Form DEF 14A FTE Networks, Inc. For: Aug 17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

| Filed by the Registrant | ☒ |

| Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

FTE NETWORKS, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ☐ | Fee paid previously with preliminary materials: | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing: | |

| (1) | Amount previously paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

FTE NETWORKS, INC.

641 Lexington Avenue, 14th Floor, New York, NY 10022

August 17, 2022

Dear Stockholders:

You are cordially invited to attend the 2022 Annual Meeting of Stockholders (the “Meeting”) of FTE Networks, Inc. (the “Company”), which will be held virtually on Monday, August 29, 2022, at 9:00 a.m. Eastern Time.

Due to the ongoing health impact of the coronavirus (COVID-19) public health crisis, and to support the health and well-being of our employees and stockholders, the Meeting will be conducted online at www.virtualshareholdermeeting.com/FTNW2022SM. There will be no physical location for stockholders to attend.

Details regarding the Meeting and the business to be conducted are more fully described in the accompanying Notice of Annual Meeting of Stockholders (the “Notice”) and Special Meeting Proxy Statement (the “Proxy Statement”).

Your vote is very important. Whether or not you plan to attend the Meeting, we encourage you to vote promptly and to vote your shares prior to the Meeting. You may vote by proxy over the internet or by mail by following the instructions in your proxy card. If you attend the Meeting, you will have the right to revoke your proxy vote and vote electronically during the Meeting via the live webcast. If you hold your shares through an account with a brokerage firm, bank or other nominee, please follow the instructions you receive from your brokerage firm, bank or other nominee to vote your shares.

Thank you for your continued support and interest.

| Sincerely, | |

| /s/ Michael P. Beys | |

| Michael P. Beys | |

| Interim Chief Executive Officer |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

OF FTE NETWORKS, INC.

TO BE HELD ON AUGUST 29, 2022

NOTICE IS HEREBY GIVEN that an Annual Meeting of Stockholders (the “Meeting”) of FTE Networks, Inc., a Nevada corporation (the “Company”), will be held virtually via live audio webcast on August 29, 2022, at 9:00 a.m., Eastern Time, to consider and vote upon the following proposals:

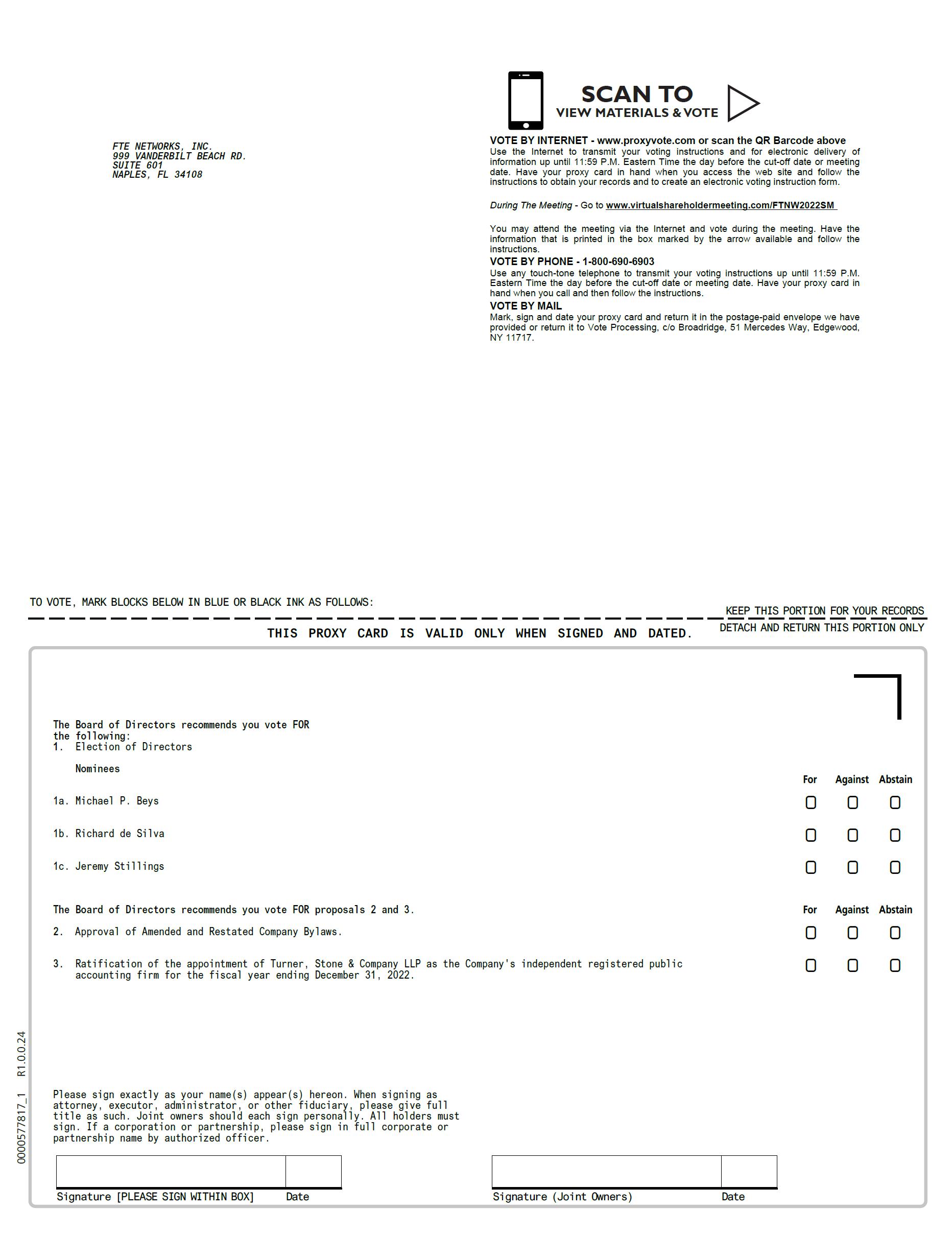

| 1. | To elect three directors to serve on the Company’s Board of Directors; | |

| 2. | Approval of amended and restated Company Bylaws; | |

| 3. | To ratify the selection of Turner, Stone & Company LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022; and | |

| 4. | To consider and vote upon such other matter(s) as may properly come before the Meeting or any adjournment thereof. |

These items of business are more fully described in the Proxy Statement accompanying this Notice. The Company’s Board of Directors (the “Board”) recommends that you vote in favor of Proposals 1, 2 and 3.

This year’s Meeting will be conducted in a virtual format only in order to assist in protecting the health and well-being of our stockholders and employees and to provide access to our stockholders regardless of geographic location. Stockholders will not be able to attend the Meeting in person; however, stockholders will be able to participate, vote electronically and submit questions during the live webcast of the Meeting by visiting www.virtualshareholdermeeting.com/FTNW2022SM and entering the control number found on their proxy card or voting instruction form. A support number will be visible 15 minutes prior to the meeting on the virtual meeting landing page if you may need assistance

Only stockholders of record, who are entitled to vote, as of July 27, 2022 (the “Record Date”) will be entitled to notice of, and to vote at, this Meeting or any adjournment or postponement thereof. The Notice contains instructions on how to access our Proxy Statement and how to vote online.

Your vote is important. Whether or not you plan to attend the Meeting, please ensure that your shares are represented by following the instructions in the proxy materials.

| Date: August 17, 2022 | BY ORDER OF THE BOARD OF DIRECTORS |

| /s/ Michael P. Beys | |

| Michael P. Beys | |

| Interim Chief Executive Officer |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS. This Proxy Statement and the proxy card are being mailed to our stockholders on or about August 17, 2022. In accordance with the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”), we are advising our stockholders of the availability on the internet of our proxy materials related to the Meeting. Because we have elected to utilize the “full set delivery” option, we are delivering paper copies of all of the proxy materials, as well as providing access to those proxy materials on a publicly accessible website. All stockholders of record who are entitled to vote and beneficial owners will have the ability to access the proxy materials at www.proxyvote.com. These proxy materials are available free of charge.

PROXY STATEMENT

FTE NETWORKS, INC.

641 Lexington Avenue, 14th Floor,

New York, NY 10022

This Proxy Statement and the accompanying proxy card are being furnished with respect to the solicitation of proxies by the Board of Directors (the “Board”) of FTE Networks, Inc., a Nevada corporation (the “Company”) for the Annual Meeting of the Stockholders (the “Meeting”) to be held virtually at 9:00 a.m., Eastern Time on Monday, August 29, 2022, via audio webcast at www.virtualshareholdermeeting.com/FTNW2022SM.

JOBS Act Explanatory Note

We are an “emerging growth company” under applicable federal securities laws and are therefore permitted to take advantage of certain reduced public company reporting requirements. As an emerging growth company, we provide in this proxy statement the scaled disclosure permitted under the Jumpstart Our Business Startups Act of 2012, including the compensation disclosures required of a “smaller reporting company,” as that term is defined in Rule 12b-2 promulgated under the Securities Exchange Act of 1934, as amended, (the “Exchange Act”). In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or the frequency with which such votes must be conducted. We will remain an “emerging growth company” until the earliest of (i) the last day of the fiscal year following the fifth anniversary of the date of our first sale of common equity securities of the issuer under an effective Securities Act registration statement, (ii) the last day of the fiscal year in which our annual gross revenues of $1.07 billion or more, (iii) the date on which we have, during the previous rolling three-year period, issued more than $1 billion in non-convertible debt securities or (iv) the date on which we are deemed to be a “large accelerated filer” as defined in the Exchange Act.

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why am I receiving these materials?

You have received these proxy materials because the Board of FTE Networks, Inc. (“we,” “us,” “our,” the “Company”) is soliciting your proxy to vote at the Meeting, including any adjournments or postponements of the Meeting. On or about August 17, 2022, we will mail the proxy materials to all stockholders of record who are entitled to vote at the Meeting.

How do I attend the Meeting?

You are invited to attend the virtual Meeting to vote on the proposals described in this Proxy Statement. However, you do not need to attend the Meeting to vote your shares. Instead, stockholders of record may vote by Internet or by completing and returning a proxy card. Additional information on how you may vote can be found below under “How do I vote?”

The Meeting will be held virtually on Monday August 29, at 9:00 a.m. Eastern Time via live webcast. You can virtually attend the Meeting by visiting www.virtualshareholdermeeting.com/FTNW2022SM, where you will be able to vote your shares and submit your questions during the Meeting via the Internet. A summary of the information you need to attend the Meeting online is provided below. There will not be a physical meeting location and you will not be able to attend in person.

Who can vote at the Meeting?

Only stockholders of record, who are otherwise entitled to vote, on July 27, 2022, will be entitled to vote at the Meeting. As of the Record Date, there were 48,766,614 shares entitled to vote, including shares of our preferred stock.

Stockholder of Record: Shares Registered in Your Name

If, on July 27, 2022, your shares were registered directly in your name and you are otherwise entitled to vote your shares, then you are a stockholder of record. As a stockholder of record, you may vote by using the Internet or by mail as described below. Stockholders of record also may attend the Meeting virtually and vote electronically.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on July 27, 2022, your shares were not held in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name,” and these materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the Meeting. However, since you are not the stockholder of record, you may not vote your shares at the Meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

There are three matters scheduled for a vote:

| 1. | To elect three directors to serve on the Company’s Board of Directors; | |

| 2. | Approval of amended and restated Company Bylaws; and | |

| 3. | To ratify the selection of Turner, Stone & Company LLP as our independent registered public accounting form for the fiscal year ending December 31, 2022; and |

What if another matter is properly brought before the Meeting?

Our Board knows of no other matters that will be presented for consideration at the Meeting. If any other matters are properly brought before the Meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How do I vote?

You may either vote “For” all the nominees to our Board or you may “Withhold” your vote for any nominee you specify. For the other matters to be voted on, you may vote “For” or “Against” or you may abstain from voting, by checking the related box. The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record who is otherwise entitled to vote, you may vote at the Meeting or by proxy using the proxy card enclosed with your mailed proxy materials. Whether or not you plan to attend the Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Meeting even if you have already voted by proxy.

| ● | You may vote by using the Internet at www.proxyvote.com by following the instructions for Internet voting on the proxy card mailed to you. Internet voting is available 24 hours a day and will be accessible until 11:59 p.m. Eastern Time on July 28, 2022. Easy-to-follow instructions allow you to vote your shares and confirm that your instructions have been properly recorded. | |

| ● | You may vote by mail by completing and mailing a proxy card. | |

| ● | The method you use to vote will not limit your right to vote at the Meeting if you decide to virtually attend the Meeting. If you wish to vote electronically at the Meeting, go to www.virtualshareholdermeeting.com/FTNW2022SM and register using your unique control number that was included in the proxy card that you received in the mail. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a voting instruction form with your proxy materials containing voting instructions from that organization rather than from the Company. Simply complete and mail the voting instruction form or follow the voting instructions in the proxy materials to ensure that your vote is counted. Follow the instructions from your broker or bank included with your mailed proxy materials, or contact your broker or bank, to request a proxy form.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own (and are entitled to vote) as of July 27, 2022.

What happens if I do not vote?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and do not vote by completing your proxy card or virtually at the Meeting, your shares will not be voted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner and do not instruct your broker, bank or other agent how to vote your shares, the question of whether your broker or nominee will still be able to vote your shares depends on the type of item being considered for a vote.

Non-Discretionary Items. The election of directors and the proposal to approve amendments to the Company’s bylaws are non-discretionary items and may not be voted on by your broker, bank or other holder of record absent specific voting instructions from you. If your bank, broker or other holder of record does not receive specific voting instructions from you, a “broker non-vote” will occur in the case of your shares for these proposals.

Discretionary Item. The ratification of Turner, Stone & Company LLP as the Company’s independent registered public accounting firm for the 2022 fiscal year is a discretionary item. Generally, brokers, banks and other holders of record that do not receive voting instructions may vote on this proposal in their discretion.

What if I return a proxy card or otherwise vote but do not make specific choices?

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted “FOR” the election of the director nominees listed in this proxy statement, “FOR” the approval of the amended and restated Company’s bylaws and “FOR” the ratification of the appointment of Turner, Stone & Company LLP as the Company’s independent registered public accounting firm for the 2022 fiscal year. If any other matter is properly presented at the Meeting, your proxy holder (one of the individuals named on your proxy card) will vote your shares using his best judgment.

Who is paying for this proxy solicitation?

The Company pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, over the telephone or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We also will reimburse brokerage firms, banks, nominees and other persons holding shares for others for the cost of forwarding proxy materials to beneficial owners and obtaining their proxies.

What does it mean if I receive more than one set of proxy materials?

If you receive more than one set of proxy materials, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the polls close at the Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

| 1. | You may submit another properly completed proxy card with a later date. | |

| 2. | You may send a timely written notice that you are revoking your proxy to our Corporate Secretary at FTE Networks, Inc., Attn: Corporate Secretary, at 641 Lexington Avenue, 14th Floor, New York, NY 10022. A revocation must be received no later than the beginning of voting at the Meeting. | |

| 3. | Participating in the Meeting and voting online at that time at www.virtualshareholdermeeting.com/FTNW2022SM. Although, online attendance at the Meeting will not, by itself, change your vote or revoke a proxy. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

What are “broker non-votes”?

As discussed above, when a beneficial owner of shares held in “street name” does not give instructions to the broker, bank, custodian or other nominee holding the shares as to how to vote on non-discretionary matters, the broker or nominee cannot vote the shares. These un-voted shares are counted as “broker non-votes.”

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. Under our Bylaws, a quorum will be present if stockholders holding at least a majority of the outstanding shares entitled to vote are present at the Meeting or represented by proxy. Abstentions and (because there is at least one “routine” matter to be voted on at the Meeting) broker non-votes will also be considered present for purposes of determining the existence of a quorum. As of the Record Date, there were 48,766,614 shares entitled to vote, including shares of our preferred stock. Thus, the holders of 24,383,308 shares must be present in person or represented by proxy at the meeting to have a quorum.

How many votes are needed to approve each proposal?

Votes will be counted by the inspector of elections appointed for the Meeting, who will separately count votes “For” and “Against,” abstentions or withheld votes, and, if applicable, broker non-votes. Votes withheld and broker non-votes with respect to Proposal 1 will have no effect and will not be counted for the purposes of the vote for Proposal 1. Abstentions and broker non-votes will be counted for the purposes of the vote total for Proposals 2 and 3 and will have the same effect as “Against” votes. The only routine matter on which brokers may vote without instructions is Proposal 3.

The following table describes the voting requirements for each proposal, including the vote required to approve each proposal and the effect that abstentions or broker non-votes will have on the outcome of the proposal:

| Proposal Number | Proposal Description | Vote Required for Approval | Effect of Abstentions |

Effect of Broker Non-Votes | ||||

| 1 | Election of directors | Nominees receiving the most “For” votes (plurality voting) | Withheld votes will have no effect | None | ||||

| 2 | Approval of Amended and Restated Company Bylaws | “For” votes from the holders of a majority of the votes cast at the Meeting | Against | Against | ||||

| 3 | Ratification of the appointment of Turner Stone as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022. | “For” votes from the holders of a majority of the votes cast at the Meeting | Against | N/A |

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote virtually at the meeting. If there is no quorum, the holders of a majority of shares present at the meeting in person or represented by proxy may adjourn the meeting to another date.

How can I find out the results of the voting at the Meeting?

Preliminary voting results will be announced at the Meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an amended Form 8-K to publish the final results.

Who should I contact if I have questions regarding the Meeting?

If you have any questions about the Meeting, the various proposals to be voted at the Meeting, and/or how to participate in the Meeting online at www.virtualshareholdermeeting.com/FTNW2022SM and vote at that time, contact the Company’s investor relations at [email protected].

PROPOSAL ONE

ELECTION OF DIRECTORS

Proposal and Required Vote

The Board has approved the following nominees for submission to our stockholders, each to serve a one-year term expiring at the annual meeting of the Company’s stockholders in 2023 or until such director’s successor shall have been duly elected and qualified (or, if earlier, such director’s removal or resignation from the Board):

| ● | Michael P. Beys; |

| ● | Richard de Silva; and |

| ● | Jeremy Stillings. |

Information concerning the director nominees, two of whom are incumbent directors of the Company, appears below. Although management does not anticipate that any of these director nominees will be unable or unwilling to stand for election, in the event of such an occurrence, proxies may be voted for a substitute designated by the Board.

Directors are elected by a plurality of the votes present at the Meeting or represented by proxy and entitled to vote at the Meeting. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the Nominees.

The Board recommends that our stockholders vote FOR the election of the three (3) director nominees.

Information Concerning Director Nominees and Other Board Members

Background information about each director nominee and other directors is set forth below, including information regarding the specific experiences, characteristics, attributes and skills that the Board considered in determining that each director should serve on the Board, and which the Board believe provide the Company with the perspective and judgment needed to guide, monitor and execute its strategies. Joseph Cunningham, an incumbent Board member, has not been nominated for election. For the avoidance of doubt, any director not submitted for nomination or elected at the Meeting shall be deemed removed from the Board and have vacated their position as Director.

Director Nominees for election at the Meeting

Michael P. Beys, age 50, has served as a member of the Board since his appointment on October 18, 2019, and as interim CEO since December 11, 2019. Mr. Beys is a partner with the law firm Beys Liston & Mobargha LLP, which he founded in 2009. He focuses his practice on federal criminal defense, complex commercial litigation and real estate litigation. From 2000 to 2005, Mr. Beys served as a federal prosecutor in the U.S. Attorney’s Office for the Eastern District of New York, where he was the lead counsel in over 100 federal prosecutions and investigations involving racketeering, fraud, tax evasion, money laundering, narcotics trafficking, violent crimes and terrorism. Mr. Beys is also currently the chairman of the board of directors of Secure Property Development & Investment, PLC, a publicly listed (London’s AIM) owner and operator of commercial and industrial properties in Eastern Europe, and a member of the Supervisory Board of Arcona Property Fund N.V., a listed fund (Euronext Amsterdam) that invests in commercial real estate in Central Europe. In 2005, he co-founded Aristone Capital, a real estate investment firm which provided mezzanine debt financing to New York area real estate developers. In 1999, he founded Cobblestone Ventures, Inc., a real estate development firm which has invested in, or actively managed, numerous conversion and new construction projects in downtown New York City. Mr. Beys received a B.A. from Harvard College and a J.D. from Columbia Law School. Given his background and experience in law enforcement and real estate, Mr. Beys is uniquely qualified to serve as a member of the Board and interim CEO and to continue the great effort to salvage and preserve shareholder value for FTE.

Richard de Silva, age 49, has served as a member of the Board since his appointment on October 18, 2019. Mr. de Silva serves as Managing Partner of Lateral Investment Management, LLC, a California-based credit and growth equity firm, which he joined in 2014. Mr. De Silva is responsible for leading the day-to-day investment activities and operations of the firm, which include investment origination, underwriting, asset management and fundraising. Mr. de Silva was previously a General Partner at Highland Capital Partners, a private equity firm. He joined Highland in 2003 and focused on investments in growth-stage technology companies. Mr. de Silva has also held operating roles in several companies as an entrepreneur and senior executive including as co-founder of IronPlanet, a marketplace for construction equipment. He received a B.A. from Harvard College, a Master of Philosophy in International Relations from Cambridge University and an M.B.A. from Harvard Business School.

Jeremy Stillings, age 44, is an attorney with a background in corporate governance and restructuring and serves on corporate boards as an independent director. He currently has no known contacts or affiliations with the Board, the Company, or any equity security holders, creditors, or other stakeholders of the Board or the Company. Mr. Stillings currently serves as an independent member of the Board of Directors for Lighthouse Resources, Inc. He also provides advisory services to a number of commercial clients regarding corporate strategy, corporate governance, and restructurings. Mr. Stillings is a licensed attorney and member of the bar of the State of Illinois, and previously was employed as an attorney specializing in corporate governance and corporate restructuring by the firms of Jenner & Block LLP, Winston & Strawn LLP, and most recently Proskauer Rose, LLP. He received a B.A. from Tulane University and a J.D. from the University of Texas.

Director who is not a Nominee for Election

Joseph Cunningham, age 74, serves as President of Liberty Mortgage Acceptance Corporation, a private mortgage lender arranging commercial mortgage-backed securities and bridge financing, which he co-founded in 1992. In 2009, Mr. Cunningham co-founded Renew Lending, Inc., a residential mortgage banking firm. Mr. Cunningham left the firm in 2017. Prior to 2009, Mr. Cunningham served as Chief Operating Officer of Colwell Financial Corporation, where he was responsible for all divisions including residential production, secondary marketing, construction lending, joint ventures, commercial real estate brokerage, loan servicing, insurance, underwriting, personnel, REO, finance and administration, and legal activities. Mr. Cunningham also previously served as Executive Vice President and Chief Financial Officer of Granite Financial Corporation, a boutique mortgage banking firm. Earlier in his career, Mr. Cunningham practiced as a CPA in the Boston office of PwC. Mr. Cunningham received a B.S. in Accounting from Boston College.

Mr. Cunningham was appointed to the Board on October 18, 2018 and served as Chair of the Audit Committee until recently when the Company learned he disclosed confidential Board information to third parties with interests adverse to the Company. The Company has sued Mr. Cunningham alleging violations of his duty of loyalty and confidentiality and his participation in a conspiracy to defraud the Company and its stockholders in connection with the Vision asset acquisition, among other allegations.

Involvement in Certain Legal Proceedings

During the past ten (10) years, none of the Nominees has been involved in any legal proceeding that is material to the evaluation of their ability or integrity relating to any of the items set forth under Item 401(f) of Regulation S-K. None of the Nominees is a party adverse to the Company or any of its subsidiaries in any material proceeding or has a material interest adverse to the Company or any of its subsidiaries.

Family Relationships

None of the Nominees or the Company’s executive officers is related by blood, marriage or adoption.

THE BOARD RECOMMENDS THAT YOU VOTE

“FOR”

THE ELECTION OF EACH NAMED NOMINEE

PROPOSAL TWO

APPROVAL OF AMENDED AND RESTATED COMPANY BYLAWS

The Board, in its continuing review of corporate governance matters, has concluded that it is advisable and in the best interests of the Company and its stockholders to amend and restate the Bylaws to conform to the Company’s evolving needs, strategy and operating environment, and Nevada Revised Statutes (NRS).

In keeping with the Company’s transparency ethic, we are asking stockholders to approve the amended and restated bylaws of the Company, attached hereto as Exhibit A.

THE BOARD RECOMMENDS THAT YOU VOTE

“FOR”

THE PROPOSAL TO APPROVE AMENDED AND RESTATED BYLAWS

PROPOSAL THREE

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

The Board intends to appoint Turner, Stone & Company LLP (“Turner Stone”) as the Company’s independent registered public accountants for the fiscal year ending December 31, 2022. Services provided to the Company by our independent registered public accountants during past two fiscal years are described below.

| Fee Category | December 31, 2021 | December 31, 2020 | ||||||

| Audit fees | $ | — | $ | 477,050 | ||||

| Audit related fees | $ | — | $ | 30,260 | (2) | |||

| Total | $ | — | $ | 507,310 | ||||

| (1) | Aggregate fees billed or expected to be billed by the principal accountant for the audit of the annual financial statements and review of the financial statements included in the registrant’s form 10-K or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for the last two fiscal years. | |

| (2) | Audit related fees consist of fees billed for services rendered in connection with the Vision Asset Purchase Agreement. |

The affirmative vote of the holders of a majority of shares represented in person or by proxy and entitled to vote on this item will be required for approval. Abstentions will be counted as represented and entitled to vote and will therefore have the effect of a negative vote.

THE BOARD RECOMMENDS THAT YOU VOTE

“FOR”

THE RATIFICATION OF THE APPOINTMENT OF TURNER, STONE & COMPANY LLP

AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS FOR THE FISCAL

YEAR ENDING DECEMBER 31, 2022

In the event stockholders do not ratify the appointment, the appointment will be reconsidered by the Board. Even if the selection is ratified, the Board in its discretion may select a different registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and our stockholders.

CORPORATE GOVERNANCE

Committees of our Board of Directors

The Board has three standing committees: an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee.

Audit Committee

Our Audit Committee assists with the Boards’ oversight responsibilities relating to our financial accounting and reporting processes and auditing processes. The purpose, authority, resources and responsibilities of our audit committee are more specifically set forth in its charter, which is available at www.ftenet.com, for our Audit Committee which provides that our Audit Committee is responsible for, among other things:

| ● | appointing, compensating, retaining, overseeing the independence and performance of and terminating our independent auditors and pre-approving all audit and non-audit services permitted to be performed by the independent auditors; |

| ● | discussing with management and the independent auditors our quarterly and annual audited financial statements, our internal control over financial reporting, and related matters; |

| ● | reviewing and discussing with management and the independent auditors the Management’s Discussion and Analysis section of the Company’s Forms 10-Q and 10-K prior to filing with the SEC; |

| ● | reviewing and discussing with the independent auditors any reports, comments or recommendations made to the Company and consulting with the independent auditors at least once per quarter regarding internal controls and reporting procedures; |

| ● | reviewing, at least quarterly, the status of any legal matters which could significantly impact the Company’s financial statements |

| ● | reviewing with management the Company’s program for promoting compliance with the applicable legal and regulatory requirements; |

| ● | reviewing and approving any related party transactions; |

| ● | monitoring compliance with our Code of Ethics; |

| ● | meeting separately, periodically, with management and the independent auditors; |

| ● | annually reviewing and reassessing the adequacy of our Audit Committee Charter; |

| ● | such other matters that are specifically delegated to our Audit Committee by our Board from time to time; and maintaining minutes of meetings and reporting regularly to the Board of Directors |

Until January 2022, the Board’s Audit Committee was comprised of Joseph Cunningham, the then-sole independent member of the Board. However, the Company has alleged Mr. Cunningham’s actions were in breach of his fiduciary duties to the Company and its stockholders, and his affiliation with parties whose interest are materially adverse to the interests of the Company and its stockholders have rendered Mr. Cunningham not independent and, thus, unable to perform his duties objectively. Due to the lack of independent directors, the Board is tasked with reviewing and approving audit-related decisions.

Compensation Committee

Our Compensation Committee has the principal responsibility for the compensation plans of the Company, particularly as applied to the compensation of executive officers and directors. We have implemented a written charter for our Compensation Committee, available at www.ftenet.com, which provides that our Compensation Committee is responsible for, among other things:

| ● | reviewing and making recommendations to our Board regarding our compensation policies and forms of compensation provided to our directors and officers; |

| ● | reviewing and assisting the Board and Management in enforcing the prohibition on loans by the company to officers and directors; |

| ● | reviewing and making recommendations to our Board regarding bonuses for our officers and other employees; |

| ● | reviewing and making recommendations to our Board regarding stock-based compensation for our directors and officers; |

| ● | annually reviewing and reassessing the adequacy of our Compensation Committee Charter; |

| ● | administering our stock option plans in accordance with the terms thereof; and |

| ● | such other matters that are specifically delegated to the Compensation Committee by our Board after the business combination from time to time. |

The Compensation Committee Charter sets forth the authority and responsibilities of the Committee for the performance evaluation and compensation of the Company’s CEO, executive officers and directors, and significant compensation arrangements, plans, policies and programs of the Company. The Committee has authority to retain such outside counsel, experts and other advisors as it determines to be necessary to carry out its responsibilities, including the authority to approve an external advisor’s fees and other retention terms on behalf of the Company. Pursuant to the Compensation Committee Charter, the Company shall provide appropriate funding to the Committee, as determined by the Committee in its capacity as a Committee of the Board, for payment of compensation to any outside advisors engaged by the Committee.

The Compensation Committee is also tasked with reviewing and approving the corporate goals and objectives relevant to CEO compensation and evaluates the CEO’s performance in light of such goals and objectives. Based on this evaluation the Committee makes and annually reviews decisions regarding: (i) salary paid to the CEO; (ii) the grant of all cash based bonuses and equity compensation to the CEO; (iii) the entering into or amendment or extension of any employment contract or similar arrangement with the CEO; (iv) any CEO severance or change in control arrangement; and (v) any other CEO compensation matters as from time to time directed by the Board. In determining the long-term incentive component(s) of the CEO’s compensation, the Committee considers the Company’s performance and relative stockholder return, the value of similar incentive awards to chief executive officers at companies that the Committee determines comparable based on factors it selects and the incentive awards given to the Company’s CEO in prior years.

Due to the lack of independent directors, the Board is tasked with reviewing and approving compensation-related decisions.

Nominating and Corporate Governance Committee

The primary purpose of our Nominating and Corporate Governance Committee is to submit candidates who have high personal and professional integrity, who have demonstrated exceptional ability and judgment and who are effective, in conjunction with the other nominees to the Board, in collectively serving the long-term interests of the stockholders. We have implemented corporate governance guidelines as well as a written charter for our Nominating and Corporate Governance Committee, available at www.ftenet.com, which provides that our Nominating and Corporate Governance Committee is responsible for, among other things:

| ● | defining the future needs of the Board and overseeing the process by which individuals may be nominated to our Board and its standing committees; |

| ● | making recommendations as to the size, functions and composition of our Board and its committees; |

| ● | identifying, recruiting, evaluating, approving and nominating potential directors; |

| ● | considering nominees proposed by our stockholders; |

| ● | establishing and periodically assessing the criteria for the selection of potential directors; |

| ● | making recommendations to the Board on new candidates for Board membership; |

| ● | Reviewing the Company’s Insider Trading Policy and recommending any changes for approval by the Board; |

| ● | overseeing corporate governance matters including educating directors and identifying any potential conflicts of interest; |

| ● | recommending that the Board establish special committees as necessary; and |

| ● | reviewing annually and reassessing the adequacy of our Nominating and Corporate Governance Committee Charter. |

In evaluating nominees, the Nominating and Corporate Governance Committee should take into consideration attributes such as leadership, independence, interpersonal skills, financial acumen, business experiences, industry knowledge, and diversity of viewpoints.

One of the primary responsibilities of the Nominating and Corporate Governance Committee is to make appropriate recommendations to the Board for the appointment or re-appointment of directors. The Company seeks to have directors who, in addition to relevant technical, commercial and securities expertise, meet the highest standards of personal integrity, judgment and critical thinking, and an ability to work in an open environment with other directors to further the interests of the Company and its shareholders. In recommending appointments to the Board, the Committee should be mindful of the overall balance of the skills, knowledge and experience of Board members against the current and future requirements of the Company and of the benefits of diversity. The Company recognizes the importance of diversity at all levels of the Company as well as on the Board and considers overall Board balance and diversity when appointing new directors. Board appointments are, in the final analysis, made on merit.

Due to the lack of independent directors, the Board is tasked with vetting and recommending director nominees for appointment and election to the Board.

Board Leadership Structure and Role in Risk Oversight

Risk oversight is administered through the Board as a whole. The Board does not have a policy on whether the offices of Chairman of the Board and Chief Executive Officer should be separate and, if they are to be separate, whether the Chairman of the Board should be selected from among the independent directors. Our Board believes that it should have the flexibility to make these determinations at any given time in the way that it believes best to provide appropriate leadership for the Company at that time and in consideration of the composition of the Board, the Company’s size, the nature of the Company’s business, litigation, and other relevant factors.

Director Independence

For independence purposes, we use the definition and standards of independence applied by the New York Stock Exchange (“NYSE”). Under the rules of NYSE, a company’s board of directors must be comprised of a majority of independent directors. A director will only qualify as an “independent director” if, in the opinion of the Company’s Board, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Michael Beys is not considered independent because of his role as interim CEO of the Company. Richard de Silva is not considered independent because of the nature and percentage of beneficial ownership of the Company. Joseph Cunningham is no longer considered independent due to his alleged affiliation with parties with interests adverse to Company and its stockholders. We expect Jeremy Stillings to qualify as an independent member of the Board if elected to the Board at the Meeting.

Board Meetings

The Board typically met once a week (a minimum of twice per month) during the fiscal year ended December 31, 2021. Each director attended greater than seventy-five percent (75%) of the aggregate of the total number of meetings of the Board (held during the period for which each director has been a director) and the total number of meetings held by all committees of the board on which each director served (during the period for which each director has been a director).

Compliance with Section 16(a) of the Exchange Act

Section 16(a) of the Exchange Act requires an issuer’s officers and directors, and persons who own more than ten percent (10%) of a registered class of a company’s equity securities, to file reports of ownership and changes in ownership with the SEC. Officers, directors, and greater than ten percent (10%) stockholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

To our knowledge, based solely on a review of the copies of such reports furnished to us, we believe that all reports under Section 16(a) required to be filed by our officers and directors and greater than ten percent (10%) beneficial owners were timely filed.

Code of Ethics

The Board adopted a Code of Business Conduct and Ethics with the purpose of assuring that all employees, directors and officers of the Company and its subsidiaries understand and adhere to high ethical standards of conduct. A copy of the Code of Business Conduct and Ethics is available on the Company website at www.ftenet.com. We have also adopted an Insider Trading Policy that applies to all directors, officers, and employees.

Indemnification of Directors and Officers

Our directors and executive officers are indemnified as provided by the Nevada law and our Bylaws. These provisions state that our directors may cause us to indemnify a director or former director against all costs, charges and expenses, including an amount paid to settle an action or satisfy a judgment, and reasonably incurred by him/her as a result of him acting as a director. The indemnification of costs can include an amount paid to settle an action or satisfy a judgment. Such indemnification is at the discretion of our Board and is subject to the Securities and Exchange Commission’s policy regarding indemnification.

EXECUTIVE OFFICERS

General

The table below lists our directors and executive officers along with each person’s age as of July 27, 2022 and any other position that such person holds.

| Name | Age | Position | ||

| Executive Officers | ||||

| Michael P. Beys | 50 | Interim Chief Executive Officer and Director | ||

| Ernest Scheidemann | 61 | Interim Chief Financial Officer | ||

| Non-Employee Directors | ||||

| Joseph Cunningham | 74 | Director | ||

| Richard de Silva | 49 | Director |

A brief biography of the executive officer who is not also a Nominee is set forth below:

Ernest Scheidemann, Interim Chief Financial Officer

Mr. Scheidemann was appointed Interim Chief Financial Officer on May 5, 2020. Mr. Scheidemann was the CFO of Benchmark Builders, Inc. from April 2017 through November 2018. From 2008 to 2015, Mr. Scheidemann was CFO of a private global software company. Prior to that, Mr. Scheidemann was the Treasurer and CFO of WCI Communities, a $2.0 billion publicly traded homebuilder from 2004 to 2008 and held various progressive finance and accounting leadership roles with AT&T Corp from 1984 through 1999. Mr. Scheidemann is a Certified Public Accountant. He holds a Certified Global Management Accountant and Certified Financial Forensics designation issued from the American Institute of CPAs. Mr. Scheidemann received a B.A. in Accounting from William Paterson University and M.B.A. in Finance and International Business from Seton Hall University.

Involvement in Certain Legal Proceedings

During the past ten (10) years, none of our officers has been involved in any legal proceeding that is material to the evaluation of their ability or integrity relating to any of the items set forth under Item 401(f) of Regulation S-K. None of the officers is a party adverse to the Company or any of its subsidiaries in any material proceeding or has a material interest adverse to the Company or any of its subsidiaries.

COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS

Executive Compensation

The following table sets forth certain information with respect to compensation for the years ended December 31, 2021 and 2020 earned by or paid to our interim chief executive officer and our two most highly compensated executive officers, other than our chief executive officer, whose total compensation exceeded $100,000 (the “named executive officers”).

Summary Compensation Table

| Name and Principal | Salary (1) | Bonus | Stock awards | Stock options | Non-equity incentive plan compensation | Nonqualified deferred compensation earnings | All other compensation | Total | ||||||||||||||||||||||||||||

| Position | Year | $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||

| Michael P. Beys, | 2021 | 776,750 | - | - | - | - | - | - | 776,750 | |||||||||||||||||||||||||||

| Interim Chief Executive Officer (2) | 2020 | 150,000 | - | - | - | - | - | - | 150,000 | |||||||||||||||||||||||||||

| Ernest Scheidemann, | 2021 | 373,110 | - | - | - | - | - | - | 373,110 | |||||||||||||||||||||||||||

| Interim Chief Financial Officer | 2020 | 359,855 | - | - | - | - | - | - | 359,855 | |||||||||||||||||||||||||||

| Stephen Goodwin, | 2021 | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||

| Former Executive Vice President of Operations | 2020 | 207,671 | - | - | - | - | - | 207,671 | ||||||||||||||||||||||||||||

| (1) | Salary amounts reflect net salary (pro-rated in some instances) paid for the last two fiscal years. |

| (2) | Mr. Beys was appointed as interim CEO on December 11, 2019. The duly constituted Compensation Committee at the time approved a cash component of Mr. Beys’ overall compensation package which provides for a monthly salary of $50,000 for the duration of his service as interim CEO, of which $150,000 was paid in 2020 and $776,750 was paid in 2021 (which includes a 2020 deferred payment of $176,750). |

(3) |

Mr. Goodwin served as Executive Vice President of Operations, for which service he was paid a total of $207,671 in 2020. |

Employment Agreements

The Company has not entered into an employment agreement with Michael Beys or Ernest Scheidemann in connection with their service as interim CEO and interim CFO

Outstanding Equity Awards at Last Fiscal Year End

There were no grants of plan-based equity awards or non-equity awards to named executives during the years ended December 31, 2020 and 2021.

Pension, Retirement or Similar Benefit Plans

There are no arrangements or plans in which we provide pension, retirement or similar benefits for directors or executive officers. We have no material bonus or profit sharing plans to which cash or non-cash compensation is or may be paid to our directors or executive officers, except that stock options may be granted at the discretion of the Board or the Compensation Committee.

Director Compensation

The following table sets forth the compensation earned by each non-executive director for the year ended December 31, 2021. As an executive director, Mr. Beys did not receive any compensation for his service as a director.

| Name | Year | Fees earned or paid in cash ($) | Stock awards ($) | Option awards ($) | Non-equity incentive plan compensation ($) | Change in pension valued and nonqualified deferred compensation earnings ($) | All other compensation ($) | Total $) | ||||||||||||||||||||||||

| Peter Ghishan | 2021 | 305,000 | - | - | - | - | - | 305,000 | (1) | |||||||||||||||||||||||

| Joseph Cunningham | 2021 | 240,000 | - | - | - | - | - | 240,000 | (2) | |||||||||||||||||||||||

| Richard de Silva | 2021 | 210,000 | - | - | - | - | - | 210,000 | (3) | |||||||||||||||||||||||

| (1) | As of fiscal year ended December 31, 2021, Mr. Ghishan earned and accrued fees for his service on the Board and as then-chair of the Compensation Committee in accordance with the Company’s Non-Employee Director Compensation Policy. Mr. Ghishan resigned from the Board, effective June 30, 2021. On August 23, 2021, in connection with Mr. Ghishan’s resignation from the Board, we entered into a Separation Agreement and Release, pursuant to which we issued Mr. Ghishan a promissory note in the principal amount of $300,000 as full and final settlement of any accrued and unpaid Board and Committee fees during his tenure. This promissory note accrues interest at 5% per annum. Mr. Ghishan’s compensation does not include the fair market value of 150,000 shares of Company common stock issued to Mr. Ghishan in 2021. | |

| (2) | As of fiscal year ended December 31, 2021, Mr. Cunningham earned and accrued fees for his service on the Board and as then-chair of the Audit Committee in accordance with the Company’s Non-Employee Director Compensation Policy, of which $45,000 was paid in cash in fiscal 2020. Mr. Cunningham’s total compensation does not include the fair market value of 150,000 shares of Company common stock issued to Mr. Cunningham in 2021. | |

| (3) | As of fiscal year ended December 31, 2021, Mr. de Silva earned and accrued fees for his service on the Board in accordance with the Company’s Non-Employee Director Compensation Policy. Mr. de Silva has not been received any cash payments in respect of earned and accrued Board fees. Mr. de Silva’s total compensation does not include the fair market value of 150,000 shares of Company common stock issued to Mr. de Silva in 2021. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Transactions with Related Persons

The following discussion relates to types of transactions involving our company and any of our executive officers, directors, director nominees or five percent (5%) stockholders, each of whom we refer to as a “related party.” For purposes of this discussion, a “related-party transaction” is a transaction, arrangement or relationship:

● in which we participate;

● that involves an amount in excess of the lesser of $120,000 or 1% of the average of our total assets at year end for the last two completed fiscal years; and

● in which a related party has a direct or indirect material interest.

From January 1, 2021 through the date of this Proxy Statement, there have been no related-party transactions, except for the executive officer and director compensation arrangements described in the section “Executive Compensation” and as described below.

Related Party Loans/Advances

| - | Between August and October 2021, Cobblestone Ventures, Inc., an entity controlled by Michael Beys, the Company’s interim CEO and a member of our Board, loaned the Company a total of $25,000 for working capital purposes, pursuant to a demand note at 10% per annum. |

| - | The Company issued a grid note, payable to Lateral Recovery, LLC, to memorialize the amounts advanced throughout 2021 for working capital purposes. The Grid Note accrues interest at 10% per annum and had an outstanding balance (including accrued interest) of $3,675,044.49 as of June 30, 2022. |

Procedure for Related Party Transactions

Any request for us to enter into a transaction with an executive officer, director, principal stockholder, or any of such persons’ immediate family members or affiliates, in which the amount involved exceeds the lesser of $120,000 or 1% of the average of our total assets at year-end for the last two completed fiscal years must first be presented to our Audit Committee (or in the absence of a duly constituted Audit Committee, the Board) for review, consideration and approval. All of our directors, executive officers and employees will be required to report to the Audit Committee or the Board any such related party transaction. In approving or rejecting the proposed agreement, our Audit Committee or the Board will consider the relevant facts and circumstances available and deemed relevant, including, but not limited to, the risks, costs and benefits to us, the terms of the transaction, the availability of other sources for comparable services or products, and the impact on a director’s independence. Our Audit Committee or Board will approve only those agreements that, in light of known circumstances, are in, or are not inconsistent with, our best interests, as our Audit Committee or Board determines in the good faith exercise of their discretion.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information concerning beneficial ownership of shares of our Common Stock with respect to (i) each person known to us to beneficially own 5% or more of the outstanding shares of our common stock, (ii) each director of our company, (iii) the executive officers of our company, and (iv) all directors and officers of our company as a group. Unless otherwise indicated or the table or the footnotes below, the address for each beneficial owner is c/o FTE Networks, Inc., 641 Lexington Avenue, 14th Floor, New York, NY 10022.

Beneficial ownership is determined in accordance with the rules of SEC and generally includes voting or investment power with respect to securities. Shares of Common Stock that are currently exercisable or exercisable within 60 days of July 27, 2022, are deemed to be beneficially owned by the person holding such securities and for the purpose of computing the percentage ownership of that person but are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

| Name of Beneficial Owner | Amount and Nature of Beneficial Ownership (1)(2) | Percentage of Class(1)(2) | ||||||

| Directors and Officers | ||||||||

| Joseph Cunningham, Director | 150,000 | * | % | |||||

| Richard de Silva, Director | 26,158,773 | (3) | 53.6 | % | ||||

| Michael P. Beys, Director and Interim CEO | - | - | % | |||||

| Ernest Scheidemann, Interim CFO | - | - | % | |||||

| All Directors and Officers as a group (4 persons) | 26,308,773 | 53.9 | % | |||||

| 5% Shareholders | ||||||||

| Lateral Investment Management (Lateral Entities) (4) | 26,008,773 | 53.3 | % | |||||

* Less than 1%.

| (1) | The beneficial ownership reported in the table includes: (1) 33,110,629 shares of Common Stock beneficially owned and entitled to vote as of July 27, 2022; (2) 2,844,985 shares of Common Stock which are issuable pursuant to conversions of the Company’s legacy Series A and Series A-1 Preferred Stock; and (3) the voting rights associated with 1,000 shares of the Company’s Series J-1 Preferred Stock and 1,000 shares of the Company’s Series J-2 Preferred Stock issued to the Lateral Entities, which are entitled to 6,405.5 votes per share of Series J-1 and Series J-2 Preferred Stock. |

| (2) | Excludes shares of Common Stock and Series I Preferred Stock issued to Alexander Szkaradek and Antoni Szkaradek in connection with the Second Amendment to the Vision Asset Purchase Agreement, which are the subject of litigation in Delaware and are not entitled to vote at this Meeting. |

| (3) | Includes 150,000 shares beneficially owned by Mr. de Silva. Mr. de Silva, as managing partner of Lateral Investment Management, may be deemed to beneficially own the shares held by the Lateral Entities. This amount does not include a total of 3,935,480 warrants held by the Lateral Entities. |

| (4) | The Lateral Entities are comprised of Lateral FTE Feeder LLC, Lateral BVM Feeder LLC, Lateral Juscom Feeder LLC, Lateral Partners LLC, Lateral SMA Agent LLC, Lateral US Credit Opportunities Fund, L.P, WVP Emerging Manager Private Onshore Fund, LLC, and Niagara Nominee LP. This amount does not include a total of 3,935,480 warrants held by the Lateral Entities. The address for Lateral Entities is 400 South El Camino Real, Suite 1100, San Mateo, CA 94402. |

OTHER MATTERS

Delivery of Documents to Stockholders Sharing an Address

Only one Proxy Statement is being delivered to two or more security holders who share an address, unless the Company has received contrary instruction from one or more of the security holders. The Company will promptly deliver, upon written or oral request, a separate copy of the Proxy Statement to a security holder at a shared address to which a single copy of the document was delivered. If you would like to request additional copies of the Proxy Statement, or if in the future you would like to receive multiple copies of information or proxy statements, or annual reports, or, if you are currently receiving multiple copies of these documents and would, in the future, like to receive only a single copy, please so instruct the Company, by writing to us at 641 Lexington Avenue, 14th Floor, New York, NY 10022.

Submission of Stockholder Proposals

If you wish to have a proposal included in our proxy statement and form of proxy for next year’s annual meeting in accordance with Rule 14a-8 under the Exchange Act, your proposal must be received by us at our principal executive offices on or before May 1, 2023 (unless the date of the 2023 annual meeting of stockholders is not within thirty (30) days of August 29, 2022, in which case the proposal must be received no later than a reasonable period of time before we begin to print and send our proxy materials for our 2023 annual meeting). A proposal which is received after that date or which otherwise fails to meet the requirements for stockholder proposals established by the SEC will not be included. The submission of a stockholder proposal does not guarantee that it will be included in the proxy statement.

Stockholder Communications

Stockholders who wish to communicate with the Board, may send a letter to the Company’s Corporate Secretary at 641 Lexington Avenue, 14th Floor, New York, NY 10022. The mailing envelope must contain a clear notation indicating that the enclosed letter is a “Stockholder Communication.” All such letters should identify the author as a security holder. All such letters will be reviewed by the Board at the next regularly scheduled Board meeting.

Interest of Officers and Directors in Matters to Be Acted Upon

Except for the election to our Board of the three nominees set forth herein, none of our officers or directors has any substantial interest in any matters to be acted upon at the Meeting.

Dissenters’ Rights of Appraisal

Under the Nevada Revised Statutes and the Company’s Articles of Incorporation, as amended, stockholders are not entitled to any appraisal or similar rights of dissenters with respect to any of the proposals to be acted upon at the Meeting.

| BY ORDER OF THE BOARD OF DIRECTORS | |

| August 17, 2022 | /s/ Michael P. Beys |

| Michael P. Beys | |

| Interim Chief Executive Officer |

EXHIBIT A

Amended and Restated Bylaws of FTE Networks, Inc.

AMENDED AND RESTATED BYLAWS

OF

FTE NETWORKS, INC.

a Nevada corporation

Adopted effective as of August [●], 2022

Table of Contents

Page | ||

| ARTICLE I | OFFICES | 1 |

| Section 1.1 | Registered Office | 1 |

| Section 1.2 | Other Offices | 1 |

| ARTICLE II | STOCKHOLDERS | 1 |

| Section 2.1 | Place of Meetings | 1 |

| Section 2.2 | Remote Communications | 1 |

| Section 2.3 | Annual Meeting | 1 |

| Section 2.4 | List of Stockholders | 2 |

| Section 2.5 | Special Meetings | 2 |

| Section 2.6 | Notice of Meetings | 2 |

| Section 2.7 | Limitation on Business | 3 |

| Section 2.8 | Quorum | 3 |

| Section 2.9 | Voting Required for Action | 3 |

| Section 2.10 | Proxies | 4 |

| Section 2.11 | Action by Written Consent | 4 |

| Section 2.12 | Closing of Transfer Books/Record Date | 4 |

| Section 2.13 | Registered Stockholders | 5 |

| ARTICLE III | DIRECTORS | 5 |

| Section 3.1 | Management of Business | 5 |

| Section 3.2 | Number; Election | 5 |

| Section 3.3 | Resignation and Vacancies | 5 |

| Section 3.4 | Removal by Stockholders | 6 |

| Section 3.5 | Meetings | 6 |

| Section 3.6 | Annual and Regular Meetings | 6 |

| Section 3.7 | Special Meetings | 7 |

| Section 3.8 | Quorum and Voting | 7 |

| Section 3.9 | Consent Without a Meeting | 7 |

| Section 3.10 | Telephonic Meetings | 7 |

| Section 3.11 | Committees; Subcommittees | 8 |

| Section 3.12 | Compensation | 8 |

| i |

Table of Contents

(continued)

Page | ||

| ARTICLE IV | OFFICERS | 9 |

| Section 4.1 | General | 9 |

| Section 4.2 | Appointment, Resignation and Removal | 9 |

| Section 4.3 | Subordinate Officers | 9 |

| Section 4.4 | Compensation | 9 |

| Section 4.5 | Duties of President | 9 |

| Section 4.6 | Duties of Chairperson of the Board | 10 |

| Section 4.7 | Duties of Vice President | 10 |

| Section 4.8 | Duties of Secretary | 10 |

| Section 4.9 | Duties of Assistant Secretaries | 10 |

| Section 4.10 | Duties of Treasurer | 10 |

| Section 4.11 | Duties of Assistant Treasurers | 11 |

| ARTICLE V | NOTICES | 11 |

| Section 5.1 | General | 11 |

| Section 5.2 | Notice to Stockholders by Electronic Transmission | 11 |

| Section 5.3 | Effectiveness of Notice | 12 |

| Section 5.4 | Notice to Person with Whom Communication is Unlawful | 12 |

| Section 5.5 | Waiver of Notice | 12 |

| ARTICLE VI | INDEMNIFICATION OF DIRECTORS, OFFICERS, EMPLOYEES AND OTHER AGENTS | 13 |

| Section 6.1 | Indemnity for Claims Not in the Name of Corporation | 13 |

| Section 6.2 | Indemnity for Claims in the Name of Corporation | 13 |

| Section 6.3 | Indemnification of Employees and Agents | 14 |

| Section 6.4 | Success on Merits | 14 |

| Section 6.5 | Advancement of Expenses | 14 |

| Section 6.6 | Limitation on Indemnification | 14 |

| Section 6.7 | Indemnity Not Exclusive | 15 |

| Section 6.8 | Insurance Indemnification | 15 |

| Section 6.9 | Conflicts | 15 |

| Section 6.10 | Indemnity Agreements | 15 |

| Section 6.11 | Survival | 16 |

| Section 6.12 | Repeal or Modification | 16 |

| ii |

Table of Contents

(continued)

Page | ||

| ARTICLE VII | CERTIFICATES OF STOCK | 16 |

| Section 7.1 | Certificates | 16 |

| Section 7.2 | Special Designation on Certificates | 17 |

| Section 7.3 | Lost Certificates | 17 |

| Section 7.4 | Transfers of Stock | 17 |

| Section 7.5 | Restrictions on Transfer or Registration of Share | 18 |

| ARTICLE VIII | GENERAL PROVISIONS | 18 |

| Section 8.1 | Dividends | 18 |

| Section 8.2 | Reserves | 18 |

| Section 8.3 | Checks | 18 |

| Section 8.4 | Fiscal Year | 18 |

| Section 8.5 | Seal | 18 |

| Section 8.6 | Captions | 19 |

| Section 8.7 | Interpretations | 19 |

| Section 8.8 | Seniority | 19 |

| Section 8.9 | Computation of Time | 19 |

| ARTICLE IX | AMENDMENTS | 19 |

| Section 9.1 | Amendments | 19 |

| SECRETARY’S CERTIFICATE | 20 | |

| iii |

AMENDED

AND RESTATED BYLAWS

OF

FTE NETWORKS, INC.

a Nevada corporation

ARTICLE I

OFFICES

Section 1.1 Registered Office. In accordance with the applicable provisions of the Nevada Revised Statutes (“NRS”), including, without limitation, NRS 78.090, the registered office of FTE Networks, Inc., a Nevada corporation (the “Corporation”), shall be maintained at such place within the State of Nevada as the Corporation’s board of directors (the “Board”) shall determine from time to time.

Section 1.2 Other Offices. The Corporation may also have offices, including it principal offices, at such other places both within and without the State of Nevada as the Board may from time to time determine or the business of the Corporation may require.

ARTICLE II

STOCKHOLDERS

Section 2.1 Place of Meetings. Subject to Section 2.2 below, all meetings of stockholders, for any purpose, may be held at such time and place, within or without the State of Nevada, as shall be determined by the Board in its sole discretion. The place of each such meeting shall be stated in the notice of meeting or in a duly executed waiver of notice thereof.

Section 2.2 Remote Communications. The Board may, in its sole discretion, determine that a meeting of stockholders shall not be held at any place, but may instead be held solely by means of remote communication in any manner permitted by Nevada law. Such means of remote communication include participation by telephone conference, video conference, or similar method of communication so long as the Corporation has implemented reasonable measures (i) to verify the identity of each person participating through such means as a stockholder and (ii) provide the stockholders a reasonable opportunity to participate in the meeting and to vote on matters submitted to the stockholders, including an opportunity to communicate, and to read or hear the proceedings of the meetings in a substantially concurrent manner with such proceedings. Participation in such meeting shall constitute presence in person at the meeting.

Section 2.3 Annual Meeting. The annual meeting of stockholders shall be held on the day and at the time set by the Board and designated in the notice thereof. A majority of the Board shall have authority to set the agenda for the annual meeting and to establish the deadline by which requests for the addition of items to the agenda shall be received. A majority of the Board may grant such requests. At the annual meeting, the stockholders shall elect, by a plurality vote, members of the Board (each such member, a “Director” and collectively, the “Directors”) and transact such other business as may properly be brought before the meeting. Notwithstanding the foregoing, in the event that the Directors are elected by written consent of the stockholders in accordance with Section 2.11 of these Bylaws (as amended from time to time in accordance with the terms hereof, and in accordance with the Corporation’s Articles of Incorporation as then in effect and applicable law, the “Bylaws”) and NRS 78.320, an annual meeting of stockholders shall not be required to be called or held for such year for such purpose, but the Board may call and notice an annual meeting for any other purpose or purposes.

| 1 |

Section 2.4 List of Stockholders. The officer who has charge of the stock ledger of the Corporation shall prepare and make a complete list of the stockholders entitled to vote for the election of Directors of the Corporation, arranged in alphabetical order, showing the address of and the number of shares registered in the name of each stockholder, and the list shall be produced and kept at the time and place of election during the whole time thereof and be subject to the inspection of any stockholder who may be present. The Corporation shall not be required to include electronic mail addresses or other electronic contact information on such list. If the meeting is to be held at a place, then the list shall be produced and kept at the time and place of the meeting during the whole time thereof, and may be examined by any stockholder who is present. If the meeting is to be held solely by means of remote communication as permitted under Section 2.2 above, then the list shall also be open to the examination of any stockholder during the whole time of the meeting on a reasonably accessible electronic network, and the information required to access such list shall be provided with the notice of the meeting.

Section 2.5 Special Meetings. Special meetings of the stockholders, for any purpose or purposes, unless otherwise prescribed by statute or by the Articles of Incorporation, may be called by the Chief Executive Officer or President and shall be called by the Chief Executive Officer, President or Secretary at the request, in writing, of a majority of the Board, or at the request, in writing, of stockholders entitled to exercise a majority of the voting power of the Corporation. Such request shall state the purpose or purposes of the proposed meeting. If any person(s) other than the Board calls a special meeting, the request shall:

(a) be in writing;

(b) specify the time of such meeting and the general nature of the business proposed to be transacted; and

(c) be delivered personally or sent by registered mail or by facsimile transmission to the Chairperson of the Board, the Chief Executive Officer, the President or the Secretary of the Corporation.

Section 2.6 Notice of Meetings. Whenever stockholders are required or authorized to take any action at a meeting, a written notice of such meeting shall be given. Such written notice must be signed by the Corporation’s Chief Executive Officer, President, a Vice President, the Secretary, an Assistant Secretary or by such other natural person or persons as the Bylaws may prescribe or permit, or as the Board may designate. In addition, such written notice shall include the following:

(a) the purpose or purposes for which the meeting is called;

(b) the time when the meeting will be held;

(c) the place where the meeting will be held; and

| 2 |

(d) if participation by means of telephone conference or similar methods of communication is going to be permitted for such meeting, the notice shall include a statement to that effect, including instructions as to how a stockholder may so participate.

Such written notice shall be given to each stockholder entitled to vote at the meeting not less than ten (10) nor more than sixty (60) days before the meeting. Such written notice shall be delivered in accordance with NRS 78.370 and Article V below.

Section 2.7 Limitation on Business. Business transacted at any special meeting of stockholders shall be limited to the purposes stated in the notice.

Section 2.8 Quorum. Stockholders of the Corporation holding at least a majority of the voting power of the Corporation, present in person or represented by proxy, regardless of whether the proxy has authority to vote on all matters, shall constitute a quorum at all meetings of the stockholders for the transaction of business, except as otherwise provided by statute or by the Articles of Incorporation. If, however, a quorum shall not be present or represented at any meeting of the stockholders, the stockholders entitled to vote thereat, present in person or represented by proxy, shall have the power to adjourn the meeting from time to time, without notice other than announcement at the meeting, until a quorum shall be present or represented. At any adjourned meeting at which a quorum shall be present or represented, any business may be transacted that might have been transacted at the meeting as originally noticed.

Section 2.9 Voting Required for Action. When a quorum is present at any meeting, the stockholders holding a majority of the voting power of the Corporation present in person or represented by proxy at such meeting shall decide any question brought before such meeting, unless the question is one upon which by express provision of the statutes or of the Articles of Incorporation, these Bylaws, or an express agreement in writing, a different vote is required, in which case such express provision shall govern and control the decision of such question. Voting for directors shall be in accordance with Section 2.3 above.

Except as may be otherwise provided in the Corporation’s Articles of Incorporation or in a Certificate of Designation or similar document filed with the Secretary of State of Nevada in accordance with NRS 78.1955, each stockholder entitled to vote at any meeting of stockholders shall be entitled to one vote for each share of capital stock held by such stockholder that has voting power upon the matter in question. Voting at meetings of stockholders need not be by written ballot and, unless otherwise required by Nevada law, need not be conducted by inspectors of election unless so determined by the holders of shares of stock having a majority of the votes that could be cast by the holders of all outstanding shares of stock entitled to vote thereon that are present in person or by proxy at such meeting. If authorized by the Board, such requirement of a written ballot shall be satisfied by a ballot submitted by electronic transmission (as defined in Section 5.2 below); provided, that any such electronic transmission must either set forth or be submitted with information from which it can be determined that the electronic transmission was authorized by the stockholder or proxy holder.

| 3 |

Section 2.10 Proxies. Except as otherwise provided in the Articles of Incorporation or in a Certificate of Designation or similar document filed with the Secretary of State of Nevada in accordance with NRS 78.1955, each stockholder shall, at every meeting of the stockholders, be entitled to one vote in person or by proxy for each share of stock having voting power held by such stockholder, but, pursuant to NRS 78.355, no proxy shall be valid after the expiration of six months from the date of its execution unless (a) coupled with an interest, or (b) the person executing it specifies therein the length of time for which it is to be continued in force, which in no case shall exceed seven years from the date of its execution.

Section 2.11 Action by Written Consent. Any action required or permitted to be taken at a meeting of the stockholders may be taken without a meeting if, before or after the action, a written consent thereto is signed by stockholders holding at least a majority of the voting power, except that if any greater proportion of voting power is required for such action at a meeting, then such greater proportion of written consents shall be required. In no instance where action is authorized by written consent need a meeting of stockholders be called or notice given.