Form DEF 14A Stone Point Credit Corp For: Nov 09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

Stone Point Credit Corporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

STONE POINT CREDIT CORPORATION

20 Horseneck Lane

Greenwich, Connecticut 06830

(203) 862-2900

September 30, 2021

Dear Stockholder:

You are cordially invited to participate in the 2021 Annual Meeting of Stockholders (the “Annual Meeting”) of Stone Point Credit Corporation (the “Company”) to be held on November 9, 2021 at 4:30 p.m., Eastern Time at One Vanderbilt Avenue, New York, NY 10017. Stockholders will also be able to register to attend the Annual Meeting virtually at the following website: www.proxydocs.com/stonepoint.

The Notice of the 2021 Annual Meeting of Stockholders and Proxy Statement accompanying this letter provide an outline of the business to be conducted at the Annual Meeting. At the Annual Meeting, you will be asked to: (i) elect one (1) director of the Company to serve for a term of three years, or until her successor is duly elected and qualified; (ii) ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2021; and (iii) to transact such other business that may properly come before the Annual Meeting. Details of the business to be conducted at the Annual Meeting are set forth in the accompanying Notice of 2021 Annual Meeting of Stockholders and Proxy Statement. I, along with other members of the Company’s management, will be available to respond to stockholders’ questions.

It is important that your shares be represented at the Annual Meeting. If you are unable to participate in the Annual Meeting during the scheduled time, I urge you to complete, date and sign the enclosed proxy card and promptly return it in the enclosed postage-paid return envelope provided or authorize your proxy through the Internet or by telephone as described on the enclosed proxy card as soon as possible even if you plan to attend the Annual Meeting.

We look forward to your participation in the Annual Meeting. Your vote and participation in the governance of the Company is very important to us.

| Sincerely yours, |

|

| David Wermuth Chairman of the Board |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on November 9, 2021

Our Proxy Statement and Annual Report on Form 10-K for the year ended December 31, 2020, are available on the internet at www.proxydocs.com/stonepoint and will be mailed to stockholders of record as of the close of business on September 20, 2021 on or around September 30, 2021.

The following information applicable to the Annual Meeting may be found in the proxy statement and accompanying proxy card:

| • | The date, time, location of the Annual Meeting; |

| • | A list of the matters intended to be acted on and our recommendations regarding those matters; and |

| • | Your Control Number that you need to vote your proxy card and/or register to attend the virtual Annual Meeting. |

If you are a stockholder of record and share an address with another stockholder and received only one set of proxy materials but would like to request a separate copy of these materials, please contact Stone Point Investor Relations at the email address and telephone number listed below. Similarly, if you are a stockholder of record, you may also contact Stone Point Investor Relations if you received multiple copies of the proxy materials and would prefer to receive a single copy in the future.

If you have questions about the Annual Meeting or other information related to the proxy solicitation, you may contact Stone Point Investor Relations at the email address and telephone number listed below.

20 Horseneck Lane

Greenwich, CT 06830

(203) 862-2900

STONE POINT CREDIT CORPORATION

20 Horseneck Lane

Greenwich, Connecticut 06830

(203) 862-2900

NOTICE OF THE 2021 ANNUAL MEETING OF STOCKHOLDERS

To be Held on

November 9, 4:30 p.m., Eastern Time

To the Stockholders of Stone Point Credit Corporation:

The 2021 Annual Meeting of Stockholders (the “Annual Meeting”) of Stone Point Credit Corporation (the “Company”) will be held on November 9, 2021, at 4:30 p.m., Eastern Time at One Vanderbilt Avenue, New York, NY 10017. Stockholders will also be able to register to attend the Annual Meeting virtually at the following website: www.proxydocs.com/stonepoint. We encourage any stockholder who plans to attend the Annual Meeting in-person to register at www.proxydocs.com/stonepoint as well.

The Annual Meeting will be held for the following purposes:

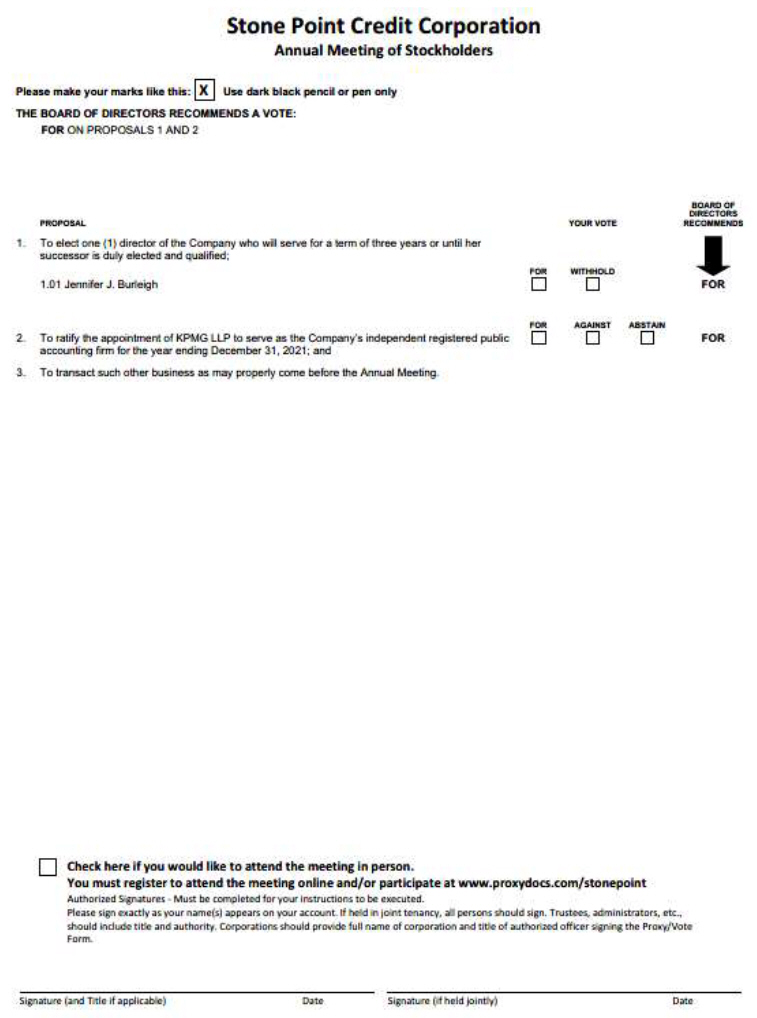

| 1. | To elect one (1) director of the Company, who will serve for a term of three years or until her successor is duly elected and qualified; |

| 2. | To ratify the appointment of KPMG LLP to serve as the Company’s independent registered public accounting firm for the year ending December 31, 2021; and |

| 3. | To transact such other business as may properly come before the Annual Meeting. |

You have the right to receive notice of and to vote prior to the Annual Meeting if you were a stockholder of record at the close of business on September 20, 2021.

If you are unable to participate in the Annual Meeting, we encourage you to vote your proxy by following the instructions provided on the Proxy Materials or the proxy card. In the event there are not sufficient votes for a quorum at the time of the Annual Meeting, the Annual Meeting may be adjourned in order to permit further solicitation of proxies by the Company.

Thank you for your support of the Company.

| By order of the Board of Directors, |

|

| Sandra M. Forman |

| Secretary |

Greenwich, Connecticut

September 30, 2021

THIS IS AN IMPORTANT MEETING. TO ENSURE PROPER REPRESENTATION AT THE ANNUAL MEETING, PLEASE COMPLETE, SIGN, DATE AND RETURN THE PROXY CARD IN THE ENCLOSED POSTAGE-PAID RETURN ENVELOPE OR AUTHORIZE YOUR PROXY BY TELEPHONE OR THROUGH THE INTERNET. EVEN IF YOU VOTE YOUR SHARES PRIOR TO THE ANNUAL MEETING, YOU STILL MAY ATTEND THE ANNUAL MEETING AND VOTE YOUR SHARES AT THE TIME OF THE ANNUAL MEETING IF YOU WISH TO CHANGE YOUR VOTE.

STONE POINT CREDIT CORPORATION

20 Horseneck Lane

Greenwich, Connecticut 06830

(203) 862-2900

PROXY STATEMENT

2021 Annual Meeting of Stockholders

To Be Held on November 9, 2021

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Stone Point Credit Corporation (the “Company,” “SPCC,” “we,” “us,” or “our”) for use at the Company’s 2021 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at One Vanderbilt Avenue, New York, NY 10017. Stockholders will also be able to register to attend the Annual Meeting virtually at the following website: www.proxydocs.com/stonepoint.

In-Person Annual Meeting

Stockholders who plan to attend the Annual Meeting in-person are encouraged to register and submit their votes at www.proxydocs.com/stonepoint prior to the Annual Meeting. All in-person attendees are required to be vaccinated against COVID-19 and show proof of vaccination.

Virtual Annual Meeting

In addition to an in-person option, the Annual Meeting will be held in a virtual or online meeting format, via live audio webcast that will provide stockholders with the ability to participate in the Annual Meeting, vote their shares and ask questions. We are leveraging technology to enhance stockholder access to the Annual Meeting by enabling attendance and participation from any location around the world. We believe that the virtual meeting format will give stockholders the opportunity to exercise the same rights as if they had attended the Annual Meeting in-person and believe that these measures will enhance stockholder access and encourage participation and communication with the Board and management.

Benefits of a Virtual Annual Meeting

We believe a virtual meeting format facilitates stockholder attendance and participation by enabling all stockholders to participate fully and equally, and without cost, using an Internet-connected device from any location around the world. In addition, the virtual meeting format increases our ability to engage with all stockholders, regardless of size, resources or physical location, and enables us to protect the health and safety of all attendees, particularly in light of the COVID-19 pandemic.

We are reserving the right, in light of COVID-19 safety protocols, to host the Annual Meeting in a virtual-ONLY setting and may close off the ability for our stockholders to attend the Annual Meeting in-person. Our goal is to keep you, our stockholders, safe along with our Board and management team. If we do elect to hold the Annual Meeting virtually or online exclusively, we will amend our Notice of Stockholder Meeting with the Securities and Exchange Commission (the “SEC”) and issue a press release. In addition, we will make the announcement at www.proxydocs.com/stonepoint.

Attendance at the Virtual Annual Meeting

In order to attend the Annual Meeting virtually, you must register at www.proxydocs.com/stonepoint. Upon completing your registration, you will receive further instructions via email, including a unique link that will

1

allow you access to the Annual Meeting and to vote and submit questions prior to or during the Annual Meeting, if needed. As part of the registration process, you must enter the Control Number located on your proxy card. We encourage all stockholders to vote prior to the Annual Meeting if possible.

On the day of the Annual Meeting, November 9, 2021, stockholders may begin to log in to the virtual Annual Meeting 15 minutes prior to the Annual Meeting. The Annual Meeting will begin promptly at 4:30 pm Eastern Time.

We will have technicians ready to assist you with any technical difficulties you may have accessing the Annual Meeting. If you encounter any difficulties accessing the virtual Annual Meeting platform, including any difficulties voting or submitting questions, you may call the technical support number that will be posted in your instructional email.

Questions at the Annual Meeting

Our Annual Meeting will allow stockholders to submit questions before and during the Annual Meeting. During a designated question and answer period at the Annual Meeting, we will respond to appropriate questions submitted by stockholders. Stockholders who attend the meeting virtually will be able to ask their questions via the online platform.

We will answer as many stockholder-submitted questions as time permits, and any questions that we are unable to address during the Annual Meeting will be answered following the Annual Meeting, with the exception of any questions that are irrelevant to the purpose of the Annual Meeting or our business or that contain inappropriate or derogatory references which are not in good taste. If we receive substantially similar questions, we will group such questions together and provide a single response to avoid repetition.

We encourage you to vote your shares during or prior to the Annual Meeting, by telephone, through the Internet, or by granting a proxy (i.e., authorizing someone to vote your shares). If you properly sign and date the accompanying proxy card or authorize your proxy by telephone or through the Internet, and the Company receives your vote in time for voting at the Annual Meeting, the persons named as proxies will vote your shares in the manner that you specify. If you validly sign and return your proxy card, but give no instructions on the proxy card, the shares covered by the proxy card will be voted FOR the election of the nominee as a director and FOR the ratification of the appointment of KPMG LLP to serve as the Company’s independent registered public accounting firm for the year ending December 31, 2021 in accordance with the recommendation of the Board.

If you are a “stockholder of record” (i.e., as of the close of business on September 20, 2021 you hold shares directly with the Company or the Company’s transfer agent in your name), you may revoke a proxy at any time by (1) notifying the Company, in writing, (2) submitting a properly executed, later-dated proxy card, or voting via Internet or telephone at a later time or (3) attending the Annual Meeting in-person or virtually and voting your shares at the Annual Meeting.

Purpose of Annual Meeting

At the Annual Meeting, you will be asked to vote on the following proposals:

| 1. | To elect one (1) director of the Company who will serve for a term of three years or until her successor is duly elected and qualified; |

| 2. | To ratify the appointment of KPMG LLP to serve as the Company’s independent registered public accounting firm for the year ending December 31, 2021; and |

| 3. | To transact such other business as may properly come before the Annual Meeting. |

2

Record Date

The record date for the Annual Meeting is the close of business on September 20, 2021 (the “Record Date”). You may cast one vote for each share of common stock that you owned as of the Record Date. As of the Record Date, there were 12,951,681 shares of the Company’s common stock issued and outstanding and entitled to vote.

Quorum and Adjournment

A quorum must be present at the Annual Meeting for any business to be conducted. The presence at the Annual Meeting, in-person or by proxy, of the holders of one-third of the issued and outstanding shares of common stock of the Company and entitled to vote as of the Record Date will constitute a quorum for purposes of the Annual Meeting. Abstentions will be deemed to be present for the purpose of determining a quorum for the Annual Meeting.

If a quorum is not present at the Annual Meeting, the presiding officer or the stockholders who are represented may adjourn the Annual Meeting until a quorum is present. Such adjournment will be permitted if approved by a majority of the votes cast by the holders of shares of our common stock present in-person or by proxy at the Annual Meeting, whether or not a quorum exists. Abstentions will have no effect on the adjournment vote. Abstentions shall not be counted as votes cast on such adjournment and will have no effect on the adjournment vote.

Vote Required

Election of Director. The election of directors in an uncontested election requires the affirmative vote of a majority of the votes cast at the Annual Meeting, provided a quorum is present. Stockholders may not cumulate their votes. Abstentions will not be included in determining the number of votes cast and, as a result, will have no effect on this proposal.

If you validly sign and return your proxy card, but give no instructions on the proxy card, the shares covered by the proxy card will be voted FOR the election of the nominee as a director in accordance with the recommendation of the Board.

Ratification of Independent Registered Public Accounting Firm. The affirmative vote of a majority of the votes cast at the Annual Meeting is required to ratify the appointment of KPMG LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021, provided a quorum is present. Abstentions will not be included in determining the number of votes cast and, as a result, will have no effect on this proposal.

If you validly sign and return your proxy card, but give no instructions on the proxy card, the shares covered by the proxy card will be voted FOR the ratification of appointment of KPMG LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021 in accordance with the recommendation of the Board.

Additional Solicitation. If there are not enough votes to approve any proposals at the Annual Meeting, the presiding officer or the stockholders who are represented may adjourn the Annual Meeting to permit the further solicitation of proxies. The persons named as proxies will vote those proxies for such adjournment, unless the proxies are marked to be voted against any proposal for which an adjournment is sought, to permit the further solicitation of proxies. In addition, the presiding officer of the Annual Meeting will have the authority to adjourn the Annual Meeting from time-to-time without notice and without the vote or approval of the stockholders.

Also, a stockholder vote may be taken on one or more of the proposals in this Proxy Statement prior to any such adjournment if there are sufficient votes for approval of such proposal(s).

3

Information Regarding This Solicitation

The Company will bear the expense of the solicitation of proxies for the Annual Meeting, including the cost of preparing, printing and mailing this Proxy Statement, the accompanying Notice of 2021 Annual Meeting of Stockholders, and proxy card.

In addition to the solicitation of proxies by the use of the mail, proxies may be solicited in-person and/or by telephone or facsimile transmission by directors, director nominee, or executive officers of the Company and/or officers or personnel of Stone Point Credit Adviser LLC (the “Adviser”), the Company’s investment adviser or its affiliates. The Adviser is located at 20 Horseneck Lane, Greenwich, Connecticut 06830. No additional compensation will be paid to directors or executive officers of the Company or personnel of the Adviser or its affiliates for such services.

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

The following table sets forth, as of September 20, 2021, the beneficial ownership of each director and executive officer of the Company, and the executive officers and directors as a group.

Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the securities. Unless otherwise indicated, the Company believes that each beneficial owner set forth in the table has sole voting and investment power and has the same address as the Company. Our address is 20 Horseneck Lane, Greenwich, Connecticut 06830.

| Name and Address of Beneficial Owner (1) |

Number of Shares Owned Beneficially (2) |

Percentage of Class (3) |

||||||

| Interested Directors |

||||||||

| Scott Bronner |

— | — | % | |||||

| David Wermuth |

— | — | % | |||||

| Independent Directors |

||||||||

| Jennifer J. Burleigh |

— | — | % | |||||

| Scott E. Heberton |

— | — | % | |||||

| Peter E. Roth |

— | — | % | |||||

| Executive Officers |

||||||||

| Gene Basov |

— | — | % | |||||

| Jacqueline Giammarco |

— | — | % | |||||

| Sally DeVino |

— | — | % | |||||

| Sandra Forman |

— | — | % | |||||

|

|

|

|

|

|||||

| All executive officers and directors as a group (nine persons) |

— | — | % | |||||

|

|

|

|

|

|||||

| (1) | The address for each of the Beneficial Owners is 20 Horseneck Lane, Greenwich, Connecticut 06830. |

| (2) | Beneficial ownership has been determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). |

| (3) | Based on a total of 12,951,681 shares issued and outstanding on September 20, 2021. |

4

Set forth below is the dollar range of equity securities beneficially owned by each of our directors as of September 20, 2021. We are not part of a “family of investment companies,” as that term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”).

| Name of Director |

Dollar Range of Equity Securities Beneficially Owned (1)(2) |

|||

| Interested Directors |

||||

| Scott Bronner |

None | |||

| David Wermuth |

None | |||

| Independent Directors |

||||

| Jennifer J. Burleigh |

None | |||

| Scott E. Heberton |

None | |||

| Peter E. Roth |

None | |||

| (1) | The dollar ranges are: None, $1-$10,000, $10,001-$50,000, $50,001-$100,000, or Over $100,000. |

| (2) | Beneficial ownership has been determined in accordance with Rule 16a-1(a)(2) of the Exchange Act. |

5

PROPOSAL I: ELECTION OF DIRECTOR

Our business and affairs are managed under the direction of our Board of Directors (“Board”). Pursuant to our charter, the Board is divided into three classes, designated Class I, Class II, and Class III. At the Annual Meeting, one Class I director shall be elected to serve a three-year term. Directors are elected for a staggered term of three years each, with a term of office of one of the three classes of directors expiring each year. Each director will hold office for the term to which he or she is elected or until his or her respective successor is duly elected and qualified.

Jennifer J. Burleigh has been nominated for election for a three-year term expiring in 2024. If elected, Ms. Burleigh will continue to serve on the Company’s Board. Ms. Burleigh is not being nominated for election pursuant to any agreement or understanding between Ms. Burleigh and the Company or any other person or entity.

Ms. Burleigh has consented to being named in this Proxy Statement and to serving as a director if re-elected at the Annual Meeting. Accordingly, the Board has no reason to believe that Ms. Burleigh will be unable or unwilling to serve.

If a nominee should decline or be unable to serve as a director, it is intended that the proxy will vote for the election of such person as is nominated by the Board as a replacement.

Information About the Director Nominee and Current Directors

As described below under “Committees of the Board of Directors—Nominating and Corporate Governance Committee,” the Board has identified certain desired attributes for director nominees. Each of our directors and the director nominee have demonstrated high character and integrity, superior credentials and recognition in his or her field and the relevant expertise and experience upon which to be able to offer advice and guidance to our management. Each of our directors and the director nominee also have sufficient time available to devote to the affairs of the Company, are able to work with the other members of the Board and contribute to the success of the Company, and can each represent the long-term interests of the Company’s stockholders as a whole. Our directors and director nominee have been selected such that the Board represents a range of backgrounds and experience.

Certain information, as of the Record Date, with respect to the director nominee for election at the Annual Meeting, as well as each of the current directors, is set forth below, including their names, ages, a brief description of their recent business experience, including present occupations and employment, certain directorships that each person holds, the year in which each person became a director of the Company, and a discussion of each person’s particular experience, qualifications, attributes or skills that lead us to conclude, as of the Record Date, that such individual should serve as a director of the Company, in light of the Company’s business and structure.

Nominee for Class I Director—Term Expiring 2024

| Name, Address |

Position(s) Held |

Terms of Office

and |

Principal Occupation(s) |

Other Directorships Held by Director or Nominee for Director During Past 5 Years | ||||

| Independent Director |

||||||||

| Jennifer J. Burleigh, 55 |

Director, Chairwoman of the Nominating and Corporate Governance Committee | Class I Director since 2020; Term expires 2021 |

Retired | Previously Director of The Caedmon School and Director of Concord Academy |

6

Jennifer J. Burleigh is not an “interested person” of the Company as defined in the 1940 Act and has served as a director since November 2020. Ms. Burleigh, a retired partner of Debevoise & Plimpton (“Debevoise”), focused her legal practice on advising sponsors of private investment funds, co-investment funds and separately managed accounts. Ms. Burleigh’s experience covers a broad array of private fund strategies, including leveraged buyout, energy/infrastructure, real estate, mezzanine and distressed debt and equity funds. Ms. Burleigh has significant experience in emerging markets fund formation, including assisting emerging market-based sponsors in accessing international markets. Ms. Burleigh also has significant experience, representing both management teams and institutions, in asset manager spin-outs and the establishment of new investment firms. She advised both sponsors and institutional buyers in connection with strategic investments in private investment firms. Ms. Burleigh advised on the formation of “permanent capital” vehicles and evergreen investment vehicles, as well as the establishment of employee investment programs. She also advised on strategic joint venture arrangements in the fund formation space. Ms. Burleigh joined Debevoise in 1994, becoming a partner in 2002. She retired from practice in 2014 and has devoted her time to non-profit work and writing fiction. Ms. Burleigh currently serves on the board of Concord Academy in Concord, Massachusetts. Ms. Burleigh received her B.A. with honors from Stanford University in 1989, and her J.D. in 1994 from Columbia Law School, where she was a Harlan Fiske Stone Scholar and a managing editor of the Columbia Law Review.

We believe that Ms. Burleigh’s substantial experience in the investment industry, including her work with various investment strategies, supports her nomination for election to the Board.

Current Directors—Not up for Election at the Annual Meeting

Class II Directors—Term Expiring 2022

| Name, Address |

Position(s) Held |

Terms of Office

and |

Principal Occupation(s) |

Other Directorships Held by Director or Nominee for Director During Past 5 Years | ||||

| Interested Director |

||||||||

| Scott Bronner, 37 |

Director and President | Class II Director since November 2020; Term expires 2022 | Managing Director at Stone Point | Director of Cross Ocean Partners, Eagle Point, Tree Line Capital Partners, Vervent, and Stretto |

Scott Bronner is an “interested person” of the Company as defined in the 1940 Act and has served as a director since November 2020. Mr. Bronner is a Managing Director at Stone Point, a member of the Adviser’s Allocation Committee, and a member of the Adviser’s Valuation Committee. He has been with Stone Point since 2009. Prior to joining Stone Point, Mr. Bronner was an Analyst in the Private Equity Division at Lehman Brothers Inc. Mr. Bronner holds a B.A. from Amherst College.

We believe that Mr. Bronner’s broad and extensive experience supports his membership on our Board.

| Name, Address |

Position(s) Held |

Terms of Office

and |

Principal Occupation(s) |

Other Directorships Held by | ||||

| Independent Director |

||||||||

| Scott E. Heberton, 55 |

Director | Class II Director since November 2020; Term expires 2022 | Head of FIG Investment Banking and Capital Markets at Wells Fargo | Director and Executive Chairman of Omni Healthcare Financial, LLC |

Scott E. Heberton is not an “interested person” of the Company as defined in the 1940 Act and has served as a director since November 2020. Mr. Heberton currently serves as an advisor to Lovell Minnick Partners and a Board Member and Executive Chairman of Omni Healthcare Financial, LLC following his retirement from Wells

7

Fargo Securities in 2019. During his tenure at Wells Fargo Securities, Scott served for over 10 years as Head of FIG Investment Banking and Capital Markets. He was a member of the Investment Bank’s Operating Committee as well as the Investment Banking Commitment Committee and Advisory Committee. Scott’s extensive career in Financial Services has been primarily focused on advisory work and capital raising for the industry verticals of Specialty Finance, Residential and Commercial Real Estate and Alternative Asset Management. Mr. Heberton earned his M.B.A. from The Fuqua School of Business at Duke University and holds a Bachelor of Arts degree in Economics from the University of Virginia.

We believe that Mr. Heberton’s broad and extensive experience in investment banking and capital markets supports his membership on our Board.

Class III Directors—Term Expiring 2023

| Name, Address |

Position(s) Held |

Terms of Office

and |

Principal Occupation(s) |

Other Directorships Held by | ||||

| Interested Director |

||||||||

| David Wermuth, 53 |

Director, Chairman of the Board of Directors | Class III Director since November 2020; Term expires 2023 | Managing Director and General Counsel of Stone Point Capital | Director of AmTrust Financial, Freepoint Commodities, JND Holdings, Safe-Guard Products International, SKY Harbor Capital Management and StoneRiver |

David Wermuth is an “interested person” of the Company as defined in the 1940 Act and has served as a director since November 2020. Mr. Wermuth is a Managing Director, the General Counsel at Stone Point, a member of the Credit Investment Committee, Investment Committees of the Trident Funds, a member of the Adviser’s Allocation Committee, and a member of the Adviser’s Valuation Committee. He joined the Stone Point platform in 1999 from Cleary, Gottlieb, Steen & Hamilton LLP, where from 1996 to 1999 he was a corporate attorney specializing in mergers and acquisitions. Prior to joining Cleary Gottlieb, Mr. Wermuth served as a law clerk to a federal judge of the U.S. Court of Appeals for the Ninth Circuit and as an auditor for KPMG Peat Marwick. Mr. Wermuth holds a B.A. from Yale University, an M.B.A. from the New York University Leonard N. Stern School of Business and a J.D. from Cornell Law School.

We believe that Mr. Wermuth’s broad and extensive experience supports his membership on our Board.

| Name, Address and Age (1) |

Position(s) Held |

Terms of Office

and |

Principal Occupation(s) |

Other Directorships Held by | ||||

| Independent Director |

||||||||

| Peter E. Roth, 62 |

Director, Chairman of the Audit Committee | Class III Director since November 2020; Term expires 2023 | Managing Partner of the Rothpoint Group LLC | Trustee of Guggenheim Credit Income Fund, Director of St. Mary’s Healthcare System for Children and City of London Investment Group | ||||

| Investment Group plc |

Peter E. Roth is not an “interested person” of the Company as defined in the 1940 Act and has served as a director since November 2020. He is Chair of the Audit Committee. Mr. Roth is the Managing Partner of the Rothpoint Group LLC, a consulting firm specializing in the financial services industry. Mr. Roth is a Non-Executive Director and Senior Independent Director of the City of London Investment Group plc, a publicly

8

traded (London Stock Exchange) asset management firm and as Chairman of the Audit Committee and a member of the Nominations and Remuneration Committees. Mr. Roth serves as an Independent Trustee of the Guggenheim Credit Income Fund (and related entities) and is Chairman of the Audit Committee and a Member of the Nomination and Governance and Independent Trustee Committees. In the non-profit sector, he serves on the Board of St. Mary’s Healthcare System for Children and is Chairman of the Finance Committee and a member of the Executive Committee. Prior to establishing Rothpoint, Mr. Roth had a 35 year plus career in the financial services industry. He was the head of investment banking at Fox, Pitt, Kelton Inc for thirteen years and a member of the firm’s Operating Committee. At Keefe, Bruyette & Woods, he joined as the Head of Insurance Investment Banking and later became the Chief Executive Officer of KBW Asset Management, an SEC registered investment firm specializing in the financial services sector. He served on the firm’s Operating Committee and was a member of the Board of Directors of KBW, Inc. at the time of its initial public offering. Mr. Roth received a Bachelor of Arts degree from the University of Pennsylvania and Master’s of Business Administration from The Wharton School at the University of Pennsylvania.

We believe that Mr. Roth’s extensive financial services experience supports his membership on our Board.

| (1) | The business address of the director nominee and other directors is c/o Stone Point Credit Corporation, 20 Horseneck Lane, Greenwich, Connecticut 06830. |

Information about Executive Officers Who Are Not Directors

The following information, as of the Record Date, pertains to our executive officers who are not directors of the Company.

| Name, Address, and Age (1) |

Position(s) Held with Company |

Principal Occupation(s) During Past 5 Years | ||

| Gene Basov, 46 |

Chief Financial Officer and Treasurer | Chief Financial Officer of Credit at Stone Point, Chief Financial Officer at Investcorp Credit Management US | ||

| Jacqueline Giammarco, 52 |

Chief Compliance Officer | Managing Director, Chief Compliance Officer and Counsel at Stone Point | ||

| Sally DeVino, 56 |

Vice President | Managing Director and Finance Director at Stone Point | ||

| Sandra Forman, 55 |

Vice President and Secretary | Deputy Chief Compliance Officer at Stone Point. General Counsel and Chief Compliance Officer at Hudson Valley Wealth Management Inc, Deputy General Counsel and Chief Compliance Officer, Registered Funds at Colony Capital | ||

| (1) | The business address of the executive officers is c/o Stone Point Credit Corporation, 20 Horseneck Lane, Greenwich, Connecticut 06830. |

Gene Basov is the Chief Financial Officer of Credit at Stone Point. Mr. Basov has been with Stone Point since 2020. Previously, Mr. Basov was Chief Financial Officer at Investcorp Credit Management US, a Vice President and Fund Group Controller at Cerberus Capital Management, a Financial Analyst at General Motors Asset Management and a Senior Auditor at Deloitte & Touche. Mr. Basov holds a B.B.A. from Baruch College, an M.B.A. from Fordham College and is a Certified Public Accountant.

9

Jacqueline Giammarco is a Managing Director and Counsel at Stone Point, as well as Stone Point’s Chief Compliance Officer. She joined Stone Point in 2012 from MF Global where from 2007 to 2012, she was Senior Vice President and Assistant General Counsel. Prior to joining MF Global, Ms. Giammarco was a corporate partner at Katten Muchin Rosenman, joining the firm as an associate in the corporate department in 1997. Ms. Giammarco advised senior executives, boards of directors and in-house counsels on a variety of corporate legal matters. Ms. Giammarco holds a B.A. from Wilfrid Laurier University, an LL.B. from the University of Alberta Law School and an LL.M. in Corporate Law from the New York University School of Law.

Sally DeVino is a Managing Director and Finance Director at Stone Point. She joined Stone Point in 1995. In 2022, she will become the Chief Financial Officer at Stone Point. Previously, she was a Senior Manager with BDO Seidman, where for eight years she provided audit, tax and consulting services in the manufacturing, construction, banking and not-for-profit industries. Ms. DeVino holds a B.S. from Manhattan College and was a Certified Public Accountant.

Sandra Forman is the Deputy Chief Compliance Officer at Stone Point. Ms. Forman joined Stone Point in 2021. Previously, Ms. Forman was General Counsel and Chief Compliance Officer at Hudson Valley Wealth Management Inc, a private wealth management firm; Deputy General Counsel and Chief Compliance Officer, Registered Funds at Colony Capital, Inc. and its predecessor NorthStar Asset Management Inc., a real estate asset manager; Senior Counsel at Proskauer Rose; and General Counsel, Chief Compliance Officer, Secretary and Director of Human Resources at Harris & Harris Group, Inc. Ms. Forman began her career as an associate in the investment management group of Skadden, Arps, Slate, Meagher & Flom LLP. Ms. Forman holds a B.A. from New York University and a J.D. from the UCLA School of Law.

Director Independence

Our Board annually determines each director’s independence. We do not consider a director independent unless the Board has determined that he or she has no material relationship with us in accordance with Section 2(a)(19) of the 1940 Act. We monitor the relationships of our directors and officers through the activities of our Nominating and Corporate Governance Committee and through a questionnaire each director completes no less frequently than annually and updates periodically as information provided in the most recent questionnaire changes.

Our governance guidelines require any director who has previously been determined to be independent to inform the Chairman of the Board and the Chair of the Nominating and Corporate Governance Committee of any change in circumstance that may cause his or her status as an independent director to change. The Board limits membership on the Audit Committee and the Nominating and Corporate Governance Committee to independent directors.

The Board has determined that each of the directors and the director nominee is independent and has no material relationship with the Company, except as a director, with the exception of David Wermuth and Scott Bronner. David Wermuth and Scott Bronner are interested persons of the Company due to their positions as members of management of Stone Point.

Board Leadership Structure

Our business and affairs are managed under the direction of our Board. Among other things, our Board sets broad policies for us and approves the appointment of our investment adviser, administrator and officers, reviews and monitors the services and activities performed by our investment adviser and executive officers and approves the engagement, and reviews performance of our independent public accounting firm. The role of our Board, and of any individual director, is one of oversight and not of management of our day-to-day affairs.

Under our bylaws, our Board may designate one of our directors as chair to preside over meetings of our Board and meetings of stockholders and to perform such other duties as may be assigned to him or her by our Board.

10

We do not have a fixed policy as to whether the Chair of the Board should be an independent director and believe that we should maintain the flexibility to select the Chair and reorganize the leadership structure, from time to time, based on the criteria that is in the best interests of the Company and its stockholders at such times.

Presently, David Wermuth serves as the Chairman of our Board. Mr. Wermuth is an “interested person” of the Company as defined in Section 2(a)(19) of the 1940 Act by virtue of his role as Managing Director of the Adviser. We believe that Mr. Wermuth’s history with the Company, familiarity with its investment platform, and extensive knowledge of the financial services industry qualify him to serve as the Chairman of our Board. We believe that the Company is best served through this existing leadership structure, as Mr. Wermuth’s relationship with the Adviser provides an effective bridge and encourages an open dialogue between management and the Board, ensuring that both groups act with a common purpose.

Our corporate governance policies include regular meetings of the independent directors in executive session without the presence of interested directors and management, the establishment of the Audit Committee and the Nominating and Corporate Governance Committee, each comprised solely of independent directors, and the appointment of a chief compliance officer, with whom the independent directors meet at least once a year without the presence of interested directors and other members of management, for administering our compliance policies and procedures.

We recognize that different board of directors’ leadership structures are appropriate for companies in different situations. We re-examine our corporate governance policies on an ongoing basis to ensure that they continue to meet our needs.

All of the independent directors play an active role on the Board. The independent directors compose a majority of our Board and are closely involved in all material deliberations related to us. Our Board believes that, with these practices, each independent director has an equal involvement in the actions and oversight role of our Board and equal accountability to us and our stockholders. Our independent directors are expected to meet separately (i) as part of each regular Board meeting and (ii) with our Chief Compliance Officer, as part of at least one Board meeting each year.

Our Board believes that its leadership structure is the optimal structure for us at this time. Our Board, which will review its leadership structure periodically as part of its annual self-assessment process, further believes that its structure is presently appropriate to enable it to exercise oversight of our business and affairs.

Board of Directors Role in Risk Oversight

Our Board oversees our business and operations, including certain risk management functions. Risk management is a broad concept comprising many disparate elements (for example, investment risk, issuer and counterparty risk, compliance risk, operational risk, and business continuity risk). Our Board implements its risk oversight function both as a whole and through its committees. While providing oversight, our Board and its committees receive reports on the Company’s and the Adviser’s activities, including reports regarding our investment portfolio and financial accounting and reporting.

As described below in more detail under “Committees of the Board of Directors,” the Audit Committee and the Nominating and Corporate Governance Committee assist the Board in fulfilling its risk oversight responsibilities. The Audit Committee’s risk oversight responsibilities include overseeing the Company’s accounting and financial reporting processes, the Company’s systems of internal control over financial reporting, and audits of the Company’s financial statements. The Nominating and Corporate Governance Committee’s risk oversight responsibilities include selecting, researching and nominating directors for election by our stockholders, developing and recommending to the Board a set of corporate governance principles and overseeing the evaluation of the Board and our management.

Our Board also performs its risk oversight responsibilities with the assistance of our Chief Compliance Officer. Our Board receives a quarterly report from our Chief Compliance Officer, who reports on our compliance with

11

the federal securities laws and our internal compliance policies and procedures as well as those of the Adviser, our administrator and our transfer agent. The Board also reviews annually a written report from the Chief Compliance Officer discussing, in detail, the adequacy and effectiveness of our compliance policies and procedures and those of our service providers.

The Audit Committee’s meetings with our independent public accounting firm also contribute to its oversight of certain internal control risks. In addition, our Board meets periodically with the Adviser to receive reports regarding our operations, including reports on certain investment and operational risks, and our independent directors are encouraged to communicate directly with senior members of our management.

Our Board believes that this role in risk oversight is effective and appropriate given the extensive regulation to which we are already subject as a business development company. As a business development company, we are required to comply with certain regulatory requirements that control the levels of risk in our business and operations. For example, our ability to incur indebtedness is limited such that our asset coverage must equal at least 150% immediately after each time we incur indebtedness, we generally have to invest at least 70% of our total assets in “qualifying assets,” and there are restrictions regarding investments in any portfolio company in which one of our affiliates currently has an investment. We believe that we have robust internal processes in place and a strong internal control environment to identify and manage risks. However, not all risks that may affect us can be identified or eliminated and some risks are beyond the control of us, the Adviser and our other service providers.

We recognize that different board of directors’ roles in risk oversight are appropriate for companies in different situations. We re-examine the manners in which the Board administers its oversight function on an ongoing basis to ensure that it continues to meet the Company’s needs.

Committees of the Board of Directors

Our Board currently has two committees: an Audit Committee and a Nominating and Corporate Governance Committee. The Board does not have a standing compensation committee because our executive officers do not receive any direct compensation from us. During the fiscal period ended 2020, our Board held two meetings, the Audit Committee held one meeting, and the Nominating and Corporate Governance Committee held one meeting. We require each director to make a diligent effort to attend all Board and committee meetings as well as each annual meeting of our stockholders. All directors attended at least 75% of the aggregate number of meetings of the Board and of the respective committees on which they serve during the fiscal period ended 2020.

Audit Committee. The Audit Committee is currently composed of all of the Independent Directors. Peter E. Roth serves as Chair of the Audit Committee. The Board has determined that Mr. Roth is an “audit committee financial expert” as that term is defined under Item 407 of Regulation S-K, as promulgated under the Exchange Act. Mr. Roth, Ms. Burleigh, and Mr. Heberton meet the current requirements of Rule 10A-3 under the Exchange Act. The Audit Committee operates pursuant to a charter approved by the Board, which sets forth the responsibilities of the Audit Committee, a copy of which is attached to this Proxy Statement as Annex A. The Audit Committee’s responsibilities include establishing guidelines and making recommendations to the Board regarding the valuation of the Company’s investments; selecting the Company’s independent registered public accounting firm; reviewing with such independent registered public accounting firm the planning, scope and results of their audit of the Company’s financial statements; pre-approving the fees for services performed; reviewing with the independent registered public accounting firm the adequacy of internal control systems; reviewing the Company’s annual audited financial statements, and periodic filings; and receiving the Company’s audit reports and financial statements.

Nominating and Corporate Governance Committee. The members of the Nominating and Corporate governance committee are the Independent Directors. Jennifer J. Burleigh serves as Chair of the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee is responsible for selecting,

12

researching and nominating directors for election by the Stockholders, selecting nominees to fill vacancies on the Board or a committee of the Board, developing and recommending to the Board a set of corporate governance principles and overseeing the evaluation of the Board and management.

Communication with the Board of Directors

Stockholders with questions about the Company are encouraged to contact the Company’s investor relations department. However, if stockholders believe that their questions have not been addressed, they may communicate with the Company’s Board by sending their communications to the Chairman of the Board of Directors, c/o Stone Point Credit Corporation, 20 Horseneck Lane, Greenwich, Connecticut 06830. All stockholder communications received in this manner will be delivered to one or more members of the Board, as appropriate.

Code of Ethics

The Company and the Adviser have each adopted a code of ethics pursuant to Rule 17j-1 under the 1940 Act and Rule 204A-1 under the Investment Advisers Act of 1940, as amended (the “Advisers Act”), respectively, that establishes procedures for personal investments and restricts certain transactions by the Company’s personnel. These codes of ethics generally will not permit investments by the Company’s and the Adviser’s personnel in securities that may be purchased or sold by the Company.

Compensation of Executive Officers

The Company does not currently have any employees and does not expect to have any employees. Each of the Company’s initial executive officers is an employee of the Adviser and/or one of its affiliates. The Company’s day-to-day investment operations will be managed by the Adviser. Most of the services necessary for the origination and management of the Company’s investment portfolio will be provided by investment professionals employed by the Adviser and/or its affiliates.

None of the Company’s executive officers will receive direct compensation from the Company. Certain of the Company’s executive officers and other members of the Investment Team, through their ownership interest in or management positions with the Adviser, may be entitled to a portion of any profits earned by the Adviser or its affiliates (including any fees payable to the Adviser under the terms of the Investment Advisory Agreement, less expenses incurred by the Adviser in performing its services under the Investment Advisory Agreement). The Adviser or its affiliates may pay additional salaries, bonuses, and individual performance awards and/or individual performance bonuses to the Company’s executive officers in addition to their ownership interest.

Compensation of Independent Directors

The Independent Directors’ annual fee is $100,000 plus $2,500 per each scheduled quarterly Board meeting attended, plus an additional $10,000 per year to be paid to the Chair of the Audit Committee and an additional $2,500 per year to be paid to the Chair of the Nominating & Corporate Governance Committee. Commencing July 1, 2021, the Chair of the Audit Committee will be paid the pro rata portion of $25,000 per year. The Independent Directors also receive reimbursement of reasonable out-of-pocket expenses incurred in connection with attending any meeting. No compensation is expected to be paid to the Interested Directors with respect to the Company.

13

The following table sets forth compensation of the Company’s independent directors for the fiscal period ended December 31, 2020.

| Name |

Fees Earned (1) |

Stock Awards (2) | All Other Compensation |

Total | ||||||||||||

| Jennifer J. Burleigh |

$ | 21,288 | — | — | $ | 21,288 | ||||||||||

| Scott E. Heberton |

$ | 20,890 | — | — | $ | 20,890 | ||||||||||

| Peter E. Roth |

$ | 22,479 | — | — | $ | 22,479 | ||||||||||

| (1) | No compensation is paid to our directors who are “interested persons,” as such term is defined in Section 2(a)(19) of the 1940 Act. |

| (2) | We do not maintain a stock or option plan, non-equity incentive plan or pension plan for our directors. |

Certain Relationships and Related Party Transactions

Investment Advisory Agreement

The Company entered into the Investment Advisory Agreement dated December 1, 2020 with the Adviser. Pursuant to the Investment Advisory Agreement, the Adviser manages the Company’s day-to-day operations and provides the Company with investment advisory services. Among other things, the Adviser (i) determines the composition and allocation of the Company’s investment portfolio, the nature and timing of the changes therein and the manner of implementing such changes; (ii) identifies, evaluates and negotiates the structure of the investments made by the Company; (iii) performs due diligence on prospective portfolio companies; (iv) executes, closes, services and monitors the Company’s investments; (v) determines the securities and other assets that the Company will purchase, retain or sell; (vi) arranges financings and borrowing facilities for the Company and (vii) provides the Company with such other investment advisory, research and related services as the Company may, from time to time, reasonably require for the investment of its fund and (viii) to the extent permitted under the 1940 Act and the Advisers Act, on the Company’s behalf, and in coordination with any sub-adviser and any administrator, provides significant managerial assistance to those portfolio companies to which the Company is required to provide such assistance under the 1940 Act, including utilizing appropriate personnel of the Adviser to, among other things, monitor the operations of the Company’s portfolio companies, participate in Board and management meetings, consult with and advise officers of portfolio companies and provide other organizational and financial consultation. The Adviser’s services under the Investment Advisory Agreement are not exclusive, and the Adviser is generally free to furnish similar services to other entities so long as its performance under the Investment Advisory Agreement is not adversely affected.

Under the Investment Advisory Agreement, the Company pays the Adviser (i) a base management fee and (ii) an incentive fee as compensation for the investment advisory and management services it provides the Company thereunder.

Base Management Fee

The Company pays to the Adviser an asset-based fee (the “Management Fee”) for management services in an amount equal to an annual rate of 1.30% of the average value of the Company’s gross assets (excluding cash and cash equivalents) as of the last day of the most recently completed calendar quarter and the last day of the immediately preceding calendar quarter payable quarterly in arrears. The Management Fee for any partial quarter will be appropriately prorated and adjusted for any share issuances or repurchases during the relevant calendar months or quarters.

Incentive Fee

Beginning on the fourth anniversary of the date on which Stockholders are required to fund their initial drawdown (the “Incentive Commencement Date”), the Company will pay the Adviser an incentive fee

14

(“Incentive Fee”) as set forth below. The Incentive Fee will consist of two parts. The first part (the “Investment Income Incentive Fee”) will be calculated and payable following the Incentive Commencement Date on a quarterly basis, in arrears, and will equal 15% of “pre-incentive fee net investment income” for the immediately preceding calendar quarter, subject to a quarterly preferred return of 1.75% (i.e., 7% annualized) measured on a quarterly basis and a “catch-up” feature. For purposes of computing the initial installment of the Investment Income Incentive Fee, if the Incentive Commencement Date does not fall on the first day of a calendar quarter, then the initial payment of the Investment Income Incentive Fee shall be payable for the period that commences on the Incentive Commencement Date through the last day of the first complete calendar quarter immediately following the Incentive Commencement Date and, thereafter, at the end of each subsequent calendar quarter as described above. The second part (the “Capital Gains Incentive Fee”) will be an annual fee that will also commence with the period beginning on the Incentive Commencement Date and will be determined and payable following the Incentive Commencement Date, in arrears, as of the end of each calendar year (or upon termination of the Investment Advisory Agreement) in an amount equal to 15% of realized capital gains, if any, determined on a cumulative basis from the Incentive Commencement Date (based on the fair market value of each investment as of such date) through the end of such calendar year (or upon termination of the Investment Advisory Agreement), computed net of all realized capital losses and unrealized capital depreciation on a cumulative basis from the Incentive Commencement Date (based on the fair market value of each investment as of such date) through the end of such calendar year (or upon termination of the Investment Advisory Agreement), less the aggregate amount of any previously paid Capital Gains Incentive Fees. For the purpose of computing the Capital Gains Incentive Fees, the calculation methodology will look through derivative financial instruments or swaps as if the Company owned the reference assets directly.

Pre-incentive fee net investment income means interest income, dividend income and any other income accrued during the calendar quarter, minus operating expenses for the quarter, including the base Management Fee, expenses payable to the Administrator under the Administration Agreement, any interest expense and distributions paid on any issued and outstanding preferred stock, but excluding (x) the Incentive Fee and (y) any realized capital gains, realized capital losses or unrealized capital appreciation or depreciation. Pre-incentive fee net investment income includes, in the case of investments with a deferred interest feature (such as debt instruments with payment-in-kind (“PIK”) interest and zero coupon securities), accrued income that the Company has not yet received in cash. The Adviser is not obligated to return to the Company the Incentive Fee it receives on PIK interest that is later determined to be uncollectible in cash.

The second component of the Incentive Fee is the Capital Gains Incentive Fee. The Capital Gains Incentive Fee is payable at the end of each calendar year in arrears and equals, commencing on the Incentive Commencement Date, 15.0% of cumulative realized capital gains, net of all realized capital losses and unrealized capital depreciation on a cumulative basis from the Incentive Commencement Date to the end of each calendar year. Each year, the Capital Gains Incentive Fee will be paid net of the aggregate amount of any previously paid Capital Gains Incentive Fee for prior periods. The Company will accrue, but will not pay, a Capital Gains Incentive Fee with respect to unrealized appreciation because a Capital Gains Incentive Fee would be owed to the Adviser if the Company were to sell the relevant investment and realize a capital gain. The fees that are payable under the Investment Advisory Agreement for any partial period will be appropriately prorated. For the sole purpose of calculating the Capital Gains Incentive Fee, the cost basis as of the Incentive Commencement Date for all of the Company’s investments made prior to the date of the Exchange Listing will be equal to the fair market value of such investments as of the last day of the calendar quarter in which the date of the Exchange Listing occurs; provided, however, that in no event will the Capital Gains Incentive Fee payable pursuant to the Investment Advisory Agreement exceed the amount permitted by the Advisers Act, including Section 205 thereof.

For the year ended December 31, 2020, base management fees were $2,877.

15

The Administrator

Stone Point Credit Adviser LLC also serves as the administrator of the Company (in such capacity, the “Administrator”). Subject to the supervision of the Board, the Administrator provides the administrative services necessary for the Company to operate and the Company will utilize the Administrator’s office facilities, equipment and recordkeeping services. The Company will reimburse the Administrator for all reasonable costs and expenses incurred by the Administrator in providing these services, facilities and personnel, as provided by the administration agreement by and between the Company and the Administrator (the “Administration Agreement”). There will be no separate fee paid in connection with the services provided under the Administration Agreement. In addition, the Administrator is permitted to delegate its duties under the Administration Agreement to affiliates or third parties, and the Company will reimburse the expenses of these parties incurred directly and/or paid by the Administrator on the Company’s behalf.

The Administration Agreement provides that, absent willful misfeasance, bad faith or negligence in the performance of its duties or by reason of the reckless disregard of its duties and obligations, the Administrator and its officers, managers, partners, agents, employees, controlling persons, members and any other person or entity affiliated with it are entitled to indemnification from us for any damages, liabilities, costs and expenses (including reasonable attorneys’ fees and amounts reasonably paid in settlement) arising from the rendering of the Administrator’s services under the Administration Agreement or otherwise as our administrator.

For the year ended December 31, 2020, the Company incurred $36,464 in expenses under the Administration Agreement which were recorded in administrative service expenses in the Consolidated Statements of Operations included in the Annual Report on Form 10-K for the year ended December 31, 2020, as filed with the SEC.

Section 16(a) Beneficial Ownership Reporting Compliance

Pursuant to Section 16(a) of the Exchange Act, the Company’s directors and executive officers, and any persons holding more than 10% of its common stock, are required to report their beneficial ownership and any changes therein to the SEC and the Company. Specific due dates for those reports have been established, and the Company is required to report herein any failure to file such reports by those due dates. Based solely on a review of the copies of such reports and written representations delivered to the Company by such persons, we believe that all Section 16(a) filing requirements applicable to our directors, executive officers, and 10.0% or greater stockholders were satisfied in a timely manner during the year ended December 31, 2020.

Required Vote

The election of directors requires the affirmative vote of a plurality of the votes cast by holders of our common stock as of the Record Date present or represented by proxy at the Annual Meeting. Stockholders may not cumulate their votes. Abstentions will not be included in determining the number of votes cast and, as a result, will have no effect on this proposal.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF THE NOMINEE NAMED IN THIS PROXY STATEMENT.

If you validly sign and return a proxy card but give no instructions on the proxy card, the shares covered by the proxy card will be voted FOR the election of the nominee as a director in accordance with the recommendation of the Board.

16

PROPOSAL II: RATIFICATION OF APPOINTMENT

OF KPMG LLP AS OUR INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM FOR THE 2021 YEAR

The Audit Committee and the independent directors of the Board of Directors (“Board”) have selected KPMG LLP (“KPMG”) to serve as the independent registered public accounting firm for the Company for the fiscal year ended December 31, 2021. While the Audit Committee is responsible for the appointment, compensation, retention, termination and oversight of the independent auditor, we are requesting, as a matter of good corporate governance, that the stockholders ratify the appointment of KPMG as our independent registered public accounting firm. If the stockholders fail to ratify the selection, the Audit Committee will reconsider whether to retain KPMG and may retain that firm or another without re-submitting the matter to our stockholders. Even if the appointment is ratified, the Audit Committee may, in its discretion, direct the appointment of a different independent registered public accounting firm at any time during the year.

KPMG has advised us that neither the firm nor any present member or associate of it has any material financial interest, direct or indirect, in the Company or its affiliates.

The following table displays fees for professional services by KPMG for the period December 1, 2020 (commencement of operations) through December 31, 2020:

| Service |

For the Period December 1, 2020 (commencement of operations) through December 31, 2020 |

|||

| Audit Fees |

$ | 80,000 | ||

| Audit Related Fees |

— | |||

| Tax Fees |

40,000 | |||

| All Other Fees |

— | |||

|

|

|

|||

| Total |

$ | 120,000 | ||

|

|

|

|||

Audit Fees: Audit fees consist of fees billed for professional services rendered for quarterly reviews and services that are normally provided by KPMG in connection with statutory and regulatory filings.

Audit-Related Fees: Audit-related services consist of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements and are not reported under “Audit Fees.” These services include attest services that are not required by statute or regulation and consultations concerning financial accounting and reporting standards.

Tax Services Fees: Tax services fees consist of fees billed for professional tax services. These services also include assistance regarding federal, state, and local tax compliance.

All Other Fees: Other fees would include fees for products and services other than the services reported above.

17

Audit Committee Report

Management is responsible for the Company’s internal control over financial reporting and the financial reporting process. The Company’s independent registered public accounting firm is responsible for performing an independent audit of the Company’s financial statements in accordance with Standards of the Public Company Accounting Oversight Board (“PCAOB”) and expressing an opinion on the conformity of the Company’s financial statements to U.S. generally accepted accounting principles (“GAAP”). The Audit Committee’s responsibility is to monitor and oversee these processes. The Audit Committee is also directly responsible for the appointment, compensation and oversight of the Company’s independent registered public accounting firm.

The Audit Committee has established a pre-approval policy that describes the permitted audit, audit-related, tax and other services to be provided by KPMG, the Company’s independent registered public accounting firm. The policy requires that the Audit Committee pre-approve the audit and non-audit services performed by the independent auditor in order to assure that the provision of such service does not impair the auditor’s independence.

The Audit Committee has reviewed, and discussed with management, the Company’s audited financial statements. Management has represented to the Audit Committee that the Company’s financial statements were prepared in accordance with GAAP.

Review and Discussion with Independent Registered Public Accounting Firm

The Audit Committee reviewed and discussed the Company’s audited financial statements with management and KPMG, the Company’s independent registered public accounting firm, with and without management present. The Audit Committee discussed the results of KPMG’s audits, the Company’s internal controls, and the quality of the Company’s financial reporting. The Audit Committee also reviewed the Company’s procedures and internal control processes designed to ensure full, fair and adequate financial reporting and disclosures, including procedures for certifications by the Company’s Principal Executive Officer and Principal Financial Officer that are required in periodic reports filed by the Company with the SEC. The Audit Committee concluded that the Company employs appropriate accounting and auditing procedures.

The Audit Committee also discussed with KPMG matters relating to KPMG’s judgments about the quality, as well as the acceptability, of the Company’s accounting principles as applied in its financial reporting as required by the PCAOB Standard 1301 (Communication with Audit Committees). In addition, the Audit Committee has discussed with KPMG its independence from management and the Company, as well as the matters in the written disclosures received from KPMG and required by PCAOB Rule 3520 (Auditor Independence). The Audit Committee received a letter from KPMG confirming its independence and discussed it with them. The Audit Committee discussed and reviewed with KPMG the Company’s critical accounting policies and practices, internal controls, other material written communications to management, and the scope of KPMG’s audits and all fees paid to KPMG during the year. The Audit Committee has adopted guidelines requiring review and pre-approval by the Audit Committee of audit and non-audit services performed by KPMG for the Company. The Audit Committee has reviewed and considered the compatibility of KPMG’s performance of non-audit services with the maintenance of KPMG’s independence as the Company’s independent registered public accounting firm.

18

Based on the Audit Committee’s review and discussions with management and the independent registered public accounting firm referred to above, the Audit Committee’s review of the Company’s audited financial statements, the representations of management and the report of KPMG to the Audit Committee, the Audit Committee recommended to the Board that the audited financial statements as of and for the year ended December 31, 2020 be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020, for filing with the SEC. The Audit Committee also recommended the appointment of KPMG to serve as the independent registered public accounting firm of the Company for the year ending December 31, 2021.

Respectfully Submitted,

The Audit Committee

Peter E. Roth (Chair)

Jennifer J. Burleigh

Scott E. Heberton

The material contained in the foregoing Audit Committee Report is not “soliciting material,” is not deemed “filed” with the SEC, and is not to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

Required Vote

The affirmative vote of a majority of the votes cast by holders of our common stock as of the Record Date present or represented by proxy at the Annual Meeting is required to approve this proposal. Stockholders may not cumulate their votes. Abstentions will not be included in determining the number of votes cast and, as a result, will have no effect on this proposal.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THIS PROPOSAL TO RATIFY THE APPOINTMENT OF KPMG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31, 2021.

If you validly sign and return but give no instructions on the proxy card, the shares covered by the proxy card will be voted FOR the ratification of the appointment of KPMG LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021 in accordance with the recommendation of our Board.

19

OTHER BUSINESS

The Board of Directors (“Board”) knows of no other business to be presented for action at the Annual Meeting. If any matters do come before the Annual Meeting on which action can properly be taken, it is intended that the proxies will vote in accordance with the judgment of the person or persons exercising the authority conferred by the proxy prior to the Annual Meeting. The submission of a proposal does not guarantee its inclusion in this Proxy Statement or presentation at the Annual Meeting unless certain securities law requirements are met.

AVAILABLE INFORMATION

We are required to file with or submit to the SEC annual, quarterly and current periodic reports, proxy statements and other information meeting the informational requirements of the Exchange Act. The SEC maintains an Internet site at http://www.sec.gov that contains reports, proxy and information statements and other information filed electronically by us with the SEC. This information will also be available free of charge by contacting us at Stone Point Credit Corporation, 20 Horseneck Lane, Greenwich, Connecticut 06830, by telephone at (203) 862-2900 or by email at [email protected].

SUBMISSION OF STOCKHOLDER PROPOSALS

Our bylaws provide that with respect to an annual meeting of stockholders, nominations of persons for election to the Board and the proposal of business to be considered by stockholders may be made only (a) pursuant to our notice of the meeting, (b) by the Board or (c) by a stockholder who is entitled to vote at the meeting and who has complied with the advance notice procedures of our bylaws. With respect to special meetings of stockholders, only the business specified in our notice of the meeting may be brought before the meeting. Nominations of persons for election to the Board at a special meeting may be made only (a) pursuant to our notice of the meeting, (b) by the Board or (c) provided that the Board has determined that directors will be elected at the meeting, by a stockholder who is entitled to vote at the meeting and who has complied with the advance notice provisions of our bylaws.

The purpose of requiring stockholders to give us advance notice of nominations and other business is to afford our Board a meaningful opportunity to consider the qualifications of the proposed nominees and the advisability of any other proposed business and, to the extent deemed necessary or desirable by our Board, to inform stockholders and make recommendations about such qualifications or business, as well as to provide a more orderly procedure for conducting meetings of stockholders. Although our bylaws do not give our Board any power to disapprove stockholder nominations for the election of directors or proposals recommending certain action, they may have the effect of precluding a contest for the election of directors or the consideration of stockholder proposals if proper procedures are not followed and of discouraging or deterring a third party from conducting a solicitation of proxies to elect its own slate of directors or to approve its own proposal without regard to whether consideration of such nominees or proposals might be harmful or beneficial to us and our stockholders.

The Company currently expects that the 2022 Annual Meeting of Stockholders will be held in November 2022. We will consider for inclusion in our proxy materials for the 2022 Annual Meeting of Stockholders, stockholder proposals that are received at our executive offices, in writing, no later than 5:00 p.m. (Eastern Time) on June 2, 2022, and that comply with all applicable requirements of Rule 14a-8 promulgated under the Exchange Act.

Any stockholder who wishes to propose a nominee to the Board or propose any other business to be considered by the stockholders (other than a stockholder proposal to be included in our proxy materials pursuant to Rule 14a-8 of the Exchange Act) must comply with the advance notice provisions and other requirements of our bylaws. A stockholder who intends to present a proposal at the next annual meeting, including the nomination of

20