Form DEF 14A PIMCO Flexible Municipal For: Jun 08

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☑ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | Definitive Joint Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

PIMCO Flexible Credit Income Fund

PIMCO Flexible Municipal Income Fund

PIMCO Managed Accounts Trust

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☑ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) |

Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials: | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

PIMCO FLEXIBLE CREDIT INCOME FUND (“PFLEX”)

PIMCO FLEXIBLE MUNICIPAL INCOME FUND (“PMFLX”)

PIMCO MANAGED ACCOUNTS TRUST (“PMAT”), on behalf of each individual series thereof:

Fixed Income SHares: Series C (“FISH: Series C”)

Fixed Income SHares: Series M (“FISH: Series M”)

Fixed Income SHares: Series R (“FISH: Series R”)

Fixed Income SHares: Series TE (“FISH: Series TE”)

Fixed Income SHares: Series LD (“FISH: Series LD”)

650 Newport Center Drive

Newport Beach, California 92660

April 21, 2021

Dear Shareholder:

On behalf of the Board of Trustees of each of PIMCO Flexible Credit Income Fund (“PFLEX”), PIMCO Flexible Municipal Income Fund (“PMFLX” and, together with PFLEX, the “Interval Funds”) and PIMCO Managed Accounts Trust (“PMAT”) (each individual series thereof, a “Portfolio” and, together with the Interval Funds, the “Funds”), I am pleased to invite you to a joint special meeting of shareholders (the “Meeting”) of the Funds, to be held at 650 Newport Center Drive, Newport Beach, California 92660 on June 8, 2021 at 9:00 A.M., Pacific Time.

At the Meeting, shareholders of each Fund will be asked to vote on the election of Trustees to the Board of Trustees of such Fund.

Your vote is important. After reviewing the proposal, the Board of Trustees of each Fund unanimously recommends that you vote “FOR” the election of the nominees. For more information about the proposal, please refer to the accompanying Proxy Statement.

No matter how many shares you own, your timely vote is important. If you are not able to attend the Meeting, then please complete, sign, date and mail the enclosed proxy card(s) promptly in order to avoid the expense of additional mailings. If you have any questions regarding the Proxy Statement, please call (877) 864-5059.

Thank you in advance for your participation in this important event.

| Sincerely, |

|

|

| Eric D. Johnson |

| President |

NOTICE OF JOINT SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 8, 2021

PIMCO FLEXIBLE CREDIT INCOME FUND (“PFLEX”)

PIMCO FLEXIBLE MUNICIPAL INCOME FUND (“PMFLX”)

PIMCO MANAGED ACCOUNTS TRUST (“PMAT”), on behalf of each individual series thereof:

Fixed Income SHares: Series C (“FISH: Series C”)

Fixed Income SHares: Series M (“FISH: Series M”)

Fixed Income SHares: Series R (“FISH: Series R”)

Fixed Income SHares: Series TE (“FISH: Series TE”)

Fixed Income SHares: Series LD (“FISH: Series LD”)

650 Newport Center Drive,

Newport Beach, California 92660

To the Shareholders of PIMCO Flexible Credit Income Fund (“PFLEX”), PIMCO Flexible Municipal Income Fund (“PMFLX” and, together with PFLEX, the “Interval Funds”), and PIMCO Managed Accounts Trust (“PMAT”) (each individual series thereof, a “Portfolio” and, together with the Interval Funds, the “Funds”):

Notice is hereby given that a Joint Special Meeting of Shareholders of each Fund (the “Meeting”) will be held at the offices of Pacific Investment Management Company LLC (“PIMCO” or the “Manager”), at 650 Newport Center Drive, Newport Beach, California 92660, on Tuesday, June 8, 2021, beginning at 9:00 A.M., Pacific Time, for the following purposes, which are more fully described in the accompanying Proxy Statement:1

| 1. | To elect Trustees of each Fund, each to hold office for the term indicated and until his or her successor shall have been elected and qualified; and |

| 2. | To transact such other business as may properly come before the Meeting or any adjournment(s) or postponement(s) thereof. |

If you are planning to attend the Meeting in-person, please call (877) 864-5059 in advance.

The Board of Trustees of each Fund has fixed the close of business on April 1, 2021 as the record date for the determination of shareholders entitled to receive notice of, and to vote at, the Meeting or any adjournment(s) or postponement(s) thereof. The enclosed proxy is being solicited on behalf of the Board of Trustees of each Fund.

If you have any questions regarding the enclosed proxy materials or need assistance in voting your shares, please contact AST Fund Solutions, LLC, at (877) 864-5059 Monday through Friday from 9:00 a.m. to 10:00 p.m., Eastern time.

| 1 | The principal executive offices of the Funds are located at 1633 Broadway, New York, New York 10019. |

PIMCO is sensitive to the health and travel concerns of the Funds’ shareholders and the evolving recommendations from public health officials. Due to the difficulties arising from the coronavirus known as COVID-19, the date, time, location or means of conducting the Meeting may change. In the event of such a change, the Funds will issue a press release announcing the change and file the announcement on the Securities and Exchange Commission’s (the “SEC”) EDGAR system, among other steps, but may not deliver additional soliciting materials to shareholders or otherwise amend the Funds’ proxy materials. The Funds may consider imposing additional procedures or limitations on Meeting attendees or conducting the Meeting as a “virtual” shareholder meeting through the internet or other electronic means in lieu of an in-person meeting, subject to any restrictions imposed by applicable law. If the Meeting will be held virtually in whole or in part, a Fund will notify its shareholders of such plans in a timely manner and disclose clear directions as to the logistical details of the “virtual” meeting, including how shareholders can remotely access, participate in and vote at such meeting. The Funds plan to announce these changes, if any, at pimco.com/en-us/our-firm/press-release, and encourage you to check this website prior to the Meeting if you plan to attend.

| By order of the Board of Trustees of each Fund, |

|

|

| Wu-Kwan Kit |

| Vice President, Senior Counsel and Secretary |

Newport Beach, California

April 21, 2021

It is important that your shares be represented at the Meeting in person or by proxy, no matter how many shares you own. If you do not expect to attend the Meeting, please complete, date, sign and return the applicable enclosed proxy or proxies in the accompanying envelope, which requires no postage if mailed in the United States. Please mark and mail your proxy or proxies promptly in order to save any additional costs of further proxy solicitations and in order for the Meeting to be held as scheduled.

PIMCO FLEXIBLE CREDIT INCOME FUND (“PFLEX”)

PIMCO FLEXIBLE MUNICIPAL INCOME FUND (“PMFLX”)

PIMCO MANAGED ACCOUNTS TRUST (“PMAT”), on behalf of each individual series thereof:

Fixed Income SHares: Series C (“FISH: Series C”)

Fixed Income SHares: Series M (“FISH: Series M”)

Fixed Income SHares: Series R (“FISH: Series R”)

Fixed Income SHares: Series TE (“FISH: Series TE”)

Fixed Income SHares: Series LD (“FISH: Series LD”)

650 Newport Center Drive,

Newport Beach, California 92660

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE JOINT SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 8, 2021

This Proxy Statement, the Annual Report to Shareholders for the fiscal year ended December 31, 2020 for PMFLX and the Annual Report to Shareholders for the fiscal year ended June 30, 2020 for PFLEX are available at pimco.com/en-us/capabilities/interval-funds. This Proxy Statement and the Annual Report to Shareholders for the fiscal year ended December 31, 2020 for PMAT are available at pimco.com/en-us/investments/fish.

PROXY STATEMENT

April 21, 2021

FOR THE JOINT SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 8, 2021

INTRODUCTION

This Proxy Statement is furnished in connection with the solicitation by the Board of Trustees (each a “Board”) of the shareholders of each of PIMCO Flexible Credit Income Fund (“PFLEX”), PIMCO Flexible Municipal Income Fund (“PMFLX” and, together with PFLEX, the “Interval Funds”), and PIMCO Managed Accounts Trust (“PMAT”) (each individual series thereof, a “Portfolio” and, PMAT together with the Interval Funds, the “Funds”) of proxies to be voted at the Joint Special Meeting of Shareholders of each Fund

1

(“Meeting”) and any adjournment(s) or postponement(s) thereof. The Meeting will be held at the offices of Pacific Investment Management Company LLC (“PIMCO” or the “Manager”), at 650 Newport Center Drive, Newport Beach, California 92660, on Tuesday, June 8, 2021, beginning at 9:00 A.M., Pacific Time. The principal executive offices of each Fund are located at 1633 Broadway, between West 50th and West 51st Streets, 42nd Floor, New York, New York 10019.

The Notice of Joint Special Meeting of Shareholders (the “Notice”), this Proxy Statement and the enclosed proxy cards are first being sent to Shareholders on or about April 27, 2021.

The Meeting is scheduled as a joint meeting of the holders of all shares of the Funds, which consist of holders of common shares of each Fund (the “Common Shareholders”) and, with respect to PMFLX only, Common Shareholders and holders of preferred shares, which include Variable Rate MuniFund Term Preferred Shares (“VMTPs”) and Remarketable Variable Rate MuniFund Term Preferred Shares (“RVMTPs”) (the “Preferred Shareholders” and, together with the Common Shareholders, the “Shareholders”). The Shareholders of each Fund are expected to consider and vote on similar matters. The Shareholders of each Fund will vote on the applicable proposal set forth herein (“Proposal”) and on any other matters that may properly be presented for vote by Shareholders of that Fund. The outcome of voting by the Shareholders of one Fund does not affect the outcome for the other Funds.

The Board of each Fund has fixed the close of business on April 1, 2021 as the record date (the “Record Date”) for the determination of Shareholders of each Fund entitled to notice of, and to vote at, the Meeting. The Shareholders of each Fund on the Record Date will be entitled to one vote per share on each matter to which they are entitled to vote and that is to be voted on by Shareholders of the Fund, and a fractional vote with respect to fractional shares, with no cumulative voting rights in the election of Trustees. With respect to PMFLX, the Preferred Shareholders will have equal voting rights (i.e., one vote per Share) with the Common Shareholders and will vote together with Common Shareholders as a single class. As summarized in the table below:

PFLEX:

The Common Shareholders of PFLEX, voting together as a single class, have the right to vote on the election of E. Grace Vandecruze, Sarah E. Cogan, Joseph B. Kittredge, Jr. and David N. Fisher, as Trustees of the Fund.

2

PMFLX:

The Common and Preferred Shareholders of PMFLX, voting together as a single class, have the right to vote on the election of E. Grace Vandecruze and Joseph B. Kittredge, Jr. as Trustees of the Fund.

PMAT:

The Common Shareholders of each Portfolio, voting together as a single class, have the right to vote on the election of E. Grace Vandecruze, Sarah E. Cogan, Joseph B. Kittredge, Jr. and David N. Fisher, as Trustees of the Fund.

Summary

| Proposal |

Common Shareholders |

Preferred Shareholders |

||||||

| Election of Trustees |

||||||||

| PFLEX |

||||||||

| Independent Trustees/Nominees* |

||||||||

| E. Grace Vandecruze |

✓ | N/A | ||||||

| Sarah E. Cogan |

✓ | N/A | ||||||

| Joseph B. Kittredge, Jr. |

✓ | N/A | ||||||

| Interested Trustees/Nominees** |

||||||||

| David N. Fisher |

✓ | N/A | ||||||

| PMFLX |

||||||||

| Independent Trustees/Nominees* |

||||||||

| E. Grace Vandecruze |

✓ | ✓ | ||||||

| Joseph B. Kittredge, Jr. |

✓ | ✓ | ||||||

| PMAT |

||||||||

| Independent Trustees/Nominees* |

||||||||

| E. Grace Vandecruze |

✓ | N/A | ||||||

| Sarah E. Cogan |

✓ | N/A | ||||||

| Joseph B. Kittredge, Jr. |

✓ | N/A | ||||||

| Interested Trustees/Nominees** |

||||||||

| David N. Fisher |

✓ | N/A | ||||||

| * | “Independent Trustees” or “Independent Nominees” are those Trustees or nominees for Trustees of the Funds (the “Nominees”) who are not “interested persons,” as defined in the Investment Company Act of 1940, as amended (the “1940 Act”), of each Fund. |

| ** | Mr. Fisher is an “interested person” of each Fund, as defined in Section 2(a)(19) of the 1940 Act (“Interested Trustee” or “Interested Nominee”), due to his affiliation with PIMCO and its affiliates. |

3

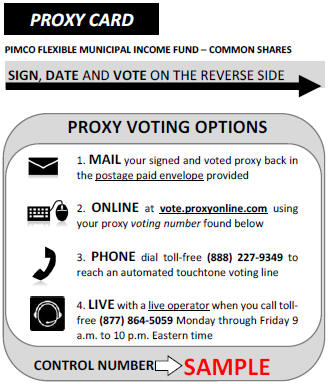

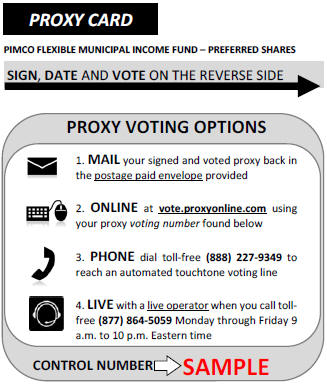

You may vote by mail by returning a properly executed proxy card, by internet by going to the website listed on the proxy card, by telephone using the toll-free number listed on the proxy card, or in person by attending the Meeting. Shares represented by duly executed and timely delivered proxies will be voted as instructed on the proxy. If you execute and mail the enclosed proxy and no choice is indicated for the election of Trustees listed in the attached Notice, your proxy will be voted in favor of the election of all Nominees. At any time before it has been voted, your proxy may be revoked in one of the following ways: (i) by timely delivering a signed, written letter of revocation to the Chief Legal Officer of the applicable Fund at 650 Newport Center Drive, Newport Beach, CA 92660, (ii) by properly executing and timely submitting a later-dated proxy vote to the Funds, or (iii) by attending the Meeting and voting in person. If you are planning to attend the Meeting in-person, please call 1-877-864-5059 in advance. You may also call this phone number for information on how to obtain directions to be able to attend the Meeting and vote in person or for information or assistance regarding how to vote by telephone, mail or by internet. Please note that any shareholder wishing to attend the meeting in-person is required to comply with any health regulations adopted by federal, state and local governments and PIMCO. If any proposal, other than the Proposal set forth herein, properly comes before the Meeting, the persons named as proxies will vote in their sole discretion.

The principal executive offices of the Funds are located at 1633 Broadway, New York, New York 10019. PIMCO serves as the investment manager of each Fund. Additional information regarding the Manager may be found under “Additional Information — Investment Manager” below.

The solicitation will be primarily by mail and by telephone and the cost of soliciting proxies for each Fund will be borne by PIMCO. Certain officers of the Funds and certain officers and employees of the Manager or its affiliates and, with respect PMAT, other representatives of the Fund or by wrap program sponsors and their representatives (none of whom will receive additional compensation therefor) may solicit proxies by telephone, mail, e-mail and personal interviews. Any out-of-pocket expenses incurred in connection with the solicitation will be borne by PIMCO, including the costs of retaining AST Fund Solutions, LLC, which are estimated to be approximately $86,000.

Unless a Fund receives contrary instructions, only one copy of this Proxy Statement will be mailed to a given address where two or more Shareholders share that address and also share the same surname. Additional copies of the Proxy Statement will be delivered promptly upon request. Requests may be sent to the Secretary of the Fund c/o Pacific Investment Management Company LLC, 650 Newport Center Drive, Newport Beach, California 92660, or by calling 1-877-864-5059 on any business day.

4

PROPOSAL: ELECTION OF TRUSTEES

The Governance and Nominating Committee and the Board of each Fund have recommended the Nominees listed herein for election as Trustees by the Shareholders of such Fund.

PFLEX. The Governance and Nominating Committee of PFLEX has recommended to the Board that E. Grace Vandecruze, Sarah E. Cogan, Joseph B. Kittredge, Jr. and David N. Fisher be nominated for election by the Common Shareholders, voting as a single class, as Trustees of the Fund.

PMFLX. The Governance and Nominating Committee of PMFLX has recommended to the Board that E. Grace Vandecruze and Joseph B. Kittredge, Jr. be nominated for election by the Common Shareholders and Preferred Shareholders, voting together as a single class, as Trustees of the Fund.

PMAT. The Governance and Nominating Committee of the Fund has recommended to the Board that E. Grace Vandecruze, Sarah E. Cogan, Joseph B. Kittredge, Jr. and David N. Fisher be nominated for election by Shareholders of each Portfolio, voting together as a single class, as Trustees of the Fund.

Mses. Vandecruze and Cogan and Mr. Kittredge are Independent Nominees, and Mr. Fisher is an Interested Nominee. Each of the Nominees was recommended for nomination by the Board of Trustees of each Fund, including the Independent Trustees. The election of each Nominee will be effective upon such Nominee’s receiving the required vote for his or her election, as discussed below.

The Board of Trustees of each Fund is currently composed of eight Trustees, six of whom are Independent Trustees and two of whom are Interested Trustees. The current Trustees are Hans W. Kertess, Deborah A. DeCotis, Joseph B. Kittredge, Jr., John C. Maney, William B. Ogden, IV, Sarah E. Cogan, David N. Fisher and Alan Rappaport. Ms. Vandecruze is the only Nominee who is not currently serving as a Trustee of the Funds. Mr. Jacobson, a former Independent Trustee, retired from the Board of each Fund effective December 31, 2020.

In light of Mr. Jacobson’s retirement, the Board of each Fund believes that it is desirable to nominate a new Trustee to the Board of each Fund. After a thorough search, the Governance and Nominating Committee nominated Ms. Vandecruze as a Trustee for each Fund. This recommendation is based, in part, on Ms. Vandecruze’s many years of investment banking experience, including experience advising insurance companies and financial organizations

5

on various corporate matters and transactions, as well as her prior service on corporate boards. Accordingly, at its March 18, 2021 meeting, upon the recommendation of the Governance and Nominating Committee, the Board of Trustees of each Fund voted, effective at the time of the Meeting, to increase the number of Trustees comprising the Board of each Fund from eight to nine pursuant to Article IV, Section 1 of the Amended and Restated Agreement and Declaration of Trust of each Fund, and nominate Ms. Vandecruze for election by Shareholders at the Meeting to serve as an Independent Trustee of the Funds.

Section 16(a) of the 1940 Act requires a shareholder vote to elect a new trustee of a fund if, after the new trustee’s appointment to the board, the board would have less than two-thirds (66.67%) of its trustees elected by shareholders. Messrs. Rappaport, Kertess, Ogden and Maney and Ms. DeCotis were most recently elected by the sole initial Shareholder of each of PFLEX and PMFLX on December 13, 2016 and May 15, 2018, respectively. In addition, Ms. Cogan and Mr. Fisher were elected by the sole initial shareholder of PMFLX on February 5, 2019. Messrs. Rappaport, Kertess, Ogden and Maney and Ms. DeCotis were most recently elected by Shareholders of each Portfolio on June 9, 2014. In light of the current composition of each Fund’s Board, the Funds are holding the Meeting to request that shareholders elect Ms. Vandecruze to serve as a Trustee of each Fund, and are also taking this opportunity to ask Shareholders to elect the other Fund Trustees who have not previously been elected by Shareholders in furtherance of the Funds’ current and future compliance with requirements under Section 16(a) of the 1940 Act. If all of the Nominees are approved by Shareholders of the Funds, the Board of Trustees of each Fund will consist of nine Trustees, two of whom will be Interested Trustees and seven of whom will be Independent Trustees.

If elected, each of the Nominees will serve as Trustee of the Funds during the continued lifetime of each Fund until he or she dies, resigns or is removed, or, if sooner, until the election and qualification of his or her successor. Unless authority is withheld, it is the intention of the persons named in the enclosed proxy for a Fund to vote each proxy for the persons listed above for that Fund, unless the proxy contains contrary instructions. Each of the Nominees has indicated he or she will serve if elected, but if he or she should be unable to serve for a Fund, the proxy holders may vote in favor of such substitute Nominee as the Board of each Fund may designate (or, alternatively, the Board may determine to save a vacancy).

Trustees and Officers

The business of each Fund is managed under the direction of each Fund’s Board. Subject to the provisions of each Fund’s Agreement and Declaration of

6

Trust, its Bylaws and Massachusetts law, each Board has all powers necessary and convenient to carry out its responsibilities, including the election and removal of the Fund’s officers.

Board Leadership Structure — As discussed above, the Board of Trustees of each Fund is currently composed of eight Trustees, six of whom are and are anticipated to continue to be Independent Trustees. An Independent Trustee serves as Chair of the Board of each Fund and is selected by a vote of the majority of the Independent Trustees. The Chair of the Board presides at meetings of the Board and acts as a liaison with service providers, officers, attorneys and other Trustees generally between meetings, and performs such other functions as may be requested by the Board from time to time.

The Board of each Fund regularly meets four times each year to discuss and consider matters concerning the Funds, and also holds special meetings to address matters arising between regular meetings. The Independent Trustees regularly meet outside the presence of management and are advised by independent legal counsel.

The Board of each Fund has established five standing Committees to facilitate the Trustees’ oversight of the management of the Funds: the Audit Oversight Committee, the Governance and Nominating Committee, the Valuation Oversight Committee, the Contracts Committee and the Performance Committee. The functions and role of each Committee are described below under “Board Committees and Meetings.” The membership of each Committee (other than the Performance Committee) consists of only the Independent Trustees. The Performance Committee consists of all of the Trustees. The Independent Trustees believe that participation on each Committee allows them to participate in the full range of the Board’s oversight duties.

The Board reviews its leadership structure periodically and has determined that this leadership structure, including an Independent Chair, a supermajority of Independent Trustees and Committee membership limited to Independent Trustees (with the exception of the Performance Committee), is appropriate in light of the characteristics and circumstances of each Fund. In reaching this conclusion, the Board considered, among other things, the predominant role of the Manager in the day-to-day management of Fund affairs, the extent to which the work of the Board is conducted through the Committees, the number of funds in the fund complex overseen by members of the Board that, the variety of asset classes those funds include, the assets of each Fund and the other funds in the fund complex and the management and other service arrangements of each Fund and such other funds. The Board also believes that its structure, including the presence of two Trustees who are or have been executives with the Manager or

7

Manager-affiliated entities, facilitates an efficient flow of information concerning the management of each Fund to the Independent Trustees.

Risk Oversight — Each of the Funds has retained the Manager to provide investment advisory services and administrative services. Accordingly, the Manager is immediately responsible for the management of risks that may arise from Fund investments and operations. Some employees of the Manager serve as the Funds’ officers, including the Funds’ principal executive officer and principal financial and accounting officer, chief compliance officer and chief legal officer. The Manager and the Funds’ other service providers have adopted policies, processes and procedures to identify, assess and manage different types of risks associated with each Fund’s activities. The Board of each Fund oversees the performance of these functions by the Manager and the Funds’ other service providers, both directly and through the Committee structure it has established. The Board of each Fund receives from the Manager a wide range of reports, both on a regular and as-needed basis, relating to the Funds’ activities and to the actual and potential risks of the Funds. These include reports on investment and market risks, custody and valuation of Fund assets, compliance with applicable laws, and the Funds’ financial accounting and reporting. In addition, the Board meets periodically with the individual portfolio managers of the Funds or their delegates to receive reports regarding the portfolio management of the Funds and their performance, including their investment risks. In the course of these meetings and discussions with the Manager, the Board has emphasized the importance of the Manager maintaining vigorous risk-management programs and procedures with respect to the Funds.

In addition, the Board of each Fund has appointed a Chief Compliance Officer (“CCO”). The CCO oversees the development of compliance policies and procedures that are reasonably designed to minimize the risk of violations of the federal securities laws (“Compliance Policies”). The CCO reports directly to the Independent Trustees, interacts with individuals within the Manager’s organization and provides presentations to the Board at its quarterly meetings and an annual report on the application of the Compliance Policies. The Board periodically discusses relevant risks affecting the Funds with the CCO at these meetings. The Board has approved the Compliance Policies and reviews the CCO’s reports. Further, the Boards annually review the sufficiency of the Compliance Policies, as well as the appointment and compensation of the CCO.

The Board of each Fund recognizes that the reports it receives concerning risk management matters are, by their nature, typically summaries of the relevant information. Moreover, the Board recognizes that not all risks that may affect the Funds can be identified in advance; that it may not be practical or cost-effective to eliminate or mitigate certain risks; that it may be necessary to bear certain

8

risks (such as investment-related risks) in seeking to achieve the Funds’ investment objectives; and that the processes, procedures and controls employed to address certain risks may be limited in their effectiveness.

The Trustees/Nominees and officers of the Funds, their years of birth, the positions they hold with the Funds, their terms of office and length of time served, a description of their principal occupations during the past five years, the number of portfolios in the fund complex that the Trustees oversee and any other public company directorships held by the Trustees are listed in the two tables immediately following. Except as shown, each Trustee’s and officer’s principal occupation and business experience for the last five years have been with the employer(s) indicated, although in some cases the Trustee may have held different positions with such employer(s).

9

Information Regarding Trustees and Nominees.

The following table provides information concerning the Trustees/Nominees of the Funds as of April 1, 2021.

| Name, Address, Year of Birth(1) |

Position(s) Held with the Funds |

Term of Office and Length of Time Served(2) |

Principal Occupation(s) During the Past 5 Years |

Number of Portfolios in Fund Complex(5) Overseen by Trustee/ Nominee |

Other Nominee | |||||

| Independent Trustees/Nominees | ||||||||||

| Deborah A. DeCotis 1952 |

Chair of the Board, Trustee |

PFLEX- Since

PMFLX- Since

PMAT- Since

Chair- |

Advisory Director, Morgan Stanley & Co., Inc. (since 1996); Member, Circle Financial Group (since 2009); Member, Council on Foreign Relations (since 2013); Trustee, Smith College (since 2017); and Director, Watford Re (since 2017). Formerly, Co-Chair Special Projects Committee, Memorial Sloan Kettering (2005-2015); Trustee, Stanford University (2010- 2015); Principal, LaLoop LLC, a retail accessories company (1999-2014); Director, Helena Rubenstein Foundation (1997-2010); and Director, Armor Holdings (2002-2010). | 29 | Trustee, Allianz Funds (2011-2021); Trustee, Virtus Funds (2021-Present) | |||||

10

| Name, Address, Year of Birth(1) |

Position(s) Held with the Funds |

Term of Office and Length of Time Served(2) |

Principal Occupation(s) During the Past 5 Years |

Number of Portfolios in Fund Complex(5) Overseen by Trustee/ Nominee |

Other Nominee | |||||

| Sarah E. Cogan 1956 |

Trustee, Nominee |

Since 2019 |

Retired Partner, Simpson Thacher & Bartlett LLP (law firm); Director, Girl Scouts of Greater New York, Inc. (since 2016); and Trustee, Natural Resources Defense Council, Inc. (since 2013). Formerly, Partner, Simpson Thacher & Bartlett LLP (1989-2018). | 29 | Trustee, Allianz Funds (2019-2021); Trustee, Virtus Funds (2021-Present) | |||||

| Hans W. Kertess 1939 |

Trustee | PFLEX- Since

PMFLX- Since

PMAT- Since |

President, H. Kertess & Co., a financial advisory company; and Senior Adviser (formerly, Managing Director), Royal Bank of Canada Capital Markets (since 2004). | 29 | Trustee, Allianz Funds (2004-2021); Trustee, Virtus AllianzGI Closed-End Funds (2021-Present) | |||||

11

| Name, Address, Year of Birth(1) |

Position(s) Held with the Funds |

Term of Office and Length of Time Served(2) |

Principal Occupation(s) During the Past 5 Years |

Number of Portfolios in Fund Complex(5) Overseen by Trustee/ Nominee |

Other Nominee | |||||

| Joseph B. Kittredge, Jr. 1954 |

Trustee, Nominee |

Since 2020 |

Trustee, Vermont Law School (since 2019); Director and Treasurer, Center for Reproductive Rights (since 2015). Formerly, Director (2013 to 2020) and Chair (2018 to 2020), ACLU of Massachusetts; General Counsel, Grantham, Mayo, Van Otterloo & Co. LLC (2005-2018) and Partner (2007-2018); President, GMO Trust (institutional mutual funds) (2009-2018); Chief Executive Officer, GMO Trust (2009-2015); President and Chief Executive Officer, GMO Series Trust (platform based mutual funds) (2011-2013). | 29 | Trustee, GMO Trust (2010-2018); Chairman of the Board of Trustees, GMO Series Trust (2011-2018). |

12

| Name, Address, Year of Birth(1) |

Position(s) Held with the Funds |

Term of Office and Length of Time Served(2) |

Principal Occupation(s) During the Past 5 Years |

Number of Portfolios in Fund Complex(5) Overseen by Trustee/ Nominee |

Other Nominee | |||||

| William B. Ogden, IV 1945 |

Trustee | PFLEX- Since

PMFLX- Since

PMAT- Since |

Retired. Formerly, Asset Management Industry Consultant; and Managing Director, Investment Banking Division of Citigroup Global Markets Inc. | 29 | Trustee, Allianz Funds (2006-2021); Trustee, Virtus AllianzGI Closed-End Funds (2021-Present). |

13

| Name, Address, Year of Birth(1) |

Position(s) Held with the Funds |

Term of Office and Length of Time Served(2) |

Principal Occupation(s) During the Past 5 Years |

Number of Portfolios in Fund Complex(5) Overseen by Trustee/ Nominee |

Other Nominee | |||||

| Alan Rappaport 1953 |

Trustee | PFLEX- Since

PMFLX- Since

PMAT- Since |

Adjunct Professor, New York University Stern School of Business (since 2011); Lecturer, Stanford University Graduate School of Business (since 2013); and Director, Victory Capital Holdings, Inc., an asset management firm (since 2013). Formerly, Advisory Director (formerly, Vice Chairman), Roundtable Investment Partners (2009-2018); Member of Board of Overseers, NYU Langone Medical Center (2015-2016); Trustee, American Museum of Natural History (2005-2015); Trustee, NYU Langone Medical Center (2007-2015); and Vice Chairman (formerly, Chairman and President), U.S. Trust (formerly, Private Bank of Bank of America, the predecessor entity of U.S. Trust) (2001-2008). | 29 | Trustee, Allianz Funds (2010-2021); Trustee, Virtus AllianzGI Closed-End Funds (2021-Present) |

14

| Name, Address, Year of Birth(1) |

Position(s) Held with the Funds |

Term of Office and Length of Time Served(2) |

Principal Occupation(s) During the Past 5 Years |

Number of Portfolios in Fund Complex(5) Overseen by Trustee/ Nominee |

Other Nominee | |||||

| E. Grace Vandecruze 1963 |

Nominee | N/A | Founder and Managing Director, Grace Global Capital LLC, a strategic advisory firm to the insurance industry (since 2006); Director and Member of the Audit Committee and the Wealth Solutions Advisory Committee, M Financial Group, a life insurance company (since 2015); Director, The Doctors Company, a medical malpractice insurance company (since 2020); Chief Financial Officer, Athena Technology Acquisition Corp, a special purpose acquisition company (since 2021); Director, Link Logistic REIT, a real estate company (since 2021); Director and Member of the Investment & Risk Committee, Resolution Life Group Holdings, a global life insurance group (since 2021); and Director, Wharton Graduate Executive Board. Formerly, Director, Resolution Holdings (2015-2019). Formerly, Director, SBLI USA, a life insurance company (2015-2018). | 0 | None |

15

| Name, Address, Year of Birth(1) |

Position(s) Held with the Funds |

Term of Office and Length of Time Served(2) |

Principal Occupation(s) During the Past 5 Years |

Number of Portfolios in Fund Complex(5) Overseen by Trustee/ Nominee |

Other Nominee | |||||

| Interested Trustees/Nominees | ||||||||||

| David N. Fisher(4) 1968

650 Newport Center Drive, Newport Beach, CA 92660 |

Trustee, Nominee |

Since January 2019 |

Managing Director and Co-Head of U.S. Global Wealth Management Strategic Accounts, PIMCO (since 2021); Managing Director and Head of Traditional Product Strategies, PIMCO (2015-2021); and Director, Court Appointed Special Advocates (CASA) of Orange County, a non-profit organization (since 2015). Formerly, Global Bond Strategist, PIMCO (2008-2015); and Managing Director and Head of Global Fixed Income, HSBC Global Asset Management (2005-2008). | 29 | None | |||||

16

| Name, Address, Year of Birth(1) |

Position(s) Held with the Funds |

Term of Office and Length of Time Served(2) |

Principal Occupation(s) During the Past 5 Years |

Number of Portfolios in Fund Complex(5) Overseen by Trustee/ Nominee |

Other Nominee | |||||

| John C. Maney(4) 1959

650 Newport Center Drive, Newport Beach, CA 92660 |

Trustee | PFLEX- Since

PMFLX- Since

PMAT- Since |

Consultant to PIMCO (since January 2020); Non-Executive Director and a member of the Compensation Committee of PIMCO Europe Ltd (since 2017). Formerly, Managing Director of Allianz Asset Management of America L.P. (2005-2019); member of the Management Board and Chief Operating Officer of Allianz Asset Management of America L.P (2006-2019); Member of the Management Board of Allianz Global Investors Fund Management LLC (2007-2014) and Managing Director of Allianz Global Investors Fund Management LLC (2011-2014). | 29 | None |

| (1) | Unless otherwise indicated, the business address of the persons listed above is c/o Pacific Investment Management Company LLC, 1633 Broadway, New York, New York 10019. |

| (2) | Under each Fund’s Agreement and Declaration of Trust, a Trustee serves during the continued lifetime of each Fund until he or she dies, resigns or is removed, or, if sooner, until the election and qualification of his or her successor. |

17

| (3) | Ms. Vandecruze does not currently serve as a Trustee of any Fund and is standing for initial election to each Fund’s Board at the Meeting. Ms. Vandecruze has been nominated to stand for election by the Governance and Nominating Committee and the Board of each Fund. |

| (4) | Each of Messrs. Fisher and Maney is an Interested Trustee of each Fund due to his affiliation with PIMCO and its affiliates. |

| (5) | The Term “Fund Complex” as used herein includes the Funds and any other registered investment company (i) that holds itself out to investors as a related company for purposes of investment and investor services; or (ii) for which PIMCO or an affiliate of PIMCO serves as primary investment adviser. Prior to February 1, 2021, the Fund Complex would have included a number of open- and closed-end funds advised by Allianz Global Investors U.S. LLC (“AllianzGI”), an affiliate of PIMCO. Effective February 1, 2021 (and February 26, 2021 with respect to Virtus AllianzGI Artificial Intelligence & Technology Opportunities Fund), however, Virtus Investment Advisers, Inc. (“Virtus”) became the primary investment adviser of those funds (such Virtus-advised funds, the “Former Allianz-Managed Funds”), and therefore they are no longer included within the definition of Fund Complex as used herein. AllianzGI has been appointed to serve as sub-adviser to most of the remaining Former Allianz-Managed Funds. |

With respect to PMAT, shares of the Portfolios are offered exclusively to clients in separate account “wrap” programs sponsored by investments advisers, including investment advisers and broker-dealers unaffiliated with PMAT and PIMCO, under which PIMCO serves as investment manager. Thus, the Trustees and officers of PMAT may not invest in the Portfolios without becoming clients of a wrap sponsor.

18

The following table states the dollar range of equity securities beneficially owned as of the Record Date by each Trustee and Nominee of each Fund and, on an aggregate basis, of any registered investment companies overseen by the Trustees in the “family of investment companies,” including the Funds.

| Name of Trustee/ Nominee |

Dollar Range of Equity Securities in the Funds* |

Aggregate Dollar Range of Equity Securities in All Registered Investment Companies Overseen by Trustee/ Nominee in the Family of Investment Companies* | ||

| Independent Trustees/Nominees | ||||

| Deborah A. DeCotis |

None | Over $100,000 | ||

| Sarah E. Cogan |

None | $50,001 - $100,000 | ||

| E. Grace Vandecruze |

None | $0 | ||

| Hans W. Kertess |

None | Over $100,000 | ||

| Joseph B. Kittredge, Jr. |

None | Over $100,000 | ||

| William B. Ogden, IV |

None | Over $100,000 | ||

| Alan Rappaport |

None | Over $100,000 | ||

| Interested Trustees/Nominees | ||||

| John C. Maney |

Over $100,000 | Over $100,000 | ||

| David N. Fisher |

Over $100,000 | Over $100,000 | ||

| * | Securities are valued as of the Record Date. |

To the knowledge of the Funds, as of the Record Date, Trustees and Nominees who are Independent Trustees or Independent Nominees and their immediate family members did not own securities of an investment adviser or principal underwriter of the Funds or a person (other than a registered investment company) directly or indirectly controlling, controlled by, or under common control with an investment adviser or principal underwriter of the Funds.

Mr. Ogden owns a less than 1% limited liability company interest in PIMCO Global Credit Opportunity Onshore Fund LLC, a PIMCO-sponsored private investment vehicle.

Compensation. Each of the Independent Trustees serves as a trustee of PCM Fund, Inc., PIMCO Municipal Income Fund, PIMCO California Municipal Income Fund, PIMCO New York Municipal Income Fund, PIMCO Municipal Income Fund II, PIMCO California Municipal Income Fund II, PIMCO New York Municipal Income Fund II, PIMCO Municipal Income Fund III, PIMCO California Municipal Income Fund III, PIMCO New York Municipal Income Fund III, PIMCO Corporate & Income Strategy Fund, PIMCO Corporate &

19

Income Opportunity Fund, PIMCO Income Opportunity Fund, PIMCO Dynamic Credit and Mortgage Income Fund, PIMCO Dynamic Income Fund, PIMCO Dynamic Income Opportunities Fund, PIMCO Income Strategy Fund, PIMCO Income Strategy Fund II, PIMCO Global StocksPLUS®& Income Fund, PIMCO High Income Fund, PIMCO Energy and Tactical Credit Opportunities Fund, and PIMCO Strategic Income Fund, Inc., each a closed-end fund for which the Manager serves as investment manager (together with the Funds, the “PIMCO Closed-End Funds”), as well as PIMCO Flexible Credit Income Fund and PIMCO Flexible Municipal Income Fund, each a closed-end management investment company that is operated as an “interval fund” for which the Manager serves as investment manager (the “PIMCO Interval Funds”) and PIMCO Managed Accounts Trust (“PMAT”), an open-end management investment company with multiple series for which the Manager serves as investment adviser and administrator (together with the PIMCO Closed-End Funds and the PIMCO Interval Funds, the “PIMCO-Managed Funds”).

Each Independent Trustee currently receives annual compensation of $225,000 for his or her service on the Boards of the PIMCO-Managed Funds, payable quarterly. The Independent Chair of the Boards receives an additional $75,000 per year, payable quarterly. The Audit Oversight Committee Chair receives an additional $50,000 annually, payable quarterly. Trustees are also reimbursed for meeting-related expenses.

Each Trustee’s compensation for his or her service as a Trustee on the Boards of the PIMCO-Managed Funds and other costs in connection with joint meetings of such Funds are allocated among the PIMCO-Managed Funds, as applicable, on the basis of fixed percentages as among the PIMCO-Managed Funds. Trustee compensation and other costs are then further allocated pro rata among the individual funds within each grouping based on each such fund’s relative net assets.

The Funds have no employees. The Funds’ officers and Interested Trustees (Mr. Fisher and Mr. Maney) are compensated by the Manager or its affiliates, as applicable.

The Trustees do not currently receive any pension or retirement benefits from the Funds or the Fund Complex (see below).

The following table provides information concerning the compensation paid to the Trustees and Nominees for the fiscal year ended June 30, 2020 for PFLEX and for the fiscal years ended December 31, 2020 for PMFLX and PMAT. For the calendar year ended December 31, 2020, the Trustees received the compensation set forth in the table below for serving as Trustees of the Funds

20

and other funds in the same Fund Complex as the Funds. Each officer and each Trustee who is a director, officer, partner, member or employee of the Manager, or of any entity controlling, controlled by or under common control with the Manager, including any Interested Trustee, serves without any compensation from the Funds.

Compensation Table

| Name of Trustee/ |

Aggregate Compensation from PFLEX for the Fiscal Year Ended June 30, 2020 |

Aggregate Compensation from PMFLX for the Fiscal Year Ended December 31, 2020 |

Aggregate Compensation from PMAT for the Fiscal Year Ended December 31, 2020 |

Total Compensation from the Funds and Fund Complex Paid to Trustees/Nominees for the Calendar Year Ended December 31, 2020(1) |

||||||||||||

| Independent Trustee/Nominee |

| |||||||||||||||

| Sarah E. Cogan |

$ | 15,175 | $ | 5,436 | $ | 22,500 | $ | 470,000 | ||||||||

| Deborah A. DeCotis |

$ | 20,233 | $ | 7,248 | $ | 30,000 | $ | 535,000 | ||||||||

| Bradford K. Gallagher(2) |

$ | 6,631 | N/A | N/A | N/A | |||||||||||

| E. Grace Vandecruze(3) |

N/A | N/A | N/A | N/A | ||||||||||||

| Hans W. Kertess |

$ | 15,175 | $ | 5,436 | $ | 22,500 | $ | 460,000 | ||||||||

| Joseph B. Kittredge, Jr.(4) |

$ | 4,523 | $ | 4,600 | $ | 16,875 | $ | 168,750 | ||||||||

| James A. Jacobson(5) |

$ | 18,547 | $ | 6,644 | $ | 27,500 | $ | 535,000 | ||||||||

| William B. Ogden, IV |

$ | 15,175 | $ | 5,436 | $ | 22,500 | $ | 465,000 | ||||||||

| Alan Rappaport |

$ | 15,175 | $ | 5,436 | $ | 22,500 | $ | 535,000 | ||||||||

| Interested Trustee/Nominee |

| |||||||||||||||

| David N. Fisher(6) |

$ | 0 | $ | 0 | $ | 0 | $ | 0 | ||||||||

| John C. Maney(6) |

$ | 0 | $ | 0 | $ | 0 | $ | 0 | ||||||||

| (1) | As of December 31, 2020, the “Fund Complex” as used herein included the PIMCO-Managed Funds and the Former Allianz-Managed Funds. As of December 31, 2020, the Trustees served on the boards of the following number of portfolios in the Fund Complex: for Ms. Cogan, 60; for |

21

| Mr. Kittredge, 29; for each of Messrs. Fisher and Maney, 28; and for each of Ms. DeCotis and Messrs. Kertess, Ogden and Rappaport, 61. For the calendar year ended December 31, 2020, amounts received by the Trustees from PIMCO-Managed Funds were: for Ms. Cogan, $225,000; for Ms. DeCotis, $300,000; for Mr. Jacobson, $275,000; for each of Messrs. Kertess, Ogden and Rappaport, $225,000; and for Mr. Kittredge, $168,750. These amounts are included in the Fund Complex totals in the table above. |

| (2) | Mr. Gallagher resigned from the Board of each Fund effective December 31, 2019. |

| (3) | Ms. Vandecruze does not currently serve as a Trustee of any Fund and is standing for initial election at the Meeting. Accordingly, Ms. Vandecruze did not receive any compensation for the calendar year ended December 31, 2020. |

| (4) | Effective June 11, 2020, Mr. Kittredge became a Trustee of the Funds. |

| (5) | Mr. Jacobson retired from the Board of each Fund as of December 31, 2020. |

| (6) | Neither Mr. Fisher nor Mr. Maney received compensation from the Funds. |

Trustee Qualifications — The Board of each Fund has determined that each Trustee is qualified to serve as such based on several factors (none of which alone is decisive). Each current Trustee, with the exception of Mr. Kittredge, has served in such role for several years. Mr. Kittredge formerly served as a Partner and General Counsel at the investment management firm of Grantham, Mayo, Van Otterloo & Co. LLC and President, CEO, and Trustee of the GMO Trust and the GMO Series Trust. In addition, Ms. Vandecruze has substantial investment banking accounting, insurance industry, consulting and corporate board experience. Accordingly, each Nominee is knowledgeable about the Funds’ business and service provider arrangements and, with the exception of Ms. Vandecruze and Mr. Kittredge, has also served for several years as trustee or director to a number of other investment companies advised by the Manager and/or its affiliates with similar arrangements to that of each of the Funds. Among the factors the Board considered when concluding that an individual is qualified to serve on the Board were the following: (i) the individual’s business and professional experience and accomplishments; (ii) the individual’s ability to work effectively with other members of the Board; (iii) the individual’s prior experience, if any, serving on the boards of public companies (including, where relevant, other investment companies) and other complex enterprises and organizations; and (iv) how the individual’s skills, experiences and attributes would contribute to an appropriate mix of relevant skills and experience on the Board.

In respect of each Trustee and Nominee, the individual’s substantial professional accomplishments and prior experience, including, in some cases, in fields related to the operations of the Funds, were a significant factor in the

22

determination by the Board that the individual is qualified to serve as a Trustee of the Funds. The following is a summary of various qualifications, experiences and skills of each Trustee (in addition to business experience during the past five years set forth in the table above) that contributed to the Board’s conclusion that an individual is qualified to serve on the Board. References to qualifications, experiences and skills are not intended to hold out the Board or individual Trustees as having any special expertise or experience, and shall not impose any greater responsibility or liability on any such person or on the Board by reason thereof.

Deborah A. DeCotis — Ms. DeCotis has substantial senior executive experience in the investment banking industry, having served as a Managing Director for Morgan Stanley. She has extensive board experience and experience in oversight of investment management functions through her experience as a former Director of the Helena Rubenstein Foundation, Stanford Graduate School of Business and Armor Holdings.

Sarah E. Cogan — Ms. Cogan has substantial legal experience in the investment management industry, having served as a partner at a large international law firm in the corporate department for over 25 years and as former head of the registered funds practice. She has extensive experience in oversight of investment company boards through her experience as counsel to the Independent Trustees of certain PIMCO-Managed Funds and as counsel to other independent trustees, investment companies and asset management firms.

David N. Fisher — Mr. Fisher has substantial executive experience in the investment management industry. Mr. Fisher is a Managing Director and Co-Head of U.S. Global Wealth Management Strategic Accounts at PIMCO. In this role, he oversees PIMCO’s major Global Wealth Management client partnerships. Prior to taking on this position, Mr. Fisher was Head of Traditional Product Strategies at PIMCO, where he oversaw teams of product strategists covering core and non-core fixed income strategies as well as the firm’s suite of equity strategies, was a Global Bond Strategist at PIMCO, and has managed PIMCO’s Total Return Strategy since 2014. Because of his familiarity with PIMCO and its affiliates, Mr. Fisher serves as an important information resource for the Independent Trustees and as a facilitator of communication with PIMCO.

Hans W. Kertess — Mr. Kertess has substantial executive experience in the investment management industry. He is the president of a financial advisory company, H. Kertess & Co. and a Senior Adviser of Royal Bank of Canada Capital Markets, and formerly served as a Managing Director of Royal Bank of Canada Capital Markets. He has significant experience in the investment banking industry.

23

Joseph B. Kittredge, Jr. — Mr. Kittredge has substantial experience in the investment management industry, having served for thirteen years as General Counsel to Grantham, Mayo, Van Otterloo & Co. LLC, the adviser to the GMO mutual fund complex, and as a Trustee and senior officer for Funds in the GMO complex. Previously, he was a partner at a large international law firm. Mr. Kittredge has extensive experience in asset management regulation and has provided legal advice to investment company boards, registered funds and their sponsors with respect to a broad range of financial, legal, tax, regulatory and other issues. He also serves as the Audit Oversight Committee’s Chair and has been determined by the Board to be an “audit committee financial expert.”

John C. Maney — Mr. Maney has substantial executive and board experience in the investment management industry. Prior to January 2020, he served in a variety of senior-level positions with investment advisory firms affiliated with the Investment Manager, including Allianz Asset Management of America L.P. (the Investment Manager’s U.S. parent company). In addition, Mr. Maney currently provides various services to the Investment Manager as a consultant. Because of his familiarity with the Investment Manager and affiliated entities, he serves as an important information resource for the Independent Trustees and as a facilitator of communication with the Investment Manager and its affiliates.

William B. Ogden, IV — Mr. Ogden has substantial senior executive experience in the investment banking industry. He served as Managing Director at Citigroup, where he established and led the firm’s efforts to raise capital for, and provide mergers and acquisition advisory services to, asset managers and investment advisers. He also has significant experience with fund products through his senior-level responsibility for originating and underwriting a broad variety of such products.

Alan Rappaport — Mr. Rappaport has substantial senior executive experience in the financial services industry. He formerly served as Chairman and President of the Private Bank of Bank of America and as Vice Chairman of U.S. Trust and as an Advisory Director of an investment firm.

E. Grace Vandecruze — Ms. Vandecruze has substantial insurance industry and investment banking experience. She is the Founder and Managing Director at Grace Global Capital LLC, which provides strategic consulting, valuation and accounting services to the insurance industry. She also has significant experience as a corporate board member. She has over 25 years of experience in public accounting, investment banking and consulting industries. She is a Certified Public Accountant.

24

Board Committees and Meetings.

Audit Oversight Committee. The Board of each Fund has established an Audit Oversight Committee in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Each Fund’s Audit Oversight Committee currently consists of Messrs. Kertess, Kittredge, Ogden, Rappaport, and Mses. Cogan and DeCotis, each of whom is an Independent Trustee. Mr. Kittredge is the current Chair of each Fund’s Audit Oversight Committee. Each Fund’s Audit Oversight Committee provides oversight with respect to the internal and external accounting and auditing procedures of each Fund and, among other things, determines the selection of the independent registered public accounting firm for each Fund and considers the scope of the audit, approves all audit and permitted non-audit services proposed to be performed by those auditors on behalf of each Fund, and approves non-audit services to be performed by the auditors for certain affiliates, including the Manager and entities in a control relationship with the Manager that provide services to each Fund where the engagement relates directly to the operations and financial reporting of the Fund. The Audit Oversight Committee considers the possible effect of those services on the independence of the Funds’ independent registered public accounting firm.

The Board of each Fund has adopted a written charter for its Audit Oversight Committee. A copy of the written charter for each Fund, as amended through January 1, 2020, is attached to this Proxy Statement as Exhibit A. A report of the Audit Oversight Committee of each of PFLEX and PMFLX, dated August 24, 2020 and February 22, 2021, respectively, is attached to this Proxy Statement as Exhibit B.

Governance and Nominating Committee. The Board of each Fund has established a Governance and Nominating Committee composed solely of Independent Trustees, currently consisting of Messrs. Kertess, Kittredge, Ogden, Rappaport and Mses. Cogan and DeCotis. Ms. DeCotis is the current Chair of each Fund’s Governance and Nominating Committee. The primary purposes and responsibilities of the Governance and Nominating Committee are: (i) advising and making recommendations to the Board on matters concerning Board governance and related Trustee practices, and (ii) the screening and nomination of candidates for election to the Board as Independent Trustees.2

| 2 | Prior to January 1, 2020, Trustee compensation was reviewed by a separate Compensation Committee established by the Board of each Fund. Each Fund’s Compensation Committee was dissolved, effective January 1, 2020. |

25

The responsibilities of the Governance and Nominating Committee include considering and making recommendations to each Fund’s Board regarding: (1) governance, retirement and other policies, procedures and practices relating to the Board and the Trustees; (2) in consultation with the Chair of the Trustees, matters concerning the functions and duties of the Trustees and committees of the Board; (3) the size of the Board and, in consultation with the Chair of the Trustees, the Board’s committees and their composition; and (4) Board and committee meeting procedures. The Committee will also periodically review and recommend for approval by the Board the structure and levels of compensation and any related benefits to be paid or provided by a Fund to the Independent Trustees for their services on the Board and any committees on the Board.

The Governance and Nominating Committee is responsible for reviewing and recommending qualified candidates to the Board in the event that a position is vacated or created or when Trustees are to be re-elected. The Board of each Fund has adopted a written charter for its Governance and Nominating Committee. A copy of the written charter for each Fund is attached to this Proxy Statement as Exhibit C.

Each member of each Fund’s Governance and Nominating Committee is “independent,” meaning persons who are not “interested persons” (as defined in the 1940 Act) of the Funds.

Qualifications, Evaluation and Identification of Trustees/Nominees. The Governance and Nominating Committee of each Fund requires that Trustee candidates have a college degree or equivalent business experience. When evaluating candidates, the Governance and Nominating Committee may take into account a wide variety of factors including, but not limited to: (i) availability and commitment of a candidate to attend meetings and perform his or her responsibilities on the Board, (ii) relevant industry and related experience, (iii) educational background, (iv) ability, judgment and expertise and (v) overall diversity of the Board’s composition. The process of identifying nominees involves the consideration of candidates recommended by one or more of the following sources: (i) the Fund’s current Trustees, (ii) the Fund’s officers, (iii) the Fund’s investment adviser, (iv) the Fund’s shareholders and (v) any other source the Committee deems to be appropriate. The Governance and Nominating Committee may, but is not required to, retain a third-party search firm at the Fund’s expense to identify potential candidates.

Consideration of Candidates Recommended by Shareholders. The Governance and Nominating Committee will review and consider nominees recommended by shareholders to serve as Trustees, provided that the recommending shareholder follows the “Procedures for Shareholders to Submit

26

Nominee Candidates”, which are set forth as Appendix A to the Funds’ Governance and Nominating Committee Charter and attached as Exhibit C to this Proxy Statement. Among other requirements, these procedures provide that the recommending shareholder must submit any recommendation in writing to the Fund, to the attention of the Fund’s Secretary, at the address of the principal executive offices of the Fund and that such submission must be received at such offices not less than 45 days nor more than 75 days prior to the date of the board or shareholder meeting at which the nominee would be elected. Because the Fund does not hold annual or other regular meetings of shareholders for the purpose of electing Trustees, the Committee will accept shareholder recommendations on a continuous basis. Any recommendation must include certain biographical and other information regarding the candidate and the recommending shareholder, and must include a written and signed consent of the candidate to be named as a nominee and to serve as a Trustee if elected. The foregoing description of the requirements is only a summary. Please refer to Appendix A to the Governance and Nominating Committee Charter, which is attached to this Proxy Statement as Exhibit C for details.

The Governance and Nominating Committee has full discretion to reject nominees recommended by Shareholders and there is no assurance that any such person properly recommended and considered by the Committee will be nominated for election to the Board of Trustees.

Diversity. The Governance and Nominating Committee takes diversity of a particular nominee and overall diversity of the Board into account when considering and evaluating nominees for Trustee. While the Committee has not adopted a particular definition of diversity, when considering a nominee’s and the Board’s diversity, the Committee generally considers the manner in which each nominee’s professional experience, education, expertise in matters that are relevant to the oversight of the Funds (e.g., investment management, distribution, accounting, trading, compliance, legal), general leadership experience, and life experience are complementary and, as a whole, contribute to the ability of the Board to oversee the Funds.

Valuation Oversight Committee. The Board of each Fund has established a Valuation Oversight Committee currently consisting of Messrs. Kertess, Kittredge, Ogden and Rappaport and Mses. Cogan and DeCotis. Mr. Ogden is the current Chair of each Fund’s Valuation Oversight Committee. The Valuation Oversight Committee has been delegated responsibility by the Board for overseeing determination of the fair value of each Fund’s portfolio securities and other assets on behalf of the Board in accordance with the Funds’ valuation procedures. The Valuation Oversight Committee of each Fund reviews and approves procedures for the fair valuation of the Fund’s portfolio securities and

27

periodically reviews information from the Manager regarding fair value determinations made pursuant to Board-approved procedures, and makes related recommendations to the full Board and assists the full Board in resolving particular fair valuation and other valuation matters. In certain circumstances as specified in the Funds’ valuation policies, the Valuation Oversight Committee may also determine the fair value of portfolio holdings after consideration of all relevant factors, which determinations shall be reported to the full Board.

Contracts Committee. The Board of each Fund has established a Contracts Committee currently consisting of Messrs. Kertess, Kittredge, Ogden, Rappaport and Mses. Cogan and DeCotis. Ms. Cogan is the current Chair of each Fund’s Contracts Committee. The Contracts Committee meets as the Board deems necessary to review the performance of, and the reasonableness of the fees paid to, as applicable, the Funds’ investment adviser(s) and any sub-adviser(s), administrators(s) and principal underwriters(s) and to make recommendations to the Board regarding the approval and continuance of each Fund’s contractual arrangements for investment advisory, sub-advisory, administrative and distribution services, as applicable.

Performance Committee. The Board of each Fund has established a Performance Committee currently consisting of Messrs. Kertess, Kittredge, Ogden, Rappaport, Maney and Fisher and Mses. Cogan and DeCotis. Mr. Rappaport is the current Chair of the Performance Committee. The Performance Committee’s responsibilities include reviewing the performance of the Funds and any changes in investment philosophy, approach and personnel of the Manager.

Meetings. With respect to PFLEX, during the fiscal year ended June 30, 2020, the Board of Trustees held four regular meetings and one special meeting. The Audit Oversight Committee met in separate session six times, the Governance and Nominating Committee met in separate session four times, the Valuation Oversight Committee met in separate session four times, the Contracts Committee met in separate session five times and the Performance Committee met in separate session four times. Each Trustee attended in person or via teleconference at least 75% of the regular meetings of the Board and meetings of the committees on and during which such Trustee served for the Fund that were held during the fiscal year ended June 30, 2020.

With respect to PMAT and PMFLX, during the fiscal year ended December 31, 2020, the Board of Trustees held four regular meetings and one special meeting. The Audit Oversight Committee met in separate session six times, the Governance and Nominating Committee met in separate session four times, the Valuation Oversight Committee met in separate session four times, the

28

Contracts Committee met in separate session five times and the Performance Committee met in separate session four times. Each Trustee attended in person or via teleconference at least 75% of the regular meetings of the Board and meetings of the committees on and during which such Trustee served for each Fund that were held during the fiscal year ended December 31, 2020.

Shareholder Communications with the Board of Trustees. The Board of Trustees of each Fund has adopted procedures by which Shareholders may send communications to the Board. Shareholders may mail written communications to the Board to the attention of the Board of Trustees, [name of Fund], c/o Fund Administration, Pacific Investment Management Company LLC, 1633 Broadway, New York, New York 10019. Shareholder communications must (i) be in writing and be signed by the Shareholder and (ii) identify the class and number of Shares held by the Shareholder or, with respect to PMAT, the Portfolio(s) they are writing about and the wrap sponsor through which the Shareholder purchased the Portfolio(s). The Secretary of each Fund or her designee is responsible for reviewing properly submitted shareholder communications. The Secretary shall either (i) provide a copy of each properly submitted shareholder communication to the Board at its next regularly scheduled Board meeting or (ii) if the Secretary determines that the communication requires more immediate attention, forward the communication to the Trustees promptly after receipt. The Secretary may, in good faith, determine that a shareholder communication should not be provided to the Board because it does not reasonably relate to a Fund or its operations, management, activities, policies, service providers, Board, officers, shareholders or other matters relating to an investment in a Fund or is otherwise routine or ministerial in nature. These procedures do not apply to (i) any communication from an officer or Trustee of a Fund, or (ii) any communication from an employee or agent of a Fund, unless such communication is made solely in such employee’s or agent’s capacity as a shareholder, but shall apply to any shareholder proposal submitted pursuant to Rule 14a-8 under the Exchange Act or any communication made in connection with such a proposal. A Fund’s Trustees are not required to attend the Fund’s shareholder meetings or to otherwise make themselves available to shareholders for communications, other than by the aforementioned procedures.

Section 16(a) Reports. Each of the Interval Funds’ Trustees and certain officers, investment adviser, certain affiliated persons of the investment adviser and persons who beneficially own more than 10% of any class of outstanding securities of such a Fund (i.e., a Fund’s Common Shares or Preferred Shares, as applicable) are required to file forms reporting their affiliation with the Fund and reports of ownership and changes in ownership of the Fund’s securities with the Securities and Exchange Commission (the “SEC”). Based solely on a review of

29

these forms filed electronically with the SEC and any written representation from reporting persons during the most recently concluded fiscal year, each Interval Fund believes that each of the Trustees and officers, investment adviser and relevant affiliated persons of the investment adviser and the persons who beneficially own more than 10% of any class of outstanding securities of the Fund has complied with all applicable filing requirements during each Interval Fund’s respective fiscal year.

Required Vote. With respect to PFLEX, the election of Mses. Vandecruze and Cogan and Messrs. Kittredge and Fisher will require a plurality of the votes of the Commons Shareholders of the Fund (voting together as a single class) cast in the election of Trustees at the Meeting, in person or by proxy. With respect to PMFLX, the election of Ms. Vandecruze and Mr. Kittredge will require a plurality of the votes of the Common Shareholders and Preferred Shareholders of the Fund (voting together as a single class) cast in the election of Trustees at the Meeting, in person or by proxy. With respect to PMAT, the election of Mses. Vandecruze and Cogan and Messrs. Fisher and Kittredge will require a plurality of the shares of PMAT (the shares of all Portfolios voting together as a single class) cast in the election of Trustees at the Meeting, in person or by proxy.

THE BOARD OF TRUSTEES OF EACH FUND UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR THE ELECTION OF ALL THE NOMINEES FOR EACH FUND.

ADDITIONAL INFORMATION

Executive and Other Officers of the Funds. The table below provides certain information concerning the executive officers of the Funds and certain other officers who perform similar duties. Officers of the Funds hold office at the pleasure of the relevant Board and until their successors are chosen and qualified, or in each case until he or she sooner dies, resigns, is removed with or without cause or becomes disqualified. Officers and employees of the Funds who are principals, officers, members or employees of the Manager are not compensated by the Funds

30

| Name, Address and Year of Birth |

Position(s) Held with Funds |

Term of Office and Length of Time Served |

Principal Occupation(s) During the Past 5 Years | |||

| Eric D. Johnson1 1970 |

President | Since 2019 | Executive Vice President and Head of Funds Business Group Americas, PIMCO. President, PIMCO-Managed Funds, PIMCO Funds, PIMCO Variable Insurance Trust, PIMCO ETF Trust, PIMCO Equity Series and PIMCO Equity Series VIT. | |||

| Keisha Audain-Pressley2 1975 |

Chief Compliance Officer |

Since 2018 | Executive Vice President and Deputy Chief Compliance Officer, PIMCO. Chief Compliance Officer, PIMCO-Managed Funds, PIMCO Funds, PIMCO Variable Insurance Trust, PIMCO ETF Trust, PIMCO Equity Series and PIMCO Equity Series VIT. | |||

| Ryan G. Leshaw1 1980 |

Chief Legal Officer |

Since 2019 | Executive Vice President and Senior Counsel, PIMCO. Chief Legal Officer, PIMCO-Managed Funds. Vice President, Senior Counsel and Secretary, PIMCO Funds, PIMCO Variable Insurance Trust, PIMCO ETF Trust, PIMCO Equity Series and PIMCO Equity Series VIT. Formerly, Associate, Willkie Farr & Gallagher LLP. | |||

| Joshua D. Ratner2 1976 |

Senior Vice President |

Since 2019 | Executive Vice President and Head of Americas Operations, PIMCO. Senior Vice President, PIMCO-Managed Funds, PIMCO Funds, PIMCO Variable Insurance Trust, PIMCO ETF Trust, PIMCO Equity Series and PIMCO Equity Series VIT. | |||

31

| Name, Address and Year of Birth |

Position(s) Held with Funds |

Term of Office and Length of Time Served |

Principal Occupation(s) During the Past 5 Years | |||

| Peter G. Strelow1 1970 |

Senior Vice President |

Since 2019 | Managing Director and Co-Chief Operating Officer, PIMCO. Senior Vice President, PIMCO-Managed Funds, PIMCO Funds, PIMCO Variable Insurance Trust, PIMCO ETF Trust, PIMCO Equity Series and PIMCO Equity Series VIT. Formerly, Chief Administrative Officer, PIMCO. | |||

| Wu-Kwan Kit1 1981 |

Vice President, Senior Counsel and Secretary |

Since 2018 | Senior Vice President and Senior Counsel, PIMCO. Vice President, Senior Counsel and Secretary, PIMCO-Managed Funds. Assistant Secretary, PIMCO Funds, PIMCO Variable Insurance Trust, PIMCO ETF Trust, PIMCO Equity Series and PIMCO Equity Series VIT. Formerly, Assistant General Counsel, VanEck Associates Corp. | |||

| Jeffrey A. Byer1 1976 |

Vice President |

Since January 2020 | Executive Vice President, PIMCO. Vice President, PIMCO-Managed Funds, PIMCO Funds, PIMCO Variable Insurance Trust, PIMCO ETF Trust, PIMCO Equity Series and PIMCO Equity Series VIT. | |||

| Brian J. Pittluck1 1977 |

Vice President |

Since January 2020 | Senior Vice President, PIMCO. Vice President, PIMCO-Managed Funds, PIMCO Funds, PIMCO Variable Insurance Trust, PIMCO ETF Trust, PIMCO Equity Series and PIMCO Equity Series VIT. | |||

| Elizabeth A. Duggan2 1964 |

Vice President |

Since March 2021 | Executive Vice President, PIMCO. Vice President, PIMCO-Managed Funds, PIMCO Funds, PIMCO Variable Insurance Trust, PIMCO ETF Trust, PIMCO Equity Series and PIMCO Equity Series VIT. | |||

32

| Name, Address and Year of Birth |

Position(s) Held with Funds |

Term of Office and Length of Time Served |

Principal Occupation(s) During the Past 5 Years | |||

| Bijal Parikh1 1978 |

Treasurer | Since January 2021 | Senior Vice President, PIMCO. Treasurer, PIMCO-Managed Funds, PIMCO Funds, PIMCO Variable Insurance Trust, PIMCO ETF Trust, PIMCO Equity Series and PIMCO Equity Series VIT. | |||

| Colleen Miller2 1980 |

Deputy Treasurer |

Since September 2020 | Senior Vice President, PIMCO. Deputy Treasurer, PIMCO-Managed Funds. Assistant Treasurer, PIMCO Funds, PIMCO Variable Insurance Trust, PIMCO ETF Trust, PIMCO Equity Series and PIMCO Equity Series VIT. | |||

| Erik C. Brown2 1967 |

Assistant Treasurer |

Since 2015 | Executive Vice President, PIMCO. Assistant Treasurer, PIMCO-Managed Funds, PIMCO Funds, PIMCO Variable Insurance Trust, PIMCO ETF Trust, PIMCO Equity Series and PIMCO Equity Series VIT. | |||

| Brandon T. Evans1 1982 |

Assistant Treasurer |

Since 2019 | Vice President, PIMCO. Assistant Treasurer, PIMCO-Managed Funds, PIMCO Funds, PIMCO Variable Insurance Trust, PIMCO ETF Trust, PIMCO Equity Series and PIMCO Equity Series VIT. | |||

| Jason J. Nagler3 1982 |

Assistant Treasurer |

Since 2015 | Senior Vice President, PIMCO. Assistant Treasurer, PIMCO-Managed Funds, PIMCO Funds, PIMCO Variable Insurance Trust, PIMCO ETF Trust, PIMCO Equity Series and PIMCO Equity Series VIT. | |||

| H. Jessica Zhang2 1973 |

Assistant Treasurer |

Since January 2020 | Senior Vice President, PIMCO. Assistant Treasurer, PIMCO-Managed Funds, PIMCO Funds, PIMCO Variable Insurance Trust, PIMCO ETF Trust, PIMCO Equity Series and PIMCO Equity Series VIT. | |||

33

| 1 | The address of these officers is Pacific Investment Management Company LLC, 650 Newport Center Drive, Newport Beach, California 92660. |

| 2 | The address of these officers is Pacific Investment Management Company LLC, 1633 Broadway, New York, New York 10019. |

| 3 | The address of these officers is Pacific Investment Management Company LLC, 401 Congress Ave., Austin, Texas 78701. |

Each of the Funds’ executive officers is an “interested person” of each Fund (as defined in Section 2(a)(19) of the 1940 Act) as a result of his or her position(s) set forth in the table above.

Investment Manager. The Manager serves as the investment manager of each of the Funds. Subject to the supervision of the Board of each Fund, the Manager is responsible for managing the investment activities of the Funds and the Funds’ business affairs and other administrative matters. The Manager is located at 650 Newport Center Drive, Newport Beach, CA, 92660. The Manager is a majority-owned indirect subsidiary of Allianz SE, a publicly traded European insurance and financial services company.

Principal Underwriter. PIMCO Investments LLC serves as the principal underwriter and distributor of the Funds (the “Distributor”). The principal business address of the Distributor is 1633 Broadway, New York, New York 10019.