Form DEFA14A Centennial Resource Deve

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material under §240.14a-12 |

Centennial Resource Development, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

COLGATE ENERGY Investor Presentation Q1 2022 CONFIDENTIAL

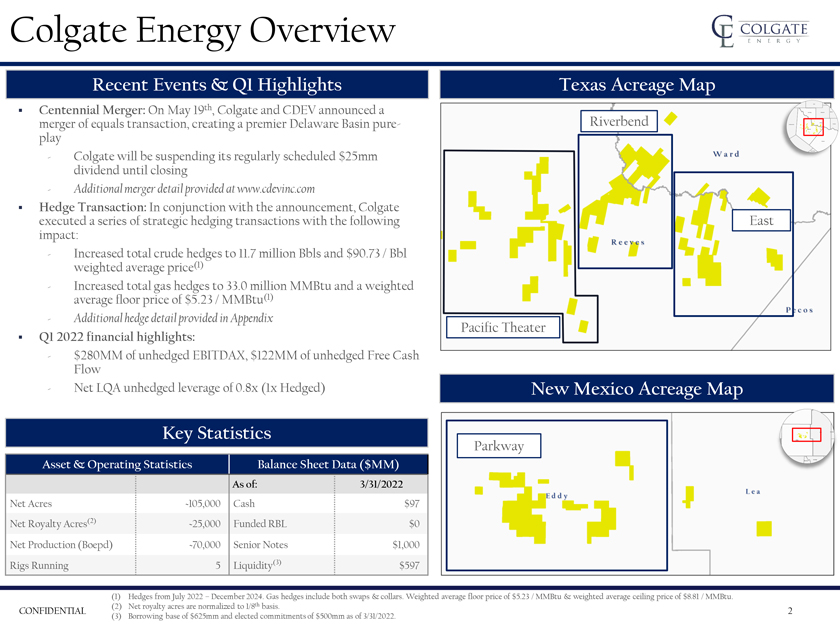

Colgate Energy Overview Centennial Merger: On May 19th, Colgate and CDEV announced a merger of equals transaction, creating a premier Delaware Basin pure-play Colgate will be suspending its regularly scheduled $25mm dividend until closing Additional merger detail provided at www.cdevinc.com Hedge Transaction: In conjunction with the announcement, Colgate executed a series of strategic hedging transactions with the following impact: Increased total crude hedges to 11.7 million Bbls and $90.73 / Bbl weighted average price(1) Increased total gas hedges to 33.0 million MMBtu and a weighted average floor price of $5.23 / MMBtu(1) Additional hedge detail provided in Appendix Q1 2022 financial highlights: $280MM of unhedged EBITDAX, $122MM of unhedged Free Cash Flow Net LQA unhedged leverage of 0.8x (1x Hedged) Pacific Theater Riverbend East Net Acres Net Royalty Acres(2) Net Production (Boepd) Rigs Running ~105,000 ~25,000 ~70,000 5 Cash Funded RBL Senior Notes Liquidity(3) $97 $0 $1,000 $597 Parkway CONFIDENTIAL (1) Hedges from July 2022 – December 2024. Gas hedges include both swaps & collars. Weighted average floor price of $5.23 / MMBtu & weighted average ceiling price of $8.81 / MMBtu. (2) Net royalty acres are normalized to 1/8th basis. (3) Borrowing base of $625mm and elected commitments of $500mm as of 3/31/2022. Recent Events & Q1 Highlights Texas Acreage Map Key Statistics New Mexico Acreage Map Asset & Operating Statistics Balance Sheet Data ($MM)

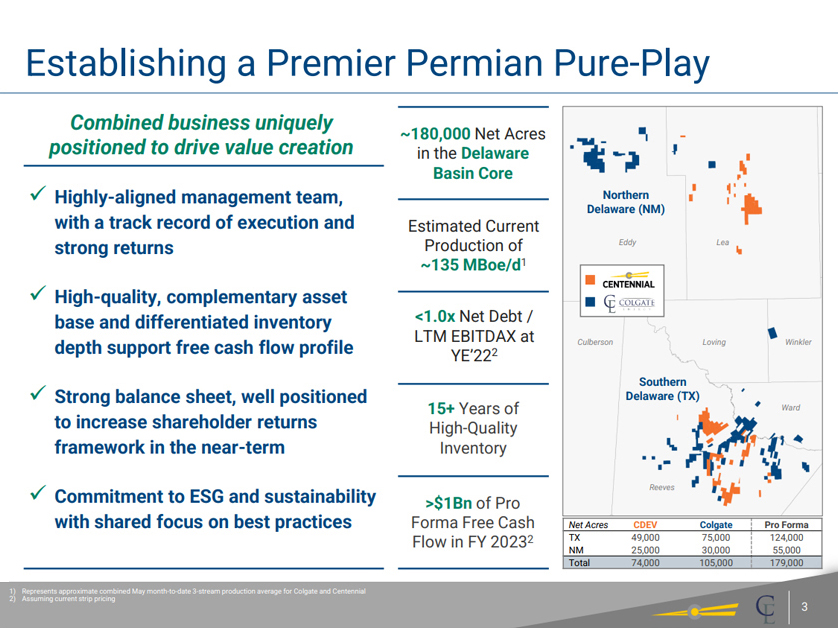

Establishing a Premier Permian Pure-Play Combined business uniquely positioned to drive value creation ~180,000 Net Acres in the Delaware Basin Core Highly-aligned management team, with a track record of execution and strong returns High-quality, complementary asset base and differentiated inventory depth support free cash flow profile Strong balance sheet, well positioned to increase shareholder returns framework in the near-term Commitment to ESG and sustainability with shared focus on best practices Estimated Current Production of ~135 MBoe/d1 <1.0x Net Debt / LTM EBITDAX at YE’222 15+ Years of High-Quality Inventory >$1Bn of Pro Forma Free Cash Flow in FY 20232 Northern Delaware (NM) Southern Delaware (TX) 1) Represents approximate combined May month-to-date 3-stream production average for Colgate and Centennial 2) Assuming current strip pricing Northern Delaware (NM) Eddy Lea Culberson Loving Winkler Southern Delaware (TX) Ward Reeves Net Acres CDEV Colgate Pro Forma TX 49,000 75,000 124,000 NM 25,000 30,000 55,000 Total 74,000 105,000 179,000

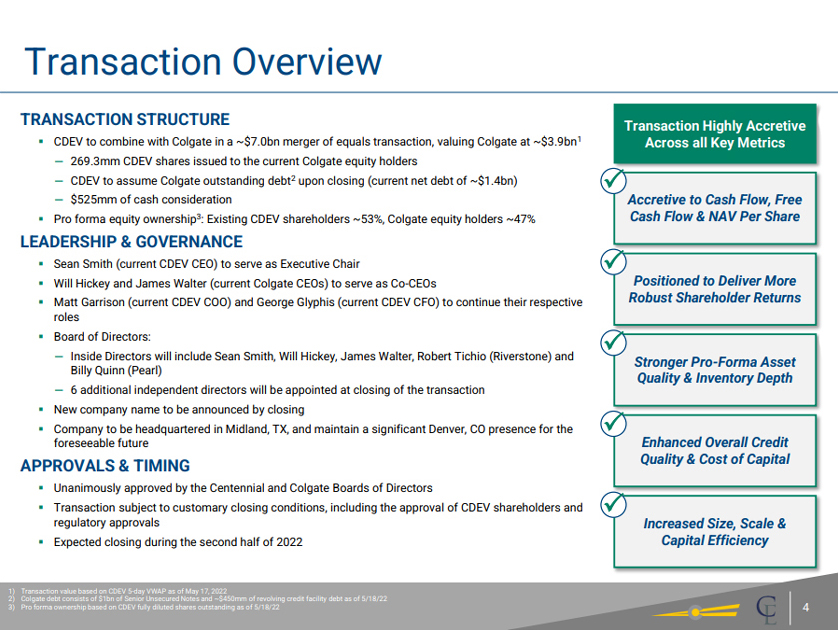

Transaction Overview TRANSACTION STRUCTURE CDEV to combine with Colgate in a ~$7.0bn merger of equals transaction, valuing Colgate at ~$3.9bn1 – 269.3mm CDEV shares issued to the current Colgate equity holders – CDEV to assume Colgate outstanding debt2 upon closing (current net debt of ~$1.4bn) – $525mm of cash consideration Pro forma equity ownership3: Existing CDEV shareholders ~53%, Colgate equity holders ~47% LEADERSHIP & GOVERNANCE Sean Smith (current CDEV CEO) to serve as Executive Chair Will Hickey and James Walter (current Colgate CEOs) to serve as Co-CEOs Matt Garrison (current CDEV COO) and George Glyphis (current CDEV CFO) to continue their respective roles Board of Directors: – Inside Directors will include Sean Smith, Will Hickey, James Walter, Robert Tichio (Riverstone) and Billy Quinn (Pearl) – 6 additional independent directors will be appointed at closing of the transaction New company name to be announced by closing Company to be headquartered in Midland, TX, and maintain a significant Denver, CO presence for the foreseeable future APPROVALS & TIMING Unanimously approved by the Centennial and Colgate Boards of Directors Transaction subject to customary closing conditions, including the approval of CDEV shareholders and regulatory approvals Expected closing during the second half of 2022 Accretive to Cash Flow, Free Cash Flow & NAV Per Share Positioned to Deliver More Robust Shareholder Returns Stronger Pro-Forma Asset Quality & Inventory Depth Enhanced Overall Credit Quality & Cost of Capital Increased Size, Scale & Capital Efficiency 1) Transaction value based on CDEV 5-day VWAP as of May 17, 2022 2) Colgate debt consists of $1bn of Senior Unsecured Notes and ~$450mm of revolving credit facility debt as of 5/18/22 3) Pro forma ownership based on CDEV fully diluted shares outstanding as of 5/18/22 Transaction Highly Accretive Across all Key Metrics

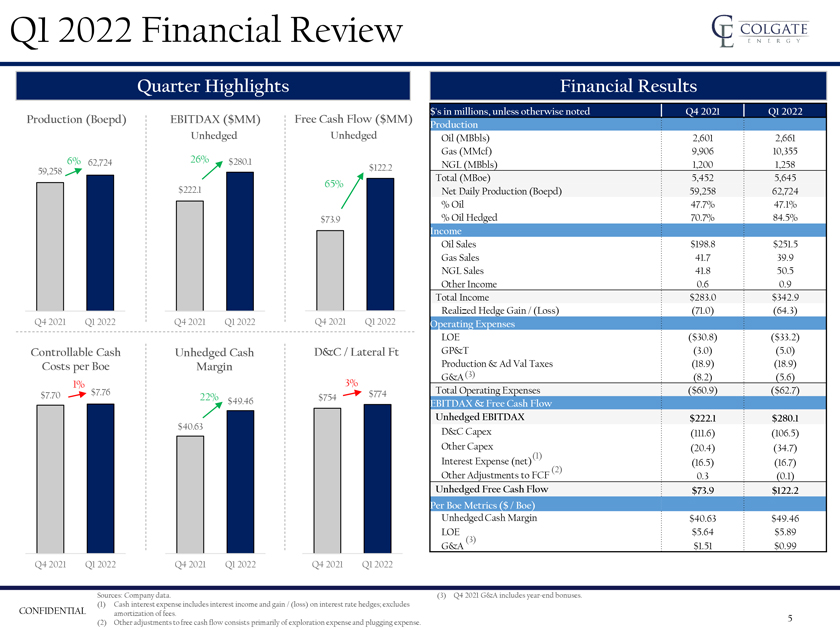

Q1 2022 Financial Review Production (Boepd) EBITDAX ($MM) Unhedged Free Cash Flow ($MM) Unhedged Controllable Cash Costs per Boe Unhedged Cash Margin D&C / Lateral Ft Oil (MBbls) Gas (MMcf) NGL (MBbls) Total (MBoe) Net Daily Production (Boepd) % Oil % Oil Hedged Oil Sales Gas Sales NGL Sales Other Income LOE GP&T Production & Ad Val Taxes G&A (3) Total Operating Expenses Unhedged EBITDAX D&C Capex Other Capex (1) Interest Expense (net) (2) Other Adjustments to FCF Unhedged Free Cash Flow Unhedged Cash Margin LOE (3) G&A 2,601 9,906 1,200 5,452 59,258 47.7% 70.7% $198.8 41.7 41.8 0.6 ($30.8) (3.0) (18.9) (8.2) ($60.9) $222.1 (111.6) (20.4) (16.5) 0.3 $73.9 $40.63 $49.46 $5.64 $5.89 $1.51 $0.99 2,661 10,355 1,258 5,645 62,724 47.1% 84.5% $251.5 39.9 50.5 0.9 $342.9 (64.3) ($33.2) (5.0) (18.9) (5.6) ($62.7) $280.1 (106.5) (34.7) (16.7) (0.1) $122.2 Sources: Company data. (3) Q4 2021 G&A includes year-end bonuses. (1) Cash interest expense includes interest income and gain / (loss) on interest rate hedges; excludes CONFIDENTIAL amortization of fees. (2) Other adjustments to free cash flow consists primarily of exploration expense and plugging expense. Quarter Highlights Financial Results $’s in millions, unless otherwise noted Q4 2021 Q1 2022 Production Income Operating Expenses EBITDAX & Free Cash Flow Per Boe Metrics ($ / Boe)

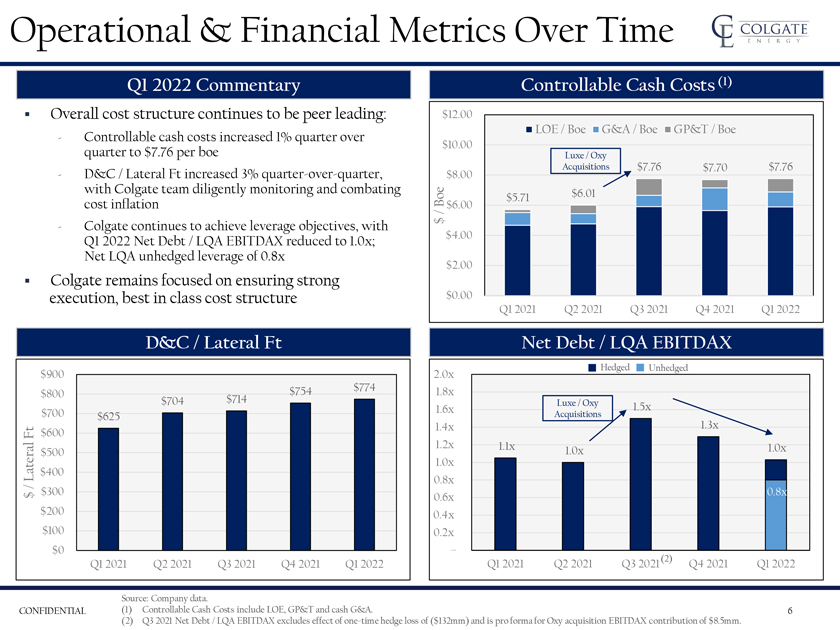

Operational & Financial Metrics Over Time

Overall cost structure continues to be peer leading:

- Controllable cash

costs increased 1% quarter over quarter to $7.76 per boe

- D&C / Lateral Ft increased 3% quarter-over-quarter, with Colgate team diligently monitoring and

combating cost inflation

- Colgate continues to achieve leverage objectives, with Q1 2022 Net Debt / LQA EBITDAX reduced to 1.0x; Net LQA unhedged leverage of 0.8x

D&C/Lateral Ft

Net Debt/LQA EBITDAX

Controllable Cash Costs(1)

Q1 2022 Commentary

Colgate remains focused on ensuring strong execution, best in class cost structure Source: Company data.

CONFIDENTIAL (1) Controllable Cash Costs include LOE, GP&T and cash G&A. (2) Q3 2021 Net Debt / LQA EBITDAX excludes effect of

one-time hedge loss of ($132mm) and is pro forma for Oxy acquisition EBITDAX contribution of $8.5mm.

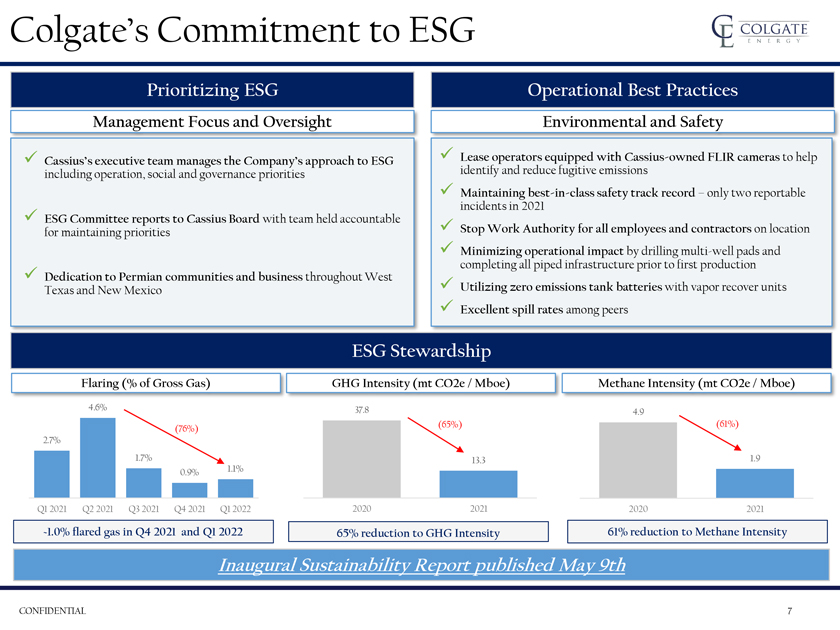

Colgate’s Commitment to ESG

Prioritizing ESG

Management Focus and Oversight

Operational Best Practices

Environmental and Safety

Cassius’s executive team manages the Company’s approach to

ESG including operation, social and governance priorities

ESG Committee reports to Cassius Board with team held accountable for maintaining priorities

Dedication to Permian communities and business throughout West Texas and New Mexico

Lease

operators equipped with Cassius-owned FLIR cameras to help identify and reduce fugitive emissions

Maintaining best-in-class safety track record – only two reportable incidents in 2021

Stop Work Authority for all employees and

contractors on location

Minimizing operational impact by drilling multi-well pads and completing all piped infrastructure prior to first production

Utilizing zero emissions tank batteries with vapor recover units

ESG Stewardship

Excellent spill rates among peers

Flaring (% of Gross Gas)

GHG Intensity (mt CO2e / Mboe)

Methane Intensity (mt CO2e / Mboe)

~1.0% flared gas in Q4 2021 and Q1 2022

65% reduction to GHG Intensity

61% reduction to Methane Intensity

Inaugural Sustainability Report published May 9th

CONFIDENTIAL 7

Appendix

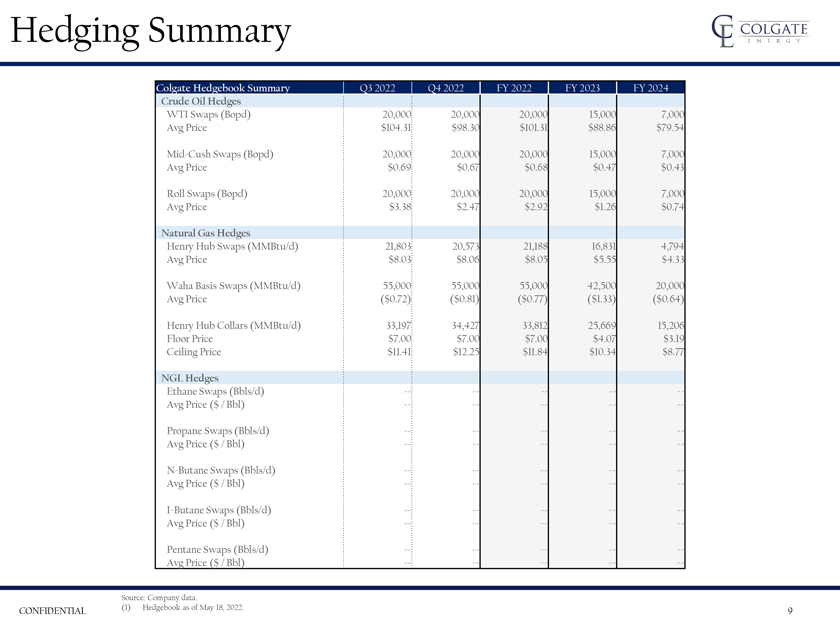

Hedging Summary

Colgate Hedgebook Summary

Q3 2022

Q4 2022

FY 2022

FY 2023

FY 2024

Crude Oil Hedges

WTI Swaps (Bopd) Avg Price

Mid-Cush Swaps (Bopd) Avg

Price

Roll Swaps (Bopd) Avg Price

Natural Gas Hedges

Henry Hub Swaps (MMBtu/d) Avg Price

Waha Basis Swaps (MMBtu/d) Avg Price

Henry Hub Collars (MMBtu/d) Floor Price Ceiling Price

NGL Hedges

Ethane Swaps (Bbls/d) Avg Price ($ / Bbl)

Propane Swaps (Bbls/d) Avg Price ($ / Bbl)

N-Butane Swaps (Bbls/d) Avg Price ($ / Bbl)

I-Butane Swaps (Bbls/d) Avg Price ($ / Bbl)

Pentane

Swaps (Bbls/d) Avg Price ($ / Bbl)

20,000 $104.31

20,000

$0.69

20,000

$3.38

21,803

$8.03

55,000

($0.72)

33,197

$7.00

$11.41

20,000

$98.30

20,000

$0.67

20,000

$2.47

20,573

$8.06

55,000

($0.81)

34,427

$7.00

$12.25

20,000 $101.31

20,000

$0.68

20,000

$2.92

21,188

$8.05

55,000

($0.77)

33,812

$7.00

$11.84

15,000

$88.86

15,000

$0.47

15,000 $1.26

16,831

$5.55

42,500

($1.33)

25,669

$4.07

$10.34

7,000

$79.54

7,000

$0.43

7,000

$0.74

4,794

$4.33

20,000

($0.64)

15,206

$3.19

$8.77

Source: Company data.

CONFIDENTIAL (1) Hedgebook as of May 18, 2022. 9

Disclaimer

Forward-Looking Statements

This presentation includes “forward-looking statements” under applicable securities laws. Such forward-looking statements are subject to a number of risks and

uncertainties, many of which are not under Colgate Energy Partners III, LLC’s (including its subsidiaries, “Colgate” or, the “Company”) control. All statements, except for statements of historical fact, made in this

presentation regarding activities, events or developments Colgate expects, believes or anticipates will or may occur in the future, such as those regarding expected results, future commodity prices, future production targets, future earnings, Free

Cash Flow, EBITDAX, leverage targets, future capital spending plans, midstream transportation agreements, improved and/or increasing capital efficiency, continued utilization of existing infrastructure, oil and gas marketability, estimated realized

oil, natural gas and natural gas liquids, acreage quality, expected drilling and development plans (including the number, type, lateral length and location of wells to be drilled, the number and type of drilling rigs and the number of wells per

pad), projected well costs and cost savings initiatives, future financial position, future technical improvements, future marketing and asset monetization opportunities, and the amount and timing of any contingent payments are forward-looking

statements. You generally can identify our forward-looking statements by the words “anticipate,” “believe,” “budgeted,” “continue,” “could,” “estimate,” “expect,”

“forecast,” “foresee,” “goal,” “intend,” “may,” “objective,” “plan,” “potential,” “predict,” “projection,” “scheduled,” “should,”

“would” and other words that convey uncertainty of future events or outcomes. All forward-looking statements speak only as of the date of this presentation. Although Colgate believes that the plans, intentions and expectations reflected in

or suggested by the forward-looking statements are reasonable, there is no assurance that these plans, intentions or expectations will be achieved. Therefore, actual outcomes and results could materially differ from what is expressed, implied or

forecast in such statements. Except as required by law, Colgate expressly disclaims any obligation to and does not intend to publicly update or revise any forward-looking statements.

With respect to any projection or forecast contained herein, including, but not limited to, the past, present, or future value of the anticipated cash flows, reserves, production,

drilling program, costs, expenses, taxes, leverage, hedging activities, Company distributions, average realized prices on the sale of the Company’s production and capital expenditures of the Company, if any, the Company hereby advises that:

(i) there are uncertainties inherent in attempting to make such projections and forecasts; (ii) the accuracy and correctness of any such projections and forecasts may be affected by information which may become available after the date of

such projections and forecasts; (iii) the underlying assumptions for the projections or forecasts could change; (iv) the projections and forecasts may no longer be accurate as a result of any of (i)-(iii) above or any other factor;

(v) neither the Company nor any of its representatives has an obligation to update any such projections or forecasts; and (vi) the projections and forecasts are not necessarily indicative of current value or future performance, which may

be significantly more or less favorable than as reflected herein. Colgate cautions you that these forward-looking statements are subject to all of the risks and uncertainties incident to the exploration for and development, production, gathering and

sale of oil, natural gas and NGLs, most of which are difficult to predict and many of which are beyond the Company’s control. These risks include, but are not limited to, commodity price volatility, inflation, lack of availability of drilling

and production equipment and services, environmental risks, drilling and other operating risks, regulatory changes, the uncertainty inherent in estimating oil and natural gas reserves and in projecting future rates of production, cash flow and

access to capital, the timing of development expenditures, impacts of world health events, including the COVID-19 pandemic, potential shut-ins of production due to lack

of downstream demand or storage capacity, and the other risks described under the heading “Risk Factors” in the offering memorandums related to the offering of Colgate’s senior notes due 2026 and Colgate’s senior notes due 2029.

Reserve engineering is a process of estimating underground accumulations of oil and natural gas that cannot be measured in an exact way. The accuracy of any

reserve estimate depends on the quality of available data, the interpretation of such data and price and cost assumptions made by reservoir engineers. In addition, the results of drilling, testing and production activities may justify revisions of

estimates that were made previously. If significant, such revisions would change the schedule of any further production and development drilling. Unless otherwise indicated, reserve and PV-10 estimates shown

herein are based on a reserves report prepared by Netherland, Sewell & Associates, Inc., the Company’s independent petroleum engineers (“NSAI”), as of December 31, 2021, and were prepared using commodity prices based on

New York Mercantile Exchange Henry Hub and WTI futures prices, referred to herein as “strip” or “NYMEX” pricing as of December 31, 2021. We believe that the use of strip pricing provides useful information about our

reserves, as the forward prices are based on the markets forward-looking expectations of oil and natural gas prices as of a certain date. Strip prices are not necessarily a projection of future oil and natural gas prices, and should be carefully

considered in addition to, and not as a substitute for, SEC prices, when considering our oil, natural gas and NGL reserves.

Industry and Market Data

Although all information and opinions expressed in this presentation, including market data and other statistical information (including estimates and projections relating to

addressable markets), were obtained from sources believed to be reliable and are included in good faith, Colgate has not independently verified the information and makes no representation or warranty, express or implied, as to its accuracy or

completeness. Some data is also based on the good faith estimates of Colgate, which are derived from its review of internal sources as well as the independent sources described above. While the Company is not aware of any misstatements regarding the

industry and market data presented in this presentation, such data involve risks and uncertainties and are subject to change based on various factors, including those factors discussed under “Forward-Looking Statements” above. The Company

has no intention and undertakes no obligation to update or revise any such information or data, whether as a result of new information, future events or otherwise, except as required by law.

CONFIDENTIAL 10

Non-GAAP Definitions

This presentation includes certain financial measures that are not calculated in accordance with GAAP. These measures include (i) EBITDAX, (ii) Free Cash Flow, (iii) PV-10, (iv) leverage ratio, (v) net debt, (vi) Cash Margin and (vii) Controllable Cash Costs. These non-GAAP financial measures are not measures of

financial performance prepared or presented in accordance with GAAP and may exclude items that are significant in understanding and assessing our financial results. Therefore, these measures should not be considered in isolation, and users of any

such information should not place undue reliance thereon. Colgate believes the presentation of these metrics may be useful to investors because it supplements investors’ understanding of our operating performance by providing information

regarding our ongoing performance that excludes items we believe do not directly affect our core operations.

EBITDAX

Colgate defines EBITDAX as net income (loss) before interest expense, net, depletion, depreciation and amortization, accretion expense on asset retirement obligation, exploration

expense, gain (loss) on sale of assets and unrealized gain (loss) on derivatives. EBITDAX is a supplemental measure of Colgate’s performance that is not required by or presented in accordance with GAAP. Colgate believes that EBITDAX may provide

additional information about its ability to meet its future requirements for debt service, capital expenditures and working capital. EBITDAX is a financial measure commonly used in the oil and natural gas industry. EBITDAX should not be considered

in isolation or as a substitute for net income, operating income, cash flows from operating activities or any other measure of financial performance presented in accordance with GAAP, or as a measure of a company’s profitability or liquidity.

Because EBITDAX excludes some, but not all, items that affect net income, the EBITDAX presented by Colgate may not be comparable to similarly titled measures of other companies. The GAAP measure most directly comparable to EBITDAX is net income.

Free Cash Flow

Colgate defines Free Cash Flow as cash provided by operating

activities before changes in working capital in excess of capital expenditures for oil and gas properties (excluding leasehold costs and acquisitions). Colgate believes that Free Cash Flow is useful to investors as it provides a measure to compare

both cash provided by operating activities and additions to oil and natural gas properties across periods on a consistent basis; however, Free Cash Flow presented by Colgate may not be comparable to similarly titled measures of other companies. The

GAAP measure most directly comparable to Free Cash Flow is cash provided by operating activities. Free Cash Flow should not be considered as an alternative to, or more meaningful than, net cash provided by operating activities as an indicator of

liquidity or operating performance.

PV-10

PV-10 is defined as the pre-tax present value of Colgate’s reserves discounted at ten percent.

The most directly comparable GAAP financial measure is standardized measure of discounted future net cash flows. Colgate’s standardized measure includes future obligations under the Texas gross margin tax, but it does not include future federal

income tax expenses because, due to Colgate’s status as a partnership for U.S. federal income tax purposes, it is not subject to federal income taxes. Colgate believes that the presentation of PV-10 is

relevant and useful to investors because it presents the relative monetary significance of its oil, natural gas and NGL properties regardless of tax structure. Further, investors may use the measure as a basis for comparison of the relative size and

value of Colgate’s reserves to other companies. Colgate uses this measure when assessing the potential return on investment related to its oil, natural gas and NGL properties. Generally, for other companies,

PV-10 is not equal to, or a substitute for, the standardized measure of discounted future net cash flows. Colgate’s PV-10 measure and the standardized measure of

discounted future net cash flows do not purport to present the fair value of Colgate’s oil, natural gas and NGL reserves.

Leverage Ratio

Colgate defines its leverage ratio as of the end of any applicable annual or quarterly period as its ratio of net debt (defined as total debt less cash and cash equivalents) as of

such date to its annualized EBITDAX for the fiscal quarter ending on such date. Colgate’s leverage ratio as presented herein may not be comparable to similarly titled measures of other companies.

Cash Margin

Cash margin is defined as oil and natural gas revenues, less LOE, production ad

valorem taxes and cash G&A, divided by production.

Controllable Cash Costs

Controllable cash costs is defined as G&A, gathering, processing and transportation, and LOE.

CONFIDENTIAL 11

Forward-Looking Statements

This communication includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, included in this communication regarding the proposed business combination between Centennial and Colgate (the “Merger”) or the strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management of Centennial, Colgate and/or the combined company are forward-looking statements. When used in this communication, the words “could,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” “goal,” “plan,” “target” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. These statements include, but are not limited to, statements about Centennial’s and Colgate’s ability to effect the Merger; the expected benefits and timing of the Merger; future dividends and share repurchases; and future plans, expectations, and objectives for the combined company’s operations after completion of the Merger, including statements about strategy, synergies, future operations, financial position, estimated revenues, projected production, projected costs, prospects, plans, and objectives of management. While forward-looking statements are based on assumptions and analyses that management of Centennial and Colgate believe to be reasonable under the circumstances, whether actual results and developments will meet such expectations and predictions depends on a number of risks and uncertainties that could cause actual results, performance, and financial condition to differ materially from such expectations. Any forward-looking statement made in this news release speaks only as of the date on which it is made. Factors or events that could cause actual results to differ may emerge from time to time, and it is not possible to predict all of them. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investors as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, the proxy statement to be filed in connection with the Merger, and the other documents filed by Centennial from time to time with the Securities and Exchange Commission (the “SEC”). These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. These risks and uncertainties may be amplified by the COVID-19 pandemic and the current military conflict in Ukraine, which have caused significant economic uncertainty. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Centennial and Colgate assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by securities and other applicable laws. Neither Centennial nor Colgate gives any assurance that any of Centennial, Colgate or the combined company will achieve its expectations.

Additional Information and Where to Find It

This communication relates to the proposed Merger between Centennial and Colgate. In connection with the proposed Merger, Centennial will file with the SEC a proxy statement on Schedule 14A (the “Proxy Statement”). Centennial will also file other documents regarding the proposed Merger with the SEC. The Proxy Statement will be sent or given to the Centennial stockholders and will contain important information about the Merger and related matters. INVESTORS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION WITH RESPECT TO THE MERGER AND THE OTHER TRANSACTIONS CONTEMPLATED BY THE BUSINESS COMBINATION AGREEMENT. You may obtain a free copy of the Proxy Statement (if and when it becomes available) and other relevant documents filed by Centennial with the SEC at the SEC’s website at www.sec.gov. You may also obtain Centennial’s documents on its website at www.cdevinc.com.

Participants in the Solicitation

Centennial, Colgate and certain of their respective directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in connection with certain matters related to the Merger and may have direct or indirect interests in the Merger. Information about Centennial’s directors and executive officers is set forth in Centennial’s Proxy Statement on Schedule 14A for its 2022 Annual Meeting of Stockholders, filed with the SEC on March 15, 2022, its Annual Report on Form 10-K for the fiscal year ended December 31, 2021, filed with the SEC on February 24, 2022, and its other documents filed with the SEC. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement and other relevant materials to be filed with the SEC regarding the proposed transaction when they become available. Investors should read the Proxy Statement carefully when it becomes available before making any voting or investment decisions. Investors may obtain free copies of these documents using the sources indicated above.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Alberto Castillo Injured in Truck Accident on Veterans Memorial Drive in Northwest Houston

- Orion Group’s Facilities Maintenance Business Enters Lock, Door, Safe, and Access Control Market Through Partnership with Academy Locksmith

- ROSEN, A LEADING LAW FIRM, Encourages Barclays PLC Investors to Secure Counsel Before Important Deadline in Securities Class Action – VXX

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share