Form DEF 14A GLAUKOS Corp For: Jun 02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Under §240.14a-12 |

| |

GLAUKOS CORPORATION | ||

(Name of Registrant as Specified In Its Charter) | ||

Not applicable | ||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

Payment of Filing Fee (Check all boxes that apply): | ||

☒ | No fee required | |

☐ | Fee paid previously with preliminary materials. | |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Thursday, June 2, 2022

9:00 a.m. Pacific Time

| | |

How to Participate: |

| Our annual meeting will be a completely virtual meeting of stockholders. To participate, vote or submit questions during the annual meeting via live audio webcast, please visit: www.virtualshareholdermeeting.com/GKOS2022. You will not be able to attend the annual meeting in person. |

Items of Business: | | (1) Elect the three Class I director nominees named in the accompanying Proxy Statement to serve as directors until the Company’s 2025 annual meeting of stockholders and until their respective successors are duly elected and qualified; (2) Approve, on an advisory basis, the compensation of the Company’s named executive officers; (3) Ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2022; and (4) Transact such other business as may properly come before the meeting or any postponements or adjournments thereof. |

Who May Vote: | | Stockholders of record at the close of business on April 6, 2022. |

STOCKHOLDER LIST: | | A list of stockholders as of the record date for the annual meeting may be accessed during the virtual annual meeting at www.virtualshareholdermeeting.com/GKOS2022 by using the control number on your Notice of Internet Availability of Proxy Materials, or on your proxy card or voting instruction form that accompanied your proxy materials. |

Your vote is important to us. Whether or not you expect to attend the annual meeting via live audio webcast, please submit a proxy or your voting instructions as soon as possible to instruct how your shares are to be voted at the annual meeting. If you participate in and vote your shares at the annual meeting, your proxy or voting instructions will not be used.

| By Order of the Board of Directors, |

| |

|

|

| Thomas W. Burns |

Chairman & Chief Executive Officer |

April 19, 2022

Forward-Looking Statements.

All statements other than statements of historical facts included in this Proxy Statement that address activities, events or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements. Although we believe that we have a reasonable basis for forward-looking statements contained herein, we caution you that they are based on current expectations about future events affecting us and are subject to risks, uncertainties and factors relating to our operations and business environment, all of which are difficult to predict and many of which are beyond our control, that may cause our actual results to differ materially from those expressed or implied by forward-looking statements in this Proxy Statement. These potential risks and uncertainties include, without limitation, uncertainties regarding the duration and severity of the COVID-19 pandemic and its impact on our business or the economy generally; the reduced physician fee and ASC facility fee reimbursement rate finalized by the U.S. Centers for Medicare & Medicaid Services for 2022 for procedures utilizing our iStent family of products and its impact on our U.S. combo-cataract glaucoma revenue; our ability to continue to generate sales of our commercialized products and develop and commercialize additional products; our dependence on a limited number of third-party suppliers, some of which are single-source, for components of our products; the occurrence of a crippling accident, natural disaster, or other disruption at our primary facility, which may materially affect our manufacturing capacity and operations; securing or maintaining adequate coverage or reimbursement by third-party payors for procedures using the iStent, the iStent inject, the iStent inject W, our corneal cross-linking products or other products in development; our ability to properly train, and gain acceptance and trust from ophthalmic surgeons in the use of our products; our ability to compete effectively in the medical device industry and against current and future competitors (including Micro-Invasive Glaucoma Surgery competitors); our compliance with federal, state and foreign laws and regulations for the approval and sale and marketing of our products and of our manufacturing processes; the lengthy and expensive clinical trial process and the uncertainty of timing and outcomes from any particular clinical trial or regulatory approval processes; the risk of recalls or serious safety issues with our products and the uncertainty of patient outcomes; our ability to protect, and the expense and time-consuming nature of protecting our intellectual property against third parties and competitors and the impact of any claims against us for infringement or misappropriation of third party intellectual property rights and any related litigation; and our ability to service our indebtedness. These and other known risks, uncertainties and factors related to Glaukos and our business are described in detail under the caption “Risk Factors” and elsewhere in our Annual Report on Form 10-K for the year ended December 31, 2021, which was filed with the Securities and Exchange Commission on February 28, 2022.Our filings with the Securities and Exchange Commission are available in the Investor Section of our website at www.glaukos.com or at www.sec.gov. In addition, information about the risks and benefits of our products is available on our website at www.glaukos.com. We do not undertake any obligation to update, amend or clarify these forward-looking statements whether as a result of new information, future events or otherwise, except as may be required under applicable securities law.

229 Avenida Fabricante

San Clemente, California 92672

PROXY STATEMENT

Annual Meeting of Stockholders

To Be Held June 2, 2022

Our Board of Directors is soliciting your proxy for the 2022 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Thursday, June 2, 2022, at 9:00 a.m. Pacific Time, and at any and all postponements or adjournments of the Annual Meeting, for the purposes set forth in the Notice of Annual Meeting of Stockholders accompanying this Proxy Statement. This Proxy Statement and our 2021 Annual Report on Form 10-K for the year ended December 31, 2021 (the “2021 Annual Report”) are first being made available to stockholders on or about April 19, 2022.

We will be hosting the Annual Meeting via live audio webcast on the Internet. Any stockholder can listen to and participate in the Annual Meeting live via the Internet at www.virtualshareholdermeeting.com/GKOS2022. Stockholders may vote and ask questions while connected to the Annual Meeting on the Internet.

You will not be able to attend the Annual Meeting in person.

Unless the context otherwise requires, references in this Proxy Statement to “Company,” “we,” “our,” “us,” and similar terms refer to Glaukos Corporation, a Delaware corporation. In addition, all references to our website in this Proxy Statement are provided for convenience only and the content on our website does not constitute a part of this Proxy Statement.

GLAUKOS CORPORATION | 2022 PROXY STATEMENT 1 | ||

Annual Meeting of Stockholders

|

|

|

TIME AND DATE | PLACE | RECORD DATE |

9:00 a.m. Pacific Time on Thursday, June 2, 2022 | The Annual Meeting will be hosted | April 6, 2022 |

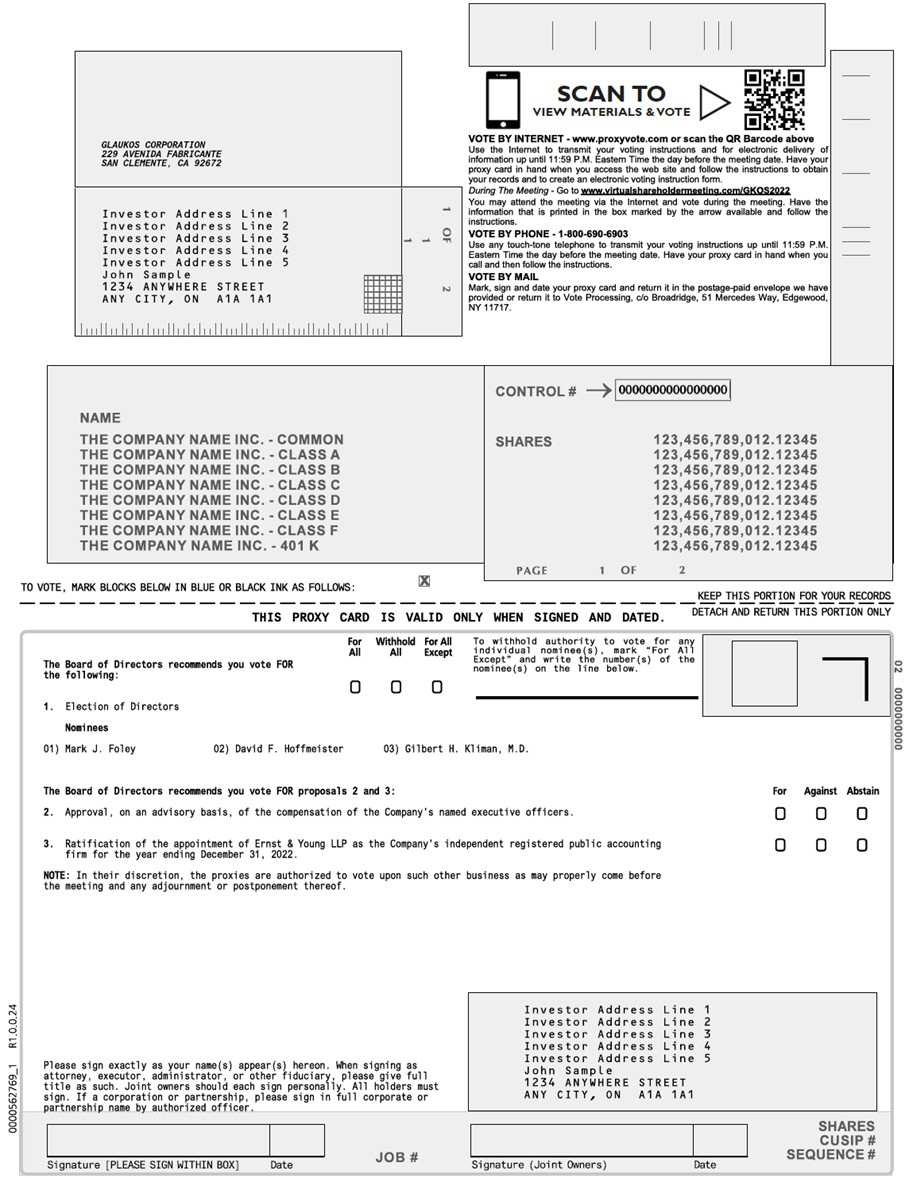

How to Vote

Stockholders as of the close of business on the record date are entitled to vote. If you are a beneficial owner who owns shares of our common stock registered in the name of a broker, bank or other nominee, please follow the instructions they provide on how to vote your shares. Stockholders of record may vote as follows:

Before the Meeting:

By Telephone. Vote by telephone by calling 1-800-690-6903. |

Via the Internet. Vote by Internet at |

By Mail. Complete and return each proxy card received in the prepaid envelope. |

During the Meeting:

Via the Internet. Vote during the meeting by Internet at www.virtualshareholdermeeting.com/GKOS2022. | |

Voting Matters

PROPOSALS | | BOARD | ||

| | | | |

2 | | Approve, on an Advisory Basis, the Compensation of the Company’s Named Executive Officers. | | FOR |

| | | | |

3 | | Ratification of Independent Registered Public Accounting Firm | | FOR |

2 2022 PROXY STATEMENT | GLAUKOS CORPORATION | ||

We will be hosting the Annual Meeting live via the Internet. You will not be able to attend the Annual Meeting in person. Any stockholder can listen to and participate in the Annual Meeting live via the Internet at www.virtualshareholdermeeting.com/GKOS2022. Our Board annually considers the appropriate format of our annual meeting. The virtual meeting will allow our stockholders to attend and participate from any location around the world. This format will enhance stockholder access and encourage participation and communication with our Board of Directors and management.

The Annual Meeting webcast will begin promptly at 9:00 a.m., Pacific Time. We encourage you to access the Meeting webcast prior to the start time. Online check-in will begin, and stockholders may begin submitting written questions, at 8:45 a.m., Pacific Time, and you should allow ample time for the check-in procedures.

Benefits of a Virtual Annual Meeting

We are embracing technology to provide expanded access, improved communication, reduced environmental impact and cost savings for our stockholders and the Company. Hosting a virtual meeting enables increased stockholder attendance and participation since stockholders can participate and ask questions from any location around the world, and provides us an opportunity to give thoughtful responses. In addition, we intend that the virtual meeting format provide stockholders a similar level of transparency to the traditional in-person meeting format and we take steps to ensure such an experience. Our stockholders will be afforded the same opportunities to participate at the virtual Annual Meeting as they would at an in-person annual meeting of stockholders.

Attendance at the Virtual Annual Meeting

You will need the control number included on your Notice of Internet Availability or your proxy card or voting instruction form (if you received a printed copy of the proxy materials) or included in the email to you if you received the proxy materials by email in order to be able to vote your shares or submit questions during the Annual Meeting. Instructions on how to connect to the Annual Meeting and participate via the Internet are posted at www.virtualshareholdermeeting.com/GKOS2022. If you do not have your control number, you will be able to access and listen to the Annual Meeting but you will not be able to vote your shares or submit questions during the Annual Meeting.

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting or submitting questions. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the virtual meeting web portal.

Questions at the Virtual Meeting

Our virtual Annual Meeting allows stockholders to submit questions and comments during the 15 minutes before the meeting and during the meeting. After the meeting, we will spend up to 15 minutes answering stockholder questions that comply with the meeting rules of conduct; the rules of conduct will be posted on the virtual meeting web portal. To the extent time doesn’t allow us to answer all of the appropriately submitted questions, we will answer them in writing on our investor relations website, at www.investors.glaukos.com, soon after the meeting. If we receive substantially similar questions, we will group such questions together and provide a single response to avoid repetition.

GLAUKOS CORPORATION | 2022 PROXY STATEMENT 3 | ||

PROPOSAL 1 — ELECTION OF DIRECTORS

| | | |

| | | |

☑ | THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR ALL” OF THE DIRECTOR NOMINEES. UNLESS OTHERWISE INSTRUCTED, THE PROXY HOLDERS WILL VOTE THE PROXIES RECEIVED BY THEM “FOR ALL” THE DIRECTOR NOMINEES. | ||

| | |

| | |

| | |

Our Board of Directors (“Board” or “Board of Directors”) is currently comprised of eight directors. Under our Certificate of Incorporation, our Board of Directors is divided into three classes, each serving a staggered three-year term and with one class being elected at each year’s annual meeting of stockholders as follows:

| ● | the Class I directors are Mark J. Foley, David F. Hoffmeister and Gilbert H. Kliman, M.D., and their terms will expire at the Annual Meeting; |

| ● | the Class II directors are Denice M. Torres and Aimee S. Weisner, and their terms will expire at the 2023 annual meeting of stockholders; and |

| ● | the Class III directors are Thomas W. Burns, Leana S. Wen, M.D. and Marc A. Stapley, and their terms will expire at the 2024 annual meeting of stockholders. |

Upon the recommendation of the Compensation, Nominating and Corporate Governance Committee (the “CNG Committee”), the Board of Directors has nominated each of Mark J. Foley, David F. Hoffmeister and Gilbert H. Kliman, M.D. for election to our Board of Directors as Class I directors to serve until the 2025 annual meeting of stockholders and until their respective successors are duly elected and qualified. Proxies may only be voted for the three Class I directors nominated for election at the Annual Meeting.

Each of the director nominees has consented to being named in this Proxy Statement and to serving as a director, if elected. We have no reason to believe that any of the nominees will be unable or unwilling for good cause to serve if elected. However, if any nominee should become unable for any reason or unwilling for good cause to serve, the proxy holders will vote the proxies received by them for another person nominated as a substitute by the Board of Directors, or the Board of Directors may reduce the number of directors on the Board.

Biographical Descriptions

Set forth below is biographical information about each of our director nominees and continuing directors. The information below is provided as of April 6, 2022. The primary experience, qualifications, attributes and skills of each of our director nominees that led to the conclusion of the CNG Committee and the Board of Directors that such nominee should serve as a member of the Board of Directors are also described below.

4 2022 PROXY STATEMENT | GLAUKOS CORPORATION | ||

PROPOSAL 1 — ELECTION OF DIRECTORS

Nominees for Election as Class I Directors at the Annual Meeting

MARK J. FOLEY | ||

Class I Age: 56 Director Since: 2014 | | POSITION AND BUSINESS EXPERIENCE |

| Mr. Foley has served as a member of our Board of Directors since 2014 and was appointed Lead Independent Director in December 2021. Mr. Foley is currently the chief executive officer of Revance Therapeutics, Inc. (Nasdaq: RVNC), a position to which he was appointed in October 2019 after being elected to the board of directors in 2017. Previously, he was the chairman, president and chief executive officer of ZELTIQ Aesthetics, Inc., a medical technology company, up until its acquisition by Allergan plc in April 2017. Prior to becoming ZELTIQ’s chief executive officer in 2012, Mr. Foley served on the board of directors having joined the company as its executive chairman in 2009. Mr. Foley also served as chairman of Arrinex from 2018 until the company's acquisition by Stryker in 2019, chairman of HintMD until its acquisition in 2020 and executive chairman at Onpharma Inc. from 2009 until its acquisition by Valeant Pharmaceuticals International, Inc. in 2014. Mr. Foley also served as a managing director at RWI Ventures, Inc. from 2004 to 2018, where he focused on healthcare investments. Prior to this, Mr. Foley held a variety of operating roles in large, public companies and venture-backed startups including United States Surgical Corporation, Guidant Corporation, Devices for Vascular Intervention, Inc. (acquired by Eli Lilly and Company), Perclose, Inc. (acquired by Abbott Laboratories) and Ventrica, Inc. (acquired by Medtronic, Inc.) where he was the founder and chief executive officer. In addition to his service on the Glaukos and Revance boards, Mr. Foley previously served on the board of directors of SI-BONE, Inc. (Nasdaq:SIBN), from June 2019 through June 2021. Mr. Foley holds a B.A. from the University of Notre Dame. | |

| BOARD QUALIFICATIONS Mr. Foley has over 25 years of medical device operating, investment and chief executive officer experience. We believe Mr. Foley’s previous medical device experience as a senior executive and his service on the boards of several medical device companies qualify him to serve on our Board of Directors. | |

DAVID F. HOFFMEISTER | ||

Class I Age: 67 Director Since: 2014 | | POSITION AND BUSINESS EXPERIENCE |

| Mr. Hoffmeister has served as a member of our Board of Directors since 2014. Mr. Hoffmeister served as the senior vice president and chief financial officer of Life Technologies Corporation, a global life sciences company, prior to its acquisition by Thermo Fisher Scientific Inc. in February 2014. From October 2004 to November 2008, he served as chief financial officer of Invitrogen Corporation, which merged with Applied Biosystems Inc. in November 2008 to form Life Technologies Corporation. Before joining Invitrogen, Mr. Hoffmeister spent 20 years with McKinsey & Company as a senior partner serving clients in the healthcare, private equity and chemical industries on issues of strategy and organization. From 1998 to 2003, Mr. Hoffmeister was the leader of McKinsey’s North American chemical practice. Mr. Hoffmeister currently serves on the boards of directors of Celanese Corporation (NYSE: CE), ICU Medical, Inc. (Nasdaq: ICUI), StepStone Group Inc. (Nasdaq: STEP), and Kaiser Permanente, a privately-held company. Mr. Hoffmeister holds a B.S. from the University of Minnesota and an M.B.A. from the University of Chicago. | |

GLAUKOS CORPORATION | 2022 PROXY STATEMENT 5 | ||

PROPOSAL 1 — ELECTION OF DIRECTORS

BOARD QUALIFICATIONS We believe Mr. Hoffmeister’s strong finance background, experience as a chief financial officer of a global biotechnology company, and public company board experience qualify him to serve on our Board of Directors. | ||

GILBERT H. KLIMAN, M.D. | ||

Class I Age: 63 Director Since: 2007 | | POSITION AND BUSINESS EXPERIENCE |

| Dr. Kliman has served on our Board since 2007, with a brief hiatus from August 2019 through March 2020 relating to the Company’s acquisition of Avedro, Inc. (an ophthalmic pharmaceutical and medical technology where Dr. Kliman also served on the board of directors). Dr. Kliman has been a partner of InterWest Partners, a venture capital firm, since 1996, and has been a managing partner there since 2016. From 1995 to 1996, Dr. Kliman was an investment manager at Norwest Venture Partners, a venture capital firm. From 1989 to 1992, Dr. Kliman served as an associate at TA Associates, a private equity investment firm. Dr. Kliman is a board-certified ophthalmologist and completed a retina research fellowship at Massachusetts Eye and Ear Infirmary and residency training at Wills Eye Hospital. Dr. Kliman holds a B.A. from Harvard University, an M.D. from the University of Pennsylvania and an M.B.A. from the Stanford Graduate School of Business. Since June 2020, Dr. Kliman serves on the board of directors of Staar Surgical Company (Nasdaq: STAA), and also sits on the board of Doximity, Inc. (NYSE: DOCS), a board he joined in 2011. He also serves as a director on the executive board of ORBIS International, a global nonprofit focused on preventing avoidable blindness. In addition to previously serving as a director of Avedro from 2015 until his resignation in 2019, Dr. Kliman also previously served on the board of directors of Restoration Robotics (Nasdaq: HAIR) from July 2007 until its acquisition by Venus Concept Inc. in November 2019. Dr. Kliman served on the board of directors of Epocrates, Inc. (acquired by athenahealth, Inc.) from 1999 to 2011, and IntraLase Corp. (acquired by Advanced Medical Optics, Inc.) from 2000 to 2007. | |

BOARD QUALIFICATIONS We believe Dr. Kliman’s prior experience as a practicing ophthalmologist, as well as his significant experience in financial markets and prior experience on the board of several U.S. public companies and various private healthcare companies, qualify him to serve on our Board of Directors. | ||

6 2022 PROXY STATEMENT | GLAUKOS CORPORATION | ||

PROPOSAL 1 — ELECTION OF DIRECTORS

All Other Continuing Directors

DENICE M. TORRES | ||

Class II Age: 62 Director Since: 2021 | | POSITION AND BUSINESS EXPERIENCE |

| Ms. Torres has served as a member of our Board of Directors since March 2021. Ms. Torres is currently chief executive officer of The Ignited Company, a Pennsylvania-based consulting firm she founded in 2017. From 2005 to 2017, she served in various senior leadership roles at Johnson & Johnson (J&J). From 2015 to 2017, she was chief strategy and transformation officer for J&J’s global medical device business. From 2011 to 2015, she was president of J&J McNeil Consumer Healthcare, where she led the recovery of OTC brands, including the iconic Tylenol portfolio, by transforming business operations, manufacturing, quality systems and commercialization approaches, and creating high levels of employee engagement across all functions of the business. From 2009 to 2011, she served as president of J&J Janssen Pharmaceuticals, Neuroscience. Before joining J&J, Ms. Torres built a successful, 14- year career at Eli Lilly and Company, where she focused on marketing and business unit management. In 2020, Ms. Torres joined the boards of venture-backed National Resilience, as well as public companies Karuna Therapeutics, Inc. (Nasdaq: KRTX), a clinical-stage biopharmaceutical company, Surface Oncology (Nasdaq: SURF), a clinical-stage immune-oncology company, and 2seventybio (Nasdaq: tsvt). Ms. Torres also previously served on the board of directors of bluebird bio, Inc. from August 2020 to November 2021 (Nasdaq: BLUE). She is also the founder of The Mentoring Place, a nonprofit organization offering free executive mentoring to help women achieve their career goals. Ms. Torres holds a B.S. in Psychology from Ball State University, a J.D. from Indiana University and an MBA from the University of Michigan. She is a member of the Michigan Bar Association. | |

BOARD QUALIFICATIONS Ms. Torres has extensive experience in the pharmaceutical and medical device industries, including executive management of global commercialization, with different medical device companies, including responsibility for quality, strategy and marketing, which we believe qualifies her to serve on our Board of Directors. | ||

AIMEE S. WEISNER | ||

Class II Age: 53 Director Since: 2014 | | POSITION AND BUSINESS EXPERIENCE |

| Ms. Weisner has served as a member of our Board of Directors since 2014. Ms. Weisner was corporate vice president, general counsel of Edwards Lifesciences Corporation from 2011 until her retirement in 2019. From 2009 to 2010, she was engaged in private practice and served as legal advisor to public pharmaceutical and medical device companies located in Southern California. Prior to this, from 2002 to 2009, Ms. Weisner served in a number of positions at Advanced Medical Optics, Inc. (acquired by Abbott Laboratories), including executive vice president, administration and secretary. From 1998 to 2002, Ms. Weisner served in a number of positions at Allergan, Inc., including vice president, assistant general counsel and assistant secretary. Ms. Weisner holds a B.A. from California State University, Fullerton, a J.D. from Loyola Law School, Los Angeles, and began her legal career as an associate at the law firm of O’Melveny & Myers LLP. Ms. Weisner has served on the board of directors of Oyster Point Pharma, Inc. (Nasdaq: OYST) since October 2019 and on the board of directors of Lensar, Inc. (Nasdaq: LNSR) since February 1, 2021. | |

GLAUKOS CORPORATION | 2022 PROXY STATEMENT 7 | ||

PROPOSAL 1 — ELECTION OF DIRECTORS

BOARD QUALIFICATIONS We believe Ms. Weisner’s extensive in-house legal and compliance experience with different medical device companies, including an in-depth understanding of regulatory and reimbursement issues, intellectual property, corporate governance, risk management, corporate transactions, human resources, and internal audit, qualify her to serve on our Board of Directors. | ||

THOMAS W. BURNS | ||

Class III Age: 61 Director Since: | | POSITION AND BUSINESS EXPERIENCE |

| Mr. Burns has served as our President, Chief Executive Officer and as a member of our Board of Directors since March 2002. In December 2021, he was appointed as the Chairman of our Board. Mr. Burns has a proven record of building successful medical device and pharmaceutical businesses and creating successful new markets in ophthalmology. Mr. Burns has more than 25 years of direct ophthalmic management experience, including over 20 years of general management experience across a broad range of ophthalmic medical devices and pharmaceuticals, drug delivery technologies, surgical products and over-the-counter products. Prior to joining our Company, Mr. Burns led Eyetech Pharmaceuticals, Inc. (acquired by OSI Pharmaceuticals, Inc.) as its president and chief operating officer and as a director. From 1990 to 1997, Mr. Burns served as senior vice president and general manager of Chiron Vision Corporation (acquired by Bausch & Lomb, Inc.), and then as vice president, global strategy and general manager, refractive surgery, of Bausch & Lomb from 1998 to 2000. Mr. Burns has served on the board of directors of Pulmonx Corporation (Nasdaq: LUNG) since September 2020. During 2018 and 2019, Mr. Burns served as a director on the board of Avedro, Inc., until his resignation in August 2019, prior to its acquisition by Glaukos. Mr. Burns has also served as an entrepreneur in residence at Versant Ventures Management, LLC. Mr. Burns received a B.A. from Yale University. | |

BOARD QUALIFICATIONS We believe Mr. Burns’ extensive understanding of our business, operations and strategy, as well as significant industry experience and corporate management skills and experience, qualify him to serve as Chairman of our Board of Directors. | ||

8 2022 PROXY STATEMENT | GLAUKOS CORPORATION | ||

PROPOSAL 1 — ELECTION OF DIRECTORS

LEANA S. WEN, MD | ||

Class III Age: 39 Director Since: 2021 | | POSITION AND BUSINESS EXPERIENCE |

| Dr. Wen has served as a member of our Board of Directors since March 2021. Dr. Wen is an emergency physician and has served as a visiting professor of health policy and management at the George Washington University School of Public Health since September 2019. She has been a contributing columnist for The Washington Post since June 2020, writing on health policy and public health, and an on-air commentator for CNN as a medical analyst since August 2020. From January 2015 to October 2018, she was the health commissioner for the city of Baltimore, where she led the nation’s oldest continuously operating health department to combat the opioid epidemic and improve maternal and child health. From 2013 to 2015, Dr. Wen served as director of patient-centered care research in the department of emergency medicine at George Washington University, and authored a critically-acclaimed book on patient advocacy. She is currently on the board of the Bipartisan Policy Center and the Baltimore Community Foundation, and chairs the advisory board of the Behavioral Health Group. She has also been a global health fellow at the World Health Organization, a consultant with the China Medical Board, and a nonresident senior fellow at the Brookings Institution. Dr. Wen also served as the President of Planned Parenthood from 2018 through 2019. She has been a member of more than ten nonprofit boards, including serving as the chair of Behavioral Health Systems Baltimore. Dr. Wen’s work has been recognized by numerous professional organizations, including as one of Modern Healthcare’s Top 50 Physician-Executives, and, in 2019, she was named one of TIME magazine’s 100 Most Influential People. She holds a B.S. from California State University, Los Angeles, an M.D. from Washington University School of Medicine and two M.Sc.s from the University of Oxford, where she was a Rhodes Scholar. She completed her residency training at Brigham & Women’s Hospital and Massachusetts General Hospital, where she was a clinical fellow at Harvard Medical School. | |

BOARD QUALIFICATIONS We believe Dr. Wen’s experience as a practicing physician, combined with her extensive experience working in governmental sectors, with innovative health companies, and serving on nonprofit boards and foundations, make her a qualified member of our Board of Directors. | ||

GLAUKOS CORPORATION | 2022 PROXY STATEMENT 9 | ||

PROPOSAL 1 — ELECTION OF DIRECTORS

MARC A. STAPLEY | ||

Class III Age: 52 Director Since: | | POSITION AND BUSINESS EXPERIENCE |

| Mr. Stapley has served as a member of our Board of Directors since 2014. He is the CEO and a member of the board of directors of Veracyte Inc. (Nasdaq: VCYT), a global diagnostics company he joined in June 2021. Prior to joining Veracyte, he served as the CEO of Helix, a population genomics company, since April 2019. Prior to Helix, he was the executive vice president, strategy and corporate development at Illumina, Inc., where he was responsible for corporate strategy, corporate and business development and global infrastructure, from 2017 to January 2019. Previously, Mr. Stapley served as Illumina’s chief administrative officer, senior vice president and chief financial officer. He was also a member of Illumina’s executive management team, responsible for directing all aspects of the company’s strategy, planning and operations. Before joining Illumina in 2012, from 2009 to 2012, Mr. Stapley was senior vice president, finance at Pfizer Inc. and was responsible for global financial processes and systems, leading integration efforts in both the Wyeth Ltd. and King Pharmaceutical, Inc. acquisitions and providing oversight to the company’s largest technology investment program. Prior to Pfizer, he served in a variety of senior finance roles at Alcatel-Lucent, including Americas chief financial officer. He also worked as finance director and controller for several groups at Cadence Design Systems, Inc. He began his career as an Auditor at Coopers & Lybrand. In addition to the Glaukos and Veracyte boards, Mr. Stapley currently serves on the board of directors for Helix Opco LLC and for Premier Foods, Inc., a private restaurant chain. He holds a B.Sc. (Honors) from The University of Reading (England) and is a member of the Institute of Chartered Accountants in England and Wales. | |

BOARD QUALIFICATIONS We believe Mr. Stapley’s extensive experience in senior finance positions with public companies qualifies him to serve on our Board of Directors. | ||

10 2022 PROXY STATEMENT | GLAUKOS CORPORATION | ||

PROPOSAL 1 — ELECTION OF DIRECTORS

Each of our directors’ specific skills and experiences are included in the table below and described more fully in their individual biographies. Even though a particular skill may not be indicated below, our directors often have some level of experience in each of the areas listed.

| Executive Leadership | • | • | • | • | • | • | • | • |

| Governance and Compliance | • | • | • | • | • | • | • | • |

| Other Public Company Board Service | • | • | • | • | • | • | • | |

| Accounting and Auditing | • | • | • | • | • | | | |

| Capital Management | • | • | • | • | • | | | |

| Sustainability | | • | | | • | | • | • |

| Mergers and Acquisitions | • | • | • | • | • | | • | |

| Regulatory & Risk Management | • | • | | | • | • | • | • |

| Legal and Human Capital Management | • | • | | | • | • | • | • |

| Public Health Policy | | | | | | | | • |

| International Commercialization | • | • | | • | • | • | • | |

| Medtech | • | • | • | • | • | • | • | • |

| Ophthalmology | • | | | • | | | • | |

| Pharmaceutical | • | • | | | • | • | • | • |

| Cybersecurity | | | | | • | | • | |

GLAUKOS CORPORATION | 2022 PROXY STATEMENT 11 | ||

Corporate Governance Guidelines

Our Board of Directors, on the recommendation of the CNG Committee, has adopted Corporate Governance Guidelines to assist the Board in the discharge of its duties and to set forth the Board of Directors’ current views with respect to selected corporate governance matters considered significant to our stockholders. Our Corporate Governance Guidelines direct our Board’s actions with respect to, among other things, our Board composition and director qualifications, responsibilities of directors, including our Lead Independent Director, director compensation, director capacity, director orientation and continuing education, succession planning and the Board’s annual performance evaluation. A current copy of our Corporate Governance Guidelines is available under “Corporate Governance” on our website at http://investors.glaukos.com.

Stockholder Engagement and Responsiveness

60% | Stockholder Engagement |

Since our IPO in 2015, we conduct regular outreach to our stockholders to build relationships, explain our corporate governance structure and executive compensation policies, and receive valuable feedback on matters that are important to them.

At our 2021 Annual Meeting of Stockholders (“2021 Annual Meeting”), our stockholders approved, by a non-binding, advisory vote, the compensation of our named executive officers. This ballot item, known as a “say-on-pay” proposal, passed with 93% of the votes cast. Following the 2021 Annual Meeting, we engaged with our stockholders regarding our executive compensation policies, corporate governance principles and sustainability efforts. We contacted holders of approximately 65% of our outstanding stock, and members of our management team spoke with, or received confirmation that no substantive engagement was required from, stockholders collectively owning approximately 60% of our outstanding stock (excluding officers and directors of the Company). These holders included 8 of our top 10 stockholders. Mr. Foley, chair of the CNG Committee and our Lead Independent Director, joined some of these calls with our top stockholders. Our Board of Directors, including all members of the CNG Committee, was provided a full report of stockholder feedback from this 2021 stockholder engagement.

Consistent with the feedback received in prior years, the stockholders with whom we spoke generally expressed broad support for our governance practices and understood the importance of having certain governance protections, such as a classified Board, for a company that has significant potential future stockholder value tied to its deep product pipeline as compared to commercialized products. Our stockholders also conveyed broad general support for our executive compensation program, stating their hope that the Company will continue its use of multi-year performance equity grants and continue to connect executive compensation to the progress of our R&D pipeline. One stockholder also noted its desire that we continue to disclose updates on the development of our pipeline products.

Notably, most stockholders expressed support for the continuing advancement of the Company’s environmental, social and governance (“ESG”) efforts. Several stockholders shared their appreciation that in 2021 our Sustainability Council, consisting of representatives from various functional areas within the Company, set goals and targets that are material to the Company and its stakeholders, comprised of employees, customers, suppliers and investors. Several stockholders shared their preference that the Company incorporate ESG incentives into its compensation program, linking executive pay to achievement of our ESG incentives.

Nearly all of the stockholders with whom we engaged requested additional understanding regarding the Company’s promotion of diversity and inclusion within its workforce. They conveyed their desire to see

12 2022 PROXY STATEMENT | GLAUKOS CORPORATION | ||

CORPORATE GOVERNANCE

enhanced disclosure regarding the composition of the Company’s workforce, including disclosure of our EEO-1 demographic data, and steps taken to ensure our workforce reflects our community and customer base.

Several stockholders also asked us about the Company’s cybersecurity efforts. They expressed a desire to better understand the Board’s role in overseeing those efforts, and have the Company set more robust goals around its data security systems and processes.

Several of our stockholders also noted that the Company has not set limits regarding director membership on public company boards, noting that they believe such limits are necessary to ensure directors are capable of devoting sufficient time to overseeing the management of the Company. One stockholder also requested additional information regarding the Company’s Board self-evaluation process, and another requested greater transparency around the Company’s pipeline product development, including anticipated timelines to approval and commercialization.

In response to stockholder feedback in 2021, the CNG Committee and Board responded by taking the following actions:

STOCKHOLDER RESPONSIVENESS

Stockholder Feedback | Responsive Action Taken | Impact of Action |

|---|---|---|

Glaukos should provide enhanced disclosure regarding the composition and demographics of its workforce, including gender and ethnicity information | √ Increased disclosure of workforce demographic data; 2021 Sustainability Report, updated in April 2022 and published to the Company’s website at http://investors.glaukos.com, includes additional ethnic and gender diversity statistics on Glaukos workforce; Company also published its EEO-1 data, available at http://investors.glaukos.com. | Provides stakeholders with visibility into Company’s diversity, equity and inclusion progress; demonstrates Company’s commitment to transparency with respect to the diversity and inclusivity of its personnel |

Company should disclose its efforts to promote an inclusive culture within its workforce | √ Employee DEI Taskforce established in 2021, creating a forum for employees to participate in championing diversity, equity and inclusive initiatives; backed by executive sponsors | Provides a voice for employees who are members of underrepresented communities to share ideas and opportunities to promote inclusiveness and diversity within the organization |

Glaukos should create a strong tie between executive compensation and ESG performance | √ 2022 Executive Bonus Program for senior leadership team, including NEOs, includes achievement of ESG goals as one of 5 corporate objectives measured to determine short-term compensation award | Focuses leadership team performance on important ESG targets and demonstrates Company and management commitment to sustainability metrics deemed material to stakeholders |

Company should address cybersecurity risk by setting challenging goals and detailing Board oversight in that area | √ 2021 Sustainability Report, published in April 2022, contains enhanced, longer-term cybersecurity targets, including formalizing Company alignment with the NIST framework by 2025; augmented disclosure around the Board’s cybersecurity oversight is included in the section titled “Audit Committee” below | Creates accountability for Company to evaluate and update cyber systems and processes to current best practices, to better protect Company intellectual property and other resources from cyber threats, ransomware and other modern risks |

GLAUKOS CORPORATION | 2022 PROXY STATEMENT 13 | ||

CORPORATE GOVERNANCE

Stockholder Feedback | Responsive Action Taken | Impact of Action |

|---|---|---|

Glaukos should set limits regarding director membership on other public company boards | √ Corporate Governance Guidelines were revised by the Board in March 2022 to provide that no director should sit on more than four public company boards, including the Company, without prior approval of the Board; directors who are executive officers of a public company should not serve on more than two public company boards without prior approval of the Board | Ensures that Company directors can devote sufficient time and attention to their duties and obligations overseeing the Company’s management and affairs |

Board should disclose greater detail regarding its robust self-evaluation process | √ Robust Board Self-Evaluation Process that is conducted each year by Board, assessing and rating such areas as Board composition, structure, oversight performance and interaction with management, as well as the performance of each individual director, is disclosed in the section titled “Board Evaluation Process” below | Allows Board to identify its own strengths and opportunities for improvement in its structure, composition and functioning, and provides valuable feedback to individual directors on their performance; provides full Board and individual director accountability |

Company should provide greater transparency into status and progress of pipeline product development | √ Company disclosed detailed clinical trial data in early 2022, comparable to its 2021 disclosure, including 36-month interim data on its iDose® TR sustained-release travoprost implant, patient enrollment status in Phase 2 clinical trials for its iLution™ cream-based formulation for the treatment of both dry eye disease and presbyopia, and the 510(k) clearance from the US FDA for its iPRIME™ Viscodelivery System; in 2022, Company began providing quarterly summary of financial results and a pipeline product update to investment community; Company also ties executive compensation to the success of its pipeline product development through its performance-based equity award grants | Allows investors and potential investors to analyze the growth and value potential of the Company and motivates management to meet the disclosed timeframes for development and approval of pipeline |

The Company and the CNG Committee listen to the input we receive from our stockholders, with the intention of responding to that input in an appropriate and thoughtful manner that considers the Company’s stage in its development cycle and its needs from a leadership and operational perspective. We believe we have responded fully and appropriately to the feedback received from stockholders through these outreach campaigns. We intend to continue the dialogue with our stockholders on these and other matters to ensure the Board of Directors is apprised of their views and governance and compensation best practices more broadly. In addition, our Board of Directors will regularly review the Company’s current corporate governance structure to ensure it continues to align the interest of the Company with its stockholders, and consider appropriate governance changes as the Company matures.

Director Independence

Under the rules of the New York Stock Exchange (the “NYSE”) and our Corporate Governance Guidelines, independent directors must comprise a majority of our Board of Directors. Under the NYSE rules, a director will only qualify as an “independent director” if our Board of Directors affirmatively determines that the director has no material relationship with us (either directly or as a partner, stockholder or officer of an organization that has a relationship with us).

14 2022 PROXY STATEMENT | GLAUKOS CORPORATION | ||

CORPORATE GOVERNANCE

Our Board of Directors reviewed its composition and the independence of our directors and considered whether any director has a material relationship with us that could interfere with his or her ability to exercise independent judgment in carrying out his or her responsibilities. Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, our Board of Directors has determined that each of Messrs. Foley, Hoffmeister and Stapley, Drs. Kliman and Wen, and Mses. Weisner and Torres is “independent” as that term is defined under the rules of the NYSE. Mr. Burns is not an independent director as a result of his position as our Chief Executive Officer. In addition, our Board of Directors previously determined that William J. Link, Ph.D. was “independent” as that term is defined under the rules of the NYSE during his service on the Board through December 2021.

In making these determinations, our Board of Directors considered the relationships that each non-employee director has with us and all other facts and circumstances our Board of Directors deemed relevant in determining independence.

Board Leadership Structure

We have no policy requiring either that the positions of the Chairperson of the Board and our Chief Executive Officer be separate or that they be occupied by the same individual. Our Board of Directors believes that it is important to retain flexibility to allocate the responsibilities of the offices of the Chairperson of the Board and Chief Executive Officer in a way that is in our best interests and the best interests of our stockholders at the time it elects a new Chief Executive Officer or Chairperson of the Board, or at other times when consideration is warranted by circumstances. Our CEO, Thomas W. Burns, was appointed Chairman of the Board upon the resignation of our prior Chairman, Dr. William J. Link, in December 2021.

Pursuant to our Corporate Governance Principles, in the event the Chairperson of the Board is not an independent director, the independent directors will annually appoint from amongst themselves a Lead Independent Director with such responsibilities as the Board shall determine from time to time. If appointed, the Lead Independent Director has the following responsibilities:

| ● | Preside at all meetings of the Board at which the Chairperson of the Board is not present, including executive sessions of the independent directors; |

| ● | Serve as liaison between the Chairperson of the Board and the independent directors; |

| ● | Approve information sent to the Board; |

| ● | Approve agendas for meetings of the Board; |

| ● | Approve meeting schedules of the Board seeking to ensure that there is sufficient time for discussion of all agenda items; |

| ● | Develop agendas for and call meetings of the independent directors when necessary or appropriate; and |

| ● | Be available for consultation and direct communication if requested by major stockholders. |

Because our Chairman is not an independent director, the independent members of the Board appointed Mr. Mark J. Foley as Lead Independent Director in December 2021. We believe the combined Chairman and CEO leadership role along with a Lead Independent Director enhances our Board’s ability to provide insight and direction on important strategic initiatives and, at the same time, promotes effective and independent oversight of management and our business.

The Board’s Role in Risk Oversight

Our Board of Directors, as a whole and through its committees, serves an active role in overseeing the management of risks related to our business. Our officers are responsible for day-to-day risk management activities. The full Board monitors risks through regular reports from each of the committee chairs, and is apprised of particular risk management issues in connection with its general oversight and approval of corporate matters. The Board and its committees oversee risks associated with their respective areas of responsibility, as summarized below. Each committee meets with key management personnel and representatives of outside advisers regularly and as required. The Board, through its Audit Committee, also

GLAUKOS CORPORATION | 2022 PROXY STATEMENT 15 | ||

CORPORATE GOVERNANCE

oversees the Company’s enterprise risk management program, which is administered by the Company’s legal and internal audit functions and facilitates the process of reviewing key external, strategic, operational and financial risks, including cybersecurity risks, as well as monitoring the effectiveness of the Company’s risk mitigation efforts.

Our Board of Directors manages specific areas of risk exposure through its committees of the Board of Directors as follows:

| ● | The Audit Committee serves an active role in overseeing the management of risks related to compliance and general operational matters, including without limitation, manufacturing, reimbursement, international expansion and cybersecurity. The Audit Committee receives regular assessments of risk related to compliance and operational matters and meets regularly with the functional leaders within the Company who manage such risks. The Audit Committee also assesses management’s identification and management of its enterprise risks, and its plans to monitor, control and minimize any risk exposure. The Audit Committee is also responsible for primary risk oversight related to our financial reporting, accounting and internal controls, oversees risks related to our compliance with legal and regulatory requirements, and meets regularly with our internal auditors and our independent registered public accounting firm. |

| ● | The CNG Committee oversees, among other things, the assessment and management of risks related to our compensation plans, policies and overall philosophy and equity-based incentive plans. The CNG Committee also oversees the assessment and management of risks related to our governance structure, including Board leadership and management succession, and ESG, climate change, diversity and inclusion and human capital management-related matters. |

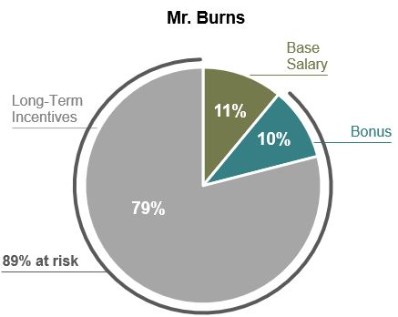

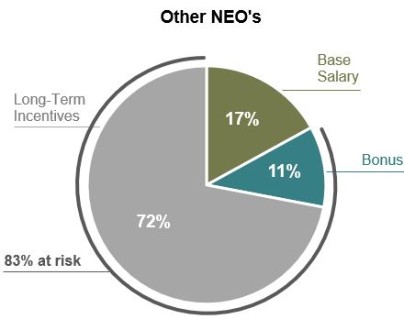

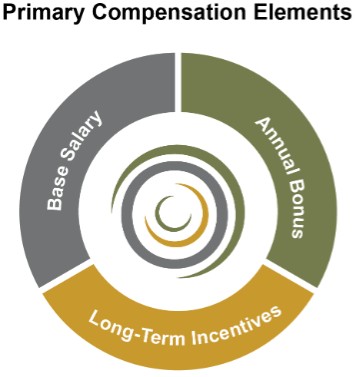

Executive Compensation Risk

The CNG Committee identifies and considers risks related to our executive compensation, including during its review and approval of our executive compensation program. Our compensation programs are designed to reward our named executive officers and other employees for the achievement of the Company’s corporate strategies, business objectives and the creation of long-term value for stockholders, while at the same time avoiding the encouragement of unnecessary or excessive risk-taking. The CNG Committee has concluded that the current executive compensation program does not encourage inappropriate or excessive risk-taking. In making its determination, the CNG Committee noted that each executive officer’s direct compensation under our executive compensation program consists primarily of a fixed base salary, an annual incentive bonus opportunity and long-term equity incentive awards. Annual incentive bonuses are balanced with long-term equity incentives, which are subject to multi-year vesting schedules or only vest upon the achievement of strategic performance objectives.

Our Board believes that the processes it has established for overseeing risk would be effective under a variety of leadership frameworks and therefore the Board’s leadership structure, as described under “Board Leadership Structure” above, was not affected by risk oversight considerations.

16 2022 PROXY STATEMENT | GLAUKOS CORPORATION | ||

CORPORATE GOVERNANCE

Committees of the Board of Directors

The Board has two standing committees: the Audit Committee and the Compensation, Nominating and Corporate Governance Committee. The written charters of these committees are available under “Corporate Governance” on our website at http://investors.glaukos.com. Additionally, in 2020, the Board formed the Equity Awards Committee, comprised of Mr. Burns, our Chairman and Chief Executive Officer, to approve equity grants to employees other than our senior leadership team, so long as such grants are within the guidelines established by our CNG Committee on an annual basis, and meet certain other limitations described in the Equity Awards Committee charter.

Director | Audit | Compensation, |

Thomas W. Burns --Chairman-- | | |

Mark J. Foley --Lead Independent Director-- | |

|

Marc A. Stapley |

| |

Aimee S. Weisner |

| |

David F. Hoffmeister |

| |

Gilbert H. Kliman, M.D. | |

|

Leana S. Wen, M.D. |

| |

Denice M. Torres | |

|

Independent Director

Independent Director  Financial Expert

Financial Expert  Committee Member

Committee Member

GLAUKOS CORPORATION | 2022 PROXY STATEMENT 17 | ||

CORPORATE GOVERNANCE

Audit Committee

Our Board of Directors determined that Messrs. Stapley and Hoffmeister, Ms. Weisner and Dr. Wen, who comprise our Audit Committee, satisfy the independence standards for such committee established by applicable SEC rules and the listing standards of the NYSE. Additionally, our Board of Directors has determined that each of Messrs. Stapley and Hoffmeister is an “audit committee financial expert” as defined by applicable SEC rules.

| | |

Committee Members | Primary Responsibilities | Number of |

Marc A. Stapley (Chair) David F. Hoffmeister Aimee S. Weisner Leana S. Wen, M.D. | • Appointing, evaluating, retaining, approving the compensation of, and assessing the independence of our independent registered public accounting firm. • Overseeing the work of our independent registered public accounting firm, including through the receipt and consideration of reports from that firm. • Reviewing and discussing with management and our independent registered public accounting firm our annual and quarterly financial statements and related disclosures. • Overseeing our internal control over financial reporting, disclosure controls and procedures and code of conduct. • Monitoring our internal audit function and overseeing the internal auditor. • Reviewing and approving or ratifying any related person transactions. • Monitoring enterprise risks including cybersecurity, operations and compliance. • Preparing the Audit Committee report required by SEC rules. | 8 |

The Company has a full-time internal audit function that reports to the Audit Committee and the Chief Financial Officer, and is responsible for, among other things, reviewing and evaluating the adequacy, effectiveness and quality of the Company’s system of internal controls. The Audit Committee engages, terminates, determines compensation for, and oversees the independent registered public accounting firm, reviews the scope of the audit by the independent registered public accounting firm and inquiries into the effectiveness of the Company’s accounting and internal control functions. The Audit Committee also approves or ratifies any related person transactions, as described under “Transactions with Related Persons” below.

In addition to overseeing our internal controls over financial reporting and the work of our independent registered public accounting firm, the Audit Committee, which is comprised solely of independent directors, also monitors our enterprise risk assessment and management efforts. The Audit Committee receives quarterly reports from management regarding operational risks facing our Company, including risks related to manufacturing, facilities, accounting and our compliance with laws and regulations.

Additionally, as formalized in its charter in 2021, the Audit Committee also oversees the management of information and cybersecurity risk. Cybersecurity risk is a material component of our enterprise risk management program. We recognize the importance of maintaining the security of our information assets and the privacy of our employees, partners, customers and patients, and devote significant attention to information and cybersecurity controls and protections. While the Audit Committee reviews and oversees the Company’s information security efforts, senior leadership is responsible for the day-to-day management of cybersecurity risk and the design and implementation of policies, processes and procedures to identify and mitigate this risk. Glaukos’ security program is structured around the industry standards for security, including the National Institute of Standards and Technology (NIST) and the International Organization for Standardization, and we are working toward formal alignment with NIST standards by 2025. Our head of IT reports directly to the Chief Financial Officer, and reports to the Audit Committee on a semi-annual basis regarding the effectiveness of our information and cybersecurity program, its inherent risks, the plans and programs designed to address these risks and our progress in doing so.

18 2022 PROXY STATEMENT | GLAUKOS CORPORATION | ||

CORPORATE GOVERNANCE

Our cybersecurity response plan is comprised of Written Incident Response and Security policies as well as our Disaster Recovery Plan, which collectively outline our approach for the urgent management, communication, and successful resolution of any known or suspected unauthorized access to our information systems. Company personnel also undergo information security awareness testing and annual training. Employees who fail our phishing tests are required to complete additional training. External parties, including cybersecurity firms, have assessed our information and cybersecurity program. We use these findings, along with employee testing results, to analyze the effectiveness of our program and to identify opportunities to address and remedy any residual information and cybersecurity risks. In addition, we maintain cyber insurance to provide coverage in the event of a data breach incident.

Compensation, Nominating and Governance Committee

Our Board of Directors determined that Mr. Foley, Dr. Kliman and Ms. Torres, who comprise our CNG Committee, satisfy the independence standards for such committee established by applicable SEC rules and the listing standards of the NYSE. In making its independence determination for each member of the CNG Committee, our Board of Directors considered whether the director has a relationship with the Company that is material to the director’s ability to be independent from management in connection with the duties of a compensation committee member.

| | |

Committee Members | Primary Responsibilities | Number of |

Mark J. Foley (Chair) Gilbert H. Kliman, M.D. Denice M. Torres | • Determining our Chief Executive Officer’s compensation. • Reviewing and approving, or making recommendations to our Board of Directors with respect to, the compensation of our other executive officers. • Overseeing and administering our cash and equity incentive plans. • Reviewing and making recommendations to our Board of Directors with respect to director compensation. • Reviewing and discussing annually with management our “Compensation Discussion and Analysis” disclosure. • Preparing the compensation committee report. • Identifying individuals qualified to become members of our Board of Directors. • Recommending to our Board of Directors the persons to be nominated for election as directors at each annual meeting of stockholders. • Evaluating the composition of each of our Board’s committees and making recommendations to the Board of Directors for changes or rotation of committee members. • Overseeing an annual self-evaluation and peer review of our Board of Directors. • Overseeing ESG, climate change, diversity and inclusion and human capital management related matters. | 4 |

The CNG Committee may form subcommittees and delegate to its subcommittees such power and authority as it deems appropriate from time to time under the circumstances. In 2020, the Board formed the Equity Awards Committee, comprised of Mr. Burns, our Chief Executive Officer, to approve equity grants to employees other than our senior leadership team so long as such grants are within the guidelines established by our CNG Committee on an annual basis and meet certain other limitations described in the Equity Awards Committee charter. The CNG Committee has no current intention to further delegate any of its responsibilities to a subcommittee. The CNG Committee may confer with the Board in determining the compensation for the Chief Executive Officer. In determining compensation for executive officers other than the Chief Executive Officer, the CNG Committee considers, among other things, the recommendations of the Chief Executive Officer.

GLAUKOS CORPORATION | 2022 PROXY STATEMENT 19 | ||

CORPORATE GOVERNANCE

Pursuant to its charter, the CNG Committee is authorized to retain or obtain the advice of compensation consultants, legal counsel or other advisors to assist in the evaluation of director and executive officer compensation or in carrying out its other responsibilities. During fiscal 2021, the CNG Committee retained Frederic W. Cook & Co., Inc. (“FW Cook”) as its compensation consultant to evaluate the existing executive and non-employee director compensation programs and perform the services that are described in the Compensation Discussion and Analysis section below. FW Cook did not provide any other services to the Company during fiscal 2021. In connection with the compensation consultant services provided by FW Cook, the CNG Committee has assessed the independence of FW Cook and does not believe its work has raised any conflict of interest.

The CNG Committee oversees the Company’s ESG efforts. As described below under the heading “ESG and Sustainability,” this ESG oversight by the CNG Committee was formalized by a December 2020 amendment to the CNG Committee’s charter as part of the Company’s enhancement of its overall sustainability program. The CNG Committee also retains direct oversight of the Company’s human capital management process, including workforce diversity and inclusion; health, safety and wellness; philanthropy and volunteerism; training and development; and compensation and benefits. The CNG Committee also oversees the Board’s director evaluation process.

Meetings and Attendance

During fiscal 2021, our Board of Directors held four meetings, the Audit Committee held eight meetings and the CNG Committee held four meetings. Each of our directors attended at least 75% of the aggregate meetings of the Board and the committees of the Board on which he or she served during the period he or she served in fiscal 2021. In addition, independent directors of our Board of Directors meet in regularly scheduled sessions without management.

It is the Board of Directors’ policy to invite and encourage directors to participate in our annual meeting of stockholders. At our virtual annual meeting of stockholders held during fiscal 2021, all of our directors participated other than Dr. William J. Link, who was unable to attend.

Succession Planning

The Board of Directors recognizes that advance planning for contingencies such as the departure, death or disability of the chief executive officer or other top executives is critical so that, in the event of an untimely vacancy, the Company has in place a succession plan to facilitate the transition to both interim and longer-term leadership. The designation of the chief executive officer, as in the case of other officers, is a decision for the Board of Directors. The Board, in a process overseen by the CNG Committee, reviews succession planning for the chief executive officer and other senior leaders on an annual basis.

20 2022 PROXY STATEMENT | GLAUKOS CORPORATION | ||

CORPORATE GOVERNANCE

Board Evaluation Process

The CNG Committee is responsible for overseeing the annual performance evaluation of our Board, which is a multi-step process designed to evaluate the performance of our Board, each of its committees and each individual director, as follows:

Step 1: Evaluation Questionnaire | Annually, each director completes an evaluation of the full Board. The evaluation is intended to provide each director with an opportunity to evaluate performance for the purpose of improving Board and committee processes and effectiveness. The detailed evaluation questionnaire, which is administered by the Company’s legal department, seeks quantitative ratings and qualitative comments in key areas of Board practice, and asks each director to evaluate how well our Board and its committees operate and to make suggestions for improvements. These key areas include Board composition and director participation, meeting procedures, materials and format, allocation and delegation of responsibilities among our Board and its committees and adequacy and availability of resources. |

Step 2: Individual Interview | After completion of the evaluation questionnaires, individual oral peer evaluation interviews are facilitated by the Company’s General Counsel regarding the engagement and performance of the full Board and each individual director. This interview is conducted to assess the contribution and execution of each director and to ascertain feedback on strengths and opportunities for improvement among the directors. The feedback received during these interviews is conveyed, on an anonymous basis, to the directors it regards. |

Step 3: Board Summary and Recommendations Implemented | The results are presented to the full Board, on an anonymous basis, for candid discussion and feedback. After receiving feedback resulting from the Board discussion, the CNG Committee recommends improvements for the Board to consider implementing, as needed. |

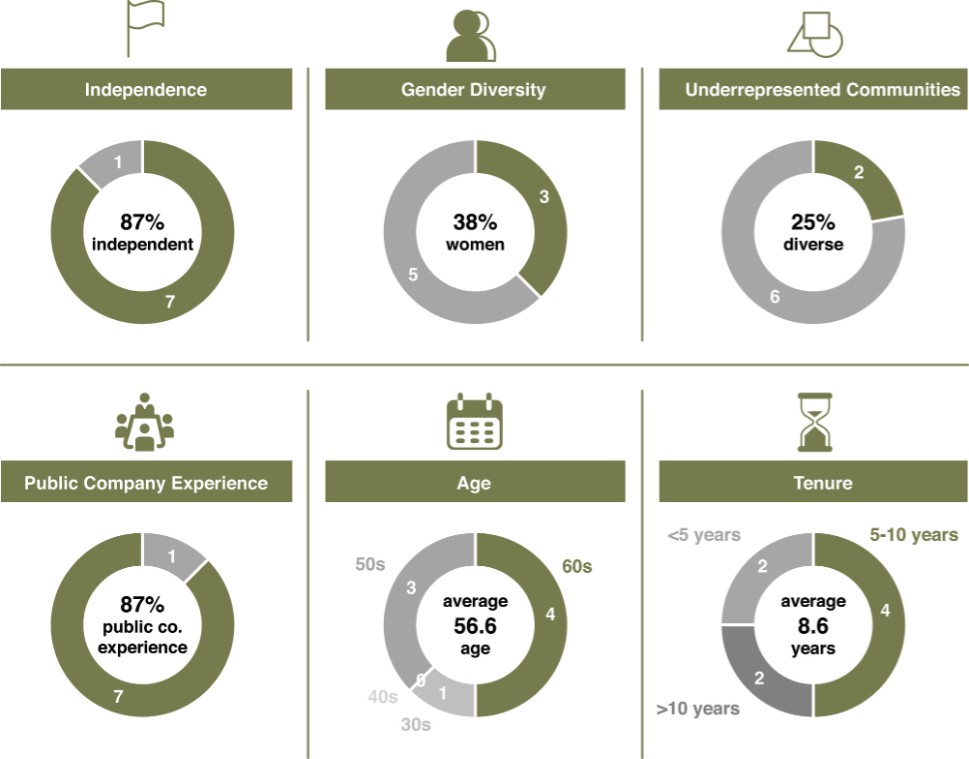

Consideration of Director Candidates

Our Board of Directors and the CNG Committee will consider director candidates recommended for election to the Board of Directors by stockholders in the same manner and using the same criteria as that used for any other director candidate. The CNG Committee has not established any specific minimum qualifications that must be met by a director candidate. In evaluating a director candidate, the CNG Committee will consider whether the composition of the Board reflects the appropriate balance of independence, sound judgment, business specialization, understanding of our business environment, willingness to devote adequate time to Board duties, technical skills, diversity and other background, experience and qualities as determined by the CNG Committee. While our Board of Directors has no formal policy for the consideration of diversity in identifying director nominees, the CNG Committee seeks to have a board of directors that will collectively represent a diversity of backgrounds and experience and will endeavor to include women and individuals from minority groups in the qualified candidate pool from which any new director candidates will be drawn. We currently have three female directors, one director who self-identifies as Asian and one director who self-identifies as Hispanic.

Stockholders who wish to recommend a director candidate for consideration by the CNG Committee and the Board should submit their recommendation in writing to the Board no later than January 1 prior to the next annual meeting of stockholders together with the following information: (1) the name and address of the stockholder as they appear on the Company’s books or other proof of share ownership; (2) the class and number of shares of common stock of the Company beneficially owned by the stockholder as of the date the stockholder submits the recommendation; (3) a description of all arrangements or understandings between the stockholder and the director candidate and any other person(s) pursuant to which the recommendation is being made; (4) the name, age, business address and residence address of the director candidate and a description of the director candidate’s business experience for at least the previous five years; (5) the principal occupation or employment of the director candidate; (6) the class and number of shares of common stock of the Company beneficially owned by the director candidate; (7) the consent of the director candidate to serve as a member of our Board of Directors if elected; and (8) any other information that would be required to be disclosed with respect to such director candidate in solicitations for proxies for the election of

GLAUKOS CORPORATION | 2022 PROXY STATEMENT 21 | ||

CORPORATE GOVERNANCE

directors pursuant to applicable rules of the Securities and Exchange Commission (“SEC”). The CNG Committee may request additional information concerning such director candidate as it deems reasonably required to determine the eligibility and qualification of the director candidate to serve as a member of the Board of Directors.

Stockholders who wish to nominate a person for election as a director in connection with an annual meeting of stockholders (as opposed to making a recommendation to the CNG Committee as described above) must deliver written notice to our Secretary in the manner described in our Amended and Restated Bylaws (“Bylaws”), and as described further under “Proposals of Stockholders and Director Nominations for 2023 Annual Meeting” below.

Board Attributes

Communications with the Board of Directors

The Board of Directors has established a process to receive communications from stockholders and other interested parties. Stockholders and other interested parties may communicate directly with members of the Board of Directors, the independent directors or the Chairman of the Board of Directors by submitting a communication in an envelope marked “Confidential” addressed to the “Board of Directors,” “Independent Members of the Board of Directors,” or “Chairperson,” as applicable, at: Glaukos Corporation, 229 Avenida Fabricante, San Clemente, California 92672. In addition, if requested by stockholders, when appropriate, the Chairperson of the Board or Lead Independent Director will also be available for consultation and direct communication with stockholders.

22 2022 PROXY STATEMENT | GLAUKOS CORPORATION | ||

CORPORATE GOVERNANCE

Policy on Pledging and Hedging of Company Shares

As part of our Insider Trading Policy adopted by our Board of Directors and applicable to our directors, officers and employees, their immediate family members sharing the same household and any entities such as trusts, partnerships, or corporations over which they have or share voting or investment control (collectively, “Insiders”), Insiders are not permitted to engage in any short sale of Glaukos securities, pledge shares as collateral for a loan or margin Glaukos securities in a margin account or purchase financial instruments (including prepaid variable forward contracts, equity swaps, collars and exchange funds), or otherwise engage in transactions, that hedge or offset, or are designed to hedge or offset, any decrease in the market value of Glaukos securities.

Code of Conduct and Ethics

We have adopted a written code of business conduct and ethics that applies to our directors, executive officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, and persons performing similar functions. A current copy of the code is posted under “Corporate Governance” on our website at http://investors.glaukos.com. To the extent required by rules adopted by the SEC and NYSE, we intend to promptly disclose future amendments to certain provisions of the code, or waivers of such provisions granted to executive officers and directors, on our website at www.glaukos.com.

GLAUKOS CORPORATION | 2022 PROXY STATEMENT 23 | ||

CORPORATE GOVERNANCE

ESG and Sustainability

As we have grown to more than 700 full-time employees worldwide with five FDA-approved products and 16 disclosed pipeline products, so too has our commitment to creating a positive impact as a responsible corporate citizen. Over the course of 2021, we continued to invest significant time and resources into better understanding what drives sustainability at Glaukos, setting meaningful goals to challenge us to continue to improve our processes and achievements with respect to ESG matters. Continuing to grow and enhance our ESG policies and programs is a key priority for us now and in the future, which we believe will benefit all our stakeholders: our employees, customers, patients, investors and communities.

In 2021, our cross-functional Sustainability Council, which is lead by executive management and overseen by the CNG Committee of the Board, focused on peer benchmarking, engaging with stakeholders and increasing our disclosure of our ESG efforts and accomplishments. In April 2022, we published our third annual sustainability report covering the 2021 calendar year (“2021 Sustainability Report”). The 2021 Sustainability Report is posted under “Corporate Governance” on our website at http://investors.glaukos.com, and references the Global Reporting Initiative (GRI) and Sustainability Accounting Standards Board (SASB) frameworks. We hope that our 2021 Sustainability Report reflects our dedication to continuous improvement and transparency. Below are highlights of our accomplishments and progress in 2021:

| Diversity & Inclusion | ● Increased gender diversity on our Board to 38% ● Increased Board members from underrepresented communities to 25% ● Created DEI Forum of 12 global, cross-functional employees and executive sponsors to champion DEI initiatives ● 42% ethnically diverse U.S. workforce ● 40% female senior management team |

| | ● |

| Product Safety | ● Zero product recalls ● Zero FDA enforcement actions taken ● Zero products on FDA’s MedWatch Safety Alerts |

| | ● |

| Environmental | ● Received ISO 14001 Certification for San Clemente manufacturing facility ● Moving to create greenhouse gas (GHG) inventory for scope 1 and 2 GHG emissions data by 2023 |

| | |

| Cybersecurity | ● 100% of Glaukos users completed cybersecurity training ● 100% of employees who failed phishing tests completed additional training ● Moving toward formal alignment with NIST standards |

| | |

| Human Capital Management | ● 82% of workforce participated in employee engagement survey ● Expanded benefits available to employees, including child and elder care assistance, family planning, pet insurance, discounted health club memberships and onsite flu and COVID vaccinations and testing |

| | |

| Access & Affordability | ● Provided over 2,300 Photrexa® kits free of charge to uninsured patients ● Donated over 200 iStent®worldwide to underserved glaucoma patients ● Employees donated nearly $100,000 to local food banks at Thanksgiving ● Glaukos Charitable Foundation donated over $200,000 to various charitable organizations |

| | ● |

24 2022 PROXY STATEMENT | GLAUKOS CORPORATION | ||

EXECUTIVE OFFICERS OF THE COMPANY

The table below sets forth certain information regarding our executive officers as of April 6, 2022:

Name | Age | Position |

Thomas W. Burns | 61 | Chairman of the Board & Chief Executive Officer |

Joseph E. Gilliam | 46 | President & Chief Operating Officer |

Alex R. Thurman | 52 | Senior Vice President & Chief Financial Officer |

Tomas Navratil | 45 | Chief Development Officer |

See “Proposal One — Election of Directors” for information concerning the business experience of Mr. Burns. Information concerning the business experience of our other executive officers is set forth below.

Joseph E. Gilliam

| Mr. Gilliam has served as our President and Chief Operating Officer since April 2022. Previously, he served as our Chief Financial Officer and Senior Vice President, Corporate Development from May 2017 to April 2022. He was responsible for the Company’s accounting, financing, business development, information technology, investor relations, regulatory, internal audit and quality franchises prior to his recent appointment. From 2013 to May 2017, he was a Managing Director in the Healthcare Investment Banking group at JPMorgan, where he led the Glaukos initial public offering for the firm. From 2000 to 2013, Mr. Gilliam held positions of increasing responsibility at JPMorgan and its predecessor organizations The Beacon Group and Chase Manhattan, with experience spanning mergers and acquisitions, primary and secondary public equity offerings, bank lending, bond offerings and other transactions. He started his career at PricewaterhouseCoopers LLP. Mr. Gilliam currently serves on the board of directors of Caris Life Sciences. Mr. Gilliam has a B.S. in accounting from the Kelly School of Business at Indiana University. |

Alex R. Thurman