Form DEF 14A Sientra, Inc. For: Dec 19

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

Sientra, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Table of Contents

SIENTRA, INC.

420 South Fairview Avenue, Suite 200

Santa Barbara, California 93117

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held On December 19, 2022

Dear Stockholder:

You are cordially invited to attend the Special Meeting of Stockholders of SIENTRA, INC., a Delaware corporation, or the Company. The meeting will be held on December 19, 2022 at 9:00 a.m. Pacific Time virtually via live webcast which can be accessed on the Internet by visiting www.virtualshareholdermeeting.com/SIEN2022SM for the following purposes:

| 1. | To approve an amendment to the Company’s amended and restated certificate of incorporation to effect a reverse stock split of the Company’s common stock, within a range, as determined by the Company’s board of directors, of one new share for every five (5) to fifteen (15) (or any number in between) shares outstanding (the “Reverse Stock Split”), the implementation and timing of which shall be subject to the discretion of the Company’s board of directors (the “Reverse Stock Split Proposal”); and |

| 2. | To approve the adjournment of the Special Meeting, if necessary, to continue to solicit votes for Proposal No. 1 (the “Adjournment Proposal” or “Proposal No. 2”). |

These items of business are more fully described in the Proxy Statement accompanying this Notice.

The record date for the Special Meeting was November 25, 2022. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment or postponement thereof.

| By Order of the Board of Directors |

| /s/ Caroline Van Hove |

| Caroline Van Hove Executive Chair of the Board |

Santa Barbara, California

November 29, 2022

To access the Special Meeting you will need a 16 digit control number. The control number is provided on your proxy card or through your broker or other nominee if you hold your shares in “street name”. Stockholders will be able to attend virtually during the Special Meeting. Whether or not you expect to attend the Special Meeting, please vote over the telephone or the Internet, or, if you receive a paper proxy card by mail, by completing and returning the proxy card mailed to you, as promptly as possible in order to ensure your representation at the Special Meeting. Voting instructions are printed on your proxy card and included in the accompanying Proxy Statement. Even if you have voted by proxy, you may still vote in person if you attend the Special Meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Special Meeting, you must obtain a proxy issued in your name from that record holder.

Table of Contents

Table of Contents

SIENTRA, INC.

420 South Fairview Avenue, Suite 200

Santa Barbara, California 93117

PROXY STATEMENT

FOR SPECIAL MEETING OF STOCKHOLDERS

To be held on December 19, 2022

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why did I receive this proxy statement?

The Board of Directors of Sientra, Inc., or the “Board,” is soliciting your proxy to vote at Sientra’s Special of Stockholders, or the “Special Meeting,” including at any adjournments or postponements of the meeting. You are invited to attend the Special Meeting to vote on the proposals described in this proxy statement. As used in this Proxy Statement, references to “we,” “us,” “our,” “Sientra” and the “Company” refer to Sientra, Inc.

How do I attend the Special Meeting?

The Special Meeting will be held on December 19, 2022 at 9:00 a.m. Pacific Time. The Special Meeting will be conducted entirely online via live webcast which can be accessed on the Internet by visiting www.virtualshareholdermeeting.com/SIEN2022SM. To access the Special Meeting, you will need a 16 digit control number. The control number is provided on your proxy card or through your broker or other nominee if you hold your shares in “street name”. Stockholders will be able to attend virtually during the Special Meeting

Who can vote at the Special Meeting?

Only stockholders of record at the close of business on November 25, 2022 will be entitled to vote at the Special Meeting. On this record date, there were 100,995,909 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on November 25, 2022 your shares were registered directly in your name with the Company’s transfer agent, Computershare, then you are a stockholder of record. As a stockholder of record, you may vote in person at the Special Meeting or vote by proxy. Whether or not you plan to attend the Special Meeting, we urge you to vote your shares electronically over the Internet, by telephone or by completing and returning a printed proxy card that you may request or that we may elect to deliver at a later time to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on November 25, 2022 your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Special Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the Special Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the Special Meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

There are two matters scheduled for a vote:

1. To approve an amendment to the Company’s amended and restated certificate of incorporation to effect a reverse stock split of the Company’s common stock, within a range, as determined by the Company’s board of directors, of one new share for every five (5) to fifteen (15) (or any number in between) shares outstanding (the “Reverse Stock Split”), the implementation and timing of which shall be subject to the discretion of the Company’s board of directors (the “Reverse Stock Split Proposal”); and

1

Table of Contents

2. To approve the adjournment of the Special Meeting, if necessary, to continue to solicit votes for Proposal No. 1 (the “Adjournment Proposal” or “Proposal No. 2”).

What if another matter is properly brought before the meeting?

The Board knows of no other matters that will be presented for consideration at the Special Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the proxy to vote on those matters in accordance with their best judgment.

How do I vote?

For Proposals 1 and 2, you may vote “For” or “Against” or abstain from voting.

The procedures for voting include:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the Special Meeting, vote by proxy over the telephone, vote by proxy through the Internet or vote by proxy using a proxy card that you may request or that we may elect to deliver at a later time. Whether or not you plan to attend the Special Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Special Meeting and vote in person even if you have already voted by proxy.

| • | To vote at the Special Meeting virtually by live webcast you must visit the following website: www.virtualshareholdermeeting.com/SIEN2022SM. You will need the 16-digit control number included on the Notice or on your proxy card (if you requested to receive printed proxy materials). The method you use to vote by proxy will not limit your right to attend the Special Meeting or vote at the Special Meeting virtually. All shares that have been properly voted and not revoked will be voted at the Special Meeting. However, even if you plan to attend the Special Meeting virtually, we recommend that you vote your shares in advance, so that your vote will be counted if you later decide not to attend the Special Meeting. |

| • | To vote using a printed proxy card that may be delivered to you, simply complete, sign and date the proxy card that may be delivered and return it promptly in the envelope provided. If you return your signed proxy card to us before the Special Meeting, we will vote your shares as you direct. |

| • | To vote by proxy over the telephone, dial toll-free 1-800-690-6903 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the control number from the Notice. Your telephone vote must be received by 11:59 p.m. Eastern Time on December 18, 2022 to be counted. |

| • | To vote by proxy through the Internet, go to www.proxyvote.com to complete an electronic proxy card. You will be asked to provide the control number from the Notice. Your Internet vote must be received by 11:59 p.m. Eastern Time on December 18, 2022 to be counted. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a Notice containing voting instructions from that organization rather than from Sientra. Simply follow the voting instructions in the Notice to ensure that your vote is counted. To vote virtually at the Special Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker or bank included with these proxy materials or contact your broker or bank to request a proxy form.

We provide Internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

2

Table of Contents

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of November 25, 2022.

What happens if I do not vote?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and do not vote by telephone, through the Internet, by completing the printed proxy card that may be delivered to you or virtually at the Special Meeting, your shares will not be voted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner and do not instruct your broker, bank, or other agent how to vote your shares, the question of whether your broker or nominee will still be able to vote your shares depends on whether the particular proposal is considered a “routine” matter. Brokers and nominees can use their discretion to vote “uninstructed” shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the applicable rules governing such brokers, we believe Proposal 1 to approve an amendment to our Charter to effect the Reverse Stock Split is likely to be considered a “routine” item. If such proposal is deemed to be “non-routine”, broker non-votes, if any, with respect to Proposal 1 will have the same effect as a vote against such proposal. Broker non-votes, if any, with respect to Proposal 2 will not affect the outcome of such proposal. Accordingly, it is particularly important that beneficial owners instruct their brokers how they wish to vote their shares. Abstention and broker non-votes will be counted for purposes of determining whether there is a quorum present at the Special Meeting.

What if I return a proxy card or otherwise vote but do not make specific choices?

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “For” the Reverse Stock Split Proposal and “For” the Adjournment Proposal. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. In addition, we have engaged Alliance Advisors, to assist in the solicitation of proxies and to provide related advice and informational support for a services fee, which is not expected to exceed $20,000. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one set of proxy materials?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the Notices to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the Special Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

| • | You may submit another properly completed proxy card with a later date. |

| • | You may grant a subsequent proxy by telephone or through the Internet. |

3

Table of Contents

| • | You may send a timely written notice that you are revoking your proxy to Sientra, Inc.’s Secretary at 420 South Fairview Avenue, Suite 200, Santa Barbara, California 93117. |

| • | You may attend the Special Meeting and vote virtually. Simply attending the Special Meeting will not, by itself, revoke your proxy. |

Your most current proxy card or telephone or Internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

When are stockholder proposals and director nominations due for next year’s annual meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by December 27, 2022 to our Secretary at 420 South Fairview Avenue, Suite 200, Santa Barbara, California 93117, and you must comply with all applicable requirements of Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended, or Exchange Act.

If you wish to submit a proposal (including a director nomination) at next year’s annual meeting that is not to be included in next year’s proxy materials, you must notify our Secretary in writing at the address above no earlier than the close of business on February 8, 2023 and no later than the close of business on March 10, 2023 in accordance with our bylaws; provided, however that if next year’s annual meeting is advanced more than 30 days prior to or delayed by more than 30 days after June 9, 2023, your proposal must be submitted not earlier than the close of business on the one hundred twentieth (120th) day prior to such annual meeting and not later than the close of business on the later of the ninetieth (90th) day prior to such annual meeting or the tenth (10th) day following the day on which public announcement of the date of such meeting is first made. You are also advised to review our bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations.

How are votes counted?

Votes will be counted by the inspector of election appointed for the Special Meeting.

With respect to the Reverse Stock Split Proposal, votes “For,” “Against,” and abstentions will be counted. Abstentions will be counted “Against” the Reverse Stock Split Proposal. With respect to the Adjournment Proposal, votes “For,” “Against,” and abstentions will be counted. Abstentions will be counted “Against” the Adjournment Proposal.

What are “broker non-votes”?

As discussed above, when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed by exchange regulation to be “non-routine,” the broker or nominee cannot vote the shares. These unvoted shares are counted as “broker non-votes.”

How many votes are needed to approve each proposal?

The following table summarizes the minimum vote needed to approve each proposal and the effect of abstentions and broker non-votes.

4

Table of Contents

| Proposal Number |

Proposal Description |

Vote Required for Approval |

Effect of Abstentions |

Effect of Non-Votes | ||||

| 1 | To approve an amendment to the Company’s amended and restated certificate of incorporation to effect a Reverse Stock Split of the Company’s common stock, within a range, as determined by the Company’s board of directors, of one new share for every five (5) to fifteen (15) (or any number in between) shares outstanding, the implementation and timing of which shall be subject to the discretion of the Company’s board of directors | The affirmative vote of holders of a majority of outstanding shares of common stock entitled to vote on the proposal is required to approve the amendment to the amended and restated certificate of incorporation of the Company effecting the Reverse Stock Split. | Against | Against | ||||

| 2 | To approve the adjournment of the Special Meeting, if necessary, to continue to solicit votes for Proposal No. 1 | “For” votes from the holders of a majority of shares present in person or represented by proxy and entitled to vote on the matter. | Against | None | ||||

How can I find out the results of the voting at the Special Meeting?

Preliminary voting results will be announced at the Special Meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the Special Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Special Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

5

Table of Contents

APPROVAL OF AN AMENDMENT TO THE AMENDED AND RESTATED CERTIFICATE OF INCORPORATION OF THE COMPANY EFFECTING THE REVERSE STOCK SPLIT

Background and Proposed Amendment

The Company is seeking an amendment to the Company’s amended and restated certificate of incorporation (the “Charter Amendment”) to effect a reverse stock split of the Company’s common stock, within a range, as determined by the Company’s board of directors, of one new share for every five (5) to fifteen (15) (or any number in between) shares outstanding (the “Reverse Stock Split”), the implementation and timing of which shall be subject to the discretion of the Company’s board of directors (the “Reverse Stock Split Proposal”).

The Reverse Stock Split will not change the number of authorized shares of common stock or Preferred Stock or the relative voting power of such holders of our outstanding common stock and Preferred Stock. The number of authorized but unissued shares of our common stock will materially increase and will be available for reissuance by the Company. The Reverse Stock Split, if effected, would affect all of our stockholders uniformly.

On November 15, 2022, the Board unanimously approved, and recommended seeking stockholder approval of the Charter Amendment set forth in Appendix A to effect the Reverse Stock Split. If this Reverse Stock Split is approved by the stockholders, the Board will have the authority, in its sole discretion, without further action by the stockholders, to effect the Reverse Stock Split. The Board’s decision as to whether and when to effect the Reverse Stock Split, if approved by the stockholders, will be based on a number of factors, including prevailing market conditions, existing and expected trading prices for our common stock, actual or forecasted results of operations, and the likely effect of such results on the market price of our common stock.

A Reverse Stock Split will also affect our outstanding stock options, restricted stock units and shares of common stock issued under our stock plans, as well as our outstanding warrants. Under these plans and securities, the number of shares of common stock deliverable upon exercise or grant must be appropriately adjusted and appropriate adjustments must be made to the purchase price per share to reflect the Reverse Stock Split.

The Reverse Stock Split is not being proposed in response to any effort of which we are aware to accumulate our shares of common stock or obtain control of the Company, nor is it a plan by management to recommend a series of similar actions to the Board or our stockholders.

Reasons for the Reverse Stock Split

The Board believes that effecting the Reverse Stock Split would increase the price of our common stock which would, among other things, help us to:

| • | Meet certain listing requirements of the Nasdaq Global Select Market; |

| • | Fulfill obligations under the Amended and Restated Facility Agreement with Deerfield Partners; |

| • | Appeal to a broader range of investors to generate greater interest in the Company; and |

| • | Improve perception of our common stock as an investment security. |

Meet Nasdaq Listing Requirements

Our common stock is listed on the Nasdaq Global Select Market under the symbol SIEN. On September 29, 2022, we received written notice (the “Notice”) from the Listing Qualifications Department of The Nasdaq Stock Market, LLC (“Nasdaq”) notifying us that, based on the closing bid price of our common stock for the last 30 consecutive trading days, we no longer comply with the minimum bid price requirement for continued listing on The Nasdaq Global Select Market. Nasdaq Listing Rule 5450(a)(1) requires listed securities to maintain a minimum bid price of $1.00 per share (the “Minimum Bid Price Requirement”), and Nasdaq Listing Rule 5810(c)(3)(A) provides that a failure to meet the Minimum Bid Price Requirement exists if the deficiency continues for a period of 30 consecutive trading days.

6

Table of Contents

The Notice has no immediate effect on the listing of our common stock on The Nasdaq Global Select Market. Pursuant to the Nasdaq Listing Rules, we have been provided an initial compliance period of 180 calendar days to regain compliance with the Minimum Bid Price Requirement. To regain compliance, the closing bid price of our common stock must be at least $1.00 per share for a minimum of 10 consecutive trading days prior to March 28, 2023, we must otherwise satisfy The Nasdaq Global Select Market’s requirements for listing.

Our Board determined that the continued listing of our common stock on The Nasdaq Global Select Market is beneficial for our stockholders. The delisting of our common stock from Nasdaq would likely have very serious consequences for the Company and our stockholders. If our common stock is delisted from The Nasdaq Global Select Market, our board of directors believes that the trading market for our common stock could become significantly less liquid, which could reduce the trading price of our common stock and increase the transaction costs of trading in shares of our common stock.

The principal purpose of the Reverse Stock Split Proposal is to decrease the total number of shares of common stock outstanding and proportionately increase the market price of the common stock in order to meet the continuing listing requirements of The Nasdaq Global Select Market. Accordingly, our board of directors approved the Reverse Stock Split Proposal in order to help ensure that the share price of our common stock meets the continued listing requirements of The Nasdaq Global Select Market. Our Board intends to effect the Reverse Stock Split Proposal only if it believes that a decrease in the number of shares outstanding is in the best interests of the Company and our stockholders and is likely to improve the trading price of our common stock and improve the likelihood that we will be allowed to maintain our continued listing on The Nasdaq Global Select Market. Our Board may determine to effect the Reverse Stock Split Proposal even if the trading price of our common stock is at or above $1.00 per share. We believe that approval of a number of alternative ratios of the Reverse Stock Split as opposed to one specific ratio of the Reverse Stock Split provides the Board with the flexibility to achieve the purposes of the Reverse Stock Split Proposal.

In addition to establishing a mechanism for the price of our common stock to meet the Minimum Bid Price Requirement, we also believe that the Reverse Stock Split Proposal will make our common stock more attractive to a broader range of institutional and other investors. It is our understanding that the current market price of our common stock may affect its acceptability to certain institutional investors, professional investors and other members of the investing public. It is also our understanding that many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. In addition, some of those policies and practices may function to make the processing of trades in low-priced stocks economically unattractive to brokers. Moreover, because brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher-priced stocks, the current average price per share of our common stock can result in individual stockholders paying transaction costs representing a higher percentage of their total share value than would be the case if the share price were substantially higher. However, some investors may view the reverse stock split negatively because it reduces the number of shares of common stock available in the public market.

Reducing the number of outstanding shares of our common stock through the Reverse Stock Split is intended, absent other factors, to increase the per share market price of our common stock. However, other factors, such as our financial results, market conditions and the market perception of our business may adversely affect the market price of our common stock. As a result, there can be no assurance that the Reverse Stock Split, if completed, will result in the intended benefits described above, that the market price of our common stock will increase following the Reverse Stock Split, that the market price of our common stock will not decrease in the future, or that our common stock will achieve a high enough price per share to permit its continued listing by Nasdaq.

Satisfy Covenant in Facility Agreement with Deerfield.

A second purpose of the Reverse Stock Split is to satisfy a covenant in our Amended and Restated Facility Agreement (as amended, the “Facility Agreement”), dated October 12, 2022, with Deerfield Partners, L.P. (“Deerfield”). Pursuant to the terms of the Facility Agreement, the Company is required to seek stockholder approval for either a reverse split of its common stock or an increase in the number of authorized shares of common stock, with such split or increase to take effect by not later than December 26, 2022. For the reasons discussed in this Proposal 1, the Board has determined that the Reverse Stock Split is in the best interests of the Company and its

7

Table of Contents

stockholders instead of seeking an increase to the number of authorized shares of common stock. If the Company does not receive approve for such a split or increase, then the convertible notes and warrants, if any, issued pursuant to the Facility Agreement will be settleable is cash and, if a Reverse Stock Split or authorized share increase has not occurred by April 12, 2023, the Company will be in default under the Convertible Notes. If we are in default, Deerfield will be entitled to the rights and remedies thereunder including, but not limited to, declaring all amounts owed under the Facility Agreement immediately due and payable. If we are unable to pay those amounts if and when owed, Deerfield could proceed against the collateral granted to it pursuant to the Facility Agreement. Further, if we are unable to repay our indebtedness and Deerfield institutes foreclosure proceedings against our assets, we could be forced into bankruptcy or liquidation and equity holders may lose the entire value of their investment. In any such bankruptcy or liquidation scenario, the value that we receive for our assets could be significantly lower than the values reflected in our financial statements.

Appeal to a Broader Range of Investors to Generate Greater Investor Interest in the Company

An increase in our stock price may make our common stock more attractive to investors. Brokerage firms may be reluctant to recommend lower-priced securities to their clients lower-priced securities. Many institutional investors have policies prohibiting them from holding lower-priced stocks in their portfolios, which reduces the number of potential purchasers of our common stock. Investment funds may also be reluctant to invest in lower-priced stocks. Investors may also be dissuaded from purchasing lower-priced stocks because the brokerage commissions, as a percentage of the total transaction, tend to be higher for such stocks. Moreover, the analysts at many brokerage firms do not monitor the trading activity or otherwise provide coverage of lower-priced stocks. Giving the Board the ability to effect the Reverse Stock Split, and thereby increase the price of our common stock, would give the Board the ability to address these issues if it is deemed necessary.

Improve the Perception of Our Common Stock as an Investment Security

The Board believes that effecting the Reverse Stock Split is one potential means of increasing the share price of our common stock to improve the perception of our common stock as a viable investment security. Lower-priced stocks have a perception in the investment community as being risky and speculative, which may negatively impact not only the price of our common stock, but also our market liquidity.

Board Discretion to Implement the Reverse Stock Split

Approval of this proposal authorizes the Board to select a one new share for every five (5) to fifteen (15). range of Reverse Stock Split ratios. The Board expects to implement the Reverse Stock Split only where the Reverse Stock Split would be in the best interests of the Company and its stockholders.

Following stockholder approval, no further action on the part of stockholders will be required to either implement or abandon the Reverse Stock Split. If the Reverse Stock Split Proposal is approved by stockholders and the Board determines to implement the Reverse Stock Split, we would communicate to the public, prior to the effective date of the Reverse Stock Split, additional details regarding the Reverse Stock Split (including the final Reverse Stock Split ratio, as determined by the Board and the proportionate decrease in the number of authorized shares of common stock and preferred stock). The Board reserves its right to elect not to proceed with the Reverse Stock Split if it determines, in its sole discretion, that the Reverse Stock Split Proposal is no longer in the best interests of the Company or its stockholders.

Certain Risks Associated with the Reverse Stock Split

Reducing the number of outstanding shares of our common stock through the Reverse Stock Split is intended, absent other factors, to increase the per share market price of our common stock. However, other factors, such as our financial results, market conditions and the market perception of our business and industry may adversely affect the market price of our common stock. As a result, there can be no assurance that the Reverse Stock Split, if completed, will result in the intended benefits described above, that the market price of our common stock will increase following the Reverse Stock Split or that the market price of our common stock will not decrease in the future. Additionally, we cannot assure you that the market price per share of our common stock after a Reverse Stock Split will increase in proportion to the reduction in the number of shares of our common stock outstanding before the Reverse Stock Split.

8

Table of Contents

Accordingly, the total market capitalization of our common stock after the Reverse Stock Split may be lower than the total market capitalization before the Reverse Stock Split.

Even if a Reverse Stock Split is effected, some or all of the expected benefits discussed above may not be realized or maintained. The market price of our common stock will continue to be based, in part, on our performance and other factors unrelated to the number of shares outstanding. The Reverse Stock Split will reduce the number of outstanding shares of our common stock without reducing the number of shares of available but unissued common stock, which will also have the effect of increasing the number of shares of common stock available for issuance. The issuance of additional shares of our common stock may have a dilutive effect on the ownership of existing stockholders. The current economic environment in which we operate, along with otherwise volatile equity market conditions, could limit our ability to raise new equity capital in the future

Effects of the Reverse Stock Split

If our stockholders approve the proposed Reverse Stock Split and the Board elects to effect the Reverse Stock Split, our issued and outstanding shares of common stock, for example, would decrease at a rate of approximately one (1) share of common stock for every ten (10) shares of common stock currently outstanding in a one-for-ten split. If approved, the Board has the discretion to select a ratio for the Reverse Stock Split between one-for-five and one-for-fifteen shares. The Reverse Stock Split would be effected simultaneously for all of our common stock, and the exchange ratio would be the same for all shares of common stock. The Reverse Stock Split would affect all of our stockholders uniformly and would not affect any stockholders’ percentage ownership interests in the Company, except to the extent that it results in a stockholder receiving cash in lieu of fractional shares. The Reverse Stock Split would not affect the relative voting or other rights that accompany the shares of our common stock, except to the extent that it results in a stockholder receiving cash in lieu of fractional shares. Common stock issued pursuant to the Reverse Stock Split would remain fully paid and non-assessable. The Reverse Stock Split would not affect our securities law reporting and disclosure obligations, and we would continue to be subject to the periodic reporting requirements of the Securities Exchange Act of 1934, as amended. We have no current plans to take the Company private. Accordingly, the Reverse Stock Split is not related to a strategy to do so.

In addition to the change in the number of shares of common stock outstanding, the Reverse Stock Split would have the following effects:

Increase the Per Share Price of our Common Stock

By effectively condensing a number of pre-split shares into one share of common stock, the per share price of a post-split share is generally greater than the per share price of a pre-split share. The amount of the initial increase in per share price and the duration of such increase, however, is uncertain. The Board may utilize the Reverse Stock Split as part of its plan to maintain the required minimum per share price of the common stock under the Nasdaq listing standards.

Increase in the Number of Shares of Common Stock Available for Future Issuance

As discussed above, by reducing the number of shares outstanding without reducing the number of shares of available but unissued common stock, the Reverse Stock Split will increase the number of authorized but unissued shares. The Board believes the increase is appropriate for use to fund the future operations of the Company. Although the Company does not have any pending acquisitions for which shares are expected to be used, the Company may also use authorized shares in connection with the financing of future acquisitions.

9

Table of Contents

The following table contains approximate information relating to our common stock, based on share information as of November 10, 2022:

| Current | After the Reverse Stock Split if the Minimum 5-1 Ratio is Selected |

After the Reverse Stock Split if the Maximum 15-1 Ratio is Selected |

||||||||||

| Authorized common stock |

200,000,000 | 200,000,000 | 200,000,000 | |||||||||

| Common stock issued and outstanding |

100,995,909 | 20,199,182 | 6,733,061 | |||||||||

| Warrants to purchase common stock outstanding |

55,616,032 | 11,123,206 | 3,707,735 | |||||||||

| Common stock issuable upon exercise of outstanding stock options, and settlement of restricted stock units and shares reserved for issuance for future grants under Stock Plans |

17,800,523 | 3,560,105 | 1,186,702 | |||||||||

| Common stock issuable upon conversion of outstanding convertible notes |

41,181,819 | (1) | 8,236,364 | 2,745,455 | ||||||||

| Common stock issuable upon achievement of certain milestones |

917,757 | 183,551 | 61,184 | |||||||||

| Authorized preferred stock |

10,000,000 | 10,000,000 | 10,000,000 | |||||||||

| Preferred stock issued and outstanding |

0 | 0 | 0 | |||||||||

| (1) | The Company may cash settle conversions pursuant to the terms of the convertible notes. |

Although the Reverse Stock Split would not have any dilutive effect on our stockholders, the Reverse Stock Split without a reduction in the number of shares authorized for issuance would reduce the proportion of shares owned by our stockholders relative to the number of shares authorized for issuance, giving the Board an effective increase in the authorized shares available for issuance, in its discretion. The Board from time to time may deem it to be in the best interests of the Company to enter into transactions and other ventures that may include the issuance of shares of our common stock. If the Board authorizes the issuance of additional shares subsequent to the Reverse Stock Split, the dilution to the ownership interest of our existing stockholders may be greater than would occur had the Reverse Stock Split not been effected.

Require Adjustment to Currently Outstanding Securities Exercisable or Convertible into Shares of our Common Stock

The Reverse Stock Split would effect a reduction in the number of shares of common stock issuable upon the exercise or conversion of our outstanding stock options, settlement of restricted stock units, conversion of our outstanding convertible notes and exercise of our outstanding warrants in proportion to the Reverse Stock Split ratio. The exercise or conversion price of outstanding options, convertible notes and warrants would increase, likewise in proportion to the Reverse Stock Split ratio.

Require Adjustment to the Number of Shares of Common Stock Available for Future Issuance Under our Equity Plans

In connection with any Reverse Stock Split, the Board would also make a corresponding reduction in the number of shares available for future issuance under our equity plans (to the extent not automatically adjusted), so as to avoid the effect of increasing the number of authorized but unissued shares available for future issuance under such plans.

In addition, the Reverse Stock Split may result in some stockholders owning “odd lots” of less than one hundred (100) shares of common stock, which may be more difficult to sell and may cause those holders to incur greater brokerage commissions and other costs upon sale.

Procedure for Effecting Reverse Stock Split

If the Company’s stockholders approve the amendment to the amended and restated certificate of incorporation of the Company effecting the Reverse Stock Split, and if the Company’s board of directors still believes that a Reverse Stock Split is in the best interests of the Company and its stockholders, the board of directors will determine the Reverse Stock Split ratio and the Company will file the amendment to the amended and restated certificate of incorporation with the Secretary of State of the State of Delaware at such time as the Company’s board of directors has determined to be the appropriate split effective time. The Company’s board of directors may delay effecting the Reverse Stock Split without resoliciting stockholder approval. Beginning at the split effective time, each certificate representing pre-split shares will be deemed for all corporate purposes to evidence ownership of post-split shares.

10

Table of Contents

As soon as practicable after the split effective time, the Company’s stockholders will be notified that the Reverse Stock Split has been effected. The Company expects that the Company’s transfer agent will act as exchange agent for purposes of implementing the exchange. No new certificates will be issued to a stockholder until such stockholder has surrendered properly completed and executed letter of transmittal to the exchange agent. Any pre-split shares submitted for transfer, whether pursuant to a sale or other disposition, or otherwise, will automatically be exchanged for post-split shares.

Effect on Beneficial Holders (i.e., Stockholders Who Hold in “Street Name”)

If the proposed Reverse Stock Split is approved and effected, we intend to treat common stock held by stockholders in “street name,” through a bank, broker, or other nominee, in the same manner as stockholders whose shares are registered in their own names. Banks, brokers or other nominees will be instructed to effect the Reverse Stock Split for their customers holding common stock in “street name.” However, these banks, brokers or other nominees may have different procedures than registered stockholders for processing the Reverse Stock Split. If you hold shares of common stock with a bank, broker or other nominee and have any questions in this regard, you are encouraged to contact your bank, broker, or other nominee.

Fractional Shares

No fractional shares will be issued in connection with the Reverse Stock Split. Stockholders of record who otherwise would be entitled to receive fractional shares will be entitled to an amount in cash (without interest or deduction) in an amount equal to the product of (x) the fractional share of common stock to which such stockholder would otherwise be entitled, as determined by the Board, multiplied by (y) the closing price of the Company’s common stock as reported on the Nasdaq Global Select Market on the date of the filing of the Certificate of Amendment to implement the Reverse Stock Split with the Secretary of State of the State of Delaware multiplied by (z) the number of shares of common stock being combined into one share of common stock in the Reverse Stock Split. Except for the right to receive the cash payment in lieu of fractional shares, stockholders will not have any voting, dividend, or other rights with respect to the fractional shares they would otherwise be entitled to receive.

Stockholders should be aware that, under the escheat laws of the various jurisdictions where stockholders may reside, where we are domiciled, and where the funds will be deposited, sums due for fractional interests that are not timely claimed after the effective date of the Reverse Stock Split may be required to be paid to the designated agent for each such jurisdiction, unless correspondence has been received by us or the exchange agent concerning ownership of such funds within the time permitted in such jurisdiction. Thereafter, stockholders otherwise entitled to receive such funds will have to seek to obtain them directly from the state to which they were paid.

Accounting Matters

The par value of our common stock would remain unchanged at $0.01 per share, if the Reverse Stock Split is effected. The Company’s stockholders’ equity in its consolidated balance sheet would not change in total. However, the Company’s stated capital (i.e., $0.01 par value times the number of shares issued and outstanding), would be proportionately reduced based on the reduction in shares of common stock outstanding. Additional paid in capital would be increased by an equal amount, which would result in no overall change to the balance of stockholders’ equity. Additionally, net income or loss per share for all periods would increase proportionately as a result of the Reverse Stock Split since there would be a lower number of shares outstanding. We do not anticipate that any other material accounting consequences would arise as a result of the Reverse Stock Split.

Potential Anti-Takeover Effect

Even though the proposed Reverse Stock Split would result in an increased proportion of unissued authorized shares to issued shares, which could, under certain circumstances, have an anti-takeover effect (for example, by permitting issuances that would dilute the stock ownership of a person seeking to effect a change in the composition of the Board or contemplating a tender offer or other transaction for the combination of us with another company), the Reverse Stock Split is not being proposed in response to any effort of which we are aware to accumulate shares of our common stock or obtain control of us, nor is it part of a plan by management to recommend a series of similar amendments to the Board and our stockholders.

11

Table of Contents

No Appraisal Rights

Our stockholders are not entitled to appraisal rights with respect to the Reverse Stock Split, and we will not independently provide stockholders with any such right.

Federal Income Tax Consequences of a Reverse Stock Split

The following discussion is a summary of certain U.S. federal income tax consequences of the Reverse Stock Split to the Company and to stockholders that hold shares of common stock as capital assets for U.S. federal income tax purposes. This discussion is based upon provisions of the U.S. Internal Revenue Code of 1986, as amended (the “Code”), the Treasury regulations promulgated under the Code, and U.S. administrative rulings and court decisions, all as in effect on the date hereof and all of which are subject to change, possibly with retroactive effect, and differing interpretations. Changes in these authorities may cause the U.S. federal income tax consequences of the Reverse Stock Split to vary substantially from the consequences summarized below.

This summary does not address all aspects of U.S. federal income taxation that may be relevant to stockholders in light of their particular circumstances or to stockholders who may be subject to special tax treatment under the Code, including, without limitation, dealers in securities, commodities or foreign currency, persons who are treated as non-U.S. persons for U.S. federal income tax purposes, certain former citizens or long-term residents of the United States, insurance companies, tax-exempt organizations, banks, financial institutions, small business investment companies, regulated investment companies, real estate investment trusts, retirement plans, persons that are partnerships or other pass-through entities for U.S. federal income tax purposes, persons whose functional currency is not the U.S. dollar, traders that mark-to-market their securities, persons subject to the alternative minimum tax, persons who hold their shares of common stock as part of a hedge, straddle, conversion or other risk reduction transaction, or who acquired their shares of common stock pursuant to the exercise of compensatory stock options, the vesting of previously restricted shares of stock or otherwise as compensation. If a partnership or other entity classified as a partnership for U.S. federal income tax purposes holds shares of common stock, the tax treatment of a partner thereof will generally depend upon the status of the partner and upon the activities of the partnership. If you are a partner in a partnership holding shares of the Company’s common stock, you should consult your tax advisor regarding the tax consequences of the Reverse Stock Split.

The Company has not sought and will not seek an opinion of counsel or a ruling from the Internal Revenue Service (the “IRS”), regarding the federal income tax consequences of the Reverse Stock Split. The state and local tax consequences of the Reverse Stock Split may vary as to each stockholder, depending on the jurisdiction in which such stockholder resides. This discussion should not be considered as tax or investment advice, and the tax consequences of the Reverse Stock Split may not be the same for all stockholders. Stockholders should consult their own tax advisors to know their individual federal, state, local and foreign tax consequences.

Tax Consequences to the Company

We believe that the Reverse Stock Split will constitute a reorganization under Section 368(a)(1)(E) of the Code. Accordingly, we should not recognize taxable income, gain or loss in connection with the Reverse Stock Split. In addition, we do not expect the Reverse Stock Split to affect our ability to utilize our net operating loss carryforwards.

Tax Consequences to Stockholders

Stockholders should not recognize any gain or loss for U.S. federal income tax purposes as a result of the Reverse Stock Split, except to the extent of any cash received in lieu of a fractional share of common stock (which fractional share will be treated as received and then exchanged for cash). Each stockholder’s aggregate tax basis in the common stock received in the Reverse Stock Split, including any fractional share treated as received and then exchanged for cash, should equal the stockholder’s aggregate tax basis in the common stock exchanged in the Reverse Stock Split. In addition, each stockholder’s holding period for the common stock it receives in the Reverse Stock Split should include the stockholder’s holding period for the common stock exchanged in the Reverse Stock Split.

12

Table of Contents

In general, a stockholder who receives cash in lieu of a fractional share of common stock pursuant to the Reverse Stock Split should be treated for U.S. federal income tax purposes as having received a fractional share pursuant to the Reverse Stock Split and then as having received cash in exchange for the fractional share and should generally recognize capital gain or loss equal to the difference between the amount of cash received and the stockholder’s tax basis allocable to the fractional share. Any capital gain or loss will generally be long term capital gain or loss if the stockholder’s holding period in the fractional share is greater than one year as of the effective date of the Reverse Stock Split. Special rules may apply to cause all or a portion of the cash received in lieu of a fractional share to be treated as dividend income with respect to certain stockholders who own more than a minimal amount of common stock (generally more than 1%) or who exercise some control over the affairs of the Company. Stockholders should consult their own tax advisors regarding the tax effects to them of receiving cash in lieu of fractional shares based on their particular circumstances.

Interests of Directors and Executive Officers

Our directors and executive officers have no substantial interests, directly or indirectly, in the matters set forth herein regarding the proposed Reverse Stock Split, except to the extent of their ownership of shares of our common stock.

Reservation of Right to Abandon Reverse Stock Split

We reserve the right to abandon the Reverse Stock Split without further action by our stockholders at any time before the effectiveness of the filing with the Secretary of the State of Delaware of the amendment to our amended and restated certificate of incorporation, even if the authority to effect the Reverse Stock Split has been approved by our stockholders at the Special Meeting. By voting in favor of the Reverse Stock Split, you are expressly also authorizing the Board to delay, not to proceed with, and abandon, the Reverse Stock Split if it should so decide, in its sole discretion, that such action is in the best interests of the Company.

Vote Required; Recommendation of the Board of Directors

The affirmative vote of holders of a majority of outstanding shares of common stock entitled to vote on the proposal is required to approve the amendment to the amended and restated certificate of incorporation of the Company effecting the Reverse Stock Split.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL 1.

13

Table of Contents

APPROVAL OF THE ADJOURNMENT OF THE SPECIAL MEETING, IF NECESSARY, TO CONTINUE TO SOLICIT VOTES FOR PROPOSAL NO. 1

Proposal

If at the Special Meeting, the number of shares of the common stock present or represented and voting in favor of Proposal 1 is insufficient to approve the proposal, our management may move to adjourn the Special Meeting in order to enable our Board to continue to solicit additional proxies in favor of Proposal 1. In that event, you will be asked to vote only upon the adjournment, postponement or continuation proposal and not on any other proposals.

In this proposal, we are asking you to authorize the holder of any proxy solicited by our Board to vote in favor of adjourning the Special Meeting and any later adjournments. If our stockholders approve the proposal, we could adjourn the Special Meeting, and any adjourned session of the Special Meeting, to use the additional time to solicit additional proxies in favor of Proposal 1, including the solicitation of proxies from stockholders that have previously voted against the proposal. Among other things, approval of the adjournment proposal could mean that, even if proxies representing a sufficient number of votes against Proposal 1 have been received, we could adjourn, postpone or continue the Special Meeting without a vote on Proposal 1 and seek to convince the holders of those shares to change their votes to votes in favor of the approval of Proposal 1.

Vote Required

Approval of any adjournment of the Special Meeting, if necessary, to continue to solicit additional votes for Proposal 1 requires the affirmative “FOR” vote of a majority of those shares present in person or represented by proxy and entitled to vote at the Special Meeting. No proxy that is specifically marked “AGAINST” Proposal 2 will be voted in favor of the adjournment, unless it is specifically marked “FOR” the discretionary authority to adjourn, postpone or continue the Special Meeting to a later date.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL 2.

14

Table of Contents

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the ownership of the Company’s common stock as of November 10, 2022 by: (i) each director; (ii) each of the named executive officers named in the Summary Compensation Table in the Company’s definitive proxy statement for its 2022 annual meeting of stockholders; (iii) all current executive officers and directors of the Company as a group; and (iv) all those known by the Company to be beneficial owners of more than five percent of its common stock.

| Beneficial Owner | Number of Shares Beneficially Owned |

Percentage of Shares Beneficially Owned |

||||||

| 5% Stockholders |

||||||||

| Norman H. Pessin (1) |

6,985,923 | 6.8 | % | |||||

| Named Executive Officers and Directors |

||||||||

| Ronald Menezes(2) |

417,822 | * | ||||||

| Oliver Bennett(3) |

141,382 | * | ||||||

| Andrew Schmidt(4) |

22,776 | * | ||||||

| Kevin O’Bolye(5) |

133,799 | * | ||||||

| Philippe A. Schaison(6) |

114,798 | * | ||||||

| Keith Sullivan(7) |

292,048 | * | ||||||

| Mary Fisher(8) |

75,841 | * | ||||||

| Caroline Van Hove(9) |

133,969 | * | ||||||

| Irina Erenburg(10) |

6,794 | * | ||||||

| Nori Ebersole(11) |

6,794 | * | ||||||

| All current executive officers and directors as a group |

1,346,023 | 1.3 | %4 | |||||

| * | Less than one percent |

This table is based upon information supplied by officers, directors and principal stockholders and Schedules 13G and 13D filed with the SEC. Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, the Company believes that each of the stockholders named in this table has sole voting and investment power with respect to the shares indicated as beneficially owned. Applicable percentages are based on 100,995,909 shares outstanding on November 10, 2022. In computing the number of shares of common stock beneficially owned by a person and the percentage ownership of that person, we have included outstanding shares of common stock options held by that person that are currently exercisable or exercisable within 60 days after November 10, 2022 and restricted stock units, or RSUs, that are vesting within 60 days after November 10, 2022. We have not deemed these shares outstanding, however, for the purpose of computing the percentage ownership of any other person.

Except as otherwise noted below, the address for each person or entity listed in the table is c/o Sientra, Inc., 420 South Fairview Avenue, Suite 200, Santa Barbara, California 93117.

| (1) | According to Schedule 13D filed with the SEC on November 15, 2022. The address for Mr. Pessin is 400 E 51st St, PH 31, New York, NY 10022. The information in the table includes warrants to purchase 1,315,000 shares of common stock exercisable within 60 days of November 10, 2022. |

| (2) | Consists of (i) 140,802 shares held of record by Mr. Menezes and (ii) 277,020 stock options exercisable within 60 days of November 10, 2022. |

| (3) | Consists of 141,382 shares held of record by Mr. Bennett. |

| (4) | Consists of 22,776 shares held of record by Mr. Schmidt. |

15

Table of Contents

| (5) | Consists of (i) 117,672 shares held of record by Mr. O’Boyle. and (ii) 16,127 stock options exercisable within 60 days of November 10, 2022. |

| (6) | Consists of 114,798 shares held of record by Mr. Schaison. |

| (7) | Consists of 292,048 shares held of record by Mr. Sullivan. |

| (8) | Consists of 75,841 shares held of record by Ms. Fisher. |

| (9) | Consists of (i) 78,579 shares held of record by Ms. Van Hove, (ii) 55,390 stock options exercisable within 60 days of November 10, 2022. |

| (10) | Consists of 6,794 shares held of record by Ms. Erenburg. |

| (11) | Consists of 6,794 shares held of record by Ms. Ebersole. |

| (12) | Consists of 348,537 stock options exercisable within 60 days of November 10, 2022. |

The Board of Directors knows of no other matters that will be presented for consideration at the Special Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on such matters in accordance with their best judgment.

| By Order of the Board of Directors |

| /s/ CAROLINE VAN HOVE |

| Caroline Van Hove Executive Chair of the Board |

November 29, 2022

16

Table of Contents

CERTIFICATE OF AMENDMENT TO THE

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION OF

SIENTRA, INC.

a Delaware corporation

Sientra, Inc. (the “Corporation”), a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the “DGCL”), hereby certifies as follows:

| 1. | The name of the Corporation is Sientra, Inc. The date of filing of the original Certificate of Incorporation of the Corporation with the Secretary of State of the State of Delaware was August 29, 2003. |

| 2. | This Certificate of Amendment to the Amended and Restated Certificate of Incorporation (this “Certificate of Amendment”) amends the Corporation’s current Amended and Restated Certificate of Incorporation (as amended, the “Prior Certificate”), and has been duly adopted by the Corporation’s Board of Directors and stockholders in accordance with the provisions of Section 242 of the DGCL and the provisions of the Prior Certificate. |

| 3. | Article FOURTH of the Prior Certificate is hereby amended by adding a new Section D stating the following: |

“D. REVERSE SPLIT. Upon the effectiveness of this Certificate of Amendment pursuant to Section 242 of the DGCL, each [* (*)] shares of Common Stock outstanding immediately prior to such filing shall be automatically combined into one (1) share of Common Stock. The aforementioned reclassification shall be referred to collectively as the “Reverse Split.” The number of authorized shares of Common Stock, and the par value thereof, shall remain as set forth in this Certificate of Incorporation.

The Reverse Split shall occur without any further action on the part of the Corporation or stockholders of the Corporation and whether or not certificates representing such stockholders’ shares prior to the Reverse Split are surrendered for cancellation. All shares of Common Stock (including fractions thereof) issuable upon the Reverse Split held by a stockholder prior to the Reverse Split shall be aggregated. No fractional interest in a share of Common Stock shall be deliverable upon the Reverse Split and each stockholder who would otherwise be entitled to a receive a fraction of a share of Common Stock upon the Reverse Split (after aggregating all shares of Common Stock held by a stockholder as aforesaid) shall, in lieu thereof, be entitled to receive a cash payment in an amount equal to the product of (x) the fractional share of Common Stock to which such stockholder would otherwise be entitled multiplied by (y) the closing price of the Corporation’s Common Stock as reported on the Nasdaq Global Select Market on the date of the filing of this Certificate of Amendment to the Restated Certificate of Incorporation with the Secretary of State of the State of Delaware multiplied by (z) the number of shares of Common Stock being combined into one share of Common Stock in the Reverse Split. The Corporation shall not be obliged to issue certificates evidencing the shares of Common Stock outstanding as a result of the Reverse Split unless and until all of the certificates evidencing the shares held by a holder prior to the Reverse Split are either delivered to the Corporation or its transfer agent, or the holder notifies the Corporation or its transfer agent that any certificates not so delivered have been lost, stolen or destroyed and executes an agreement satisfactory to the Corporation to indemnify the Corporation from any loss incurred by it in connection with such certificates.”

| 4. | All other provisions of the Prior Certificate shall remain in full force and effect. |

| 5. | This Certificate of Amendment shall be effective at [___] P.M. Eastern Time on December __, 2022. |

[the signature page follows]

Table of Contents

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to its Amended and Restated Certificate of Incorporation to be executed by its duly authorized officer.

| Dated: [____ __], 2022 | SIENTRA, INC. | |||||

| By: |

| |||||

| Name: | Ronald Menezes | |||||

| Title: | Chief Executive Officer | |||||

| * | By approving this amendment, stockholders will approve the combination of any whole number of shares of common stock between and including five (5) and fifteen (15) into one (1) share. The certificate of amendment filed with the Secretary of State of the State of Delaware will include only that number determined by the Board of Directors to be in the best interests of the Corporation and its stockholders. The Board of Directors will not implement any amendment providing for a different split ratio. |

Signature Page to Certificate of Amendment

Table of Contents

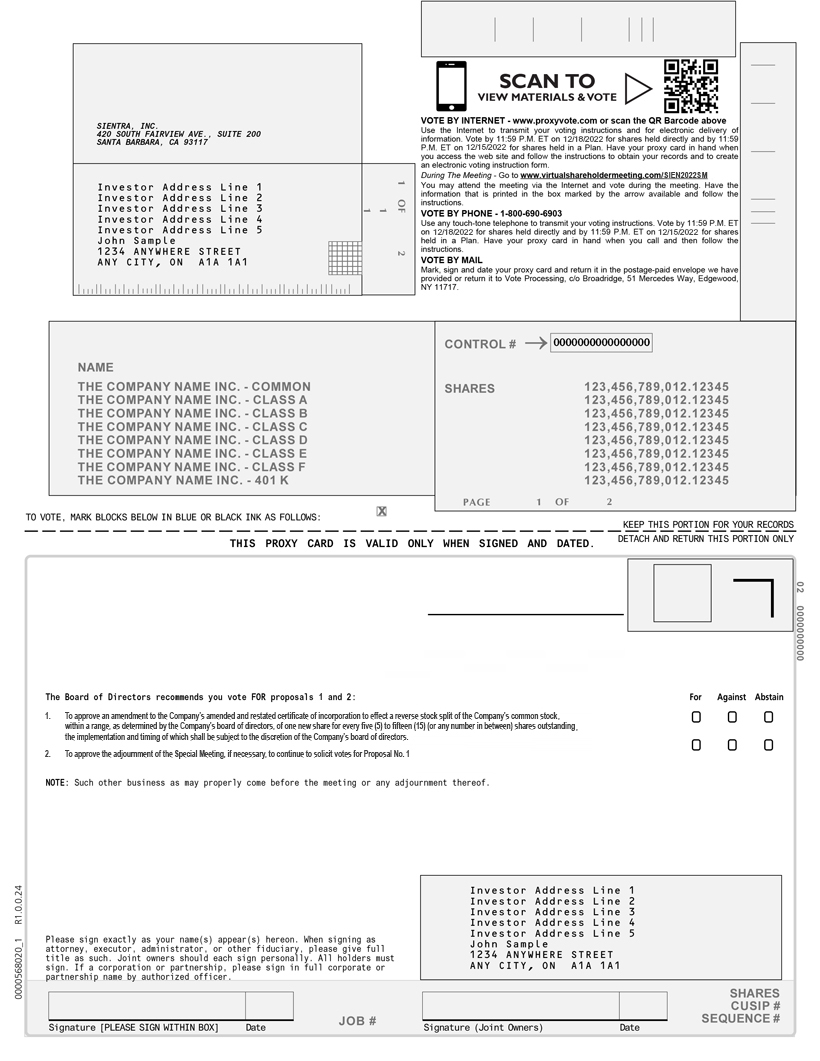

SIENTRA, INC. 420 SOUTH FAIRVIEW AVE., SUITE 200 SANTA BARBARA, CA 93117 Investor Address Line 1 Investor Address Line 2 Investor Address Line 3 Investor Address Line 4 Investor Address Line 5 John Sample 1234 ANYWHERE STREET ANY CITY, ON A1A 1A1 1 OF 2 11 SCAN TO VIEW MATERIALS & VOTE VOTE BY INTERNET - www.proxyvote.com or scan the QR Barcode above Use the Internet to transmit your voting instructions and for electronic delivery of information. Vote by 11:59 P.M. ET on 12/18/2022 for shares held directly and by 11:59 P.M. ET on 12/15/2022 for shares held in a Plan. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. During The Meeting - Go to www.virtualshareholdermeeting.com/SIEN2022SM You may attend the meeting via the Internet and vote during the meeting. Have the information that is printed in the box marked by the arrow available and follow the instructions. VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions. Vote by 11:59 P.M. ET on 12/18/2022 for shares held directly and by 11:59 P.M. ET on 12/15/2022 for shares held in a Plan. Have your proxy card in hand when you call and then follow the instructions. VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. NAME THE COMPANY NAME INC. COMMON THE COMPANY NAME INC. - CLASS A THE COMPANY NAME INC. - CLASS B THE COMPANY NAME INC. - CLASS C THE COMPANY NAME INC. - CLASS D THE COMPANY NAME INC. - CLASS E THE COMPANY NAME INC. - CLASS F THE COMPANY NAME INC. - 401 K CONTROL # 0000000000000000 SHARES 123,456,789,012.12345 123,456,789,012.12345 123,456,789,012.12345 123,456,789,012.12345 123,456,789,012.12345 123,456,789,012.12345 123,456,789,012.12345 123,456,789,012.12345 PAGE 1 OF 2 TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: KEEP THIS PORTION FOR YOUR RECORDS DETACH AND RETURN THIS PORTION ONLY THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. The Board of Directors recommends you vote FOR proposals 1 and 2: 1. To approve an amendment to the Companys amended and restated certificate of incorporation to effect a reverse stock split of the Companys common stock, within a range, as determined by the Companys board of directors, of one new share for every five (5) to fifteen (15) (or any number in between) shares outstanding, the implementation and timing of which shall be subject to the discretion of the Companys board of directors. 2. To approve the adjournment of the Special Meeting, if necessary, to continue to solicit votes for Proposal No. 1 NOTE: Such other business as may properly come before the meeting or any adjournment thereof. For Against Abstain Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer. Investor Address Line 1 Investor Address Line 2 Investor Address Line 3 Investor Address Line 4 Investor Address Line 5 John Sample 1234 ANYWHERE STREET ANY CITY, ON A1A 1A1 Signature [PLEASE SIGN WITHIN BOX] Date JOB # Signature (Joint Owners) Date SHARES CUSIP # SEQUENCE # 0000568020_1 R1.0.0.24 02 0000000000

Table of Contents

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting: The Proxy Statement and Form 10-K are available at www.proxyvote.com SIENTRA, INC. Special Meeting of Stockholders December 19, 2022 9:00 AM PDT This proxy is solicited by the Board of Directors The stockholder hereby appoints Ronald Menezes and Oliver C. Bennett, or either of them, as proxies, each with the power to appoint his substitute, and hereby authorizes them to represent and to vote, as designated on the reverse side of this ballot, all of the shares of common stock of SIENTRA, INC. that the stockholder is entitled to vote at the Special Meeting of Stockholders to be held at 9:00 AM, Pacific Daylight Time on December 19, 2022, by live webcast, which can be accessed on the Internet by visiting www.virtualshareholdermeeting.com/SIEN2022SM. To access the Special Meeting of Stockholders you will need the information that is printed in the box marked by the arrow (located on the "Agenda" page of this proxy). This proxy, when properly executed, will be voted in the manner directed herein. If no such direction is made, this proxy will be voted in accordance with the Board of Director's recommendations. Continued and to be signed on reverse side 0000568020_2 R1.0.0.24

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Agents Win Again! Epique Realty Amazes with Incredible Last Benefit Reveal at PowerCON: Delta Dental and Vision

- Australian Oilseeds, Largest APAC Producer of Non-Chemical, Non-GMO “Cold-Processing” Vegetable Oil, Enters into Contract with Woolworths and Costco Australia.

- Belite Bio Announces $25 Million Registered Direct Offering

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share