Form DEF 14A Kaleyra, Inc. For: Oct 28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

| Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

Kaleyra, Inc.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

September 28, 2021

Dear Stockholder:

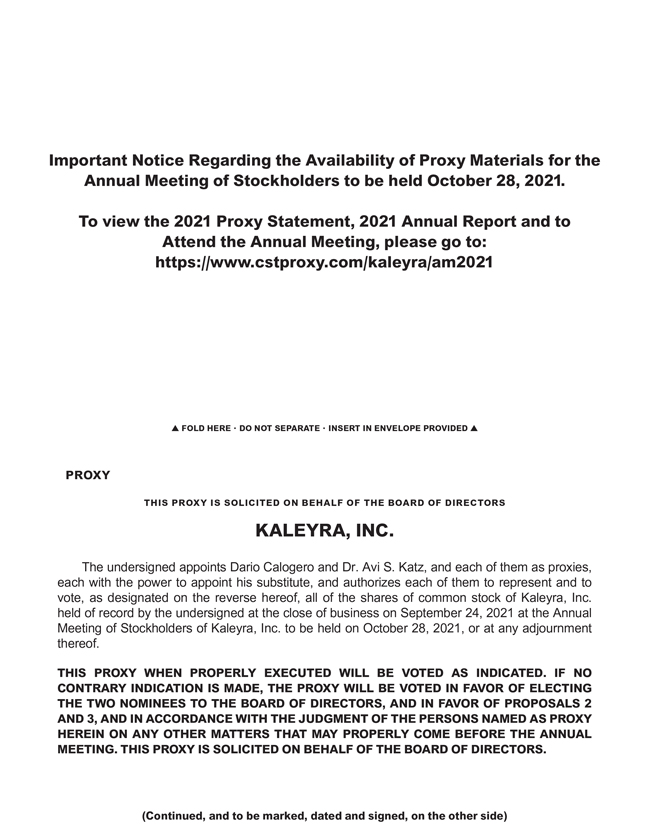

You are cordially invited to attend this year’s annual meeting of stockholders of Kaleyra, Inc. on October 28, 2021 at 8:00 a.m. Pacific Time. The meeting will be held virtually, at https://www.cstproxy.com/kaleyra/am2021. The meeting will commence with a discussion and voting on the matters set forth in the accompanying Notice of Annual Meeting of Stockholders followed by presentations and a report on our operations.

The Notice of Annual Meeting of Stockholders and a Proxy Statement, which describe the formal business to be conducted at the meeting, accompany this letter. A copy of our Annual Report to Stockholders is also enclosed for your information.

The matters to be acted upon are described in the Notice of Annual Meeting of Stockholders and Proxy Statement. Following the formal business of the meeting, we will report on our operations and respond to questions from stockholders.

Whether or not you plan to attend the meeting, your vote is very important and we encourage you to vote promptly. You may vote by proxy over the Internet, or, if you received paper copies of the proxy materials by mail, you can also vote by mail by following the instructions on the proxy card. If you attend the meeting you will, of course, have the right to revoke the proxy and vote your shares in person. If you hold your shares through an account with a brokerage firm, bank or other nominee, please follow the instructions you receive from your brokerage firm, bank or other nominee to vote your shares. We look forward to seeing you at the annual meeting.

Sincerely yours,

/s/ Dario Calogero

DARIO CALOGERO

President and

Chief Executive Officer

NOTICE OF 2021 ANNUAL MEETING OF STOCKHOLDERS

To Be Held October 28, 2021

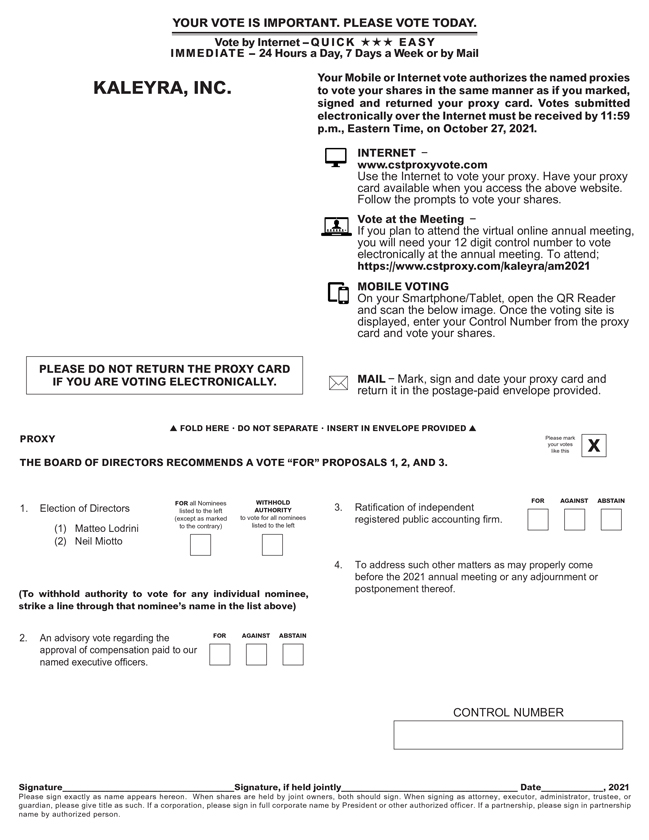

The 2021 annual meeting of stockholders of Kaleyra, Inc., a Delaware corporation, will be held on October 28, at 8:00 a.m. Pacific Time, virtually at https://www.cstproxy.com/kaleyra/am2021, for the following purposes:

1. To elect two Class II directors to hold office until the 2024 annual meeting and until their respective successors are elected and qualified.

2. To vote on a non-binding advisory resolution to approve the compensation of our Named Executive Officers (as defined in the Proxy Statement).

3. To ratify the appointment of EY S.p.A. as our independent registered public accounting firm for the fiscal year ending December 31, 2021.

4. To transact such other business as may properly come before the meeting or any adjournment or postponement of the meeting.

Our board of directors recommends a vote FOR Items 1, 2, and 3. Stockholders of record at the close of business on September 24, 2021 are entitled to notice of, and to vote at, the meeting and any adjournment or postponement thereof. For ten days prior to the meeting, a complete list of stockholders entitled to vote at the meeting will be available for examination by any stockholder, for any purpose relating to the meeting, during ordinary business hours at our principal offices located at Via Marco D’Aviano, 2, Milano, Italy 20131.

By order of the Board of Directors,

/s/ Dr. Avi S. Katz

Dr. Avi S. Katz

Chairman of the Board and Secretary

September 28, 2021

IMPORTANT: Please vote your shares via the Internet, as described in the accompanying materials, to assure that your shares are represented at the meeting, or, if you received a paper copy of the proxy card by mail, you may mark, sign and date the proxy card and return it in the enclosed postage-paid envelope. If you attend the meeting, you may choose to vote in person even if you have previously voted your shares.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON OCTOBER 28, 2021: Our Proxy Statement is enclosed. Financial and other information concerning Kaleyra, Inc. is contained in our Annual Report to Stockholders for the fiscal year ended December 31, 2021. A complete set of proxy materials relating to our annual meeting, consisting of the Notice of Annual Meeting, Proxy Statement, Proxy Card and Annual Report to Stockholders, is available on the Internet and may be viewed at https://www.cstproxy.com/kaleyra/am2021.

2021 PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in our Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting.

Annual Meeting of Stockholders

| ● Time and date: | 8:00 a.m., Pacific Time, October 28, 2020 | |

| ● Place: | Virtually, at: https://www.cstproxy.com/kaleyra/am2021 | |

| ● Record date: | September 24, 2021 | |

| ● How to vote: | In general, you may vote by the Internet or mail. See “Voting Instructions” on page 4 for more detail regarding how you may vote if you are a registered holder or a beneficial owner of shares held in “street name.” | |

Voting Matters

| Board Voting Recommendations |

Page Reference (for more detail) |

|||||

| Election of directors |

FOR EACH DIRECTOR NOMINEE | 5 | ||||

| Advisory vote on the compensation of our named executive officers |

FOR | 16 | ||||

| Ratification of EY S.p.A. as our independent registered public accounting firm for fiscal 2021 |

FOR | 17 | ||||

Board Nominees

| Committee Members | ||||||||||||||||||||||||

| Name |

Age | Director Since |

Occupation |

Independent | AC | CC | NGC | |||||||||||||||||

| Matteo Lodrini |

54 | November 2019 | Financial Executive | X | X | X | X | |||||||||||||||||

| Neil Miotto |

75 | December 2017 | Financial Consultant | X | C | X | ||||||||||||||||||

| AC | Audit Committee |

| C | Chair |

| CC | Compensation Committee |

| NGC | Nominating and Governance Committee |

Fiscal 2020 Business Performance and Executive Pay Highlights

| • | Revenue. Total revenue for the full year 2020 was $147.4 million, a 14% increase when compared to 2019 revenue of $129.6 million. |

| • | Gross Profit. Gross profit for the full year 2020 was $24.4 million, a 7% decrease when compared to 2019 gross profit of $26.4 million. |

| • | Net Loss. Net loss for the full year 2020 was $(26.8) million, compared to 2019 net loss of $(5.5) million. |

1

| • | Liquidity. As of December 31, 2020, cash and cash equivalents were $33.0 million. Cash used in operating activities was $12.3 million during the full year 2020, compared with cash provided in operating activities of $6.5 million during the full year 2019. |

| • | Liabilities. Total liabilities were reduced by $30.2 million, down 19% since December 31, 2019. |

| Named Executives |

Salary | Stock Awards |

Option Awards |

Non-Equity Incentive Plan Compensation |

All Other Compensation |

Total | ||||||||||||||||||

| Dario Calogero President and Chief Executive Officer |

$ | 453,976 | $ | — | — | — | $ | 454,699 | $ | 908,675 | ||||||||||||||

| Giacomo Dall’Aglio EVP and Chief Financial Officer |

$ | 293,538 | $ | — | — | 85,494 | $ | 289,465 | $ | 668,497 | ||||||||||||||

| Julia Pulzone (1) Former EVP and Chief Financial Officer (1) |

$ | — | — | — | — | — | $ | — | ||||||||||||||||

| Luca Giardina Papa (2) Former Chief Financial Officer |

$ | — | $ | — | — | — | $ | — | $ | — | ||||||||||||||

| (1) | Ms. Pulzone became the Chief Financial Officer of Kaleyra S.p.A. on March 18, 2019 and ceased being Kaleyra’s EVP and Chief Financial Officer effective December 12, 2019, as such no compensation was reported for fiscal year 2020. |

| (2) | Mr. Papa served as the Chief Financial Officer of Kaleyra S.p.A. prior to March 18, 2019, as such no compensation for the role of Chief Financial Officer was reported for fiscal year 2020. |

2

KALEYRA, INC.

VIA MARCO, D’AVIANO, 2

MILANO, ITALY 20131

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD OCTOBER 28, 2021

The Board of Directors of Kaleyra, Inc. is soliciting your proxy for the 2021 Annual Meeting of Stockholders to be held on October 28, 2021, or any adjournment or postponement thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. This Proxy Statement and related materials are first being made available to stockholders on or about September 28, 2021. References in this Proxy Statement to the “Company,” “we,” “our,” “us” and “Kaleyra” are to Kaleyra, Inc., and references to the “annual meeting” are to the 2021 Annual Meeting of Stockholders. When we refer to Kaleyra’s fiscal year, we mean the annual period ending on December 31. This Proxy Statement covers our 2020 fiscal year, which was from January 1, 2020 through December 31, 2020 (“fiscal 2020”).

SOLICITATION AND VOTING

Record Date

Only stockholders of record at the close of business on September 24, 2021 will be entitled to notice of and to vote at the meeting and any adjournment thereof. As of the record date, 41,691,081 shares of common stock were outstanding and entitled to vote.

Quorum

A majority of the shares of common stock outstanding as of the record date, or 41,691,081 shares of common stock, must be represented at the meeting, either in person or by proxy, to constitute a quorum for the transaction of business at the meeting. The 2,798,058 issued shares of common stock held by Kaleyra as Treasury Shares (which are not considered as outstanding), as a matter of Delaware law, do not count for purposes of determining whether a quorum is present at the meeting and are not entitled to be voted. Your shares will be counted towards the quorum if you submit a valid proxy (or one is submitted on your behalf by your broker or bank) or if you vote in person at the meeting. Abstentions and “broker non-votes” (shares held by a broker or nominee that does not have the authority, either express or discretionary, to vote on a particular matter) will each be counted as present for purposes of determining the presence of a quorum.

Vote Required to Adopt Proposals.

Each share of our common stock outstanding on the record date is entitled to one vote on each of the two director nominees and one vote on each other matter. For the election of directors, the two director nominees who receive the highest number of “For” votes will be elected as Class II directors. You may vote “For” or “Withhold” with respect to each director nominee. Votes that are withheld will be excluded entirely from the vote with respect to the nominee from which they are withheld and will have the same effect as an abstention. With respect to each of the other proposals, approval of the proposal requires the affirmative vote of a majority of the shares present and entitled to vote.

Effect of Abstentions and Broker Non-Votes.

Shares not present at the meeting and shares voted “Withhold” will have no effect on the election of directors. For each of the other proposals, abstentions will have the same effect as an “against” vote. If you are a beneficial owner and hold your shares in “street name” in an account at a bank or brokerage firm, it is critical that you cast your vote if you want it to count in the election of directors and the executive compensation advisory proposal. Under the rules governing banks and brokers who submit a proxy card with respect to shares held in

3

street name, such banks and brokers have the discretion to vote on routine matters, but not on non-routine matters. Routine matters include the ratification of auditors. Non-routine matters include the election of directors and the executive compensation advisory proposal. Banks and brokers may not vote on these proposals if you do not provide specific voting instructions. Accordingly, we encourage you to vote promptly, even if you plan to attend the annual meeting. In tabulating the voting results for any particular proposal, shares that constitute broker non-votes are not considered entitled to vote on that proposal.

Voting Instructions

If you complete and submit your proxy card or voting instructions, the persons named as proxies will follow your voting instructions. If no choice is indicated on the proxy card, the shares will be voted as the board recommends on each proposal. Many banks and brokerage firms have a process for their beneficial owners to provide instructions via the Internet. The voting form that you receive from your bank or broker will contain instructions for voting.

Depending on how you hold your shares, you may vote in one of the following ways:

Stockholders of Record: You may vote by proxy or over the Internet. Please follow the instructions provided in the Notice, or, if you requested printed copies of the proxy materials, on the proxy card you received, then sign and return it in the prepaid envelope. You may also vote in person at the annual meeting.

Beneficial Stockholders: Your bank, broker or other holder of record will provide you with a voting instruction card for you to use to instruct them on how to vote your shares. Check the instructions provided by your bank, broker or other holder of record to see which options are available to you. However, since you are not the stockholder of record, you may not vote your shares in person at the annual meeting unless you request and obtain a valid proxy from your bank, broker or other agent.

Votes submitted via the Internet must be received by 11:59 p.m., Eastern Time, on October 27, 2021. Submitting your proxy via the Internet will not affect your right to vote in person should you decide to attend the annual meeting in person.

If you are a stockholder of record, you may revoke your proxy and change your vote at any time before the polls close by returning a later-dated proxy card, by voting again by Internet as more fully detailed in your Notice or proxy card, or by delivering written instructions to the Corporate Secretary before the annual meeting. Attendance at the annual meeting will not in and of itself cause your previously voted proxy to be revoked unless you specifically so request or vote again at the annual meeting. If your shares are held in an account at a bank, brokerage firm or other agent, you may change your vote by submitting new voting instructions to your bank, brokerage firm or other agent, or, if you have obtained a legal proxy from your bank, brokerage firm or other agent giving you the right to vote your shares, by attending the annual meeting and voting in person.

Solicitation of Proxies

We will bear the cost of soliciting proxies. In addition to soliciting stockholders by mail, we will request banks, brokers and other intermediaries holding shares of our common stock beneficially owned by others to obtain proxies from the beneficial owners and will reimburse them for their reasonable, out-of-pocket costs. We may use the services of our officers, directors and employees to solicit proxies, personally or by telephone, without additional compensation.

Voting Results

We will announce preliminary voting results at the annual meeting. We will report final results in a Form 8-K report filed with the SEC.

4

PROPOSAL NO. 1

ELECTION OF DIRECTORS

We have a classified Board of Directors consisting of two Class I directors, two Class II directors and two Class III directors. At each annual meeting of stockholders, directors are elected for a term of three years to succeed those directors whose terms expire at the annual meeting dates. We have one vacancy for a seventh director, which our Board will act with regard to filling when a candidate is identified.

The term of the Class II directors will expire on the date of the upcoming annual meeting. Accordingly, two persons are to be elected to serve as Class II directors of the Board of Directors at the meeting. The Board of Director’s nominees for election by the stockholders to those two positions are the current Class II members of the Board of Directors, Matteo Lodrini and Neil Miotto. If elected, each nominee will serve as a director until our annual meeting of stockholders in 2024 and until their respective successors are elected and qualified. If any of the nominees declines to serve or becomes unavailable for any reason, or if a vacancy occurs before the election (although we know of no reason to anticipate that this will occur), the proxies may be voted for such substitute nominees as we may designate. The proxies cannot vote for more than two persons.

The two nominees for Class II director receiving the highest number of votes will be elected as Class II directors. A “Withhold” vote will have no effect on the vote.

The Board of Directors recommends that you vote “FOR” the nominees named above.

The names of our current directors, including the nominees for Class II directors to be elected at this meeting, and certain information about them as of September 28, 2021 is set forth below.

| Name |

Principal Occupation |

Age | Director Since | |||

| Class I Directors Whose Terms Expire at the 2023 Annual Meeting of Stockholders: | ||||||

| Dr. Emilio Hirsch | Author, Entrepreneur, and Professor | 56 | 2020 | |||

| John J. Mikulsky | Businessman and Engineer | 76 | 2017 | |||

| Class II Directors Nominated for Election at the 2021 Annual Meeting of Stockholders: | ||||||

| Matteo Lodrini | Financial Executive | 54 | 2019 | |||

| Neil Miotto | Financial Consultant | 75 | 2017 | |||

| Class III Directors Whose Terms Expire at the 2022 Annual Meeting of Stockholders: | ||||||

| Dario Calogero | Chief Executive Officer | 58 | 2019 | |||

| Dr. Avi S. Katz | Businessman and Engineer | 63 | 2017 | |||

Directors’ Principal Occupation, Business Experience, Qualifications, and Directorships

Dario Calogero has served as the Chief Executive Officer of Kaleyra S.p.A and a member of Kaleyra S.p.A.’s Board of Directors since the company was founded in 1999. He became a director and the Chief Executive Officer of Kaleyra upon the closing of the Business Combination. As a serial entrepreneur, he bootstrapped Kaleyra S.p.A. from its inception, quickly positioning the company in the mobile banking space, and leading the company as it expanded its product offerings and completed several acquisitions. Prior to founding Kaleyra S.p.A., Mr. Calogero held executive positions with Oracle, Fiat Chrysler Automobiles and management consulting companies including PricewaterhouseCoopers. Mr. Calogero holds a master’s degree in economics from Bocconi University in Milan. Kaleyra believes that Mr. Calogero is qualified to serve on the Board based on his historic knowledge of Kaleyra and his leadership and managerial experience.

5

Dr. Emilio Hirsch joined the Board of Directors on February 10, 2020, upon the resignation of Simone Fubini from the Board of Directors. Dr. Hirsch has been since 2005 a Full Professor of Experimental Biology at the Medical School of the University of Torino, Italy. Dr. Hirsch is an affiliate and director of Esse Effe S.p.A (“Esse Effe”), which is Kaleyra’s largest stockholder. Dr. Hirsch oversees Esse Effe’s holdings, particularly its real estate holdings. Dr. Hirsch is also an entrepreneur and the author of over two hundred and fifty publications. He graduated from the University of Torino in 1988, and also received his Ph.D. from the University of Torino in 1994. Kaleyra believes that Dr. Hirsch is qualified to serve on the Board of based upon his entrepreneurial background, and as he has been attending board meetings of Kaleyra S.p.A., Kaleyra’s wholly-owned operating subsidiary, for the last four years and has great familiarity with Kaleyra as a result, his historic knowledge of Kaleyra.

Dr. Avi S. Katz served as GigCapital, Inc. (formerly NYSE: GIG) Founder, Executive Chairman of the Board, Chief Executive Officer, President and Secretary since October 2017 and upon the closing of the Business Combination, when GigCapital, Inc. renamed itself Kaleyra, Inc., Dr. Katz transitioned to be the Executive Chairman of our Board of Directors of Kaleyra, Inc. (NYSE: KLR). Dr. Katz has spent approximately 34 years in international executive positions within the technology, media and telecommunications (TMT) industry working for privately held start-ups, middle-cap companies and large enterprises. In these roles, Dr. Katz has been instrumental in launching and accelerating entities, building teams, large scale fund-raising, developing key alliances and technology partnerships, domestic and international M&A activities, business development, financial management, global operations and sales and marketing. Dr. Katz is the Founder and Sole Founding Manager of GigCapital Global (GigCG), which he incepted in 2017, and its affiliated entities, including GigAcquisitions, LLC, GigAcquisitions2, LLC, GigAcquisitions3, LLC, GigAcquisitions4, LLC, GigAcquisitions5, LLC, GigAcquisitions6, LLC and GigInternational1 Sponsor, LLC, all of which are sponsors to Private-to-Public Equity (PPE) companies which have been formed for the purpose of acquiring companies in the technology industry. GigCG is an inceptor and managing group of Private-to-Public Equity (PPE) entities, also known as a blank check company or special purpose acquisition company (SPAC) vehicles. Following the inception of GigCapital, inc., in March 2019, Dr. Katz founded GigCapital2, Inc. (“GIG2”, formerly NYSE: GIX), a PPE company. On June 9, 2021, GIG2 was renamed UpHealth, Inc. and continues to be listed on the NYSE under the new ticker symbol “UPH” following GIG2’s business combinations with UpHealth Holdings, Inc. and Cloudbreak Health, LLC. He is the Executive Chairman of the Board of UpHealth, Inc. (NYSE: UPH) since inception of the company as GIG2, and was the Chief Executive Officer of GIG2 from March 2019 until August 2019. In February 2020, Dr. Katz co-founded GigCapital3, Inc. (“GIG3”, formerly NYSE: GIK) PPE company. On May 6, 2021, GIG3 was renamed Lightning eMotors, Inc. and continues to be listed on the NYSE under the new ticker symbol “ZEV.” From the inception of GIG3 until the closing of its business combination in May 2021, Dr. Katz served as the Chief Executive Officer, Executive Chairman and Secretary of GIG3. Following the business combination, Dr. Katz serves as the Co-Chairman of the Board of Directors of Lightning eMotors, Inc (NYSE ZEV). He is also the Founder of four other Private-to-Public Equity (PPE) companies, three of which he is also Executive Chairman – GigCapital4, Inc. (“GIG4”, NASDAQ: GIG), GigCapital5, Inc. (“GIG5”) and GigInternational1, Inc. (“GIGINTL1”, NASDAQ: GIW) since their inceptions in December 2020, February 2021, and February 2021 respectively – and one of which he is also a member of the board of directors – GigCapital6, Inc. (“GIG6”) since February 2021. GIG4 and GIGINTL1 have already conducted their initial public offerings in February 2021 and May 2021, respectively, and in June 2021, GIG4 has announced a proposed business combination with BigBear.ai Holdings, LLC. GIG5 and GIG6 have each filed registration statements with the SEC for their initial public offerings. Dr. Katz is also the sole founding managing member of GigFounders, LLC and a founding managing member of GigManagement, LLC. Dr. Katz is also the co-founder and from its inception in December 2018 until August 2020, served as the Executive Chairman of the Board of Cognizer, Inc., an artificial intelligence (“AI”) company with a natural language understanding platform based on deep learning formed in December 2018. Previously, Dr. Katz dedicated 10 years to developing and managing GigPeak (NYSE American: formerly GIG), originally known as GigOptix, Inc. since he incepted it in April 2007 until its sale in April 2017, GigPeak provided semiconductor integrated circuits (ICs) and software solutions for high-speed connectivity and video compression. While Dr. Katz was at GigPeak’s helm, the company completed 10 M&A deals. GigPeak was sold to Integrated Device Technology, Inc. (Nasdaq: IDTI) for $250 million in cash

6

in April 2017. From 2003 to 2005, Dr. Katz was the chief executive officer, president, and member of the Board of Directors of Intransa, Inc., which at the time provided full-featured, enterprise-class IP-based Storage Area Networks (SAN). From 2000 to 2003, Dr. Katz was the Chief Executive Officer of Equator Technologies. Equator Technologies sought to commercialize leading edge programmable media processing platform technology for the rapid design and deployment of digital media and imaging products. Equator Technologies was sold to Pixelworks, Inc. for $110 million in 2005. Dr. Katz has held several leadership positions over the span of his 34-year career within the technology industry and has made numerous angel investments in high-tech companies around the world. In addition, Dr. Katz is a graduate of the Israeli Naval Academy and holds a B.Sc. and Ph.D. in Semiconductors Materials from the Technion (Israel Institute of Technology). He is a global philanthropist, serial entrepreneur and long-time angel investor in the TMT sector, holds many U.S. and international patents, has published many technical papers and is the editor of a number of technical books. Kaleyra believes Dr. Katz is qualified to serve on the Board based on his leadership, industry, investing and managerial (as a chief executive officer and director of publicly-listed companies) experience.

Matteo Lodrini. Matteo Lodrini joined Kaleyra S.p.A.’s Board of Directors in 2017 and became a director of Kaleyra upon the closing of the Business Combination. Since 2007, Mr. Lodrini has served as the Chief Financial Officer of De Nora Group, a high-growth, global water treatment sector company. He is responsible for all financial operations including leading the company’s acquisition strategy. Mr. Lodrini is a finance executive with significant experience in all phases of cross border corporate transactions, global business development, corporate finance and capital markets, and has an in-depth knowledge of financial operations and controls and internal audit processes. Mr. Lodrini holds a master’s degree in Economics from Brescia University and a masters in Corporate Finance from SDA Bocconi in Milan. Kaleyra believes that Mr. Lodrini is qualified to serve on the Board of Directors based on his financial and managerial experience.

John J. Mikulsky joined the Board of Directors as an independent director in December of 2017. He joined the board of directors of GigCapital2, Inc. in March 2019, and served on that board until the business combination of GigCapital2, Inc. with UpHealth Holdings, Inc, and Cloudbreak Health, LLC in June 2021. He joined the board of directors of Cognizer, Inc. in March 2019, serving on that board until August 2020. He joined the board of directors of GigCapital3, Inc. in February 2020, and served on that board until the business combination of GigCapital3, Inc. with Lightning Systems, Inc. in May 2021. Mr. Mikulsky served as the Chief Executive Officer of Traycer Diagnostic Systems, Inc. from August 2016 to December 2017, and as a director, from October 2014 to December 2017. He previously served as President and Chief Executive Officer of Endwave Corporation (“Endwave”; Nasdaq: ENWV) from December 2009 until June 2011, when Endwave was acquired by GigOptix, Inc. (subsequently known as GigPeak, Inc. (“GigPeak”); NYSE MKT: GIG); subsequent to such acquisition, he served on the Board of Directors of GigPeak from June 2011 until its sale to Integrated Device Technology, Inc. in April 2017. From May 1996 until November 2009, Mr. Mikulsky served Endwave in a multitude of capacities including Vice President of Product Development, Vice President of Marketing and Business Development and Chief Operating Officer. Prior to Endwave, Mr. Mikulsky worked as a Technology Manager for Balazs Analytical Laboratory, from 1993 until 1996, a provider of analytical services to the semiconductor and disk drive industries. Prior to 1993, Mr. Mikulsky worked at Raychem Corporation, most recently as a Division Manager for its Electronic Systems Division. Mr. Mikulsky holds a B.S. in electrical engineering from Marquette University, an M.S. in electrical engineering from Stanford University and an S.M. in Management from the Sloan School at the Massachusetts Institute of Technology. Kaleyra believes that Mr. Mikulsky is qualified to serve on the Board based on his industry and managerial experience, and his experience serving on public company boards.

Neil Miotto joined the Kaleyra’s Board in October 2017. Mr. Miotto also serves as a director of UpHealth, Inc. since its inception as GigCapital2, Inc. in March 2019, Lightning eMotors, Inc. since its inception as GigCapital3, Inc. in February 2020, GigCapital4, Inc. since December 2020, and GigCapital5, Inc. since February 2021. and was a director of Cognizer, Inc. from March 2019 to August 2020. In addition, Mr. Miotto served on the Board of Directors of Micrel, Inc. prior to its sale to Microchip Technology Inc. in May 2015, and on the Board of Directors of GigPeak, Inc. from 2008 until its sale to Integrated Device Technology, Inc. in April

7

2017. Mr. Miotto is a financial consultant and a retired assurance partner of KPMG LLP, where he was a partner for twenty-seven years until his retirement in September 2006. Since his retirement from KPMG LLP, Mr. Miotto has provided high-level financial consulting services to companies in need of timely accounting assistance and in serving on public company boards. He is deemed to be a “audit committee financial expert” under SEC rules. While at KPMG LLP, Mr. Miotto focused on serving large public companies. Mr. Miotto also served as an SEC reviewing partner while at KPMG LLP. He is a member of the American Institute of Certified Public Accountants. He holds a Bachelor of Business Administration degree from Baruch College, of The City University of New York. Kaleyra believes that Mr. Miotto is qualified to serve on the Board based on his financial and managerial experience, and his experience serving on public company boards.

CORPORATE GOVERNANCE

Director Independence

The Board of Directors has determined that, other than Mr. Calogero, each of the current members of the Board is an “independent director” for purposes of the listing standards of the New York Stock Exchange (“NYSE”) and Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended, as the term relates to membership on the board of directors and the various committees of the board of directors, and which is defined generally as a person other than an executive officer or employee of Kaleyra or its subsidiaries or any other individual having a relationship, which, in the opinion of our Board of Directors would interfere with the director’s exercise of independent judgment in carrying out the responsibilities of a director.

Board Responsibilities and Structure

The Board oversees, counsels, and directs management in the long-term interests of Kaleyra and our stockholders. The Board’s responsibilities include:

| • | selecting, evaluating the performance of, and determining the compensation of the CEO and other executive officers; |

| • | planning for succession with respect to the position of CEO and monitoring management’s succession planning for other executive officers; |

| • | reviewing and approving our major financial objectives and strategic and operating plans, and other significant actions; |

| • | overseeing the conduct of our business and the assessment of our business and other enterprise risks to evaluate whether the business is being properly managed; and |

| • | overseeing the processes for maintaining our integrity with regard to our financial statements and other public disclosures, and compliance with law and ethics. |

The Board and its committees met throughout the year on a set schedule, held special meetings, and acted by written consent from time to time as appropriate. The Board did hold a meeting with only its independent directors in 2020. Board members have access to all of our employees outside of Board meetings, and the Board encourages each director to visit each Kaleyra site on a regular basis and meet with local management at each site, but it did not happen in 2020 because of the pandemic.

Board Leadership Structure. The Board does not have a fixed policy regarding the separation of the offices of Chairman of the Board and Chief Executive Officer and believes that it should maintain the flexibility to select the Chairman of the Board and its leadership structure, from time to time, based on the criteria that it deems in the best interests of Kaleyra and its stockholders. However, the Board does maintain a separate Executive

8

Chairman of the Board who is not the Chief Executive Officer of Kaleyra. The duties of the Executive Chairman of the Board include:

| • | presiding over all meetings of the Board; |

| • | preparing the agenda for Board meetings in consultation with the CEO and other members of the Board; |

| • | working with the Chairman of the Nominating and Corporate Governance Committee to manage the Board’s process for annual director self-assessment and evaluation of the Board and of the CEO; and |

| • | presiding over all meetings of stockholders. |

The Board’s Role in Risk Oversight at Kaleyra

One of the Board’s functions is oversight of risk management at Kaleyra. “Risk” is inherent in business, and the Board seeks to understand and advise on risk in conjunction with the activities of the Board and the Board’s committees.

Defining Risk. The Board and management consider “risk” for these purposes to be the possibility that an undesired event could occur that might adversely affect the achievement of our objectives. Risks vary in many ways, including the ability of Kaleyra to anticipate and understand the risk, the types of adverse impacts that could occur if the undesired event occurs, the likelihood that an undesired event and a particular adverse impact would occur, and the ability of Kaleyra to control the risk and the potential adverse impacts. Examples of the types of risks faced by Kaleyra include:

| • | macro-economic risks, such as inflation, reductions in economic growth, or recession; |

| • | political risks, such as restrictions on access to markets, confiscatory taxation, or expropriation of assets; |

| • | “event” risks, such as natural disasters; and |

| • | business-specific risks related to strategic position, operational execution, financial structure, legal and regulatory compliance, and corporate governance. |

Not all risks can be dealt with in the same way. Some risks may be easily perceived and controllable, and other risks are unknown; some risks can be avoided or mitigated by particular behavior, and some risks are unavoidable as a practical matter. For some risks, the potential adverse impact would be minor, and, as a matter of business judgment, it may not be appropriate to allocate significant resources to avoid the adverse impact; in other cases, the adverse impact could be significant, and it is prudent to expend resources to seek to avoid or mitigate the potential adverse impact. In some cases, a higher degree of risk may be acceptable because of a greater perceived potential for reward. Kaleyra engages in numerous activities seeking to align its voluntary risk-taking with company strategy, and understands that its projects and processes may enhance Kaleyra’s business interests by encouraging innovation and appropriate levels of risk-taking.

Management is responsible for identifying risk and risk controls related to significant business activities; mapping the risks to company strategy; and developing programs and recommendations to determine the sufficiency of risk identification, the balance of potential risk to potential reward, the appropriate manner in which to control risk, and the support of the programs discussed below and their risk to company strategy. The Board implements its risk oversight responsibilities by having management provide periodic briefing and informational sessions on the significant voluntary and involuntary risks that Kaleyra faces and how Kaleyra is seeking to control risk if and when appropriate. In some cases, as with risks of new technology and risks related to product acceptance, risk oversight is addressed as part of the full Board’s engagement with the CEO and management. In other cases, a Board committee is responsible for oversight of specific risk topics. For example, the Audit Committee oversees issues related to internal control over financial reporting and significant pending

9

and threatened litigation, and the Compensation Committee oversees risks related to compensation programs, as discussed in greater detail below. Presentations and other information for the Board and Board committees generally identify and discuss relevant risk and risk control, and the Board members assess and oversee the risks as a part of their review of the related business, financial, or other activity of Kaleyra. The full Board also receives specific reports on enterprise risk management, in which the identification and control of risk are the primary topics of the discussion.

Risk Assessment in Compensation Programs. We have assessed Kaleyra’s compensation programs and have concluded that our compensation policies and practices do not create risks that are reasonably likely to have a material adverse effect on Kaleyra. Kaleyra management assessed Kaleyra’s executive and broad-based compensation and benefits programs on a worldwide basis to determine if the programs’ provisions and operations create undesired or unintentional risk of a material nature. This risk assessment process included a review of program policies and practices; program analysis to identify risk and risk control related to the programs; and determinations as to the sufficiency of risk identification, the balance of potential risk to potential reward, risk control, and the support of the programs and their risks to company strategy. Although we reviewed all compensation programs, we focused on the programs with variability of payout, with the ability of a participant to directly affect payout and the controls on participant action and payout. Kaleyra’s existing compensation policies and philosophies support the use of base salary, annual cash incentive bonus, annual equity-based compensation and long-term equity-based incentive compensation. In addition, as discussed further below there can be special achievement bonuses.

Based on the foregoing, we believe that our compensation policies and practices do not create inappropriate or unintended significant risk to Kaleyra as a whole. We also believe that our incentive compensation arrangements provide incentives that do not encourage risk-taking beyond the organization’s ability to effectively identify and manage significant risks; are compatible with effective internal controls and the risk management practices of Kaleyra; and are supported by the oversight and administration of the Compensation Committee with regard to executive compensation programs.

Executive Sessions

The independent directors meet on a regular basis as often as necessary to fulfill their responsibilities, including at least annually in executive session without the presence of non-independent directors and management.

Meetings of the Board of Directors and Committees

The Board of Directors held fourteen meetings during the fiscal year ended December 31, 2020. The Board of Directors has three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. During the last fiscal year, each of our directors attended at least 75% of the total number of meetings of the board and all of the committees of the board on which such director served during that period.

The following table sets forth the standing committees of the board of directors and the members of each committee as of the date that this Proxy Statement was first made available to our stockholders:

| Name of Director |

Audit | Compensation | Nominating and Corporate Governance | |||

| Dario Calogero |

||||||

| Dr. Emilio Hirsch |

X | |||||

| Dr. Avi S. Katz |

||||||

| Matteo Lodrini |

X | X | X | |||

| John J. Mikulsky |

X | Chair | Chair | |||

| Neil Miotto |

Chair | X | ||||

| Number of meetings during fiscal 2020: |

5 | 9 | 2 |

10

Audit Committee

We have established an Audit Committee of the Board. Messrs. Miotto, Mikulsky, and Lodrini serve as members of our Audit Committee. Mr. Miotto serves as chairman of the Audit Committee. Under the NYSE listing standards and applicable SEC rules, we are required to have three members of the Audit Committee all of whom must be independent. Messrs. Miotto, Mikulsky, and Lodrini are independent.

Each member of the Audit Committee is financially literate and our Board has determined that Mr. Miotto qualifies as an “audit committee financial expert” as defined in applicable SEC rules.

We have adopted an Audit Committee charter, which details the purpose and principal functions of the Audit Committee, including:

| • | assisting the Board in the oversight of (1) the accounting and financial reporting processes of Kaleyra and the audits of the financial statements of Kaleyra, (2) the preparation and integrity of the financial statements of Kaleyra, (3) the compliance by Kaleyra with financial statement and regulatory requirements, (4) the performance of Kaleyra’s internal finance and accounting personnel and its independent registered public accounting firms, and (5) the qualifications and independence of Kaleyra’s independent registered public accounting firms; |

| • | reviewing with each of the internal and independent registered public accounting firms the overall scope and plans for audits, including authority and organizational reporting lines and adequacy of staffing and compensation; |

| • | reviewing and discussing with management and internal auditors Kaleyra’s system of internal control and discuss with the independent registered public accounting firm any significant matters regarding internal controls over financial reporting that have come to its attention during the conduct of its audit; |

| • | reviewing and discussing with management, internal auditors and independent registered public accounting firm Kaleyra’s financial and critical accounting practices, and policies relating to risk assessment and management; |

| • | receiving and reviewing reports of the independent registered public accounting firm discussing 1) all critical accounting policies and practices to be used in the firm’s audit of Kaleyra’s financial statements, 2) all alternative treatments of financial information within generally accepted accounting principles that have been discussed with management, ramifications of the use of such alternative disclosures and treatments, and the treatment preferred by the independent registered public accounting firm, and 3) other material written communications between the independent registered public accounting firm and management, such as any management letter or schedule of unadjusted differences; |

| • | reviewing and discussing with management and the independent registered public accounting firm the annual and quarterly financial statements and section entitled “Management’s Discussion and Analysis of Financial Conditions and Results of Operations” of Kaleyra prior to the filing of Kaleyra’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q; |

| • | reviewing, or establishing, standards for the type of information and the type of presentation of such information to be included in, earnings press releases and earnings guidance provided to analysts and rating agencies; |

| • | discussing with management and independent registered public accounting firm any changes in Company’s critical accounting principles and the effects of alternative GAAP methods, off-balance sheet structures and regulatory and accounting initiatives; |

| • | reviewing material pending legal proceedings involving Kaleyra and other contingent liabilities; |

| • | meeting periodically with the Chief Executive Officer, Chief Financial Officer, the senior internal auditing executive and the independent registered public accounting firm in separate executive sessions to discuss results of examinations; |

11

| • | reviewing and approving all transactions between Kaleyra and related parties or affiliates of the officers of Kaleyra requiring disclosure under Item 404 of Regulation S-K prior to Kaleyra entering into such transactions; |

| • | establishing procedures for the receipt, retention and treatment of complaints received by Kaleyra regarding accounting, internal accounting controls or auditing matters, and the confidential, anonymous submissions by employees or contractors of concerns regarding questionable accounting or accounting matters; |

| • | reviewing periodically with Kaleyra’s management, independent registered public accounting firm and outside legal counsel (i) legal and regulatory matters which may have a material effect on the financial statements, and (ii) corporate compliance policies or codes of conduct, including any correspondence with regulators or government agencies and any employee complaints or published reports that raise material issues regarding Kaleyra’s financial statements or accounting policies and any significant changes in accounting standards or rules promulgated by the Financial Accounting Standards Board, the SEC or other regulatory authorities; and |

| • | establishing policies for the hiring of employees and former employees of the independent registered public accounting firm. |

Compensation Committee

We have established a Compensation Committee of the Board. Messrs. Mikulsky, Miotto, and Lodrini serve as members of our Compensation Committee. Mr. Mikulsky serves as chairman of the Compensation Committee. We have adopted a Compensation Committee charter, which details the purpose and responsibility of the Compensation Committee, including:

| • | reviewing the performance of the Chief Executive Officer and executive management; |

| • | assisting the Board in developing and evaluating potential candidates for executive positions (including Chief Executive Officer); |

| • | reviewing and approving goals and objectives relevant to the Chief Executive Officer and other executive officer compensation, evaluate the Chief Executive Officer’s and other executive officers’ performance in light of these corporate goals and objectives, and set Chief Executive Officer and other executive officer compensation levels consistent with its evaluation and the company philosophy; |

| • | approving the salaries, bonus and other compensation for all executive officers; |

| • | reviewing and approving compensation packages for new corporate officers and termination packages for corporate officers as requested by management; |

| • | reviewing and discussing with the Board and senior officers plans for officer development and corporate succession plans for the Chief Executive Officer and other senior officers; |

| • | reviewing and making recommendations concerning executive compensation policies and plans; |

| • | reviewing and recommending to the Board the adoption of or changes to the compensation of Kaleyra’s directors; |

| • | reviewing and approving the awards made under any executive officer bonus plan, and provide an appropriate report to the Board; |

| • | reviewing and making recommendations concerning long-term incentive compensation plans, including the use of stock options, restricted stock units (RSUs) and other equity-based plans, and, except as otherwise delegated by the Board of Directors, acting on as the “Plan Administrator” for equity-based and employee benefit plans; |

| • | approving all special perquisites, special cash payments and other special compensation and benefit arrangements for Kaleyra’s executive officers and employees; |

12

| • | reviewing periodic reports from management on matters relating to Kaleyra’s personnel appointments and practices; |

| • | assisting management in complying with Kaleyra’s proxy statement and annual report disclosure requirements; |

| • | issuing an annual report of the Compensation Committee on Executive Compensation for Kaleyra’s annual proxy statement in compliance with applicable SEC rules and regulations; |

| • | annually evaluating the Committee’s performance and the committee’s charter and recommending to the Board of Directors any proposed changes to the charter or the committee; and |

| • | undertaking all further actions and discharge all further responsibilities imposed upon the Committee from time to time by the Board, the federal securities laws or the rules and regulations of the SEC. |

The charter also provides that the Compensation Committee may, in its sole discretion, retain or obtain the advice of a compensation consultant, independent legal counsel or other adviser and will be directly responsible for the appointment, compensation and oversight of the work of any such adviser. However, before engaging or receiving advice from a compensation consultant, external legal counsel or any other adviser, the Compensation Committee will consider the independence of each such adviser, including the factors required by the NYSE and the SEC.

Nominating and Corporate Governance Committee

We have established a Nominating and Corporate Governance Committee of the Board. Messrs. Hirsch, Lodrini and Mikulsky serve as members of our Nominating and Corporate Governance Committee. Mr. Mikulsky serves as chairman of the Nominating and Corporate Governance Committee. We have adopted a Nominating and Corporate Governance Committee charter, which details the purpose and responsibilities of the Nominating and Corporate Governance Committee, including:

| • | developing and recommending to the Board the criteria for appointment as a director; |

| • | identifying, considering, recruiting and recommending candidates to fill new positions on the Board; |

| • | reviewing candidates recommended by stockholders; |

| • | conducting the appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates; and |

| • | recommending director nominees for approval by the Board and election by the stockholders at the next annual meeting. |

The charter also provides that the Nominating and Corporate Governance Committee may, in its sole discretion, retain or obtain the advice of, and terminate, any search firm to be used to identify director candidates, and will be directly responsible for approving the search firm’s fees and other retention terms.

We have not formally established any specific, minimum qualifications that must be met or skills that are necessary for directors to possess. In general, in identifying and evaluating nominees for director, the Board considers educational background, diversity of professional experience, knowledge of our business, integrity, professional reputation, independence, wisdom, and the ability to represent the best interests of our stockholders. Prior to our initial business combination, holders of our public shares did not have the right to recommend director candidates for nomination to our Board.

Director Nominations

In addition to any other applicable requirements, for a nomination to be made by a stockholder, such stockholder must have given timely notice thereof in proper written form to the Secretary. To be timely, a

13

stockholder’s notice to the Secretary must be received by the Secretary at the principal executive offices of Kaleyra (i) in the case of an annual meeting, not later than the close of business on the 90th day nor earlier than the opening of business on the 120th day before the anniversary date of the immediately preceding annual meeting of stockholders; provided, however, that in the event that the annual meeting is called for a date that is not within 30 days before or after such anniversary date, notice by the stockholder to be timely must be so received no earlier than the opening of business on the 120th day before the meeting and not later than the later of (x) the close of business on the 90th day before the meeting or (y) the close of business on the 10th day following the day on which public announcement of the date of the annual meeting was first made by Kaleyra; and (ii) in the case of a special meeting of stockholders called for the purpose of electing directors, not later than the close of business on the 10th day following the day on which public announcement of the date of the special meeting is first made by Kaleyra. In no event shall the public announcement of an adjournment or postponement of an annual meeting or special meeting commence a new time period (or extend any time period) for the giving of a stockholder’s notice as described herein.

Communications with Directors

Stockholders may communicate with Kaleyra’s Board of Directors through Kaleyra’s Secretary by sending an e-mail to [email protected], or by writing to the following address: Board of Directors, c/o Secretary, Kaleyra, Inc., Via Mario D ‘Aviano, 2, 20131 Milan, Italy. Kaleyra’s Secretary will forward all correspondence to the Board of Directors, except for spam, junk mail, mass mailings, product complaints or inquiries, job inquiries, surveys, business solicitations or advertisements, or patently offensive or otherwise inappropriate material. Kaleyra’s Secretary may forward certain correspondence, such as product-related inquiries, elsewhere within Kaleyra for review and possible response.

Director Attendance at Annual Meetings

We attempt to schedule our annual meeting of stockholders at a time and date to accommodate attendance by directors taking into account the directors’ schedules. All directors are encouraged to attend our annual meeting of stockholders.

Committee Charters and Other Corporate Governance Materials

We have adopted a Code of Ethics applicable to our management team and employees in accordance with applicable federal securities laws. You are able to review these documents by accessing our public filings at the SEC’s web site at www.sec.gov. In addition, a copy of the Code of Ethics will be provided without charge upon request from us, or may accessed on our company website at https://investors.kaleyra.com/. We intend to disclose any amendments to or waivers of certain provisions of our Code of Ethics in a Current Report on Form 8-K.

Our Board of Directors has adopted a written charter for each of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. Each charter is available on our website at https://investors.kaleyra.com/corporate-governance/governance-documents.

Corporate Governance Guidelines

We have adopted Corporate Governance Guidelines that address the composition of the Board, criteria for Board membership and other Board governance matters. These guidelines are available on our website at https://investors.kaleyra.com/corporate-governance/governance-documents. A printed copy of the guidelines may also be obtained by any stockholder upon request.

14

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee are or have been an officer or employee of Kaleyra. During fiscal December 31, 2020, no member of the Compensation Committee had any relationship with Kaleyra requiring disclosure under Item 404 of Regulation S-K. During the fiscal year ended December 31, 2020, none of Kaleyra’s executive officers served on the compensation committee (or its equivalent) or board of directors of another entity any of whose executive officers served on Kaleyra’s Compensation Committee or Board of Directors.

15

PROPOSAL NO. 2

NON-BINDING ADVISORY VOTE

TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

Background

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, or the Dodd-Frank Act, requires that our stockholders have the opportunity to cast a non-binding, advisory vote on the compensation of our named executive officers, commonly referred to as a “Say-on-Pay” vote. Because the vote is advisory, it is not binding on Kaleyra, our Board of Directors or our Compensation Committee in any way. However, our Board of Directors and our Compensation Committee value the opinions of our stockholders and, to the extent there is any significant vote against the executive compensation as disclosed in this Proxy Statement, we will consider our stockholders’ concerns and evaluate what actions, if any, may be appropriate to address those concerns. As determined by the Board of Directors and subsequently approved by the stockholders by a non-binding advisory vote at last years’ annual stockholder meeting, the “Say-on-Pay” vote will be held annually at the annual meeting of stockholders and we expect that the next “Say-on-Pay” vote will be held at our 2022 annual meeting of stockholders.

As described in the Executive Compensation section included elsewhere in this Proxy Statement, we seek to closely align the interests of our executive officers with the interests of our stockholders and to offer compensation that will enable us to attract and retain superior executive talent. Please read the Executive Compensation section of this Proxy Statement for a more detailed discussion about our compensation philosophy and our executive compensation programs.

The advisory vote on executive compensation solicited by this proposal is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers, which is disclosed elsewhere in this Proxy Statement. Furthermore, because this non-binding, advisory resolution primarily relates to the compensation of our named executive officers that has already been paid or contractually committed, there is generally no opportunity for us to revisit these decisions.

Stockholders will be asked at the annual meeting to approve the following resolution pursuant to this Proposal No. 2:

“RESOLVED, that the stockholders of Kaleyra, Inc. approve, on an advisory basis, the compensation of Kaleyra’s named executive officers for the fiscal year ended December 31, 2020, as disclosed in Kaleyra’s definitive Proxy Statement for the 2021 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Executive Compensation section, the compensation tables and the related narrative discussion.”

Vote Required and Board of Directors Recommendation

The affirmative vote of a majority of the shares present in person or by proxy and entitled to vote on the matter is required for approval of this resolution. Abstentions will have the same effect as a vote against the resolution. Because broker non-votes are not counted as votes for or against this resolution, they will have no effect on the outcome of the vote.

The Board of Directors unanimously recommends that you vote “FOR” approval of the foregoing resolution.

16

PROPOSAL NO. 3

RATIFICATION OF APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of our Board of Directors has selected EY S.p.A. (“EY”) to serve as our independent registered public accounting firm to audit the consolidated financial statements of Kaleyra for the fiscal year ending 2021. Although stockholder ratification of the Audit Committee’s selection of our independent registered public accounting firm is not required by our Second Amended and Restated Bylaws or otherwise, we are submitting the selection of EY for stockholder ratification as a matter of good corporate governance and so that our stockholders may participate in this important corporate decision. If not ratified, the Audit Committee will reconsider the selection, although the Audit Committee will not be required to select a different independent registered public accounting firm for Kaleyra. Even if the appointment is ratified, our Board may direct the appointment of a different independent registered public accounting firm at any time during the year if they determine that such a change would be in the best interests of Kaleyra and its stockholders.

For this annual meeting of stockholders, a representative of EY is expected to be present, with the opportunity to make a statement if the representative desires to do so, and is expected to be available to respond to appropriate questions.

Change of Auditors in September 2021

As previously reported on Kaleyra’s Current Reports on Form 8-K, filed with the SEC on September 17, 2021, the Board dismissed BPM LLP (“BPM”) as Kaleyra’s independent registered public accounting firm effective as of the filing of the Company’s Quarterly Report on Form 10-Q for the period ending on September 30, 2021 with the Securities and Exchange Commission. BPM had acted in such capacity since its appointment in fiscal year 2019.

The reports of BPM on Kaleyra’s consolidated financial statements as of December 31, 2020 and 2019 and for each of the two years in the period ended December 31, 2020 did not contain an adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles.

In connection with the audits of Kaleyra’s consolidated financial statements as of December 31, 2020 and 2019 and for each of the two years in the period ended December 31, 2020, and in the subsequent interim period through September 17, 2021, there were no (1) disagreements with BPM on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which, if not resolved to BPM’s satisfaction, would have caused BPM to make reference to the matter in its report. There were no “reportable events” as that term is described in Item 304(a)(1)(v) of Regulation S-K other than:

For the year ended December 31, 2019, the Company reported material weaknesses in its internal control over financial reporting related to (1) lack of review and approval process over journal entries and (2) lack of timeliness, quality and existence of account reconciliations and review controls.

During the fiscal years ended December 31, 2020 and 2019, and the subsequent interim period from January 1, 2021, through the date of EY’s engagement, neither Kaleyra nor anyone acting on its behalf has consulted with EY regarding (i) the application of accounting principles to a specific transaction, either completed or proposed, or the type of audit opinion that might be rendered with respect to Kaleyra’s consolidated financial statements, and neither a written report or oral advice was provided to Kaleyra that EY concluded was an important factor considered by Kaleyra in reaching a decision as to any accounting, auditing, or financial reporting issue, (ii) any matter that was the subject of a disagreement within the meaning of Item 304(a)(1)(iv) of Regulation S-K, or (iii) any reportable event within the meaning of Item 304(a)(1)(v) of Regulation S-K.

17

Principal Accountant Fees and Services

The following table sets forth the aggregate fees billed to Kaleyra for the fiscal years ended 2020 and 2019 by BPM (in thousands):

| Fiscal Year Ended December 31, 2020 |

Fiscal Year Ended December 31, 2019 |

|||||||

| Audit fees (1) |

$ | 938 | $ | 766 | ||||

| Audit-related fees (2) |

68 | — | ||||||

| Tax fees (3) |

41 | 6 | ||||||

| All other fees (4) |

— | — | ||||||

| (1) | Audit fees consist of fees billed for professional services rendered for the audit of our year-end consolidated financial statements, reviews of the quarterly condensed consolidated financial statements and services that are normally provided by our independent registered public accounting firm in connection with statutory and regulatory filings. |

| (2) | Audit-related fees consist of fees billed for assurance and related services that are reasonably related to performance of the audit or review of our year-end financial statements and are not reported under “Audit Fees.” These services include attest services that are not required by statute or regulation and consultation concerning financial accounting and reporting standards, including permitted due diligence services related to a potential business combination or acquisition. |

| (3) | Tax fees consist of fees billed for professional services relating to tax compliance, tax planning and tax advice. |

| (4) | All other fees consist of fees for products and services other than the services reported above. |

The Audit Committee has determined that all services performed by BPM are compatible with maintaining the independence of BPM. The Audit Committee’s policy is to pre-approve all audit and permissible non-audit services provided by our independent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services. The Audit Committee has delegated to the chair of the Audit Committee the authority to approve permitted services provided that the chair reports any decisions to the Audit Committee at its next scheduled meeting. The independent registered public accounting firm and management are required to periodically report to the Audit Committee regarding the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval process.

Vote Required and Board of Directors Recommendation

The affirmative vote of a majority of the votes cast affirmatively or negatively on the proposal at the annual meeting is required for approval of this proposal. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum but will not have any effect on the outcome of the proposal. If the stockholders do not approve the ratification of EY as our independent registered public accounting firm, the Audit Committee will reconsider its selection.

The Board of Directors unanimously recommends that you vote “FOR” the ratification of the appointment of EY as our independent registered public accounting firm for the fiscal year ending December 31, 2021.

18

REPORT OF THE AUDIT COMMITTEE

The Audit Committee currently consists of three directors, each of whom, in the judgment of the board of directors, is an “independent director” as defined in the listing standards of the NYSE. The Audit Committee acts pursuant to a written charter that has been adopted by the board of directors. A copy of the charter is available on Kaleyra’s website at https://investors.kaleyra.com/corporate-governance/governance-documents.

The Audit Committee oversees Kaleyra’s financial reporting process on behalf of the board of directors. The Audit Committee is responsible for retaining Kaleyra’s independent registered public accounting firm, evaluating its independence, qualifications and performance, and approving in advance the engagement of the independent registered public accounting firm for all audit and non-audit services. Management has the primary responsibility for the consolidated financial statements and the financial reporting process, including internal controls, and procedures designed to insure compliance with applicable laws and regulations. Kaleyra’s independent registered public accounting firm, BPM LLP, and going forward starting for fiscal year 2021, EY S.p.A., is responsible for expressing an opinion as to the conformity of our audited consolidated financial statements with accounting principles generally accepted in the United States of America.

The Audit Committee has reviewed and discussed with management Kaleyra’s audited consolidated financial statements. The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed under the rules adopted by the Public Company Accounting Oversight Board (United States) (“PCAOB”). In addition, the Audit Committee has met with the independent registered public accounting firm, with and without management present, to discuss the overall scope of the independent registered public accounting firm’s audit, the results of its examinations, its evaluations of Kaleyra’s internal controls and the overall quality of Kaleyra’s financial reporting.

The Audit Committee has received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence and has discussed with the independent registered public accounting firm its independence.

Based on the review and discussions referred to above, the Audit Committee recommended to Kaleyra’s Board of Directors that Kaleyra’s audited consolidated financial statements be included in Kaleyra’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020.

AUDIT COMMITTEE

Neil Miotto, Chair

John J. Mikulsky

Matteo Lodrini

The foregoing Report of the Audit Committee shall not be deemed to be incorporated by reference into any filing of Kaleyra under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that Kaleyra specifically incorporates such information by reference in such filing and shall not otherwise be deemed “filed” under either the Securities Act or the Exchange Act or considered to be “soliciting material.”

19

EXECUTIVE COMPENSATION

Compensation Philosophy and Objectives

Kaleyra has developed an executive compensation program that is consistent with Kaleyra’s existing compensation policies and philosophies, which are designed to align compensation with its business objectives and the creation of stockholder value, while enabling Kaleyra to attract, motivate and retain individuals who contribute to its long-term success. Decisions on the executive compensation program are made by the Compensation Committee of the Board and as necessary, approved by the entire Board.

Decisions regarding executive compensation reflect a belief that our executive compensation program must be competitive in order to attract and retain highly competent executive officers as well as include a significant element of “pay for performance”. The Compensation Committee seeks to implement these compensation policies and philosophies by linking a significant portion of Kaleyra’s executive officers’ cash compensation to the achievement of annual performance objectives and by providing a portion of their compensation as both annual and long-term incentive compensation in the form of equity awards. Further, the Compensation Committee seeks to tie our executive compensation levels to the compensation practices of our peer companies and the shareholder returns achieved by those peer companies by setting our relative executive compensation percentile levels comparable to the relative shareholder return percentile level achieved by Kaleyra as compared to its peer companies.

Compensation for Kaleyra’s executive officers has three primary components: base salary, an annual cash incentive bonus and long-term equity-based incentive compensation.

Employment Agreements

On March 13, 2020, Kaleyra entered into an employment agreement with its Chief Executive Officer, Mr. Dario Calogero. That employment agreement provides that Mr. Calogero will receive a base salary at an annual rate of $450,000, subject to increase from time to time as determined by the Board or its Compensation Committee, and a relocation allowance covering the period of time that Mr. Calogero is based in New York of $400,000 per year, as well as that he shall be eligible to receive an annual bonus of 100% of his base salary based upon financial and operational objectives achievable within an applicable fiscal year and long-term equity-based awards. The employment agreement with Mr. Calogero is discussed in more detail below under the caption “Employment Arrangements with Named Executive Officers.” However, the base salary for Mr. Calogero as stated in the employment agreement is established based on the scope of his responsibilities, taking into account market compensation paid by comparable companies for equivalent positions. Prior to June 2021, Kaleyra’s EVP and Chief Financial Officer, Mr. Giacomo Dall’Aglio did not have an employment agreement with Kaleyra. Instead, in December 2019, the Board determined that Mr. Dall’Aglio will receive a base salary at an annual rate of €250,000, subject to increase from time to time as determined by the Board or its Compensation Committee, a monthly relocation allowance covering the period of time that Mr. Dall’Aglio is based in New York at the annual rate of €175,000, with payments ending on June 30, 2021, and that he is eligible to receive a bonus of 50% of his base salary based upon financial and operational objectives achievable within an applicable fiscal year as well as long-term equity-based awards. On June 2, 2021, Kaleyra entered into a formal written employment agreement with Mr. Dall’Aglio. Under the employment agreement, Mr. Dall’Aglio will receive a base salary at an annual rate of $300,000, subject to increase from time to time as determined by the Board or its Compensation Committee and he remains eligible to receive a bonus of 50% of his base salary based upon financial and operational objectives achievable within an applicable fiscal year as well as long-term equity-based awards. Furthermore, base salaries will be reviewed annually by the Compensation Committee to the extent recommended upon advice and counsel of its advisors, and any increases are expected to be similar in scope to Kaleyra’s overall corporate salary increase, if any. For comparison purposes, Kaleyra has utilized compensation survey data from Compensia and the peer company proxy filings. Kaleyra’s philosophy is to target the named executive officer base salaries to be in the range between the median up to the 75th percentile of salaries for

20

executives in equivalent positions at comparable companies. Kaleyra believes targeting the named executive officer salaries to be in the range between the median up to the 75th percentile of salaries relative to comparable companies reflects Kaleyra’s best efforts to ensure it is neither overpaying nor underpaying its named executive officers.

Annual Bonuses

Kaleyra uses annual cash incentive bonuses for the named executive officers to tie a portion of their compensation to financial and operational objectives and key results achievable within the applicable fiscal year. Near the beginning of each year, the Compensation Committee selects the performance targets, or Objectives and Key Results (“OKR”) or other bonus performance objectives of Kaleyra, target amounts, target award opportunities and other term and conditions of annual cash bonuses for the named executive officers. Following the end of each year, the Compensation Committee will determine the extent to which the OKR or other performance objectives were achieved and the amount of the award that is payable to the named executive officers. In addition, on occasion, and at the sole discretion of the Board or the Compensation Committee, Kaleyra may grant special achievement bonuses to the named executive officers and others in recognition of a special event or achievement that has significantly improved the performance, strength or nature of Kaleyra and its business.