Form DEF 14A GREENLIGHT CAPITAL RE, For: Jul 26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| Filed by the Registrant | ý | ||||

| Filed by a Party other than the Registrant | o | ||||

| Check the appropriate box: | |||||

| o | Preliminary Proxy Statement | ||||

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||

| ý | Definitive Proxy Statement | ||||

| o | Definitive Additional Materials | ||||

| o | Soliciting Material Pursuant to Section 240.14a-12 | ||||

GREENLIGHT CAPITAL RE, LTD.

(Name of Registrant As Specified in its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ý | No fee required. | ||||

| o | Fee paid previously with preliminary materials | ||||

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||

GREENLIGHT CAPITAL RE, LTD.

65 Market Street, Suite 1207

Jasmine Court, Camana Bay

P.O. Box 31110

Grand Cayman, KY1-1205

Cayman Islands

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON JULY 26, 2022

Notice is hereby given that the Annual General Meeting of Shareholders, or the Meeting, of Greenlight Capital Re, Ltd., or the Company, will be held at the Company’s offices at 65 Market Street, Suite 1207, Jasmine Court, Camana Bay, Grand Cayman, Cayman Islands on July 26, 2022 at 9:00 a.m. (local time), for the following purposes:

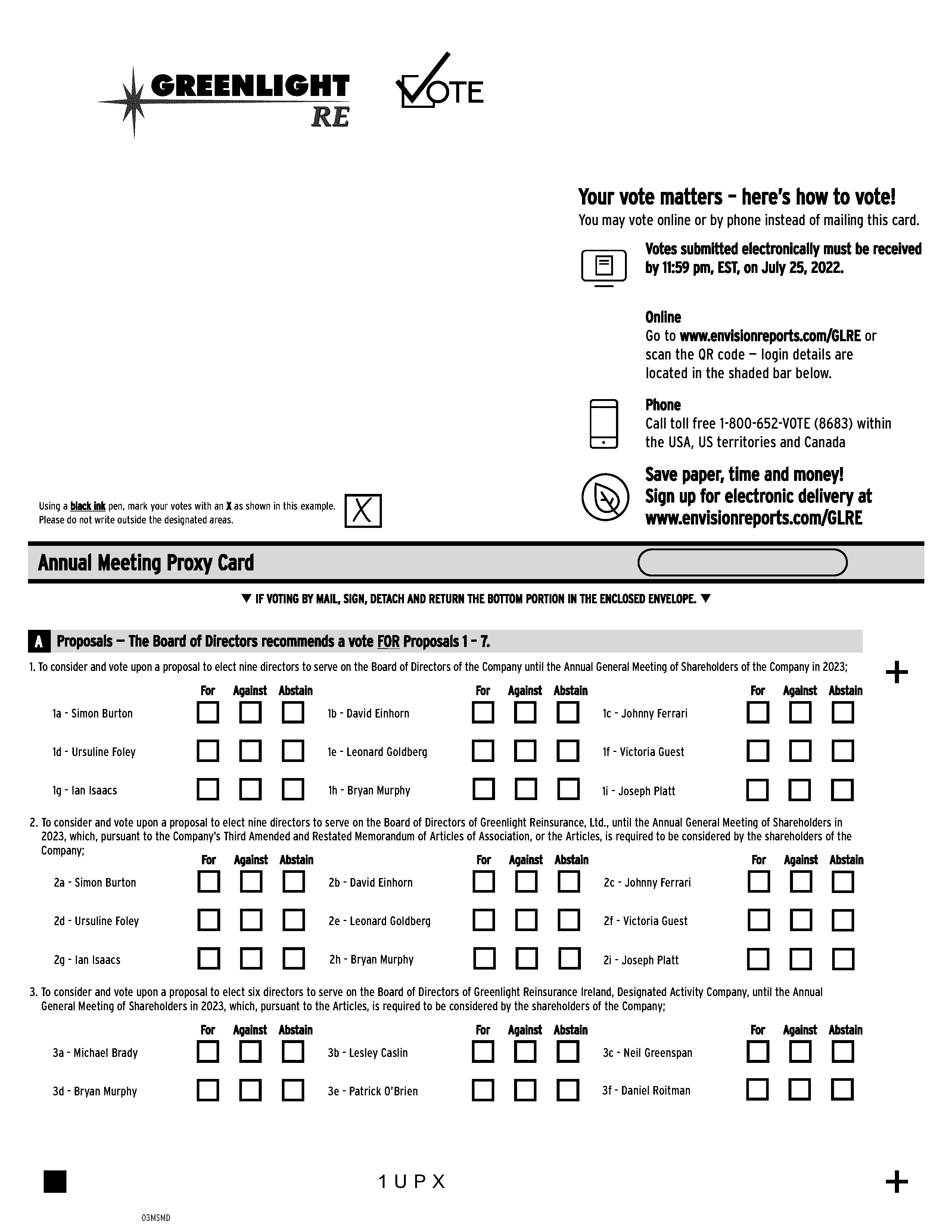

1. To consider and vote upon a proposal to elect nine directors to serve on the Board of Directors of the Company until the Annual General Meeting of Shareholders of the Company in 2023, or the 2023 Meeting;

2. To consider and vote upon a proposal to elect nine directors to serve on the Board of Directors of Greenlight Reinsurance, Ltd. until the 2023 Meeting, which, pursuant to the Company’s Third Amended and Restated Memorandum and Articles of Association, or the Articles, is required to be considered by the shareholders of the Company;

3. To consider and vote upon a proposal to elect six directors to serve on the Board of Directors of Greenlight Reinsurance Ireland, Designated Activity Company until the 2023 Meeting, which, pursuant to the Articles, is required to be considered by the shareholders of the Company;

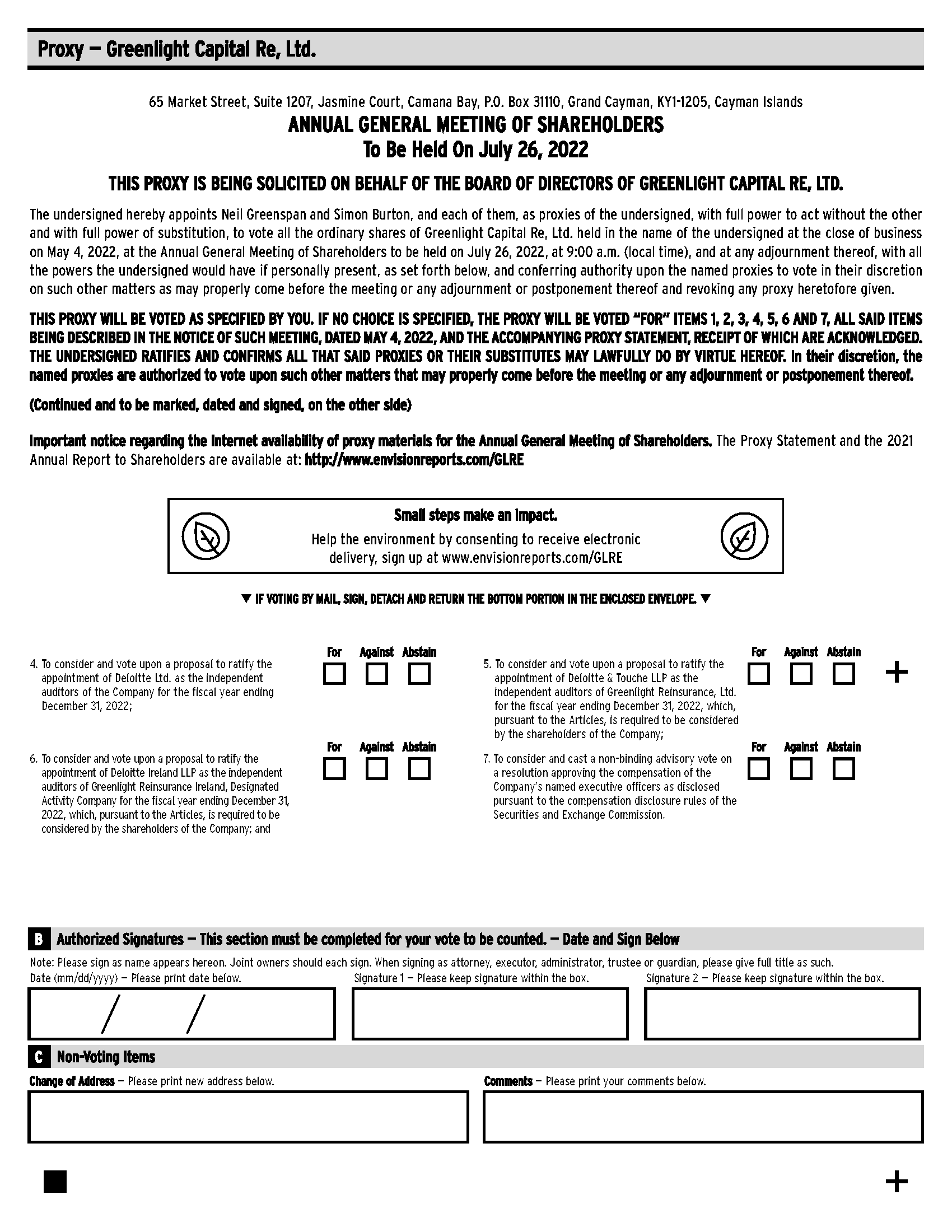

4. To consider and vote upon a proposal to ratify the appointment of Deloitte Ltd. as the independent auditors of the Company for the fiscal year ending December 31, 2022;

5. To consider and vote upon a proposal to ratify the appointment of Deloitte & Touche LLP as the independent auditors of Greenlight Reinsurance, Ltd. for the fiscal year ending December 31, 2022, which, pursuant to the Articles, is required to be considered by the shareholders of the Company;

6. To consider and vote upon a proposal to ratify the appointment of Deloitte Ireland LLP as the independent auditors of Greenlight Reinsurance Ireland, Designated Activity Company for the fiscal year ending December 31, 2022, which, pursuant to the Articles, is required to be considered by the shareholders of the Company;

7. To consider and cast a non-binding advisory vote on a resolution approving the compensation of the Company’s named executive officers as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission; and

8. To transact any other business that may properly come before the Meeting or any adjournment or postponement thereof.

Information concerning the matters to be acted upon at the Meeting is set forth in the accompanying Proxy Statement.

Only shareholders of record, as shown by the transfer books of the Company, at the close of business on May 4, 2022 will be entitled to notice of, and to vote at, the Meeting or any adjournments or postponements thereof.

In accordance with rules adopted by the Securities and Exchange Commission, we are pleased to furnish these proxy materials to shareholders over the Internet rather than in paper form. We believe these rules allow us to provide our shareholders with expedited and convenient access to the information they need, while helping to conserve natural resources and lower the costs of printing and delivering proxy materials.

Whether or not you plan to attend the Meeting, we hope you will vote as soon as possible. Voting your proxy will ensure your representation at the Meeting. We urge you to carefully review the proxy materials and to vote FOR the election of each director nominee named in Proposals 1, 2 and 3 and FOR Proposals 4 through 7.

| By Order of the Board of Directors, | ||||||||

/s/ Simon Burton | ||||||||

| Simon Burton | ||||||||

| Chief Executive Officer | ||||||||

| April 28, 2022 | ||||||||

| Grand Cayman, Cayman Islands | ||||||||

MEETING INFORMATION

| DATE | TIME | PLACE | |||||||||

July 26, 2022 | 9:00 a.m., Local Time | 65 Market Street, Suite 1207, Jasmine Court, Camana Bay, Grand Cayman, Cayman Islands 1-800-652-8683 | |||||||||

HOW TO VOTE

Your vote is very important. Whether or not you plan to attend the Meeting, we encourage you to read this proxy statement and submit your proxy so that your shares can be voted at the Meeting and to help us ensure a quorum at the Meeting. You may nonetheless vote in person if you attend the Meeting.

| IN PERSON | BY PHONE | BY INTERNET | BY MAIL | ||||||||

| You may come to the Meeting and cast your vote in person | 1-800-690-6903 | www.proxyvote.com | Mark, sign and date your proxy card and return it in the postage-paid envelope | ||||||||

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDERS MEETING TO BE HELD ON JULY 26, 2022: THE NOTICE OF ANNUAL MEETING OF SHAREHOLDERS, PROXY STATEMENT AND THE ANNUAL REPORT TO STOCKHOLDERS ARE AVAILABLE AT www.envisionreports.com/GLRE | ||||||||

TABLE OF CONTENTS

| Page | |||||

THE COMPANY AT A GLANCE | |||||

GREENLIGHT CAPITAL RE, LTD.

65 Market Street, Suite 1207, Jasmine Court, Camana Bay

P.O. Box 31110

Grand Cayman, KY1-1205

Cayman Islands

PROXY STATEMENT

ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON JULY 26, 2022

GENERAL INFORMATION

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors, or our Board, of Greenlight Capital Re, Ltd., or the Company, of proxies for use at the Annual General Meeting of Shareholders of the Company, or the Meeting, to be held at 65 Market Street, Suite 1207, Jasmine Court, Camana Bay, Grand Cayman, Cayman Islands on July 26, 2022 at 9:00 a.m. (local time), and at any and all adjournments or postponements thereof, for the purposes set forth in the accompanying Notice of Annual General Meeting of Shareholders. The Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021, including consolidated financial statements, or the Annual Report, is included with this Proxy Statement for informational purposes and not as a means of soliciting your proxy. We will furnish any exhibit to our Annual Report at no charge to any shareholder who provides a written request to the Company’s Secretary at the address above. You can also access our filings with the Securities and Exchange Commission, including our Annual Reports and all amendments thereto, at www.sec.gov.

This Proxy Statement and the accompanying proxy card and Notice of Annual General Meeting of Shareholders are first being provided to shareholders on or about April 28, 2022.

Unless otherwise indicated or unless the context otherwise requires, all references in this Proxy Statement to “the Company,” “GLRE,” “we,” “us,” “our,” and similar expressions are references to Greenlight Capital Re, Ltd. All references to “Greenlight Re” are references to Greenlight Reinsurance, Ltd., a Cayman Islands reinsurer and wholly-owned subsidiary of GLRE. All references to “GRIL” are references to Greenlight Reinsurance Ireland, Designated Activity Company, an Ireland reinsurer and wholly-owned subsidiary of GLRE.

PROXY SUMMARY

This summary highlights certain information in this Proxy Statement and does not contain all the information you should consider in voting your shares. Please refer to the complete Proxy Statement and our Annual Report prior to voting at the Meeting.

Items of Business

The items of business to be addressed at the Meeting are as follows:

1. Elect each of the nine (9) director nominees to serve on the Company’s Board of Directors until the Annual General Meeting of Shareholders of the Company in 2023, or the 2023 Meeting;

2. Elect each of the nine (9) director nominees to serve on the Board of Directors of Greenlight Reinsurance, Ltd., or Greenlight Re, until the 2023 Meeting;

3. Elect each of the six (6) director nominees to serve on the Board of Directors of Greenlight Reinsurance Ireland, Designated Activity Company, or GRIL, until the 2023 Meeting;

4. Ratify the appointment of Deloitte Ltd., an independent registered public accounting firm, as the Company’s independent auditors for the fiscal year ending December 31, 2022;

5. Ratify the appointment of Deloitte & Touche LLP, an independent registered public accounting firm, as Greenlight Reinsurance, Ltd.’s independent auditors for the fiscal year ending December 31, 2022;

6. Ratify the appointment of Deloitte Ireland LLP as Greenlight Reinsurance Ireland, Designated Activity Company’s independent auditors for the fiscal year ending December 31, 2022;

1

7. Conduct a non-binding advisory vote on executive compensation; and

8. Transact any other business that may properly come before the Meeting or any adjournment or postponement thereof.

Recommendations of the Board

Our Board recommends that our shareholders take the following actions at the Meeting:

| Proposal | Board Voting Recommendation | Page Reference | |||||||||

| 1 | Election of the Company’s Board of Directors | FOR each nominee | 9 | ||||||||

| 2 | Election of Greenlight Re’s Board of Directors | FOR each nominee | 30 | ||||||||

| 3 | Election of GRIL’s Board of Directors | FOR each nominee | 30 | ||||||||

| 4 | Ratification of Company’s Auditors | FOR | 31 | ||||||||

| 5 | Ratification of Greenlight Re’s Auditors | FOR | |||||||||

| 6 | Ratification of GRIL’s Auditors | FOR | |||||||||

| 7 | Advisory Vote on Say-on-Pay | FOR | |||||||||

THE COMPANY AT A GLANCE

Overview

Established in 2004, the Company is a specialist property and casualty reinsurance company with operations based in the Cayman Islands, Ireland, and the UK. We provide risk management products and services to insurance, reinsurance, and other risk marketplaces. The Company complements its underwriting activities with a non-traditional investment approach designed to achieve higher rates of return over the long term than reinsurance companies that exclusively employ more traditional investment strategies. In 2018, we launched our Greenlight Re Innovations unit, or Innovations, which supports technology innovators in the (re)insurance space by providing investment, risk capacity, and access to a broad insurance network.Our Innovations unit seeks to develop a range of risk products via strategic partnerships and other methods to access fee income, a stream of underwriting business, and investment upside potential.

| Open Market Underwriting | ||

•Where we have domain-specific expertise and a high level of market access, we may seek to act as the lead underwriter to achieve greater influence in negotiating pricing, terms, and conditions. •Where our expertise is sufficient to evaluate the risk thoroughly, we will generally seek to participate in syndicated placements negotiated and priced by another party that we judge to have market-leading expertise in the class or as a quota share retrocessionaire of a market-leading reinsurer. | ||

2

| Alternative Investments | ||

•We aim to complement our underwriting results with a non-traditional investment approach to achieve higher rates of return over the long term than reinsurance companies that exclusively employ more traditional investment strategies; •Our investment portfolio is managed according to a value-oriented philosophy, in which our investment advisor takes long positions in perceived undervalued securities and short positions in perceived overvalued securities. | ||

| Innovations Underwriting | ||

We We expect each of our Innovations’ relationships to have at least one of the following criteria: •Adds expertise to our company in specific risk areas, technology, product innovation, or other areas; •Provides access to a pool of capital, to products, or distribution; •Generates a durable strategic or competitive position in one or more markets and increases our opportunities to achieve revenue growth and margin expansion. •The value we add primarily comes from the application of our risk expertise, not solely capital or reinsurance support. | ||

Corporate Governance Highlights

We are committed to good corporate governance, which promotes the long-term interests of shareholders, strengthens Board and management accountability and helps build public trust in the Company. The section entitled “Corporate Governance and Board of Directors and Committees” beginning on page 18 describes our corporate governance framework, which includes the following highlights:

•Annual election of directors •Seven of our nine director nominees are independent and two are female •Four of our nine director nominees joined our Board since 2017 (three directors added in 2021) •Comprehensive Code of Ethics and Business Conduct and Corporate Governance Guidelines •Conflict of Interest and Related Party Transaction Policy | •Frequent executive sessions of independent members of the Board and Committees •Separate Chair, CEO and Lead Independent Director •Nominating, Governance and Corporate Responsibility Committee participates in executive succession planning •Directors elected by majority vote •Regular Board, Committee and Director peer evaluations | •Board and Committee review of strategic, operational and compliance risks •Ethics and corporate compliance hotline •Ordinary Share Ownership Guidelines for Directors and Officers adopted in 2021 •Pay for Performance alignment •Coordinated investor outreach •No poison pill | ||||||||||||||||||||||||

2021 Shareholder Engagement and Responsiveness

In light of the results of our non-binding advisory vote on executive compensation at our 2021 Annual General Meeting of Shareholders held on May 4, 2021, or the 2021 Say-on-Pay Proposal, we proactively reached out to shareholders representing approximately 59% of our outstanding ordinary shares and engaged with shareholders representing approximately 35% of our outstanding ordinary shares. The chair of our Compensation Committee of the Board, or the Compensation Committee, who was joined in certain discussions by the Chair of our Board, Chief Financial Officer and General Counsel, engaged with certain shareholders in order to discuss compensation and governance matters.

In response to shareholder discussions, with the goal of building long-term value for our shareholders, the Board considered the feedback received and took the following actions:

3

| Investor Feedback | GLRE Response | |||||||

| Corporate Governance | ||||||||

| Skills matrix for Board members | •Created and included Board skills matrix. See “Director Nominee Skills and Qualifications.” | |||||||

| Additional disclosure of skill sets of newly appointed directors | •Included additional biographical and skill set information for all director nominees. See “Director Nominee Biographical Information” and “Director Nominee Skills and Qualifications.” | |||||||

| Additional disclosure relating to Board diversity | •Added two female directors in 2021 and enhanced disclosure on the Board’s position on diversity. See “Board Diversity.” | |||||||

| Additional disclosure relating Board refreshment and Board evaluation processes | •Enhanced disclosure on the Board refreshment and Board evaluation procedures. See “Self-Evaluation and Peer Review Processes.” | |||||||

| Disclosure of Board oversight of ESG | •Amended the charter of the Nominating & Corporate Governance Committee (now called the “Nominating, Governance and Corporate Responsibility Committee”) to require the committee to at least annually review with management the impact of the Company’s business operations and business practices with respect to issues such as environment, health and safety, corporate citizenship, public policy and community involvement and related matters, and make recommendations to the Board as deemed appropriate. See “Nominating, Governance and Corporate Responsibility Committee.” | |||||||

| Executive Compensation | ||||||||

| Inclusion of more than one metric in LTIP | •The performance component of 2022 LTIP awards is based on more than one performance metric. See “Stock Incentive Plan Awards.” | |||||||

| Additional disclosure on LTIP vesting criteria, including certain performance conditions | •Enhanced disclosure of LTIP vesting criteria. See “Stock Incentive Plan Awards.” | |||||||

| Additional disclosure regarding peer group composition | •Enhanced disclosure of peer group analysis process. See “Role of the Compensation Consultant/Peer Group.” | |||||||

| Continue consideration of ownership levels of management to create “owner’s mindset in management” | •Adopted Ordinary Share Ownership Guidelines. See “Ordinary Share Ownership Guidelines.” | |||||||

| Adopt stock ownership guidelines | •Adopted Ordinary Share Ownership Guidelines for directors and officers. | |||||||

| Shareholder Rights | ||||||||

| Additional disclosure regarding shareholder rights | •Included a reference to the summary of shareholders’ rights. See “Voting Securities and Vote Required.” | |||||||

Environmental, Social and Governance

As a global provider of risk protection to cedents around the world, we believe that environmental, social and governance, or ESG, considerations should be at the heart of our operations. Our values of sound risk management, good governance, sustainability and social responsibility are reflected in how we operate our business, and are reflected in how we

4

treat our colleagues, our clients and communities. The Nominating, Governance and Corporate Responsibility Committee has ultimate oversight over our ESG strategy and practices and is responsible for reporting to the Board periodically on these issues.

Governance

We maintain our Code of Ethics of Business Conduct and Ethics, or the Code of Ethics, that showcases our Company’s values to do the right thing. The Code of Ethics has important guidelines, expectations and information that our employees, officers and directors commit to, to guide their day-to-day business behavior. To further align the values of each company stakeholder, we also maintain an insider trading policy, share ownership and retention policy, conflicts and related party policies, and corporate governance guidelines. See “Corporate Governance Highlights.”

Diversity, Equity and Inclusion

We aim to push one another’s thinking, challenge long-held beliefs and assumptions and positively influence the social, environmental and economic well-being of our employees and the communities in which we live and operate. We help our employees and their families thrive by offering comprehensive benefits plans and personal and professional wellness tools, including premium healthcare benefits, a flexible work policy and company-sponsored access to professional development and training seminars. We believe our organic efforts relating to diversity, equity and inclusion, as evidenced by the composition of our workforce, is an integral component to our success and our culture. In support of our commitment, we have bolstered our corporate culture initiatives and goals, which we believe is vital to our business success.

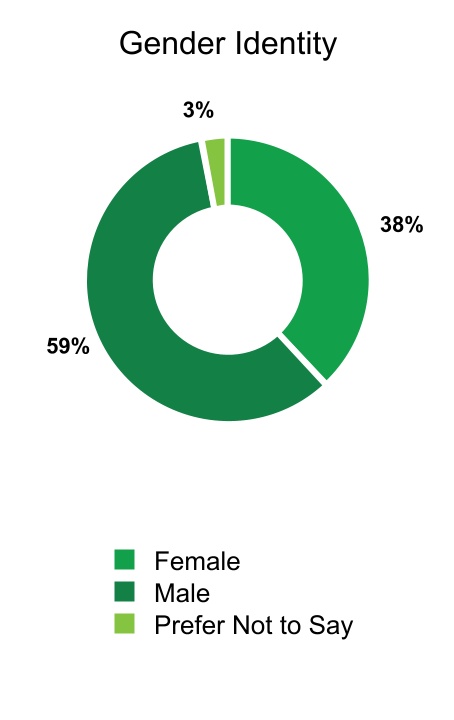

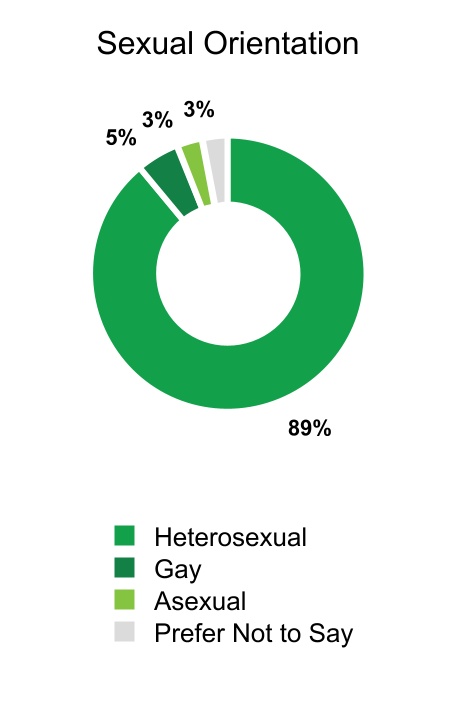

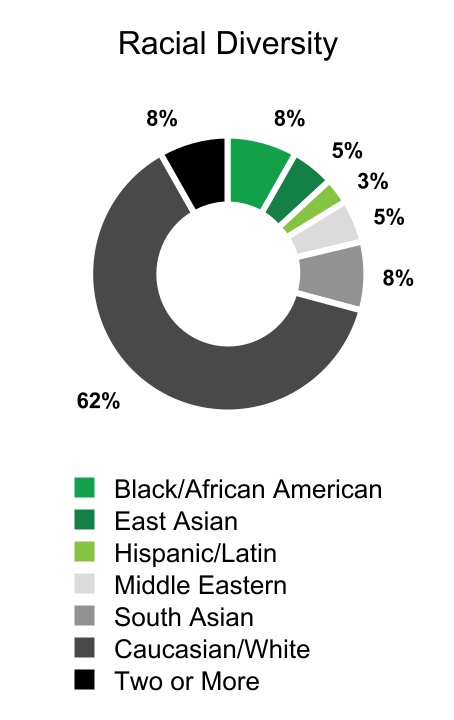

Anticipating the evolving needs of our business strategy demands diverse ideas, perspectives, expertise and continued innovation. As a part of this effort to build the company’s future, we continue to focus on fostering a culture of inclusion to attract, develop and retain diverse talent at all levels of our company. In March 2022, we conducted a survey completed by 39 of our 44 employees. Of those who responded, 38% identified as female, 8% identified as gay or asexual, and 37% identified as racially or ethnically diverse. The company is developing a diverse Board. Our directors and alternate director are nationally diverse, comprised of citizens from the United States, Cayman Islands, Canada, Colombia, United Kingdom and Ireland and 22% of our directors are female. Diversity continues to be an important consideration in our approach to Board composition.

We are investing in a culture where everyone can feel a sense of ownership and accountability. This is best evidenced by our compensation structure, which balances the importance of both enterprise and individual performance. We believe everyone deserves equal opportunities for growth and advancement. Central to this goal is developing strong leaders who embrace our differences to inspire our best solutions. We believe that investing in our people and giving back to our communities builds and strengthens ties to the Company, our clients and our shareholders, which, in turn, advances better outcomes for all of our stakeholders.

5

Community

We aim to positively influence social, environmental and economic conditions for our employees, and by extension the communities where we live and work.

The Company and our Board value each of our employees and remains committed to ensuring that a safe and healthy workplace and environment is maintained. Within the company, we are helping our full-time and part-time employees and their families thrive by offering comprehensive benefit plans and personal and professional wellness tools, including premium healthcare benefits, a flexible work policy and company-sponsored access to professional development and training seminars. In 2020, we adopted a flexible workplace schedule to mitigate the risk of COVID-19 to our employees. In addition to workplace respect, we expect employees to preserve and promote a clean, safe, and healthy local and global environment.

In addition, our company has had a Charity Committee since 2006, which is composed of employees with oversight from a designated executive officer. The Charity Committee considers donation requests by employees that focus on areas of environment, youth and sports, arts and culture and benevolence. Additionally, at the discretion of the designated executive officer, the Company matches contributions made by our employees to non-profit organizations, including to environmental and social causes.

Since 2008, we have a scholarship program that provides financial assistant to Caymanian students who wish to further their post-high school education locally, allowing them to obtain degrees or vocational training in the field of their choice. During 2021, we granted scholarships to 16 eligible Caymanian students to assist with their post-secondary education.

Environmental

The Company understands its responsibility not only to provide solutions that help our clients manage their environmental and climate change risks, but also to monitor and control our carbon usage and ecological impact. Our Company is headquartered in Camana Bay, which is a community that values sustainable practices and initiatives, including the Cayman Island’s first glass recycling program, a farmers market to encourage locally-sourced food and electric vehicle charging stations. While our operations do not have a large physical footprint, we recognize that even the smallest measures contribute to minimizing our environmental impact and maximizing the sustainability of our business. As part of those small efforts, we have reduced our printing, leverage cloud application services and third party hosting to reduce datacenter processing. By virtue of our business, the Company assesses and offers protection against weather-related risks such as hurricanes, storms, wildfires and floods, helping businesses and individuals proactively manage their exposure to such risks.

VOTING

Voting Procedures

As a shareholder of GLRE, you have a right to vote on certain business matters affecting GLRE. The proposals that will be presented at the Meeting and upon which you are being asked to vote are discussed below under the “Proposals” section. Each Class A ordinary share of GLRE you owned as of the record date, May 4, 2022, entitles you to one vote on each proposal presented at the Meeting, subject to certain provisions of our Third Amended and Restated Memorandum and Articles of Association, or our Articles, as described below under “Voting Securities and Vote Required.”

Electronic Availability of Proxy Materials for 2022 Annual Meeting

Under rules adopted by the Securities and Exchange Commission, or the SEC, we are furnishing proxy materials to our shareholders primarily via the Internet, instead of mailing printed copies of those materials to each shareholder. On or about May 9, 2022 we will mail to our shareholders (other than those who previously requested electronic or paper delivery of all proxy materials) a Notice of Internet Availability containing instructions on how to access our proxy materials, including our proxy statement and our annual report. The Notice of Internet Availability also instructs you on how to access your proxy card to vote over the Internet, by mail or telephone.

This process is designed to expedite shareholders’ receipt of proxy materials, help conserve natural resources and lower the cost of the Meeting. However, if you would prefer to receive printed proxy materials, please follow the instructions included in the Notice of Internet Availability. If you have previously elected to receive our proxy materials electronically, you will continue to receive these materials via e-mail unless you elect otherwise.

6

Requesting a Paper Copy of Proxy Materials

Any registered shareholder receiving a Notice of Internet Availability who would like to request a separate paper copy of these materials, should: (1) go to www.envisionreports.com/GLRE and follow the instructions provided; (2) send an e-mail message to investorvote@computershare.com with “Proxy Materials Greenlight Capital Re, Ltd.” in the subject line and provide your name, address and the control number that appears in the box on the Notice of Internet Availability, and state in the e-mail that you want a paper copy of current meeting materials; or (3) call our stock transfer agent (Toll Free) at 1(866) 641-4276.

VOTING SECURITIES AND VOTE REQUIRED

As of April 28, 2022 the following ordinary shares are issued and outstanding:

•28,466,516 Class A ordinary shares, par value $0.10 per share; and

•6,254,715 Class B ordinary shares, par value $0.10 per share.

The above ordinary shares are our only classes of equity shares outstanding and entitled to vote at the Meeting.

Class A Ordinary Shares

Each Class A ordinary share is entitled to one vote per share. However, except upon unanimous consent of the Board of Directors of the Company, or our Board, no holder is permitted to acquire an amount of shares which would cause any person to own (directly, indirectly or constructively under applicable United States tax attribution and constructive ownership rules) 9.9% or more of the total voting power of the total issued and outstanding ordinary shares, such person referred to hereinafter as a 9.9% Shareholder. The Board will reduce the voting power of any holder that is a 9.9% Shareholder to the extent necessary such that the holder ceases to be a 9.9% Shareholder. In connection with this reduction, the voting power of the other shareholders of the Company may be adjusted pursuant to the terms of the Articles. Accordingly, certain holders of Class A ordinary shares may be entitled to more than one vote per share subject to the 9.9% restriction in the event that our Board is required to make an adjustment on the voting power of any 9.9% Shareholder or the voting power of a holder of Class B ordinary shares as described below.

Class B Ordinary Shares

Each Class B ordinary share is entitled to ten votes per share. However, the total voting power of all Class B ordinary shares, as a class, will not exceed 9.5% of the total voting power of the total issued and outstanding ordinary shares. The voting power of any Class A ordinary shares held by any holder of Class B ordinary shares (whether directly, or indirectly or constructively under applicable United States tax attribution and constructive ownership rules) will be included for purposes of measuring the total voting power of the Class B ordinary shares. The Board will reduce the voting power of any holder of Class B ordinary shares if the Class B ordinary shares, as a class, own more than 9.5% of the total voting power of the total issued and outstanding ordinary shares to the extent necessary such that the Class B ordinary shares, as a class, cease to own more than 9.5% of the total voting power of the outstanding ordinary shares. In connection with this reduction, the voting power of the other holders of ordinary shares of the Company will be adjusted pursuant to the terms of the Articles.

All of the Class B ordinary shares, equivalent to 17.3% of the issued and outstanding ordinary shares of the Company as of April 28, 2022 are beneficially held by David Einhorn, chair of our Board. As result of reduction of the voting power of the Class B ordinary shares, Mr. Einhorn is entitled to vote only 9.5% of the total voting power of the total issued and outstanding ordinary shares. Accordingly, the ten times voting rights afforded to the holders of the Class B ordinary shares currently has no practical impact or effect and does not provide any voting advantage to Mr. Einhorn as the beneficial holder of the Class B ordinary shares.

Voting Reduction

The applicability of the voting power reduction provisions to any particular shareholder depends on facts and circumstances that may be known only to the shareholder or related persons. Accordingly, we request that any holder of ordinary shares with reason to believe that it is a 9.9% Shareholder contact us promptly so that we may determine whether the voting power of such holder’s ordinary shares should be reduced. By submitting a proxy, a holder of ordinary shares will be deemed to have confirmed that, to its knowledge, it is not, and is not acting on behalf of, a 9.9% Shareholder. The directors of the Company are empowered to require any shareholder to provide information as to that shareholder’s beneficial ownership of ordinary shares, the names of persons having beneficial ownership of the shareholder’s ordinary shares, relationships with other

7

shareholders or any other facts the directors may consider relevant to the determination of the number of ordinary shares attributable to any person. The directors may disregard the votes attached to ordinary shares of any holder who fails to respond to such a request or who, in their judgment, submits incomplete or inaccurate information. The directors retain certain discretion to make such final adjustments that they consider fair and reasonable in all the circumstances as to the aggregate number of votes attaching to the ordinary shares of any shareholder to ensure that no person shall be a 9.9% Shareholder at any time.

Quorum; Vote Required

The attendance of two or more persons representing, in person or by proxy, more than 50% of the issued and outstanding ordinary shares as of May 4, 2022, the record date for the determination of persons entitled to receive notice of, and to vote at, the Meeting, or the Record Date, is necessary to constitute a quorum at the Meeting. Assuming that a quorum is present, the affirmative vote of the holders of a simple majority of the ordinary shares voted will be required to elect each of the director nominees named in Proposals 1, 2 and 3 and to approve Proposals 4 through 6, each set forth in the Notice of Annual General Meeting of Shareholders. Although the advisory vote in Proposal 7 is non-binding as provided by law, our Board of Directors will review the result of the vote and take it into account in making future determinations concerning executive compensation. Proposals 2, 3, 5 and 6, which seek the approval of certain matters relating to Greenlight Re and GRIL, must be submitted for approval by our shareholders pursuant to our Articles. Our Board of Directors will vote the shares in these subsidiaries at their respective annual general meetings in the same proportion as the votes received at the Meeting from our shareholders on these matters.

With regard to any proposal or director nominee, votes may be cast in favor of or against such proposal or director nominee or a shareholder may abstain from voting on such proposal or director nominee. Abstentions will be excluded entirely from the vote and will have no effect except that abstentions and “broker non-votes” will be counted toward determining the presence of a quorum for the transaction of business. Generally, broker non-votes occur when ordinary shares held by a broker for a beneficial owner are not voted on a particular proposal because the broker has not received voting instructions from the beneficial owner, and the broker does not have discretionary authority to vote on a particular proposal.

8

SOLICITATION AND REVOCATION

Proxies must be received by us by 11:59 p.m. (local time) on July 25, 2022, the day prior to the Meeting day. A shareholder may revoke his or her proxy at any time up to one hour prior to the commencement of the Meeting.

To do this, you must:

•enter a new vote by telephone, over the Internet or by signing and returning another proxy card at a later date;

•file a written revocation with the Secretary of the Company at our address set forth above;

•file a duly executed proxy bearing a later date; or

•appear in person at the Meeting and vote in person.

The individuals designated as proxies in the proxy card are officers of the Company.

All ordinary shares represented by properly executed proxies that are returned, and not revoked, will be voted in accordance with the instructions, if any, given thereon. If no instructions are provided in an executed proxy, it will be voted FOR the election of each director nominee named in Proposals 1, 2 and 3 and FOR each of Proposals 4 through 7, each proposal as described herein as set forth on the accompanying form of proxy, and in accordance with the proxy holder’s best judgment as to any other business as may properly come before the Meeting. If a shareholder appoints a person other than the persons named in the enclosed form of proxy to represent him or her, such person should vote the shares in respect of which he or she is appointed proxy holder in accordance with the directions of the shareholder appointing him or her.

PROPOSAL ONE

ELECTION OF DIRECTORS OF THE COMPANY

Our Articles provide that our Board shall be appointed annually for a term of appointment that will end at the conclusion of the Annual General Meeting of Shareholders of the Company following the one at which they were appointed. Currently, we have nine directors serving on our Board. At the recommendation of our Nominating, Governance and Corporate Responsibility Committee, our Board has nominated Simon Burton, David Einhorn, Johnny Ferrari, Ursuline Foley, Leonard Goldberg, Victoria Guest, Ian Isaacs, Bryan Murphy and Joseph Platt to serve as the directors of the Company, to be voted on by all holders of record of ordinary shares as of the Record Date. Our Board has no reason to believe that any nominee will not continue to be a candidate or will not be able to serve as a director of the Company if elected. In the event that any nominee is unable to serve as a director, the proxy holders named in the accompanying proxy have advised that they will vote for the election of such substitute or additional nominee(s) as our Board may propose. Our Board unanimously recommends that you vote FOR the election of each of the nominees.

Director Nominees

Unless otherwise directed, the persons named in the proxy intend to vote all proxies FOR the election of each of the following director nominees.

| Name | Age | Position | Director Since | |||||||||||||||||

Simon Burton(3) | 51 | Director, Chief Executive Officer and Chief Underwriting Officer | 2017 | |||||||||||||||||

David Einhorn(3) | 53 | Chair | 2004 | |||||||||||||||||

Johnny Ferrari(1) | 54 | Director | 2021 | |||||||||||||||||

Ursuline Foley(1)(2) | 61 | Director | 2021 | |||||||||||||||||

Leonard Goldberg(3) | 59 | Director | 2005 | |||||||||||||||||

Victoria Guest(4) | 55 | Director | 2021 | |||||||||||||||||

Ian Isaacs(2) | 67 | Director | 2008 | |||||||||||||||||

Bryan Murphy(2)(3)(4) | 76 | Director | 2008 | |||||||||||||||||

| Joseph Platt | 74 | GLRE Director: 2004 – 2021. Greenlight Re Director: 2004 – present | — | |||||||||||||||||

9

(1) Member of Audit Committee as of April 28, 2022

(2) Member of Compensation Committee as of April 28, 2022

(3) Member of Underwriting Committee as of April 28, 2022

(4) Member of Nominating, Governance and Corporate Responsibility Committee as of April 28, 2022

(2) Member of Compensation Committee as of April 28, 2022

(3) Member of Underwriting Committee as of April 28, 2022

(4) Member of Nominating, Governance and Corporate Responsibility Committee as of April 28, 2022

There is no family relationship among any of the nominees, directors and/or any of the executive officers of the Company.

Each of the nominees have consented to serve as a director of the Company if elected.

Director Nominee Skills and Qualifications

Our Board seeks directors with a broad range of skills, experience and perspectives in order to ensure effective oversight of the Company’s strategies and risks. The Board believes its members must be willing and able to devote adequate time and effort to Board responsibilities. In evaluating director candidates, the Nominating, Governance and Corporate Responsibility Committee evaluates attributes such as independence, integrity, expertise, breadth of experience, diversity, knowledge about the Company’s business and industry and ownership in the Company. The skills matrix below highlights our director nominees’ key skills and qualifications that are directly relevant to our business, strategy and operations. The Board reviews this matrix and the overall Board composition periodically in order to ensure the appropriate balance of diversity, knowledge and experience.

Skills and Qualifications(1) | Simon Burton | David Einhorn | Johnny Ferrari | Ursuline Foley | Leonard Goldberg | Victoria Guest | Ian Isaacs | Bryan Murphy | Joseph Platt | |||||||||||||||||||||||

Insurance/Financial Services Industry Experience promotes our Board’s ability to define and direct our differentiated strategy, evaluate potential transactions, and oversee and strategically guide or management team | ü | ü | ü | ü | ü | ü | ü | ü | ||||||||||||||||||||||||

Senior Leadership Experience enhances our Board’s ability to understand and impact the opportunities and challenges management faces in leading our businesses | ü | ü | ü | ü | ü | ü | ü | ü | ü | |||||||||||||||||||||||

Financial Reporting Expertise strengthens the Board’s oversight of our financial statements and internal controls | ü | ü | ü | ü | ||||||||||||||||||||||||||||

Risk Assessment/Risk Management Experience strengthens the Board’s oversight of complex risks facing the Company | ü | ü | ü | ü | ü | ü | ü | |||||||||||||||||||||||||

Legal/Regulatory Expertise provides the Board with insights into the highly regulated insurance and financial services industries. | ü | ü | ü | ü | ü | ü | ||||||||||||||||||||||||||

10

Public Company Board Experience equips our Board to maintain robust governance and board practices that are designed to put owners first | ü | ü | ü | ü | ||||||||||||||||||||||||||||

Global /International Experience yields an understanding of diverse business environments, economic conditions, and cultural perspectives that informs our global business and strategy and enhances oversight of our multinational operations. | ü | ü | ü | ü | ü | ü | ü | ü | ü | |||||||||||||||||||||||

Cybersecurity/Technology Experience prepares the Board for making decisions in a digital environment and implementing cybersecurity safeguard. | ü | ü | ||||||||||||||||||||||||||||||

(1) The lack of a checkmark for a particular item does not mean that the director does not possess that qualification, skill or experience, but rather the checkmark indicates that the item is a particularly prominent qualification, skill or experience that the director brings to the Board.

Director Nominee Biographical Information

Set forth below is biographical information concerning each nominee for election as a director of the Company, including a discussion of such nominee’s particular experience, qualifications, attributes or skills that lead our Nominating, Governance and Corporate Responsibility Committee and our Board of Directors, or the Board, to conclude that the nominee should serve as a director of the Company. Messrs. Ferrari and Platt and Mses. Foley and Guest were nominated by the Nominating, Governance and Corporate Responsibility Committee, which is composed solely of non-management directors.

11

Simon Burton Age: 51 Director Since: 2017 | Business Experience: Mr. Burton has served as Chief Executive Officer since July 2017 and was also appointed as the Chief Underwriting Officer of the Company and Greenlight Re, effective as of September 4, 2020. From June 2014 until his appointment as our Chief Executive Officer, Mr. Burton participated in a variety of entrepreneurial efforts in the reinsurance and insurance industry. From July 2012 to June 2014, Mr. Burton served as Chief Executive Officer and director of S.A.C. Re, Ltd., or SAC Re, from its inception until its sale to Hamilton Insurance Group, Ltd., where he was responsible, among other things, for building the company’s global reinsurance portfolio. From June 2010 to July 2012, Mr. Burton was involved in the strategic planning, capital raising and formation of SAC Re. Prior to SAC Re, from January 2007 to June 2010, Mr. Burton served in a variety of roles at Lancashire Group, including Deputy Chief Executive Officer and Chief Executive Officer of the company’s Bermuda subsidiary. Mr. Burton also spent 10 years at Financial Solutions International, an underwriting division of ACE Limited, where he eventually rose to the role of President. | ||||||||||||||||||||||

Education: Mr. Burton received his Bachelor of Science degree in Mathematics from Imperial College, London University. | |||||||||||||||||||||||

Qualifications: Mr. Burton has 25 years of reinsurance underwriting and business experience. As Greenlight Re’s Chief Executive Officer and Chief Underwriting Officer, together with his extensive senior management experience in the international insurance and reinsurance industry, Mr. Burton has extensive knowledge of the Company’s culture, underwriting portfolio and Innovations unit, and our strategic opportunities and challenges. | |||||||||||||||||||||||

David Einhorn Age: 53 Director Since: 2004 | Business Experience: Mr. Einhorn has been Chair of our Board since August 6, 2004. Mr. Einhorn also has served as a director of Greenlight Re since 2004. Mr. Einhorn co-founded, and has served as the President of, Greenlight Capital, Inc., since January 1996. Mr. Einhorn serves as President of DME Advisors, LP, or DME Advisors, the investment advisor of Solasglas Investments in which the Company invests. Greenlight Capital, Inc. and DME Advisors are affiliates of the Company. | ||||||||||||||||||||||

Education: Mr. Einhorn graduated summa cum laude with distinction from Cornell University in 1991 where he earned a B.A. from the College of Arts and Sciences. | |||||||||||||||||||||||

Directorships: Since April 2006, Mr. Einhorn has served as a director of Green Brick Partners, Inc. (Nasdaq: GRBK). | |||||||||||||||||||||||

Qualifications: Mr. Einhorn’s business acumen, public company board experience, extensive investment experience and share ownership provides valuable strategic leadership to the Company. | |||||||||||||||||||||||

12

Johnny Ferrari Age: 54 Director Since: 2021 | Business Experience: Mr. Ferrari is currently a consultant to companies in the financial services industry after having retired from KPMG International, or KPMG, in June 2021. Prior to his retirement, Mr. Ferrari specialized in providing audit services to companies in the banking, insurance and asset management industries. Mr. Ferrari held multiple roles for KPMG and its member firms including serving as a member of the Global Monitoring Group for KPMG International from July 2017 to June 2021, Chief Operating Officer for Audit Quality for KPMG EMA Region from October 2019 to June 2021 and as an Audit Partner for KPMG Cayman Islands from October 2003 to September 2019, including serving as Partner in Charge of Risk Management from October 2012 to September 2019. Mr. Ferrari also served as a member of KPMG’s Executive Management Committee and participated on the Audit Quality Professional Practice Steering Committee from October 2012 to September 2019. Mr. Ferrari has significant experience in the preparation of financial statements in accordance with United States and International generally accepted accounting principles. | ||||||||||||||||||||||

Education: Mr. Ferrari holds a Bachelor’s degree from the University of Toronto. Mr. Ferrari is a member of the Chartered Professional Accountants of Ontario and Cayman Islands Institute of Professional Accountants. | |||||||||||||||||||||||

Qualifications: Mr. Ferrari’s international audit, accounting, regulatory and operational experience, as well as his deep familiarity with the financial services industry, adds financial expertise, compliance risk oversight and leadership to the Board. | |||||||||||||||||||||||

13

Ursuline Foley Age: 61 Director Since: 2021 | Business Experience: From April 2016 until her retirement in October 2018, Ms. Foley served as Chief Corporate Operations Officer and Managing Director of XL Group PLC, a global provider of commercial insurance and reinsurance, which became AXA XL in September 2018. From 2010 to April 2016, Ms. Foley served as Chief Information Officer, Chief Data Officer (Enterprise Enablement Strategy) for XL Group PLC. Ms. Foley has also served in other senior roles for XL Group PLC, including Senior Vice President, Chief Information Officer of Reinsurance for the Property and Casualty, Life and Financial Lines for XL Reinsurance. | ||||||||||||||||||||||

Education: Ms. Foley graduated from University College Cork, where she earned a Bachelor’s degree in 1982 and a Teaching Diploma in 1983, and from Pace University, where she earned a Masters of Computer Science in 1981. Ms. Foley also holds certificates from Babson University in Technology Leadership, the NYC College of Finance and NYC College of Insurance. | |||||||||||||||||||||||

Directorships: Ms. Foley currently serves on the board of directors of Provident Financial Services, Inc. (NYSE: PFS) and Provident Bank and is a member of the Risk and Technology committees. Ms. Foley also serves as a director of DOCOsoft Ltd., a software company providing claims management, document management and workflow software solutions for the global insurance and financial services markets. Ms. Foley also currently serves on several advisory and non-profit boards of directors. | |||||||||||||||||||||||

Qualifications: Ms. Foley possesses substantial executive leadership skills and valuable operational, cyber, risk and technology insights into global business strategy. Her other significant public and private company board experience enhances our governance structure and broadens the Board’s perspectives. | |||||||||||||||||||||||

14

Leonard Goldberg Age: 59 Director Since: 2005 | Business Experience: Mr. Goldberg serves as President of Len Goldberg Inc., a consulting firm providing services to the insurance industry and as an executive advisor to a private equity firm investing in the insurance industry. He served as our interim Chief Executive Officer from March 31, 2017 through June 30, 2017 and as our as Chief Executive Officer of our Company from August 2005 through August 2011. Mr. Goldberg has more than 30 years of insurance and reinsurance experience. He worked with the Alea Group, a reinsurance company, from August 2000 to August 2004, including serving as Chief Executive Officer of Alea North America Insurance Company and Alea North America Specialty Insurance Company from March 2002 to August 2004, where he was responsible for the insurance and reinsurance strategy for the North America region. Prior to working with the Alea Group, Mr. Goldberg served as Chief Actuary and Senior Vice President – Financial Products of Custom Risk Solutions, a managing general agency company, from April 1999 to August 2000. From May 1995 to December 1998, Mr. Goldberg provided various actuarial services to Zurich Group, a reinsurance company, including acting as chief actuary of Zurich Re London. | ||||||||||||||||||||||

Education: Mr. Goldberg received his B.A. in Mathematics from Rutgers University in 1984 and Masters in Business Administration, Finance Concentration, from Rutgers Executive MBA program in 1993 and is a Fellow of the Casualty Actuarial Society and a member of the American Academy of Actuaries. | |||||||||||||||||||||||

Directorships: Mr. Goldberg currently sits on the board of directors of Transverse Insurance Group, Transverse Insurance Company and Transverse Specialty Insurance Company. | |||||||||||||||||||||||

Qualifications: Mr. Goldberg’s prior experience as Chief Executive Officer of the Company, as well as his significant underwriting and actuarial expertise and business experience, provides him with deep familiarity the reinsurance industry. Mr. Goldberg’s multilayered understanding of our Company and the reinsurance industry brings valuable insights to our Board. | |||||||||||||||||||||||

15

Victoria Guest Age: 55 Director Since: 2021 | Business Experience: Ms. Guest was General Counsel and Corporate Secretary of Hamilton Insurance Group, Ltd., a Bermuda-based holding company for insurance and reinsurance operations, from December 2013 until retirement in November 2017. From July 2012 to December 2013, Ms. Guest was General Counsel and Corporate Secretary of SAC Re Holdings, Ltd, a Bermuda-based reinsurer. Ms. Guest has also served as General Counsel and Corporate Secretary of Ariel Holdings, Ltd. from July 2009 to June 2012 and RAM Holdings, Ltd. from January 2006 to June 2009. Prior to 2006, Ms. Guest was a corporate associate with New York City based law firms. | ||||||||||||||||||||||

Education: Ms. Guest has a Juris Doctor from Harvard Law School and a Bachelor of Arts from Stanford University. | |||||||||||||||||||||||

Directorships: Ms. Guest served on the board of directors of Ram Reinsurance Company Ltd. Ms. Guest currently serves on the board of directors of The Bessemer Group, Incorporated and its principal subsidiary banks, and the board of managers/directors of Bessemer Securities LLC and its principal subsidiary. | |||||||||||||||||||||||

Qualifications: Ms. Guest brings to our Board significant legal, insurance regulatory and governance expertise gained from years of in-house and private practice experience. Her professional experience, including serving on the board of a multi-family office that oversees more than $140 billion in assets, and seasoned judgment provides significant value in assessing risk and overseeing strategy and compliance matters. | |||||||||||||||||||||||

Ian Isaacs Age: 67 Director Since: 2008 | Business Experience: Since August 2015, Mr. Isaacs has served as Managing Member of Katonah Research LLC, a firm which provides market intelligence to professional investors. From September 2012 to April 2015, Mr. Isaacs served as a senior partner at Gagnon Securities, a New York-based broker dealer where his duties included providing portfolio analytics and market intelligence to institutional investors. Previously, from April 2008 to July 2012, Mr. Isaacs served as a senior partner at Merlin Securities, a San Francisco-based broker dealer. Mr. Isaacs previously served as a director of our Board from its founding in July 2004 until February 2007. Mr. Isaacs stepped down from the Board in February of 2007, due to his then-current employer’s policy prohibiting its employees from serving on boards of publicly-traded companies. Mr. Isaacs rejoined the Board in May 2008, shortly after joining Merlin Securities. Mr. Isaacs also has served as a director of Greenlight Re since 2008. Previously, from July 2000 to March 2008, Mr. Isaacs served as a Senior Vice President, Investments, with UBS Financial Services, a subsidiary of UBS AG, a Zurich-based investment bank. At UBS Financial Services and Merlin Securities, Mr. Isaacs conducted market research for institutional investors, including Greenlight Capital, Inc. | ||||||||||||||||||||||

Education: Mr. Isaacs holds a Bachelor of Arts from Carleton College. | |||||||||||||||||||||||

Qualifications: Mr. Isaacs brings significant experience in the securities business, including experience evaluating business models and executive strategy. His financial investment experience and expertise provides valuable insight into our alternative asset strategy. | |||||||||||||||||||||||

16

Bryan Murphy Age: 76 Director Since: 2008 | Business Experience: Mr. Murphy has served on our Board since 2008 and has served as the Chair of the Board of GRIL since December 5, 2018. From 1996 until his retirement in December 2007, Mr. Murphy served as a founding director and Chief Executive Officer of Island Heritage Holdings Ltd., a Cayman Islands based property, liability and automobile insurer. Prior to Island Heritage, Mr. Murphy acted as a consultant to Trident Partnership from 1994 to 1996 and was employed by International Risk Management Group from 1978 to 1994. Mr. Murphy has over 40 years’ experience in the insurance business and has held senior positions in several countries, including the Cayman Islands, Ireland, Ethiopia and Saudi Arabia. | ||||||||||||||||||||||

Education: Mr. Murphy holds a degree in Economics and Mathematics from University College, Dublin, Ireland. | |||||||||||||||||||||||

Directorships: From 2014 to 2016, Mr. Murphy served on the board of directors of Bahamas First General Insurance Co., a company that provides general insurance coverage in the Bahamas. Mr. Murphy currently serves on the board of directors of Montgomery Insurance Company and Cayman First Insurance Company Ltd. | |||||||||||||||||||||||

Qualifications: Mr. Murphy brings substantial executive experience through which he has gained valuable operational insights and strategic and long-term planning capabilities. He possesses extensive international business management experience in the insurance and reinsurance industry, which provides our Board with valuable insights into global business strategy. | |||||||||||||||||||||||

17

Joseph Platt Age: 74 Director Nominee Director: 2004-2021 | Business Experience: Mr. Platt is an active investor as the general partner at Thorn Partners, LP, a family limited partnership, since 1997. Mr. Platt’s career at Johnson and Higgins, or J&H, a global insurance broker and employee benefits consultant, spanned 27 years until the sale of J&H to Marsh & McLennan Companies in March 1997. At the time of the sale of J&H, Mr. Platt was an owner, director and executive vice president responsible for North America and marketing and sales worldwide. Mr. Platt was head of the operating committee and a member of the executive committee at J&H. | ||||||||||||||||||||||

Education: Mr. Platt received his B.A. from Manhattan College in 1968 and his J.D. from Fordham University Law School in 1971. Mr. Platt also attended Harvard Business School’s Advanced Management Program in 1983. Mr. Platt is a member of the New York State Bar Association. | |||||||||||||||||||||||

Directorships: Mr. Platt serves as a Trustee of the BlackRock Multi Asset Board (MAB) Funds. He also serves as a Director of CONSOL Energy Inc. (NYSE: CEIX), a NYSE listed coal company. From 2004 to May 2021, he served on the Board of the Company. | |||||||||||||||||||||||

Qualifications: Mr. Platt has substantial executive experience, insurance industry knowledge and compensation and benefits expertise. Having served as the lead director of our Board from 2004 to 2021, he adds to the mix of experiences on our Board that promote a robust and deliberative decision-making process. His prior leadership roles with the Company, as well as experiences and leadership roles with other public companies in other industries, enable him to provide valuable contributions and diverse perspective to our Board and its committees. | |||||||||||||||||||||||

CORPORATE GOVERNANCE AND BOARD OF DIRECTORS AND COMMITTEES

Board Leadership Structure

Our Board is committed to objective, independent leadership and views independent oversight as central to effective Board governance, serving the interests of our shareholders and other stakeholders, and to executing on our strategic objectives and creating long term value.

Since the Company’s formation in 2004, the Company has separated the positions of Chair of the Board and Chief Executive Officer. David Einhorn, who, through an affiliate, sponsored the Company and is the President of DME Advisors, the investment advisor of Solasglas Investments, LP, or SILP, in which each of Greenlight Reinsurance and GRIL is a limited partner, has served as Chair of the Board since August 2004. Since July 1, 2017, Mr. Simon Burton has served as Chief Executive Officer of the Company. The Board has historically had a Lead Director, which position has been vacant since the Annual General Meeting of Shareholders held on May 4, 2021. The Board expects to fill the Lead Director position promptly following the Meeting.

We believe it is the Chair of the Board’s responsibility to run the Board, the lead director’s responsibility to provide independent oversight and chair executive sessions of the Board and the Chief Executive Officer’s responsibility to run the Company. We believe it is beneficial to have a Chair of the Board who can concentrate on leading the Board and not have to be involved in the day-to-day operations of the Company and a Lead Director who can focus on chairing meetings of the independent directors, including executive sessions, and ensure that the concerns of the independent directors are heard. In the absence of the Lead Director, the Board has continued to hold separate executive sessions with its independent directors.

By having three different individuals serve as Chair of the Board, Lead Director and Chief Executive Officer, our Chief Executive Officer is able to focus the vast amount of his time and energy in running the Company and furthering its operational business strategy. We believe our board leadership structure with a Chair of the Board with significant investment

18

experience and expertise, an independent Lead Director with significant board experience and a Chief Executive Officer with significant leadership and management experience and expertise, complements our underwriting and investment strategies and helps us to further our business strategy and objectives.

We currently have seven independent directors and two non-independent directors. The non-independent directors are David Einhorn, Chair of the Board, and Simon Burton, our Chief Executive Officer and Chief Underwriting Officer. Our current independent directors are Alan Brooks, Johnny Ferrari, Ursuline Foley, Leonard Goldberg, Victoria Guest, Ian Isaacs, and Bryan Murphy. Alan Brooks is not standing for reelection to the Board or the board of directors of Greenlight Re, but was an independent director during the term of his service in 2021; director nominee Joseph Platt is also independent. We currently have an Audit Committee, a Compensation Committee and a Nominating, Governance and Corporate Responsibility Committee, each of which is composed solely of independent directors, as well as an Underwriting Committee. Our Board is committed to maintaining a majority independent Board and believes that the number of independent, experienced directors on our Board provides the necessary and appropriate oversight for our Company.

Alternate Director

Section 14 of the Articles provides that any director (other than an alternate director) may, by writing, appoint any other director, or any other person willing to act, to be an alternate director for such director and, by writing, may remove from office an alternate director so appointed by him or her. We anticipate that Mr. Einhorn, if re-elected, will continue to appoint Daniel Roitman as his alternate director. Mr. Roitman has served as Chief Operating Officer and partner of Greenlight Capital, Inc. since January 2003. From 1996 through 2002, Mr. Roitman served as a vice president at Goldman Sachs. Before joining Goldman Sachs, Mr. Roitman was employed as a member of the New York technology practice at Andersen Consulting, now Accenture. Mr. Roitman earned a B.S. with distinction in electrical engineering from Cornell University in 1991 and a Master of Engineering in 1992. Mr. Roitman graduated with distinction from the New York University Stern School of Business in 2002, earning an MBA in Finance.

Board and Committee Risk Oversight

The Board provides oversight with respect to the Company’s risk assessment and risk management duties, which are designed to identify, prioritize, assess, monitor, address and mitigate material risks to the Company, including strategic, operational, compliance, public reporting, cybersecurity, technology, financial, underwriting, legal, regulatory, tax, compensatory and ESG risks. The Board administers oversight function at the Board level and through the Audit Committee, the Underwriting Committee, the Compensation Committee and the Nominating, Governance and Corporate Responsibility Committee. The Board oversees strategic, operational and compliance risks.

Each of the Audit Committee, the Compensation Committee, the Underwriting Committee and the Nominating, Governance and Corporate Responsibility Committee is responsible for discussing certain guidelines and policies with management that govern the process by which risk assessment and control is handled.

19

| Committee Roles in Risk Oversight | |||||||||||||||||

| Audit Committee | Assists the Board in its oversight responsibilities regarding: •the integrity of the Company’s financial statements; •the Company’s compliance with legal and regulatory requirements; •the Company’s accounting, auditing and financial reporting processes generally; •the independent auditor’s qualifications, independence and performance; and •the Company’s systems of internal controls regarding finance and accounting. Discusses with management the policies with respect to risk assessment and risk. Oversees related party transactions. | ||||||||||||||||

| Compensation Committee | Assists the Board in ensuring that: •a proper system of long-term and short-term compensation is in place to provide performance-oriented incentives to management; and •compensation plans are appropriate and competitive and properly reflect the objectives and performance of management and the Company. | ||||||||||||||||

| Underwriting Committee | Assists the Board in its oversight responsibilities by: •establishing and reviewing our underwriting policies and guidelines; •overseeing our underwriting process and procedures; •monitoring our underwriting performance; and •overseeing our underwriting risk management exposure. | ||||||||||||||||

| Nominating, Governance and Corporate Responsibility Committee | Assists the Board in its oversight responsibilities by: •overseeing the evaluation of the Board’s performance, Board composition and skillset, refreshment and committee leadership; •evaluating the Company’s governance practices and monitoring shareholder feedback; •reviewing, evaluating and monitoring succession planning for senior management and the Board; and •reviewing the Company’s operations and business practices with respect to issues including the environment, health, safety, corporate citizenship, public policy and community involvement. | ||||||||||||||||

The Company’s senior management is responsible for the day-to-day management of the risks facing the Company, including strategic, operational, compliance, public reporting, data security, financial, underwriting, legal, regulatory, tax, ESG and reputational risks. Management carries out this risk management responsibility through a coordinated effort among the various risk management functions within the Company and reports to the Board and its committees, as appropriate.

Board and Committee Meetings

Our Board has four standing committees: an Audit Committee, a Compensation Committee, a Nominating, Governance and Corporate Responsibility Committee and an Underwriting Committee. Each committee has a written charter. See table under “Director Nominees” for current membership of each committee as of the date of this proxy statement and fiscal year 2021 meeting information for each of the Board committees.

We had four (4) meetings of the Board of Directors in 2021. Each of our directors, attended in person at least 75% of the aggregate of the total meetings of the Board of Directors and any committee on which they served in 2021. All of our then-serving directors attended our 2021 annual general meeting of shareholders which was held on May 4, 2021.

20

Members of the Audit Committee, Compensation Committee and Nominating, Governance and Corporate Responsibility Committee must meet all applicable independence tests of the Nasdaq stock market rules and the applicable rules and regulations promulgated by the SEC. Each member of the Audit Committee, Compensation Committee, Nominating, Governance and Corporate Responsibility Committee and Underwriting Committee is appointed by our Board and recommended for such nominations by our Nominating, Governance and Corporate Responsibility Committee.

| AUDIT COMMITTEE | ||||||||||||||

Members: •Alan Brooks, chair and financial expert as defined under the rules of the SEC. •Johnny Ferrari, financial expert as defined under the rules of the SEC •Ursuline Foley Number of Meetings in 2021: 5 The Audit Committee is currently composed entirely of non-management directors, each of whom the Board has determined is independent in accordance with the Nasdaq stock market rules and applicable rules and regulations promulgated under the Securities Exchange Act of 1934, as amended, or the Exchange Act. The Audit Committee is governed by a written charter approved by our Board, which outlines its primary duties and responsibilities and which can be found on our website at www.greenlightre.com. | Purpose: To oversee the accounting and financial reporting processes of the Company and the audit of the Company’s financial statements. Primary Responsibilities: •Assist the Board in oversight of the Company’s financial statements, including the Company’s systems of internal controls regarding finance and accounting. •Assist the Board in its oversight of the independent auditor’s qualifications, independence and performance. •Oversee the appointment, compensation, retention and work of the Company’s independent registered public accounting firm. •Assist the Board with oversight of the compliance of the Company with legal and regulatory requirements. •Prepare the Audit Committee report to be included in the Company’s annual proxy statement. | |||||||||||||

21

| COMPENSATION COMMITTEE | ||||||||||||||

Members: •Ian Isaacs, chair •Bryan Murphy •Ursuline Foley Number of Meetings in 2021: 4 All of the members of our Compensation Committee are independent as defined under the Nasdaq stock market rules and applicable SEC rules and regulations. Our Compensation Committee has the authority to delegate its responsibilities to a subcommittee or to officers of the Company to the extent permitted by applicable law and the compensation plans of the Company if it determines that such delegation would be in the best interest of the Company. The Compensation Committee is governed by a written charter approved by our Board, which outlines its primary duties and responsibilities and which can be found on our website at www.greenlightre.com. | Purpose: To discharge the responsibilities of our Board relating to compensation of our executive officers. Primary Responsibilities: •Establish, in consultation with senior management, the Company’s general compensation philosophy and objectives. •Review and approve the Company’s goals and objectives relevant to the compensation of the CEO, annually evaluate the CEO’s performance and determine the CEO’s compensation level based on this evaluation. •Review and makes recommendations to the Board with respect to the compensation of the Company’s executive officers. •Review and make recommendations to the Board regarding the general compensation and benefits policies and practices of the Company. •Review and make periodic recommendations to the Board as to director compensation and benefit policies. •Prepare the Compensation Committee Report to be included in the Company’s annual proxy statement. | |||||||||||||

22

| NOMINATING, GOVERNANCE AND CORPORATE RESPONSIBILITY COMMITTEE | ||||||||||||||

Members: •Bryan Murphy, chair •Alan Brooks •Victoria Guest Number of Meetings in 2021: 4 All of the members of our Nominating, Governance and Corporate Responsibility Committee are independent as defined under the Nasdaq stock market rules and applicable SEC rules and regulations. The Nominating, Governance and Corporate Responsibility Committee makes recommendations to our Board as to nominations and compensation for our Board and committee members, as well as structural, governance and procedural matters. The Nominating, Governance and Corporate Responsibility Committee is governed by a written charter approved by our Board, which outlines its primary duties and responsibilities and which can be found on our website at www.greenlightre.com. | Purpose: To assist the Board in identifying individuals qualified to serve as members of the Board, develop and recommend to the Board a set of corporate governance guidelines, including ESG practices, oversee the evaluation of the Board and evaluate and monitor succession planning for the Company’s senior management. Primary Responsibilities: •Identify individuals qualified to become Board Members and assess the diversity of the Board. •Recommend to the Board the director nominees for election each meeting of the shareholders at which directors will be elected and recommend to the Board nominees to fill any vacancies and newly created directorships on the Board. •Determine and monitor whether or not each director and prospective director is “independent” and ensure that a majority of the Board is “independent”. •Develop and recommend to the Board a set of corporate governance guidelines, including evolving ESG best practices. •Oversee the evaluation of the Board. •Annually recommend to the Board the chairs and members of each of the Board’s committees. •Reviews the performance of our Board and the Company’s succession planning. | |||||||||||||

23

| UNDERWRITING COMMITTEE | ||||||||||||||

Members: •Bryan Murphy, chair •David Einhorn •Leonard Goldberg •Simon Burton Number of Meetings in 2021: 4 The Underwriting Committee, among other things, establishes and reviews our underwriting policies and guidelines, oversees our underwriting process and procedures, monitors our underwriting performance and oversees our underwriting risk management exposure. | Purpose: To advise the Board and management concerning the establishment and review of each of the Company’s underwriting policies and guidelines and oversee and monitor the Company’s underwriting processes, performance, and risk management exposure. Primary Responsibilities: •Approve and periodically review the Company’s underwriting guidelines and policies. •Review compliance with underwriting guidelines and policies and outwards reinsurance programs and practices. •Review the performance of major business sectors, large single risks and correlated aggregated risks to determine current risk profile. •Monitor the Company’s major risk exposures and underwriting function. •Evaluate the Company’s professional and development plans for key reinsurance underwriting and actuarial functions. | |||||||||||||

Independence

The Nominating, Governance and Corporate Responsibility Committee and the Board of Directors have reviewed the responses of nominees to a questionnaire asking about their relationships (and those of immediate family members) with the Company and other potential conflicts of interest and have reviewed Nasdaq National Market Place Rule 5605, or Rule 5605, in determining the independence of each director nominee.

Certain of our directors or director nominees have invested or are invested in funds managed by Greenlight Capital, Inc. or its affiliates. We refer to these funds as the Greenlight Funds. Each of the Greenlight Funds is an affiliate of DME Advisors, the investment advisor of SILP, in which the Company invests. DME Advisors receives significant fees from SILP. DME Advisors is an affiliate of David Einhorn, the Chair of the Board, and Mr. Einhorn has been deemed to not be independent due to his relationship with DME Advisors. As of December 31, 2022, Joseph Platt and Ian Isaacs were both limited partners in the Greenlight Funds, but do not directly or indirectly benefit from the advisory fees payable to DME Advisors from SILP. In determining whether each of Messrs. Platt and Isaacs is independent, the Nominating, Governance and Corporate Responsibility Committee considered his respective limited partner interest in the Greenlight Funds, other relationship with Mr. Einhorn, including charitable giving, and the fact that over the last three fiscal years no director received any compensation or other special benefits from the Greenlight Funds or DME Advisors. Under Rule 5605, the Nominating, Governance and Corporate Responsibility considered the investments of Messrs. Platt and Isaacs in the Greenlight Funds, and ultimately determined that such investments would not interfere with their respective ability to exercise independent judgment in carrying out the responsibilities as a director of the Company.

Further, in determining whether Ms. Guest is independent, the Nominating, Governance and Corporate Responsibility Committee considered Ms. Guest’s prior working relationship with Mr. Burton as SAC Re and determined that such relationship would not interfere with her ability to exercise independent business judgment in carrying out the responsibilities as a director of the Company.

The Nominating, Governance and Corporate Responsibility Committee considered that Mr. Goldberg was the chief executive officer of the Company from 2005 to 2011 and the interim chief executive officer in 2017 and that Institutional Shareholder Services does not, pursuant to its own voting guidelines, deem Mr. Goldberg to be independent. Notwithstanding, the Nominating, Governance and Corporate Responsibility Committee determined that Mr. Goldberg is independent pursuant to Rule 5605.

24

| Director or Director Nominee | Independent | Material Transactions and Relationships | ||||||||||||

Alan Brooks(1) | Yes | None | ||||||||||||

| Simon Burton | No | Chief Executive Officer and Chief Underwriting Officer of the Company and Greenlight Re | ||||||||||||

| David Einhorn | No | President of Greenlight Capital, Inc. and DME Advisors | ||||||||||||

| Johnny Ferrari | Yes | None | ||||||||||||

| Ursuline Foley | Yes | None | ||||||||||||

| Leonard Goldberg | Yes | None | ||||||||||||

| Victoria Guest | Yes | None | ||||||||||||

| Ian Isaacs | Yes | None | ||||||||||||

| Bryan Murphy | Yes | None | ||||||||||||

| Joseph Platt | Yes | None | ||||||||||||

(1) Mr. Brooks is not standing for re-election.

Board Diversity

Our Nominating, Governance and Corporate Responsibility Committee seeks diverse skills sets and perspectives in order to provide representation of varied backgrounds, perspective and expertise to support the demands of our business. In 2021, three new directors were added to our Board, two of whom are female.

We believe that our current directors bring a diverse set of skills and experience, as well as age, cultural and geographic diversity to the Company that are important to the execution of our strategic goals. When seeking new director candidates, our Nominating, Governance and Corporate Responsibility Committee considers a candidate’s business and professional experience, as well as their gender, racial and geographic diversity.

For an in-depth look at our director nominee’s skills and experience, refer to the skills matrix under “Proposal One — Election of Directors of the Company — Director Nominee Skills and Qualifications.” Among our nine nominees for election to our Board, two nominees self-identify as female and the alternate director self-identified as Hispanic.

25

| Board Diversity Matrix (as of April 27, 2022) | ||||||||||||||

| Total Number of Directors | 10(1) | |||||||||||||

| Part I. Gender Identity | ||||||||||||||

| Female | Male | Non-Binary | Did Not Disclose Gender | |||||||||||

| Directors | 2 | 8 | - | 0 | ||||||||||

| Part II. Demographic Background | ||||||||||||||