Form DEF 14A VISA INC. For: Jan 24

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

VISA INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

Table of Contents

Notice of Annual Meeting and Proxy Statement 2023

Table of Contents

Dear Fellow Stockholder,

On behalf of the Board of Directors, we want to thank you for your investment in Visa and encourage you to vote your shares by proxy at this year’s Annual Meeting. There are five matters on the agenda: the election of directors, Say-on-Pay, advisory vote on the frequency of future advisory votes on executive compensation, ratification of the auditors, and one stockholder proposal.

At Visa, we are guided by our purpose, which is to uplift everyone, everywhere by being the best way to pay and be paid. Our purpose is demonstrated in our business and in our environmental, social, and governance (ESG) efforts, which are an important priority for Visa and continue to be an increasing focus for our investors, partners, and employees, as well as governments and other stakeholders.

Our Board oversees our ESG strategy and activities at both the full Board and committee levels, with the Nominating and Corporate Governance Committee having formal responsibility for oversight of our ESG policies and programs. Throughout the year, we made significant progress across each of our five ESG pillars: Empowering People & Economies, Securing Commerce & Protecting Customers, Investing in Our Workforce, Protecting the Planet, and Operating Responsibly. Some highlights across these pillars include:

| • | We have helped digitally enable over 40 million small and micro businesses as of September 2022, as we work toward our goal of reaching 50 million by the end of 2023. |

| • | We have invested over $10 billion in technology over the last five years, including to reduce fraud and enhance network security. |

| • | We achieved the highest rating in our sector from Gartner Consulting during our 2022 cybersecurity program review. |

| • | We supported more than 6,000 employees from 58 countries who volunteered more than 55,000 hours to strengthen the communities in which we live and work. |

| • | We completed the first year of the Visa Black Scholars and Jobs Program, hosted the inaugural Visa Black Scholars Summit, and welcomed our second cohort of scholars to continue building on the momentum of the program. |

| • | We received third party validation of our 2030 science-based target as an interim goal toward our 2040 net zero target. This builds on Visa’s achievement of purchasing 100% renewable electricity and attaining carbon neutrality for our operations in 2020. |

| • | We advanced on our aspiration to be a climate positive company through expanded sustainability solutions, such as the Visa Eco Benefits bundle, for our clients. |

| • | We continued to receive recognition of our ESG leadership from third-party organizations, including inclusion in the Bloomberg Gender Equality Index, the Dow Jones Sustainability North America Index for the fifth consecutive year, and Ethisphere’s World’s Most Ethical Companies for the tenth consecutive year. |

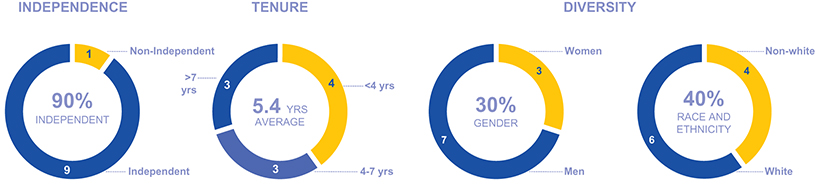

This year, Visa’s corporate governance practices continued to help promote long-term value and strong Board and management accountability to our diverse set of stakeholders. The Board is focused on prioritizing the right mix of skills, qualifications, experiences, tenure, and diversity to promote and support Visa’s long-term strategy. Women comprise 30% of the Board’s nominees, and 40% of the Board’s nominees are racially or ethnically diverse. During 2022 we welcomed two independent directors to the Board, Teri L. List and Kermit R. Crawford. Teri and Kermit each bring decades of senior leadership experience to the Board, providing diverse perspectives and expertise that will be invaluable to Visa. In addition, Mary Cranston and Bob Matschullat will be retiring from the Board at this year’s Annual Meeting after contributing 15 years of distinguished leadership and service, including as committee chairs, and with Bob serving as our former Chairman of the Board. On behalf of the Board, we sincerely thank Mary and Bob for their dedicated service and many contributions to Visa over the years.

Finally, as we have recently announced, we are pleased to share that Ryan McInerney will be Visa’s next Chief Executive Officer, and Al Kelly will move to the role of Executive Chairman, both effective February 1, 2023. The Board of Directors also expects to appoint Ryan to the Board effective upon his transition to Chief Executive Officer. This leadership change reflects the Board’s thoughtful and well-established approach to succession. Ryan is a very seasoned leader in the payments and consumer banking industry. In his role as President over the past 10 years, Ryan has been responsible for Visa’s global businesses, delivering value to the company’s financial

Table of Contents

institutions, acquirers, merchants, and partners in more than 200 countries and territories around the world. He has overseen the company’s market teams, business units, product team, merchant team, and client services. We look forward to working with Ryan to continue to drive Visa’s success, growth, and innovation.

Thank you for your continued support of Visa, and we look forward to your attendance at this year’s Annual Meeting.

|

|

| |

|

Al Kelly Chairman and Chief Executive Officer |

John Lundgren Lead Independent Director |

Table of Contents

Items of Business

| 1. | To elect the ten director nominees named in this proxy statement; |

| 2. | To approve, on an advisory basis, the compensation paid to our named executive officers; |

| 3. | To hold an advisory vote on the frequency of future advisory votes to approve executive compensation; |

| 4. | To ratify the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2023; |

| 5. | To vote on a stockholder proposal requesting an independent board chair policy; and |

| 6. | To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof. |

The proxy statement more fully describes these proposals.

Record Date

Holders of our Class A common stock at the close of business on November 25, 2022 are entitled to notice of and to vote on all proposals at the Annual Meeting and any adjournment or postponement thereof.

Attending the Annual Meeting

The meeting will be held on Tuesday, January 24, 2023 at 8:30 a.m. Pacific Time. Log-in begins at 8:15 a.m. Eligible holders of our Class A common stock will be able to attend the meeting online, vote their shares electronically, and submit questions during the meeting by visiting virtualshareholdermeeting.com/V2023. To participate in the virtual meeting, you will need the 16-digit control number included on your Notice of Internet Availability of Proxy Materials, proxy card, or voting instruction form. Please refer to the “Attending the Meeting” section of the proxy statement for more details about attending the Annual Meeting online. This year’s meeting will be held exclusively online; we are not holding an in-person meeting.

Proxy Voting

Your vote is very important. Whether or not you plan to attend the Annual Meeting online, please vote at your earliest convenience by following the instructions in the Notice of Internet Availability of Proxy Materials or the proxy card you received in the mail. You may revoke your proxy at any time before it is voted. Please refer to the “Voting and Meeting Information” section of the proxy statement for additional information.

On December 1, 2022, we released the proxy materials to the stockholders of our Class A common stock and sent to these stockholders (other than those Class A stockholders who previously requested electronic or paper delivery) a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy materials, including our proxy statement and our fiscal year 2022 Annual Report, and to vote through the Internet or by telephone.

By Order of the Board of Directors

Kelly Mahon Tullier

Vice Chair, Chief People and Administrative Officer,

and Corporate Secretary

San Francisco, California

December 1, 2022

Important Notice Regarding the Availability of Proxy Materials

for the 2023 Annual Meeting of Stockholders to be held on January 24, 2023.

The proxy statement and Visa’s Annual Report for fiscal year 2022 are available at

| investor.visa.com | . |

Table of Contents

| PROXY SUMMARY | 1 | |||

| CORPORATE GOVERNANCE | 10 | |||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| Attendance at Board, Committee, and Annual Stockholder Meetings |

16 | |||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| COMMITTEES OF THE BOARD OF DIRECTORS | 21 | |||

| 22 | ||||

| 22 | ||||

| 24 | ||||

| 24 | ||||

| 27 | ||||

| 27 | ||||

| Criteria for Nomination to the Board of Directors and Diversity |

28 | |||

| COMPENSATION OF NON-EMPLOYEE DIRECTORS | 29 | |||

| Highlights of our Non-Employee Director Compensation Program |

29 | |||

| 30 | ||||

| 30 | ||||

| 31 | ||||

| 31 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| PROPOSAL 1 – ELECTION OF DIRECTORS | 34 | |||

| DIRECTOR NOMINEE BIOGRAPHIES | 36 | |||

| BENEFICIAL OWNERSHIP OF EQUITY SECURITIES | 41 | |||

| EXECUTIVE OFFICERS | 43 | |||

| COMPENSATION DISCUSSION AND ANALYSIS | 45 | |||

| 45 | ||||

| 46 | ||||

| 50 | ||||

| 50 | ||||

| Summary of Fiscal Year 2022 Base Salary and Incentive Compensation |

52 | |||

| 53 | ||||

| 64 | ||||

| 65 | ||||

| 66 | ||||

i

Table of Contents

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

INFORMATION ABOUT OUR 2023 ANNUAL MEETING OF STOCKHOLDERS

|

|

Date and Time |

Tuesday, January 24, 2023 at 8:30 a.m. Pacific Time | ||

|

|

Place

|

This year’s meeting will be held virtually via a live webcast at virtualshareholdermeeting.com/V2023

| ||

|

|

Record Date |

November 25, 2022 | ||

VOTING MATTERS

|

|

Proposals

|

Board

|

Page Number

| |||

| 1

|

Election of ten director nominees

|

FOR (each nominee)

|

34

| |||

| 2

|

Approval, on an advisory basis, of compensation paid to our named executive officers

|

FOR

|

87

| |||

| 3

|

Advisory vote on the frequency of future advisory votes to approve executive compensation

|

ONE YEAR

|

87

| |||

| 4

|

Ratification of the appointment of our independent registered public accounting firm

|

FOR

|

88

| |||

| 5

|

To vote on a stockholder proposal requesting an independent board chair policy

|

AGAINST

|

90

| |||

1

Table of Contents

CORPORATE GOVERNANCE AND BOARD HIGHLIGHTS

We are committed to corporate governance practices that promote long-term value and strengthen Board and management accountability to our stockholders, customers, and other stakeholders. Information regarding our corporate governance framework begins on page 10, which includes the following highlights:

| Number of director nominees |

10 | Demonstrated commitment to Board refreshment |

| |||

| Percentage of independent director nominees |

90% | Annual Board, committee, and director evaluations |

| |||

| Directors attended at least 75% of meetings |

|

Regularly focus on director succession planning |

| |||

| Annual election of directors |

|

Risk oversight by full Board and committees |

| |||

| Majority voting for directors |

|

Stock ownership guidelines for directors and executive officers |

| |||

| Proxy access (3%/3 years) |

|

Proactive, ongoing engagement with stockholders |

| |||

| Robust Lead Independent Director duties |

|

ESG oversight by full Board and committees |

| |||

| Regular executive sessions of independent directors |

|

Political Participation, Lobbying and Contributions Policy |

| |||

2

Table of Contents

Snapshot of 2023 Director Nominees

Our director nominees exhibit an effective mix of diversity, experience, and perspectives

|

Director Since |

Committee |

Other Current Public Boards |

||||||||||||||||||

| Name | Principal Occupation | Independent | ARC | CC | FC | NCGC | ||||||||||||||

|

Lloyd A. Carney |

2015 | Founder and Chief Acquisition Officer, Carney Technology Acquisition Corp II |

✓ |

|

|

|

|

2 | |||||||||||

|

Kermit R. Crawford |

2022 |

Director |

✓ |

(1) |

(1) |

2 |

|||||||||||||

|

Francisco Javier Fernández-Carbajal |

2007 | Director General, Servicios Administrativos Contry SA de CV |

✓ | ● | ● |

|

3 | ||||||||||||

|

Alfred F. Kelly, Jr. |

2014 | Chairman and CEO, Visa |

– |

|

|

|

– | ||||||||||||

|

Ramon Laguarta |

2019 | Chairman and CEO, PepsiCo, Inc. |

✓ |

● |

|

|

● | 1 | |||||||||||

|

Teri L. List |

2022 | Director |

✓ |

● | ● |

|

|

3 | |||||||||||

|

John F. Lundgren |

2017 |

Lead Independent Director, Visa |

✓ |

|

● |

|

● |

1 |

|||||||||||

|

Denise M. Morrison |

2018 | Founder, Denise Morrison & Associates, LLC | ✓ | ● |

|

|

|

2 | |||||||||||

|

Linda J. Rendle |

2020 | CEO, The Clorox Company | ✓ | ● | ● | 1 | |||||||||||||

|

|

Maynard G. Webb, Jr. |

2014 | Founder, Webb Investment Network | ✓ |

|

|

● |

|

1 | |||||||||||

|

ARC = Audit and Risk Committee CC = Compensation Committee FC = Finance Committee NCGC = Nominating and Corporate Governance Committee |

|

| (1) |

Kermit R. Crawford will join the ARC and NCGC effective January 1, 2023. |

3

Table of Contents

Our Compensation Philosophy, Principles, and Key Elements

The compensation program for our named executive officers (NEOs) helps us attract and retain key talent and promote performance that enhances stockholder value and drives long-term strategic outcomes, including the Company’s broader ESG efforts.

There are three primary principles that guide our compensation program design and administration: (1) pay for performance; (2) promote alignment with stakeholders’ interests; and (3) attract, motivate, and retain key talent.

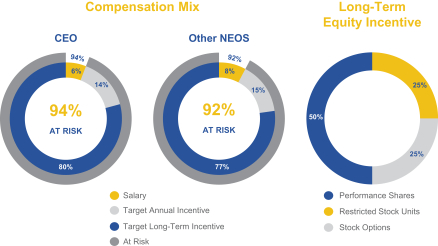

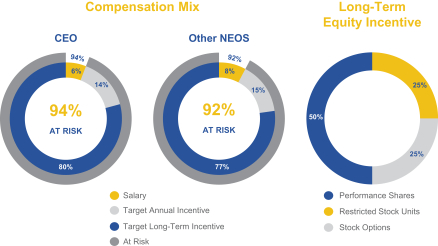

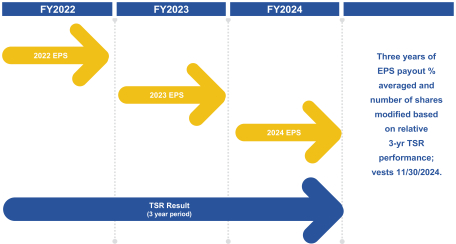

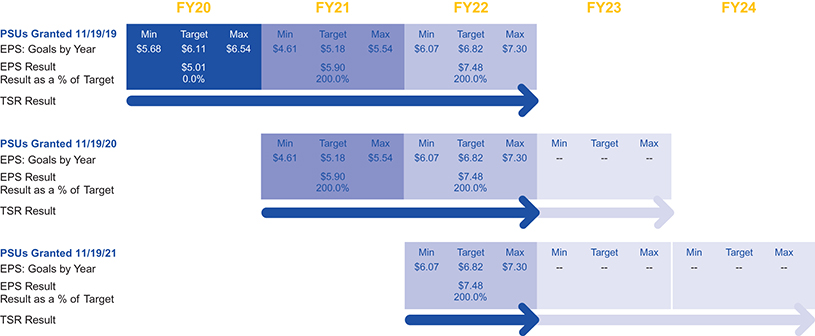

We tie a substantial portion of our NEOs’ target annual compensation to the achievement of pre-established financial and non-financial objectives that support our business strategy, with a mix that balances short- and long-term performance goals. Further, our annual incentive plan incorporates ESG metrics that are tied to the Company’s strategic objectives. Our long-term equity awards align the interests of our NEOs with our stakeholders’ interests and link a substantial portion of compensation to the achievement of earnings per share (EPS) results that drive stockholder value and relative total shareholder return (TSR).

For fiscal year 2022, 94% of the target total direct compensation for our Chairman and Chief Executive Officer was variable and at risk, and an average of 92% was variable and at risk for our other NEOs.

| Compensation

|

|

Link to Strategy

|

|

Strategy &

| ||||

| Annual Incentive Plan

|

● Based on a scorecard that incorporates metrics in four categories, each of which is aligned with our corporate strategy: Financial; Client; Foundational; and Operational Excellence, Talent, & ESG

● Year-end performance is evaluated against pre-established performance goals in the scorecard

● Final payout is based on the Compensation Committee’s analysis of the Company’s performance against all scorecard metrics and individual performance

|

Aligns NEOs’ interests with stakeholders’ interests by:

● rewarding performance for achievement of strategic goals, which are designed to position the Company competitively

● promoting strong financial results and stockholder value | ||||||

| Long-Term Equity Awards |

● Substantial portion of compensation is linked to achievement of long-term corporate performance using equity incentives, including performance shares based on EPS and relative TSR results over three years

● Individual performance, which is tied to our strategic objectives, is considered in setting the value of our NEOs’ long-term equity grants

● The number of performance shares that ultimately vests at the end of the three-year performance period is formulaic and based on pre-established performance conditions |

Further aligns NEOs’ interests with stakeholders’ interests by:

● taking company and individual performance into account in determining equity grant values

● linking a substantial portion of long-term compensation to the achievement of EPS results that drive stockholder value and relative TSR | ||||||

4

Table of Contents

| Principles of our Compensation Program

| ||

| Pay for Performance |

The key principle of our compensation philosophy is pay for performance. We favor variable “at risk” pay opportunities over fixed pay, with a significant portion of our NEOs’ total compensation determined based on performance against annual and long-term goals and stockholder return. | |

|

Promote Alignment with Stakeholders’ Interests |

We reward performance that meets or exceeds the goals that the Compensation Committee establishes with the objective of increasing stockholder value over time, aligning with other stakeholders’ interests, and driving long-term strategic outcomes, including the Company’s broader ESG efforts. | |

|

Attract, Motivate, and Retain Key Talent |

We design our compensation program to attract, motivate, and retain key talent. | |

Key Elements of our Fiscal Year 2022 Compensation Program

EXECUTIVE COMPENSATION PROGRAM HIGHLIGHTS

| WHAT WE DO: | ||

|

|

Pay for performance | |

|

|

Annual say-on-pay vote | |

|

|

Recoupment policies | |

|

|

Short-term and long-term incentives/measures | |

|

|

Capped incentive awards | |

|

|

Independent compensation consultant | |

|

|

Stock ownership guidelines | |

|

|

Limited perquisites | |

|

|

Proactive, ongoing engagement with stockholders | |

|

|

Pay linked to ESG factors | |

| WHAT WE DO NOT DO: | ||

|

|

Gross-up excise taxes

| |

|

|

Reprice stock options | |

|

|

Provide fixed-term employment agreements | |

|

|

Provide for single-trigger severance arrangements | |

|

|

Allow hedging and pledging of Visa securities

| |

5

Table of Contents

FISCAL YEAR 2022 COMPANY HIGHLIGHTS

During the fiscal year ended September 30, 2022, Visa delivered strong financial results, with net revenues, net income, and EPS all up more than 20% year-over-year.

| NET REVENUES | GAAP NET INCOME | NON-GAAP NET INCOME(1) | ||

| $29.3B | $15.0B | $16.0B | ||

| up 22% from prior year | up 21% from prior year | up 24% from prior year |

| DIVIDENDS & | ||||

| GAAP EPS | NON-GAAP EPS(1) | SHARE BUYBACKS | ||

| $7.00 | $7.50 | $14.8B | ||

| up 24% from prior year | up 27% from prior year | up 29% from prior year |

| (1) | For further information regarding non-GAAP adjustments, including a reconciliation of our GAAP to non-GAAP financial results, please see Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations – Overview in our 2022 Annual Report on Form 10-K as filed with the Securities and Exchange Commission on November 16, 2022. |

BOARD’S ROLE IN LONG-TERM STRATEGIC PLANNING

The Board takes an active role with management to formulate and review Visa’s long-term corporate strategy. Each quarter, the Board and management confer on the execution of our long-term strategic plans, and the status of key initiatives, opportunities, and risks facing Visa. In addition, the Board regularly conducts in-depth long-term strategic reviews with our senior management team. During these reviews, the Board and management discuss the payments landscape, emerging technological and competitive threats, and short- and long-term plans and priorities within our strategy.

Additionally, the Board annually discusses and approves the budget and capital requests, which are firmly linked to Visa’s long-term strategic plans and priorities. Through these processes, the Board brings its collective, independent judgment to bear on the most critical long-term strategic issues facing Visa. For more information on our long-term strategy and the progress we made against our strategic goals in fiscal year 2022, please see our 2022 Annual Report, including the letter from our Chairman and Chief Executive Officer, Alfred F. Kelly, Jr., to our stockholders.

6

Table of Contents

TALENT AND HUMAN CAPITAL MANAGEMENT

Attracting, developing, and advancing the best people globally is crucial to all aspects of Visa’s activities and long-term success, and is central to our long-term strategy. Best-in-class, diverse teams and an inclusive culture inspire leadership, encourage innovative thinking, and support the development and advancement of all employees.

These guiding principles have been more important than ever in light of the continuing challenges posed by events such as the COVID-19 pandemic and the impact of developments related to the war in Ukraine. At Visa, we are committed to the health and safety of our employees and their families. In fiscal year 2022, a large majority of our workforce continued to work remotely for the first half of the year, and we maintained strong safety protocols and procedures consistent with applicable requirements and guidelines for the employees who continued to work on site. To meet the evolving needs of our workforce, we deepened our commitment to employee wellbeing, through broad engagement with our leadership, targeted programs, and expanded benefits. We also executed a phased approach to reopening our offices, with employee health and wellbeing as a top priority. We are providing our employees with enhanced flexibility in how and where we work while maintaining collaboration and community. As we plan for the future of work, we expect to monitor and evolve our approach to continue to provide the right flexible balance for Visa.

At Visa, all employees are encouraged and empowered to be leaders through embracing the Visa Leadership Principles. These Leadership Principles are integrated into core talent processes, and employees are evaluated not only on their performance, but also how they embody the Leadership Principles:

| We lead by

|

We excel with partners

|

We communicate openly

|

We act decisively

|

We enable and

|

We collaborate

| |||||

| Be accountable

Treat others with

Demonstrate a |

Build strong

Provide excellent

Take a solutions- oriented approach |

Promote a shared

Communicate

Value others’ |

Challenge the

Decide quickly

Learn from our |

Inspire success

Remove barriers

Value inclusivity and |

Break down silos

Engage with our

Deliver as One Team | |||||

The tone and culture of Visa is set at the Board level. The full Board has oversight of human capital management and performs regular reviews, including annual reviews of succession planning for our Chief Executive Officer. Our Board committees have responsibility for specific areas of human capital management. The Nominating and Corporate Governance Committee is responsible for director succession and refreshment, as well as management succession and development planning. Our Compensation Committee is responsible for reviewing Visa’s programs and practices related to executive workforce inclusion and diversity as well as the administration of compensation programs in a non-discriminatory manner. Management is responsible for developing policies and processes that reflect and reinforce our desired corporate culture, including policies and processes related to strategy, risk management, and ethics and compliance.

Employee Development and Engagement

Visa understands that being an employer of choice requires best-in-class career and skills development along with innovative programs. This year, we introduced a career framework with philosophies and tools for employees to plan their growth and career at Visa. We also implemented new guidelines to drive increased internal mobility for employees. We support employees in their development through our award-winning Visa University. Our global learning platform, Learning Hub, houses more than 200,000 learning resources on a number of topics, including sales, technology, product, and leadership development training on our gamified platform. Visa’s annual Learning Festival includes courses taught and facilitated by Visa leaders and external speakers who bring real-world context and ideas for practical application that are aligned with our goals.

7

Table of Contents

We recognize that building an inclusive and high-performing culture requires an engaged workforce, where employees are motivated to do their best work every day. Our engagement approach centers on communication and recognition. We communicate with our employees in a variety of ways, including biweekly video updates from our Chairman and Chief Executive Officer, company intranet, digital signage, email newsletters, live events in regional offices, and quarterly all-staff meetings. Our recognition programs include our Go Beyond platform, where managers and peers recognize employees who exemplify our leadership principles. In 2022, we created our new Employee Value Proposition, Powering Payments, Empowering People, which is closely linked to our purpose and will be used to attract, develop, and advance top-notch talent.

We assess employee engagement through a variety of channels, including employee pulse surveys, which provide feedback on a variety of topics, such as company direction and strategy, wellbeing, inclusion and diversity, individual growth and development, collaboration, and confidence and pride.

Employee Benefits

We believe our employees are critical to the success of our business, and we structure our total rewards and benefits package to attract and retain a talented and engaged workforce. We continue to evolve our programs to meet our employees’ needs, providing comprehensive wellbeing, financial, and quality of life coverage. Our programs vary by location, but may include the following:

8

Table of Contents

Inclusion and Diversity

Visa believes in an inclusive and diverse workplace where everyone is accepted, everywhere. We are driven to create a culture in which individual differences, experiences, and capabilities are valued and contribute to our business success. By leveraging the diverse backgrounds and perspectives of our worldwide teams, we are able to achieve better solutions for our clients and create a connected workplace to attract and advance top talent. Visa’s approach to inclusion and diversity involves the following:

We are committed to doing our part to improve our inclusion and increase our diversity. Visa is driving important change through specific actions, including making progress toward our goals to increase the number of U.S. employees from underrepresented groups, continuing to support the Visa Black Scholars and Jobs Program, and hosting a “Global Inclusion Talks” series to promote internal education and conversation. We are also providing professional development and mentorship programs, equipping our employees with training and tools to be active allies, and enhancing our supplier diversity efforts.

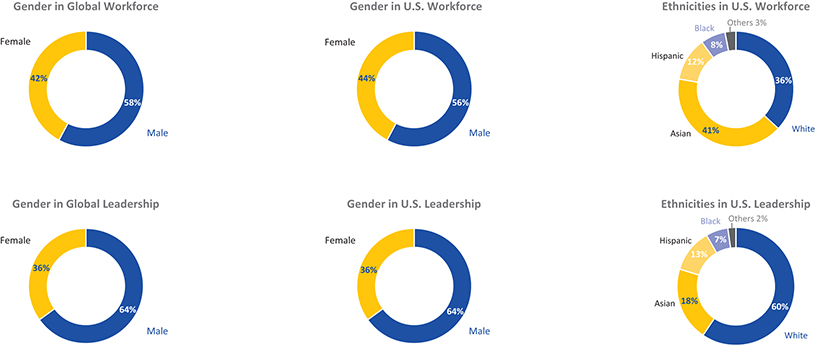

Workforce Demographics

Visa tracks, measures, and evaluates our workforce representation and impact as part of our strategic business imperative to build a diverse and inclusive organization. We are committed to reporting our workforce demographics annually.

Notes:

| • | Demographic data is based on Company records as of September 30, 2022. |

| • | Leadership: Defined as Vice President and above. |

| • | Others: Defined as American Indian/Alaska Native, Native Hawaiian/Other Pacific Islander, and two or more races. Ethnicity data does not include employees who choose not to disclose or who leave the field blank. |

9

Table of Contents

Members of our Board oversee our business through discussions with our Chief Executive Officer; President; Vice Chair, Chief Financial Officer; Vice Chair, Chief People and Administrative Officer, and Corporate Secretary; General Counsel; Chief Risk Officer; President, Technology; and other officers and employees, and by reviewing materials provided to them and participating in regular meetings of the Board and its committees.

The Board regularly monitors our corporate governance policies and profile to confirm we meet or exceed the requirements of applicable laws, regulations and rules, and the listing standards of the New York Stock Exchange (NYSE). We have instituted a variety of practices to foster and maintain responsible corporate governance, which are described in this section. To learn more about Visa’s corporate governance and to view our Corporate Governance Guidelines, Code of Business Conduct and Ethics, and the charters of each of the Board’s committees, please visit the Investor Relations page of our website at investor.visa.com under “Corporate Governance.” Our Environmental, Social & Governance Report is located on our website at visa.com/esg. You may request a printed copy of any of these documents free of charge by contacting our Corporate Secretary at Visa Inc., P.O. Box 193243, San Francisco, CA 94119 or [email protected].

Al Kelly currently serves as Chairman and Chief Executive Officer, and John Lundgren serves as Lead Independent Director. While the Company does not have a policy on whether the roles of Chairperson and Chief Executive Officer should be split, the Board believes that the combined role is in the best interests of the Company and its stockholders at this time, as this structure allows Mr. Kelly to effectively manage the business, execute on our strategic priorities, and lead the Board, while empowering Mr. Lundgren to provide independent Board leadership and oversight. The Board believes that Mr. Kelly’s inclusive leadership style and decades of payments expertise make him uniquely qualified to lead discussions of the Board; foster an important unity of leadership between the Board and management; and promote alignment of the Company’s strategy with its operational execution. Upon effecting the Chief Executive Officer transition on February 1, 2023, the Board has determined that Mr. Kelly will continue to serve as Executive Chairman. Mr. Lundgren has significant experience as a CEO, including in a combined role of CEO and Chair, so he is familiar with the combined board leadership structure and the importance of building strong relationships with the various constituencies.

To further promote independent leadership, the Board has developed a robust set of responsibilities for the Lead Independent Director role, including:

| • | calling, setting the agenda for, and chairing periodic executive sessions and meetings of the independent directors; |

| • | chairing Board meetings in the absence of the Chairperson or when it is deemed appropriate arising from the Chairperson’s management role or non-independence; |

| • | providing feedback to the Chairperson and Chief Executive Officer on corporate and Board policies and strategies and acting as a liaison between the Board and the Chief Executive Officer; |

| • | facilitating communication among directors and between the Board and management; |

| • | in concert with the Chairperson and Chief Executive Officer, advising on the agenda, schedule, and materials for Board meetings and strategic planning sessions based on input from directors; |

| • | coordinating with the Chair of the Nominating and Corporate Governance Committee, leading the independent directors’ involvement in Chief Executive Officer succession planning, selection of committee chairs and committee membership, and the Board evaluation process; |

| • | coordinating with the Chair of the Compensation Committee and leading the independent directors’ evaluation of Chief Executive Officer performance and compensation; |

10

Table of Contents

| • | communicating with stockholders as necessary; and |

| • | carrying out such other duties as are requested by the independent directors, the Board, or any of its committees from time to time. |

The Board periodically reviews the Board’s leadership structure and its appropriateness given the needs of the Board and the Company at such time.

In addition to our Lead Independent Director, independent directors chair the Board’s four standing committees: the Audit and Risk Committee, chaired by Lloyd A. Carney; the Compensation Committee, chaired by Denise M. Morrison; the Finance Committee, chaired by Robert W. Matschullat; and the Nominating and Corporate Governance Committee, chaired by Maynard G. Webb, Jr. In their capacities as independent committee chairs, Messrs. Carney, Matschullat, and Webb and Ms. Morrison each have responsibilities that contribute to the Board’s oversight of management, as well as facilitating communication among the Board and management.

Board of Directors and Committee Evaluations

Our Board recognizes that a robust and constructive Board and committee evaluation process is an essential component of Board effectiveness. As such, our Board and each of its committees conduct an annual evaluation facilitated by an independent third party, which includes a qualitative assessment by each director of the performance of the Board and the committee or committees on which the director sits. The Board also conducts an annual peer review, which is designed to assess individual director performance. The Nominating and Corporate Governance Committee, in conjunction with the Lead Independent Director, oversees the evaluation process.

| Review of Evaluation

|

Advanced

|

One-on-One

|

Evaluation Results

| |||

| NCGC reviews evaluation process annually | Covers: • Board efficiency and effectiveness • Board and committee composition • Quality of board discussions • Quality of information and materials provided • Board processes • Board culture |

One-on-one discussions between independent, third-party facilitator and each director to solicit their views on the Board’s effectiveness |

• Preliminary evaluation results are discussed with the NCGC Chair, Board Chair, and Lead Independent Director • Final evaluation results and recommendations are discussed with the Board, committees, and individual directors | |||

|

Feedback Incorporated Over the past few years, the evaluation process has led to a broader scope of topics covered in the Board meetings, improvements in Board process, and changes to Board and committee composition and structure.

This year’s evaluation identified areas for continued focus, including: • management, director, and committee succession planning; • enhancements to support board effectiveness; • risk management; and • Board composition in support of long-term strategy.

| |

Director Succession Planning and Board Refreshment

In addition to executive and management succession, the Nominating and Corporate Governance Committee regularly oversees and plans for director succession and refreshment of the Board to cultivate a mix of skills, experience, tenure, and diversity that promote and support the Company’s long-term strategy. In doing so, the

11

Table of Contents

Nominating and Corporate Governance Committee takes into consideration the overall needs, composition, and size of the Board, as well as the criteria adopted by the Board regarding director candidate qualifications, which are described in the section entitled Committees of the Board of Directors – Criteria for Nomination to the Board of Directors and Diversity. Individuals identified by the Nominating and Corporate Governance Committee as qualified to become directors are then recommended to the Board for nomination or election.

The NYSE’s listing standards and our Corporate Governance Guidelines provide that a majority of our Board and every member of the Audit and Risk, Compensation, and Nominating and Corporate Governance committees must be “independent.” Our Certificate of Incorporation further requires that at least 58% of our Board be independent. Under the NYSE’s listing standards, our Corporate Governance Guidelines, and our Certificate of Incorporation, no director will be considered to be independent unless our Board affirmatively determines that such director has no direct or indirect material relationship with Visa or our management. Our Board reviews the independence of its members annually and has adopted guidelines to assist it in making its independence determinations. For details, see our Corporate Governance Guidelines, which can be found on the Investor Relations page of our website at investor.visa.com under “Corporate Governance.”

In October 2022, with the assistance of legal counsel, our Board conducted its annual review of director independence and affirmatively determined that each of our non-employee directors (Lloyd A. Carney, Mary B. Cranston, Kermit R. Crawford, Francisco Javier Fernández-Carbajal, Ramon Laguarta, Teri L. List, John F. Lundgren, Robert W. Matschullat, Denise M. Morrison, Linda J. Rendle, and Maynard G. Webb, Jr.) is “independent” as that term is defined in the NYSE’s listing standards, our independence guidelines, and our Certificate of Incorporation. In addition, the Board previously determined that Suzanne Nora Johnson and John Swainson were “independent” while they served on the Board during fiscal year 2022.

In making the determination that the directors listed above are independent, the Board considered relevant transactions, relationships, and arrangements, including those specified in the NYSE listing standards and our independence guidelines, and determined that these relationships were not material relationships that would impair the directors’ independence. In this regard, the Board considered that certain directors serve as directors of other companies with which the Company engages in ordinary-course-of-business transactions, and that, in accordance with our director independence guidelines, none of these relationships constitute material relationships that would impair the independence of these individuals. Discretionary contributions to certain charitable organizations with which some of our directors are affiliated also were considered, and the Board determined that the amounts contributed to each of these charitable organizations in the past fiscal year were less than $120,000 and that these contributions otherwise created no material relationships that would impair the independence of those individuals.

In addition, each member of the Audit and Risk Committee and the Compensation Committee meets the additional, heightened independence criteria applicable to such committee members under the applicable NYSE rules.

Executive Sessions of the Board of Directors

The non-employee, independent members of our Board and all committees of the Board generally meet in executive session without management present during their Board and committee meetings. John Lundgren, our Lead Independent Director, presides over executive sessions of the Board, and the committee chairs, each of whom is independent, preside over executive sessions of the committees.

12

Table of Contents

Limitation on Other Board and Audit Committee Service

Our Corporate Governance Guidelines establish the following limits on our directors serving on publicly-traded company boards and audit committees:

| Director Category |

Limit on publicly-traded board and committee service, including Visa | |

| All directors |

4 boards | |

| Directors who are executives of a publicly-traded company |

2 boards | |

| Directors who serve on our Audit and Risk Committee |

3 audit committees | |

The Nominating and Corporate Governance Committee may grant exceptions to the limits on a case-by-case basis after taking into consideration the facts and circumstances of the request. Our Corporate Governance Guidelines provide that prior to accepting an invitation to serve on the board or audit committee of another publicly-traded company, a director should advise our Corporate Secretary of the invitation. The Corporate Secretary will review the matter with the Lead Independent Director or the Chair of the Board, the Chair of the Nominating and Corporate Governance Committee, and the Chief Executive Officer, so that the Board, through the Nominating and Corporate Governance Committee, has the opportunity to review the director’s ability to continue to fulfill his or her responsibilities as a member of the Company’s Board or Audit and Risk Committee. When reviewing such a request, the Nominating and Corporate Governance Committee may consider a number of factors, including the director’s other time commitments, record of attendance at Board and committee meetings, potential conflicts of interest and other legal considerations, and the impact of the proposed directorship or audit committee service on the director’s availability.

Mr. Carney serves as chief acquisition officer of Carney Technology Acquisition Corp. II (CTAC), a special purpose acquisition company (SPAC). Mr. Carney reports to the chief executive officer of CTAC and does not serve on the board of directors. Mr. Carney is not considered an executive of a publicly-traded company for purposes of the Board’s policy limiting service on other public company boards, given that service as an officer of a SPAC does not have the same demands as being an executive officer of a typical publicly-traded company.

Ms. List serves on three public company audit committees in addition to being a member of our Audit and Risk Committee. The Nominating and Corporate Governance Committee and the Board considered Ms. List’s service on four public company audit committees, including her professional qualifications, former experience as a public company chief financial officer, and the nature of and time involved in her service on other boards. Following such review, the Board determined that such simultaneous service would not impair the ability of Ms. List to effectively serve on the Company’s Audit and Risk Committee and waived the limit for service on the Audit and Risk Committee for Ms. List.

Management Development and Succession Planning

Our Board believes that one of its primary responsibilities is to oversee the development and retention of executive talent and to ensure that an appropriate succession plan is in place for our Chief Executive Officer and other members of senior management. Each quarter, the Nominating and Corporate Governance Committee meets with our Vice Chair, Chief People and Administrative Officer and other executives to discuss management succession and development planning and to address potential vacancies in senior leadership. In addition, the Board annually reviews succession planning for our Chief Executive Officer.

13

Table of Contents

The Board of Directors’ Role in Risk Oversight

Our Board recognizes the importance of effective risk oversight in running a successful business and in fulfilling its fiduciary responsibilities to Visa and its stockholders. While the Chief Executive Officer; President; Chief Risk Officer; General Counsel; Vice Chair, Chief Financial Officer; Vice Chair, Chief People and Administrative Officer; President, Technology; and other members of our senior leadership team are responsible for the day-to-day management of risk, our Board is responsible for promoting an appropriate culture of risk management within the Company and for setting the right “tone at the top,” overseeing our aggregate risk profile, and monitoring how the Company addresses specific risks, such as strategic and competitive risks, financial risks, brand and reputation risks, cybersecurity and technology risks, ecosystem risks, legal and compliance risks, regulatory risks, and operational risks.

Board of Directors

| • The Board exercises its oversight responsibility for risk both directly and through its standing committees. • Throughout the year, the Board and each committee spend a portion of their time reviewing and discussing specific risk topics. • On an annual basis, the Chief Risk Officer and other members of senior management report on our top enterprise risks, and the steps management has taken or will take to mitigate these risks. • Our President, Technology, provides regular updates to the Board on technology and cybersecurity, including an annual in-depth review. • Our General Counsel updates the Board regularly on material legal and regulatory matters. • Written reports also are provided to and discussed by the Board regularly regarding recent business, legal, regulatory, competitive, and other developments impacting the Company.

|

|

|

|

|

| |||

| Audit and Risk Committee

Oversees risks related to our enterprise risk management framework and programs, including:

• financial statements, financial reporting, and internal controls;

• tax strategy;

• legal and regulatory;

• corporate risk profile, top risks, and key operational risks;

• technology, including information security and cybersecurity;

• global privacy program;

• compliance and ethics program, including anti-money laundering and sanctions; and

• operational resilience program

|

Compensation Committee

Oversees risks related to employees and compensation, including:

• our compensation policies and practices for all employees; and

• our incentive and equity-based compensation plans

For additional information regarding the Compensation Committee’s review of compensation-related risk, please see the section entitled Risk Assessment of Compensation Programs. |

Finance Committee

Oversees risks related to mergers and acquisitions and certain financial matters, including:

• capital investments;

• debt;

• credit and liquidity; and

• capital structure |

Nominating and Corporate Governance Committee

Oversees risks related to our overall corporate governance, including:

• Board effectiveness;

• Board and committee composition;

• Board size and structure;

• director independence;

• Board succession;

• senior management succession;

• ESG strategy, programs, and reporting; and

• political participation and contributions

| |||

In addition, each of the committees meets in executive session with management to discuss our risks and exposures. For example, in 2022, the Audit and Risk Committee met regularly with our Chief Risk Officer; General Counsel; Chief Ethics and Compliance Officer; Vice Chair, Chief Financial Officer; Chief Auditor; and other members of senior management.

14

Table of Contents

Our Board and management team greatly value the opinions and feedback of our stockholders. We have proactive, ongoing engagement with our stockholders throughout the year focused on ESG matters, including corporate governance, corporate responsibility and sustainability, and executive compensation, in addition to the ongoing dialogue among our stockholders and our Chairman and Chief Executive Officer, Vice Chair, Chief Financial Officer, and Investor Relations team on Visa’s financial and strategic performance. Our Chairman and Chief Executive Officer and our Lead Independent Director also met with several of our investors this year to discuss corporate governance, corporate responsibility, and executive compensation matters.

|

We contacted our

Top 75 Stockholders

|

Representing approximately

65% of our outstanding Class A common stock | |

| We held videoconference meetings with

48 stockholders |

Representing approximately

26% of our outstanding Class A common stock | |

| Prior to Annual Meeting

• We reach out to our top 75 investors to discuss corporate governance, sustainability, human capital management, and executive compensation matters, and solicit feedback.

• Our Board is provided with our stockholders’ feedback for consideration.

• Board and management discuss feedback and whether action should be taken.

• Disclosure enhancements are considered.

• We review vote proposals and solicit support for Board recommendations on management and stockholder proposals.

|

|

Annual Meeting of Stockholders

• Our stockholders vote on election of directors, executive compensation, ratification of our auditors, and other management and stockholder proposals. |

|

Post Annual Meeting

• Our Board and management review the vote results from our annual meeting.

• Board and management discuss vote results and whether action should be taken.

• We start preparing our agenda for our next year of engagement.

| ||||

Feedback from this year’s investor meetings was positive overall with many investors expressing appreciation for the increased transparency in our disclosures on ESG matters. Topics covered during our discussions with investors included:

| • | our environmental footprint, climate change, and sustainable commerce, including Visa’s climate goals; |

| • | human capital management, including workforce diversity, equity, and inclusion; |

| • | Board leadership; |

| • | Board composition, skills, tenure, and diversity; |

| • | Board risk oversight, including cybersecurity, data privacy, brand and reputation, and legal and regulatory; and |

| • | our executive compensation program and philosophy, and ESG metrics in the annual incentive plan. |

A summary of the feedback we received was discussed and considered by the Board, and enhancements have been made to certain of our disclosures to improve transparency.

15

Table of Contents

Communicating with the Board of Directors

Our Board has adopted a process by which stockholders or other interested persons may communicate with the Board or any of its members. Stockholders and other interested parties may send communications in writing to any or all directors (including the Chair or the non-employee directors as a group) electronically to [email protected] or by mail c/o our Corporate Secretary, Visa Inc., P.O. Box 193243, San Francisco, CA 94119. Communications that meet the procedural and substantive requirements of the process approved by the Board will be delivered to the specified member of the Board, non-employee directors as a group, or all members of the Board, as applicable, on a periodic basis, which generally will be in advance of or at each regularly scheduled meeting of the Board. Communications of a more urgent nature will be referred to the Corporate Secretary, who will determine whether it should be delivered more promptly. Additional information regarding the procedural and substantive requirements for communicating with our Board may be found on our website at investor.visa.com, under “Corporate Governance – Contact the Board.”

All communications involving accounting, internal accounting controls, and auditing matters, possible violations of, or non-compliance with, applicable legal and regulatory requirements or the Code of Business Conduct and Ethics, or retaliatory acts against anyone who makes such a complaint or assists in the investigation of such a complaint, may be made via email to [email protected]; through our Confidential Compliance Hotline at (888) 289-9322 or our Confidential Online Compliance Hotline at visa.alertline.com; or by mail to Visa Inc., Business Conduct Office, P.O. Box 193243, San Francisco, CA 94119. All such communications will be handled in accordance with our Whistleblower Policy, a copy of which may be obtained by contacting our Corporate Secretary.

Attendance at Board, Committee, and Annual Stockholder Meetings

Our Board and its committees meet throughout the year on a set schedule, hold special meetings as needed, and act by written consent from time to time. The Board met seven times during fiscal year 2022. Each director attended at least 94% or more of the aggregate of: (i) the total number of meetings of the Board held during the period in fiscal year 2022 for which he or she served as a director, and (ii) the total number of meetings held by all committees of the Board on which such director served as a member during the period in fiscal year 2022. The total number of meetings held by each committee is listed below, under Committees of the Board of Directors. It is our policy that all members of the Board should endeavor to attend the annual meeting of stockholders. All ten of our then directors attended the 2022 Annual Meeting of Stockholders. Ms. List and Mr. Crawford joined the Board in April 2022 and October 2022, respectively and, therefore, did not attend the 2022 Annual Meeting.

Our Board has adopted a Code of Business Conduct and Ethics, which applies to all directors, officers, employees, and contingent staff of the Company. This Code includes a supplemental Code of Ethics for Certain Executives and Financial Officers, which applies to our Chief Executive Officer, Chief Financial Officer, Controller, Chief People and Administrative Officer, General Counsel, and other senior financial officers, whom we refer to collectively as senior officers. These Codes require the senior officers to engage in honest and ethical conduct in performing their duties, provide guidelines for the ethical handling of actual or apparent conflicts of interest between personal and professional relationships, and provide mechanisms to report unethical conduct. Our senior officers are held accountable for their adherence to the Codes. If we amend or grant any waiver from a provision of our Codes for officers or directors, we will publicly disclose such amendment or waiver in accordance with and if required by applicable law, including by posting such amendment or waiver on our website at investor.visa.com within four business days.

Political Engagement and Disclosure

Public sector decisions significantly affect our business and industry, as well as the communities in which we operate. For this reason, we participate in the political process through regular engagement with government

16

Table of Contents

officials and policy-makers, by encouraging the civic involvement of our employees, and by contributing to candidates and political organizations where permitted by applicable law. We are committed to conducting these activities in a transparent manner that reflects responsible corporate citizenship and best serves the interests of our stockholders, employees, and other stakeholders. Additional information regarding our political activities and oversight may be found at usa.visa.com/about-visa/esg/operating-responsibly.html.

Visa has a Political Participation, Lobbying and Contributions Policy (PPLC Policy) that prohibits our directors, officers, and employees from using Company resources to promote their personal political views, causes, or candidates, and specifies that the Company will not directly or indirectly reimburse any personal political contributions or expenses. Directors, officers, and employees also may not lobby government officials on the Company’s behalf absent the pre-approval of the Company’s Global Government Engagement department. As such, our lobbying and political spending seek to promote the interests of the Company and its stockholders, and not the personal political preferences of our directors or executives.

Under the PPLC Policy, the Nominating and Corporate Governance Committee must pre-approve the use of corporate funds for political contributions, including contributions made to trade associations to support targeted political campaigns and contributions to organizations registered under Section 527 of the U.S. Internal Revenue Code to support political activities. The PPLC Policy further requires the Company to make reasonable efforts to obtain from U.S. trade associations whose annual membership dues exceed $25,000 the portion of such dues that are used for political contributions. This information must then be included in the semiannual contribution reports that are posted on our website.

We endeavor to maintain a healthy and transparent relationship with governments around the world by communicating our views and concerns to elected officials and policy-makers. As an industry leader, we encounter challenges and opportunities on a wide range of policy matters. These issues may include regulations and policies on interchange fees, cybersecurity, data security, privacy, intellectual property, surcharging, payroll and prepaid cards, mobile payments, tax, international trade and market access, and financial inclusion, among others.

The Nominating and Corporate Governance Committee reviews our political contributions and lobbying expenditures on a semiannual basis, which includes information regarding memberships in, or payments to, tax-exempt organizations that write and endorse model legislation. Additional information on our political contributions and lobbying expenditures can be found on our website, including our semiannual contribution reports and links to our quarterly U.S. federal lobbying activities and expenditures reports.

In 2022, the Center for Political Accountability assessed our disclosures for its annual Center for Political Accountability CPA-Zicklin Index of Corporate Political Disclosure and Accountability, and designated Visa a “Trendsetter” (the highest designation in the CPA-Zicklin Index) with a perfect score of 100.

Environmental, Social, and Governance

We believe that as a trusted brand in payments, Visa has an opportunity and responsibility to contribute to a more inclusive, equitable, and sustainable world. As we work toward this goal, we are committed to managing the risks and opportunities that arise from ESG issues, providing transparency of our ESG performance, and enabling strong executive and Board oversight of our overall ESG strategy. In fiscal year 2022, the Board, in full and in individual committees, discussed a range of ESG topics, including but not limited to human capital management, inclusion and diversity, climate strategy, political engagement and contributions, technology, cybersecurity, and data privacy.

17

Table of Contents

Integrated Approach

Visa strives to be an industry leader in addressing ESG issues and overall management. To do so, we continue to take an integrated approach to our ESG performance and transparency.

| • | Materiality-based Strategy: In line with international ESG guidelines and corporate best practices, Visa conducts a biennial ESG materiality assessment, which enables us to monitor and reassess our approach to managing priority topics. Visa ’s overall approach to ESG focuses on identifying relevant and significant topics that align Visa’s long-term business strategy and success with the importance of those topics to our stakeholders, including employees, clients, investors, ESG ratings agencies, governments, civil society organizations, communities, and others. |

| • | Governance: At the Board level, the Nominating and Corporate Governance Committee has formal responsibility to oversee and review our management of ESG matters, overall ESG strategy, stakeholder engagement, formal reporting, and policies and programs in specific areas, including environmental sustainability, climate change, human rights, political activities and expenditures, social impact, and philanthropy. These responsibilities are incorporated into the charter for the Nominating and Corporate Governance Committee, which is available on the Investor Relations page of our website at investor.visa.com under “Corporate Governance – Committee Composition.” |

| • | Engagement: Understanding the views of Visa stakeholders supports our work across our business and ESG strategic priorities. We regularly engage with our stakeholders to help inform our ESG strategy, priorities, and actions. |

| • | Reporting: Visa is committed to providing transparency regarding our ESG approach and performance through various channels and platforms of ESG reporting. We publish our ESG Report annually, which is aligned with leading reporting frameworks, such as those from the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), relevant World Economic Forum (WEF) Stakeholder Capitalism Metrics, and others. In addition, we participate in: |

| • | Additional reporting initiatives such as CDP and the Workforce Disclosure Initiative (WDI); |

| • | Engagements with ESG ratings firms; |

| • | ESG-focused rankings and lists; and |

| • | Ongoing dialogue with stakeholders on our ESG performance. |

18

Table of Contents

Key Focus Areas of ESG Strategy and Recent Progress

Our ESG strategy focuses on priority issues in five areas, each of which is informed by our materiality assessment and stakeholder engagement.

|

Empowering People, Communities, and Economies • Digital Equity • Financial Access • Small and Micro Businesses • Empowering Women • Local Communities |

|

✓ Helped digitally enable over 40 million small and micro businesses (SMBs) as of September 2022, as we work toward our goal to digitally enable 50 million SMBs worldwide ✓ Continued to expand our global Practical Business Skills platform that delivers free digital education resources to SMB owners and entrepreneurs with visitors from over 150 countries ✓ Shared global insights through the Visa Economic Empowerment Institute on digital equity, SMB digitization, and remittance payments to help governments advance public policies that create more inclusive economies ✓ Supported more than 6,000 employees from 58 countries who volunteered more than 55,000 hours to strengthen the communities in which we live and work ✓ Visa Foundation committed $15.5 million in grant funding and $35.5 million in impact investments supporting gender diverse and inclusive small businesses globally | ||

|

Investing in our Workforce • Inclusion and Diversity • Learning and Development • Employee Engagement • Benefits and Wellbeing • Employee Safety |

|

✓ Made progress towards our goal to increase representation of employees from underrepresented groups in our U.S. leadership and broader workforce ✓ Maintained gender pay equity globally, as well as pay equity by race/ethnicity in the U.S. ✓ Welcomed the inaugural cohort of Visa Black Scholars to our first Visa Black Scholars Summit ✓ Held the fourth annual Visa Learning Festival with more than 50 virtual sessions and in-person events, with nearly 30% of employees registered to participate ✓ Launched the Visa Career Development Framework with digital tools to drive employee growth, mobility, and engagement ✓ Announced New Child Bonding Leave, which sets a global minimum of 14 weeks paid leave for all parents | ||

|

Securing Commerce and Protecting Customers • Payments Security • Cybersecurity • Consumer Privacy • Responsible Data Use • Transaction Integrity |

|

✓ Invested over $10 billion in technology over the last five years, including to reduce fraud and enhance network security ✓ Deployed artificial intelligence-enabled capabilities and always-on experts to proactively detect and prevent billions of dollars of attempted fraud ✓ Promoted the adoption of scalable technologies, such as network tokenization and 3DS, that enhanced transaction security globally ✓ Achieved the highest rating in our sector from Gartner Consulting during our 2022 cybersecurity program review ✓ Enhanced the Visa Global Privacy Program to anticipate increased and evolving privacy regulations and consumer expectations ✓ Decreased enumeration attack volumes with new analytical capabilities, enhanced tools, and the launch of a targeted compliance program | ||

|

Protecting the Planet • Visa Operations • Sustainable Commerce |

|

✓ Maintained 100% renewable electricity and carbon neutral operations ✓ Reduced Scopes 1 and 2 greenhouse gas emissions by 93% since fiscal year 2018, driven largely by switch to renewable electricity ✓ Received third party validation of Visa’s 2030 science-based targets as an interim goal toward our 2040 net-zero target and expanded engagement of Visa’s suppliers in support of our 2030 and 2040 emissions goals including Scope 3 reductions ✓ Completed the second year of Visa’s Green Bond use of proceeds, now totaling $243.3 million in eligible spend across areas such as green buildings, energy efficiency, and renewable energy ✓ Entered into our first commercial airline program for sustainable aviation fuel purchasing ✓ Advanced Visa’s sustainability solutions (e.g., Ecolytiq and Visa Eco Benefits) ✓ Formed new sustainable commerce partnerships with Ellen MacArthur Foundation, JustCharge, and others | ||

|

Operating Responsibly • Corporate Governance • Ethics and Compliance • Engaging with Governments • Human Rights • Responsible Sourcing • Tax Compliance and Governance |

|

✓ Overall diversity of Board nominees is 70%, with women comprising 30% of the nominees, and 40% of the nominees are racially or ethnically diverse ✓ Held Ethics in Action Week, celebrating the integral role of ethics in Visa’s culture ✓ Named to the Ethisphere World’s Most Ethical Companies list for the tenth consecutive year ✓ Received a 100% rating from the CPA–Zicklin Index for our disclosures related to corporate political contributions and recognized as a “Trendsetter” for the seventh consecutive year ✓ Continued our engagement with sports bodies, civil society organizations, and the Centre for Sport & Human Rights to promote respect of human rights in sport | ||

19

Table of Contents

Third-Party Recognition of our ESG Leadership

We continued to receive recognition of our ESG leadership by third-party organizations:

| • | Dow Jones Sustainability North America Index (DJSI) – Included in DJSI North America for fifth consecutive year; included in S&P’s 2022 Sustainability Yearbook for second consecutive year |

| • | CDP Climate Change – A List |

| • | Bloomberg Gender Equality Index |

| • | MSCI – Maintained “A” rating |

| • | Sustainalytics – Low Risk – ESG Risk Rating |

| • | America’s 100 Most Just Companies |

| • | World’s Most Ethical Companies – Named for the tenth consecutive time in 2022 |

| • | Best Places to Work for LGBTQ+ Equality 2022 – 100% on the Human Rights Campaign (HRC) Corporate Equality Index |

We encourage you to read more about how we are working to build a more inclusive, equitable, and sustainable world for everyone, everywhere at visa.com/esg and in our 2021 Environmental, Social and Governance Report. Our website and our 2021 Environmental, Social & Governance Report are not part of or incorporated by reference into this proxy statement. Our ESG goals are aspirational and may change. Statements regarding our goals are not guarantees or promises that they will be met.

20

Table of Contents

COMMITTEES OF THE BOARD OF DIRECTORS

The current standing committees of the Board are the Audit and Risk Committee, the Compensation Committee, the Finance Committee, and the Nominating and Corporate Governance Committee. Each of the standing committees operates pursuant to a written charter, which are available on the Investor Relations page of our website at investor.visa.com under “Corporate Governance – Committee Composition.”

Audit and Risk Committee

|

Committee members: Lloyd A. Carney*, Chair Ramon Laguarta Teri L. List* Denise M. Morrison*

*Audit Committee Financial Expert

Number of meetings in fiscal year 2022: 8 |

“Despite the challenges of 2022, including the war in Ukraine, we continued our focus on Visa’s operational resiliency and key risks, including ecosystem, credit settlement, technology, cybersecurity, fraud, regulatory, and third-party risks.”

– Lloyd A. Carney, Chair |

| ||

Key Activities in 2022

| • | Monitored the integrity of our financial statements, our compliance with legal and regulatory requirements, our internal controls over financial reporting, and the performance of our internal audit function and KPMG LLP, our independent registered public accounting firm; |

| • | Discussed the qualifications and independence of KPMG and recommended their re-appointment for fiscal year 2022; |

| • | Selected, approved the compensation of, and oversaw the work of KPMG, including the scope of and plans for the audit for fiscal year 2023; |

| • | Reviewed and discussed with management the disclosures required to be included in our Annual Report on Form 10-K and our quarterly reports on Form 10-Q, including the Company’s significant accounting policies and areas subject to significant judgment and estimates; |

| • | Discussed with KPMG their critical audit matters; |

| • | Approved fees for KPMG for fiscal year 2022 and all audit, audit-related, and non-audit fees and services consistent with our pre-approval policy; |

| • | On a quarterly basis, reviewed audit results and findings prepared by Internal Audit; |

| • | Reviewed and recommended that the Board approve our Audit and Risk Committee charter, reviewed and recommended that the Board approve amendments to our Code of Business Conduct and Ethics, monitored compliance with our Code of Business Conduct and Ethics, and reviewed the implementation and effectiveness of the Company’s compliance and ethics program; |

| • | Reviewed and discussed with management the Company’s financial risks, top risks, and other risk exposures and the steps taken to monitor and control those exposures, including our Risk Management Framework and Enterprise Risk Management Framework and programs, ecosystems risks, credit settlement risk programs, and our acquired entities’ risk profiles; |

| • | Monitored the Company’s technology risks, including operational resilience, privacy and data protection, and cybersecurity; |

| • | Reviewed and approved our Third-Party Lifecycle Management Program, Related Person Transactions Policy, fiscal year 2022 Global Operational Resilience Program plan, Risk Appetite Framework, and fiscal year 2022 internal audit plan; |

| • | Reviewed the Company’s insurance coverage and programs, and tax audits; and |

21

Table of Contents

| • | Reviewed the procedures for the receipt, retention, and treatment of complaints we receive under the Company’s Whistleblower Policy, including regarding accounting, internal accounting controls, or auditing matters and the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters. |

Certain Relationships and Related Person Transactions

The Audit and Risk Committee has adopted a written Statement of Policy with respect to Related Person Transactions (Statement of Policy), governing any transaction, arrangement, or relationship between the Company and any related person where the related person had, has, or will have a direct or indirect material interest. Under the Statement of Policy, the Audit and Risk Committee reviews related person transactions and may approve or ratify them only if it is determined that they are in, or not inconsistent with, the best interests of the Company and its stockholders. When reviewing a related person transaction, the Audit and Risk Committee may take into consideration all of the relevant facts and circumstances available to it, including: (i) the material terms and conditions of the transaction or transactions; (ii) the related person’s relationship to Visa; (iii) the related person’s interest in the transaction, including their position or relationship with, or ownership of, any entity that is a party to or has an interest in the transaction; (iv) the approximate dollar value of the transaction; (v) the availability from other sources of comparable products or services; and (vi) an assessment of whether the transaction is on terms that are comparable to the terms available to us from an unrelated third party.

In the event we become aware of a related person transaction that was not previously approved or ratified under the Statement of Policy, the Audit and Risk Committee will evaluate all options available, including ratification, revision, or termination of the related person transaction. The Statement of Policy is intended to augment and work in conjunction with our other policies that include code of conduct or conflict of interest provisions, including our Code of Business Conduct and Ethics.

We engage in transactions, arrangements, and relationships with many other entities, including financial institutions and professional organizations, in the ordinary course of our business. Some of our directors, executive officers, greater than five percent stockholders, and their immediate family members, each a related person under the Statement of Policy, may be directors, officers, partners, employees, or stockholders of these entities. We carry out transactions with these entities on customary terms, and, in many instances, our directors and executive officers may not be aware of them. To our knowledge, since the beginning of fiscal year 2022, no related person has had a material interest in any of our business transactions or relationships.

Report of the Audit and Risk Committee

The Committee, which is composed of independent directors, is responsible for monitoring and overseeing Visa’s financial reporting process on behalf of the Board. The functions of the Committee are described in greater detail in the Audit and Risk Committee Charter, adopted by the Board, which may be found on the Company’s website at investor.visa.com under “Corporate Governance – Committee Composition.” Visa’s management has the primary responsibility for establishing and maintaining adequate internal financial controls, for preparing the financial statements, and for the public reporting process. KPMG LLP, Visa’s independent registered public accounting firm, is responsible for expressing opinions on the conformity of the Company’s audited financial statements with accounting principles generally accepted in the United States of America and on the Company’s internal control over financial reporting.

In this context, the Committee has reviewed and discussed with management the Company’s audited consolidated financial statements for the fiscal year ended September 30, 2022. In addition, the Committee has discussed with KPMG the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (PCAOB) and the Securities and Exchange Commission.

The Committee also has received the written disclosures and the letter from KPMG required by the applicable requirements of the PCAOB regarding the independent registered public accounting firm’s communications with

22

Table of Contents

the audit committee concerning independence, and the Committee has discussed the independence of KPMG with that firm. The Committee also has considered whether KPMG’s provision of non-audit services to the Company impairs the auditor’s independence, and concluded that KPMG is independent from the Committee, the Company, and the Company’s management.

Based on the Committee’s review and discussions noted above, the Committee recommended to the Board that the Company’s audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2022, for filing with the Securities and Exchange Commission.

Audit and Risk Committee of the Board of Directors

Lloyd A. Carney (Chair)

Ramon Laguarta

Teri L. List