Form DEF 14A ENNIS, INC. For: Jul 14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE SECURITIES

EXCHANGE ACT OF 1934 (AMENDMENT NO.)

Filed by the Registrant

Filed by a Party other than the Registrant

Check the appropriate box:

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material Pursuant to Section 240.14a-12. |

Ennis, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

No fee required. |

||

|

|

|

||

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-12.

|

||

|

(1) |

|

Title of each class of securities to which transaction applies: |

|

|

|

|

|

|

|

(2) |

|

Aggregate number of securities to which transaction applies: |

|

|

|

|

|

|

|

(3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

|

|

|

|

(4) |

|

Proposed maximum aggregate value of transaction: |

|

|

|

|

|

|

|

(5) |

|

Total fee paid: |

|

|

|

Fee paid previously with preliminary materials. |

|

|

|

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

(1) |

|

Amount Previously Paid: |

|

|

|

|

|

(2) |

|

Form, Schedule or Registration Statement No.: |

|

|

|

|

|

(3) |

|

Filing Party: |

|

|

|

|

|

(4) |

|

Date Filed: |

Ennis, Inc.

2441 Presidential Parkway

Midlothian, TX 76065

June 3, 2022

Dear Shareholders:

The board of directors and management cordially invite you to attend the Annual Meeting of Shareholders of Ennis, Inc. to be held at 10:00 a.m., local time, on Thursday, July 14, 2022, at the Midlothian Conference Center, One Community Circle, Midlothian, Texas 76065. The formal notice of the Annual Meeting and Proxy Statement are attached.

Ennis, Inc. has chosen to furnish its Proxy Statement and Annual Report to its shareholders over the internet, as allowed by the rules of the U.S. Securities and Exchange Commission. Rather than mailing paper copies, we believe that this e-proxy process will expedite shareholder receipt of the materials and lower Ennis’s expenses associated with this process. As a shareholder of Ennis, you are receiving by mail (or electronic mail) a Notice of Internet Availability of Proxy Materials (the “Notice”) which will instruct you on how to access and review the Proxy Statement and Annual Report over the internet. The Notice will also instruct you how to vote your shares over the internet. Shareholders who would like to receive a paper copy of our Proxy Statement and Annual Report, free of charge, should follow the instructions in the Notice. Shareholders who request paper copies will also receive a proxy card or voting instructions form to allow them to vote their shares by mail in addition to over the internet or by telephone.

It is important that your shares be voted at the meeting in accordance with your preference. If you do not plan to attend, you may vote your shares by following the instructions in the Notice. If you submit your proxy and are able to attend the meeting and wish to vote in person, you may withdraw your proxy at that time. See response to the question “How do I vote?” in the Proxy Statement for a more detailed description of voting procedures and the response to the question “Do I need an admission ticket to attend the Annual Meeting?” in the Proxy Statement for our procedures for admission to the meeting.

Sincerely,

|

|

|

Keith S. Walters |

|

Vera Burnett |

President, Chief Executive Officer and |

|

Chief Financial Officer |

Chairman of the Board |

|

|

Ennis, Inc.

2441 Presidential Parkway

Midlothian, TX 76065

NOTICE OF 2022 ANNUAL MEETING OF SHAREHOLDERS

To Be Held Thursday, July 14, 2022

To our shareholders:

Notice is hereby given that the Annual Meeting of Shareholders of Ennis, Inc. will be held on Thursday, July 14, 2022 at 10:00 a.m., local time, at the Midlothian Conference Center located at One Community Circle, Midlothian, Texas 76065 (the “Annual Meeting”). At the Annual Meeting, we will ask you to vote on the following proposals:

• The election of three directors to serve for a three-year term or until their successors are duly elected and qualified;

• The ratification of the appointment of the Company’s independent registered public accounting firm; and

• The non-binding advisory approval of the Company's compensation of its named executive officers.

In their discretion, the proxies are authorized to vote, as described in the accompanying Proxy Statement, upon any other business as may properly come before the Annual Meeting or any adjournment or postponement of the meeting.

Only shareholders of record at the close of business on May 16, 2022 are entitled to receive notice of and to vote their shares at the Annual Meeting.

Ennis, Inc. is pleased to take advantage of the rules of the Securities and Exchange Commission that allow issuers to furnish proxy materials to their shareholders over the internet. Ennis, Inc. believes that this process allows us to provide you with the information you need while lowering the costs associated with the Annual Meeting. While you are cordially invited to attend the Annual Meeting in person, you may either vote in person at the Annual Meeting, or vote by proxy, which allows your shares to be voted at the Annual Meeting even if you are not able to attend. However, to ensure that your vote is counted at the Annual Meeting, please vote as promptly as possible.

|

|

By Order of the Board of Directors |

|

|

|

|

|

|

|

|

|

|

|

Dan Gus |

|

|

Corporate Secretary |

|

|

Midlothian, Texas |

|

|

June 3, 2022 |

ENNIS, INC.

2441 Presidential Parkway

Midlothian, Texas 76065

PROXY STATEMENT

FOR

ANNUAL MEETING OF SHAREHOLDERS

To be held on July 14, 2022

TABLE OF CONTENTS

|

Page |

|

|

QUESTIONS AND ANSWERS REGARDING THE PROXY STATEMENT AND ANNUAL MEETING |

1 |

7 |

|

7 |

|

Ratification of Independent Registered Public Accounting Firm |

8 |

Non-Binding Advisory Approval of the Company's Compensation of its Named Executive Officers |

9 |

10 |

|

12 |

|

15 |

|

15 |

|

15 |

|

15 |

|

15 |

|

16 |

|

Board Leadership Structure, Board Meetings and Executive Sessions |

16 |

17 |

|

17 |

|

17 |

|

18 |

|

18 |

|

18 |

|

18 |

|

19 |

|

19 |

|

19 |

|

19 |

|

19 |

|

20 |

|

22 |

|

22 |

|

22 |

|

23 |

|

23 |

|

24 |

|

25 |

|

26 |

|

Security Ownership of the Board of Directors and Executive Officers |

26 |

28 |

|

29 |

|

29 |

|

Policy Regarding Pre-Approval of Services Provided by the Independent Auditors |

30 |

30 |

|

31 |

31 |

|

31 |

|

31 |

|

33 |

|

42 |

|

43 |

|

44 |

|

45 |

|

46 |

|

46 |

|

Nonqualified Contribution and Deferred Compensation in Last Fiscal Year |

47 |

47 |

|

49 |

|

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLAN |

51 |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE |

51 |

52 |

|

52 |

QUESTIONS AND ANSWERS REGARDING THE PROXY STATEMENT AND ANNUAL MEETING

When and where is the Annual Meeting?

The Annual Meeting of Shareholders of Ennis, Inc. (“Ennis,” the “Company”) will be held on Thursday, July 14, 2022, at 10:00 a.m. local time at the Midlothian Conference Center located at One Community Circle, Midlothian, Texas 76065 (the “Annual Meeting”). You are invited to attend the Annual Meeting and are requested to vote on the proposals described in this proxy statement (the “Proxy Statement”).

Why did I receive a notice in the mail regarding the internet availability of proxy materials instead of a full set of proxy materials?

Pursuant to rules adopted by the U.S. Securities and Exchange Commission (the “SEC”), Ennis has elected to provide access to its Proxy Statement and Annual Report, which we refer to as the proxy materials, over the internet or, upon your request, has delivered printed versions of the proxy materials to you by mail. The proxy materials are being provided in connection with Ennis’s solicitation of proxies for use at the Annual Meeting or at any adjournment or postponement thereof. Accordingly, the Company sent a Notice of Internet Availability of Proxy Materials (the “Notice”) on or about June 3, 2022 to its shareholders entitled to receive notice of and to vote at the meeting.

All shareholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the internet or to request a printed set may be found in the Notice. In addition, shareholders may request to receive proxy materials in printed form by mail or electronically by email on an on-going basis. Ennis encourages shareholders to take advantage of the availability of the proxy materials over the internet.

How can I access the proxy materials electronically?

The Notice will provide you with instructions regarding how to:

Ennis’s proxy materials are also available on Ennis’s website at www.ennis.com/investor_relations.

Choosing to receive future proxy materials by email will save Ennis the cost of printing and mailing documents to you thereby lowering the costs associated with the Annual Meeting. If you choose to receive future proxy materials by email, you will receive an email message next year with instructions containing a link to those materials and a link to the proxy voting website. Your election to receive proxy materials by email will remain in effect until you terminate it.

What is included in the proxy materials?

Ennis’s Annual Report on Form 10-K for the year ended February 28, 2022, as filed with the SEC on May 9, 2022 (the “Annual Report”), and this Proxy Statement.

If you requested printed versions of these materials by mail, these materials also include the proxy card or voting instruction form for the Annual Meeting.

I may have received more than one Proxy Statement. Why?

If you received more than one Proxy Statement, your shares are probably registered differently or are in more than one account. Please vote each proxy card/notice that you received.

How does the Board of Directors recommend that I vote my shares?

Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Company’s Board of Directors (the “Board”). The Board’s

1

recommendation can be found with the description of each item in this Proxy Statement. In summary, the Board recommends a vote:

FOR, the Board’s proposal to elect the nominated Directors;

FOR, the Board’s proposal to ratify the selection of Grant Thornton LLP as our independent registered public accounting firm; and

FOR, the non-binding advisory approval of the Company's compensation for our named executive officers.

What will occur at the Annual Meeting?

We will determine whether enough shareholders are present at the meeting to conduct business. Your shares are counted as present at the Annual Meeting if you attend the meeting and vote in person or if you properly return a proxy by mail. In order for us to hold our meeting, holders of a majority of our outstanding shares of our Common Stock (“Common Stock”) as of May 16, 2022, must be present in person or by proxy at the meeting. This is referred to as a quorum. Abstentions and broker non-votes will be counted for purposes of establishing a quorum at the meeting.

All shareholders of record at the close of business on May 16, 2022, will be entitled to vote on matters presented at the meeting or any adjournment thereof. On May 16, 2022, there were 25,819,260 shares of our Common Stock issued and outstanding. The holders of a majority, or 12,909,631 of the shares, of our Common Stock entitled to vote at the meeting must be represented at the meeting in person or by proxy to have a quorum for the transaction of business at the meeting and to act on the matters specified in the Notice.

If a quorum of shareholders are present at the meeting to conduct business, then we will: i) vote to elect as members of our Board the following individuals for a three-year term: John R. Blind, Barbara T. Clemens and Michael J. Schaefer; ii) ratify the selection of Grant Thornton LLP as our independent registered public accounting firm for fiscal year ending February 28, 2023 (which we refer to as fiscal year 2023); iii) tabulate the non-binding advisory approval of the Company's compensation for our named executive officers; and iv) conduct any other business properly coming before the meeting.

After each proposal has been voted on at the meeting, we will discuss and take action on any other matter that is properly brought before the meeting. We have hired Computershare Investor Services, LLC (“Computershare”), our transfer agent, to count the votes represented by proxies cast by ballot. Employees of Computershare and our legal counsel will act as inspectors of election. It is also expected that the Board and management will participate in the solicitation of proxies, including through shareholder outreach regarding the proposals to be considered at the Annual Meeting and the Board’s recommendations regarding such proposals.

A representative of Grant Thornton LLP, our independent registered public accounting firm, is expected to be present at the Annual Meeting and will be afforded an opportunity to make a statement, if such representative so desires, and to respond to appropriate questions.

How many votes are necessary to elect the nominees for director?

When a quorum is present, directors will be elected by a majority of votes cast, unless the election is contested, in which case directors will be elected by a plurality of votes cast. An election will be contested if the number of nominees, as determined by the Board, exceeds the number of directors to be elected. A “majority of votes cast” means that the number of shares voted “for” a director exceeds the number of votes cast “against” that director. The following will not be deemed votes cast: (i) a share otherwise present at the meeting but for which there is an abstention and (ii) a share otherwise present at the meeting as to which a shareholder gives no authority or direction. Brokers are not permitted to vote for the election of directors, unless you provide specific instructions to them by completing and returning the Voting Instruction Form or following the instructions provided to you by your broker for voting your shares by telephone or the internet. With respect to the election of directors, shareholders have cumulative voting rights, which means that each shareholder entitled to vote (a) has the number of votes equal to the number of shares held by such shareholder multiplied by the number of directors to be elected and (b) may cast all such votes for one nominee or distribute such shareholder’s votes among the nominees as the shareholder chooses. The right to cumulate votes may not be exercised until a shareholder has given written notice of the shareholder’s intention to vote cumulatively to the Corporate Secretary on or before the day preceding the election. If any shareholder gives such

2

written notice, then all shareholders entitled to vote or their proxies may cumulate their votes. Upon such written notice, the persons named in the accompanying form of proxy may cumulate their votes. As a result, the Board also is soliciting discretionary authority to cumulate votes.

How are votes counted for the election of directors?

In the election of directors, you may vote “FOR,” “AGAINST,” or “ABSTAIN” with respect to each of the nominees. Abstentions will be counted for purposes of determining the presence or absence of a quorum only.

What happens if a director in an uncontested election does not receive a majority of votes cast for his or her election?

If a director in an uncontested election does not receive a majority of votes cast for his or her election, the director will, within ten business days of certification of election results, submit to the Board a letter of resignation for consideration by the Nominating and Corporate Governance Committee (the “Nominating Committee”). The Nominating Committee will promptly assess the appropriateness of such nominee continuing to serve as a director and recommend to the Board the action to be taken with respect to such tendered resignation. The Board will determine whether to accept or reject such resignation or what other action should be taken within 90 days of the certification of election results.

What if a nominee is unwilling or unable to serve?

The persons nominated for election to our Board have agreed to stand for election. However, should a nominee become unable or unwilling to accept nomination or election, the proxies will be voted for the election of such other person as the Board may recommend. Our Board has no reason to believe that the nominees will be unable or unwilling to serve if elected, and to the knowledge of the Board, the nominees intend to serve the entire term for which election is sought.

How many votes are necessary to ratify the selection of Grant Thornton LLP?

The ratification of the selection of Grant Thornton LLP, as our independent registered public accounting firm, requires the affirmative vote of the shareholders present or represented by proxy and representing a majority of votes entitled to be cast. Abstentions will have no effect as a vote. Brokers holding shares for beneficial owners have discretionary voting power to vote such shares in favor of this proposal, unless instructed otherwise. Even if the shareholders ratify the appointment, the Audit Committee may, in its discretion, direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the Company’s best interests and the interests of the shareholders. The Audit Committee believes it is important for the Company’s registered public accounting firm to maintain their independence and objectivity. As such, from time-to-time the Audit Committee will contact other firms for consideration as the Company’s independent public accounting firm. This evaluation was performed most recently with respect to the audit for the fiscal year ended February 28, 2022 (which we refer to as fiscal year 2022). After consideration, the Audit Committee decided to continue to retain Grant Thornton as the Company’s independent public accounting firm.

How many votes are necessary for non-binding, advisory approval of the Company’s compensation of its named executive officers?

The affirmative vote of the majority of the shareholders present or represented by proxy entitled to cast votes will constitute non-binding advisory approval of the compensation of the Company’s named executive officers. Abstentions will have no effect as a vote. Brokers will not have discretionary voting power on this proposal and are not permitted to vote on this proposal, unless you provide specific instructions to them by completing and returning the Voting Instructions Form or following the instructions provided to you by your broker for voting your shares by telephone or the internet. As your vote is advisory, it will not be binding upon the Board. The Compensation Committee of our Board (the “Compensation Committee” or the “Committee”) and the Board will take the views of shareholders into account when considering future executive compensation arrangements.

3

In 2020, the Company did not receive a majority of votes entitled to be cast for this proposal (46% voted FOR). The Board believes the failure of the vote to pass was due largely to the recommendation of Institutional Shareholder Services (“ISS”), an outside proxy advisory firm, which advised the Company’s institutional shareholders to vote against the Company’s executive compensation program. In 2021, the Board proposed a new Long-Term Incentive Program that addressed the principal concerns raised by ISS in 2020. Both ISS and Glass Lewis responded favorably to the proposed changes and recommended that shareholders vote FOR the 2021 Long Term Incentive Plan and cast votes in favor of the 2021 Long Term Incentive Plan and the compensation of the Company’s named executive officers. Both the 2021 Long Term Incentive Plan and the Company’s executive compensation arrangements were approved by more than 95% of voted shares. For additional information, please see Proposal No. 3 – Non-Binding Advisory approval of the Company's compensation of its named executive officers.

What is the difference between holding shares of Ennis stock as a “shareholder of record” and as a “beneficial owner”?

Many of our shareholders hold their shares through a broker, bank, or other nominee rather than directly in their own name. As summarized below, there are some distinctions between holding shares as a “shareholder of record” and holding shares as a “beneficial owner” in street name.

If your shares are registered directly in your name with our transfer agent, Computershare, you are the “shareholder of record” of the shares. If your shares are held in a brokerage account or by a bank or by another nominee, you are the “beneficial owner” of shares held in street name.

How do I vote?

You may vote using any of the following methods:

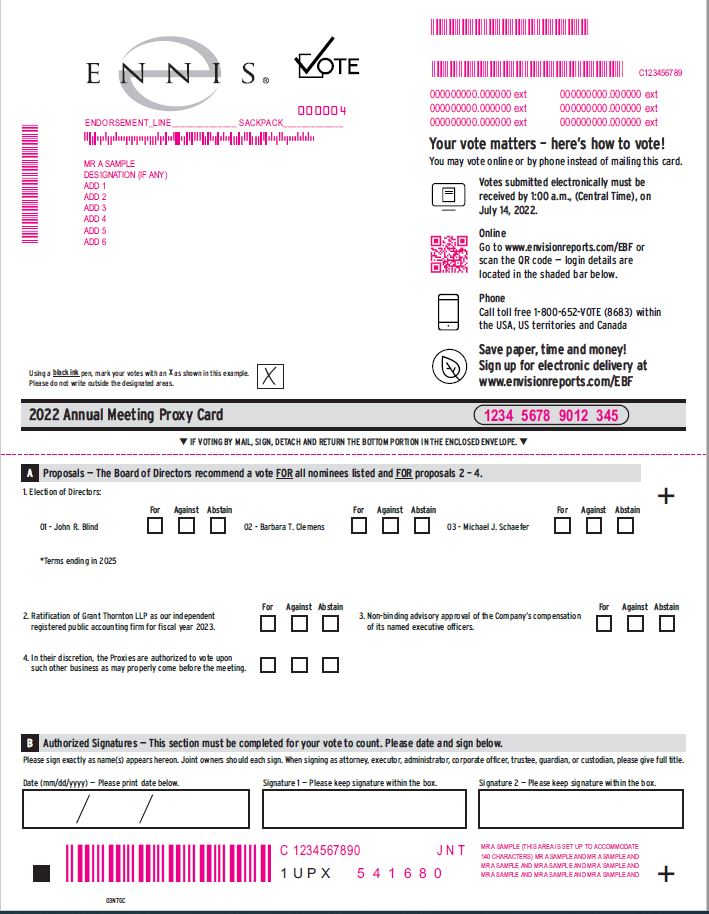

If you are a shareholder of record, you will need the control number included on the Notice to access the proxy materials. Follow the instructions on the Notice to vote your shares electronically over the internet. If you are a beneficial owner of shares, you may vote your shares electronically over the internet by following the instructions sent to you by your broker, bank, or other holder of record.

If you are a shareholder of record, request from us, by following the instructions on the Notice, printed copies of the proxy materials, which will include a proxy card. If you are a beneficial owner of shares, you may vote your shares by mail by following the instructions sent to you by your broker, bank, or other holder of record. Be sure to complete, sign, and date the proxy card or voting instruction form and return it in the prepaid envelope.

If you are a shareholder of record, you may vote your share telephonically by calling the toll-free number that is referenced in the proxy materials available over the internet or by mail. If you are a beneficial owner of shares, you may vote your shares telephonically by following the instructions sent to you by your broker, bank, or other holder of record.

All shareholders of record may vote in person at the Annual Meeting. You can request a ballot at the meeting. You may also be represented by another person at the Annual Meeting by executing a proper proxy designating that person. If you are a beneficial owner of shares, you must obtain a legal proxy from your broker, bank, or other holder of record and present it to the inspector of election with your ballot to be able to attend or vote at the Annual Meeting.

Internet and telephone voting facilities for shareholders of record will be available 24 hours a day and will close at 1:00 a.m. central time on July 14, 2022. The availability of internet and telephone voting for beneficial owners will depend on the voting process of your broker, bank, or other holder of record. We therefore recommend that you follow the voting instructions in the materials provided to you by your broker, bank or other holder of record. If you vote over the internet or by telephone, you do not have to return a proxy card or voting instruction form. If you are located outside the U.S. or Canada, please use the internet or mail voting methods. Your vote is important.

4

What can I do if I change my mind after I vote my shares?

If you are a shareholder of record, you can revoke your proxy prior to the completion of voting at the Annual Meeting by:

If you are a beneficial owner of shares, you may submit new voting instructions by contacting your broker, bank, or other holder of record. You may also vote in person at the Annual Meeting if you obtain a legal proxy as described in the answer to the previous question.

Will my shares be voted if I do not provide my proxy and do not attend the Annual Meeting?

If you do not provide a proxy or vote the shares held in your name, your shares will not be voted.

If you hold your shares through one of the Company’s employee benefit plans and do not vote your shares, your shares (along with all other shares in the plan for which votes are not cast) will be voted pro rata by the trustee in accordance with the votes directed by other participants in the plan who elect to act as a fiduciary entitled to direct the trustee of the applicable plan on how to vote the shares.

What happens if I do not give specific voting instructions?

If you are a shareholder of record and you sign and return a proxy card without giving specific instructions, the proxy holders will vote your shares in the manner recommended by the Board on all matters presented in this Proxy Statement. With respect to any other matters properly presented for a vote at the Annual Meeting (that is, which are not presented in this Proxy Statement), the proxy holders may use their discretion to determine how to vote your shares.

If you are a beneficial owner of shares and do not provide your broker, bank or other holder of record with specific voting instructions, then under the rules of the New York Stock Exchange (“NYSE”), your broker, bank, or other holder of record may only vote on matters for which it has discretionary voting power to vote. If your broker, bank, or other holder of record does not receive instructions from you on how to vote your shares and such holder does not have discretion to vote on the matter, then that holder will inform the inspector of election that it does not have the authority to vote on the matter with respect to your shares and your shares will not be voted on that matter.

How do I raise an issue for discussion or vote at the next Annual Meeting?

Under SEC rules, a shareholder who intends to present a proposal, including the nomination of directors, at the 2023 Annual Meeting and who wishes the proposal to be included in the Proxy Statement for that meeting must submit the proposal in writing to our Corporate Secretary. The proposal must be received no later than February 3, 2023, which is 120 days prior to the first anniversary of the date on which this Proxy Statement was first released to our shareholders in connection with the 2022 Annual Meeting. However, if the date of the 2023 Annual Meeting is changed by more than 30 days from July 14, 2023 (the one-year anniversary of our 2022 Annual Meeting), then the deadline for receipt of shareholder proposals will be a reasonable time before we print and send proxy materials for the 2023 Annual Meeting. Any such proposals must comply with SEC regulations under Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), regarding the inclusion of shareholder proposals in company-sponsored proxy materials.

All written proposals should be directed to Investor Relations Department, Ennis, Inc., P.O. Box 403, Midlothian, Texas 76065-0403.

5

The Nominating Committee is responsible for selecting and recommending director candidates to our Board, and will consider nominees recommended by shareholders pursuant to the Corporate Governance Guidelines set forth on the Company’s website (the “Corporate Governance Guidelines”). If you wish to have the Nominating Committee consider a nominee for director, pursuant to these guidelines you must send a written notice to the Company’s Corporate Secretary at the address provided above and include the information required by the charter of our Nominating Committee (the “Nominating Committee Charter”), as discussed in the section entitled Director Nomination Processes of this Proxy Statement.

Could other matters be decided at the Annual Meeting?

As of the date we began to deliver the Notice, we did not know of any matters to be brought before the Annual Meeting other than those described in this Proxy Statement.

If you vote your shares over the internet or by telephone or you sign and return a proxy card or voting instructions form, and other matters are properly presented at the Annual Meeting for consideration, the proxies appointed by the Board (the persons named in your proxy card) will have the discretion to vote on those matters for you. The proxies intend to vote in accordance with their best judgment in the interest of Ennis and its shareholders.

Is there a list of shareholders entitled to vote at the Annual Meeting?

The names of shareholders of record entitled to vote at the Annual Meeting will be available at the Annual Meeting, and for ten days prior to the meeting for any purpose germane to the meeting, between the hours of 8:30 a.m. and 5:00 p.m. central time, at our corporate headquarters at 2441 Presidential Parkway, Midlothian, Texas 76065 by contacting our Corporate Secretary.

Who will pay for the cost of this solicitation?

Our Board has sent you this Proxy Statement. Our directors, officers, and employees may solicit proxies by mail, by telephone, or in person. Those persons will receive no additional compensation for any solicitation activities. We will request banking institutions, brokerage firms, custodians, trustees, nominees, and fiduciaries that hold our Common Stock of record to forward solicitation materials to the beneficial owners of that Common Stock, and we will, upon the request of those record holders, reimburse reasonable forwarding expenses. We will pay the costs of preparing, printing, assembling, and mailing the proxy materials used in the solicitation of proxies.

Do I need an admission ticket to attend the Annual Meeting?

You will need an admission ticket or proof of stock ownership to enter the Annual Meeting. If you are a shareholder of record, your admission ticket is the Notice mailed (or sent electronically) to you or the admission ticket attached to your proxy card if you elected to receive a paper copy of the proxy materials. If you plan to attend the Annual Meeting, please bring it with you to the Annual Meeting.

If you are a beneficial owner of shares and you plan to attend the Annual Meeting, you must present proof of your ownership of Ennis Common Stock, such as a bank or brokerage account statement, to be admitted to the Annual Meeting.

No cameras, recording equipment, electronic devices, large bags, briefcases, or packages will be permitted in the Annual Meeting. Certain procedural rules pertaining to conduct at the meeting will be outlined by the Secretary of the Annual Meeting to allow shareholders to address questions to the appropriate person. If you have any questions about attending the meeting, please call investor relations at 972-775-9800 or toll-free at 800-752-5386.

Where can I find the voting results of the Annual Meeting?

We will announce the voting results at the Annual Meeting and will publish the vote count in a current report on Form 8-K. We will file that report with the SEC on or before July 20, 2022. This Form 8-K will be available without charge to shareholders upon written request to Investor Relations Department, Ennis, Inc., P.O. Box 403, Midlothian, Texas 76065-0403 or via the internet at www.ennis.com.

6

PROPOSAL NO. 1

APPROVAL OF ELECTION OF EACH OF THE THREE DIRECTOR NOMINEES

The number of directors who shall constitute the Board is currently set at nine, as set forth in the Company’s Articles of Incorporation and Bylaws. The Board consists of three classes serving staggered three-year terms as set forth in Article Five of the Articles of Incorporation. Directors for each class are elected at the Annual Meeting held in the year in which the term for their class expires. The staggered Board structure was approved by our shareholders at the June 13, 1983 Annual Meeting.

Our Board proposes the election of John R. Blind., Barbara T. Clemens, and Michael J. Schaefer as directors to hold office for a term of three years, expiring at the close of our Annual Meeting of Shareholders to be held in 2025 or until their successors are duly elected and qualified. It is the Board’s opinion that because of each candidates’ business experience and prior tenure as a director of the Company, each is sufficiently familiar with the Company and its business to competently direct the Company’s business affairs. Biographical information on each candidate is set forth in the Directors — Summary of Our Non-Employee Directors and Executive Officers sections of this Proxy Statement.

If any of the nominees become unavailable for election, which is not anticipated, the proxies will be voted for the election of such other person as the Board may recommend.

The Board recommends that shareholders vote “FOR” the nominees for director set forth above.

7

PROPOSAL NO. 2

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Although SEC regulations and NYSE listing requirements require the Company’s independent registered public accounting firm to be engaged, retained and supervised by the Audit Committee, the Board considers the selection of an independent registered public accounting firm to be an important matter to shareholders and considers a proposal for shareholders to ratify such appointment to be an opportunity for shareholders to provide input to the Audit Committee and the Board on a key corporate governance issue.

Grant Thornton LLP has served as the Company’s independent registered public accounting firm for the fiscal years 2005 through 2022 and has reported on our financial statements during such time period. The Audit Committee has selected Grant Thornton LLP as the Company’s independent registered public accounting firm for fiscal year 2023. The Board is asking shareholders to ratify this selection.

Even if the shareholders ratify the appointment, the Audit Committee may, in its discretion, appoint a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change would be in the best interests of the Company and its shareholders. The Audit Committee periodically considers whether there should be a rotation of the independent registered public accounting firms because the Audit Committee believes it is important for the registered public accounting firm to maintain independence and objectivity. After considering all factors, the Audit Committee has determined that it is in the best interest of the Company and its shareholders to retain Grant Thornton LLP as the Company’s independent registered public accounting firm for fiscal year 2023.

Representatives of Grant Thornton LLP are expected to be present at the Annual Meeting, will have an opportunity to make a statement if they so desire, and are expected to be available to respond to appropriate questions.

The Board recommends a vote “FOR” the proposal to ratify the selection of the Company’s independent registered public accounting firm for fiscal year 2023.

8

PROPOSAL NO. 3

NON-BINDING ADVISORY APPROVAL OF THE COMPANY'S COMPENSATION OF ITS NAMED EXECUTIVE OFFICERS

Pursuant to Section 14A of the Exchange Act, at the Annual Meeting, Ennis shareholders have the opportunity to vote on an advisory resolution, otherwise known as “say-on-pay,” to approve the compensation of Ennis’s named executive officers (“NEOs”), as described in the Executive Compensation section of this Proxy Statement. Because your vote is advisory, it will not be binding upon the Board. However, the Compensation Committee and the Board will take the outcome of the vote into account when considering future executive compensation arrangements. The say-on-pay vote currently occurs each year, and the next vote will occur at the 2023 Annual Meeting.

In 2020, the Company did not receive a majority of votes entitled to be cast for this proposal (46% voted FOR). The Board believes the failure of the vote to pass was due largely to the recommendation of Institutional Shareholder Services (“ISS”), an outside proxy advisory firm, which advised the Company’s institutional shareholders to vote against the Company’s executive compensation program. In 2021, the Board proposed a new Long-Term Incentive Program that addressed the principal concerns raised by ISS in 2020. Both ISS and Glass Lewis responded favorably to the proposed changes and recommended that shareholders vote FOR the 2021 Long Term Incentive Plan and cast votes in favor of the 2021 Long Term Incentive Plan and the compensation of the Company’s named executive officers. Both the 2021 Long Term Incentive Plan and the Company’s executive compensation arrangements were approved by substantial majority votes.

Since last year’s annual shareholder meeting, there have been no material changes to the Company’s compensation arrangements for its named executive officers. However, there have been changes to the Company’s executive leadership since last year’s proxy statement. As previously reported, the Company’s former CFO, Richard Travis, retired in September 2020. In June of 2021, the Board appointed Vera Burnett as Chief Financial Officer to fill the vacancy created by Mr. Travis’s retirement. In December 2021, Michael Magill retired from his position as Executive Vice-President and Secretary. In June of 2021, the Board appointed Dan Gus as the Company’s general counsel. Upon Mr. Magill’s retirement, the Board appointed Mr. Gus to the position of Secretary and he has assumed much of the duties previously performed by Mr. Magill.

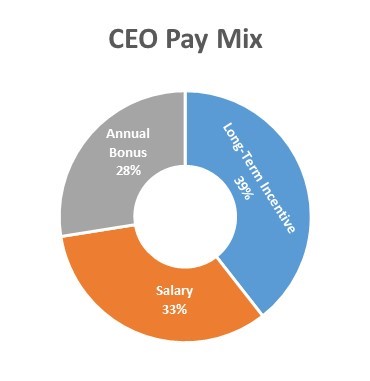

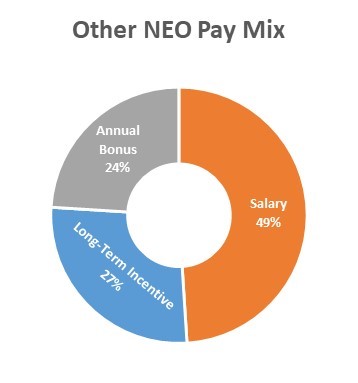

Our Compensation Committee is committed to creating an executive compensation program that enables us to retain and attract high-quality executives that have targeted incentives to build long-term value for our shareholders. The Company’s compensation package utilizes a mixture of cash and equity awards to align executive compensation with both short- and long-term performance. Under the New Long-Term Incentive Program, the use of earnings before interest, taxes, depreciation and amortization (“EBITDA”) as a performance indicator rewards NEOs for focusing on growth in cash flow, which will allow us to maintain a strong and growing dividend stream to our shareholders. Additionally, achieving a strong return on equity (“ROE”) average during the performance period will indicate how well the Company is performing with the equity in place. Having those performance awards adjusted for relative total shareholder return (“TSR”) performance will provide a means of measuring the Company’s performance against our peer group. These programs reflect the Committee’s philosophy that executive compensation should reward superior performance and provide accountability for underperformance. The year over year goals in these measures increase by ten percent (10%) each year. Our Compensation Committee considers this to be aggressive. At the same time, we believe our programs do not encourage excessive risk-taking by our management team. The Board believes that our philosophy and practices have resulted in executive compensation decisions that are appropriate and that have benefited the Company over time.

For these reasons, the Board requests that our shareholders provide the non-binding advisory approval of the Company’s executive compensation for our NEOs, as described in this Proxy Statement pursuant to the SEC disclosure rules, including the Compensation Discussion and Analysis, the executive compensation tables and the related footnotes and narrative accompanying the tables.

The Board recommends that you vote “FOR” the non-binding advisory approval of the Company's compensation of its named executive officers.

9

ENVIRONMENTAL DISCLOSURES

The Company’s commitment to responsible environmental stewardship is enshrined in our Standards of Business Conduct. Ennis respects the environment and protects our natural resources. We comply with all laws and regulations regarding the use and preservation of our land, air, and water. We are subject to various federal, state, and local environmental laws and regulations concerning, among other things, wastewater discharges, air emissions and solid waste disposal. Our manufacturing processes do not emit substantial foreign substances into the environment. We do not believe that our compliance with federal, state, or local statutes or regulations relating to the protection of the environment has any material effect upon capital expenditures, earnings or our competitive position. In the realm of eco-conscious and cost effective, the two disciplines are considered complimentary goals. Thus management will focus on providing processes which improve the environment and favorably impact our financial results.

Carbon & Climate

Today, the term “carbon footprint” is often used as shorthand for the amount of carbon (usually in tonnes) being emitted by an activity or organization. The carbon footprint is also an important component of the Ecological Footprint, since it is one competing demand for biologically productive space. Carbon emissions from burning fossil fuel accumulate in the atmosphere if there is not enough bio-capacity dedicated to absorb these emissions. The combination of all these forces—consumption, deforestation, agriculture and food, emissions—underscores more than ever the value of a comprehensive measure like the Ecological Footprint that takes into account all competing demands on the biosphere, including CO2 emissions and the capacity of our forests and oceans to absorb carbon. Obviously our Company’s 50 locations use energy to produce products, and energy to transport people and material to those plants. Our primary material is paper so deforestation is a critical concern as well as a critical goal for creating additional forests in the biosphere to absorb carbon. We deal with paper suppliers who are SFI, FSC and PEFC certified. They commit to sustainable recreation of forests for pulp supply.

Energy Efficiency Initiatives

Periodically, our plants engage with local energy suppliers to ask for recommendations on lowering energy usage. Participation in these energy audits generally results in replacing old lighting with more efficient LED lighting, which substantially lowers the amount of wattage to achieve a similar amount of lumens necessary for production. Our plants are increasingly relying on “presence” lighting systems that turn on and off as employees move through a facility, further reducing energy usage. Moreover, our energy audits have enabled us to save energy and money by identifying opportunities to convert to more energy efficient equipment in our operations. Our plant managers have learned that making more sustainable choices actually enhances the bottom line of their operations.

Fuel Efficiency

Another aspect of our business model which reduces carbon emissions is the reduction in transportation costs for our employees, as well as our customers. We have 80% of our facilities in small towns where the employees are less than 10 miles from the plant, and travel time is minimal. Our geographical dispersion reduces the amount of transportation time associated with delivering our products to our customers. We recognize that shipping our products to market creates economic impacts. Hence, we have partnered with a principal shipping vendor that shares our commitment to responsible and sustainable environmental stewardship. Our principal shipping vendor has set a goal to achieve carbon neutrality by 2050. By 2025, it aims to fuel 40% of its ground operations with alternate fuels and supply 25% of the electricity needs of its facilities from renewable sources.

GHG Emissions

A typical passenger vehicle emits about 4.6 metric tons of carbon dioxide per year (a Greenhouse Gas emission). This assumes the average gasoline vehicle on the road today has a fuel economy of about 22.0 miles per gallon and drives around 11,500 miles per year. Every gallon of gasoline burned creates about 8,887 grams of CO2. As noted above, 80% of our facilities are in small towns where the employees live within 10 miles of the facility. That would put our average employee traveling about 4600 miles per year of round-trip visits to the facility or 40% of the average. The reduction in employee miles driven due to the proximity of our plants to our employees reduces the “carbon footprint” of our operations by eliminating a substantial portion of the carbon discharge related to employee commuting.

10

Technology

Newer digital technology relies on less energy that older web-based presses due to shorter runs and ink jet technology. This allows the Company to expand its product capabilities into shorter run, variable imaging print in a more cost efficient manner. At the same time it is reducing our carbon footprint while improving our margins.

Natural Resource Stewardship

Water – The use of soy-based inks allows us to avoid more harmful cleaning solutions which are environmentally dangerous. We use those soy-based inks in approximately 80% of our products. We use environmentally friendly cleaning agents to insure that our waste water is not contaminated and does not require special disposal.

Land, Forests and Biodiversity – Our primary supplier of paper is vital to our business as they supply raw materials that are minimally altered during the production process. Our core partner is SFI, FSC and PEFC certified. The SFI Forest Management Standard covers key values such as protection of biodiversity, species at risk and wildlife habitat; sustainable harvest levels; protection of water quality; and prompt regeneration. FSC certification ensures that products come from responsibly managed forests that provide environmental, social and economic benefits. At PEFC, they care for forests globally and locally. They work to protect our forests by promoting sustainable forest management through certification. This means that can all benefit from the many products that forests provide now, while ensuring these forests will be around for generations to come. The Company’s primary material supplier insures that all of their supply chain materials are sourced with similar accredited suppliers allowing for more transparency and a more trustworthy supplier commitment to quality, safety and the protection of our natural resources. Ethical and responsible paper suppliers support sustainable forest management and reduce deforestation by enabling economically productive land use without deforestation. Whereas other agricultural uses may require deforestation for cultivation of food crops or grazing in order to generate economic returns, the paper industry provides landowners the opportunity to realize an economic return on their land through responsible harvesting and forest management that preserves forested land as a renewable resource that increases carbon absorption.

Waste Management and Mitigation

Manufacturing Waste – Our plants generally have programs in place for recycling waste materials that are generated in our manufacturing operations. The first priority is to reduce waste through prudent use of materials, but some degree of material waste in manufacturing is inevitable. In the past year, our plants have recycled more than 28 million pounds of waste materials, including paper, plastics, cardboards, metals, batteries and pallets.

Packaging Material – The Company works with its freight carriers to minimize the amount of packing material that goes into boxes along with the product. The Company uses biodegradable materials which can be recycled.

Electronic Waste – The Company recycles old computers and computer peripheral equipment through an external source.

Hazardous and Non-hazardous Waste - Additionally we use material safety sheets which outline which materials could be hazardous so as to minimize the use of more hazardous materials. Given the low and de minimis use of these our plants generally fit in the lowest category or reporting standards to various state and local environmental agencies. The Company ensures that we comply with state and Federal environmental laws including Proposition 65 in California and Conflict Materials compliance. Our plants are increasingly resorting to chemical free computer-to-plate technologies in the printing process. As noted above, our use of soy-based inks also reduces the need for harsh or hazardous chemical cleaning agents.

11

Human Capital Management

Ennis, Inc. is a 113-year old print manufacturing and service company with 1,997 employees geographically dispersed in 55 facilities throughout the United States. The employees of Ennis, Inc. are the Company’s greatest asset. They are the foundation of the Company’s success and help the Company maintain a culture of caring for each other, acting with honesty and dedication to the success of our business. Each of our employees is responsible for the quality of their work product internally and externally. The Company has expanded over the years through a combination of organic growth and acquisitions. As of February 28, 2022, our workforce includes 1,751 non-exempt and 246 exempt employees. This past year our turnover rate was 18% due to an unexpected increase in retirements and resignations. With the exception of this year, average turnover averages between 5% and 8%. All of our employees are based in the U.S.

A Diverse Workforce

We have wide diversity within our facilities and follow the Equal Opportunity Act. Ennis promotes a cooperative and productive work environment by supporting the cultural and ethnic diversity of its workforce and is committed to providing equal employment opportunity to all qualified employees and applicants. We do not unlawfully discriminate on the basis of race, color, sex, sexual orientation, religion, national origin, marital status, age, disability, or veteran status in any personnel practice, including recruitment, hiring, training, promotion, and discipline. We are an Equal Opportunity Employer and we comply with all employment laws including Title VII of the Civil Rights Act of 1964, Immigration and Nationality Act, and the IRCA. We take allegations of harassment and unlawful discrimination seriously and address all such concerns that are raised regarding this policy. At Ennis, diversity begins with its Board of Directors. Our Board of directors is ethnically diverse with four (4) of our seven (7) Independent Directors representing two females, one Hispanic male and one African American male. This represents 58% of our Independent Directors. The past year, we experienced increased diversity at the executive and management levels of the Company as well as a female employee was appointed as Chief Financial Officer and an African American employee was appointed as the Company’s Director of Information Technology. The gender and ethnic makeup of the Company overall is as follows:

Ethnicity |

|

Female |

|

|

Male |

|

|

% |

||

African American |

|

|

40 |

|

|

|

51 |

|

|

4.6% |

Hispanic |

|

|

50 |

|

|

|

89 |

|

|

6.9% |

Asian |

|

|

10 |

|

|

|

24 |

|

|

1.7% |

American Indian |

|

|

4 |

|

|

|

6 |

|

|

0.5% |

Pacific Islander |

|

— |

|

|

|

1 |

|

|

0.1% |

|

2 or More Races |

|

|

11 |

|

|

|

10 |

|

|

1.0% |

White |

|

|

665 |

|

|

|

1,036 |

|

|

85.2% |

Total |

|

780 / 39.1% |

|

|

1,217 / 60.9% |

|

|

— |

||

Total Minority |

|

115 / 5.8% |

|

|

181 / 9.1% |

|

|

14.8% |

||

The Company employs seventy-four (74) veterans which equals to 3.7% of the workforce. The key management of the Company includes 246 key employees. Eighty-three (83) of these key employees are female. The workforce is mature with average age of 51 and average service of 9.8 years. The majority of the workforce is very specialized as printing press operators, specialized finishing, customer service, sales, administrative staff and management. Approximately 9% of our workforce is unionized. The Company respects and has an excellent working relationship with the unions and members.

Each facility is operated as an independent business within the community of operations. The Corporate office staff provides assistance and support for operations. Most of our operations are one of the major employers within the community they are located. Our local payroll contributes substantially to these local communities.

Employee Compensation and Retention

The Company is committed to fair and competitive compensation of our employees. This is accomplished through our focused wage and salary administration and continued monitoring of industry, national and regional competitive

12

dynamics. Ennis provides an industry leading compensation and benefits program for our employees. Facilities are focused on paying competitively within their communities and within our industry. The normal work week is 40 hours with overtime averaging 6%-10%. All non-exempt employees are paid 1-1/2 times for all overtime hours worked. The median annual compensation within our company is $52,249.

The Company’s employees receive an attractive offering of benefits including:

Employee Health and Safety

Ennis, Inc. is committed to operating in a safe, secure and responsible manner for the benefit of its employees, customers and communities where we operate. Our extensive health and safety programs have been very effective in protecting our employees from sickness and accidents. Safety, cleanliness and housekeeping are a core focus of our operating management. The Company supports our management and employees through safety audits and inspections of our facilities. A comprehensive Health and Safety Policy is in place at all facilities and holds managers and employees accountable for its execution. Employee training is monitored and employee completion is verified.

Health and Safety during COVID-19 Pandemic

Our company was considered an essential business by the U.S. Postal Service and the printing industry was determined to be a critical supplier to the infrastructure sectors needed to remain open and was deemed to be critical to the economic health of the country. We did a risk assessment and after considering and implementing CDC recommendations at our facilities, we were able to keep the majority of our employees working and receiving pay. Our employees were and continue to be very diligent in following safety protocols. Fifteen (15) percent of our employees self-reported positive COVID-19 infections during the year. These infections were widely dispersed which allowed continued operations and employment. Our company has encouraged our workforce to get vaccinated and has paid the full cost for employee testing and vaccinations. We are very appreciative of our employees’ continued efforts and confidence.

13

Supply Chain Standards

Ennis vendors must adhere to the highest standards of ethical behavior and regulatory compliance and operate in the best interest of Ennis. Vendors are expected to provide high-quality services and products while maintaining flexibility and cost-effectiveness. All vendors can access and read the Ennis Code of Conduct on our website and, when appropriate, train their employees and representatives to ensure that they are aware of Ennis’ expectations regarding their behavior. Major or critical vendors (as determined by the Company) may be asked on a periodic basis to confirm in writing that they have read and understand the Ennis Code of Conduct and know of no circumstances that would be in violation thereof. We do not engage in any unethical or illegal conduct with any of our vendors. We do not allow our employees to accept incentives such as kickbacks or bribes in return for conducting business with them. Any such action from an employee, officer or director of an acquired company prior to such company being acquired by Ennis would no longer be tolerated. Any such action currently taking place by an employee, officer or director will result in immediate termination of their employment or membership to the Board.

Data Security and Privacy

Our business is built around providing products through information provided to us by our customers, and we treat that information with confidentiality and integrity. We are committed to creating a trustworthy environment for Internet users, and continually striving to protect their online privacy is at the core of this commitment. We have adopted privacy practices, developed technological solutions to empower individuals to help protect their online privacy, and continue to educate customers about how they can use these tools to manage their personally identifiable information while they use the Internet.

Ethical Marketing and Communication

We establish and maintain clear, honest, and open communications; listen carefully; and build our relationships on trust, respect, and mutual understanding. We are accountable and responsive to the needs of our customers, consumers, and partners and take our commitments to them seriously. Our advertising, sales, and promotional literature seeks to be truthful, accurate, and free from false claims. We provide our shareholders with timely and appropriate information subject only to competitive and legal constraints.

14

CORPORATE GOVERNANCE MATTERS

General

Our Corporate Governance Guidelines address the following matters, among others: director qualifications, director responsibilities, the role of the lead director, committees of the Board, director access to officers, employees and independent advisors, director compensation, Board performance evaluations, director orientation and continuing education, CEO evaluation, and succession planning. The Corporate Governance Guidelines also contain categorical standards, which are consistent with the standards set forth in the NYSE listing standards, to assist the Board in determining the independence of the Company’s directors. A copy of these guidelines is available free of charge upon written request to Investor Relations Department, Ennis, Inc., P.O. Box 403, Midlothian, Texas 76065-0403 or via the internet at www.ennis.com.

Board Size

As of May 31, 2022, our Board consists of nine members as provided in our bylaws.

The names of our current Board members, their professional experience and attributes are described in this Proxy Statement and in our Annual Report on Form 10-K.

Board Responsibilities

Our business is managed under the direction of the Board. The Board monitors management on behalf of the shareholders. Among the Board’s major responsibilities are:

Directors are expected to maintain a good attendance record and familiarize themselves with any materials distributed prior to each Board or committee meeting. All directors may place items on agendas for Board meetings. The chair of each committee (the “Chair” or “Chairman”) clears agendas for the meetings of their respective committee, and committee members may place items on the agenda.

As stated above, the Board is responsible for oversight of succession planning for the CEO. Given the age of executive management, the Board considered succession planning at various meetings over the past year. While there is no current plan for the CEO to retire, the lead director did appoint several Board members to author guidelines for a succession planning process. These guidelines have been approved by the Board and will be implemented if and should it become necessary.

Risk Oversight

The Board exercises oversight of the Company’s operational, financial, and strategic matters, as well as compliance and legal risk. The Board is responsible for assuring appropriate alignment of its leadership structure and oversight of management. Pursuant to delegated authority as permitted by the Company’s Bylaws, Corporate

15

Governance Guidelines, and committee charters, the Board’s three standing committees oversee certain risks. The Board considers broad risk factors in their executive sessions.

Criteria for Membership on the Board

When identifying director nominees, the Nominating Committee seeks director candidates with high personal and professional ethics, integrity and values. In addition, the Nominating Committee looks for nominees who have outstanding records of accomplishments in their chosen business or profession and are committed to representing the long-term interest of our shareholders. The Board seeks members reflecting a range of talents, ages, skills, diversity, and expertise, particularly in the areas of accounting and finance, management, domestic and international markets, current or past involvement in our industry, and leadership sufficient to provide sound and prudent guidance with respect to the Company’s operations and interests.

The Board has become increasingly diverse in its composition in recent years. Alex Quiroz, an Hispanic native of Mexico with prior experience in the printing industry, has been a Board member since 2003. In 2019, the shareholders elected the Company’s first female director, Barbara Clemens, who had extensive experience in the paper industry prior to joining the Board. Then, in 2020, the shareholders elected Aaron Carter, an executive with broad retail experience, as the first African American member of the Board. Then in 2021, Margaret Walters became the second female member of the Board when she was appointed on the recommendation of the Nominating and Corporate Governance Committee to fill the vacancy created by the retirement of Godfrey M. Long. The increasing racial and gender diversity of the Board has occurred organically as the Nominating and Corporate Governance Committee has sought to identify nominees who bring particular business skills and experience to the Board. A diverse board does not have to be engineered or contrived. Rather, in an increasingly diverse culture, the composition of the Board will mirror that diversity as we seek the best candidates based on skills and ability rather than gender or ethnicity. A diverse board is the natural result of identifying talent and ability without any gender or ethnic constraints. Thus, the Board will continue to reflect gender and ethnic diversity as we continue to seek out qualified candidates to fill vacancies on the Board as they occur.

The Company requires that its Board members be able to dedicate the time and resources sufficient to ensure the diligent performance of their duties on the Company’s behalf, including attending Board and applicable committee meetings. Physical attendance is mandatory for all Board and committee meetings to constitute attendance pursuant to our Bylaws. The Director must also have the financial wherewithal to meet the stock ownership requirements of Directors. The Board does not have a formal tenure or retirement age policy. However, the Company has replaced six of its directors over the last six years, which resulted in the average age of our directors being reduced by six years, from 71 years old to 65 years old, and the average tenure of our directors being reduced from 12.7 years to 6.6 years. As such, the Nominating Committee believes that there is no need to have a formal tenure or retirement age policy at this time.

Board Leadership Structure, Board Meetings and Executive Sessions

The Board does not maintain a strict policy regarding the separation of the offices of Chairman of the Board and CEO. However, the Board does review its structure on an annual basis and firmly believes this is a matter that should be part of any succession planning process. We currently believe there is no benefit in separation of the two offices considering the open and effective relationship the Board enjoys with the incumbent CEO.

As set forth in our Corporate Governance Guidelines, the Chair of the Nominating Committee serves as our lead director, with such duties as set forth in those Guidelines. As current Chair of the Nominating Committee, John R. Blind currently serves as lead director. The duties of the lead director include the following:

16

The Board not only holds regular quarterly meetings but also holds other meetings each year to review the Company’s strategy, to approve its annual business plan and annual budget, and to act on the Company’s regulatory filings with the SEC. Special meetings of the Board have occurred in connection with unusual occurrences, such as the sale of a subsidiary or the purchase of a company. The Board also communicates informally with management on a regular basis.

Non-employee directors meet without management or employee directors present, at every regularly scheduled Board meeting. All Board committees may meet with the CEO as a guest, but are not required to do so. The CEO may be excused from any meeting at the request of the independent directors to allow the committee to speak candidly. The Company’s by-laws maintains that Company’s President and CEO cannot be a member of a committee and has no voting rights.

Committees of the Board

The Board has the following three standing committees that are comprised entirely of independent directors: the Audit Committee, the Compensation Committee and the Nominating Committee. Each committee meets in sessions on pre-determined dates and as needed.

Director Nomination Process

The Nominating Committee Charter allows shareholders to recommend to the Nominating Committee candidates for membership on the Board. To utilize this process and recommend a candidate for director using this process: (i) the shareholder must follow procedures set forth in the Nominating Committee Charter and (ii) the candidate must meet the qualification standards set forth in the Company’s Corporate Governance Guidelines.

Shareholders wishing to submit the name of a candidate for the Board must submit a resume of the candidate, proof of ownership of 3% or more of the Company’s stock, and that they have held such stock at a 3% or more level for more than three years from the date of their proposal and such other requirements as set forth in Rule 14a-11 of the Exchange Act. They must also consent to have their name disclosed in the Proxy Statement.

Candidates recommended by the Company’s shareholders are evaluated on the same basis as candidates recommended by the Company’s directors, CEO, other executive officers, third party search firms, or other sources and the Nominating Committee’s judgment is final as to the candidates submitted for election. The Nominating Committee will request and review the resume of any of the candidates based on the qualifications set forth in the Nominating Committee Charter and the Company’s Corporate Governance Guidelines. There can only be one shareholder nominee in our proxy statement for any given Annual Meeting.

Director Independence

Our Corporate Governance Guidelines provide that the Board must be composed of a majority of independent directors. “Independence” for these purposes means the director meets the independence requirements set forth in the Exchange Act, the rules adopted by the SEC thereunder and the corporate governance and other listing standards of the NYSE. The Board has reviewed the independence of our directors using these standards. Under rules adopted by the NYSE, no Board member qualifies as independent unless (i) the Board affirmatively determines that the director has no material relationship with us and (ii) the director is not disqualified from being independent as set forth therein. In evaluating each director’s independence, the Board considers all relevant facts and circumstances in making a determination of independence. In particular, when assessing the materiality of a director’s relationship with us, the Board considers the issue not merely from the standpoint of the director, but also from the standpoint of persons or organizations with which the director has an affiliation.

17

In its determination of independence, the Board reviewed and considered all relationships and transactions between each director, such director’s family members or any business, charity or other entity in which such director has an interest, on the one hand, and we, our affiliates, or our senior management has an interest, on the other. As a result of this review, the Board has determined that each non-employee director (other than Mr. Mozina and Ms. Walters) meets the standards regarding independence set forth in the Corporate Governance Guidelines of the Company, is in compliance with NYSE rules, and has no material relationship with the Company. The Board has determined that the current independent directors, which consist of Mr. Blind, Mr. Carter, Ms. Clemens, Mr. Quiroz, Mr. Priddy and Mr. Schaefer, constitute a majority of the Board. If all three 2022 nominees are elected, independent directors will continue to constitute a majority of the Board.

The two non-independent, non-employee directors are Gary Mozina and Margaret Walters. Mr. Mozina was elected by the unanimous consent of the directors to fill the Board position vacated due to the resignation of Mr. Magill from the Board in May 2019. Mr. Mozina was elected by the shareholders in 2020 for a three-year term ending in 2023. Mr. Mozina is the former owner of Integrated Print & Graphics (“IPG”), which the Company acquired in March 2019. Mr. Mozina’s knowledge of the print segment, both as a manufacturer and as a distributor with connections in the Chicago marketplace, was a critical factor in the Board’s determination that he should fill the seat vacated by Mr. Magill. Since there is a continuing sourcing agreement with Mr. Mozina’s distributorship involving IPG, and because the Company leases the existing IPG space from him, the Board determined that Mr. Mozina should not be classified as an independent director. However, Mr. Mozina’s has been instrumental in the Company’s efforts to identify and pursue important business opportunities in the Chicago market and he has been a very good advocate for the Company within the industry. For additional information, see Certain Relationships and Related Transactions and Director Independence, below. Despite the determination that Mr. Mozina is not an independent director, Mr. Mozina is not employed as an officer or otherwise by Ennis or any of its subsidiaries, which qualifies Mr. Mozina as a non-employee director for purposes of our policies applicable to non-employee directors.

Margaret Walters was appointed in September 2021 to fill the vacancy created by the retirement of Mr. Long. Due to her marriage to CEO Keith Walters, she is not classified as an independent director. Nevertheless, in the context of the Board’s succession planning, two critical factors in appointing Ms. Walters to the Board was to strengthen shareholder alignment and the continuity of the Company’s key industry relationships. For nearly 25 years, Ms. Walters has helped cultivate important relationships with suppliers, distributors, and other printing companies through her regular attendance at industry events and trade shows. Through the relationships she has established over the years, Ms. Walters has played an integral role in completing some of the Company’s most important acquisitions.

Director Access to Management and Independent Advisors

All directors are able to directly contact members of management, including, in the case of the Audit Committee, direct access to the head of internal audit. Broad management participation is encouraged in presentations to the Board, and executive management frequently meets with Board members on an individual basis. The Board and its committees are empowered to hire, at the Company’s expense, their own financial, legal, and other experts to assist them in addressing matters of importance to the Company.

Board Self-Evaluation

The Nominating Committee conducts a self-evaluation of the Board’s performance annually, which includes a review of the Board’s composition, responsibilities, leadership and committee structure, processes and effectiveness. The Nominating Committee of the Board conducts a similar self-evaluation with respect to each committee. In addition, each member of the Board is individually evaluated by each other member of the Board, on a periodic basis and annually upon reaching age 75 or when up for election.

Director Orientation and Education

Directors are provided with materials regarding Ennis upon their initial election to the Board. Other orientation procedures include meetings with senior executives of the Company in its major business units.

Non-Employee Director Compensation and Stock Ownership

The Nominating Committee reviews non-employee director compensation and benefits on an annual basis and makes recommendations to the Board regarding appropriate compensation for the Board’s approval. It is the Company’s policy that a portion of non-employee directors’ compensation should be equity-based. For details on the

18

compensation currently provided to non-employee directors, please see the Director Compensation section of this Proxy Statement.

In 2011, a stock ownership policy for all non-employee directors was modified and adopted by the Board. This policy requires that all non-employee directors will maintain at all times a minimum ownership investment in our Common Stock equal to six times their annual retainer with additional ownership investment encouraged. A newly elected, non-employee director has five years to satisfy this minimum ownership investment. For additional information of non-employee director stock ownership, please see the Security Ownership of the Board of Directors and Executive Officers section of this Proxy Statement.

The Company also expects all directors to comply with all federal and state laws regarding trading in securities of the Company and disclosing material, non-public information regarding the Company. The Company has procedures in place to assist directors in complying with these laws including an Insider Trading Policy put into place in January of 2008, as modified from time to time, which prohibits officers and directors from hedging or pledging their securities or from engaging in short-term or speculative trade transactions in the Company’s securities.

Code of Business Conduct and Ethics

The Company has adopted a Standards of Professional Conduct for Officers, Employees, and Directors (“Standards of Professional Conduct”) designed to help directors and employees resolve ethical issues in an increasingly complex global business environment. Our Standards of Professional Conduct applies to all directors and employees, including the CEO, the CFO, and all other executive officers. Our Standards of Professional Conduct covers topics including, but not limited to, conflicts of interest, insider trading, competition and fair dealing, discrimination and harassment, confidentiality, payments to government personnel, anti-boycott laws, U.S. embargos and sanctions, compliance procedures, and employee complaint procedures. Our Standards of Professional Conduct is posted on our website under the “Corporate Governance” caption in the “Investor Relations” section. A copy of the Standards of Professional Conduct is available free of charge by contacting Investor Relations Department, Ennis, Inc., P.O. Box 403, Midlothian, TX 76065-0403.

Communication with the Board