Form 8-K/A QUANTA SERVICES, INC. For: Oct 08

Exhibit 23.1

Consent of Independent Certified Public Accountants

We have issued our report dated April 1, 2021, with respect to the consolidated financial statements of Blattner Holding Company for the year ended December 31, 2020 included in the Current Report of Quanta Services, Inc. on Form 8-K filed on December 22, 2021. We consent to the incorporation by reference of said report in the Registration Statements of Quanta Services, Inc. on Forms S-3 (File No. 333-248776 and File No. 333-228402) and Forms S-8 (File No. 333-231769, File No. 333-226780, File No. 333-193616 and File No. 333-174374).

/s/ Grant Thornton LLP

Minneapolis, Minnesota

December 22, 2021

Consolidated Financial Statements and Report of Independent Certified Public Accountants Blattner Holding Company and Subsidiaries December 31, 2020 Exhibit 99.1

Contents Page Report of Independent Certified Public Accountants 3 Consolidated Financial Statements Consolidated balance sheet 5 Consolidated statement of earnings 7 Consolidated statement of comprehensive income 8 Consolidated statement of changes in shareholders’ equity 9 Consolidated statement of cash flows 10 Notes to consolidated financial statements 12

GT.COM Grant Thornton LLP is the U.S. member firm of Grant Thornton International Ltd (GTIL). GTIL and each of its member firms are separate legal entities and are not a worldwide partnership. Board of Directors Blattner Holding Company We have audited the accompanying consolidated financial statements of Blattner Holding Company (a Minnesota corporation) and subsidiaries (collectively, the “Company”), which comprise the consolidated balance sheet as of December 31, 2020, and the related consolidated statements of earnings, comprehensive income, changes in shareholders’ equity, and cash flows for the year then ended, and the related notes to the consolidated financial statements. Management’s responsibility for the financial statements Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. Auditor’s responsibility Our responsibility is to express an opinion on these consolidated financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. REPORT OF INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS GRANT THORNTON LLP 200 S. Sixth Street, Suite 1400 Minneapolis, MN 55402 D +1 612 332 0001 F +1 612 332 8361

Opinion In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Blattner Holding Company and subsidiaries as of December 31, 2020, and the results of their operations and their cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America. /s/ GRANT THORNTON LLP Minneapolis, Minnesota April 1, 2021

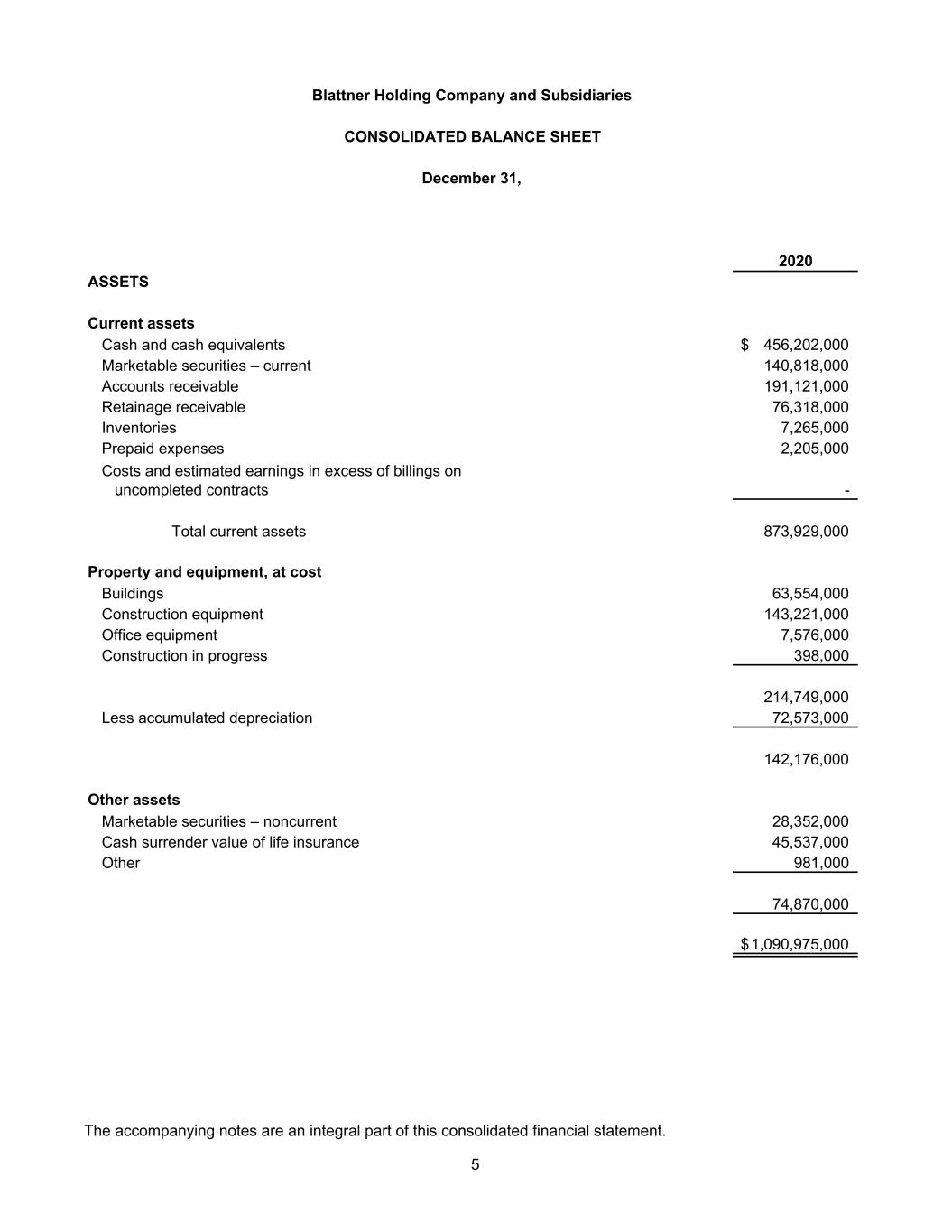

2020 ASSETS Current assets Cash and cash equivalents 456,202,000$ Marketable securities – current 140,818,000 Accounts receivable 191,121,000 Retainage receivable 76,318,000 Inventories 7,265,000 Prepaid expenses 2,205,000 Costs and estimated earnings in excess of billings on uncompleted contracts - Total current assets 873,929,000 Property and equipment, at cost Buildings 63,554,000 Construction equipment 143,221,000 Office equipment 7,576,000 Construction in progress 398,000 214,749,000 Less accumulated depreciation 72,573,000 142,176,000 Other assets Marketable securities – noncurrent 28,352,000 Cash surrender value of life insurance 45,537,000 Other 981,000 74,870,000 1,090,975,000$ Blattner Holding Company and Subsidiaries CONSOLIDATED BALANCE SHEET December 31, The accompanying notes are an integral part of this consolidated financial statement. 5

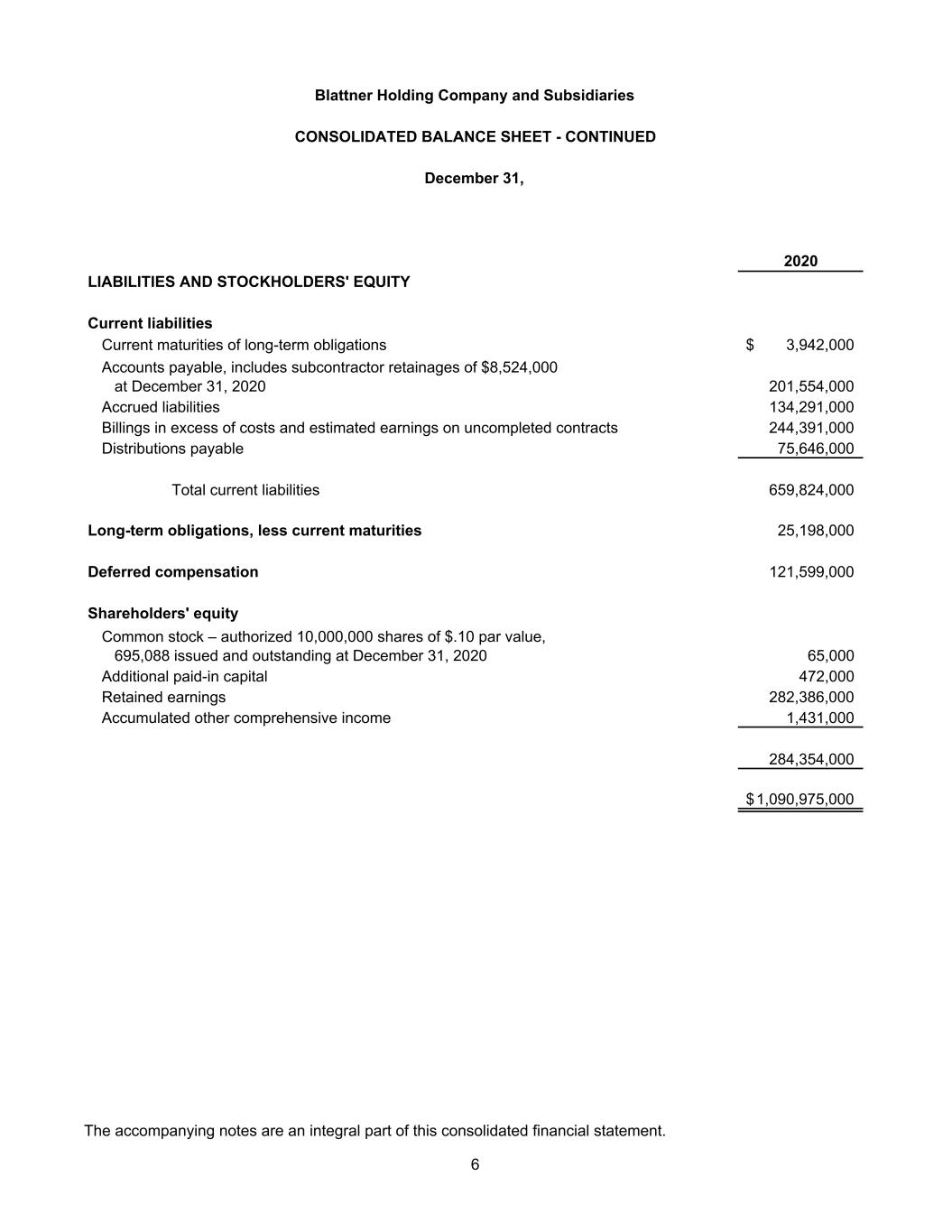

2020 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities Current maturities of long-term obligations 3,942,000$ Accounts payable, includes subcontractor retainages of $8,524,000 at December 31, 2020 201,554,000 Accrued liabilities 134,291,000 Billings in excess of costs and estimated earnings on uncompleted contracts 244,391,000 Distributions payable 75,646,000 Total current liabilities 659,824,000 Long-term obligations, less current maturities 25,198,000 Deferred compensation 121,599,000 Shareholders' equity Common stock – authorized 10,000,000 shares of $.10 par value, 695,088 issued and outstanding at December 31, 2020 65,000 Additional paid-in capital 472,000 Retained earnings 282,386,000 Accumulated other comprehensive income 1,431,000 284,354,000 1,090,975,000$ Blattner Holding Company and Subsidiaries CONSOLIDATED BALANCE SHEET - CONTINUED December 31, The accompanying notes are an integral part of this consolidated financial statement. 6

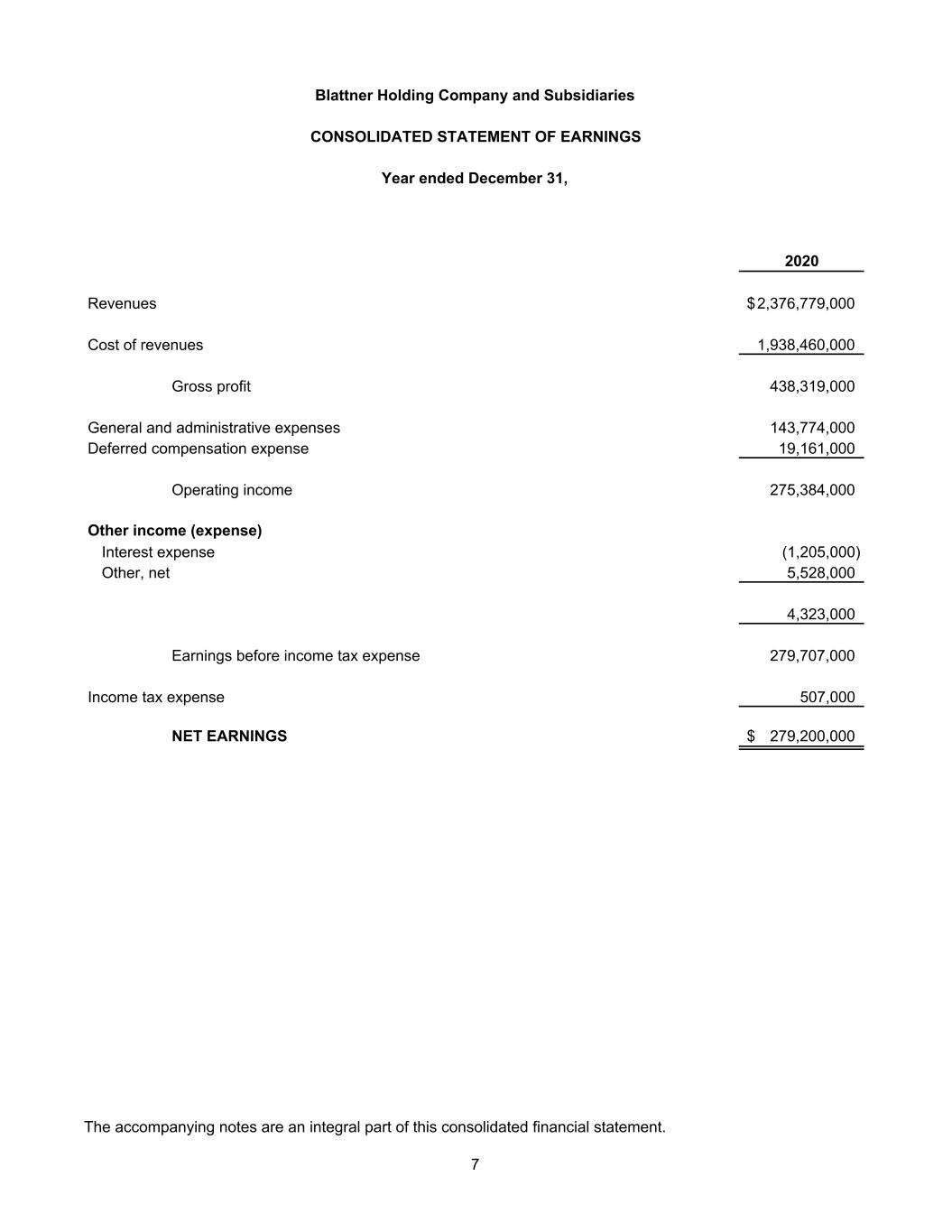

2020 Revenues 2,376,779,000$ Cost of revenues 1,938,460,000 Gross profit 438,319,000 General and administrative expenses 143,774,000 Deferred compensation expense 19,161,000 Operating income 275,384,000 Other income (expense) Interest expense (1,205,000) Other, net 5,528,000 4,323,000 Earnings before income tax expense 279,707,000 Income tax expense 507,000 NET EARNINGS 279,200,000$ Blattner Holding Company and Subsidiaries CONSOLIDATED STATEMENT OF EARNINGS Year ended December 31, The accompanying notes are an integral part of this consolidated financial statement. 7

2020 Net earnings 279,200,000$ Unrealized holding gains on debt securities arising during period 316,000 Comprehensive income 279,516,000$ Blattner Holding Company and Subsidiaries CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME Year ended December 31, The accompanying notes are an integral part of this consolidated financial statement. 8

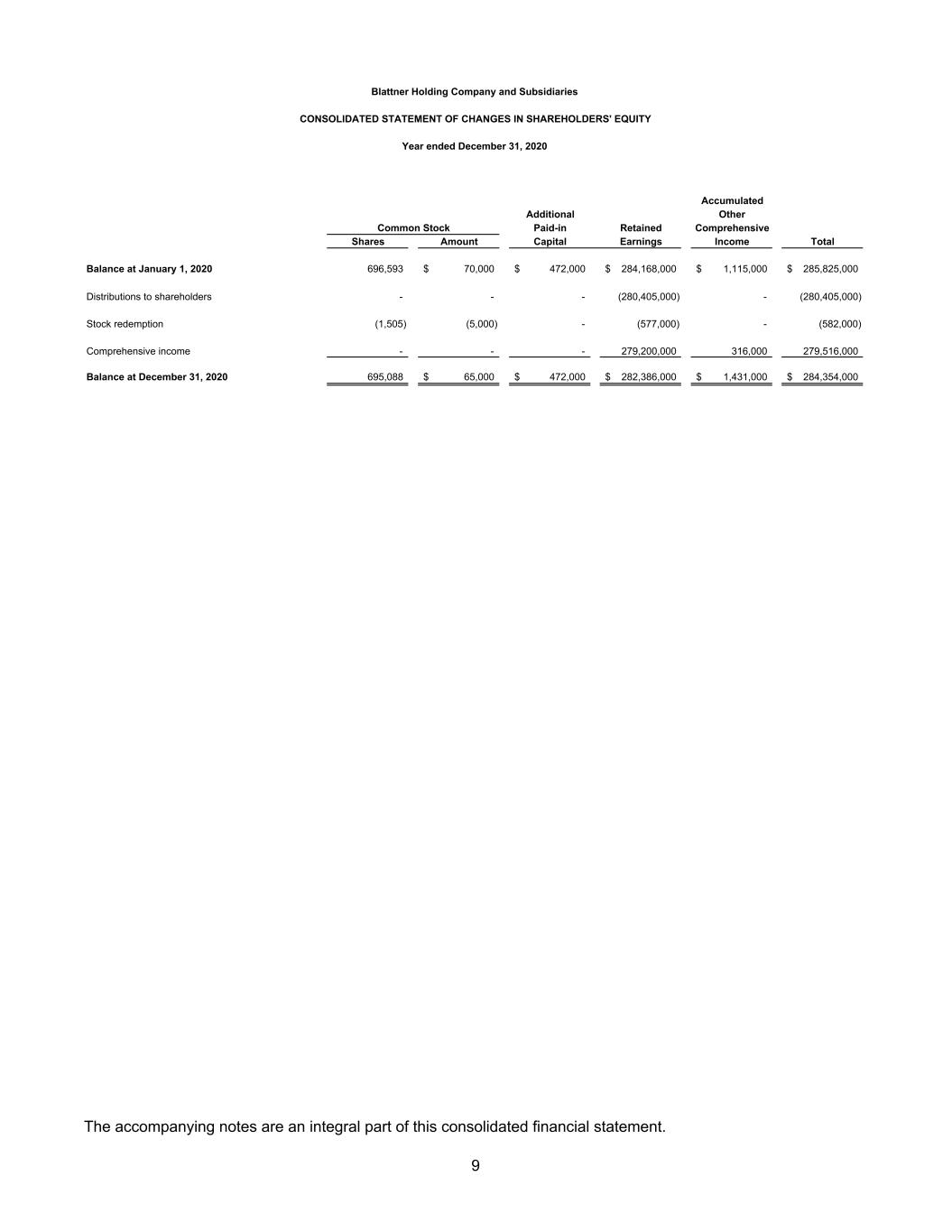

Accumulated Additional Other Paid-in Retained Comprehensive Shares Amount Capital Earnings Income Total Balance at January 1, 2020 696,593 70,000$ 472,000$ 284,168,000$ 1,115,000$ 285,825,000$ Distributions to shareholders - - - (280,405,000) - (280,405,000) Stock redemption (1,505) (5,000) - (577,000) - (582,000) Comprehensive income - - - 279,200,000 316,000 279,516,000 Balance at December 31, 2020 695,088 65,000$ 472,000$ 282,386,000$ 1,431,000$ 284,354,000$ Year ended December 31, 2020 CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY Blattner Holding Company and Subsidiaries Common Stock The accompanying notes are an integral part of this consolidated financial statement. 9

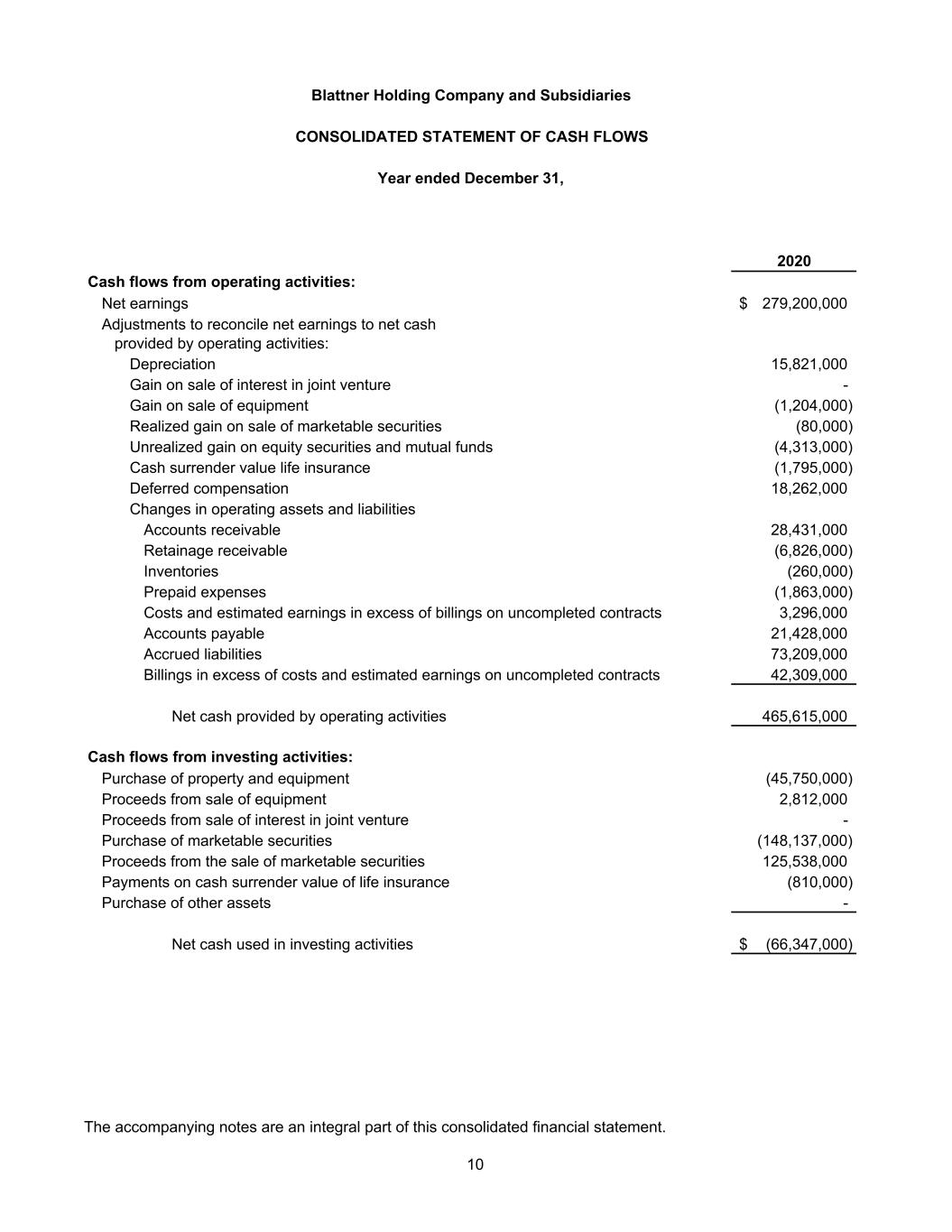

2020 Cash flows from operating activities: Net earnings 279,200,000$ Adjustments to reconcile net earnings to net cash provided by operating activities: Depreciation 15,821,000 Gain on sale of interest in joint venture - Gain on sale of equipment (1,204,000) Realized gain on sale of marketable securities (80,000) Unrealized gain on equity securities and mutual funds (4,313,000) Cash surrender value life insurance (1,795,000) Deferred compensation 18,262,000 Changes in operating assets and liabilities Accounts receivable 28,431,000 Retainage receivable (6,826,000) Inventories (260,000) Prepaid expenses (1,863,000) Costs and estimated earnings in excess of billings on uncompleted contracts 3,296,000 Accounts payable 21,428,000 Accrued liabilities 73,209,000 Billings in excess of costs and estimated earnings on uncompleted contracts 42,309,000 Net cash provided by operating activities 465,615,000 Cash flows from investing activities: Purchase of property and equipment (45,750,000) Proceeds from sale of equipment 2,812,000 Proceeds from sale of interest in joint venture - Purchase of marketable securities (148,137,000) Proceeds from the sale of marketable securities 125,538,000 Payments on cash surrender value of life insurance (810,000) Purchase of other assets - Net cash used in investing activities (66,347,000)$ Blattner Holding Company and Subsidiaries CONSOLIDATED STATEMENT OF CASH FLOWS Year ended December 31, The accompanying notes are an integral part of this consolidated financial statement. 10

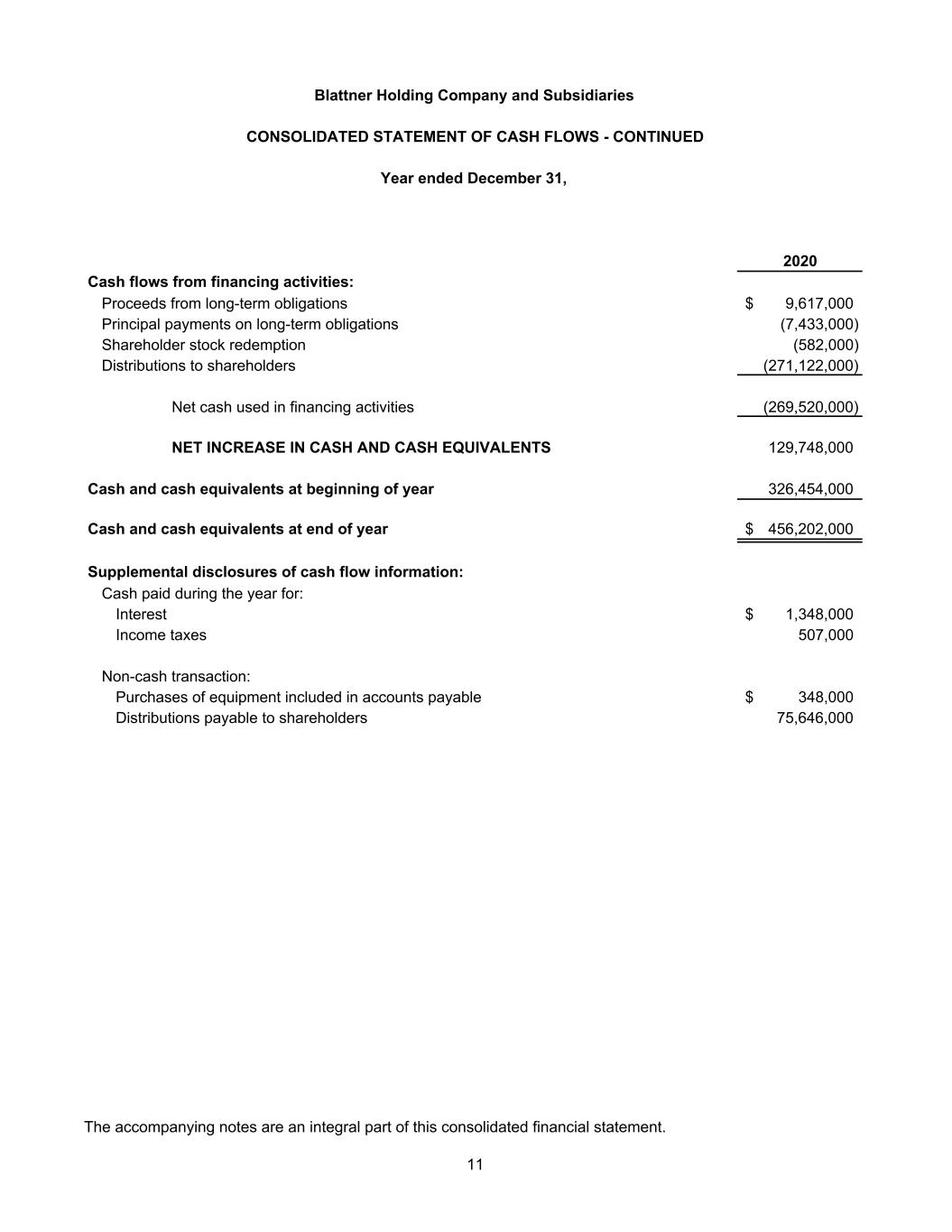

2020 Cash flows from financing activities: Proceeds from long-term obligations 9,617,000$ Principal payments on long-term obligations (7,433,000) Shareholder stock redemption (582,000) Distributions to shareholders (271,122,000) Net cash used in financing activities (269,520,000) NET INCREASE IN CASH AND CASH EQUIVALENTS 129,748,000 Cash and cash equivalents at beginning of year 326,454,000 Cash and cash equivalents at end of year 456,202,000$ Supplemental disclosures of cash flow information: Cash paid during the year for: Interest 1,348,000$ Income taxes 507,000 Non-cash transaction: Purchases of equipment included in accounts payable 348,000$ Distributions payable to shareholders 75,646,000 Blattner Holding Company and Subsidiaries CONSOLIDATED STATEMENT OF CASH FLOWS - CONTINUED Year ended December 31, The accompanying notes are an integral part of this consolidated financial statement. 11

Blattner Holding Company and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS December 31, 2020 12 NOTE A - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Blattner Holding Company and Subsidiaries (collectively, the “Company”) is a diversified electrical generation contractor that operates principally throughout the United States. The Company’s significant accounting policies have been applied consistently in the preparation of the accompanying consolidated financial statements and are summarized as follows: Principles of Consolidation The consolidated financial statements include the accounts of Blattner Holding Company and its wholly owned subsidiaries. All intercompany transactions have been eliminated in consolidation. Revenue and Cost Recognition Revenue is recognized when control of the promised goods or services is transferred to our customers in an amount that reflects the consideration we expect to be entitled to in exchange for transferring those goods or providing those services. We account for a contract when it has approval and commitment from both parties, the rights of the parties are identified, payment terms are known, the contract has commercial substance and collectability of consideration is probable. A performance obligation is a promise in a contract to transfer a distinct good or service to the customer. A contract’s transaction price is allocated to each distinct performance obligation and recognized as revenue when, or as, the performance obligation is satisfied and control is transferred to the customer. For the Company’s construction contracts, there is generally a single performance obligation as the promise to transfer individual goods or services is not separately identifiable from other promises within the contracts, and therefore, not distinct. The bundle of good and services within each contract represents the combined output for which the customer has contracted. Typically the transaction price corresponds to the contractually agreed consideration and it is allocated to the performance obligation within each contract. The Company earns and recognizes revenue through lump-sum (i.e., fixed price) contracts which are recognized over time using input methods to measure progress towards satisfying the performance obligation. Revenues from these contracts transferred over time made up 100% of the Company’s revenue for the year ended December 31, 2020. Revenue from lump-sum contracts is recognized on the percentage-of-completion method, measured by the percentage of costs incurred to date to estimate total costs for each contract, which management deemed to be the best available measure of progress. Revenues from time and material contracts are recognized based on costs incurred during the period plus the fee earned. The payment terms of the contracts are consistent with normal payment terms of the industry in which we operate. Incurred costs represent work performed, which best represents the transfer of control to the customer. These costs include all direct material, labor, equipment, subcontractor labor, and those indirect costs related to contract performance, such as indirect labor, supplies, and repairs. General and administrative costs are charged to expense as incurred. The Company records revenue excluding the effects of sales tax collected. On December 31, 2020, the Company had $1,914 million of remaining performance obligations from construction contracts. The Company estimates that sustainably all performance obligations at December 31, 2020 will be recognized as revenue in the subsequent year. The Company estimates the profit on a contract as the difference between the total estimated revenue and expected costs to complete a contract, and recognizes that profit over the life of the contract. Contract

Blattner Holding Company and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2020 13 estimates are based on various assumptions to project the outcome of future events that can span multiple years. These assumptions include labor and material costs and availability, project complexity, subcontractor performance, and availability and timing of customer funding. Typically the transaction price corresponds to the contractually agreed consideration and it is allocated to the performance obligation within each contract. If there is a contract where the transaction price is not fixed, the Company estimates variable consideration at the most likely amount it expects to be entitled. These estimates are based on anticipated performance and information that is reasonably available. Changes in estimated job profitability resulting from job performance, job conditions, contract penalty provisions, claims, change order, and final contract settlements are accounted for as changes in estimates in the current period. Provisions for estimated losses on uncompleted contracts are recorded in the period in which such losses are determined. For contracts in which a portion of the transaction price is retained and paid after the good or service has been transferred to the customer, the Company does not recognize a significant financing component. The primary purpose of the retainage payment is often to provide the customer with assurance that the Company will perform its obligation under the contract, rather than to provide financing to the customer. Cash and Cash Equivalents The Company maintains its cash balances in multiple financial institutions located in the United States. The Company considers all highly liquid investments and financial instruments with original maturities when purchased of three months or less to be cash equivalents. At times, such balances may be in excess of Federal Deposit Insurance Corporation insurance limits. The Company has not experienced any losses in such accounts. Marketable Securities The Company evaluates the classification of investments in marketable securities as trading, available-for- sale or held-to-maturity at the time of purchase and periodically re-evaluates such classification. All of the Company’s marketable securities are classified as available-for-sale and are reported at fair value at December 31, 2020. Realized gains and losses and declines in value determined to be other-than- temporary on available-for-sale securities are included in other income. Unrealized gains and losses are included in accumulated other comprehensive income for debt securities. The unrealized gains and losses related to equity securities and mutual funds are recognized and included as part of net earnings. The cost of securities sold is based on the specific-identification method. The short-term marketable securities mature in less than one year. The Company has the intent to hold long-term marketable securities for more than one year. Accounts Receivable The Company grants credit to customers in the normal course of business, but generally does not require collateral or other security to support amounts due, but relies upon its right to file liens on the customer’s property. Accounts outstanding longer than the contractual payment terms are considered past due. It is the opinion of management that an allowance for doubtful accounts is not necessary. The Company considers a number of factors, including the length of time accounts receivable are past due, the Company’s previous loss history, the customer’s current ability to pay its obligation to the Company and the condition of the general economy and the industry as a whole in making this determination. The Company charges bad debts to operations when they are deemed uncollectible. Bad debt write-offs historically have not been significant.

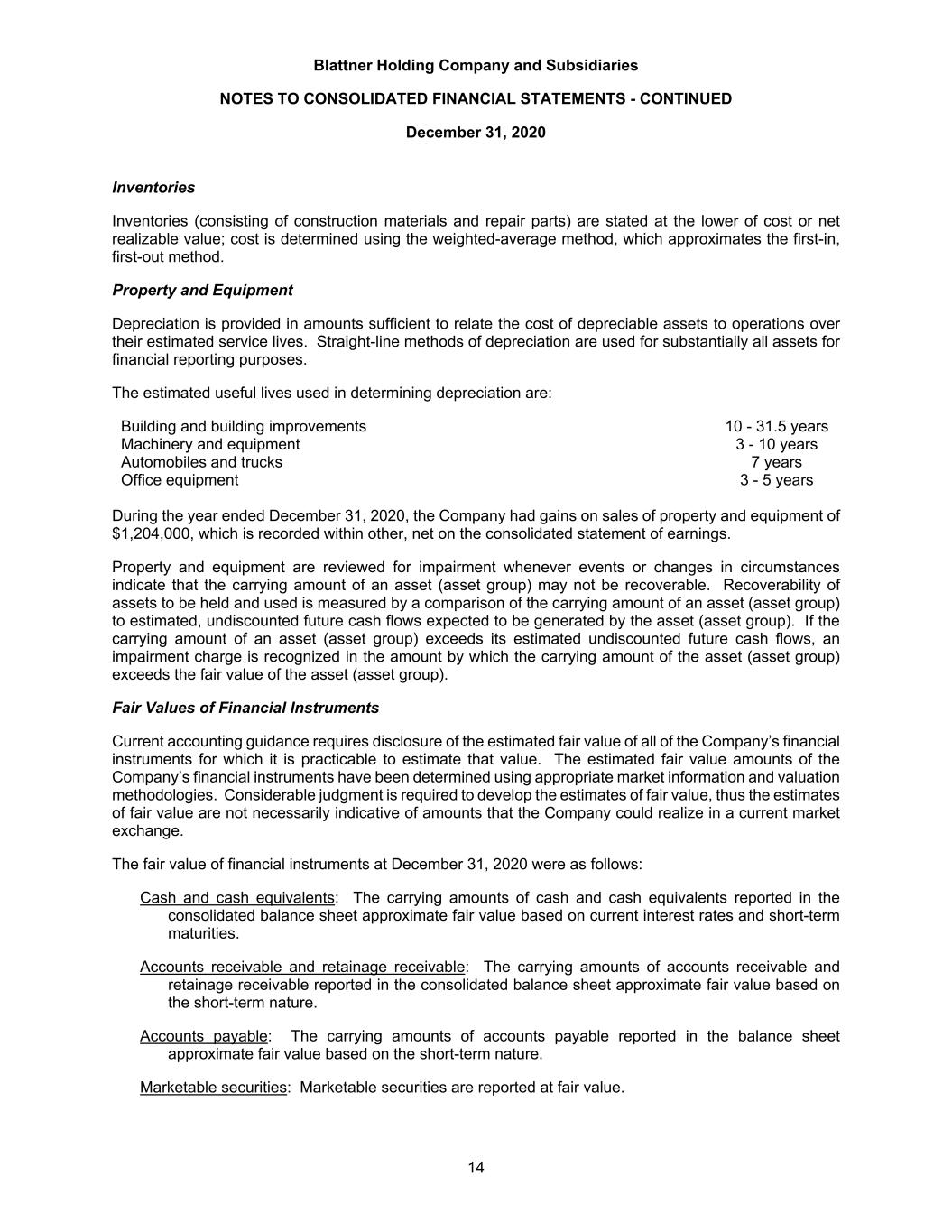

Blattner Holding Company and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2020 14 Inventories Inventories (consisting of construction materials and repair parts) are stated at the lower of cost or net realizable value; cost is determined using the weighted-average method, which approximates the first-in, first-out method. Property and Equipment Depreciation is provided in amounts sufficient to relate the cost of depreciable assets to operations over their estimated service lives. Straight-line methods of depreciation are used for substantially all assets for financial reporting purposes. The estimated useful lives used in determining depreciation are: Building and building improvements 10 - 31.5 years Machinery and equipment 3 - 10 years Automobiles and trucks 7 years Office equipment 3 - 5 years During the year ended December 31, 2020, the Company had gains on sales of property and equipment of $1,204,000, which is recorded within other, net on the consolidated statement of earnings. Property and equipment are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset (asset group) may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset (asset group) to estimated, undiscounted future cash flows expected to be generated by the asset (asset group). If the carrying amount of an asset (asset group) exceeds its estimated undiscounted future cash flows, an impairment charge is recognized in the amount by which the carrying amount of the asset (asset group) exceeds the fair value of the asset (asset group). Fair Values of Financial Instruments Current accounting guidance requires disclosure of the estimated fair value of all of the Company’s financial instruments for which it is practicable to estimate that value. The estimated fair value amounts of the Company’s financial instruments have been determined using appropriate market information and valuation methodologies. Considerable judgment is required to develop the estimates of fair value, thus the estimates of fair value are not necessarily indicative of amounts that the Company could realize in a current market exchange. The fair value of financial instruments at December 31, 2020 were as follows: Cash and cash equivalents: The carrying amounts of cash and cash equivalents reported in the consolidated balance sheet approximate fair value based on current interest rates and short-term maturities. Accounts receivable and retainage receivable: The carrying amounts of accounts receivable and retainage receivable reported in the consolidated balance sheet approximate fair value based on the short-term nature. Accounts payable: The carrying amounts of accounts payable reported in the balance sheet approximate fair value based on the short-term nature. Marketable securities: Marketable securities are reported at fair value.

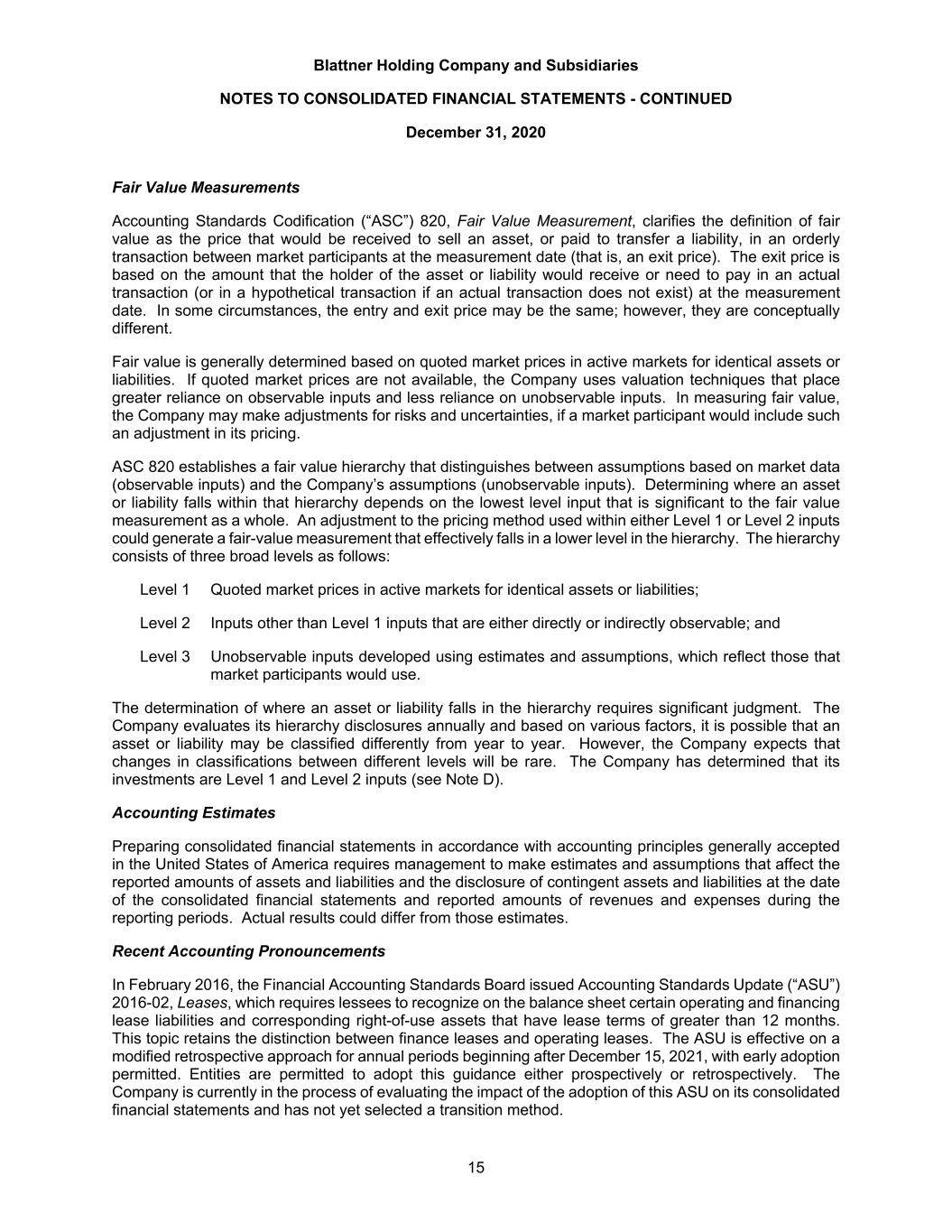

Blattner Holding Company and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2020 15 Fair Value Measurements Accounting Standards Codification (“ASC”) 820, Fair Value Measurement, clarifies the definition of fair value as the price that would be received to sell an asset, or paid to transfer a liability, in an orderly transaction between market participants at the measurement date (that is, an exit price). The exit price is based on the amount that the holder of the asset or liability would receive or need to pay in an actual transaction (or in a hypothetical transaction if an actual transaction does not exist) at the measurement date. In some circumstances, the entry and exit price may be the same; however, they are conceptually different. Fair value is generally determined based on quoted market prices in active markets for identical assets or liabilities. If quoted market prices are not available, the Company uses valuation techniques that place greater reliance on observable inputs and less reliance on unobservable inputs. In measuring fair value, the Company may make adjustments for risks and uncertainties, if a market participant would include such an adjustment in its pricing. ASC 820 establishes a fair value hierarchy that distinguishes between assumptions based on market data (observable inputs) and the Company’s assumptions (unobservable inputs). Determining where an asset or liability falls within that hierarchy depends on the lowest level input that is significant to the fair value measurement as a whole. An adjustment to the pricing method used within either Level 1 or Level 2 inputs could generate a fair-value measurement that effectively falls in a lower level in the hierarchy. The hierarchy consists of three broad levels as follows: Level 1 Quoted market prices in active markets for identical assets or liabilities; Level 2 Inputs other than Level 1 inputs that are either directly or indirectly observable; and Level 3 Unobservable inputs developed using estimates and assumptions, which reflect those that market participants would use. The determination of where an asset or liability falls in the hierarchy requires significant judgment. The Company evaluates its hierarchy disclosures annually and based on various factors, it is possible that an asset or liability may be classified differently from year to year. However, the Company expects that changes in classifications between different levels will be rare. The Company has determined that its investments are Level 1 and Level 2 inputs (see Note D). Accounting Estimates Preparing consolidated financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the consolidated financial statements and reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates. Recent Accounting Pronouncements In February 2016, the Financial Accounting Standards Board issued Accounting Standards Update (“ASU”) 2016-02, Leases, which requires lessees to recognize on the balance sheet certain operating and financing lease liabilities and corresponding right-of-use assets that have lease terms of greater than 12 months. This topic retains the distinction between finance leases and operating leases. The ASU is effective on a modified retrospective approach for annual periods beginning after December 15, 2021, with early adoption permitted. Entities are permitted to adopt this guidance either prospectively or retrospectively. The Company is currently in the process of evaluating the impact of the adoption of this ASU on its consolidated financial statements and has not yet selected a transition method.

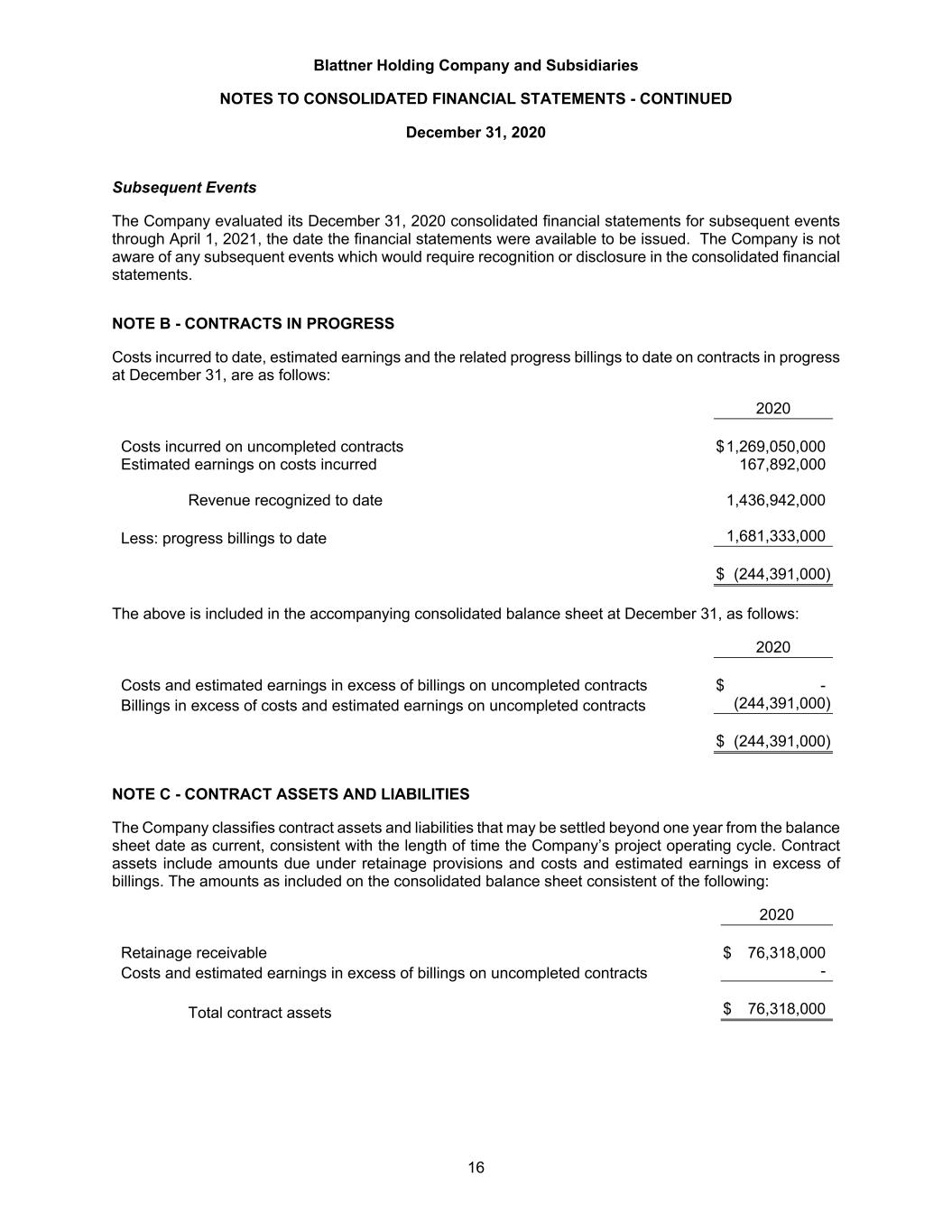

Blattner Holding Company and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2020 16 Subsequent Events The Company evaluated its December 31, 2020 consolidated financial statements for subsequent events through April 1, 2021, the date the financial statements were available to be issued. The Company is not aware of any subsequent events which would require recognition or disclosure in the consolidated financial statements. NOTE B - CONTRACTS IN PROGRESS Costs incurred to date, estimated earnings and the related progress billings to date on contracts in progress at December 31, are as follows: 2020 Costs incurred on uncompleted contracts $ 1,269,050,000 Estimated earnings on costs incurred 167,892,000 Revenue recognized to date 1,436,942,000 Less: progress billings to date 1,681,333,000 $ (244,391,000) The above is included in the accompanying consolidated balance sheet at December 31, as follows: 2020 Costs and estimated earnings in excess of billings on uncompleted contracts $ - Billings in excess of costs and estimated earnings on uncompleted contracts (244,391,000) $ (244,391,000) NOTE C - CONTRACT ASSETS AND LIABILITIES The Company classifies contract assets and liabilities that may be settled beyond one year from the balance sheet date as current, consistent with the length of time the Company’s project operating cycle. Contract assets include amounts due under retainage provisions and costs and estimated earnings in excess of billings. The amounts as included on the consolidated balance sheet consistent of the following: 2020 Retainage receivable $ 76,318,000 Costs and estimated earnings in excess of billings on uncompleted contracts - Total contract assets $ 76,318,000

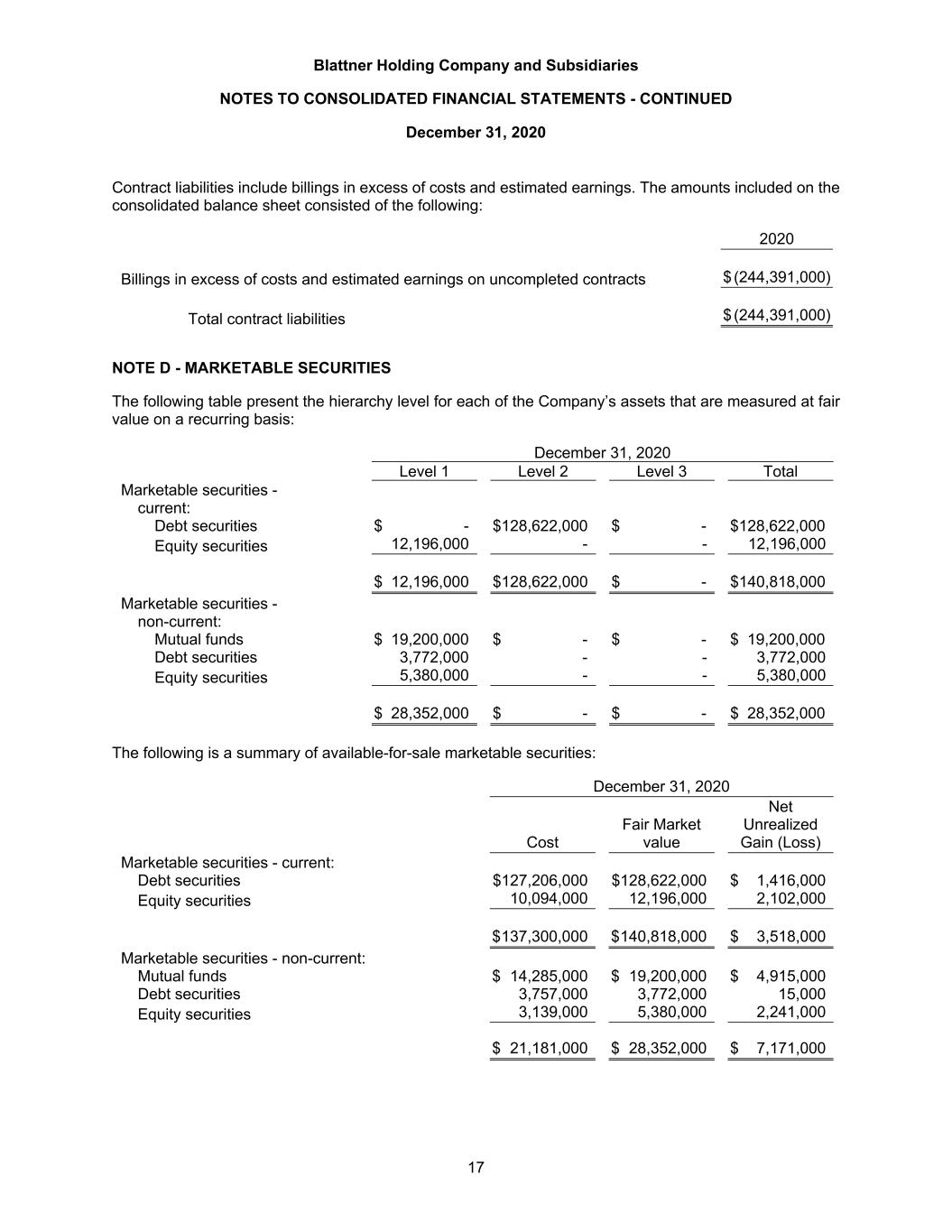

Blattner Holding Company and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2020 17 Contract liabilities include billings in excess of costs and estimated earnings. The amounts included on the consolidated balance sheet consisted of the following: 2020 Billings in excess of costs and estimated earnings on uncompleted contracts $ (244,391,000) Total contract liabilities $ (244,391,000) NOTE D - MARKETABLE SECURITIES The following table present the hierarchy level for each of the Company’s assets that are measured at fair value on a recurring basis: December 31, 2020 Level 1 Level 2 Level 3 Total Marketable securities - current: Debt securities $ - $128,622,000 $ - $128,622,000 Equity securities 12,196,000 - - 12,196,000 $ 12,196,000 $128,622,000 $ - $140,818,000 Marketable securities - non-current: Mutual funds $ 19,200,000 $ - $ - $ 19,200,000 Debt securities 3,772,000 - - 3,772,000 Equity securities 5,380,000 - - 5,380,000 $ 28,352,000 $ - $ - $ 28,352,000 The following is a summary of available-for-sale marketable securities: December 31, 2020 Cost Fair Market value Net Unrealized Gain (Loss) Marketable securities - current: Debt securities $127,206,000 $128,622,000 $ 1,416,000 Equity securities 10,094,000 12,196,000 2,102,000 $ 137,300,000 $ 140,818,000 $ 3,518,000 Marketable securities - non-current: Mutual funds $ 14,285,000 $ 19,200,000 $ 4,915,000 Debt securities 3,757,000 3,772,000 15,000 Equity securities 3,139,000 5,380,000 2,241,000 $ 21,181,000 $ 28,352,000 $ 7,171,000

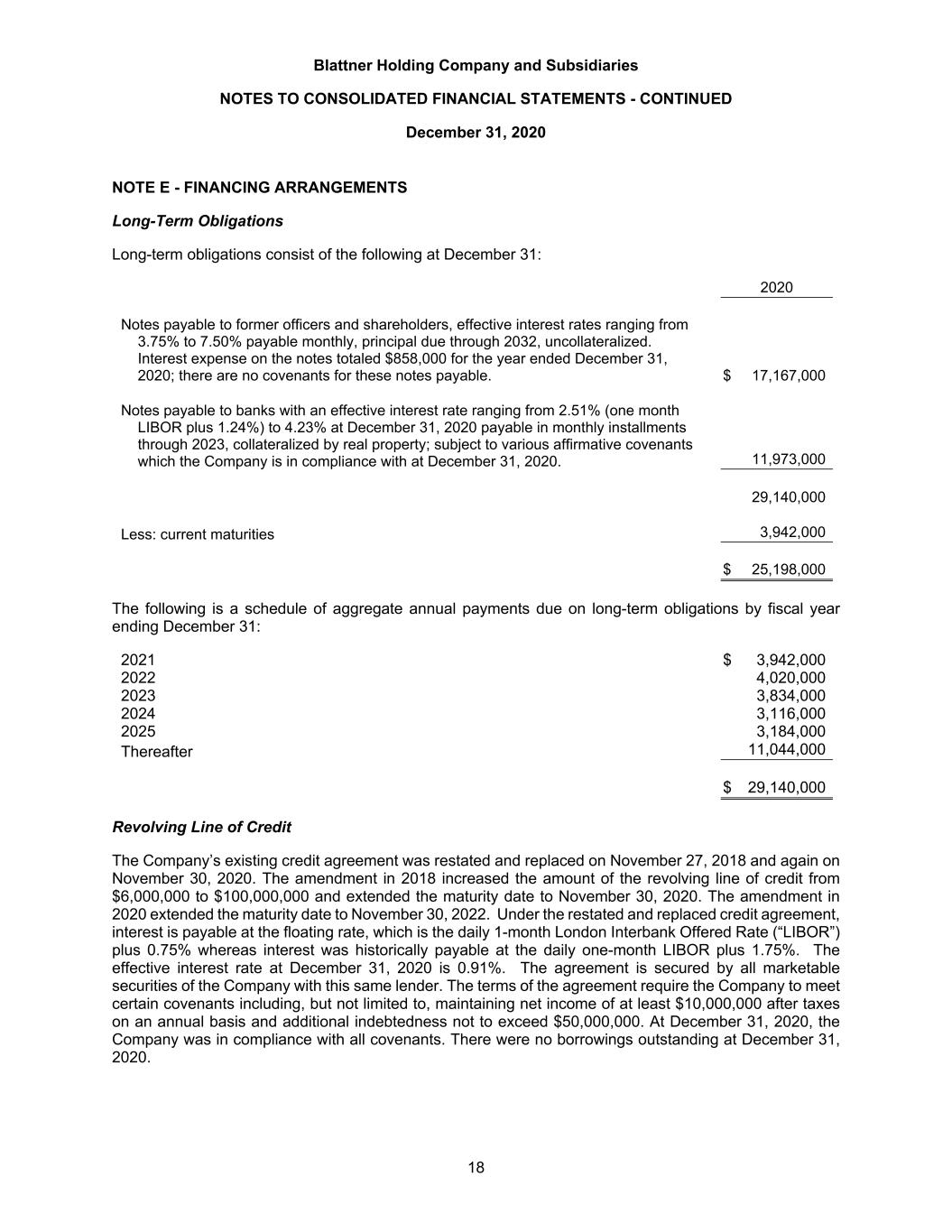

Blattner Holding Company and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2020 18 NOTE E - FINANCING ARRANGEMENTS Long-Term Obligations Long-term obligations consist of the following at December 31: 2020 Notes payable to former officers and shareholders, effective interest rates ranging from 3.75% to 7.50% payable monthly, principal due through 2032, uncollateralized. Interest expense on the notes totaled $858,000 for the year ended December 31, 2020; there are no covenants for these notes payable. $ 17,167,000 Notes payable to banks with an effective interest rate ranging from 2.51% (one month LIBOR plus 1.24%) to 4.23% at December 31, 2020 payable in monthly installments through 2023, collateralized by real property; subject to various affirmative covenants which the Company is in compliance with at December 31, 2020. 11,973,000 29,140,000 Less: current maturities 3,942,000 $ 25,198,000 The following is a schedule of aggregate annual payments due on long-term obligations by fiscal year ending December 31: 2021 $ 3,942,000 2022 4,020,000 2023 3,834,000 2024 3,116,000 2025 3,184,000 Thereafter 11,044,000 $ 29,140,000 Revolving Line of Credit The Company’s existing credit agreement was restated and replaced on November 27, 2018 and again on November 30, 2020. The amendment in 2018 increased the amount of the revolving line of credit from $6,000,000 to $100,000,000 and extended the maturity date to November 30, 2020. The amendment in 2020 extended the maturity date to November 30, 2022. Under the restated and replaced credit agreement, interest is payable at the floating rate, which is the daily 1-month London Interbank Offered Rate (“LIBOR”) plus 0.75% whereas interest was historically payable at the daily one-month LIBOR plus 1.75%. The effective interest rate at December 31, 2020 is 0.91%. The agreement is secured by all marketable securities of the Company with this same lender. The terms of the agreement require the Company to meet certain covenants including, but not limited to, maintaining net income of at least $10,000,000 after taxes on an annual basis and additional indebtedness not to exceed $50,000,000. At December 31, 2020, the Company was in compliance with all covenants. There were no borrowings outstanding at December 31, 2020.

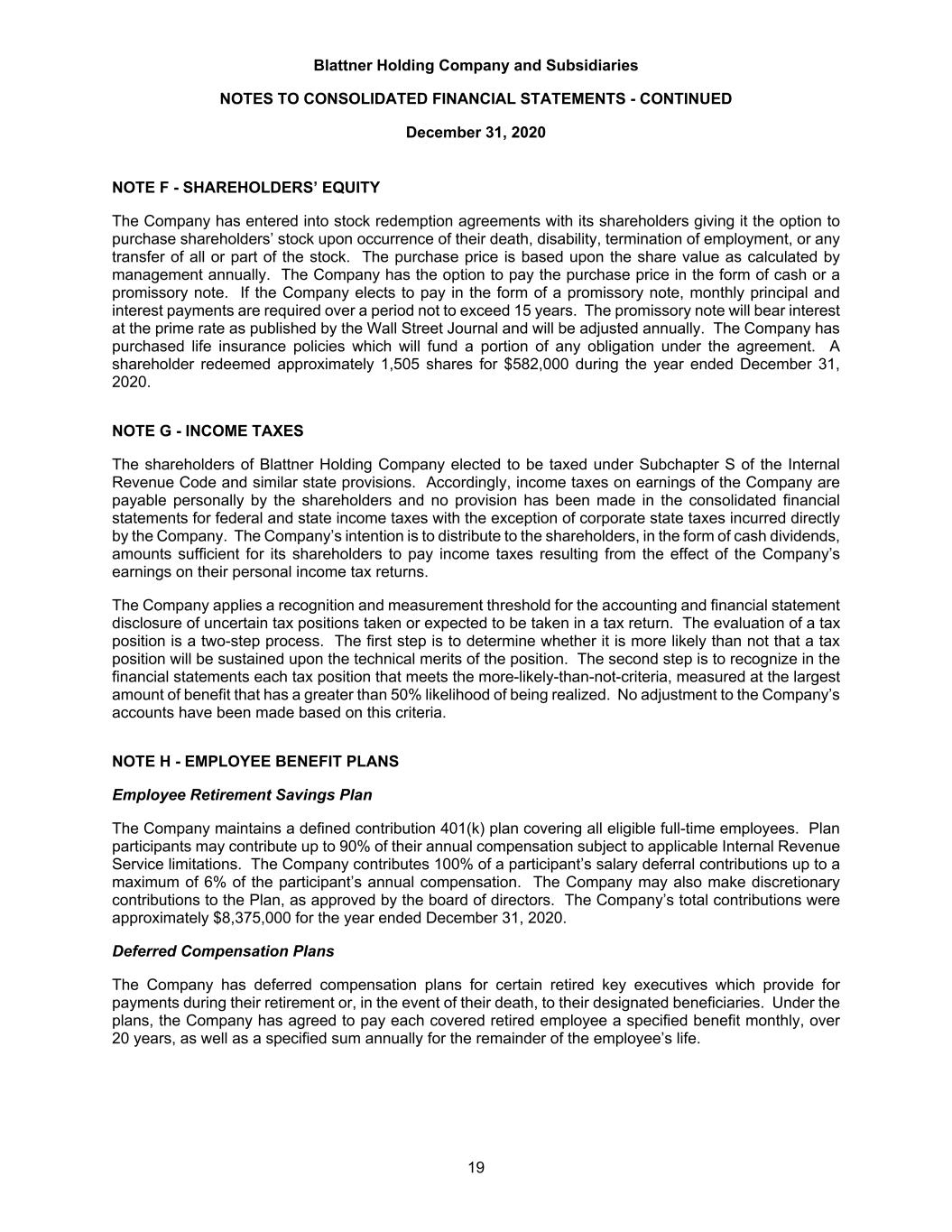

Blattner Holding Company and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2020 19 NOTE F - SHAREHOLDERS’ EQUITY The Company has entered into stock redemption agreements with its shareholders giving it the option to purchase shareholders’ stock upon occurrence of their death, disability, termination of employment, or any transfer of all or part of the stock. The purchase price is based upon the share value as calculated by management annually. The Company has the option to pay the purchase price in the form of cash or a promissory note. If the Company elects to pay in the form of a promissory note, monthly principal and interest payments are required over a period not to exceed 15 years. The promissory note will bear interest at the prime rate as published by the Wall Street Journal and will be adjusted annually. The Company has purchased life insurance policies which will fund a portion of any obligation under the agreement. A shareholder redeemed approximately 1,505 shares for $582,000 during the year ended December 31, 2020. NOTE G - INCOME TAXES The shareholders of Blattner Holding Company elected to be taxed under Subchapter S of the Internal Revenue Code and similar state provisions. Accordingly, income taxes on earnings of the Company are payable personally by the shareholders and no provision has been made in the consolidated financial statements for federal and state income taxes with the exception of corporate state taxes incurred directly by the Company. The Company’s intention is to distribute to the shareholders, in the form of cash dividends, amounts sufficient for its shareholders to pay income taxes resulting from the effect of the Company’s earnings on their personal income tax returns. The Company applies a recognition and measurement threshold for the accounting and financial statement disclosure of uncertain tax positions taken or expected to be taken in a tax return. The evaluation of a tax position is a two-step process. The first step is to determine whether it is more likely than not that a tax position will be sustained upon the technical merits of the position. The second step is to recognize in the financial statements each tax position that meets the more-likely-than-not-criteria, measured at the largest amount of benefit that has a greater than 50% likelihood of being realized. No adjustment to the Company’s accounts have been made based on this criteria. NOTE H - EMPLOYEE BENEFIT PLANS Employee Retirement Savings Plan The Company maintains a defined contribution 401(k) plan covering all eligible full-time employees. Plan participants may contribute up to 90% of their annual compensation subject to applicable Internal Revenue Service limitations. The Company contributes 100% of a participant’s salary deferral contributions up to a maximum of 6% of the participant’s annual compensation. The Company may also make discretionary contributions to the Plan, as approved by the board of directors. The Company’s total contributions were approximately $8,375,000 for the year ended December 31, 2020. Deferred Compensation Plans The Company has deferred compensation plans for certain retired key executives which provide for payments during their retirement or, in the event of their death, to their designated beneficiaries. Under the plans, the Company has agreed to pay each covered retired employee a specified benefit monthly, over 20 years, as well as a specified sum annually for the remainder of the employee’s life.

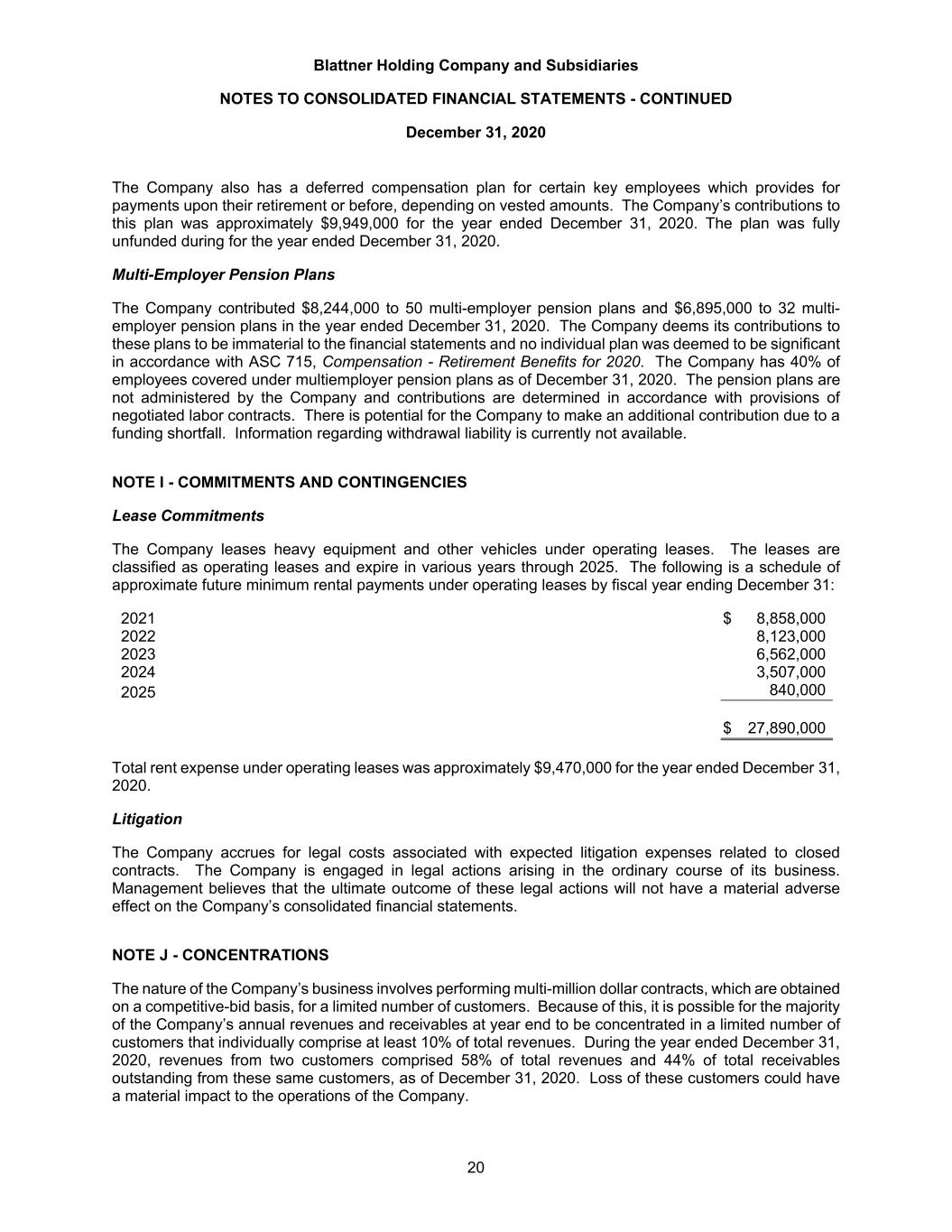

Blattner Holding Company and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED December 31, 2020 20 The Company also has a deferred compensation plan for certain key employees which provides for payments upon their retirement or before, depending on vested amounts. The Company’s contributions to this plan was approximately $9,949,000 for the year ended December 31, 2020. The plan was fully unfunded during for the year ended December 31, 2020. Multi-Employer Pension Plans The Company contributed $8,244,000 to 50 multi-employer pension plans and $6,895,000 to 32 multi- employer pension plans in the year ended December 31, 2020. The Company deems its contributions to these plans to be immaterial to the financial statements and no individual plan was deemed to be significant in accordance with ASC 715, Compensation - Retirement Benefits for 2020. The Company has 40% of employees covered under multiemployer pension plans as of December 31, 2020. The pension plans are not administered by the Company and contributions are determined in accordance with provisions of negotiated labor contracts. There is potential for the Company to make an additional contribution due to a funding shortfall. Information regarding withdrawal liability is currently not available. NOTE I - COMMITMENTS AND CONTINGENCIES Lease Commitments The Company leases heavy equipment and other vehicles under operating leases. The leases are classified as operating leases and expire in various years through 2025. The following is a schedule of approximate future minimum rental payments under operating leases by fiscal year ending December 31: 2021 $ 8,858,000 2022 8,123,000 2023 6,562,000 2024 3,507,000 2025 840,000 $ 27,890,000 Total rent expense under operating leases was approximately $9,470,000 for the year ended December 31, 2020. Litigation The Company accrues for legal costs associated with expected litigation expenses related to closed contracts. The Company is engaged in legal actions arising in the ordinary course of its business. Management believes that the ultimate outcome of these legal actions will not have a material adverse effect on the Company’s consolidated financial statements. NOTE J - CONCENTRATIONS The nature of the Company’s business involves performing multi-million dollar contracts, which are obtained on a competitive-bid basis, for a limited number of customers. Because of this, it is possible for the majority of the Company’s annual revenues and receivables at year end to be concentrated in a limited number of customers that individually comprise at least 10% of total revenues. During the year ended December 31, 2020, revenues from two customers comprised 58% of total revenues and 44% of total receivables outstanding from these same customers, as of December 31, 2020. Loss of these customers could have a material impact to the operations of the Company.

Unaudited Consolidated Financial Statements Blattner Holding Company and Subsidiaries June 30, 2021 Exhibit 99.2

Contents Page Unaudited Consolidated Financial Statements Consolidated balance sheet 3 Consolidated statement of earnings 5 Consolidated statement of comprehensive income 6 Consolidated statement of changes in shareholders’ equity 7 Consolidated statement of cash flows 8 Notes to consolidated financial statements 9

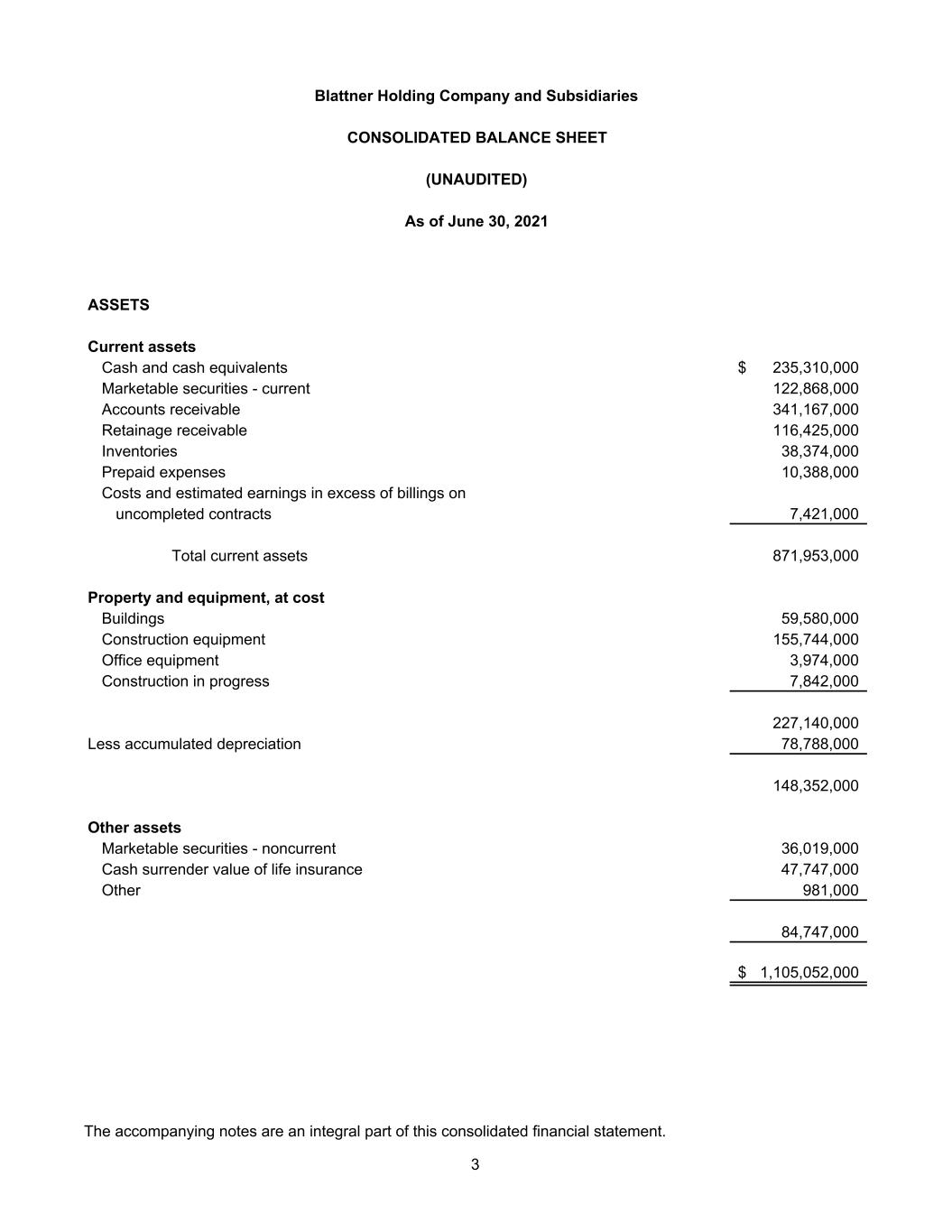

ASSETS Current assets Cash and cash equivalents 235,310,000$ Marketable securities - current 122,868,000 Accounts receivable 341,167,000 Retainage receivable 116,425,000 Inventories 38,374,000 Prepaid expenses 10,388,000 Costs and estimated earnings in excess of billings on uncompleted contracts 7,421,000 Total current assets 871,953,000 Property and equipment, at cost Buildings 59,580,000 Construction equipment 155,744,000 Office equipment 3,974,000 Construction in progress 7,842,000 227,140,000 Less accumulated depreciation 78,788,000 148,352,000 Other assets Marketable securities - noncurrent 36,019,000 Cash surrender value of life insurance 47,747,000 Other 981,000 84,747,000 1,105,052,000$ Blattner Holding Company and Subsidiaries CONSOLIDATED BALANCE SHEET As of June 30, 2021 (UNAUDITED) The accompanying notes are an integral part of this consolidated financial statement. 3

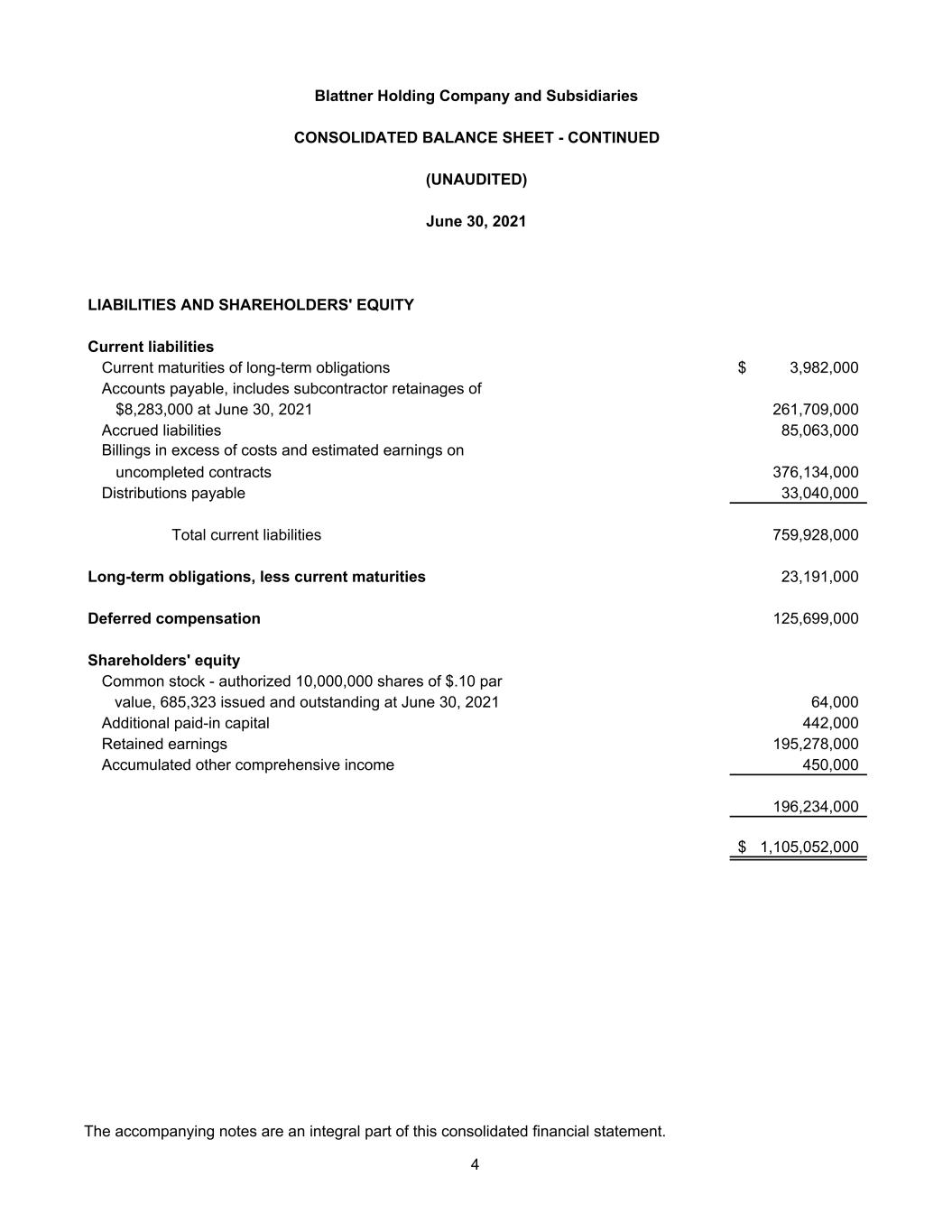

LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities Current maturities of long-term obligations 3,982,000$ Accounts payable, includes subcontractor retainages of $8,283,000 at June 30, 2021 261,709,000 Accrued liabilities 85,063,000 Billings in excess of costs and estimated earnings on uncompleted contracts 376,134,000 Distributions payable 33,040,000 Total current liabilities 759,928,000 Long-term obligations, less current maturities 23,191,000 Deferred compensation 125,699,000 Shareholders' equity Common stock - authorized 10,000,000 shares of $.10 par value, 685,323 issued and outstanding at June 30, 2021 64,000 Additional paid-in capital 442,000 Retained earnings 195,278,000 Accumulated other comprehensive income 450,000 196,234,000 1,105,052,000$ Blattner Holding Company and Subsidiaries CONSOLIDATED BALANCE SHEET - CONTINUED June 30, 2021 (UNAUDITED) The accompanying notes are an integral part of this consolidated financial statement. 4

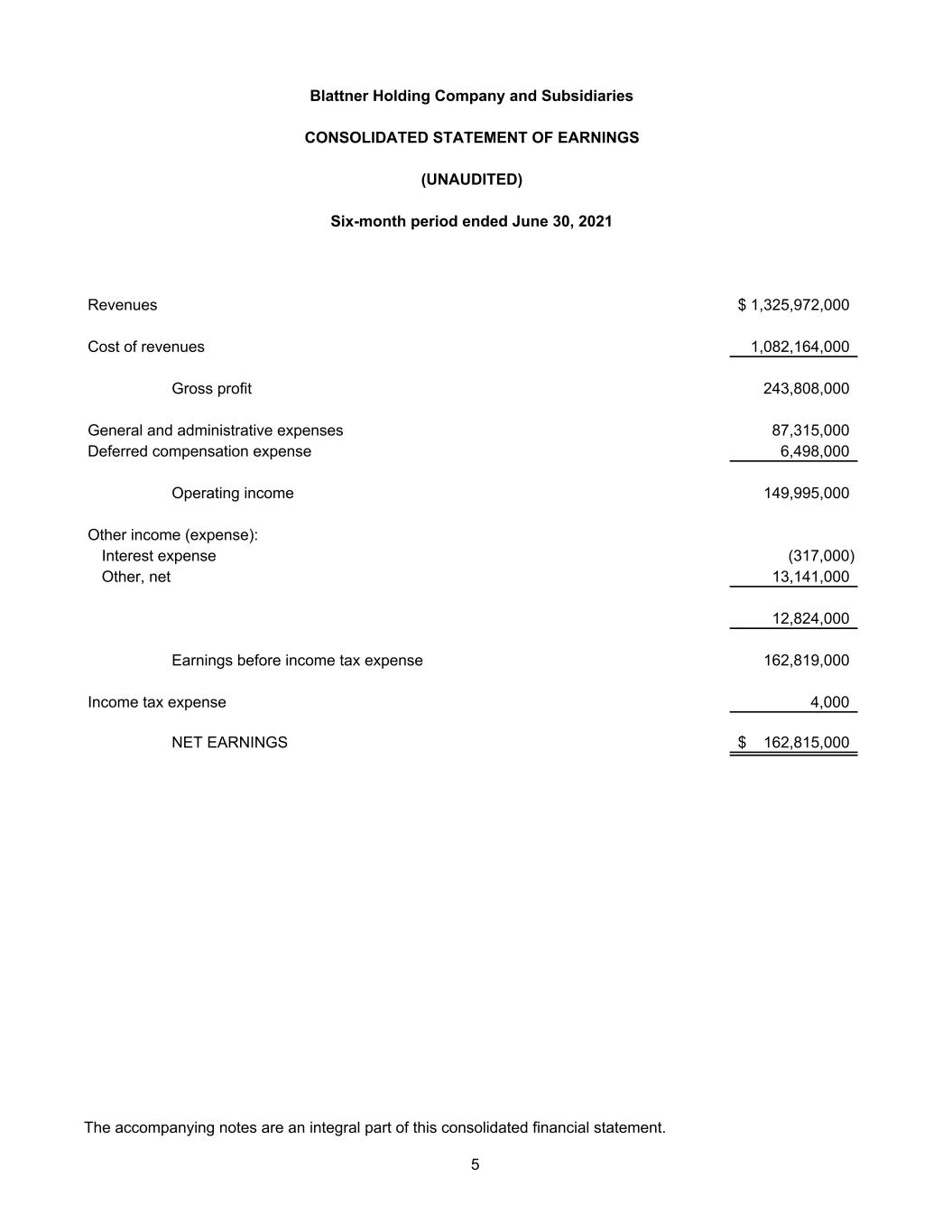

Revenues 1,325,972,000$ Cost of revenues 1,082,164,000 Gross profit 243,808,000 General and administrative expenses 87,315,000 Deferred compensation expense 6,498,000 Operating income 149,995,000 Other income (expense): Interest expense (317,000) Other, net 13,141,000 12,824,000 Earnings before income tax expense 162,819,000 Income tax expense 4,000 NET EARNINGS 162,815,000$ Blattner Holding Company and Subsidiaries CONSOLIDATED STATEMENT OF EARNINGS Six-month period ended June 30, 2021 (UNAUDITED) The accompanying notes are an integral part of this consolidated financial statement. 5

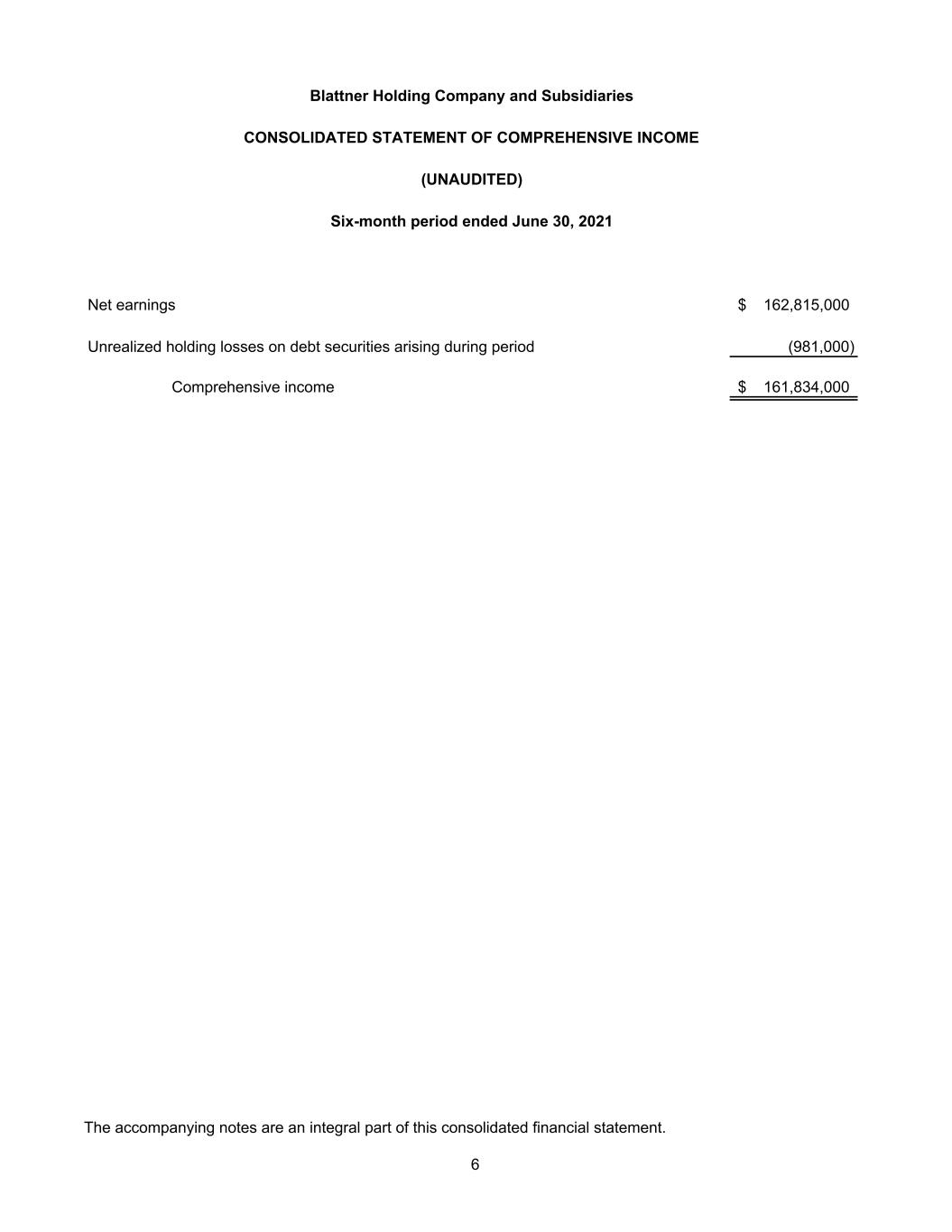

Net earnings 162,815,000$ Unrealized holding losses on debt securities arising during period (981,000) Comprehensive income 161,834,000$ Blattner Holding Company and Subsidiaries CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME Six-month period ended June 30, 2021 (UNAUDITED) The accompanying notes are an integral part of this consolidated financial statement. 6

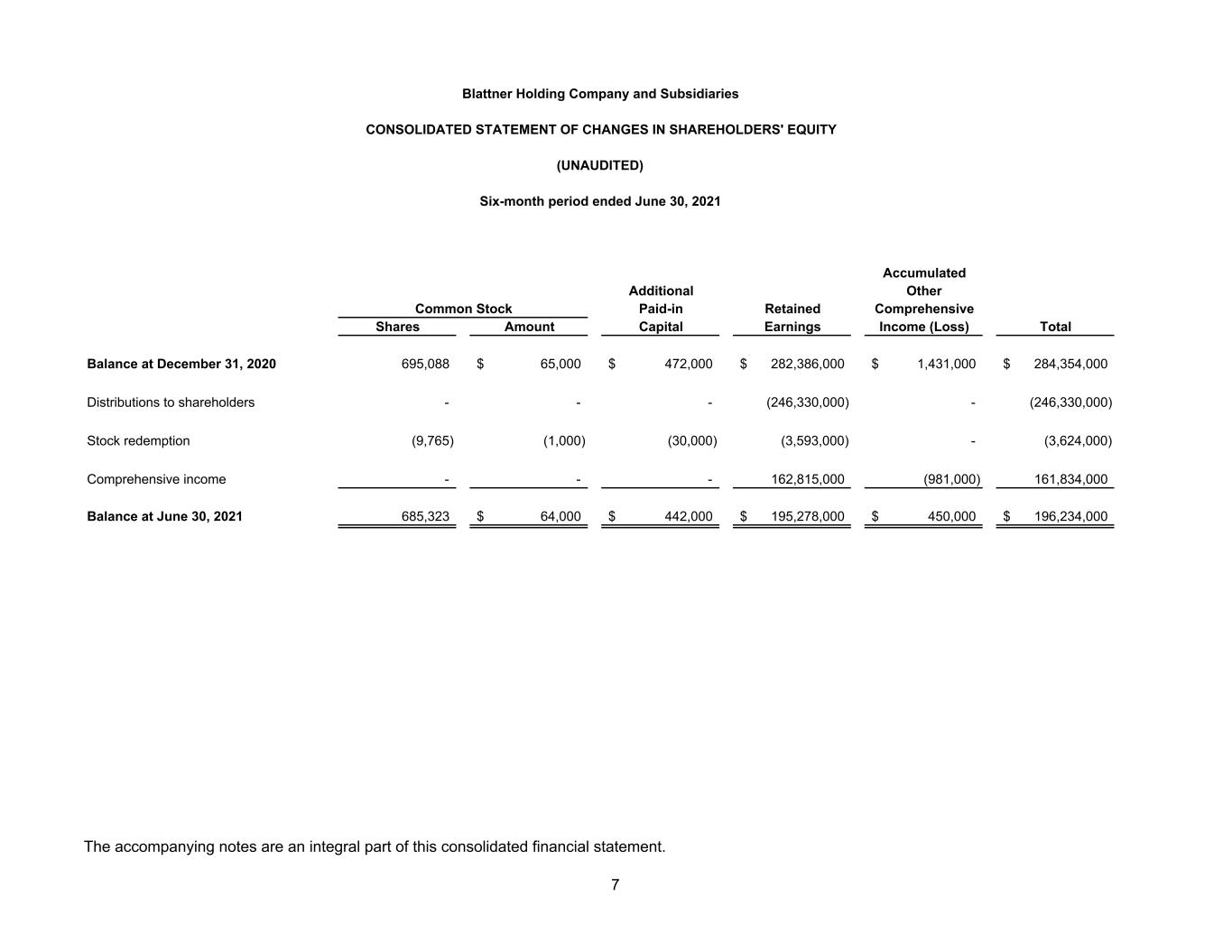

Accumulated Additional Other Paid-in Retained Comprehensive Shares Amount Capital Earnings Income (Loss) Total Balance at December 31, 2020 695,088 65,000$ 472,000$ 282,386,000$ 1,431,000$ 284,354,000$ Distributions to shareholders - - - (246,330,000) - (246,330,000) Stock redemption (9,765) (1,000) (30,000) (3,593,000) - (3,624,000) Comprehensive income - - - 162,815,000 (981,000) 161,834,000 Balance at June 30, 2021 685,323 64,000$ 442,000$ 195,278,000$ 450,000$ 196,234,000$ Six-month period ended June 30, 2021 CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY Blattner Holding Company and Subsidiaries Common Stock (UNAUDITED) The accompanying notes are an integral part of this consolidated financial statement. 7

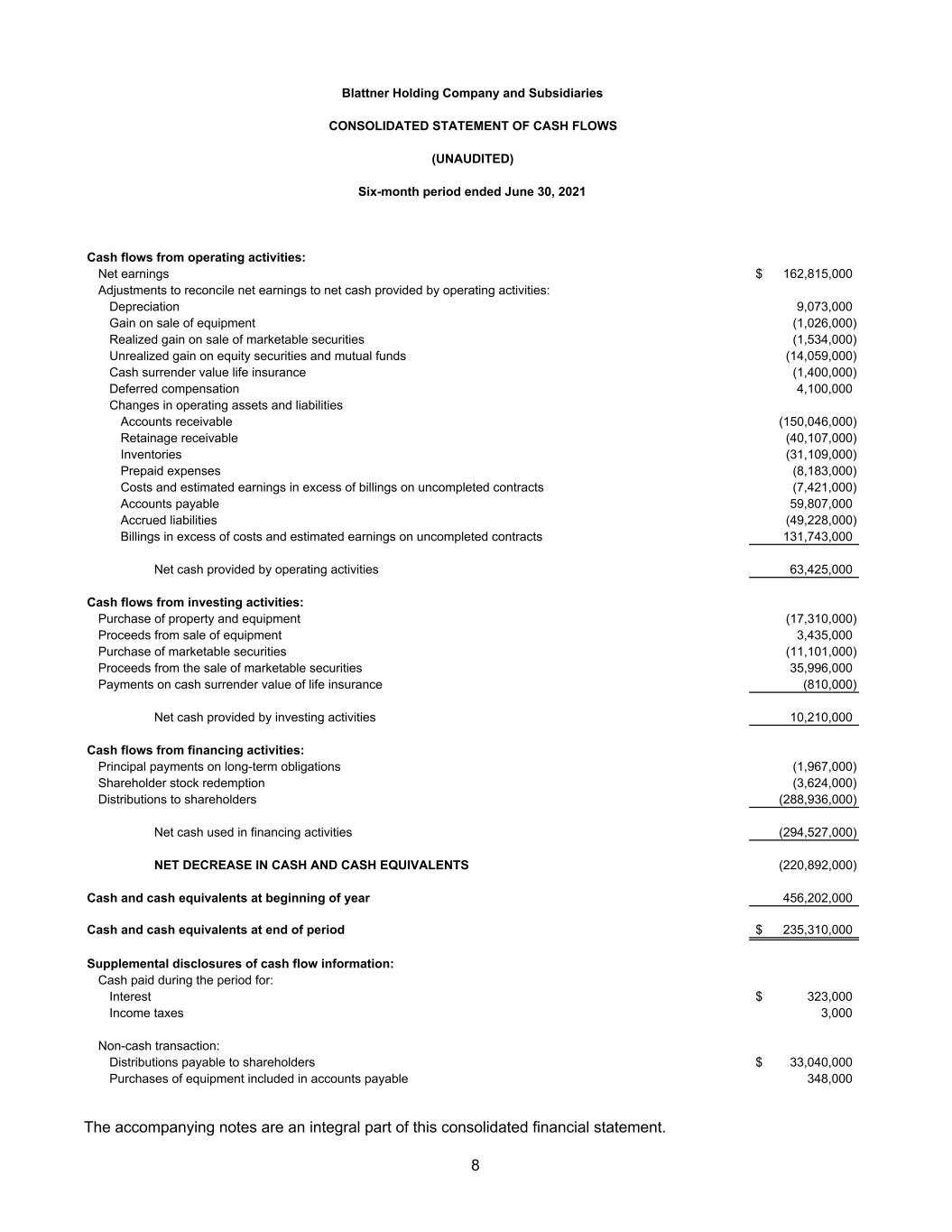

Cash flows from operating activities: Net earnings 162,815,000$ Adjustments to reconcile net earnings to net cash provided by operating activities: Depreciation 9,073,000 Gain on sale of equipment (1,026,000) Realized gain on sale of marketable securities (1,534,000) Unrealized gain on equity securities and mutual funds (14,059,000) Cash surrender value life insurance (1,400,000) Deferred compensation 4,100,000 Changes in operating assets and liabilities Accounts receivable (150,046,000) Retainage receivable (40,107,000) Inventories (31,109,000) Prepaid expenses (8,183,000) Costs and estimated earnings in excess of billings on uncompleted contracts (7,421,000) Accounts payable 59,807,000 Accrued liabilities (49,228,000) Billings in excess of costs and estimated earnings on uncompleted contracts 131,743,000 Net cash provided by operating activities 63,425,000 Cash flows from investing activities: Purchase of property and equipment (17,310,000) Proceeds from sale of equipment 3,435,000 Purchase of marketable securities (11,101,000) Proceeds from the sale of marketable securities 35,996,000 Payments on cash surrender value of life insurance (810,000) Net cash provided by investing activities 10,210,000 Cash flows from financing activities: Principal payments on long-term obligations (1,967,000) Shareholder stock redemption (3,624,000) Distributions to shareholders (288,936,000) Net cash used in financing activities (294,527,000) NET DECREASE IN CASH AND CASH EQUIVALENTS (220,892,000) Cash and cash equivalents at beginning of year 456,202,000 Cash and cash equivalents at end of period 235,310,000$ Supplemental disclosures of cash flow information: Cash paid during the period for: Interest 323,000$ Income taxes 3,000 Non-cash transaction: Distributions payable to shareholders 33,040,000$ Purchases of equipment included in accounts payable 348,000 Blattner Holding Company and Subsidiaries CONSOLIDATED STATEMENT OF CASH FLOWS Six-month period ended June 30, 2021 (UNAUDITED) The accompanying notes are an integral part of this consolidated financial statement. 8

Blattner Holding Company and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) June 30, 2021 9 NOTE A - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Blattner Holding Company and Subsidiaries (collectively, the “Company”) is a diversified electrical generation contractor that operates principally throughout the United States. The Company’s significant accounting policies have been applied consistently in the preparation of the accompanying consolidated financial statements and are summarized as follows: Principles of Consolidation The consolidated financial statements include the accounts of Blattner Holding Company and its wholly owned subsidiaries. All intercompany transactions have been eliminated in consolidation. Revenue and Cost Recognition Revenue is recognized when control of the promised goods or services is transferred to our customers in an amount that reflects the consideration we expect to be entitled to in exchange for transferring those goods or providing those services. We account for a contract when it has approval and commitment from both parties, the rights of the parties are identified, payment terms are known, the contract has commercial substance and collectability of consideration is probable. A performance obligation is a promise in a contract to transfer a distinct good or service to the customer. A contract’s transaction price is allocated to each distinct performance obligation and recognized as revenue when, or as, the performance obligation is satisfied and control is transferred to the customer. For the Company’s construction contracts, there is generally a single performance obligation as the promise to transfer individual goods or services is not separately identifiable from other promises within the contracts, and therefore, not distinct. The bundle of good and services within each contract represents the combined output for which the customer has contracted. Typically the transaction price corresponds to the contractually agreed consideration and it is allocated to the performance obligation within each contract. The Company earns and recognizes revenue through lump-sum (i.e., fixed price) contracts which are recognized over time using input methods to measure progress towards satisfying the performance obligation. Revenues from these contracts transferred over time made up 100% of the Company’s revenue for the six-month period ended June 30, 2021. Revenue from lump-sum contracts is recognized on the percentage-of-completion method, measured by the percentage of costs incurred to date to estimate total costs for each contract, which management deemed to be the best available measure of progress. Revenues from time and material contracts are recognized based on costs incurred during the period plus the fee earned. The payment terms of the contracts are consistent with normal payment terms of the industry in which we operate. Incurred costs represent work performed, which best represents the transfer of control to the customer. These costs include all direct material, labor, equipment, subcontractor labor, and those indirect costs related to contract performance, such as indirect labor, supplies, and repairs. General and administrative costs are charged to expense as incurred. The Company records revenue excluding the effects of sales tax collected. As of June 30, 2021, the Company had $1,947 million of remaining performance obligations from construction contracts. The Company estimates that sustainably all performance obligations as June 30, 2021 will be recognized as revenue in the subsequent twelve months.

Blattner Holding Company and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED (UNAUDITED) June 30, 2021 10 The Company estimates the profit on a contract as the difference between the total estimated revenue and expected costs to complete a contract, and recognizes that profit over the life of the contract. Contract estimates are based on various assumptions to project the outcome of future events that can span multiple years. These assumptions include labor and material costs and availability, project complexity, subcontractor performance, and availability and timing of customer funding. Typically the transaction price corresponds to the contractually agreed consideration and it is allocated to the performance obligation within each contract. If there is a contract where the transaction price is not fixed, the Company estimates variable consideration at the most likely amount it expects to be entitled. These estimates are based on anticipated performance and information that is reasonably available. Changes in estimated job profitability resulting from job performance, job conditions, contract penalty provisions, claims, change order, and final contract settlements are accounted for as changes in estimates in the current period. Provisions for estimated losses on uncompleted contracts are recorded in the period in which such losses are determined. For contracts in which a portion of the transaction price is retained and paid after the good or service has been transferred to the customer, the Company does not recognize a significant financing component. The primary purpose of the retainage payment is often to provide the customer with assurance that the Company will perform its obligation under the contract, rather than to provide financing to the customer. Cash and Cash Equivalents The Company maintains its cash balances in multiple financial institutions located in the United States. The Company considers all highly liquid investments and financial instruments with original maturities when purchased of three months or less to be cash equivalents. At times, such balances may be in excess of Federal Deposit Insurance Corporation insurance limits. The Company has not experienced any losses in such accounts. Marketable Securities The Company evaluates the classification of investments in marketable securities as trading, available-for- sale or held-to-maturity at the time of purchase and periodically re-evaluates such classification. All of the Company’s marketable securities are classified as available-for-sale and are reported at fair value as of June 30, 2021. Realized gains and losses and declines in value determined to be other-than-temporary on available-for-sale securities are included in other income. Unrealized gains and losses are included in accumulated other comprehensive income for debt securities. The unrealized gains and losses related to equity securities and mutual funds are recognized and included as part of net earnings. The cost of securities sold is based on the specific-identification method. The short-term marketable securities mature in less than one year. The Company has the intent to hold long-term marketable securities for more than one year. Accounts Receivable The Company grants credit to customers in the normal course of business, but generally does not require collateral or other security to support amounts due, but relies upon its right to file liens on the customer’s property. Accounts outstanding longer than the contractual payment terms are considered past due. It is the opinion of management that an allowance for doubtful accounts is not necessary. The Company considers a number of factors, including the length of time accounts receivable are past due, the Company’s previous loss history, the customer’s current ability to pay its obligation to the Company and the condition of the general economy and the industry as a whole in making this determination. The Company charges bad debts to operations when they are deemed uncollectible. Bad debt write-offs historically have not been significant.

Blattner Holding Company and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED (UNAUDITED) June 30, 2021 11 Inventories Inventories (consisting of construction materials and repair parts) are stated at the lower of cost or net realizable value; cost is determined using the weighted-average method, which approximates the first-in, first-out method. Property and Equipment Depreciation is provided in amounts sufficient to relate the cost of depreciable assets to operations over their estimated service lives. Straight-line methods of depreciation are used for substantially all assets for financial reporting purposes. The estimated useful lives used in determining depreciation are: Building and building improvements 10 - 31.5 years Machinery and equipment 3 - 10 years Automobiles and trucks 7 years Office equipment 3 - 5 years During the six-month period ended June 30, 2021, the Company had gains on sales of property and equipment of $1,026,000, which is recorded within Other, net on the consolidated statements of earnings. Property and equipment are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset (asset group) may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset (asset group) to estimated, undiscounted future cash flows expected to be generated by the asset (asset group). If the carrying amount of an asset (asset group) exceeds its estimated undiscounted future cash flows, an impairment charge is recognized in the amount by which the carrying amount of the asset (asset group) exceeds the fair value of the asset (asset group). Fair Values of Financial Instruments Current accounting guidance requires disclosure of the estimated fair value of all of the Company’s financial instruments for which it is practicable to estimate that value. The estimated fair value amounts of the Company’s financial instruments have been determined using appropriate market information and valuation methodologies. Considerable judgment is required to develop the estimates of fair value, thus the estimates of fair value are not necessarily indicative of amounts that the Company could realize in a current market exchange. The fair value of financial instruments as of June 30, 2021 were as follows: Cash and cash equivalents - The carrying amounts of cash and cash equivalents reported in the consolidated balance sheet approximate fair value based on current interest rates and short-term maturities. Accounts receivable and retainage receivable - The carrying amounts of accounts receivable and retainage receivable reported in the consolidated balance sheet approximate fair value based on the short-term nature. Accounts payable - The carrying amounts of accounts payable reported in the consolidated balance sheet approximate fair value based on the short-term nature.

Blattner Holding Company and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED (UNAUDITED) June 30, 2021 12 Marketable securities - Marketable securities are reported at fair value. Fair Value Measurements Accounting Standards Codification (“ASC”) 820, Fair Value Measurement, clarifies the definition of fair value as the price that would be received to sell an asset, or paid to transfer a liability, in an orderly transaction between market participants at the measurement date (that is, an exit price). The exit price is based on the amount that the holder of the asset or liability would receive or need to pay in an actual transaction (or in a hypothetical transaction if an actual transaction does not exist) at the measurement date. In some circumstances, the entry and exit price may be the same; however, they are conceptually different. Fair value is generally determined based on quoted market prices in active markets for identical assets or liabilities. If quoted market prices are not available, the Company uses valuation techniques that place greater reliance on observable inputs and less reliance on unobservable inputs. In measuring fair value, the Company may make adjustments for risks and uncertainties, if a market participant would include such an adjustment in its pricing. ASC 820 establishes a fair value hierarchy that distinguishes between assumptions based on market data (observable inputs) and the Company’s assumptions (unobservable inputs). Determining where an asset or liability falls within that hierarchy depends on the lowest level input that is significant to the fair value measurement as a whole. An adjustment to the pricing method used within either Level 1 or Level 2 inputs could generate a fair-value measurement that effectively falls in a lower level in the hierarchy. The hierarchy consists of three broad levels as follows: Level 1 Quoted market prices in active markets for identical assets or liabilities; Level 2 Inputs other than Level 1 inputs that are either directly or indirectly observable; and Level 3 Unobservable inputs developed using estimates and assumptions, which reflect those that market participants would use. The determination of where an asset or liability falls in the hierarchy requires significant judgment. The Company evaluates its hierarchy disclosures annually and based on various factors, it is possible that an asset or liability may be classified differently from year to year. However, the Company expects that changes in classifications between different levels will be rare. The Company has determined that its investments are Level 1 and Level 2 inputs (see Note D). Accounting Estimates Preparing consolidated financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the consolidated financial statements and reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates. Recent Accounting Pronouncements In February 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2016-02, Leases, which requires lessees to recognize on the balance sheet certain operating and financing lease liabilities and corresponding right-of-use assets that have lease terms of greater than 12 months. This topic retains the distinction between finance leases and operating leases.

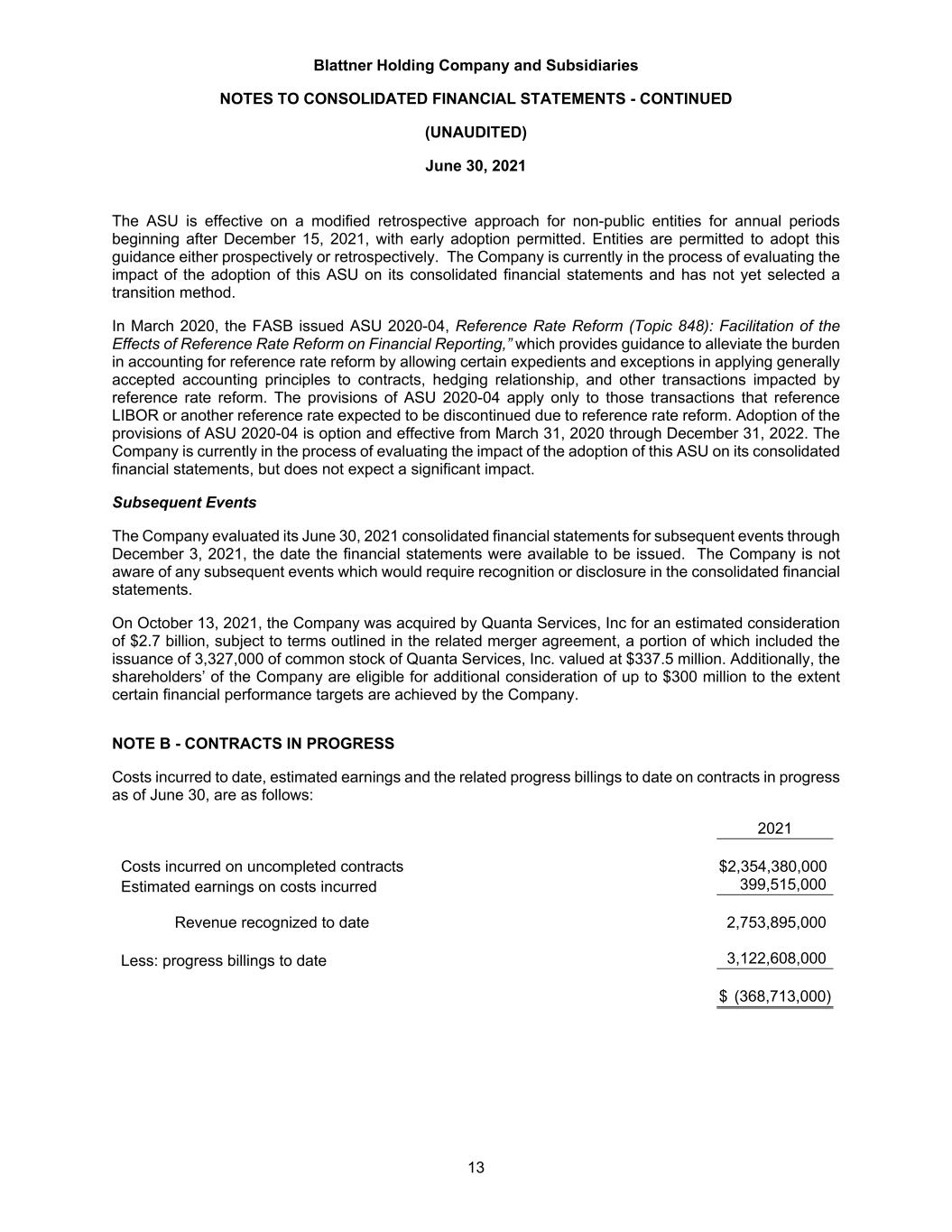

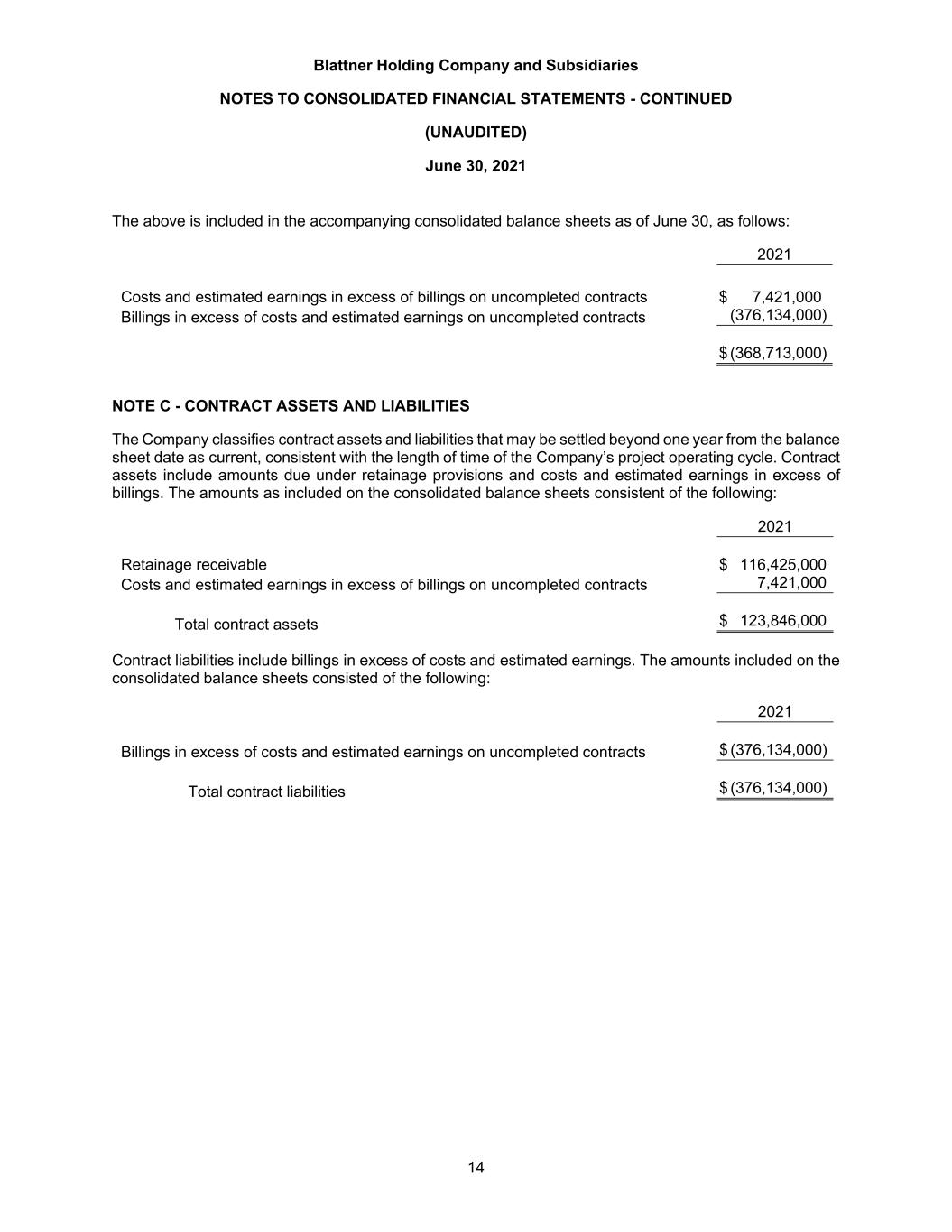

Blattner Holding Company and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED (UNAUDITED) June 30, 2021 13 The ASU is effective on a modified retrospective approach for non-public entities for annual periods beginning after December 15, 2021, with early adoption permitted. Entities are permitted to adopt this guidance either prospectively or retrospectively. The Company is currently in the process of evaluating the impact of the adoption of this ASU on its consolidated financial statements and has not yet selected a transition method. In March 2020, the FASB issued ASU 2020-04, Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting,” which provides guidance to alleviate the burden in accounting for reference rate reform by allowing certain expedients and exceptions in applying generally accepted accounting principles to contracts, hedging relationship, and other transactions impacted by reference rate reform. The provisions of ASU 2020-04 apply only to those transactions that reference LIBOR or another reference rate expected to be discontinued due to reference rate reform. Adoption of the provisions of ASU 2020-04 is option and effective from March 31, 2020 through December 31, 2022. The Company is currently in the process of evaluating the impact of the adoption of this ASU on its consolidated financial statements, but does not expect a significant impact. Subsequent Events The Company evaluated its June 30, 2021 consolidated financial statements for subsequent events through December 3, 2021, the date the financial statements were available to be issued. The Company is not aware of any subsequent events which would require recognition or disclosure in the consolidated financial statements. On October 13, 2021, the Company was acquired by Quanta Services, Inc for an estimated consideration of $2.7 billion, subject to terms outlined in the related merger agreement, a portion of which included the issuance of 3,327,000 of common stock of Quanta Services, Inc. valued at $337.5 million. Additionally, the shareholders’ of the Company are eligible for additional consideration of up to $300 million to the extent certain financial performance targets are achieved by the Company. NOTE B - CONTRACTS IN PROGRESS Costs incurred to date, estimated earnings and the related progress billings to date on contracts in progress as of June 30, are as follows: 2021 Costs incurred on uncompleted contracts $2,354,380,000 Estimated earnings on costs incurred 399,515,000 Revenue recognized to date 2,753,895,000 Less: progress billings to date 3,122,608,000 $ (368,713,000)

Blattner Holding Company and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED (UNAUDITED) June 30, 2021 14 The above is included in the accompanying consolidated balance sheets as of June 30, as follows: 2021 Costs and estimated earnings in excess of billings on uncompleted contracts $ 7,421,000 Billings in excess of costs and estimated earnings on uncompleted contracts (376,134,000) $ (368,713,000) NOTE C - CONTRACT ASSETS AND LIABILITIES The Company classifies contract assets and liabilities that may be settled beyond one year from the balance sheet date as current, consistent with the length of time of the Company’s project operating cycle. Contract assets include amounts due under retainage provisions and costs and estimated earnings in excess of billings. The amounts as included on the consolidated balance sheets consistent of the following: 2021 Retainage receivable $ 116,425,000 Costs and estimated earnings in excess of billings on uncompleted contracts 7,421,000 Total contract assets $ 123,846,000 Contract liabilities include billings in excess of costs and estimated earnings. The amounts included on the consolidated balance sheets consisted of the following: 2021 Billings in excess of costs and estimated earnings on uncompleted contracts $ (376,134,000) Total contract liabilities $ (376,134,000)

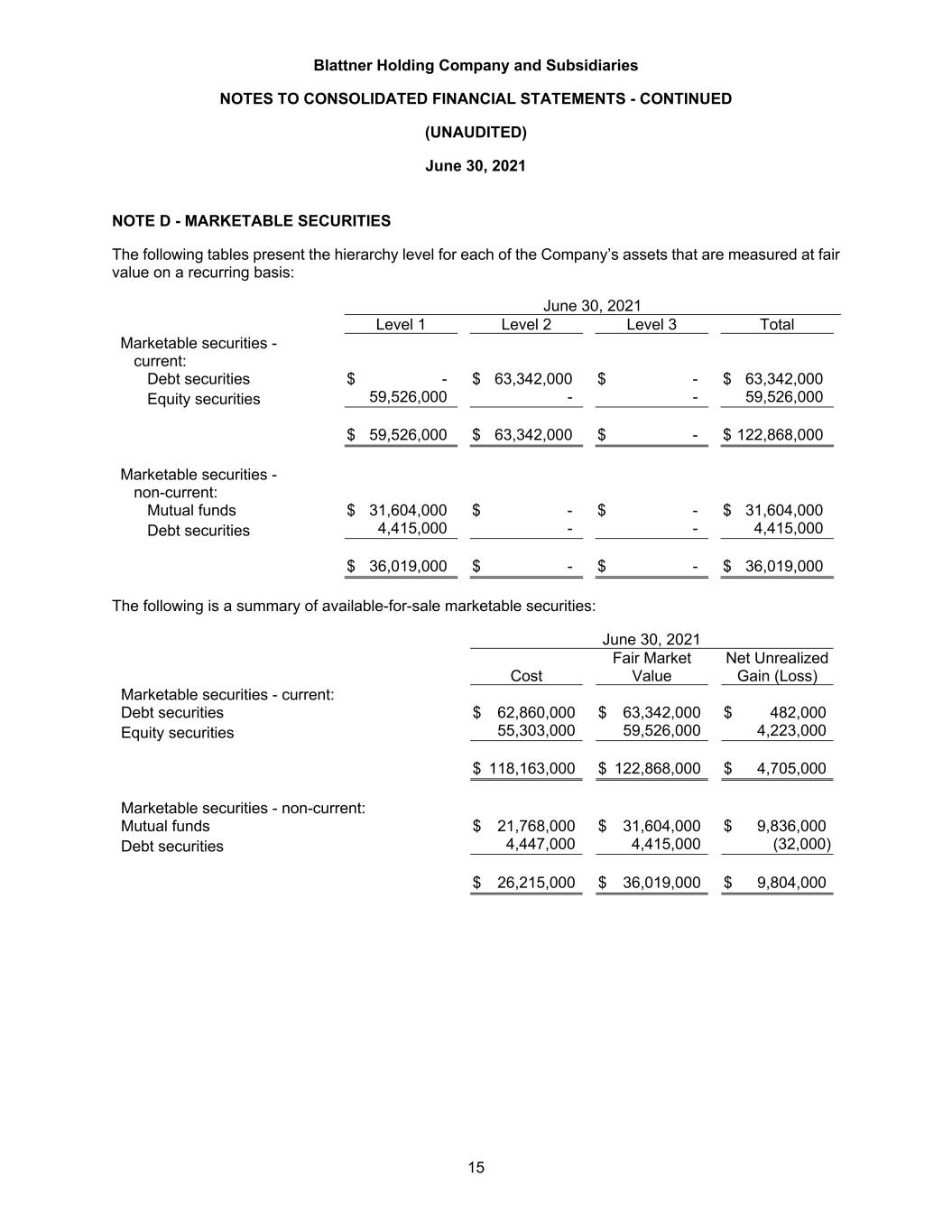

Blattner Holding Company and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED (UNAUDITED) June 30, 2021 15 NOTE D - MARKETABLE SECURITIES The following tables present the hierarchy level for each of the Company’s assets that are measured at fair value on a recurring basis: June 30, 2021 Level 1 Level 2 Level 3 Total Marketable securities - current: Debt securities $ - $ 63,342,000 $ - $ 63,342,000 Equity securities 59,526,000 - - 59,526,000 $ 59,526,000 $ 63,342,000 $ - $ 122,868,000 Marketable securities - non-current: Mutual funds $ 31,604,000 $ - $ - $ 31,604,000 Debt securities 4,415,000 - - 4,415,000 $ 36,019,000 $ - $ - $ 36,019,000 The following is a summary of available-for-sale marketable securities: June 30, 2021 Cost Fair Market Value Net Unrealized Gain (Loss) Marketable securities - current: Debt securities $ 62,860,000 $ 63,342,000 $ 482,000 Equity securities 55,303,000 59,526,000 4,223,000 $ 118,163,000 $ 122,868,000 $ 4,705,000 Marketable securities - non-current: Mutual funds $ 21,768,000 $ 31,604,000 $ 9,836,000 Debt securities 4,447,000 4,415,000 (32,000) $ 26,215,000 $ 36,019,000 $ 9,804,000

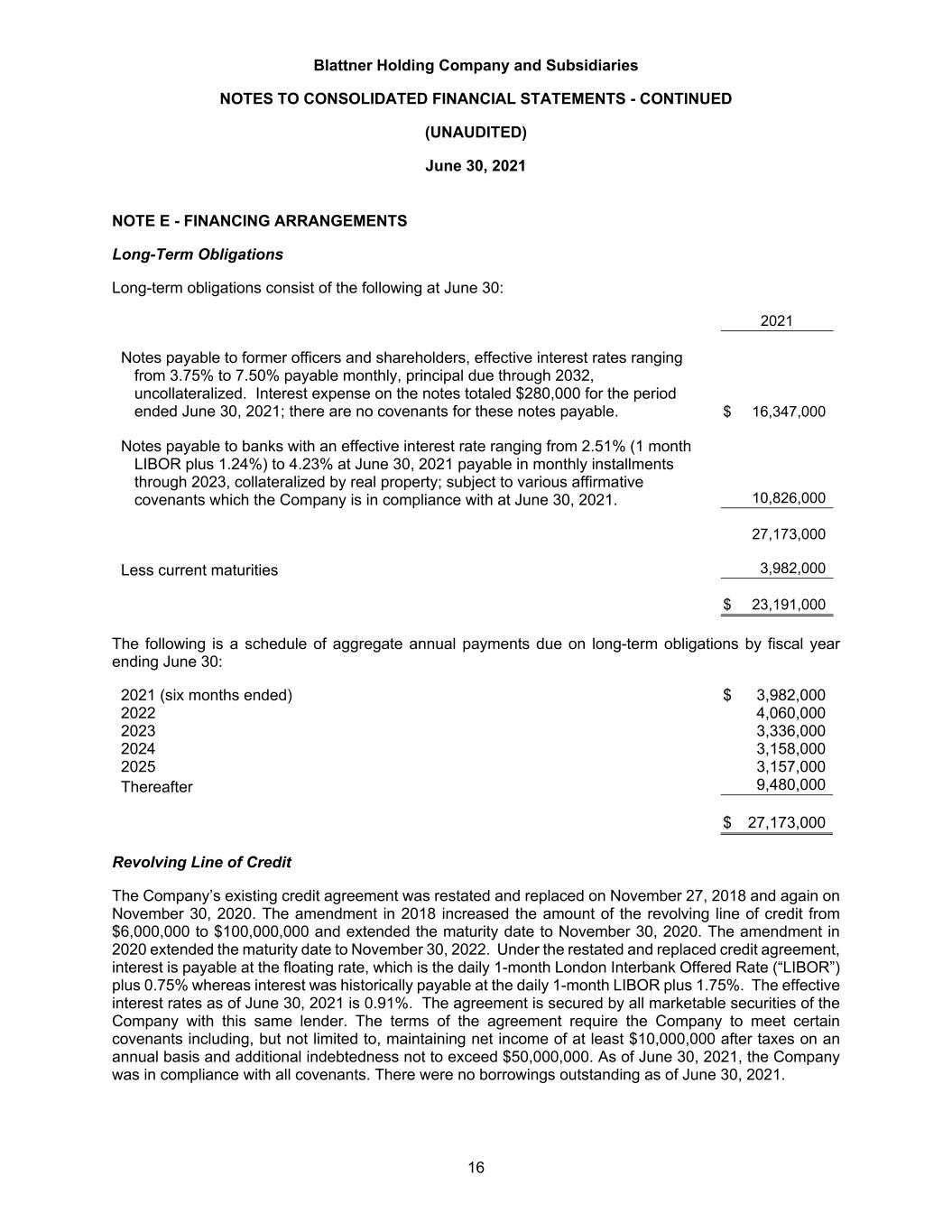

Blattner Holding Company and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED (UNAUDITED) June 30, 2021 16 NOTE E - FINANCING ARRANGEMENTS Long-Term Obligations Long-term obligations consist of the following at June 30: 2021 Notes payable to former officers and shareholders, effective interest rates ranging from 3.75% to 7.50% payable monthly, principal due through 2032, uncollateralized. Interest expense on the notes totaled $280,000 for the period ended June 30, 2021; there are no covenants for these notes payable. $ 16,347,000 Notes payable to banks with an effective interest rate ranging from 2.51% (1 month LIBOR plus 1.24%) to 4.23% at June 30, 2021 payable in monthly installments through 2023, collateralized by real property; subject to various affirmative covenants which the Company is in compliance with at June 30, 2021. 10,826,000 27,173,000 Less current maturities 3,982,000 $ 23,191,000 The following is a schedule of aggregate annual payments due on long-term obligations by fiscal year ending June 30: 2021 (six months ended) $ 3,982,000 2022 4,060,000 2023 3,336,000 2024 3,158,000 2025 3,157,000 Thereafter 9,480,000 $ 27,173,000 Revolving Line of Credit The Company’s existing credit agreement was restated and replaced on November 27, 2018 and again on November 30, 2020. The amendment in 2018 increased the amount of the revolving line of credit from $6,000,000 to $100,000,000 and extended the maturity date to November 30, 2020. The amendment in 2020 extended the maturity date to November 30, 2022. Under the restated and replaced credit agreement, interest is payable at the floating rate, which is the daily 1-month London Interbank Offered Rate (“LIBOR”) plus 0.75% whereas interest was historically payable at the daily 1-month LIBOR plus 1.75%. The effective interest rates as of June 30, 2021 is 0.91%. The agreement is secured by all marketable securities of the Company with this same lender. The terms of the agreement require the Company to meet certain covenants including, but not limited to, maintaining net income of at least $10,000,000 after taxes on an annual basis and additional indebtedness not to exceed $50,000,000. As of June 30, 2021, the Company was in compliance with all covenants. There were no borrowings outstanding as of June 30, 2021.

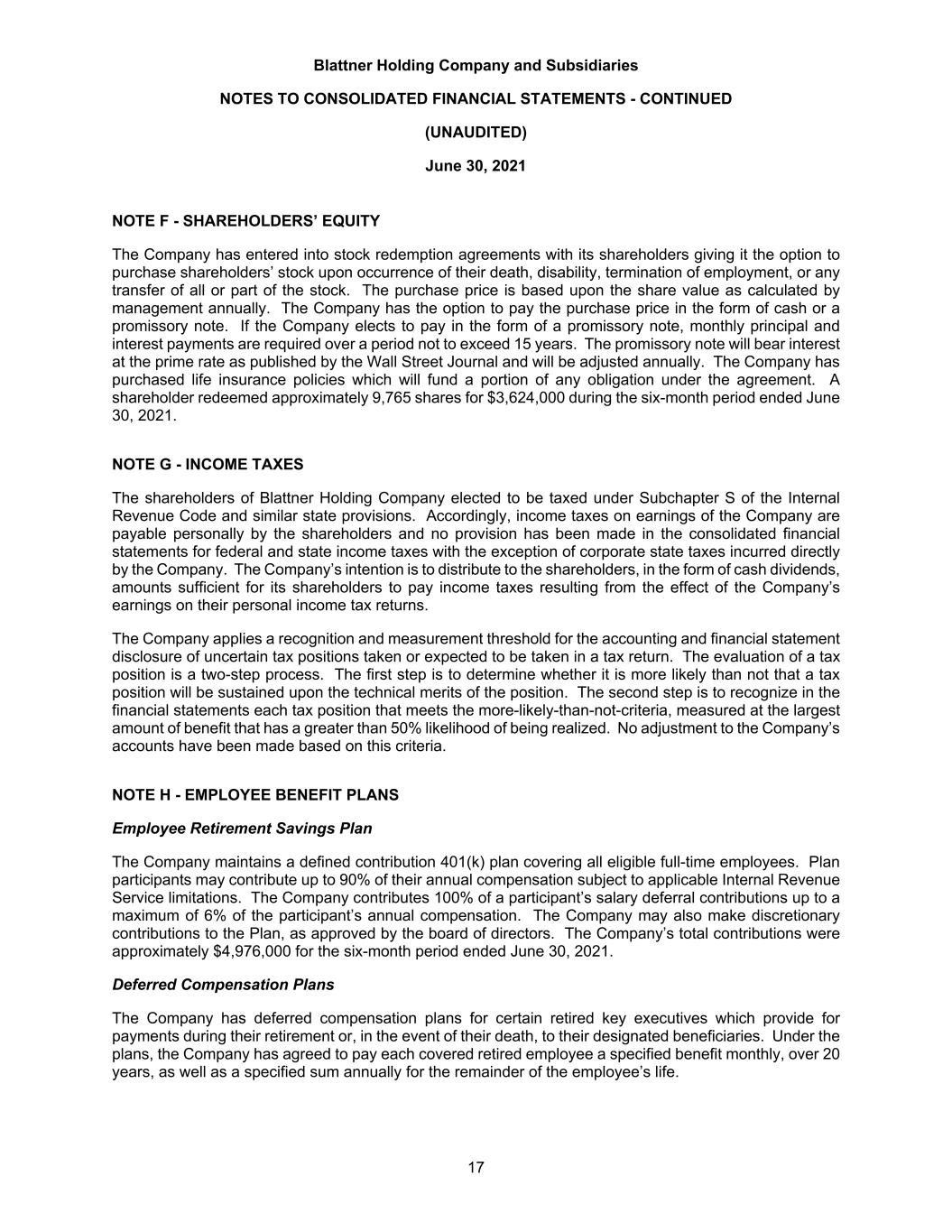

Blattner Holding Company and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED (UNAUDITED) June 30, 2021 17 NOTE F - SHAREHOLDERS’ EQUITY The Company has entered into stock redemption agreements with its shareholders giving it the option to purchase shareholders’ stock upon occurrence of their death, disability, termination of employment, or any transfer of all or part of the stock. The purchase price is based upon the share value as calculated by management annually. The Company has the option to pay the purchase price in the form of cash or a promissory note. If the Company elects to pay in the form of a promissory note, monthly principal and interest payments are required over a period not to exceed 15 years. The promissory note will bear interest at the prime rate as published by the Wall Street Journal and will be adjusted annually. The Company has purchased life insurance policies which will fund a portion of any obligation under the agreement. A shareholder redeemed approximately 9,765 shares for $3,624,000 during the six-month period ended June 30, 2021. NOTE G - INCOME TAXES The shareholders of Blattner Holding Company elected to be taxed under Subchapter S of the Internal Revenue Code and similar state provisions. Accordingly, income taxes on earnings of the Company are payable personally by the shareholders and no provision has been made in the consolidated financial statements for federal and state income taxes with the exception of corporate state taxes incurred directly by the Company. The Company’s intention is to distribute to the shareholders, in the form of cash dividends, amounts sufficient for its shareholders to pay income taxes resulting from the effect of the Company’s earnings on their personal income tax returns. The Company applies a recognition and measurement threshold for the accounting and financial statement disclosure of uncertain tax positions taken or expected to be taken in a tax return. The evaluation of a tax position is a two-step process. The first step is to determine whether it is more likely than not that a tax position will be sustained upon the technical merits of the position. The second step is to recognize in the financial statements each tax position that meets the more-likely-than-not-criteria, measured at the largest amount of benefit that has a greater than 50% likelihood of being realized. No adjustment to the Company’s accounts have been made based on this criteria. NOTE H - EMPLOYEE BENEFIT PLANS Employee Retirement Savings Plan The Company maintains a defined contribution 401(k) plan covering all eligible full-time employees. Plan participants may contribute up to 90% of their annual compensation subject to applicable Internal Revenue Service limitations. The Company contributes 100% of a participant’s salary deferral contributions up to a maximum of 6% of the participant’s annual compensation. The Company may also make discretionary contributions to the Plan, as approved by the board of directors. The Company’s total contributions were approximately $4,976,000 for the six-month period ended June 30, 2021. Deferred Compensation Plans The Company has deferred compensation plans for certain retired key executives which provide for payments during their retirement or, in the event of their death, to their designated beneficiaries. Under the plans, the Company has agreed to pay each covered retired employee a specified benefit monthly, over 20 years, as well as a specified sum annually for the remainder of the employee’s life.

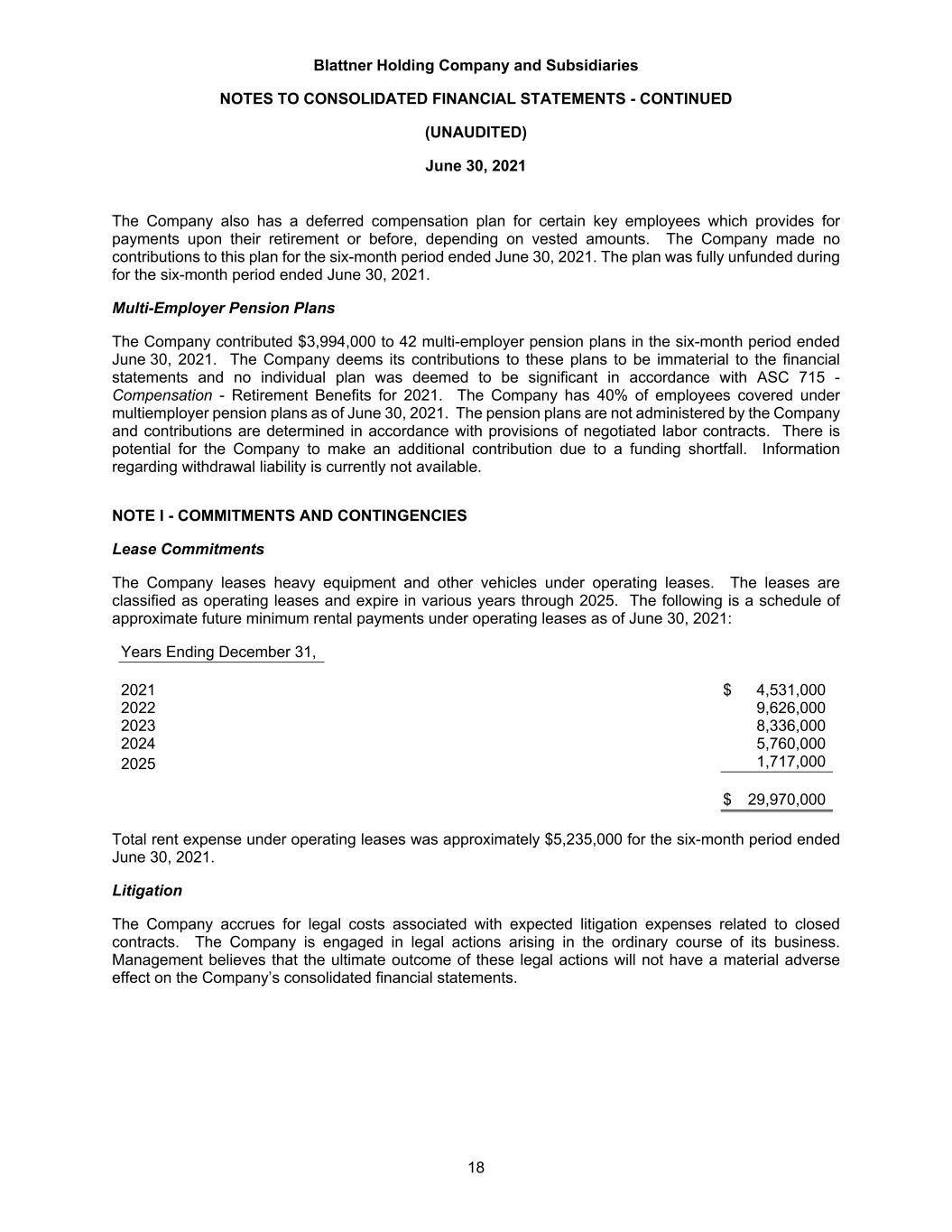

Blattner Holding Company and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED (UNAUDITED) June 30, 2021 18 The Company also has a deferred compensation plan for certain key employees which provides for payments upon their retirement or before, depending on vested amounts. The Company made no contributions to this plan for the six-month period ended June 30, 2021. The plan was fully unfunded during for the six-month period ended June 30, 2021. Multi-Employer Pension Plans The Company contributed $3,994,000 to 42 multi-employer pension plans in the six-month period ended June 30, 2021. The Company deems its contributions to these plans to be immaterial to the financial statements and no individual plan was deemed to be significant in accordance with ASC 715 - Compensation - Retirement Benefits for 2021. The Company has 40% of employees covered under multiemployer pension plans as of June 30, 2021. The pension plans are not administered by the Company and contributions are determined in accordance with provisions of negotiated labor contracts. There is potential for the Company to make an additional contribution due to a funding shortfall. Information regarding withdrawal liability is currently not available. NOTE I - COMMITMENTS AND CONTINGENCIES Lease Commitments The Company leases heavy equipment and other vehicles under operating leases. The leases are classified as operating leases and expire in various years through 2025. The following is a schedule of approximate future minimum rental payments under operating leases as of June 30, 2021: Years Ending December 31, 2021 $ 4,531,000 2022 9,626,000 2023 8,336,000 2024 5,760,000 2025 1,717,000 $ 29,970,000 Total rent expense under operating leases was approximately $5,235,000 for the six-month period ended June 30, 2021. Litigation The Company accrues for legal costs associated with expected litigation expenses related to closed contracts. The Company is engaged in legal actions arising in the ordinary course of its business. Management believes that the ultimate outcome of these legal actions will not have a material adverse effect on the Company’s consolidated financial statements.

Blattner Holding Company and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED (UNAUDITED) June 30, 2021 19 NOTE J - CONCENTRATIONS The nature of the Company’s business involves performing multi-million dollar contracts, which are obtained on a competitive-bid basis, for a limited number of customers. Because of this, it is possible for the majority of the Company’s annual revenues and receivables at year end to be concentrated in a limited number of customers that individually comprise at least 10% of total revenues. During the six-month period ended June 30, 2021, revenues from two customers comprised 50% of total revenues and 66% of total receivables outstanding from four customers as of June 30, 2021. Loss of these customers could have a material impact to the operations of the Company.

Exhibit 99.3

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS

Introduction

On October 13, 2021 (the “date of the Acquisition”), Quanta Services, Inc. (the “Company” or “Quanta”) completed the previously announced acquisition (the “Acquisition”) of Blattner Holding Company (“Blattner”) pursuant to the terms and conditions of the Agreement and Plan of Merger (the “Merger Agreement”), dated as of September 1, 2021, by and among the Company, Quanta Merger Sub, LLC, a Delaware limited liability company and wholly owned subsidiary of the Company (“Merger Sub”), Blattner, David Henry Company, a Minnesota corporation and wholly owned subsidiary of Blattner, and, solely for certain sections specified in the Merger Agreement, the Designated Company Shareholders (as defined in the Merger Agreement). Pursuant to the Merger Agreement, Merger Sub merged with and into Blattner, with Blattner surviving the merger as a wholly owned subsidiary of the Company.

Consideration paid by the Company in connection with the Acquisition consisted of $2.35 billion paid or payable in cash and 3,326,955 shares of Quanta common stock, which had a fair value of $345.4 million as of the date of the Acquisition. The final amount of consideration for the Acquisition remains subject to certain post-closing adjustments, including with respect to net working capital (inclusive of cash) and certain assumed liabilities. Additionally, pursuant to the terms of the Merger Agreement, the former Blattner owners are eligible for the potential payment of up to $300.0 million of contingent consideration, payable to the extent the acquired business achieves certain financial performance targets over a three-year period beginning in January 2022. Based on the estimated fair value of the contingent consideration, Quanta recorded a $125.6 million liability as of the date of the Acquisition. Contingent consideration is earned based on performance during each year of the three-year performance period, and amounts earned are payable in cash after the end of the applicable performance year. The Company may defer payment of earned contingent consideration amounts, at its sole discretion, until after the end of the entire three-year performance period; however, any deferred amounts will accrue interest at five percent per annum until paid.

The following unaudited pro forma condensed combined financial information (the “Pro Forma Financial Statements”) give effect to the Acquisition, which has been accounted for using the acquisition method of accounting with Quanta identified as the accounting acquirer. Under the acquisition method of accounting, Quanta has recorded assets acquired and liabilities assumed from Blattner at their respective acquisition date fair values on the closing date of the Acquisition.

The Pro Forma Financial Statements have been prepared from the respective historical consolidated financial statements of Quanta and Blattner, adjusted to give effect to the Acquisition. The unaudited pro forma condensed combined balance sheet (the “Pro Forma Balance Sheet”) combines the historical consolidated balance sheets of Quanta and Blattner as of June 30, 2021, giving effect to the Acquisition as if it had been completed on June 30, 2021. The unaudited pro forma condensed combined statements of operations (the “Pro Forma Statements of Operations”) for the six months ended June 30, 2021 and the year ended December 31, 2020 combine the historical consolidated statements of operations of Quanta and Blattner, giving effect to the Acquisition as if it had been completed on January 1, 2020. The Pro Forma Financial Statements contain certain reclassification adjustments to conform the historical Blattner financial statement presentation to Quanta’s financial statement presentation, as described further in Note 5 to the Pro Forma Financial Statements.

The Pro Forma Financial Statements are presented to reflect the Acquisition and the financing arrangements of Quanta in connection therewith and do not represent what Quanta’s financial position or results of operations would have been had the Acquisition occurred on the dates noted above, nor do they project the financial position or results of operations of the Company at any time following the Acquisition. The Pro Forma Financial Statements are intended to provide information about the continuing impact of the Acquisition as if it had been consummated earlier. The adjustments included in the Pro Forma Financial Statements are based on available information as of the date hereof and certain assumptions that management believes are factually supportable and are expected to have a continuing impact on Quanta’s results of operations with the exception of certain non-recurring charges to be incurred in connection with the Acquisition, as further described in Note 6 to the Pro Forma Financial Statements. In the opinion of management, all material adjustments necessary to state fairly the Pro Forma Financial Statements have been made.

Quanta and Blattner have incurred certain non-recurring charges in connection with the Acquisition, the substantial majority of which consist of fees paid to financial, legal and accounting advisors, compensation triggered upon the change in control of Blattner and certain bank-related fees. These non-recurring charges could affect the future results of the Company in the period in which such charges are incurred; however, these costs are not expected to be incurred in any period beyond twelve months after the closing date of the Acquisition. Accordingly, the Pro Forma Statement of Operations for the year ended December 31, 2020 includes these non-recurring charges as described in Note 6.

1

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS

Quanta has used information currently available to determine preliminary fair value estimates for the Acquisition consideration and its allocation to the tangible assets and identifiable intangible assets acquired and liabilities assumed. The fair value of consideration transferred to acquire Blattner was allocated based upon the estimated fair values of the assets acquired and liabilities assumed as of the date of the Acquisition, and the amounts for intangible assets are provisional and based on consultation with an independent valuation firm that assisted management with the valuation process. The assumptions and estimates used to determine the preliminary purchase price allocation and fair value adjustments are described in the notes accompanying the Pro Forma Financial Statements. Additionally, within the measurement period further adjustments to the purchase price allocation may be required as Quanta is able to, among other things, complete more detailed procedures to finalize valuations.

The transaction accounting adjustments are preliminary and subject to change as additional information becomes available and additional analysis is performed. The preliminary transaction accounting adjustments have been made solely for the purpose of providing the Pro Forma Financial Statements, and an increase or decrease in the fair value of any assets acquired and liabilities assumed upon completion of Quanta’s final valuation analyses would result in adjustments to the Pro Forma Balance Sheet and, if applicable, the Pro Forma Statement of Operations. As a result, the final purchase price allocation may be materially different than that reflected in the preliminary purchase price allocation presented herein.