Form DEF 14A PARKER HANNIFIN CORP For: Oct 27

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

PARKER-HANNIFIN CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| (2) | Aggregate number of securities to which the transaction applies: |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

PARKER-HANNIFIN CORPORATION

Notice of Annual Meeting of Shareholders

| DATE | TIME | VIRTUAL ADDRESS | ||||||||

| Wednesday October 27, 2021

|

9:00 AM, EDT | virtualshareholdermeeting.com/PH2021 | ||||||||

To Our Shareholders:

You are cordially invited to attend the Annual Meeting of Shareholders of Parker-Hannifin Corporation. The meeting will be held virtually via live webcast at www.virtualshareholdermeeting.com/PH2021, on Wednesday, October 27, 2021 at 9:00 a.m., Eastern Daylight Time, for the following purposes:

| ✔ | To elect the twelve individuals named in the Proxy Statement as Directors for a term expiring at the Annual Meeting of Shareholders in 2022; |

| ✔ | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2022; |

| ✔ | To approve, on a non-binding, advisory basis, the compensation of our Named Executive Officers; and |

| ✔ | To transact such other business as may properly come before the meeting. |

|

|

|

| |||||||||

| Vote Via Internet | Vote By Phone | Vote By Mail | Vote at the Meeting | |||||||||

| www.proxyvote.com | 800-690-6903 | Vote Processing c/o Broadridge 51 Mercedes Way, Edgewood, NY 11717 |

www.virtualshareholdermeeting.com/ PH2021 | |||||||||

Because of the ongoing impacts and uncertainty regarding the coronavirus pandemic, or COVID-19, we have decided that this year’s Annual Meeting will be virtual only. Similar to last year, the meeting will be conducted via live webcast, and you will be able to submit questions and vote your shares electronically. Please refer to the section “How to Attend the Annual Meeting of Shareholders” for more information.

Shareholders of record at the close of business on September 3, 2021 are entitled to vote at the meeting. Your vote is important, so if you do not expect to attend the meeting, or if you do plan to attend but wish to vote by proxy, please mark, date, sign and return the enclosed proxy card promptly in the envelope provided or vote electronically via the internet or by telephone in accordance with the instructions on the proxy card.

Thank you for your support of Parker-Hannifin Corporation.

By Order of the Board of Directors

Joseph R. Leonti

| September 24, 2021 | Secretary |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders

to be held on October 27, 2021.

This Proxy Statement, along with our Annual Report on Form 10-K for the fiscal year ended June 30, 2021, is available free of charge on our investor relations website (www.phstock.com).

Table of Contents

| 33 | ||||

| 33 | ||||

| 34 | ||||

| 35 | ||||

| 40 | ||||

| 43 | ||||

| 49 | ||||

| 50 | ||||

| 51 | ||||

| 52 | ||||

| 52 | ||||

| 54 | ||||

| 56 | ||||

| 58 | ||||

| 59 | ||||

| 60 | ||||

| Potential Payments Upon Termination or Change of Control at June 30, 2021 |

61 | |||

| 72 | ||||

| 73 | ||||

| 75 | ||||

| Item 2 - Ratification of the Appointment of Independent Registered Public Accounting Firm |

76 | |||

| 78 | ||||

| 80 | ||||

| 82 | ||||

| 83 | ||||

| 83 | ||||

| 84 | ||||

| 86 | ||||

| Parker-Hannifin Corporation | 2021 Proxy Statement ◆ (i) |

Table of Contents

PARKER-HANNIFIN CORPORATION

6035 Parkland Boulevard—Cleveland, Ohio 44124-4141

This Proxy Statement is furnished in connection with the solicitation by our Board of Directors of proxies to be voted at the Annual Meeting of Shareholders scheduled to be held on October 27, 2021, and at all adjournments thereof. Only shareholders of record at the close of business on September 3, 2021 will be entitled to vote at the meeting. On September 3, 2021, 128,557,052 common shares were outstanding and entitled to vote at the meeting. Each share is entitled to one vote. This Proxy Statement and the form of proxy are being mailed to shareholders on or about September 24, 2021.

Our Global Code of Business Conduct, our Corporate Governance Guidelines, and our Independence Standards for Directors are posted and available on the Corporate Governance page of our investor relations website at www.phstock.com. Shareholders may request copies of these documents, free of charge, by writing to Parker-Hannifin Corporation, 6035 Parkland Boulevard, Cleveland, Ohio 44124-4141, Attention: Secretary, or by calling (216) 896-3000. The information contained on or accessible through our website is not a part of this Proxy Statement.

This summary highlights certain information relating to our 2021 Annual Meeting of Shareholders and our corporate governance and executive compensation. Additional details are found throughout this Proxy Statement.

Voting Matters and Board Recommendations

| Voting Matters |

Board

| |

| Election of Directors |

FOR ALL NOMINEES | |

| Ratification of Deloitte & Touche LLP as Independent Auditor |

FOR | |

|

Advisory Vote to Approve Named Executive Officer Compensation |

FOR | |

Business Highlights and Performance

| • | In a year marked by an ongoing global pandemic, we delivered strong financial performance and value for our shareholders, including: |

| ◆ | Record sales of $14.35 billion; |

| ◆ | Record cash flow from operations of $2.58 billion; |

| ◆ | Record net income, earnings per share and segment operating margins; |

| ◆ | Increased annual dividend per share for the 65th year in a row; and |

| ◆ | Significantly reduced our debt. |

| • | The Win Strategy, our foundational business framework, drove sustained profitable growth and strong financial performance among our diversified industrial proxy peers. The actions taken under The Win Strategy to strengthen our portfolio and improve our performance have built a business that we believe is better equipped than ever before to be resilient across macro-economic cycles. |

| • | Our Purpose Statement: Enabling Engineering Breakthroughs that Lead to a Better Tomorrow continued to provide inspiration and direction for our team members, and represents how we can strengthen our communities and have a positive impact on the world. |

| • | We believe we are well-positioned to capitalize as the global economic recovery progresses. |

| Parker-Hannifin Corporation | 2021 Proxy Statement ◆ 1 |

Table of Contents

PROXY STATEMENT SUMMARY

Response to COVID-19

The remarkable performance of our team members during the COVID-19 pandemic embodies the Parker culture and values that unite us. Throughout the pandemic, we have maintained manufacturing capacity across the enterprise, demonstrating the essential nature of Parker’s technologies around the world. Our team members continue to deliver technologies used in, among other applications, ventilators to treat those who are sick; engine filters and transmission components for heavy-duty trucks to transport food, water and supplies; aerospace rotorcraft products to support emergency transport of patients; refrigeration technologies to help keep food fresh and medicine viable; and many other technologies essential to people’s daily lives. Across countless critical applications, Parker products and systems continue to assist in the fight against COVID-19 and support its treatment around the world.

Safety is always our number one priority. We implemented heightened measures to promote safety in our facilities in response to the pandemic to protect our team members, including remote work and physical distancing protocols, among many others. We also were diligent about managing our costs, and implemented operational changes to weather the negative impact of the pandemic and economic downturn on our business.

Fiscal year 2021 was challenging, but our unrelenting focus on The Win Strategy drove us to record levels of performance. Guided by our Purpose, we believe we are well-positioned to emerge from the COVID-19 pandemic stronger than ever before.

Board and Corporate Governance Highlights

Our Board of Directors is committed to sound corporate governance practices, promoting the long-term interests of our shareholders and holding itself and management accountable for our performance.

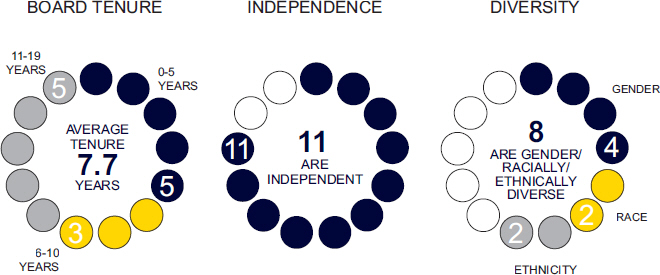

Fiscal year 2021 was significant with respect to the structure and composition of our Board. We added three new Directors in Jillian C. Evanko, Lance M. Fritz and William F. Lacey, strengthening the culture, skills and gender and racial diversity of our Board. The metrics included in the graphics below reflect our Board structure and composition with our thirteen current Directors. Each Director nominee brings his or her own unique background and range of expertise, knowledge and experience which provides an optimal and diverse mix of skills and qualifications necessary for our Board to effectively fulfill its oversight responsibilities.

| 2 ◆ 2021 Proxy Statement | Parker-Hannifin Corporation |

Table of Contents

PROXY STATEMENT SUMMARY

We are pleased to provide the following key governance highlights. We believe these measures position us to continue to drive team member engagement, customer experience, profitable growth and financial performance. In considering our governance and compensation programs for fiscal year 2021, we utilized insights drawn from engagement with our shareholders and the results of our shareholder votes.

| Parker-Hannifin Corporation | 2021 Proxy Statement ◆ 3 |

Table of Contents

PROXY STATEMENT SUMMARY

|

Corporate Governance Highlights

| ||||

|

• Added three new Directors in fiscal year 2021, strengthening the culture, skills and gender and racial diversity of our Board |

• Require each search for qualified Director candidates to include individuals with diverse backgrounds, including diversity of gender, ethnicity and race | |||

|

• Annual election of all Directors |

• Published Global Code of Business Conduct applicable to our Board of Directors | |||

|

• Published Corporate Governance Guidelines |

• Board Committees are 100% comprised of independent Directors | |||

|

• Majority voting and resignation policy for uncontested Director elections |

• Our Amended and Restated Regulations permit proxy access for eligible shareholders | |||

|

• Average age of our Directors is 60 years |

• Robust stock ownership guidelines for our Directors and executive officers (all of whom are compliant with such guidelines) | |||

|

• Director retirement is mandatory after reaching age 72 |

• The Board of Directors includes four women, two racially diverse members and two ethnically diverse members | |||

|

• Each Committee of our Board of Directors has a published charter that is reviewed and evaluated at least annually |

• Annual Board, Committee and individual Director evaluations | |||

|

• Each of our Directors attended more than 75% of his or her meetings of our Board of Directors and his or her Committee meetings during fiscal year 2021 |

• Annual reviews of our Chief Executive Officer by all independent Directors | |||

|

• None of our Directors are “overboarded” – four do not sit on any other public company boards, seven sit on just one other public company board, one sits on just two other public company boards, and one sits on three other public company boards |

• 61% of our Directors have a tenure of 10 years or less. Tenure of this year’s Directors:

0-5 years: 38.5% 6-10 years: 23% >10 years: 38.5% | |||

|

• Our Chairman of the Board and Lead Director ensure the entire Board of Directors maintains regular oversight of key risk areas, such as corporate strategy, management succession planning, cyber security, enterprise risk management, and environmental, social and governance (ESG) matters |

• Independent Directors meet regularly and frequently (at least four times per year) without management present | |||

Our Shareholder Engagement Efforts

We actively seek and highly value feedback from our shareholders. During fiscal year 2021, in addition to our traditional investor relations outreach efforts, we proactively reached out to shareholders representing approximately 54% of our outstanding common stock to engage with them on environmental, social and governance matters. Our outreach was accepted by, and we engaged with, shareholders representing approximately 21% of our outstanding common stock, covering a wide range of topics including:

| • | COVID-19 response; |

| • | Environmental, climate and sustainability matters; |

| • | Executive compensation and our commitment to aligning pay with performance; |

| • | Board composition; |

| • | Board leadership structure; |

| • | Risk oversight and management; |

| • | Our corporate governance practices; |

| • | Business strategy; and |

| • | Other ESG topics, including human capital management and diversity. |

| 4 ◆ 2021 Proxy Statement | Parker-Hannifin Corporation |

Table of Contents

PROXY STATEMENT SUMMARY

We also shared the feedback received during these meetings with our Corporate Governance and Nominating Committee, our Human Resources and Compensation Committee and our full Board of Directors. As a result of our shareholder engagement efforts and the feedback we received, we strengthened our disclosures in this Proxy Statement to provide additional information on our business performance and accomplishments, the structure and composition of our Board, our shareholder engagement efforts, and our ESG program.

Corporate Social Responsibility and Sustainability

Our ESG program includes a range of initiatives around corporate social responsibility and sustainability, taking into account the interests of our key stakeholders, including our shareholders, team members, customers and communities. Issues that we focus on include, among others, workplace health and safety, energy efficiency, waste management, climate risk, human capital management, diversity and inclusion, supply chain management and business ethics and compliance.

Our Board maintains oversight over ESG matters at the full Board level and through our relevant committees, while senior management manages and monitors such matters on a day-to-day basis throughout the year. The full Board reviews our ESG program at least annually.

We publish our Sustainability Report in line with Sustainability Accounting Standards Board (SASB) standards, addressing the many ways in which we apply our core technologies to make a positive impact on the world, including through our team members, social responsibility, environmental initiatives, product stewardship, and governance, ethics and compliance. The Report is available on our website at www.phstock.com. Selected aspects of our most recent Report are highlighted below:

| ● | Safety. Safety is a core value that all team members share, and our goal is to achieve a zero-incident workplace. To measure our safety progress, we have established long-term safety targets. Our goal is to be best in our peer group by 2023 and report zero serious safety incidents by 2025. We have reduced our Recordable Incident Rate by 72% from 2015 through 2020, including a 35% reduction improvement in 2020 over 2019. |

| ● | Environmental Stewardship. We are committed to driving sustainable, long-term growth and doing so in a way that makes the world a better place. |

| • | We are committing to achieve carbon neutral operations by 2040. To ensure continued progress forward in minimizing our carbon footprint, we established a series of emissions targets, which include: |

| ◆ | Reducing absolute emissions directly from our operations by 50% by 2030; |

| ◆ | Reducing indirect absolute emissions related to materials sourcing, logistics and services by 15% by 2030, and by 25% by 2040; and |

| ◆ | Achieving carbon neutral operations by 2040. |

| • | Since 2010, we have reduced energy intensity (MWh/USD) by 42% and greenhouse gas intensity (MT/USD) by 50%. |

| • | We have reported energy and emissions data to the Carbon Disclosure Project (CDP) since 2008, and in 2020 our Climate Change Score was again ranked in the top quartile among diversified industrial companies. |

| • | We recycle more than 85% of waste generated from our manufacturing operations, and we continue to reduce the volume of waste sent to landfills. |

| • | Since 2013, we have been a member of the U. S. Environmental Protection Agency SmartWay® Transport Partnership aimed at identifying technologies and strategies to reduce carbon emissions and set goals and track progress towards reducing fuel consumption and improve the efficiency of freight transport. |

| Parker-Hannifin Corporation | 2021 Proxy Statement ◆ 5 |

Table of Contents

PROXY STATEMENT SUMMARY

| ● | Diversity and Inclusion. An inclusive environment is a core tenet of our values and one of our key measures of success within The Win Strategy. In 2020, we appointed our first Vice President of Diversity and Inclusion to lead an ongoing commitment to an inclusive and welcoming workplace. We also established four global High Performance Teams (HPTs) focused on Talent Attraction, Talent Development, Governance and Knowledge. Each team is led by a senior executive and tasked with rethinking the way we attract and develop diverse candidates, share knowledge and track the impact of our efforts to ensure continued progress in fostering an inclusive culture. |

| ● | Parker-Hannifin Foundation. Parker-Hannifin Foundation donated nearly $6 million in total to hundreds of qualified charitable organizations in 2020, and $4 million in 2021 to date, with a focus on communities in need, education, disaster relief and energy and water conservation. |

We are proud of our corporate social responsibility and sustainability accomplishments, but recognize that best practices in ESG integration and reporting frameworks continue to evolve. While there is more work to be done, we are confident in our strategy of achieving business success through social responsibility and sustainable business practices.

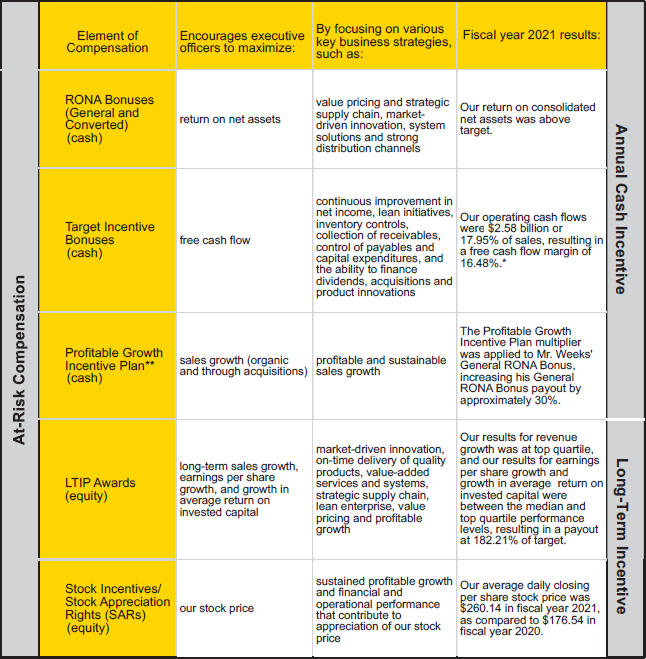

Executive Compensation Highlights

The following table highlights some of the key aspects of our executive compensation program for fiscal year 2021. This table is not a substitute for, nor does it purport to include, all of the information provided in our Compensation Discussion and Analysis section and the Compensation Tables presented later in this Proxy Statement.

|

Executive Compensation Highlights

| ||

|

• Executive compensation program with pay-for-performance structure aligned with The Win Strategy |

• The target compensation package for our Chief Executive Officer is a mix of 9% fixed and 91% at-risk, and for our other Named Executive Officers is an average mix of 21% fixed and 79% at-risk

| |

|

• Annual advisory vote on executive compensation with consistent high degree of approval |

• One-year minimum vesting or performance period requirements for restricted stock awards, restricted stock unit awards, unrestricted stock awards, grants of stock options, and stock appreciation rights under our Amended and Restated 2016 Omnibus Stock Incentive Plan

| |

|

• “Claw back” policy to recover or withhold incentive-based compensation to executive officers in certain circumstances

|

• Anti-hedging and anti-pledging policy for Directors and executive officers | |

|

• As part of our company-wide cost control measures related to COVID-19 and the economic downturn, the base salaries of our Named Executive Officers were reduced beginning in the fourth quarter of fiscal year 2020 and extended through the first quarter of fiscal year 2021 in amounts ranging from 20% to 50% of base salary. Further, the base salaries for our Named Executive Officers in fiscal year 2021 were not increased over fiscal year 2020 levels | ||

| 6 ◆ 2021 Proxy Statement | Parker-Hannifin Corporation |

Table of Contents

ITEM 1 – ELECTION OF DIRECTORS

Shareholder approval is sought to elect Lee C. Banks, Jillian C. Evanko, Lance M. Fritz, Linda A. Harty, William F. Lacey, Kevin A. Lobo, Joseph Scaminace, Åke Svensson, Laura K. Thompson, James R. Verrier, James L. Wainscott and Thomas L. Williams as Directors for a term that will expire at our Annual Meeting of Shareholders in 2022.

Candy M. Obourn, who is currently serving as one of our Directors, will not stand for re-election at the Annual Meeting.

Our Board of Directors has concluded that the nominees presented in this “Item 1—Election of Directors” collectively represent a highly-qualified and diverse group of individuals who will effectively serve the long-term interests of our business, our team members and our shareholders. Our Board of Directors believes that each nominee should serve on our Board for the coming year based on his or her record of effective past service on our Board and the specific experiences, qualifications, attributes and skills described in his or her biographical information presented in this “Item 1—Election of Directors” section.

Should any nominee become unable to accept nomination or election, the proxies will be voted for the election of another person as our Board of Directors may recommend. However, our Board of Directors has no reason to believe that this circumstance will occur.

NOMINEES FOR ELECTION AS DIRECTORS FOR TERMS EXPIRING IN 2022

|

Director Since: 2015 Age: 58 Committees: None |

LEE C. BANKS

Mr. Banks has been our Vice Chairman and President since August 2021. From February 2015 to August 2021 he was President and Chief Operating Officer. He was our Executive Vice President from August 2008 to February 2015 and our Operating Officer from November 2006 to February 2015.

Our Board believes that Mr. Banks will effectively serve our Board of Directors, our business, our team members and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service as Vice Chairman and President, President and Chief Operating Officer, and in various other senior leadership positions during his 30-year career with us;

• intimate working knowledge of our day-to-day business, plans, strategies and initiatives;

• service on other public company boards;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors, our business, our team members, and our shareholders and a high level of integrity, honesty, judgment and professionalism.

Other Public Company Directorships: • Westinghouse Air Brake Technologies Corporation (Wabtec)(since 2020) • Nordson Corporation (former)(2010-2020) |

| Parker-Hannifin Corporation | 2021 Proxy Statement ◆ 7 |

Table of Contents

ITEM 1 - ELECTION OF DIRECTORS

|

Director since 2021 Age: 43 Committees (upon election): • Audit • Human Resources and Compensation |

JILLIAN C. EVANKO

Ms. Evanko has been President and Chief Executive Officer of Chart Industries, Inc. (cryogenic technologies) since June 2018. She was the Chief Financial Officer of Chart from March 2017 until January 2019. Prior to Chart, Ms. Evanko served as Vice President and Chief Financial Officer of Truck-Lite Co., LLC (truck and commercial vehicle products) since October 2016. Prior to Truck-Lite, Ms. Evanko was Vice President and Chief Financial Officer of Dover Corporation’s Dover Fluids (diversified global manufacturer) since January 2014.

Our Board believes that Ms. Evanko will effectively serve our Board of Directors, our business, our team members and our shareholders based on her significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service as Chief Executive Officer and Chief Financial Officer of Chart Industries, Inc., and other leadership positions at successful global companies of significant size;

• service on other public company boards;

• independence under the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism.

Other Public Company Directorships: • Chart Industries, Inc. (since 2018) • Alliant Energy Corporation (former)(2019-2021) |

|

Director since 2021 Age: 58 Committees (upon election): • Corporate Governance and Nominating • Human Resources and Compensation |

LANCE M. FRITZ

Mr. Fritz has been Chairman of the Board of Union Pacific Corporation since October 2015, and President and Chief Executive Officer since February 2015.

Our Board believes that Mr. Fritz will effectively serve our Board of Directors, our business, our team members and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service as President and Chief Executive Officer of Union Pacific Corporation and other leadership positions at successful global companies of significant size;

• service on other public company boards;

• independence under the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism.

Other Public Company Directorships: • Union Pacific Corporation (since 2015) |

| 8 ◆ 2021 Proxy Statement | Parker-Hannifin Corporation |

Table of Contents

ITEM 1 - ELECTION OF DIRECTORS

|

Director since 2007 Age: 61 Committees: • Audit (Chair) • Corporate Governance and Nominating |

LINDA A. HARTY

Now retired, Ms. Harty was Treasurer of Medtronic plc (medical technology) from February 2010 to April 2017.

Our Board believes that Ms. Harty will effectively serve our Board of Directors, our business, our team members and our shareholders based on her significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service in senior finance and accounting leadership positions at Medtronic plc and other successful global companies of significant size;

• service on other public company boards;

• former Certified Public accountant (CPA) and qualification as an audit committee financial expert as defined in the federal securities laws;

• independence under the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism.

Other Public Company Directorships: • Westinghouse Air Brake Technologies Corporation (Wabtec)(since 2016) • Syneos Health, Inc. (since 2017) • Chart Industries, Inc. (since 2021) |

|

Director since 2021 Age: 56 Committees (upon election): • Audit • Corporate Governance and Nominating |

WILLIAM F. LACEY

Mr. Lacey has been President and Chief Executive Officer of GE Lighting (lighting technology), a Savant company, since January 2016. He previously served as Chief Financial Officer of GE Home and Business Solutions Lighting from 2011 to 2015.

Our Board believes that Mr. Lacey will effectively serve our Board of Directors, our business, our team members and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service as President and Chief Executive Officer of GE Lighting and other General Electric businesses, all successful global companies of significant size;

• independence under the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism.

|

| Parker-Hannifin Corporation | 2021 Proxy Statement ◆ 9 |

Table of Contents

ITEM 1 - ELECTION OF DIRECTORS

|

Director Since: 2013 Age: 56 Committees: • Audit • Human Resources and Compensation |

KEVIN A. LOBO

Mr. Lobo has been Chairman of the Board of Stryker Corporation (medical technology) since July 2014 and has been Chief Executive Officer, President and a Director since October 2012.

Our Board believes that Mr. Lobo will effectively serve our Board of Directors, our business, our team members and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service in senior leadership positions at Stryker Corporation and other successful global companies of significant size;

• service on other public company boards;

• qualification as an audit committee financial expert as defined in the federal securities laws;

• independence under the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism.

Other Public Company Directorships: • Stryker Corporation (since 2012) | |

|

Director Since: 2004 Age: 68 Committees: • Corporate Governance and Nominating • Human Resources and Compensation (Chair) |

JOSEPH SCAMINACE

Now retired, Mr. Scaminace served as a Director and Chief Executive Officer of OM Group, Inc. (metal-based specialty chemicals) from June 2005 to October 2015 and Chairman of the Board of OM Group from August 2005 to October 2015.

Our Board believes that Mr. Scaminace will effectively serve our Board of Directors, our business, our team members and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service as Chief Executive Officer and Chairman of the Board of OM Group, Inc., and prior leadership positions at other global industrial companies of significant size;

• service on other public company boards;

• independence under the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism.

Other Public Company Directorships: • Cintas Corporation (since 2010)(Lead Director) | |

| 10 ◆ 2021 Proxy Statement | Parker-Hannifin Corporation |

Table of Contents

ITEM 1 - ELECTION OF DIRECTORS

|

Director Since: 2010 Age: 69 Committees: • Audit • Corporate Governance and Nominating |

ÅKE SVENSSON

Mr. Svensson is Chairman of Swedavia AB (transport infrastructure). He was Chairman of the Association of Swedish Engineering Industries (manufacturing trade organization), and Board Member of the Confederation of Swedish Enterprises from May 2018 until May 2020. He was previously Director General of Swedish Engineering Industries from September 2010 to August 2016. Mr. Svensson is a former Director of Saab AB.

Our Board believes that Mr. Svensson will effectively serve our Board of Directors, our business, our team members and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service as Chief Executive Officer and President of Saab AB, a successful European aerospace, defense and security company of significant size;

• extensive knowledge of European aerospace, defense and security businesses and related issues and trends;

• independence under the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism. | |

|

Director Since 2019 Age: 57 Committees: • Audit • Corporate Governance and Nominating |

LAURA K. THOMPSON

Now retired, Ms. Thompson served as Executive Vice President of The Goodyear Tire & Rubber Company (tire manufacturing) from December 2013 until her retirement in March 2019, and Chief Financial Officer of Goodyear from December 2013 until October 2018.

Our Board believes that Ms. Thompson will effectively serve our Board of Directors, our business, our team members and our shareholders based on her significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service as Executive Vice President and Chief Financial Officer and in other key leadership positions at The Goodyear Tire & Rubber Company, a manufacturing company of significant size;

• service on other public company boards;

• qualification as an audit committee financial expert as defined in the federal securities laws;

• independence under the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism.

Other Public Company Directorships: • Wesco International (since 2019) • Titan International, Inc. (since 2021) | |

| Parker-Hannifin Corporation | 2021 Proxy Statement ◆ 11 |

Table of Contents

ITEM 1 - ELECTION OF DIRECTORS

|

Director Since: 2016 Age: 58 Committees: • Audit • Human Resources and Compensation |

JAMES R. VERRIER

Now retired, Mr. Verrier served as a Board Advisor to BorgWarner, Inc. (powertrain solutions) from August 1, 2018 until his retirement on February 28, 2019. He previously served as Chief Executive Officer and director of BorgWarner, Inc. from January 2013 until July 31, 2018, and President of BorgWarner from March 2012 until July 31, 2018.

Our Board believes that Mr. Verrier will effectively serve our Board of Directors, our business, our team members and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• service as a director, Chief Executive Officer and President of BorgWarner, Inc., a successful publicly-traded global automotive industry components and parts supplier of significant size;

• service on other public company boards;

• independence under the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism.

Other Public Company Directorships: • BorgWarner, Inc. (former)(2013-2018) | |

|

Director Since: 2009 Age: 64 Committees: • Corporate Governance and Nominating (Chair and Lead Director) • Human Resources and Compensation |

JAMES L. WAINSCOTT

Now retired, Mr. Wainscott was Chairman of the Board of AK Steel Holding Corporation (steel producer) from January 2006 to May 2016; and President, Chief Executive Officer and a Director of AK Steel Holding Corporation from October 2003 to January 2016.

Our Board believes that Mr. Wainscott will effectively serve our Board of Directors, our business, our team members and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service as President, Chief Executive Officer and Chairman of the Board of AK Steel Holding Corporation, a successful global industrial company of significant size;

• service on other public company boards;

• independence under the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors;

• proven ability to effectively serve as our Lead Director and to otherwise work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors and integrity, honesty, judgment and professionalism.

Other Public Company Directorships: • CSX Corporation (since 2020) | |

| 12 ◆ 2021 Proxy Statement | Parker-Hannifin Corporation |

Table of Contents

ITEM 1 - ELECTION OF DIRECTORS

|

Director Since: 2015 Age: 62 Committees: None |

THOMAS L. WILLIAMS

Mr. Williams has been our Chairman of the Board since January 2016; and our Chief Executive Officer since February 2015. He was our Executive Vice President from August 2008 to February 2015 and our Operating Officer from November 2006 to February 2015.

Our Board believes that Mr. Williams will effectively serve our Board of Directors, our business, our team members and our shareholders based on his significant and diverse experiences, skills, qualifications and viewpoints from, among other things:

• extensive service as Chief Executive Officer, Executive Vice President and Operating Officer and various other operational leadership positions during his 17-year career with us;

• intimate, working knowledge of our day-to-day business, plans, strategies and initiatives;

• service on other company boards;

• proven ability to work efficiently and effectively with our other Directors to oversee and address issues and risks facing our business; and

• high level of commitment to our Board of Directors, our business, our team members, and our shareholders, and a high level of integrity, honesty, judgment and professionalism.

Other Public Company Directorships: • The Goodyear Tire & Rubber Company (since 2019) • Chart Industries, Inc. (former)(2008-2019) |

ANNUAL ELECTIONS; MAJORITY VOTING; NO CUMULATIVE VOTING

Our Amended and Restated Regulations provide for the annual election of our entire Board of Directors. Accordingly, each Director elected at this Annual Meeting of Shareholders will hold office until the next Annual Meeting of Shareholders and until his or her successor is elected.

Our Amended Articles of Incorporation provide for a majority voting standard in the annual election of our Directors. Accordingly, at each Annual Meeting of Shareholders, each candidate for Director is elected only if the votes “for” the candidate exceed the votes “against” the candidate, unless the number of candidates exceeds the number of Directors to be elected. If the number of candidates exceeds the number of Directors to be elected, then in that election the candidates receiving the greatest number of votes shall be elected. Abstentions and broker non-votes shall not be counted as votes “for” or “against” a candidate, and shareholders are not able to cumulate votes in the election of Directors.

| Parker-Hannifin Corporation | 2021 Proxy Statement ◆ 13 |

Table of Contents

ITEM 1 - ELECTION OF DIRECTORS

NEW ELECTIONS and DEPARTURES

On January 10, 2021, Robert G. Bohn retired from our Board of Directors. Immediately prior to his retirement, Mr. Bohn served on the Audit and the Human Resources and Compensation Committees. Candy M. Obourn, who is currently serving as one of our Directors, will not stand for re-election at the Annual Meeting.

In fiscal year 2021, Jillian C. Evanko, Lance M. Fritz and William F. Lacey were identified as potential Director candidates and were evaluated by management and our Corporate Governance and Nominating Committee. Upon our Corporate Governance and Nominating Committee’s recommendations and as permitted under our Amended and Restated Regulations, our Board of Directors elected Ms. Evanko and Mr. Fritz on January 27, 2021, and Mr. Lacey on April 22, 2021, for terms expiring at this Annual Meeting of Shareholders. More detail and information on our Director recruiting, succession and refreshment process can be found under the caption “Director Selection and Nomination, Qualifications and Diversity.”

|

RECOMMENDATION REGARDING PROPOSAL 1:

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR

|

| 14 ◆ 2021 Proxy Statement | Parker-Hannifin Corporation |

Table of Contents

BOARD OF DIRECTORS

MEETINGS AND ATTENDANCE; EXECUTIVE SESSIONS

During fiscal year 2021, there were ten meetings of our Board of Directors. Each Director attended at least 75% of the meetings held by our Board of Directors and the Committees of our Board of Directors on which he or she served.

We hold a regularly scheduled meeting of our Board of Directors in conjunction with our Annual Meeting of Shareholders. Directors are expected to attend the Annual Meeting of Shareholders absent an appropriate reason. We held our Annual Meeting of Shareholders virtually in 2020 and all of the members of our Board of Directors attended and were available to answer shareholder questions.

In accordance with the listing standards of the New York Stock Exchange, our non-management Directors are scheduled to meet regularly in executive sessions without management and, if required, our independent Directors will meet at least once annually. Additional meetings of our non-management Directors may be scheduled from time to time when our non-management Directors determine that such meetings are desirable. Our non-management Directors met four times during fiscal year 2021.

NUMBER; CURRENT TERM; RELATIONSHIPS

Our Board of Directors presently consists of thirteen members. The current term of each member of our Board of Directors expires at our 2021 Annual Meeting of Shareholders. If all of the Director nominees are elected, we expect our Board of Directors to consist of twelve members after the 2021 Annual Meeting of Shareholders. None of our Directors are related to each other and no arrangements or understandings exist pursuant to which any Director was selected as a Director or Director nominee.

Our Corporate Governance Guidelines require at least a majority of our Directors to be “independent” as defined in the listing standards established by the New York Stock Exchange. Our Board of Directors has also adopted standards for Director independence, which are set forth in our Independence Standards for Directors.

We strongly favor a governance structure that includes an independent Board of Directors. Of the thirteen current members of our Board of Directors, eleven are independent based on our Board of Directors’ consideration of the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors. In addition, each of the Audit Committee, the Corporate Governance and Nominating Committee and the Human Resources and Compensation Committee of our Board of Directors is composed entirely of independent Directors. As a result, our independent Directors directly oversee critical matters such as our executive compensation program for executive officers, our Corporate Governance Guidelines, policies and practices, the integrity of our financial statements and our internal controls over financial reporting.

Our Board of Directors has affirmatively determined that the following eleven individuals who currently serve as Directors are independent: Jillian C. Evanko, Lance M. Fritz, Linda A. Harty, William F. Lacey, Kevin A. Lobo, Candy M. Obourn, Joseph Scaminace, Åke Svensson, Laura K. Thompson, James R. Verrier and James L. Wainscott.

Among other things, our Board of Directors does not consider a Director to be independent unless it affirmatively determines that the Director has no material relationship with us either directly or as a partner, shareholder or officer of an organization that has a relationship with us. Our Corporate Governance and Nominating Committee and our Board of Directors annually reviews and determines which of its members are independent based on the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors. During such review, our Corporate Governance and Nominating Committee and our Board of Directors broadly consider all facts and circumstances which they deem relevant, including any commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships between us and any of our Directors.

| Parker-Hannifin Corporation | 2021 Proxy Statement ◆ 15 |

Table of Contents

CORPORATE GOVERNANCE

In fiscal year 2021, after considering the facts and circumstances applicable to each Director, our Board of Directors determined that Ms. Evanko, and Messrs. Fritz, Lacey and Lobo served as executive officers of companies that have existing customer and/or supplier relationships with us, and that such relationships required further analysis to confirm their independence. Our Corporate Governance and Nominating Committee and our Board of Directors further analyzed these relationships and found that each of Ms. Evanko, and Messrs. Fritz, Lacey and Lobo does not receive any direct or indirect personal benefits as a result of these relationships, and that the amounts paid to or by us under such relationships fell significantly below the threshold for independence provided in the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors. Based on such further analysis, our Board of Directors affirmatively concluded that each of Ms. Evanko, and Messrs. Fritz, Lacey and Lobo is independent.

Our Board of Directors currently employs a “dual leadership” structure. We have a Lead Director who is also the Chair of the Corporate Governance and Nominating Committee, and a Chairman of the Board, who is our Chief Executive Officer. Our Lead Director is elected solely by the independent members of our Board of Directors and holds a position separate and independent from our Chairman of the Board. Our Corporate Governance Guidelines provide that the Chair of the Corporate Governance and Nominating Committee will serve as our Lead Director and that the Chair of the Corporate Governance and Nominating Committee is elected every five years.

The specific authorities, duties and responsibilities of our Lead Director are described in our Corporate Governance Guidelines. Among other things, our Lead Director presides over and supervises the conduct of all meetings of our independent Directors, calls meetings of our independent Directors, and prepares and approves all agendas and schedules for meetings of our Board.

Our Board believes that having a Lead Director who is elected by our independent Directors ensures that our Board will at all times have an independent Director in a leadership position. At the same time, our Board of Directors believes that it is important to maintain flexibility in its leadership structure to allow for a member of management to serve in a leadership position alongside the Lead Director if our Board of Directors determines that such a leadership structure best meets the needs of our Board, our business, our team members and our shareholders.

Our Board has determined that this leadership structure is currently more efficient and effective than a structure which employs a single, independent Chairman of the Board. Our Board of Directors views this structure as one that ensures both independence in leadership and a balance of knowledge, power and authority. For example, our leadership structure employs both a Chairman of the Board who is also our Chief Executive Officer and who possesses an intimate working knowledge of our day-to-day business, plans, strategies and initiatives, and a Lead Director who has a strong working relationship with our non-management, independent Directors. These two individuals combine their unique knowledge and perspectives to ensure that management and our independent Directors work together as effectively as possible. Among other things, our Chairman of the Board ensures that our Board addresses strategic issues that management considers critical, while our Lead Director ensures that our Board addresses strategic issues that our independent Directors consider critical.

Our Board recognizes, however, that no single leadership model may always be appropriate. Accordingly, our Board of Directors regularly reviews its leadership structure to ensure that it continues to represent the most efficient and effective structure for our Board of Directors, our business, our team members and our shareholders.

DIRECTOR SELECTION AND NOMINATION, QUALIFICATIONS AND DIVERSITY

The Corporate Governance and Nominating Committee of our Board is responsible for identifying, evaluating and recommending potential Director candidates. The Corporate Governance and Nominating Committee ensures that Director recruiting, succession and refreshment are persistent areas of focus and regularly reviews the size, composition and independence of our Board, and any expected vacancies, in determining whether and to what extent to actively recruit new Directors or to replace departing Directors.

The Corporate Governance and Nominating Committee utilizes a variety of methods and processes to identify potential Director candidates, including through reputable third-party search firms, unsolicited recommendations from other third-party search firms, and referrals from current or past members of our Board. In addition, the Corporate Governance and Nominating Committee will give appropriate consideration to qualified persons

| 16 ◆ 2021 Proxy Statement | Parker-Hannifin Corporation |

Table of Contents

CORPORATE GOVERNANCE

recommended by shareholders for nomination as Directors (provided that such recommendations comply with the procedures set forth under the caption “Shareholder Recommendations for Director Nominees”) and will consider such candidates on the same basis as candidates recommended by other sources. The Corporate Governance and Nominating Committee generally will not, however, consider recommendations for Director nominees submitted by individuals who are not affiliated with us.

The Corporate Governance and Nominating Committee has developed and implemented a robust process to ensure that its formal Director searches are appropriately scoped and designed to produce a slate of potential candidates representing a broad range of backgrounds, educations, experiences, skills and viewpoints that will enable them, individually and collectively, to address the issues affecting our Board, our business, our team members and our shareholders, and optimize the functioning and decision-making and oversight roles of our Board and its Committees. The Corporate Governance and Nominating Committee currently focuses on the following key search and evaluation criteria, but considers the entirety of each proposed candidate’s credentials and all available information that may be relevant to each candidate’s nomination.

| Key Criteria | Overall Philosophy and Approach | |

|

Culture and Values |

The Corporate Governance and Nominating Committee places high value on cultural fit. Our Directors must be able to work together to efficiently and effectively oversee the issues and risks facing our business, and have the commitment, integrity, honesty, judgment and professionalism required under our Corporate Governance Guidelines and Global Code of Business Conduct, and to otherwise serve the long-term interests of our Board of Directors, our business, our team members and our shareholders.

| |

|

Diversity |

The Corporate Governance and Nominating Committee firmly believes diversity is critical to a well-functioning Board of Directors, and is committed to enhancing diversity on our Board. As a result, our Corporate Governance Guidelines require each search for qualified director candidates to include individuals with diverse backgrounds, including gender, ethnicity and race. In our most recently completed Director search in 2021, for example, a majority of the candidates presented for consideration were diverse candidates which ultimately resulted in the elections of Ms. Evanko, Mr. Fritz and Mr. Lacey, strengthening the gender and racial diversity of our Board.

| |

| Skills and Qualifications |

The Corporate Governance and Nominating Committee also believes it is essential to have a Board with the range of skills and experience needed to effectively evaluate, monitor and oversee the wide range of considerations presented by the size and scope of our Company, operations, products and markets. As a result, the Corporate Governance and Nominating Committee seeks to identify nominees who are well equipped with a broad set of key skills, including the following:

| |

| • service as a Chief Executive Officer, Chief Operating Officer, Chief Financial Officer, or in other senior leadership positions at publicly-traded companies; | ||

| • significant experience in corporate strategy, manufacturing, sales and marketing, industrial business, aerospace business, international business, finance and accounting, technology and digital applications, and other key areas; | ||

| • ability to effectively evaluate, monitor and oversee the most critical risks facing our business; and | ||

| • independence under the applicable independence standards of the New York Stock Exchange and our Independence Standards for Directors.

| ||

The Corporate Governance and Nominating Committee, utilizing its robust and thoughtful approach to Director recruiting, succession and refreshment, has built an experienced, diverse and independent Board that provides significant oversight over our plans and strategies for growth, financial performance and shareholder value creation.

Management and our Board of Directors and its Committees are collectively engaged in identifying, overseeing, evaluating and managing the material risks facing our business to ensure that our strategies and

| Parker-Hannifin Corporation | 2021 Proxy Statement ◆ 17 |

Table of Contents

CORPORATE GOVERNANCE

objectives work to minimize such risks. Our Board of Directors has the ultimate responsibility to monitor the risks facing our business. Among other things, our Board of Directors reviews and discusses in detail, at least annually, our corporate strategy and annual operating plan, which covers significant strategic topics such as our key markets, operational priorities under The Win Strategy, strategic positioning, financial and operational outlooks, capital allocation, balance sheet strength, debt portfolio and positions, share repurchase activity, and dividend history and strategies. Our Board also maintains regular oversight of other key risk areas including review at least annually of management succession planning, cyber security, enterprise risk management, and environmental, social and governance (ESG) matters, among others.

Various members of our management are responsible for our day-to-day risk management activities, including members of our Human Resources, Internal Audit and Compliance, Legal, Tax, Risk Management, Treasury, Finance, and Information Technology departments, and our internal Cyber Security Committee. Those individuals are charged with identifying, overseeing, evaluating and managing risks in their areas of responsibility and for ensuring that any significant risks are addressed with our Board or the appropriate Board Committees. The Committees of our Board of Directors are each responsible for the various areas of risk oversight as described in the “Committees of our Board of Directors” section of this Proxy Statement. Management and the Chair of the applicable Committee ensure that any significant risks are reported to and addressed with the entire Board of Directors. Our Lead Director and the other Committee Chairs ensure that risk management is a recurring agenda item for meetings of our Board and its Committees.

Management and our Board of Directors and its Committees also engage outside advisors where appropriate to assist in the identification, oversight, evaluation and management of the risks facing our business. These outside advisors include our independent registered public accounting firm, external legal counsel and insurance providers, and the independent executive and non-employee Director compensation consultant retained by the Human Resources and Compensation Committee.

Our Board believes that its current level of independence, leadership structure and qualifications and diversity of its members facilitate the effective identification, oversight, evaluation and management of risk. Our Lead Director meets regularly with our other independent Directors without management to discuss current and potential risks and the means of mitigating those risks, and has the authority to direct and evaluate our risk management efforts.

Management and our Board of Directors and its Committees view the risk management role of our Board of Directors and its Committees, and their relationship with management in the identification, oversight, evaluation and management of risk, as paramount to the short-term viability and long-term sustainability of our business.

COMMITTEES OF OUR BOARD OF DIRECTORS

BOARD COMMITTEES; COMMITTEE CHARTERS

Our Board has established and delegated certain authorities and responsibilities to three committees: the Human Resources and Compensation Committee, the Corporate Governance and Nominating Committee, and the Audit Committee. Each Committee of our Board is governed by a written charter which is posted and available on the Corporate Governance page of our investor relations website at www.phstock.com. Shareholders may request copies of these charters, free of charge, by writing to Parker-Hannifin Corporation, 6035 Parkland Boulevard, Cleveland, Ohio 44124-4141, Attention: Secretary, or by calling (216) 896-3000.

All members of each Committee are independent under the listing standards of the New York Stock Exchange as well as our Independence Standards for Directors. Each Committee regularly reports its activities to the full Board of Directors.

| 18 ◆ 2021 Proxy Statement | Parker-Hannifin Corporation |

Table of Contents

COMMITTEES OF OUR BOARD OF DIRECTORS

Information about the current respective Committee memberships and number of meetings is reflected in the following table:

| Directors

|

Audit

|

Corporate

|

Human Resources

| |||

| Linda A. Harty (ACFE) |

CHAIR | ◆ | ||||

| Kevin A. Lobo (ACFE) |

◆ | ◆ | ||||

| Candy M. Obourn |

◆ | ◆ | ||||

| Joseph Scaminace |

◆ | CHAIR | ||||

| Åke Svensson |

◆ | ◆ | ||||

| Laura K. Thompson (ACFE) |

◆ | ◆ | ||||

| James R. Verrier |

◆ | ◆ | ||||

| James L. Wainscott |

CHAIR | ◆ | ||||

|

Fiscal Year 2021 Meetings |

5 | 5 | 4 | |||

If all of the current Director Nominees are elected at the Annual Shareholder Meeting, the Committee memberships will be as follows:

| Directors

|

Audit

|

Corporate

|

Human Resources

| |||

| Jillian C. Evanko |

◆ | ◆ | ||||

| Lance M. Fritz |

◆ | ◆ | ||||

| Linda A. Harty (ACFE) |

CHAIR | ◆ | ||||

| William F. Lacey |

◆ | ◆ | ||||

| Kevin A. Lobo (ACFE) |

◆ | ◆ | ||||

| Joseph Scaminace |

◆ | CHAIR | ||||

| Åke Svensson |

◆ | ◆ | ||||

| Laura K. Thompson (ACFE) |

◆ | ◆ | ||||

| James R. Verrier |

◆ | ◆ | ||||

| James L. Wainscott |

CHAIR | ◆ | ||||

Our Board of Directors has determined that each of Linda A. Harty, Kevin A. Lobo and Laura K. Thompson are audit committee financial experts (designated in the above table as (ACFE)) as defined in the federal securities laws.

Each of our Committees works with the applicable members of our Human Resources, Internal Audit and Compliance, Legal, Tax, Risk Management, Treasury, Finance, and Information Technology departments and other management personnel to oversee and evaluate risks relevant to each Committee.

THE HUMAN RESOURCES AND COMPENSATION COMMITTEE

The Human Resources and Compensation Committee oversees the administration, structure and determination of our executive compensation program. In addition, the Human Resources and Compensation Committee works with its independent executive compensation consultant and our human resources, legal and other management personnel to oversee and evaluate risks arising from and relating to our compensation policies and practices for all team members, our succession planning and talent development strategies and initiatives, and other human resources issues facing our business.

In particular, the Human Resources and Compensation Committee monitors any significant existing or potential risks arising from our compensation policies and practices for all team members through its oversight of an

| 19 ◆ 2021 Proxy Statement | Parker-Hannifin Corporation |

Table of Contents

COMMITTEES OF OUR BOARD OF DIRECTORS

annual compensation risk review conducted by management and the Human Resources and Compensation Committee’s independent executive compensation consultant. The results of this review are evaluated and discussed among management, the Human Resources and Compensation Committee and its independent executive compensation consultant and, if any significant risks are identified, the full Board of Directors. Based on the review conducted during fiscal year 2021, we believe that our current compensation policies and practices are designed to mitigate risks related to compensation, and such policies and practices are not reasonably likely to have a material adverse effect on our business.

The annual compensation risk review begins with a global assessment of any plans or programs that could potentially encourage excessive risk-taking or otherwise present significant risks to our business. The review also takes into account our individual business units to determine whether any of them carries a significant portion of our risk profile, structures compensation significantly different than others or is significantly more profitable than others.

The review then evaluates whether the applicable plans and programs are likely to encourage excessive risk-taking or detrimental behavior, vary significantly from our risk-reward structure, or otherwise present significant risks to our business.

During our fiscal year 2021 compensation risk review, we also identified and evaluated various mechanisms that we currently have in place that may serve to mitigate any existing or potential risks arising from our compensation policies and practices, including the following:

| • | our executive officers and other management-level team members are compensated with a mix of annual and long-term incentives, fixed and at-risk compensation, cash and multiple forms of equity compensation; |

| • | compensation packages gradually become more focused on long-term, at-risk and equity compensation as our team members ascend to and through management-level positions; |

| • | our global compensation plans and programs generally utilize the same or substantially similar performance measures; |

| • | we use multiple performance measures to determine payout levels under certain elements of incentive compensation and different performance measures for our annual incentives as compared to our long-term incentives; |

| • | the performance of our team members is not evaluated or measured based solely on changes in our stock price; |

| • | our incentive compensation programs generally limit payouts to a specified maximum, while those that do not are mitigated by other factors (e.g., stock appreciation rights are mitigated by long-term vesting periods and stock ownership guidelines); |

| • | we do not offer “guaranteed” bonuses and all of our incentive compensation elements carry downside risk for participants; |

| • | our executive officers are subject to specific stock ownership guidelines, a “claw back” policy and provisions requiring forfeiture of certain elements of incentive compensation under certain circumstances; |

| • | our compensation packages, including severance packages and supplemental pensions, are within market ranges; |

| • | the Human Resources and Compensation Committee has the discretion to assess the quality of our results in relation to our various performance measures and the risks taken to attain those results in approving final incentive payouts; |

| • | our decentralized organizational structure lessens the impact of any excessive risks taken by individual business units or operating groups; and |

| 20 ◆ 2021 Proxy Statement | Parker-Hannifin Corporation |

Table of Contents

COMMITTEES OF OUR BOARD OF DIRECTORS

| • | our team members are evaluated, measured and assessed based on their compliance with our Global Code of Business Conduct and other internal policies and controls, and the extent to which they act in the best interests of our business and our shareholders. |

During the annual compensation risk review, we also consider whether any changes to our compensation plans and programs may be necessary to further mitigate risk. The Human Resources and Compensation Committee did not make any changes to our compensation plans and programs based on the results of our fiscal year 2021 review.

THE CORPORATE GOVERNANCE AND NOMINATING COMMITTEE

Among other things, the Corporate Governance and Nominating Committee is responsible for evaluating and recommending to our Board of Directors qualified nominees for election as Directors and qualified Directors for Committee membership, establishing evaluation procedures for the performance of our Board of Directors and its Committees, developing corporate governance guidelines and independence standards, and considering other matters regarding our corporate governance structure. In addition, the Corporate Governance and Nominating Committee works with our legal and other management personnel to oversee and evaluate:

| • | Director independence, qualifications and diversity issues; |

| • | Board of Directors and Committee leadership, composition, function and effectiveness; |

| • | alignment of the interests of our shareholders with the performance of our Board of Directors; |

| • | compliance with applicable corporate governance rules and standards; and |

| • | other corporate governance issues and trends. |

The Audit Committee of our Board of Directors is our standing audit committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934. Each member of our Audit Committee is independent, as defined in our Independence Standards for Directors and in compliance with the independence standards applicable to audit committee members under the New York Stock Exchange listing standards and under the federal securities laws.

Among other things, the Audit Committee is responsible for appointing, compensating, retaining, and overseeing our independent registered public accounting firm and evaluating its independence, approving all audit and non-audit engagements with our independent registered public accounting firm, and reviewing our annual and quarterly financial statements, internal and independent audit plans, the results of such audits and the adequacy of our internal control structure.

In addition, the Audit Committee works with our internal audit and compliance, legal, tax, treasury and finance departments and other management personnel to oversee and evaluate risks, including major financial, tax, strategic, and operational risk exposures and risks related to compliance with legal and regulatory requirements, and significant litigation and claims.

The Audit Committee also meets privately at each of its meetings with representatives from our independent registered public accounting firm and our Vice President – Audit, Compliance and Enterprise Risk Management.

| Parker-Hannifin Corporation | 2021 Proxy Statement ◆ 21 |

Table of Contents

REVIEW AND APPROVAL OF TRANSACTIONS WITH RELATED PERSONS

The Corporate Governance and Nominating Committee is responsible for considering questions of possible conflicts of interest of Directors and executive officers and for making recommendations to prevent, minimize or eliminate such conflicts of interest. Our Global Code of Business Conduct provides that our Directors, officers, and other team members and their spouses and other close family members must avoid interests or activities that create any actual or potential conflict of interest. These restrictions cover, among other things, interests or activities that result in receipt of improper personal benefits by any person as a result of his or her position as our Director, officer, or other team member or as a spouse or other close family member of any of our Directors, officers or other team members. Our Global Code of Business Conduct also requires our Directors, officers and other team members to promptly disclose any potential conflicts of interest to our Corporate Compliance Office. We also require that each of our executive officers and Directors complete a detailed annual questionnaire that requires, among other things, disclosure of any transactions with a related person meeting the minimum threshold for disclosure under the relevant U.S. Securities and Exchange Commission, or SEC, rules. All responses to the annual questionnaires are reviewed and analyzed by our legal counsel and, as necessary or appropriate, presented to the Corporate Governance and Nominating Committee for analysis, consideration and, if appropriate, approval.

The Corporate Governance and Nominating Committee will consider the following in determining if any transaction with a related person or party should be approved, ratified or rejected:

| • | the nature of the related person’s interest in the transaction; |

| • | the material terms of the transaction; |

| • | the importance of the transaction to the related person and to us; |

| • | whether the transaction would impair the judgment or the exercise of the fiduciary obligations of any Director or executive officer; |

| • | the possible alternatives to entering into the transaction; |

| • | whether the transaction is on terms comparable to those available to third parties; and |

| • | the potential for an actual or apparent conflict of interest. |

During fiscal year 2021, we reviewed the annual questionnaires and determined that no related-party transactions exist. This review included a detailed evaluation of the transactions reviewed and analyzed by our Board of Directors in determining Director independence as described in the “Director Independence” section of this Proxy Statement. Based on management’s review and analysis, no actual or potential related-party transactions were presented to the Corporate Governance and Nominating Committee for analysis, consideration or approval.

DELINQUENT SECTION 16(a) REPORTS

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers, Directors and beneficial owners of more than 10% of our Common Shares to file initial stock ownership reports and reports of changes in ownership with the SEC. Based solely on a review of these reports, as filed electronically with the SEC during fiscal year 2021, and upon written representations from our executive officers and Directors, we believe that all Directors, Officers and 10% or greater beneficial owners complied with all such filing requirements for fiscal year 2021, except that due to administrative error a late Form 4 was filed on May 18, 2021 for Mr. Malone with respect to two transactions that occurred on May 7, 2021.

Our Amended and Restated Regulations permit a shareholder, or a group of up to twenty shareholders, owning three percent or more of the Company’s outstanding shares of Common Stock continuously for at least three years to nominate and include the Company’s annual meeting proxy materials a number of director nominees up to a greater of (x) two, or (y) twenty percent of the Board, provided that the shareholder(s) and nominee(s) satisfy the requirements specified in our Amended and Restated Regulations.

| 22 ◆ 2021 Proxy Statement | Parker-Hannifin Corporation |

Table of Contents

OTHER GOVERNANCE MATTERS

Our Board of Directors maintains a “claw back” policy which allows us to recover or withhold any Target Incentive Bonuses, General RONA Bonuses, Converted RONA Bonuses or LTIP Awards which are paid or payable to an executive officer if:

| • | payment, grant or vesting was based on the achievement of financial results that were subsequently the subject of a restatement of any of our financial statements filed with the SEC; |

| • | our Board of Directors determines in its sole discretion that the fraud or misconduct of the executive officer caused or contributed to the need for the restatement; |

| • | the amount that would have been paid or payable to the executive officer would have been less if the financial results had been properly reported; and |

| • | our Board of Directors determines in its sole discretion that it is in our best interests and in the best interests of our shareholders to require the executive officer to repay or forfeit all or any portion of the amount paid or payable. |

Our stock ownership guidelines align the financial interests of our executive officers and Directors with those of our shareholders by encouraging the accumulation and retention of our common stock by our Directors and executive officers. Our Board of Directors has approved the following amended stock ownership guidelines for our Directors and executive officers:

|

Participants

|

Guidelines

|

|

Chairman of the Board and Chief Executive Officer |

Six times annual base salary | |||

| Vice Chairman and President |

Four times annual base salary | |||

| Chief Operating Officer |

Four times annual base salary | |||

| Executive or Senior Vice Presidents |

Three times annual base salary | |||

| Other Executive Officers |

Two times annual base salary | |||

| Non-Management Directors |

Five times annual retainer |

The recommended time period for achieving compliance with the guidelines is five years from election or appointment to the position that is subject to the guidelines. The Human Resources and Compensation Committee reviews share ownership information with the Chief Executive Officer in August of each year to ensure compliance with the guidelines. As of June 30, 2021, all executive officers and Directors in their positions for at least five years were in compliance with the guidelines.

STOCK OWNERSHIP RESTRICTIONS - SPECULATIVE TRANSACTIONS / HEDGING