Form DEF 14A Southern States Bancshar For: Dec 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under 14a-12

Southern States Bancshares, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and O-11

SOUTHERN STATES

BANCSHARES, INC.

615 Quintard Avenue

Anniston, Alabama 36201

March 22, 2023

Dear Stockholder:

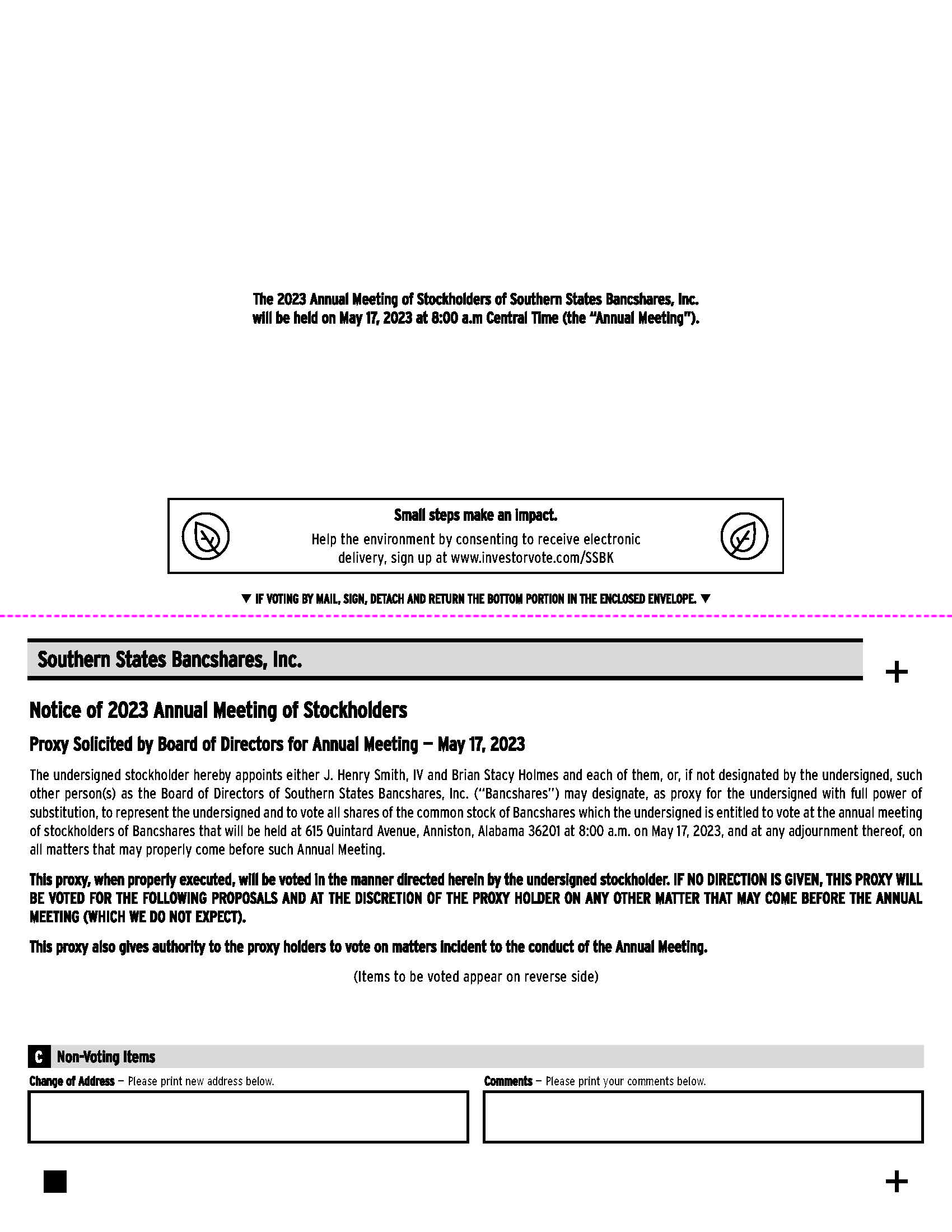

You are cordially invited to attend the 2023 Annual Meeting of Stockholders (the “annual meeting”) of Southern States Bancshares, Inc. (the “Company”). The annual meeting will be held on Wednesday, May 17, 2023 at 8:00 a.m., central time, at 615 Quintard Avenue, Anniston, Alabama 36201.

The notice of annual meeting and proxy statement appearing on the following pages describe the formal business to be transacted at the annual meeting. Directors and officers of the Company, as well as a representative of Mauldin & Jenkins, LLC, the Company’s independent registered public accounting firm, will be present to respond to appropriate questions of stockholders.

It is important that your shares are represented at this meeting, whether or not you attend the annual meeting and regardless of the number of shares you own. To make sure your shares are represented, we urge you to vote online, by phone or to mail your completed proxy card. This will not prevent you from voting in person at the annual meeting but will assure that your vote is counted if you are unable to attend the annual meeting for any reason.

We look forward to seeing you at the annual meeting.

Sincerely,

Stephen W. Whatley

Chairman and Chief Executive Officer

This proxy statement is first being sent to the stockholders of the Company on or about March 31, 2023.

NOTICE OF THE 2023 ANNUAL MEETING OF STOCKHOLDERS OF

SOUTHERN STATES BANCSHARES, INC.

______________________________

| TIME AND DATE: | 8:00 a.m., central time, on Wednesday, May 17, 2023. | |||||||

| PLACE: | Southern States Bancshares, Inc., 615 Quintard Avenue, Anniston, Alabama 36201. | |||||||

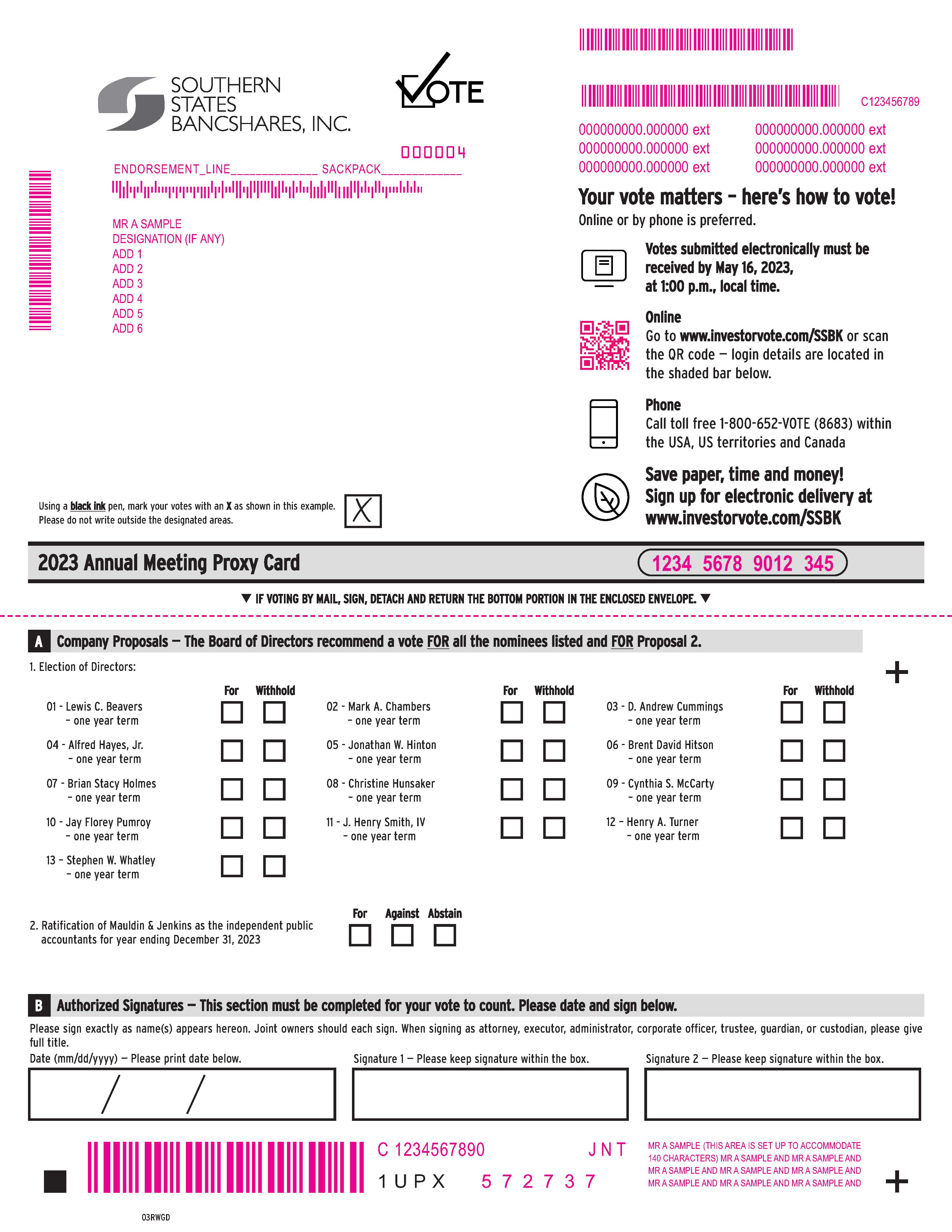

| ITEMS OF BUSINESS: | (1) | To elect Lewis C. Beavers, Mark A. Chambers, Daniel A. Cummings, Alfred Hayes, Jr., Jonathan W. Hinton, Brent David Hitson, Brian Stacy Holmes, Christine Hunsaker, Cynthia S. McCarty, Jay Florey Pumroy, J. Henry Smith IV, Henry A. Turner, and Stephen W. Whatley; | ||||||

| (2) | To ratify the selection of Mauldin & Jenkins, LLC by the Audit Committee of the Board of Directors (the “board” ) as our independent registered public accounting firm for the year ending December 31, 2023; and | |||||||

| (3) | To transact such other business as may properly come before the annual meeting and any adjournment or postponement of the meeting. | |||||||

| RECORD DATE: | To vote, you must have been a stockholder at the close of business on March 15, 2023. A complete list of such stockholders will be available for inspection at the Company’s offices in Anniston, Alabama during normal business hours for a period of 10 days prior to the annual meeting, and also during the annual meeting until the close of such meeting. | |||||||

Your vote is important. It is important that your shares be represented and voted at the annual meeting. You can vote your shares online or by completing and returning the proxy card or voting instruction card sent to you. Voting instructions are printed on your proxy card or voting instruction card and are included in the accompanying proxy statement. You can revoke a proxy at any time before its exercise at the annual meeting by following the instructions in the proxy statement. Whether or not you plan to attend the annual meeting, please vote online or by marking, signing, dating and promptly returning the proxy card or voting instruction card.

By Order of the Board of Directors | |||||

| |||||

Sheila Wells | |||||

Corporate Secretary | |||||

Anniston, Alabama | |||||

March 22, 2023 | |||||

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on May 17, 2023 | |||||

This proxy statement, proxy card and the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 are available at www.investorvote.com/SSBK | |||||

INFORMATION ABOUT THE ANNUAL MEETING

This proxy statement is furnished in connection with the solicitation of proxies by the board of Southern States Bancshares, Inc. (“Southern States,” “we,” “us,” “our,” or the “Company”) to be used at the 2023 Annual Meeting of Stockholders of the Company (the “annual meeting”). The Company is the holding company for Southern States Bank (the “Bank”).

Internet Availability of Proxy Materials

This proxy statement, our annual report to shareholders and our Annual Report on Form 10-K are available at our corporate website at www.southernstatesbank.net. You also can obtain copies of the notice, proxy statement and the Annual Report on Form 10-K without charge at the SEC’s website at www.sec.gov and may access these materials at www.investorvote.com/SSBK. A Notice of Internet Availability of Proxy Materials regarding this proxy statement is being first mailed to stockholders on or about March 31, 2023, containing instructions on how to access and review our proxy materials. The notice of internet availability of proxy materials also instructs you how you may submit your proxy online or via mail. If you would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting those materials included in the notice of internet availability of proxy materials.

Website addresses referenced herein are intended to provide inactive, textual references only, and the information on these websites is not part of this proxy statement.

Time and Location

The annual meeting will be held in at 615 Quintard Avenue, Anniston, Alabama 36201 and will begin promptly at 8:00 a.m., central time, on Wednesday, May 17, 2023.

1

Who Can Vote at and Attend the Annual Meeting

Stockholders of Record

You are entitled to vote your shares of Southern States common stock if you held your shares as of the close of business on March 15, 2023 (the “Record Date”).

Beneficial Owners

If your shares are held in a stock brokerage account or by a bank or other nominees as of the Record Date, you are considered the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by your broker, bank or other nominee. As the beneficial owner, you have the right to direct your broker on how to vote your shares. Your broker, bank or other nominee has enclosed a voting instruction form for you to use in directing it on how to vote your shares. If you wish to attend the annual meeting in person, you must obtain a “legal” proxy from your broker or other nominee.

As of the close of business on the Record Date, 8,747,763 shares of Southern States common stock were outstanding and entitled to vote. Each share of common stock has one vote.

Items Voted on; Vote Required

Quorum

The annual meeting will be held only if there is a quorum. A majority of the outstanding shares of Southern States common stock entitled to vote, represented in person or by proxy at the annual meeting, constitutes a quorum. If you return valid proxy instructions or attend the annual meeting, your shares will be counted for purposes of determining whether there is a quorum, even if you abstain from voting. Abstentions and broker non-votes will be treated as present for purposes of determining the presence or absence of quorum.

Vote Required

Directors are elected by a plurality. “Plurality” means that the nominees receiving the largest number of votes cast will be elected up to the maximum number of directors to be elected at the annual meeting. The maximum number of directors to be elected at the annual meeting is thirteen. There is no cumulative voting for the election of directors.

For all other matters, the affirmative vote of the majority of the shares of common stock represented at the meeting and entitled to vote on the subject matter is required, unless the vote of a greater number or voting by classes is required by law, or by the Company’s amended and restated certificate of incorporation or bylaws.

Abstentions and Broker Non-Votes

An abstention occurs when a stockholder attends the annual meeting, either in person or by proxy, but withholds or abstains from voting. A broker non-vote occurs when a broker, bank or other nominee holding shares for a beneficial owner does not vote on a particular proposal because the broker, bank or other nominee does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner. Brokers, banks and other nominees will only have discretionary voting power with respect to Proposal 2, the ratification of Mauldin & Jenkins, LLC as our independent registered public accounting firm for the year ending December 31, 2023.

In voting on the election of directors, you may vote in favor of the nominees or withhold votes as to the nominees. In the election of directors, broker non-votes and votes withheld are treated as present for quorum purposes only and will have no effect on the outcome of the election of directors.

In voting on the approval to ratify the appointment of Mauldin & Jenkins, LLC as the Company’s independent registered public accounting firm for the year ending December 31, 2023, you may vote for or against the proposal, or abstain from voting. We do not expect to receive broker non-votes on this item as brokers, banks or other nominees will have discretionary authority to vote shares for which street name stockholders do not provide voting instructions. Abstentions will be treated as votes against the ratification of Mauldin & Jenkins, LLC as our independent registered public accounting firm for the year ending December 31, 2023.

2

Voting by Proxy

This proxy statement is being sent to you by the board to request that you allow your shares of the Company common stock to be represented at the annual meeting by the persons named in the proxy card. All shares of Company common stock represented at the annual meeting by properly executed and dated proxies will be voted according to the instructions indicated on the proxy card. If you vote online, by phone, or if you sign, date and return a proxy card without giving voting instructions, your shares will be voted as recommended by the board.

The board recommends that you vote:

| • | “FOR” each of the nominees; and | |||||||

| • | “FOR” the ratification of the appointment of Mauldin & Jenkins, LLC as the Company’s independent registered public accounting firm for the year ended December 31, 2023. | |||||||

If any matter not described in this proxy statement is properly presented at the annual meeting, the persons named in the proxy card will use their judgment to determine how to vote your shares. This includes a motion to adjourn or postpone the meeting to solicit additional proxies. If the annual meeting is adjourned or postponed, your shares of Southern States common stock may also be voted by the persons named in the proxy card on the new meeting date, unless you have revoked your proxy. The Company does not know of any other matters to be presented at the annual meeting.

If your Southern States common stock is held in street name, you will receive instructions from your broker, bank or other nominee that you must follow to have your shares voted. Your broker, bank or other nominee may allow you to deliver your voting instructions online. Please see the instruction form provided by your broker, bank or other nominee that accompanies this proxy statement. If you wish to change your voting instructions after you have returned your voting instruction form to your broker, bank or other nominees, you must contact your broker, bank or other nominee.

Revoking Your Proxy

You may revoke your proxy at any time before the vote is taken at the annual meeting. To revoke your proxy, you must either advise the Corporate Secretary of the Company in writing, addressed to Corporate Secretary, Southern States Bancshares, Inc., 615 Quintard Avenue, Anniston, Alabama 36201 before your Company common stock has been voted at the annual meeting, deliver a later-dated and executed valid proxy or if you are a shareholder of record or otherwise hold a voted proxy, attend the annual meeting and vote your shares in person. Attendance at the annual meeting will not in itself constitute revocation of your proxy.

Requirement for Stockholder Nomination of Director Candidates and Stockholder Proposals Not Intended for Inclusion in the Company's Proxy Materials

Consideration of Director Recommendations by Stockholders. It is the policy of the Nominating and Corporate Governance Committee to consider director candidates nominated by stockholders who appear to be qualified to serve on the board on the same basis as other candidates. The Nominating and Corporate Governance Committee may choose not to consider an unsolicited recommendation if no vacancy exists on the board. In order to avoid the unnecessary use of the Nominating and Corporate Governance Committee’s resources, the Nominating and Corporate Governance Committee will consider only those director candidates recommended in accordance with the procedures set forth below.

To submit a recommendation for a director candidate to the Nominating and Corporate Governance Committee, a stockholder should submit the following information in writing, addressed to the Chair of the Nominating and Corporate Governance Committee, care of the Corporate Secretary, Southern States Bancshares, Inc., 615 Quintard Avenue, Anniston, Alabama 36201:

•the name, age, business address and residence address of nominee;

•the principal occupation or employment of the nominee;

•the class or series and number of all shares of stock of the Company that are owned beneficially or of record by the nominee and any affiliates or associates of such person and certain other stock ownership matters; and

•any other information relating to such nominee that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors pursuant to Section 14 of the Exchange Act, and the rules and regulations promulgated thereunder.

3

The stockholder making the nomination is required to provide information similar to that above for itself. Please see our bylaws for a complete description of the information required for stockholders to submit a nomination. To be timely, a stockholder’s notice must be delivered to, or be mailed and received at, the address set forth above no earlier than February 17, 2024 and no later than March 18, 2024; provided, however, that in the event that the 2024 annual meeting is called for a date that is not within twenty-five (25) days before or after the anniversary date of the 2023 annual meeting, notice by the stockholder in order to be timely must be received not later than the close of business on the tenth (10th) day following the day on which such notice of the date of the annual meeting was mailed or such public disclosure of the date of the annual meeting was made, whichever first occurs.

Consideration of Other Business. If a stockholder desires the board to consider any other business, the stockholder should submit the following information in writing, addressed to the Corporate Secretary, Southern States Bancshares, Inc., 615 Quintard Avenue, Anniston, Alabama 36201:

•a brief description of each matter desired to be brought before the annual meeting (including the specific text of any resolutions);

•the reasons for conducting such business at the annual meeting;

•the class or series and number of all shares of stock of the Company that are owned beneficially or of record by the nominee and any affiliates or associates of such person and certain other stock ownership matters;

•a description of all agreements, arrangements, or understandings between the stockholder and other persons related to the proposal;

•a representation that the stockholder giving notice intends to appear in person or by proxy at the annual meeting to bring such business before the meeting; and

•any other information relating to such person that would be required to be disclosed in a proxy statement or other filing required to be made in connection with the solicitation of proxies by such person with respect to the proposed business to be brought by such person before the annual meeting.

Please see our bylaws for a complete description of the information required for stockholders to submit in order to bring other business before an annual meeting. To be timely, a stockholder’s notice must be delivered to, or be mailed and received at, the address set forth above no earlier than February 17, 2024 and no later than March 18, 2024; provided, however, that in the event that the 2024 annual meeting is called for a date that is not within twenty-five (25) days before or after the anniversary date of the 2023 annual meeting, notice by the stockholder in order to be timely must be so received not later than the close of business on the tenth (10th) day following the day on which such notice of the date of the annual meeting was mailed or such public disclosure of the date of the annual meeting was made, whichever first occurs.

Requirements for Stockholder Proposals to Be Included in the Company’s Proxy Materials

Stockholders interested in submitting a proposal (other than the nomination of directors) for inclusion in the proxy materials to be distributed by us for our 2024 Annual Meeting of Stockholders may do so by following the procedures prescribed in Rule 14a-8 promulgated under the Exchange Act. The Company must receive proposals that stockholders seek to include in the proxy statement for the Company’s next annual meeting no later than December 2, 2023. If next year’s annual meeting is held on a date more than 30 calendar days from May 17, 2024, a stockholder proposal must be received by a reasonable time before the Company begins to print and mail its proxy solicitation for such annual meeting. Any stockholder proposals will be subject to the requirements of our Amended and Restated Bylaws (“Bylaws”) and Rule 14a-8 promulgated under the Exchange Act regarding the inclusion of stockholder proposals in company-sponsored proxy materials. Such proposals should be sent to Southern States Bancshares, Inc., Corporate Secretary, 615 Quintard Avenue, Anniston, Alabama 36201.

In addition to satisfying the foregoing requirements, to comply with the universal proxy rules, shareholders who intend to solicit proxies in support of director nominees other than our nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than March 18, 2024. However, if the date of the 2024 annual meeting is more than 30 days before or after the date of the anniversary of the 2023 annual meeting, the notice must be provided by the close of business on the later of the sixtieth day prior to the 2024 annual meeting or the tenth day following the day on which public announcement of the date of the 2024 annual meeting is first made, as provided by Rule 14a-19. These deadlines assume that the shareholder has not previously filed a proxy statement with the required information.

Dissenter and Appraisal Rights

There are no dissenter or appraisal rights for the matters to be voted upon at the annual meeting.

4

Shareholders Sharing an Address

We will deliver only one set of proxy materials to multiple stockholders sharing an address unless we have received contrary instructions from one or more of the stockholders. We undertake to deliver promptly, upon written or oral request, an additional copy of the proxy materials to a stockholder at a shared address to which a single copy has been delivered. A stockholder can notify us that the shareholder wishes to receive a separate copy of the proxy materials by contacting us at the following address or phone number: Corporate Secretary, Southern States Bancshares, Inc., 615 Quintard Avenue, Anniston, Alabama 36201, or (256) 241-1092. Conversely, if multiple stockholders sharing an address receive multiple proxy materials and wish to receive only one, such stockholders can notify us at the address or phone number set forth above.

Communications with the Board of Directors

Stockholders or other interested parties can contact the board, any committee of the board, or any director in particular by writing to: Corporate Secretary, Southern States Bancshares, Inc., 615 Quintard Avenue, Anniston, Alabama 36201. Stockholders or other interested parties should mark the envelope containing each communication as “Stockholder Communication with Directors” and clearly identify the intended recipient(s) of the communication. We will review and forward each communication, as expeditiously as reasonably practicable, to the addressee(s) if the communication falls within the scope of matters generally considered by the board. To the extent the subject matter of a communication relates to matters that have been delegated by the board to a committee or to an executive officer, then the legal department may forward the communication to the chairman of the appropriate committee or the appropriate executive officer.

Proxy Solicitation Costs

The accompanying proxy is being solicited by the board. The Company will pay the cost of this proxy solicitation. The Company will also reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy materials to the beneficial owners of the Company. In addition to soliciting proxies by mail, directors, officers and regular employees of the Company may solicit proxies personally or by telephone. None of these persons will receive additional compensation for these activities.

5

PROPOSAL 1 - ELECTION OF DIRECTORS

Board of Directors

Our board oversees our business and monitors the performance of management. The following table sets forth certain information about our directors, including their names, ages and year in which they began serving as a director of the Company.

| Directors | Age | Director Since | ||||||||||||

| Lewis C. Beavers | 72 | 2019 | ||||||||||||

| Daniel A. Cummings | 53 | February 2023 | ||||||||||||

| Alfred J. Hayes, Jr. | 78 | 2015 | ||||||||||||

| Jonathan W. Hinton | 40 | February 2023 | ||||||||||||

| Brent David Hitson | 56 | 2007 | ||||||||||||

| Brian Stacy Holmes | 59 | 2007 | ||||||||||||

| Christine Hunsaker | 56 | February 2023 | ||||||||||||

| Cynthia S. McCarty | 62 | 2020 | ||||||||||||

| Jay Florey Pumroy | 66 | 2007 | ||||||||||||

| J. Henry Smith, IV | 53 | 2009 | ||||||||||||

| Henry A. Turner | 76 | 2008 | ||||||||||||

| Mark A. Chambers | 59 | 2022 | ||||||||||||

| Stephen W. Whatley | 71 | 2007 | ||||||||||||

In accordance with our bylaws, the total number of directors constituting the entire board may not be less than five nor more than fifteen. Our board is currently composed of thirteen members, each elected for a one year term, or until his or her successor is elected or qualified, or until his or her earlier death, resignation or removal. Our directors discharge their responsibilities throughout the year at board and committee meetings and also through telephone contact and other communications with our executive officers or directors.

Stephen W. Whatley’s employment agreement provides that he will be nominated as a director so that he may remain a director during the term of his employment.

A brief description of the background of each of our directors, together with the experience, qualifications, attributes or skills that qualify each to serve as a director, is set forth below (other than Stephen W. Whatley and Mark Chambers, whose backgrounds are provided further below in “Current Executive Officers”).

Lewis C. Beavers. Mr. Beavers has worked as the managing partner of Lawrence, See & Beavers, a privately owned accounting firm, since 1976, and has served as Secretary and Treasurer of L&A Enterprises, Inc., a residential construction company, since 2002. He has served as a member of the Finance Committee of the Douglas County Chamber of Commerce since 2005 and has previously served on several advisory boards of community banks in Georgia. From 2006 until 2019, he served on the board of directors of Small Town Bank. Mr. Beavers holds a Bachelor of Business Administration in Accounting and Finance from West Georgia College. He received his CPA certificate in 1975 and currently holds a Residential Construction Contractor’s license from Georgia. Mr. Beavers’ extensive accounting and financial expertise, including in our industry and related industries, are among his qualifications to serve as a member of our board.

Daniel A. Cummings. Mr. Cummings has been a commercial real estate investor for more than 20 years in the Atlanta area. Earlier in his career, he worked for a regional financial institution, where he was responsible for the placement of more than $1 billion in debt and equity financing with local, regional, and national real estate operators. Mr. Cummings holds a Bachelor of Arts in Economics and a Masters of Business Administration from Louisiana State University. Mr. Cummings’s knowledge in business and economics are among his qualifications to serve as a member of our board.

6

Alfred J. Hayes, Jr. Mr. Hayes has over 40 years of banking experience. Mr. Hayes retired from First Union Bank in 1997 after 30 years, and from Colonial Bank in 2009. Mr. Hayes is active in civic, social, and professional organizations in Columbus, Georgia. Mr. Hayes holds a Bachelor of Business Administration in Real Estate from the University of Georgia and a Masters of Business Administration from Columbus State University. Mr. Hayes’ extensive experience working in our industry and his understanding of the regulatory structure in which we operate are among his qualifications to serve as a member of our board.

Jonathan W. Hinton. Mr. Hinton is the founder and CEO of RavenVolt, now a subsidiary of ABM Industries. RavenVolt designs and builds turn-key microgrid projects across the United States. The company focuses on solar, battery, fuel cell, diesel and natural gas microgrids at national retailers, industrials, utilities and water treatment plants. Mr. Hinton holds a Bachelor of Business Administration in Accounting from Georgia State University and a Masters of Business Administration from the Massachusetts Institute of Technology. Mr. Hinton’s entrepreneurial expertise and knowledge in accounting are among his qualifications to serve as a member of our board.

Brent David Hitson. Mr. Hitson is a partner at Burr & Forman LLP, a law firm in Birmingham, Alabama, a position he has held since 2005. Mr. Hitson holds a Bachelor of Science in Business Administration from Auburn University and a Juris Doctorate from Cumberland School of Law at Samford University. Upon graduation from law school in 1996, Mr. Hitson spent a year working as a judicial law clerk at the United States Court of Federal Claims in Washington, D.C. Mr. Hitson is licensed to practice law in Alabama, Georgia and Mississippi, and has handled matters in multiple state and federal courts across the United States. Mr. Hitson’s legal expertise combined with his past experience owning and managing his own company are among his qualifications to serve as a member of our board.

Brian Stacy Holmes. Mr. Holmes has owned and served as President of Holmes II Excavation, Inc., a privately owned construction company, since 1992. Mr. Holmes has also owned and served as managing member of Holmes Properties, LLC, a real estate investment company, since 1999, and as owner and managing member of Salt Creek Land Company, LLC, a real estate investment company, since 2001. Mr. Holmes is currently part owner and member of TLC, LLC, a real estate investment company, which he has owned since 2010. Mr. Holmes’ experience and expertise in management and business operations are among his qualifications to serve as a member of our board.

Christine Hunsaker. Ms. Hunsaker is the founder and president of Hunsaker Partners, a funeral services company that owns and operates cemeteries, funeral homes and crematories throughout Greater Atlanta. She is a veteran of the industry and previously held senior executive positions at leading funeral service companies. Ms. Hunsaker holds a Masters of Business Administration from the University of Cape Town. Ms. Hunsakers’s extensive managerial experience and knowledge of business operations are among her qualifications to serve as a member of our board.

Cynthia S. McCarty. Ms. McCarty is a professor of economics at Jacksonville State University, a position she has held since 1990. Ms. McCarty holds a Bachelor of Arts degree in Foreign Language International Trade with a minor in Finance and Economics from Auburn University. She also holds a Masters in Business Administration from the University of North Carolina Chapel Hill. Ms. McCarty’s business and economic knowledge and expertise are among her qualifications to serve as a member of our board.

Jay Florey Pumroy. Mr. Pumroy holds a Bachelor of Science Degree in Accounting from the University of Alabama in Birmingham and a Juris Doctorate Degree from the University of Alabama. Mr. Pumroy is Senior Partner with the law firm of Wilson, Dillon, Pumroy & James, LLC, Anniston, Alabama, where he has practiced continuously since 1982. Mr. Pumroy is also licensed to practice law in Georgia. He is a member of the Calhoun/Cleburne Bar Association, the Alabama State Bar and the State Bar of Georgia. Mr. Pumroy is a member of the American Land Title Association, the Calhoun County Chamber of Commerce, the Alabama Cattlemen’s Association, an affiliate member of the Calhoun County Area Board of Realtors and was an associate member of the Home Builders Association of Greater Calhoun County for many years. Mr. Pumroy served as a Director of Mt. Cheaha Corporation, a Harley Davidson Motorcycle franchisee, from 2004 until 2020, served as a Member of the Board of Directors for the East Central Region of Colonial Bank from 1987 until 2006 and has served as a member of the Board of Directors of the Anniston Soup Bowl, Inc., a non-profit corporation, since 2013. Mr. Pumroy holds, or has held, investments in retail and commercial properties through various entities including Business Park, LLC, Covington Properties South, LLC, Leighton Avenue Properties, LLC, Medical Facilities Co., LLC, Northeast Alabama Real Estate Co., LLC, Raintree Developers, Inc., Retail Properties, LLC, and Woodstock Land Co., LLC. Mr. Pumroy’s legal background and business management experience are among his qualifications to serve as a member of our board.

J. Henry Smith, IV. For more than 20 years, Mr. Smith has served as President of Interstate Sheet Metal Co., Inc., a sheet metal contractor specializing in public works projects and other large contracts throughout Alabama. He holds a Bachelor of Arts in History from Vanderbilt University. Mr. Smith’s extensive managerial experience, as well as his business development and project execution experience and knowledge of business operations, are among his qualifications to serve as a member of our board.

7

Henry A. Turner. Mr. Turner worked at Honda Motor Company, a publicly traded automobile manufacturer, in its Alabama Operations for more than 20 years, including as a purchasing manager for Honda of America, from 1988 until 2000, and Department Manager, Purchasing Department for Honda of Alabama, from 2000 until 2010. Prior to joining the Honda Motor Company, Mr. Turner worked as a registered representative with Murch and Co., a private brokerage firm. Mr. Turner has served on a number of civic organizations, including as a member and Chairperson of the South Regions Minority Supplier Development Council and currently as a member of the board of directors of the Minority Business Opportunity Committee since 2011. Mr. Turner holds a Bachelor of Science in General Business from John Carroll University. Mr. Turner’s many years of leadership experience at a large public company, his background and finance, and his experience serving civic organizations and the community are among his qualifications to serve as a member of our board.

The board unanimously recommends a vote “FOR” each of the director nominees.

Directors are elected by a plurality of the votes. Broker non-votes and votes withheld will have no effect on the outcome of the election of directors.

8

PROPOSAL 2. RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the board has selected Mauldin & Jenkins, LLC to be the Company’s independent registered public accounting firm for the 2023 fiscal year. Mauldin & Jenkins, LLC has served as our independent registered public accounting firm since 2007. A representative of Mauldin & Jenkins, LLC will be present at the annual meeting to respond to appropriate questions from stockholders and will have the opportunity to make a statement should he or she desire to do so.

In determining whether to reappoint Mauldin & Jenkins, LLC as the Company’s independent registered public accounting firm, the Audit Committee took into consideration a number of factors, including the length of time the firm has been engaged, the quality of the Audit Committee’s ongoing discussions with Mauldin & Jenkins, LLC, an assessment of the professional qualifications and past performance of Mauldin & Jenkins, LLC and the potential impact of changing independent registered public accounting firms. Through its experience with the Company, Mauldin & Jenkins, LLC has gained institutional knowledge and expertise regarding the Company’s operations, accounting policies and practices and internal control over financial reporting.

If the ratification of the appointment of Mauldin & Jenkins, LLC is not approved at the annual meeting, the Audit Committee will consider other independent registered public accounting firms. In addition, if the ratification of Mauldin & Jenkins, LLC is approved by stockholders at the annual meeting, the Audit Committee may also consider other independent registered public accounting firms in the future if it determines that such consideration is in the best interests of the Company and its stockholders.

The board unanimously recommends a vote “FOR” the ratification of the appointment of Mauldin & Jenkins, LLC as the Company’s independent registered public accounting firm.

To be approved, the appointment of Mauldin & Jenkins, LLC as our independent registered public accounting firm must receive an affirmative vote of a majority of the shares represented at the meeting and entitled to vote on the matter. Abstentions will be treated as votes against the ratification of Mauldin & Jenkins, LLC as our independent registered public accounting firm for the year ending December 31, 2023. We do not expect to receive broker non-votes in this Item.

Audit and Non-Audit Fees

The following table sets forth the fees billed to the Company for the fiscal years ending December 31, 2022 and December 31, 2021 for services provided by Mauldin & Jenkins, LLC.

| 2022 | 2021 | |||||||||||||

| Audit Fees (1) | $ | 162,605 | $ | 143,503 | ||||||||||

| Audit-Related Fees (2) | 26,404 | 76,574 | ||||||||||||

| Tax Fees (3) | 9,500 | 9,500 | ||||||||||||

| (1) | Fees include Federal Deposit Insurance Corporation Improvement Act of 1991 internal control audit, financial statement and 10-K audit and review of quarterly SEC filings. | |||||||||||||

| (2) | Includes 401(k) Plan audit and registration statement filings with the SEC. | |||||||||||||

| (3) | Includes preparation and filing of tax returns. | |||||||||||||

Pre-Approval of Services by Mauldin & Jenkins, LLC

The Audit Committee is responsible for appointing, setting compensation and overseeing the work of Mauldin & Jenkins, LLC. In accordance with its charter, the Audit Committee approves, in advance, all audit and permissible non-audit services to be performed by Mauldin & Jenkins, LLC. Such approval process ensures that Mauldin & Jenkins, LLC does not provide any non-audit services to the Company that are prohibited by law or regulation. Requests for services by Mauldin & Jenkins, LLC for compliance with the auditor services policy must be specific as to the particular services to be provided. The request may be made with respect to either specific services or a type of service for predictable or recurring services.

Any proposed specific engagement may be presented to the Audit Committee for consideration at its next regular meeting or, if earlier consideration is required, to the Audit Committee chairman, or one or more of its members. The chairman, member or members to whom such authority is delegated shall report any specific approval of services for ratification at the next regular meeting of the Audit Committee. The Audit Committee will regularly review summary reports detailing all services being provided to the Company by its independent registered public accounting firm.

9

During the year ended December 31, 2022, all services were approved, in advance, by the Audit Committee in compliance with these procedures.

Audit Committee Report

The Company’s management is responsible for the Company’s internal control over financial reporting. Mauldin & Jenkins, LLC is responsible for performing an independent audit of the Company’s consolidated financial statements and issuing an opinion on the conformity of those financial statements with generally accepted accounting principles. The Audit Committee oversees the Company’s internal control over financial reporting on behalf of the board.

In this context, the Audit Committee has met and held discussions with management and Mauldin & Jenkins, LLC. Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and Mauldin & Jenkins, LLC.

The Audit Committee has also reviewed and discussed with the Company’s management the audited financial statements in the Annual Report. In addition, the Audit Committee discussed with Mauldin & Jenkins, LLC those matters required to be discussed under applicable Public Company Accounting Oversight Board (“PCAOB”) rules or standards and the SEC. Additionally, Mauldin & Jenkins, LLC provided to the Audit Committee the written disclosures and the letter required under applicable PCAOB rules or standards. The Audit Committee also discussed with Mauldin & Jenkins, LLC its independence from the Company. In concluding that the accounting firm is independent, the Audit Committee considered, among other factors, whether the non-audit services provided by Mauldin & Jenkins, LLC were compatible with their independence.

The Audit Committee discussed with Mauldin & Jenkins, LLC the overall scope and plans for their audit. The Audit Committee meets with Mauldin & Jenkins, LLC, with and without management present, to discuss the results of their audit, their evaluation of the Company’s internal control over financial reporting, and the overall quality of the Company’s financial reporting process.

In performing all of these functions, the Audit Committee acts only in an oversight capacity. In its oversight role, the Audit Committee relies on the work and assurances of the Company’s management, which has the primary responsibility for financial statements and reports, and of Mauldin & Jenkins, LLC who, in its report, expresses an opinion on the conformity of the Company’s financial statements to generally accepted accounting principles. The Audit Committee’s oversight does not provide it with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations.

Furthermore, the Audit Committee’s considerations and discussions with management and Mauldin & Jenkins, LLC do not assure that the Company’s financial statements are presented in accordance with generally accepted accounting principles, that the audit of the Company’s consolidated financial statements has been carried out in accordance with the standards of the PCAOB or that the Company’s independent registered public accounting firm is in fact “independent.”

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the board, and the Board has approved, that the audited consolidated financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC. The Audit Committee has appointed, and has requested stockholder ratification of, the selection of Mauldin & Jenkins, LLC for the fiscal year ended December 31, 2023.

Lewis C. Beavers

Alfred J. Hayes, Jr.

J. Henry Smith, IV

10

CORPORATE GOVERNANCE

Director Qualifications

We believe that our directors should have the highest professional and personal ethics and values, consistent with our longstanding values and standards. They should have broad experience at the policy-making level in business, government or civic organizations. They should be committed to enhancing stockholder value and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on their own unique experience. Each director must represent the interests of all stockholders. When considering potential director candidates, our board also considers the candidate’s independence, character, judgment, diversity, age, skills, including financial literacy, and experience in the context of our needs and those of our board. While we have no formal policy regarding the diversity of our board, our board may consider a broad range of factors relating to the qualifications and background of director nominees, which may include personal characteristics. Our board of director’s priority in selecting board members is the identification of persons who will further the interests of our stockholders through his or her record of professional and personal experiences and expertise relevant to our growth strategy.

Board Diversity Matrix

The table below contains information based on the voluntary self-identification of each member of the Company’s board as of March 22, 2023.

Board Diversity Matrix (as of March 22, 2023) | ||||||||||||||

| Total Number of Directors | 13 | |||||||||||||

| Female | Male | Non-Binary | Did Not Disclose Gender | |||||||||||

| Part I: Gender Identity | ||||||||||||||

| Directors | 2 | 11 | 0 | 0 | ||||||||||

| Part II: Demographic Background | ||||||||||||||

| African American or Black | 0 | 1 | 0 | 0 | ||||||||||

| Alaskan Native or Native American | 0 | 0 | 0 | 0 | ||||||||||

| Asian | 0 | 0 | 0 | 0 | ||||||||||

Hispanic or Latinx | 0 | 0 | 0 | 0 | ||||||||||

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 | ||||||||||

| White | 2 | 10 | 0 | 0 | ||||||||||

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 | ||||||||||

| LGBTQ+ | 1 | |||||||||||||

| Did Not Disclose Demographic Background | 0 | |||||||||||||

Director Independence

Under the rules of NASDAQ, independent directors must comprise a majority of our board. The rules of NASDAQ, as well as those of the SEC, also impose several other requirements with respect to the independence of our directors. Our board has undertaken a review of the independence of each non-employee director based upon these rules and the charter of our Nominating and Corporate Governance Committee. Applying these standards, our board has affirmatively determined that, with the exception of Mr. Pumroy, Mr. Holmes and Mr. Cummings, each of our current non-employee directors qualifies as an independent director under the applicable rules. The eight independent directors constitute a majority of the thirteen members of our board.

In making independence determinations, our board has considered the current and prior relationships that each director has with us and all other facts and circumstances our board deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each director, and the transactions involving them described in the section titled “Certain Relationships and Related Party Transactions.”

11

Board Leadership Structure

Our board meets at least quarterly. Our board solicits input and nominations from its members and elects one of its members as Chairman. The roles of Chief Executive Officer and Chairman of our board are held by Stephen W. Whatley, and, we do not have a policy regarding the separation of these roles, as our board believes that it is in the best interests of our organization to make that determination from time to time based on the position and direction of our organization and the membership of our board. Our board has determined that combining the roles of Chief Executive Officer and Chairman is in the best interests of our stockholders at this time because the combined roles allow for a single point of leadership and is acceptable based on our size and complexity.

Our independent directors have also determined that it is optimal for the board to have a “lead director,” whose responsibilities include, among others, presiding over executive sessions of the independent directors and establishing the agenda for each meeting of the independent directors. Mr. Smith has served as lead independent director since March 2022.

Additionally, the board periodically meets in executive session without the presence of the Chairman of the Board, Chief Executive Officer or other members of management. The lead director presides at these meetings and provides the board’s guidance and feedback to the President and Chief Executive Officer and the Company’s management team.

Board Risk Management and Oversight

Our board is ultimately responsible for the oversight of our overall risk management processes while the Bank’s board is responsible for risk management oversight at the Bank. Our board approves policies that set operational standards and risk limits at the Bank, and any changes to the Bank’s risk management program require approval by the Bank’s board. Management is responsible for the implementation, integrity and maintenance of our risk management systems ensuring the directives are implemented and administered in compliance with the approved policy. Our board has established standing committees to oversee our corporate risk governance processes, as described more fully below. In addition, we have appointed a Chief Risk Officer, who is a member of our executive management team, to support the risk oversight responsibilities of the board and its committees and to involve management in risk management as appropriate by establishing committees comprised of management personnel who are assigned responsibility for oversight of certain operational risks. The Chief Risk Officer reports to the board periodically on our enterprise-wide risk management system. Greg Smith serves as our Chief Risk Officer.

Compensation Committee Interlocks and Insider Participation

No members of our compensation committee have been an officer or employee of the Company or the Bank. None of our executive officers is expected to serve or have served as a member of the board, compensation committee or other board committee performing equivalent functions of any entity that has one or more executive officers serving as one of our directors or on our compensation committee. To the extent that any members of our compensation committee have participated in transactions with us, a description of those transactions is provided in “Executive Compensation,” "Director Compensation,” and “Certain Relationships and Related Party Transactions.”

Code of Business Conduct and Ethics

Our board has adopted a Code of Business Conduct and Ethics that is designed to ensure that our directors, executive officers and employees meet the highest standards of ethical conduct. The Code of Business Conduct and Ethics requires that our directors, executive officers and associates avoid conflicts of interest, comply with all laws and other legal requirements, conduct business in an honest and ethical manner and otherwise act with integrity and in our best interest. Amendments to the Code of Business Conduct and Ethics, or any waivers of their requirements with respect to our directors or executive officers, will be disclosed on our corporate website or by such other means as may be required by applicable NASDAQ rules. A copy of our Code of Business Conduct and Ethics is available free of charge on the Investor Relations section of our website at www.southernstatesbank.net.

Hedging

Our insider trading policy, which applies to our officers, directors, employees and consultants, prohibits hedging.

Board Committees

Our board has established standing committees in connection with the discharge of its responsibilities. These committees include the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. Our board also may establish such other committees as it deems appropriate, in accordance with applicable law and regulations and our corporate governance documents.

12

Audit Committee

Our Audit Committee, which is a separately-designated audit committee in accordance with 3(a)(58)(A) of the Exchange Act, consists of Messrs. Beavers (Chairman), Hayes, Smith and Hunsaker. Our Audit Committee has the responsibility for, among other things:

•overseeing the design and implementation of our internal audit function;

•selecting, engaging and overseeing the independent auditors;

•overseeing the integrity of our financial statements, including the annual audit, the annual audited financial statements, financial information included in our periodic reports that will be filed with the SEC and any earnings releases or presentations;

•overseeing our financial reporting process and internal controls;

•overseeing our compliance with applicable laws and regulations;

•overseeing our compliance and risk management functions;

•overseeing our process for receipt of complaints and confidential, anonymous submissions regarding accounting, internal accounting controls or auditing matters; and

•reviewing and investigating any possible violation of the Code of Business Conduct and Ethics or other standards of business conduct by any director or executive officer of the Company.

Rule 10A-3 promulgated by the SEC under the Exchange Act and applicable NASDAQ rules require our audit committee to be comprised entirely of independent directors. Our board has affirmatively determined that each of the members of our Audit Committee is independent under the rules of NASDAQ and for purposes of serving on an audit committee under applicable SEC rules. Our board also has determined that Mr. Beavers qualifies as an “audit committee financial expert” as defined by the SEC. Our board has adopted a written charter for our Audit Committee, which is available free of charge on the Investor Relations section of our website at www.southernstatesbank.net.

Compensation Committee

Our Compensation Committee consists of Messrs. Smith (Chairman), Hayes, Turner and Beavers. Our Compensation Committee is responsible for, among other things:

•reviewing and approving goals and objectives relevant to the compensation of our executive officers;

•evaluating the performance of our executive officers and determining and approving the compensation levels of executive officers based on that evaluation;

•reviewing and administering our equity incentive plans, including the 2017 Incentive Stock Compensation Plan, and executive compensation programs;

•reviewing, approving and submitting to the board for approval other compensation of our executive officers, and any significant amendments or changes to such arrangements; and

•preparing the report of the Compensation Committee as required by item 407(e)(5) of Regulation S-K, when applicable.

Applicable NASDAQ rules require the Compensation Committee to be comprised entirely of independent directors. Our board has affirmatively determined that each of the members of our Compensation Committee is independent under the rules of NASDAQ and for purposes of serving on a Compensation Committee under applicable SEC rules, and that each are “non-employee directors” as defined in Rule 16b-3 of the Exchange Act. To the extent that the Compensation Committee has one or more members who are not “non-employee directors” as defined in Rule 16b-3 of the Exchange Act, grants of stock or equity awards will be made by a subcommittee of the Compensation Committee consisting solely of “non-employee directors” or by our full board or directors. The Compensation Committee may form and delegate authority to subcommittees as the Compensation Committee deems necessary or appropriate. Our board has adopted a written charter for the Compensation Committee, which is available free of charge on the Investor Relations section of our website at www.southernstatesbank.net.

13

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee consists of Messrs. Hitson (Chairman), Hayes, Hinton and Turner. Our Nominating and Corporate Governance Committee is responsible for, among other things:

•identifying individuals qualified to become board members consistent with criteria approved by the board;

•selecting, or recommending that the board select, director nominees for the next annual meeting of stockholders or to fill vacancies;

•assisting the board in fulfilling its oversight responsibilities relating to developing and implementing sound governance policies and practices;

•recommending director committee assignments; and

•developing and overseeing a process for the annual evaluation of the board and management.

In identifying potential director candidates, the Nominating and Corporate Governance Committee relies on any source available for the identification and recommendation of candidates, including current directors and officers. In addition, the Nominating and Corporate Governance Committee may from time to time engage a third party search firm to identify or evaluate, or assist in identifying or evaluating potential candidates, for which the third party search firm will be paid a fee.

Applicable NASDAQ rules require director nominees to be selected, or recommended for the board’s section, either by independent directors constituting a majority of the board’s independent directors, or by a committee consisting solely of independent directors. We have established a Nominating and Corporate Governance committee comprised entirely of independent directors. Our board has affirmatively determined that each of the members of our Nominating and Corporate Governance Committee is independent under the rules of NASDAQ. Our board has adopted a written charter for our Nominating and Corporate Governance Committee, which is available free of charge on the Investor Relations section of our website at www.southernstatesbank.net.

Meetings of Directors and Committees

The board held fourteen meetings during 2022, and our independent directors met in executive session one time during 2022. The Audit Committee held four meetings in 2022, the Compensation Committee held two meetings in 2022, and the Nominating and Corporate Governance Committee held one meeting in 2022. During 2022, each of our directors attended at least 75% of the meetings of the board and the meetings of the committees of the board on which that director served.

Attendance at Annual Meetings

The board encourages all directors to attend the annual meeting. We anticipate that all of our directors will attend the annual meeting by phone or in person. All of our directors then serving attended the annual meeting in 2022 by phone or in person.

14

CURRENT EXECUTIVE OFFICERS

Executive Officers

The following table sets forth certain information regarding our executive officers and the executive officers of the Bank, including their names, ages and positions:

| Name | Age | Position with Southern States and the Bank | ||||||||||||

| Stephen W. Whatley | 71 | Chairman of the Board of Southern States and the Bank and Chief Executive Officer of Southern States | ||||||||||||

| Mark A. Chambers | 59 | President and director of Southern States and the Bank and Chief Executive Officer of the Bank | ||||||||||||

| Lynn J. Joyce | 59 | Senior Executive Vice President and Chief Financial Officer | ||||||||||||

| Greg Smith | 61 | Senior Executive Vice President and Chief Risk Officer | ||||||||||||

| Jack Swift | 61 | Senior Executive Vice President and Chief Operating Officer | ||||||||||||

The business experience of each of our executive officers is set forth below. There are no arrangements or understandings between any of the officers and any other person pursuant to which he or she was selected as an officer. The compensation for Mr. Whatley, Mr. Chambers and Ms. Joyce is set forth below under “Executive Compensation” and such persons are sometimes referred to as “named executive officers.”

Stephen W. Whatley. Mr. Whatley has served as our Chief Executive Officer since 2007 and Chairman of our board since 2014. Mr. Whatley has worked in the banking industry since 1973, in states across the country. Prior to joining Southern States, he served as Market President of Colonial Bank from 1982 through 2006. From 1980 until 1982, he served as Vice President Commercial Lender of AmSouth Bank and, from 1978 until 1982, as Vice President of Trust Company Bank. Whatley served as board member for the East Central Region of Colonial Bank from 1989 until 2000. He currently serves on the Wetlands America Trust Board. Mr. Whatley has served previously on the board of a number of non-profit entities, including Ducks Unlimited, Inc. and Community Action Agency. Mr. Whatley holds a Bachelor of Science in Economics from Auburn University and a Master of Arts in Economics from California State University at Los Angeles. Mr. Whatley’s extensive experience working in leadership roles in the banking industry, together with his skills and knowledge of the industry, are among his qualifications to serve as our Chairman of the Board and Chief Executive Officer.

Mark A. Chambers. Mr. Chambers has served as our President since 2019 and joined the board on March 16, 2022. From 2007 until 2019, he served as Senior Executive Vice President and President, Southeast Region of Southern States. Prior to joining Southern States, Mr. Chambers worked as Market President at Wachovia Bank from 2004 until 2007, and as a Commercial Lender at Aliant Bank from 1998 until 2004. Mr. Chambers holds a Bachelor of Science in Finance and a Master of Business Administration from Auburn University.

Lynn J. Joyce. Ms. Joyce has served as Senior Executive Vice President and Chief Financial Officer of Southern States since 2013. Prior to joining Southern States, she served as Executive Vice President and Chief Financial Officer of First Financial Bank, a NASDAQ listed institution for a portion of time during her tenure, from 1992 until 2013. From 1986 until 1992, Ms. Joyce worked in the audit division of a major accounting firm. Ms. Joyce is a member of the Alabama Society of Certified Public Accountants. Ms. Joyce holds a Bachelor of Science in Business Administration – Accounting from the University of Alabama, in Huntsville.

Greg Smith. Mr. Smith has served as Senior Executive Vice President and Chief Risk Officer of Southern States since 2019. From 2006 until 2019, he served as our Senior Vice President and Chief Credit Officer. Prior to joining Southern States, he worked as Credit Admin, Commercial Loan Officer and Market President at Regions Bank. Mr. Smith holds a Bachelor of Science in Finance from the University of Alabama.

Jack Swift. Mr. Swift has served as our Senior Executive Vice President and Chief Operating Officer since 2019. From 2006 until 2019, he served as Senior Executive Vice President and President, Central Region of Southern States. Prior to joining Southern States, he served as Senior Vice President of Colonial Bank from 1996 until 2006, and as Vice President of SouthTrust Bank from 1992 until 1996. Mr. Swift holds a Bachelor of Arts in Business Administration from Birmingham Southern University.

Our executive officers are appointed by our board and hold office until their successors are duly appointed and qualified or until their earlier death, resignation or removal. The executive officers of Southern States Bank are appointed by the board of Southern States and Bank hold office until their successors are duly appointed and qualified or until their earlier death, resignation or removal.

In addition to the executive officers listed above, the Bank is managed by a team of experienced bankers who oversee various aspects of our organization including lending, credit administration, treasury services, wealth management, marketing, finance, operations, information technology, regulatory compliance, risk management and human resources. Our team has a demonstrated track record of achieving profitable growth, maintaining a strong credit culture, implementing a relationship-driven approach to banking and successfully executing acquisitions. The depth of our team’s experience, market knowledge and long-term relationships in Alabama and West Georgia provide us with a steady source of referral.

15

EXECUTIVE COMPENSATION

We have opted to comply with the executive compensation disclosure rules applicable to “emerging growth companies.” In accordance with such rules, we are permitted to provide a Summary Compensation Table and an Outstanding Equity Awards at Fiscal Year End Table, as well as limited narrative disclosures. Further, our reporting obligations extend only to the individuals serving as our principal executive officer and our two other most highly compensated executive officers, which are referred to as our “named executive officers.” This section provides an overview of our executive compensation program, including a narrative description of the material factors necessary to understand the information disclosed in the summary compensation table below.

The compensation reported in the Summary Compensation Table below is not necessarily indicative of how we will compensate our named executive officers in the future. We will continue to review, evaluate and modify our compensation framework to maintain a competitive total compensation package.

Our named executive officers for the year ended December 31, 2022 were:

•Stephen W. Whatley, Chairman and Chief Executive Officer of Southern States, Chairman of the Bank;

•Mark A. Chambers, President of Southern States and the Bank, Chief Executive Officer of the Bank; and

•Lynn J. Joyce, Senior Executive Vice President and Chief Financial Officer of Southern States and the Bank.

Summary Compensation Table

The following table summarizes the total compensation paid to or earned by each of the named executive officers for the years ended December 31, 2022 and 2021. Unless otherwise noted, all cash compensation for each of our named executive officers was paid by the Bank.

| Name and Principal | Year | Salary ($) | Bonus ($) | Stock Awards ($) (1) | Option Awards ($) (1) | Non-Equity Incentive Plan Compensation ($) (2) | All Other Compensation ($) (3) | Total ($) | ||||||||||||||||||||||||||||||||||||||||||

| Stephen W. Whatley | 2022 | 517,500 | 132,500 | 800,092 | 75,000 | 294,630 | 36,228 | 1,855,950 | ||||||||||||||||||||||||||||||||||||||||||

| Chairman and Chief Executive Officer | 2021 | 500,000 | 77,500 | 71,073 | 71,073 | 250,000 | 36,422 | 1,006,068 | ||||||||||||||||||||||||||||||||||||||||||

| Mark A. Chambers | 2022 | 415,000 | 55,000 | 664,624 | 43,116 | 206,739 | 38,128 | 1,422,607 | ||||||||||||||||||||||||||||||||||||||||||

| President and Director | 2021 | 345,000 | — | 40,888 | 40,888 | 150,938 | 37,173 | 614,887 | ||||||||||||||||||||||||||||||||||||||||||

| Lynn J. Joyce | 2022 | 329,130 | 45,000 | 609,472 | 39,757 | 140,539 | 42,279 | 1,206,177 | ||||||||||||||||||||||||||||||||||||||||||

| Senior Executive Vice President and Chief Financial Officer | 2021 | 318,000 | — | 37,763 | 37,763 | 119,250 | 39,454 | 552,230 | ||||||||||||||||||||||||||||||||||||||||||

(1) The amounts set forth reflect the aggregate grant date fair value of restricted stock issued as equity incentive under our 2017 Incentive Stock Compensation Plan and a one time grant of restricted stock units under our Executive Deferred Restricted Stock Unit Plan in accordance with FASB ASC Topic 718. See “Note 11” in the consolidated financial statements of our Annual Report on Form 10-K for additional detail regarding the assumptions underlying the value of these equity awards. Reflects an adjustment from our prior Summary Compensation Tables to present the aggregate grant date fair value in the year granted, rather than the year in which the award relates. See “Executive Compensation — Narrative Disclosure to the Compensation Table — Equity Awards” below.

(2) Represents amounts earned and paid under the Southern States Bank Performance Incentive Plan with respect to performance in the year ended December 31, 2022.

(3) The following table shows the amounts included in “All Other Compensation.”

| Name and Principal | Year | Car Allowance ($) | Country Club Dues ($) | 401(k) Employer Contributions ($) (1) | Life Insurance Premiums ($) (2) | Dividends Paid ($) (3) | Total ($) | |||||||||||||||||||||||||||||||||||||

| Stephen W. Whatley | 2022 | 15,000 | 1,260 | 15,250 | 1,500 | 3,218 | 36,228 | |||||||||||||||||||||||||||||||||||||

| 2021 | 15,000 | 1,260 | 14,500 | 1,500 | 4,162 | 36,422 | ||||||||||||||||||||||||||||||||||||||

| Mark A. Chambers | 2022 | 20,000 | — | 15,250 | 1,500 | 1,378 | 38,128 | |||||||||||||||||||||||||||||||||||||

| 2021 | 20,000 | — | 14,500 | 1,500 | 1,173 | 37,173 | ||||||||||||||||||||||||||||||||||||||

| Lynn J. Joyce | 2022 | 15,000 | 9,300 | 15,250 | 1,500 | 1,229 | 42,279 | |||||||||||||||||||||||||||||||||||||

| 2021 | 15,000 | 7,200 | 14,500 | 1,500 | 1,254 | 39,454 | ||||||||||||||||||||||||||||||||||||||

(1) Represents Southern States’ matching contributions under the Southern States 401(k) Plan.

(2) Represents the employer-paid insurance premiums.

(3) Represents dividends paid on restricted stock that was not vested.

16

Narrative Disclosure to the Summary Compensation Table

General

We compensate our named executive officers through a combination of base salary, annual incentive bonuses (under the Southern States Bank Performance Incentive Plan), discretionary bonuses, equity awards (under the 2017 Incentive Stock Compensation Plan and Executive Deferred Restricted Stock Unit Plan), and other benefits including perquisites. Our Compensation Committee believes our executive compensation practices should attract, motivate, and retain key talent, while also tying pay to performance to promote stockholder value and core values. Each element of compensation is designed to achieve a specific purpose and to contribute to a total package that is competitive with similar packages provided by other institutions that compete for the services of individuals like our named executive officers. During 2022, decisions regarding compensation were made by the Compensation Committee.

Base Salary

We provide each of our named executive officers with a competitive fixed annual base salary. When setting the base salary of each named executive officer for 2022, the Compensation Committee considered a variety of considerations, including: salaries offered by members of our peer group as set forth in information provided by our external compensation consultant, Compensation Advisors, which is a member of Newcleus; internal pay equity considerations; the results achieved by each executive; future potential; experience; and scope of responsibilities. On an annual basis, the Compensation Committee reviewed base salaries of our named executive officers. The Compensation Committee, without the involvement of any of our named executive officers, determined the base salary for Mr. Whatley. With respect to our other named executive officers, the Compensation Committee, while overseeing the process and having the authority to override any compensation decisions, has historically allowed Mr. Whatley latitude in establishing base salaries. Base salaries paid during the year ended December 31, 2022 appear in the Salary column of the Summary Compensation Table for 2022.

In January 2023, base salaries were increased to $550,000, $470,000 and $350,000 for Mr. Whatley, Mr. Chambers and Ms. Joyce, respectively.

Annual Incentive Bonus

Our named executive officers participate in the Southern States Bank Performance Incentive Plan (“PIP”), a performance-based annual cash incentive plan intended to incentivize Company performance. Under the PIP, participants, including our named executive officers, are eligible to earn bonuses as a percentage of annual base salary based on achievement of goals established by the Compensation Committee typically at the beginning of each year in consultation with senior management. At the end of the year, to the extent the applicable goals are met, the participant will be eligible for a bonus. The overall percentage of goals achieved must be 80% or higher in order for any incentive awards to be paid. An unacceptable level of problem loans issued by Southern States Bank can reduce incentive payments for affected participants and their management. The ultimate amount of the award can be adjusted up or down in the discretion of senior management and the Compensation Committee.

For the year ended December 31, 2022, the performance factors for the PIP for our named executive officers were net income after taxes (weighted 40%), loan portfolio balance growth (weighted 40%), checking deposit balance growth (weighted 15%), and money market account and savings balance growth (weighted 5%).

Based on actual performance for the year ended December 31, 2022, Mr. Whatley was eligible to earn 32% to 62% of his base salary, Mr. Chambers was eligible to earn 28% to 54.3% of his base salary, and Ms. Joyce was eligible to earn 24% to 46.5% of her base salary. For the year ended December 31, 2022, Mr. Whatley earned a bonus of $294,630, or 56.9% of his base salary, Mr. Chambers earned a bonus of $206,739, or 49.8% of his base salary, and Ms. Joyce earned a bonus of $140,539, or 42.7% of her base salary. The bonuses were paid in February 2023, and appear in the Non-Equity Incentive Plan Compensation column of the Summary Compensation Table above for 2022.

Discretionary and Other Bonus

Discretionary bonuses are determined on a discretionary basis and are generally based on individual and company performance. For performance during the year ended December 31, 2022, Mr. Whatley, Mr. Chambers and Ms. Joyce were paid discretionary bonuses of $55,000, $55,000 and $45,000, respectively. These bonuses were paid in February 2023. In addition, for the year ended December 31, 2022, Mr. Whatley was paid a bonus of $77,500, which is the third of three annual bonuses in that amount the Company paid to Mr. Whatley for successfully completing the acquisition of Small Town Bank. As a result, Mr. Whatley’s total bonus for the year ended December 31, 2022 was $132,500. These bonuses appear in the Bonus column of the Summary Compensation Table above for 2022.

17

Equity Awards

Our named executive officers are eligible for long-term equity incentive awards under the 2017 Incentive Stock Compensation Plan as amended (the “Plan”). The Compensation Committee believes that granting equity awards to our named executive officers enhances performance consistent with our corporate strategic values, focuses our executives on long-term performance results consistent with the Company’s long-term strategic plan, and strengthens the link between executive pay and our stockholders by creating a shared interest in the Company’s growth. Awards under the Plan may be in the form of shares of restricted stock (“Restricted Stock”), incentive stock options (“ISOs”) or non-qualified stock options (“NQSOs”), and beginning in December 2022, restricted stock units (“RSUs”). Awards vest over time under the conditions set forth in the applicable award agreement.

When granting awards, the Compensation Committee establishes a target award for each participant which, for our named executive officers, is stated as a percentage of annual base salary. Awards issued in February 2022 were based on 2021 base salaries and split equally between Restricted Stock and ISOs, and the applicable percentages of base salary were 30% for Mr. Whatley, and 25% for Mr. Chambers and Ms. Joyce. The amounts shown in the Stock Awards column of the Summary Compensation Table for 2022 reflect grants of 3,639, 2,092 and 1,929 shares of Restricted Stock to Mr. Whatley, Mr. Chambers and Ms. Joyce, respectively, in February 2022, which were valued at $75,000, $43,116 and $39,757, respectively, and vest in one-third increments over three years, beginning on the date of the grant. The amounts shown in the Option Awards column of the Summary Compensation Table above reflect grants of 6,014, 3,458 and 3,188 ISOs to Mr. Whatley, Mr. Chambers and Ms. Joyce, respectively, in February 2022. The ISOs vest in one-third increments over three years, beginning on the date of the grant. The exercise price of the ISOs is $20.61 per share.

On February 15, 2023, the Compensation Committee made grants of 2,568, 1,716 and 1,361 shares of Restricted Stock to Mr. Whatley, Mr. Chambers and Ms. Joyce, which vest in one-third increments over three years with the first vesting beginning on the date of the grant. On February 15, 2023, the Compensation Committee made awards of 3,999, 2,673 and 2,120 ISOs to Mr. Whatley, Mr. Chambers and Ms. Joyce, respectively. The ISOs vest in one-third increments over three years, with the first vesting beginning on the date of the grant. The exercise price of the ISOs is $30.23 per share. The Restricted Stock and ISO granted on February 15, 2023 will appear in the Summary Compensation Table for our 2024 annual meeting of shareholders.

Benefits and Other Perquisites

Our named executive officers are eligible to participate in the same benefit plans available to all of our full-time employees, including medical, dental, vision, life, disability and accidental death insurance.

We also provide our employees, including our named executive officers, with several retirement benefits. Our retirement plans are designed to assist our employees with planning for and securing appropriate levels of income during retirement. We believe these plans help us attract and retain quality employees, including executives, by offering benefits similar to those offered by our competitors.