Form DEF 14A WESTERN DIGITAL CORP For: Nov 16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section

14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

Western Digital Corporation

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy

Statement, if other than the Registrant)

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | ||

| ☑ | No fee required | |

| ☐ | Fee paid previously with preliminary materials | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

|

Our strategy across five major | |

|

Drive Differentiated Leadership in Flash ●Capitalize on market transition to solid state drives

●Focus on gross margin leadership

●Manage capital investment tactfully | |

|

Create what’s next Western Digital is on a mission to unlock the potential of data by harnessing the possibility to use it. With both flash and hard disk drive (“HDD”) franchises, underpinned by groundbreaking advancements in memory technologies, we create breakthrough innovations and powerful data storage solutions that enable the world to actualize its aspirations. Our broad portfolio provides powerful data storage solutions for everyone, from the smallest, intelligent devices to the largest public clouds. Through our innovation, we strive to fuel the potential for what’s possible and create a world where data is an accessible asset that leads to deeper connections, new breakthroughs and smarter decisions. Quality products, exceptional customer service and industry-leading solutions all come from a culture that’s inclusive, forward-thinking and bold. Building global trust for over 50 years, we proudly offer solutions via our portfolio of brands – Western Digital®, WD®, SanDisk®, SanDisk® Professional and WD_BLACK™. Recognized as one of the World’s Most Ethical Companies (Ethisphere) and America’s Most Responsible Companies (Newsweek), Western Digital operates in 35+ countries with approximately 65,000 employees and maintains approximately 13,500 active patents. | ||

|

Capitalize on the HDD opportunity in the cloud ●Ensure reliable capacity growth and improved total cost of ownership

●Enhance customers’ ability to generate value from data

●Develop new technologies across the storage landscape | |

|

Grow through innovation across the entire portfolio ●Lead in areal density

●Reimagine every subsystem for HDD

●Drive capital-efficient bit growth in flash

●Maintain leadership in high performance charge trap cell | |

|

Deliver Customer Value ●Expand relationships at our largest customers to enrich our value

●Increase long-term engagement and through-cycle agreements with key hyperscalers

●Establish ourselves as “The Supplier” for storage in retail, e-tail and distribution channels, while developing our online store as a preferred channel | |

|

Accelerate Operational Excellence ●Achieve operational excellence to translate technology into stockholder value

●Meet quarter-to-quarter cost down target to improve gross margin while improving inventory

●Focus on sustainability and digital innovation of our manufacturing processes | |

|

Our Purpose | ||

| 1 |

Letter from Our Chair and

Lead Independent Director

Dear Fellow Stockholders:

|

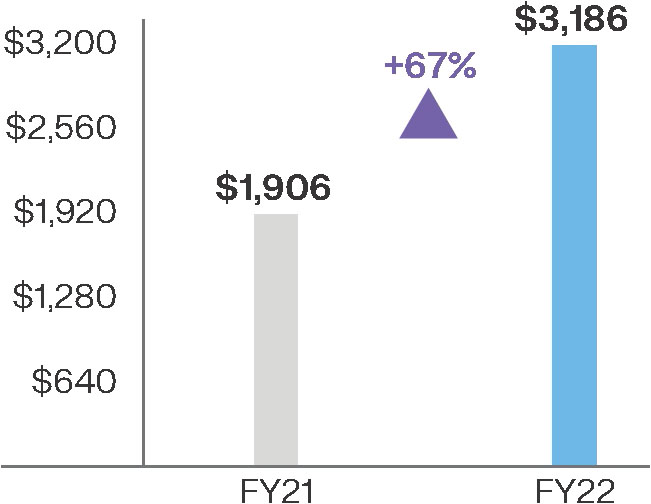

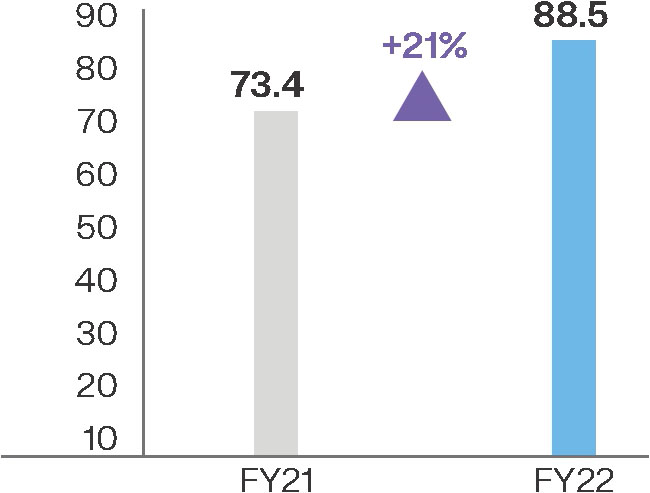

On behalf of the entire Board, thank you for your continued support and trust in Western Digital. We are proud of our achievements and performance during fiscal 2022 as we continue to navigate challenging market dynamics and disruptions. This year, our team has taken steps to further align our long-term strategy with our stockholders’ interests and to undergo a comprehensive and thorough review of strategic alternatives. As we approach our 2022 Annual Meeting, our Board would like to take the opportunity to share how we are addressing key topics of stockholder interest. Review of Strategic Options and Continued Focus on Strong Execution Our Board prioritizes effective oversight of Western Digital’s corporate strategy and execution to drive long-term value for our stockholders. During fiscal 2022, our team delivered strong revenue and earnings growth driven by a focus on execution, innovation, and product development. This strong operational performance is underscored by our management team’s navigation of ongoing macro environment dynamics and continued supply chain challenges. Despite this strong operating performance, the Board believed it was important to review other alternatives for unlocking |

stockholder value. As a result, we announced a review of strategic alternatives aimed at further optimizing long-term value for our stockholders. Our Board’s Executive Committee oversees the strategic review process, while our full Board carefully considers feedback from our dialogues with stockholders. We are fully evaluating a range of alternatives, including options for separating our flash and HDD franchises. Our intention is that the decisions yielded from this review will generate even greater stockholder value. Commitment to Leading Corporate Governance and Oversight Our Board is committed to maintaining the highest standards of corporate governance. This year, our routine evaluation of our governance practices prompted changes to further enhance our Board’s oversight, including adding political activity oversight to our Governance Committee’s formal responsibilities. As Western Digital evolves, we continue to evaluate our corporate governance practices to foster comprehensive and best-practice oversight. Also, as part of our commitment to best governance practices, we maintain a robust Board evaluation and refreshment process. Since 2020, we have welcomed three |

new independent directors to our Board, each of whom brings extensive experience and a new perspective. Our Board continues to value diversity; four of our last six independent director appointments were women and two were from underrepresented communities. Board-driven Stockholder Engagement In the past fiscal year, we maintained our year-round engagement with stockholders. Our stockholders’ feedback is a key input to our Board’s decision-making and our conversations have given us a greater understanding of a range of topics including business and strategy, board composition and diversity, executive compensation, people management and corporate responsibility matters. Directors, along with key members of our management team, participate in these discussions. Over the past year, we reached out to stockholders representing approximately 59% of shares outstanding and our engagement team conducted calls with 15 stockholders representing 33% of shares outstanding. These engagements continue to provide us with valuable feedback that allows our Board to better understand our stockholders’ priorities and perspectives and to incorporate them into our deliberations and decision making. |

| 2 | Western Digital 2022 Proxy Statement |

|

Corporate Responsibility and Sustainability At Western Digital, we are deeply committed to corporate responsibility in all aspects of our business, which includes transparency through robust disclosures. In the past year, we published our 2021 Sustainability Report. The report aligns with the Sustainability Accounting Standards Board (SASB) standards, Task Force on Climate-Related Financial Disclosures (TCFD) recommendations, UN Sustainable Development Goals (UN SDGs) and Global Reporting Initiative (GRI) standards. Within this report, we share key updates related to our commitment to emissions and energy intensity reductions, and initiatives to minimize our environmental impact and strengthen our supply chain, among others. |

We Ask for Your Support Thank you for your ongoing support and investment in Western Digital. We are grateful for the opportunity to serve the Company as we continue to strategically focus on sustainable and long-term growth. We welcome and appreciate your input and support for our voting recommendations at our Annual Meeting on November 16, 2022. Sincerely,  MATTHEW E. MASSENGILL  STEPHANIE A. STREETER |

|

| |

3 |

Notice of Annual Meeting

of Stockholders

Western Digital Corporation

5601 Great Oaks Parkway, San Jose,

California 95119

|

Date November 16, 2022 |

|

Time |

|

Location |

|

Who Can Vote A list of stockholders as of the record date for the annual meeting may be accessed during the virtual annual meeting at www.virtualshareholdermeeting. com/WDC2022 by using the control number on your Notice of Internet Availability of Proxy Materials, or on your proxy card or voting instruction form that accompanied your proxy materials. |

Matters to be Voted on

| Proposal |

Board Recommendation | ||

| 01 | Election of the eight director nominees named in the attached Proxy Statement to serve until our next annual meeting of stockholders and until their respective successors are duly elected and qualified |

|

VOTE FOR |

| 02 | Approval on an advisory basis of the named executive officer compensation disclosed in the attached Proxy Statement |

|

VOTE FOR |

| 03 | Approval of the amendment and restatement of our 2021 Long-Term Incentive Plan to increase by 2.75 million the number of shares of our common stock available for issuance under that plan |

|

VOTE FOR |

| 04 | Approval of the amendment and restatement of our 2005 Employee Stock Purchase Plan to increase by 6 million the number of shares of our common stock available for issuance under that plan |

|

VOTE FOR |

| 05 | Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for fiscal 2023 |

|

VOTE FOR |

At the meeting, we will also consider any other business that may properly come before our annual meeting and any postponements or adjournments of the meeting.

By Order of our Board of Directors,

MICHAEL C. RAY

Executive Vice President, Chief Legal Officer and Secretary

October 3, 2022

Voting Shares in Advance of the Meeting

Your vote is very important. Please submit your proxy as soon as possible via the Internet, telephone or mail. Submitting your proxy by one of these methods will ensure your vote will be counted regardless of whether you attend the annual meeting.

|

|

| ||

| Via the Internet Visit the website listed on your notice, proxy card or voting instruction form |

|

By Phone |

|

By Mail |

Important notice regarding the availability of proxy materials for our annual meeting of stockholders to be held on November 16, 2022:

On or about October 3, 2022, proxy materials for the annual meeting, including the attached Proxy Statement and our Annual Report for the fiscal year ended July 1, 2022, are being furnished to stockholders entitled to vote at the annual meeting. The Proxy Statement and 2022 Annual Report are available on our Investor Relations website at investor.wdc.com. You can also view these materials at www.proxyvote.com by using the control number provided on your proxy card or Notice of Internet Availability of Proxy Materials.

| 4 | Western Digital 2022 Proxy Statement |

Disclaimers

Cautionary Note Regarding

Forward-Looking Statements

This Proxy Statement contains forward-looking statements, including but not limited to, statements concerning our product and technology portfolio, views with respect to the growth of digital data, our business strategy and strategic priorities, including our review of strategic alternatives, our ability to execute our strategy, our future financial performance, our expectations regarding the impact of COVID-19 and other global events, our director succession plans and plans for our corporate responsibility and sustainability program, including our science-based emissions reduction targets, policies and reporting in the area of human rights and diversity and inclusion efforts. These forward-looking statements are based on our current expectations and are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements, including: volatility in global economic conditions; future responses to and effects of the COVID-19 pandemic; impact of business and market conditions; the outcome and impact of our ongoing strategic review, including with respect to customer and supplier relationships, regulatory and contractual restrictions, stock price volatility and the diversion of management’s attention from ongoing business operations and opportunities; impact of competitive products and pricing; our development and introduction of products based on new technologies and expansion into new data storage markets; risks associated with cost saving initiatives, restructurings, acquisitions, divestitures, mergers, joint ventures and our strategic relationships; difficulties or delays in manufacturing or other supply chain disruptions; hiring and retention of key employees; our level of debt and other financial obligations; changes to our relationships with key customers; disruptions in operations from cybersecurity incidents or other system security risks; actions by competitors; risks associated with compliance with changing legal and regulatory requirements and the outcome of legal proceedings; and other risks and uncertainties listed in our 2022 Annual Report on Form 10-K and our other reports filed with the Securities and Exchange Commission (the “SEC”), to which your attention is directed. You should not place undue reliance on these forward-looking statements, which speak only as of the date hereof, and we undertake no obligation to update these forward-looking statements to reflect subsequent events or circumstances.

Website References

You may also access additional information about Western Digital at investor.wdc.com. References to our website throughout this Proxy Statement are provided for convenience only and the content on our website does not constitute a part of this Proxy Statement.

| |

5 |

| 6 | Western Digital 2022 Proxy Statement |

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider. We encourage you to read this entire Proxy Statement for more information about these topics prior to voting.

Our Director Nominees

| Proxy Summary |

7 |

Board Nominee Highlights

| INDEPENDENCE | GENDER | AGE | TENURE |

| 88% Independent |

38% Women |

62 Years Average Age |

6 Years Average Tenure |

|

|

|

|

WOMEN IN BOARD LEADERSHIP ROLES

| Lead Independent Director | Audit Committee Chair | Governance Committee Chair |

Corporate Governance Highlights

Our Board of Directors is committed to maintaining the highest standards of corporate governance. We believe our strong corporate governance practices help promote the long-term interests of our stockholders and build public trust in us.

Corporate Governance Developments

Below is a description of some recent developments in our corporate governance practices:

| ● | Delegation of political and lobbying activity oversight, including strategy, activities and expenditures, to the Governance Committee following the establishment of our Government Affairs function |

| ● | Delegation of oversight responsibility to the Audit Committee of the legal and regulatory requirements regarding public disclosure of topics covered by our corporate responsibility and sustainability programs |

| ● | Clarification of committee and full Board roles in succession planning for our CEO and the executive team |

| ● | Implementation of quarterly assessments by the Governance Committee of actions taken in response to Board evaluations |

| 8 | Western Digital 2022 Proxy Statement |

CORPORATE GOVERNANCE BEST PRACTICES

|

✓Robust year-round Board-led stockholder engagement program that informs Board decisions

✓Independent Board leadership, including a Lead Independent Director with clearly defined roles and responsibilities

✓Commitment to Board diversity, with our Corporate Governance Guidelines requiring the Governance Committee to include, and instruct any search firm it engages to include, women and members of underrepresented communities in the director selection pool

✓Four of our last six independent director appointments were women and two were from underrepresented communities

✓Women serve in key Board leadership positions as our Lead Independent Director and Chairs of the Audit Committee and Governance Committee

✓All directors elected annually by a simple majority of votes cast

✓Seven of eight director nominees are independent

✓Director retirement policy upon reaching age 72

✓Active Board refreshment resulting in three new independent non-employee directors being appointed since 2020

✓Overboarding policy for additional public company directorships by directors |

✓Active Board oversight of strategic planning and risk management

✓Board committee oversight of corporate responsibility, sustainability and human capital management

✓Annual sustainability reporting via standalone Sustainability Report aligned with leading frameworks and standards

✓Succession planning for directors, our CEO and other key officers

✓Board committee oversight of political and lobbying activities and expenditures

✓Annual Board and committee self-evaluations

✓Annual individual assessments of directors

✓Anti-hedging, anti-pledging and clawback policies

✓All non-employee directors comply with our stock ownership guidelines

✓All executive officers achieved stock ownership requirements pursuant to our guidelines |

Year-Round Stockholder Engagement

As a continuation of our robust Board-driven stockholder engagement program, over the past year, we reached out to stockholders representing approximately 59% of shares outstanding and conducted calls with stockholders representing approximately 33% of shares outstanding, composed of investors with a variety of investment styles and geographic locations. Please see the section entitled “Corporate Governance Matters—Stockholder Engagement—Year-Round Stockholder Engagement and Feedback” on page 21 for a description of the topics discussed and stockholder feedback during our summer 2022 stockholder engagement.

|

We reached out to stockholders representing approximately 59% of shares outstanding and conducted calls with stockholders representing approximately 33% of shares outstanding |

| Proxy Summary |

9 |

Corporate Responsibility and Sustainability

We believe responsible and sustainable business practices support the long-term success of our company. The practices help keep our communities and our environment vibrant and healthy. They also lead us to more efficient and resilient business operations, help us meet our customers’ efficiency targets, reduce risks of misconduct and legal liability, enhance the reliability of our supply chain and improve the health, well-being, engagement and productivity of our employees. We believe that being an industry leader is not just about having talented employees or innovative products. It is also about doing business the right way, every day. That is why our commitment to corporate responsibility is deeply embedded throughout our business.

From fiscal 2020 to fiscal 2021, we reduced aggregate Scope 1 and market-based Scope 2 emissions by more than 6%. We were also recognized as one of the World’s Most Ethical Companies for the fourth consecutive year in 2022 by Ethisphere and one of America’s Most Responsible Companies by Newsweek in 2021 and 2022.

Additionally, we thrive on the power and potential of diversity. By taking into account various perspectives, we get the best outcomes for our employees, our company, our customers and the world around us. We are committed to promoting an inclusive environment where every individual can thrive through a sense of belonging, respect and contribution. In fiscal 2022, we were once again recognized by Human Rights Campaign Best Places to Work for LGBTQ+ Equality 2022. We also received the Above and Beyond Award and the Pro Patria Award from the Employer Support of the Guard and Reserve for our support of employees who serve in the U.S. National Guard and Reserve.

Our 2021 Sustainability Report is located on our Corporate Responsibility – Overview page at www.westerndigital.com. The topics covered were selected based on a detailed materiality assessment completed by a third party, which incorporated input from investors, customers and other stakeholders, as well as strategic priorities, and the report aligns with the Sustainability Accounting Standards Board (“SASB”) standards, Task Force on Climate-Related Financial Disclosures (“TCFD”) recommendations, UN Sustainable Development Goals (“UN SDGs”) and Global Reporting Initiative (“GRI”) standards. The Governance Committee oversees our corporate responsibility and sustainability policies and programs pursuant to its charter. For more information, please refer to the section entitled “Corporate Responsibility and Sustainability” on page 22. We plan to release our 2022 Sustainability Report later this calendar year.

| 10 | Western Digital 2022 Proxy Statement |

Our Board of Directors is presenting eight nominees for election as directors at our 2022 annual meeting of stockholders (“Annual Meeting”). Each of the nominees is currently a member of our Board and was elected to our Board at the 2021 annual meeting of stockholders. Each director elected at the Annual Meeting will serve until our 2023 annual meeting of stockholders and until a successor is duly elected and qualified. Each of the nominees has consented to be named in this Proxy Statement and to serve as a director if elected. If any nominee is unable or unwilling for good cause to stand for election or serve as a director if elected, the persons named as proxies may vote for a substitute nominee designated by our existing Board of Directors, or our Board may choose to reduce its size.

Ms. Price has not been nominated for re-election at the Annual Meeting and her term of service will end immediately prior to the Annual Meeting. Our Board intends to reduce the size of our Board to eight directors immediately following the Annual Meeting. Stockholders may not vote their shares for more than eight director nominees.

Vote Required for Approval

Each director nominee will be elected as a director if the nominee receives the affirmative vote of a majority of the votes cast with respect to his or her election (in other words, the number of votes “FOR” a director must exceed the number of votes cast “AGAINST” that director). You may vote FOR, AGAINST or ABSTAIN with respect to each director nominee. Proxies received by our Board of Directors will be voted FOR each director nominee unless specified otherwise.

Under our By-laws, any incumbent director who fails to be elected must offer to tender his or her resignation to our Board. If the director conditions his or her resignation on acceptance by our Board, the Governance Committee will then make a recommendation to our Board on whether to accept or reject the resignation or whether other action should be taken. Our Board will act on the resignation and publicly disclose and explain its decision within 90 days from the date the election results are certified. The director who tenders his or her resignation will not participate in our Board’s or the committee’s decision.

| Corporate Governance Matters |

11 |

Below is information about the experience and other key qualifications and attributes of each of our Board’s eight director nominees.

KIMBERLY E. ALEXY, 52

INDEPENDENT Director Since: November 2018

Committees:

|

QUALIFICATIONS Ms. Alexy brings to our Board deep expertise in finance, securities and corporate governance at several financial institutions and publicly held companies, with more than 25 years of experience in capital markets, corporate finance and investments. Ms. Alexy has a CFA designation and also contributes her specialized knowledge of cybersecurity issues, which includes a CERT Certificate in Cybersecurity Oversight for corporate directors issued by the CERT Division of the Software Engineering Institute at Carnegie Mellon University. Her financial skills and prior experience qualify her as an audit committee financial expert under SEC rules. In addition, her service on numerous public company boards of directors, including having served as a chair of the audit or governance committees of many of those boards, provides our Board with valuable insights and perspectives. Current ●Five9, Inc.

Past Five Years ●Mandiant, Inc.

●Alteryx, Inc.

●CalAmp Corporation

●Microsemi Corporation

|

CAREER HIGHLIGHTS Alexy Capital Management, a private investment fund ●Founder and principal (2005-present)

Prudential Securities ●Senior vice president and managing director (1998-2003)

Lehman Brothers ●Vice president of equity research (1995-1998)

|

THOMAS CAUFIELD, 63

INDEPENDENT Director Since: July 2021

Committees:

|

QUALIFICATIONS Dr. Caulfield brings to our Board many years of experience in the semiconductor industry, spanning engineering, management and global operational leadership, and expertise in business leadership, corporate strategy, manufacturing and marketing experience. He also brings prior public company board experience. Current ●GlobalFoundries Inc.

Past Five Years ●None

|

CAREER HIGHLIGHTS GlobalFoundries, Inc., a multinational semiconductor contract manufacturing and design company ●CEO (March 2018-present)

●Senior vice president and general manager, Fab 8 semiconductor wafer manufacturing facility (2014-March 2018)

Soraa, Inc. ●President and chief operating officer (2012-2014)

Caitin Inc. ●CEO (2010-2012)

|

|

Audit |  |

Compensation and Talent |  |

Governance |  |

Executive |  |

Committee Chair |

| 12 | Western Digital 2022 Proxy Statement |

MARTIN I. COLE, 66

INDEPENDENT Director Since: December 2014

Committees:

|

QUALIFICATIONS Mr. Cole brings to our Board extensive senior executive leadership experience across a variety of business sectors and geographies. This demonstrates his ability to provide strategic advice and lead multiple teams across a variety of business sectors, and provides him with wide-ranging insights, including relating to technology solutions, which are an important part of our business. Mr. Cole has significant experience establishing and overseeing executive compensation programs as a former executive, CEO and as a board and compensation committee member at other public companies. His former executive and board roles, along with his financial experience, qualify him as an audit committee financial expert under SEC rules. Current ●The Western Union Company

Past Five Years ●Cloudera, Inc.

|

CAREER HIGHLIGHTS 3i Group plc, a private equity firm ●Senior adviser (January 2017-present)

Cloudera, Inc., an enterprise data management systems company ●Interim CEO (August 2019-January 2020)

Accenture plc ●Chief executive – technology (2012-2014)

●Chief executive – communications, media and technology group (2006-2012)

●Chief executive – government operating group (2004-2006)

●Managing partner, outsourcing and infrastructure group (2002-2004)

|

TUNÇ DOLUCA, 64

INDEPENDENT Director Since: August 2018

Committees:

|

QUALIFICATIONS Mr. Doluca brings to our Board 40 years of executive leadership and technical experience in the semiconductor industry, which provides our Board with valuable perspectives directly relevant to our business. As a seasoned CEO and director of a large public technology company, he has expertise in corporate strategy, financial management, operations, marketing and research and development, and significant experience establishing and overseeing executive compensation programs, all which are critical to achieving our strategic objectives. Current ●Analog Devices, Inc.

Past Five Years ●Maxim Integrated

|

CAREER HIGHLIGHTS Maxim Integrated (acquired by Analog Devices, Inc. in August 2021), an integrated circuits manufacturing company ●President and CEO (2007- August 2021)

●Group president (2005-2007)

●Senior vice president (2004-2005)

●Vice president (1994-2004)

|

|

Audit |  |

Compensation and Talent |  |

Governance |  |

Executive |  |

Committee Chair |

| Corporate Governance Matters |

13 |

DAVID V. GOECKELER, 60

CHIEF EXECUTIVE OFFICER Director Since: March 2020

Committees:

|

QUALIFICATIONS Mr. Goeckeler brings to our Board indispensable knowledge and expertise developed during his 20 years of experience in technical and leadership positions at Cisco, including more than six years in senior management positions there, and his current position as our CEO. Current ●Automatic Data Processing, Inc.

Past Five Years ●None

|

CAREER HIGHLIGHTS Western Digital Corporation ●CEO (March 2020-present)

Cisco Systems, Inc., a multinational technology company ●Executive vice president and general manager, networking and security (July 2017-March 2020)

●Senior vice president and general manager, networking and security business group (2016-2017)

●Senior vice president and general manager, security business (2014-2016)

|

MATTHEW E. MASSENGILL, 61

INDEPENDENT CHAIR OF THE BOARD Director Since: January 2000

Committees:

|

QUALIFICATIONS Mr. Massengill brings to our Board extensive and significant experience directly relevant to our business developed during his many years of service to Western Digital as an executive and Board member. As our former CEO, President and Chief Operating Officer, he has a deep understanding of our operations, provides valuable knowledge to our Board on the issues we face to achieve our strategic objectives and has extensive international experience. His prior service on numerous other public company boards of directors also provides our Board with important board-level perspective. Current ●None

Past Five Years ●Microsemi Corporation

|

CAREER HIGHLIGHTS Western Digital Corporation ●Chair of the Board (2001-2007)

●CEO (2000-2005)

●President (2000-2002)

●Chief Operating Officer (1999-2000)

|

|

Audit |  |

Compensation and Talent |  |

Governance |  |

Executive |  |

Committee Chair |

| 14 | Western Digital 2022 Proxy Statement |

STEPHANIE A. STREETER, 65

LEAD INDEPENDENT DIRECTOR Director Since: November 2018

Committees:

|

QUALIFICATIONS Ms. Streeter brings to our Board extensive senior executive leadership experience overseeing companies with manufacturing and operations across the globe. She has served on several public company boards of directors, with substantial governance experience as a director and former governance committee member of several public companies such as Goodyear and Kohl’s. She also has significant experience establishing and overseeing executive compensation programs as a former CEO and as a board and compensation committee member at other public companies. Current ●Kohl’s Corporation

Past Five Years ●Olin Corporation

●Goodyear Tire & Rubber Company

|

CAREER HIGHLIGHTS Libbey Inc. ●CEO (2011-2016)

U.S. Olympic Committee ●Acting CEO (2009-2010)

●Board member (2004-2009)

Banta Corporation ●President and CEO (2001-2007)

|

MIYUKI SUZUKI, 62

INDEPENDENT Director Since: July 2021

Committees:

|

QUALIFICATIONS Ms. Suzuki brings to our Board extensive leadership experience in the technology and telecommunications industries. She has deep global operations experience across the Asia Pacific region, including substantial governance experience as a director of two-Japanese based companies (MetLife Japan and Jera Co., Inc.). Current ●Twilio Inc.

Past Five Years ●None

|

CAREER HIGHLIGHTS Cisco Systems, Inc. ●President, Asia Pacific, Japan and China (January 2018-February 2021)

●President and general manager, Japan (2015-January 2018)

Jetstar Japan ●President and CEO (2011-2015)

KVH (now Colt Technology Services) ●President and vice chairman (2007-2011)

Lexis Nexis Asia Pacific ●President and CEO (2004-2006)

Japan Telecom ●Executive vice president and head of consumer business (2002-2004)

|

|

Audit |  |

Compensation and Talent |  |

Governance |  |

Executive |  |

Committee Chair |

| Corporate Governance Matters |

15 |

Director Meeting Attendance

During fiscal 2022, our Board of Directors met 12 times. Each of the directors who served during fiscal 2022 attended 75% or more of the aggregate number of Board meetings and meetings of our Board committees on which he or she served during fiscal 2022.

Our Board strongly encourages each director to attend our annual meeting of stockholders. All directors standing for election at the 2021 annual meeting of stockholders were in attendance.

STRONG DIRECTOR ENGAGEMENT

Average director attendance at fiscal 2022 Board and committee meetings:

| Board | Audit | Compensation and Talent | Governance |

| 97% | 96% | 97% | 91% |

Over 95% Board and committee meeting aggregate average attendance in fiscal 2022.

Our Board of Directors believes our nominees’ breadth of experience, diversity and mix of qualifications, attributes, tenure and skills strengthen our Board’s independent leadership and effective oversight of management.

| INDEPENDENCE | GENDER | AGE | TENURE |

| 88% Independent |

38% Women |

62 Years Average Age |

6 Years Average Tenure |

|

|

|

|

WOMEN IN BOARD LEADERSHIP ROLES

| Lead Independent Director | Audit Committee Chair | Governance Committee Chair |

| 16 | Western Digital 2022 Proxy Statement |

DIRECTOR NOMINEE SKILLS, EXPERIENCE AND BACKGROUNDS

|

|

|

|

|

|

|

| ||

|

EXECUTIVE EXPERIENCE Experience in executive-level positions is important to gain a practical understanding of complex organizations, corporate governance, operations, talent development, strategic planning and risk management |

|

|

|

|

|

|

| |

|

SEMICONDUCTOR EXPERIENCE Experience in the semiconductor industry is important in understanding our technology, products and operations, which is critical for our future growth |

|

|

|

|

|

|

|

|

|

DATA INFRASTRUCTURE EXPERIENCE Experience in data infrastructure, including related software, hardware and data centers, storage, protection and management is important to understanding the issues and opportunities facing our business |

|

|

|

|

|

|

|

|

|

STRATEGIC TRANSACTIONS EXPERIENCE Experience leading a company through a large transition, transformation, integration, merger or acquisition is key to our Board’s review of strategic alternatives aimed at further optimizing long-term value for our stockholders |

|

|

|

|

|

|

|

|

|

MANUFACTURING Experience with sophisticated, large-scale manufacturing increases our Board’s understanding of our distribution, supply chain and manufacturing facilities |

|

|

|

|

|

|

|

|

|

OPERATIONS AND INFRASTRUCTURE Experience with complex, global operations assists our Board in fostering our operational excellence and adapting to evolving market conditions |

|

|

|

|

|

|

|

|

|

TECHNOLOGY/INNOVATION Experience in researching, developing or designing leading-edge technologies is critical for the continued growth and innovation of our business |

|

|

|

|

|

|

|

|

|

GLOBAL EXPERIENCE Experience with businesses with substantial international operations provides critical business and cultural perspectives to our Board and is important in understanding the strategic opportunities and risks relating to our business |

|

|

|

|

|

|

|

|

|

FINANCE AND ACCOUNTING Experience overseeing accounting and financial reporting is key to our Board’s oversight of our financial reporting process and internal controls |

|

|

|

|

|

|

|

|

|

CYBERSECURITY Experience understanding and managing information technology and cybersecurity threats is increasingly important to mitigate risks to our business |

|

|

|

|

|

|

|

|

|

RISK MANAGEMENT Experience in assessing and managing enterprise risks is critical to our Board’s role in overseeing our enterprise risk management program |

|

|

|

|

|

|

|

|

|

CORPORATE SUSTAINABILITY AND RESPONSIBILITY Experience in assessing environmental, sustainability, climate-related risks and social responsibility initiatives is critical to our Board’s role in overseeing our corporate responsibility and sustainability policies and programs |

|

|

|

|

|

|

|

|

|

HUMAN CAPITAL MANAGEMENT Experience in human capital management in large organizations assists our Board in overseeing succession planning, talent development and our executive compensation program |

|

|

|

|

|

|

|

|

|

MEMBER OF AN UNDERREPRESENTED COMMUNITY Self-identifies as racially or ethnically diverse, or as a member of the LGBTQ+ community |

| |||||||

|

GENDER Self-identified gender Male = M; Female = F; Nonbinary, third gender or other = O |

F | M | M | M | M | M | F | F |

|

Indicates “Technical or Managerial Expertise” (expertise derived from direct and hands-on experience or direct managerial experience with the subject matter during his/her career) |

|

Indicates “Working Knowledge” (experience derived through: (i) board or relevant committee membership at our company or another public company; (ii) executive leadership or board membership of a public company in the relevant industry; or (iii) consulting, investment banking, private equity investing or legal experience) |

| OUR BOARD IS HIGHLY ENGAGED AND WELL QUALIFIED, AND ALL DIRECTOR NOMINEES POSSESS THE SKILLS AND EXPERIENCES NECESSARY TO OVERSEE OUR EVOLVING AND GROWING BUSINESS. |

| Corporate Governance Matters |

17 |

Board Diversity Matrix (As of October 3, 2022)

Our Board of Directors believes that having a mix of directors with diverse and complementary qualifications, expertise and attributes is fundamental to meeting its oversight responsibility. The table below reflects certain diversity information for our current Board based on self-identification by each director.(1)

| Total Number of Directors | 9 | |||||||

| Did Not Disclose | ||||||||

| Female | Male | Non-Binary | Gender | |||||

| Part 1: Gender Identity | ||||||||

| Directors | 4 | 5 | — | — | ||||

| Part II: Demographic Background | ||||||||

| African American or Black | 1 | — | — | — | ||||

| Asian | 1 | — | — | — | ||||

| White | 2 | 5 | — | — |

| (1) | Includes information for Paula A. Price, who has not been nominated for reelection at the Annual Meeting and her term of service will end immediately prior to the Annual Meeting. |

Director Independence

Our Board of Directors has reviewed and discussed information provided by the directors and our company with regard to each director’s business and personal activities, as well as those of the director’s immediate family members, as they may relate to our company or our management. The purpose of this review is to determine whether there are any transactions or relationships that would be inconsistent with a determination that a director is independent under the listing standards of the Nasdaq Stock Market. Based on its review, our Board has affirmatively determined that, except for serving as a member of our Board, none of our current non-employee directors (Messrs. Caulfield, Cole, Doluca or Massengill, or Mses. Alexy, Price, Streeter or Suzuki) has any relationship that, in the opinion of our Board, would interfere with such director’s exercise of independent judgment in carrying out his or her responsibilities as a director, and that each such director qualifies as “independent” as defined by the listing standards of the Nasdaq Stock Market. Our Board also previously determined that Kathleen A. Cote, who served as a non-employee director until her retirement from our Board in November 2021, qualified as “independent” as defined by the listing standards of the Nasdaq Stock Market during the period of her service in fiscal 2021. Mr. Goeckeler is currently a full-time, executive-level employee of our company and, therefore, is not “independent” as defined by the listing standards of the Nasdaq Stock Market.

| 18 | Western Digital 2022 Proxy Statement |

Director Nominations, Board Refreshment

and Diversity

Key Director Criteria

The Governance Committee has adopted a policy regarding critical factors to be considered in selecting director nominees, which include: the nominee’s personal and professional ethics, integrity and values; the nominee’s intellect, judgment, foresight, skills, experience and achievements, all of which are viewed in the context of the overall composition of our Board of Directors; the absence of any conflict of interest or legal impediment to, or restriction on, the nominee serving as a director; having a majority of independent directors on our Board; and representation of the long-term interests of our stockholders as a whole and a diversity of backgrounds and expertise, which are most needed and beneficial to our Board and our company.

The Governance Committee is committed to Board diversity and takes into account the personal characteristics, experience and skills of current and prospective directors, including gender, race, ethnicity and membership in another underrepresented community, to ensure that a broad range of perspectives is represented on our Board to effectively perform its governance role and oversee the execution of our strategy.

As further detailed below, the Governance Committee annually evaluates the size and composition of our Board and assesses whether the composition appropriately aligns with our evolving business and strategic needs. Through this process, our Board, upon the recommendation of the committee, develops a list of qualifications, skills and attributes sought in director candidates. Specific director criteria evolve over time to reflect our strategic and business needs and the changing composition of our Board.

Diverse Director Candidate Pool Provision

Our Corporate Governance Guidelines require the Governance Committee to include, and instruct any search firm it engages to include, women and members of underrepresented communities in the pool from which the committee selects director nominees. The diverse director candidate pool provision reflects our Board’s continued commitment to diversity in the boardroom. Of the last six independent directors to join our Board, four were women, including two from underrepresented communities.

| Corporate Governance Matters |

19 |

Director Nomination Process

|

ASSESS |

|

Our Board of Directors, led by the Governance Committee, evaluates the size and composition of our Board at least annually, considering the evolving skills, perspectives and experience needed on our Board to perform its governance and oversight role as our business transforms and the underlying risks change over time. Among other factors, the committee considers our strategy and needs, as well as our directors’ skills, expertise, experiences, tenure, age and backgrounds, including gender, race, ethnicity and membership in another underrepresented community. After assessing these factors, our Board develops criteria for potential candidates to be additive and complementary to the overall composition of our Board. Specific director criteria evolve over time to reflect our strategic and business needs and the changing composition of our Board. | |

|

IDENTIFY |

|

The Governance Committee is authorized to use any methods it deems appropriate for identifying candidates for membership on our Board of Directors, including considering recommendations from incumbent directors, management or stockholders and engaging the services of an outside search firm to identify suitable potential director candidates. The committee will include, and instruct any search firm it engages to include, women and members of underrepresented communities in the pool of director candidates. | |

|

EVALUATE |

|

The Governance Committee has established a process for evaluating director candidates that it follows regardless of who recommends a candidate for consideration. Through this process, the committee considers a candidate’s skills and experience, outside commitments and other available information regarding each candidate. For incumbent director candidates, this process includes consideration of the results of the annual Board and committee evaluations. See the section entitled “Board Processes and Policies—Board Evaluation” below. Following the evaluation, the committee recommends nominees to our Board. | |

|

NOMINATE |

|

Our Board of Directors considers the Governance Committee’s recommended nominees, analyzes their independence and qualifications and selects nominees to be presented to our stockholders for election to our Board. | |

Stockholder Recommendations and Nominations of Director Candidates

The Governance Committee may receive recommendations for director candidates from our stockholders. Additionally, our stockholders may nominate director candidates for inclusion in our proxy materials pursuant to the proxy access right set forth in our By-laws or may nominate directors for election at future annual meetings of our stockholders pursuant to the advance notice provisions set forth in our By-laws, in each case as described further below.

Stockholder Recommendations of Director Candidates

A stockholder may recommend a director candidate to the Governance Committee by delivering a written notice to our Secretary at our principal executive offices and including the following in the notice: the name and address of the stockholder as they appear on our books or other proof of share ownership; the class and number of shares of our common stock beneficially owned by the stockholder as of the date the stockholder gives written notice; a description of all arrangements or understandings between the stockholder and the director candidate and any other person(s) pursuant to which the recommendation or nomination is to be made by the stockholder; the name, age, business address and residence address of the director candidate and a description of the director candidate’s business experience for at least the previous five years; the principal occupation or employment of the director candidate; the class and number of shares of our common stock beneficially owned by the director candidate; the consent of the director candidate to serve as a member of our Board of Directors if appointed or elected; and any other information required to be disclosed with respect to a director nominee in solicitations for proxies for the election of directors pursuant to applicable rules of the SEC.

| 20 | Western Digital 2022 Proxy Statement |

The committee may require additional information as it deems reasonably required to determine the eligibility of the director candidate to serve as a member of our Board of Directors. Stockholders recommending candidates for consideration by our Board in connection with the next annual meeting of stockholders should submit their written recommendation no later than June 1 of the year of that meeting.

The committee will evaluate director candidates recommended by stockholders for election to our Board in the same manner and using the same criteria as it uses for any other director candidate. If the committee determines that a stockholder-recommended candidate is suitable for membership on our Board, it will include the candidate in the pool of candidates to be considered for nomination upon the occurrence of the next vacancy on our Board or in connection with the next annual meeting of stockholders.

Proxy Access

Our By-laws provide for proxy access, a means for our stockholders to include stockholder-nominated director candidates in our proxy materials for annual meetings of stockholders. A stockholder, or group of not more than 20 stockholders (collectively, an “eligible stockholder”), meeting specified eligibility requirements is generally permitted to nominate the greater of: (i) two director nominees; and (ii) 20% of the number of directors on our Board. In order to be eligible to use the proxy access process, an eligible stockholder must, among other requirements, have owned 3% or more of our outstanding common stock continuously for at least three years and deliver written notice of the nomination to our Secretary in the manner described in Section 2.14 of our By-laws and within the time periods set forth in this Proxy Statement in the section entitled “Additional Information—General Information About the Annual Meeting—Submission of Stockholder Proposals and Director Nominations.” Use of the proxy access process to submit stockholder nominees is subject to additional eligibility, procedural and disclosure requirements set forth in Section 2.14 of our By-laws.

Other Director Nominations

Stockholders who wish to nominate a person for election as a director in connection with an annual meeting of stockholders (as opposed to making a recommendation to the Governance Committee as described above) and who do not intend for the nomination to be included in our proxy materials pursuant to the proxy access process described above must comply with the advance notice requirement set forth in our By-laws. To comply, a stockholder must deliver written notice of the nomination to our Secretary in the manner described in Section 2.11 of our By-laws and within the time periods set forth in this Proxy Statement in the section entitled “Additional Information—General Information About the Annual Meeting—Submission of Stockholder Proposals and Director Nominations.”

Board Refreshment

Our Board of Directors believes that periodic Board refreshment can provide new experiences and fresh perspectives to our Board and is most effective if it is sufficiently balanced to maintain continuity among Board members that will allow for the sharing of historical perspectives and experiences relevant to our company. Our Board seeks to achieve this balance through its director succession planning process and director retirement policy described below. Our Board also utilizes the annual Board and individual director assessment process discussed below under “Board Processes and Policies—Board Evaluation” to help inform its assessment of our Board’s composition and Board refreshment needs. In keeping with our commitment to Board refreshment, we have currently engaged an executive search firm to assist us in identifying and evaluating potential independent director nominees to join our Board.

| Seven New Directors Elected in the Past Five Years |

Succession Planning

Our Board of Directors is focused on ensuring that it has members with diverse skills, expertise, experience, tenure, age and backgrounds, including gender, race and ethnicity, because a broad range of perspectives is critical to effective corporate governance and overseeing the execution of our strategy. The Governance Committee has developed a long-range succession plan to identify and recruit new directors, and three independent non-employee directors have been appointed since 2020. The committee also plans for the orderly succession of the Chairs of our Board’s committees.

| Additional Information |

21 |

Retirement Policy

To help facilitate the periodic refreshment of our Board of Directors, our Corporate Governance Guidelines provide that no director shall be nominated for re-election after the director has reached the age of 72. Three members of our Board have retired pursuant to this retirement policy since 2019.

Board’s Role and Responsibilities

Our Board of Directors and management are committed to regular engagement with our stockholders and soliciting their views and input on important performance, executive compensation, governance, environmental, social, human capital management and other matters.

| ● |

Board-Driven Engagement. In addition to the Governance Committee’s oversight of the stockholder engagement process and the periodic review and assessment of stockholder input, our directors also engage directly with our stockholders by periodically participating in stockholder outreach. |

| ● |

Year-Round Engagement and Board Reporting. Our executive management members and directors, together with our investor relations and legal teams, conduct outreach to stockholders throughout the year to obtain their input on key matters and keep our management and Board informed about the issues that our stockholders tell us matter most to them. |

| ● |

Transparency and Informed Compensation Decisions and Governance Enhancements. The Compensation and Talent and Governance Committees routinely review our executive compensation design and governance practices and policies, respectively, with an eye towards continual improvement and enhancements. Stockholder input is regularly shared with our Board, its committees and management, facilitating a dialogue that provides stockholders with transparency into our executive compensation design and governance practices and considerations, and informs our company’s enhancement of those practices. |

Year-Round Stockholder Engagement

|

Over the past year, we reached out to stockholders representing approximately 59% of shares outstanding and conducted calls with stockholders representing approximately 33% of shares outstanding, composed of investors with a variety of investment styles and geographic locations. Our Chair of the Compensation and Talent Committee, an independent director, led many of these stockholder calls. |

Summer 2022 Stockholder Engagement and Feedback

In our recent summer 2022 stockholder engagement, we discussed a variety of topics. Key areas of focus included the following topics:

| ● |

Our strategic review process, the evolution of our business and product strategy and resulting performance |

| ● |

Executive compensation philosophy and actions taken in light of the strategic review process, ongoing stockholder feedback and further refinement in aligning pay with performance |

| ● |

Executive leadership team composition and alignment with our long-term strategy |

| ● |

Board composition, skills, experience and diversity |

| ● |

Corporate responsibility and sustainability, including recent highlights related to our energy and emissions, human rights and lifecycle impacts work |

| ● |

Diversity, equity and inclusion (“DE&I”) initiatives, reporting and oversight |

| 22 | Western Digital 2022 Proxy Statement |

Given the significance of the strategic review that was underway during these engagements, investors appreciated Board dialogue on prioritizing long-term value creation, maintaining the leadership team during this period and evolving our incentive structures to be durable into the future. Investors also appreciated the progress we made in the areas of sustainability disclosure and DE&I initiatives.

We share all feedback received as part of our engagement program with our Board to help inform dialogue and future decisions. In the past year, for example, stockholder feedback influenced changes in how we manage our dilution and the incorporation of environmental, social and governance (“ESG”) goals into our incentive compensation program. Specifically, we took action to manage our equity burn rate and dilution by introducing cash awards for mid-level employees in lieu of equity under our long-term incentive (“LTI”) program. As the Compensation and Talent Committee made adjustments to the fiscal 2023 compensation program, the committee approved the addition of ESG goals for the fiscal 2023 short-term incentive (“STI”) plan as part of the individual performance component (“IPC”), which include emissions reduction goals and DE&I goals for our named executive officers.

Corporate Responsibility and Sustainability

We believe responsible and sustainable business practices support our long-term success as a company. Those practices help keep our communities and our environment vibrant and healthy. They also lead us to more efficient and resilient business operations, help us meet our customers’ efficiency targets, reduce risks of misconduct and legal liability, enhance the reliability of our supply chain and improve the health, well-being, engagement and productivity of our employees. We believe that being an industry leader is not just about having talented employees or innovative products. It is also about doing business the right way, every day. That is why our commitment to sound corporate responsibility is deeply rooted in all aspects of our business.

Oversight by Our Board of Directors

Sound corporate responsibility in all aspects of our business is a focus of our Board of Directors. The Governance Committee is responsible for assisting our Board in overseeing the development and maintenance of our corporate responsibility and sustainability policies, practices and programs, including our public sustainability reporting. The committee has specific responsibility for periodically reviewing our policies and practices related to human rights, environmental and climate change and other topics as may be designated by our Board from time to time. The committee receives updates from our sustainability group and management regularly, including progress towards our sustainability initiatives or established targets or goals, and reviews trends, priorities and implementation of new sustainability initiatives.

The Audit Committee is responsible for reviewing the implementation of legal or regulatory requirements regarding public disclosure of topics covered by our corporate responsibility and sustainability programs and management’s controls and procedures with respect to these disclosures.

In addition, the Compensation and Talent Committee periodically reviews our people policies and programs, including those focusing on talent attraction, engagement and retention, DE&I and other topics as may be designated by our Board from time to time.

| Corporate Governance Matters |

23 |

2021 Sustainability Report

Our 2021 Sustainability Report is located on our Corporate Responsibility – Overview page at www.westerndigital.com. The topics covered were selected based on a detailed materiality assessment completed by a third party, which incorporated input from investors, customers and other stakeholders, as well as strategic priorities, and the report aligns with SASB standards, TCFD recommendations, UN SDGs and GRI standards. Below are notable highlights from our 2021 Sustainability Report, which covered our fiscal 2021:

|

Human Rights and Labor |

|

Energy and Emissions |

|

Lifecycle Impacts |

|

Respecting human rights is a foundational aspect of how we do business. We work diligently to foster a working environment where Western Digital employees and employees of our suppliers can be treated with respect and dignity and are provided with fair and safe working conditions. ●Completed a global human rights impact assessment

●Expanded our disclosure of human rights and labor management practices in our Modern Slavery Compliance Statement

●Enhanced human rights-related training to our supply chain |

We aim to do our part in helping build an environmentally sustainable future by reducing our energy consumption, investing in conservation projects and managing our impacts on the environment. ●Set science-based emissions reduction targets, which were approved by the Science Based Targets initiative

●Achieved a year-over-year 3.8% reduction in energy use and a 25% reduction in energy intensity

●Completed a climate-scenario analysis aligned with TCFD recommendations

●Completed a robust Scope 3 emissions data analysis to support emissions reduction targets |

We care for our world at every step, everywhere we operate. Because our products are used widely throughout the world, we are committed to delivering products designed and manufactured with long-term sustainability in mind. ●Enabled the diversion of over six metric tons of waste from landfills since the launch of our product takeback program in April 2020

●Completed several ISO-conformant lifecycle assessments to evaluate the impacts of our products

●Kicked off new initiatives to reduce packaging and increase use of recycled materials | |||

|

|

|||||

|

Diversity, Equity and Inclusion |

|

Health and Safety/COVID-19 |

|

Integrity |

|

Our people are Western Digital’s most valuable resource. We believe we can achieve the best business outcomes by empowering our diverse and talented employees to make an impact, together. ●Disclosed pay equity results and Employment Information Report (EEO-1) data

●Recognized for the third consecutive year by Women’s Choice Award as a Best Company for Millennials, and received a perfect score from Human Rights Campaign in their Corporate Equality Index

●Promoted a Global Anti-Harassment and Discrimination Policy with associated training worldwide |

As a company that has positioned itself to be the world’s leading data infrastructure company, we remain committed to providing essential infrastructure to support our world community during this worldwide pandemic. We do so with the health and safety of our employees as our first priority. ●Phased return-to-site plan based on local guidance and global best practice

●Facilitated vaccinations, including through vaccine drives in India, Thailand, Malaysia and the Philippines

●Provided paid leave for employees impacted by COVID-19 |

As a global company operating across a wide range of geographies, Western Digital is committed to doing business fairly and legally. We set a consistent tone across our organization to form our global culture of integrity. ●Recognized by Ethisphere Institute for the fourth consecutive year as one of the World’s Most Ethical Companies

●100% of operations assessed for risks related to corruption since 2016

●Zero reportable breaches of personal data in 2020 or in 2021 | |||

| 24 | Western Digital 2022 Proxy Statement |

Our People Strategy

Our employees are paramount to our journey to transform our company and redefine the data storage market. To this end, our people strategy is grounded in the intention to hire, engage and retain the best talent to support our vision of creating breakthrough innovation that enables the world to actualize its aspirations. We hired a new Chief People Officer in fiscal 2022 to help accelerate the transformation of our human resources function to be more people-centric and to drive better outcomes for the business.

Diversity, Equity and Inclusion

We aim to leverage the power and potential of diversity. We are committed to promoting an inclusive environment where every individual can thrive through a sense of belonging, respect and contribution. We are committed to hiring inclusively, providing training and development opportunities, ensuring equitable pay for all employees and we continue to focus on increasing diverse representation at every level of our company.

|

Racial/Ethnic Diversity(1) |

Gender Diversity | |

|

U.S. Management |

Management |

Technical Staff |

We saw percentage point increases among our new college graduate hires in fiscal 2022 of 2.5 for women, 1.4 for Hispanic/Latinx and 1.0 for multiracial representation.

| (1) | As of July 1, 2022. Racially/ethnically diverse U.S. Management group consists of members of Asian, Black/African American, Hispanic/Latinx or other racially or ethnically diverse communities. |

Our employee resource groups (“ERGs”) help create an inclusive culture that embraces the uniqueness of our employees. We have several ERG communities, focusing on women, LGBTQ+, racial and ethnic minorities, military and people with disabilities. In fiscal 2022, we launched a self-identification initiative that invited employees to share more about who they are across dimensions of gender, gender identity, veteran status and disabilities. Participation was optional, data was protected and the results were anonymized. We believe an in-depth understanding of our employee population will enable us to better engage and retain our talent.

| Corporate Governance Matters |

25 |

Compensation and Benefits

We believe in the importance of investing in our people, and we do that through a robust total rewards program. Some achievements and initiatives of our compensation program include:

| ● | Benchmarked our compensation and benefits programs using market data from reputable third-party consultants |

| ● | Conducted internal focus groups and employee surveys to inform programs and identify opportunities |

| ● | Expanding our annual pay equity assessment to cover 100% of our employee population globally to ensure that men and women receive equal pay for equal work |

| ● | Implemented a global recognition program as part of compensation to celebrate the contributions of employees who bring our core values and cultural attributes to life |

| ● | Expanded benefits access for our employees to caregivers and enhanced behavioral health benefits for dependent children in the U.S. |

| ● | Enhanced medical coverage in our larger countries and offered flexible benefits in India |

Talent Attraction, Development and Engagement

Foundational to our people strategy is the attraction, development and engagement of our employees. In fiscal 2022, we continued to enhance our people strategy with the following achievements and initiatives:

| ● | Adopted a skills-based philosophy that screens and hires employees based on capabilities and potential, and we plan to continue the implementation of these practices in fiscal 2023 |

| ● | Conducted a pilot program that aimed to remove potential for bias from our talent sourcing process and broaden our diverse talent pool, and tested technology to make sure that job descriptions utilize inclusive language |

| ● | Delivered unconscious bias training to leaders, equipping them to lead inclusively and identify unconscious bias |

| ● | Invested in leadership development through our flagship program, “leader essentials,” to help people at all levels cultivate skills, such as effective communication, creating an inclusive culture and building effective relationships |

| ● | Conducted employee surveys with an overall employee survey participation rate of 90%, allowing employees to voice their opinion on topics related to our culture and human capital management initiatives |

| 26 | Western Digital 2022 Proxy Statement |

Risk Oversight and Compensation Risk Assessment

Board’s Role in Risk Oversight

Our Board of Directors’ role in risk oversight involves both our full Board and its committees. Individual committees are charged with ensuring that reasonable information and reporting systems exist to identify potential risks to our company encountered through their respective committee work and with exercising appropriate oversight of those risks. Potential risks are raised to the Audit Committee and full Board for inclusion in our enterprise risk management (“ERM”) process. Our Board believes that the processes it has established for overseeing risk would be effective under a variety of leadership frameworks, and therefore such processes do not materially affect its choice of leadership structure as described in the section entitled “Board Structure—Board Leadership Structure” below.

|

BOARD OF DIRECTORS |

||||

|

| |||

|

||||

|

AUDIT

COMMITTEE ●Oversees ERM, internal audit and internal controls processes and policies and our Chief Audit Executive

●Oversees the following risk topics:

●Financial reporting, accounting, internal controls, fraud and capital structure

●Legal and regulatory compliance, including our Ethics and Compliance program

●Legal and regulatory requirements regarding public disclosure of topics covered by our corporate responsibility and sustainability programs

●Cybersecurity (receives quarterly updates from our Chief Information Security Officer)

●Tax and transfer pricing matters

●General business risks |

COMPENSATION AND

TALENT COMMITTEE Oversees the following risk topics:

●Compensation programs, policies and practices

●Equity and other incentive plans

●Recruiting, engagement and retention

●Human capital management, including DE&I

●CEO succession planning and senior leadership development |

GOVERNANCE

COMMITTEE Oversees the following risk topics:

●Board and committee composition, including Board leadership structure

●Director succession planning

●Corporate governance policies and practices

●Corporate responsibility and sustainability policies and programs, including related to human rights, environmental and climate change

●Corporate political and lobbying activities and expenditures |

||

|

||||

| |

MANAGEMENT Each of our major business unit and functional area heads, with the assistance from their staff, work with our internal audit and ERM functions to identify risks that could affect achievement of business strategies or objectives and develop risk mitigation measures, contingency plans and a consolidated risk profile that is reviewed and discussed with our CEO and CFO before presentation to the Audit Committee. On a regular basis, our ERM function reviews with senior management and the committee the risk profile and action plan progress, which are also made available to our Board. Our Chief Audit Executive also develops a risk-based internal audit plan utilizing the ERM consolidated risk profile. |

|||

| Corporate Governance Matters |

27 |

Compensation Risk Assessment

Consistent with SEC disclosure requirements, we reviewed our fiscal 2022 compensation policies and practices to determine whether they encourage excessive risk taking. We concluded that our compensation programs do not create risks that are reasonably likely to have a material adverse effect on our company.

Chief Executive Officer Evaluation and Succession Planning

Evaluation

The Compensation and Talent Committee reviews and approves our CEO’s goals and objectives. Our Compensation and Talent Committee Chair leads the evaluation of our CEO’s performance in light of those goals and objectives by seeking input from each non-employee director, which is then discussed with our Board of Directors. Following the evaluation of our CEO’s performance, the committee determines and approves our CEO’s compensation.

Succession Planning

The Compensation and Talent Committee oversees CEO and key management personnel succession planning. Our Board of Directors periodically reviews the succession plan for key management personnel, including the CEO’s and key management’s development plans. Directors engage with potential CEO and key management personnel successors at Board and committee meetings and in less formal settings to allow directors to personally assess candidates. Furthermore, our Board periodically reviews the overall composition of our key management personnel’s qualifications, tenure and experience.

Emergency Succession

Our Board of Directors has also adopted an emergency CEO succession plan. The plan will become effective in the event our CEO becomes unable to perform his or her duties in order to minimize potential disruption or loss of continuity to our business and operations. Our emergency CEO succession plan is reviewed annually by the Governance Committee and our Board.

| 28 | Western Digital 2022 Proxy Statement |

Board Leadership Structure

Our Board of Directors does not have a policy with respect to whether the roles of Chair of the Board and CEO should be separate and, if they are to be separate, whether our Chair of the Board should be selected from our directors who are not our employees (referred to in this Proxy Statement as our “non-employee directors”) or should be an employee.

Current Leadership Structure

|

|

| ||

| DAVID V. GOECKELER | MATTHEW E. MASSENGILL | STEPHANIE A. STREETER | ||

| Chief Executive Officer | Independent Chair of the Board | Lead Independent Director |

We currently separate the roles of CEO and Chair of the Board, with Mr. Massengill currently serving as Chair of the Board. Our Board believes this is the appropriate leadership for our company at this time because it permits Mr. Goeckeler, as our CEO, to focus on setting our strategic direction, day-to-day leadership and our performance, while permitting our Chair of the Board to focus on providing guidance to our CEO and setting the agenda for Board meetings. Our Board also believes that the separation of our CEO and Chair of the Board roles assists our Board in providing robust discussion and evaluation of strategic goals and objectives.

Our Corporate Governance Guidelines provide that our Board will appoint a Lead Independent Director if our Chair of the Board is not an independent director under the Nasdaq Stock Market listing standards or if our Board otherwise deems it appropriate. Although our Board has determined that Mr. Massengill is independent under the Nasdaq Stock Market listing standards, because he is a former executive Chair of the Board, President and CEO of our company, our Board determined it was appropriate to appoint Ms. Streeter as our Lead Independent Director. Ms. Streeter’s leadership roles on our prior special CEO search committee, in successful director searches and as our Governance Committee Chair qualify her to serve as our Lead Independent Director.

Our Board of Directors acknowledges that no single leadership model is right for all companies at all times. As such, our Board periodically reviews its leadership structure and may, depending on the circumstances, choose a different leadership structure in the future.

The duties of our Lead Independent Director include:

| ● | Acting as a liaison between our independent directors and management |

| ● | Assisting our Chair of the Board in establishing the agenda for Board meetings |

| ● | Coordinating the agenda for, and chairing, the executive sessions of our independent directors |

| ● | Presiding at any Board meeting at which our Chair is not present |

| ● | Overseeing our Board evaluation process |

| ● | Overseeing our stockholder engagement efforts and being available for engagement with stockholders as appropriate |

| ● | Performing such other duties as may be specified by our Board of Directors from time to time |

Our independent directors also meet regularly in executive sessions without management to review, among other things, our strategy, financial performance, management effectiveness and succession planning.

| Corporate Governance Matters |

29 |

Committees

Our Board of Directors has standing Audit, Compensation and Talent, Governance and Executive Committees. Each of the standing committees operates pursuant to a written charter that is available on our website under “Leadership & Governance” at investor.wdc.com. Our Board has affirmatively determined that all members of the Audit, Compensation and Talent and Governance Committees are independent as defined under the listing standards of the Nasdaq Stock Market and applicable SEC rules.

| Audit Committee | Meetings Held in Fiscal 2022: 8 | Committee Report: page 95 |

|

COMMITTEE MEMBERS |

KEY RESPONSIBILITIES |

Kimberly E.

Alexy (Chair)  Paula A. Price(1)  Martin I. Cole |

●Directly responsible for appointing, compensating and overseeing independent accountants, with input from management

●Pre-approves all audit and non-audit services

●Reviews annual and quarterly financial statements

●Reviews adequacy of accounting and financial personnel resources

●Oversees and appoints our chief audit executive and reviews our internal audit plan and internal controls