Form DEF 14A 8X8 INC /DE/ For: May 27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☒ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

8x8, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

| |||||

DEAR 8X8 STOCKHOLDERS

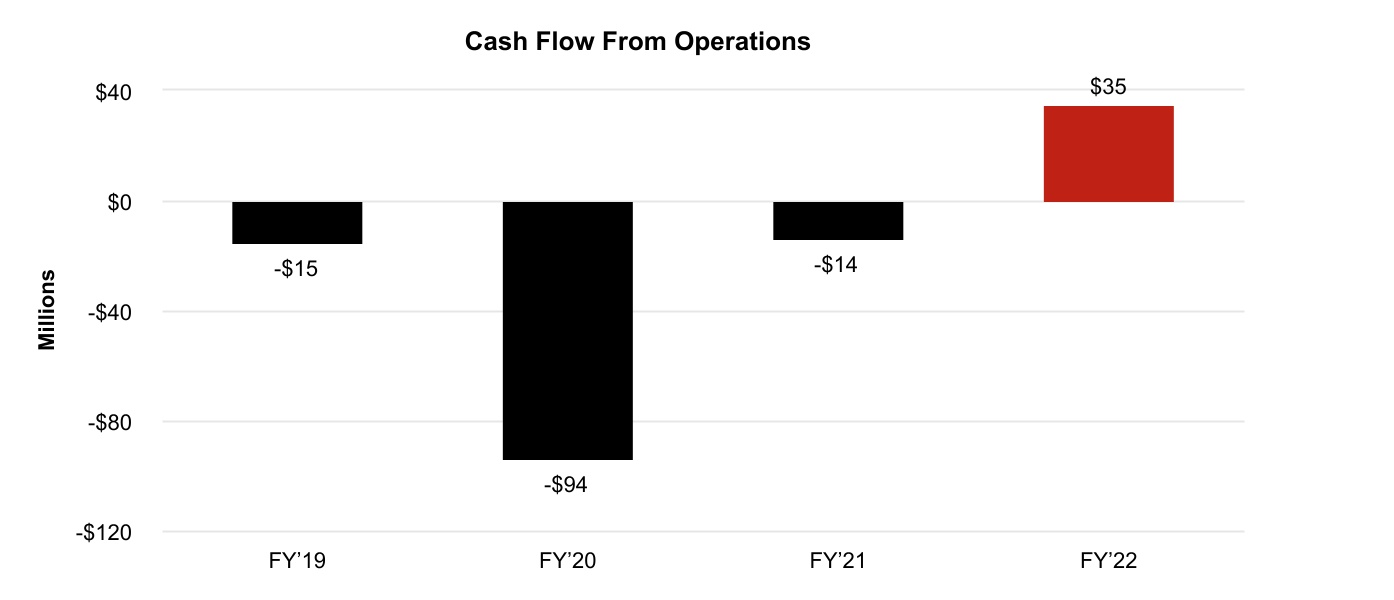

DAVID SIPES CEO AND BOARD MEMBER June __, 2022  | In fiscal 2022, we added industry-leading talent, expanded our enterprise customer base, and delivered solid financial results. We increased revenue by 20 percent from the prior year, achieved profitability on a non-GAAP basis1, and delivered more than $34 million in operating cash flow, the highest cash generation in several years. We increased our investment in innovation, and completed our acquisition of Fuze, Inc., a privately held Unified Communications as a Service (UCaaS) company. The start of our fiscal 2022 coincided with the beginning of the second year of the global COVID-19 pandemic. As the year progressed, it became increasingly clear that the pre-pandemic workplace had permanently changed with organizations accelerating their plans for digital transformation and migration of their communications infrastructures to the cloud. Against this backdrop, we defined our vision and our strategy: accelerate innovation and expand our global coverage to enable a world without silos, where every employee is connected, every organization is agile, and every communication delivers a great experience. I have not met a partner, prospect or customer for whom this vision does not resonate and I believe we are uniquely positioned to deliver on this promise. In May 2021, we introduced XCaaS™ (eXperience Communications as a Service™), our integrated unified communications and contact center solution. XCaaS is built on our resilient, secure, and compliant 8x8 eXperience Communications Platform™, which offers the highest levels of reliability and includes the industry’s only financially-backed, platform-wide 99.999 percent uptime service-level agreement (SLA) across an integrated cloud UCaaS and CCaaS solution. | |||||||

With XCaaS as the foundation, we outlined four initiatives for Fiscal 2022:1

•Expand our platform advantage through innovation,

•Win together with partners,

•Expand our enterprise customer base, and

•Drive operational excellence to achieve greater efficiencies as we scale the business.

With our employees’ continued dedication and ingenuity, we made significant progress across all four initiatives in Fiscal 2022.

In close collaboration with our customers, we focused our research and development efforts on innovations that bridge the communication gap between frontline agents and knowledge workers. Significant innovations introduced during the year included:

•8x8 Frontdesk, an XCaaS composed experience for receptionists and other users that enables high volume interactions using advanced contact center and unified communications capabilities.

•8x8 Agent Workspace, a new 8x8 Contact Center composed experience that transforms the contact center agent role. 8x8 Agent Workspace is a fully browser-based, design-led interface, delivering a tailored and intuitive experience with powerful contact queuing and handling features to enhance productivity and personalize both agent and customer engagement.

•8x8 Conversation IQ, which extends formal contact center capabilities, such as quality management and speech analytics, to all user roles using conversational artificial intelligence (AI).

•Extensions to 8x8 Voice for Microsoft Teams, including presence synchronization, call recording, and Conversation IQ. Our direct routing solution for Microsoft Teams delivers enterprise-grade global telephony and integrated contact center capabilities to organizations adopting Microsoft Teams as part of their Microsoft productivity suite.

1 For a discussion of our non-GAAP metrics and reconciliation of GAAP to Non-GAAP metrics, please refer to the 8x8, Inc. Fourth Quarter and Fiscal 2022 Financial Results filed on Form 8-K with the SEC on May 10, 2022.

•Enhancements to 8x8 Work to meet enterprise customer requirements, including support for more concurrent meetings participants, video meeting breakout rooms, and detailed meeting summaries. We also launched 8x8 Work for Web, a browser-based solution for a secure communications and collaboration experience across almost any device and operating system.

Our industry leadership and innovations have been consistently recognized by industry experts. In fiscal 2022, we were

•Named a Leader in the 2021 Gartner® Magic Quadrant™ for Unified Communications as a Service, Worldwide2, for the tenth consecutive year, and a challenger in the 2021 Gartner Magic Quadrant for Contact Center as a Service3, for the seventh consecutive year.

•Recognized as an innovation leader in the Frost Radar™: Communications Platforms as a Service Industry, 2021.

•Awarded the 2021 CRN Tech Innovator Award for 8x8 XCaaS.

•Named a winner in the category of Best Innovation in Customer Experience for the Best of Enterprise Connect 2022 Awards.

We also expanded our enterprise-grade PTSN replacement services to 50 countries and territories, including the industry’s first integrated solution in the Philippines, China and Indonesia. Our Global ReachTM business phone services and contact center capabilities are now available in regions representing more than 85 percent of the world’s gross domestic product.

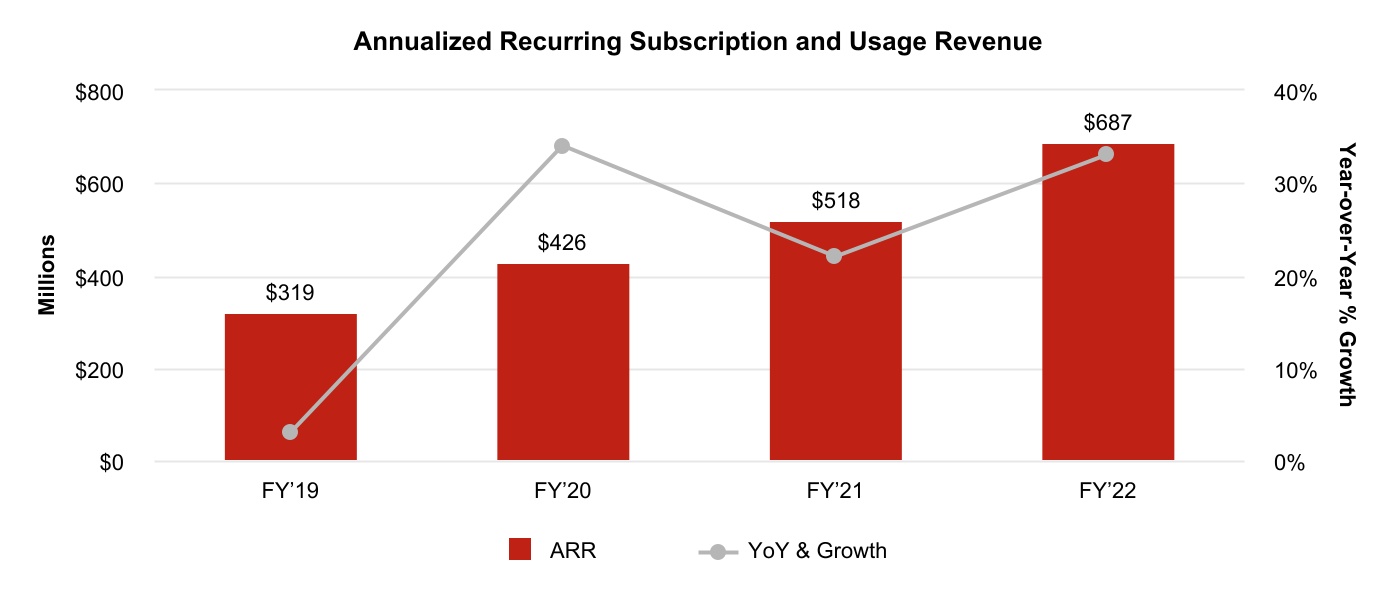

The feature richness of our platform and our global coverage align with the needs of enterprise customers as they optimize employee and customer experiences for the new agile workplace. To drive our success in this important market segment, we increased our investment in channel programs and our customer success organization. The growth and shifting mix of our ARR4 demonstrate the positive returns generated by these investments:

•The number of enterprise customers, defined as customers generating more than $100,000 in ARR, increased from 761 at the end of fiscal 2021 to more than 1,300 at the end of fiscal 2022. At year-end, enterprise customers accounted for 57 percent of total ARR, up from 49 percent at the end of 2021.

•The number of active channel partners increased to more than 1,400 and channel ARR increased 77 percent year-over-year. We were also awarded a 5-star rating in the CRN 2022 Partner Program Guide.

•Customer retention was at an all-time high as we exited the year, reflecting our platform advances and increased customer support capacity.

While these metrics include the addition of the Fuze, Inc. customer base, the trends were well established prior to the acquisition. Our growth, combined with substantial progress reducing carrier and other costs associated with our service revenue, allowed us to achieve our non-GAAP operating margin target in the third fiscal quarter, a quarter ahead of plan.

Our balanced approach to growth and profitability reflected my discussions with shareholders when I joined 8x8 as CEO in late fiscal 2021. They encouraged me to focus our development on XCaaS, where 8x8 is clearly differentiated, to target the enterprise customers who benefit most from our solutions, and to achieve the positive cash flow necessary to fund our future growth. Although the stock market has not yet rewarded our progress, I believe the discipline of this framework positions us for long-term success and enables us to deliver value to all our stakeholders in the future.

We begin fiscal 2023 stronger than we were a year ago. We have a differentiated solution that addresses the needs of organizations to modernize their communications, elevate employee and customer experience, and reduce total cost of ownership. We have increased the depth and breadth of our leadership team. And we have a clear vision of our future, supported by actionable initiatives and a framework of accountability.

I thank you for your continued support. I look forward to reporting on our continued progress in fiscal 2023.

David Sipes

Chief Executive Officer and Member of the Board of Directors

Chief Executive Officer and Member of the Board of Directors

2 Gartner Magic Quadrant for Unified Communications as a Service, Worldwide, Rafael Benitez, Megan Fernandez, Daniel O'Connell, Christopher Trueman, Pankil Sheth, October 18, 2021. This Magic Quadrant report name has changed from 2015 onwards to 2015-2021: Magic Quadrant for Unified Communications as a Service, Worldwide, 2014: Magic Quadrant for Unified Communications as a Service, North America with Additional Regional Presence, 2012-2013: Magic Quadrant for Unified Communications as a Service, North America.

3 Gartner Magic Quadrant for Contact Center as a Service, Drew Kraus, Pri Rathnayake, Steve Blood, August 9, 2021.

4 Annualized Recurring Subscriptions and Usage (“ARR”) equals the sum of the most recent month of (i) recurring subscription amounts and (ii) platform usage charges for all CPaaS customers (subject to a minimum billings threshold for a period of at least six consecutive months), multiplied by 12.

| |||||

NOTICE OF THE 2022 ANNUAL MEETING OF STOCKHOLDERS

The 2022 Annual Meeting of Stockholders of 8x8, Inc. (“8x8” or the “Company”), a Delaware corporation, will be held at the date, time and place indicated below.

MEETING INFORMATION

JULY 12, 2022

9:00 a.m. Pacific Time

JULY 12, 2022

9:00 a.m. Pacific Time

All stockholders are cordially invited to virtually attend the 2022 Annual Meeting. We will be hosting the Annual Meeting via live webcast on the Internet. Any stockholder can listen to and participate in the Annual Meeting live via the Internet at www.virtualshareholdermeeting.com/8x82022. Stockholders may vote and ask questions while connected to the Annual Meeting on the Internet. You will not be able to attend the Annual Meeting in person. Instructions on how to participate in the Annual Meeting and demonstrate proof of stock ownership are posted at www.virtualshareholdermeeting.com/8x82022. However, to ensure your representation at the 2022 Annual Meeting, you are urged to vote as promptly as possible. Any stockholder of record virtually attending the 2022 Annual Meeting may vote even if he or she has previously returned a proxy. The items of business are summarized below and are described in more detail in the Proxy Statement accompanying this notice.

| ITEMS OF BUSINESS | |||||

| 1. | To elect eight directors to hold office until the 2023 Annual Meeting of Stockholders and until their respective successors have been elected and qualified. The Company’s nominees are Jaswinder Pal Singh, David Sipes, Monique Bonner, Todd Ford, Alison Gleeson, Vladimir Jacimovic, Eric Salzman and Elizabeth Theophille. | ||||

| 2. | To ratify the appointment of Moss Adams LLP as the Company’s independent registered public accounting firm for the fiscal year ending March 31, 2023. | ||||

| 3. | To approve, through an advisory vote, the Company’s executive compensation for the fiscal year ended March 31, 2022. | ||||

| 4. | To approve the Company’s 2022 Equity Incentive Plan, including the reservation of 8,000,000 new shares for issuance thereunder. | ||||

| 5. | To approve amendments to the Company’s Amended and Restated 1996 Employee Stock Purchase Plan, including the reservation of 3,600,000 additional shares for issuance. | ||||

| 6. | To approve an amendment to the Company’s Restated Certificate of Incorporation to increase the number of authorized shares of common stock from 200,000,000 to 300,000,000 shares. | ||||

RECORD DATE

Stockholders of record at the close of business on Tuesday, May 17, 2022 are entitled to notice of and to vote at the 2022 Annual Meeting or at any adjournments or postponements thereof.

STOCKHOLDER LIST

A list of stockholders entitled to vote will be available for 10 days prior to the Annual Meeting at our headquarters, 675 Creekside Way, Campbell, California 95008. If you would like to view the stockholder list, please contact our Investor Relations department at (408) 495-2524 to schedule an appointment or for alternative arrangements to the extent office access is impracticable due to the COVID-19 pandemic. In addition, a list of stockholders of record will be available during the Annual Meeting for inspection by stockholders of record for any legally valid purpose related to the Annual Meeting at www.virtualshareholdermeeting.com/8x82022.

By Order of the Board of Directors,

Jaswinder Pal Singh

Campbell, California

June 8, 2022

Jaswinder Pal Singh

Campbell, California

June 8, 2022

TABLE OF CONTENTS

| PAGE | |||||

| TABLE OF CONTENTS | ||||||||

PROPOSAL SIX — APPROVAL OF AMENDMENT TO OUR RESTATED CERTIFICATE INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES | |||||

CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS

This news release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Any statements that are not statements of historical fact may be deemed to be forward-looking statements. For example, words such as “may,” “will,” “should,” “estimates,” “predicts,” “potential,” “continue,” “strategy,” “believes,” “anticipates,” “plans,” “expects,” “intends,” and similar expressions are intended to identify forward-looking statements. These forward-looking statements include but are not limited to: changing industry trends, operational and economic impacts of the COVID-19 pandemic, new product innovations and integrations, market demand for our products, channel and e-commerce growth, sales and marketing activities, the future impact of the Fuze, Inc. acquisition on our operations and financial results, strategic partnerships, business strategies, improved customer acquisition and support costs, customer churn, future operating performance and efficiencies, financial outlook, revenue growth, and profitability. You should not place undue reliance on such forward-looking statements. Actual results could differ materially from those projected in forward-looking statements depending on a variety of factors, including, but not limited to: the impact of economic downturns on us and our customers, including the impacts of the COVID-19 pandemic; the conflict between Russia and Ukraine and related sanctions; inflationary pressures; rising interest rates; customer cancellations and rate of customer churn; customer acceptance and demand for our new and existing cloud communication and collaboration services and features, including voice, contact center, video, messaging, and communication APIs; competitive market pressures, and any changes in the competitive dynamics of the markets in which we compete; the quality and reliability of our services; our ability to scale our business; customer acquisition costs; our reliance on a network of channel partners to provide substantial new customer demand; timing and extent of improvements in operating results from increased spending in marketing, sales, and research and development; the amount and timing of costs associated with recruiting, training and integrating new employees and retaining existing employees; our reliance on infrastructure of third-party network services providers; risk of failure in our physical infrastructure; risk of defects or bugs in our software; risk of cybersecurity breaches; our ability to maintain the compatibility of our software with third-party applications and mobile platforms; continued compliance with industry standards and regulatory and privacy requirements, globally; introduction and adoption of our cloud software solutions in markets outside of the United States; risks relating to the acquisition and integration of Fuze, Inc. and other businesses we have acquired or may acquire in the future; risks related to our senior convertible notes and the related capped call transactions; and potential future intellectual property infringement claims and other litigation that could adversely impact our business and operating results.

For a discussion of such risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” in the Company’s reports on Forms 10-K and 10-Q, as well as other reports that 8x8, Inc. files from time to time with the U.S. Securities and Exchange Commission (the “SEC”). All forward-looking statements are qualified in their entirety by this cautionary statement, and 8x8, Inc. undertakes no obligation to update publicly any forward-looking statement for any reason, except as required by law, even as new information becomes available or other events occur in the future.

GARTNER DISCLAIMER

The Gartner content described herein (the "Gartner Content") represent(s) research opinion or viewpoints published as part of a syndicated subscription service by Gartner, Inc. ("Gartner") and are not representations of fact. Gartner Content speaks as of its original publication date (and not as of the date of this proxy statement) and the opinions expressed in the Gartner Content are subject to change without notice.

PROXY SUMMARY

The following is a summary of certain key information in our Proxy Statement. This is only a summary, and it may not contain all of the information that is important to you. For more complete information, please review the full Proxy Statement and our Annual Report on Form 10-K for the year ended March 31, 2022. In this Proxy Statement, we refer to 8x8, Inc. as “8x8,” the “Company,” “we” or “us,” and we refer to our fiscal year ended March 31, 2022 as “fiscal 2022” or “F2022.” Please note that the information on, or accessible through, our website is expressly not incorporated by reference in this Proxy Statement.

ELIGIBILITY TO VOTE

Stockholders of record at the close of business on Tuesday, May 17, 2022 are entitled to notice of and to vote at the 2022 Annual Meeting or at any adjournments or postponements thereof.

HOW TO VOTE

You may vote using any one of the following methods. In all cases, you should have your 16-Digit Control Number from your proxy card available and follow the instructions. Voting will be accepted until 11:59 p.m. (EDT) on July 11, 2022:

| Online at www.proxyvote.com |  | By Telephone at 1-800-690-6903 | |||||||||||||||||

| Online using your mobile device by scanning the QR Code |  | By mail by voting, signing and timely mailing your Proxy Card | |||||||||||||||||

MEETING INFORMATION

| Time and Date: | Tuesday, July 12, 2022 at 9:00 a.m. Pacific | |||||||

| Virtual Meeting Address: | www.virtualshareholdermeeting.com/8x82022 | |||||||

VOTING MATTERS AND BOARD RECOMMENDATIONS

The table below includes a brief description of each matter to be voted upon at the Annual Meeting, along with the voting recommendation of our board of directors, or “Board.”

| Description of Proposals | Board Vote Recommendation | Page Reference | ||||||||||||

| 1. | To elect eight directors to hold office until the 2023 Annual Meeting of Stockholders and until their respective successors have been elected and qualified. The Company’s nominees are Jaswinder Pal Singh, David Sipes, Monique Bonner, Todd Ford, Alison Gleeson, Vladimir Jacimovic, Eric Salzman and Elizabeth Theophille. | FOR each Company Nominee | ||||||||||||

| 2. | To ratify the appointment of Moss Adams LLP as the Company’s independent registered public accounting firm for the fiscal year ending March 31, 2023. | FOR | ||||||||||||

| 3. | To approve, through an advisory vote, the Company’s executive compensation for the fiscal year ended March 31, 2022. | FOR | ||||||||||||

| 4. | To approve the 8x8, Inc. 2022 Equity Incentive Plan, including the reservation of 8,000,000 new shares for issuance thereunder. | FOR | ||||||||||||

| 5. | To approve amendments to the Company’s Amended and Restated 1996 Employee Stock Purchase Plan, including the reservation of 3,600,000 additional shares for issuance. | FOR | ||||||||||||

| 6. | To approve an amendment to the Company’s Restated Certificate of Incorporation to increase the number of authorized shares of common stock from 200,000,000 to 300,000,000 shares. | FOR | ||||||||||||

8x8, Inc. | PROXY STATEMENT 1

| PROXY SUMMARY | ||||||||

DIRECTOR NOMINEES

In Proposal One, our stockholders are asked to vote on the election of the eight individuals nominated by the Board, each of whom is currently serving as a director. The tables below set forth basic information concerning each nominee individually and highlight certain qualifications, areas of expertise and attributes of our nominees collectively.

| Name | Age | Director Since | Principal Occupation | Independent | ||||||||||||||||||||||

Jaswinder Pal Singh(1) | 57 | 2013 | Professor of Computer Science, Princeton University | Yes | ||||||||||||||||||||||

| David Sipes | 55 | 2020 | Chief Executive Officer, 8x8, Inc. | No | ||||||||||||||||||||||

| Monique Bonner | 51 | 2018 | Board Director and Advisor | Yes | ||||||||||||||||||||||

| Todd Ford | 55 | 2019 | Board Director and Advisor | Yes | ||||||||||||||||||||||

| Alison Gleeson | 56 | 2021 | Board Director and Advisor | Yes | ||||||||||||||||||||||

| Vladimir Jacimovic | 58 | 2014 | Managing Partner of Continuum Capital Partners LLC | Yes | ||||||||||||||||||||||

| Eric Salzman | 55 | 2012 | Chief Executive Officer, Safeguard Scientifics, Inc. | Yes | ||||||||||||||||||||||

| Elizabeth Theophille | 55 | 2019 | Chief Technology Transformation Officer, Novartis AG | Yes | ||||||||||||||||||||||

(1)Dr. Singh has served as Chairman of the Board since December 10, 2020.

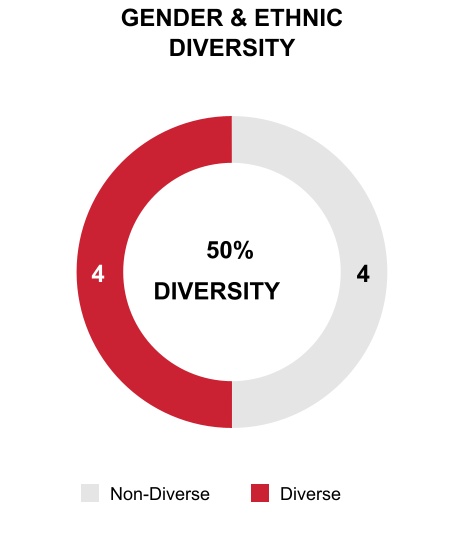

BOARD OF DIRECTORS SNAPSHOT

Ensuring the Board is composed of directors who bring diverse perspectives, experience and backgrounds to effectively represent the long-term interests of stockholders is a key priority of our Board. In this regard, the Board believes that conducting regular, periodic assessments of its composition and size is an important aspect of an effective governance structure. The Board seeks a balance between retaining directors with deep knowledge of our Company and our industry, while adding directors who bring new perspectives. Since the beginning of fiscal 2019, we have added five new Board members while taking steps to increase the Board’s breadth and depth of experience and diversity. In fiscal 2021, we appointed Dr. Singh from Lead Independent Director to Chairman of the Board. In fiscal 2022, we appointed Ms. Gleeson to the Board. Ms. Gleeson is a globally recognized executive who was previously Senior Vice President of the Cisco Americas organization, where she focused on evolving Cisco’s go-to-market strategy, strengthening relationships with top partners, and spearheading innovative solutions for customers.

2 8x8, Inc. | PROXY STATEMENT

| PROXY SUMMARY | ||||||||

CORPORATE GOVERNANCE HIGHLIGHTS (page 7)

We are committed to the highest standards of corporate governance. Our Governance and Nominating Committee monitors new and changing trends and best practices in corporate governance, considers whether we should make changes in light of these trends, and makes recommendations to the Board. The table below sets forth some highlights of our corporate governance programs and policies.

| Board and Committees | Management | Stockholders Rights and Engagement | ||||||||||||

•Separate Chairman and CEO roles. | •Robust executive and Board member stock ownership requirements, including a 6X ownership requirement for our CEO (ratio of value of equity ownership to base salary). | •We have a single-class share capital structure. Each issued and outstanding share of our stock is entitled to one vote per share on all matters submitted to the stockholders for a vote | ||||||||||||

▪Seven of our eight director nominees are independent, including all members of our three standing committees. | ▪We do not allow short sales, hedging or pledging of stock ownership positions, or transactions involving derivatives of our stock, by employees, management or Board members. | ▪We do not have a classified board structure or multi-year directorships. All of our directors are elected on an annual basis. | ||||||||||||

▪Our Board and each of its three standing committees conduct a formal assessment of its performance on an annual basis. | ▪Related party transactions involving management or a member of our Board require prior approval of the Audit Committee. | ▪Our capital structure and organizational documents do not reflect any “poison pill” provisions. | ||||||||||||

▪Regular executive sessions are conducted by the independent directors without management present, overseen by our independent Chairman of the Board. | ▪Executive compensation is reviewed by the Compensation Committee annually, with advice and data (including a benchmark analysis) provided by an independent compensation consultant. | ▪None of our officers or directors (nor any of their affiliates) has a controlling interest in our stock. Our officers and directors as a group hold less than 5% of our outstanding common stock. | ||||||||||||

▪Our Board adopted a CEO Absence Event Management Process in 2016, which was reviewed by the Governance and Nominating Committee in 2020 as part of our ongoing succession planning. | ▪A significant portion of each executive’s annual compensation is “at risk” and a significant portion of long-term equity incentive compensation depends on our stock performance relative to either the Russell 2000 index or the S&P Software and Services index. | ▪We do not have a super-majority approval requirement to amend any of our organizational documents. | ||||||||||||

▪Director compensation is reviewed by our Compensation Committee at least once every two years, per our Corporate Governance Principles, with advice and data provided by an independent compensation consultant. | ▪We have clawback rights under our 2012 equity incentive plan and our proposed 2022 equity incentive plan that permit us to recover long-term gains under specified circumstances. | ▪We have an active and ongoing stockholder outreach and engagement program. | ||||||||||||

▪Our Board has adopted a majority voting policy requiring (and each nominee for director has agreed) that if the nominee fails to receive more votes cast “FOR” his or her selection than “WITHHELD,” the nominee shall tender his or her resignation from the Board. | ||||||||||||||

8x8, Inc. | PROXY STATEMENT 3

| PROXY SUMMARY | ||||||||

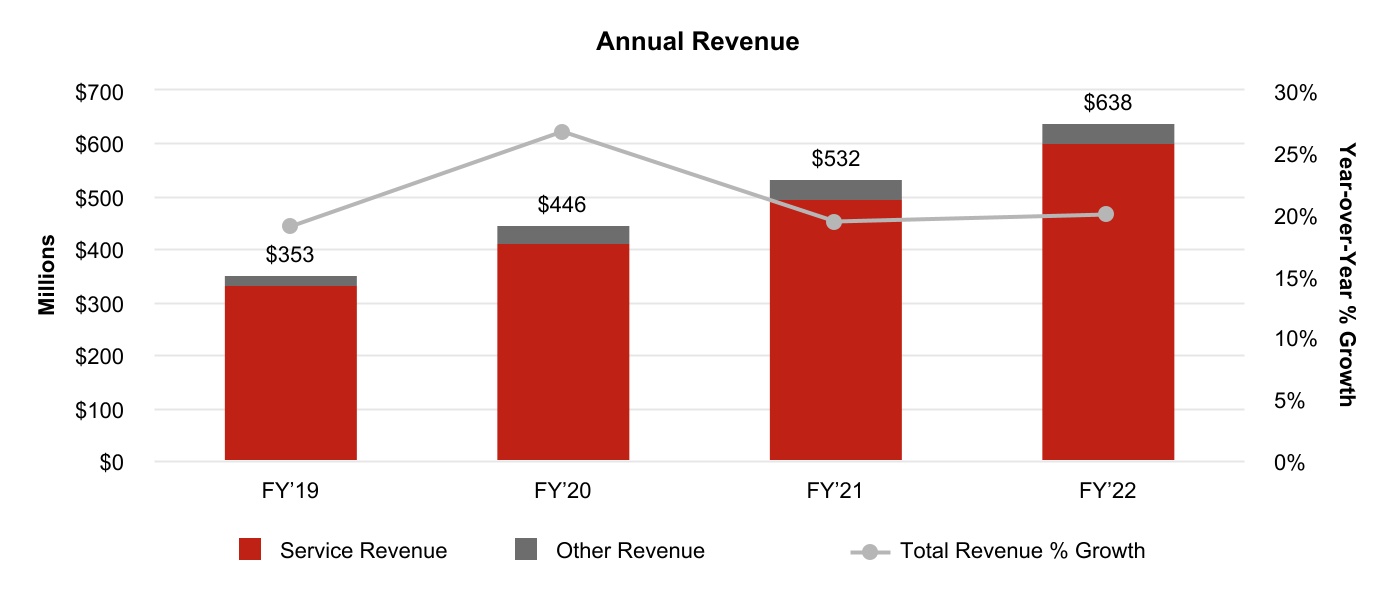

FISCAL 2022 BUSINESS HIGHLIGHTS

We address a large market opportunity as enterprises around the world recognize that an integrated, cloud-based unified communications and contact center solution is a critical component to meeting the requirements of a rapidly modernizing workforce. By continuing to innovate across our 8x8 XCaaS platform, we help organizations optimize employee and customer experience, regardless of location or device.

In fiscal 2022, we increased our investment in innovation, added industry-leading talent, expanded our enterprise customer base, and delivered improved financial results. Some of our business achievements and milestones during fiscal 2022 included the following:

▪Total revenue increased 20% from fiscal 2021 to $638.1 million. Total service revenue grew approximately 21% year-over-year to $602.4 million.

▪We ended the year with total ARR of $687.0 million, an increase of 33% year-over-year. ARR from our targeted enterprise and mid-market customers was $520.7 million, an increase of 49% from the end of fiscal 2021. Enterprise and mid-market customers accounted for 76% of total ARR at the end of fiscal 2022, compared to 68% at the end of fiscal 2021.

▪ARR for our integrated XCaaS solution increased 35% year-over-year to $239.0 million.

▪We achieved non-GAAP profitability and generated $34 million in cash flow from operations.

▪We completed the acquisition of Fuze, Inc. a privately held unified communications as a service company, for approximately $250 million in cash and stock. The acquisition increased our capacity for innovation, expanded our enterprise customer base, and created a large cross-sell opportunity for our contact center solution and integrated XCaaS platform. The acquisition was accretive to gross and operating profit in the fourth fiscal quarter.

▪We expanded our global coverage to 50 countries and territories, including industry-first offerings in Indonesia and the Philippines.

▪We accelerated innovation and introduced significant new enhancements to our XCaaS platform that leverage our the integration of unified communication and contact center capabilities in a single platform. 8x8 Frontdesk and 8x8 Agent Workspace are composed experiences that bridge the communications gap between knowledge workers and contact center agents to elevate both the employee and customer experience. Conversation IQ extends quality management and speech analytics across the organization using conversational artificial intelligence (AI).

▪We enhanced our enterprise-grade 8x8 Voice for Microsoft Teams with value-added features such as presence synchronization, call recording and Conversation IQ.

▪We invested in go-to-market strategies focused on our enterprise channel partners, which resulted in 33% year-over-year growth in channel ARR. We received a 5-Star rating by CRN in its Partner Program Guide for the second consecutive year.

▪We were named a Leader in the 2021 Gartner Magic Quadrant for Unified Communications as a Service, Worldwide for the tenth consecutive year and a Challenger in Magic Quadrant for Contact Center as a Service for the seventh consecutive year.

The graphs below illustrate our annual performance in key performance metrics:

4 8x8, Inc. | PROXY STATEMENT

| PROXY SUMMARY | ||||||||

8x8, Inc. | PROXY STATEMENT 5

| PROXY SUMMARY | ||||||||

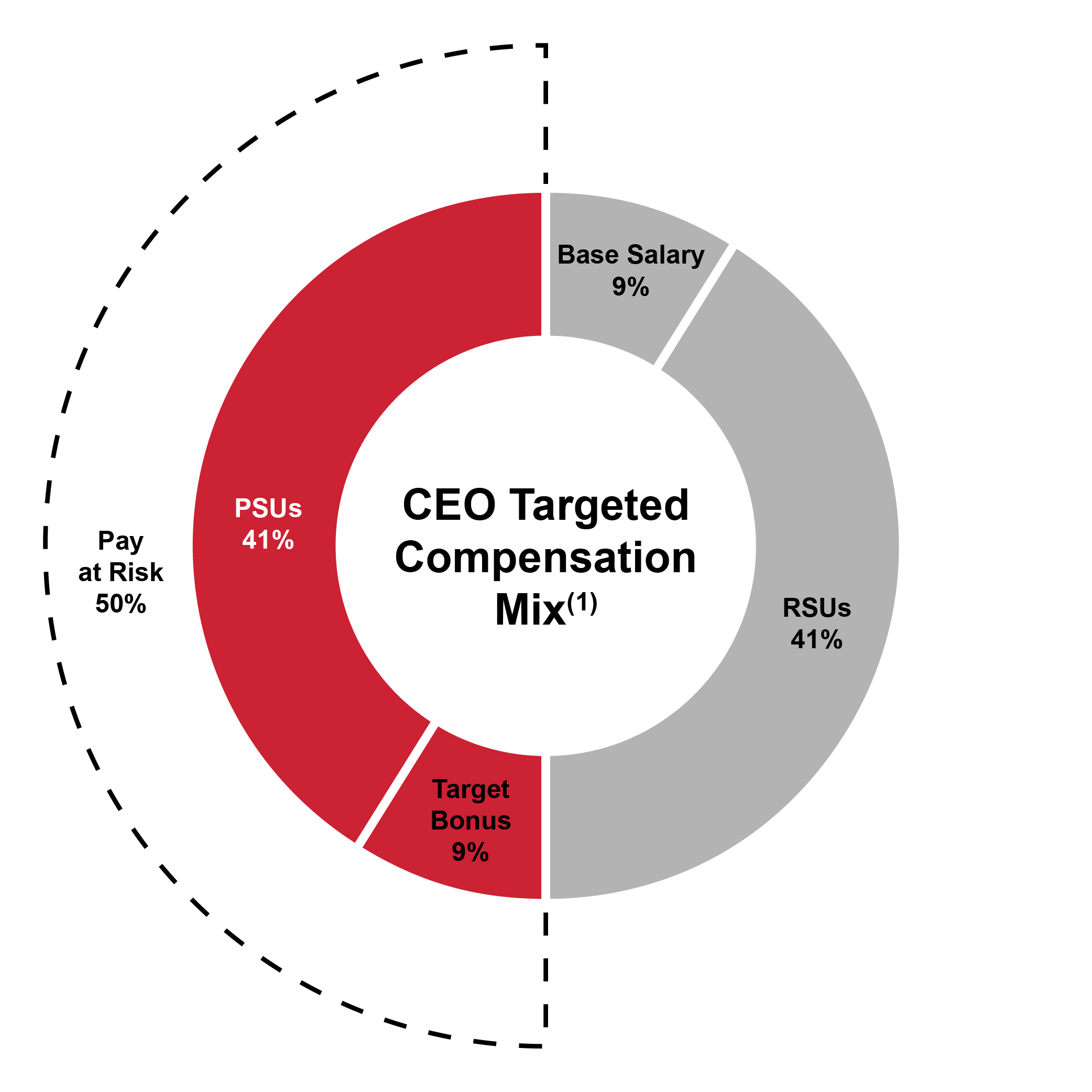

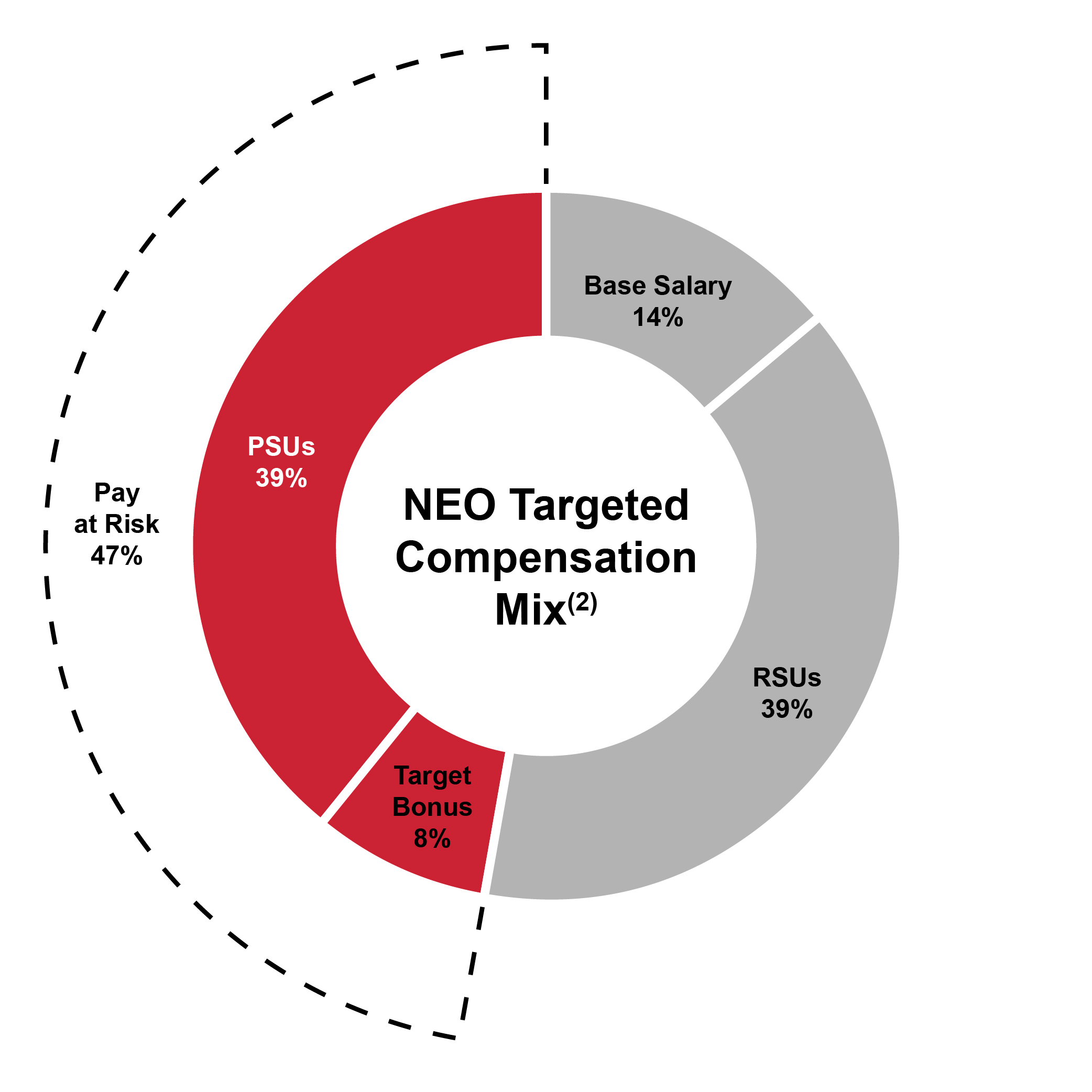

EXECUTIVE COMPENSATION HIGHLIGHTS (page 30)

We have designed our executive compensation program to:

▪Attract, develop, motivate and retain top talent and focus our executive officers on goals that increase long-term stockholder value;

▪Ensure executive compensation is aligned with our corporate strategies and business objectives;

▪Provide meaningful equity ownership opportunities to our executives to align their incentives with the creation of sustainable stockholder value;

▪Ensure fairness among our executives by recognizing the contributions each executive officer makes to our success, as well as his or her compensation history and experience level; and

▪Provide an incentive for long-term continued employment with us.

The table below lists some specific elements that our program possesses and avoids in turn.

| What We Have | What We Don’t Have | |||||||

▪An executive compensation program based on our “pay for performance” philosophy and aligned with peer compensation policies. | ▪No pension arrangements or non-qualified deferred compensation plans for our executive officers. | |||||||

▪Stock ownership guidelines for named executive officers and non-employee directors. | ▪No special health or welfare plans for our executive officers. | |||||||

▪100% independence of Compensation Committee members. | ▪No single-trigger acceleration of compensation or benefits for our executive officers in connection with a change-in-control. | |||||||

▪Regular review of executive target total direct compensation and long-term incentive compensation relative to peer companies of similar size, market capitalization, and operating characteristics. | ▪No “gross-ups” or other tax reimbursement payments on any severance or change-in-control payments or benefits for our executives. | |||||||

•Engagement of an independent compensation consultant to monitor compensation trends and advise the Compensation Committee. | •No “evergreen” provision in our Amended and Restated 2012 Equity Incentive Plan or proposed 2022 Equity Incentive Plan. | |||||||

•A substantial portion of the total value of annual equity awards granted to our executives (50%) is “at risk” based on the achievement of corporate and individual performance objectives, as well as our stock performance relative to stock market benchmark indices. | •No guaranteed incentive compensation or excessive severance payments. | |||||||

•Opportunity to receive annual bonus in shares in lieu of cash. | •No repricing of option awards without shareholder approval (except in connection with certain corporate events where a repricing is necessary for equitable treatment). | |||||||

•The long-term equity incentives granted to our named executive officers vest or are earned over multi-year periods, consistent with current market practice and our pay-for-performance and retention objectives. | ||||||||

6 8x8, Inc. | PROXY STATEMENT

CORPORATE GOVERNANCE

GOVERNANCE FRAMEWORK

As stated in our Corporate Governance Principles, our Board is the ultimate decision-making body of the Company, except with respect to matters reserved to the stockholders. The Board selects the Chief Executive Officer, who is charged with the conduct of the Company’s business. The Board acts as an advisor and counselor to senior management and ultimately monitors its performance. The fundamental objective of the Board is to build long-term sustainable growth in stockholder value for the Company.

In furtherance of this mission, we have adopted a comprehensive corporate governance framework designed to enable the Board, among other things, to:

▪provide effective oversight of the senior management team in connection with its conduct of the Company’s business and affairs;

▪allow the Board to make decisions independent of management;

▪align the interests of the Board and management with those of our stockholders; and

▪maintain compliance with the requirements of the New York Stock Exchange (the “NYSE”) and applicable law.

The framework helps determine our policies and practices with respect to Board composition, Board independence, Board and committee evaluations, executive compensation, stockholder engagement, risk oversight and more.

Copies of our current corporate governance documents and policies, including our Code of Business Conduct and Ethics, Corporate Governance Principles and committee charters, are available on the Investor Relations section of our website at http://investors.8x8.com. The Board reviews these corporate governance documents and policies at least every two years, and revises them when the Board determines it would serve the interests of the Company and its stockholders to do so, such as in response to changing governance practices or legal requirements.

BOARD COMPOSITION

CRITERIA FOR EVALUATING CANDIDATES. The Board, with input from the Governance and Nominating Committee, is responsible for periodically determining the appropriate skills, perspectives, experiences, and characteristics required of Board candidates, taking into account the Company’s needs and current make-up of the Board. Among other factors considered in the selection of each candidate, the Governance and Nominating Committee considers the following attributes, criteria and qualifications:

▪knowledge, experience, skills and expertise, particularly in areas critical to understanding the Company and its business;

▪ethnic and gender diversity;

▪personal and professional integrity and character;

▪business judgment;

▪time availability in light of other commitments, particularly service on the boards of other publicly-held companies;

▪dedication; and

▪conflicts of interest.

While the Governance and Nominating Committee has not established specific minimum qualifications for directors, the committee believes that candidates and nominees must reflect a Board that is comprised of directors who:

▪have strong integrity;

▪have qualifications that will enhance the overall effectiveness of the Board;

▪have the highest professional and personal ethics and values, and will conduct themselves consistently with our Code of Business Conduct and Ethics (the “Code of Ethics”);

▪will comply with our corporate governance, conflict of interest, confidentiality, stock ownership and insider trading policies and guidelines, and all other codes of conduct, policies and guidelines, as well as any relevant securities and other laws, rules, regulations and listing standards, in each case as applicable to members of the Board; and

▪satisfy other relevant standards that may be required by applicable rules and regulations, such as financial literacy or financial expertise with respect to prospective Audit Committee members.

As a matter of policy, the Board believes that a substantial majority of the directors should be independent within the meaning of the rules of the NYSE and the applicable independence requirements of the federal securities laws and regulations. The Board also believes that it is important to strike the right balance in its composition to ensure that there is an appropriate range and mix of expertise, diversity and knowledge.

8x8, Inc. | PROXY STATEMENT 7

| CORPORATE GOVERNANCE | ||||||||

DIVERSITY. In identifying candidates for the Board, the Governance and Nominating Committee considers foremost the qualifications and experience that the Committee believes would best suit the Board’s needs created by each particular vacancy. As part of the process, the Governance and Nominating Committee and the Board endeavor to have a Board composed of individuals with diverse backgrounds, viewpoints, and life and professional experiences, provided that such individuals should all have a high level of management and/or financial experience. While the Company has no formal diversity policy that applies to the consideration of director candidates, the Governance and Nominating Committee has determined that diversity should be an important consideration in the selection of candidates, and that the Board should be comprised of members who reflect diversity not only in race and gender, but also in viewpoints, experiences, backgrounds, skills and other qualities and attributes.

Consistent with commitments we made to our stockholders in connection with our 2018 annual meeting, the Board has since added three female members and increased ethnic diversity.

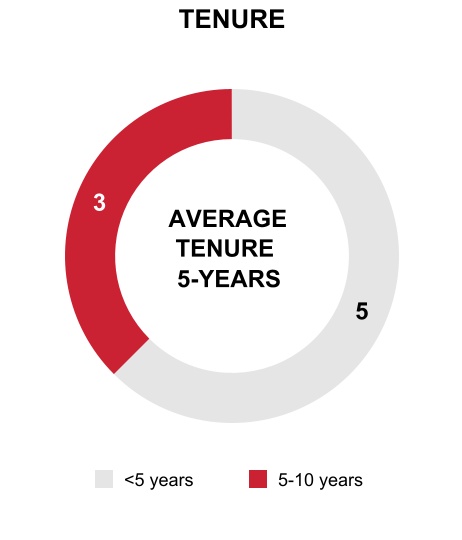

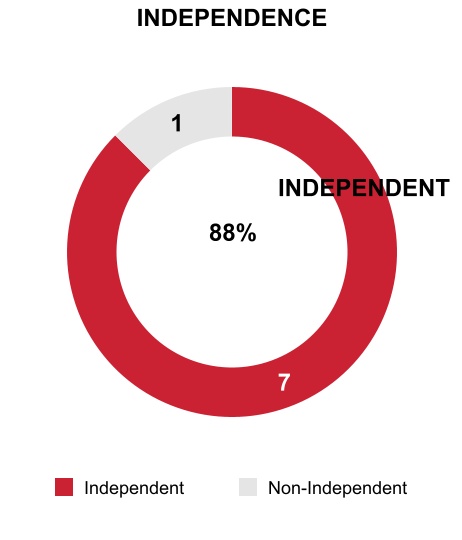

REFRESHMENT OF THE BOARD. Since our 2021 annual meeting, we appointed a new Board member, Alison Gleeson. Seven of our eight Board members, including the Chairman of the Board, are independent within the meaning of the rules of the NYSE and the applicable independence requirements of the federal securities laws and regulations. Since our 2018 annual meeting, we have replaced four members of our Board and expanded the size of the Board from seven to eight members. Each of the five added directors is nominated for re-election at the 2022 annual meeting. Importantly, since our 2018 annual meeting, the average tenure of our Board members has declined from 9.1 to 4.6 years, gender diversity has increased from 0% to 43%, and ethnic diversity has also increased. These changes reflect the Board’s commitment to bringing in fresh perspectives and increasing ethnic and gender diversity. The table compares the composition of our board in 2018 to today:

Board Composition Metrics

| 2018 | 2022 | |||||||

| Average Tenure | 9.1 years | 4.6 years | ||||||

| Independence | 71% | 88% | ||||||

| Gender Diversity | —% | 43% | ||||||

| Ethnic Diversity | 29% | 43% | ||||||

These changes to our Board and its three standing committees are explained in more detail below.

| CHANGES SINCE 2018 ANNUAL MEETING | ||

| AUGUST 5, 2021: Alison Gleeson appointed as a new director. | ||

▪Ms. Gleeson appointed to the Board based on her extensive enterprise sales and go-to-market experience, filling a vacancy left by Bryan Martin when he did not stand for re-election at the 2021 annual meeting. | ||

▪Ms. Gleeson appointed as a member of the Compensation Committee. | ||

| DECEMBER 10, 2020: David Sipes appointed as new CEO and as a new director, replacing Vikram Verma; Dr. Singh appointed as Chairman | ||

▪Mr. Sipes appointed as CEO and to the Board based on his high-growth cloud and SaaS industry experience, replacing Mr. Verma, who stepped down from the Board when he resigned as CEO in December 2020. | ||

▪Our Lead Independent Director Dr. Singh appointed as Chairman of the Board, replacing Mr. Martin, who did not stand for re-election at the 2020 annual meeting. | ||

| JUNE 19, 2019: Elizabeth Theophille appointed as a new director. | ||

▪Ms. Theophille appointed to the Board based on her experience with digital transformation in cloud-based solutions and European market expertise, filling a future vacancy that would be created by Mr. Potter when he did not stand for re-election at the 2019 annual meeting. | ||

▪Ms. Theophille appointed as a member of the Governance and Nominating Committee. | ||

▪Board size increased temporarily from eight to nine members and reverted to eight members concurrently with election of directors at the 2019 annual meeting. | ||

| JUNE 1, 2019: Todd Ford appointed as a new director, succeeding Major General Guy L. Hecker, Jr. | ||

▪Mr. Ford appointed to the Audit Committee based on his financial experience in SaaS business models and adjacent markets, filling a vacancy left by Gen. Hecker’s departure, and named Chair of Audit Committee, succeeding Mr. Potter in that role. | ||

▪Mr. Ford appointed as a member of the Compensation Committee, increasing its size from three to four members. | ||

8 8x8, Inc. | PROXY STATEMENT

| CORPORATE GOVERNANCE | ||||||||

| MAY 6, 2019: Major General Guy L. Hecker, Jr. retired from the Board. | ||

▪Dr. Singh appointed as Lead Independent Director, succeeding Gen. Hecker in that role. | ||

▪Dr. Singh appointed as a member of the Compensation Committee, filling a vacancy left by Gen. Hecker’s departure. | ||

▪Dr. Singh appointed as a member of the Governance and Nominating Committee, filling a vacancy left by Gen. Hecker’s departure. | ||

▪Ms. Bonner was appointed Chair of the Governance and Nominating Committee, filling a vacancy left by Gen. Hecker’s departure. | ||

▪Board size increased from seven to eight directors. | ||

▪Ms. Bonner appointed as a member of the Audit Committee, replacing Dr. Singh. | ||

▪Ms. Bonner appointed as a member of the Governance and Nominating Committee, increasing its size from two to three members. | ||

The Board has not established term limits in the belief that compulsory retirement from the Board could cause the Board to lose the valuable contributions of directors who have developed unique perspectives and insight into the Company. As an alternative to term limits, the Governance and Nominating Committee reviews each director’s continuing contribution to the Board as part of the annual assessment process and whenever a director experiences a change in professional responsibilities. These regular reviews ensure that the collective skills and experience of our Board members continue to match the needs of the Company and best serve the interests of our diverse community of stakeholders. Every Board member is expected to ensure that he or she devotes the time necessary to discharge his or her duties as a director effectively and that other existing and planned future commitments do not materially interfere with his or her service.

| STEP 1 | è | STEP 2 | è | STEP 3 | è | STEP 4 | ||||||||||||||

| Identify optimum board profile to drive corporate growth, including experience, skills, expertise, diversity, personal and professional integrity, and business judgement. | Review suitability for continued board service for each board member based on optimum board profile | Identify, recruit and interview potential candidates to board positions, including candidates recommended by stockholders | Recommend to the board the director nominees for election to the board | |||||||||||||||||

IDENTIFYING AND EVALUATING DIRECTOR NOMINEES. The Board is responsible for selecting and nominating candidates for election by the stockholders and for filling vacancies on the Board. The Governance and Nominating Committee recommends to the Board (a) first-time nominees for election, based on the need for new Board members as identified by the Governance and Nominating Committee and the Chairman or other Board members, as well as (b) incumbent directors for re-election, as appropriate.

The Governance and Nominating Committee reviews the composition of the Board at least annually with the Board as a whole and, if necessary, recommends measures to be taken so that the Board (a) reflects the appropriate balance of knowledge, experience, skills, expertise and diversity required for the Board as a whole to continue to provide effective oversight and otherwise fulfill its fiduciary and other duties, and (b) contains at least the minimum number of independent directors required by the NYSE and any other applicable law, rule or regulation.

In selecting individuals for nomination, the Governance and Nominating Committee seeks the input of the Chairman of the Board and other Board members and may use a third-party search firm to assist in identifying and contacting candidates who meet the expertise, personal integrity, and diversity criteria established by the Committee. The Governance and Nominating Committee will also consider individuals recommended for Board membership by our stockholders, in accordance with our bylaws and applicable law.

Prospective candidates are interviewed by our Chairman of the Board, our Chief Executive Officer, and at least one member of the Governance and Nominating Committee. During the selection process, the full Board is kept informed of progress. The Governance and Nominating Committee will consider the suitability of each candidate, including the current members of the Board, in light of the current size and composition of the Board. In evaluating the qualifications of the candidates, the Governance and

8x8, Inc. | PROXY STATEMENT 9

| CORPORATE GOVERNANCE | ||||||||

Nominating Committee may consider many factors, as discussed above. The Governance and Nominating Committee does not intend to alter the manner in which it evaluates candidates, based on whether the candidate was recommended by a stockholder or not.

The Governance and Nominating Committee meets to consider and recommend final candidate(s) for approval by the Board. Once a candidate is selected for appointment to the Board, or to stand for election or re-election, as applicable, the Chairman extends the invitation to join the Board, or to stand for election or re-election, on the Board’s behalf.

Upon completion of its review and evaluation of the candidates in May 2022, our Governance and Nominating Committee recommended the candidates named in this Proxy Statement, which the full Board approved.

Stockholder Nominations and Recommendations

The Governance and Nominating Committee will consider any recommendations and nominations for candidates to the Board from stockholders, as required by its charter. When submitting candidates for nomination to be elected at an annual or special meeting of stockholders, stockholders must follow the notice procedures and provide the information required in our by-laws. The following is a partial summary of those procedures and requirements.

Stockholder recommendations for candidates to the Board must be sent in writing to our Secretary at the address of our principal executive offices, currently 675 Creekside Way, Campbell, CA 95008. To be timely, a stockholder’s notice proposing the nomination of a director at an annual meeting must be delivered to or mailed and received at our principal executive offices not less than 90 calendar days nor more than 120 calendar days in advance of the first anniversary of the previous year’s annual meeting of stockholders. If no annual meeting was held in the previous year or the date of the annual meeting is more than 30 calendar days earlier than the date contemplated at the time of the previous year’s proxy statement, notice must be received not later than the close of business on the 10th day following the day on which the date of the annual meeting is publicly announced. A timely notice for the nomination of a director by a stockholder at a special meeting of stockholders must be delivered to or mailed and received at our principal executive offices not later than the close of business on the later of (a) the 90th day prior to the special meeting, and (b) the 10th day following the day on which public disclosure of the date of the special meeting is first made.

The stockholder’s notice must include certain information about the stockholder (and all persons participating with the stockholder in any proxy solicitation for the proposal) and certain information about the candidate, as set forth in our by-laws, including, but not limited to, the candidate’s name, age, business address and residence address, the candidate’s principal occupation or employment for the past 5 years, the stockholder’s name and address, the class and number of shares of our stock and other securities, including derivatives, beneficially owned by the proposing stockholder and by such candidate, any short interest in any of our securities held by the proposing stockholder, all voting rights with respect to our stock beneficially owned by the stockholder and others joining in the proposal, and a description of all arrangements or understandings between the stockholder making such recommendation and each candidate and any other person or persons (naming such person or persons) pursuant to which the recommendations are to be made by the stockholder, as well as any other information relating to such recommended candidate that is required to be disclosed in solicitations of proxies for elections of directors, or is otherwise required, in each case pursuant to Regulation 14A under the Exchange Act.

In addition, if requested, the proposed nominee must furnish additional information to determine whether he or she is eligible to serve as an independent director or that could be material to a reasonable stockholder’s understanding of the independence, or lack thereof, of the proposed nominee, as set forth in our by-laws.

We encourage stockholders to refer to our by-laws for complete information regarding the requirements for submitting stockholder proposals and nominating director candidates. You may contact us at 8x8, Inc., Attn: Secretary, 675 Creekside Way, Campbell, CA 95008, for a copy of the relevant by-law provisions on this topic. Our by-laws also can be found where our filed reports are located on the SEC’s website at http://www.sec.gov.

BOARD SIZE AND STRUCTURE. The Board periodically reviews its size, assesses its ability to function effectively based on its size and composition, and determines whether any changes to the size of the Board are appropriate. As described above, the size of our Board increased from seven to eight members during our 2019 fiscal year with the appointment of Monique Bonner. We believe that an eight-member Board is suited to the size of our current operations and otherwise appropriate to allow the Board to function effectively.

Dr. Singh, formerly our Lead Independent Director, was appointed to the Chairman role in December 2020, replacing Bryan Martin, who did not stand for reelection. With Dr. Singh’s appointment, it was no longer necessary to have a Lead Independent Director. While our Corporate Governance principles do not require that the roles of Chairman and Chief Executive Officer be held by different individuals, the Board believes that the separation of the offices of the Chairman and Chief Executive Officer is appropriate at this time because it allows our Chief Executive Officer to focus primarily on our business strategy, operations and corporate vision. In accordance with governance best practices, if, in the future, the Chairman role is held by a non-independent Director, then our Corporate Governance Principles require the appointment of a Lead Independent Director from among the independent members of the Board. These principles reflect our belief that it is important for the Board to retain flexibility to determine whether the two roles should be separate or combined, and whether the Chairman should be independent or not, based upon the Board’s assessment of the Company’s needs and leadership at a given point in time.

10 8x8, Inc. | PROXY STATEMENT

| CORPORATE GOVERNANCE | ||||||||

DIRECTOR INDEPENDENCE

The rules of the NYSE require that a majority of our directors be independent within the meaning of those rules. In addition, our Corporate Governance Principles require that a substantial majority of our directors be independent.

For a director to be considered independent under the NYSE rules, our Board must affirmatively determine that the director:

▪has no material relationship with 8x8, any of our subsidiaries, or any member of our management, either directly or indirectly (for example, as a partner, stockholder or officer of an organization that has a relationship with us); and

▪satisfies each of the requirements under Rule 303A.02(b) of the NYSE rules.

The Board has adopted a definition of independence which conforms to the above independence requirements in the NYSE listing rules and further requires a director not to have any relationship (material or otherwise, and including social relationships) that would reasonably be expected to impair his or her exercise of independent judgment in carrying out the responsibilities of a director.

We believe it is important that, in making a determination of independence, our Board broadly consider all relevant facts and circumstances. In particular, when assessing the materiality of a director’s relationship with us (whether commercial, consulting, charitable, familial or otherwise), our Board considers the issue not merely from the standpoint of the director, but also from that of persons or organizations with which the director has an affiliation.

In addition, in affirmatively determining the independence of any director who will serve on our Compensation Committee, our Board must consider all factors specifically relevant to determining whether the individual has a relationship to us which is material to that director’s ability to be independent from management in connection with the duties of a Compensation Committee member.

These factors include:

▪the source of compensation of the director, including any consulting, advisory or other compensatory fee paid by the listed company to such director; and

▪whether such a director is affiliated with 8x8, a subsidiary of 8x8 or an affiliate of a subsidiary of 8x8.

When considering the sources of a director’s compensation in this context, the Board considers whether the director receives compensation from any person or entity that would impair his or her ability to make independent judgments about the listed Company’s executive compensation. When considering an affiliate relationship a director has with the Company, a subsidiary of the Company, or an affiliate of a subsidiary of the Company, in determining his or her independence for purposes of Compensation Committee service, the board considers whether the affiliate relationship places the director under the direct or indirect control of 8x8 or our senior management, or creates a direct relationship between the director and members of senior management, in each case of a nature that would impair his or her ability to make independent judgments about the listed Company’s executive compensation.

Our Board has determined that seven of its eight current nominees for re-election, who are all current members, are “independent” within the meaning of Rule 303A.02 of the NYSE rules and under our own definition of independence:

| Independent | Not Independent | |||||||

| Jaswinder Pal Singh | David Sipes | |||||||

| Monique Bonner | ||||||||

| Todd Ford | ||||||||

| Alison Gleeson | ||||||||

| Vladimir Jacimovic | ||||||||

| Eric Salzman | ||||||||

| Elizabeth Theophille | ||||||||

In making these determinations, the Board affirmatively determined that there are no business relationships that are material or that would interfere with the exercise of independent judgment by any of the independent directors in their service on the Board or its committees.

In making this determination with respect to Mr. Ford, the Board considered, among other factors, that Coupa Software, Inc. (“Coupa”), of which Mr. Ford was the former Chief Financial Officer, is both a customer of the Company (in that we received payments of approximately $22,000 from Coupa during fiscal 2022) and a vendor to the Company (in that we made payments of approximately $66,000 to Coupa during fiscal 2022). The Board considered the materiality of these arrangements from the

8x8, Inc. | PROXY STATEMENT 11

| CORPORATE GOVERNANCE | ||||||||

perspective of both the Company and Coupa, and took into account the fact that Coupa became a customer of the Company several years before Mr. Ford joined the Board, in making its determination regarding Mr. Ford’s independence.

Each of the Board’s Audit Committee, Compensation Committee and Governance and Nominating Committee is composed solely of independent directors in accordance with the NYSE listing rules.

BOARD MEETINGS AND ATTENDANCE

The Board held a total of seven meetings during fiscal 2022. None of the members of our Board standing for reelection attended less than 75% of the meetings of the Board during fiscal 2022.

Pursuant to our Corporate Governance Principles, members of the Board are encouraged, but are not required, to attend each annual meeting of stockholders. One of our directors attended last year’s annual meeting of stockholders held in August 2021.

COMMITTEES

The Board has three standing committees: an Audit Committee, a Compensation Committee and a Governance and Nominating Committee.

The Board has adopted charters for each of these committees that are available on the investor relations section of our website under “Corporate Governance”, which can be found at http://investors.8x8.com. Each committee reviews its charter on an annual basis and makes recommendations to the Board for any changes based on its review. The composition of each standing committee is indicated in the table below.

| Director | Independent | Audit | Compensation | Governance and Nominating | Other Role | ||||||||||||

| Jaswinder Pal Singh | Yes |  |  | Chair(1) | |||||||||||||

| David Sipes | No | ||||||||||||||||

| Monique Bonner | Yes |  |  | ||||||||||||||

| Todd Ford | Yes |  |  | ||||||||||||||

| Alison Gleeson | Yes |  | |||||||||||||||

| Vladimir Jacimovic | Yes | ||||||||||||||||

| Eric Salzman | Yes |  |  | ||||||||||||||

| Elizabeth Theophille | Yes |  | |||||||||||||||

| = Committee Chair |  | = Committee member | Chair = Chairman of the Board | ||||||||||

(1)The information presented in this table is as of the date of this Proxy Statement, unless stated otherwise.

12 8x8, Inc. | PROXY STATEMENT

| CORPORATE GOVERNANCE | ||||||||

| Audit Committee | |||||||||||

Current Members: Todd Ford Monique Bonner Eric Salzman Current Chair: Todd Ford Former Members Who Served During F2022: None | Purpose: The Audit Committee oversees our corporate accounting and financial reporting process and performs several functions in the execution of this role. Fiscal 2022 Meetings: 4 | ||||||||||

Responsibilities of the Audit Committee include: ▪Evaluates the performance of and assesses the qualifications of the independent auditors ▪Determines whether to retain or terminate the existing independent auditors or to appoint and engage new independent auditors. Reviews and approves the retention of the independent auditors to perform any proposed permissible non-audit services ▪Confers with management and the independent auditors regarding the effectiveness of internal controls over financial reporting ▪Discusses with management and the independent auditors the results of the annual audit and the results of the reviews of our quarterly financial statements ▪Reviews and approves all business transactions between us and any director, officer, affiliate or related party, including transactions required to be reported in our Proxy Statement ▪Oversees the Company’s internal audit function, risk management processes, and system of internal controls Independence: The Board has determined that each of the current members meets the requirements for membership to the Audit Committee, including the independence requirements under NYSE Rules 303A.02 and SEC Rule 10A-3(b)(i), and is financially literate in accordance with the additional audit committee requirements of NYSE Rule 303A.07. The Board has identified Mr. Ford as an “audit committee financial expert” as defined under Item 407(d)(5)(ii) of Regulation S-K, but that status does not impose duties, liabilities, or obligations that are greater than the duties, liabilities, or obligations otherwise imposed on him as a member of our Audit Committee or our Board. | |||||||||||

| Compensation Committee | |||||||||||

Current Members: Eric Salzman Jaswinder Pal Singh Todd Ford Alison Gleeson Current Chair: Eric Salzman Former Members Who Served During F2022: None | Purpose: The Compensation Committee reviews and recommends compensation arrangements for the Chief Executive Officer for approval by the independent members of the Board and approves the compensation arrangements for all other executives at the level of senior vice president and above. Fiscal 2022 Meetings: 4 | ||||||||||

Responsibilities of the Compensation Committee include: ▪Recommends the compensation of the Chief Executive Officer to the independent members of the Board for approval ▪Reviews and approves corporate goals and objectives relevant to CEO compensation and evaluates the CEO’s performance in light of those goals and objectives ▪Approves, in consultation with the Chief Executive Officer, the compensation of all other executive officers ▪Oversees our human capital management efforts, including talent acquisition and retention ▪Administers our stock-based award and employee stock purchase plans, as well as our employee bonus plan ▪Reviews and approves all employment, severance and change-in-control agreements, and special or supplemental benefits applicable to executive officers ▪Engages independent compensation consulting firm to advise on executive compensation Independence: The Board has determined that each of the current members meets the requirements for membership to the Compensation Committee, including the independence requirements of the SEC and the NYSE listing standards under Rule 303A.05. | |||||||||||

8x8, Inc. | PROXY STATEMENT 13

| CORPORATE GOVERNANCE | ||||||||

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Compensation Committee of the Board currently consists of Mr. Salzman, Mr. Ford, Dr. Singh and Ms. Gleeson. None of these individuals is currently an officer or employee of ours or was an officer or employee of ours at any time during fiscal 2022. None of our executive officers or directors served as a member of the board or compensation committee of any entity that had one or more executive officers serving as a member of the Board or our Compensation Committee at any time during fiscal 2022.

| Governance and Nominating Committee | |||||||||||

Current Members: Monique Bonner Jaswinder Pal Singh Elizabeth Theophille Current Chair: Monique Bonner Former Members Who Served During F2022: Eric Salzman | Purpose: The Governance and Nominating Committee identifies and recommends to the Board individuals qualified to serve as directors of the Company, advises the Board with respect to its committees’ composition, oversees the evaluation of the Board, and oversees other matters of corporate governance. Fiscal 2022 Meetings: 4 | ||||||||||

Responsibilities of the Governance and Nomination Committee include: ▪Identifies, reviews and evaluates candidates to serve as directors of the Company, consistent with criteria approved by the Board and set forth in the committee’s charter ▪Recommends to the Board candidates for election to the Board, making recommendations to the Board regarding the membership of the committees of the Board ▪Reviews and evaluates the suitability of incumbent directors for continued service on the Board (including those recommended by stockholders) ▪Develops and recommends to the Board for approval Corporate Governance Principles and advises on succession plans for the CEO and other executive officers ▪Oversees our environmental and social responsibility programs ▪Reviews and formalizes proposals to amend our certificate of incorporation and by-laws ▪Adopts the procedures pursuant to which the Board and each Committee is to conduct an annual evaluation of its own performance and reviews the results of these evaluations and makes recommendations to the Board ▪Reviews CEO succession plan and unexpected absence event policy with CEO Independence: Pursuant to the charter of the Governance and Nominating Committee, all members of the Governance and Nominating Committee must be qualified to serve under the NYSE listing rules and any other applicable law, rule regulation and other additional requirements that the Board deems appropriate. The Board has determined that each of the three current members meet these requirements. | |||||||||||

CODE OF BUSINESS CONDUCT AND ETHICS

We are committed to maintaining the highest standards of business conduct and ethics. Our Code of Ethics reflects the values and the business practices and principles of behavior that support this commitment. The Code of Ethics is available on the investor relations section of our website under “Corporate Governance”, which can be found at http://investors.8x8.com. We will post any amendment to, or a waiver from, a provision of the Code of Ethics that are required to be disclosed by the rules of the SEC or NYSE on our website at http://investors.8x8.com.

Our Board updated our Code of Ethics in March 2019 to add new provisions that reflect our commitment to environmental stewardship, sustainability, human rights and fair labor practices. While these have always been important concerns for us as an organization, inclusion in our Code of Ethics formalizes our commitment. We are incorporating these principles into the design of our core business procedures, and we expect to continue to do so in the future as we grow and scale our business.

14 8x8, Inc. | PROXY STATEMENT

| CORPORATE GOVERNANCE | ||||||||

SHAREHOLDER ENGAGEMENT

We believe that effective corporate governance includes regular, constructive conversations with our stockholders on a broad range of governance and business topics, including our business strategy and execution, our executive compensation philosophy and approach, governance topics, and our culture and human capital management.

In fiscal 2021 ended March 31, 2021, we participated in more than 170 virtual meetings with institutional stockholders representing more than 40% of our total shares outstanding. We met regularly with 6 of our top 10 stockholders (100% of our non-index, non-broker holders in the top 10), who collectively represented approximately 30% of shares outstanding. This included direct engagement by our second largest holder, Sylebra, with our lead independent director. The primary topic in these meetings was corporate performance, including revenue growth, negative cash flow, lack of profitability and available cash resources. As a direct result of our engagement with our top holders, especially 3 of our top 5 holders, we named Samuel Wilson as Chief Financial Officer in June 2020 (replacing Steven Gatoff) and David Sipes as Chief Executive Officer in December 2020 (replacing Vikram Verma). The market responded favorably to the appointment of Mr. Sipes, resulting in a 35% increase in our stock price the day following the CEO transition announcement. The one-day appreciation in our stock price increased the calculated value of the equity portion of Mr. Sipes’ new hire package from $18 million to $27 million, as discussed further in the Executive Compensation section below.

Although our executive compensation practices had not been raised as a concern by stockholders during our engagement with holders in the prior 12-month engagement cycle, we proactively made the following changes to our executive compensation program for Fiscal 2022:

•We revised our executive severance and change in control policies to standardize payouts for our executives and more closely align with the practices of other technology companies based in Silicon Valley. We do not intend to offer large, non-standard payments to departing executives in the future.

•We added non-GAAP gross profit to revenue as a performance metric for our short-term incentive compensation program. We believe that adding gross profit to revenue as a performance metric aligns short term incentive pay with our short-term performance objectives because cost of goods sold is our single largest expense category, and improved gross profit performance relative to revenue growth demonstrates improved unit economics, a key driver in achieving profitable growth. Achieving non-GAAP profitability was consistently stated as an important milestone in our discussions with stockholders who told us they believed showing increasing gross profit will be an important factor in achieving a higher valuation for our stock.

These changes were made prior to the advisory vote on Fiscal 2021 executive compensation, and reflect our intention to align our executive compensation programs with industry practices and stockholder interests. Our changes to our executive severance and change in control policy address one of the issues that resulted in an increase in “against” votes in 2021. Further, while we feel that Dave Sipes' new hire award was appropriate to induce him to join the company, and aligned with similar awards offered to similar caliber of candidates at other companies, we understand the concerns of the shareholders that voted against our program last year and are committed to not making any similar large, one-time discretionary awards during the period covered by his new hire award.

In fiscal 2022 ended March 31, 2022, we expanded our investor relations team and participated in more than 185 virtual meetings or calls with our stockholders, who collectively represented approximately 50% of shares outstanding (approximately 55% of shares held by our top 10 stockholders and 100% of our non-index, non-broker holders in the top 10). Topics included corporate strategies to achieve long-term growth and profitability goals, the competitive environment in unified communications, acquisition strategies, capital structure, and culture and employee retention in a highly competitive market for talent. 8x8 participants included our investor relations team, our CFO, our CEO, our CTO, our CPO, and our Chief Legal Officer. Stockholder feedback on our strategies and financial performance was reported to our Audit Committee by our CFO and stockholder feedback regarding executive compensation was reported to our Compensation Committee by our Chief Legal Officer.

With respect to our executive compensation programs, our stockholders:

•Understood the non-recurring nature of Mr. Sipes new hire package in fiscal 2021 and that Mr. Sipes’ compensation package, including equity incentive compensation, for fiscal 2022 and subsequent years would be consistent with compensation packages offered to on-going executives at comparable companies (as compared to a new hire equity compensation package designed to induce an executive to join the company and align with the long term interests of stockholders).

•Appreciated our proactive changes to our executive severance policy and the addition of a profitability metric to our short-term incentive performance achievement milestones.

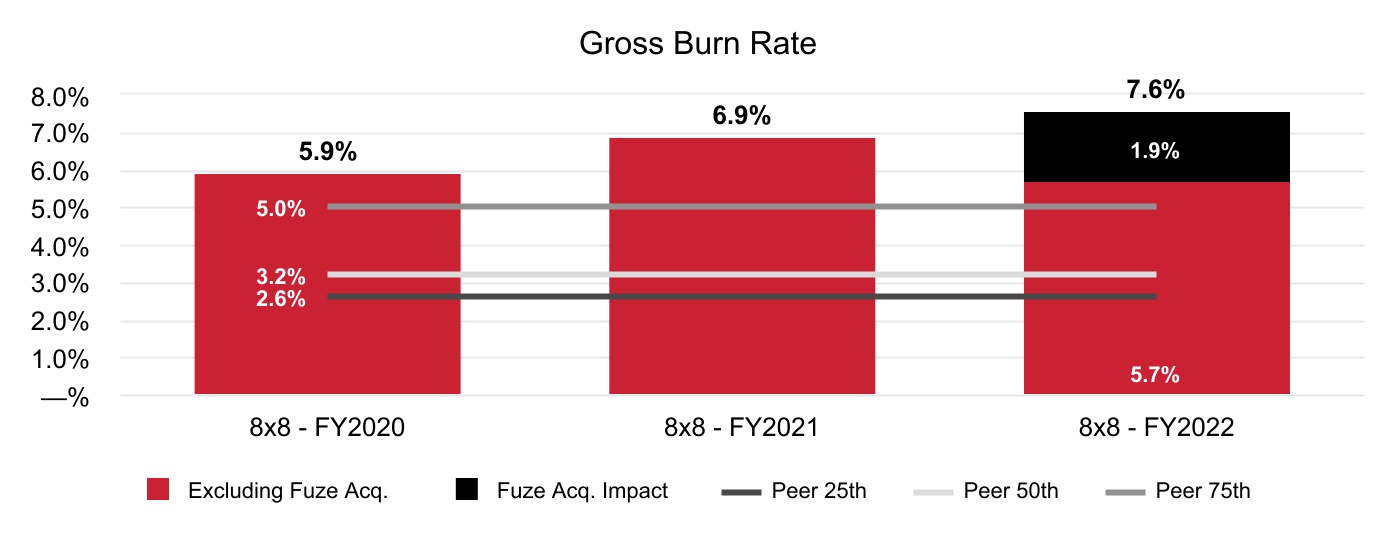

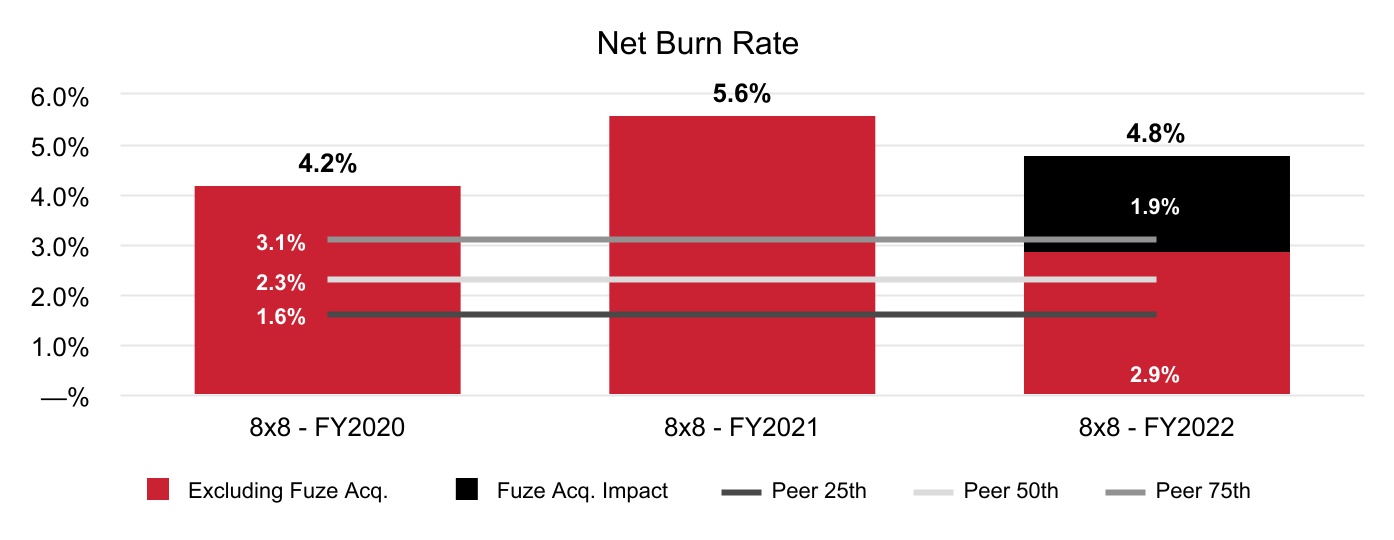

Additionally, in discussions regarding stock-based compensation, stockholders appreciated our longer-term objective of reducing the dilutive effect of equity compensation and acknowledged our improvement during the year, excluding the Fuze, Inc. acquisition – see below in the “Compensation Discussion & Analysis” section for further discussion of our stock based compensation historically relative to peers. They also recognized the need to attract and retain highly qualified executives and employees to

8x8, Inc. | PROXY STATEMENT 15

| CORPORATE GOVERNANCE | ||||||||

achieve our growth and profitability objectives, as well as the extraordinarily competitive current environment for talent, especially in the U.S.

In Fiscal 2023, we intend to expand our stockholder engagement efforts, as well as increase direct participation of Board members.

Maintaining an active dialogue with our stockholders is consistent with our corporate values of transparency and accountability, and we intend to continue these efforts in the future. For more information on our shareholder engagement program, please see the “Results of 2021 Stockholder Advisory Vote on Executive Compensation” section below.

CORPORATE GOVERNANCE PRINCIPLES

Our Board has adopted Corporate Governance Principles which address various matters relating to Board and Committee structure, composition, meetings and responsibilities. The Corporate Governance Principles are posted on our website at http://investors.8x8.com.

BOARD’S ROLE IN THE OVERSIGHT OF RISK

The full Board is involved in the oversight of our risk management program. The Board as a whole is consulted on any matters which might result in material financial changes, investments, or our strategic direction of the Company. The Board oversees these risks through its interaction with senior management, which occurs at formal Board meetings and committee meetings and through other periodic written and oral communications.

Additionally, the Board has delegated some of its risk oversight activities to its committees. For example, the Compensation Committee considers the risks associated with compensation for our named executive officers and directors, including whether any of our compensation policies has the potential to encourage excessive risk-taking. The Audit Committee oversees compliance with our Code of Ethics, our financial reporting process, and our systems of internal controls, and reviews with management our major risk exposures (including cybersecurity) and the steps taken to control such exposures.

COMPENSATION RISK ASSESSMENT

The Compensation Committee has reviewed our compensation programs to ensure that our incentive and other motivational elements of compensation are aligned with long-term value creation, taking into consideration prudent risk management. We do not believe any of our compensation policies and practices create any risks that are reasonably likely to have a material adverse effect on us. In making this determination, the Compensation Committee considered the mix of fixed and variable compensation, our use of equity in our long-term incentive compensation arrangements, the time horizon of performance measurement in incentive opportunities, and the ability of the Compensation Committee and management to rely on judgment in determining compensation and assessing performance outcome.

COMMUNICATIONS WITH THE BOARD

The Board has implemented a process by which stockholders and other interested parties, including, without limitation, customers, vendors, and business partners, may send written communications directly to the attention of the Board, our non-management directors (as a group), our Chairman, or any other individual Board member. The process is explained on our website at http://investors.8x8.com in the Governance section under the heading “Contact the Board.”

SUSTAINABILITY AND CORPORATE SOCIAL RESPONSIBILITY

OUR APPROACH

We believe our social responsibility to our employees and stockholders is to, among other things, make the world a better place.

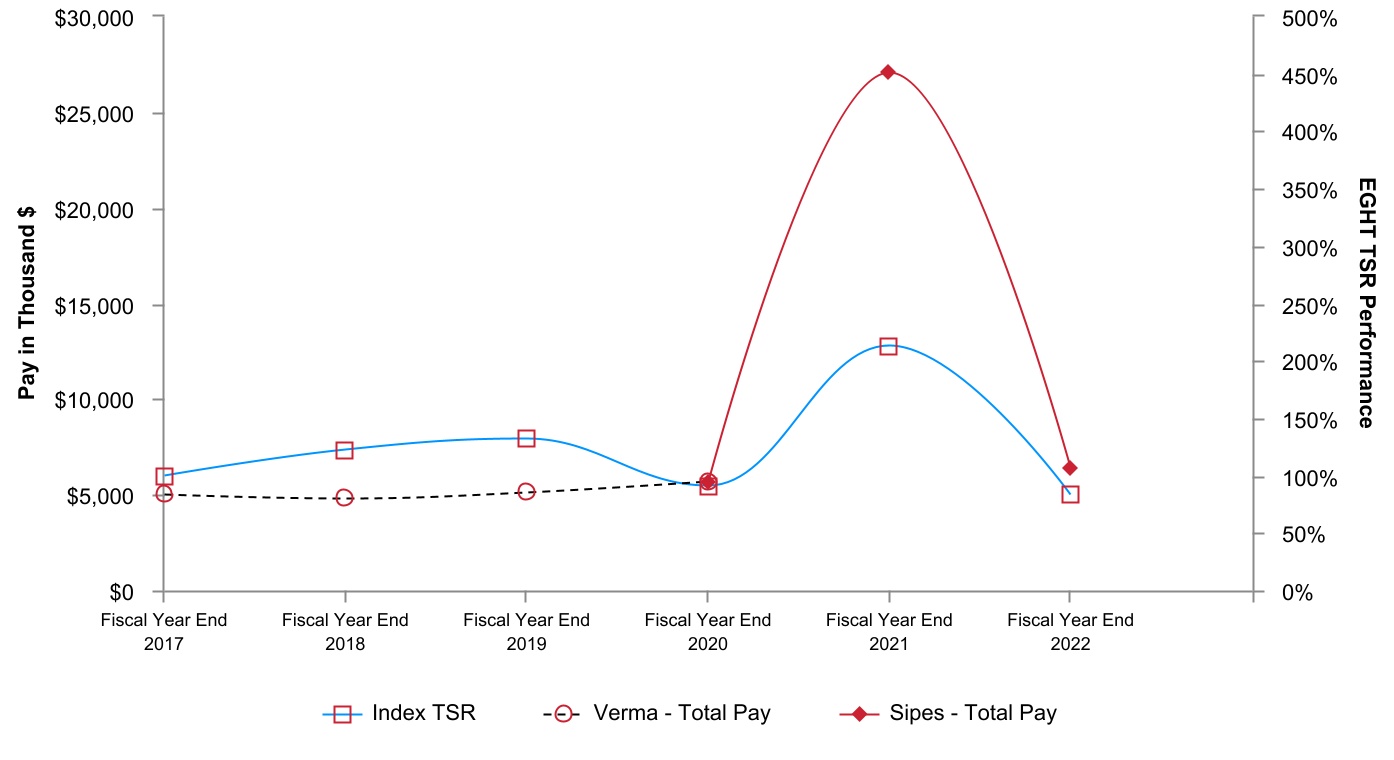

Our cloud-based solutions enable the new agile workplace by empowering employees to work and collaborate from anywhere, from any device, at any time. We believe our cloud-based solutions can play an important role in supporting the sustainability goals of our customers by reducing the need for on-premise hardware (and associated energy consumption) and enabling remote work (resulting in reduced commute times and reduced greenhouse gas emissions), among other benefits.