellowstone” and after the Closing, “PubCo”), entered into a definitive equity purchase agreement (the “Equity Purchase Agreement”), which was subsequently announced on August 2, 2021.

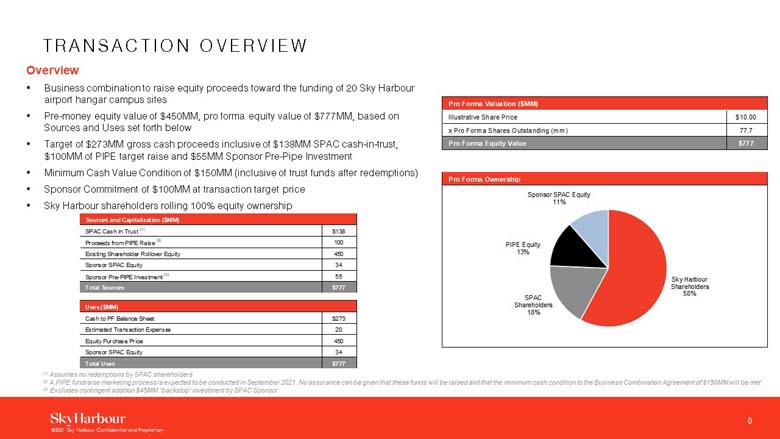

As part of the transaction, BOC YAC Funding LLC, a Delaware limited liability company (“BOC YAC”), a subsidiary of Boston Omaha Corporation (“Boston Omaha”), has agreed to invest $55 million directly into Sky, and upon the successful consummation of the business combination, this investment will convert into 5,500,000 shares of the post-combination public company’s Class A common stock, valued at $10.00 per share (the “BOC Initial Investment”). This investment, which will be funded into escrow and is expected to be released to Sky prior to the closing of the business combination, is contingent upon Sky raising at least $80 million in a private activity bond offering. In the event the business combination is not consummated, Boston Omaha’s investment will remain as Series B Preferred units of Sky. In addition, the parties will seek to raise additional funding to support the business combination through a private placement investment (“PIPE”) to be consummated at the closing of the transaction of approximately $100 million.

In addition to the approximately $138 million raised in connection with Yellowstone’s initial public offering and associated private placement currently held in trust (the “Trust Account”), and Boston Omaha’s above referenced $55 million investment, BOC YAC has agreed to provide to Sky a backstop (consisting of securities and/or cash) valued at up to an additional $45 million through the purchase of additional shares of Yellowstone Class A common stock at a price of $10 per share immediately prior to the consummation of the business transaction if needed to meet the minimum investment condition of $150 million in cash and securities to Sky at the closing (the “Back-Stop Financing”). The Back-Stop Financing will occur if (i) the amount of cash available in the Trust Account immediately prior to Closing after deducting only the amounts payable to Yellowstone stockholders who have validly redeemed their Yellowstone Class A common stock (in all cases after taking into account amounts to be paid in respect of (x) the Deferred Underwriting Commission being held in the Trust Account, and (y) any other transaction expenses of Yellowstone), plus (ii)the BOC Initial Investment, and (iii) any additional financing amounts (including through a PIPE) actually received prior to or substantially concurrently with the Closing (the sum of (i), (ii) and (iii), the “Available Buyer Financing”), is less than $150 million.

The transactions contemplated by the Equity Purchase Agreement are referred to herein collectively as the “Business Combination”. This Form 8-K is being filed to describe the material terms of the Equity Purchase Agreement and related agreements, which are filed as exhibits herewith. Capitalized terms used in this Form 8-K but not otherwise defined herein have the meanings given to them in the Equity Purchase Agreement.

Item 1.01 Entry Into A Material Definitive Agreement.

Equity Purchase Agreement

The Equity Purchase Agreement, dated August 1, 2021 (the “Effective Date”), was entered into by and between Sky and Yellowstone. Each of Sky’s existing equityholders (collectively, the “Sky Existing Equityholders”) separately entered into an Equityholders Voting and Support Agreement irrevocably agreeing to vote in favor of the business combination set forth in the Equity Purchase Agreement. In addition, the Equity Purchase Agreement and the transactions contemplated thereby were unanimously approved by both Yellowstone’s board of directors and the board of managers of Sky, respectively.

Business Combination

Pursuant to the Equity Purchase Agreement, following the closing of the Business Combination (the “Closing”), PubCo will be organized in an umbrella partnership–C corporation (“Up-C”) structure, in which substantially all of the assets of the combined company will be held by Sky, and PubCo’s only assets will be its equity interests in Sky. At the Closing:

● Yellowstone will amend its existing certificate of incorporation to: (a) change its name to “Sky Harbour Group Corporation”, (b) convert all then-outstanding shares of Class B common stock, par value $0.0001 per share, of Yellowstone (the “Yellowstone Class B common stock”), held by Sponsor (the “Sponsor Stock”) into shares of Class A common stock, par value $0.0001 per share, of PubCo (such class A common stock, the “PubCo Class A Common Stock”), and (c) issue to the Sky Existing Equityholders Class B common stock, par value $0.0001 per share, of PubCo (the “PubCo Class B Common Stock”), which carries one vote per share but no economic rights;

● Sky and its members will adopt the Third Amended and Restated Limited Liability Company Agreement of Sky (the “A&R Operating Agreement”) to (a) restructure its capitalization to (i) issue to Yellowstone the number of common units of Sky equal to the number of outstanding shares of PubCo Class A Common Stock immediately after giving effect to the Business Combination (taking into account any redemption of Yellowstone Common Stock, and any Additional PIPE Investment) (the “PubCo Units”), (ii) reclassify the existing Sky common units (other than any existing Sky incentive common units (an “Existing Sky Prior Incentive Equity Unit”), existing Sky series A preferred units, and the existing Sky series B preferred units into Sky common units, and (iii) reclassify all of the Existing Sky Prior Incentive Equity Units into Sky incentive equity units, concurrently with and subject to adjustments affecting the number of units and exercise price (as applicable) thereof, following the Closing and (b) appoint PubCo as the managing member of Sky;

● As consideration for the PubCo Units, Yellowstone will contribute to Sky the amount held in the Trust Account, less the amount of cash required to fund the redemption of Class A common stock, par value $0.0001 per share, of Yellowstone (the “Yellowstone Class A common stock”) held by eligible stockholders who properly elect to have their shares redeemed as of the Closing, any additional PIPE investment which may be raised between now and the closing (the “Additional PIPE Investment”), and the cash and securities contribution pursuant to the Back-Stop Financing, less the deferred underwriting commission payable to Wells Fargo Securities (the “Contribution Amount”). Immediately after the contribution of the Contribution Amount, Sky will pay the amount of unpaid fees, commissions, costs or expenses that have been incurred by Sky and Yellowstone in connection with the Business Combination (the “Transaction Expenses”) by wire transfer of immediately available funds on behalf of Sky and Yellowstone to those persons to whom such amounts are owed; and

● Without any action on the part of any holder of a warrant to purchase one whole share of Yellowstone Class A common stock (a “Yellowstone Warrant”), each Yellowstone Warrant that is issued and outstanding immediately prior to the Closing will be converted into a warrant to purchase one whole share of PubCo Class A Common Stock in accordance with its terms.

Representations and Warranties, Covenants

Under the Equity Purchase Agreement, parties to the agreement made customary representations and warranties for transactions of this type regarding themselves. The representations and warranties made under the Equity Purchase Agreement will not survive the Closing. In addition, the parties to the Equity Purchase Agreement agreed to be bound by certain covenants that are customary for transactions of this type, including obligations of the parties to use commercially reasonable efforts to operate their respective businesses in the ordinary course, and to refrain from taking certain specified actions without the prior written consent of the applicable party, in each case, subject to certain exceptions and qualifications. Additionally, the parties have agreed not to solicit, negotiate or enter into a competing transaction and Sponsor has agreed to vote all shares owned by it in favor of the Business Combination. The covenants of the parties set forth in the Equity Purchase Agreement will not survive the Closing, except for covenants and agreements that by their terms are to be performed in whole or in part after the Closing.

Termination

The Equity Purchase Agreement may be terminated under certain customary and limited circumstances at any time prior to the Closing, including, among others, the following:

(i) by written notice from Sky or Yellowstone to the other party if the Closing has not occurred by March 31, 2022, such extended deadline (the “Outside Closing Date”);

(ii) upon the applicable parties’ mutual written consent;

(iii) by Yellowstone or Sky if the consummation of the Business Combination is prohibited by law;

(iv) by Yellowstone, if Sky does not raise at least $80,000,000 in gross proceeds from a contemplated private activity bond financing (the “Bond Financing”); or

(v) the non-breaching party if Yellowstone or Sky materially breaches a representation, warranty, covenant or other agreement by such party that (a) results in the failure to satisfy a closing condition of the breaching party and that is incapable of being cured by the Outside Closing Date, or if capable of being cured by the Outside Closing date is not cured within 20 business days of the non-breaching party notifying the breaching party of such breach. None of the parties to the Equity Purchase Agreement are required to pay a termination fee or reimburse any other party for its expenses as a result of a termination of the Equity Purchase Agreement.

Conditions to Each Party’s Obligations to Close

Under the Equity Purchase Agreement, the obligations of the parties to consummate the Business Combination are subject to the satisfaction or waiver of certain customary closing conditions of the respective parties, including, without limitation: (a) the representations and warranties of the respective parties being true and correct subject to the materiality standards contained in the Equity Purchase Agreement; (b) material compliance by the parties of their respective pre-closing covenants and agreements, subject to the standards contained in the Equity Purchase Agreement; (c) the approval by Yellowstone’s stockholders of the transactions contemplated by the Equity Purchase Agreement; (d) the absence of a Company Material Adverse Effect (as defined in the Equity Purchase Agreement) since the Effective Date that is continuing and uncured; (e) Yellowstone having at least $5,000,001 in tangible net assets immediately prior to the Closing; (f) Yellowstone having no indebtedness in excess of $2,500,000; (g) PubCo remaining listed on Nasdaq; (h) the consummation of the Bond Financing; and (i) the cash proceeds from the Trust Account, net of any amounts paid to Yellowstone’s stockholders that exercise their redemption rights, plus the amounts raised in the BOC Initial Investment and any Additional PIPE Investment, equaling no less than $150,000,000 in value at the Closing. As part of the Back-Stop Financing, if it occurs, BOC YAC may provide such financing through cash, securities of publicly-traded corporations or a combination of both.

Agreements to be Entered into at Closing

At the Closing, the Sky Existing Equityholders, PubCo and Sky will enter into the A&R Operating Agreement.

At the Closing of the Business Combination, PubCo, Sky, the Sky Existing Equityholders and the TRA Holder Representative will enter into a Tax Receivable Agreement (the “Tax Receivable Agreement”). Pursuant to the Tax Receivable Agreement, PubCo will generally be required to pay the applicable TRA Holders (as defined in the Tax Receivable Agreement) 85% of the amount of savings, if any, in U.S. federal, state, local, and foreign taxes that are based on, or measured with respect to, net income or profits, and any interest related thereto that PubCo (and applicable consolidated, unitary, or combined subsidiaries thereof, if any) realizes, or is deemed to realize, as a result of certain tax attributes, including:

● existing tax basis in certain assets of Sky and certain of its direct or indirect Subsidiaries (as defined in the Tax Receivable Agreement), including assets that will eventually be subject to depreciation or amortization, once placed in service, attributable to Sky common units acquired by PubCo from a TRA Holder, each as determined at the time of the relevant acquisition;

● tax basis adjustments resulting from taxable exchanges of Sky common units (including any such adjustments resulting from certain payments made by PubCo under the Tax Receivable Agreement) acquired by PubCo from a TRA Holder pursuant to the terms of the A&R Operating Agreement; and

● tax deductions in respect of portions of certain payments made under the Tax Receivable Agreement.

In addition, at the Closing, PubCo will enter into (i) a Stockholders’ Agreement with the Sky Existing Equityholders and the Sponsor (the “Stockholders’ Agreement”). Pursuant to the Stockholders’ Agreement, among other things, the Sky Existing Equityholders and the Sponsor will respectively agree to vote each of their respective securities of PubCo that may be voted in the election of PubCo’s directors in accordance with the provisions of the Stockholders’ Agreement. At Closing, the PubCo Board of Directors (the “PubCo Board”) will initially consist of seven directors. Tal Keinan will have the right, pursuant to the Stockholders’ Agreement, to designate four directors for appointment to such vacancies at any time. Each of Sky’s largest Series A investors and BOC YAC Funding LLC will have the right to designate a director. Each of the Existing Equityholders and BOC YAC Funding LLC will respectively agree to vote for each of those nominees at each meeting of stockholders called for the purpose of electing directors. The director designation rights will each fall away when certain conditions are met.

A copy of the Equity Purchase Agreement is attached as Exhibit 2.1 hereto and is incorporated herein by reference, and the foregoing description of the Equity Purchase Agreement is qualified in its entirety by reference thereto. The Equity Purchase Agreement provides investors with information regarding its terms and is not intended to provide any other factual information about the parties. In particular, the assertions embodied in the representations and warranties contained in the Equity Purchase Agreement were made as of the execution date of the Equity Purchase Agreement only and are qualified by information in confidential disclosure schedules provided by the parties in connection with the signing of the Equity Purchase Agreement. These disclosure schedules contain information that modifies, qualifies, and creates exceptions to the representations and warranties set forth in the Equity Purchase Agreement. Moreover, certain representations and warranties in the Equity Purchase Agreement may have been used for the purpose of allocating risk between the parties rather than establishing matters of fact. Accordingly, you should not rely on the representations and warranties in the Equity Purchase Agreement as characterizations of the actual statements of fact about the parties.

In addition to the Equity Purchase Agreement, the Sponsor has entered into a Sponsor Voting and Support Agreement, attached hereto as Exhibit 10.2, and is incorporated herein by reference, pursuant to which BOC YAC has agreed to provide the Back-Stop Financing. The foregoing description of the Sponsor Voting and Support Agreement is qualified in its entirety by reference thereto.

Item 3.02 Unregistered Sales of Equity Securities.

The disclosure set forth above under the heading “Equity Purchase Agreement – Business Combination” in Item 1.01 of this Current Report are incorporated by reference into this Item 3.02. The shares of PubCo Class A Common Stock to be issued to BOC YAC and the shares of PubCo Class B Common Stock to be issued to the Sky Existing Equityholders will not be registered under the Securities Act of 1933 (the “Securities Act”), as amended, in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act and/or Regulation D promulgated thereunder.

Item 7.01 Regulation FD Disclosure.

On August 2, 2021 Yellowstone issued a press release announcing the execution of the Equity Purchase Agreement. The press release is attached hereto as Exhibit 99.1 and incorporated by reference herein.

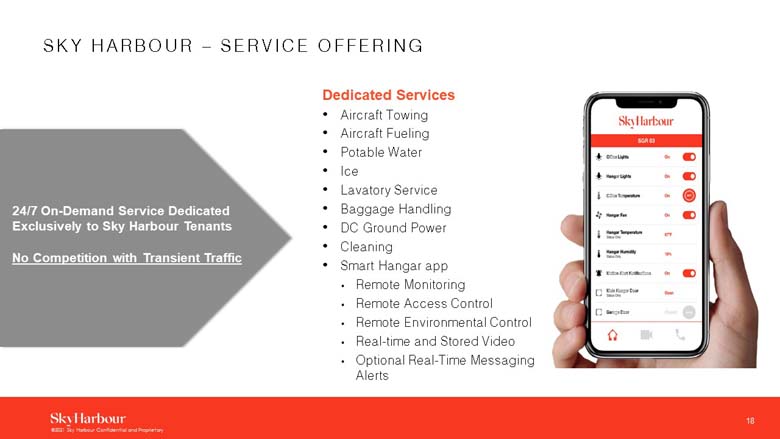

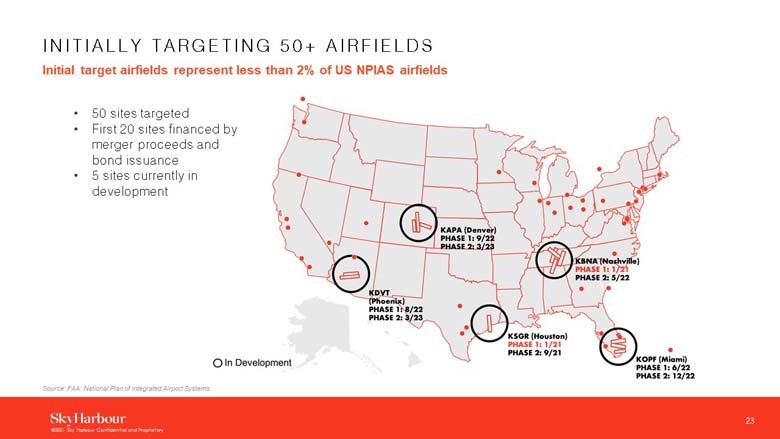

Furnished as Exhibit 99.2 hereto and incorporated into this Item 7.01 by reference is the investor presentation that Yellowstone and Sky have prepared for use in connection with various meetings and conferences with certain investors.

The information in this Item 7.01, including Exhibits 99.1 and 99.2, is being furnished and will not be deemed to be filed for purposes of Section 18 of the Exchange Act, or otherwise be subject to the liabilities of that section, nor will it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

Additional Information

Yellowstone intends to file a preliminary proxy statement with the U.S. Securities and Exchange Commission (the “SEC”) in connection with the proposed Business Combination, Yellowstone will mail the definitive proxy statement and other relevant documents to its stockholders. This communication does not contain all the information that should be considered concerning the Business Combination. It is not intended to provide the basis for any investment decision or any other decision in respect to the proposed Business Combination. Yellowstone’s stockholders and other interested persons are advised to read, when available, the preliminary proxy statement, any amendments thereto, and the definitive proxy statement in connection with Yellowstone’s solicitation of proxies for the special meeting to be held to approve the Business Combination as these materials will contain important information about Sky and Yellowstone and the proposed the Business Combination. The definitive proxy statement will be mailed to the stockholders of Yellowstone as of a record date to be established for voting on the Business Combination. Such stockholders will also be able to obtain copies of the proxy statement, without charge, once available, at the SEC’s website at http://www.sec.gov.

Participants in the Solicitation

Yellowstone, Sponsor and their respective directors, executive officers, other members of management, and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies of Yellowstone’s stockholders in connection with the Business Combination. Investors and security holders may obtain more detailed information regarding the names and interests in the Business Combination of Yellowstone’s directors and officers in Yellowstone’s filings with the SEC, including Yellowstone’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020, which was filed with the SEC on March 12, 2021, as amended on May 24, 2021 and such information and names of Sky’s directors and executive officers will also be in the proxy statement of Yellowstone for the Business Combination. Stockholders can obtain copies of Yellowstone’s filings with the SEC, without charge, at the SEC’s website at www.sec.gov.

Sky and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from Yellowstone’s stockholders in connection with the Business Combination. A list of the names of such directors and executive officers and information regarding their interests in the Business Combination will be included in the proxy statement for the Business Combination when available.

No Offer or Solicitation

This communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities or the solicitation of any vote in any jurisdiction pursuant to the Business Combination or otherwise, nor shall there be any sale, issuance or transfer or securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Forward-Looking Statements

This communication includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Exchange Act that are not historical facts and involve risks and uncertainties that could cause actual results to differ materially from those expected and projected. All statements, other than statements of historical fact contained in this communication including, without limitation, statements regarding Yellowstone’s or Sky’s financial position, business strategy and the plans and objectives of management for future operations; anticipated financial impacts of the Business Combination; the satisfaction of the closing conditions to the Business Combination; and the timing of the completion of the Business Combination, are forward-looking statements. Words such as “expect,” “believe,” “anticipate,” “intend,” “estimate,” “seek” and variations and similar words and expressions are intended to identify such forward-looking statements. Such forward-looking statements relate to future events or future performance, but reflect management’s current beliefs, based on information currently available.

These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside Yellowstone’s and Sky’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (i) the occurrence of any event, change or other circumstances that could give rise to the termination of the Equity Purchase Agreement or could otherwise cause the Business Combination to fail to close; (ii) the outcome of any legal proceedings that may be instituted against Yellowstone and Sky following the execution of the Equity Purchase Agreement and the Business Combination; (iii) any inability to complete the Business Combination, including due to failure to obtain approval of the stockholders of Yellowstone or other conditions to closing in the Equity Purchase Agreement; (iv) the failure of Sky to raise at least $80,000,000 in gross proceeds from its planned private activity bond financing; (v) the inability to maintain the listing of the shares of common stock of the post-acquisition company on The Nasdaq Stock Market following the Business Combination; (vi) the risk that the Business Combination disrupts current plans and operations as a result of the announcement and consummation of the Business Combination; (vii) the ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably and retain its key employees; (viii) costs related to the Business Combination; (ix) changes in applicable laws or regulations; (x) the possibility that Sky or the combined company may be adversely affected by other economic, business, and/or competitive factors; and (xi) other risks and uncertainties indicated in the proxy statement, including those under the section entitled “Risk Factors”, and in Yellowstone’s other filings with the SEC.

Yellowstone cautions that the foregoing list of factors is not exclusive. Yellowstone cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. For information identifying important factors that could cause actual results to differ materially from those anticipated in the forward-looking statements, please refer to the Risk Factors section of Yellowstone’s Annual Report on Form 10-K filed with the SEC. Yellowstone’s securities filings can be accessed on the EDGAR section of the SEC’s website at www.sec.gov. Except as expressly required by applicable securities law, Yellowstone disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise.

Further, Sky Harbour Capital LLC (the “Bond Borrower”), a subsidiary of Sky, expects to raise capital through a municipal bond offering. That bond offering is being made through a Preliminary Offering Statement (“POS”), which contains a number of disclosures regarding the Bond Borrower and its subsidiaries, which will comprise the obligated group (the “Obligated Group”) for such bonds. The POS disclosure includes projections regarding the future business obligations of the Obligated Group and other disclosure pertaining to the Obligated Group. Because the POS disclosure has been drafted to convey information concerning only the Obligated Group, such disclosure should not be relied upon in making an investment decision regarding Yellowstone or Sky.

ITEM 9.01 Financial Statements and Exhibits.

(d) Exhibits. The Exhibit Index set forth below is incorporated herein by reference.

EXHIBIT INDEX

|

Exhibit Number |

Exhibit Title |

| 2.1 | Equity Purchase Agreement |

| 10.1 | Sponsor Voting and Support Agreement |

| 99.1 | Press Release dated August 2, 2021 |

| 99.2 | Investor Presentation |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

YELLOWSTONE ACQUISITION COMPANY (Registrant) By: /s/ Joshua P. Weisenburger Joshua P. Weisenburger, Chief Financial Officer |

Date: August 3, 2021

Exhibit 2.1

EQUITY PURCHASE AGREEMENT

by and between

YELLOWSTONE ACQUISITION COMPANY

and

SKY HARBOUR LLC

dated as of August 1, 2021

TABLE OF CONTENTS

| Page | ||

| ARTICLE I DEFINITIONS | 2 | |

| 1.1 | Certain Definitions | 2 |

| 1.2 | Terms Defined Elsewhere | 11 |

| ARTICLE II PURCHASE AND SALE TRANSACTIONS | 13 | |

| 2.1 | Existing Company Unit Re-classification; Purchase and Sale of Common Units; Conversion of Buyer Stock; Issuance of PubCo Stock | 13 |

| 2.2 | Treatment of Incentive Units | 15 |

| 2.3 | Warrants | 15 |

| 2.4 | Directors of PubCo | 15 |

| 2.5 | Closing; Closing Date | 15 |

| 2.6 | Taking of Necessary Action; Further Action | 16 |

| 2.7 | Withholding | 16 |

| ARTICLE III REPRESENTATIONS AND WARRANTIES OF THE COMPANY | 16 | |

| 3.1 | Organization and Standing | 16 |

| 3.2 | Authorization | 17 |

| 3.3 | Governmental Authorization | 17 |

| 3.4 | Non-Contravention | 17 |

| 3.5 | Capital Structure | 18 |

| 3.6 | Financial Statements | 18 |

| 3.7 | Absence of Certain Changes | 19 |

| 3.8 | Properties | 20 |

| 3.9 | Litigation | 20 |

| 3.10 | Contracts | 20 |

| 3.11 | Licenses and Permits | 21 |

| 3.12 | Compliance with Laws | 21 |

|

3.13 |

Intellectual Property | 21 |

| 3.14 | Employees | 23 |

| 3.15 | Tax Matters | 25 |

| 3.16 | Environmental Laws | 25 |

| 3.17 | Finders’ Fees | 25 |

| 3.18 | Insurance | 25 |

| 3.19 | Affiliate Arrangements | 25 |

TABLE OF CONTENTS

(continued)

| 3.20 | Information Supplied | 26 |

| 3.21 | No Other Representations | 26 |

| ARTICLE IV REPRESENTATIONS AND WARRANTIES OF BUYER | 26 | |

| 4.1 | Corporate Existence and Power | 26 |

| 4.2 | Corporate Authorization | 26 |

| 4.3 | Governmental Authorization | 27 |

| 4.4 | Non-Contravention | 27 |

| 4.5 | Finders’ Fees | 27 |

| 4.6 | Issuance of Stock | 27 |

| 4.7 | Capitalization | 27 |

| 4.8 | Trust Account; Financial Capacity | 29 |

| 4.9 | Listing | 30 |

| 4.10 | Board Approval | 30 |

| 4.11 | Buyer SEC Documents and Financial Statements; Internal Controls | 30 |

| 4.12 | Litigation | 33 |

| 4.13 | Business Activities; Absence of Changes | 33 |

| 4.14 | Compliance with Laws | 34 |

| 4.15 | Investment Company Act; JOBS Act | 34 |

| 4.16 | Tax Matters | 34 |

| 4.17 | Transactions with Affiliates | 35 |

| 4.18 | Proxy Statements | 36 |

| 4.19 | Takeover Statutes and Charter Provisions | 36 |

| 4.20 | Property | 36 |

| 4.21 | Material Contracts; Defaults | 36 |

| 4.22 | Independent Investigation | 37 |

| 4.23 | No Other Representations | 37 |

| ARTICLE V COVENANTS OF THE COMPANY AND BUYER | 37 | |

| 5.1 | Conduct of the Business of the Company | 37 |

| 5.2 | Conduct of the Business of Buyer | 40 |

| 5.3 | No Solicitation; Support | 43 |

| 5.4 | Access to Information | 43 |

| 5.5 | Notices of Certain Events | 44 |

TABLE OF CONTENTS

(continued)

| 5.6 | SEC Filings; Buyer Special Meeting | 44 |

| 5.7 | Trust Account | 48 |

| 5.8 | PIPE Investment | 49 |

| 5.9 | Directors’ and Officers’ Indemnification and Insurance | 50 |

| 5.10 | Efforts; Further Assurances | 51 |

| 5.11 | Tax Matters | 51 |

| 5.12 | Buyer Filings and Nasdaq Listing | 53 |

| 5.13 | Preparation and Delivery of Additional Financial Statements | 53 |

| 5.14 | Reserved | 53 |

| 5.15 | Employee Matters | 53 |

| ARTICLE VI CONDITIONS TO CLOSING | 54 | |

| 6.1 | Condition to the Obligations of the Parties | 54 |

| 6.2 | Conditions to Obligations of Buyer | 55 |

| 6.3 | Conditions to Obligations of the Company | 56 |

| ARTICLE VII TERMINATION | 57 | |

| 7.1 | Termination | 57 |

| 7.2 | Effect of Termination; Survival | 59 |

| ARTICLE VIII MISCELLANEOUS | 59 | |

| 8.1 | Notices | 59 |

| 8.2 | Amendments; Waivers; Remedies | 60 |

| 8.3 | Arm’s Length Bargaining; No Presumption Against Drafter | 61 |

| 8.4 | Publicity | 61 |

| 8.5 | Expenses | 61 |

| 8.6 | No Assignment or Delegation | 61 |

| 8.7 | Governing Law | 62 |

| 8.8 | Counterparts; Facsimile Signatures | 62 |

| 8.9 | Entire Agreement | 62 |

| 8.10 | Severability | 62 |

| 8.11 | Construction of Certain Terms and References; Captions | 62 |

| 8.12 | Third Party Beneficiaries | 64 |

| 8.13 | Trust Account Waiver | 65 |

TABLE OF CONTENTS

(continued)

| 8.14 | No Recourse | 65 |

| 8.15 | Submission to Jurisdiction | 65 |

| 8.16 | Nonsurvival of Representations, Warranties and Covenants | 66 |

| 8.17 | Enforcement | 66 |

| 8.18 | Schedules and Exhibits | 66 |

| 8.19 | Waiver of Jury Trial; Exemplary Damages | 66 |

| 8.20 | Waiver of Conflicts | 67 |

| 8.21 | Acknowledgements | 68 |

Annexes

|

Annex A |

Existing Equityholders |

Exhibits

|

Exhibit A |

Form of Company A&R Operating Agreement |

|

Exhibit B |

Form of Buyer A&R Certificate of Incorporation |

|

Exhibit C |

Form of Buyer A&R Bylaws |

|

Exhibit D |

Form of Tax Receivable Agreement |

|

Exhibit E |

Form of Stockholders’ Agreement |

|

Exhibit F |

Form of Lock-Up Agreement |

|

Exhibit G |

Form of Equityholder Support Agreement |

|

Exhibit H |

Form of Sponsor Support Agreement |

|

Exhibit I |

Equity Incentive Plan Term Sheet |

EQUITY PURCHASE AGREEMENT

This EQUITY PURCHASE AGREEMENT (this “Agreement”), dated as of August 1, 2021 (the “Effective Date”), by and between Sky Harbour LLC, a Delaware limited liability company (the “Company”), and Yellowstone Acquisition Company, a Delaware corporation (prior to the Closing, “Buyer”, and from and after the Closing, “PubCo”). All capitalized terms used in this Agreement shall have the meanings ascribed to such terms in ARTICLE I or as otherwise defined elsewhere in this Agreement.

W I T N E S E T H:

WHEREAS, Buyer is a blank check company formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination;

WHEREAS, at the Closing, the Existing Equityholders, Buyer and the Company will enter into a Third Amended and Restated Limited Liability Company Operating Agreement, substantially in the form attached hereto as Exhibit A (the “A&R Operating Agreement”) to, among other things, (1) restructure the capitalization of the Company at the Closing to (x) authorize the issuance of Common Units to Buyer, (y) re-classify the Existing Company Units held by the Existing Equityholders into Common Units as contemplated in this Agreement and the A&R Operating Agreement and (z) maintain each Incentive Unit (whether vested or unvested), as outstanding and subject to the A&R Operating Agreement and (2) appoint Buyer as the managing member of the Company;

WHEREAS, at the Closing, Buyer will (1) amend and restate its Certificate of Incorporation with the Second Amended and Restated Certificate of Incorporation attached hereto as Exhibit B (the “A&R Certificate of Incorporation”) to, among other things, (x) convert all then‑outstanding shares of Buyer Class B Common Stock into shares of PubCo Class A Common Stock, (y) authorize the issuance of PubCo Class B Common Stock and (z) change the name of Buyer to “Sky Harbour Group Corporation” and (2) replace its existing bylaws by adopting the bylaws attached hereto as Exhibit C (the “Buyer A&R By-laws”);

WHEREAS, at the Closing, the Existing Equityholders, the Company and Buyer will enter into the Tax Receivable Agreement, substantially in the form attached hereto as Exhibit D (the “Tax Receivable Agreement”);

WHEREAS, at the Closing, the Existing Equityholders, BOC Yellowstone I LLC, a Delaware limited liability company (“Sponsor I”) and BOC Yellowstone II LLC, a Delaware limited liability company (“Sponsor II” and, together with Sponsor I, “Sponsor”) and Buyer will enter into the Stockholders’ Agreement substantially in the form attached hereto as Exhibit E (the “Stockholders’ Agreement”); and

WHEREAS, concurrently with the entry into this Agreement, (1) Buyer, the Existing Equityholders, Sponsor and the other Persons set forth therein have entered into the Lock-Up Agreement in the form attached hereto as Exhibit F (the “Lock-Up Agreement”), (2) the Existing Equityholders and Buyer have entered into the Support Agreement in the form attached hereto as Exhibit G (the “Equityholder Support Agreement”) and (3) the Sponsor has entered into the Support Agreement in the attached hereto as Exhibit H (the “Sponsor Support Agreement” and, together with the Equityholder Support Agreement, the “Support Agreements”).

NOW, THEREFORE, in consideration of the premises set forth above, which are incorporated in this Agreement as if fully set forth below, and the representations, warranties, covenants and agreements contained in this Agreement, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound hereby, the parties accordingly agree as follows:

ARTICLE I

DEFINITIONS

1.1 Certain Definitions. For the purposes of this Agreement, the term:

“Action” means any civil, criminal or administrative action, suit, demand, claim, charge, complaint, litigation, audit, formal proceeding, arbitration or hearing.

“Additional Agreements” means the A&R Operating Agreement, the Tax Receivable Agreement, the Stockholders’ Agreement, the Lock-Up Agreement, the Subscription Agreements (if any), and the Support Agreements.

“Affiliate” means, with respect to any Person, any other Person directly or indirectly Controlling, Controlled by, or under common Control with such Person. For avoidance of any doubt, with respect to all periods subsequent to the Closing, Buyer will be an Affiliate of the Company.

“Authority” means any nation or government, any state, province or other political subdivision thereof, any entity exercising executive, legislative, judicial, regulatory or administrative functions of or pertaining to government, including any court, arbitrator (public or private) or other body or administrative, regulatory or quasi-judicial authority, agency, department, board, commission or instrumentality of any federal, state, local or foreign jurisdiction.

“Back-Stop Shares” means Marketable Securities of Persons other than Boston Omaha Corporation that are owned beneficially or of record by Boston Omaha Corporation or its Affiliates. For the avoidance of doubt, Back-Stop Shares shall not include any securities of Boston Omaha Corporation.

“BOC YAC Funding LLC” means BOC YAC Funding LLC, a Delaware limited liability company and a wholly-owned direct subsidiary of Boston Omaha Corporation.

“Bond Financing” means a debt financing by the Company for an aggregate amount of at least $80,000,000 in gross proceeds from tax-advantaged private activity bonds for the use of the Subsidiaries in substantially the manner described in the draft preliminary offering statement made available to Buyer.

“Books and Records” means, with respect to any Person, all books and records, ledgers, employee records, customer lists, files, correspondence, and other records of every kind (whether written, electronic, or otherwise embodied) owned or used by such Person or any of its Subsidiaries or in which such Person or any of its Subsidiaries’ assets, the business or its transactions are otherwise reflected.

“Business Day” means any day other than a Saturday, Sunday or a legal holiday on which commercial banking institutions in New York are authorized to close for business.

“Buyer Board” means the board of directors of Buyer.

“Buyer Class A Common Stock” means the shares of class A common stock, par value $0.0001 per share, of Buyer, prior to the effectiveness of the A&R Certificate of Incorporation.

“Buyer Class B Common Stock” means the shares of class B common stock, par value $0.0001 per share, of Buyer, prior to the effectiveness of the A&R Certificate of Incorporation.

“Buyer Common Stock” means, collectively, the Buyer Class A Common Stock and the Buyer Class B Common Stock.

“Buyer Fundamental Representations” means the representations and warranties set forth in Sections 4.1, 4.2, 4.4, 4.5 and 4.7.

“Buyer Stock Redemption” means the election of an eligible holder of Buyer Common Stock (as determined in accordance with the applicable Buyer’s Organizational Documents and the Investment Management Trust Agreement) to redeem all or a portion of such holder’s Buyer Common Stock, at the per-share price, payable in cash, equal to such holder’s pro rata share of the Trust Account (as determined in accordance with Buyer’s Organizational Documents and the Investment Management Trust Agreement) in connection with the Closing.

“Buyer Unit” means a unit of Buyer comprised of one share of Buyer Class A Common Stock and one-half of one Buyer Warrant.

“Buyer Warrant” means each whole warrant to purchase one whole share of Buyer Class A Common Stock at a price of $11.50 per share.

“CARES Act” means the Coronavirus Aid, Relief, and Economic Security Act (Pub. L. 116-136) and any administrative or other guidance published with respect thereto by any Authority.

“Closing Date Contribution Amount” means, as of immediately prior to the Closing, an aggregate amount equal to the sum of (without duplication), (a) an amount equal to (1) the amount of cash in the Trust Account, less (2) the required amount of cash taken from the Trust Account to fund any Buyer Stock Redemptions, plus (b) the PIPE Financing Amount (disregarding, for the purposes of this definition, (i) clause (y) in the definition of “PIPE Financing Amount” if (and only if) the Series B Financing has not been consummated prior to the Closing) and (ii) clause (x) in the definition of “PIPE Financing Amount”.

“Closing Form 8-K” means the Form 8-K announcing the Closing.

“Code” means the Internal Revenue Code of 1986, as amended.

“Common Units” means the “Common Units” of the Company (as defined in the A&R Operating Agreement).

“Company Fundamental Representations” means the representations and warranties set forth in Sections 3.1, 3.2, 3.4, 3.5 and 3.17.

“Company Material Adverse Effect” means an event, occurrence, fact, condition or change that has, or would reasonably be expected to have, a material adverse effect on the condition, business or operations of the Company and the Company Subsidiaries, taken as a whole, provided, however, that “Company Material Adverse Effect” shall not include or take into account any event, occurrence, fact, condition or change, directly or indirectly, arising out of or attributable to: (i) general economic or political conditions; (ii) conditions generally affecting the industries in which the Company and the Company Subsidiaries operate; (iii) any changes in financial, banking or securities markets in general, including any disruption thereof and any decline in the price of any security or any market index or any change in prevailing interest rates, or currency exchange rates, monetary policy or fiscal policy; (iv) acts of war (whether or not declared), armed hostilities or terrorism, and any pandemic, epidemics or human health crises (including COVID-19, or any COVID-19 Measures or any change in such COVID-19 Measures or interpretations thereof); (v) any action required by this Agreement or any action taken (or omitted to be taken) with the written consent of or at the written request of Buyer; (vi) changes in GAAP and interpretations thereof, or any changes in applicable Law; (vii) the announcement, pendency or completion of the transactions contemplated by this Agreement, including losses or threatened losses of employees, customers, suppliers, vendors, distributors or others having relationships with the Company or the Company Subsidiaries; (viii) any natural or man-made disaster or acts of God; (ix) any action taken by Buyer or its Affiliates; (x) any failure by the Company to meet any internal or published projections, forecasts or revenue or earnings predictions (provided that the underlying causes of such failures (subject to the other provisions of this definition) shall not be excluded if not otherwise falling within any of clauses (i) though (ix) above), except, in the case of each of clauses (i), (ii), (iii) and (viii), to the extent such event, occurrence, fact, condition or change materially and disproportionately affects the Company and the Company Subsidiaries, taken as a whole, relative to other companies in the industries in which the Company and the Company Subsidiaries operate (in which case only the incremental material and disproportionate impact will be taken into account in determining whether there has been a Company Material Adverse Effect).

“Company Subsidiaries” means the Subsidiaries of the Company.

“Confidentiality Agreement” means the Non-Disclosure Agreement, dated as of April 6, 2021, by and between the Company and Buyer.

“Consent” means any consent, approval, clearance, authorization or other similar actions.

“Contracts” means all legally-binding contracts, agreements, notes, indentures, leases, licenses and sublicenses, commitments, undertakings, whether oral or written.

“Control” means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by Contract or otherwise; and the terms “Controlled” and “Controlling” shall have the meaning correlative to the foregoing.

“COVID-19” means SARS-CoV-2 or COVID-19, and any evolutions or mutations thereof or related or associate epidemics, pandemic or disease outbreaks.

“COVID-19 Measures” means any quarantine, “shelter in place,” “stay at home,” workforce reduction, social distancing, shut down, closure, sequester, safety or similar Law, directive, guidelines or recommendations promulgated by any Authority, including the Centers for Disease Control and Prevention and the World Health Organization, in connection with or in response to COVID-19, including the CARES Act and Families First Act, or any change in such Law, directive, guideline, recommendation or interpretation thereof.

“Deferred Underwriting Commission” has the meaning ascribed to such term in the Underwriting Agreement, dated October 19, 2020, by and between Buyer and Wells Fargo Securities.

“DGCL” means the Delaware General Corporate Law.

“EDGAR” means the SEC’s Electronic Data Gathering, Analysis and Retrieval system.

“Employee Benefit Plan” means each “employee benefit plan” (as such term is defined in Section 3(3) of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), whether or not subject to ERISA), each pension, retirement, profit-sharing, savings, health, welfare, post-employment welfare, bonus, incentive, commission, equity or equity-based, deferred compensation, severance, retention, accident, disability, employment, change of control, stock purchase, separation, consulting, vacation, paid time off, fringe benefit and each other benefit or compensatory plan, program, policy Contract or arrangement that any member of the Company Group maintains, sponsors or contributes to, is required to contribute to or under or with respect to which any member of the Company Group has any liability.

“Environmental Laws” means any Law relating to (a) releases or threatened release of Hazardous Substances; (b) pollution or protection of employee health or safety, public health or the environment; or (c) the manufacture, handling, transport, use, treatment, storage, or disposal of Hazardous Substances.

“Equity” means, with respect to any Person, any capital stock, membership interests, other share capital, equity or ownership interest or other security of or held by such Person.

“Exchange Act” means the Securities Exchange Act of 1934.

“Existing Company Common Units” means the “Common Units” of the Company (as defined in the Existing Company LLCA), prior to the effectiveness of the A&R Operating Agreement.

“Existing Company LLCA” means the Second Amended and Restated Operating Agreement of the Company, to be entered into upon the consummation of the Series B Financing, in the form attached as Exhibit D to the Series B Financing Agreement.

“Existing Company Series A Preferred Units” means the “Series A Preferred Units” of the Company (as defined in the Existing Company LLCA), prior to the effectiveness of the A&R Operating Agreement.

“Existing Company Series B Preferred Units” means the “Series B Preferred Units” of the Company (as defined in the Existing Company LLCA), prior to the effectiveness of the A&R Operating Agreement.

“Existing Company Units” means, collectively, the Existing Company Common Units, the Existing Company Series A Preferred Units and the Existing Company Series B Preferred Units.

“Existing Equityholders” means the equityholders of the Company set forth on Annex A hereto.

“Existing Equityholder Transaction Proposals” means the approval of this Agreement, the Additional Agreements (including, for the avoidance of doubt, the adoption by the Company of the A&R Operating Agreement) and the transactions contemplated hereby and thereby, the reclassification of Existing Company Units into, and the issuance of, the Common Units, and such other actions necessary or advisable (and agreed upon by Buyer and the Company) for the consummation of the foregoing transactions.

“Existing Equityholder Approval” means the vote or written consent of all Existing Equityholders.

“FAA” means the Federal Aviation Administration of the U.S. Department of Transportation.

“Fraud” means, with respect to any Person, an actual and intentional fraud by such Person with respect to the making of representations and warranties contained in this Agreement by such Person and not with respect to any other matters; provided that, such actual and intentional fraud of such Person hereto specifically excludes any statement, representation or omission made negligently or recklessly and shall only be deemed to exist if (i) such Person had knowledge that the representations and warranties made by such Person were inaccurate when made, (ii) that such representations and warranties were made with the express intent to induce the other Person to rely thereon and that such other Person would take action or inaction to such other Person’s detriment, (iii) such reliance and subsequent action or inaction by such other Person was justifiable and (iv) such action or inaction resulted in actual material damages to such other Person.

“GAAP” means U.S. generally accepted accounting principles, consistently applied.

“Incentive Equity Units” shall have the meaning given to such term in the A&R Operating Agreement.

“Incentive Unit Allocation” shall mean the number of Common Units that would be issued if all of Incentive Equity Units that will be issued pursuant to Section 4.2.4 of the A&R Operating Agreement at Closing where exchanged for Common Units in accordance with Section 11.3 of the A&R Operating Agreement at the Closing (and determined based on the Fair Market Value (as defined in the A&R Operating Agreement) of each such Incentive Unit as of the Closing Date).

“Incentive Units” means the “Incentive Units” of the Company (as defined in the Existing Company LLCA).

“Indebtedness” means with respect to any Person, (a) all obligations of such Person for borrowed money (including amounts by reason of overdrafts and amounts owed by reason of letter of credit reimbursement agreements) including with respect thereto, all interests, fees and costs and prepayment and other penalties, (b) all obligations of such Person evidenced by bonds, debentures, notes or similar instruments, (c) all obligations of such Person under conditional sale or other title retention agreements relating to property purchased by such Person, (d) all obligations of such Person issued or assumed as the deferred purchase price of property or services (other than accounts payable to creditors for goods and services incurred in the ordinary course of business), (e) all Indebtedness of others secured by (or for which the holder of such Indebtedness has an existing right, contingent or otherwise, to be secured by) any lien or security interest on property owned or acquired by such Person, whether or not the obligations secured thereby have been assumed, (f) all obligations of such Person under leases required to be accounted for as capital leases under GAAP, other than any lease obligations which would not have been capitalized under GAAP before the implementation of ASC 842 and (g) all guarantees of obligations described in clauses (a) through (f) by such Person. For the avoidance of doubt, the Deferred Underwriting Commission shall not be deemed Indebtedness.

“Intellectual Property” means all patents, patent applications, registered and unregistered trademarks, trademark applications, registered and unregistered service marks, service mark applications, tradenames, copyrights, trade secrets, domain names, information and proprietary rights and processes, similar or other intellectual property rights, subject matter of any of the foregoing, tangible embodiments of any of the foregoing, and licenses in, to and under any of the foregoing.

“Investment Company Act” means the Investment Company Act of 1940, as amended.

“Investment Management Trust Agreement” means the Investment Management Trust Agreement, dated October 21, 2020, between Buyer and Continental Stock Transfer & Trust Company, as trustee..

“IPO” means the initial public offering of Buyer pursuant to the Prospectus.

“Law” means any domestic or foreign, federal, state, municipality or local law, statute, ordinance, code, common law, act or treaty of any applicable Authority, including rule or regulation promulgated thereunder.

“Lead Investor Warrant” shall have the meaning assigned to such term in the Series B Financing Agreement.

“Lien” means, with respect to any asset, any mortgage, lien, license, pledge, charge, security interest or encumbrance of any kind in respect of such asset, and any conditional sale or voting agreement or proxy, including any agreement to give any of the foregoing.

“Marketable Securities” means equity securities that at the time of transfer to the Company (i) are freely tradable pursuant to a registration under the Securities Act or will be eligible for resale under Rule 144 of the Securities Act within one year from the date of transfer to the Company, (ii) immediately after giving effect to their contribution will not be subject to any “lock-up” or other contractual restrictions on transfer or any contractual limitations on sale or transfer, (iii) are a class of securities generally traded on or through one or more established public markets, and (iv) may be sold without regard to volume limitations after the holder of such securities has met all applicable holding period resale requirements under Rule 144 of the Securities Act.

“Nasdaq” means The Nasdaq Capital Market LLC.

“Net Outstanding Buyer Shares” means a number equal to (a) the number of shares of Buyer Common Stock outstanding as of the date of this Agreement, plus (b) the number of shares of PubCo Class A Common Stock issued pursuant to the PIPE Investment, plus (c) the number of shares of PubCo Class A Common Stock issued pursuant to the Back-Stop Share Transfer, minus (d) the number of shares of Buyer Common Stock redeemed pursuant to the Buyer Stock Redemptions.

“Order” means any decree, order, judgment, ruling, writ, judicial or arbitral award, injunction, verdict, determination, binding decision, rule or consent of or by an Authority.

“Ordinary Course Tax Sharing Agreement” means any written commercial agreement entered into in the ordinary course of business the principal subject matter of which is not Tax but which contains customary Tax indemnification, allocation or gross-up provisions.

“Organizational Documents” means, with respect to any Person, its certificate of incorporation and bylaws, operating or limited liability company agreement, limited partnership agreement, memorandum and articles of association or similar organizational documents, in each case, as amended.

“Permitted Liens” means (i) all defects, exceptions, covenants, conditions, restrictions, easements, rights of way encumbrances and other similar matters affecting title to any real property and other title defects which do not materially impair the use or occupancy of such real property or the operation of the business of the Company and the Company Subsidiaries (taken as a whole); (ii) mechanics’, carriers’, workers’, repairers’ and similar statutory Liens arising or incurred in the ordinary course of business for amounts (A) that are not delinquent, (B) that are not material to the business, operations and financial condition of the Company and the Company Subsidiaries (taken as a whole) so encumbered, either individually or in the aggregate, and (C) that do not result from a breach, default or violation by the Company or any of the Company Subsidiaries of any Contract or Law; (iii) Liens for Taxes, assessments or governmental charges or levies which are not yet due and payable or which are being contested in good faith by appropriate proceedings (provided appropriate reserves required pursuant to GAAP have been made in respect thereof); (iv) zoning, building codes and other land use Laws regulating the use or occupancy of real property or the activities conducted thereon which are imposed by any Authority having jurisdiction over any real property which are not violated by the current use or occupancy of such real property other than any violations that would not be reasonably expected to, individually or in the aggregate, be material to the Company and the Company Subsidiaries (taken as a whole); (v) ordinary course purchase money Liens and Liens securing rental payments under operating or capital lease arrangements for amounts not yet due or payable; (vi) non-exclusive licenses to Intellectual Property granted in the ordinary course of business; and (vii) other Liens arising or incurred in the ordinary course of business that would not be reasonably expected to, individually or in the aggregate, be material to the Company and the Company Subsidiaries (taken as a whole).

“Person” means an individual, corporation, partnership (including a general partnership, limited partnership or limited liability partnership), limited liability company, association, trust or other entity or organization, including a government, domestic or foreign, or political subdivision thereof, or an agency or instrumentality thereof.

“PIPE Financing Amount” means (x) the aggregate gross purchase price actually received by the Company prior to the Closing for the Existing Company Series B Preferred Units sold pursuant to the Series B Financing, plus (y) the aggregate gross purchase price actually received by Buyer prior to or substantially concurrently with the Closing for the PubCo Class A Common Stock in the PIPE Investment, plus (z) the aggregate Share Value of the Back-Stop Shares (calculated on an after-tax basis assuming a sale of the Back-Stop Shares by the Company) and cash delivered in lieu of all or some portion of the Back-Stop Shares actually received by the Company prior to or substantially concurrently with the Closing.

“PubCo Class A Common Stock” means the shares of class A common stock, par value $0.0001 per share, of PubCo as set forth in the A&R Certificate of Incorporation.

“PubCo Class B Common Stock” means the shares of class B common stock, par value $0.0001 per share, of PubCo as set forth in the A&R Certificate of Incorporation.

“PubCo Warrant” means warrants for PubCo Class A Common Stock (which shall be in the identical form of the Buyer Warrants, but in the name of PubCo).

“Representatives” means, with respect to a Person, such Person’s directors, managers, officers, employees, advisors, agents, consultants, attorneys, accountants, investment bankers or other representatives of such Person.

“Sarbanes-Oxley Act” means the Sarbanes-Oxley Act of 2002.

“SEC” means the Securities and Exchange Commission.

“Securities” means, with respect to any Person, (i) any securities (including debt securities) directly or indirectly convertible into or exchangeable or exercisable for any Equity or securities containing any profit participation features, (ii) any rights, warrants or options directly or indirectly to subscribe for or to purchase any Equity or securities containing any profit participation features, or to subscribe for or to purchase any securities (including debt securities) convertible into or exchangeable or exercisable for any Equity or securities containing any profit participation features, (iii) any share appreciation rights, phantom share rights, other rights the value of which is linked to the value of any securities or interests referred to in clauses (i) through (ii) above or other similar rights or (iv) any securities (including debt securities) issued or issuable with respect to the securities or interests referred to in clauses (i) through (iii) above in connection with a combination of shares, recapitalization, merger, consolidation or other reorganization.

“Securities Act” means the Securities Act of 1933, as amended.

“Series B Financing” means the convertible preferred Series B equity financing contemplated by the Series B Financing Agreement, including any such financing at the initial closing contemplated thereby.

“Series B Financing Agreement” shall mean that certain Unit Purchase Agreement, dated as of the date hereof, by and among BOC YAC Funding LLC, the Company and the other parties thereto.

“Share Value” means the volume weighted average trading price of the relevant stock comprising the Back-Stop Shares during the 20 trading day period immediately preceding the Closing Date, multiplied by the number of shares comprising the Back-Stop Shares.

“Subsidiary” or “Subsidiaries” means (i) one or more entities of which at least fifty percent (50%) of the capital stock or share capital or other equity or voting securities are Controlled or owned, directly or indirectly, by the respective Person and (ii) any partnership, limited liability company, joint venture or other entity of which the respective Person or any Subsidiary is a general partner, manager, managing member or the equivalent.

“Tax Return” means any return, information return, declaration, or any similar statement, and any amendment thereto, including any attached Schedule and supporting information that is filed or required to be filed with any Taxing Authority in connection with the determination, assessment, collection or payment of a Tax.

“Tax Sharing Agreement” means any agreement or arrangement pursuant to which the Company or any Company Subsidiary is or may be obligated to indemnify any Person for, or otherwise pay, any Tax of or imposed on another Person, or pay over to any other Person any amount determined by reference to actual or deemed Tax benefits, Tax assets or attributes or Tax savings, other than an Ordinary Course Tax Sharing Agreement.

“Tax(es)” means all U.S. federal, state, local, or non-U.S. net or gross income, net or gross receipts, net or gross proceeds, payroll, employment, excise, stamp, occupation, windfall or excess profits, profits, customs, capital stock, withholding, social security, unemployment, real property, personal property (tangible and intangible), sales, use, transfer, value added, alternative or add-on minimum, capital gains, ad valorem, franchise, capital, estimated, goods and services, premium, environmental or other taxes, assessments, duties or similar charges of any kind whatsoever in the nature of tax, including all interest, penalties and additions to tax imposed by or otherwise payable to any Taxing Authority with respect to the foregoing.

“Taxing Authority” means the U.S. Internal Revenue Service and any other Authority responsible for the collection, assessment or imposition of any Tax or the administration of any Law relating to any Tax.

“Transaction Expenses” means, collectively, the amount of the unpaid fees, commissions, costs or expenses that have been incurred by the Company or Buyer in connection with the negotiation, execution or delivery of this Agreement and the Additional Agreements or the consummation of the transactions contemplated hereby or thereby (including the Series B Financing and in securing the PIPE Financing Amount), including costs and expenses of the Company’s or Buyer’s advisors in relation thereto and any Transfer Taxes. With respect to Buyer, Transaction Expenses shall also include any unpaid operational expenses and Indebtedness as of the Closing and the Deferred Underwriting Commission and any expense incurred in obtaining directors and officers insurance for the purposes of Section 5.9.

“Transfer Taxes” means any and all transfer, documentary, sales, use, gross receipts, stamp, registration, value added, recording, escrow and other similar Taxes and fees (including any penalties and interest) incurred in connection with the transactions contemplated by this Agreement.

“Treasury Regulations” means the United States Treasury Regulations promulgated under the Code.

“TSA” means the Transportation Security Administration of the U.S. Department of Homeland Security.

“Warrant Agreement” means the Warrant Agreement, dated as of October 21, 2020, between Continental Stock Transfer & Trust Company and Buyer.

1.2 Terms Defined Elsewhere. The following terms are defined elsewhere in this Agreement, as indicated below:

|

Additional Buyer SEC Documents |

Section 4.11(a) |

|

Agreement |

Preamble |

|

Alternative Proposal |

Section 5.3 |

|

Alternative Transaction |

Section 5.3 |

|

A&R Certificate of Incorporation |

Recitals |

|

A&R Operating Agreement |

Recitals |

|

Available Buyer Funding |

Section 5.7(a) |

|

Back-Stop Share Transfer |

Section 6.3(e) |

|

Balance Sheet Date |

Section 3.6(c) |

|

BOC Common Units |

Section 2.1(b) |

|

Business Combination |

Section 4.8(a) |

|

Business Plan |

Section 3.20 |

|

Buyer |

Preamble |

|

Buyer A&R By-laws |

Recitals |

|

Buyer Board Recommendation |

Section 5.6(f) |

|

Buyer D&O Indemnified Persons |

Section 5.9(a) |

|

Buyer Financial Statements |

Section 4.11(b) |

|

Buyer Governmental Approval |

Section 4.3 |

|

Buyer Impairment Effect |

Section 4.3 |

|

Buyer Material Contracts |

Section 4.21(a) |

|

Buyer Post-Closing Representation |

Section 8.20(a) |

|

Buyer Related Party |

Section 4.17 |

|

Buyer SEC Documents |

Section 4.11(a) |

|

Buyer Special Meeting |

Section 5.6(c) |

|

Buyer Stockholder Approval Matters |

Section 5.6(c) |

|

Clearance Date |

Section 5.6(f) |

|

Closing |

Section 2.5 |

|

Closing Date |

Section 2.5 |

|

Company |

Preamble |

|

Company Affiliate Arrangement |

Section 3.19 |

|

Company D&O Indemnified Persons |

Section 5.9(a) |

|

Company Governmental Approval |

Section 3.3 |

|

Compensation Consultant |

Section 5.15(b) |

|

Disclosure Schedules |

ARTICLE III |

|

D&O Indemnified Persons |

Section 5.9(a) |

|

Effective Date |

Preamble |

|

Employee Confidential Information Agreements |

Section 3.14(h) |

|

Equity Incentive Plan |

Section 5.15(a) |

|

Equityholder Support Agreement |

Recitals |

|

Existing Equityholder Post-Closing Representation |

Section 8.20(b) |

|

Financial Statements |

Section 3.6(a) |

|

Form 10-K/A |

Section 4.11(c) |

|

Governmental Approvals |

Section 4.3 |

|

Hazardous Substance |

Section 3.16 |

|

HSR Act |

Section 3.3 |

|

Intended Tax Treatment |

Section 5.11(b) |

|

Key Employee |

Section 3.14(c) |

|

Lock-Up Agreement |

Recitals |

|

Minimum Available Buyer Funding Amount |

Section 5.7(a) |

|

Non-Recourse Parties |

Section 8.14 |

|

Outside Closing Date |

Section 7.1(c) |

|

PIPE Investment |

Section 5.8(a) |

|

PIPE Investors |

Section 5.8(a) |

|

Pending Applications |

Section 3.11 |

|

Prospectus |

Section 8.13 |

|

Proxy Statement |

Section 5.6(c) |

|

PubCo |

Preamble |

|

Related Claim |

Section 8.15(a) |

|

Remedies Exception |

Section 3.2 |

|

Required Buyer Stockholder Approval |

Section 6.1(b) |

|

Schedules |

ARTICLE III |

|

Specified Courts |

Section 8.15(a) |

|

Sponsor |

Recitals |

|

Sponsor I |

Recitals |

|

Sponsor II |

Recitals |

|

Sponsor Support Agreement |

Recitals |

|

Stockholders’ Agreement |

Recitals |

|

Subscription Agreements |

Section 5.8(a) |

|

Support Agreements |

Recitals |

|

Tax Receivable Agreement |

Recitals |

|

Trust Account |

Section 4.8(a) |

|

Trustee |

Section 4.8(a) |

|

Waiving Parties |

Section 8.20(a) |

ARTICLE II

PURCHASE AND SALE TRANSACTIONS

2.1 Existing Company Unit Re-classification; Purchase and Sale of Common Units; Conversion of Buyer Stock; Issuance of PubCo Stock. Upon the terms and subject to the conditions set forth in this Agreement, at the Closing:

(a) The Existing Company Common Units held by each Existing Equityholder that held Founder Units or Series A Preferred Units (each as defined in the Existing LLCA and assuming the conversion thereof into Existing Company Common Units in accordance with the Existing Company LLCA) shall automatically be re-classified into a number of Common Units equal to the product of (x) 45,000,000, less the Incentive Unit Allocation, multiplied by (y) a fraction, the numerator of which is the number of Existing Company Common Units held by such Existing Equityholder (assuming the automatic conversion of all Existing Company Series A Preferred Units and Founder Units into Existing Company Common Units in accordance with Section 2.10(p) of the Existing Company LLCA) and the denominator of which is the number of Existing Company Common Units held by all Existing Equityholders that held Founder Units or Series A Preferred Units (assuming the automatic conversion of all Existing Company Series A Preferred Units and Founder Units into Existing Company Common Units in accordance with Section 2.10(p) of the Existing Company LLCA), in each case free and clear of all Liens other than restrictions pursuant to the Company’s Organizational Documents, applicable securities Laws, this Agreement and the Additional Agreements.

(b) (i) All Existing Company Series B Preferred Units shall automatically be re-classified into a total of 5,500,000 Common Units (the “BOC Common Units”), free and clear of all Liens other than restrictions pursuant to the Company’s Organizational Documents, applicable securities Laws, this Agreement and the Additional Agreements; and (ii) immediately following the Closing, BOC YAC Funding LLC shall be deemed to have elected to redeem all of the BOC Common Units pursuant to Section 11.1 of the A&R Operating Agreement (and shall be deemed to have elected a Share Settlement (as defined in the A&R Operating Agreement)) in exchange for 5,500,000 shares of Pubco Class A Common Stock, free and clear of all Liens other than restrictions pursuant to PubCo’s Organizational Documents, applicable securities Laws, this Agreement and the Additional Agreements;

(c) Buyer shall contribute to the Company the Closing Date Contribution Amount and, in consideration thereof, the Company shall issue to Buyer a number of Common Units equal to the number of Net Outstanding Buyer Shares, free and clear of all Liens other than restrictions pursuant to the Company’s Organizational Documents, applicable securities Laws, this Agreement and the Additional Agreements;

(d) Immediately following the transaction set forth in Section 2.1(c), the Company shall make payments of the Transaction Expenses by wire transfer of immediately available funds on behalf of the Company and Buyer to the Persons to whom such amounts are owed;

(e) Simultaneously with the transaction set forth in Section 2.1(a), Buyer will file the A&R Certificate of Incorporation with the Delaware Secretary of State;

(f) As of immediately prior to the Delaware Secretary of State’s acceptance of the A&R Certificate of Incorporation, each share of Buyer Class B Common Stock issued and outstanding immediately prior to the Closing will automatically convert into one (1) share of Buyer Class A Common Stock pursuant to Section 4.3 of Buyer’s existing certificate of incorporation;

(g) Immediately following the Delaware Secretary of State’s acceptance of the A&R Certificate of Incorporation, PubCo shall (i) issue the number of shares of PubCo Class B Common Stock to each Existing Equityholder (other than BOC YAC Funding LLC or its Affiliates) equal to the number of Common Units issued to such Existing Equityholder pursuant to Section 2.1(a) hereof, free and clear of all Liens other than restrictions pursuant to PubCo’s Organizational Documents, and (ii) make appropriate book entries to the accounts designated in writing by such Existing Equityholders at least five (5) Business Days prior to Closing evidencing the issuances to such Existing Equityholders of PubCo Class B Common Stock.

2.2 Treatment of Incentive Units. Effective as of and conditioned upon the Closing, by virtue of the transactions contemplated by this Agreement, each outstanding Incentive Unit (whether vested or unvested), shall be automatically converted into Incentive Equity Units in accordance with Section 4.2.4 of the A&R Operating Agreement.

2.3 Warrants.

(a) Buyer Warrants. Immediately following the Delaware Secretary of State’s acceptance of the A&R Certificate of Incorporation, and without any action on the part of any holder of a Buyer Warrant, each Buyer Warrant that is issued and outstanding immediately prior to the Closing shall be converted into a corresponding PubCo Warrant exercisable for PubCo Class A Common Stock in accordance with its terms.

(b) Lead Investor Warrants. Immediately following the Delaware Secretary of State’s acceptance of the A&R Certificate of Incorporation, and without any action on the part of any holder of a Lead Investor Warrant, each Lead Investor Warrant that is issued and outstanding immediately prior to the Closing (other than any Lead Investor Warrant held by BOC YAC Funding LLC or its Affiliates, which shall be automatically cancelled upon the Closing in accordance with its terms) shall be converted into a corresponding PubCo Warrant exercisable for PubCo Class A Common Stock in accordance with its terms.

2.4 Directors of PubCo. Immediately after the Closing, (a) PubCo’s board of directors shall be composed in accordance with the provisions of the Stockholders’ Agreement.

2.5 Closing; Closing Date. Unless this Agreement is earlier terminated in accordance with ARTICLE VII, the closing of the transactions contemplated by this Agreement (the “Closing”) shall take place by conference call and exchange of signature pages by email or electronic transmission at 9:00 a.m. New York time on a date no later than two (2) Business Days after the satisfaction or waiver (to the extent permitted by applicable Law) of all the conditions set forth in ARTICLE VI, or at such other place and time as the Company and Buyer may mutually agree upon. The date on which the Closing actually occurs is hereinafter referred to as the “Closing Date”. In the event that all of the conditions set forth in ARTICLE VI have been satisfied or waived such that the Closing would occur pursuant to this Section 2.5, but the Company notifies Buyer in writing that PubCo would not be able to satisfy its requirements to file the Closing Form 8-K within four (4) Business Days following the Closing because the Company cannot provide financial statements that are compliant with Regulation S-X of the Securities Act that are required to be filed with such Closing Form 8-K, then the Closing shall be delayed until such time as the Company is able to provide such financial statements, but in no event past the Outside Closing Date, and the Company shall use its reasonable best efforts to provide such compliant financial statements as promptly as possible.

2.6 Taking of Necessary Action; Further Action.