Form DEF 14A VIAVI SOLUTIONS INC. For: Nov 09

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant o

Check the appropriate box:

| o | Preliminary Proxy Statement | ||||

| o | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||

| x | Definitive Proxy Statement | ||||

| o | Definitive Additional Materials | ||||

| o | Soliciting Material Pursuant to § 240.14a-12 | ||||

VIAVI SOLUTIONS INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | ||||

| o | Fee paid previously with preliminary materials. | ||||

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||

Notice of 2022

Virtual Annual Meeting

of Stockholders

and Proxy Statement

Viavi Solutions, Inc.

November 9, 2022, at

10:00 a.m. Mountain Time

1445 South Spectrum Blvd, Suite 102

Chandler, Arizona 85286

(408) 404-3600

Fiscal Year 2022 (“FY22”) Virtual Annual Meeting of Stockholders & Proxy Statement

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, WE ENCOURAGE YOU TO READ THIS PROXY STATEMENT AND SUBMIT YOUR PROXY OR VOTING INSTRUCTIONS AS SOON AS POSSIBLE. PLEASE REFER TO (I) THE INSTRUCTIONS OF THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS YOU RECEIVED IN THE MAIL, (II) THE SECTION ENTITLED GENERAL INFORMATION BEGINNING ON PAGE 86 OF THIS PROXY STATEMENT, OR (III) IF YOU REQUESTED TO RECEIVE PRINTED PROXY MATERIALS, YOUR ENCLOSED PROXY CARD. | ||

IMPORTANT NOTICE REGARDING THE PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON NOVEMBER 9, 2022: The notice of Annual Meeting, Proxy Statement and the Annual Report on Form 10-K for the fiscal year ended July 2, 2022, are available free of charge at the following website: www.edocumentview.com/VIAV | ||

GO GREEN!

REGISTER ELECTRONICALLY

FOR STOCKHOLDER MATERIALS

Viavi Solutions Inc. is pleased to take advantage of the Securities and Exchange Commission rules allowing companies to furnish this Proxy Statement and Annual Report over the internet to our stockholders who hold Common Stock. We believe that this e-proxy process, also known as “Notice and Access” will expedite the receipt of proxy materials by our stockholders, reduce our printing and mailing expenses and reduce the environmental impact of producing the materials required for our annual meeting of stockholders.

You should refer to the “General Information About the Annual Meeting” portion of the following Proxy Statement or contact our Investor Relations hotline at 408-404-6305 for assistance regarding instructions on how to register for and access our Proxy Statement and Annual Report online.

Dear Stockholders:

The independent directors of Viavi Solutions Inc. (“VIAVI”) and I are inviting you to attend VIAVI’s 2022 Annual Meeting of Stockholders, which will be held virtually on November 9, 2022, at 10:00 a.m. Mountain Time. As we approach the 2022 Annual Meeting, I would like to share with you some of our business and financial highlights from fiscal year 2022 (“FY22”) as well as some of our recent stockholder outreach efforts and ESG Initiatives.

| Business and Financial Highlights | ||

During FY22, we demonstrated the overall strength and resilience of our business model. Despite experiencing global supply chain disruptions, higher shipping-related charges, and inflationary pressures, we saw significant improvements in our financial results compared to fiscal year 2021.

Our financial highlights included a record year for revenue and increases in both our GAAP and non-GAAP operating margins, with our non-GAAP operating margin at an all-time high. We also completed a $400 million high-yield 2029 note offering at an attractive 3.75% interest rate, and retired about 57% of existing convertible notes in FY22. Further, during FY22, we repurchased 14.8 million shares of our common stock for $235.5 million.

| Investor Outreach and Engagement | ||

We recognize the importance of regular and transparent communication with our stockholders, and we aim to engage with our stockholders on a regular basis.

After last year’s Say on Pay vote, we expanded our outreach and engagement efforts to ensure that stockholders had an opportunity to provide feedback on our executive compensation program, as well as our corporate governance practices and environmental, social and governance (“ESG”) initiatives and other topics of concern. Over the last year, we contacted 25 stockholders representing 70% of total shares outstanding, and engaged with 13 stockholders representing approximately 51% of our total outstanding shares. Following these discussions and in light of our continued commitment to corporate governance best practices, we are making or considering a number of enhancements to our executive compensation program as described in detail in this Proxy Statement. In addition, based on this feedback, we expanded our key corporate governance and ESG disclosures in this Proxy Statement and in our 2022 ESG Report.

| Environmental, Social, and Governance | ||

We have taken steps to further strengthen our ESG initiatives, including embracing the practices and behaviors that create the right environment for people to succeed. This included conducting our inaugural ESG Priority Assessment for our 2022 ESG Report, allowing us to identify the environmental, social, and governance topics with the greatest impact on our business strategy, success, and ability to generate long-term value.

The 2022 ESG Report was also our first ESG disclosure aligned with the recommendations of Task Force on Climate-Related Financial Disclosures, and included our second disclosure in alignment with the Sustainability Accounting Standards Board standards. We continue to reduce our environmental impact and maintain a strong company culture in our operations, and advance innovation that delivers a positive impact via our products and services.

| FY22 Virtual Annual Meeting | ||

We have designed the virtual 2022 Annual Meeting to provide the same rights and opportunities to participate as stockholders would have at an in-person meeting. Details regarding how to access the virtual meeting via the internet and the business to be conducted at the meeting are more fully described in the accompanying Notice of 2022 Annual Meeting of Stockholders and Proxy Statement. Whether or not you plan to attend the meeting, please vote as your vote is important.

On behalf of the Board of Directors, we would like to express our appreciation for your continued support of VIAVI.

Sincerely,

Oleg Khaykin

President and Chief Executive Officer

September 29, 2022

Table of Contents

VIAVI at a Glance | |||||

A-1 | |||||

VIAVI Solutions Inc. | FY 2022 Notice of Annual Meeting & Proxy Statement | i

NOTICE OF 2022 VIRTUAL ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON NOVEMBER 9, 2022

Virtual Meeting Logistics

| Date | Time | Live Webcast | ||||||

|  |  | ||||||

| Wednesday, November 9, 2022 | 10:00 a.m., Mountain Time | https://meetnow.global/MWX2G6V Access begins at 9:30 a.m., Mountain Time | ||||||

Items of Business

Stockholders will be asked to vote on the following matters at the 2022 Virtual Annual Meeting of Stockholders (the "2022 Annual Meeting") of VIAVI:

| PROPOSAL | BOARD VOTING RECOMMENDATION | PAGE REFERENCE (FOR MORE DETAIL) | ||||||||||||||||||

| Management Proposals | ||||||||||||||||||||

Proposal 1. Election of Directors The Board of Directors (the "Board,” and each member a “Director”) believes that each of the Director nominees has the knowledge, experience, skills and background necessary to contribute to an effective and well-functioning Board. |  | Vote FOR each Director nominee | ||||||||||||||||||

Proposal 2. Ratification of the Appointment of PricewaterhouseCoopers LLP as VIAVI’s independent registered public accounting firm for fiscal year 2023 The Audit Committee and the Board believe that the continued retention of PricewaterhouseCoopers LLP to serve as VIAVI’s independent auditors is in the best interests of VIAVI and its stockholders. |  | Vote FOR | ||||||||||||||||||

Proposal 3. Approval, in a Non-Binding Advisory Vote, of the Compensation for Named Executive Officers The Board believes that the compensation of our named executive officers as disclosed in this Proxy Statement for fiscal year 2022 is well aligned with VIAVI’s performance and the interests of our stockholders. |  | Vote FOR | ||||||||||||||||||

Stockholders will also consider any other business properly brought before the meeting or any adjournment.

VIAVI Solutions Inc. | FY 2022 Notice of Annual Meeting & Proxy Statement | 1

| Notice of 2022 Annual Meeting | ||

This summary provides an overview of selected information in this year’s Proxy Statement. We encourage you to read the entire Proxy Statement before voting.

Important Meeting Information

| Record Date | ||

Stockholders of record as of September 21, 2022 will be able to vote and participate in the 2022 Annual Meeting of Stockholders using the control number included on their Notice of Internet Availability of Proxy Materials, proxy card or on the instructions that accompanied their proxy materials. Each share of common stock of the Company is entitled to one vote for each director nominee and one vote for each of the proposals.

| Proxy Materials | ||

Please note that we are providing proxy materials and access to our Proxy Statement to our stockholders via our website instead of mailing printed copies to each of our stockholders. By doing so, we save costs and reduce our impact on the environment.

Beginning on September 29, 2022, we will mail or otherwise make available to each of our shareholders a Notice of Internet Availability of Proxy Materials, which contains instructions on how to access our proxy materials and vote by telephone or through the internet and includes instructions on how to receive a paper copy of the proxy materials by mail. If you attend the Annual Meeting virtually, you may withdraw your proxy and vote online during the Annual Meeting if you so choose.

| Technical Issues | ||

Contact (800) 736-3001 (toll-free) or +1 (781) 575-3100 (international) or review the instructions on the virtual meeting website if you experience any technical difficulties or have trouble accessing the virtual meeting.

| Asking Questions | ||

During the meeting, questions can only be submitted in the question box provided at: https://meetnow.global/MWX2G6V

Your Vote is Important

Whether or not you plan to attend the meeting, we encourage you to read this Proxy Statement and submit your proxy or voting instructions as soon as possible. please refer to (i) the instructions of the Notice of Internet Availability of Proxy Materials you received in the mail, (ii) the section entitled General Information About the Annual Meeting beginning on page 86. of this Proxy Statement, or (iii) if you requested to receive printed proxy materials, your enclosed proxy card.

By Order of the Board of Directors,

Oleg Khaykin

President and Chief Executive Officer

Chandler, Arizona

September 29, 2022

IMPORTANT NOTICE REGARDING THE PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON NOVEMBER 9, 2022: The notice of Annual Meeting, Proxy Statement and the Annual Report on Form 10-K for the fiscal year ended July 2, 2022, are available free of charge at the following website: www.edocumentview.com/VIAV | ||

2 | VIAVI Solutions Inc. | FY 2022 Notice of Annual Meeting & Proxy Statement

VIAVI at a Glance

Our Values

The following six VIAVI business values articulate the cultural identity for VIAVI and provide shared understanding of expectations across the company.

VIAVI Solutions Inc. | FY 2022 Notice of Annual Meeting & Proxy Statement | 3

VIAVI at a Glance | ||

Fiscal Year 2022 Financial Performance

VIAVI’s financial results for fiscal year 2022 (July 3, 2021 to July 2, 2022, and “FY22”) demonstrate the overall strength and resilience of our business model. Despite experiencing global supply chain disruptions, higher shipping-related charges, and inflationary pressures, we saw significant improvements in our financial results compared to fiscal year 2021 (“FY21”), including a record year for revenue and increases in both our GAAP and non-GAAP operating margins, with our non-GAAP operating margin at an all-time high. GAAP EPS was down largely due to the loss incurred in connection with the repurchase of certain convertible notes. We also made a number of capital structure improvements, which included the completion of a $400 million high-yield 2029 note offering an attractive 3.75% interest rate, and the retirement of about 57% of existing convertible notes in FY22. Also, during FY22, we repurchased 14.8 million shares of our common stock for $235.5 million.

| Net Revenues grew 7.8% year-over-year to | GAAP Operating Margin grew 240 basis points year-over-year to | Total Consolidated GAAP EPS decreased 75.9% year-over-year to | ||||||||||||

| $1.3 Billion | 14.3% | $0.07(1)(2) | ||||||||||||

Capital Returned to Stockholders in FY22 | Non-GAAP Operating Margin grew 110 basis points year-over-year to | Total Consolidated non-GAAP EPS grew 14.5% year-over-year to | ||||||||||||

| $235.5 Million | 22.2%(1) | $0.95(1) | ||||||||||||

(1)Appendix A includes a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures.

(2)GAAP EPS decrease largely due to the loss incurred in connection with the repurchase of certain convertible notes.

| Business Overview | ||

Strong Growth for Network and Service Enablement in Fiber and Wireless

•Our Network Enablement (“NE”) business segment experienced strong revenue growth driven by fiber and wireless, with revenues growing 13.3% year-over-year as North American service providers upgraded and expanded their networks with fiber optics, and wireless demand increased in FY22.

•Our Service Enablement (“SE”) business segment experienced a 13.1% increase in revenue year over year as we saw strong growth in assurance solutions and data center products, in part due to increased market demand for 5G and growth in network traffic.

Continued Growth in Optical Security and Performance (“OSP”) Products

•Revenue from our OSP business segment decreased by 4.9% year-over-year, primarily driven by a decrease in demand for our consumer electronics and industrial products.

Successfully Managing Supply Chain Disruptions

•We continued to execute successfully in FY22 despite supply chain shortages. Our ability to secure critical components, build inventory and meet customer demands has been a great differentiator and enabled us to grow revenue and market share.

4 | VIAVI Solutions Inc. | FY 2022 Notice of Annual Meeting & Proxy Statement

VIAVI at a Glance | ||

Compensation Discussion and Analysis Highlights

Compensation Policies and Practices

Our commitment to designing an executive compensation program that is consistent with responsible financial and risk management is reflected in the following policies and practices:

| What We Do | What We Don’t Do | ||||||||||

| þ | Compensation Committee is comprised 100% of independent Directors. | û | No employment agreements that provide for fixed terms or automatic compensation increases or equity awards. | ||||||||

| þ | Independent compensation consultant retained by the Compensation Commit | û | No repricing or repurchasing of underwater stock options without stockholder approval. | ||||||||

| þ | Balance short- and long-term incentives, cash and equity and fixed and variable pay elements. | û | No dividends or dividend equivalents on unearned awards. | ||||||||

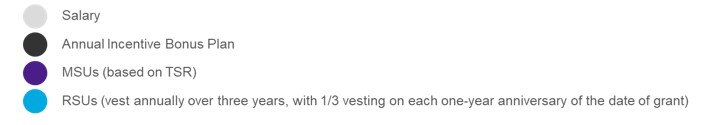

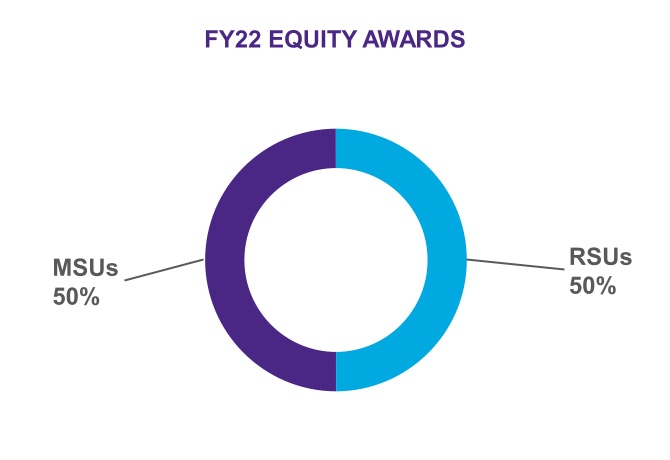

| þ | Performance-based awards comprising approximately 50% of the overall equity allocation to executive officers. | û | No pledging or hedging of VIAVI securities. | ||||||||

| þ | Require one-year minimum vesting for awards granted under the Amended and Restated 2003 Equity Incentive Plan, subject to certain exceptions. | û | No “single trigger” change in control acceleration of vesting for equity awards. | ||||||||

| þ | Maintain a clawback policy that applies to both cash incentives and equity awards. | û | No excessive perquisites. | ||||||||

| þ | Assess and mitigate compensation risk. | û | No excessive cash severance payments or benefits. | ||||||||

| þ | Solicit an annual advisory vote on executive compensation. | û | No executive pension plans or supplemental executive retirement plans. | ||||||||

| þ | Maintain stock ownership guidelines. | û | No "golden parachute" tax gross-ups. | ||||||||

| û | No multiple classes of equity or non-voting stock | ||||||||||

Incentive Program – Pay-for-Performance Highlights

As described more fully in the Compensation Discussion and Analysis (CD&A) section of this Proxy Statement, our Named Executive Officers (NEOs) are compensated in a manner consistent with our performance-based pay philosophy and corporate governance best practices:

■Pay for Performance: Align executive compensation to the success of our business objectives and the VIAVI growth strategy

■Competitiveness: Provide competitive compensation that attracts and retains top-performing executive officers

■Outperformance: Motivate executive officers to achieve results that exceed our strategic plan targets

■Stockholder Alignment: Align the interests of executive officers and stockholders through the managed use of long-term incentives

■Balance: Set performance goals that reward an appropriate balance of near- and long-term results

■Internal Pay Equity: Promote collaboration among executive officers by considering internal pay equity in setting compensation levels

VIAVI Solutions Inc. | FY 2022 Notice of Annual Meeting & Proxy Statement | 5

VIAVI at a Glance | ||

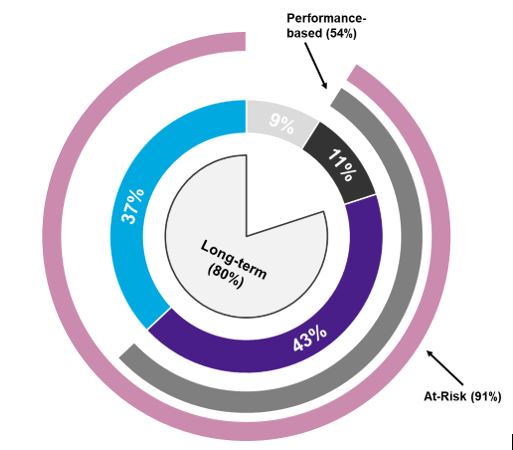

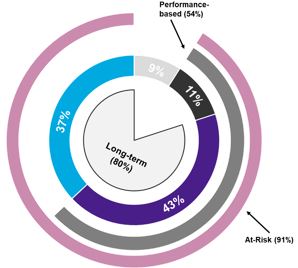

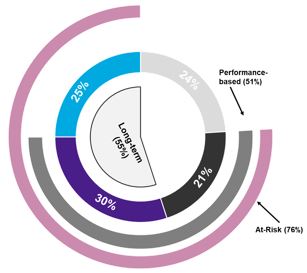

FY22 CEO Target Total Direct Compensation

54% performance-based and 91% at risk

FY22 Incentive Plan Results (CEO)

| FY22 VPP Payout | MSUs Earned in FY22 | FY22 Performance | ||||||

$365K for H1 of FY2022 | FY2019 MSUs: 130.25% of 3rd tranche earned | 67.1 percentile TSR ranking | ||||||

FY2020 MSUs: 37.00% of 2nd tranche earned | 36.1 percentile TSR ranking | |||||||

$573K for H2 of FY2022 | FY2021 MSUs: 83.33% of 1st tranche earned | 50.0 percentile TSR ranking | ||||||

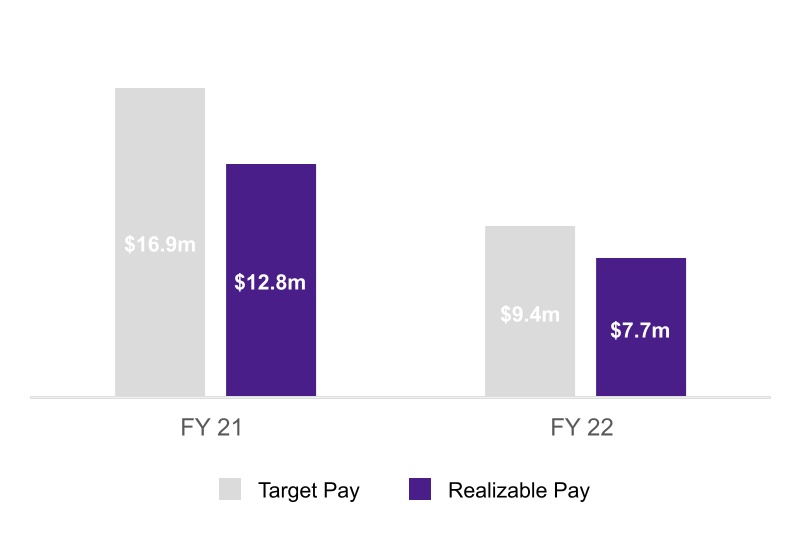

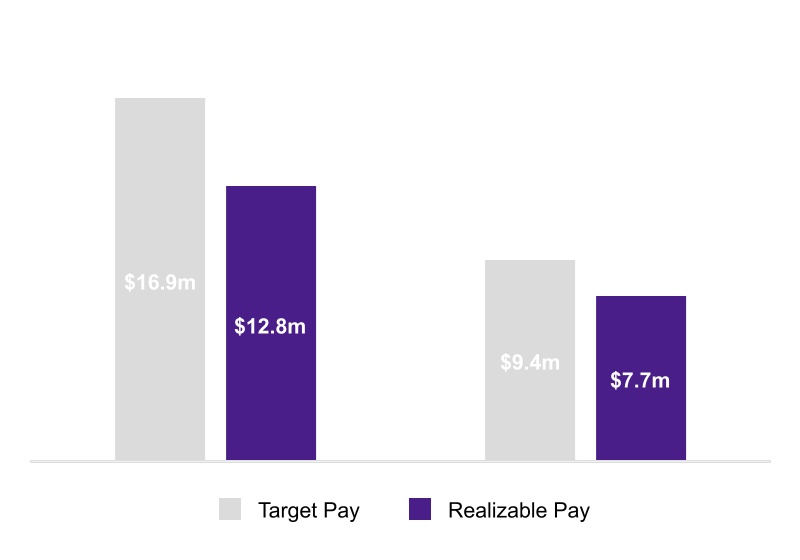

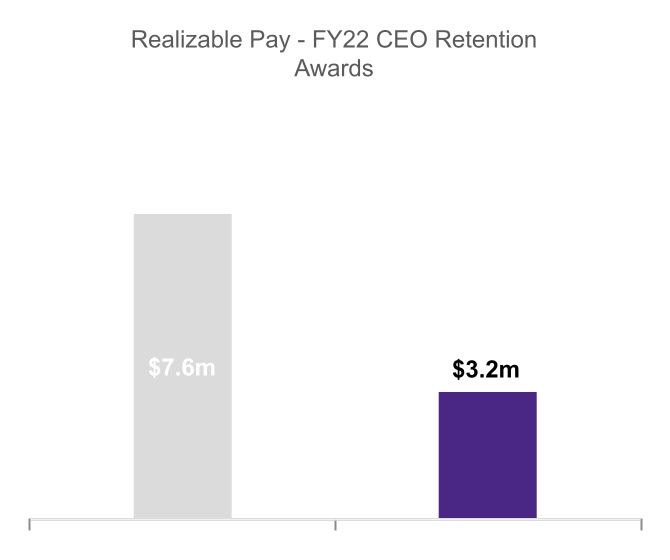

CEO Compensation and Performance Alignment

See page 50 of the CD&A for more information.

6 | VIAVI Solutions Inc. | FY 2022 Notice of Annual Meeting & Proxy Statement

VIAVI at a Glance | ||

Environmental, Social, and Governance Highlights

Over the past few years, and through the uncertainties of the COVID-19 pandemic, VIAVI has taken steps to further strengthen our Environmental, Social, and Governance (“ESG”) initiatives, including embracing the practices and behaviors that create the right environment for people to succeed. VIAVI values the contributions of our people, and we strive for a workplace where our employees feel they belong. Our corporate policies are intended to reflect a culture of integrity across our global workforce and we continue to act responsibly on behalf of our customers, partners, stockholders, and employees, and do so while engaging responsibly with our communities.

Conducted our inaugural ESG Priority Assessment | Affiliate member of Responsible Business Alliance | Achieved 2015 CO2 emissions reduction goal to reduce CO2 emissions by 20% by 2025 | Launched packaging initiative to explore ways of reusing or recycling packaging material | |||||||||||||||||

Continued development of human capital management programs focused on talent planning, talent acquisition, rewards and development | Best-in-class Total Recordable Injury Rate (TRIR) of 0.23 injuries per 100 full-time workers per year | Diversity, equity and inclusion (“DEI’) strategy focused on three pillars - Leadership, Culture and Talent | Signatory of US IP Alliance Diversity Pledge to address and improve DEI within the U.S. patent and technology system | |||||||||||||||||

In FY22, on average, 28 percent of U.S. suppliers were certified as diverse, verified by a third party on a quarterly basis | VIAVI and our employees supported a number of community initiatives, including donations supporting Ukraine | Compensation Committee oversight of Human Capital Management | Audit Committee oversight of cyber security and other information technology risks, controls and procedures | |||||||||||||||||

Governance Committee oversight of the Company’s programs, policies and practices related to ESG matters and related disclosures | Management Level ESG Steering Committee oversight of the Company’s ESG policies, practices and initiatives | Established a Global Environmental Policy and a Global Human and Labor Rights Policy | Published 2022 ESG Report pursuant to SASB and TCFD standards | |||||||||||||||||

VIAVI Solutions Inc. | FY 2022 Notice of Annual Meeting & Proxy Statement | 7

Corporate Governance | ||

Corporate Governance

VIAVI is a company that prioritizes best-in-class governance and compliance by adopting market leader standards for Board composition and corporate governance. We believe that good corporate governance is an important component in enhancing investor confidence in the Company and increasing stockholder value. Continuing to develop and implement best practices throughout our corporate governance structure is a fundamental part of our strategy to enhance performance by creating an environment that increases operational efficiency and ensures long-term productivity growth. Good corporate governance practices also ensure alignment with stockholder interests by promoting fairness, transparency, and accountability in our business activities.

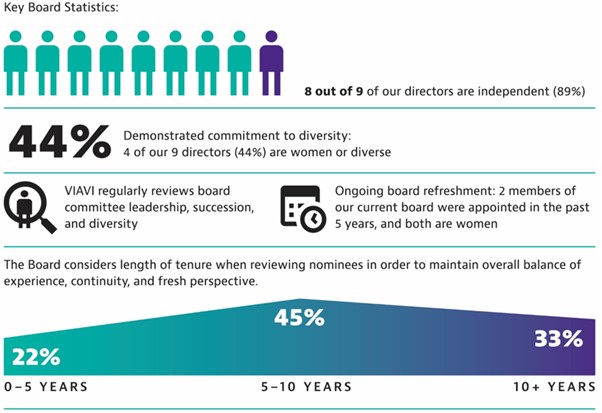

Corporate Governance Highlights

We are vocal advocates for the adoption of sound corporate governance policies that include strong Board leadership and strategic deliberation, prudent management practices and transparency.

Highlights of our governance practices, among others include:

Non-executive, independent Board Chair | Annual election of Directors | Majority voting for Directors in uncontested elections | All committees are comprised of independent Directors | |||||||||||||||||

All members of the Audit Committee are Audit Committee Financial Experts | Executive sessions of independent Directors | Annual Board, individual Director and Committee evaluations | Risk oversight by Board and Committees, including with respect to cybersecurity | |||||||||||||||||

44% of the Board is comprised of women or is diverse | Procedures for stockholders to communicate directly with the Board | Stock ownership requirements for Directors and executives | Annual advisory vote on executive compensation | |||||||||||||||||

Annual review of Committee charters and Corporate Governance Guidelines | Compensation Committee oversight of human capital management including DEI | Governance Committee oversight of the Company’s ESG matters | Management Level ESG Steering Committee responsible for the Company’s ESG policies, strategies and initiatives | |||||||||||||||||

Robust training and compliance programs, with 100% employee participation in Code of Business Conduct Training | No pledging or hedging of VIAVI securities | No multi-voting or non-voting stock. | Our CEO ranked as the #1 CEO in 2019 for the Mid-Cap Technology, Media, and Telecommunications Sector by Institutional Investor, LLC | |||||||||||||||||

8 | VIAVI Solutions Inc. | FY 2022 Notice of Annual Meeting & Proxy Statement

Corporate Governance | ||

Board Leadership

The Board has determined that it is in the best interest of the Company to maintain separate Board Chair and Chief Executive Officer positions. The Board believes that having an independent Director serve as Chair is the most appropriate leadership structure, as this enhances its independent oversight of management and the Company’s strategic planning, reinforces the Board’s ability to exercise its independent judgment to represent

stockholder interests, and strengthens the objectivity and integrity of the Board. Moreover, we believe an independent Chair can more effectively lead the Board in objectively evaluating the performance of management, including the Chief Executive Officer, and guide it through appropriate Board governance processes.

The duties of the Chair of the Board and Chief Executive Officer are set forth in the table below:

Chair of the Board | Chief Executive Officer | |||||||

▪Sets the agenda of Board meetings ▪Presides over meetings of the full Board ▪Contributes to Board governance and Board processes ▪Communicates with all Directors on key issues and concerns outside of Board meetings ▪Presides over meetings of stockholders | ▪Sets strategic direction for the Company ▪Creates and implements the Company’s vision and mission ▪Leads the affairs of the Company, subject to the overall direction and supervision of the Board and its committees and subject to such powers as reserved by the Board and its committees | |||||||

Director Independence

In accordance with current Nasdaq listing standards, the Board, on an annual basis, affirmatively determines the independence of each Director and nominee for election as a Director. Our Director independence standards include all elements of independence set forth in the Nasdaq listing standards, and can be found in our Corporate Governance Guidelines, which are included in the “Governance” section of our website at www.viavisolutions.com/en-us/corporate/about-us/environment-social-and-governance. The Board has determined that each of its non-employee Directors was independent as determined by the relevant Nasdaq listing standard for board independence and for any committee which such Director served on during FY22.

In making the determination of the independence of our Directors, the Board considered whether there were any transactions between VIAVI and entities associated with our Directors or members of their immediate families, including transactions involving VIAVI, investments in companies in which our Directors or their affiliated, and determined there were none. Additionally, there are no family relationships among any of our executive officers and Directors.

Independent Directors | ||||||||

| ||||||||

| 8 of 9 Directors are Independent | ||||||||

| Audit Committee Chair | Independent |  | ||||||

| Compensation Committee Chair | Independent |  | ||||||

| Corporate Development Committee Chair | Independent |  | ||||||

| Governance Committee Chair | Independent |  | ||||||

VIAVI Solutions Inc. | FY 2022 Notice of Annual Meeting & Proxy Statement | 9

Corporate Governance | ||

Board Composition, Experience and Diversity

The Governance Committee regularly reviews the overall composition of the Board and its committees to assess whether it reflects the appropriate mix of skills, experience, backgrounds and qualifications that are relevant to VIAVI’s current and future global business and strategy.1

(1)For the purpose of the above figures, this information relates to our Directors who are serving as of the date of this Proxy Statement and each year refers to the 12-month period ending on September 29th.

Board Diversity Matrix

| Board Size: | ||||||||

| Total Number of Directors | 9 | |||||||

| Gender: | Male | Female | ||||||

| Number of Directors based on gender identity | 7 | 2 | ||||||

| Number of Directors who identify in any of the categories below: | ||||||||

| Asian | 1 | |||||||

| Hispanic or Latinx | 1 | |||||||

| White | 5 | 2 | ||||||

10 | VIAVI Solutions Inc. | FY 2022 Notice of Annual Meeting & Proxy Statement

Corporate Governance | ||

Role of the Committees in Risk Oversight

Our Board committees assist the Board in fulfilling its risk oversight responsibilities. Generally, the committee with subject matter expertise in a particular area is responsible for overseeing the management of risk in that area. When any of the committees receives a report related to material risk oversight, the chair of the relevant committee reports on the discussion to the full Board.

| THE BOARD | ||||||||

| Our Board is ultimately responsible for oversight of risks | ||||||||

| AUDIT COMMITTEE | ||||||||

| The Audit Committee coordinates the Board’s oversight of the Company’s internal controls over financial reporting and disclosure controls and procedures as well as the Company’s cybersecurity and information technology risks, controls and procedures. | ||||||||

| COMPENSATION COMMITTEE | GOVERNANCE COMMITTEE | |||||||

| The Compensation Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks arising from our compensation policies and programs as well as succession planning for senior executives and human capital management. | The Governance Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks associated with board organization, membership and structure, corporate governance and ESG topics | |||||||

VIAVI Solutions Inc. | FY 2022 Notice of Annual Meeting & Proxy Statement | 11

Corporate Governance | ||

Board Oversight of Risk

We take a comprehensive approach to risk management as we believe risk can arise in every decision and action taken by the Company, whether strategic or operational. Consequently, we seek to include risk management principles in all of our management processes and in the responsibilities of our employees at every level. Our comprehensive approach is reflected in the reporting processes by which our management provides timely and comprehensive information to the Board to support the Board’s role in oversight, approval and decision-making.

Role of Management

Management is responsible for the day-to-day supervision of risk, while the Board, as a whole and through its committees, has the ultimate responsibility for the oversight of risk management. In June 2021, the Company conducted a comprehensive enterprise risk assessment survey covering key functional areas and business units. The results were reviewed and discussed by senior management in December 2021, and presented to the full Board in February 2022. Senior management attends Board meetings, provides presentations on operations including significant risks, and is available to address any questions or concerns raised by the Board.

Managing COVID-19 Risks

The Company continues to support the workforce through the ongoing COVID-19 pandemic, guided by our policies and local site leadership. Our global COVID-19 Committee at the executive level, regional and local Pandemic Response Teams, Return to Work guidelines and a global flexible workplace policy all enable us to help our employees and their families stay healthy and safely navigate the challenging and changing environment. Through regular updates and communications with management, the Board has actively participated in overseeing the Company’s COVID-19 response by monitoring the impact of COVID-19 on the Company’s financial position and results of operations, understanding how management is assessing the impact, and considering the nature and adequacy of management’s responses, including health safeguards, business continuity, internal communications, and infrastructure.

Compensation Program Risk Assessment

Consistent with SEC disclosure requirements, in FY22, a team composed of senior members of our human resources, finance and legal departments and our compensation consultant, Compensia, Inc. (“Compensia”), inventoried and reviewed elements of our compensation policies and practices. This team then reviewed these policies and practices with Company’s management to assess whether any of our policies or practices create risks that are reasonably likely to have a material adverse effect on the Company. This assessment included a review of the primary design features of the Company’s compensation policies and practices, the process for determining executive and employee compensation and consideration of features of our compensation program that help to mitigate risk. Management reviewed and discussed the results of this assessment with the Compensation Committee, which consulted with Compensia. Based on this review, we believe that our compensation policies and practices, individually and in the aggregate, do not create risks that are reasonably likely to have a material adverse effect on the Company.

12 | VIAVI Solutions Inc. | FY 2022 Notice of Annual Meeting & Proxy Statement

Corporate Governance | ||

Information Security Oversight

Information security is the responsibility of our Information Security team, overseen by our Chief Information Security Officer. We leverage a combination of the National Institute of Standards and Technology (NIST) Cybersecurity Framework, International Organization for Standardization and Center for internet Security best practice standards to measure security posture, deliver risk management and provide effective security controls.

Our information security practices include development, implementation, and improvement of policies and procedures to safeguard information and ensure availability of critical data and systems. Our Information Security team conducts annual information security awareness training for employees involved in our systems and processes that handle customer data and audits of our systems and enhanced training for specialized personnel. Our program further includes review and assessment by external, independent third-parties, who assess and report on our internal incident response preparedness and help identify areas for continued focus and improvement.

As set forth in its charter, our Audit Committee, comprised fully of independent Directors, is responsible for oversight of risk, including cybersecurity and information security risk. Our Audit Committee has established a Cybersecurity Steering Committee consisting of two independent Directors, Timothy Campos (who serves as Chair of the Cybersecurity Steering Committee) and

Laura Black as well as our Chief Information Officer, our Chief Information Security Officer and other members of our management representing a variety of teams and functions including legal, finance, and internal audit. Each of the members of our Cybersecurity Steering Committee has work experience managing cybersecurity and information security risks, an understanding of the cybersecurity threat landscape and/or knowledge of emerging privacy risks.

The purpose of the Cybersecurity Steering Committee is to ensure our compliance with reasonable and appropriate organizational, physical, administrative and technical measures designed to protect the integrity, security and operations of our information technology systems, transactions, and data owned by us, by providing guidance and oversight of our information technology and cybersecurity program.

The Cybersecurity Steering Committee generally meets twice per fiscal quarter and generally delivers reports and updates to the Audit Committee at each scheduled Audit Committee meeting. The Audit Committee or, at the Audit Committee’s instruction, the Cybersecurity Steering Committee regularly briefs the full Board on these matters, and the Board receives regular updates on the status of the information security program, including but not limited to relevant cyber threats, roadmap and key initiative updates, and the identification and management of information security risks.

Our Information Security Oversight Structure | ||||||||||||||||||||

| Information Security Team |  | Cybersecurity Steering Committee |  | Audit Committee |  | The Board | ||||||||||||||

VIAVI Solutions Inc. | FY 2022 Notice of Annual Meeting & Proxy Statement | 13

Corporate Governance | ||

The Board of Directors and Its Committees

The Board has four standing committees: the Audit Committee, Compensation Committee, Corporate Development Committee, and Governance Committee. Our Audit, Compensation, Corporate Development, and Governance Committees operate pursuant to charters that have been approved by the Board, are reviewed at

least annually, and are available on our website at investor.viavisolutions.com/governance/committee-charters.

The table below indicates the composition of each of the committees of our Board (as of July 2, 2022):

| DIRECTORS | Audit Committee | Compensation Committee | Corporate Development Committee | Governance Committee | ||||||||||||||||||||||||||||

| Richard E. Belluzzo |  |  |  | |||||||||||||||||||||||||||||

| Keith Barnes |  |  |  |  | ||||||||||||||||||||||||||||

| Laura Black |  |  | ||||||||||||||||||||||||||||||

| Tor Braham |  | |||||||||||||||||||||||||||||||

| Timothy Campos |  |  | ||||||||||||||||||||||||||||||

| Donald Colvin |  |  |  | |||||||||||||||||||||||||||||

| Masood A. Jabbar |  |  |  | |||||||||||||||||||||||||||||

| Oleg Khaykin | ||||||||||||||||||||||||||||||||

| Joanne Solomon |  |  | ||||||||||||||||||||||||||||||

| Chair of the Board |  | Committee Member | |||||||||||||||||

| Committee Chairperson |  | Financial Expert | |||||||||||||||||

Board Meetings and Director Attendance

During FY22, the Board held 9 meetings. Each Director attended at least 75% of the aggregate of all meetings of the Board and any committees on which they served during FY22 after becoming a member of the Board or after being appointed to a particular committee.

The Company encourages, but does not require, its Board members to attend the 2022 Annual Meeting. All then-current Directors attended the 2021 Annual Meeting.

FY22 Average Board Meeting Attendance | ||

| 98% | ||

14 | VIAVI Solutions Inc. | FY 2022 Notice of Annual Meeting & Proxy Statement

Corporate Governance | ||

Audit Committee

| Responsibilities | Current Members | |||||||

The primary responsibility of the Audit Committee is to assist the full Board in fulfilling its oversight responsibilities with respect to: •The integrity of the Company’s financial statements and other financial information provided by the Company to its stockholders, the public and others; | Donald Colvin (Chair) Keith Barnes Masood A. Jabbar Joanne Solomon Meetings: 8 meetings during FY22. Attendance: The average attendance of the Directors at Audit Committee meetings in FY22 was 100%. Independence: The Board has determined that all members of the Audit Committee are “independent” as defined in the applicable rules and regulations of the Securities and Exchange Commission (the “SEC”) and Nasdaq. Financial Experts: The Board has determined that Keith Barnes, Donald Colvin, Masood A. Jabbar and Joanne Solomon are “audit committee financial expert(s)” as defined by Item 407(d) of Regulation S-K of the Exchange Act. | |||||||

▪The Company’s systems of disclosure controls and internal controls regarding finance, accounting, legal compliance and ethical behavior; ▪The Company’s auditing, accounting and financial reporting processes generally; ▪The appointment, qualifications and performance of the Company’s internal audit function and independent auditors; ▪Pre-approval of services (both audit and non-audit) to be provided by the independent auditors; and ▪Review related party transactions. ▪Whether the Company’s independent auditors’ provision of non-audit services is compatible with maintaining the independence of the independent auditors. ▪The Company’s cybersecurity and information security risk management. A copy of the Audit Committee charter can be viewed at the Company’s website at investor.viavisolutions.com. Joanne Solomon was appointed to the Audit Committee effective February 18, 2022. | ||||||||

VIAVI Solutions Inc. | FY 2022 Notice of Annual Meeting & Proxy Statement | 15

Corporate Governance | ||

Compensation Committee

| Responsibilities | Current Members | |||||||

The primary responsibility of the Compensation Committee is to assist the full Board in fulfilling its oversight responsibilities with respect to: ▪The Company’s overall compensation policies, structure and programs (including with respect to wages, salaries, bonuses, equity plans, employee benefit plans and other benefits) for its employees and officers; | Keith Barnes (Chair) Richard E. Belluzzo Timothy Campos Meetings: 5 meetings during FY22. Attendance: The average attendance of the Directors at Audit Committee meetings in FY22 was 100%. Independence: The Board has determined that all members of the Compensation Committee are “independent” as defined in the applicable rules and regulations of the SEC and Nasdaq. | |||||||

▪The annual review and approval of the compensation policies applicable to the Company’s executive officers (including the Company’s named executive officers), including the relationship of the Company’s achievement of its goals and objectives to executive compensation; ▪The annual review and recommendation to the Board for approval of corporate goals and objectives relevant to the compensation of the CEO, and to at least annually evaluate the performance of the CEO in light of these goals and objectives; ▪Review matters related to succession planning and executive development for executive officers; ▪Oversee the implementation and administration of the Company’s equity incentive, stock option and stock purchase plans; ▪Review the results of the stockholder advisory vote regarding the Company’s executive compensation (the “Say on Pay Vote”) and make appropriate recommendations to the Board; and ▪Oversee the development, implementation and effectiveness of the Company’s practices, policies and strategies relating to human capital management as they relate to the Company’s workforce generally, including but not limited to policies and strategies regarding recruiting, selection, career development and progression, and diversity, equity and inclusion practices. Additional information on the Compensation Committee’s processes and procedures for consideration of executive compensation are addressed in the “Compensation Discussion and Analysis” below. A copy of the Compensation Committee charter can be viewed at the Company’s website at investor.viavisolutions.com. | ||||||||

16 | VIAVI Solutions Inc. | FY 2022 Notice of Annual Meeting & Proxy Statement

Corporate Governance | ||

Corporate Development Committee

| Responsibilities | Current Members | |||||||

The primary responsibility of the Corporate Development Committee is to assist the full Board in fulfilling its oversight responsibilities with respect to: ▪The review of all strategic transactions for which Board or Corporate Development Committee approval is required and to make appropriate recommendations to the Board with respect to any Strategic Transaction for which Board approval is required. | Masood A. Jabbar (Chair) Laura Black Tor Braham Timothy Campos Donald Colvin Meetings: 4 meetings during FY22. Attendance: The average attendance of the Directors at Corporate Development Committee meetings in FY22 was 100%. Independence: The Board has determined that all members of the Corporate Development Committee are “independent” as defined in the applicable rules and regulations of the SEC and Nasdaq. | |||||||

The Corporate Development Committee reviews and approves certain strategic transactions for which approval of the full Board is not required and makes recommendations to the Board regarding those transactions for which the consideration of the full Board is appropriate. A copy of the Corporate Development Committee charter can be viewed at the Company’s website at investor.viavisolutions.com. | ||||||||

VIAVI Solutions Inc. | FY 2022 Notice of Annual Meeting & Proxy Statement | 17

Corporate Governance | ||

Governance Committee

| Responsibilities | Current Members | |||||||

The primary responsibility of the Governance Committee is to assist the full Board in fulfilling its oversight responsibilities with respect to: ▪Developing, and annually updating, a long-term plan for Board composition that takes into consideration the current strengths, weaknesses, skills and experience on the Board, anticipated retirement dates and the strategic direction of the Company; ▪Develop recommendations regarding the essential and desired skills and experience for potential Directors, taking into consideration the Board’s short and long-term needs; ▪Recommend to the Board nominees for election as members of the Board (in performing this function, the Board has authorized and appointed the Governance Committee to serve as the Company’s Nominating Committee); ▪Review, monitor and make recommendations regarding the orientation and ongoing performance and development of Directors, and develop, recommend and oversee continuing education programs for Directors as and when deemed appropriate; ▪Recommend appropriate Board, committee and individual Director evaluation programs to the Board and oversee the implementation and administration of such programs once approved by the Board; ▪Monitor and evaluate professional, employment and other changes affecting Directors to ensure compliance with Board guidelines and the Company’s Code of Business Conduct; ▪Review and evaluate the Company’s programs, policies and practices relating to ESG and related disclosures; and ▪Review and monitor key public policy trends, issues, regulatory matters and other concerns that may affect the Company’s business, strategies, operations, performance or reputation. The Governance Committee operates under a written charter setting forth the functions and responsibilities of the committee. A copy of the charter can be viewed at the Company’s website at investor.viavisolutions.com. | Richard E. Belluzzo (Chair) Keith Barnes Laura Black Meetings: 4 meetings during FY22. Attendance: The average attendance of the Directors at Governance Committee meetings in FY22 was 100%. Independence: The Board has determined that all members of the Governance Committee are “independent” as defined in the applicable rules and regulations of the SEC and Nasdaq. | |||||||

18 | VIAVI Solutions Inc. | FY 2022 Notice of Annual Meeting & Proxy Statement

Corporate Governance | ||

Director Evaluations

Our Board maintains a regular and robust evaluation process designed to continually assess its effectiveness, and the Board believes that the effectiveness of its Directors and committees is critical to the Company’s success and to the protection of long-term stockholder value. Every year, the Board conducts a formal evaluation of each committee, individual Directors, and the Board as a whole. Our process is designed to gauge understandings of and effectiveness in board composition and conduct; meeting structure and materials; committee composition; strategic planning and oversight; succession planning; culture and diversity; and other relevant topics, such

as crisis management and ESG-related perspectives and skills.

The process involves the Governance Committee, working with the Board Chair, designing this year’s evaluation process, which includes three components: (1) written questionnaires, (2) individual third-party interviews with certain Directors, and (3) group discussions. When designing the evaluation process and questions, the Board considers the current dynamics of the boardroom, the Company, and our industries, the format of previous annual evaluations, and issues that are at the forefront of our investors’ minds.

| Written Questionnaires | Directors responded to a custom questionnaire, meant to gauge understandings of and effectiveness in board and committee composition and conduct, and individual Director performance, and to identify suggested ways to implement best practices in fiscal year 2023 (“FY23”). | ||||

| |||||

| Third Party Interviews | Certain Directors participated in individual third-party interviews, which responded to questions for each of their Committee assignments and identified Committee strengths and accomplishments in FY22 together with recommended changes in committee practices for FY23. | ||||

| |||||

| Group Discussions | In addition to written questionnaires and individual Director interviews, the annual Board, committee, and Director evaluation included group discussions among certain Directors regarding the evaluation process. | ||||

| |||||

| Third Party Review & Report of Results | The findings of the annual Board, committee and Director evaluation process were prepared by a third party to protect the anonymity and the integrity of the evaluation process, with the findings presented to the Governance Committee. | ||||

| |||||

| Discussion of Results | The Chair of the Governance Committee presented the results of the annual Board, committee, and Director assessment to the Board, and the Directors discussed the results and identified any appropriate follow-up actions. | ||||

VIAVI Solutions Inc. | FY 2022 Notice of Annual Meeting & Proxy Statement | 19

Corporate Governance | ||

Director Selection and Nomination Process

In reviewing potential candidates for the Board, the Governance Committee considers the individual’s experience in the Company’s industry, the general business or other experience of the candidate, the needs of the Company for an additional or replacement Director, the personality of the candidate, the candidate’s interest in the business of the Company, as well as numerous other subjective criteria. Of greatest importance is the individual’s integrity, willingness to be involved and ability to bring to the Company experience and knowledge in areas that are most beneficial to the Company. Directors should be highly accomplished in their respective field, with superior credentials and recognition. In selecting Director nominees, the Committee generally seeks active and former leaders of major complex organizations, including scientific, government, educational and other non-profit institutions.

The Governance Committee intends to continue to evaluate candidates for election to the Board on the basis of the foregoing criteria.

It is the Governance Committee’s goal to nominate candidates with diverse backgrounds and capabilities, to reflect the diverse nature of the Company’s stakeholders (security holders, employees, customers and suppliers), while emphasizing core excellence in areas relevant to the Company’s long-term business and strategic objectives.

A detailed description of the criteria used by the Governance Committee in evaluating potential candidates may be found in the charter of the Governance Committee.

In February 2022, Joanne Solomon was appointed to the Board. She was initially recommended by our Chief Executive Officer. She was then considered by the Governance Committee, which after conducting its regular evaluation process where it was determined Ms. Solomon as the most qualified candidate, recommended her appointment to the full Board for approval.

| The Governance Committee regularly evaluated the needs of the Board in terms of areas relevant to the Company’s long-term business and strategic objectives as well as considerations regarding diversity, individual and director qualifications, attributes, skills and experience. | ||

| ||

| Director nominees are identified with input from directors, search firms, stockholders, and/or members of management. | ||

| ||

| The Governance Committee evaluates Director nominee qualifications, reviews for potential conflicts, instances of over boarding, independence, and interviews candidates and recommend nominees to the Board. | ||

| ||

| The Board evaluates Director nominees, discusses impacts on the Board, and selects Director nominees for considerations at our annual meetings. | ||

| ||

| Our stockholders vote on Director nominees at our annual meetings. | ||

20 | VIAVI Solutions Inc. | FY 2022 Notice of Annual Meeting & Proxy Statement

Corporate Governance | ||

Stockholder Recommendations for Board Candidates

The Governance Committee will consider and make recommendations to the Board regarding any stockholder recommendations for candidates to serve on the Board. Stockholders wishing to recommend candidates for Director positions may do so by providing a timely notice in writing to the Company’s Secretary at 1445 South Spectrum Blvd, Suite 102, Chandler, Arizona 85286, providing the proposed candidate’s curriculum vitae and other information specified in the Company’s Bylaws, which can be found at www.viavisolutions.com. There are no differences in the manner in which the Governance Committee evaluates nominees for Director based on whether the nominee is recommended by a stockholder.

For information about how stockholders can nominate candidates for Director positions, please see “General Information About the Annual Meeting” below.

Board Refreshment

Thoughtful consideration is continuously given to the composition of our Board in order to maintain an appropriate mix of experience and qualifications, introduce fresh perspectives, and broaden and diversify the views and experience represented on the Board. The Board seeks the most qualified candidates as well as focuses on a diverse composition, including diversity of perspectives, backgrounds, experience and other characteristics such as gender and race. 22% of our Board has been a new nominee in the last five years. Additionally, our last three new Director nominees have been women, representing our efforts to identify qualified candidates regardless of gender or other categories of diversity.

Two out of Nine Directors

Communication between Stockholders and Directors

Stockholders may communicate with the Company’s Board through the Secretary by sending an email to bod@viavisolutions.com, or by writing to the following address: Chair of the Board, c/o Company Secretary, Viavi Solutions Inc., 1445 South Spectrum Blvd, Suite 102, Chandler, Arizona 85286. The Company’s Secretary will forward all correspondence to the Board, except for spam,

junk mail, mass mailings, product complaints or inquiries, job inquiries, surveys, business solicitations or advertisements, or patently offensive or otherwise inappropriate material. The Company’s Secretary may forward certain correspondence, such as product-related inquiries, elsewhere within the Company for review and possible response.

Code of Ethics

The Company has adopted a Code of Ethics (known as the Code of Business Conduct) for its Directors, officers and other employees. The Company will post on its website any amendments to, or waivers from, any provision of its Code of Business Conduct.

A copy of the Code of Business Conduct is available on the Company’s website at https://www.viavisolutions.com/en-us/literature/code-business-conduct-en.pdf.

VIAVI Solutions Inc. | FY 2022 Notice of Annual Meeting & Proxy Statement | 21

Corporate Governance | ||

Management Succession Planning

Our Board of Directors believes that effective management of succession planning, particularly for our executive officers, has played an important role in the past successful transitions of executive officers and is important for the continued advancement of VIAVI. Pursuant to our Compensation Committee Charter, the Compensation Committee will at least annually review succession, retention and management development plans for our CEO and the company’s other executive officers, and report to the Board on these matters. The criteria used to assess potential candidates are formulated based on the Company’s strategic priorities, and include having the ability to perform and transform, and build talent and

culture, and having a growth mindset and breadth of perspective. The Compensation Committee is responsible for follow-up actions with respect to succession planning, as may be delegated by our Board from time to time.

Further, our CEO has Executive Leadership Development and Succession plan goals that are tied to his compensation as discussed in more detail in the CD&A. On at least on an annual basis, our CEO will make detailed presentations to our Board on executive officer plans and individual development plans for identified successors.

22 | VIAVI Solutions Inc. | FY 2022 Notice of Annual Meeting & Proxy Statement

Corporate Governance | ||

Stockholder Engagement and Outreach

We recognize the importance of regular and transparent communication with our stockholders. Each year, we engage with our stockholders including our top institutional investors, and after last year’s Say on Pay vote, VIAVI expanded its outreach and engagement efforts to ensure that stockholders had an opportunity to provide feedback on the Company’s executive compensation program, corporate governance practices and ESG initiatives as well as any other topics of concern.

As part of our stockholder engagement efforts over the last year, we contacted 25 stockholders representing 70% of total shares outstanding, and held meetings and conference calls with 13 stockholders representing approximately 51% of our outstanding shares, an increase of 11% over FY21. Stockholders met with VIAVI’s Board Chair, the Chair of the Compensation Committee, and Company leadership from legal, investor relations, and human resources.

| VIAVI contacted 25 stockholders representing 70% of total shares outstanding | VIAVI met with 13 stockholders representing approximately 51% of shares outstanding | |||||||

Our Stockholder Engagement Program

Stockholder engagement is essential to our ongoing review of our corporate governance, ESG, and executive compensation programs and practices. Executive management, Investor Relations and the Corporate Secretary engage with stockholders from time to time to understand their perspectives on a variety of corporate governance matters, including executive compensation, corporate governance policies and corporate sustainability practices.

In addition to one-on-one engagements, we communicate with stockholders through a number of routine forums, including:

▪Quarterly earnings presentations;

▪SEC filings;

▪The Annual Report and Proxy Statement;

▪The annual stockholders meeting; and

▪Investor meetings, conferences and web communications.

We relay stockholder feedback and trends on corporate governance, ESG and executive compensation developments to our Board and its standing Committees and work with them to enhance our practices and improve our disclosures.

Stockholder Engagement Outcomes in FY22

As part of our stockholder engagement efforts over the last year, we heard from our stockholders on key corporate governance, executive compensation, and sustainability-related matters. Important topics included our approach to executive compensation, our climate change-related goals and commitments, and a strong interest in human capital management programs with a focus on DEI.

As a result of our engagement efforts, we have done the following:

| Executive Compensation | ||

| We are making or considering changes to our approach for executive compensation in FY23 and FY24. See our CD&A for more information. | ||

| ESG Disclosures and Sustainability | ||

We expanded our ESG disclosures and practices to meet stockholder expectations, including conducting our first ESG priority assessment, aligning our disclosures with the recommendations of the Task Force on Climate-Related Financial Disclosures, and preparing additional disclosure regarding our reduced CO2 emissions, human capital management strategy, diversity initiatives, and other priority ESG topics. | ||

| Key Corporate Governance Disclosures | ||

| We expanded our disclosures in this FY22 Proxy Statement regarding key corporate governance features, including the Board’s oversight of information security, succession planning, and our Director evaluation process. | ||

VIAVI Solutions Inc. | FY 2022 Notice of Annual Meeting & Proxy Statement | 23

| Corporate Governance | ||

Environmental, Social, and Governance Matters

At VIAVI, we are focused on helping our customers succeed, creating a more inclusive workforce, and making our business more sustainable. In calendar 2022, we deepened our approach to ESG by conducting our inaugural ESG Priority Assessment. The ESG Priority Assessment is a governance measure that guides our overall ESG strategy, as the process is designed to identify the environmental, social, and governance topics having the greatest impact on our business strategy, success, and ability to generate long-term value. We aim to regularly assess a wide range of ESG topics to inform

our strategy, and plan to increase the scope of our priority assessment as well as the level of involvement by our internal and external stakeholders in subsequent iterations.

For more information regarding our ESG initiatives, progress to date and related matters, please visit the "Environment, Social, and Governance" section of our corporate website, which can be found at viavisolutions.com/en-us/corporate/about-us/

environment-social-and-governance.

environment-social-and-governance.

Board, Committee and Management Oversight of ESG

Given the importance of ESG matters to the long-term success of our business, our Board and its committees play important roles in overseeing critical ESG matters.

| THE BOARD | ||||||||

| Our Board is responsible for oversight of ESG risks and opportunities. | ||||||||

| ||||||||

| GOVERNANCE COMMITTEE | ||||||||

Review and evaluate the Company’s programs, policies, and practices relating to ESG and related disclosures. Review and monitor key public policy trends, issues, regulatory matters, and other concerns that may affect the Company’s business, strategies, operations, performance, or reputation. Nominate Director candidates with diverse backgrounds and capabilities to reflect the diverse nature of the Company’s stakeholders (security holders, employees, customers, and suppliers), while emphasizing core excellence in areas pertinent to our long-term business and strategic objectives. other concerns that may affect the company’s business, strategies, operations, performance or reputation. | ||||||||

| ||||||||

| COMPENSATION COMMITTEE | AUDIT COMMITTEE | |||||||

| Oversee the development, implementation, and effectiveness of the Company’s practices, policies, and strategies relating to human capital management as they relate to the Company’s workforce generally, including but not limited to policies and strategies regarding recruiting, selection, career development and progression, and DEI practices. | Review the Company’s cybersecurity and other information technology risks, controls, and procedures, including review of the threat landscape facing our Company and our Company strategy to mitigate cybersecurity risks and potential breaches. | |||||||

| ||||||||

| ESG EXECUTIVE STEERING COMMITTEE | ||||||||

| In fiscal year 2020, we established a management level ESG Executive Steering Committee, which is responsible for reviewing and approving policies, strategies and initiatives relating to ESG. The members of the ESG Executive Steering Committee represent a variety of teams and functions, including legal, investor relations, human resources, environmental, health and safety, product compliance, supply chain, finance and marketing. | ||||||||

24 | VIAVI Solutions Inc. | FY 2022 Notice of Annual Meeting & Proxy Statement

| Corporate Governance | ||

Environmental Sustainability

VIAVI promotes environmentally friendly practices and strives to conduct business in an environmentally sustainable manner, which we believe is important to our customers and contributes to our reputation and brand. While our facilities and operations have a relatively modest environmental footprint, we engage in and seek to improve our preservation, conservation, recycling, and waste reduction practices. VIAVI focuses on environmental sustainability in a number of ways, including by managing our carbon footprint, by reducing resource consumption, and by working to use reclaimed water

| Sustainability Reporting | ||||

We file annual reports with the CDP (formerly the Carbon Disclosure Project) and report key environmental metrics using the SASB Hardware, Telecommunication Services, and Electrical & Electronic Equipment standards, which we believe are most relevant to our operations. Additionally, our inaugural 2022 ESG Report includes disclosure aligned with the recommendations of the TCFD, including relevant disclosure of our climate-related governance, strategy, risk management, and relevant metrics and targets.

| Water Conservation | ||||

We are working with Santa Rosa, California, to redirect our reclaimed water to the agricultural community to offset their use of drinking water. Furthermore, when we opened our new facilities in Chandler, Arizona, we chose to use reclaimed water for an evaporative cooling system. This not only uses less power than other kinds of air conditioning, but made us the first company in Chandler, AZ to use reclaimed water in this way.

| Reducing Resource Consumption | ||||

In calendar year 2022, we launched a packaging initiative to explore ways of reusing as much of the packaging material as we can and recycling anything that cannot be reused. Reusable packaging is always our preference, so it is important to examine processes and materials throughout the supply chain, make improvements, and strive to operate in an efficient and sustainable manner. Although VIAVI is already compliant with global packaging regulations, we believe there is still more that we can do to minimize our impact on the environment.

| Managing Our Carbon Footprint | ||||

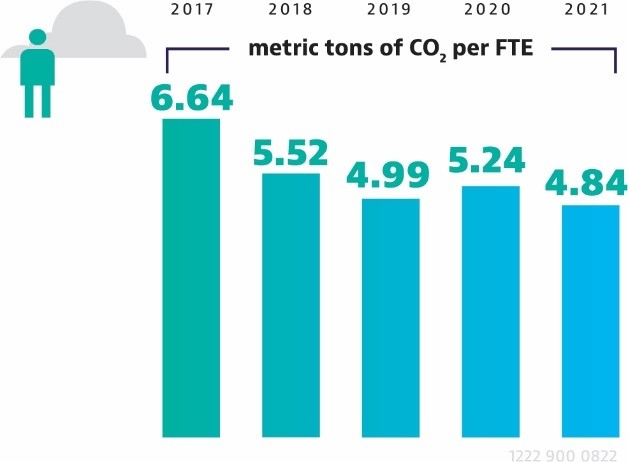

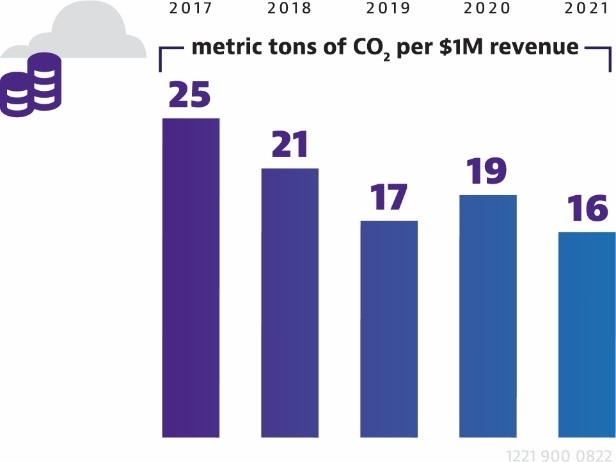

In calendar year 2015, we set a corporate goal to reduce our overall carbon footprint by 20% by calendar year 2025. We surpassed that goal in calendar year 2021 when our CO2 emissions were reduced by 42%, compared to our 2015 CO2 emissions. This includes a year-over-year decrease in Scope 2 CO2 emissions, which can be largely attributed to upgrading our lighting at a large manufacturing site to use less energy, and having more accurate data regarding CO2 emissions related to the electricity we purchase. CO2 emissions intensity decreased between calendar year 2017 and calendar year 2021 on both a headcount Full Time Equivalent (FTE) and a revenue basis.

CO2 Emissions Intensity (Headcount) | ||

| ||

CO2 Emissions Intensity (Revenue) | ||

| ||

VIAVI Solutions Inc. | FY 2022 Notice of Annual Meeting & Proxy Statement | 25

| Corporate Governance | ||

Human Capital Management

The VIAVI culture is made up of the diverse contributions of our 3,600 employees worldwide (as of July 2, 2022) representing more than 30 self-identified nationalities working across 30 countries. VIAVI is committed to promoting and maintaining a diverse and inclusive work environment and offering equal opportunities to everyone. We seek to empower our employees to learn and develop their skills to accelerate their career and to attract best-in-class talent. The CEO and the SVP Human Resources are responsible for the development of our People Strategy and execute on this with the support of the Executive Management Team. We regularly update and partner with the Compensation Committee of the Board of Directors on human capital matters.

| Talent Development | ||||

Our talent development programs promote the VIAVI Business Values through a passion for learning and performance. We are developing relevant and useful learning resources for our employees, managers, and leaders that invite a growth mindset and create an appetite for lifelong learning. We continue to deliver our global Leadership Development Program, with over 70% of our managers joining the Manager Development and Strategic Leadership Series in FY22. We intend for this to create alignment across the organization on the expectations of leaders, and how we can continue to develop leadership capabilities. In FY22, VIAVI also instituted the Dr. H. Angus Macleod Scholarship program at the University of Arizona Wyant College of Optical Sciences to honor a pioneer of optical science who mentored a generation of students to become foundational contributors to the field. It is our hope that this gift creates access for more talent to enter the optical space as a career, and to increase our local connection to the community.

| Talent Rewards | ||||

Our compensation and benefit programs are designed to recognize our employees' individual performance and contributions to our business results, including competitive base salaries and variable pay for all employees, share-based equity award grants, health and welfare benefits, time-off, development programs and training, and opportunities to give back to our communities. We provide talent rewards that are competitive in the marketplace. We support equal pay for equal work, pay transparency as well as all federal anti-discrimination laws applicable to employment, including those within Title VII of the Civil Rights Act.

| Prioritizing Health and Safety | ||||

VIAVI is committed to maintaining an inclusive, supportive, safe, and healthy work environment where our employees can thrive. We demand strict compliance with all applicable health and safety regulations, offer robust training to our employees on health and safety matters, maintain controls and proper disposal of hazardous materials, and track workplace incidents and injuries. We maintain and regularly update emergency and disaster recovery plans. The success of our Safety program is demonstrated by our best-in-class Total Recordable Injury Rate (TRIR) of only 0.23 injuries per 100 full-time workers per year.

26 | VIAVI Solutions Inc. | FY 2022 Notice of Annual Meeting & Proxy Statement

| Corporate Governance | ||

Diversity, Equity and Inclusion

As an international company, the diversity of our workforce is important to VIAVI. We are committed to promoting and maintaining an inclusive work environment that is free of unlawful discrimination and retaliation and harassment in any form and offering equal opportunities to everyone.

| Strategic Approach to Diversity, Equity and Inclusion | ||||

Our Diversity, Equity and Inclusion Statement maps out our guiding principles in this mission-critical area. We are widening our understanding of diversity to embrace not only identity, but also the practices and behaviors that create the right environment for people to succeed.

| Diversity, Equity and Inclusion Pillars | ||||

We have established three critical DEI pillars, which are the areas in which we focus our DEI efforts: culture, talent and leadership. Within those pillars, we established key actions and steps to drive DEI improvements. In addition to our internal efforts to improve DEI, VIAVI is exploring ways in which we can support DEI in our industry and communities. To that end, we have signed on to the US IP Alliance’s Diversity Pledge, along with several other technology companies. This initiative seeks to address and improve DEI in the U.S. patent and technology system. Specifically, the pledge involves efforts to improve opportunities for women, underrepresented minorities and veterans in the U.S. patent system.

| Early-Career Programs | ||||

VIAVI has developed programs that assist with sourcing diverse candidates and lowering barriers to entry within the industry and that offer recent engineering graduates a diverse mixture of experiences to grow personally and

professionally by providing emerging talent as well as our established workforce with opportunities to embrace other cultures and gain more of a global view and appreciation for diverse viewpoints. We feel this exposure will support their future success and help them to become ambassadors of a collaborative, global R&D community for future hires.

| Supply Chain Diversity | ||||

VIAVI believes a diverse supply chain supports greater innovation and value for our business while helping to build long-term profitable partnerships. Our vision is to grow a diverse and inclusive global supply chain, which includes annual spending with diverse-owned suppliers as well as working with others to expand and enable inclusive sourcing practices across the industry. The VIAVI Global Indirect Sourcing and Procurement team (“GSP”) works with internal business partners to identify diversity spend goals. GSP submits VIAVI diversity spend reports to customers based on customer requirements. In FY22, on average, 28% of our U.S. suppliers were certified as diverse, verified by a third party on a quarterly basis. VIAVI tracks 17 different categories, which are determined based on diversity factors.

| Board Diversity | ||||

It is the Governance Committee’s goal to nominate candidates with diverse backgrounds and capabilities, to reflect the diverse nature of the Company’s stakeholders (security holders, employees, customers and suppliers), while emphasizing core excellence in areas relevant to the Company’s long-term business and strategic objectives. We appointed two highly respected women industry experts to our Board in the past three calendar years. 44% percent of our Board are women or diverse.

VIAVI Solutions Inc. | FY 2022 Notice of Annual Meeting & Proxy Statement | 27

| Corporate Governance | ||

Corporate and Global Citizenship

We are a global corporation with strong ties to the local communities in which we operate. We encourage our employees to actively participate in volunteering efforts and support educational organizations, and many of our employees contribute their time, money, and energy to make an impact in the communities where they live and work.

| Community Investment | ||||

Employees across 48 global sites regularly participate in sports challenges, advocate for others, create awareness, and raise money to positively influence and impact their communities. Despite the effects of COVID-19 on our communities, including an inability to be co-located in some instances, our employees continued to rise to the challenge.

| Community Projects in China | ||||

Throughout China, VIAVI employees stay involved in various environmental initiatives. In Beijing, employees practice alternative commutes by biking, taking a bus, or walking to work to reduce traffic congestion and air pollution. Employees in Shenzhen volunteer their time in coastal cleanup events. In Suzhou, employees host a charity bazaar with items donated by employees and handicrafts made by Suzhou Disabled Persons’ Federation. Revenue raised is donated to the children in the Suzhou Social Welfare Institute.

| Community Outreach in Sonoma County | ||||

The VIAVI Community Affairs Team in Santa Rosa, California, is inspiring tomorrow’s workforce by supporting educational activities across Sonoma County. VIAVI is celebrating its 14th year of involvement with the Mike Hauser Academy (MHA) program. The Academy welcomes students finishing the 8th grade to spend three weeks in the summer to gain a direct learning experience interacting with science, technology, engineering, and mathematics (STEM) companies. Students visit the VIAVI facility to learn alongside engineers and participate in hands-on math and science applications to apply classroom lessons to STEM professions. VIAVI of Santa Rosa also supports the Career Tech Education (CET) foundation, local high schools, and elementary schools, as well as Sonoma State University with scholarships to foster innovation from early education to a career in a STEM-related field.

| Ottawa Office Supporting Local Charities | ||||

The team members in Ottawa, Canada, are experienced fundraisers, taking part in a fundraising event called

Movember every year for the past 20 years. In Spring 2022, they embraced a new challenge, the May 50K, in aid of Multiple Sclerosis. The virtual event, aimed at getting people moving, propelled the team to walk, run and cycle through the 50-kilometer finish line and raised more than CAD $2,600 for the charity, taking the number 3 workplace spot on the fundraising leader board.

| Ukraine Donation | ||||

We are looking to do our part in helping to relieve the human suffering in the Ukraine by making a corporate donation to nonprofit organizations providing emergency response on the ground. After carefully researching various organizations, we have identified UNICEF and German Red Cross as the relief entities best positioned to deliver help immediately.

| Children’s Book | ||||

VIAVI employees wrote a contemporary story about the impact of fiber on communities that was made into a children’s book. The story is about the efforts of a hard-working fiber technician operating in various weather conditions to connect people to the fiber optic broadband network. Technicians across Europe use the book in conjunction with a VIAVI-branded plush toy to make a positive connection with children while working in their communities. The book is available at no cost, and donations are accepted to help raise funds for local charities. The book translated in German supports the Mental Health Foundation and the book translated in French supports children in hospitals.

Responsible Business Conduct

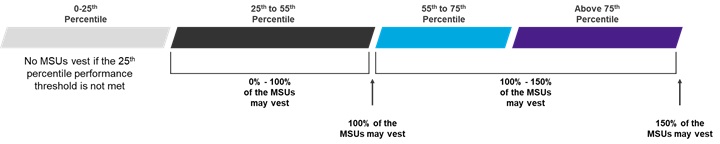

VIAVI is committed to responsible business conduct, and one of the ways we demonstrate this is by being an Affiliate member of the Responsible Business Alliance. As a member, VIAVI supports and has adopted the Vision and Mission of the RBA: