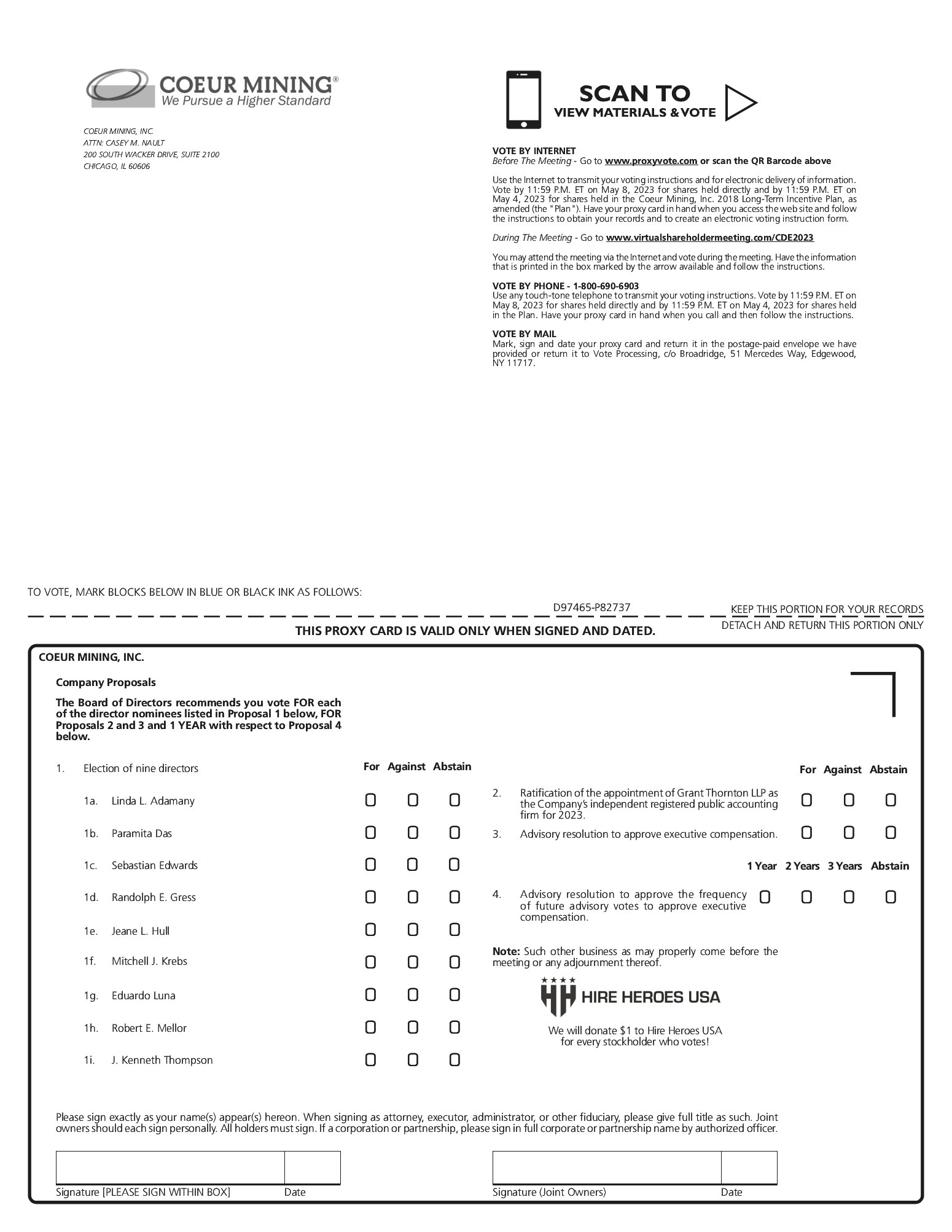

When and where is the Annual Meeting?

The 2023 Annual Meeting will be held on Tuesday, May 9, 2023, at 9:30 a.m., Central Time,

and will be conducted solely in a virtual format. The health and well-being of our employees, Board members and stockholders is our top priority. The Annual Meeting will be conducted as a live audio webcast.

How Can I Access the Annual Meeting?

Stockholders can join the Annual Meeting by navigating to

www.virtualshareholdermeeting.com/cde2023. Online access to the audio webcast will begin approximately 15 minutes before the start of the Annual Meeting to allow time for you to log-in and test your device’s audio system. We encourage you to

access the meeting in advance of the designated start time. Stockholders participating in the Annual Meeting will be able to vote their shares electronically during the Annual Meeting and may submit questions during the virtual event using the

directions on the meeting website at www.virtualshareholdermeeting.com/cde2023. Technical support will be available prior to and during the meeting at virtualshareholdermeeting.com.

Will I Be Able to Participate in the Virtual Annual Meeting?

We have designed the format of the Annual Meeting so that stockholders are afforded the

same rights and opportunities to participate as they would have at an in-person meeting. After the business portion of the Annual Meeting concludes and the meeting is adjourned, we expect to hold a Q&A session during which we intend to

answer questions submitted during the meeting that are pertinent to the Company and the items being brought before the stockholder vote at the Annual Meeting, as time permits. Our responses to questions properly submitted will be made available

to all stockholders on the Annual Meeting website promptly following completion of the Annual Meeting. The Q&A session will be conducted in accordance with the Rules for Conduct of Meeting, which will be available for review at the Annual

Meeting at www.virtualshareholdermeeting.com/cde2023. Stockholders participating in the Annual Meeting will be able to vote their shares electronically during the Annual Meeting using the directions on the meeting website. To participate in the

Annual Meeting, you will need the 16-digit control number found on your proxy card, voting instruction form or notice of internet availability. If you hold your shares in the name of a broker, bank, trustee or other nominee, you may need to

contact your broker, bank, trustee or other nominee for assistance with your 16-digit control number.

Who is entitled to vote at the Annual Meeting? What is the Record Date?

All stockholders of record as of the close of business on the Record Date, March 15, 2023,

are entitled to vote at the Annual Meeting and any adjournment or postponement thereof upon the matters listed in the Notice of Annual Meeting. Each stockholder is entitled to one vote for each share held of record on that date. As of the close

of business on the Record Date, a total of 321,389,804 shares of our common stock were outstanding.

What is the difference between a stockholder of record and a stockholder

who holds in street name?

If your shares of Coeur common stock are registered directly in your name with our transfer

agent, Computershare Trust Company, N.A., you are a stockholder of record, and these proxy materials are being sent directly to you from the Company.

If your shares of Coeur common stock are held in “street name” meaning your shares of Coeur

common stock are held in a brokerage account or by a bank or other nominee, you are the beneficial owner of these shares, and these proxy materials are being forwarded to you by your broker, banker or other nominee, who is considered the

stockholder of record with respect to such shares. As the beneficial owner of Coeur common stock, you have the right to direct your broker, bank or other nominee on how to vote, and you will receive instructions from your broker, bank or other

nominee describing how to vote your shares of Coeur common stock.

Tweet

Tweet Share

Share