Form DEF 14A Walgreens Boots Alliance For: Jan 26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section

14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

Walgreens Boots Alliance, Inc.

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy

Statement, if other than the Registrant)

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | ||

| ☑ | No fee required | |

| ☐ | Fee paid previously with preliminary materials | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

| Contents |

| Notable Governance Developments and Where to Read More | ||

| Hear from our new Lead Independent Director | 4 | |

| Expanded of our stockholder outreach program and disclosure related thereto | 8 | 31 | 61 | |

| Added new directors in an active year of Board refreshment | 9 | 28 | |

| Meaningful enhancements made to our executive compensation program | 10 | 63 | |

| Added technology oversight to our Finance Committee to align our Board structure and strategy | 43 | |

| Introduced periodic third-party Board evaluations to strengthen Board effectiveness | 45 | |

| Substantially revised Compensation Discussion and Analysis to promote clarity and transparency | 58 | |

| Performed holistic reassessment of our compensation philosophy | 59 | |

|

Our Board of Directors (the “Board”) is soliciting your proxy on behalf of the Company for our 2023 annual meeting of stockholders (the “Annual Meeting”), which will be held on January 26, 2023 at 8:30 a.m., Pacific Time, or any adjournment or postponement thereof. This Proxy Statement (this “Proxy Statement”) and the accompanying Notice of Annual Meeting of Stockholders and proxy card are being distributed, along with the 2022 Annual Report, beginning on December 8, 2022 to holders of our common stock, par value $0.01 per share, as of the close of business on November 28, 2022 (the “Record Date”). The Proxy Statement Summary highlights selected information that is provided in more detail throughout this Proxy Statement. The Proxy Statement Summary does not contain all of the information you should consider before voting. You should read the full Proxy Statement before casting your vote. Unless otherwise stated, references herein to the “Company,” “WBA,” “we,” “us,” and “our” refer to Walgreens Boots Alliance, Inc. Unless otherwise stated, all information presented in this Proxy Statement is based on our fiscal calendar, which ends on August 31 (e.g., references to “2022” refer to the fiscal year ended August 31, 2022). |

| 2 | Walgreens Boots Alliance, Inc. |

| A message from our executive chairman and our CEO |

|

Dear Fellow Investors,

We are pleased to present the accompanying Walgreens Boots Alliance Proxy Statement and Annual Report.

Fiscal year 2022 marked the first year of our transformation to a consumer-centric healthcare company, and we are very pleased with the major progress we’ve made. While we are still in the early stages, our strategy is working and we are well underway in bringing our vision to life: to be the leading partner in reimagining local healthcare and wellbeing for all.

As we look to the road ahead with great confidence, our singular focus is on driving real value for our customers, our communities, our team members and you, our stockholders. Ginger Graham, our Board’s Lead Independent Director, covers more details on our strong momentum in the Proxy Statement.

As you’ll recall, in October 2021, we introduced four strategic priorities to achieve advantaged growth in community healthcare. Since then, we have continually delivered with numerous accomplishments despite a difficult operating environment, and we remain committed to sharing how we are tracking against our priorities with accountability and transparency.

Our best-in-class assets are scaling to accelerate growth and profitability of our U.S. healthcare business. Additionally, we are strengthening our core pharmacy and retail business, investing in strategic talent and innovative capabilities, and taking bold and measured steps to simplify our portfolio.

Throughout all of our work, our purpose of “more joyful lives through better health” continues to guide us. We are making impactful change as a force for good globally, including addressing health disparities and inequities as well as social determinants that can be barriers in many of the communities we serve.

We are very well positioned as we move into the next year, and will continue to execute swiftly on our vision and build a solid foundation for sustainable shareholder value creation. We look forward to sharing more at our 2023 Annual Meeting of Stockholders, which will take place January 26, 2023, at 8:30 a.m. PT at The Resort at Pelican Hill in Newport Coast, California.

Thank you, and we deeply appreciate your support on our transformation journey.

Sincerely,

|

| |

| Stefano Pessina Executive Chairman |

Rosalind G. Brewer Chief Executive Officer |

| 2023 Proxy Statement | 3 |

| A message from our lead independent director |

|

2022 was a pivotal year for WBA, as we began the journey of executing on a new strategy to transform WBA into a healthcare company. The Board’s oversight and advisory role was critical in the development of the Company’s strategy. I am honored to be writing you for the first time as WBA’s Lead Independent Director and to share some Board priorities and activities in the last year.

New Independent Board Leadership. As you will see in this Proxy Statement, Bill Foote will retire from the Board and will not stand for re-election at the Annual Meeting of Stockholders. Bill has enthusiastically served this Company and its predecessors for over 25 years and leaves a legacy of uncompromising independent leadership. On behalf of the Board, we are incredibly grateful to Bill for his contributions to and leadership of your Board. I am humbled to assume the role of Lead Independent Director and fully appreciate the importance of the role to an effective Board. I commit to you that I will be resolute in executing my responsibility to help ensure that the Board exercises prudent, independent judgement and provides effective oversight.

Say-on-Pay and Stockholder Engagement. Stockholder feedback is a key input in the Board’s decision-making process and, as Lead Independent Director, I personally look forward to engaging with you moving forward. Our conversations over the last two years have focused on executive compensation. What we heard is that, while investors support the overall design of our compensation program and recent changes, they noted proxy advisory firm criticism of responsiveness to stockholders with regard to concerns with the discretion used by the Compensation and Leadership Performance Committee (the “CLP Committee”) in 2020 that led to unfavorable Say-on-Pay vote results in 2021 and 2022. In discussing the rationale for the CLP Committee’s decision, modifications made to our plan design to avoid such discretion in the future and the CLP Committee’s public communication of its intention to not use positive discretion in the future, many investors, including six of our top seven stockholders, who represent approximately 39% of our outstanding shares, noted their satisfaction with the responsiveness of the Board but communicated their desire for more robust disclosures regarding our stockholder engagement program and outcomes. As a result, we have significantly expanded our disclosures related to stockholder engagement on pages 8, 31 and 61 of this Proxy Statement.

Aligning the Board with Our Strategy. We are continuously focused on ensuring that the Board is comprised of directors with a diverse mix of skills, backgrounds and perspectives that are equipped to oversee the success of the business. 2022 was no different. Given our strategic shift, the Board successfully recruited multiple directors with extensive healthcare and technology and data privacy and security expertise over the last

year. We believe these new directors will serve as critical assets to stockholders and your Board for years to come. We also reconstituted the Finance Committee of the Board as the Finance and Technology Committee, reflecting the Board’s ongoing focus on aligning one governance structure to our strategy.

Shaping Company Strategy and Overseeing Risk. Ensuring engaged and effective oversight of strategy and risk is essential to the Company’s creation of long-term sustainable value. This was of particular importance in 2022 as the Company worked to develop a new healthcare-focused strategy. Your Board worked tirelessly with senior management inside and outside the boardroom analyzing and providing insight on the strengths, weaknesses, opportunities and risks as the strategy developed. The Board has remained focused and engaged as we have begun to execute on the strategy.

ESG. Environmental, Social and Government (“ESG”) excellence is integrated and prioritized within our strategy as a healthcare company. We set ambitious targets across the ESG spectrum, including with regard to climate change and diversity, equity and inclusion, on an annual basis and have incorporated these goals into our compensation program. I encourage you to review our 2021 ESG report and our Compensation Discussion and Analysis in this Proxy Statement to learn more about those goals.

The composition, function and actions of our Board can be traced back to one fundamental principle: Corporate Responsibility. On behalf of my fellow independent directors and the entire Board, we thank you for your partnership with WBA. We thank you for your investment in WBA. And finally, we appreciate your trust and confidence in our leadership.

Sincerely,

Ginger L. Graham

Lead Independent Director

| 4 | Walgreens Boots Alliance, Inc. |

| Notice of 2023 annual meeting of stockholders |

|

|

| ||

| Date and Time | Location | Who Can Vote | ||

| Thursday, January 26, 2023 at 8:30 a.m. Pacific Time |

The Resort at Pelican Hill 22701 Pelican Hill Road South Newport Coast, CA 92657 |

The Board of Directors has fixed the close of business on November 28, 2022 as the record date. You are entitled to vote at the Annual Meeting and at any adjournment thereof if you were a holder of the Company’s common stock as of the close of business on November 28, 2022. |

| Proposals That Require Your Vote | Board Recommendation | Learn More | |||

| 1 | Vote on the election of 10 director nominees named in this Proxy Statement | FOR each nominee | Page 12 | ||

| 2 | Approve, on an advisory basis, our named executive officer compensation | FOR | Page 57 | ||

| 3 | Ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending August 31, 2023 | FOR | Page 97 | ||

| 4-5 | Consider two stockholder proposals, if properly presented at the meeting | AGAINST | Page 101 | ||

Stockholders will also transact such other business as may properly be brought before the meeting or any adjournment thereof by or at the direction of the Board.

Your vote is important. Please vote by Internet, telephone or mail as soon as possible to ensure your vote is recorded properly. Stockholders of record may vote without attending the Annual Meeting by one of the following methods:

|

|

Telephone |

|

Internet | |||

Complete, sign and date the enclosed proxy card and return it in the prepaid envelope provided. |

Call the toll-free telephone number 1-800-690-6903 and follow the recorded instructions. |

Go to https://www.proxyvote.com and follow the instructions on the website. |

These proxy materials are first being sent (or, as applicable, made available) to stockholders commencing on December 8, 2022.

If you want to attend the Annual Meeting in person, you must pre-register and obtain an admission ticket in advance and have a valid, government-issued photo identification. To do so, please follow the instructions on page 113 of this Proxy Statement.

By order of the Board of Directors,

Joseph B. Amsbary, Jr.

Senior Vice President, Corporate Secretary

December 8, 2022

Walgreens Boots Alliance, Inc.

108 Wilmot Road

Deerfield, Illinois 60015

(principal executive office)

| 2023 Proxy Statement | 5 |

| Our company |

Our purpose, vision and values

| Our purpose | Our vision | |||

|

More joyful lives through better health. |

To be the leading partner in reimagining local healthcare and well-being for all. | |||

|

Our values Walgreens Boots Alliance takes seriously its aim of creating joyful lives through better health, reflected in our core values: | ||||

|

|

Courageous |

|

Connected | |

|

We are bold, honest and decisive |

We are working together to create more joyful lives | |||

|

Committed |

|

Curious | |

|

We are determined to do right by our customers, patients and each other |

We are continuously exploring and re-inventing our future | |||

At a glance: WBA

Walgreens Boots Alliance is an integrated healthcare, pharmacy and retail leader serving millions of customers and patients every day, with a 170-year heritage of caring for communities. A trusted, global innovator in retail pharmacy with approximately 13,000 locations across the U.S., Europe and Latin America, WBA plays a critical role in the healthcare ecosystem. The Company is reimagining local healthcare and well-being for all as part of its purpose – to create more joyful lives through better health.

The Company’s three financial reporting segments are U.S. Retail Pharmacy, International and U.S. Healthcare and our retail brands include Walgreens, Boots, Duane Reade, Farmacias Benavides and Farmacias Ahumada.

WBA has multiple portfolios of highly regarded and long-established product brands. Our No7 Beauty Company business unit believes in creating the best beauty and skincare for everyone, enriching communities and sustaining our planet. Its brands are No7, Soap & Glory, Liz Earle, Botanics, Sleek MakeUP and YourGoodSkin. Other owned brands include our Boots health and beauty lines such as Boots Pharmaceuticals over-the-counter remedies and Soltan suncare; and numerous Walgreens products across a range of brand names and categories including Nice! food and beverages, Walgreens over-the-counter products and Complete Home household goods.

More information about our segments and our owned brands can be found on our corporate website and in our Annual Report.

Our principal executive offices are located in Deerfield, Illinois, USA.

2022 performance

highlights

WBA has delivered ahead of expectations in the first year of our transformation to a consumer-centric healthcare company. Our resilient business achieved growth while navigating macroeconomic headwinds. Our strategic actions are unlocking sustainable stockholder value as we simplify the Company and continue our journey to being a healthcare leader.

|

Sales(1) $132.7B in fiscal 2022, up year-on-year on a reported and constant currency basis |

|

Reported EPS(2) |

|

Adjusted EPS(1)(2)(3) |

|

Increased dividend for |

|

U.S. Healthcare Investments

|

| (1) | Results are for WBA continuing operations. |

| (2) | On a diluted basis. |

| (3) | Non-GAAP financial measure. Please refer to Appendix A beginning on page 116 for related definitions and reconciliations to the most directly comparable U.S. GAAP financial measures. |

| 6 | Walgreens Boots Alliance, Inc. |

Our company

Commitment to ESG excellence

Environmental and social

Our ESG strategy is concentrated on four focus areas - healthy communities, healthy planet, sustainable marketplace, and healthy and inclusive workplace. These pillars help us deliver on our purpose of creating more joyful lives through better health.

To learn more about the company’s ESG strategy, please visit our website at walgreenbootsalliance.com/corporate-responsibility

| Joyful Lives Better Health | ||||

| (1) | 30% decrease in scope 1 and scope 2 emissions by fiscal 2030 vs fiscal 2019. |

Governance

| Key governance practices | |

|

●Annual Election of All Directors;

●Majority Voting for All Directors in Uncontested Elections;

●Cumulative Voting for Election of Directors;

●No Supermajority Voting Provisions;

●No Stockholder Rights Plan (“Poison Pill”);

●3%, 3-Year Proxy Access By-law;

●Stockholder Right to Request Special Meetings at 20%;

●Stockholder Right to Act by Written Consent;

●Annual Board and Committee Evaluation Process;

●Periodic Third-Party Board Evaluations;

●Robust independent Lead Director responsibilities;

●Board Composition Requirement of Two-Thirds Independent Directors; |

●Proactive Board and Committee refreshment with focus on diversity and the optimal mix of skills and experience;

●Regular Executive Sessions of Independent Directors;

●Enhanced Commitment to Diversity, including Women and Minorities, in Corporate Governance Documents;

●Strategic and Risk Oversight by Board and Committees;

●Commitment to Sustainability at the Senior Executive and Board Levels;

●Stock Ownership Guidelines for Executives and Directors;

●Policies Prohibiting Hedging and Short Sales of Stock by Directors, Executives and Senior Employees; and

●Robust Stockholder Engagement.

|

| 2023 Proxy Statement | 7 |

Our company

Stockholder outreach

| Engagement | ||||||

|

Our Annual Stockholder Outreach Program In fiscal 2022 and the months leading up to the filling of this Proxy Statement we conducted our robust stockholder outreach program regarding executive compensation and ESG. |

Other Ways We Engage ●Quarterly earnings calls

●Industry presentations and conferences

●Company-hosted events presentations

●Robust investor relations function, including road show meetings with investors and analysts

●Regular communication with credit rating agencies | |||||

|

Who Participated ●Lead Independent Director/Chair of Nominating and Governance Committee

●Chair of the CLP Committee

●Senior Management

●Investor Relations

●Subject Matter Experts |

Who We Engage ●Institutional Investors

●Proxy advisory firms

●ESG rating firms |

|||||

|

How We Engage ●One-on-one meetings

●Written and electronic communications |

Separate from our governance outreach, our CEO, CFO and investor relations team have met with representatives of more than 50 current and potential investors since mid-October 2022. | |||||

Who We Engaged In Our Annual Stockholder Outreach Program

| Outreach to 55% of shares outstanding |

Engagement with |

Board engagement with |

What We Heard During Fiscal 2022 Engagement

|

Executive Compensation Some investors noted proxy advisory criticism around lack of responsiveness related to the use of discretion utilized by the Company in the 2020 long-term incentive plan. We also heard a desire to utilize a relative performance metric in our executive compensation program. |

What We Have Done in Response ●We published supplemental disclosure and engaged with investors regarding rationale for the use of discretion and plan design modifications made to avoid such a situation in the future and communicated the CLP Committee’s position that it has no intention of using positive discretion in the future. Many stockholders, including six of our top seven stockholders representing approximately 39% of outstanding shares, specifically noted their support for our 2022 say on pay proposal and satisfaction with the Company’s responsiveness to the feedback on the matter.

●We added a relative total stockholder return (“rTSR”) modifier to our fiscal 2023-2025 performance share plan design. | |

|

Environment Investors want to see clear disclosures on climate change strategy, goals and progress, as well as a clear framework for how climate strategy is integrated into business strategy. |

●We enhanced our ESG Report released in 2022 to, among other things, include disclosures in accordance with recommendations of the Task Force on Climate-Related Financial Disclosures (“TCFD”).

●We recently completed climate scenario analysis, the results of which will be discussed in our upcoming ESG Report.

●We appointed Alethia Jackson as Senior Vice President, ESG and Chief DEI Officer in August 2022 to expand and advance our ESG and DEI initiatives. | |

|

Diversity, Equity and Inclusion Investors want to understand how companies are advancing DEI initiatives and strategy, both at the board level and among the employee-base. |

●We issued our annual DEI Report in fiscal 2022, which reflects our commitment to DEI throughout the Company.

●We publicly disclosed our annual EEO-1 report and committed to do so annually in order to enhance transparency about our workforce diversity.

●We are the first company in the S&P 500 to include disability representation as a separate, standalone metric within its fiscal 2023 annual cash incentive plan. | |

|

Board Composition Investors are focused on Board tenure and refreshment and whether companies have the right skills and expertise on boards to advance and oversee corporate strategy. |

●Our Board refreshment efforts in 2022 resulted in the addition of directors with extensive healthcare and technology expertise, aligning our Board with our strategy.

●Following our recent Board refreshment efforts, the current average tenure of our Board nominees is 7.2 years, which is below the 7.8 year S&P 500 average.(1)

(1) Source: 2022 Spencer Stuart Board Index |

|

Where to find more information about our stockholder outreach and say-on-pay response |

|

See pages 31–35 in the Corporate Governance section and 61-64 in the Compensation Discussion and Analysis section below. |

| 8 | Walgreens Boots Alliance, Inc. |

| Proxy summary |

| Proposal 1 | ||||

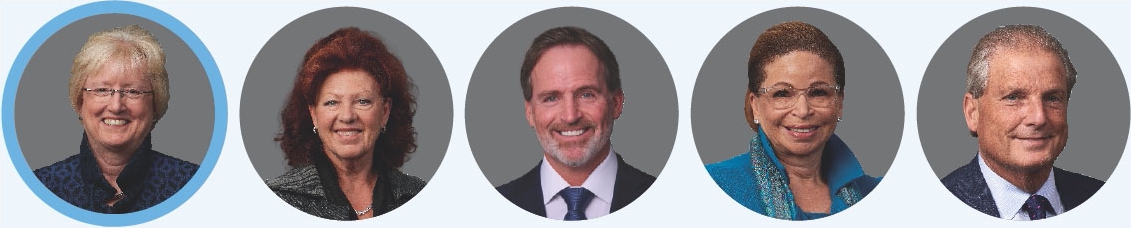

| Our 2023 Director Nominees | ||||

|

Janice M.

Babiak Age: 64

Director since: 2012 |

|

Inderpal

S. Bhandari Age: 63

Director since: 2022 |

|

Rosalind G.

Brewer Age: 60

Director since: 2021 |

|

Ginger L.

Graham Age: 67

Director since: 2010 | |||

|

Former Managing Partner, Ernst & Young LLP

Committees:  |

Global Chief Data Officer, International Business Machines Corporation

Committees: F |

Chief Executive Officer, Walgreens Boots Alliance, Inc. |

Lead Independent Director

Former President and CEO, Amylin Pharmaceuticals Committees:  | |||||||

|

Bryan C.

Hanson Age: 55

Director since: 2022 |

|

Valerie

B. Jarrett Age: 66

Director since: 2020 |

|

John A.

Lederer Age: 67

Director since: 2015 |

|

Dominic P.

Murphy Age: 55

Director since: 2012 | |||

|

Chief Executive Officer, Zimmer Biomet Holdings, Inc.

Committees: F C |

Chief Executive Officer, Obama Foundation

Committees: A C |

Senior Advisor, Sycamore Partners

Committees: C F N |

Managing Partner and Co-Head of UK Investments, CVC Capital Partners

Committees: F N | |||||||

|

Stefano

Pessina Age: 81

Director since: 2012 |

|

Nancy M.

Schlichting Age: 68

Director since: 2006 |

Keys:

Independent Independent Chair ChairAAudit

CCompensation and Leadership Performance

FFinance and Technology

NNominating and Governance

| ||||||

|

Executive Chairman, Walgreens Boots Alliance, Inc. |

Former CEO, Henry Ford Health System

Committees: A  |

|||||||||

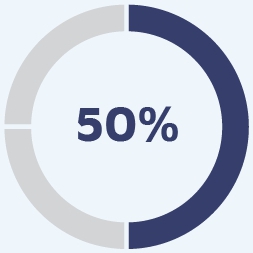

Board Nominee Demographics

| Independence | Tenure and refreshment | |||

Each member of the Audit Committee, the CLP Committee, the Finance and Technology Committee and the Nominating and Governance Committee is independent |

7.2 years average tenure |

4 nominees | ||

|

Diversity |

Age | |||

|

|

| ||

| The Board recommends a vote FOR each of the director nominees. | See Page 12 |

| (1) | Source: 2022 Spencer Stuart Board Index |

| 2023 Proxy Statement | 9 |

Proxy summary

| Proposal 2 | ||||

| Advisory vote to approve named executive officer compensation |

||||

Key achievements in fiscal 2022

We are an integrated healthcare, pharmacy and retail leader serving millions of customers and patients every day through dispensing medications, improving access to a wide range of health services, providing high quality health and beauty products and offering anytime, anywhere convenience across our digital platforms, with sales of $132.7 billion in the fiscal year ended August 31, 2022. We made tremendous progress on our strategic priorities in fiscal 2022. Specifically, we:

| ● | Met or exceeded our strategic goals for fiscal 2022 with respect to the adjusted operating income of our U.S. Retail Pharmacy segment, retail comparable sales growth and retail gross margin, despite a challenging macro environment. |

| ● | Accelerated U.S. healthcare strategy through strategic investments in VillageMD, Shields Health Solutions and CareCentrix. |

| ● | Raised the projected annual three-year savings target under our Transformational Cost Management Program from $3.3 billion to $3.5 billion through fiscal 2024. |

| ● | Continued to build a high-performance culture and a winning team by expanding our Executive Committee to operate and structure ourselves as a healthcare company. |

Compensation philosophy and executive compensation program

The Company holistically reassessed its compensation philosophy and executive compensation program during fiscal 2022 to evaluate whether they were aligned with the cultural transformation that the Company has undertaken and reflective of our business strategy to focus on becoming a leader in U.S. healthcare.

This assessment, as well as consideration of our stockholders’ views on executive compensation, led to numerous changes to our compensation philosophy and programs. We encourage our stockholders to read “Executive Compensation—Compensation Discussion and Analysis—Executive Summary” for a detailed overview of our revised compensation philosophy and additional rationale for these changes.

| Recent Developments and Enhancements To Our Executive Compensation Program |

|

Base Salaries ●We did not provide fiscal 2023 salary increases to our Named Executive Officers.

●We continued to invest in our front-line team members throughout the ongoing pandemic and inflationary economic environment, including recognizing pharmacy team members for their critical role in fighting the pandemic through new bonuses and rewards, as well as implementing an increased starting wage for U.S. team members of $15.00 an hour (fully implemented in November 2022).

Annual Cash Incentive Awards ●We repositioned and expanded our DEI annual bonus metrics into “Health Equity” metrics beginning in fiscal 2023, which includes new disability representation and environmental sustainability focused goals and aligns with our strategic shift to healthcare.

Long-Term Incentive Awards ●We contemporized our fiscal 2023-2025 performance share design by introducing a market-competitive maximum payout opportunity of 200%, as well as a relative TSR performance modifier.

●We eliminated stock options from the long-term incentive mix beginning in fiscal 2023, and discontinued the use of the discretionary individual adjustment factor that historically applied to stock option grants.

Other Compensation Policies ●The CLP Committee reiterated that it has no intention of using positive discretion in our incentive programs in the future.

●We adopted policy limiting executive officer cash separation payments to no more than 2.99 times annual base salary plus target annual bonus without stockholder approval. |

| The Board recommends a vote FOR this proposal. | See Page 57 |

| 10 | Walgreens Boots Alliance, Inc. |

Proxy summary

| Proposal 3 | ||||

| Ratification of the appointment of Deloitte & Touche LLP as the independent registered public accounting firm for fiscal year 2023 |

||||

|

●The Audit Committee has re-appointed Deloitte to serve as our independent registered public accounting firm and as auditors of our consolidated financial statements for fiscal 2023.

●Deloitte has been the independent registered public accounting firm of the Company (including its predecessor, Walgreens) since May 2002. |

●Deloitte provided the Audit Committee with the written disclosures and the letter required by the applicable requirements of the PCAOB regarding Deloitte’s communications with the Audit Committee concerning independence, and the Audit Committee has discussed and confirmed with Deloitte its independence. |

| The Board recommends a vote FOR this proposal. | See Page 97 |

| Proposals 4-5 | ||||

| Stockholder proposals | ||||

Proposal 4 – Stockholder proposal requesting report on public health costs due to tobacco product sales and the impact on overall market returns

Stockholders request the Board of Directors commission and disclose a report on the external public health costs created by the sale of tobacco products by the Company and the manner in which such costs affect the vast majority of its stockholders who rely on overall market returns.

Proposal 5 – Stockholder proposal requesting an independent board chairman

Stockholder requests that our Board of Directors adopt a policy and amend the Company’s governing documents to require that two separate people hold the office of Chairman of the Board and Chief Executive Officer.

| The Board recommends a vote AGAINST each stockholder proposal. | See Page 101 |

| 2023 Proxy Statement | 11 |

| Corporate governance |

| Proposal 1 | ||||

| Election of Directors |

|

Vote FOR | ||

| What am I voting on? |

Stockholders are being asked to elect 10 director nominees named in this Proxy Statement for a one-year term. |

| What is the Board’s voting recommendation? |

The Board recommends a vote “FOR” each of the director nominees named in this Proxy Statement. Valid proxies solicited by the Board will be so voted unless stockholders specify a contrary choice in their voting instructions. |

| What is the required vote? |

With respect to the election of directors, the number of votes “FOR” a director’s election must be a majority of the votes cast by the holders of the shares of our common stock voting in person or by proxy at the Annual Meeting with respect to that director’s election. Abstentions with respect to a director will have the same effect as a vote “AGAINST” him or her. |

Upon the recommendation of the Nominating and Governance Committee, the Board has nominated 10 directors for election at the Annual Meeting, each to hold office until our next annual meeting of stockholders and until his or her successor is duly elected and qualified or upon his or her earlier death, resignation, or removal. After over 25 years of service as a director of the Company, Mr. Foote notified us on October 27, 2022 of his decision not to stand for re-election at the Annual Meeting.

All of the nominees are currently serving as directors of the Company. Each nominee was elected to the Board by our stockholders at our 2022 annual meeting of stockholders (the “2022 Annual Meeting”) except for Inderpal S. Bhandari, who was elected to the Board effective September 6, 2022, and Bryan C. Hanson, who was elected to the Board effective October 27, 2022. Mr. Bhandari was recommended for consideration by a third-party consulting firm engaged to identify, evaluate, and conduct due diligence on potential director candidates. Mr. Hanson was first identified as a prospective director candidate by recommendation of members of the Board. All of the nominees are expected to attend the Annual Meeting.

|

Each nominee has agreed to be named in this Proxy Statement and to serve if elected. Consequently, we know of no reason why any of the nominees would be unable or unwilling to serve if elected. However, if any nominee is for any reason unable or unwilling to serve, the proxyholders intend to vote all proxies received by them for any substitute nominee proposed by the Board (consistent with any applicable terms of the Shareholders’ Agreement, as defined and described further in “—Director Nomination Process—Shareholders’ Agreement and Other Arrangements with Mr. Pessina” below), unless the Board instead chooses to reduce its size. We are committed to the principle that a firm foundation of board effectiveness is essential to best serve the interests of stockholders, guide the Company and oversee management. As is detailed below in “—Board Effectiveness is the Foundation of Our Corporate Governance,” we believe that our Board functions in an effective manner and that this is a result of having a strong Lead Independent Director to work alongside our Executive Chairman, the right combination of diverse and expert individuals on the Board, and the right processes and structures in place to promote the efficient, engaged and dynamic execution of the Board’s duties and responsibilities. |

|

| 12 | Walgreens Boots Alliance, Inc. |

Corporate governance

We believe decisions regarding the structure and composition of the Board are critical to ensuring a strong Board that is best suited to guide the Company. As specified in its charter, the Nominating and Governance Committee oversees our director nomination process.

|

1 Consideration of Necessary Skills, Experience and Attributes |

The Nominating and Governance Committee considers a wide range of factors when assessing potential director nominees. It actively seeks out women and individuals from minority groups to include in the pool from which Board nominees are chosen. The Nominating and Governance Committee’s assessment of potential directors includes a review of the potential nominee’s judgment, experience, independence, understanding of our business or other related industries, and such other factors as the Nominating and Governance Committee concludes are pertinent in light of the needs of the Board. The Nominating and Governance Committee’s goal is to put forth a diverse slate of candidates with a combination of skills, experience, viewpoints, perspectives and personal qualities that will best serve the Board, the Company and our stockholders. | |

|

|||

|

2 Assessment of Current Board Composition |

With respect to the potential re-nomination of current directors, the Nominating and Governance Committee assesses their current contributions to the Board. Among other matters, the Nominating and Governance Committee considers the results of the annual evaluation of the Board and its Committees (which the Nominating and Governance Committee also oversees) when assessing potential director nominees. More detail regarding this annual evaluation process can be found in “—Board Operation and Additional Governance Matters—Board Evaluation and Director Peer Review Process” below. | |

|

|||

|

3 Nomination for Stockholder Vote |

The Nominating and Governance Committee recommends to the Board a slate of candidates for election at each annual meeting of stockholders. The Nominating and Governance Committee assesses how each potential nominee would impact the skills and experience represented on the Board as a whole in the context of the Board’s overall composition and the current and anticipated future needs of the Company and the Board. The Nominating and Governance Committee also evaluates whether a potential director nominee meets the qualifications required of all directors and any of the key qualifications and experience to be represented on the Board, as described further in “—Board Membership Criteria” below. |

Stockholder-recommended director candidates

Nominees may be suggested by directors, members of management, stockholders or other third parties. Stockholders who would like the Nominating and Governance Committee to consider their recommendations for director nominees should submit the recommendations in writing by mail to Walgreens Boots Alliance, Inc., 108 Wilmot Road, MS #1858, Deerfield, Illinois 60015, Attention: Corporate Secretary. The Nominating and Governance Committee considers stockholder-recommended candidates on the same basis as other suggested nominees.

Stockholder-nominated director candidates (“proxy access”)

We have adopted a proxy access by-law, which permits a stockholder, or a group of up to 20 stockholders, owning 3% or more of our outstanding common stock continuously for at least three years to nominate and include in our proxy materials director nominees constituting up to 20% of the Board, provided that the stockholder(s) and the nominee(s) satisfy the requirements specified in Article II, Section 2.20 of our by-laws. See “Additional Information—Director Nominations for Inclusion in the Proxy Statement for the 2024 Annual Meeting” below for more information.

| 2023 Proxy Statement | 13 |

Corporate governance

Shareholders’ agreement and other arrangements with Mr. Pessina

On August 2, 2012, in connection with Walgreens’ acquisition of 45% of Alliance Boots GmbH (“Alliance Boots”), Walgreen Co., Kohlberg Kravis Roberts & Co. L.P. (“KKR”), and, inter alios, Stefano Pessina, our current Executive Chairman and former CEO (and together with certain of his affiliates, the “SP Investors”), entered into a Shareholders’ Agreement (the “Shareholders’ Agreement”). Pursuant to the Shareholders’ Agreement, for so long as the SP Investors continue to meet certain common stock beneficial ownership thresholds and subject to certain other conditions, the SP Investors are entitled to designate a nominee for election to the Board. The SP Investors continue to meet these beneficial ownership thresholds, and Mr. Pessina is the current designee of the SP Investors. In addition, on July 23, 2020, Mr. Pessina and the Company entered into a letter agreement which provides, among other things, that upon the effective date of the appointment of the new CEO, the Board will appoint Mr. Pessina on an annual basis (subject to applicable law, including fiduciary duties) as Executive Chairman, provided that Mr. Pessina is a member of the Board at the time. For more information about the Shareholders’ Agreement, see “—Director Independence and Related Party Transactions—Related Party Transactions” below.

Agreement involving VillageMD board nominee

In connection with the launch of our U.S. Healthcare segment, in November 2021 the Company made an additional $5.2 billion investment in VillageMD in order to increase its ownership stake in VillageMD to approximately 63% from approximately 30%. In connection with this incremental investment, the Company and VillageMD entered into an Appointment and Waiver Agreement, dated as of November 24, 2021 (the “Prior Appointment Agreement”), which granted certain founders of VillageMD (the “VillageMD Founders”) with the right to appoint one member of VillageMD’s governing body to the Board. On January 27, 2022, Steven J. Shulman was appointed to the Board pursuant to the Prior Appointment Agreement. See “—Director Independence and Related Party Transaction—Related Party Transactions” below for more information. As previously disclosed by the Company, on December 1, 2022 Mr. Shulman resigned as a member of the Board.

On December 7, 2022 the Company and VillageMD, of which a majority of the outstanding equity interests on a fully diluted basis remain beneficially owned by the Company, entered into a new Nomination Rights Agreement (the “VillageMD Nomination Agreement”). The Prior Appointment Agreement is no longer in effect.

The VillageMD Nomination Agreement provides the VillageMD Founders with the right to appoint one director to the Board (the “VillageMD Representative”) and the opportunity to maintain rights to such directorship by subsequently nominating one director for election to the Board to serve as the VillageMD Representative at future applicable meetings of stockholders as long as certain conditions are satisfied, including requirements that:

| (i) | VillageMD and the VillageMD Founders must consult with and consider the opinions of the Company with respect to the selection of any VillageMD Representative in good faith; |

| (ii) | the VillageMD Representative is subject to a due diligence review process reasonably consistent with the process undertaken for other director candidates and nominees, and must be reasonably acceptable to the Company and approved by the Nominating and Governance Committee; |

| (iii) | the VillageMD Representative must be independent for purposes of service as a director on the Board, including under the applicable rules and standards set forth in the Corporate Governance Guidelines of the Company and of the Securities and Exchange Commission (the “SEC”) and the Nasdaq Stock Market (“Nasdaq”), as determined in good faith by the Board and the Nominating and Governance Committee; and |

| (iv) | VillageMD shall cause the VillageMD Representative to provide information for the Company’s proxy statement related to any election of a VillageMD Representative and such VillageMD Representative’s consent to serve as a director of the Company, among other things. |

Under the terms of the VillageMD Nomination Agreement, the Company is subject to certain obligations with respect to the inclusion of the VMD Representative in the Board’s slate of nominees for election and proxy statements, as well as the Board’s recommendation of the VMD Representative for election. Further, the VMD Representative will be eligible to receive compensation and benefits for services as a director of the Company in the same manner and on the same basis as the other directors of the Company.

In the event that the VillageMD Founders cease to own at least 50% of the outstanding equity interests of VillageMD on a fully diluted basis that they owned as of the date of the VillageMD Nomination Agreement, all rights and obligations of the VillageMD Founders under the VillageMD Nominating Agreement will instead become rights and obligations of the then current Chief Executive Officer of VillageMD acting in such capacity. The VillageMD Nomination Agreement, and the director designation and nomination rights provided therein, terminate upon the earlier of (a) the date upon which the Company ceases to consolidate VillageMD for purposes of the Company’s consolidated financial statements and (b) the date upon which the Company ceases to be entitled to designate a majority of the members of the governing body of VillageMD.

In connection with Mr. Shulman’s resignation as a member of the Board as described above, the Board correspondingly reduced the number of directors of the Company by one. Pursuant to the VillageMD Nomination Agreement, the VillageMD Founders have the right to designate a new VillageMD Representative for appointment to the Board as described above, which we do not expect to take place until after the 2023 Annual Meeting. At the time of the appointment of the VillageMD Representative, the Board expects to increase the number of directors by one to accommodate the appointment.

| 14 | Walgreens Boots Alliance, Inc. |

Corporate governance

Pursuant to its charter, the Nominating and Governance Committee is charged with establishing, and reviewing as necessary, criteria to be used by the Board for selecting directors. The Nominating and Governance Committee believes there are general qualifications that all directors must exhibit and other key qualifications and experience that should be represented on the Board as a whole, but not necessarily by each director.

Core competencies required of all directors

The Nominating and Governance Committee seeks to construct a Board consisting of directors with the following qualities:

|

Experience ●High-level leadership experience in business or managerial activities and significant accomplishments;

●Expertise in key facets of corporate management;

●Breadth of knowledge about issues affecting the Company; and

●Proven ability and willingness to contribute special competencies to the Board’s activities. |

Personal attributes ●Personal integrity;

●Loyalty to the Company and concern for its success and welfare;

●Willingness to apply sound and independent business judgment;

●Awareness of a director’s vital role in good corporate governance and citizenship;

●Willingness and energy to devote the time necessary for meetings and for consultation on relevant matters; and

●Willingness to assume the fiduciary responsibility of a director and enthusiasm about the prospect of serving. |

With respect to directors who are not current employees of the Company (“Non-Employee Directors”), the Nominating and Governance Committee also focuses on continued independence under Nasdaq listing standards (other than with respect to former employees or directors who are not otherwise deemed to be independent), transactions that may present conflicts of interest, changes in principal business activities and overall prior contributions to the Board.

Key skills qualifications and experience to be represented on the board

The Board has identified key skills, qualifications and experience that are important to be represented on the Board as a whole in light of our current business strategy and expected needs. The table below summarizes the key skills, qualifications and experience of the director nominees. This summary is not intended to be an exhaustive list of skills or contributions to the Board. See “—2023 Director Nominees” below for skills, qualifications and experience of each nominee.

|

Business Development and M&A |

|

Finance and Accounting |

|

Human Capital |

|

Corporate Governance | ||||

|

10/10 |

|

10/10 |

|

10/10 |

|

10/10 | ||||

|

Healthcare or Regulated Industries |

|

Global Operations |

|

Current or Former Public Company CEO |

|

Retail or Consumer-Facing Industries |

||||

|

9/10 |

|

9/10 |

|

5/10 |

|

7/10 | ||||

|

Risk Management |

|

Technology or E-commerce |

||||||||

|

7/10 |

|

5/10 |

| 2023 Proxy Statement | 15 |

Corporate governance

Consideration of diversity

The Nominating and Governance Committee also assesses whether the group of nominees is comprised of individuals with a diversity of perspectives, viewpoints, backgrounds and professional experiences that would best serve the Board, the Company, and our stockholders. The Board, in accordance with our Corporate Governance Guidelines, considers diversity in broad terms, including, but not limited to, competencies, experience, geography, gender, ethnicity, race and age, with the goal of obtaining diverse perspectives, viewpoints, backgrounds and professional experiences. In 2020, the Board reaffirmed its commitment to diversity when it amended the Corporate Governance Guidelines and the charter of the Nominating and Governance Committee to provide that, when searching for new directors, the Nominating and Governance Committee will actively seek out women and individuals from minority groups to include in the pool from which Board nominees are chosen. Since October 2020, the Board has appointed three diverse directors: Valerie B. Jarrett, who was the Company’s first female African American director and is one of five women on the Board; Rosalind G. Brewer, the Company’s first female African American CEO who, at the time of her appointment, was the only female African American CEO in the Fortune 500 and is one of five women on the Board; and Inderpal S. Bhandari, the Company’s first Asian American director.

Board diversity matrix

The table below provides certain highlights of the composition of our Board members and nominees as of December 8, 2022. Each of the categories listed in the table below has the meaning as it is used in Nasdaq Rule 5605(f).

| Board Diversity Matrix (as of December 8, 2022) | ||||

| Total Number of Directors | 11 | |||

| Female | Male | Non-Binary | Did Not Disclose Gender | |

| Gender Identity | ||||

| Directors | 5 | 6 | - | - |

| Demographic Background | ||||

| African American or Black | 2 | - | - | - |

| Asian | - | 1 | - | - |

| White | 3 | 5 | - | - |

| LGBTQ+ | 1 | |||

Our by-laws provide that the number of directors shall be determined by the Board, which has currently set the number at 11. The Board reserves the right to increase or decrease its size at any time. Upon the recommendation of the Nominating and Governance Committee, the Board has nominated each of the following 10 nominees for election at the Annual Meeting. Due to Mr. Foote’s decision not to stand for re-election at the Annual Meeting, the number of directors will be reduced from 11 to 10 as of the Annual Meeting if the 10 nominees are elected at the Annual Meeting. Proxies cannot be voted for a greater number of persons than the nominees named. All of the nominees, other than Ms. Brewer and Mr. Pessina, are independent under Nasdaq listing standards. See “—Director Independence and Related Party Transactions” below for more information. The Board believes that each nominee has the skills, experience and personal qualities the Board seeks in its directors, and that the combination of these nominees creates an effective and well-functioning Board, with a diversity of perspectives, viewpoints, backgrounds and professional experiences that best serves the Board, the Company and our stockholders. Included in each director nominee’s biography is a description of select key qualifications and experience that led the Board to conclude that each nominee is qualified to serve as a member of the Board. All biographical information below is as of the Record Date.

| William Foote, who will retire and not stand for re-election at the 2023 Annual Meeting, has been an effective leader and a valuable member of our Board. We thank him for his guidance and over 25 years of dedicated service to the Company and the Board. |

| 16 | Walgreens Boots Alliance, Inc. |

Corporate governance

|

Janice M. INDEPENDENT Director since: April 2012 Age: 64 Committee Memberships: ●Audit (Chair)

●Finance

Other Current Public Company Boards: ●Bank of Montreal

|

Professional Experience Ernst & Young LLP, an accounting firm ●Former Managing Partner

●Variety of roles in the United States and the United Kingdom (1982-2009)

●Founder and Global Leader of EY’s Climate Change and Sustainability Services practice (July 2008-December 2009)

●Board Member and Managing Partner of Regulatory & Public Policy for the Northern Europe, Middle East and India and Africa (“NEMIA”) region (July 2006-July 2008)

●A founder of EY’s technology security and risk services practice in 1996, building and leading cyber and IT security, data analytics, and technology risk practices in the NEMIA region

Key Qualifications and Experience ●Ms. Babiak is a U.S.-qualified Certified Public Accountant (CPA), Certified Information Systems Auditor (CISA), and Certified Information Security Manager (CISM). She is a Chartered Accountant (FCA) and a member of the Institute of Chartered Accountants in England and Wales (ICAEW), of which she served as a Council Member from 2011 until she reached the term limit in 2019.

●Ms. Babiak brings to the Board her general management expertise and depth of experience in the areas of audit, accounting, and finance, through her prior experience as a Council Member of the ICAEW and as a managing partner at EY, including service as partner for a number of retail and healthcare-related industry clients. With her extensive accounting knowledge and experience, she is highly qualified to serve as the chair of the Audit Committee of the Board (the “Audit Committee”) and as a member of the Finance and Technology Committee of the Board (the “Finance and Technology Committee”). Through her career experience and current CISM and CISA qualifications, she provides the Board with meaningful insight and knowledge related to information technology, cybersecurity best practices, and the relationship between information security programs and broader business goals and objectives. Her international experience, leadership in the areas of climate change and sustainability, and experience working with and serving on the audit committees of other publicly-traded companies further contribute to the perspective and judgment that she brings to service on the Board.

Other Directorships ●Ms.

Babiak has served on the board of directors of Bank of Montreal since October 2012. Previously, she served on the board of directors

of Euromoney Institutional Investor PLC, an international business-information group listed on the London Stock Exchange, from

December 2017 to November 2022, as a non-executive director of Royal Mail Holdings plc from March 2013 to April 2014 as it

transitioned from government ownership to a FTSE 100-listed company; Experian plc from April 2014 to January 2016; and Logica plc

from January 2010 until its sale in August 2012. |

| 2023 Proxy Statement | 17 |

Corporate governance

|

Inderpal S. INDEPENDENT Director since: Age: 63 Committee Memberships: ●Finance

and Technology

|

Professional Experience International Business Machines Corporation, a global technology company ●Global Chief Data Officer (December 2015-Present)

Cambia Health Solutions, Inc., a regional health plan provider and healthcare investment firm ●Senior Vice President and Chief Data Officer (2014-2015)

Express Scripts Inc., a pharmacy benefit management and pharmacy services company ●Chief Data Officer and Vice President, Knowledge Solutions (2012-2014)

Medco Health Solutions, Inc., a pharmacy benefit management and pharmacy services company ●Chief Data Officer and Vice President, Health Data and Analytics (2006-2012)

Key Qualifications and Experience ●With his deep experience as Chief Data Officer at multiple large companies, Mr. Bhandari provides the Board with strong technology experience coupled with business leadership and expertise. In addition, he brings to the Board insight and knowledge of specific healthcare technology matters given his extensive experience in the healthcare industry.

Other Directorships ●Mr. Bhandari has served on the boards of directors of a number of privately-held companies. |

| 18 | Walgreens Boots Alliance, Inc. |

Corporate governance

|

Rosalind G. CHIEF Director since: Age: 60

|

Professional Experience Walgreens Boots Alliance, Inc. ●Chief Executive Officer and Director (March 2021-Present)

Spelman College ●Chairperson, Board of Trustees

Starbucks Corporation, a global food and beverage company ●Director (March 2017-February 2021)

●Group President, Americas and Chief Operating Officer (October 2017-February 2021)

Walmart Inc., a global retailer ●President and Chief Executive Officer, Sam’s Club (February 2012-February 2017)

●Executive Vice President and President, East Business Unit (February 2011-January 2012)

●Executive Vice President and President, Walmart South (February 2010-February 2011)

●Senior Vice President and Division President, Southeast Operating Division (March 2007-January 2010)

●Regional General Manager, Georgia Operations (2006-February 2007)

Kimberly-Clark Corporation, a global health and hygiene products company ●President, Global Nonwovens Division (2004-2006)

●Various management positions (1984-2006)

Key Qualifications and Experience ●Ms. Brewer was appointed as Chief Executive Officer in March 2021. Ms. Brewer’s experience serving in a range of leadership positions with Starbucks Corporation and Walmart, Inc., two of the largest global companies, provides her with great breadth and depth of understanding of the strategic, operational, financial and human capital issues facing companies. It also gives her valuable insights and perspectives with respect to our retail and consumer-facing operations. Her extensive public company directorship experience, including as a former director of Amazon.com, Inc., the world’s largest online retailer, provides her with valuable perspective on corporate responsibility and governance matters and enables her to draw on various viewpoints in her service as Chief Executive Officer and on the Board.

Other Directorships ●Ms. Brewer formerly served on the board of directors of Amazon.com, Inc. from February 2019 until February 2021. She also formerly served on the boards of directors of Lockheed Martin Corporation from April 2011 until October 2017 and Molson Coors Brewing Company from 2006 until 2011. |

| 2023 Proxy Statement | 19 |

Corporate governance

|

Ginger L. LEAD INDEPENDENT Director since: April 2010 Age: 67 Committee Memberships: ●Audit

●Compensation and Leadership Performance

●Nominating and Governance (Chair)

Other Current Public Company Boards: ●Clovis Oncology, Inc.

|

Professional Experience Two Trees Consulting, Inc., a healthcare and executive leadership consulting firm ●President and Chief Executive Officer (November 2007-December 2016)

Harvard Business School ●Senior Lecturer (October 2009-June 2012)

Amylin Pharmaceuticals, a biopharmaceutical company ●Director (1995-2009)

●Chief Executive Officer (September 2003-March 2007)

●President (September 2003-June 2006)

Guidant Corporation, a cardiovascular medical device manufacturer ●Various positions including Group Chairman, Office of the President, President of the Vascular Intervention Group, and Vice President (1994-2003)

Key Qualifications and Experience ●Ms. Graham brings to the Board her extensive experience in senior management and leadership roles in the healthcare industry, including experience leading companies in drug, device, and product development and commercialization. The Board values her insight and experience, including her service on the faculty of Harvard Business School where she taught classes in entrepreneurship. She also brings to her service on the Board valuable experience as a director of publicly- and privately-held life sciences companies and as a consultant to healthcare companies regarding strategy, leadership, team building, and capability building.

Other Directorships ●Ms. Graham has served on the board of directors of Clovis Oncology, Inc. since 2013 (and has served as its chair since 2019). She also served on the board of directors of Genomic Health, Inc. from 2008 until its merger with Exact Sciences Corporation in 2020. |

| 20 | Walgreens Boots Alliance, Inc. |

Corporate governance

Bryan C. Hanson INDEPENDENT Director since:

October 2022 Age: 55

Committee Memberships:

●Compensation and Leadership Performance

●Finance and Technology

Other Current Public

Company Boards: ●Zimmer Biomet Holdings, Inc.

|

Professional Experience Zimmer Biomet Holdings, Inc., a manufacturer of medical devices

●Chairman of the Board (2021-Present)

●President and Chief Executive Officer (2017-Present)

Medtronic plc, a medical device company

●Executive Vice President and Group President, Minimally Invasive Therapies Group (2015-2017)

Covidien, a medical supplier company

●Group Vice President, Covidien (2014-2015)

●Group President, Medical Devices & U.S. (2013-2014)

●Group President, Surgical Solutions and President, Energy-based Devices (2011-2013)

Key Qualifications and Experience ●Mr. Hanson brings to the Board his extensive experience of the healthcare field. He has significant experience in financial management, strategic planning, mergers and acquisitions, business integration, risk management and dealing with the regulatory aspects of the healthcare sector.

Other Directorships ●Mr. Hanson has served on the board of directors of Zimmer Biomet Holdings, Inc. since 2017 and as its Chairman of the Board since 2021. |

| 2023 Proxy Statement | 21 |

Corporate governance

Valerie B. Jarrett INDEPENDENT Director since:

October 2020 Age: 66

Committee Memberships:

●Audit

●Compensation and Leadership Performance

Other Current Public

Company Boards: ●Lyft, Inc.

●Ralph Lauren Corporation

●Sweetgreen, Inc.

|

Professional Experience Obama Foundation, a non-profit organization

●Chief Executive Officer (October 2021-Present)

●President/Senior Advisor (April 2018-October 2021)

University of Chicago Law School

●Distinguished Senior Fellow (January 2018-Present)

United States White House

●Senior Advisor to the President (January 2009-January 2017)

The Habitat Company, a Chicago real estate development and management firm

●Various senior positions, including Chief Executive Officer (1995-2009)

City of Chicago

●Commissioner of the Chicago Department of Planning and Development (1992-1995)

●Former Deputy Chief of Staff for the Mayor

Key Qualifications and Experience ●Ms. Jarrett brings to the Board her unique experience and expertise in governmental and public policy matters, including as a result of her service to a former President of the United States and in various positions with the City of Chicago, along with significant private sector experience. The Board also values her diverse perspectives as a business executive and civic leader, as well as an African American woman.

Other Directorships ●Ms. Jarrett has served on the boards of directors of Lyft, Inc., a ride-sharing service company, since July 2017, Ralph Lauren Corporation, a premium lifestyle products company, since October 2020, and Sweetgreen, Inc. a healthy restaurant and lifestyle brand, since August 2020. She also serves on the board of Ariel Investments, LLC, a private investment company. She was formerly on the board of directors of 2U, Inc., an education technology company, from December 2017 to October 2021. |

| 22 | Walgreens Boots Alliance, Inc. |

Corporate governance

John A. Lederer INDEPENDENT Director since:

April 2015 Age: 67

Committee Memberships:

●Compensation and Leadership Performance

●Finance and Technology (Acting Chair)

●Nominating and Governance

Other Current Public

Company Boards: ●NextPoint Financial, Inc.

|

Professional Experience Sycamore Partners, a private equity firm

●Senior Advisor (September 2017-Present)

●Interim Chief Executive Officer (June 2021-Present) and Executive Chairman (September 2017-Present) of privately-held Staples, Inc. (and its newly formed and independent U.S. and Canadian retail businesses following acquisition by Sycamore Partners in 2017), a leading provider of office products and services to business customers

US Foods Holding Corp., a leading food service distributor in the United States

●President and Chief Executive Officer (2010-2015)

Duane Reade, a New York-based pharmacy retailer (acquired by Walgreens in 2010)

●Chairman of the Board and Chief Executive Officer (2008-2010)

Loblaw Companies Limited, Canada’s largest grocery retailer and wholesale food distributor

●President (2000-2006)

●Spent 30 years in various positions including a number of leadership roles

Key Qualifications and Experience ●Mr. Lederer brings to the Board significant management and business experience in the retail and healthcare industries as a result of his experience as Chief Executive Officer of a retail pharmacy. The Board values his understanding of the business operations of and issues facing large retail companies, including in the areas of marketing, merchandising, and supply chain logistics. Mr. Lederer also has extensive experience with respect to mergers & acquisitions and other corporate development activities. His prior and current service as a director of several public companies also provides him with insight into public company operations, including with respect to talent development, executive compensation, and succession planning.

Other Directorships ●Mr. Lederer has served on the board of directors of NextPoint Financial Inc. (formerly NextPoint Acquisition Corp.), a company listed on the Toronto Stock Exchange, since 2020. He previously served on the boards of directors of US Foods Holding Corp. from 2010 until May 2022, and Maple Leaf Foods, a company listed on the Toronto Stock Exchange, from 2016 until May 2021. He also previously served on the boards of directors of Restaurant Brands International from 2014 until 2016 and Tim Hortons Inc., from 2007 until 2014, when it was acquired by Restaurant Brands International. |

| 2023 Proxy Statement | 23 |

Corporate governance

Dominic P. Murphy INDEPENDENT Director since:

August 2012 Age: 55

Committee Memberships:

●Finance and Technology

●Nominating and Governance

|

Professional Experience CVC Capital Partners, a private investment firm

●Managing Partner and Co-Head of UK Investments (2019-Present)

8c Capital LLP, a private investment firm

●Founder and Chief Executive Officer (2017-2019)

KKR, a private equity firm

●Partner, responsible for the development of the firm’s activities in the United Kingdom and Ireland, served as the head of its healthcare industry team in Europe and served as a member of the firm’s European investment and portfolio management committees (2005-2017)

Cinven, a European-based private equity firm

●Partner (1996-2004)

3i Group plc, an international investment management firm

●Investment Manager (1994-1996)

Key Qualifications and Experience ●Mr. Murphy brings to the Board his considerable international business experience gained through his prior role in KKR-related private equity investments. The Board values his insights and experience, including his substantial mergers & acquisitions, corporate finance, and retail and healthcare industry experience, as well as his in-depth familiarity with many of the markets in which we operate. He also brings valuable insights gained from his experience serving as a director of publicly- and privately-held healthcare companies.

Other Directorships ●Mr. Murphy served on the board of directors of THG Holdings plc, a digital first consumer brands group listed on the London Stock Exchange, from 2014 until June 2022. From 2007 until 2015, he served on the board of directors of Alliance Boots and certain of its affiliates. |

| 24 | Walgreens Boots Alliance, Inc. |

Corporate governance

Stefano Pessina EXECUTIVE CHAIRMAN Director since:

April 2012 Age: 81

|

Professional Experience Walgreens Boots Alliance, Inc.

●Executive Chairman (March 2021-Present)

●Chief Executive Officer (July 2015-March 2021)

●Executive Vice Chairman (January 2015-March 2021)

●Acting Chief Executive Officer (January 2015-July 2015)

Alliance Boots

●Executive Chairman (July 2007-December 2014)

●Former Executive Deputy Chairman

Alliance UniChem

●Executive Deputy Chairman prior to the merger of Alliance UniChem and Boots Group

●Chief Executive Officer (2001-December 2004)

Key Qualifications and Experience ●As our Executive Chairman, Mr. Pessina leads our Board and brings an in-depth knowledge of the Company, including through his prior service as Chief Executive Officer of the Company and Executive Chairman of Alliance Boots, as well as in the retail and healthcare industries. His substantial international business experience and business acumen provide the Board with valued strategic, financial, and operational insights and perspectives. The Board also values Mr. Pessina’s significant mergers and acquisitions experience as well as his experience serving on the boards of directors of numerous publicly- and privately-held healthcare and retail companies. He brings valued perspective and judgment to the Board’s discussions regarding our competitive landscape and strategic opportunities and challenges.

Other Directorships ●Mr. Pessina serves on the board of directors of a number of privately-held companies. He served on the board of directors of Galenica AG, a publicly-traded Swiss healthcare group, from 2000 until 2017. |

| 2023 Proxy Statement | 25 |

Corporate governance

Nancy M. Schlichting INDEPENDENT Director since:

October 2006 Age: 68

Committee Memberships:

●Audit

●Compensation and Leadership Performance (Chair)

Other Current Public

Company Boards:

●Baxter International, Inc.

●Encompass Health Corporation

●Pear Therapeutics, Inc.

|

Professional Experience Henry Ford Health System, a leading hospital network and healthcare and medical services provider

●Chief Executive Officer (June 2003-December 2016)

●Executive Vice President (June 1999-June 2003)

●President and Chief Executive Officer of Henry Ford Hospital (August 2001-June 2003)

Key Qualifications and Experience ●As a result of her leadership of hospitals and health systems, Ms. Schlichting brings to her service on the Board a deep knowledge and understanding of the healthcare industry. The Board highly values her experience and insights gained at Henry Ford Health System, where she was responsible for the strategic and operational performance of a leading integrated health system, including an academic medical center, community hospitals, a health plan, a multi-specialty medical group, and an ambulatory and health retail network.

Other Directorships ●Ms. Schlichting has served on the board of directors of Baxter International, Inc. since December 2021, following the acquisition by Baxter International, Inc. of Hill-Rom Holdings, Inc., where she served on the board of directors from March 2017 until December 2021. She also has served on the boards of directors of Encompass Health Corporation (formerly HealthSouth Corporation) since December 2017 and Pear Therapeutics, Inc. since January 2021. She also serves on the board of directors of Duke University and the Duke University Health System. |

| 26 | Walgreens Boots Alliance, Inc. |

Corporate governance

Board effectiveness is the foundation of our corporate governance

We are committed to the principle that a firm foundation of board effectiveness is essential to best serve the interests of stockholders, guide the Company and oversee management. Board effectiveness results from having the right combination of diverse and expert individuals on the Board as well as having the right processes and structures in place to promote the efficient, engaged and dynamic execution of the Board’s duties and responsibilities.

|

Board Composition | |

|

Key Skills and Attributes

●Identifies desirable skills, attributes and qualifications in light of the Company’s current strategy, anticipated market conditions and industry challenges and opportunities

●Focuses on a Board that is composed each year of the mix of directors best able to serve the evolving needs of the Company and that regularly considers fresh viewpoints and perspectives

Board Diversity

●Commits to board diversity in a broad sense, including, but not limited to, competencies, experience, geography, gender, ethnicity, race and age

●Actively seeks out women and individuals from minority groups to include in the pool from which Board nominees are chosen

Director Evaluations

●Assesses the effectiveness of each director, the Board as a whole and its Committees

●Identifies opportunities to enhance individual and group performance, including through director training or Board operational changes

●Allows the Board to have the best mix and fit on an ongoing basis |

Succession Planning

●Identifies directors approaching retirement age or who otherwise are expected to resign from the Board

●Allows the Board to plan for replacement of such departing director’s skill set and Committee leadership and membership

Director Orientation and Continuing Education

●Informs directors about the Company’s business and significant operational, financial, accounting and risk management matters

●Allows directors to stay current on industry and company trends

Retirement Policy

●Supports Board refreshment

●Provides flexibility to allow Nominating and Governance Committee and Board to nominate candidates above retirement age if in best interests of the Company (and the nomination is approved by the Board) |

|

Director Nominee Identification

●Identifies potential nominees possessing the skills and attributes that can best serve the Company in combination with the other nominees

|

●Includes assessment of current directors for re-nomination |

|

Board Effectiveness |

|

Board Operation | |

|

Leadership Structure

●Lead Independent Director focused on the long-term objectives of all stakeholders of the Company

●Executive Chairman focused on leadership of the Board

●CEO focused on setting strategy and leading our business and operations

Allocation of Oversight Responsibility

●Board and its Committees provide oversight and guidance to management regarding our strategy, operating plans, and overall performance

●At least one meeting between the Board and management each year to focus on our long-term business strategic planning |

Committee Assignments and Rotation

●Committee assignments reviewed at least annually and more frequently as needed

Stockholder Engagement

●As part of our formal engagement program, we reached out to approximately 50 of our largest stockholders

●Discussed a wide range of topics and took specific actions in response to stockholder feedback

Board Compensation

●A substantial portion of each Non-Employee Director’s annual compensation is in the form of equity to help align his or her compensation with the interests of our stockholders

●Directors are required to meet established stock ownership guidelines |

| 2023 Proxy Statement | 27 |

Corporate governance

Our commitment to strong corporate governance

The Board believes that a commitment to strong corporate governance standards is an essential element of enhancing long-term stockholder value in a sustainable manner. The Board believes that its commitment to good governance is demonstrated in part by the continuous implementation of best governance practices, as set forth in part on page 7, that the Board believes are in the best interests of our Company.

The Board has adopted Corporate Governance Guidelines that are designed to provide guidance as a component of the flexible framework within which the Board, assisted by its Committees, oversees and directs the affairs of the Company. The Corporate Governance Guidelines establish policies and practices with respect to numerous areas of Board operations and responsibilities, including in the areas of Board structure and leadership and director independence. The Board periodically reviews the Corporate Governance Guidelines and updates them in response to changing regulatory requirements and evolving best practices. A copy of the Corporate Governance Guidelines can be found at https://investor.walgreensbootsalliance.com/governance.

Active board refreshment and committee rotation

40% of our director nominees were first elected to our board in the past three years.

|

2020 |

2021 |

2022 |

||||

|

|

|

| |||

|

Valerie B. |

Rosalind G. |

Inderpal S. |

Bryan C. |

The Board believes that a degree of refreshment is important to ensure that Board composition is aligned with the changing needs of the Company and the Board, and that fresh viewpoints and perspectives are regularly considered. The Board also believes that directors develop an understanding of the Company and an ability to work effectively as a group over time that provides significant value, and therefore a significant degree of continuity year-over-year should be expected.

As part of planning for director succession, the Nominating and Governance Committee periodically engages in the consideration of potential director candidates, occasionally with the assistance of a third-party advisor or recruitment firm.

|

Director nominee tenure balance |