Form DEF 14A Motorola Solutions, Inc.

Table of Contents

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Table of Contents

Table of Contents

|

|

|

| ||

Dear Fellow Motorola Solutions Shareholder:

At Motorola Solutions, we believe that safety and security are foundational to enable communities and businesses to thrive. Our technologies strengthen the intersection between public safety and enterprise security, helping to ensure the safety of millions of people around the world – from classrooms to hospitals, airports to stadiums, in the office and in our communities.

And as we see the increasing and complex nature of threats around the world, the work we do and the technologies we create are more critical than ever. We remain committed to making strategic investments, inspiring innovation and advancing the technologies that meet our customers’ unique challenges, ultimately helping to create a safer environment for all.

Most importantly, we know that it’s not only what we do, but how we do it that makes a difference to our customers and the communities we serve. Our values unite our global workforce of approximately 20,000 strong – we are inclusive, innovative, passionate, driven, accountable and partners. And we remain steadfast in our intent to embed diversity, equity and inclusion (“DEI”) across our company, from the design of our technologies to the suppliers we work with and the partnerships we establish to help recruit a diverse talent pipeline.

I’m particularly proud of our efforts throughout 2022, focused on:

| • | Continuing to prioritize the safety and welfare of our people and those who we serve. |

| • | Investing $779 million in research and development, delivering next-generation technologies while growing our portfolio of intellectual property, which stands at approximately 6,530 granted patents with approximately 870 patents pending. |

| • | Diversifying the expertise of our board of directors with the addition of Dr. Ayanna Howard, adding deep expertise in artificial intelligence, robotics and human-computer interaction. |

| • | Incorporating additional DEI practices into our hiring to help ensure our global workforce reflects a diverse range of backgrounds and experiences. |

| • | Giving back to our communities with employees volunteering more than 75,000 hours and the majority of the Motorola Solutions Foundation’s $9.5 million in strategic grants directly benefiting people of color, including first responders, students and teachers. |

| • | Reaffirming our commitment to addressing the effects of climate change and publishing our inaugural Task Force on Climate-Related Financial Disclosures report. |

| • | Maintaining our disciplined and strategic approach to capital allocation, with a focus on investing for the long term and delivering superior value to shareholders, including $1.2 billion across seven acquisitions, $836 million in share repurchases and $530 million paid in dividends. |

In this past year, we achieved record earnings per share, record sales in both segments and all three technologies, and ended the year with record backlog of $14.3 billion, up 6% versus a year ago. Notably, capping the year with our acquisition of Rave Mobile Safety, our total addressable market has increased to $60 billion.

The momentum of our business is strong. Our accomplishments and performance in 2022 demonstrate the value Motorola Solutions can create for its shareholders, grounded in our people-first culture and commitment to operate responsibly, while continuing to invest in the technologies that advance the future of public safety and enterprise security.

Thank you for your continued support.

Gregory Q. Brown

Chairman and CEO

Table of Contents

|

|

PRINCIPAL EXECUTIVE OFFICES: 500 West Monroe Street Chicago, Illinois 60661 |

| ||

March 30, 2023

NOTICE OF 2023 VIRTUAL ANNUAL MEETING OF SHAREHOLDERS

Annual Meeting Date: Tuesday, May 16, 2023

Time: 9:30 a.m. Central Time

Virtual Meeting Site: www.virtualshareholdermeeting.com/MSI2023

This year’s virtual annual meeting (the “Annual Meeting”) will be held entirely online via live audio webcast. The Annual Meeting will begin promptly at 9:30 a.m. Central Time. For more information regarding how to attend the Annual Meeting online, please see the section titled “User’s Guide” on page 90 of this Proxy Statement. Shareholders will be able to listen, vote, and submit questions from their home or from any remote location that has internet connectivity. There will be no physical location for shareholders to attend. Shareholders may only attend, vote, and submit questions during the Annual Meeting by logging in at www.virtualshareholdermeeting.com/MSI2023 and entering the 16-digit control number included in their Notice of Internet Availability of Proxy Materials (the “Notice”), voting instruction form, or proxy card.

The purpose of the meeting is to:

| 1. | elect the eight director nominees named in this Proxy Statement for a one-year term; |

| 2. | ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2023; |

| 3. | hold a shareholder advisory vote to approve the Company’s executive compensation; |

| 4. | hold a shareholder advisory vote to approve the frequency of the advisory vote to approve the Company’s executive compensation; and |

| 5. | act upon such other matters as may properly come before the Annual Meeting. |

Only Motorola Solutions shareholders of record at the close of business on March 17, 2023 (the “record date”) will be entitled to notice of, and to vote at, the meeting or any adjournment or postponement thereof. The Notice, which contains instructions regarding how to access this Proxy Statement, the proxy card and the Company’s 2022 Annual Report, is first being mailed to shareholders on or about March 30, 2023. In addition, this Proxy Statement, the proxy card and the Company’s 2022 Annual Report are available at www.ProxyVote.com.

If you are a “street name” shareholder (meaning that your shares are registered in the name of your broker, bank or other nominee), you will receive instructions from such bank, broker or other nominee describing how to vote your shares.

By order of the Board of Directors,

Kristin L. Kruska

Secretary

|

REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS:

|

||||||||

|

|

ONLINE BEFORE THE MEETING

|

|

BY MAIL

|

|||||

| visit www.proxyvote.com

|

If you received a printed copy of the proxy card, mark, sign, date and return the proxy card using the postage-paid envelope provided.

|

|||||||

|

|

BY TELEPHONE

|

|

ONLINE AT THE VIRTUAL ANNUAL MEETING

|

|||||

| Use the toll-free telephone number listed on your proxy card.

|

Attend the virtual Annual Meeting at www.virtualshareholdermeeting.com/MSI2023

|

|||||||

THIS MEETING WILL TAKE PLACE ONLINE ONLY. THERE IS NO PHYSICAL LOCATION. In order to attend the meeting as a shareholder, you will need the 16-digit control number included on your Notice, proxy card or voting instruction form.

Table of Contents

|

TABLE OF CONTENTS

|

|

|

PROXY STATEMENT

| 1 | ||||

| 13 | ||||

| PROPOSAL NO. 1 — ELECTION OF EIGHT DIRECTORS NAMED IN THIS PROXY STATEMENT FOR A ONE-YEAR TERM |

13 | |||

| 13 | ||||

| 18 | ||||

| 18 | ||||

| 21 | ||||

| 25 | ||||

| 26 | ||||

| 28 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

| 33 | ||||

| 33 | ||||

| 34 | ||||

| PROPOSAL NO. 2 — RATIFICATION OF THE APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2023 | 37 | |||

| OUR PAY | 38 | |||

| PROPOSAL NO. 3 — ADVISORY APPROVAL OF THE COMPANY’S EXECUTIVE COMPENSATION | 38 | |||

| COMPENSATION DISCUSSION AND ANALYSIS | 39 | |||

| 40 | ||||

| 41 | ||||

| 51 | ||||

| 55 | ||||

| 57 | ||||

| 58 | ||||

| 59 | ||||

| 62 | ||||

| COMPENSATION AND LEADERSHIP COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION |

62 | |||

| 63 | ||||

| 63 | ||||

| 66 | ||||

| 67 | ||||

| 68 | ||||

| 69 | ||||

| 70 | ||||

| 70 | ||||

| 71 | ||||

| TERMINATION OF EMPLOYMENT AND CHANGE IN CONTROL ARRANGEMENTS |

72 | |||

| 79 | ||||

| 80 | ||||

| 83 | ||||

| PROPOSAL NO. 4 — ADVISORY APPROVAL OF THE FREQUENCY OF THE ADVISORY VOTE TO APPROVE THE COMPANY’S EXECUTIVE COMPENSATION | 84 | |||

| 85 | ||||

| 85 | ||||

| 87 | ||||

| 87 | ||||

| 88 | ||||

| 88 | ||||

| 90 | ||||

| 90 | ||||

| 90 | ||||

| 91 | ||||

| 94 | ||||

| 96 | ||||

Table of Contents

| PROXY STATEMENT SUMMARY |

This proxy statement (the “Proxy Statement”) is being furnished to holders of common stock, $0.01 par value per share (the “Common Stock”) of Motorola Solutions, Inc. (“we,” “our,” “Motorola Solutions,” “MSI” or the “Company”). Proxies are being solicited on behalf of the Board of Directors of the Company (the “Board”) to be used at the 2023 Annual Meeting of Shareholders (the “Annual Meeting”) to be held virtually at www.virtualshareholdermeeting.com/MSI2023 on Tuesday, May 16, 2023 at 9:30 a.m. Central Time, for the purposes set forth in the Notice of 2023 Virtual Annual Meeting of Shareholders. This Proxy Statement is dated March 30, 2023 and is being distributed to shareholders on or about March 30, 2023.

WHAT IS MOTOROLA SOLUTIONS?

Motorola Solutions is a global leader in public safety and enterprise security. Our technologies in Land Mobile Radio Communications (“LMR” or “LMR Communications”), Video Security and Access Control and Command Center, bolstered by managed and support services, help make communities safer and businesses stay productive and secure. We serve more than 100,000 public safety and commercial customers in over 100 countries, providing “purpose-built” solutions designed for their unique needs. Headquartered in Chicago, we have a rich heritage of innovation focusing on advancing global safety for more than 90 years that our approximately 20,000 employees continue today.

PERFORMANCE AND ACCOMPLISHMENTS

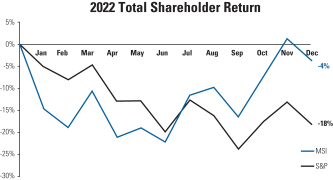

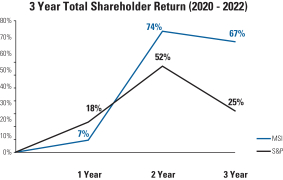

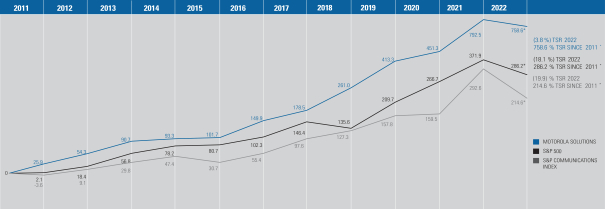

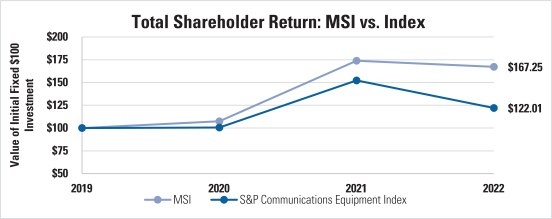

TOTAL SHAREHOLDER RETURN (in percent)

PERFORMANCE HIGHLIGHTS SINCE 2011

|

758.6% TOTAL SHAREHOLDER RETURN*

|

51% REDUCTION IN SHARE COUNT

|

$18.7 BILLION IN CAPITAL RETURN

|

| * | Based on the split adjusted closing price of MSI common stock on December 31, 2010 and the closing price of MSI common stock on December 31, 2022, illustrating the growth of an initial investment of $100 on December 31, 2010, including payment of dividends. |

| Motorola Solutions Notice of 2023 Annual Meeting of Shareholders and Proxy Statement | 1 |

Table of Contents

| 2022 HIGHLIGHTS

|

||||||

|

• Grew sales 12% to record $9.1 billion

• Achieved record sales in both segments and all three technologies

• Grew backlog 6% compared to 2021, to record $14.3 billion

• Increased quarterly dividend 11% to $0.88 per share

• Generated $1.8 billion of operating cash flow

• Issued $600 million of new long-term debt and repaid $275 million of outstanding long-term debt

|

• Capital allocation of cash included $836 million of share repurchases and $530 million of dividends. The Company also invested approximately $1.2 billion on seven acquisitions in 2022:

• Ava Security Limited, a provider of cloud-native video security and analytics

• TETRA Ireland Communications Limited, the provider of Ireland’s National Digital Radio Service

• Calipsa, Inc., a provider of cloud-native advanced video analytics

• Videotec S.p.A., a provider of ruggedized video security solutions

• Barrett Communications Pty Ltd, a provider of specialized radio communications

• Futurecom Systems Group ULC, a provider of radio coverage extensions solutions

• Rave Mobile Safety, Inc., a provider of mass notification and incident management services

|

• Employees volunteered a record of more than 75,000 hours during the year

• Met goal of partnering with at least 10% diverse and small business suppliers

• Announced Public Safety Threat Alliance, a cybersecurity threat intelligence sharing and collaboration hub

• Named to Fortune’s 2023 World’s Most Admired Companies and ranked No. 1 for the Network and Other Communications Equipment category

• Named to Forbes 2022 World’s Best Employers List

• Named to The Wall Street Journal list of 250 Best-Managed Companies

• Named to Fast Company’s World‘s Most Innovative Companies

• Named to Disability Equality Index Best Places to Work |

||||

2023 ANNUAL MEETING OF SHAREHOLDERS

| • | Date and Time: Tuesday, May 16, 2023, 9:30 a.m. Central Time |

| • | Virtual Meeting Site: www.virtualshareholdermeeting.com/MSI2023 |

| • | Record Date: March 17, 2023 |

| • Voting: | Shareholders as of the close of business on the record date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on. |

| • | Online meeting only: No physical location |

| Items to be Voted On | Our Board’s Recommendation | ||||

| Election of Eight Director Nominees Named in this Proxy Statement for a One-Year Term (page 13) |

FOR | ||||

| Ratification of the Appointment of PricewaterhouseCoopers LLP as the Company’s Independent Registered Public Accounting Firm for 2023 (page 37) |

FOR | ||||

| Advisory Approval of the Company’s Executive Compensation (page 38) |

FOR | ||||

| Advisory Approval of the Frequency of the Advisory Vote to Approve the Company’s Executive Compensation (page 84) |

1 YEAR | ||||

| 2 | Motorola Solutions Notice of 2023 Annual Meeting of Shareholders and Proxy Statement |

Table of Contents

| DIRECTOR NOMINEE HIGHLIGHTS (page 13)

|

Board Committees (as of March 30, 2023) | |||||||||||||||||

| Name | Director Since |

Indep. | Other Public Co. Boards |

Position | Audit | Comp. | Gov. & Nom. |

Exec. | ||||||||||

| Gregory Q. Brown |

2007 | 0 |

Chairman and CEO, Motorola Solutions, Inc.

|

| ||||||||||||||

| Kenneth D. Denman |

2017 |

|

|

|

2 |

General Partner, Sway Ventures

|

|

|

| |||||||||

| Egon P. Durban |

2015 |

|

|

|

5 | Co-CEO of Silver Lake |

|

|||||||||||

| Dr. Ayanna M. Howard |

2022 |

|

|

|

1 |

Dean of the College of Engineering at The Ohio State University

|

|

|||||||||||

| Clayton M. Jones |

2015 |

|

|

|

1 |

Former Chairman, CEO and President, Rockwell Collins, Inc.

|

|

|||||||||||

| Judy C. Lewent |

2011 |

|

|

|

0 |

Former EVP and CFO, Merck & Co., Inc.

|

|

| ||||||||||

| Gregory K. Mondre |

2015 |

|

|

|

1 | Co-CEO of Silver Lake |

|

|||||||||||

| Joseph M. Tucci |

2017 |

|

|

|

1 |

Chairman of Bridge Growth Partners

|

|

|

| |||||||||

= Chair of Committee

= Chair of Committee

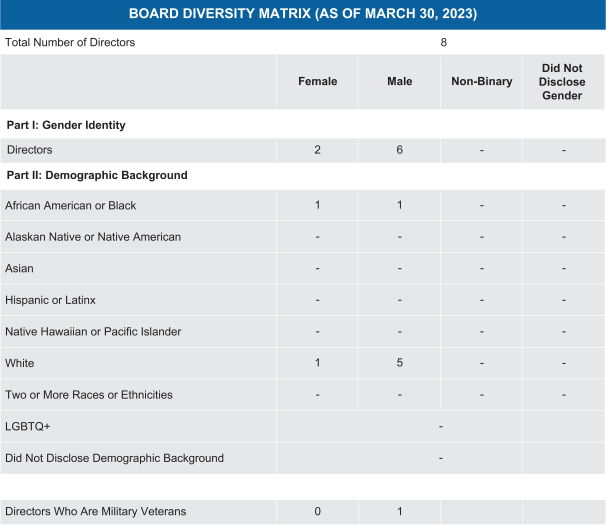

DIRECTOR NOMINEES STATISTICS

|

Independence 88%

|

Average Tenure 8 Years

|

Gender and/or Racial Diversity 38%

|

Average Age 62 Years

|

| Motorola Solutions Notice of 2023 Annual Meeting of Shareholders and Proxy Statement | 3 |

Table of Contents

| 4 | Motorola Solutions Notice of 2023 Annual Meeting of Shareholders and Proxy Statement |

Table of Contents

DIVERSITY OF SKILLS AND EXPERIENCE

|

|

Gregory Q. Brown |

Kenneth D. Denman |

Egon P. Durban |

Dr. Ayanna M. Howard |

Clayton M. Jones |

Judy C. Lewent |

Gregory K. Mondre |

Joseph M. Tucci | ||||||||||||||||||||||||||||||||

| Independence |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||||||

| Gender and/or racial diversity |

✓ | ✓ | ✓ | |||||||||||||||||||||||||||||||||||||

| Relevant industry experience |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||||||

| Public Company CEO, division CEO or CFO |

✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||||||||

| Financial and accounting expertise |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||

| Technology experience |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||

| Cybersecurity, safety and security experience |

✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||||||

| Software and services business experience |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||||

| Global business experience |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||||||

| Developing markets experience |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||||

| Government, public policy, regulatory experience |

✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||||||||

| Private equity, investment banking or capital allocation experience |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||

| Public company board experience |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||

| Human capital management experience |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||

| Motorola Solutions Notice of 2023 Annual Meeting of Shareholders and Proxy Statement | 5 |

Table of Contents

GOVERNANCE HIGHLIGHTS (page 18)

| • | Further amended and restated our amended and restated bylaws (our “Bylaws”) in November 2022 to reflect, among other items, updates to the Delaware General Corporation Law and the Securities and Exchange Commission’s (the “SEC”) adoption of the universal proxy rules |

| • | Revised our Board Governance Guidelines in November 2022 and February 2023 to, among other items, update our director commitment policy and update the director stock ownership requirements |

| • | Broad-reaching environmental, social and governance (“ESG”) program with Governance and Nominating Committee oversight of ESG matters as well as Audit Committee oversight of ESG-related risks, which included the publication of our inaugural Task Force on Climate-Related Financial Disclosures (“TCFD”) Report in 2022 |

| • | 7 of our 8 directors are independent, including all committee members |

| • | All members of our Audit Committee qualify as “audit committee financial experts” |

| • | Lead Independent Director |

| • | Regular executive session meetings of independent directors |

| • | Annual election of directors |

| • | Annual director self-assessment process |

| • | No supermajority voting provisions in our organizational documents |

| • | No “poison pill” |

| • | Robust oversight of risk |

| • | Director Independence Guidelines |

| • | Majority voting standard in uncontested director elections |

| • | 20% threshold for shareholder right to call special meeting |

| • | Shareholder right to act by written consent |

| • | Succession planning |

| • | Proactive shareholder engagement |

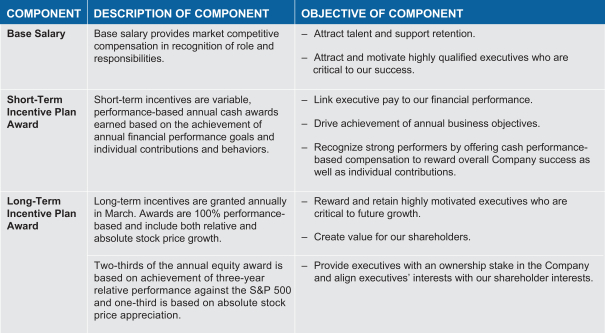

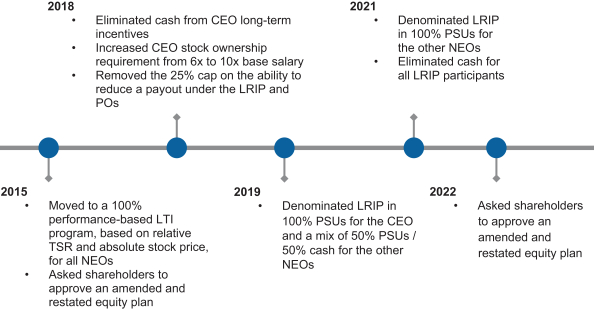

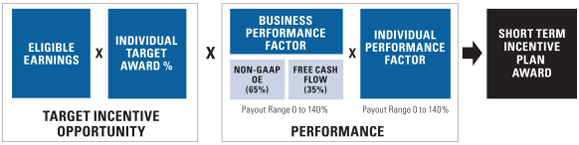

EXECUTIVE COMPENSATION PROGRAM HIGHLIGHTS (page 39)

| • | At the 2022 Annual Meeting of Shareholders, our shareholders approved the Motorola Solutions Amended and Restated Omnibus Incentive Plan of 2015, effective as of May 17, 2022 |

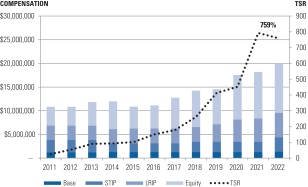

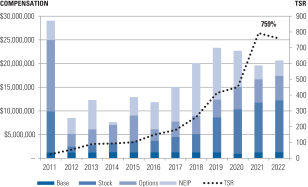

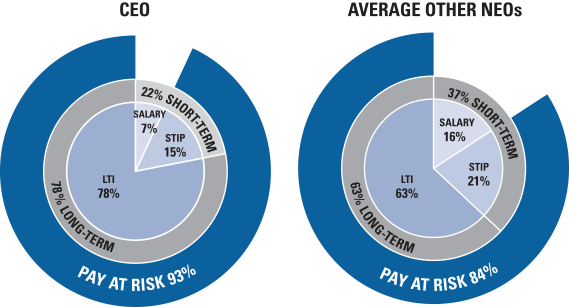

| • | Pay-for-performance and at-risk compensation |

| • | A significant portion of our targeted annual compensation is performance-based and/or subject to forfeiture (“at-risk”), with emphasis on variable pay to reward short- and long-term performance measured against pre-established objectives informed by the Company’s strategy. For 2022, performance-based compensation comprised approximately 93% of the targeted annual compensation for our CEO and, on average, approximately 84% of the targeted annual compensation for our other NEOs. |

| • | Compensation aligned with shareholder interests |

| • | Performance measures for incentive compensation are linked to the overall performance of the Company and are designed to be aligned with the creation of long-term shareholder value. |

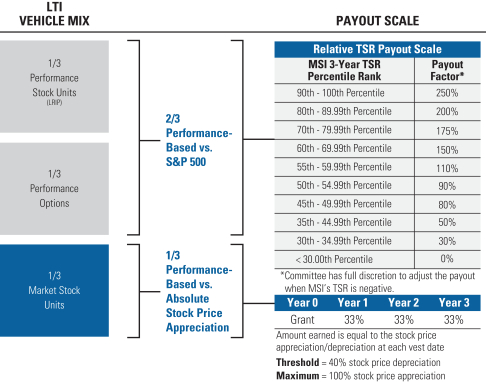

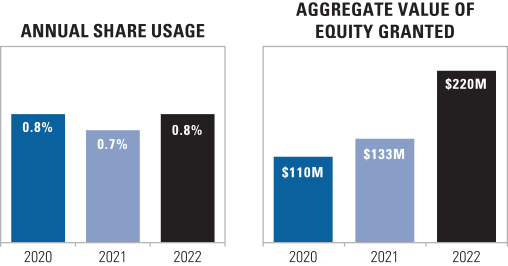

| • | Emphasis on future pay opportunity vs. current pay |

| • | Our long-term incentive awards are equity-based, use multi-year vesting provisions to encourage retention, and are designed to align our NEOs’ interests with long-term shareholder interests. For 2022, long-term equity compensation comprised approximately 78% of the targeted annual compensation for our CEO and, on average, approximately 63% of the targeted annual compensation for the other NEOs. |

| • | Retention of independent compensation consultant |

| • | Annual “say on pay” vote |

| • | No excise tax gross-up provisions |

| • | A recoupment “clawback” policy for compensation paid to certain officers |

| • | Robust stock ownership guidelines for directors and officers |

| • | An anti-hedging policy |

| • | “Double trigger” severance benefits in the event of a change in control |

| • | No repricing of options without shareholder approval |

| • | No excessive perquisites |

| 6 | Motorola Solutions Notice of 2023 Annual Meeting of Shareholders and Proxy Statement |

Table of Contents

|

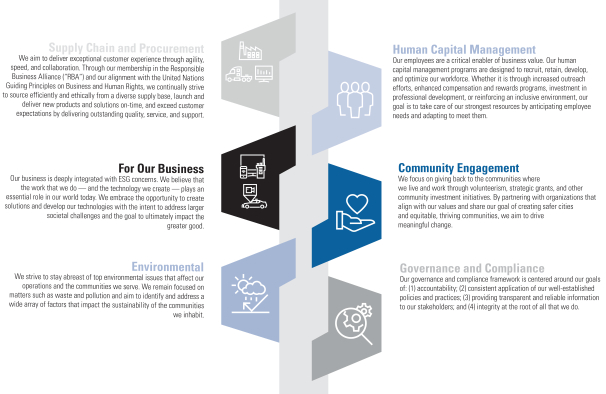

MOTOROLA SOLUTIONS’ ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG) PROGRAM |

Corporate responsibility is embedded in our strategy and operations. Our Vice President, Legal and ESG, works closely with the Executive Management ESG Governance Team (which is led by two members of our Executive Committee) to develop and implement our ESG-related strategies and programs across our global organization to shape our culture and corporate handprint. We aim for responsible and inclusive growth through our ESG program, which centers around the following six pillars:

We are proud of the various recognitions that we have received in the ESG space, such as those noted below.

| Motorola Solutions Notice of 2023 Annual Meeting of Shareholders and Proxy Statement | 7 |

Table of Contents

The following table describes our 2022 ESG highlights, organized across our six pillars:

| E |

Environment |

• In 2022 we published our inaugural TCFD report, providing detail on our climate-related metrics and targets, risk management, strategy and governance.

• We implemented a new GHG calculation software tool that aims to increase data accuracy and continuously improve our carbon calculation methodology in our efforts to continuously align with the Science Based Target Initiative.

• We are transitioning all new product packaging to 100% recyclable materials and reduced overall packaging volume by ~40% for all Watchguard products.

• We launched a third party assessment of the environmental impact of our business travel in order to identify opportunities to reduce our carbon footprint.

• We also increased our electric or hybrid vehicle purchases by more than 21% for our leased fleet of vehicles that we use in our business.

• Our Green Procurement Policy is designed to encourage alternatives to the products we procure that are more energy efficient, contain more recycled content and reduce waste.

• We updated our Supplier Code of Conduct to require our suppliers to develop an environmental impact reduction plan and begin reporting their emissions and waste.

| ||

| S |

Supply Chain & Procurement |

• Our commitment to providing economic opportunities to small and diverse-owned suppliers remained steadfast. We achieved our 2022 goal of partnering with at least 10% diverse and small business suppliers, and nearly doubled our partnerships with diverse and small business suppliers within our indirect procurement platform.

• We were named one of Resilinc’s Top 30 Most Resilient Suppliers in the High Tech Industry.

• In addition to maintaining our ISO 9001, ISO 14001, and ISO 45001 certifications, we also grew our total number of ISO certifications by a minimum of 53% at required sites.

• We issued corporate responsibility surveys to suppliers requesting that they confirm their adherence to our diversity and labor policies.

• We reinforce the health and safety of our supply chain by applying our Health and Safety policy to contractors and suppliers, where applicable.

| ||

| 8 | Motorola Solutions Notice of 2023 Annual Meeting of Shareholders and Proxy Statement |

Table of Contents

| S |

Human Capital Management |

Recruitment, Retention, and Development:

• Across 72 countries 21,000 employees and contractors took more than 200,000 hours of training including virtual/instructor led and self paced (eLearning). eLearning grew 8% with primary consumption in cybersecurity, professional development, product technologies, and compliance courses.

• In partnership with our talent development team and the DEI office, we launched a program to identify ways to improve transparency in our selection process as a tool for attracting and retaining expatriate talent.

• We launched an Employee Brand Ambassador Program (“EBAP”) Champions Committee to help leverage our corporate partnerships in an effort to increase our recruiting impact in diverse, high-performing talent pools. We mobilized the EBAPs to increase outreach at a number of our recruiting events across the globe, including those held in North America, London, Warsaw, and Malaysia.

• We created the Motorola Solutions ADVANCE HBCU Program, which is an intensive professional development workshop and hiring event for students attending a Historically Black College or University (“HBCU”).

• We launched a DEI badging program, which advances DEI education and communication for managers, and expanded our training for managers relating to talent acquisition and development, performance management and rewards.

• We expanded equity eligibility guidelines to allow leaders to compensate high-potential employees and provide equity to a broader population of employees.

• WayUp included us in its Top 100 Internship Programs for 2022 with 59% diverse representation in the intern cohort (up from 50% in 2021).

• We launched the Project Bulldog initiative with the U.S. Department of Defense SkillBridge program, which provides our hiring managers with early access to military members who are looking for on-the-job training opportunities while they prepare to retire or separate from the military and re-enter the civilian workforce. These efforts resulted in five veteran hires.

• We scored 100 on the Disability Equality Index benchmarking tool, which helps us to build a roadmap of measurable, tangible actions in an effort to achieve disability inclusion and equality in the workplace.

Health, Safety, and Employee Wellbeing:

• Following the outbreak of the Russia-Ukraine conflict, we formed a cross-functional core team of Krakow employees to help close to 400 Ukrainian refugees. We collected donations from employees to provide health care and food packages, transportation to temporary living facilities, and support local relief centers. We also provided some refugees with training and career counseling, and provided employees who are Ukrainian citizens with additional paid time off and financial aid.

• We continued to offer clinics to vaccinate employees against influenza and COVID-19.

Operations:

• We published a mid-year update of our year-end demographic data to track interim progress and included self-identification data disclosing the number of employees who self-identify as veterans, persons with disabilities, and/or LGBTQ+.

| ||

| Motorola Solutions Notice of 2023 Annual Meeting of Shareholders and Proxy Statement | 9 |

Table of Contents

| S |

Community Engagement |

Volunteerism:

More than one in four employees across more than 40 countries volunteered in 2022, a 70% increase year over year. Employees logged more than 75,000 volunteer hours, yielding $2.3 million in value generated for charitable organizations around the world. Key initiatives included:

• Our employees led volunteering and fundraising efforts for Pratham USA, one of the largest non-governmental education organizations in India. Through their “Read-A-Thon” program, 75 employees volunteered almost 500 hours, while employees and the Foundation collectively raised $45,000 USD for the organization, providing a year’s worth of education to over 1,800 children.

• We contributed over 200 hours to rehab Sheck’s House, a residency facility for homeless veterans in Washington DC, replacing fences, planting, cleaning, and painting the interior.

• Our employees rallied around mental health services for youth and support for first responders and veterans through volunteer partnerships with Hollyburn Community Services and Honour House Society in Vancouver. At both organizations, employees spent over 50 hours beautifying the grounds and building spaces for at-risk youth and veterans, respectively.

• Employees in our Krakow office mobilized to help their Ukrainian neighbors and colleagues at the onset of the Russia-Ukraine conflict, spending thousands of hours volunteering. Key initiatives included food and clothing donation drives, incorporating volunteerism into team meetings, and translation and transportation assistance Ukrainian refugees arriving in Poland.

• In Brazil we led a workshop for nearly 400 students about the Future of Work, covering topics such as hard/soft skills, careers and technology via a partnership with Junior Achievement São Paulo.

• Our Penang site logged over 7,000 hours of volunteering in 2022 with a 53% participation rate, the most of any company site. The site hosted 62 volunteer and giving opportunities activities, 50 of which took place during our company’s Global Months of Service. Most, if not all, of these events were done in partnership with organizations like the American Chamber of Commerce Malaysia (AMCHAM), Malaysia Semiconductor Industry Association (MSIA) and Penang Science Cluster (PSC).

• Our employees across 43 countries logged more than 47,000 volunteer hours during our 2022 Global Months of Service September and October. Their participation resulted in $300,000 in donations to nonprofits, many of whom serve underrepresented and underserved populations.

Donations and Charitable Giving:

The Motorola Solutions Foundation (the “Foundation”) is our charitable and philanthropic arm, which has donated more than $100 million over the last 10 years to organizations working to create safer cities and equitable thriving communities, with a focus on programs that support first responders and promote technology and engineering education. The Foundation’s giving benefits students, teachers, first responders, veterans and community members. The Foundation once again allocated the majority of its 2022 grant funding to programs that directly support people of color. Other highlights include:

• The Foundation granted more than $12 million to more than 4,000 charitable organizations around the world. Of this, $9.5 million was awarded to more than 160 charitable organizations in 23 countries through the Foundation’s strategic grants program, which prioritizes first responder programs and technology and engineering education.

• Through its annual grants program, the Foundation continued to strive to be a leading funder for programs that support our first responders, with notable year over year increases in strategic areas, including a:

| ||

| 10 | Motorola Solutions Notice of 2023 Annual Meeting of Shareholders and Proxy Statement |

Table of Contents

|

• 22% increase in support for programs focused on first responder mental health,

• 27% increase in support for programs that promote diversity among first responders,

• 52% increase in support to frontline healthcare workers,

• 43% increase in support to programs focused on school safety, and

• 45% increase in support to programs that seek to improve police-community relations (in each case, as compared to 2021)

• Further, the Foundation awarded $1.3 million in strategic grants to programs that support women ages 8-30 in technology and engineering education. 57% of the Foundation’s funding to technology and engineering programs supported women, while 75% directly benefited people of color.

• On Giving Tuesday, the Foundation provided all full and part -time employees $25 to donate to an eligible charitable organization of their choice.

• Through disaster relief grants, employee donations and Foundation matching, the Foundation and employees collectively donated nearly $500,000 to relief efforts related to the Russia-Ukraine conflict and Hurricane Ian.

| ||||

| S |

Our Business |

• We expanded the scope and reach of our information security and privacy certifications, achieving the following ISO certifications: 27001 (information security management), 27017 (information security for cloud services), 27018 (protection of personally identifiable information in public clouds) and 27701 (privacy management system). These certifications address our Privacy and Information Security Management System governing the information assets and data processed by our development and technical engineering support operations for the products and services at 28 sites worldwide.

• We also achieved SOC2 Type II reporting (an internal controls reporting system concerning company safeguards of customer data) for including the security, confidentiality, processing integrity, availability and privacy trust criteria across these same 28 sites.

• In furtherance of our information security and privacy practices, we expanded our business continuity activities to achieve ISO certification to the 22301 standard for business continuity management systems at seven of our largest sites worldwide. As of the date of this Proxy Statement, an additional four sites are currently in the process of achieving the ISO 22301 certification.

• We launched the Public Safety Threat Alliance (“PSTA”), an Information Sharing and Analysis Organization that is dedicated to providing the public safety community with relevant and actionable cyber intelligence in an effort to help them improve their cybersecurity postures. The PSTA was recognized in late 2022 by the Cybersecurity and Infrastructure Agency – an agency of the US Department of Homeland Security charged with leading the effort to enhance the security, resiliency, and reliability of the Nation’s cybersecurity and communications infrastructure.

• Binding Corporate Rules are legally binding internal rules and policies enabling multinational companies to transfer EU personal data internally. Our Binding Corporate Rules compliance approach received regulatory approval in line with the European General Data Protection Regulations.

• We continued to conduct internal data privacy assessments of our product offerings and continued to strive to improve our internal methods for data protection by, among other efforts, implementing a security scorecard for our employees to provide feedback regarding their individual security postures.

• We continued to strive to increase our employee fluency in protecting against malware and cyber attacks.

| ||

| Motorola Solutions Notice of 2023 Annual Meeting of Shareholders and Proxy Statement | 11 |

Table of Contents

|

• An independent third party found our Enterprise Information Security program to be a leader compared to our industry peers, when assessed against the NIST Cybersecurity Framework. We were particularly recognized for leveraging new emerging technology and innovation through automation in the Enterprise Security Program.

• We updated our security practices with respect to acquisitions, which assisted in accelerating our integrations by approximately 80% and yielding a 80% drop in Mergers and Acquisitions (M&A) Infrastructure Integration Security cycle time.

• In 2022, we initiated a long-term lab security project to protect Motorola Solutions’ intellectual property in non-standard security environments.

• Two sites were added to our Integrated Management System Certification for ISO9001/ISO14001/ISO18001: Richardson, TX and Edinborough, Scotland. The Interexport business in Chile also transitioned to the MSI Global certification.

| ||||

| G |

Governance and Compliance |

• Dr. Ayanna Howard joined our Board of Directors in February 2022, providing deep knowledge in robotics, human-computer interaction and artificial intelligence.

• The Audit Committee and Governance and Nominating Committee of our Board were briefed on ESG-related matters at a number of their regular meetings.

• We continued to refine our due diligence processes designed to mitigate the risk of certain products and technologies in our portfolio being used outside of their intended purpose or in a manner that results in harmful social impact, particularly in countries with a known track record of corruption or human right issues per the Transparency International Corruption Perception Index.

• We updated several of our governance documents to, among other things, aim to remove terminology or language that could be perceived as non-inclusive.

• In compliance with regulatory requirements and government sanctions, we suspended all sales, provision of services, and shipments of our products to Russia and Belarus.

| ||

We anticipate that our 2022 corporate responsibility report will be available on our corporate website during the summer of 2023. The information accessible through our corporate website is not incorporated by reference into and is not a part of this Proxy Statement.

| 12 | Motorola Solutions Notice of 2023 Annual Meeting of Shareholders and Proxy Statement |

Table of Contents

|

OUR BOARD

|

| PROPOSAL NO. 1 — ELECTION OF EIGHT DIRECTOR NOMINEES NAMED IN THIS PROXY STATEMENT FOR A ONE-YEAR TERM |

Proposal Number 1 of this Proxy Statement enables you to vote on the members of your Board.* We open the Proxy Statement with this proposal because we believe there is no more important vote than that of electing the fiduciaries who oversee Motorola Solutions on your behalf.

To inform that vote, we provide you information here on, among other topics:

| • | Who our Board is – including their qualifications |

| • | How our Board is selected and assessed |

| • | How our Board governs the Company |

| • | How our Board is organized |

| • | How you can communicate with our Board |

| • | How our Board is compensated |

WHO WE ARE – BOARD

Our Board believes that each nominee has the skills, experience and personal qualities our Board seeks in its directors, and that the combination of these nominees creates an effective and well-functioning Board, with a diversity of perspectives, viewpoints, backgrounds and professional experiences that best serves our Board, the Company and our shareholders.

Each of the nominees named below is currently a director of the Company. Each of the director nominees was elected at the Annual Meeting of Shareholders held on May 17, 2022. The ages shown are current as of the date of this Proxy Statement. Joseph M. Tucci has reached the age of 75, however, given Mr. Tucci’s extensive industry knowledge and his position as Chair of the Compensation and Leadership Committee, our Board has granted a one-year waiver of the retirement age for Mr. Tucci. Included in each nominee’s biography is a description of select key qualifications, experience and characteristics, including each nominee’s self-identified race, that led our Board to conclude that each nominee is qualified to serve as a member of our Board.

|

GREGORY Q. BROWN |

Mr. Brown joined the Company in 2003, was appointed as Chief Executive Officer of Motorola, Inc. in January 2008, and since May 2011 has been the Chairman and Chief Executive Officer of Motorola Solutions, Inc.

Other Public Company Boards: In the last five years, Mr. Brown served on the board of Xerox Corporation from January 2017 to May 2019.

Board Committees: Executive (Chair)

Director Qualifications:

● Public company CEO, relevant industry, technology, software and services business, and cybersecurity, safety and security experience as Chairman and CEO of the Company and former Chairman and CEO of Micromuse, Inc.

● Financial and accounting expertise, global business, capital allocation, developing markets, government, public policy, and regulatory experience as Chairman and CEO of the Company, former chair and board member of the Federal Reserve Bank of Chicago, former Vice Chair of the U.S. – China Business Council, and former member of the President of the United States’ Management Advisory Board

● Government, public policy, and regulatory experience as a member of The Business Council, and former member of the Business Roundtable and of the President’s National Security Telecommunications Advisory Committee (NSTAC)

● Public company board experience | |

|

| ||

|

Principal Occupation: Chairman and Chief | ||

|

Age: 62 Race: White Director since: 2007 Chairman since: 2011 | ||

|

| ||

|

| ||

|

| ||

| * | The number of directors of the Company to be elected at the Annual Meeting is eight. If elected by our shareholders at the Annual Meeting, each director nominee will serve a one-year term ending at the 2024 Annual Meeting of Shareholders. Each director will hold office until such director’s respective successor is elected and qualified or until such director’s earlier death or resignation. Each of the nominees has consented to being named in this Proxy Statement and to serve as a director if elected. However, if any nominee is not available to serve as a director for any reason at the time of the Annual Meeting, the proxies will be voted for the election of such other person or persons as the Board may designate, unless the Board, in its discretion, reduces the number of directors. The Board has the authority under our Bylaws to increase or decrease the size of the Board and to fill vacancies between Annual Meetings of Shareholders. |

| Motorola Solutions Notice of 2023 Annual Meeting of Shareholders and Proxy Statement | 13 |

Table of Contents

|

KENNETH D. DENMAN |

Mr. Denman is a General Partner at Sway Ventures, a venture capital firm that invests in early to mid-stage technology companies. He was the CEO and President of Emotient, Inc., a company that uses artificial intelligence to analyze facial expressions to detect emotions, from 2012 to 2016. He also served as the Chief Executive Officer of Openwave Systems Inc. from 2008 to 2011 and as a director from 2004 to 2011. He served as the Chief Executive Officer and President and director of iPass, Inc. from 2001 to 2008 and as its Chairman from 2003 to 2008. Mr. Denman is also a member of the Board of Trustees of Seattle Children’s Hospital.

Other Public Company Boards: Costco Wholesale Corporation and VMware, Inc. In the last five years, Mr. Denman served on the boards of LendingClub Corporation from July 2017 to February 2021, and Mitek Solutions, Inc. from December 2016 to December 2019.

Board Committees: Compensation and Leadership, Governance and Nominating (Chair), Executive

Director Qualifications:

● Relevant industry and technology experience, and financial and accounting expertise as former CEO and President of Emotient, Inc., Openwave Systems, Inc. and iPass, Inc.

● Software and services business, cybersecurity and safety and security experience as former CEO and President of Emotient, Inc., Openwave Systems, Inc. and iPass, Inc.

● Public company CEO, global business, and developing markets experience as former CEO and President of iPass, Inc. and Openwave Systems, Inc.

● Private equity, investment banking, and capital allocation experience as a General Partner of Sway Ventures

● Public company board experience | |

|

| ||

| Principal Occupation: General Partner, Sway Ventures | ||

|

Age: 64 Race: Black Director since: 2017 Lead Independent Director since 2019 Independent | ||

|

| ||

|

| ||

|

| ||

|

| ||

|

|

|

EGON P. DURBAN |

Mr. Durban is Co-CEO and Managing Partner of Silver Lake, a global technology investment firm, and is based in the firm’s Menlo Park office. Mr. Durban joined Silver Lake in 1999 as a founding principal and was previously Managing Partner and Managing Director from January 2013 to December 2019. He has worked in the firm’s New York office, as well as its London office, which he launched and managed from 2005 to 2010.

Other Public Company Boards: Dell Technologies Inc., Endeavor Group Holdings, Inc., Qualtrics International Inc., which has signed a binding agreement (subject to customary closing conditions) to be taken private, Unity Software Inc. and VMware, Inc., which has signed a binding agreement (subject to antitrust approval) to be acquired by Broadcom. In the last five years, Mr. Durban served on the boards of Pivotal Software, Inc. from April 2018 to January 2020, SecureWorks Corp. from December 2015 to May 2020, and Twitter, Inc. from March 2020 to October 2022.

Board Committees: Compensation and Leadership

Director Qualifications:

● Relevant industry, technology, global business, developing markets, and software and services business experience as Co-CEO of Silver Lake

● Financial and accounting expertise and private equity, investment banking and capital allocation experience as Co-CEO of Silver Lake and as a former associate with Morgan Stanley’s Investment Banking Division

● Public company board experience | |

|

| ||

|

Principal Occupation: Co-CEO, Silver Lake | ||

|

Age: 49 Race: White Director since: 2015 Independent

| ||

|

| ||

|

| ||

|

| ||

|

|

| 14 | Motorola Solutions Notice of 2023 Annual Meeting of Shareholders and Proxy Statement |

Table of Contents

|

AYANNA M. HOWARD |

Dr. Howard is the dean of the College of Engineering at The Ohio State University, as well as a tenured professor in the college’s Department of Electrical and Computer Engineering with a joint appointment in Computer Science and Engineering, positions that she has held since 2021. Dr. Howard is also the founder and board president of Zyrobotics, Inc., a non-profit organization that provides AI-powered STEM tools for early childhood education. Dr. Howard held various positions at the Georgia Institute of Technology (“Georgia Tech”) from 2005 to 2021, including as the Chair of the School of Interactive Computing from 2018 to 2021, and as the Linda J. and Mark C. Smith Professor, School of Electrical & Computer Engineering from 2015 to 2021. Prior to her time at Georgia Tech, Dr. Howard worked at NASA’s Jet Propulsion Laboratory in various roles from 1993 to 2005.

Other Public Company Boards: Autodesk, Inc.

Board Committees: Audit

Director Qualifications:

● Financial and accounting expertise and private equity, investment banking, and capital allocation experience as the founder of Zyrobotics, Inc., and from her receipt of her M.B.A. from the Drucker Graduate School of Management

● Government, public policy and regulatory experience as the dean of the College of Engineering at The Ohio State University and former roles at NASA’s Jet Propulsion Laboratory

● Relevant industry, technology, cybersecurity, safety and security, and software and services business experience as the founder of Zyrobotics, Inc., dean of the College of Engineering at The Ohio State University and former roles at NASA’s Jet Propulsion Laboratory

● Public company board experience | |

|

| ||

|

Principal Occupation: Dean of the College of Engineering, The Ohio State University | ||

|

Age: 51 Race: Black Director since: 2022 Independent | ||

|

| ||

|

| ||

|

| ||

|

|

|

CLAYTON M. JONES |

Mr. Jones served as Chairman of the Board of Rockwell Collins from 2002 through July 2014, and as Chief Executive Officer from June 2001 until his retirement in July 2013. Mr. Jones also served as President of Rockwell Collins and Corporate Officer and Senior Vice President of Rockwell International, which he joined in 1979. Mr. Jones is also a U.S. Air Force veteran.

Other Public Company Boards: Deere & Company. In the last five years, Mr. Jones served on the board of Cardinal Health, Inc. from September 2012 to November 2018.

Board Committees: Audit

Director Qualifications

● Public company CEO, financial and accounting expertise, and global business experience as former CEO of Rockwell Collins

● Relevant industry, technology, cybersecurity, safety and security and private equity, investment banking and capital allocation experience as former CEO of Rockwell Collins and Corporate Officer and Senior Vice President of Rockwell International

● Government, public policy and regulatory experience as a former member of The Business Council, the Business Roundtable and the President’s National Security Telecommunications Advisory Committee

● Public company board experience | |

|

| ||

|

Principal Occupation: Retired; Formerly Chairman, Chief Executive Officer and President, Rockwell Collins, Inc. (“Rockwell Collins”) | ||

|

Age: 73 Race: White Director since: 2015 Independent

|

| Motorola Solutions Notice of 2023 Annual Meeting of Shareholders and Proxy Statement | 15 |

Table of Contents

|

JUDY C. LEWENT |

Ms. Lewent served as Chief Financial Officer of Merck, a pharmaceutical company, from 1990 until her retirement in 2007. Prior roles at Merck include Executive Vice President from 2001 to 2007 and President, Human Health Asia from 2003 to 2005.

Other Public Company Boards: In the last 5 years, Ms. Lewent served on the boards of GlaxoSmithKline plc from April 2011 to May 2021, and Thermo Fisher Scientific, Inc. from May 2008 to May 2021. Ms. Lewent also served on the board of Motorola, Inc. from May 1995 to May 2010.

Board Committees: Audit (Chair), Executive

Director Qualifications:

● Public company CFO, financial and accounting expertise, capital allocation experience, and global business experience as the former CFO of Merck

● Technology experience as a life member of the Massachusetts Institute of Technology

● Developing markets experience as the former CFO of Merck and former board member of GlaxoSmithKline

● Government, public policy, and regulatory experience as former CFO at Merck and former board member of GlaxoSmithKline and Thermo Fisher

● Public company board experience | |

|

| ||

|

Principal Occupation: Retired; Formerly Executive Vice President & Chief Financial Officer, Merck & Co., Inc. (“Merck”) | ||

|

Age: 74 Race: White Director since: 2011 Independent

|

|

GREGORY K. MONDRE |

Mr. Mondre is Co-CEO and Managing Partner of Silver Lake, a global technology investment firm, and is based in New York. Mr. Mondre joined Silver Lake in 1999 and was previously Managing Partner and Managing Director from January 2013 to December 2019. Prior to his time at Silver Lake, Mr. Mondre was a principal at TPG, where he focused on private equity investments across a wide range of industries, with a particular focus on technology.

Other Public Company Boards: GoodRx Holdings, Inc. In the last five years, Mr. Mondre served on the boards of Expedia Group from May 2020 to October 2021, GoDaddy, Inc. from May 2014 to February 2020, and Sabre Corporation from March 2007 to December 2018.

Board Committees: Governance and Nominating

Director Qualifications:

● Relevant industry, technology, global business, developing markets, and software and services business experience as Co-CEO of Silver Lake

● Financial and accounting expertise and private equity, investment banking, and capital allocation experience as Co-CEO of Silver Lake and as former principal at TPG

● Public company board experience | |

|

| ||

|

Principal Occupation: Co-CEO, Silver Lake | ||

|

Age: 48 Race: White Director since: 2015 Independent

|

| 16 | Motorola Solutions Notice of 2023 Annual Meeting of Shareholders and Proxy Statement |

Table of Contents

|

JOSEPH M. TUCCI |

Mr. Tucci is the Chairman of Bridge Growth Partners. He is a founder, served as director from September 2016 to July 2022, and as the Co-Chairman and Co-Chief Executive Officer from September 2016 to February 2019, of GTY Technology Holdings, Inc., a software-as-a-service company that offers a cloud-based suite of solutions for the public sector in North America. Mr. Tucci was the Chairman and Chief Executive Officer of EMC Corporation, a provider of enterprise storage systems, software, and networks. He was EMC’s Chairman from January 2006 and CEO from January 2001 until September 2016, when Dell Technologies acquired the company.

Other Public Company Boards: Paychex, Inc. In the last five years, Mr. Tucci also served on the board of GTY Technology Holdings, Inc. from September 2016 to July 2022.

Board Committees: Compensation and Leadership (Chair), Governance and Nominating, Executive

Director Qualifications:

● Public company CEO, technology, global business, software and services business experience, and financial and accounting expertise as former Chairman, CEO and President of EMC Corporation

● Relevant industry, developing markets, and private equity experience as former Co-CEO and Co-Chairman of GTY Technology Holdings, Inc. and founding member and current Chairman of Bridge Growth Partners

● Government, public policy, and regulatory experience as a former member of the Business Roundtable and Chair of its Task Force on Education and the Workforce and as a former member of the Technology CEO Council

● Public company board experience | |

|

| ||

|

Principal Occupation: Chairman of Bridge Growth Partners | ||

|

Age: 75 Race: White Director since: 2017 Independent | ||

|

| ||

|

| ||

|

| ||

|

| ||

RECOMMENDATION OF THE BOARD

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE ELECTION OF THE EIGHT NOMINEES NAMED HEREIN AS DIRECTORS. UNLESS OTHERWISE INDICATED ON YOUR PROXY, YOUR SHARES WILL BE VOTED FOR THE ELECTION OF SUCH EIGHT NOMINEES AS DIRECTORS.

| Motorola Solutions Notice of 2023 Annual Meeting of Shareholders and Proxy Statement | 17 |

Table of Contents

OUR BOARD’S QUALIFICATIONS

We believe our Board should be comprised of individuals with appropriate skills and experiences to meet its board governance responsibilities and contribute effectively to the Company. Our Governance and Nominating Committee carefully considers the skills and experiences of current directors and new candidates to ensure that they meet the needs of the Company before nominating directors for election to our Board. All of our non-employee directors serve on Board committees, further supporting our Board by providing expertise to those committees. The needs of the committees also are reviewed when considering nominees to our Board. Our Board has a deep working knowledge of matters common to large companies and is comprised of individuals with a mix of skills and qualifications which include:

| • | Independence: Seven of eight director nominees |

| • | Gender and/or racial diversity: Three of eight director nominees |

| • | Relevant industry experience: Seven of eight director nominees |

| • | Public company CEO, division CEO or CFO: Five of eight director nominees |

| • | Financial and accounting expertise: All director nominees |

| • | Technology experience: All director nominees |

| • | Cybersecurity, safety and security experience: Four of eight director nominees |

| • | Software and services business experience: Six of eight director nominees |

| • | Global business experience: Seven of eight director nominees |

| • | Developing markets experience: Six of eight director nominees |

| • | Government, public policy and regulatory experience: Five of eight director nominees |

| • | Private equity, investment banking or capital allocation experience: All director nominees |

| • | Public company board experience: All director nominees |

| • | Human capital management experience: All director nominees |

Specific experience, qualifications, attributes and skills of our nominees are listed in the biographies above.

HOW OUR BOARD IS SELECTED AND ASSESSED

Director Nominating Process

The Governance and Nominating Committee recommends candidates to our Board it believes are qualified and suitable to become members of our Board. The Governance and Nominating Committee also considers the performance of incumbent directors in determining whether to recommend them for re-election. The Governance and Nominating Committee considers recommendations from many sources, including members of our Board, management and search firms. From time to time, Motorola Solutions hires search firms to help identify and facilitate the screening and interview process of director candidates. In 2022, we continued our retention of Russell Reynolds to assist with this process. Russell Reynolds compiles a list of candidates (which may include candidates recommended by other search firms), evaluates each candidate and makes recommendations to the Governance and Nominating Committee. They screen candidates based on our Board’s criteria, perform reference checks, prepare a biography of each candidate for the Governance and Nominating Committee’s review and help arrange interviews if necessary. The Governance and Nominating Committee and the Chairman of the Board will conduct interviews with candidates who meet our Board’s criteria. Subject to the requirements set forth below in the section of this Proxy Statement titled “Agreement with Silver Lake” on page 20, the Governance and Nominating Committee has full discretion in considering potential candidates and making its nominations to our Board.

In connection with the Investment Agreement (as defined herein) entered into with affiliates of Silver Lake, Messrs. Durban and Mondre are Silver Lake designees on the Company’s slate of nominees for election to the Board. For more information, see the section of this Proxy Statement titled “Agreement with Silver Lake” on page 20.

The Governance and Nominating Committee will consider nominees recommended by Motorola Solutions shareholders as described below. A description of certain considerations our Governance and Nominating Committee reviews in evaluating director nominees is described in “Skills, Experience, and Commitment to Diversity” on page 19 of this Proxy Statement. A shareholder wishing to propose a candidate for consideration should forward the candidate’s name and information about the candidate’s qualifications in writing to Secretary, Motorola Solutions, Inc., 500 West Monroe Street, Chicago, IL 60661. Our Secretary will forward all recommendations received to the Chair of our Governance and Nominating Committee for discussion and consideration. A shareholder who wishes to directly nominate an individual as a director candidate, rather than recommending the individual to the Governance and Nominating Committee as a nominee, must comply with the advance notice requirements for shareholder nominations set forth in Article III, Section 13 of our Bylaws (including the requirement to provide reasonable evidence that such shareholder has complied with the requirements of Rule 14a-19 of the Securities Exchange Act, as amended (the “Exchange Act”)) or the proxy access process set forth in Article III, Section 17 of our Bylaws. See the section titled “Important Dates for the 2024 Annual Meeting” on page 94 of this Proxy Statement for further information on these procedures.

| 18 | Motorola Solutions Notice of 2023 Annual Meeting of Shareholders and Proxy Statement |

Table of Contents

Governance and Nominating Committee Director Commitment Level Assessment

Our Board recognizes that a robust evaluation and assessment process is an essential component of strong corporate governance practices and promoting Board effectiveness. The Governance and Nominating Committee oversees an annual assessment of our director nominees of director commitment levels with respect to service on other public company boards. We revised our director commitment policy in our Board Governance Guidelines in November 2022 to provide that the Chairman of the Board and the Lead Independent Director may serve on no more than four public boards (including our own, unless the Chairman of the Board is a “named executive officer,” in which case such limit shall be three public boards), and all other director nominees may serve on no more than five public boards (including our own), in each case with consideration given to public company leadership roles (the “Director Commitment Policy”).

With respect to the Governance and Nominating Committee’s annual review of director commitment levels, the Governance and Nominating Committee affirms that all director nominees other than Egon Durban are compliant with the Director Commitment Policy as of the date of this Proxy Statement. With respect to Egon Durban, the Governance and Nominating Committee assessed Mr. Durban’s commitment levels and took into account Mr. Durban’s performance on our Board, as well as the publicly announced strategic transactions with respect to Qualtrics International Inc. and VMware, Inc. We note that based solely on publicly available information, these potential strategic transactions, if consummated, are expected to be completed in 2023. Thereafter, Mr. Durban would only be serving on three other public company boards. In this respect, he therefore is expected to become compliant with the Director Commitment Policy by the end of this calendar year.

Skills, Experience, and Commitment to Diversity

Our Board seeks members with varying professional backgrounds and other differentiating personal characteristics who combine a broad spectrum of experience and expertise with a reputation for integrity. Our Board believes that maintaining a diverse membership enhances our Board’s discussions and enables the Board to better represent all of the Company’s constituents. As stated in our Board Governance Guidelines, when selecting directors, our Board and the Governance and Nominating Committee review and consider many factors, including: experience in the context of the Board’s needs; integrity; leadership qualities; diversity; ability to exercise sound judgment; existing time commitments; years to retirement age; and independence. They also consider ethical standards. Our Board Governance Guidelines maintain that diversity is one of the many factors considered by our Board and the Governance and Nominating Committee when selecting director nominees. Our Board and the Governance and Nominating Committee recognize the importance of a Board representing diverse knowledge and experiences and strive to nominate directors with a variety of complementary skills, backgrounds and perspectives so that, as a group, the Board will possess the appropriate talent, skills, experience and expertise to oversee the Company’s businesses. The Governance and Nominating Committee annually assesses the effectiveness of its director nomination process and the Board Governance Guidelines.

Board Assessment and Director Peer Review and Process

Our Board recognizes that a robust evaluation and assessment process is an essential component of strong corporate governance practices and promoting Board effectiveness. The Governance and Nominating Committee oversees an annual assessment process of our director nominees. Our Board Governance Guidelines provide that, at a minimum, the annual assessment of director nominees will address the overall effectiveness, achievement of mission, discharge of responsibilities, structure, meetings, processes, relationships with management and Board and committee development. Such assessment process also includes the following steps:

| 1 | The Governance and Nominating Committee reviews the format of the Board assessment and director peer review process as necessary to help ensure that the solicited feedback remains relevant and appropriate. | |

| ||

| 2 | Each director completes an annual self-assessment of the Board and the committees on which such director serves. These self-assessments are designed to help assess the skills, qualifications, and experience represented on the Board and its committees, and to determine whether the Board and its committees are functioning effectively. | |

| ||

| 3 | The results of this annual self-assessment are discussed by the full Board and each committee, as applicable, and changes to the Board’s and its committees’ practices are implemented as appropriate. | |

| ||

| 4 | The Lead Independent Director also conducts a confidential director peer review process. As part of this process, the Lead Independent Director speaks with each other director individually to obtain insights regarding the contributions of other directors (and the Chairman of the Board may speak with each other director regarding the contributions of the Lead Independent Director), and to discuss issues in greater depth and obtain more targeted feedback with respect to Board, committee and individual director effectiveness.

| |

| Motorola Solutions Notice of 2023 Annual Meeting of Shareholders and Proxy Statement | 19 |

Table of Contents

With respect to Mr. Brown, the Compensation and Leadership Committee also conducts an annual review of his performance as CEO, as described in our Board Governance Guidelines and the charter of the Compensation and Leadership Committee.

Board Refreshment

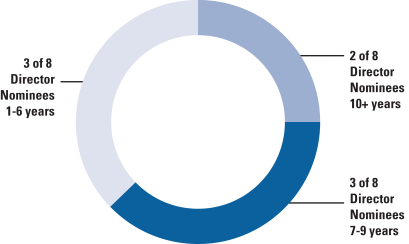

Our Board believes that a degree of Board refreshment is important to ensure that Board composition is aligned with the changing needs of the Company and the Board, and that fresh viewpoints and perspectives are regularly considered. Our Board also believes that directors develop an understanding of the Company and an ability to work effectively as a group over time that provides significant value, and therefore a significant degree of continuity year-over-year should be expected. Our current director nominee tenure as of March 30, 2023 is as follows:

| DIRECTOR NOMINEE TENURE DIVERSITY

|

BOARD REFRESHMENT

|

|||||||

|

+6

Directors added |

-5

Directors retired |

||||||

| over the last 8 years

|

||||||||

Our Board does not have absolute limits on the length of time that a director may serve, but considers the tenure of directors as one of several factors in re-nomination decisions. As set forth in our Board Governance Guidelines, the Board requires that a director must offer to resign if a significant change in personal circumstances, including job responsibilities, occurs, and has established a retirement age of 75 for non-executive directors, requiring such directors to tender their resignation from the Board at the annual meeting of shareholders following their 75th birthday. Directors who are members of management will retire from the Board upon retirement from the Company. The CEO may remain on the Board after retirement from the Company with the approval of the Board. There are no additional exemptions or conditions to this retirement policy other than what is set forth in our Board Governance Guidelines. Joseph M. Tucci has reached the age of 75; however, given Mr. Tucci’s extensive industry knowledge and position as chair of the Compensation and Leadership Committee, our Board has granted a one-year waiver of the retirement age for Mr. Tucci.

While our Board believes that refreshment is an important consideration in assessing Board composition, it also believes the best interests of the Company are served by being able to take advantage of all available talent. Therefore, our Board does not make determinations with regard to its membership based solely on age or tenure.

Agreement with Silver Lake

On September 5, 2019, in connection with the Company’s continuing relationship with Silver Lake and the Company’s repurchase and settlement of the outstanding principal amount of 2.00% senior convertible notes due 2020 issued to Silver Lake, the Company entered into an investment agreement with affiliates of Silver Lake (the “Investment Agreement”), relating to the issuance to Silver Lake (references to Silver Lake in this section “Agreement with Silver Lake” refer to such affiliates of Silver Lake mentioned above) $1 billion in aggregate principal amount of 1.75% senior convertible notes due 2024 (the “2024 Notes”). The Investment Agreement provides that Silver Lake will, subject to certain conditions, continue to have rights to representation on the Board and requires that, for so long as Silver Lake has rights to nominate a director to the Board, the Company will include a Silver Lake designee on its slate of nominees for election to the Board at each of the Company’s meetings of shareholders in which directors are to be elected and to use its reasonable efforts to cause the election of such person. In addition, with respect to the voting obligations in the Investment Agreement, Silver Lake is deemed to own only shares of Common Stock that have actually been issued upon conversion or repurchase by the Company of any of the 2024 Notes. These voting obligations require Silver Lake to vote any shares of Common Stock beneficially owned by it in support of Company-nominated directors and otherwise in accordance with the recommendations of the Board. However, as of the date of this Proxy Statement, Silver Lake has not converted any of the 2024 Notes into shares, and therefore has no shares related to the 2024 Notes to vote.

For further information regarding the Investment Agreement, including a description of certain obligations and restrictions binding on the parties, as well as a copy of such Investment Agreement, please refer to the Company’s Current Report on Form 8-K filed with the SEC on September 5, 2019, and see Note 5 Debt and Credit Facilities of our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2022.

| 20 | Motorola Solutions Notice of 2023 Annual Meeting of Shareholders and Proxy Statement |

Table of Contents

HOW OUR BOARD GOVERNS THE COMPANY

We believe that the governance tone of a company is set at the top. Our Board has:

| • | Responsibility for overseeing management and providing strategic guidance |

| • | A belief in the steady refreshment of our Board to bring new and diverse perspectives |

| • | A belief in the importance of staying well informed |

| • | A willingness to manage risks, seize opportunities and embrace leadership |

Board Governance Practices and Principles

We adhere to a number of good board governance practices and principles:

| • | Governance and Nominating Committee oversight of ESG matters as well as Audit Committee oversight of ESG-related risks |

| • | 7 of our 8 directors are independent, including all committee members |

| • | A Lead Independent Director |

| • | All members of our Audit Committee qualify as “audit committee financial experts” |

| • | Regular executive session meetings of independent directors |

| • | Annual director self-assessment process |

| • | Robust oversight of risk |

| • | Board Governance Guidelines, which we revised in November 2022 to update our director commitment policy and in February 2023 to update the director stock ownership requirements, |

| • | Director Independence Guidelines |

Corporate Governance Practices and Principles

We maintain a strong foundation of corporate governance practices and principles:

| • | Further amended and restated our Bylaws in November 2022 to reflect, among other items, updates to the Delaware General Corporation Law and the SEC’s adoption of the universal proxy rules |

| • | Proxy access provision in our Bylaws |

| • | Annual election of directors |

| • | No super majority voting provisions in our organizational documents |

| • | No “poison pill” |

| • | Majority voting standard in uncontested director elections |

| • | 20% threshold for shareholder right to call special meeting |

| • | Shareholder right to act by written consent |

| • | Succession planning (for additional information, see “Human Capital Management and Succession Planning” on page 22 of this Proxy Statement) |

| • | Proactive shareholder engagement (for additional information, see “Shareholder Engagement” on page 24 of this Proxy Statement) |

Compensation Governance Practices and Principles

We maintain a robust compensation governance framework:

| • | At the 2022 Annual Meeting of Shareholders, our shareholders approved the Motorola Solutions Amended and Restated Omnibus Incentive Plan of 2015, effective as of May 17, 2022 |

| • | Pay-for-performance and at-risk compensation |

| • | A significant portion of our targeted annual compensation is performance-based and/or subject to forfeiture (“at-risk”), with emphasis on variable pay to reward short- and long-term performance measured against pre-established objectives informed by the Company’s strategy. For 2022, performance-based compensation comprised approximately 93% of the targeted annual compensation for our CEO and, on average, approximately 84% of the targeted annual compensation for our other NEOs. |

| • | Compensation aligned with shareholder interests |

| • | Performance measures for incentive compensation are linked to the overall performance of the Company and are designed to be aligned with the creation of long-term shareholder value. |

| Motorola Solutions Notice of 2023 Annual Meeting of Shareholders and Proxy Statement | 21 |

Table of Contents

| • | Emphasis on future pay opportunity vs. current pay |

| • | Our long-term incentive awards are equity-based, use multi-year vesting provisions to encourage retention, and are designed to align our NEOs’ interests with long-term shareholder interests. For 2022, long-term equity compensation comprised approximately 78% of the targeted annual compensation for our CEO and, on average, approximately 63% of the targeted annual compensation for the other NEOs. |

| • | Retention of independent compensation consultant |

| • | Annual “say on pay” vote |

| • | No excise tax gross-up provisions |

| • | A recoupment “clawback” policy for compensation paid to certain officers |

| • | Robust stock ownership guidelines for directors and officers |

| • | An anti-hedging policy |

| • | Double trigger” severance benefits in the event of a change in control |

| • | No repricing of options without shareholder approval |

| • | No excessive perquisites |

Governance of Risks and Corporate Controls

We maintain comprehensive governance of risks and corporate controls:

| • | Code of Business Conduct |

| • | Supplier Code of Conduct and regular supplier audits |

| • | Annual training programs for employees addressing information security, intellectual property protection and data protection and privacy |

| • | Anti-Human Trafficking Compliance Plan |

| • | Robust oversight of risk (for additional information, see “Risk Oversight” on page 22 of this Proxy Statement) |

We encourage you to visit www.motorolasolutions.com/investors/corporate-governance.html to obtain more information and view our governance documents, including our Code of Business Conduct and our Board Governance Guidelines, which are publicly available on such website. The information contained on or accessible through our corporate website is not incorporated by reference into and is not a part of this Proxy Statement. Any legally required disclosures regarding amendments to, or waivers of, provisions of our Code of Business Conduct will be posted on our website within four business days following the date of the amendment or waiver. There were no waivers in 2022.

Human Capital Management and Succession Planning