Form DEF 14A Lazard Ltd For: Apr 29

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Information Required in Proxy Statement

Schedule 14A Information

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission |

|

☒ |

Definitive Proxy Statement |

|

Only (as permitted by Rule 14a-6(e)(2)) |

|

☐ |

Definitive Additional Materials |

|

|

|

☐ |

Soliciting Material Pursuant to § 240.14a-12 |

|

|

Lazard Ltd

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

|

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

|

(1) |

Title of each class of securities to which transaction applies:

|

|

|

(2) |

Aggregate number of securities to which transaction applies:

|

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4) |

Proposed maximum aggregate value of transaction:

|

|

|

(5) |

Total fee paid:

|

|

☐ |

Fee paid previously with preliminary materials. |

|

|

|

|

|

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

(1) |

Amount Previously Paid:

|

|

|

(2) |

Form, Schedule or Registration Statement No.:

|

|

|

(3) |

Filing Party:

|

|

|

(4) |

Date Filed:

|

|

|

|

|

|

|

|

Notice of Annual Meeting and Proxy Statement |

|

|

|

|

|

|

|

|

|

|

|

|

|

2021 Annual General Meeting of Shareholders

|

|

|

|

Date: |

April 29, 2021 |

|

|

|

|

Time: |

9:00 a.m. Eastern Daylight Time |

|

|

|

|

Place: |

Virtual annual meeting www.meetingcenter.io/267587835 Password LAZ2021 |

|

|

|

|

In light of the continuing public health concerns regarding the COVID-19 pandemic, the Annual General Meeting of Shareholders will again be held in a virtual meeting format only. Please see the General Information section of this Proxy Statement for additional information regarding voting and attending our Annual General Meeting of Shareholders.

The Notice of Meeting, Proxy Statement and Annual Report on Form 10-K are available free of charge at www.lazard.com/investorrelations/

|

|

Items of Business

|

1. |

Election of three directors to our Board of Directors for a three-year term expiring at the conclusion of the Company’s annual general meeting in 2024; |

|

2. |

Consideration of a non-binding advisory vote regarding executive compensation; |

|

3. |

Approval of the amendment to our 2018 Incentive Compensation Plan, or the 2018 Plan, to increase the number of shares of Class A common stock authorized for issuance under the 2018 Plan. We refer to this as the “2018 Incentive Compensation Plan Amendment”; |

|

4. |

Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2021 and authorization of the Company’s Board of Directors, acting by its Audit Committee, to set their remuneration; and |

|

5. |

Consideration of any other matters that may properly be brought before the meeting or any adjournment or postponement thereof. |

Only shareholders of record at the close of business on March 4, 2021 may vote by attending the virtual meeting or by proxy at the meeting or any adjournment or postponement thereof.

Proxy Statement and Other Materials

The Proxy Statement is being first sent to shareholders on or about March 16, 2021, together with a copy of the Company’s 2020 Annual Report, which includes financial statements for the period ended December 31, 2020 and the related independent auditor’s reports. Those financial statements will be presented at the meeting.

Your vote is important. Please exercise your shareholder right to vote.

|

By order of the Board of Directors, |

|

|

|

Scott D. Hoffman |

|

Chief Administrative Officer, General Counsel and Secretary |

|

1 |

|

|

1 |

|

|

1 |

|

|

2 |

|

|

Shareholder Engagement and Corporate Sustainability Highlights |

4 |

|

6 |

|

|

|

|

|

Item 1 |

|

|

8 |

|

|

Information About the Director Nominees and Continuing Directors |

9 |

|

13 |

|

|

|

|

|

Information Regarding the |

14 |

|

14 |

|

|

16 |

|

|

17 |

|

|

19 |

|

|

20 |

|

|

22 |

|

|

22 |

|

|

22 |

|

|

23 |

|

|

24 |

|

|

25 |

|

|

25 |

|

|

27 |

|

|

28 |

|

Item 2 |

|

|

29 |

|

|

|

|

|

29 |

|

|

30 |

|

|

31 |

|

|

Key Enhancements and Refinements to Our Compensation Program |

32 |

|

33 |

|

|

43 |

|

|

|

|

|

55 |

|

|

69 |

|

|

69 |

|

|

|

|

|

Item 3 |

|

|

72 |

|

|

73 |

|

|

76 |

|

|

78 |

|

|

|

|

|

Item 4 |

|

|

86 |

|

|

|

|

|

Shareholder Proposals and Nominations for the 2022 Annual General Meeting |

89 |

|

|

|

|

90 |

|

|

|

|

|

Annex A |

|

|

A-1 |

|

|

|

|

|

Annex B |

|

|

B-1 |

This summary highlights information contained elsewhere in this Proxy Statement or in our Annual Report on Form 10-K for the Fiscal Year Ended December 31, 2020, or the 2020 Annual Report. This summary does not contain all the information you should consider, and you should read the entire Proxy Statement carefully before voting. In this Proxy Statement, the terms “we”, “our”, “us”, the “firm”, “Lazard” or the “Company” refer to Lazard Ltd and its subsidiaries, including Lazard Group LLC.

Voting Matters and Board Recommendations

The following table summarizes the matters to be voted upon at our 2021 Annual General Meeting of Shareholders and the Board of Directors’ voting recommendations with respect to each matter.

|

Agenda |

Matter |

Board |

|

Item 1 |

Election of three directors to our Board of Directors for a three-year term expiring at the conclusion of the Company’s annual general meeting in 2024 |

VOTE FOR |

|

Item 2 |

Consideration of a non-binding advisory vote regarding executive compensation |

VOTE FOR |

|

Item 3 |

Approval of the 2018 Incentive Compensation Plan Amendment |

VOTE FOR |

|

Item 4 |

Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2021 and authorization of the Company’s Board of Directors, acting by its Audit Committee, to set their remuneration |

VOTE FOR |

|

|

|

|

|

|

|

OPERATING REVENUE |

|

AWARDED |

|

OPERATING MARGIN, |

|

$2,524M Operating revenue reflects strong performance in Financial Advisory and Asset Management; 1% lower than operating revenue in 2019 |

|

59.8% Continuing cost discipline with consistent deferral policy |

|

23.1% Consistent focus on our operating margin |

|

|

|

|

|

|

|

|

|

|

|

|

|

RETURN OF CAPITAL

|

|

NET INCOME, AS ADJUSTED |

|

ADJUSTED EARNINGS PER SHARE, DILUTED |

|

$365M Demonstrated long-term commitment to shareholder value creation and return of excess capital |

|

$410M 7% higher than 2019 |

|

$3.60 10% higher than 2019 |

|

|

|

|

|

|

For definitions of the financial measures used above, see endnotes to the section titled “Compensation Discussion and Analysis”, which are located on page 54 of this Proxy Statement.

Page 1

Proxy Statement Summary | Corporate Governance Highlights

Corporate Governance Highlights

We are committed to the highest standards of corporate governance that serve the best interests of our Company and stakeholders, and to active engagement with our shareholders throughout the year. We believe our ongoing engagement with shareholders helps us achieve balanced and appropriate solutions for the oversight and management of our business. The following table summarizes certain highlights of our corporate governance practices and policies.

|

|

|

|

|

Independent Board |

|

• Nine of our eleven current directors are independent, as is our new director nominee • All Committees of the Board of Directors, or the Board, are comprised entirely of independent directors |

|

Strong Independent |

|

• Active Lead Independent Director with expansive responsibilities • Selected by independent directors |

|

Diverse and |

|

• Diverse and international Board in terms of gender, ethnicity and nationality; following the Annual General Meeting, we expect that half of our independent directors will be women • Wide array of qualifications, skills and attributes to the Board, supporting its oversight role on behalf of shareholders • Overall attendance by our directors at Board and Committee meetings averaged over 99% in 2020 • Annual Board and Committee evaluations and self-assessments |

|

Executive Sessions |

|

• Independent directors meet regularly without management present |

|

Succession Planning |

|

• Board takes an active role in succession planning • Succession and executive development are discussed with the Chief Executive Officer, or CEO, as well as without the CEO present in executive sessions • Directors meet with senior managers who are not Named Executive Officers, or NEOs |

|

New Term Limit |

|

• In early 2021, we implemented a term limit policy for independent directors • Independent directors are limited to serving four complete terms, in addition to any partial term • New independent director nominated for election in 2021 resulting in five new independent directors nominated or appointed over the last five years |

|

Disciplined |

|

• We pay for performance and we are committed to compensation discipline and governance • We have enhanced our compensation programs to encourage investment for the future growth of our business and to include a modifier tied to total shareholder return, further aligning the performance of our NEOs to shareholder success |

|

Board Equity |

|

• Majority of director compensation is paid in deferred stock units which remain invested in the Company until the director leaves the Board |

|

Accountability |

|

• Majority voting policy for directors in uncontested elections • No shareholder rights plan or poison pill • Shareholders owning 10% or more of our outstanding share capital have the right to convene a special meeting |

Page 2

Proxy Statement Summary | Corporate Governance Highlights

Our Board of Directors and Its Committees

|

|

Committees of the Board of Directors |

|||

|

Board of Directors |

Audit |

Compensation |

Nominating & |

Workplace and |

|

Andrew M. Alper (Independent) |

✓ |

Chair |

|

|

|

Ashish Bhutani (CEO of LAM) |

|

|

|

|

|

Richard N. Haass (Independent) |

|

|

✓ |

✓ |

|

Steven J. Heyer (Independent) |

✓ |

✓ |

Chair |

|

|

Kenneth M. Jacobs (Chairman and CEO) |

|

|

|

|

|

Michelle Jarrard (Independent) |

✓ |

✓ |

|

✓ |

|

Sylvia Jay (Independent) |

|

|

✓ |

✓ |

|

Iris Knobloch (Independent) |

|

✓ |

✓ |

|

|

Philip A. Laskawy (Independent) |

Chair |

✓ |

|

|

|

Jane L. Mendillo (Independent) |

✓ |

|

|

✓ |

|

Richard D. Parsons (Lead Independent Director) |

|

✓ |

✓ |

Chair |

Our Leadership Structure

|

• |

Kenneth M. Jacobs serves as Chairman of our Board of Directors and CEO. Richard D. Parsons serves as our Board’s Lead Independent Director, or Lead Director. This leadership structure provides: |

|

|

▪ |

unified leadership and focused vision; |

|

|

▪ |

effective leadership in light of the nature of the Company and its experience and history; and |

|

|

▪ |

fluid communication and coordination between the Board and management. |

|

• |

Our Lead Director, working with our other independent directors: |

|

|

▪ |

provides active oversight of the development and implementation of the Company’s strategy; |

|

|

▪ |

provides thorough oversight and evaluation of CEO and senior management performance and compensation, and has regular discussions with our CEO about the Company and its strategy; and |

|

|

▪ |

reviews and approves Board meeting schedules and agendas. |

Page 3

Proxy Statement Summary | Corporate Governance Highlights

|

|

Board Independence

|

• |

Our Board has determined that nine of our Board’s eleven current members (representing over 80% of our Board’s members), including our Lead Director, are independent under the listing standards of the New York Stock Exchange, or the NYSE, and our own Standards of Director Independence. |

|

• |

Our Board has determined that our new director nominee is independent under the same standards. |

|

• |

Each of the Board’s Committees, including the Compensation Committee, which ultimately determines the CEO’s compensation, consists entirely of independent directors, and each Committee has a different chairperson. |

|

• |

Each Committee Chair reviews and approves meeting schedules and agendas for their relevant Committee. |

|

• |

Executive sessions of our Board follow regularly scheduled Board meetings, and our Lead Director presides over executive sessions. |

|

• |

Many meetings of the Board’s Committees also include executive sessions, and the Chair of the applicable Committee presides over those executive sessions. |

|

• |

Our Board, through its Nominating & Governance Committee, evaluates itself annually and feedback is discussed at meetings of the Nominating & Governance Committee and the Board. |

Shareholder Engagement and Corporate Sustainability Highlights

Shareholder Engagement

|

• |

We highly value the perspectives of our stakeholders and proactively engage throughout the year. |

|

• |

In 2020, we hosted meetings with approximately 90% of active shareholders, based on reported holdings, and numerous potential shareholders. |

|

• |

We prioritize long-term value creation and return of excess capital to shareholders through a flexible capital allocation strategy, while retaining sufficient capital for operating needs. |

|

• |

We believe we have a strong pay for performance compensation program with rigorous quantitative metrics and our employees hold a significant portion, approximately 21%, of fully diluted shares outstanding. |

|

• |

We assess feedback from our stakeholders and continually enhance dialogue and reporting of pertinent investor information. |

Corporate Sustainability

|

• |

Our Board has oversight responsibility for our global culture and sustainability efforts, while management provides senior-level input and review and strategic execution of our initiatives. |

|

• |

Our annual Corporate Sustainability Report, or CSR, addresses environmental, social and governance (ESG) topics important to our stakeholders and to our business. Recent additions to our CSR include: |

|

|

▪ |

Depiction of the results of our materiality assessment conducted to prioritize ESG topics |

|

|

▪ |

Presentation of our Guiding Principles: Excellence, Empowerment and Engagement |

|

|

▪ |

Alignment of values and strategic pillars |

Page 4

Proxy Statement Summary | Corporate Governance Highlights

|

|

|

|

▪ |

Independent verification of greenhouse gas (GHG) emissions |

|

|

▪ |

Response to the Sustainability Accounting Standards Board (SASB) |

|

• |

Our focus on ESG topics include: |

|

|

▪ |

Evaluating environmental risks and opportunities in our investments and strategic advice; |

|

|

▪ |

Continuing to foster our culture of excellence and increasing our focus on diversity, inclusion and equality; and |

|

|

▪ |

Leading with integrity and engaging with our stakeholders. |

|

• |

Our pledge to the CEO Action for Diversity & Inclusion reaffirms our commitment to building a stronger and more diverse workforce, and expanding mentorship and allyship. |

|

• |

Our commitment to the United Nations Global Compact, the world’s largest corporate sustainability initiative, solidifies our alignment with the ten principles addressing human rights, labor, environment and anti-corruption. |

Page 5

Proxy Statement Summary | Executive Compensation Highlights

Executive Compensation Highlights

We encourage our shareholders to review the section titled “Compensation Discussion and Analysis” below for a comprehensive discussion of our executive compensation for 2020.

Our Compensation Philosophy

|

✓ |

|

Retain and Attract Talented Individuals |

✓ |

|

Structured Decision-Making Process |

|

✓ |

|

Pay for Performance |

✓ |

|

Commitment to Compensation Governance |

|

✓ |

|

Pay with Long-Term, Forward-Looking Equity Awards |

✓ |

|

Maintain Compensation Discipline |

|

✓ |

|

Pay with Performance-based, “At-risk” Awards |

✓ |

|

Consistency on Deferred Compensation |

Our NEO Compensation Program Design

|

Fixed Compensation |

|

Base Salary |

Salary for most recent fiscal year |

|

Performance-based |

|

Annual Cash Incentive |

Determined based on the Compensation Committee’s assessment of Company, business segment (for the CEOs of LAM and Financial Advisory) and individual performance during the fiscal year and, in the case of the CEO, his performance in reference to goals and objectives set during the year |

|

|

Performance-based |

Long-term “at-risk” equity awards with payout based on objective and pre-selected criteria |

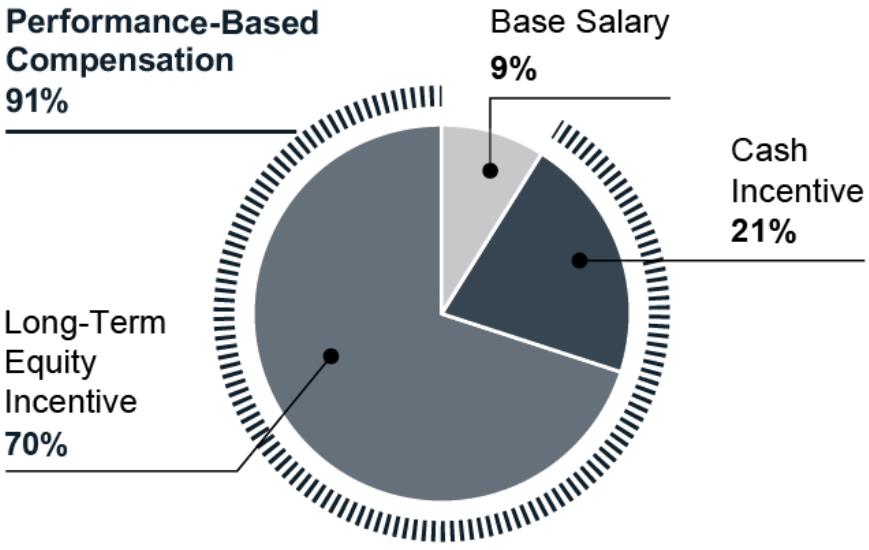

Our CEO’s 2020 Compensation: Flat compared to 2019

|

Fixed Compensation |

|

Base Salary |

$ |

900,000 |

9% of Total Compensation |

|

Performance-based |

|

Annual Cash Incentive |

$ |

2,100,000 |

21% of Total Compensation |

|

Compensation |

|

Performance-based |

$ |

7,000,000 |

70% of Total Compensation |

|

Our CEO’s 2020 Compensation Mix

|

|

|

Page 6

Proxy Statement Summary | Executive Compensation Highlights

Compensation Committee Considerations for Our CEO’s 2020 Compensation

Total 2020 compensation awarded to our CEO was flat compared to 2019. Our Compensation Committee considered the following factors in determining our CEO’s total compensation for 2020:

|

• |

our strong financial performance in 2020, as reflected in the 2020 financial highlights described above, in the context of a global pandemic and associated global macroeconomic conditions and, in particular, our strong results in the second half of 2020; |

|

• |

the continued achievement of our financial goals described in this Proxy Statement; |

|

• |

our CEO’s active engagement throughout the pandemic and management of business operations through the crisis, including his extraordinary leadership in managing the sudden transition to a remote work environment necessary to protect employee health and safety, proving the value of the Company’s investments in technology infrastructure; |

|

• |

through our CEO’s leadership, the Company’s continued cultivation of a workplace culture that fosters productivity and professional and personal development, and values diversity and inclusion, while successfully attracting, retaining and motivating valuable professionals; |

|

• |

our continued active communication with shareholders and the analyst community regarding our strategic plan, initiatives for profitable growth and ESG efforts through the publication of the CSR, and dedication to strengthening our outreach efforts and enhancing investor awareness of the Company’s business model, strategic objectives and accomplishments; |

|

• |

our CEO’s individual contributions toward client relationships and activities in support of our Financial Advisory business; |

|

• |

our CEO’s active role in the recruitment of key professionals across our businesses and the development of new investment strategies in our Asset Management business; and |

|

• |

our CEO’s leadership in maintaining and fostering a culture of cost discipline throughout the firm, reaffirming our commitment to cost control. |

Page 7

ELECTION OF DIRECTORS

Our Board of Directors is divided into three classes. Members of each class serve for a three-year term. Shareholders elect one class of directors at each annual general meeting. At this annual general meeting, shareholders will vote on the election of the three nominees described below for a term ending at the 2024 annual general meeting.

The following section contains information provided by the nominees and continuing directors about their principal occupation, business experience and other matters. Messrs. Alper and Bhutani are current directors of the Company. Prof. Dr. Dr. Achleitner was recommended to the Nominating & Governance Committee for consideration as a nominee by one of our directors. Each nominee has indicated to us that he or she will serve if elected. We do not anticipate that any nominee will be unable or unwilling to stand for election, but if that happens, your proxy may be voted for another person nominated by the Board. In accordance with the Board’s recently adopted policy on term limits for independent directors, current directors Steven J. Heyer and Sylvia Jay are not standing for reelection when their terms expire at our 2021 Annual General Meeting.

Director Attributes Anticipated Following our 2021 Annual General Meeting

|

|

|

|

|

|

|

(1) Includes one independent director and our executive directors. |

BOARD OF DIRECTORS’ RECOMMENDATION

|

The Board of Directors recommends a vote FOR the election of each nominee listed below. |

Unless otherwise directed in the proxy, the persons named in the proxy will vote FOR each nominee listed below.

Page 8

Item 1: Election of Directors | Nominees for Election

Nominees for Election as Directors for A Three-Year Term Expiring In 2024

|

Andrew M. Alper

Age: 63 years Independent Director Director since October 2012

Committees: • Audit • Compensation (Chair) |

Andrew M. Alper serves as Chairman of Alper Investments, Inc. From October 2006 to January 2013, Mr. Alper served as the Chairman and Chief Executive Officer of EQA Partners, LP, a limited partnership engaged in a global macro strategy. From February 2002 to June 2006, Mr. Alper served as President of the New York City Economic Development Corporation and Chairman of the New York City Industrial Development Agency, appointed to both positions by Mayor Michael Bloomberg. Prior to that, Mr. Alper spent 21 years in the Investment Banking Division of Goldman, Sachs & Co., where he was Chief Operating Officer of the Investment Banking Division from 1997 to 2000. Mr. Alper was co-head of the Financial Institutions Group of the Investment Banking Division of Goldman, Sachs & Co. from 1994 to 1997. Mr. Alper previously served on the board of directors of FBR Capital Markets Corporation from January 2007 until June 2009. Mr. Alper is a member of the board of trustees of the University of Chicago and served as its Chairman from June 2009 until May 2015. Mr. Alper also serves as a trustee of the University of Chicago Medical Center and the Mount Sinai Medical Center in New York.

Qualifications: Mr. Alper was selected to be a director of Lazard because of his extensive experience with the financial and operational aspects of businesses that are comparable to Lazard, as well as his background and experience in government service. |

|

Ashish Bhutani

Age: 60 years Executive Director Director since March 2010 |

Ashish Bhutani is a Vice Chairman and a Managing Director of Lazard and has been the Chief Executive Officer of Lazard Asset Management LLC, or LAM, since March 2004. Mr. Bhutani previously served as Head of New Products and Strategic Planning for LAM from June 2003 to March 2004. Prior to joining Lazard, he was Co-Chief Executive Officer, North America, of Dresdner Kleinwort Wasserstein from 2001 to the end of 2002, and was a member of its Global Corporate and Markets Board, and a member of its Global Executive Committee. Mr. Bhutani worked at Wasserstein Perella Group (the predecessor to Dresdner Kleinwort Wasserstein) from 1989 to 2001, serving as Deputy Chairman of Wasserstein Perella Group and Chief Executive Officer of Wasserstein Perella Securities from 1994 to 2001. Mr. Bhutani began his career at Salomon Brothers in 1985, where he was a Vice President in Fixed Income. Mr. Bhutani is a member of the Board of Directors of four registered investment companies, which are part of the Lazard fund complex. Mr. Bhutani is also a member of the Board of Directors of City Harvest.

Qualifications: Mr. Bhutani was selected to be a director of Lazard because of his extensive background, experience and knowledge of the asset management industry, his role within the firm as Chief Executive Officer of LAM and Mr. Jacobs’ and the Board’s desire that Mr. Bhutani become a regular contributor to the Board’s deliberations. |

Page 9

Item 1: Election of Directors | Nominees for Election

Directors Continuing in Office

(Term Expiring in 2022)

|

Richard N. Haass

Age: 69 years Independent Director Director since April 2016

Committees: • Nominating & Governance • Workplace and Culture |

Richard N. Haass, in his eighteenth year as president of the Council on Foreign Relations, has served as the senior Middle East advisor to President George H.W. Bush and as a principal advisor to Secretary of State Colin Powell. He was also U.S. coordinator for policy toward the future of Afghanistan and the U.S. envoy to both the Cyprus and Northern Ireland peace talks. A recipient of the State Department’s Distinguished Honor Award, the Presidential Citizens Medal, and the Tipperary International Peace Award, Dr. Haass has authored or edited books on both U.S. foreign policy and management. A Rhodes Scholar, he holds Master and Doctor of Philosophy degrees from Oxford University. From February 2007 until February 2015, Dr. Haass served as a member of the board of directors of Fortress Investment Group.

Qualifications: Dr. Haass was selected to be a director of Lazard because of his global perspective, fostered over many years at the highest levels of engagement, as well as his background and experience in government service. |

|

Jane L. Mendillo

Age: 62 years Independent Director Director since April 2016

Committees: • Audit • Workplace and Culture |

Jane L. Mendillo has spent over 30 years in the fields of endowment and investment management. As the CEO of the Harvard Management Company from 2008 to 2014, she managed Harvard University’s approximately $37 billion global endowment and related assets across a wide range of public and private markets. Ms. Mendillo was previously the Chief Investment Officer at Wellesley College for six years. Prior to that, she spent 15 years at the Harvard Management Company in various investment roles. Earlier in her career she was a management consultant at Bain & Co. and worked at the Yale Investment Office. Ms. Mendillo is a member of the board of directors of General Motors. She is also on the board of directors of the Berklee College of Music. She also serves as senior investment advisor and trustee to the Old Mountain Private Trust Company. She is a graduate of Yale College and the Yale School of Management.

Qualifications: Ms. Mendillo was selected to be a director of Lazard because of her unique financial perspective, having successfully stewarded Harvard Management Company through the financial crisis, and her extensive experience in the field of asset management. |

|

Richard D. Parsons

Age: 72 years Lead Independent Director Director since June 2012

Committees: • Compensation • Nominating & Governance • Workplace and Culture (Chair) |

Richard D. Parsons is a co-founder and partner of Imagination Capital LLC, a venture capital firm launched in November 2017, and has been a senior advisor to Providence Equity Partners LLC since September 2009. Mr. Parsons is a member of the board of directors of The Estée Lauder Companies Inc., The Madison Square Garden Company and Group Nine Acquisition Corp. From September 2018 to October 2018, Mr. Parsons served as the interim Chairman of the board of directors of CBS Corporation. From May 2014 to September 2014, Mr. Parsons served as the interim Chief Executive Officer of the Los Angeles Clippers. Mr. Parsons previously served as Chairman of the board of directors of Citigroup Inc. from February 2009 through April 2012, and had served as a director of Citigroup Inc. since 1996. From May 2003 until his retirement in December 2008, Mr. Parsons served as Chairman of the board of directors of Time Warner Inc., and from May 2002 until December 2007, Mr. Parsons served as Chief Executive Officer of Time Warner Inc. Mr. Parsons was formerly Chairman and Chief Executive Officer of Dime Bancorp, Inc. Among his numerous community and nonprofit activities, Mr. Parsons is chairman emeritus of the Partnership for New York City, chairman of the Jazz Foundation of America, and chairman of the board of trustees of the Rockefeller Foundation. He also serves on the boards of the Commission on Presidential Debates and the Apollo Theater Foundation.

Qualifications: Mr. Parsons was selected to be a director of Lazard because of his extensive and diverse leadership experience with both financial services and non-financial services businesses. |

Page 10

Item 1: Election of Directors | Nominees for Election

Directors Continuing in Office

(Term Expiring in 2023)

|

Kenneth M. Jacobs

Age: 62 years Executive Director |

Kenneth M. Jacobs has served as Chairman of the Board of Directors and Chief Executive Officer of Lazard Ltd and Lazard Group since November 2009. Mr. Jacobs has served as a Managing Director of Lazard since 1991 and had been a Deputy Chairman of Lazard from January 2002 until November 2009. Mr. Jacobs also served as Chief Executive Officer of Lazard North America from January 2002 until November 2009. Mr. Jacobs initially joined Lazard in 1988. Mr. Jacobs is a member of the Board of Trustees of the University of Chicago and the Brookings Institution. Mr. Jacobs earned an MBA from the Stanford University Graduate School of Business and a Bachelor’s Degree in Economics at the University of Chicago.

Qualifications: Mr. Jacobs was selected to be the Chairman and Chief Executive Officer of Lazard because of his vision, intellect and dynamism, his proven track record of creativity in building new businesses, and his skills as a trusted advisor, collaborator and team leader.

|

|

Iris Knobloch

Age: 58 years Independent Director Director since April 2018

Committees: • Compensation • Nominating and Governance |

Iris Knobloch is currently President of WarnerMedia in France, Germany, the Benelux, Austria and Switzerland and was previously President of Warner Bros. Entertainment in France beginning in 2006. She is responsible for the development and execution of WarnerMedia’s strategy as well as coordinating and optimizing all commercial and group marketing activities in the region. Previously, she was in charge of Time Warner’s International Relations and Strategic Policy for Europe. Prior to Warner Bros., Ms. Knobloch was an attorney with Norr, Stiefenhofer & Lutz and with O’Melveny & Myers in Munich, New York and Los Angeles. Ms. Knobloch is the Vice Chairman and Lead Independent Director of the board of directors of AccorHotels and a member of the board of directors of LVMH Moët Hennessy-Louis Vuitton. She is a governor of the American Hospital in Paris. She was previously a member of the supervisory board of Axel Springer from April 2018 until December 2019 and was a member of the board of directors of Central European Media Enterprises from April 2014 to June 2018. She received a J.D. degree from Ludwig-Maximilians-Universitaet and an L.L.M. degree from New York University.

Qualifications: Ms. Knobloch was selected to be a director of Lazard because of her Continental European perspective from her leadership positions in multi-national businesses, and her experience in strategy, digital media, and emerging markets. |

Page 11

Item 1: Election of Directors | Nominees for Election

|

Philip A. Laskawy

Age: 79 years Independent Director Director since July 2008

Committees: • Audit (Chair) • Compensation |

Philip A. Laskawy served as Chairman and Chief Executive Officer of Ernst & Young from 1994 until his retirement in 2001, after 40 years of service with the professional services firm. Mr. Laskawy served as Chairman of the International Accounting Standards Board from 2006 to 2007, and as a member of the 1999 Blue Ribbon Committee on Improving the Effectiveness of Corporate Audit Committees. Mr. Laskawy is chairman of the board of directors of Covetrus, Inc., lead director of Henry Schein, Inc., and a member of the board of directors of Loews Corp.

Qualifications: Mr. Laskawy was selected to be a director of Lazard because of his expertise in the areas of auditing and accounting, his qualifications as an “audit committee financial expert” and the unique perspective he brings as a former chief executive of a major professional services firm. |

Page 12

Item 1: Election of Directors | Majority Vote Policy

Our Board has adopted a majority vote policy in connection with the election of directors.

In an uncontested election of directors, any nominee who receives a greater number of votes “withheld” from his or her election than votes “for” his or her election will, within five days following the certification of the shareholder vote, tender his or her written resignation to the Chairman of the Board for consideration by the Nominating & Governance Committee. As used herein, an “uncontested election of directors” is an election in which the number of nominees is not greater than the number of Board seats open for election.

The Nominating & Governance Committee will consider such tendered resignation and, promptly following the date of the shareholders’ meeting at which the election occurred, will make a recommendation to the Board concerning the acceptance or rejection of such resignation. In determining its recommendation to the Board, the Nominating & Governance Committee will consider all factors deemed relevant by the members of the Nominating & Governance Committee including, without limitation, the stated reason or reasons why shareholders who cast “withhold” votes for the director did so, the qualifications of the director (including, for example, the impact the director’s resignation would have on the Company’s compliance with the requirements of the SEC, the NYSE and Bermuda law), and whether the director’s resignation from the Board would be in the best interests of the Company and its shareholders.

The Nominating & Governance Committee also will consider a range of possible alternatives concerning the director’s tendered resignation as members of the Nominating & Governance Committee deem appropriate including, without limitation, acceptance of the resignation, rejection of the resignation, or rejection of the resignation coupled with a commitment to seek to address and cure the underlying reasons reasonably believed by the Nominating & Governance Committee to have substantially resulted in the “withheld” votes.

The Board will take formal action on the Nominating & Governance Committee’s recommendation no later than 90 days following the date of the shareholders’ meeting at which the election occurred. In considering the Nominating & Governance Committee’s recommendation, the Board will consider the information, factors and alternatives considered by the Nominating & Governance Committee and such additional information, factors and alternatives as the Board deems relevant.

Following the Board’s decision on the Nominating & Governance Committee’s recommendation, the Company will promptly disclose, in a Form 8-K filed with the Securities and Exchange Commission, the Board’s decision, together with an explanation of the process by which the decision was made. If the Board has not accepted the tendered resignation, it will also disclose the reason or reasons for doing so.

No director who, in accordance with this policy, is required to tender his or her resignation, shall participate in the Nominating & Governance Committee’s deliberations or recommendation, or in the Board’s deliberations or determination, with respect to accepting or rejecting his or her resignation as a director.

Page 13

INFORMATION REGARDING THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Lazard is governed by a Board of Directors and various committees of the Board that meet throughout the year. Our Board has established four standing committees: the Audit Committee, the Compensation Committee, the Nominating & Governance Committee and the Workplace and Culture Committee. Each of the standing committees has adopted and operates under a written charter, all of which are available on our website at www.lazard.com/investorrelations/. Other corporate governance documents also are available on our website, including our Corporate Governance Guidelines and our Code of Business Conduct and Ethics. A copy of each of these documents is available to any shareholder upon request.

Chairman and Chief Executive Officer

Kenneth M. Jacobs has served as Chairman of the Board and CEO of the Company since November 2009. The Board carefully considered a variety of governance arrangements following the sudden death of the Company’s former Chairman and CEO in October 2009, including separating the roles of Chairman and CEO. The Board appointed Mr. Jacobs as the Company’s Chairman and CEO following this measured and comprehensive review. At the same time, the Board also recognized the need for strong independent perspectives to balance the combined Chairman and CEO positions and to avoid any potential conflicts. The Board created the Lead Director position in November 2009 to provide this balance.

The Board believes that the Company and its shareholders are best served by maintaining the flexibility to have either the same individual serve as Chairman and CEO or to separate those positions based on what is in the best interests of the Company and its shareholders at a given point in time. The Board believes that the members of the Board possess considerable experience, breadth of skills and unique knowledge of the challenges and the opportunities the Company faces and that the Board is best positioned to identify the person who has the skill and commitment to be an effective Chairman.

The Board believes there is no single best organizational model that is the most effective in all circumstances, and the Board retains the right to separate the positions of Chairman and CEO if it deems it appropriate in the future.

Lead Director

Mr. Parsons was originally appointed as the Lead Director for the Board in February 2018. Mr. Parsons’s appointment was reconfirmed by the independent members of the Board in February 2019, 2020 and 2021. Mr. Parsons is a strong, independent and active director with clearly defined leadership authority and responsibilities. In addition to his role as Lead Director, Mr. Parsons serves as Chair of the Workplace and Culture Committee and as a member of the Compensation Committee and the Nominating & Governance Committee.

Page 14

Information Regarding the Board of Directors and Corporate Governance | Leadership Structure

The responsibilities and duties of the Lead Director include the following:

|

• |

presiding at meetings of the Board in the absence of the Chairman, including the executive sessions of the independent members of the Board, and providing feedback to the CEO, other senior executives and key managing directors, as appropriate, from such executive sessions of the independent directors; |

|

• |

for the purpose of facilitating timely communication, serving as a liaison between (1) the independent directors (including committee chairpersons) and (2) the CEO, other senior executives and, in consultation with the CEO, key managing directors regarding significant matters (without impeding or replacing direct communication between the CEO and other directors or between or among other directors); |

|

• |

with input from the other independent directors, (1) reviewing and approving Board meeting schedules, as well as the agendas for such meetings and (2) calling meetings of the independent directors and setting the agendas in connection with such meetings; |

|

• |

together with the Board, providing oversight and advice to the CEO regarding corporate strategy, direction and implementation of initiatives; |

|

• |

in consultation with the CEO, identifying and supporting talented individuals within the Company; |

|

• |

being available for consultation or direct communication with significant shareholders; |

|

• |

together with the Compensation Committee, conducting periodic performance appraisals of the CEO; |

|

• |

coordinating the activities of the chairpersons of Board committees; and |

|

• |

performing such other duties as the Board may from time to time delegate to the Lead Director. |

Our Lead Director also presides at meetings of the Board, or the relevant portions of such meetings, when it would not be appropriate for our Chairman and CEO to preside.

The Board believes Mr. Jacobs serving as Chairman and CEO and Mr. Parsons serving as a separate and independent Lead Director provides the most effective leadership for the Company at the present time, offers an appropriate balance between the roles and provides a satisfactory counterbalance to the combined role of Chairman and CEO.

Page 15

Information Regarding the Board of Directors and Corporate Governance | Shareholder Engagement

|

|

|

|

|

|

|

|

Prepare Our Board monitors and assesses • Performance and outlook • Strategy and growth opportunities • Investment and capital return • Investor ownership trends • Governance best practices |

|

Engage Executive management is proactive • Meets with investment community regularly to discuss market trends, performance and outlook • Provides two-way dialogue to deepen insights and augment perception |

|

|

|

|

|

|

|

|

|

Respond Our Board and executive management identify and implement enhancements • Transparency and disclosure practices • Team and viewpoint refreshment • Long-term focus throughout economic cycles |

|

Evaluate Shareholder perspective • Investment themes, market sentiment, changes in risk profile • Economic and macro background • Fundamental and relative performance • Shareholder voting results

|

|

|

|

|

|

|

|

|

We highly value engagement with our shareholders and maintain an active dialogue through individual and small group meetings as well as participation in investment conferences. We engage with our shareholders and potential investors throughout the year on a wide variety of topics, such as business strategy, market conditions, financial performance, competitive landscape, capital allocation, regulatory and governance changes, and environmental and social responsibility.

In 2020, our shareholder engagement transitioned to a virtual format following the onset of the global COVID-19 pandemic. Despite the restrictions placed on travel and meetings, our engagement with our shareholders continued at a consistent pace, although the ability to meet new investors and build relationships was impacted in some respects by the unprecedented and critical situation. We have seen widespread adoption of virtual meeting formats and believe this method of interaction will become more normal course of business, facilitating even more extensive engagement, while the eventual easing of travel restrictions should enable us to incorporate more in person introductory meetings over time. |

|

|

We conduct significant outreach each year following the distribution of our annual proxy. We value our shareholders’ opinions and continually take into consideration their feedback as part of our ongoing evaluation of our executive compensation programs. Our strong foundation of shareholder engagement has resulted in a history of implementing changes over the years based on shareholder feedback, such as recently implementing a tenure policy for independent directors that enhances Board refreshment by limiting independent directors to serving four complete terms (in addition to any partial term), and making significant enhancements to the performance metrics applicable to our NEOs in order to better align their compensation with shareholder benefits.

Page 16

Information Regarding the Board of Directors and Corporate Governance | Shareholder Feedback on Executive Compensation

Shareholder Feedback on Executive Compensation

After more than five years of strong (95%+) shareholder support on our advisory vote regarding executive compensation, we received just under 80% support at our 2020 Annual General Meeting of Shareholders.

As it does every year, our Compensation Committee has focused on the feedback received from shareholders regarding executive compensation-related matters during our outreach in 2020, which included outreach to approximately 80% of our institutional shareholders. Shareholder feedback, as well as feedback from other parties, was reviewed by the Compensation Committee in making its pay determinations in respect of 2020 compensation. A summary of the key areas of the feedback we received and our response is provided in the chart below.

Page 17

Information Regarding the Board of Directors and Corporate Governance | Shareholder Feedback on Executive Compensation

|

Topic Discussed |

|

Our Response |

|

|

|

|

|

|

|

|

|

|

|

We are committed to buying back shares to offset the potentially dilutive impact of equity compensation each year and have done so each year since 2012. Our fully diluted share count has declined 14% from year-end 2017 and we have a share repurchase authorization to continue our practice of offsetting the potentially dilutive impact of equity compensation, and to purchase shares in excess of the shares granted annually. Shareholder feedback on this topic noted that the burn rate calculated by some methodologies is above a broad sector industry average. We believe this is due to the nature of (1) our cost structure in which our employees are our greatest asset and thus compensation is the largest component of our expenses and (2) our compensation structure which prioritizes shareholder alignment and long-term value creation through the use of equity-based compensation. Our demonstrated history of offsetting the potentially dilutive impact of the equity component of our compensation programs is an important aspect of our equity compensation practices and most shareholders are supportive of maintaining our stock-based compensation program. We believe these practices reflect a responsible approach to equity compensation. |

|

|

|

|

|

|

|

|

|

Annual Incentive Awards |

|

Our annual incentive compensation reflects the achievement of Company goals and individual contributions of our management team toward these goals, which are described for each NEO under the section titled “2020 Compensation for Each of Our NEOs—Compensation Decisions”. Consistent with competitive market practice in our industry, the Compensation Committee establishes annual incentive compensation based on a rigorous assessment of performance and, in the case of the CEO, his performance in reference to goals and objectives set during the year. This approach allows us to balance the objective, pre-established elements of our compensation program with the need to tailor overall compensation in a given fiscal year to reflect particular circumstances and appropriately incentivize our NEOs. Shareholder feedback on this topic reflected an understanding of market practice in the financial services industry, our rigorous overall compensation program and the inclusion of qualitative factors on a short-term basis while maintaining discipline in our long-term compensation program overall. |

|

|

|

|

Page 18

Information Regarding the Board of Directors and Corporate Governance | Corporate Sustainability Report

Corporate Sustainability Report: Creating Value Responsibly

Lazard published its second annual Corporate Sustainability Report in 2020, reporting on fiscal year 2019, which focuses on the core topics prioritized by our stakeholders–employees, clients, shareholders, business partners and communities. This voluntary disclosure provides a summary of the principles, programs and policies that reflect our commitment to a sustainable future. As a global firm that has advised clients on their most important financial matters during our more than 170-year history, the principles of sustainability are ingrained in Lazard’s culture and operations.

We are committed to serving our clients, developing our people and supporting our communities. Our Board and management are focused on cultivating a workplace environment that attracts and retains exceptional talent and a diversity of perspectives. Encouraging an engaged workplace where employees feel connected allows them to thrive personally and professionally.

We recognize our business has an affect beyond the profits we generate. While we seek to generate value for our shareholders, we also seek to create long term societal value through our contributions to global economies, our reputation for innovation, our culture of quality and prudence, and our belief in generating a sustainable future for the next generation. As a global investor, we see the integration of sustainability considerations as an essential part of any long-term investment process. Companies and sovereign issuers that operate in a sustainable way, with a recognition of how their activities intersect with the environment and society, are likely to represent more attractive long-term investment opportunities. Those that do not, are at risk of structural decline as they become subject to regulatory, commercial, or financial pressure to change.

As a firm, we have developed the Guiding Principles of excellence, empowerment and engagement to help us to achieve the greatest impact for all Lazard stakeholders. These Guiding Principles reflect our distinctive culture and our aspirations for the future. They have shaped our success in the past and point the way forward toward sustainable growth.

Page 19

Information Regarding the Board of Directors and Corporate Governance | Board Committees

|

|

|

|

|

AUDIT COMMITTEE |

|

COMPENSATION COMMITTEE |

|

Members: Philip A. Laskawy (Chair) Andrew M. Alper Steven J. Heyer Jane L. Mendillo Michelle Jarrard

Meetings in 2020: 5 |

|

Members: Andrew M. Alper (Chair) Steven J. Heyer Michelle Jarrard Iris Knobloch Philip A. Laskawy Richard D. Parsons Meetings in 2020: 9 |

|

|

|

|

|

Primary Responsibilities: The Audit Committee assists our Board of Directors in fulfilling its oversight responsibilities with respect to: • monitoring the integrity of our financial statements; • assessing the qualifications, independence and performance of our independent auditor; • evaluating the performance of our internal audit function; • reviewing the Company’s major financial risk exposures and the steps taken to monitor and control such exposures; and • monitoring the Company’s compliance with certain legal and regulatory requirements. The Audit Committee also selects and oversees Lazard’s independent auditor, and pre-approves all services to be performed by the independent auditor pursuant to the Audit Committee pre-approval policy. All members of the Audit Committee are independent as required by Lazard and the listing standards of the NYSE. All members of the Audit Committee are financially literate, as determined by the Board of Directors. The Board of Directors has determined that Mr. Laskawy has the requisite qualifications to satisfy the SEC’s definition of “audit committee financial expert”. |

|

Primary Responsibilities: The Compensation Committee assists the Board of Directors by overseeing our firm-wide compensation plans, policies and programs and has full authority to: • determine and approve the compensation of our CEO; • review and approve the compensation of our other executive officers; • review our compensation programs as they affect all managing directors and employees; and • administer the 2018 Plan, the Lazard Ltd 2008 Incentive Compensation Plan, or the 2008 Plan, and any successor plans. All members of the Compensation Committee are independent as required by Lazard and the listing standards of the NYSE. From time to time the Compensation Committee has established special equity award pools pursuant to the 2018 Plan for the express purpose of granting awards to new hires and, under certain circumstances, retention awards to key employees (other than our executive officers). The Compensation Committee granted to our CEO (or his designee) authority to determine the amount, terms and conditions of all awards made from these pools and required that the Compensation Committee be updated on all such awards at regularly scheduled meetings. The Compensation Committee directly engaged Compensation Advisory Partners, or CAP, an independent compensation consulting firm, to assist it with various compensation analyses, as well as to provide consulting on executive compensation practices and determinations, including information on equity-based award design. CAP generally attends meetings of the Compensation Committee. In addition, Kenneth M. Jacobs, our CEO, generally attends meetings of the Compensation Committee and expresses his views on the Company’s overall compensation philosophy. Following year end, Mr. Jacobs makes recommendations to the Compensation Committee as to the total compensation package (salary, annual cash incentive and long-term incentive compensation awards) to be paid to each of the other executive officers. |

Page 20

Information Regarding the Board of Directors and Corporate Governance | Board Committees

|

NOMINATING & GOVERNANCE COMMITTEE |

|

WORKPLACE AND CULTURE COMMITTEE |

|

Members: Steven J. Heyer (Chair) Richard N. Haass Sylvia Jay Iris Knobloch Richard D. Parsons Meetings in 2020: 5 |

Members: Richard D. Parsons (Chair) Richard N. Haass Michelle Jarrard Sylvia Jay Jane L. Mendillo Meetings in 2020: 3 |

|

|

|

|

|

|

Primary Responsibilities: The Nominating & Governance Committee assists our Board of Directors in promoting sound corporate governance principles and practices by: • leading the Board in an annual review of its own performance; • identifying individuals qualified to become Board members, consistent with criteria approved by the Board; • recommending to the Board the director nominees for the next annual general meeting of shareholders; • recommending to the Board director nominees for each committee of the Board; • recommending to the Board compensation of non-executive directors; and • reviewing and reassessing the adequacy of the Corporate Governance Guidelines. The Nominating & Governance Committee also is responsible for recommending to the Board of Directors standards regarding the independence of non-executive directors and reviewing such standards on a regular basis to confirm that such standards remain consistent with sound corporate governance practices and with any legal, regulatory or NYSE requirements. All members of the Nominating & Governance Committee are independent as required by Lazard and the listing standards of the NYSE. |

|

Primary Responsibilities: The Workplace and Culture Committee assists and advises management in continuing to cultivate and reinforce a workplace culture that helps attract, motivate and retain talented people, allows them to thrive, fosters productivity and professional and personal development, values diversity and inclusion, and encourages its people to engage with each other and their communities by: • overseeing efforts by management to communicate, promote and embed principles integral to a workplace culture that attracts, motivates and retains the best people; • periodically discussing with management the development, implementation and effectiveness of the Company’s policies and strategies relating to workplace culture; and • reviewing efforts by management to enhance diversity and inclusion in the Company’s workforce, including at management levels. All members of the Workplace and Culture Committee are independent. |

ATTENDANCE

The Board held seven meetings in 2020 and also met informally several times during 2020 to receive updates from our CEO regarding our response to the COVID-19 pandemic and its strategic, financial and employee health and safety implications. In 2020, overall attendance by our directors at meetings of the Board and its Committees averaged over 99%. Each such director attended at least 75% of the meetings of the Board and Committees on which he or she served (and that were held during the period for which he or she had been a director or Committee member, as applicable). In 2020, all of our directors attended the 2020 Annual General Meeting of Shareholders.

Page 21

Information Regarding the Board of Directors and Corporate Governance | Risk Oversight, Code of Business Conduct and Ethics, Communications with the Board

Management within each of Lazard’s operating locations is principally responsible for managing the risks within its respective business on a day-to-day basis. The Board, working together with the Audit Committee, reviews the Company’s risk profile and risk management strategies at regular intervals. Members of the Company’s finance team, led by the Chief Financial Officer and the Head of Risk Management, also review with the Audit Committee categories of risk the Company faces, including any risk concentrations, risk interrelationships and financial and cyber risk exposures, as well as the likelihood of occurrence, the potential impact of those risks and the steps management has taken to monitor, mitigate and control such exposures. The Company’s Chief Information Officer and Chief Information Security Officer also frequently participate in these reviews. Updates on risks deemed material to the Company are reviewed at regular meetings of the Audit Committee and reported to the full Board. In addition, the Compensation Committee reviews compensation programs for consistency and alignment with Lazard’s strategic goals, and in connection therewith reviews Lazard’s compensation practices to assess the risk that they will have a material adverse effect on the Company.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics that is applicable to all directors, managing directors, officers and employees of Lazard and its subsidiaries and affiliates. We have also adopted a Supplement to the Code of Business Conduct and Ethics for certain other senior officers, including our Chief Executive Officer, Chief Financial Officer and principal accounting officer. Each of these codes is available on our website at www.lazard.com/investorrelations/. A print copy of each of these documents is available to any shareholder upon request. We intend to disclose amendments to, or waivers from, the Code of Business Conduct and Ethics, if any, on our website.

Anyone who wishes to send a communication to our non-executive directors as a group may do so by mail at the address listed below, and by marking the envelope, Attn: Non-Executive Directors of the Lazard Ltd Board of Directors.

Lazard Ltd

30 Rockefeller Plaza

New York, NY 10112

The Lazard Ltd Board of Directors

c/o the Corporate Secretary

These procedures are also posted on our website at www.lazard.com/investorrelations/.

Page 22

Information Regarding the Board of Directors and Corporate Governance | Board Evaluation Process

Our Board is committed to continually improving in all aspects of corporate governance and our Board and the individual directors regularly evaluate their own effectiveness and the effectiveness of the Board process. As part of that review, the Nominating & Governance Committee conducts an annual review in which each director completes a self-evaluation questionnaire to assess overall effectiveness, including with respect to strategic oversight, interactions with and evaluations of management, board culture, board structure and operation, governance policies and committee structure and composition. The results of these evaluations are aggregated and shared on an anonymous basis with the Nominating & Governance Committee, which then reviews and presents its findings to the full Board for discussion and feedback. Through this regular self-assessment, the Board identifies areas for further reflection and improvement and, as appropriate, updates or changes our existing practices. The Nominating & Governance Committee annually reviews, updates and approves the evaluation framework, including the director evaluation questionnaires, in light of changing conditions and shareholder interests.

|

Annual Process is Initiated |

|

|

The Nominating & Governance Committee initiates the annual evaluation process by reviewing and updating the self-assessment process and approving the director self-evaluation questionnaires. |

|

|

|

|

|

|

Individual Director Evaluations & Self-Assessments |

|

|

Each director completes an annual self-evaluation questionnaire to help evaluate whether the Board and each director are functioning effectively, including with respect to its interaction with management, and to provide an opportunity to reflect upon and improve the Board’s policies, procedures, and structure. |

|

|

|

|

|

|

One-On-One Director Interviews |

|

|

At the direction of the Nominating & Governance Committee, private interviews are periodically conducted with individual directors to discuss feedback. |

|

|

|

|

|

|

Review by Nominating & Governance Committee |

|

|

The results of the director self-evaluation questionnaires are compiled and anonymized, then shared with the Nominating & Governance committee, which reviews and discusses the evaluations and highlights key areas for further discussion, reflection and improvement. |

|

|

|

|

|

|

Presentation of Findings |

|

|

The Nominating & Governance Committee presents its findings to the full Board for discussion and feedback. Based on these findings, the Board assesses the overall effectiveness of the Board and identifies possible areas for further consideration and improvement. |

|

|

|

|

|

|

Feedback Incorporated |

|

|

In response to feedback solicited from the Board, the Nominating & Governance Committee discusses areas of focus for improvement and works with management and the Board committees to develop appropriate action plans. Recent areas identified for continued consideration include instituting a new term limit policy for independent directors, refreshing required director qualifications, reassessing the board structure and enhancing the focus of materials presented to the Board and its Committees. |

|

|

|

|

|

Page 23

Information Regarding the Board of Directors and Corporate Governance | Policy on Director Qualifications and Nomination Process

Policy on Director Qualifications and Nomination Process

The Board’s Nominating & Governance Committee is responsible for evaluating and recommending to the Board proposed nominees for election to the Board of Directors. As part of its process, the Nominating & Governance Committee will consider director candidates recommended for consideration by members of the Board, by management and by shareholders. It is the policy of the Nominating & Governance Committee to consider candidates recommended by shareholders in the same manner as other candidates. Candidates for the Board of Directors must be experienced, dedicated and meet the highest standards of ethics and integrity. All directors represent the interests of all shareholders, not just the interests of any particular shareholder, shareholder group or other constituency. The Nominating & Governance Committee periodically reviews with the Board the requisite skills and characteristics for new directors, taking into account the needs of Lazard and the composition of the Board as a whole. A majority of our directors must satisfy the independence requirements of both Lazard and the NYSE. Likewise, each member of the Audit Committee must be financially literate and at least one member must possess the requisite qualifications to satisfy the SEC’s definition of “audit committee financial expert”. Once a candidate is identified, the Nominating & Governance Committee will consider the candidate’s mix of skills and experience with businesses and other organizations of comparable size, as well as his or her reputation, background and time availability (in light of anticipated needs). The Nominating & Governance Committee also will consider the interplay of the candidate’s experience with the experience of other Board members, the extent to which the candidate would be a desirable addition to the Board and any committees of the Board and any other factors it deems appropriate, including, among other things, diversity and inclusion. The Nominating & Governance Committee views diversity and inclusion broadly, encompassing differing viewpoints, professional experience, industry background, education, geographical orientation and particular skill sets, as well as race and gender.

|

➊ |

|

➋ |

|

➌ |

|

➍ |

|

|

|

|

|

|

|

|

|

Candidate Recommendation |

|

Nominating & Governance Committee |

|

Board of Directors |

|

Shareholders |

|

|

|

|

|

|

|

|

|

As part of its regular review and recommendation process, the Nominating & Governance Committee will consider candidates recommended by the Board, by management and by shareholders. |

|

The Nominating & Governance Committee evaluates candidates to ensure requisite experience, dedication, and integrity. The committee also considers the interplay of a candidate’s experience with that of other Board members, the needs of the Company, as well as other factors it deems appropriate, including, among other things, diversity and inclusion. |

|

After candidates are recommended by the Nominating & Governance Committee, the Board evaluates each candidate, taking into consideration the needs of the Board, including independence requirements.

|

|

Our Board is committed to nominating the best candidates for election by our shareholders, who have the opportunity to elect three candidates to serve as directors at the 2021 Annual General Meetings of Shareholders. |

|

|

||||||

|

The Company continuously seeks to bring fresh perspectives to the board, demonstrated by the implementation of a new term limit policy for independent directors, nominating a new independent director this year and electing four other new directors within the past five years. |

||||||

Shareholders wishing to recommend to the Nominating & Governance Committee a candidate for director at our 2022 Annual General Meeting of Shareholders may do so by submitting in writing such candidate’s name, in compliance with the procedures of our Bye-laws, and along with the other information required by our Bye-laws, to the Secretary of our Board of Directors at: Lazard Ltd, Office of the Secretary, 30 Rockefeller Plaza, New York, New York 10112 between December 30, 2021 and January 29, 2022.

Page 24

Information Regarding the Board of Directors and Corporate Governance | Director Independence, Director Compensation For 2020

Pursuant to the corporate governance listing standards of the NYSE, the Board of Directors has adopted standards for determining whether directors have material relationships with Lazard. The standards are set forth on Annex A to this Proxy Statement. Under these standards, a director employed by Lazard cannot be deemed to be an “independent director”, and consequently Messrs. Jacobs and Bhutani are not independent directors of Lazard.

The Board of Directors has determined that none of our other directors or director nominees have a material relationship with Lazard under the NYSE corporate governance listing standards and the Board of Directors’ standards for director independence and, accordingly, that each of our directors and director nominees (other than Messrs. Jacobs and Bhutani) is independent under the NYSE corporate governance listing standards.

In making its determination, the Board of Directors carefully considered the previously disclosed engagement of Lazard’s Financial Advisory business by Haymaker Acquisition Corp., of which Mr. Heyer was at the time the Chairman and Chief Executive Officer, in 2018. Pursuant to the engagement, Lazard provided financial advisory services to Haymaker Acquisition Corp. in connection with a business combination transaction and is entitled to receive aggregate fees of approximately $3 million. The Board of Directors noted that (i) the engagement terms were negotiated in the ordinary course of business on an arms-length basis, (ii) the revenue relating to the engagement is expected to be less than 1% of the gross revenue of both Lazard and Haymaker Acquisition Corp.’s successor in respect of any year for which payments would be made, and (iii) the engagement was pre-approved by the Nominating & Governance Committee.

Director Compensation for 2020

Directors who are officers of the Company do not receive any fees for their service as directors. In 2020, our directors’ compensation program provided that each of our non-executive directors would receive an annual cash retainer of $126,000 and an annual award of deferred stock units, or DSUs, with a grant date value of $154,000. An additional annual retainer was paid to the Lead Director and the chairs of each committee of the Board of Directors as follows: the Lead Director, $50,000; the chair of the Audit Committee, $30,000; the chair of the Nominating & Governance Committee, $20,000; the chair of the Compensation Committee, $20,000; and the chair of the Workplace and Culture Committee, $20,000. The other members of the Audit Committee were paid an additional annual retainer of $20,000, and the other members of the Nominating & Governance Committee, the Compensation Committee and the Workplace and Culture Committee were paid an additional annual retainer of $15,000, in respect of each applicable committee. All additional annual retainers were payable 45% in cash and 55% in DSUs.

Cash compensation is paid out on a quarterly basis (on February 15, May 15, August 15 and November 15, or, in each case, the first business day thereafter), and the DSU awards described above are granted on an annual basis on June 1st of each year, or the first business day thereafter, except for initial pro-rated grants made to new directors upon their election or appointment to the Board of Directors, and to continuing directors upon their appointment to new Board Committees or positions. The number of DSUs granted is determined based on the NYSE closing price of our Class A common stock on the trading day immediately preceding the date of grant.

Non-executive directors may elect to receive additional DSUs in lieu of some or all of their cash compensation pursuant to the Directors Fee Deferral Unit Plan. DSUs awarded under this plan are granted on the same quarterly payment dates as cash compensation would have been received, and the number of DSUs is determined based on the NYSE closing price of our Class A common stock on the trading day immediately preceding the date of grant. Messrs. Alper, Haass, Heyer and Parsons and Ms. Mendillo elected to participate in this plan during 2020 and have each elected to continue to participate in this plan during 2021.

Page 25

Information Regarding the Board of Directors and Corporate Governance | Director Compensation for 2019

All DSUs awarded under these arrangements are converted to shares of our Class A common stock on a one-for-one basis and distributed to a director only after he or she resigns from, or otherwise ceases to be a member of, the Board of Directors. Dividend equivalent payments are made in respect of DSUs, which are paid in cash at the same rate and time that dividends are paid on shares of our Class A common stock.

The Nominating & Governance Committee regularly reviews our director compensation program.

The table below sets forth the compensation paid to our non-executive directors during 2020.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fees Earned or Paid in Cash |

|

|

Stock Awards (1) |

|

|

Total |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Andrew M. Alper (2) |

|

$ |

144,053 |

|

|

$ |

176,014 |

|

|

$ |

320,067 |

|

|

Richard N. Haass (2) |

|

$ |

139,564 |

|

|

$ |

170,507 |

|

|

$ |

310,071 |

|

|

Steven J. Heyer (2) |

|

$ |

150,802 |

|

|

$ |

184,260 |

|

|

$ |

335,062 |

|

|

Michelle Jarrard |

|

$ |

142,198 |

|

|

$ |

179,772 |

|

|

$ |

321,970 |

|

|

Sylvia Jay |

|

$ |

139,500 |

|

|

$ |