Form DEF 14A Invitation Homes Inc. For: May 18

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 | |

Invitation Homes Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies:

| |||

| 2) | Aggregate number of securities to which transaction applies:

| |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| 4) | Proposed maximum aggregate value of transaction:

| |||

| 5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) | Amount Previously Paid:

| |||

| 2) | Form, Schedule or Registration Statement No.:

| |||

| 3) | Filing Party:

| |||

| 4) | Date Filed:

| |||

Table of Contents

Notice of Annual Meeting

and

Proxy Statement

2021 Annual Meeting of Stockholders

May 18, 2021

Table of Contents

Dear Fellow Stockholders:

On behalf of the Board of Directors of Invitation Homes Inc., I invite you to attend our 2021 annual meeting of stockholders (the “Annual Meeting”) at 4:00 p.m., Central time, on Tuesday, May 18, 2021. Due to the continuing public health impact of the coronavirus (COVID-19) pandemic, this year’s Annual Meeting will be a virtual meeting, conducted via live audio webcast. You will be able to attend the Annual Meeting online, vote your shares electronically and submit your questions during the Annual Meeting via a live audio webcast by visiting www.virtualshareholdermeeting.com/INVH2021. Further details about how to attend the Annual Meeting and submit questions, and information on the business to be conducted at the Annual Meeting are included in the accompanying Notice of 2021 Annual Meeting of Stockholders and Proxy Statement.

In accordance with the Securities and Exchange Commission rules allowing companies to furnish proxy materials to their stockholders over the Internet, we have sent most of our stockholders of record at the close of business on March 23, 2021 a Notice of Internet Availability of Proxy Materials on or about April 6, 2021. The notice contains instructions on how to access our Proxy Statement and Annual Report and vote online. If you would like to receive a printed copy of our proxy materials from us instead of downloading a printable version from the Internet, please follow the instructions for requesting such materials included in the notice, as well as in the attached Proxy Statement.

Your vote is important to us. Whether you own a few shares or many, and whether or not you plan to attend the Annual Meeting, it is important that your shares be represented and voted. You may vote your shares on the Internet, by telephone or by completing, signing and promptly returning a proxy card, or you may vote via the Internet at the Annual Meeting. Each of these options will ensure that your shares will be represented and voted at the Annual Meeting.

On behalf of the Board of Directors and associates of Invitation Homes Inc., we appreciate your continued support.

Sincerely,

Dallas B. Tanner

President and Chief Executive Officer

April 6, 2021

Table of Contents

Notice of 2021 Annual Meeting of Stockholders

| DATE AND TIME: TUESDAY, MAY 18, 2021 4:00 p.m., Central time |

VIRTUAL LOCATION: You can attend the Annual Meeting online, vote your shares electronically and submit your questions during the Annual Meeting, by visiting www.virtualshareholdermeeting.com/INVH2021. You will need your 16-Digit Control Number included on your Notice or your proxy card (if you received a printed copy of the proxy materials) to join the Annual Meeting.

| |

ITEMS OF BUSINESS:

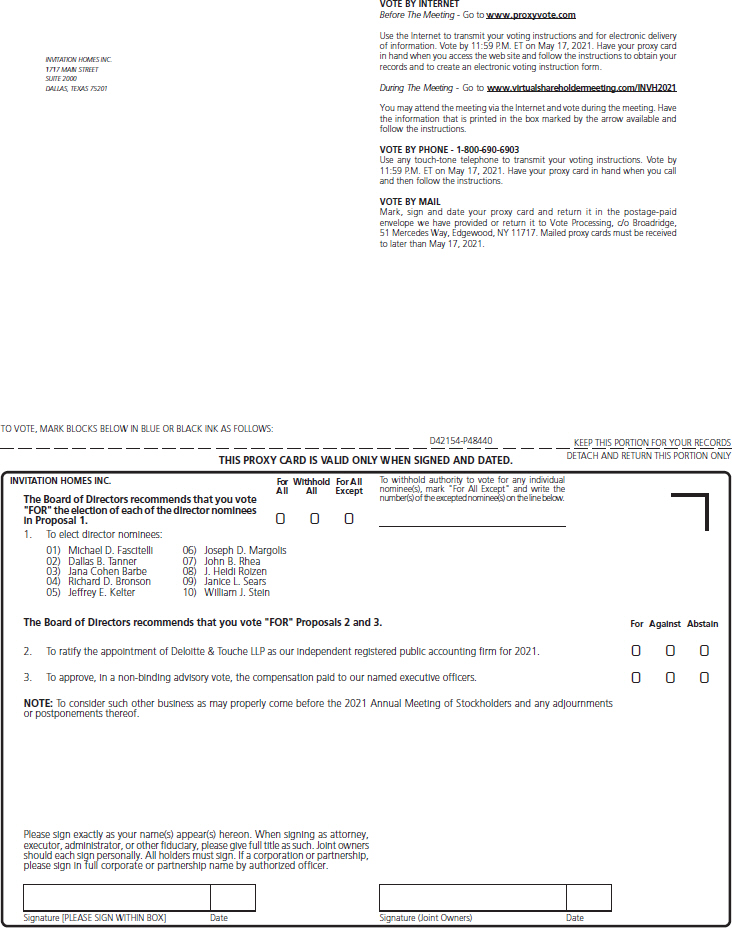

| 1. | To elect the director nominees listed in the Proxy Statement. |

| 2. | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2021. |

| 3. | To approve, in a non-binding advisory vote, the compensation paid to our named executive officers. |

| 4. | To consider such other business as may properly come before the 2021 annual meeting of stockholders (the “Annual Meeting”) and any adjournments or postponements thereof. |

The Proxy Statement following this Notice of Annual Meeting of Invitation Homes Inc., a Maryland corporation, describes these matters in detail. We have not received notice of any other proposals to be presented at the Annual Meeting.

RECORD DATE:

The Board of Directors of Invitation Homes Inc. established the close of business on March 23, 2021 as the record date for the Annual Meeting. Accordingly, holders of record of our common stock at the close of business on that date are entitled to notice of, and to vote at, the Annual Meeting and any postponements or adjournments of the meeting.

VOTING BY PROXY:

To ensure your shares are voted, you may vote your shares over the Internet, by telephone or by requesting a proxy card to complete, sign and return by mail. If your shares are held by a broker, bank or other nominee, please follow their instructions to authorize your proxy.

By Order of the Board of Directors of Invitation Homes Inc.,

Mark A. Solls

Executive Vice President,

Chief Legal Officer and Secretary

Dallas, Texas

April 6, 2021

This Notice of Annual Meeting and Proxy Statement are first being distributed or made available, as the case may be, on or about April 6, 2021.

|

IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON MAY 18, 2021

|

|

The Notice of Annual Meeting, Proxy Statement and Invitation Homes Inc.’s Annual Report are available free of charge at www.proxyvote.com, a site that does not have “cookies” that identify visitors to the site.

|

Table of Contents

| i | 2021 Proxy Statement |

Table of Contents

| 71 | ||||

| 71 | ||||

| 71 | ||||

| 71 | ||||

| 72 | ||||

| 72 | ||||

| 72 | ||||

| 73 | ||||

| A-1 | ||||

| A-1 | ||||

| 2021 Proxy Statement | ii |

Table of Contents

|

|

PROXY STATEMENT

April 6, 2021

Why am I receiving these materials?

This Proxy Statement and related proxy materials are first being made available to stockholders of Invitation Homes Inc., a Maryland corporation (“Invitation Homes,” the “Company,” “we,” “our” or “us”) on or about April 6, 2021, for use at our 2021 annual meeting of stockholders (the “Annual Meeting”) to be held on Tuesday, May 18, 2021, at 4:00 p.m., Central time, and any adjournments or postponements thereof. This year’s Annual Meeting will be a completely virtual meeting of stockholders. You are invited to attend the virtual Annual Meeting online, vote your shares electronically and submit your questions during the Annual Meeting, by visiting www.virtualshareholdermeeting.com/INVH2021. Proxies are being solicited by the Board of Directors of the Company (the “Board”) to give all stockholders of record at the close of business on March 23, 2021 (the “Record Date”) an opportunity to vote on matters properly presented at the Annual Meeting. The mailing address of our principal executive offices is Invitation Homes Inc., 1717 Main Street, Suite 2000, Dallas, Texas 75201.

There are three proposals to be considered and voted on at the Annual Meeting:

| Proposal 1: |

To elect the director nominees listed in this Proxy Statement. | |

| Proposal 2: |

To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2021. | |

| Proposal 3: |

To approve, in a non-binding advisory vote, the compensation paid to our named executive officers. | |

Stockholders as of the close of business on the Record Date may vote at the Annual Meeting or any postponement or adjournment thereof. As of the Record Date, there were 567,650,321 shares of our common stock outstanding. You have one vote for each share of common stock held by you as of the Record Date, including shares:

| • | Held directly in your name as “stockholder of record” (also referred to as “registered stockholder”); and |

| • | Held for you in an account with a broker, bank or other nominee (shares held in “street name”). Street name holders generally cannot vote their shares directly and instead must instruct the broker, bank or other nominee how to vote their shares. Please refer to information from your broker, bank or other nominee on how to submit voting instructions. |

The presence in person or by proxy of stockholders entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting will constitute a quorum to transact business at the Annual Meeting. Stockholders who properly authorize a proxy but who instruct their proxy holder to abstain from voting on one or more matters are counted as present and entitled to vote for purposes of determining a quorum. Shares represented by “broker non-votes,” described below, that are present and entitled to vote at the Annual Meeting will be counted for purposes of determining a quorum.

| 1 | 2021 Proxy Statement |

Table of Contents

|

General Information (continued)

|

A broker non-vote occurs when shares held by a broker, bank or other nominee are not voted with respect to a proposal because (1) the broker, bank or other nominee has not received voting instructions from the stockholder who beneficially owns the shares and (2) the broker, bank or other nominee lacks the authority to vote the shares at his/her discretion. Under current New York Stock Exchange (“NYSE”) interpretations that govern broker non-votes, Proposals 1 and 3 are considered non-discretionary matters, and a broker, bank or other nominee will lack the authority to vote shares at his/her discretion on such proposals. Proposal 2 is considered a discretionary matter and a broker, bank or other nominee will be permitted to exercise his/her discretion. This means that, if you hold your shares in street name and do not provide voting instructions to your broker, bank or other nominee, your shares will not be voted on Proposals 1 and 3 but may be voted on Proposal 2 in the discretion of your broker, bank or other nominee.

How many votes are required to approve each proposal?

With respect to the election of directors (Proposal 1), under our Bylaws, directors are elected by a plurality vote, which means that the director nominees with the greatest number of votes cast, even if less than a majority, will be elected. There is no cumulative voting in the election of directors.

With respect to the ratification of our independent registered public accounting firm (Proposal 2), and the approval, in a non-binding advisory vote, of the compensation paid to our named executive officers (Proposal 3), under our Bylaws, approval of each proposal requires a majority of the votes cast.

With respect to the election of directors (Proposal 1), you may vote “FOR” or “WITHHOLD” with respect to each nominee. Votes that are “withheld” will have the same effect as an abstention and will not count as a vote “FOR” or “AGAINST” a director, because directors are elected by plurality voting. Broker non-votes will not affect the outcome of this proposal.

With respect to the ratification of our independent registered public accounting firm (Proposal 2), you may vote “FOR,” “AGAINST” or “ABSTAIN.” For Proposal 2, abstentions will not affect the outcome of this proposal; however, as this proposal is considered a discretionary matter, brokers are permitted to exercise their discretion to vote uninstructed shares on this proposal.

With respect to the approval, in a non-binding advisory vote, of the compensation paid to our named executive officers (Proposal 3), you may vote “FOR,” “AGAINST” or “ABSTAIN.” For Proposal 3, abstentions and broker non-votes will not affect the outcome of this proposal.

If you sign and submit your proxy card without voting instructions, your shares will be voted in accordance with the recommendation of the Board with respect to the proposals and in accordance with the discretion of the holders of the proxy with respect to any other matters that may be voted upon.

Representatives of Broadridge Financial Solutions, Inc. will tabulate the votes and act as inspectors of election.

| 2021 Proxy Statement | 2 |

Table of Contents

|

General Information (continued)

|

How does the Board recommend that I vote?

Our Board recommends that you vote your shares as set forth below:

| Proposal 1: | To elect the director nominees listed in this Proxy Statement.

“FOR” each of the nominees for election as directors set forth in this Proxy Statement.

Our Board unanimously believes that all of the director nominees listed in this Proxy Statement have the requisite qualifications to provide effective oversight of the Company’s business and management. | |

| Proposal 2: | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2021.

“FOR” the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2021.

Our Audit Committee and the Board believe that the retention of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for 2021 is in the best interest of the Company and its stockholders. | |

| Proposal 3: | To approve, in a non-binding advisory vote, the compensation paid to our named executive officers.

“FOR” the approval, in a non-binding advisory vote, of the compensation paid to our named executive officers.

We are seeking a non-binding advisory vote to approve, and our Board recommends that you approve, the 2020 compensation paid to our named executive officers, which is described in the section of this Proxy Statement titled “Executive Compensation.” | |

How do I vote my shares without attending the Annual Meeting?

Your vote is important and we encourage you to vote promptly. If you are a stockholder of record, you may vote your shares in the following ways:

By Internet—If you have Internet access, you may vote by going to www.proxyvote.com and by following the instructions on how to complete an electronic proxy card. You will need the control number included on your proxy card in order to vote by Internet.

By Telephone—If you have access to a touch-tone telephone, you may vote by dialing 1-800-690-6903 and by following the recorded instructions. You will need the control number included on your proxy card in order to vote by telephone.

By Mail—You may vote by mail by completing, signing and dating the enclosed proxy card where indicated and by mailing or otherwise returning the card in the envelope that has been provided to you. You should sign your name exactly as it appears on the proxy card. If you are signing in a representative capacity (for example, as guardian, executor, trustee, custodian, attorney or officer of a corporation), indicate your name and title or capacity.

If you hold your shares in street name, you may submit voting instructions to your broker, bank or other nominee. In most instances, you will be able to do this over the Internet, by telephone or by mail. Please refer to information from your broker, bank, or other nominee on how to submit voting instructions.

Internet and telephone voting facilities will close at 11:59 p.m. Eastern time on May 17, 2021, and mailed proxy cards must be received no later than May 17, 2021.

When and where will the Annual Meeting be held?

Our Annual Meeting will be held at 4:00 p.m., Central time, on Tuesday, May 18, 2021, via live audio webcast, online at www.virtualshareholdermeeting.com/INVH2021. For information on how to attend the virtual Annual Meeting, see “General Information—How do I attend and vote my shares at the virtual Annual Meeting.”

| 3 | 2021 Proxy Statement |

Table of Contents

|

General Information (continued)

|

How do I attend and vote my shares at the virtual Annual Meeting?

Our Board of Directors considers the appropriate format of the stockholder meeting on an annual basis. In light of the continuing public health concerns due to the COVID-19 pandemic and to support the health and well-being of our stockholders and associates, this year’s Annual Meeting will be a virtual meeting, conducted via live audio webcast. Any stockholder can attend the Annual Meeting live online at www.virtualshareholdermeeting.com/INVH2021. If you virtually attend the Annual Meeting, you can vote your shares electronically, and submit your questions during the Annual Meeting, by visiting www.virtualshareholdermeeting.com/INVH2021. A summary of the information you need to attend the Annual Meeting via the Internet is provided below:

| • | Instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at www.virtualshareholdermeeting.com/INVH2021; |

| • | Assistance with questions regarding how to attend and participate via the Internet will be provided at www.virtualshareholdermeeting.com/INVH2021 on the day of the Annual Meeting; |

| • | Stockholders may vote and submit questions while attending the Annual Meeting via the Internet (for information on how to ask questions during the virtual Annual Meeting, see “General Information—How can I ask questions at the virtual Annual Meeting?”); and |

| • | You will need your control number that is included in your Notice of Internet Availability of Proxy Materials, or if you received a printed copy of the proxy materials, in your proxy card or the instructions that accompanied your proxy materials in order to enter the Annual Meeting and to vote during the Annual Meeting. |

Whether you plan to attend the Annual Meeting or not, we encourage you to vote in advance over the Internet, by telephone or mail so that your vote will be counted if you do not vote at the Annual Meeting.

Will I be able to participate in the virtual Annual Meeting on the same basis I would be able to participate in a live annual meeting?

As noted above, due to the continuing public health impact of the COVID-19 pandemic, this year’s Annual Meeting will be held as a virtual-only meeting. The online meeting format for the Annual Meeting will enable full and equal participation by all our stockholders from any place in the world at little to no cost.

Stockholders at the virtual-only meeting will have the same rights as at an in-person meeting, including the rights to vote and ask questions at the Annual Meeting. We believe that hosting a virtual meeting provides expanded access, improved communication and cost savings for our stockholders and the Company. You may vote during the Annual Meeting by following the instructions that will be available on the Annual Meeting website at www.virtualshareholdermeeting.com/INVH2021 during the Annual Meeting.

In addition, the virtual format allows stockholders to ask questions of our Board or management during the live Q&A session of the Annual Meeting. At that time, we will answer questions as they come in, to the extent relevant to the business of the Annual Meeting, as time permits. In the event any pertinent questions cannot be answered during the Annual Meeting due to time constraints, such questions and management’s answers will be made publicly available on our investor relations website promptly after the virtual Annual Meeting. If there are matters of individual concern to a stockholder and not of general concern to all stockholders, we provide an opportunity for stockholders to contact our investor relations department separately at (844) 456-INVH (4684) or [email protected].

How can I ask questions at the virtual Annual Meeting?

If you wish to submit a question during the Annual Meeting, log into the Annual Meeting website at www.virtualshareholdermeeting.com/INVH2021, type your question into the “Ask a Question” field, and click “Submit.” As noted above, we will answer questions as they come in, to the extent relevant to the business of the Annual Meeting, as time permits. Consistent with our prior annual meetings, we kindly ask stockholders not to ask more than one question to allow us to answer questions from as many stockholders as possible. Questions from multiple stockholders on the same topic or that are otherwise related may be grouped, summarized and answered together. Off-topic, personal or other inappropriate questions will not be answered.

To be sure that all stockholders are afforded the same rights and opportunities to participate as they would at an in-person meeting, all of our Board members and executive officers are expected to join the Annual Meeting. If you

| 2021 Proxy Statement | 4 |

Table of Contents

|

General Information (continued)

|

want to participate in our Annual Meeting, but cannot submit your question using the Annual Meeting website, please contact our investor relations department at (844) 456-INVH (4684) or [email protected] for accommodations.

What can I do if I need technical assistance during the virtual Annual Meeting?

If you encounter any difficulties accessing or participating in the Annual Meeting, please call the technical support number that will be posted on the Annual Meeting log-in page at www.virtualshareholdermeeting.com/INVH2021. Technicians will be available to assist you.

If I can’t participate in the live Annual Meeting webcast, can I listen to it later?

The Annual Meeting will be recorded. A webcast playback will be available to the public at www.virtualshareholdermeeting.com/INVH2021 within approximately 24 hours after the completion of the Annual Meeting. No one attending the Annual Meeting via the webcast or telephone is permitted to use any audio recording device.

May I change my vote or revoke my proxy?

Yes. Whether you have authorized a proxy by Internet, telephone or mail, if you are a stockholder of record, you may change your voting instructions or revoke your proxy by:

| • | sending a written statement to that effect to our Corporate Secretary at Invitation Homes Inc., 1717 Main Street, Suite 2000, Dallas, Texas 75201, provided such statement is received no later than May 17, 2021; |

| • | authorizing a proxy again by Internet or telephone at a later time before the closing of those voting facilities at 11:59 p.m. on May 17, 2021; |

| • | submitting a properly signed proxy card with a later date that is received by our Corporate Secretary at Invitation Homes Inc., 1717 Main Street, Suite 2000, Dallas, Texas 75201, no later than May 17, 2021; or |

| • | attending the Annual Meeting and voting during the Annual Meeting. |

If you hold shares in street name, you may submit new voting instructions by contacting your broker, bank or other nominee, or as otherwise provided in the instructions provided to you by your broker, bank or other nominee.

Could other matters be decided at the Annual Meeting?

At the date this Proxy Statement went to press, we did not know of any matters that may be properly presented at the Annual Meeting other than those referred to in this Proxy Statement. If other matters are properly presented at the Annual Meeting for consideration and you are a stockholder of record and have submitted a proxy card, the persons named in your proxy card will have the discretion to vote on those matters for you.

Who will pay for the cost of this proxy solicitation?

We will pay the cost of soliciting proxies. Proxies may be solicited on our behalf by our directors, officers and other Company associates (for no additional compensation) in person or by telephone, electronic transmission and facsimile transmission. Brokers, banks and other nominees will be requested to solicit proxies or authorizations from beneficial owners and will be reimbursed for their reasonable expenses.

| 5 | 2021 Proxy Statement |

Table of Contents

|

|

PROPOSAL NO. 1—ELECTION OF DIRECTORS

At present, the number of directors that comprise our Board is 11. At the recommendation of the Nominating and Corporate Governance Committee, effective as of the Annual Meeting the Board set the number of directors that will comprise our Board at 10. Our Board has considered, and at the recommendation of the Nominating and Corporate Governance Committee, nominated each of the following nominees for a one-year term expiring at our annual meeting of stockholders to be held in 2022 (the “2022 Annual Meeting”) or until his or her successor is duly elected and qualifies or until his or her earlier death, resignation, retirement, disqualification or removal: Jana Cohen Barbe, Richard D. Bronson, Michael D. Fascitelli, Jeffrey E. Kelter, Joseph D. Margolis, John B. Rhea, J. Heidi Roizen, Janice L. Sears, William J. Stein, and Dallas B. Tanner. Action will be taken at the Annual Meeting for the election of these nominees. On March 29, 2021, Mr. Bryce Blair, a current member and Chairperson of our Board, informed the Company that he would not stand for re-election to our Board when his current term expires at the Annual Meeting. We are grateful to have benefited from Mr. Blair’s expertise, valuable business insights and strong commitment to Invitation Homes and our stockholders.

All of the nominees have indicated that they will be willing and able to serve as directors, but, if any of them should decline or be unable to act as a director, the individuals designated in the proxy cards as proxies will exercise the discretionary authority provided to vote for the election of such substitute nominee selected by our Board, unless the Board alternatively acts to reduce the size of the Board or maintain a vacancy on the Board in accordance with our Bylaws. The Board has no reason to believe that any such nominees will be unable or unwilling to serve.

We believe that our director nominees bring an extraordinary wealth of experience, skills and backgrounds to the Board. Our Board plays a key role in guiding the vision, mission and strategic direction of our Company. Their individual and collective expertise is essential to the execution of our long-term strategy and achievement of our vision of becoming the premier choice in home leasing. Learn more about each nominee to our Board under “—Nominees for Election to the Board of Directors in 2021.”

Director Nominees’ Snapshot

|

Name and Primary Occupation |

Age | Director Since |

Independent | |||||||

| Michael D. Fascitelli* Owner and Principal, MDF Capital LLC; Managing Partner, Imperial Companies; Board of Trustees Member, Vornado Realty Trust; Director, Radius Global Infrastructure, Inc. |

64 | 2017 | Yes | |||||||

| Dallas B. Tanner President and Chief Executive Officer, Invitation Homes |

40 | 2019 | ||||||||

| Jana Cohen Barbe Senior Partner, Dentons; Director, The Boler Company |

58 | 2018 | Yes | |||||||

| Richard D. Bronson Chief Executive Officer, The Bronson Companies, LLC; Lead Director, Starwood Property Trust, Inc. |

76 | 2017 | Yes | |||||||

| Jeffrey E. Kelter Founding Partner, KSH Capital; Chairman, Jack Creek Investment Corp. |

65 | 2017 | Yes | |||||||

| Joseph D. Margolis Chief Executive Officer, Extra Space Storage, Inc. |

60 | 2020 | Yes | |||||||

| John B. Rhea Partner, Centerview Partners; Director, State Street Corporation |

55 | 2015 | Yes | |||||||

| J. Heidi Roizen Partner, Threshold Ventures |

63 | 2020 | Yes | |||||||

| Janice L. Sears Managing Director, Western Region Head, Real Estate Investment Banking Group (Retired), Banc of America Securities; San Francisco Market President (Retired), Bank of America |

60 | 2017 | Yes | |||||||

| William J. Stein Senior Managing Director, The Blackstone Group L.P. (“Blackstone”) |

59 | 2012 | Yes | |||||||

| * | Following the Annual Meeting, our Board plans to appoint Mr. Fascitelli as the Chairperson of the Board, subject to his election at the Annual Meeting. |

| 2021 Proxy Statement | 6 |

Table of Contents

|

Proposal No. 1—Election of Directors (continued)

|

Director Nominees’ Collective Skills

| Real Estate

Our real estate and single family rental industry expertise is core to our success. We benefit from directors sharing their experience in real estate development, operations and investments, and providing valuable guidance on real estate finance and capital markets. |

|

Investment

Our approach to investment and asset management requires a Board with expertise to provide sound oversight and guide our real estate finance and investment strategies. |

| |||

| Operations

With our operations spanning a diverse mix of markets, suppliers, contractors and partners – we benefit from directors who have successfully led complex operations and can help us optimize our business model. |

|

Financial / Banking

As a fast growing company with a vast financial footprint, it is essential that we have directors with strong financial acumen and experience. |

| |||

| Risk Management

Risk management experience is a vital perspective on our Board, enabling us to effectively monitor, manage and ultimately mitigate various forms of risk we face in our business. |

|

Corporate Governance / Regulatory

Substantive corporate governance and regulatory experience on our Board offers us insight into the best governance practices and the regulatory environment of the jurisdictions in which we operate and provides leadership in strategic implementation of diversity, sustainability and other aspects of corporate social responsibility. |

| |||

| Strategic

Our dynamic operations require a Board with strong strategic insights gained through multi-faceted and challenging prior experiences. |

|

Active Executive / Robust Business Experience

As a fast growing company leading the single-family industry, we require a Board well-versed in navigating complexity and capitalizing on business opportunities to further our innovation and growth. |

| |||

| 7 | 2021 Proxy Statement |

Table of Contents

|

Proposal No. 1—Election of Directors (continued)

|

Nominees for Election to the Board of Directors in 2021

The following information describes the offices held, other business directorships and the term of service of each director nominee. Beneficial ownership of equity securities of the director nominees is shown under “Ownership of Securities” below. The biographical description for each nominee below includes the specific experience, qualifications, attributes and skills that led to the conclusion by the Board that such person should serve as a director.

| MICHAEL D. FASCITELLI | ||||

|

|

Age: 64

Director since: November 2017

|

|||

Mr. Fascitelli has served on our Board since November 2017. Prior to the merger (the “Merger”) with Starwood Waypoint Homes (“SWH”) in November 2017, from January 2016 to November 2017, Mr. Fascitelli served on the Board of SWH and, from January 2014 to January 2016, served on the Board of Starwood Waypoint Residential Trust (“SWAY”), SWH’s predecessor. Since June 2013, Mr. Fascitelli has been the owner and principal of MDF Capital LLC, a private investment firm. Mr. Fascitelli is also a co-founder and a Managing Partner of Imperial Companies, a real estate investment and development company. Mr. Fascitelli has served as member of the Board of Trustees of Vornado Realty Trust (NYSE: VNO) since 1996. He served as the President of Vornado Realty Trust from 1996 to April 2013 and its Chief Executive Officer from May 2009 to April 2013. Mr. Fascitelli served as the President of Alexander’s Inc., a real estate investment trust and an affiliate of Vornado Realty Trust, from December 1996 to April 2013. Prior to joining Vornado Realty Trust in 1996, Mr. Fascitelli was a partner at Goldman Sachs & Co., an investment banking firm, in charge of its real estate practice since 1992. Mr. Fascitelli also serves as a Co-Chairman of the board of directors of Radius Global Infrastructure, Inc. (NASDAQ: RADI), one of the largest international aggregators of rental streams underlying wireless sites through the acquisition and management of ground, tower, rooftop and in-building cell site leases, and as the chairman of the investment committee and a board member of Quadro Partners Inc. (formerly Cadre), a real estate technology company. He serves as a board member of Child Mind Institute, The Rockefeller University, Urban Land Institute and University of Rhode Island Foundation. Mr. Fascitelli is a former Commissioner of the Port Authority of New York and New Jersey and a past Chairman of the Wharton Real Estate Center where he served on the executive committee.

Our Board considered Mr. Fascitelli’s long and successful track record in various leadership roles including his executive experience as President and Chief Executive Officer of Vornado Realty Trust and his extensive knowledge of and experience in the real estate industry, which the Board believes provide us with valuable experience and insight.

| 2021 Proxy Statement | 8 |

Table of Contents

|

Proposal No. 1—Election of Directors (continued)

|

| DALLAS B. TANNER | ||||

|

|

Age: 40

Director since: January 2019

|

|||

Mr. Tanner has served as our President and Chief Executive Officer (CEO) and a Board member since January 2019. As a founding member of our business, Mr. Tanner has been at the forefront of creating the single-family rental industry. Since the founding of Invitation Homes in April 2012, he has served as Executive Vice President and Chief Investment Officer, and from August 2018 to January 2019 as Interim President. He served on the boards of holding entities that owned our business prior to our initial public offering (“IPO”) in February 2017 (the “IH Holding Entities”). Mr. Tanner has almost 20 years of real estate experience through the establishment of numerous real estate platforms. In 2005, he founded Treehouse Group, for which he privately sourced funds for platform investments, including single-family rental homes, multifamily properties, manufactured housing, residential land, bridge financing and property management. Mr. Tanner continues to be involved in Treehouse Group’s interest in Pathfinder Ventures, a Southwest-focused commercial real estate fund. In addition, he was a partner in a successful acquisition of First Scottsdale Bank of Arizona. Mr. Tanner served on the Maricopa County (Arizona) Flood Control Board and on the advisory board of First Scottsdale Bank. He is actively involved in American Indian Services and served as a missionary in the Netherlands and Belgium.

Our Board considered Mr. Tanner’s extensive hands-on experience in real estate investment, including the establishment of numerous real estate platforms, and as a founding member of our business, experience managing day-to-day operations of our Company and his prior executive positions. Mr. Tanner’s role as our President and CEO brings management perspective to Board deliberations and provides valuable information about the status of our day-to-day operations.

| JANA COHEN BARBE | ||||

|

|

Age: 58

Director since: November 2018

|

|||

Ms. Barbe joined our Board in November 2018. Ms. Barbe is a senior partner at Dentons, the world’s largest law firm, where she has also served as the first Global Vice Chair from the U.S. Region and the former Chair of both the Financial Institutions and Real Estate Sectors. Ms. Barbe spent her career advising financial institutions and insurance companies on highly sophisticated tax advantaged and social investing. Ms. Barbe serves as a director of The Boler Company, a family office with operations across the globe in manufacturing, real estate and other holdings, including Hendrickson International, the world’s leading manufacturer and supplier of medium- and heavy-duty truck suspensions, axel systems and related components for global transportation industry. Ms. Barbe is also the Chief Executive Officer of Henley Farms, Inc., her family’s thoroughbred breeding business based in Lexington, Kentucky. An impassioned advocate for women, Ms. Barbe is the Chairman of the Board of Advisors of Catalyst, Inc. Equally committed to her community, Ms. Barbe is a past Chairman of the Board of Thresholds, Illinois’ oldest and largest provider of supportive affordable housing.

Our Board considered Ms. Barbe’s real estate and finance background, including chairing Dentons’ Real Estate Practice and Financial Institutions Sector, her expertise in transactional, operational and regulatory matters and strategic vision and her risk management experience, which are a complement to the skills and qualifications of our directors.

| 9 | 2021 Proxy Statement |

Table of Contents

|

Proposal No. 1—Election of Directors (continued)

|

| RICHARD D. BRONSON | ||||

|

|

Age: 76

Director since: November 2017

|

|||

Mr. Bronson has served on our Board since November 2017. Prior to the Merger, from January 2016 to November 2017, Mr. Bronson served on the Board of SWH and, from January 2014 to January 2016, served on the Board of SWAY. Mr. Bronson has been the Chief Executive Officer of The Bronson Companies, LLC, a real estate development company, since 2000 and has been involved in the development of several shopping centers and office buildings throughout the U.S. Mr. Bronson currently serves on the Board and as a Lead Director and the Chair of the Compensation Committee of the board of trustees of Starwood Property Trust, Inc. (NYSE: STWD) and was previously a director of TRI Pointe Group, Inc. (NYSE: TPH) and Mirage Resorts Inc. (NYSE:MRI). Additionally, he is currently on the board of directors of Starwood Real Estate Income Trust. He also previously served as President of New City Development, an affiliate of Mirage Resorts Inc., where he oversaw many of the company’s new business initiatives and activities outside Nevada, and was Vice President of the International Council of Shopping Centers, an association representing 50,000 industry professionals in more than 80 countries. Mr. Bronson currently serves on the Advisory Board of the Neurosurgery Department at UCLA Medical Center.

Our Board considered Mr. Bronson’s governance expertise, his corporate and board experience and knowledge in the real estate industry, which the Board believes provides us with valuable insight into potential investments and the current state of the real estate markets.

| JEFFREY E. KELTER | ||||

|

|

Age: 66

Director since: November 2017

|

|||

Mr. Kelter has served on our Board since November 2017. From January 2016 to November 2017, Mr. Kelter served on the Board of SWH and, from January 2014 to January 2016, served on the Board of SWAY. Mr. Kelter is the Chairman of Jack Creek Investment Corp., a special purposes acquisition company focused on the broader food and consumer products logistics and supply chain ecosystems value chain. Mr. Kelter is a founding partner of KSH Capital, which provides real estate entrepreneurs with capital and expertise to grow their platforms. Prior to founding KSH Capital, Mr. Kelter was the founding partner and Chief Executive Officer of KTR Capital Partners, a private equity real estate investment and operating company focused on industrial properties throughout North America, until its May 2015 sale to Prologis, Inc. (NYSE: PLD). From 1997 to 2004, Mr. Kelter was President and Chief Executive Officer and served on the Board of Keystone Property Trust (“Keystone”), an industrial real estate investment trust (“REIT”). Mr. Kelter formerly served on the Board of Gramercy Property Trust (NYSE: GPT) from 2015 to 2018. Mr. Kelter founded the predecessor to Keystone in 1982, and took the company public in 1997, where he and the management team directed its operations until its sale in 2004. Prior to forming Keystone, he served as President and Chief Executive Officer of Penn Square Properties, Inc., a real estate company which he founded in 1982. Mr. Kelter currently serves as a trustee of the Urban Land Institute, Cold Spring Harbor Laboratory, Westminster School and Trinity College.

Our Board considered Mr. Kelter’s management leadership and governance experience as President and Chief Executive Officer of Keystone and Penn Square and his extensive experience of over 20 years in commercial real estate.

| 2021 Proxy Statement | 10 |

Table of Contents

|

Proposal No. 1—Election of Directors (continued)

|

| JOSEPH D. MARGOLIS | ||||

|

|

Age: 60

Director since: May 2020

|

|||

Mr. Margolis is the Chief Executive Officer of Extra Space Storage, Inc. (NYSE: EXR). He held this position since January 1, 2017. Previously, he served as Executive Vice President and Chief Investment Officer of Extra Space Storage, Inc. from July 2015 until December 31, 2016. Mr. Margolis served as a member of the board of directors of Extra Space Storage, Inc. from February 2005 until July 2015. From 2011 until July 2015, he was Senior Managing Director and Partner at Penzance Properties, a vertically integrated owner, operator and developer of office and other properties in the Washington, D.C. metro area. Previously, Mr. Margolis was a co-founding partner of Arsenal Real Estate Funds, a private real estate investment management firm, from 2004 through 2011. Before forming Arsenal in 2004, from 1992 to 2004, Mr. Margolis held senior positions at Prudential Real Estate Investors in portfolio management, capital markets and as General Counsel. Before that, Mr. Margolis worked for The Prudential Insurance Company of America as in-house real estate counsel from 1988 through 1992, and as a real estate associate at the law firm of Nutter, McClennen & Fish from 1986 through 1988.

Our Board considered Mr. Margolis’ extensive finance and real estate experience and senior executive experience in dealing with complex management, financial, risk assessment, business and governance issues, which enable him to provide us with business leadership and financial expertise.

| JOHN B. RHEA | ||||

|

|

Age: 55

Director since: October 2015

|

|||

Mr. Rhea has served on our Board since January 2017 and, prior to our IPO, from October 2015 to January 2017, served on the boards of the IH Holding Entities. Since September 2020, Mr. Rhea has been a partner at Centerview Partners, an independent investment banking advisory firm. In March 2021, Mr. Rhea was elected to the board of directors of State Street Corporation (NYSE:STT), one of the world’s leading providers of financial services to institutional investors, including investment servicing, investment management and investment research and trading. Mr. Rhea served as Senior Advisor and President, Corporate Finance & Capital Markets at Siebert Williams Shank & Co., LLC, a full-service investment banking firm, from June 2017 to September 2020. Mr. Rhea is also Managing Partner of RHEAL Capital Management, LLC, a real estate development and investment firm he founded in March 2014, specializing in affordable and market rate housing, public private partnerships, and acquisition and repositioning of commercial real estate in urban communities. Mr. Rhea previously served as a Senior Advisor to The Boston Consulting Group, a worldwide management consulting firm from July 2014 to September 2017. From May 2009 to January 2014, Mr. Rhea was a senior appointee of Michael R. Bloomberg, Mayor of the City of New York, where he served as Chairman and Chief Executive Officer of the New York City Housing Authority, the largest public housing authority in North America. Prior to his service with the Bloomberg Administration, Mr. Rhea was Managing Director and Co-Head of Consumer and Retail investment banking at Barclays Capital (and its predecessor firm Lehman Brothers) from May 2005 to April 2009. Previously, Mr. Rhea served as Managing Director at JPMorgan Chase & Co. from May 1997 to April 2005. Earlier in his career, Mr. Rhea worked at PepsiCo, Inc. and The Boston Consulting Group. Mr. Rhea has served on and chaired several non-profit boards and is currently a director of Wesleyan University, Red Cross Greater New York and University of Detroit Jesuit High School.

| 11 | 2021 Proxy Statement |

Table of Contents

|

Proposal No. 1—Election of Directors (continued)

|

Our Board considered Mr. Rhea’s significant experience in our industry, including in development and regulation and his prior senior positions at real estate companies and regulatory bodies, including as Chairman and CEO of the New York City Housing Authority, and other companies. The Board also considered Mr. Rhea’s extensive experience in the investment banking industry.

| J. HEIDI ROIZEN | ||||

|

|

Age: 63

Director since: May 2020

|

|||

Ms. Roizen has been a partner with leading venture capital firm Threshold Ventures (formerly DFJ Ventures) since 2012 and serves as a board director for privately held portfolio companies Planet, Zoox, Memphis Meats and Polarr. Ms. Roizen is also a member of the board of directors of DMGT, a public global media and information services company (LSE: DMGT). She also co-leads the Threshold Venture Fellows program in the Engineering Department at Stanford University and serves on the Advisory Council of Stanford’s Institute for Human-Centered Artificial Intelligence. Among her past activities, Ms. Roizen has been a partner at DFJ and Mobius Venture Capital from 1999 to 2006, and has served as a member of the Board of Directors of the National Venture Capital Association, where she served on the Executive Committee, chaired the annual conference and chaired the Public Outreach committee. She has served on numerous private and public company boards, including TiVo (NASDAQ: TIVO) and Great Plains Software (was NASDAQ: GPSI until it was acquired by Microsoft). Before becoming a venture capitalist, Ms. Roizen served as Vice President of World Wide Developer Relations for Apple. Ms. Roizen started her career as an early Silicon Valley pioneer, co-founding software company T/Maker in 1983 and serving as its CEO for over a decade until its acquisition by Deluxe Corporation (NYSE: DLX) in 1994. During that time, she also served on the Board of Directors and as president of the Software Publishers Association (now the Software Industry and Information Association—SIIA). Also active in nonprofit organizations, Ms. Roizen is a member of the Board of Advisors of the National Center for Women in Information Technology and of Springboard Enterprises. She is a past board member of the Stanford Alumni Association, where she served on its Trustee Nominating Committee for five years. Ms. Roizen is a frequent guest speaker at business schools across the country and is the subject of a popular HBS case about building business networks. In 2018, Ms. Roizen was named the “Financial Woman of the Year” by the Financial Women of San Francisco.

Our Board considered Ms. Roizen’s experience in entrepreneurial growth and business development and strong ability to assess risks relating to new ventures and investments, which bring business leadership, financial expertise and risk management skills to the Board. Mr. Roizen’ deep board experience also brings governance expertise to our Board.

| 2021 Proxy Statement | 12 |

Table of Contents

|

Proposal No. 1—Election of Directors (continued)

|

| JANICE L. SEARS | ||||

|

|

Age: 60

Director since: January 2017

|

|||

Ms. Sears has served on our Board since January 2017. Ms. Sears previously served as independent director, Audit Chair of Essex Property Trust (NYSE: ESS), which owns multi-family rental properties, independent director, Board Chair of The Swig Company, an owner of large office properties, and independent director, Audit Chair of BioMed Realty Trust, a life-sciences owner, sold to Blackstone Real Estate in 2016. She also served as independent director and Advisor to Helix RE, a real estate software startup. Prior to 2009, Ms. Sears held the position of Managing Director, Western Region Head in the Real Estate Investment Banking Group at Banc of America Securities. Concurrently, as the San Francisco Market President for Bank of America, she managed a senior leadership team, deepening relationships with nonprofits and local governments. Prior to 1988, Ms. Sears was a Real Estate Economist at both Chemical Bank and Citicorp in New York. Ms. Sears’ activities have included G100, West Audit Committee Network, Nareit, ULI, NACD, WOB, and Athena Alliance. She is a frequent speaker including at both Harvard and Columbia Business Schools. Ms. Sears was named ‘Forever Influential’ by SF Business Times and inducted into the Allen Matkins Hall of Fame and gained annual recognition by Bisnow’s Bay Area Power Women, among other awards. Ms. Sears is active philanthropically both on boards and spending time in the community including with Compass Family Services, Meals on Wheels, tutoring at the Marina Middle School, and serving meals at St. Anthony’s.

Our Board considered Ms. Sears’ knowledge of capital markets and accounting methods and principles, as well as her extensive banking and financial background and experience working in the commercial real estate and REIT industry.

| WILLIAM J. STEIN | ||||

|

|

Age: 59

Director since: October 2012

|

|||

Mr. Stein has served on our Board since January 2017 and, prior to our IPO, from October 2012 to January 2017, served on the boards of the IH Holding Entities. Mr. Stein has been a Senior Managing Director of Blackstone since January 2006. Since joining Blackstone in 1997, Mr. Stein has been involved in the direct asset management and asset management oversight of Blackstone’s global real estate platform. Before joining Blackstone, Mr. Stein was a Vice President at Heitman Real Estate Advisors and JMB Realty Corp. Mr. Stein currently serves on the Board of Nevada Property 1 LLC (The Cosmopolitan of Las Vegas), where he serves on the Audit Committee, and on the Board of Edens Investment Trust. He previously served on the Board of Hilton Worldwide Holdings Inc. (NYSE: HLT), Extended Stay America, Inc. (NYSE: STAY), La Quinta Holdings Inc. (NYSE: LQ) and Brixmor Property Group Inc. (NYSE: BRX). Mr. Stein is a member of the University of Michigan Ross School of Business Advisory Board and the University of Michigan Real Estate Fund Advisory Board.

Our Board considered Mr. Stein’s tenure with Blackstone, his involvement in the direct asset management and asset management oversight of Blackstone’s global real estate platform, his extensive financial background and his experience as an asset manager focusing on real estate investments.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE DIRECTOR NOMINEES NAMED ABOVE.

| 13 | 2021 Proxy Statement |

Table of Contents

|

|

THE BOARD OF DIRECTORS AND CERTAIN GOVERNANCE MATTERS

The business and affairs of the Company are managed under the direction of our Board, as provided by Maryland law, and the Company conducts its business through meetings of the Board and its four standing committees: the Audit Committee, the Compensation and Management Development Committee, the Nominating and Corporate Governance Committee and the Investment and Finance Committee.

We are committed to exercising and maintaining strong corporate governance practices. We believe that good governance promotes the long-term interests of our stockholders, strengthens Board and management accountability and improves our standing as a trusted member of the communities we serve. Notable features of our corporate governance are set forth below.

Corporate Governance Snapshot

|

Number of Independent Director Nominees Standing for Election

|

9

| |

|

Total Number of Director Nominees

|

10

| |

|

Average Age of Director Nominees Standing for Election

|

60

| |

|

Average Tenure of Directors Standing for Election (years)

|

3.8

| |

|

Chairperson Position Separate from President and CEO

|

Yes

| |

|

Annual Election of All Directors

|

Yes

| |

|

Stockholder Rights Plan

|

No

| |

|

Limits on the Number of Directorships Held by Directors

|

Yes

| |

|

Regular Executive Sessions of Independent Directors

|

Yes

| |

|

New Director Orientation

|

Yes

| |

|

Annual Board and Committee Self-Evaluations

|

Yes

| |

|

Annual Review of Management Succession Plans

|

Yes

| |

|

Code of Business Conduct and Ethics

|

Yes

| |

|

Policies and Practices to Align Executive Compensation with Long-Term Stockholder Interests

|

Yes

| |

|

Stock Ownership Requirements for Executive Officers

|

Yes

| |

|

Stock Ownership Requirements for Directors

|

Yes

| |

|

Anti-Hedging and Anti-Pledging Policies

|

Yes

| |

|

Clawback Policy (Long-Term Incentive Awards)

|

Yes

|

Stockholder Rights and Accountability

| • | Our Board is not classified and each of our directors is subject to annual reelection (we will not classify our Board in the future without the approval of our stockholders); |

| • | Stockholders holding at least 10% of outstanding shares have the right to call special meetings; |

| • | Stockholders holding a majority of outstanding shares have the right to amend, alter or repeal our Bylaws, or adopt new Bylaws; |

| • | Stockholders may act by written consent; |

| 2021 Proxy Statement | 14 |

Table of Contents

|

The Board of Directors and Certain Governance Matters (continued)

|

| • | We do not have a stockholder rights plan, and we will not adopt a stockholder rights plan in the future without stockholder approval; |

| • | We have opted out of the Maryland business combination and control share acquisition statutes and cannot opt in without stockholder approval; and |

| • | We actively engage with our stockholders, seek input, address questions and concerns, and provide perspective on Company policies and practices through our direct outreach to investors, our annual meetings of stockholders and regular detailed investor presentations. |

Board Practices

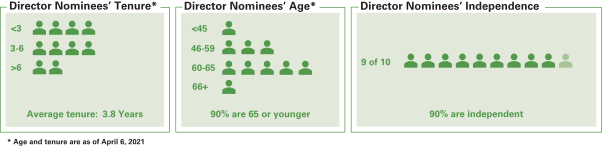

| • | A substantial majority of our directors (90% of our director nominees) are independent; |

| • | Each of our Audit Committee, Compensation and Management Development Committee, and Nominating and Corporate Governance Committee is composed entirely of independent directors; |

| • | Our Board is led by our Chairperson, and the Chairperson position is separate from our President and CEO; |

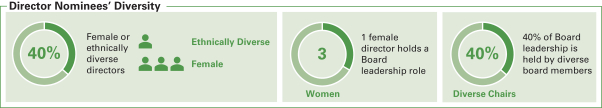

| • | Our Board is committed to diversity, and 40% of our director nominees represent gender and ethnically diverse populations; |

| • | We conduct annual Board and committee evaluations; |

| • | Generally, our directors are not expected to serve after reaching age 75; |

| • | We intend that no director serve more than 15 years on our Board, and director nominees’ average tenure is 3.8 years; |

| • | Our independent directors meet regularly in executive sessions without the presence of our corporate officers or non-independent directors; |

| • | We have instituted limits on the number of directorships held by our directors to prevent “overboarding”; |

| • | We provide robust director orientation and continuing education programs; |

| • | The Board is committed to refreshment, and four of our 10 director nominees joined the Board since the beginning of 2018; |

| • | The Board regularly rotates committee members; and |

| • | Our Code of Business Conduct and Ethics applies to members of the Board. |

Robust Stock Ownership Requirements

Our directors and executive officers are subject to stock ownership and retention requirements:

| • | President and CEO: 6X base salary; |

| • | Executive officers: 3X base salary; and |

| • | Non-employee directors: 5X annual cash retainer for Board service. |

See “Executive Compensation—Compensation Discussion and Analysis—Other Matters—Stock Ownership Policy” for more details.

| 15 | 2021 Proxy Statement |

Table of Contents

|

The Board of Directors and Certain Governance Matters (continued)

|

Director Independence and Independence Determinations

Under our Corporate Governance Guidelines and the NYSE rules, a director is not independent unless the Board affirmatively determines that, in addition to not having a disqualifying relationship, as set forth in the NYSE rules, he or she does not have a direct or indirect material relationship with the Company or any of its subsidiaries which, in the opinion of the Board would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Our Corporate Governance Guidelines define independence in accordance with the independence definition in the current NYSE corporate governance rules for listed companies. Our Corporate Governance Guidelines require the Board to review the independence of all directors at least annually. In the event a director has a relationship with the Company that is relevant to his or her independence and is not addressed by the objective tests set forth in the NYSE independence definition, the Board will determine, considering all relevant facts and circumstances, whether such relationship is material and whether such relationship would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

The Nominating and Corporate Governance Committee undertook reviews of director independence and made recommendations to our Board as to those directors meeting the requisite NYSE independence standards applicable to serve on the Board and any heightened standards to serve on a committee of the Board. As a result of these reviews, the Board has affirmatively determined that each of Jana Cohen Barbe, Bryce Blair, Richard D. Bronson, Michael D. Fascitelli, Jeffrey E. Kelter, Joseph. D. Margolis, John B. Rhea, J. Heidi Roizen, Janice L. Sears and William J. Stein is independent under all applicable NYSE standards for Board service and under our Corporate Governance Guidelines. In addition, the Board previously determined that Kenneth A. Caplan, Robert G. Harper and Barry S. Sternlicht, who served on our Board for a portion of 2020 but were not nominated for re-election at our 2020 annual meeting of stockholders, were independent under all applicable NYSE independence standards for Board service and under our Corporate Governance Guidelines.

At the committee level, the Board has affirmatively determined that each of the current members of the Audit Committee (Jana Cohen Barbe, J. Heidi Roizen, Janice L. Sears and William J. Stein) is “independent” for purposes of Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and that each of the current members of the Compensation and Management Development Committee (Jana Cohen Barbe, Michael D. Fascitelli, Jeffrey E. Kelter, Joseph D. Margolis and John B. Rhea) is “independent” for purposes of Section 10C(b) of the Exchange Act. The Board has also affirmatively determined that each of Richard D. Bronson and Janice L. Sears, whom the Board plans to appoint to the Compensation and Management Development Committee following the Annual Meeting, is “independent” for purposes of Section 10C(b) of the Exchange Act.

In making its independence determinations, the Board considered and reviewed all information known to it, including information identified through directors’ questionnaires.

Our Articles of Incorporation and our Bylaws provide that our Board will consist of such number of directors as may from time to time be fixed by the Board, but may not be more than 15 or fewer than the minimum number permitted by Maryland law, which is one.

Our Board is led by our Chairperson, and the Chairperson position is separate from our President and CEO position. We believe that the separation of the Chairperson and President and CEO positions is appropriate corporate governance for us at this time. Accordingly, Mr. Blair serves as Chairperson, while Mr. Tanner serves as our President and CEO. Following the Annual Meeting, our Board plans to appoint Mr. Fascitelli as the Chairperson of the Board, subject to his election at the Annual Meeting, and Mr. Tanner will continue to serve as our President and CEO. Our Board believes that this structure best encourages the free and open dialogue of competing views and provides for strong checks and balances. Additionally, our Chairperson’s attention to Board and committee matters allows the President and CEO to focus more specifically on overseeing the Company’s day-to-day operations, as well as strategic opportunities and planning.

| 2021 Proxy Statement | 16 |

Table of Contents

|

The Board of Directors and Certain Governance Matters (continued)

|

Committees of the Board of Directors; Meetings of the Board of Directors and its Committees

Our Board has established an Audit Committee, a Compensation and Management Development Committee, a Nominating and Corporate Governance Committee and an Investment and Finance Committee. The following table provides the current membership of each of the standing Board committees.

| Director |

Audit Committee |

Compensation and Management Development Committee |

Nominating and Corporate Governance Committee |

Investment and Finance Committee | ||||

| Bryce Blair* |

|

|

|

| ||||

| Dallas B. Tanner |

|

|

|

Member | ||||

| Jana Cohen Barbe | Member | Member |

|

| ||||

| Richard D. Bronson |

|

|

Member | Member | ||||

| Michael D. Fascitelli |

|

Member |

|

Chairperson | ||||

| Jeffrey E. Kelter |

|

Member | Member |

| ||||

| Joseph D. Margolis |

|

Member |

|

Member | ||||

| John B. Rhea |

|

Chairperson | Member |

| ||||

| J. Heidi Roizen | Member |

|

Member |

| ||||

| Janice L. Sears | Chairperson |

|

|

Member | ||||

| William J. Stein |

Member

|

|

Chairperson |

| ||||

| * | Chairperson of the Board (Mr. Blair informed the Company that he would not stand for re-election to our Board at the Annual Meeting). |

During the year ended December 31, 2020, the Board held 13 meetings, the Audit Committee held five meetings, the Compensation and Management Development Committee held eight meetings, the Nominating and Corporate Governance Committee held four meetings and the Investment and Finance Committee held five meetings. In 2020, each director attended at least 75% of the meetings of the Board and of the committees on which he or she served as a member during the time in which he or she served as a member of the Board or such committees. All directors are expected to make every effort to attend all meetings of the Board, meetings of the committees of which they are members and our annual meeting of stockholders. We expect all directors to attend any meeting of stockholders, and all of our directors attended the 2020 annual meeting of stockholders.

| 17 | 2021 Proxy Statement |

Table of Contents

|

The Board of Directors and Certain Governance Matters (continued)

|

Audit Committee

|

Chair: Ms. Sears

Additional Committee Members: Ms. Barbe Ms. Roizen Mr. Stein

• All members are “independent” in accordance with our Audit Committee charter and the applicable NYSE and Exchange Act rules

• All members are financially literate within the meaning of the NYSE rules

• Ms. Sears, Ms. Roizen and Mr. Stein qualify as “audit committee financial experts” as defined by applicable rules of the Securities and Exchange Commission (the “SEC”)

• Governed by a Board-approved charter |

Primary Responsibilities:

• assisting the Board with its oversight of our accounting and financial reporting process and financial statement audits;

• assisting the Board with its oversight of our disclosure controls procedures and our internal control over financial reporting;

• assessing the independent registered public accounting firm’s qualifications and independence;

• engaging the independent registered public accounting firm;

• overseeing the performance of our internal audit function and independent registered public accounting firm;

• assisting with our compliance with legal and regulatory requirements in connection with the foregoing; and

• overseeing our enterprise risk management program, covering exposure to risks facing the Company, including, but not limited to, financial, tax, legal and enterprise risks, and technology and information security risks, including cybersecurity, data privacy, business continuity and disaster recovery.

The Audit Committee has established policies and procedures for the pre-approval of all services provided by the independent registered public accounting firm. See “Proposal 2—Pre-Approval Policy for Services of Independent Registered Public Accounting Firm.” The Audit Committee also has established procedures for the receipt, retention and treatment, on a confidential basis, of complaints received by the Company regarding its accounting, internal controls and auditing matters.

The Audit Committee charter is available on our website at: www.invitationhomes.com under “About Us”—“Investors”—“Corporate Governance”—“Governance Documents”—“Audit Committee Charter.”

|

| 2021 Proxy Statement | 18 |

Table of Contents

|

The Board of Directors and Certain Governance Matters (continued)

|

Compensation and Management Development Committee

|

Chair: Mr. Rhea

Additional Committee Members: Ms. Barbe Mr. Fascitelli Mr. Kelter Mr. Margolis

• All members are “independent” in accordance with our Compensation and Management Development Committee charter and the applicable NYSE and Exchange Act rules

• Governed by a Board-approved charter |

Primary Responsibilities:

• establishing and reviewing the Company’s overall compensation philosophy;

• overseeing the goals, objectives and compensation of our President and CEO, including evaluating the performance of the President and CEO in light of those goals;

• reviewing and determining the salaries, performance-based incentives, and other matters related to the compensation of our other executive officers;

• making recommendations to the Board regarding director compensation;

• approving our incentive and equity compensation plans and setting the terms of and making awards thereunder;

• assisting the Board in review and consideration of succession plans for our officers, and establishing and evaluating plans and programs for management development; and

• assisting with our compliance with the compensation rules, regulations and guidelines promulgated by the NYSE, the SEC and other laws, as applicable.

For a description of our process for determining compensation, including the role of the Compensation and Management Development Committee’s independent compensation consultant, see “Executive Compensation—Compensation Discussion and Analysis.”

The Compensation and Management Development Committee charter is available on our website at: www.invitationhomes.com under “About Us”—“Investors”—“Corporate Governance”—“Governance Documents”—“Compensation and Management Development Committee Charter.”

Compensation Committee Interlocks and Insider Participation. During 2020, our Compensation and Management Development Committee was composed of Mr. Rhea, Ms. Barbe, Mr. Fascitelli, Mr. Kelter and Mr. Margolis. During 2020 and as of the date of this Proxy Statement, none of our executive officers served as a director or member of the compensation committee (or other committee serving an equivalent function) of any other entity whose executive officers served on our Compensation and Management Development Committee or Board.

|

| 19 | 2021 Proxy Statement |

Table of Contents

|

The Board of Directors and Certain Governance Matters (continued)

|

Nominating and Corporate Governance Committee

|

Chair: Mr. Stein

Additional Committee Members: Mr. Bronson Mr. Kelter Mr. Rhea Ms. Roizen

• All members are “independent” in accordance with our Nominating and Corporate Governance Committee charter and the applicable NYSE rules

• Governed by a Board-approved charter |

Primary Responsibilities:

• developing a set of governance principles applicable to the Company and overseeing the Company’s governance policies;

• identifying, reviewing, assessing and making recommendations to the Board as to candidates to serve on the Board and its committees;

• considering matters related to director independence and conflicts of interest;

• recommending those to serve as committee chairpersons;

• overseeing the annual evaluation of the Board and management; and

• providing oversight with respect to the Company’s environmental, social and related governance (“ESG”) strategy, initiatives and policies.

The Nominating and Corporate Governance Committee charter is available on our website at: www.invitationhomes.com under “About Us”—“Investors”—“Corporate Governance”—“Governance Documents”—“Nominating and Corporate Governance Committee Charter.”

|

Investment and Finance Committee

|

Chair: Mr. Fascitelli

Additional Committee Members: Mr. Bronson Mr. Margolis Ms. Sears Mr. Tanner

• Governed by a Board-approved charter |

Primary Responsibilities:

• overseeing matters related to the Company’s investments in real estate assets proposed by management;

• overseeing the performance of the Company’s assets;

• reviewing the Company’s investment and disposition policies, procedures, strategies and programs; and

• reviewing the Company’s capital raising and other financing activities.

The Investment and Finance Committee charter is available on our website at: at www.invitationhomes.com under “About Us”—“Investors”—“Corporate Governance”—“Governance Documents”—“Investment and Finance Committee Charter.”

|

| 2021 Proxy Statement | 20 |

Table of Contents

|

The Board of Directors and Certain Governance Matters (continued)

|

The Nominating and Corporate Governance Committee is responsible for recommending to the Board nominees for election as director, and the Board is responsible for selecting nominees for election. This nomination process occurs as part of the nomination of the slate of directors for election at our annual meeting of stockholders and at times when there is a vacancy on the Board or other need to add a director to the Board.

As part of this nomination process, the Nominating and Corporate Governance Committee weighs the characteristics, experience, independence, diversity and skills of potential candidates for election to the Board and, in considering such candidates, also assesses the size, composition and combined expertise of the Board and the extent to which the candidate would fill a present need on the Board. As the application of these factors involves the exercise of judgment, the Nominating and Corporate Governance Committee does not have a standard set of fixed qualifications that is applicable to all director candidates, but rather takes into account all factors it considers appropriate such as the individual’s relevant career experience, strength of character, judgment, familiarity with the Company’s business and industry, independence of thought, an ability to work collegially, diversity of background, existing commitments to other businesses, potential conflicts of interest with other pursuits, legal considerations, corporate governance background, financial and accounting background, executive compensation background, relevant industry experience and technical skills and the size, composition and combined expertise of the existing Board.

The Nominating and Corporate Governance Committee may seek referrals and/or receive recommendations from other members of the Board, management, stockholders and other sources, including third party recommendations. The Nominating and Corporate Governance Committee may also retain a search firm to assist it in identifying candidates to serve as directors of the Company. The Nominating and Corporate Governance Committee uses the same criteria for evaluating candidates regardless of the source of the referral or recommendation. When considering director candidates, the Nominating and Corporate Governance Committee seeks individuals with backgrounds and qualities that, when combined with those of our incumbent directors, provide a blend of skills and experience to further enhance the Board’s effectiveness.

In connection with its annual recommendation of a slate of nominees for election at the annual meeting, the Nominating and Corporate Governance Committee also may assess the contributions of those directors recommended for re-election in the context of the Board evaluation process and other perceived needs of the Board. When considering whether the directors and nominees have the experience, qualifications, attributes and skills, taken as a whole, to enable the Board to satisfy its oversight responsibilities effectively in light of our business and structure, the Board focused primarily on the information discussed in each of the director nominees’ biographical information set forth above.

In connection with its recommendation of a slate of nominees for election at the Annual Meeting, our Nominating and Corporate Governance Committee and the Board also considered that Mr. Bronson reached the age of 76 in 2021 and determined that, because of Mr. Bronson’s expertise, valuable business insights and strong commitment to Invitation Homes, an exception to our general practice to not recommend for reelection a director following his or her 75th birthday is warranted.

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders. Any recommendation submitted to the Secretary of the Company should be in writing and should include any supporting material the stockholder considers appropriate in support of that recommendation, but must include information that would be required under the rules of the SEC to be included in a proxy statement soliciting proxies for the election of such candidate and a written consent of the candidate to serve as one of our directors if elected. Stockholders wishing to propose a candidate for consideration may do so by submitting the above information to the attention of the Corporate Secretary, Invitation Homes Inc., 1717 Main Street, Suite 2000, Dallas, Texas 75201. All recommendations for nomination received by the Corporate Secretary that satisfy our bylaw requirements relating to such director nominations will be presented to the Nominating and Corporate Governance Committee for its consideration. Stockholders also must satisfy the notification, timeliness, consent and information requirements set forth in our Bylaws. These requirements are also described under the caption “Stockholder Proposals for the 2022 Annual Meeting.”

Composition of the Board Committees

The Board, upon recommendation from the Nominating and Corporate Governance Committee, annually reviews and determines the composition of the committees. Through periodic committee refreshment, we balance the benefits derived from continuity and depth of experience with the benefits gained from fresh perspectives and enhancing our directors’ understanding of different aspects of our business.

| 21 | 2021 Proxy Statement |

Table of Contents

|

The Board of Directors and Certain Governance Matters (continued)

|

As part of our ongoing commitment to proactive Committee refreshment, following the Annual Meeting, the Board plans to appoint the following members to the standing committees (assuming all director nominees are elected).

| Director |

Audit Committee |

Compensation and Management Development Committee |

Nominating and Corporate Governance Committee |

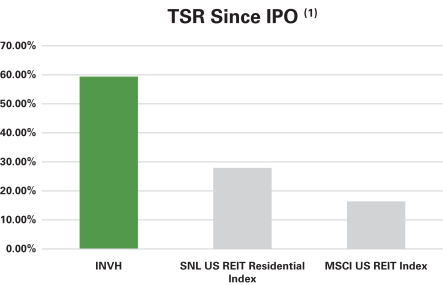

Investment and Finance Committee | ||||||||||||||||