Form DEF 14A CARDINAL HEALTH INC For: Nov 05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to

Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant |  |

Filed by a party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material Pursuant to §240.14a-12 |

CARDINAL HEALTH, INC.

(Name of Registrant as Specified in its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | ||

|

No fee required. | |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

|

Fee paid previously with preliminary materials. | |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount previously paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

GREGORY B. KENNY Chairman of the Board |

LETTER TO CARDINAL HEALTH SHAREHOLDERS In the past extraordinary year, we focused on protecting our employees and serving our healthcare provider customers, while continuing to execute on our strategic priorities. The Board has been active during these challenging times, and below are our insights into key focus areas for the company. |

September 23 , 2021

|

FISCAL 2021 PERFORMANCE In fiscal 2021, the company grew revenue and non-GAAP earnings per share, divested the Cordis business, identified $250 million of additional cost savings opportunities, strengthened our balance sheet with strong operating cash flow and debt reduction, and extended our Red Oak Sourcing venture with CVS Health. Despite these achievements, performance in our business segments fell below expectations in the latter part of the year. As we start fiscal 2022, we remain confident in our strategy and are encouraged by the tailwinds behind our growth areas, such as Specialty and Nuclear, and strong cash flow generation. RESPONDING TO THE 2020 SAY-ON-PAY VOTE In response to the disappointing 2020 say-on-pay vote, our Human Resources and Compensation Committee Chair and I undertook a broad-based and multi-faceted effort to meet with investors and understand and address their concerns. In these meetings, shareholders expressed support for the fundamentals of our executive compensation program and its alignment of pay and performance but thought that we should have disclosed how the Committee considered opioid litigation accruals in our compensation determinations last year. Based on what we heard from shareholders as well as on progress on the opioid litigation settlement, the Human Resources and Compensation Committee took a set of actions. We provide detailed disclosure in this proxy statement about how the impact of the opioid litigation on the company and its shareholders was considered in fiscal 2021 compensation decisions. |

+6% |

|

REVENUE GROWTH IN FY 2021 VS FY 2020 |

|

+24% |

|

OPERATING CASH FLOW |

|

|

| CardinalHealth / 2021 PROXY STATEMENT | 3 |

OUR ONGOING RESPONSE TO THE OPIOID EPIDEMIC

The Board’s Ad Hoc Committee on opioids continues to oversee the company’s controlled substance anti-diversion program as well as the company’s efforts to defend and resolve governmental opioid litigation. In July, we announced that we and two other national distributors have negotiated a proposed settlement agreement which, if all conditions are satisfied, would result in the settlement of a substantial majority of opioid lawsuits filed by state and local governmental entities. We believe the proposed settlement agreement and the process it establishes are important steps toward achieving broad resolution of governmental opioid claims and delivering meaningful relief to communities across the United States.

THE COMPOSITION OF OUR BOARD AND UPDATES TO OUR COMMITTEES

My fellow directors and I seek to create a culture of open, direct, and respectful dialogue among our members, who bring an array of skills, backgrounds, and expertise. This year, we reaffirmed our commitment to diversity when we amended our Corporate Governance Guidelines to reflect our practice of including women and racially and ethnically diverse candidates in the initial pool of candidates for new director searches.

As a result of our director retirement age limit, Mike Losh is stepping down from the Board at the Annual Meeting of Shareholders. On behalf of the Board, we thank him for his valuable service to the Board and as Audit Committee Chair. In addition, Cal Darden retired from the Board earlier this year, and we thank him for his many contributions over the span of his 15 years of service on the Board.

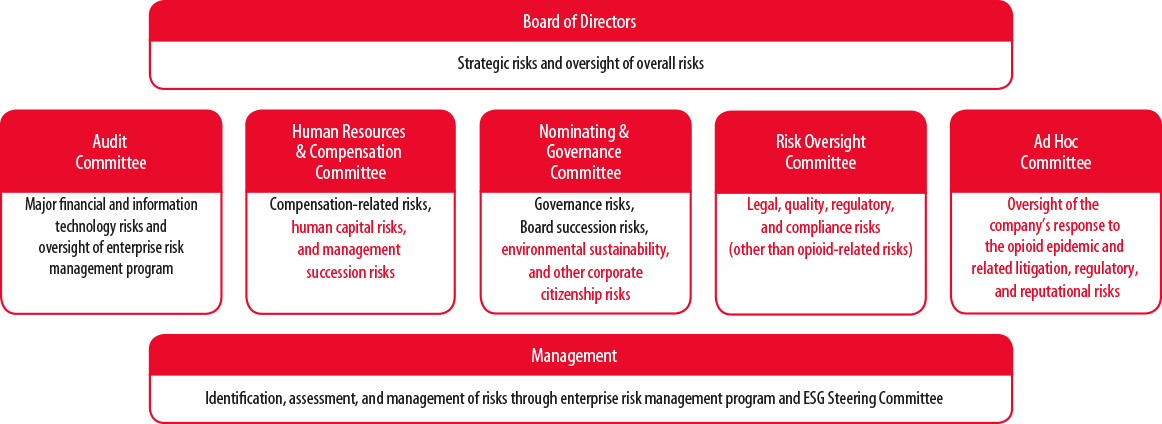

This past May, the Board formed a new standing Risk Oversight Committee to oversee compliance, legal, regulatory, and quality matters. The Committee is chaired by John Weiland and is composed entirely of independent directors. This new committee oversees some of the areas previously under the purview of the Audit Committee.

The Ad Hoc Committee remains in place to oversee opioid matters. To ensure there is strong communication and effective coordination between committees, John Weiland is sitting on both the Risk Oversight and Audit Committees and Sheri Edison and I are sitting on both the Risk Oversight and Ad Hoc Committees.

A CONTINUED COMMITMENT TO OPERATING RESPONSIBLY AND SUSTAINABLY

During the past year, we continued to advance our environmental, social, and governance, or ESG, agenda. With respect to diversity, equity, and inclusion, we established specific goals to significantly increase the representation in management of women, African American and Black, and other ethnically diverse employees. Addressing environmental sustainability, we established a significant enterprise-wide greenhouse gas reduction goal for Scope 1 and Scope 2 emissions.

NAVIGATING THE GLOBAL COVID-19 PANDEMIC

As the global pandemic has entered a new phase with the advent of effective vaccines and new virus variants, we have continued to prioritize the health and safety of our employees so we can fulfill our mission of delivering critical products and solutions to frontline healthcare workers around the world. In addition to expanded sick leave, paid-time-off, and child and elder care resources available to employees, we have taken steps to ensure that we are addressing workplace wellness and self-care. Although our operating environment remains dynamic, the pandemic has reinforced our critical role in the supply chain and highlighted opportunities for us to enhance our operations and evolve for future growth.

The Board thanks our dedicated employees for their efforts during this past year. They have come together during the pandemic to truly deliver for our customers. We all continue to navigate this challenging time with resolve and purpose. On behalf of our Board, I thank you for your share ownership and for your continued support of the company. Together, we will enable Cardinal Health to perform our essential role in healthcare now and into the future.

Sincerely,

Gregory B. Kenny

Chairman of the Board

| CardinalHealth / 2021 PROXY STATEMENT | 4 |

NOTICE

September 23 , 2021 |

|

|

FRIDAY, NOVEMBER 5, 2021 8:00 a.m. Eastern Time Virtual Meeting www.virtualshareholdermeeting.com/CAH2021

|

||

|

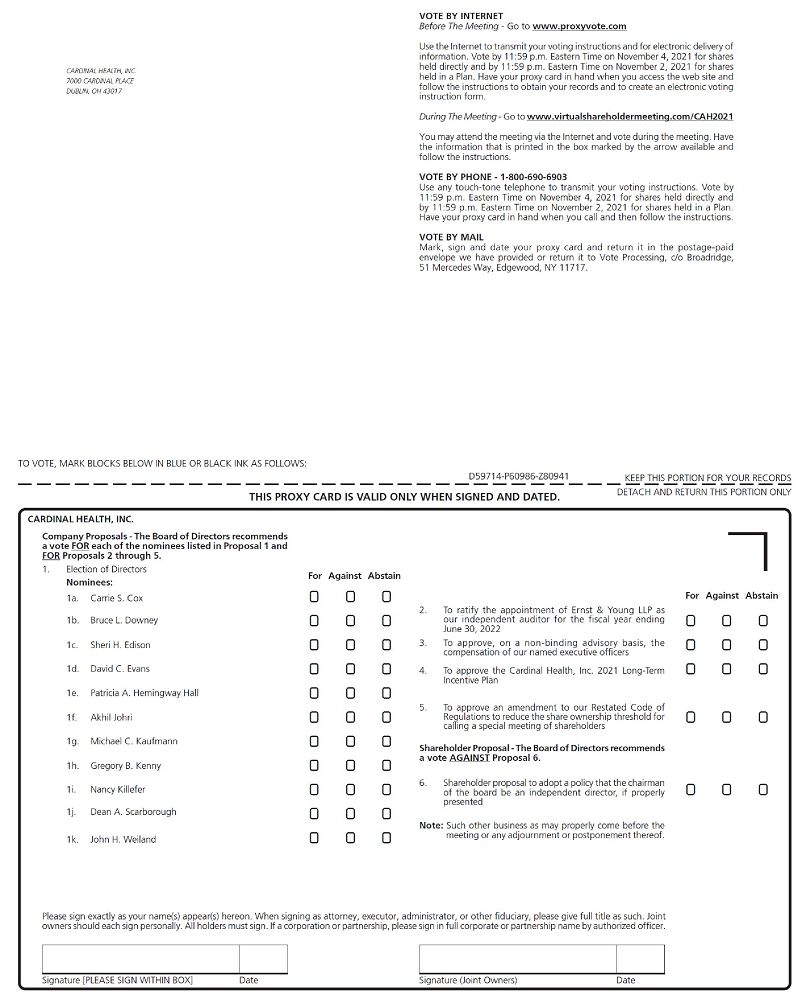

Due to the public health impact of the coronavirus (“COVID-19”) pandemic and to support the health and well-being of our employees and shareholders, this year’s Annual Meeting of Shareholders (“Annual Meeting”) will again be conducted exclusively online without an option for physical attendance. You will be able to participate in the virtual meeting online, vote your shares electronically, and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/CAH2021. VIRTUAL MEETING This year’s meeting is a virtual shareholder meeting at RECORD DATE September 7, 2021. Only shareholders of record at the close of business on the record date are entitled to receive notice of, and to vote at, the Annual Meeting. PROXY VOTING Make your vote count. Please vote your shares promptly to ensure the presence of a quorum during the Annual Meeting. Voting your shares now via the Internet, by telephone, or by signing, dating, and returning the enclosed proxy card or voting instruction form will save the expense of additional solicitation. If you wish to vote by mail, we have enclosed an addressed envelope with postage prepaid if mailed in the United States. Submitting your proxy now will not prevent you from voting your shares during the Annual Meeting, as your proxy is revocable at your option. We are requesting your vote to: ITEMS OF BUSINESS |

VOTE IN ADVANCE OF THE MEETING IN ONE OF FOUR WAYS: |

|

|

INTERNET Visit 24/7 www.proxyvote.com |

|

|

BY TELEPHONE Call the toll-free number 1-800-690-6903 within the United States, U.S. territories, or Canada |

|

|

BY MAIL Mark, sign, and date proxy card and return by mail in enclosed postage-paid envelope |

|

|

Virtual Meeting See page 85 for instructions on how to attend |

|

Please refer to the enclosed proxy materials or the information forwarded by your bank, broker, or other holder of record to see which voting methods are available to you.

|

||

(1)

Elect the 11 director nominees named in the proxy statement; (2)

Ratify the appointment of Ernst & Young LLP as our independent auditor for the fiscal year ending June 30, 2022; (3)

Approve, on a non-binding advisory basis, the compensation of our named executive officers; (4)

Approve the Cardinal Health, Inc. 2021 Long-Term Incentive Plan; (5)

Approve an amendment to our Restated Code of Regulations to reduce the share ownership threshold for calling a special meeting of shareholders; (6)

Vote on a shareholder proposal described in the accompanying proxy statement, if properly presented at the meeting; and (7)

Transact such other business as may properly come before the meeting or any adjournment or postponement. |

||

MEETING DETAILS See “Proxy Summary” and “Other Matters” for details. |

||

Important notice regarding the availability of proxy materials for the Annual Meeting to be held on November 5, 2021: The Notice of Annual Meeting of Shareholders, the accompanying proxy statement, and our 2021 Annual Report to Shareholders are available at www.proxyvote.com. These proxy materials are first being sent or made available to shareholders commencing on September 23 , 2021. |

||

By Order of the Board of Directors. |

||

John M. Adams, Jr. Senior Vice President, Associate General Counsel and Secretary |

| CardinalHealth / 2021 PROXY STATEMENT | 5 |

THIS SUMMARY HIGHLIGHTS CERTAIN INFORMATION CONTAINED ELSEWHERE IN OUR PROXY STATEMENT. THIS SUMMARY DOES NOT CONTAIN ALL THE INFORMATION THAT YOU SHOULD CONSIDER, AND YOU SHOULD CAREFULLY READ THE ENTIRE PROXY STATEMENT AND OUR 2021 ANNUAL REPORT TO SHAREHOLDERS BEFORE VOTING. REFERENCES TO OUR FISCAL YEARS IN THE PROXY STATEMENT MEAN THE FISCAL YEAR ENDED OR ENDING ON JUNE 30 OF SUCH YEAR. FOR EXAMPLE, “FISCAL 2021” REFERS TO THE FISCAL YEAR ENDED JUNE 30, 2021.

Headquartered in Dublin, Ohio, we are a global integrated healthcare services and products company providing customized solutions for hospitals, healthcare systems, pharmacies, ambulatory surgery centers, clinical laboratories, physician offices, and patients in the home. We distribute pharmaceuticals and medical products and provide cost-effective solutions that enhance supply chain efficiency. We connect patients, providers, payers, pharmacists, and manufacturers for integrated care coordination and better patient management. We manage our business and report our financial results in two segments: Pharmaceutical and Medical.

Revenue was $162.5 billion, up 6% from the prior year.

GAAP diluted earnings per share (“EPS”) was $2.08 primarily due to opioid litigation accruals. Non-GAAP EPS was $5.57, a 2% increase over the prior year despite an estimated $200 million year-over-year operating earnings headwind related to COVID-19.

GAAP operating earnings were $472 million primarily due to opioid litigation accruals. Non-GAAP operating earnings were $2.3 billion, a 5% decrease over the prior year and below our expectations. This was largely due to a $197 million inventory reserve adjustment.

We continued to streamline our cost structure and surpassed our enterprise cost savings target for the third consecutive year.

We generated strong operating cash flow of $2.4 billion, returning nearly $800 million to shareholders in dividends ($573 million) and share repurchases ($200 million) and strengthening our balance sheet by repaying $542 million in long-term debt. In August 2021, we called for redemption another $572 million in long-term debt.

As part of our continued portfolio evaluation, we divested our Cordis business, closing the transaction in August 2021.

In August 2021, we amended our Red Oak Sourcing agreement with CVS Health to extend the term of the generic pharmaceutical sourcing venture through June 2029.

Extensive negotiations in the governmental opioid litigation culminated in a July 2021 announcement that we and two other national distributors have reached a proposed settlement agreement which, if all conditions are satisfied, would result in settlement of a substantial majority of opioid lawsuits filed by state and local governmental entities. We accrued an additional $1.2 billion in fiscal 2021 relating to opioid litigation.

Throughout the unprecedented events of the last year, we prioritized the health and safety of our employees and fulfilling our mission of delivering critical products and solutions to healthcare workers. We expand on these points below under “Response to COVID-19.”

See Annex A for reconciliations to the comparable financial measures prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) and the reasons why we use non-GAAP financial measures.

Includes pre-tax accruals of $1.17 billion ($945 million after tax or $3.21 per share) recorded in fiscal 2021 related to the opioid litigation.

Total shareholder return (“TSR”) over the period from July 1, 2020 through June 30, 2021 expressed as a percentage, calculated based on changes in stock price assuming reinvestment of dividends.

| CardinalHealth / 2021 PROXY STATEMENT | 6 |

Throughout the COVID-19 pandemic, our mission of delivering products and solutions to improve the lives of people every day has become more important than ever.

Helping Our Customers and Partners

In response to the pandemic, we have worked across our entire network in a variety of ways, including increasing our manufacturing of needed products, leveraging our global footprint and relationships with suppliers to get products to our customers quickly, and collaborating with public and private sector partners to help deliver products and services where they are most needed.

Some efforts we are particularly proud of include partnering with the Centers for Disease Control and Prevention (“CDC”) as a network administrator to enable retail independent, small chain, and long-term care pharmacy customers to participate in the vaccination effort. Collectively, our network of community pharmacy customers has administered more than 3.4 million doses of COVID-19 vaccines. And nearly 2,000 of our participating pharmacies serve vulnerable populations.

We partnered with the Strategic National Stockpile, which supplements state and local medical supplies and equipment during public health emergencies, to store and distribute 80,000 pallets of personal protective equipment (“PPE”). We are also one of the companies supplying needles and syringes to the Strategic National Stockpile for inclusion in kits to accompany vaccine doses.

In our home state, our OptiFreight logistics business was selected by the Ohio Department of Health to support efforts to distribute vaccines within the state (allowing for same-day delivery to approximately 350 locations across 88 counties).

Our frontline employees have continued to work daily in distribution centers, manufacturing sites, pharmacies, and other clinical sites as part of a critical infrastructure industry. Protecting the health and safety of all our employees and their families has been our top priority throughout the COVID-19 pandemic. As we have navigated our way through the pandemic, we have had to make many decisions about our employees’ safety, which have been based on science and in consultation with our Chief Medical Officer.

With the onset of the pandemic, we implemented enhanced worksite hygiene practices and cleaning procedures in all our facilities to help keep our employees safe. We also transitioned our office-based employees to a remote work model and implemented new technologies and practices ensuring ongoing productivity. Our safety measures have helped us to avoid a wide spread of COVID-19 among our employees.

We have provided educational and mental health benefits for all our employees to support their total well-being. We also have provided additional compensation for our frontline teams who continue to demonstrate day in and day out why we are essential to care. We have partnered with health systems and state governments to facilitate onsite vaccine clinics and have conducted onsite vaccine clinics for our own employees as well as offering our hourly employees incentives to get vaccinated.

With the rebound in COVID-19 cases, we continue to monitor the situation and take the necessary precautions to protect our employees working in company facilities, such as requiring wearing masks. We also have developed a flexible work policy that will provide office- and field-based employees the opportunity to work remotely within established guidelines upon an eventual return to the office. But whether on the front lines or working from home, our employees have shown incredible commitment and dedication and have lived our Cardinal Health values every day.

| CardinalHealth / 2021 PROXY STATEMENT | 7 |

Governance and Board Highlights

|

|

|

| CardinalHealth / 2021 PROXY STATEMENT | 8 |

11 |

10 |

5 |

6 5 years |

5. 7 years |

Nominees |

Independent |

Gender or |

Average age |

Average tenure |

Nominee |

Age |

Occupation |

Director since |

Independent |

Committees |

|||||

A* |

AH |

H |

N |

R |

||||||

|

Carrie S. Cox |

64 |

Retired EVP and President, Global Pharmaceuticals, Schering-Plough and retired Chairman and CEO, Humacyte, Inc. |

2009 |

|

|

◆ |

|

|

|

|

Bruce L. Downey |

73 |

Retired Chairman and CEO, Barr Pharmaceuticals and Partner, NewSpring Health Capital II, L.P. |

2009 |

|

|

|

|

◆ |

|

|

Sheri H. Edison |

64 |

Retired EVP and General Counsel, Amcor |

2020 |

|

|

◆ |

|

|

◆ |

|

David C. Evans |

58 |

Retired EVP and CFO, Scotts Miracle-Gro and Battelle Memorial Institute |

2020 |

|

◆ |

|

|

|

|

|

Patricia A. Hemingway Hall |

68 |

Retired President and CEO, Health Care Service Corp. |

2013 |

|

|

|

◆ |

|

|

|

Akhil Johri |

60 |

Retired EVP and CFO, United Technologies |

2018 |

|

|

|

|

◆ |

|

|

Michael C. Kaufmann |

58 |

CEO, Cardinal Health |

2018 |

|

|

|

|

|

|

|

Gregory B. Kenny Chairman of the Board |

68 |

Retired President and CEO, General Cable |

2007 |

|

|

◆ |

|

◆ |

◆ |

|

Nancy Killefer |

67 |

Retired Senior Partner, Public Sector Practice, McKinsey |

2015 |

|

|

|

◆ |

|

◆ |

|

Dean A. Scarborough |

65 |

Retired Chairman and CEO, Avery Dennison |

2019 |

|

|

|

◆ |

|

◆ |

|

John H. Weiland |

65 |

Retired President and COO, C. R. Bard |

2019 |

|

◆ |

|

|

|

|

| Key: | |||

Chair Chair |

A: Audit | H: Human Resources and Compensation | R: Risk Oversight |

| ◆ Member | AH: Ad Hoc | N: Nominating and Governance | |

| * Current Audit Committee member J. Michael Losh was not nominated for re-election because he has reached the retirement age of 75. | |||

| CardinalHealth / 2021 PROXY STATEMENT | 9 |

Shareholder Engagement: Compensation and Governance Actions

Addressing the 2020 Say-on-Pay Vote

At the 2020 Annual Meeting, we received 61% shareholder support for our executive compensation program. In response, Board Chairman Greg Kenny and Human Resources and Compensation Committee (“Compensation Committee”) Chair Carrie Cox undertook a broad-based and multi-faceted effort to meet with investors and understand and address their concerns.

In these meetings, shareholders expressed support for the fundamentals of our executive compensation program and its alignment of pay and performance but thought that we should have disclosed in last year’s proxy statement how the Compensation Committee considered opioid litigation accruals in our compensation determinations last year. Based on what we heard from shareholders as well as on progress on the proposed settlement of governmental opioid litigation, the Compensation Committee took several actions:

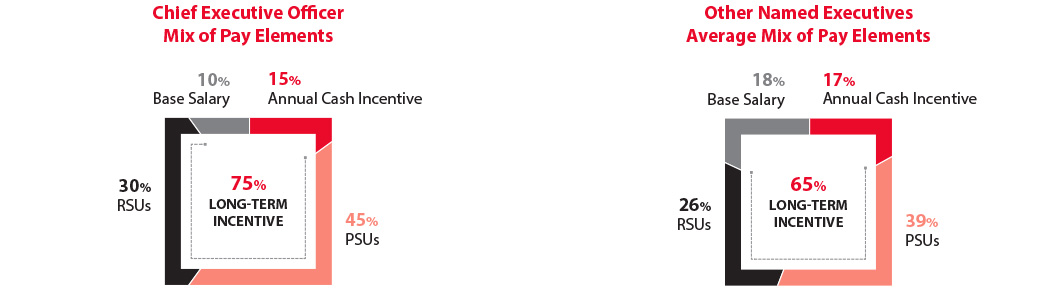

reduced the Chief Executive Officer’s (“CEO’s”) fiscal 2021 annual cash incentive award by 65% by eliminating any payout for the earnings component of the award, resulting in a final award of 40% of his target;

reduced fiscal 2021 annual cash incentive awards for other named executive officers by 20%, resulting in final awards of 90% of their targets;

deferred 50% of the CEO’s fiscal 2022 performance share unit (“PSU”) grant to pay out over a two-year period after vesting;

deferred 33% of other executives’ fiscal 2022 PSU grants to pay out a year after vesting;

increased our CEO’s stock ownership guideline to 10 times base salary;

eliminated any upward benefit from the relative TSR modifier on future PSU grants if absolute TSR is negative; and

as anticipated, will return to setting three-year goals in the PSU program beginning with the fiscal 2023 grant.

The Compensation Committee also supported a bonus payment to all non-incentive eligible employees from a portion of the annual cash incentive funding reduction, recognizing their work during the pandemic to fulfill the company’s mission of delivering critical products and solutions to healthcare workers.

In addition to the actions outlined above, we expanded diversity, equity, and inclusion (“DE&I”) metrics in the fiscal 2022 annual incentive plan and PSU program.

These actions are described in greater detail on page 48 of the Compensation Discussion and Analysis (“CD&A”).

It has been our long-standing practice to meet with shareholders throughout the year so that the Board and management can discuss our governance, executive compensation, and sustainability practices.

Typically, our shareholder engagement process begins in the summer by soliciting feedback from large investors on governance practices and other topics, which we then communicate to Board. In the fall, we file our proxy statement and then discuss proxy topics with large investors before the Annual Meeting. In the winter, we review voting results from the Annual Meeting, including investor feedback.

This year, in response to last year’s say-on-pay vote, we reached out to investors representing 61% of our outstanding shares and ultimately met with investors representing 43% of our outstanding shares over two separate periods — immediately after the 2020 Annual Meeting and again in the summer of 2021. While the discussions in these meetings centered on our executive compensation program, they also covered topics such as Board oversight of our response to the opioid epidemic (including opioid litigation and settlement negotiations), Board composition and refreshment, the new Risk Oversight Committee, DE&I initiatives, our approach to environmental sustainability, and our response to the COVID-19 pandemic. We also have continued to hold constructive discussions with members of Investors for Opioid and Pharmaceutical Accountability (“IOPA”).

For more information on our shareholder engagement approach generally, see pages 33 and 34. For more information on our shareholder engagement efforts in response to last year’s say-on-pay vote, see pages 44 and 45 of CD&A.

Board Responsiveness to Shareholder Feedback

After considering feedback from shareholders and focusing on best practices, we took the following governance and environmental, social, and governance (“ESG”) actions in 2021:

We took the compensation-related actions that are outlined above under “Addressing the 2020 Say-on-Pay Vote” and in CD&A.

We established and publicly announced specific goals to significantly increase the representation in management of women, African American and Black, and other ethnically diverse employees and disclosed EEO-1 U.S. employee demographic data and pay equity data.

We established a significant greenhouse gas emissions reduction goal for the company.

We enhanced our commitment to Board diversity by amending our Corporate Governance Guidelines to reflect our practice of including women and racially and ethnically diverse candidates in the initial pool of candidates for new director searches.

| CardinalHealth / 2021 PROXY STATEMENT | 10 |

We amended our Corporate Governance Guidelines to provide that, whenever possible, the Chairman of the Board be an independent director. We have had an independent, non-executive Chairman since 2018.

We agreed to enhance our lobbying disclosure in our next Political Contributions and Activities Report.

We leveraged the Sustainability Accounting Standards Board (“SASB”) reporting standards in our Corporate Citizenship Report and issued a Task Force on Climate-related Financial Disclosures (“TCFD”) report.

For more information on our shareholder engagement approach generally and other actions we have taken in response to shareholder feedback, see pages 33 and 34.

Addressing the Opioid Epidemic

We remain deeply concerned about the impact the opioid epidemic is having on individuals, families, and communities across the nation and are committed to being part of the solution.

As a distributor and an intermediary in the supply chain, we provide a secure channel to deliver all kinds of medications from the hundreds of manufacturers that make them to the thousands of our hospital and pharmacy customers licensed to dispense them to their patients, and we work diligently to identify, stop, and report to regulators any suspicious orders of controlled substances. As threats evolve, we constantly adapt our system to prevent the diversion and misuse of medications.

Board Oversight of Our Response to the Opioid Epidemic

The Board remains active in overseeing our response to the opioid epidemic. The Board’s Ad Hoc Committee, composed of independent directors Cox, Downey, Edison, and Kenny, assists the Board in its oversight of opioid-related issues. The Ad Hoc Committee, which was formed in 2018, continues to meet at least twice per quarter and engage with the other directors on opioid-related issues at every Board meeting.

The Ad Hoc Committee receives regular updates on progress toward a global settlement as well as updates on the status of litigation and government investigations, our controlled substance anti-diversion program, legislative and regulatory developments, and shareholder engagement.

Proposed Settlement of Governmental Opioid Litigation

After several years of negotiations, in July 2021, we announced that we and two other national distributors have reached a proposed settlement which, if all conditions are satisfied, would result in the settlement of a substantial majority of opioid lawsuits filed by state and local governmental entities.

We believe the proposed settlement agreement and the process it establishes are important steps toward achieving broad resolution of governmental opioid claims and delivering meaningful relief to thousands of communities across the United States.

If a final settlement is reached, it would collectively provide communities up to approximately $21 billion over 18 years. Subject to certain future milestones and the level of participation, we would be responsible for up to $6.4 billion in contributions under the proposed settlement agreement, the majority of which would be paid over 18 years. The proposed settlement agreement is subject to contingencies and will not become effective unless and until the boards of directors of the three distributors each make separate independent determinations that enough states and political subdivisions have agreed to the agreement to proceed. In early September 2021, we announced that we and the two other national distributors had determined that enough states have agreed to settle to proceed to the next phase of subdivisions sign-on.

The proposed settlement agreement includes injunctive relief terms governing settling distributors’ controlled substance anti-diversion programs, including with respect to governance, independence, and training of the personnel operating our anti-diversion program, due diligence for new and existing customers, ordering limits for certain products, and suspicious order monitoring. A monitor will be selected to oversee compliance with these provisions for a period of five years. The distributors will engage a third-party vendor to act as a clearinghouse for data aggregation and reporting and will fund the clearinghouse for 10 years.

If a settlement cannot be finalized and plaintiffs instead choose to pursue their claims in court, we will continue to assert our strong defenses in pending litigation.

| CardinalHealth / 2021 PROXY STATEMENT | 11 |

Controlled Substance Anti-Diversion Program

We are vigilant in combating the diversion of controlled substances for improper use. We have continually upgraded our anti-diversion program to make sure it is robust and effective in a context of evolving risks. Our team includes investigators, data analysts, former law enforcement officers, pharmacists, and compliance officers.

We carefully evaluate pharmacies before they become customers, including taking steps to understand their business and historical prescription drug ordering patterns. We use this information, along with statistical models and other criteria, to establish pharmaceutical distribution thresholds specific to each customer. When a customer’s order exceeds an established threshold, the order is held, reviewed further, and typically canceled. Canceled orders are reported to the U.S. Drug Enforcement Administration (“DEA”) and any required state regulators. We also have a team of experienced investigators who conduct regular site visits to customers across the country to look for any visible signs of diversion.

We employ third-party experts to help assess and enhance our anti-diversion program. In addition, we also utilize internal resources to audit aspects of the program and suggest enhancements.

Our Efforts to Fight Prescription Opioid Misuse

For more than a decade, we have invested millions of dollars to educate people of all ages about medication safety and the dangers of misusing prescription medications. Since 2009, Generation Rx, an evidence-informed prevention education and awareness program founded at The Ohio State University College of Pharmacy, has been funded by investments from the Cardinal Health Foundation. Using Generation Rx resources, Cardinal Health employees, customers, and members of the community have provided medication safety lessons to millions of people.

We continue to look for innovative ways to expand the reach of Generation Rx, and, in 2019, we teamed up with The Ohio State University athletics department to develop public service announcements with university sports personalities. These announcements played at university sporting events, on the radio, and online through 2020 and into 2021. To date, they have reached more than 15 million Ohio State sports fans across the country.

In addition to the pivotal messages taught by Generation Rx, the Cardinal Health Foundation has provided grants to a wide range of nonprofit organizations to support their work in building awareness about the importance of using medications safely, expanding community drug takeback initiatives, and reducing the number opioids prescribed. Grants from the Cardinal Health Foundation have also supported critical partnerships between colleges of pharmacy, state pharmacy associations, and community pharmacists to deploy strategies to improve awareness and reduce unnecessary prescribing in five states.

We also have continued our long-standing national partnership with Kroger to host drug takeback events during the DEA’s National Prescription Drug Takeback Days at Kroger pharmacy locations across the country. And, in addition to our important community work, we continue our mandatory online training for all U.S. employees to help them better understand opioid misuse, our commitment to fighting it, and how they can support the work.

Where to Find More Information

More information about the topics discussed in this section can be found on our website at www.cardinalhealth.com under “About Us — Corporate Citizenship — Addressing the Opioid Crisis: Board Engagement and Governance” and “About Us — Corporate Citizenship — Combating Opioid Misuse.” The information on these web pages is not incorporated by reference into this proxy statement.

| CardinalHealth / 2021 PROXY STATEMENT | 12 |

As a global company, we know that the long-term health of our employees, our customers and partners, and our communities depends on a healthier, more sustainable world, where all people are treated fairly. We continually push ourselves to find ways to care for our people and our planet. Here are a few 2021 ESG highlights:

|

|

|

|

|

|

|

|

||||

|

|

Creating a diverse, equitable, and inclusive future |

|

|

Our enterprise |

|

|

Enhancing our political contribution and lobbying reporting |

|

||

|

Having devoted years to building a strong foundation, we communicated a strategy to increase diverse representation in leadership. We set the following goals to change our workforce representation by 2030:  globally, increase representation of women at the manager level and above to 48% (up from 40%);  in the United States, increase representation of African American and Black employees at the manager level and above to 11% (up from 5%); and  in the United States, increase representation of all other ethnically diverse groups at the manager level and above to 23% (up from 17%). To achieve these goals, we have developed a comprehensive talent strategy for attracting, developing, and retaining diverse talent, from entry-level to senior leadership positions. As noted in the CD&A, these goals have been incorporated into our fiscal 2022 compensation programs. We also disclosed our EEO-1 U.S. employee demographic data and pay equity metrics for women and minority employees. |

|

We set a new enterprise-wide greenhouse gas reduction goal. After having reported on our Scope 1 and Scope 2 greenhouse gas emissions for many years now, we set a goal for a 50% reduction in Scope 1 and Scope 2 emissions by 2030 , as we do our part to reduce our environmental impact. In addition, we expanded more broadly a total waste management initiative that simplifies and standardizes waste management, and we signed a power purchase agreement to use 100% renewable power for our corporate offices in Dublin, Ohio and our pharmaceutical National Logistics Center in Groveport, Ohio. |

|

We agreed to enhance our political contribution reporting practices next year. We have issued an annual Political Contributions and Activities Report since 2015 and have continued to discuss our political contribution reporting practices with investors to understand their perspectives. Following engagement with members of IOPA, we agreed to enhance our lobbying reporting next year, including more detail on state and trade association expenditures. |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sustainability reporting |

|

|

Commitment |

|

|

High priority on making communities stronger |

|

||

|

We continued to advance our sustainability reporting and transparency. We have issued an annual Corporate Citizenship Report since 2017 and began leveraging the SASB reporting standards for healthcare distributors in our 2020 report in addition to the Global Reporting Initiative (“GRI”) standards. We just issued our 2021 Corporate Citizenship Report, which was accompanied for the first time by a TCFD report addressing our climate-related risks and opportunities. |

|

Celebrating 50 years by emphasizing our commitment to our communities. We celebrated our 50th anniversary in January this year and kicked off of a year of service for our employees around the world. Our employees are passionate about giving back to our communities; during this year of service, we have a collective goal of giving 50,000 hours of volunteer service. |

|

We continued to place a high priority on making communities stronger through the Cardinal Health Foundation’s philanthropic donations. Through the Cardinal Health Foundation, we work to improve the health of our communities, particularly for marginalized populations. The Foundation focuses its investments on impacting social determinants of health, particularly hunger and homelessness, and by increasing both access to and the quality of physical and behavioral healthcare services. |

|

|||||

More information about our ESG efforts can be found in our Corporate Citizenship Reports posted on our website at www.cardinalhealth.com under “About Us — Corporate Citizenship.” The information in these reports is not incorporated by reference into this proxy statement.

| CardinalHealth / 2021 PROXY STATEMENT | 13 |

TIME AND DATE |

PLACE |

RECORD DATE |

Friday, November 5, 2021 8:00 a.m. |

Virtual Meeting |

September 7, 2021 |

Due to COVID-19, this year’s Annual Meeting will again be conducted exclusively online without an option for physical attendance. You will be able to participate in the virtual Annual Meeting online, vote your shares electronically, and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/CAH2021 and entering the 16-digit control number included in the Notice of Internet Availability of Proxy Materials, voting instruction form, or proxy card that was sent to you with this proxy statement.

If you do not have a 16-digit control number, you may still attend the meeting as a guest in listen-only mode. To attend as a guest, please visit www.virtualshareholdermeeting.com/CAH2021 and enter the information requested on the screen to register as a guest. Please note that you will not have the ability to vote or ask questions during the meeting if you participate as a guest.

For further information on how to attend and participate in the virtual Annual Meeting, please see “Other Matters” beginning on page 85 in this proxy statement.

Shareholders will be asked to vote on the following proposals at the Annual Meeting:

Proposal |

Board Recommendation |

Page Reference |

Proposal 1: to elect the 11 director nominees named in this proxy statement |

FOR each director nominee |

|

Proposal 2: to ratify the appointment of Ernst & Young LLP as our independent auditor for the fiscal year ending June 30, 2022 |

FOR |

|

Proposal 3: to approve, on a non-binding advisory basis, the compensation of our named executive officers |

FOR |

|

Proposal 4: to approve the Cardinal Health, Inc. 2021 Long-Term Incentive Plan |

FOR |

|

Proposal 5: to approve an amendment to our Restated Code of Regulations to reduce the share ownership threshold for calling a special meeting of shareholders |

FOR |

|

Proposal 6: shareholder proposal to adopt a policy that the chairman of the board be an independent director |

AGAINST |

How to Vote in Advance of the Annual Meeting

You can return voting instructions in advance of the Annual Meeting by any of the means set forth below. Internet or telephone voting is available until Thursday, November 4, 2021 at 11:59 p.m. Eastern Time.

INTERNET |

TELEPHONE |

|

Visit 24/7 www.proxyvote.com |

Call the toll-free number 1-800-690-6903 within the |

Mark, sign, and date your proxy card and return it by mail in the enclosed postage-paid envelope |

| CardinalHealth / 2021 PROXY STATEMENT | 14 |

Election of Directors

Our Board currently has 12 members. Eleven of our directors are standing for election at the Annual Meeting to serve until the next Annual Meeting of Shareholders and until their successor is elected and qualified or until their earlier resignation, removal from office, or death. J. Michael Losh, a director since 2018, was not nominated for re-election because he has reached the retirement age of 75. The size of the Board will be reduced to 11 at the time of the Annual Meeting. Calvin Darden, a director since 2005, retired from the Board in April 2021.

Each director nominee agreed to be named in this proxy statement and to serve if elected. If, due to death or other unexpected occurrence, one or more of the director nominees is not available for election, proxies will be voted for the election of any substitute nominee the Board selects.

|

THE BOARD RECOMMENDS THAT YOU VOTE FOR THE ELECTION OF THE NOMINEES LISTED ON PAGES 16 THROUGH 21. |

Board Membership Criteria: What We Look For

The Nominating and Governance Committee considers and reviews with the Board the appropriate skills and characteristics for Board members in the context of the Board’s current composition and objectives. Criteria for identifying and evaluating candidates for the Board include:

business experience, qualifications, attributes, and skills, such as relevant industry knowledge (including pharmaceutical, medical device, and other healthcare industry knowledge), accounting and finance, operations, technology, and international markets;

leadership experience as a chief executive officer, senior executive, or leader of a significant business operation or function;

financial and accounting experience as a chief financial officer;

independence (including independence from the interests of any single group of shareholders);

judgment and integrity;

ability to commit sufficient time and attention to the activities of the Board;

diversity of age, gender, and race and ethnicity; and

absence of conflicts with our interests.

In 2021, the Board reaffirmed its commitment to diversity when it amended the Corporate Governance Guidelines to reflect its practice that, as part of the search process for each new director, the Nominating and Governance Committee includes, and instructs any search firm to include, women and racially and ethnically diverse candidates in the initial pool from which candidates are selected.

| CardinalHealth / 2021 PROXY STATEMENT | 15 |

The Board seeks members that possess the experience, skills, and diverse backgrounds to perform effectively in overseeing our current and evolving business and strategic direction and to properly perform the Board’s oversight responsibilities. All director nominees bring to the Board a wealth of executive leadership experience derived from their diverse professional backgrounds and areas of expertise. As a group, they have business acumen, healthcare and global business experience, and financial expertise, as well as public company board experience. In addition, five of the 11 director nominees are gender or racially or ethnically diverse. Each director nominee has sound judgment and integrity and is able to commit sufficient time and attention to the activities of the Board. All director nominees (other than our CEO) are independent.

CARRIE S. COX |

||

Age 64 Director since: 2009 INDEPENDENT DIRECTOR Board Committees:  Human Resources and Compensation  Ad Hoc |

Executive Vice President and President of Global Pharmaceuticals, Schering-Plough Corporation (retired); Chairman and Chief Executive Officer of Humacyte, Inc. (retired) |

|

Other public company boards: |

||

Current |

Within last five years |

|

Organon & Co.  Selecta Biosciences, Inc.  Texas Instruments Incorporated |

Array BioPharma Inc.  Celgene Corporation  electroCore, Inc. |

|

Background |

||

Ms. Cox served as Chairman and Chief Executive Officer of Humacyte, Inc., a privately held, development stage company focused on regenerative medicine, from 2010 to 2018 and as its Executive Chairman from 2018 to 2019. She was Executive Vice President and President of Global Pharmaceuticals at Schering-Plough Corporation, a multinational branded pharmaceutical manufacturer, from 2003 until its merger with Merck & Co. in 2009. She was Executive Vice President and President of the Global Prescription business of Pharmacia Corporation, a pharmaceutical and biotechnology company, from 1997 to 2003. |

||

Qualifications |

||

Through her roles as an executive of Schering-Plough, President of Pharmacia’s Global Prescription business, and Chief Executive Officer of Humacyte and as a licensed pharmacist, Ms. Cox brings to the Board substantial expertise in healthcare, particularly the branded pharmaceutical and international aspects. She draws on this experience in discussions relating to Pharmaceutical segment strategy, healthcare compliance, and the opioid epidemic, including in meetings of the Board’s Ad Hoc Committee. Ms. Cox worked in the global branded pharmaceutical industry for over 40 years, giving her relevant experience with large, multinational healthcare companies in the areas of regulatory compliance, global markets, and manufacturing operations. She also brings to the Board, and to her role chairing our Human Resources and Compensation Committee, valuable perspectives and insights from her service on the boards of directors of Organon, Selecta Biosciences, and Texas Instruments and prior service on the Array BioPharma, Celgene, and electroCore boards. She currently serves as Chairman of the Board at Organon and Selecta Biosciences and previously served as Chairman of the Board at Array BioPharma and Lead Director at Texas Instruments. Ms. Cox also currently chairs Organon’s Talent Committee and sits on Selecta Biosciences’ and Texas Instruments’ Compensation Committees and previously sat on Celgene’s Compensation and Development Committee. |

||

BRUCE L. DOWNEY |

||

Age 73 Director since: 2009 INDEPENDENT DIRECTOR Board Committees:  Nominating and Governance  Ad Hoc |

Chairman and Chief Executive Officer of Barr Pharmaceuticals, Inc. (retired); Partner of NewSpring Health Capital II, L.P. |

|

Other public company boards: |

||

Current |

Within last five years |

|

C4 Therapeutics, Inc. |

Melinta Therapeutics, Inc.  Momenta Pharmaceuticals, Inc. |

|

Background |

||

Mr. Downey was Chairman and Chief Executive Officer of Barr Pharmaceuticals, Inc., a global generic pharmaceutical manufacturer, from 1994 until 2008 when the company was acquired by Teva Pharmaceutical Industries Ltd. Mr. Downey has served on a part-time basis as a Partner of NewSpring Health Capital II, L.P., a venture capital firm, since 2009. Before his career at Barr Pharmaceuticals, Mr. Downey was a practicing attorney for 20 years, having worked in both private practice and with the U.S. Department of Justice. |

||

Qualifications |

||

Having spent 14 years as Chairman and Chief Executive Officer of Barr Pharmaceuticals, Mr. Downey brings to the Board substantial global experience in the areas of healthcare, regulatory compliance, manufacturing operations, finance, human resources, and corporate governance. He offers valuable experience in the pharmaceutical and international aspects of our businesses, and he draws on his extensive legal and healthcare experience in chairing the Ad Hoc Committee and leading Board discussions related to opioid litigation and the opioid epidemic. Mr. Downey also brings to the Board valuable perspectives and insights from his service on the board of directors of C4 Therapeutics and former service on the boards of directors of Melinta Therapeutics and Momenta Pharmaceuticals, including service as Momenta’s independent chair. |

||

| CardinalHealth / 2021 PROXY STATEMENT | 16 |

SHERI H. EDISON |

||

Age 64 Director since: 2020 INDEPENDENT DIRECTOR Board Committees:  Risk Oversight  Ad Hoc

|

Executive Vice President and General Counsel of Amcor plc (retired) |

|

Other public company boards: |

||

Current |

Within last five years |

|

None |

AK Steel Holding Corporation |

|

Background |

||

Ms. Edison served as Executive Vice President and General Counsel of Amcor plc, a global packaging company, from 2019 through June 2021. Prior to that, she served as Senior Vice President, Chief Legal Officer, and Secretary of Bemis Company, Inc., also a global packaging company, from 2017 until Bemis was acquired by Amcor in 2019. Ms. Edison also served as Vice President, General Counsel, and Secretary of Bemis from 2010 to 2016. She came to Bemis from Hill-Rom Holdings Inc., a global medical device company, where she had served as Senior Vice President and Chief Administrative Officer from 2007 to 2010 and Vice President, General Counsel, and Secretary from 2004 to 2007. Ms. Edison began her career in private legal practice. |

||

Qualifications |

||

Having served in general counsel and other functional roles at publicly traded manufacturing companies in industries such as medical devices and packaging, Ms. Edison brings to the Board substantial experience in the areas of healthcare, legal, regulatory compliance, corporate governance, strategy, and international markets. She also brings prior private legal practice experience, which further bolsters her understanding of a dynamic legal and regulatory environment. Ms. Edison draws on her extensive legal experience in contributing to Risk Oversight Committee discussions as well as to Ad Hoc Committee and Board discussions related to opioid litigation and the opioid epidemic. She also brings to the Board valuable perspectives and insights from her many years of functional and operational leadership experience and her prior service on the board of directors of AK Steel. |

||

DAVID C. EVANS |

||

Age 58 Director since: 2020 INDEPENDENT DIRECTOR Board Committees:  Audit |

Executive Vice President and Chief Financial Officer of The Scotts Miracle-Gro Company and Battelle Memorial Institute (retired) |

|

Other public company boards: |

||

Current |

Within last five years |

|

The Scotts Miracle-Gro Company |

None |

|

Background |

||

Mr. Evans was Executive Vice President and Chief Financial Officer of Battelle Memorial Institute, a private research and development organization, from 2013 to 2018. Prior to that, he was Chief Financial Officer of The Scotts Miracle-Gro Company, a consumer lawn and garden products company, from 2006 until 2013 and Executive Vice President, Strategy and Business Development of Scotts from 2011 until 2013. In all, he spent 20 years in various managerial roles at Scotts. Most recently, Mr. Evans was Cardinal Health’s interim Chief Financial Officer from September 2019 through May 2020. |

||

Qualifications |

||

We elected Mr. Evans to the Board based on his deep financial background as Chief Financial Officer at Scotts Miracle-Gro and Battelle. Having spent 25 years in financial leadership positions with these organizations, Mr. Evans brings to the Board substantial experience in the areas of finance and accounting, investor relations, capital markets, strategy, tax, and information technology. He also provides valuable insights in the areas of financial reporting and internal controls. Through his experience with Scotts Miracle-Gro, he provides a deep understanding of the financial aspects of, and capital deployment for, a publicly traded company. His service in an interim executive role at Cardinal Health brings company and industry knowledge to the Board. Mr. Evans also brings valuable perspectives and insights from his service on the board of directors of Scotts Miracle-Gro, including service on its Audit Committee. |

||

| CardinalHealth / 2021 PROXY STATEMENT | 17 |

PATRICIA A. HEMINGWAY HALL |

||

Age 68 Director since: 2013 INDEPENDENT DIRECTOR Board Committees:  Human Resources and Compensation  Nominating and Governance |

President and Chief Executive Officer of Health Care Service Corporation (retired) |

|

Other public company boards: |

||

Current |

Within last five years |

|

Halliburton Company  ManpowerGroup Inc. |

Celgene Corporation |

|

Background |

||

Ms. Hemingway Hall served as President and Chief Executive Officer of Health Care Service Corporation, a mutual health insurer (“HCSC”), from 2008 until 2016. Previously, she held several executive leadership positions at HCSC, including President and Chief Operating Officer from 2007 to 2008 and Executive Vice President of Internal Operations from 2006 to 2007. |

||

Qualifications |

||

As retired President and Chief Executive Officer of HCSC, the largest mutual health insurer in the United States operating through several state Blue Cross and Blue Shield Plans, Ms. Hemingway Hall brings to the Board valuable experience regarding evolving healthcare payment models and the industry’s regulatory environment. She worked in healthcare for over 30 years, first as a registered nurse and later in health insurance, and has relevant experience in the areas of healthcare reform, regulatory compliance, government relations, finance, information technology, and human resources. Ms. Hemingway Hall also brings to the Board and to her roles chairing our Nominating and Governance Committee and serving on our Human Resources and Compensation Committee, valuable perspectives and insights from her service on the boards of directors of Halliburton and ManpowerGroup and former service on Celgene’s board of directors. She chairs ManpowerGroup’s Nominating and Governance Committee and sits on its Audit Committee and sits on Halliburton’s Compensation and Nominating and Corporate Governance Committees. |

||

AKHIL JOHRI |

||

Age 60 Director since: 2018 INDEPENDENT DIRECTOR Board Committees:  Audit  Nominating and Governance |

Executive Vice President and Chief Financial Officer of United Technologies Corporation (retired) |

|

Other public company boards: |

||

Current |

Within last five years |

|

The Boeing Company |

None |

|

Background |

||

Mr. Johri served as Executive Vice President and Chief Financial Officer of United Technologies Corporation (“UTC”), a provider of high technology products and services to the building systems and aerospace industries, from 2015 to November 2019 and retired from UTC in April 2020. From 2013 to 2014, he served as Chief Financial Officer and Chief Accounting Officer of Pall Corporation, a global supplier of filtration, separations, and purifications products, and from 2011 to 2013, he was Vice President of Finance and Chief Financial Officer of UTC Propulsion & Aerospace Systems, which included Pratt & Whitney and UTC Aerospace Systems. Mr. Johri’s prior roles with UTC include leading investor relations, as well as holding senior financial roles with global business units, including 12 years in the Asia Pacific Region. |

||

Qualifications |

||

Having spent more than 25 years in financial leadership positions with UTC and Pall Corporation, Mr. Johri brings to the Board substantial experience in the areas of global finance and accounting, investor relations, capital markets, mergers and acquisitions, tax, information technology, and international markets. He also provides valuable insights in the areas of financial reporting and internal controls. Through his experience in senior leadership roles with UTC’s businesses, he provides a deep understanding of the financial aspects of, and capital deployment for, a publicly traded multinational company. Mr. Johri also brings to the Board valuable perspectives and insights from his service on Boeing’s board of directors, including chairing its Audit Committee. |

||

| CardinalHealth / 2021 PROXY STATEMENT | 18 |

MICHAEL C. KAUFMANN |

||

Age 58 Director since: 2018

|

Chief Executive Officer of Cardinal Health, Inc. |

|

Other public company boards: |

||

Current |

Within last five years |

|

MSC Industrial Direct Co., Inc. |

None |

|

Background |

||

Mr. Kaufmann has served as Chief Executive Officer of Cardinal Health since January 2018. From November 2014 to December 2017, he served as our Chief Financial Officer and from August 2009 to November 2014, he served as our Chief Executive Officer — Pharmaceutical Segment. Prior to that, he held a range of other senior leadership roles here spanning operations, sales, and finance, including in both our Pharmaceutical and Medical segments. |

||

Qualifications |

||

As our Chief Executive Officer and having spent over 30 years at Cardinal Health, Mr. Kaufmann draws on his deep knowledge of our daily operations and our industry, customers, suppliers, employees, and shareholders to provide the Board with a unique and very important perspective on our business and a conduit for information from management. Prior leadership positions across the company provide him with expertise in the areas of healthcare, distribution operations, finance, international markets, mergers and acquisitions, and regulatory compliance. He also provides the Board with an understanding of the strategic and financial implications of business, regulatory, and economic factors impacting our company from having played an important role in key strategic initiatives. In addition, Mr. Kaufmann brings relevant experience and perspectives to the Board from his service on the board of directors of MSC Industrial Direct, including service on its Audit and Compensation Committees. |

||

GREGORY B. KENNY |

||

Age 68 Director since: 2007 INDEPENDENT CHAIRMAN OF THE BOARD Board Committees:  Nominating and Governance  Risk Oversight  Ad Hoc |

President and Chief Executive Officer of General Cable Corporation (retired) |

|

Other public company boards: |

||

Current |

Within last five years |

|

Ingredion Incorporated |

AK Steel Holding Corporation |

|

Background |

||

Mr. Kenny served as President and Chief Executive Officer of General Cable Corporation, a global manufacturer of aluminum, copper, and fiber-optic wire and cable products, from 2001 until 2015. Prior to that, he was President and Chief Operating Officer of General Cable from 1999 to 2001 and Executive Vice President and Chief Operating Officer from 1997 to 1999. Mr. Kenny previously served in executive level positions at Penn Central Corporation, where he was responsible for corporate business strategy, and in diplomatic service as a Foreign Service Officer with the U.S. Department of State. |

||

Qualifications |

||

Mr. Kenny has been our Chairman of the Board since November 2018 and was independent Lead Director from 2014 to 2018. He brings to the Board significant experience in the areas of board leadership, corporate governance, manufacturing operations, international markets, finance, and human resources. He also draws upon his board governance and leadership experience previously chairing our Nominating and Governance and Human Resources and Compensation Committees and chairing Ingredion’s board of directors and its Corporate Governance and Nominating Committee. Both in his current role as Chairman of the Board and his prior role as independent Lead Director, Mr. Kenny has promoted strong independent Board leadership and a robust, deliberative decision-making process among independent directors. Mr. Kenny also brings to the Board valuable perspectives and insights from his former service on AK Steel’s board of directors. |

||

| CardinalHealth / 2021 PROXY STATEMENT | 19 |

NANCY KILLEFER |

||

Age 67 Director since: 2015 INDEPENDENT DIRECTOR Board Committees:  Human Resources and Compensation  Risk Oversight |

Senior Partner, Public Sector Practice of McKinsey & Company, Inc. (retired) |

|

Other public company boards: |

||

Current |

Within last five years |

|

Certara, Inc.  Facebook, Inc.  Natura &Co Holding S.A. |

Avon Products, Inc.  CSRA, Inc.  Computer Sciences Corporation  Taubman Centers, Inc.  The Advisory Board Company |

|

Background |

||

Ms. Killefer served as Senior Partner of McKinsey & Company, Inc., a global management consulting firm, from 1992 until 2013. She joined McKinsey in 1979 and held a number of key leadership roles, including serving as a member of the firm’s governing board. Ms. Killefer founded McKinsey’s Public Sector Practice in 2007 and served as its managing partner until her retirement. She also served as Assistant Secretary for Management, Chief Financial Officer, and Chief Operating Officer for the U.S. Department of Treasury from 1997 to 2000. |

||

Qualifications |

||

Having served in key leadership positions in both the public and private sectors and provided strategic counsel to healthcare and consumer-based companies during her 30 years with McKinsey, Ms. Killefer brings to the Board substantial experience in the areas of strategic planning, including healthcare strategy, and marketing and brand-building. Her extensive experience as managing partner of McKinsey’s Public Sector Practice and as a chief financial officer of a government agency provides valuable insights in the areas of government relations, public policy, and finance. Ms. Killefer also brings to the Board valuable perspectives and insights from her service on the board of directors of Certara (including service on its Audit Committee), Facebook (including chairing its Privacy Committee and serving on its Audit and Risk Oversight Committee), and Natura (including service on its Organization and People Committee), and her prior service on the boards of directors of Avon Products, CSRA, Inc. (including service as its independent chair), Computer Sciences Corporation, Taubman Centers, and The Advisory Board. |

||

DEAN A. SCARBOROUGH |

||

Age 65 Director since: 2019 INDEPENDENT DIRECTOR Board Committees:  Human Resources and Compensation  Risk Oversight |

Chairman and Chief Executive Officer of Avery Dennison Corporation (retired) |

|

Other public company boards: |

||

Current |

Within last five years |

|

Graphic Packaging Holding Company |

Avery Dennison Corporation  Mattel, Inc. |

|

Background |

||

Mr. Scarborough served as Chairman and Chief Executive Officer of Avery Dennison Corporation, a packaging and labeling solutions company, from 2014 to 2016. Prior to that, he served as Avery Dennison’s Chairman, President, and Chief Executive Officer from 2010 to 2014 and as its President and Chief Executive Officer from 2005 to 2010. After stepping down as Chief Executive Officer, Mr. Scarborough remained Chairman of the Board through April 2019. Having joined Avery Dennison in 1983, Mr. Scarborough served in a series of leadership roles both in the United States and abroad until he was appointed Chief Operating Officer in 2000 and later Chief Executive Officer. |

||

Qualifications |

||

Having served as Avery Dennison’s Chief Executive Officer for 11 years, Mr. Scarborough brings to the Board substantial experience in manufacturing and distribution operations. As a former public company chief executive officer, he has relevant experience in finance, human resources, and corporate governance. He also brings a global business and manufacturing perspective, having led Avery Dennison’s Label and Packaging Materials Europe business while he was based in the Netherlands. Mr. Scarborough also brings to the Board valuable perspectives and insights from his service on the board of directors of Graphic Packaging Holding Company, including service on its Compensation and Management Development Committee, and prior service on Mattel, Inc.’s board of directors, including its Compensation Committee. |

||

| CardinalHealth / 2021 PROXY STATEMENT | 20 |

JOHN H. WEILAND |

||

Age 65 Director since: 2019 INDEPENDENT DIRECTOR Board Committees:  Audit  Risk Oversight |

President and Chief Operating Officer of C. R. Bard, Inc. (retired) |

|

Other public company boards: |

||

Current |

Within last five years |

|

None |

Celgene Corporation  C. R. Bard, Inc.  West Pharmaceutical Services, Inc. |

|

Background |

||

Mr. Weiland served as President and Chief Operating Officer of medical device company C. R. Bard, Inc. from 2003 until 2017, when Bard was acquired by Becton, Dickinson and Company. He also served on Bard’s board of directors from 2005 to 2017, becoming Vice Chairman of the Board in 2016. Mr. Weiland joined Bard in 1996 and held the position of Group President, with global responsibility for several Bard divisions and its worldwide manufacturing operations prior to becoming President and Chief Operating Officer. Prior to Bard, he held senior management positions at Dentsply International, American Hospital Supply, Baxter Healthcare, and Pharmacia AB. |

||

Qualifications |

||

Mr. Weiland brings over 40 years of healthcare industry experience to the Board, including executive leadership at a medical device company and significant international business experience. He has relevant experience in regulatory compliance, global markets, and manufacturing operations. Mr. Weiland draws on his extensive regulatory and medical device compliance experience in chairing the new Risk Oversight Committee. He also brings to the Board valuable perspectives and insights from his prior service on the boards of directors of Celgene Corporation, including service on its Audit Committee, and West Pharmaceutical Services’ board of directors, including chairing its Compensation and Finance Committees. |

||

| CardinalHealth / 2021 PROXY STATEMENT | 21 |

Our director nominees possess relevant skills and experience that contribute to a well-functioning Board that effectively oversees our strategy and management.

Director Nominee Skills and |

Cox |

Downey |

Edison |

Evans |

Hemingway Hall |

Johri |

Kaufmann |

Kenny |

Killefer |

Scarborough |

Weiland |

|

Board leadership as a board chair, lead director, or committee chair equips directors to lead our Board and its committees |

|

|

|

|

|

|

|

|

|

|

|

|

Financial expertise as a finance executive or CEO brings valuable experience to the Board and our management team |

|

|

|

|

|

|

|

|

|

|

|

|

Healthcare expertise as a leader of a healthcare company or a consulting firm with a healthcare practice provides industry experience |

|

|

|

|

|

|

|

|

|

|

|

|

Operations experience increases the Board’s understanding of our distribution and manufacturing operations |

|

|

|

|

|

|

|

|

|

|

|

|

Regulatory/legal/public policy experience helps the Board assess and respond to an evolving business and healthcare regulatory environment |

|

|

|

|

|

|

|

|

|

|

|

|

International experience brings critical insights into the opportunities and risks of our international businesses |

|

|

|

|

|

|

|

|

|

|

|

|

Information technology experience contributes to the Board’s understanding of the information technology aspects of our business |

|

|

|

|

|

|

|

|

|

|

|

|

Diversity of gender and race/ethnicity(1) |

|

|

|

|

|

|

|

|

|

|

|

|

(1)

Mses. Cox, Hemingway Hall, and Killefer have self-identified as women, Ms. Edison has self-identified as a woman and African American/Black, and Mr. Johri has self-identified as Asian. |

||||||||||||

| CardinalHealth / 2021 PROXY STATEMENT | 22 |

Our Board’s Composition and Structure

Our Board Leadership Structure

Mr. Kenny has served as the independent, non-executive Chairman of the Board since November 2018.

In addition to serving as a liaison between the Board and management, key responsibilities of the Chairman include:

calling meetings of the Board and independent directors;

setting the agenda for Board meetings in consultation with the other directors, the CEO, and the corporate secretary;

reviewing Board meeting schedules to ensure that there is sufficient time for discussion of all agenda items;

reviewing and approving Board meeting materials before circulation and providing guidance to management on meeting presentations;

chairing Board meetings, including the executive sessions of the independent directors;

participating in the annual CEO performance evaluation;

conferring with the CEO on matters of importance that may require Board action or oversight;

as a member of the Nominating and Governance Committee, evaluating potential director candidates, assisting with director recruitment, recommending committee chairs and membership, and recommending updates to the company’s Corporate Governance Guidelines; and

holding governance discussions with large investors.

In 2021, the Board amended the Corporate Governance Guidelines to provide that, whenever possible, the Chairman of the Board shall be an independent director. The amended Guidelines further provide that in the event the Chairman is not independent, the independent directors will elect an independent director to serve as Lead Director.

Our Corporate Governance Guidelines provide that the Board should be diverse, engaged, and independent. In identifying and evaluating candidates for the Board, the Nominating and Governance Committee considers the diversity of the Board, including diversity of skills, experience, and backgrounds, as well as gender and racial/ethnic diversity. We believe that our Board nominees reflect an appropriate mix of skills, experience, and backgrounds and strike the right balance of longer serving and newer directors.

In 2021, the Board reaffirmed its commitment to diversity by amending our Corporate Governance Guidelines to reflect the Board’s practice that, as part of the search process for each new director, the Nominating and Governance Committee includes, and instructs any search firm to include, women and racially and ethnically diverse candidates in the initial pool from which candidates are selected. See page 22 for the self-identified gender and race and ethnicity of our diverse director nominees.

Director Onboarding and Education

The Nominating and Governance Committee is responsible for identifying, reviewing, and recommending director candidates, and our Board is responsible for selecting candidates for election as directors based on the Nominating and Governance Committee’s recommendations.

Following the departures of Colleen Arnold and Cal Darden in the last year, and anticipating the upcoming departure of Mr. Losh following the Annual Meeting, the Nominating and Governance Committee has engaged a search firm to assist with identifying and evaluating potential Board candidates. The Committee is initially targeting candidates with technology or healthcare experience.

New directors typically participate in a comprehensive, full-day director orientation program, which includes meetings with senior management. This orientation program helps new directors become familiar with our business and strategy,

| CardinalHealth / 2021 PROXY STATEMENT | 23 |

significant financial matters, information technology and security matters, our legal, governance, quality, and compliance programs and practices, and our human resources function.

Prior to the first meeting of the Risk Oversight Committee, we conducted an orientation with management and internal and outside counsel for the prospective Committee members covering ethics and compliance, privacy, product quality and safety, and legal risks.

We encourage our directors to attend outside director and other continuing education programs and make available to directors information on director education programs that might be of interest on developments in our industry, corporate governance, regulatory requirements and expectations, the economic environment, or other matters relevant to their duties as a director. In the past year, our directors have attended programs sponsored by the National Association of Corporate Directors and Tapestry Networks, among others.

The Board held 12 meetings during fiscal 2021. Each director attended 75% or more of the meetings of the Board and Board committees on which he or she served during the fiscal year. Average director attendance at all Board and Board committee meetings was 97%.

All of our directors at the time attended the 2020 Annual Meeting of Shareholders. Absent unusual circumstances, each director is expected to attend the Annual Meeting of Shareholders.

The Board has four standing committees: the Audit Committee; the Nominating and Governance Committee; the Human Resources and Compensation Committee; and, newly formed in May 2021, the Risk Oversight Committee. Each member of these committees is independent under our Corporate Governance Guidelines and under applicable committee independence rules.

The charter for each of these committees is available on our website at www.cardinalhealth.com under “About Us — Corporate — Investor Relations — Corporate Governance — Board Committees and Charters.” This information also is available in print (free of charge) to any shareholder who requests it from our Investor Relations department.

The Board also has an Ad Hoc Committee of independent directors formed in 2018 to assist the Board in its oversight of opioid-related issues. The Surgical Gown Recall Oversight Committee of independent directors formed in January 2020 to assist the Board in oversight of a surgical gown recall was terminated in May 2021 and its responsibilities were transitioned to the Risk Oversight Committee.

|

|

Members:(1) |

The Audit Committee’s primary duties are to: |

Akhil Johri (Chair)(2) David C. Evans(3) J. Michael Losh(2) John H. Weiland

Meetings in fiscal 2021: 7 |

■

oversee the integrity of our financial statements, including reviewing annual and quarterly financial statements and earnings releases and the effectiveness of our internal and disclosure controls; ■

appoint the independent auditor and oversee its qualifications, independence, and performance, including pre-approving all services by the independent auditor; ■

review our internal audit plan and oversee our internal audit department; ■

oversee our compliance with legal and regulatory requirements with respect to audit, accounting, and financial disclosure matters and related internal controls(4); and ■

oversee our major financial and information technology risk exposures and our process for assessing and managing risk through our enterprise risk management program. |

|