Form DEF 14A EDWARD JONES MONEY MARKE For: Apr 19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN A PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934, as amended

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under Rule 14a-12 | |

EDWARD JONES MONEY MARKET FUND

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies:

| |||

| 2) | Aggregate number of securities to which transaction applies:

| |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| 4) | Proposed maximum aggregate value of transaction:

| |||

| 5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) | Amount Previously Paid:

| |||

| 2) | Form, Schedule or Registration Statement No.:

| |||

| 3) | Filing Party:

| |||

| 4) | Date Filed:

| |||

EDWARD JONES MONEY MARKET FUND

12555 Manchester Road

St. Louis, Missouri 63131

Dear Shareholder:

Enclosed is a notice, proxy statement and proxy card for a Special Meeting of Shareholders (the “Meeting”) of the Edward Jones Money Market Fund (the “Fund”). The Meeting is scheduled for April 19, 2022. If you are a shareholder of record of the Fund as of the close of business on February 23, 2022 (the “Record Date”), you are entitled to vote at the Meeting, and any adjournments or postponements of the Meeting.

Due to the public health impact of the coronavirus pandemic (“COVID-19”), the Meeting will be held in virtual meeting format only, via the Internet, with no physical in-person meeting. You will be able to attend and participate in the Meeting by registering online at https://viewproxy.com/EdwardJones/broadridgevsm/. If you plan on attending the Meeting, please follow the instructions below and register to attend by April 17, 2022 at 9:30 a.m. (Central time). Please refer to the enclosed proxy statement as well as the information below for details on the proposal.

At the Meeting, shareholders of the Fund will be asked to elect eleven nominees to the Board of Trustees of the Fund. Currently, the mutual funds offered by Edward D. Jones & Co., L.P. (“Edward Jones”) are overseen by two separate groups of trustees. One of these groups consists of the current Trustees of the Fund. The other group consists of members of the board of trustees of the Bridge Builder Core Bond Fund, Bridge Builder Core Plus Bond Fund, Bridge Builder Municipal Bond Fund, Bridge Builder Large Cap Growth Fund, Bridge Builder Large Cap Value Fund, Bridge Builder Small/Mid Cap Growth Fund, Bridge Builder Small/Mid Cap Value Fund, and Bridge Builder International Equity Fund (each, a “BBT Fund,” and together, the “BBT Funds”), each a series of Bridge Builder Trust (“BBT”). The Board that oversees the Fund and the board of trustees of BBT are each proposing to align the membership of the boards so that all of the mutual funds offered by Edward Jones are overseen by the same group of trustees. Four of the nominees currently serve as Trustees of the Fund. Five of the nominees currently serve as trustees of BBT. Two of the nominees would be new independent members who are not currently Trustees of the Fund or trustees of BBT. A separate proxy statement is being sent to shareholders of BBT, who are also being asked to vote on election of the same slate of eleven nominees to the board of trustees of BBT. As described in the enclosed proxy statement, bringing the membership of the boards into alignment would

broaden the diversity of viewpoints, skill sets, backgrounds and depths of experiences brought to bear in oversight of the Fund, increase the gender and racial diversity of the Board’s membership, address anticipated succession planning needs of the Board into the future, promote efficiency and consistency in the oversight of all funds in the Edward Jones mutual fund complex, and result in other potential benefits to shareholders of the Fund, including the potential for shareholders to benefit from economies of scale in the longer-term as certain costs might be spread over a greater asset base. Information about the nominees is provided in the accompanying proxy statement.

The Board of Trustees of the Fund has unanimously approved each nominee and recommends that you vote “FOR” the election of each nominee.

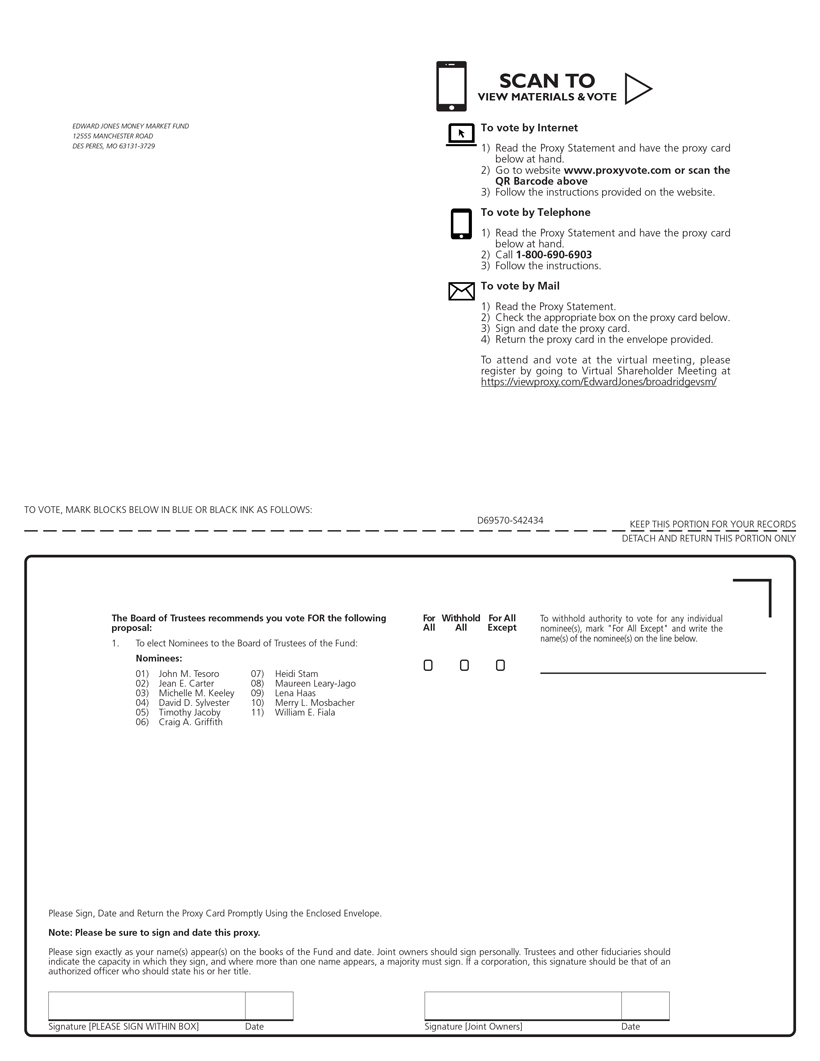

Your vote is important to us. Please take a few minutes to review this proxy statement and vote your shares today. There are several ways in which you can cast your vote. To vote, you may use any of the following methods:

| 🌑 | By Internet. Have your proxy card available. Go to the website listed on your card. Follow the instructions found on the website. |

| 🌑 | By Telephone. Have your proxy card available. Call the toll-free number 1-833-501-4829. Follow the recorded instructions. |

| 🌑 | By Mail. Please complete, date and sign your proxy card before mailing it in the enclosed postage-paid envelope. |

| 🌑 | At the Meeting over the Internet. Shareholders of record as of the close of business on the Record Date will be able to attend and participate in the virtual Meeting by registering online at https://viewproxy.com/EdwardJones/broadridgevsm/. Please plan to register prior to the Meeting, by April 17, 2022 at 9:30 a.m. (Central time). Even if you plan to attend the Meeting, we recommend that you also authorize your proxy as described herein so that your vote will be counted if you decide not to attend the Meeting. Please see the “Voting, Quorum and Other Matters” section in the accompanying proxy statement for more details regarding the logistics of the virtual format of the Meeting. |

If you have any questions before you vote, please call Broadridge Financial Solutions, Inc., at the toll-free number 1-833-501-4829. They will be happy to help you understand the proposal and assist you in voting.

Thank you for your attention and consideration of this important matter and for your investment in the Fund.

Sincerely,

|

|

| Julius A. Drelick III |

| President |

PROMPT EXECUTION AND RETURN OF THE ENCLOSED PROXY CARD IS REQUESTED. A SELF-ADDRESSED, POSTAGE-PAID ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE, ALONG WITH INSTRUCTIONS ON HOW TO VOTE OVER THE INTERNET OR BY TELEPHONE, SHOULD YOU PREFER TO VOTE BY ONE OF THOSE METHODS.

EDWARD JONES MONEY MARKET FUND

12555 Manchester Road

St. Louis, Missouri 63131

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 19, 2022

Notice is hereby given that a Special Meeting of Shareholders (the “Meeting”) of the Edward Jones Money Market Fund (the “Fund”) will be held at 9:30 a.m. (Central time) on April 19, 2022. Due to the public health impact of the coronavirus pandemic (“COVID-19”), the Meeting will be held in virtual meeting format only, via the Internet, with no physical in-person meeting.

At the Meeting, shareholders of record of the Fund will be asked to elect the following eleven individuals to serve as Trustees of the Fund (i) Maureen Leary-Jago, Timothy Jacoby, David D. Sylvester and Lena Haas, each a current Trustee of the Fund, (ii) John M. Tesoro, Jean E. Carter, Michelle M. Keeley, William E. Fiala and Merry L. Mosbacher, each a current trustee of the Bridge Builder Trust (“BBT”), a separate group of mutual funds sponsored by Edward Jones, and (iii) Heidi Stam and Craig A. Griffith, each of whom was nominated in October 2021 to join the BBT board as a trustee of BBT, but has not yet been elected by the BBT shareholders to the BBT board, and to act upon the transaction of such other business, if any, as may properly come before the Meeting.

Please take some time to read the enclosed proxy statement. It discusses this proposal in more detail. If you were a shareholder as of the close of business on February 23, 2022 (the “Record Date”), you may vote at the Meeting or at any adjournments or postponements of the Meeting. In light of the public health impact of COVID-19, you will not be able to attend the Meeting in person. However, shareholders of the Fund on the Record Date may participate in and vote at the Meeting on the Internet by virtual means. To participate in the Meeting virtually, shareholders must register in advance by visiting https://viewproxy.com/EdwardJones/broadridgevsm/ and submitting the requested required information to Broadridge Financial Solutions, Inc. (“Broadridge”), the Fund’s proxy tabulator. Please plan to register prior to the Meeting, by April 17, 2022 at 9:30 a.m. (Central time).

Shareholders whose shares are held by a broker, bank or other nominee must first obtain a “legal proxy” from the applicable nominee/record holder, who will then provide the shareholder with a newly-issued control number. Once shareholders have obtained a new control number, they must visit https://viewproxy.com/EdwardJones/broadridgevsm/ and submit their name

and newly issued control number in order to register to participate in and vote at the Meeting. After shareholders have submitted their registration information, they will receive an e-mail from Broadridge that confirms that their registration request has been received and is under review by Broadridge. Once shareholders’ registration requests have been accepted, they will receive (i) an email containing an event link to attend the Meeting, and (ii) an email with a password to enter at the event link in order to access the Meeting.

Shareholders may vote before or during the Meeting at https://viewproxy.com/EdwardJones/broadridgevsm/. Only shareholders of the Fund present virtually or by proxy will be permitted to attend the virtual Meeting and be able to vote, or otherwise exercise the powers of a shareholder, at the Meeting. If you cannot attend virtually, please vote by mail, telephone or Internet. Just follow the instructions on the enclosed proxy card. If you have questions, please call 1-833-501-4829.

It is important that you vote. The Board of Trustees of the Fund has unanimously approved each nominee and recommends that you vote “FOR” the election of each nominee.

Important Notice Regarding the Availability of Proxy Materials for the

Special Meeting of Shareholders to Be Held on April 19, 2022.

The proxy statement is available at www.proxyvote.com.

| By Order of the Board of Trustees |

|

| Evan S. Posner |

| Secretary |

EDWARD JONES MONEY MARKET FUND

12555 Manchester Road

St. Louis, Missouri 63131

PROXY STATEMENT

SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 19, 2022

This proxy statement is furnished in connection with the solicitation of proxies by the Edward Jones Money Market Fund (the “Fund”) to be voted at a special meeting of shareholders on April 19, 2022 at 9:30 a.m. Central time, and at any adjournments or postponements thereof (such special meeting and any adjournments or postponements thereof are hereinafter referred to as the “Meeting”). Due to the public health impact of the coronavirus pandemic (“COVID-19”), the Meeting will not be held in person but rather will be held as a virtual meeting. Shareholders of record of the Fund at the close of business on February 23, 2022 (the “Record Date”) are entitled to notice of, and to vote at, the Meeting. This proxy statement and the accompanying notice of special meeting and proxy card are first being mailed to shareholders on or about March 18, 2022.

At the Meeting, shareholders of record of the Fund will be asked to elect eleven Trustees to the Board of Trustees of the Fund, and to act upon the transaction of such other business, if any, as may properly come before the Meeting.

Each full share of the Fund will be entitled to one vote at the Meeting, and each fraction of a share will be entitled to the fraction of a vote equal to the proportion of a full share represented by the fractional share. The number of shares of the Fund issued and outstanding as of the Record Date is included in Appendix A.

In this proxy statement, the term “Board” refers to the Board of Trustees of the Fund, and the term “Trustee” refers to each trustee of the Fund. A Trustee who is an “interested person,” as defined in the Investment Company Act of 1940, as amended (the “1940 Act”), of the Fund is referred to in this proxy statement as an “Interested Trustee.” A Trustee who is not an “interested person,” as defined in the 1940 Act, of the Fund is referred to in this proxy statement as an “Independent Trustee.” Edward Jones Money Market Fund is referred to in this proxy statement as the “Fund.”

1

ELECTION OF TRUSTEES

Proposal

Shareholders are being asked to elect eleven individuals to serve on the Board of Trustees of the Fund (the “Proposal”).

Background

The Edward D. Jones & Co., L.P. (“Edward Jones”) family of mutual funds currently consists of the Fund and the eleven (eight active and three inactive) series of the Bridge Builder Trust (“BBT,” and such series, the “BBT Funds,” and each, a “BBT Fund”), which are 1940 Act-registered funds (collectively, the “Edward Jones Fund Complex”). The investment adviser and administrator of the Fund is Passport Research, Ltd. (“Passport”) and the investment adviser of BBT is Olive Street Investment Advisers, LLC (“Olive Street”). Passport and Olive Street are each affiliates of Edward Jones. Edward Jones serves as the distributor and transfer agent to the Fund.

Currently, the Fund and BBT are each overseen by separate boards of trustees with different individuals serving as board members. If approved by shareholders, the Proposal would establish a unified board comprised of a common group of members that oversees the entire Edward Jones Fund Complex (the “Unified Board”). The Unified Board would be composed of all of the existing board members of the Fund and BBT and two new independent members who do not currently serve on either board, as discussed further below.

The Board and the board of trustees of BBT (the “BBT Board” and collectively, the “Existing Boards”) separately determined that there are potential benefits to shareholders of the Fund and BBT, respectively, to consolidate oversight of the funds in the Edward Jones Fund Complex by aligning the membership of the Board with the membership of the BBT Board so that all funds in the Edward Jones Fund Complex are overseen by the same group of trustees. To establish the Unified Board, the Board is proposing that shareholders elect the following individuals to serve as Trustees of the Fund: (i) Maureen Leary-Jago, Timothy Jacoby, David D. Sylvester and Lena Haas, each a current Trustee of the Fund (each, a “Current Trustee” and collectively, the “Current Trustees”), (ii) John M. Tesoro, Jean E. Carter, Michelle M. Keeley, William E. Fiala and Merry L. Mosbacher, each a current trustee of BBT, and (iii) Heidi Stam and Craig A. Griffith, each of whom was nominated in October 2021 to join the BBT

2

Board as a trustee of BBT, but has not yet been elected by the BBT shareholders to the BBT Board (each, a “Nominee” and collectively, the “Nominees”). See the table below for pertinent information about each of the Nominees. Mr. Fiala, a current interested trustee of BBT and the current Chair of the BBT Board, previously intended to retire from the BBT Board on December 31, 2021, but has agreed to remain on the BBT Board to assist the BBT Board members with the transition to, and integration of, the Unified Board. If elected, Mr. Fiala currently anticipates retiring from the Unified Board on December 31, 2022, but his actual retirement date may be sooner or later than December 31, 2022. In furtherance of the effort to establish the Unified Board, a separate proxy statement is being sent to the shareholders of BBT seeking approval of the election of the same slate of Nominees to the BBT Board.

| Nominee | Independent or Interested |

Existing Board Member? |

Name of Trust Overseen by Existing Board Member | |||

| Lena Haas | Interested | Yes | Edward Jones Money Market Fund | |||

| David D. Sylvester | Independent | Yes | Edward Jones Money Market Fund | |||

| Timothy Jacoby | Independent | Yes | Edward Jones Money Market Fund | |||

| Maureen Leary-Jago | Independent | Yes | Edward Jones Money Market Fund | |||

| William E. Fiala | Interested | Yes | Bridge Builder Trust | |||

| Merry L. Mosbacher | Interested | Yes | Bridge Builder Trust | |||

| Jean E. Carter | Independent | Yes | Bridge Builder Trust | |||

| Michelle M. Keeley | Independent | Yes | Bridge Builder Trust | |||

| John M. Tesoro | Independent | Yes | Bridge Builder Trust | |||

| Heidi Stam | Independent | No* | Not Applicable | |||

| Craig A. Griffith | Independent | No* | Not Applicable |

* Ms. Stam and Mr. Griffith were each nominated in October 2021 to join the BBT Board as a trustee of BBT and, since then, has participated in an observer capacity at the BBT Board’s meetings, as described further below.

Section 16(a) of the 1940 Act generally requires the trustees of an investment company, such as the Fund, to be elected by shareholder vote. Section 16(a) provides, however, that trustees may be appointed without the election by shareholders if, immediately after such appointment, at least two-thirds of the trustees then holding office have been elected by shareholders. As currently constituted, the Board has four Trustees, three of whom (Ms. Leary-Jago and Messrs. Sylvester and Jacoby) have been previously elected by shareholders and one of whom (Ms. Haas) has been appointed by the Board but not

3

previously elected by shareholders. Accordingly, an election by shareholder vote must be held in order for the Board to add the seven Nominees who are not Current Trustees (Mses. Mosbacher, Carter, Keeley and Stam and Messrs. Fiala, Griffith and Tesoro).

Each Nominee has consented to being named in this proxy statement and has agreed to serve (or continue to serve, as applicable) as a Trustee if elected. There is no reason to believe that any of the Nominees will become unable to serve or for good cause will not serve as a Trustee, but if that should occur before the Meeting, proxies may be voted for a replacement Nominee, if any, designated by the current Board members. If elected, the terms of office for the Nominees who are not Current Trustees are expected to commence on or about the date of the Meeting. Each Current Trustee holds office and, if elected as a Board member, the other Nominees will hold office, until his or her successor is elected and qualified or until his or her earlier death, resignation, retirement or removal. The Board has determined that the number of its Board members shall be fixed at eleven to accommodate the Nominees, subject to any further changes in Board size permitted by applicable law.

Board Nomination Process and Summary of Factors Considered In Connection with Board Unification

In the late summer 2021, each Existing Board and its Governance and Nominating Committee had been engaged in active discussions regarding succession planning and evaluating potential alternatives to adding new individuals with complimentary qualifications, skills and experience in order to fill current and/or anticipated vacancies on the Existing Board due to trustee retirements or resignations. In connection with a broader initiative undertaken by Edward Jones to suggest approaches to further enhance the effectiveness of board oversight across the Edward Jones Fund Complex, Edward Jones recommended that each Existing Board consider a proposal to align the membership of the boards into the Unified Board so that all funds in the Edward Jones Fund Complex would be overseen by the same group of trustees. Over the course of the past several months (the “Evaluation Period”), the Existing Boards, as Boards, Committees or individually, met on several occasions with each other and with, and apart from, Edward Jones to consider and develop the proposal to transition to a Unified Board. Among the meetings held with Edward Jones was a joint meeting of the Existing Boards on October 7, 2021, at which representatives of Edward Jones presented to the Existing Boards on, among other things, Edward Jones’ rationale for the proposal, the background and history of each Existing Board

4

and various potential benefits arising from the unified board structure, including potential benefits to (a) the Fund and BBT and their respective shareholders, (b) the Existing Boards, and (c) Edward Jones. Throughout the Evaluation Period, the Independent Trustees of each Existing Board also met regularly with their independent legal counsel, outside the presence of the Interested Trustees, Fund officers, and representatives of Edward Jones, to consider and discuss matters relating to the alignment of the membership of the boards.

During the Evaluation Period, each Existing Board’s Governance and Nominating Committee, which consists solely of Independent Trustees, and which, among other things, considers recommendations on nominations for trustees, met in a series of meetings to evaluate the candidacy of each of the Nominees, including their qualifications and experiences. The members of the Board’s Governance and Nominating Committee met with each of the Nominees who currently serve as trustees of BBT and Ms. Stam and Mr. Griffith. Similarly, the members of the BBT Board’s Governance and Nominating Committee met with each of the Current Trustees and Ms. Stam and Mr. Griffith. All of the Nominees also attended certain meetings of the Board and the BBT Board during the Evaluation Period.

As a result of the above process, separate meetings of each Existing Board and its Governance and Nominating Committee were held on February 21, 2022, at which they further discussed and evaluated the various potential benefits of the proposed board unification and further evaluated the candidacy of each of the Nominees (or, in the case of the BBT Board and its Governance and Nominating Committee, each of the Nominees other than Ms. Stam and Mr. Griffith, which occurred in October 2021). At the conclusion of the February 21, 2022 meetings, each Existing Board’s Governance and Nominating Committee unanimously selected and nominated each of the Nominees and recommended that the Existing Board accept such selections and nominations (or, in the case of the BBT Board and its Governance and Nominating Committee, each of the Nominees other than Ms. Stam and Mr. Griffith, which occurred in October 2021). Based upon this recommendation, each Existing Board, including its independent trustees, unanimously accepted the selections and nominations of such Nominees and voted to nominate each such Nominee for election by shareholders.

In reaching its determination to select and nominate each of the Nominees, the Board’s Governance and Nominating Committee carefully evaluated the experience, demonstrated capabilities, commitment, reputation, background,

5

knowledge of the investment business and general understanding of business and financial matters of each Nominee (as further described below). The Board’s Governance and Nominating Committee also considered the overall diversity of the proposed Unified Board’s composition. Specifically, the Board’s Governance and Nominating Committee considered how each Nominee could be expected to contribute to overall diversity in the backgrounds, race, gender, skills, experiences and views of the Board’s members and thereby enhance the effectiveness of the Board. Each Nominee for Independent Trustee was recommended by the Board’s Governance and Nominating Committee and each Nominee for Interested Trustee was recommended by Passport and Edward Jones.

In addition to evaluating each Nominee, the Trustees focused on the potential benefits to shareholders of the Fund of moving to a unified board structure in which a common group of members would oversee the entire Edward Jones Fund Complex, and considered a number of factors, including, but not limited to, the following (as well as other information described in this proxy statement):

| ● | An increase to the size of the Board would broaden the diversity of viewpoints, skill sets, backgrounds and depths of experiences brought to bear in oversight of the Fund on behalf of shareholders and better enable the Board to respond to complexities of registered fund governance and oversight (including compliance, regulatory and risk management oversight) and evolving market conditions, as well as the potential future growth of the Fund. |

| ● | The election of the Nominees would increase the gender and racial diversity of the membership of the Board. |

| ● | The Nominees have certain overlapping skills, qualifications and experience that would help to ensure that the Board is not without a key skill set upon an unexpected future resignation or departure of a Trustee. |

| ● | The election of the Nominees would address anticipated succession planning needs of the Board into the future because it would allow several future vacancies on the Board (due to resignations, departures or retirements) to be filled without the time and fund expense (borne by shareholders) of calling another shareholder meeting. |

6

| ● | The unified board structure would allow the Board to gain new members that already have experience with the Edward Jones Fund Complex, which may better position the Board to respond to management’s business and product initiatives. |

| ● | A larger, more diverse fund complex (consisting of the Fund and BBT) may improve retention and attraction of qualified members to the Board in the future. |

| ● | The unified board structure would eliminate operational and administrative burdens of supporting two different boards in the Edward Jones Fund Complex, which may promote a more efficient use of resources by management, potentially enhance management’s productivity and better enable management to focus greater time and resources on matters that more directly benefit shareholders. |

| ● | An increase in the size of the Board would provide an opportunity for the use of additional Board committees (or working groups comprised of subsets of Trustees) in the future to provide greater focus on important matters, whether specific to a particular fund (or groups of funds) or complex wide. |

| ● | The unified board structure would promote efficiency and consistency in the oversight of all funds in the Edward Jones Fund Complex, including by: |

| ○ | promoting the development of uniform compliance and governance policies (with consistent policies, consistently applied); |

| ○ | reducing some overlap of oversight obligations, as the Fund and BBT are served by many of the same service providers and personnel and face similar issues with respect to certain of their fundamental activities (e.g., compliance, valuation, liquidity, risk management and financial reporting); |

| ○ | reducing the aggregate number of Existing Board meetings and having matters of common interest between the Existing Boards discussed at a single meeting of the Unified Board (as opposed to separately by each Existing Board at its own meeting); and |

7

| ○ | allowing for more efficient, effective and transparent communications across the Edward Jones Funds Complex, including communications among board members as well as communications between management and board members. |

| ● | The unified board structure would provide the potential for shareholders to benefit from economies of scale in the longer-term as certain fixed costs involved in the operation of the Fund and the Board would be allocated among all of the funds in the Edward Jones Fund Complex and, thus, might be spread over a greater asset base. |

| ● | The establishment of the unified board structure is not expected to impact the Fund’s expense ratio. |

With respect to their consideration of the establishment of the Unified Board, the Board did not identify any particular information or consideration that was all-important or controlling, and each individual Trustee may have attributed different weights to various factors and information.

INFORMATION ABOUT THE NOMINEES

The Nominees, their year of birth, position with the Fund, term of office with the Fund and length of time served, their principal occupations and other directorships for the past five years and the number of funds in the Edward Jones Fund Complex he or she is expected to oversee following the establishment of the Unified Board, subject to shareholder approval of the Proposal, are set forth below. The address of each Nominee is c/o Edward Jones Money Market Fund, 12555 Manchester Road, St. Louis, MO 63131.

| Name and Age | Position the Fund |

Term of Office and Length of Time Served |

Principal Occupation During Past Five Years |

Number Funds in

Edward Complex(2) Overseen by |

Other Directorships Held During Past Five Years or | |||||

| Nominees for Independent Trustees of the Fund | ||||||||||

| Jean E. Carter (Born: 1957) |

Nominee | N/A | Retired; Director of Investment Management Group for Russell Investment Group (1982-2005). | 12 | Independent Trustee, Bridge Builder Trust (11 series) (2013-present); Trustee, Brandes U.S. registered mutual funds (2008-2020). | |||||

8

| Name and Age | Position the Fund |

Term of Office and Length of Time Served |

Principal Occupation During Past Five Years |

Number Funds in

Edward Complex(2) Overseen by |

Other Directorships Held During Past Five Years or | |||||

| Craig A. Griffith (Born: 1958) |

Nominee | N/A | Retired; Partner at Sidley Austin LLP (1998-2019). | 12 | None. | |||||

| Timothy Jacoby (Born: 1952) |

Current Trustee and Nominee |

Indefinite Term; Since January 2017 |

Retired; Previously, Partner at Deloitte & Touche LLP (2000-2014). | 12 | Audit Committee Chair, Perth Mint Physical Gold ETF (AAAU) (2018-2020); Independent Trustee, Exchange Traded Concepts Trust (17 funds) (2014-present); Exchange Listed Funds Trust (18 funds) (2014-present). | |||||

| Michelle M. Keeley (Born: 1964) |

Nominee | N/A | Retired; Executive Vice President, Ameriprise Financial Services, Inc. (2002-2010). | 12 | Independent Trustee, Bridge Builder Trust (11 series) (2015-present); Independent Director, American Equity Life Holding Company (June 2020-2022); Independent Director, Federal Home Loan Bank of Des Moines (2015-2021). | |||||

| Maureen Leary-Jago (Born: 1952) |

Current Lead Independent Trustee and Nominee |

Indefinite Term; Since January 2017 |

Retired; Previously, Senior Global Advisor at MFS (2004-2016). | 12 | None. | |||||

9

| Name and Age | Position the Fund |

Term of Office and Length of Time Served |

Principal Occupation During Past Five Years |

Number Funds in

Edward Complex(2) Overseen by |

Other Directorships Held During Past Five Years or | |||||

| Heidi Stam (Born: 1956) |

Nominee | N/A | Retired; Managing Director and General Counsel, Vanguard (2005-2016). | 12 | Trustee, CBRE Global Real Estate Income Fund (2021-present); Vice Chair, Investor Advisory Committee, U.S. Securities and Exchange Commission (2020-2021); Committee Member, Investor Advisory Committee, U.S. Securities and Exchange Commission (2017-2021); Council Member, National Adjudicatory Council, FINRA (2017-2021). | |||||

| David D. Sylvester (Born: 1950) |

Current Trustee and Nominee |

Indefinite Term; Since January 2017 |

Retired; Previously, Portfolio Manager at Wells, Fargo & Co. (1979-2015). | 12 | Trustee, Minnehaha Academy (2017-present). | |||||

| John M. Tesoro (Born: 1952) |

Nominee | N/A | Retired; Partner, KPMG LLP (2002-2012). | 12 | Independent Trustee, Bridge Builder Trust (11 series) (2013-present); Independent Trustee, BBH Trust (nine U.S. mutual funds) (2014-present); Director, Teton Advisors, Inc., registered investment adviser (2013-2021). | |||||

10

| Name and Age | Position the Fund |

Term of Office and Length of Time Served |

Principal Occupation During Past Five Years |

Number Funds in

Edward Complex(2) Overseen by |

Other Directorships Held During Past Five Years or | |||||

| Nominees for Interested Trustees of the Fund(1) | ||||||||||

| William E. Fiala (Born: 1967) |

Nominee | N/A | Subordinated Limited Partner, The Jones Financial Companies, LLLP (since 2022); Principal, Edward Jones, and General Partner, The Jones Financial Companies, LLLP (1994 - 2021) | 12 | Chairperson, Bridge Builder Trust (11 series) (2020-present); Trustee, Bridge Builder Trust (11 series) (2013-present). | |||||

| Lena Haas (Born: 1975) |

Current Chair, Trustee and Nominee |

Indefinite Term; Since October 2018 |

Principal, Products (March 2020 – present) and Principal, Banking and Trust Services (November 2017 – March 2020) at Edward Jones; Previously, Senior Vice President, Head of Investing Product Management and Retirement, E*TRADE Financial and President of E*TRADE Capital Management (2011 – 2017) | 12 | Director, Craft Alliance Center of Art and Design. | |||||

11

| Name and Age | Position the Fund |

Term of Office and Length of Time Served |

Principal Occupation During Past Five Years |

Number Funds in

Edward Complex(2) Overseen by |

Other Directorships Held During Past Five Years or | |||||

| Merry L. Mosbacher (Born: 1958) |

Nominee | N/A | Subordinated Limited Partner, The Jones Financial Companies, LLLP (since 2020); Principal, Edward Jones, and General Partner, The Jones Financial Companies, LLLP (1986-2019); Associate, Edward Jones (1982-1985). | 12 | Trustee, Bridge Builder Trust (11 series) (2020-present). | |||||

(1) Ms. Haas is and, if elected, Mr. Fiala and Ms. Mosbacher will be, an “interested person” of the Fund as defined by the 1940 Act by virtue of the fact that they are affiliated persons of The Jones Financial Companies, L.L.L.P., the parent company of Passport and Edward Jones.

(2) The “Edward Jones Fund Complex” consists of the Fund and the eleven series of BBT (eight active series and three inactive series). No current Trustee oversees, nor receives compensation from, BBT, which is advised by Olive Street, an affiliate of Passport.

QUALIFICATIONS OF INDIVIDUAL NOMINEES

The following is a summary of each Nominee’s experience, qualifications, attributes and skills considered by the Board’s Governance and Nominating Committee and that served as a basis for the Board’s conclusion that each Nominee is qualified to serve (or continue to serve, as applicable) on the Board. The Board’s Governance and Nominating Committee considered the factors as its members deemed relevant to evaluating the Nominees and considered whether each Nominee possesses the requisite skills and attributes to carry out the applicable oversight responsibilities with respect to the Fund, including, as applicable, their positions as members of the Board or the BBT Board and their knowledge of Edward Jones, as well as their ability to review and understand information about the Fund provided to them by management, to identify and request other information they may deem relevant to the performance of their duties, to question management and

12

other service providers regarding material factors bearing on the management and administration of the Fund, and to exercise their business judgment in a manner that serves the best interests of the Fund’s shareholders. The Nominees have varied experiences, attributes and skills that may be utilized in overseeing the operations of the Fund. No one factor was decisive or controlling in the selection of an individual as a Nominee.

Nominees for Interested Trustee

Mr. Fiala has significant financial services and mutual fund experience as a Principal of Edward Jones for over 27 years. He has served as a leader of the firm’s Current Business Segment team, a leader of the Advice and Guidance team within the firm’s Client Strategies Group, Director of Portfolio Solutions, and Director of Research. Mr. Fiala also served as Co-Chair of Edward Jones’ Investment Policy Committee for eight years and holds a CFA designation.

Ms. Haas has held a variety of leadership roles at Edward Jones and other financial services firms, in which she gained extensive experience with mutual funds and other investment products. She also currently serves on the board of a non-profit organization.

Ms. Mosbacher has significant financial services and mutual fund experience as a Principal of Edward Jones for over 33 years. She has served as a Principal in the following areas at Edward Jones: Branch Team Inclusion & Diversity; Packaged Products Strategy; Insurance & Annuity Products; and Investment Banking. She also has experience as a director on several non-profit boards and the Insured Retirement Institute.

Nominees for Independent Trustee

Ms. Carter has significant investment advisory experience as a senior executive of Russell Investment Group, serving as a managing director, member of the corporate operating committee and a member of the investment management group’s fund strategy committee. She joined Russell Investment Group in 1982. Ms. Carter has also served as an Independent Trustee on the board of another investment company, which consisted of eight series in its trust. She is a previous Chair of that board. These positions over the course of 23 years involved oversight of over 140 funds and the development of a mutual fund business joint venture.

13

Mr. Griffith has substantial experience with the financial services industry and with federal securities laws and regulations. Mr. Griffith was a partner in the Global Finance Group of Sidley Austin LLP. His practice focused on securitization and structured finance, which encompassed term and conduit executions involving a variety of assets. Mr. Griffith worked on large, complex industrial/consumer transactions, including direct asset purchases, master trusts, and whole business securitizations for clients that included commercial and investment banks, insurance companies, and other financial institutions.

Mr. Jacoby has over 35 years of combined public accounting and investment management industry experience, which he has gained through various leadership roles at audit and investment management firms, with industry associations and on the boards of other registered funds. Mr. Jacoby has been determined to qualify as an Audit Committee Financial Expert for the Fund. The Board believes Mr. Jacoby’s experience, qualifications, attributes or skills on an individual basis and in combination with those of the other Trustees, lead to the conclusion that he possesses the requisite skills and attributes to carry out oversight responsibilities as Audit Committee Financial Expert for the Fund.

Ms. Keeley has significant financial services and mutual fund experience as an executive vice president for Ameriprise Financial Services, Inc. where she was responsible for managerial oversight for fixed income portfolio management, research and trading as well as the value and mid-cap growth equity portfolio management and research teams. As an Executive Vice President at Ameriprise, Ms. Keeley also served on the Balance Sheet Management Committee and Capital Markets Committee. She has over 20 years of experience in the mutual fund industry. Ms. Keeley also has experience as a director on several corporate and non-profit boards, including currently serving as a director of Graywolf Press. She previously served as a director of American Equity Life Holding Company (“American Equity Life”) and served on the Executive Compensation and Talent Committee, and as Chair of the Investment Committee, of the board of directors of American Equity Life. Ms. Keeley also previously served as a director of the Federal Home Loan Bank of Des Moines (“FHLB”), Chair of the FHLB Board’s Finance and Planning Committee and Chair of the FHLB Board’s Human Resources and Compensation Committee.

Ms. Leary-Jago has gained experience with multiple aspects of the investment management industry, including operations, risk management and compliance, through various leadership roles at investment management firms and with industry associations.

14

Ms. Stam has significant experience as a managing executive and general counsel of Vanguard, a registered investment adviser, and the Vanguard mutual funds, and as an Associate Director of the SEC’s Division of Investment Management. She also serves as a trustee of the CBRE Global Real Estate Income Fund, a closed-end fund listed on the New York Stock Exchange. Ms. Stam has substantial experience in and knowledge of the investment management industry, investment company and investment adviser regulation and operations, shareholder relations and fund governance, which provides her with important perspectives on the operation and management of the Fund.

Mr. Sylvester managed short-term funds and money market funds for over 40 years. During that time, he was responsible for a large money market fund complex, and played a lead role in the complex’s response to money market fund reform, as well as numerous money market fund acquisitions and mergers.

Mr. Tesoro has extensive experience in internal control and risk assessments, including compliance issues related to the Investment Company and Investment Advisers Acts of 1940. He worked in public accounting for 38 years, primarily auditing mutual funds and registered investment advisers. From 1995-2002, he was the Partner-in-Charge of Arthur Andersen LLP’s US Investment Management Industry Program. Mr. Tesoro joined KPMG LLP in 2002 as a partner and continued to work with numerous financial institutions. Mr. Tesoro serves as an Independent Trustee and Audit Committee Chair on the Board of Trustees of the BBH Trust (a mutual fund complex). He also serves as a trustee on the Board of Catholic Charities, Diocese of Trenton, New Jersey. Mr. Tesoro has been determined to qualify as an Audit Committee Financial Expert for BBT. The BBT Board believes Mr. Tesoro’s experience, qualifications, attributes or skills on an individual basis and in combination with those of the other BBT trustees, lead to the conclusion that he possesses the requisite skills and attributes to carry out oversight responsibilities as Audit Committee Financial Expert for BBT.

15

NOMINEE OWNERSHIP OF FUND SHARES

The following table provides information, as of December 31, 2021, regarding the dollar range of beneficial ownership by each Nominee in the Fund.

| Aggregate Ownership in the Family of Investment Companies (1) | ||

| Nominees for Independent Trustee | ||

| Jean E. Carter |

None | |

| Craig Griffith |

None | |

| Timothy Jacoby |

None | |

| Michelle M. Keeley |

None | |

| Maureen Leary-Jago |

None | |

| Heidi Stam |

None | |

| David D. Sylvester |

None | |

| John M. Tesoro |

None | |

| Nominees for Interested Trustee | ||

| William E. Fiala |

Over $100,000 | |

| Lena Haas |

Over $100,000 | |

| Merry L. Mosbacher |

Over $100,000 | |

(1) The Fund is the only investment company in the Family of Investment Companies.

16

TRUSTEE COMPENSATION

Set forth below is the compensation paid by the Fund to current members of the Board for the fiscal year ending February 28, 2022.

| Name of Person/Position |

Aggregate Compensation From

the |

Pension or Benefits Part of Expenses |

Estimated Retirement |

Total from Fund Edward

Jones to Trustees | ||||

| David D. Sylvester, Independent Trustee |

$165,250 | N/A | N/A | $165,250 | ||||

| Maureen Leary-Jago, Independent Trustee | $165,250 | N/A | N/A | $165,250 | ||||

| Timothy Jacoby, Independent Trustee |

$165,250 | N/A | N/A | $165,250 | ||||

| Lena Haas, Interested Trustee(1) |

None | N/A | N/A | None |

(1) Ms. Haas does not receive compensation from the Fund for her service as a Trustee. Ms. Haas receives compensation from Edward Jones for her service as a Trustee.

(2) The “Edward Jones Fund Complex” consists of the Fund and the eleven series of BBT (eight active series and three inactive series). No Trustee of the Fund currently oversees, nor receives compensation from, BBT.

Currently, Independent Trustees of the Fund each receive an annual retainer and per meeting fees for Board meeting attendance. Independent Trustees receive additional per meeting fees from the Fund for any special Board or Committee meetings depending on the length of the meeting. All Trustees are reimbursed for reasonable expenses incurred in connection with attending in-person meetings. The Fund has no pension or retirement plan.

The Nominee who is not currently an Independent Trustee of the Fund received no compensation from the Fund during the fiscal year ending February 28, 2022. The Nominees who are independent trustees of BBT received compensation from BBT for their service on the BBT Board.

Please see the “Impact of Unified Board on Board Governance Structure and Oversight Practices” section below for a discussion of potential changes to the Board’s current trustee compensation methodology.

17

THE ROLE OF THE BOARD, BOARD LEADERSHIP STRUCTURE AND BOARD OVERSIGHT OF RISK MANAGEMENT

The Role of the Board. The Board oversees the management and operations of the Fund. Like all mutual funds, the day-to-day management and operation of the Fund is the responsibility of the various service providers to the Fund, such as Passport, Federated Investment Management Company (the “Sub-adviser”), the Fund’s sub-adviser, Edward Jones, in its capacity as the Fund’s distributor (the “Distributor”), and State Street Bank and Trust Company, the Fund’s custodian. The Board has appointed various senior employees of Edward Jones as officers of the Fund, with responsibility to monitor and report to the Board on the Fund’s operations. In conducting this oversight, the Board receives regular reports from these officers and the service providers. For example, the Treasurer reports as to financial reporting matters.

In addition, Passport and the Sub-adviser provide regular reports on the investment strategy and performance of the Fund. The Board has appointed a Chief Compliance Officer who administers the Fund’s compliance program and regularly reports to the Board as to compliance matters. These reports are provided as part of formal Board meetings which are typically held quarterly and involve the Board’s review of recent operations. In addition, various members of the Board also meet with management in less formal settings, between formal Board meetings, to discuss various topics. In all cases, however, the role of the Board and of any individual Trustee is one of oversight and not of management of the day-to-day affairs of the Fund and its oversight role does not make the Board a guarantor of the Fund’s investments, operations or activities.

Board Structure and Leadership. The Board has structured itself in a manner that it believes allows it to perform its oversight function effectively. It has established two standing committees, a Governance and Nominating Committee and an Audit Committee, which are discussed in greater detail below. Three-quarters (75%) of the Board is comprised of Trustees who are Independent Trustees, which generally are Trustees who are not affiliated with Passport, the Sub-adviser, the Distributor, or their affiliates. The Chairperson of the Board is an Interested Trustee. The Board has determined not to combine the Chairperson position and the principal executive officer position and has appointed a senior employee of Edward Jones as the President of the Fund. The Board reviews its structure and the structure of its committees annually. The Board has determined that the structure of the Interested Chairperson and the Lead Independent Trustee of the Fund (as discussed

18

below), the composition of the Board, and the function and composition of its various committees are appropriate means to address any potential conflicts of interest that may arise. The leadership structure of the Board may be changed, at any time and in the discretion of the Board, including in response to changes in circumstances or the characteristics of the Fund.

Maureen Leary-Jago, an Independent Trustee, serves as the Lead Independent Trustee of the Fund. In her role as Lead Independent Trustee, Ms. Leary-Jago, among other things: (i) presides over Board meetings in the absence of the Chairperson of the Board; (ii) presides over executive sessions of the Independent Trustees; (iii) along with the Chairperson of the Board, oversees the development of agendas for Board meetings; (iv) facilitates dealings and communications between the Independent Trustees and management, and among the Independent Trustees; and (v) has such other responsibilities as the Board or Independent Trustees may determine from time to time.

Timothy Jacoby, an Independent Trustee, serves as Chair of the Audit Committee of the Fund (see description below). The Audit Committee is comprised of all of the Independent Trustees.

David Sylvester, an Independent Trustee, serves as Chair of the Governance and Nominating Committee of the Fund (see description below). The Governance and Nominating Committee is comprised of all of the Independent Trustees.

Board Oversight of Risk Management. As part of its oversight function, the Board receives and reviews various risk management reports and discusses these matters with appropriate management and other personnel. Because risk management is a broad concept comprised of many elements (e.g., investment risk, issuer and counterparty risk, liquidity risk, compliance risk, operational risks, business continuity risks, etc.), the oversight of different types of risks is handled in different ways. For example, the Audit Committee meets with the Treasurer and the Fund’s independent registered public accounting firm to discuss, among other things, the internal control structure of the Fund’s financial reporting function. The Board meets quarterly, and otherwise as needed, with the Chief Compliance Officer to discuss compliance, operational, and other risks and how they are managed. The Board also receives reports from Passport and the Sub-adviser’s portfolio management personnel as to investment risks of the Fund. In addition to these reports, from time to time, the Board receives reports from Passport as to enterprise risk management.

19

With respect to valuation, the Board has delegated day-to-day valuation issues to a Valuation Committee. The Valuation Committee includes at least one officer of the Fund and at least one representative of the Adviser, as appointed by the Board. No Board member serves on the Valuation Committee. The function of the Valuation Committee is to value securities held by the Fund for which current and reliable market quotations are not readily available or for which amortized cost is determined not to approximate fair value. Such securities are valued at their respective fair values as determined in good faith by the Valuation Committee, acting pursuant to the procedures approved by the Board, and the actions of the Valuation Committee are subsequently reviewed by the Board.

The Board recognizes that not all risks that may affect the Fund can be identified and/or quantified, that it may not be practical or cost-effective to eliminate or mitigate certain risks, that it may be necessary for the Fund to bear certain risks (such as investment-related risks) to achieve the Fund’s goals, and that the processes, procedures and controls employed to address certain risks may be limited in their effectiveness.

Board Meetings and Board Committees. During the fiscal year ended February 28, 2022, the Board met nine (9) times. The Fund does not have a policy with regard to attendance of Trustees at shareholder meetings. No shareholder meeting for the Fund was held during the most recent fiscal year.

The Board has established the following standing committees:

Governance and Nominating Committee. David Sylvester, an Independent Trustee, serves as Chair of the Governance and Nominating Committee of the Fund. The Governance and Nominating Committee is comprised of all of the Independent Trustees. As set forth in its charter (a copy of which is attached hereto as Appendix B), the Governance and Nominating Committee assists the Board in fulfilling its governance-related responsibilities, including making recommendations regarding the Board’s size, composition, leadership structure, committees, compensation, retirement and self-assessment, among other things. The Governance and Nominating Committee makes recommendations regarding nominations for Independent Trustees and will consider candidates properly submitted by shareholders to fill vacancies on the Board, if any, which must be sent to the attention of the President of the Fund in writing together with the appropriate biographical information concerning each such proposed candidate. For a candidate to be properly submitted by a shareholder, the submission must comply with the notice provisions set forth in the Governance and Nominating Committee

20

Charter and the Fund’s By-Laws. In general, to be considered by the Governance and Nominating Committee, such nominations, together with all required biographical information, any information required to be disclosed about a candidate in a Fund proxy statement or other regulatory filing for the election of Trustees, and any other information requested by the Governance and Nominating Committee that it deems reasonable to its evaluation of the candidate, must be delivered to and received by the President of the Fund at the principal executive offices of the Fund not later than 120 days prior to the shareholder meeting at which any such nominee would be voted on. Submission of a Trustee candidate recommendation by a shareholder does not guarantee such candidate will be nominated as a Trustee.

The Governance and Nominating Committee identifies and screens Independent Trustee candidates for nomination and appointment to the Board and submits final recommendations to the full Board for approval. In doing so, the Governance and Nominating Committee takes into account such factors as it considers relevant, including without limitation, educational background, strength of character, mature judgment, career specialization, relevant technical skills or financial acumen, diversity of viewpoint, industry knowledge, experience, demonstrated capabilities, independence, commitment, reputation, background, diversity, understanding of the investment business and understanding of business and financial matters generally. No one factor is controlling, either with respect to the group or any individual.

In addition to the above, each candidate must: (i) display the highest personal and professional ethics, integrity and values; (ii) have the ability to exercise sound business judgment; (iii) be highly accomplished in his or her respective field; (iv) have relevant expertise and experience; (v) be able to represent all shareholders and be committed to enhancing long-term shareholder value; and (vi) have sufficient time available to devote to activities of the Board and to enhance his or her knowledge of the Fund’s business. The Governance and Nominating Committee reviews its process for identifying and evaluating nominees for trustees annually in connection with the Committee’s review of its charter.

The Governance and Nominating Committee met three times during the fiscal year ended February 28, 2022.

Audit Committee. Timothy Jacoby, an Independent Trustee, serves as Chair of the Audit Committee of the Fund. The Audit Committee is comprised of all of the Independent Trustees. The Audit Committee meets twice a year or

21

more frequently as circumstances dictate. The function of the Audit Committee is to assist the Board in fulfilling its oversight responsibilities relating to the accounting and financial reporting policies and practices of the Fund, including by providing independent and objective oversight over the Fund’s accounting policies, financial reporting and internal control system, as well as the work of the independent registered public accounting firm retained by the Fund (the “independent auditors”). The Audit Committee also serves to provide an open avenue of communication among the independent auditors, Fund management and the Board.

The Audit Committee met twice during the fiscal year ended February 28, 2022.

Impact of Unified Board on Board Governance Structure and Oversight Practices. The Board and the BBT Board do not have identical governance structures and oversight practices. If all of the Nominees are elected by shareholders of the Fund and by shareholders of BBT, resulting in the proposed Unified Board, the Board will consider whether any changes to its current governance structure and oversight practices would be appropriate in light of the alignment of the membership of the boards. The Board and the BBT Board each have the same two standing committees: an Audit Committee and a Governance and Nominating Committee. If elected, the Nominees for Independent Trustee who are not currently members of the Board would be expected to join the Board’s Audit Committee and Governance and Nominating Committee, and the Board will consider whether any changes to its committee structure, committee practices, committee composition and committee charter would be appropriate in light of the board membership alignment. In addition, if the Nominees are elected, it is expected that the Board will reconsider its compensation structure in place for the Independent Trustees such that the members of the Board and the BBT Board who are not affiliated with Edward Jones would be compensated under a new, unified compensation structure, which may be different from the compensation structure described above under the section entitled “Trustee Compensation”. It is expected that the members of the Board and the BBT Board who are affiliated with Edward Jones would continue to be compensated by Edward Jones or an Edward Jones affiliate for their service as Trustees.

REQUIRED VOTE

If a quorum is present, each Nominee receiving a plurality of the votes cast at the Meeting will be elected as a Trustee of the Fund. The presence virtually

22

or by proxy of shareholders holding one-third of the shares of the Fund entitled to vote at the Meeting constitutes a quorum for purposes of acting on the Proposal.

Under a plurality vote, the Nominees who receive the highest number of votes will be elected, even if they receive votes from less than a majority of the votes cast. Because each Nominee is running uncontested for his or her Board seat, assuming a quorum is present, all eleven Nominees are expected to be elected as Trustees, as each Nominee who receives a single vote in his or her favor will be elected. Votes not cast or votes to withhold (or abstentions) will have no effect on the election outcome.

THE BOARD OF TRUSTEES, INCLUDING THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE ELECTION OF EACH NOMINEE.

23

ADDITIONAL INFORMATION

EXECUTIVE OFFICERS

The current officers of the Fund, their year of birth, position with the Fund, term of office with the Fund and length of time served, and their principal occupation for the past five years are set forth below. The address of each officer is c/o Edward Jones Money Market Fund, 12555 Manchester Road, St. Louis, MO 63131.

| Name and Age | Position with the Fund |

Term of Office and Length of Time Served |

Principal Occupation During Past Five Years or | |||

| Julius A. Drelick III (Born: 1966) |

President | Indefinite Term; Since July 2019 | Director of Proprietary Fund Strategy & Management, Edward Jones (since 2016); Senior Vice President and Chief Compliance Officer, Voya Investment Management, LLC (2013-2016); Vice President, Head of Mutual Fund Product Development and Strategic Planning, Voya Investment Management, LLC (2007-2013). | |||

| Aaron J. Masek (Born: 1974) |

Treasurer | Indefinite Term; Since January 2017 |

Director, Finance, Edward Jones (since 2015); Vice President and Treasurer, AQR Funds (2010-2015). |

24

| Name and Age | Position with the Fund |

Term of Office and Length of Time Served |

Principal Occupation During Past Five Years or | |||

| Paul W. Felsch (Born: 1982) |

Chief Compliance Officer and Vice President | Indefinite Term; Since January 2020 | Senior Compliance Counsel, Edward Jones (since December 2016); Associate Compliance Counsel, Edward Jones (December 2013-November 2016). | |||

| Evan S. Posner (Born: 1979) |

Secretary | Indefinite Term; Since July 2021 | Associate General Counsel at Edward Jones (since 2018); Previously, Assistant Secretary of the Fund (2019-2021); Previously, Vice President, Counsel at Voya Investment Management (2012 – 2018). | |||

| James E. Goundrey (Born: 1977) |

Assistant Secretary | Indefinite Term; Since July 2021 | Associate General Counsel at Edward Jones (since 2019); Previously, Vice President, Senior Counsel at State Street Global Advisers (2015 – 2019). |

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

PricewaterhouseCoopers LLP (“PwC”) serves as the independent registered public accounting firm for the Fund. PwC also reviews and signs as preparer

25

the Fund’s U.S. Income Tax Return for Regulated Investment Companies, Form 1120-RIC, and the Return of Excise Tax on Undistributed Income of Regulated Investment Companies, Form 8613, and provides certain permitted non-audit services. PwC has confirmed to the Fund’s Audit Committee that they are independent auditors with respect to the Fund. Representatives of PwC are not expected to be present at the Meeting but have been given the opportunity to make a statement if they so desire and will be available should any matter arise requiring their presence.

Audit Fees. Below are the aggregate fees billed by PwC in the Fund’s last two fiscal years for audit fees. Audit fees refer to performing an audit of the Fund’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years.

| 2021 | 2022 | |

|

$75,100 |

$76,906 |

Audit-Related Fees. There were no fees billed by PwC in the Fund’s last two fiscal years for assurance and related services by PwC that are reasonably related to the performance of the audit, and are not reported under “Audit Fees” above.

Tax Fees. Below are the aggregate fees billed by PwC in the Fund’s last two fiscal years for professional services rendered by PwC for tax compliance, tax advice, and tax planning.

| 2021 | 2022 | |

|

$6,540 |

$6,540 |

All Other Fees. There were no fees billed by PwC in the Fund’s last two fiscal years for products and services provided by PwC, other than the services reported above.

None of the services described above were approved by the Audit Committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

Aggregate Non-Audit Fees. Below are the aggregate non-audit fees billed by PwC in the Fund’s last two fiscal years for services rendered to the Fund and to the Fund’s investment advisers (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by

26

another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the Fund (collectively, “Fund Affiliated Entities”).

| 2021 | 2022 | |||

|

Fund |

$6,540 | $6,540 | ||

|

Fund Affiliated Entities |

$99,740 | $99,740 |

During the past two fiscal years, all non-audit services provided by PwC to Fund Affiliated Entities that were required to be pre-approved were pre-approved by the Audit Committee. Included in the Audit Committee’s pre-approval of these non-audit services was the review and consideration as to whether the provision of these non-audit services is compatible with maintaining PwC’s independence.

Audit Committee Pre-Approval Procedures. The charter adopted by the Audit Committee contains procedures pursuant to which services proposed to be performed by PwC may be pre-approved by the Audit Committee. These procedures provide that:

| 🌑 | The Audit Committee is required to pre-approve audit and non-audit services performed by PwC in order to assure that the provision of such services do not impair PwC’s independence. Notwithstanding the foregoing, pre-approval of certain non-audit services for the Fund and Fund Affiliated Entities is not required when permitted pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. In such instances, the Audit Committee (or its delegate) will approve such services prior to the completion of the audit. |

| 🌑 | The Audit Committee has delegated pre-approval authority to its Chair for engagements of less than $15,000. The Committee will designate another member with such pre-approval authority when the Chair is unavailable. Any proposed services equal to or exceeding $15,000 will require specific pre-approval by the Audit Committee. |

| 🌑 | The Chair will report any pre-approval decisions to the Audit Committee at its next scheduled meeting. |

27

OWNERSHIP OF THE FUND

Appendix C sets forth the persons who owned of record 5% or more of the outstanding shares of a class of the Fund as of the Record Date. On that date, the Nominees and officers of the Fund, together as a group, beneficially owned less than 1% of the Fund’s outstanding shares.

VOTING AUTHORITY OF EDWARD JONES

Edward Jones Brokerage Clients. Edward Jones offers shares of the Fund to certain brokerage clients as a cash sweep option in their accounts. Because the Proposal will be considered “routine” under the rules promulgated by the New York Stock Exchange LLC, if any Edward Jones brokerage client fails to provide Edward Jones voting instructions on the Proposal with respect to their Fund shares, Edward Jones is permitted to vote such shares on the Proposal. With respect to all clients that do not provide Edward Jones such voting instructions, it is Edward Jones’ policy to vote all such shares proportionally to the votes received from all other Edward Jones clients, a practice commonly referred to as “echo” or “mirror” voting. As of the Record Date, approximately 78% of the shares of the Fund were held by Edward Jones brokerage clients.

Edward Jones Advisory Clients. Edward Jones also offers shares of the Fund as the exclusive cash sweep option to investors participating in Edward Jones Advisory Solutions® and Edward Jones Guided Solution®, each an investment advisory program or asset-based fee program sponsored by Edward Jones. Unless a client has “opted out,” Advisory Solutions fund model clients have delegated proxy voting responsibility with respect to shares of the Fund held by the clients to Edward Jones pursuant to the terms of their respective separate agreements with Edward Jones. Accordingly, Edward Jones has the authority to vote on behalf of these clients the shares of the Fund held by the clients. Conversely, Guided Solutions clients have retained the responsibility for voting proxies arising from any securities held in their account, including shares of the Fund. Accordingly, Edward Jones does not exercise proxy voting authority for advisory clients in Guided Solutions and will not vote on the Proposal on behalf of Guided Solutions clients.

Edward Jones will vote any shares of the Fund over which it has voting authority (i.e., shares held by certain Advisory Solutions clients) consistent with its proxy voting policies and procedures. Pursuant to Edward Jones’ proxy voting procedures, Edward Jones’ Proxy Policy Committee (the “Proxy Committee”) will determine if any material conflicts of interest arise

28

with respect to Edward Jones voting on a proposal on a proxy and, if it determines that no such material conflicts arise, the proposal is voted in accordance with the determination of the Proxy Committee.

Following careful analysis and consideration, the Proxy Committee determined that there are no material conflicts of interest that arise with respect to Edward Jones voting on the Proposal. In reaching its conclusion, the Proxy Committee considered a number of factors, including, the following:

| 🌑 | Eight of the eleven Nominees are not affiliated persons of, and do not have a material relationship with, Edward Jones or any of its affiliates. These eight Nominees are considered not to be “interested persons” of the Fund (as such term is defined in the 1940 Act), and would be Independent Trustees of the Fund if elected. |

| 🌑 | Six of the eight Nominees for Independent Trustee currently serve as an Independent Trustee of the Fund or an independent trustee of BBT and each has brought a wide range of experience to his or her respective board, and is expected to continue to bring, such expertise to the Unified Board. The remaining two Nominees for Independent Trustee, Ms. Stam and Mr. Griffith, were each evaluated and selected and nominated by the Board’s Governance and Nominating Committee, which is comprised entirely of Independent Trustees. |

| 🌑 | The Board’s Governance and Nominating Committee evaluated and selected and nominated Mr. Fiala and Mses. Haas and Mosbacher, each an affiliated person of Edward Jones, as nominees for Interested Trustees. |

| 🌑 | The Board, which is made up of a majority of Independent Trustees, and based upon the recommendation of the Board’s Governance and Nominating Committee, has unanimously voted to nominate each Nominee for election by the shareholders of the Fund as a Trustee of the Fund. |

Based on its considerations, the Proxy Committee concluded that the election of each Nominee is in the best interests of the Fund and its shareholders and that the proxies solicited by the Fund held by Advisory Solutions’ clients shall be voted FOR the election of each Nominee.

29

As of the Record Date, Edward Jones possessed voting power for approximately 1% of the shares of the Fund.

SERVICE PROVIDERS

The names and addresses of the Adviser and the Sub-advisers are included in Appendix D.

Edward Jones, the Fund’s transfer agent and distributor, is located at 12555 Manchester Road, St. Louis, Missouri 63131.

PAYMENT OF EXPENSES

All expenses related to conducting this proxy, including, but not limited to, legal fees, the cost of preparing, printing and mailing the enclosed proxy, accompanying notice and this Proxy Statement, and costs in connection with the solicitation of proxies, if any, will be allocated to the Fund. However, Passport will bear all or a portion of the expenses related to conducting this proxy as a result of the application of the existing expense limitation and positive yield waiver agreements currently in place between Passport and the Fund. In addition, Passport has further agreed to bear the expenses related to conducting this proxy to the extent necessary to limit the maximum amount of proxy expenses borne by the Fund to 50% of the total proxy expenses.

Solicitation may be made by letter or telephone by officers or employees of Passport and its affiliates and their representatives. Brokerage houses, banks and other fiduciaries may be requested to forward proxy solicitation material to their principals to obtain authorization for the execution of proxies. The Fund will reimburse brokerage firms, custodians, banks and fiduciaries for their expenses in forwarding this Proxy Statement and proxy materials to the beneficial owners of the Fund’s shares.

In addition, the Fund has retained Broadridge Financial Solutions, Inc. (“Broadridge”), a proxy solicitation firm, to assist in the solicitation of proxies. Broadridge may solicit proxies personally and by telephone. It is anticipated that the mailing service, proxy solicitation costs, and postage and printing costs associated with this Proxy Statement, are estimated at approximately $2.4 million, plus reimbursements of out-of-pocket expenses.

30

ANNUAL AND SEMI-ANNUAL REPORTS TO SHAREHOLDERS

For a free copy of the Fund’s semi-annual report dated August 31, 2021 or annual report dated February 28, 2021, shareholders of the Fund may call their Edward Jones financial advisor or the Fund at 1-800-441-2357, visit www.edwardjones.com/moneymarket, or write to the Fund at:

Mailing Address:

Edward Jones Money Market Fund

12555 Manchester Road

Saint Louis, Missouri 63131

SUBMISSION OF SHAREHOLDER PROPOSALS

The Fund is organized as a voluntary association (commonly known as a “business trust”) under the laws of the Commonwealth of Massachusetts. As such, the Fund is not required to, and does not, hold annual meetings. Nonetheless, the Board may call a special meeting of shareholders for action by shareholder vote as may be required by the 1940 Act or as required or permitted by the Declaration of Trust and By-Laws of the Fund. Shareholders of the Fund who wish to present a proposal for action at a future meeting should submit a written proposal to the Fund for inclusion in a future proxy statement. Submission of a proposal does not necessarily mean that such proposal will be included in the Fund’s proxy statement since inclusion in the proxy statement is subject to compliance with certain federal regulations. Shareholders retain the right to request that a meeting of the shareholders be held for the purpose of considering matters requiring shareholder approval.

SHAREHOLDER COMMUNICATIONS WITH TRUSTEES

Shareholders wishing to submit written communications to the Board or an individual Trustee should send their communications to Edward Jones Money Market Fund, 12555 Manchester Road, St. Louis, Missouri 63131.

VOTING, QUORUM AND OTHER MATTERS

Only shareholders of record on the Record Date will be entitled to participate and vote at the Meeting on the Internet by virtual means. To participate in the Meeting virtually, shareholders must register in advance by visiting https://viewproxy.com/EdwardJones/broadridgevsm/ and submitting the requested required information to Broadridge, the Fund’s proxy tabulator. Please plan to register prior to the Meeting, by April 17, 2022 at 9:30 a.m. (Central time).

31

Shareholders whose shares are registered directly with the Fund in the shareholder’s name will be asked to submit their name and control number found on the shareholder’s proxy card in order to register to participate in and vote at the Meeting. Shareholders whose shares are held by a broker, bank or other nominee must first obtain a “legal proxy” from the applicable nominee/record holder, who will then provide the shareholder with a newly-issued control number. We note that obtaining a legal proxy may take several days. Requests for registration must be received before the scheduled time for commencement of the Meeting. Shareholders should consider registering well in advance of the scheduled time in order to avoid any potential issues in becoming registered. Once shareholders have obtained a new control number, they must visit https://viewproxy.com/EdwardJones/broadridgevsm/ and submit their name and newly issued control number in order to register to participate in and vote at the Meeting.

After shareholders have submitted their registration information, they will receive an e-mail from Broadridge that confirms that their registration request has been received and is under review by Broadridge. Once shareholders’ registration requests have been accepted, they will receive (i) an email containing an event link to attend the Meeting, and (ii) an email with a password to enter at the event link in order to access the Meeting. Shareholders may vote before or during the Meeting at https://viewproxy.com/EdwardJones/broadridgevsm/. Only shareholders of the Fund present virtually or by proxy will be permitted to attend the virtual Meeting and be able to vote, or otherwise exercise the powers of a shareholder, at the Meeting.

Where shares are held of record by more than one person, any co-owner or co-fiduciary may execute the proxy or give authority to an agent, unless the Secretary of the Fund is notified in writing by any co-owner or co-fiduciary that the joinder of more than one is to be required. All proxies shall be filed with and verified by the Secretary or Assistant Secretary of the Fund, or the person acting as Secretary of the Meeting. Unless otherwise specifically limited by their term, all proxies shall entitle the holders thereof to vote at any adjournments or postponements of the Meeting. Any person giving a proxy has the power to revoke it at any time prior to its exercise by executing a superseding proxy or by submitting a written notice of revocation to the Secretary of the Fund. If no instruction is given on the submitted proxy, the persons named as proxies will vote the shares represented thereby in favor of the election of each Nominee.