Form 8-K/A Digital Media Solutions, For: Aug 09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________________________________

FORM 8-K/A

Amendment No. 1

__________________________________________________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): August 10, 2022

__________________________________________________________________________

Digital Media Solutions, Inc.

(Exact name of Registrant as specified in its charter)

__________________________________________________________________________

| Delaware | 001-38393 | 98-1399727 | ||||||

| (State of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||||||

4800 140th Avenue N., Suite 101 Clearwater, Florida | 33762 | ||||

| (Address of principal executive offices) | (Zip Code) | ||||

(877) 236-8632

(Registrant’s telephone number, including area code)

__________________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Class A common stock, $0.0001 par value per share | DMS | New York Stock Exchange | ||||||||||||

| Redeemable warrants to acquire Class A common stock | DMS WS | New York Stock Exchange | ||||||||||||

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY NOTE

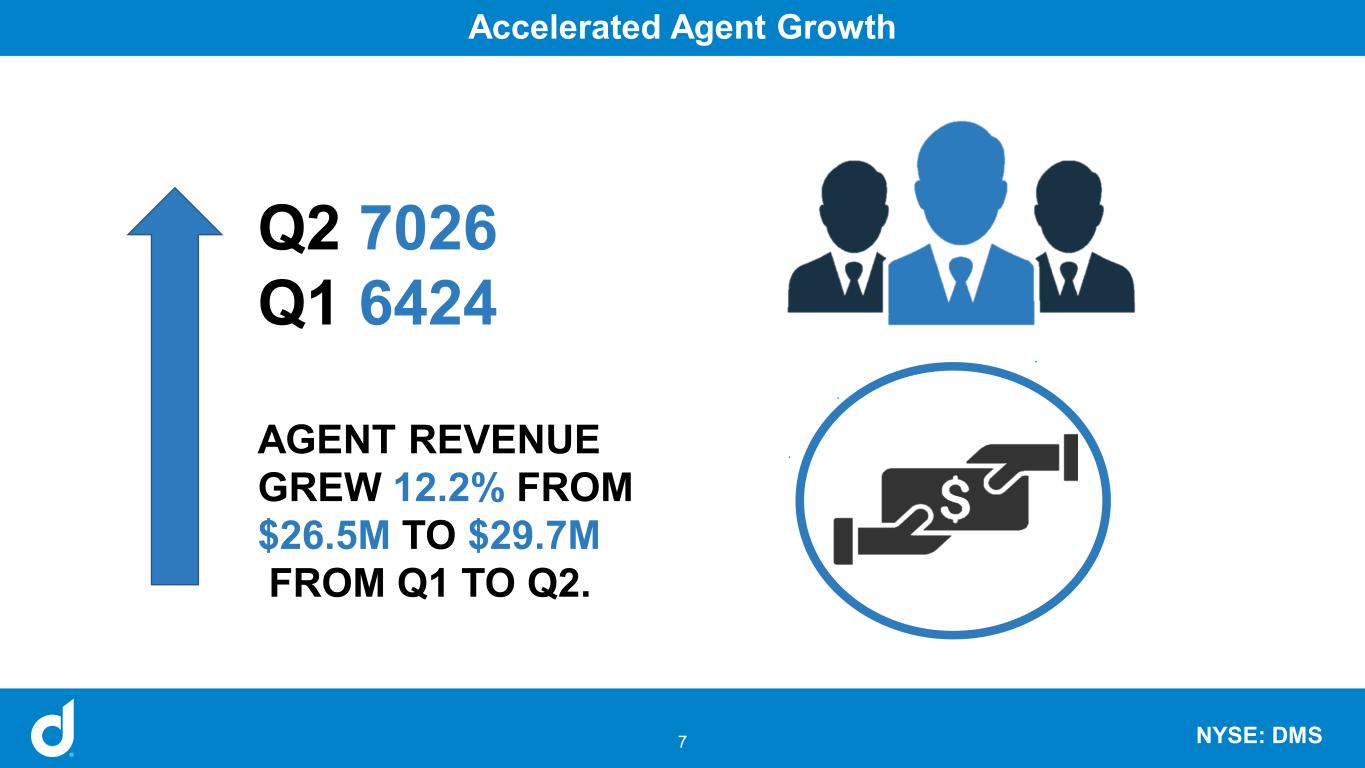

Digital Media Solutions, Inc. (the "Company") is furnishing this Amendment No. 1 to the Current Report on Form 8-K to amend Item 7.01 of the Current Report on Form 8-K filed on August 9, 2022 (the “Original Form 8-K”) solely to include an additional slide entitled “Accelerated Agent Growth” to provide further detail with respect to the increase in both the number of insurance agents and corresponding revenue. No other changes have been made to the Original Form 8-K or the Exhibit.

Item 7.01. Regulation FD Disclosure.

The executive officers of Digital Media Solutions, Inc. (the “Company”) intend to use the material filed herewith, in whole or in part, in one or more meetings with investors and analysts. A copy of the investor presentation is attached hereto as Exhibit 99.1.

The Company does not intend for this Item 7.01 or Exhibit 99.1 to be treated as “filed” for purposes of the Securities Exchange Act of 1934, as amended, or incorporated into its filings under the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits

The following exhibit relating to Item 7.01 shall be deemed to be “furnished” and not “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section:

| Exhibit Number | Description | ||||||||||

| Digital Media Solutions, Inc. Investor Presentation | |||||||||||

| 104 | Cover Page Interactive File (the cover page tags are embedded within the Inline XBRL document). | ||||||||||

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: August 10, 2022

| Digital Media Solutions, Inc. | |||||

| /s/ Richard Rodick | |||||

| Name: | Richard Rodick | ||||

| Title: | Chief Financial Officer | ||||

Investor Presentation August 2022 Digital Media Solutions (NYSE: DMS) is a leading provider of technology-enabled, data-driven digital performance advertising solutions connecting consumers and advertisers. Through our brand-direct and marketplace campaigns, DMS increases consumer access to branded products, services, promotions and savings while removing friction from the advertising ecosystem by delivering the right message to the right person at the right time and place. NYSE: DMS

Safe Harbor This presentation includes “forward-looking statements” within the meaning of that term in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and are made in reliance upon the "safe harbor" protections provided by such acts for forward-looking statements. These forward-looking statements are often identified by words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions. These forward-looking statements include, without limitation, DMS’s expectations with respect to its future performance and its ability to implement its strategy, and are based on the beliefs and expectations of our management team from the information available at the time such statements are made. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside DMS’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) the COVID-19 pandemic or other public health crises; (2) changes in client demand for our services and our ability to adapt to such changes; (3) the entry of new competitors in the market; (4) the ability to maintain and attract consumers and advertisers in the face of changing economic or competitive conditions; (5) the ability to maintain, grow and protect the data DMS obtains from consumers and advertisers; (6) the performance of DMS’s technology infrastructure; (7) the ability to protect DMS’s intellectual property rights; (8) the ability to successfully source and complete acquisitions and to integrate the operations of companies DMS acquires, including Traverse Data, Inc., the assets of Crisp Marketing, LLC and Aimtell, Inc., PushPros, Inc. and Aramis Interactive; (9) the ability to improve and maintain adequate internal controls over financial and management systems, and remediate the identified material weakness; (10) changes in applicable laws or regulations and the ability to maintain compliance; (11) our substantial levels of indebtedness; (12) volatility in the trading price on the NYSE of our common stock and warrants; (13) fluctuations in value of our private placement warrants; and (14) other risks and uncertainties indicated from time to time in DMS’s filings with the SEC, including those under “Risk Factors” in DMS’s Annual Report on Form 10-K and its subsequent filings with the SEC. There may be additional risks that we consider immaterial or which are unknown, and it is not possible to predict or identify all such risks. DMS cautions that the foregoing list of factors is not exclusive. DMS cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. DMS does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Non-GAAP Financial Measures In addition to providing financial measurements based on accounting principles generally accepted in the United States of America (“GAAP”), this presentation includes additional financial measures that are not prepared in accordance with GAAP (“non-GAAP”), including adjusted EBITDA, unlevered free cash flow, unlevered free cash flow conversion and Variable Marketing Margin. Definitions of each non-GAAP financial measure can be located in the Appendix. A reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures can be found below. For guidance purposes, the company is not providing a quantitative reconciliationof adjusted EBITDA and Variable Marketing Margin in reliance on the “unreasonable efforts” exception for forward-looking non-GAAP measures set forth in SEC rules because certain financial information, the probable significance of which cannot be determined, is not available and cannot be reasonably estimated without unreasonable effort and expense. We use these financial measures internally to review the performance of our business units without regard to certain accounting treatments and non-recurring items. We believe that presentation of these non-GAAP financial measures provides useful information to investors regarding our results of operations. Because of these limitations, management relies primarily on its GAAP results and uses non-GAAP measures only as a supplement. Disclaimer 2

Financial Performance Overview 3 1. Market-to-market warrant liability adjustments. 2. Balance includes business combination transaction fees and related payments on Company’s EIP, acquisition incentive payments, contingent consideration accretion, earnout payments and pre-acquisition expenses. 3. Balance includes legal fees associated with acquisitions and other extraordinary matters, costs related to philanthropic initiatives, and private warrant transaction related costs. 4. Costs savings as a result of the company reorganization initiated in Q2 2020. 5. Cost synergies expected as a result of the full integration of the acquisitions. 2021 Subtract: 1H '21 Q3-Q4 YTD Add: 1H '22 LTM Net revenue 427,935$ 201,882$ 226,053$ 200,307$ 426,360$ Cost of revenue 300,016 140,541 159,474 145,624 305,098 Salaries and related costs 48,014 21,977 26,037 26,945 52,982 General and administrative expenses 43,049 17,514 25,535 23,544 49,080 Acquisition costs 1,967 1,400 567 292 858 Change in fair value of contigent consideration liabili 1,106 560 546 2,536 3,082 Depreciation and amortization 25,401 12,463 12,938 14,233 27,170 Other income 0 0 0 0 0 Income (loss) from operations 8,383$ 7,427$ 956$ (12,867)$ (11,911)$ Interest expense 14,166 6,879 7,288 7,502 14,790 Change in fair value of warrant liabilities (18,115) (7,435) (10,680) (3,480) (14,160) Change in tax receivable agreement liability (15,289) 0 (15,289) 0 (15,289) Loss on extinguishment of debt 2,108 2,108 0 0 0 Loss on disposal of assets 8 0 8 0 8 Net income (loss) before income taxes 25,504$ 5,875$ 19,630$ (16,889)$ (12,541)$ Income tax expense 19,311 1,148 18,163 355 18,519 Net income (loss) 6,193$ 4,727$ 1,466$ (17,244)$ (31,060)$ Adjustments: Interest expense 14,166 6,879 7,288 7,502 14,790 Income tax expense 19,311 1,148 18,163 355 18,519 Depreciation and amortization 25,401 12,463 12,938 14,233 27,170 Change in fair value of warrant liabilities (1) (18,115) (7,435) (10,680) (3,480) (14,160) Change in tax receivable agreement liability (15,289) 0 (15,289) 0 (15,289) Debt extinguishment 2,108 2,108 0 0 0 Stock-based compensation 6,463 2,530 3,933 3,908 7,841 Restructuring 1,118 81 1,038 2,178 3,216 Acquisition costs (2) 3,073 1,960 1,113 2,828 3,940 Other expense (3) 6,744 3,242 3,501 3,234 6,735 Subtotal before additional adjustments 51,173 27,703 23,470 13,514 21,702 Pro Forma Cost Savings - Reorganization (4) 31 31 0 0 0 Pro Forma Cost Savings - Acquisitions (5) 3,330 1,800 1,530 0 1,530 Acquisition EBITDA 2,711 2,711 0 0 0 Accounts reserved 944 0 944 0 944 Adjusted EBITDA 58,189 32,245 25,944 13,514 39,458 Capital Expenditures 9,114 4,212 4,902 3,197 8,099 Unlevered Free Cash Flow 49,075 28,033 21,042 10,317 31,359 Unlevered Free Cash Flow Conversion 84.3% 86.9% 81.1% 76.3% 79.5% Adjusted EBITDA Margin % 13.6% 16.0% 11.5% 6.7% 9.3% as reported in the 10/K and 10Q

Performance-Based Digital Advertising Solutions 4 • Competitive advantage from first-party data asset that provides real-time, actionable consumer insights and data signals proven effective at driving growth and protecting margins • Proven value proposition supports consumer optionality and advertiser need to de-risk media spend while scaling results • Industry-agnostic solutions serve growing portfolio of loyal blue- chip advertiser clients across fast-growing verticals, including insurance, ecommerce and consumer finance • Dynamic diversification within insurance and other verticals allows us to pivot in parallel with consumer and advertiser demand to maintain growth momentum • Attractive financial profile, through long-term achievement of EBITDA profitability and FCF generation, plus demonstrated track record of accretive M&A further accelerating growth Through our marketplaces and brand-direct campaigns, DMS increases consumer access to branded products, services, promotions and savings opportunities. As a result, DMS provides superior customer acquisition solutions to our broad-based digital advertiser clients. 4

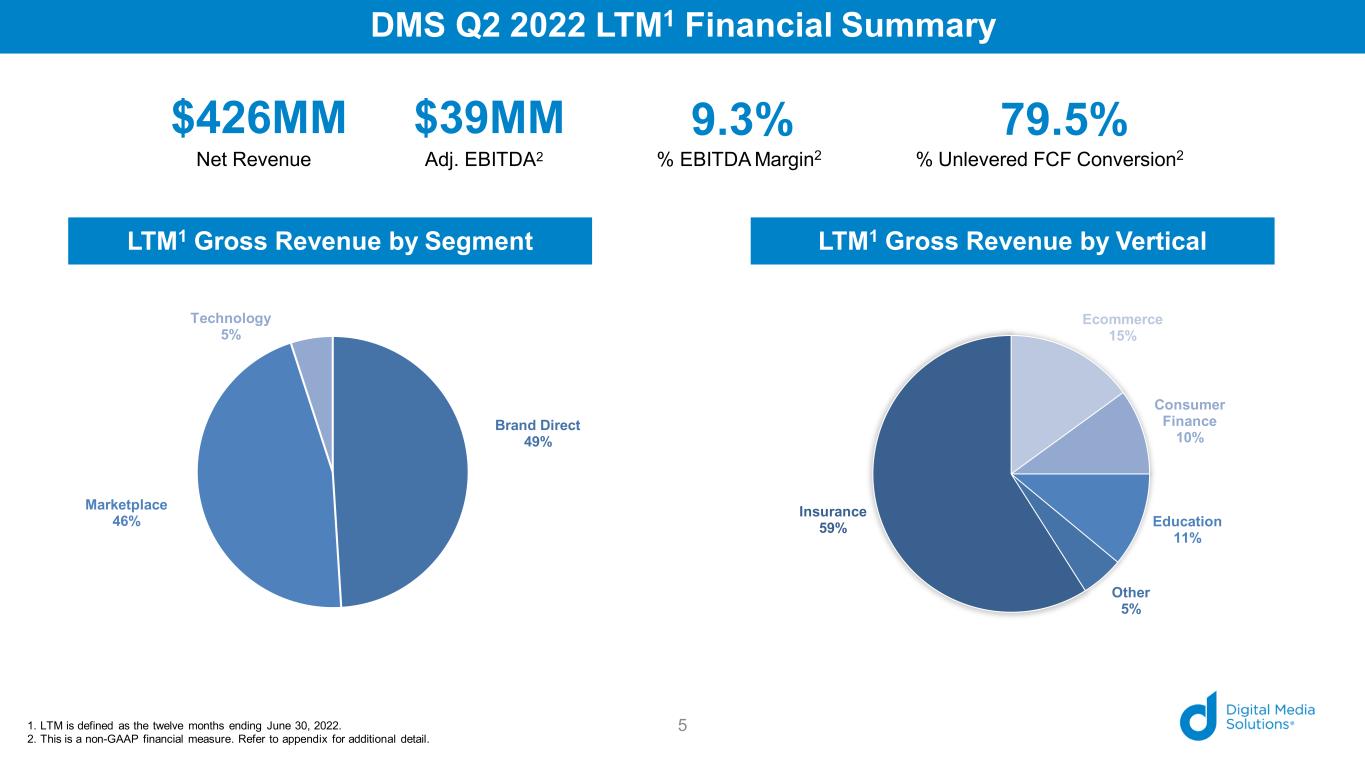

DMS Q2 2022 LTM1 Financial Summary LTM1 Gross Revenue by Vertical 51. LTM is defined as the twelve months ending June 30, 2022. 2. This is a non-GAAP financial measure. Refer to appendix for additional detail. Ecommerce 15% Consumer Finance 10% Education 11% Other 5% Insurance 59% Brand Direct 49% Marketplace 46% Technology 5% LTM1 Gross Revenue by Segment Net Revenue Adj. EBITDA2 % EBITDA Margin2 % Unlevered FCF Conversion2 $426MM $39MM 9.3% 79.5%

Significant Reach Of The DMS Platform 6 Note: 6 NYSE: DMS ~2,000 ~7,000 ~500 250MM 7BN 7.3BN Enterprise Level Clients Unique Consumer Profiles Engagement Events In Q2Quarterly Consumer Impressions SMB Clients FTEs

Accelerated Agent Growth 7 Note: 7 NYSE: DMS AGENT REVENUE GREW 12.2% FROM $26.5M TO $29.7M FROM Q1 TO Q2. Q2 7026 Q1 6424

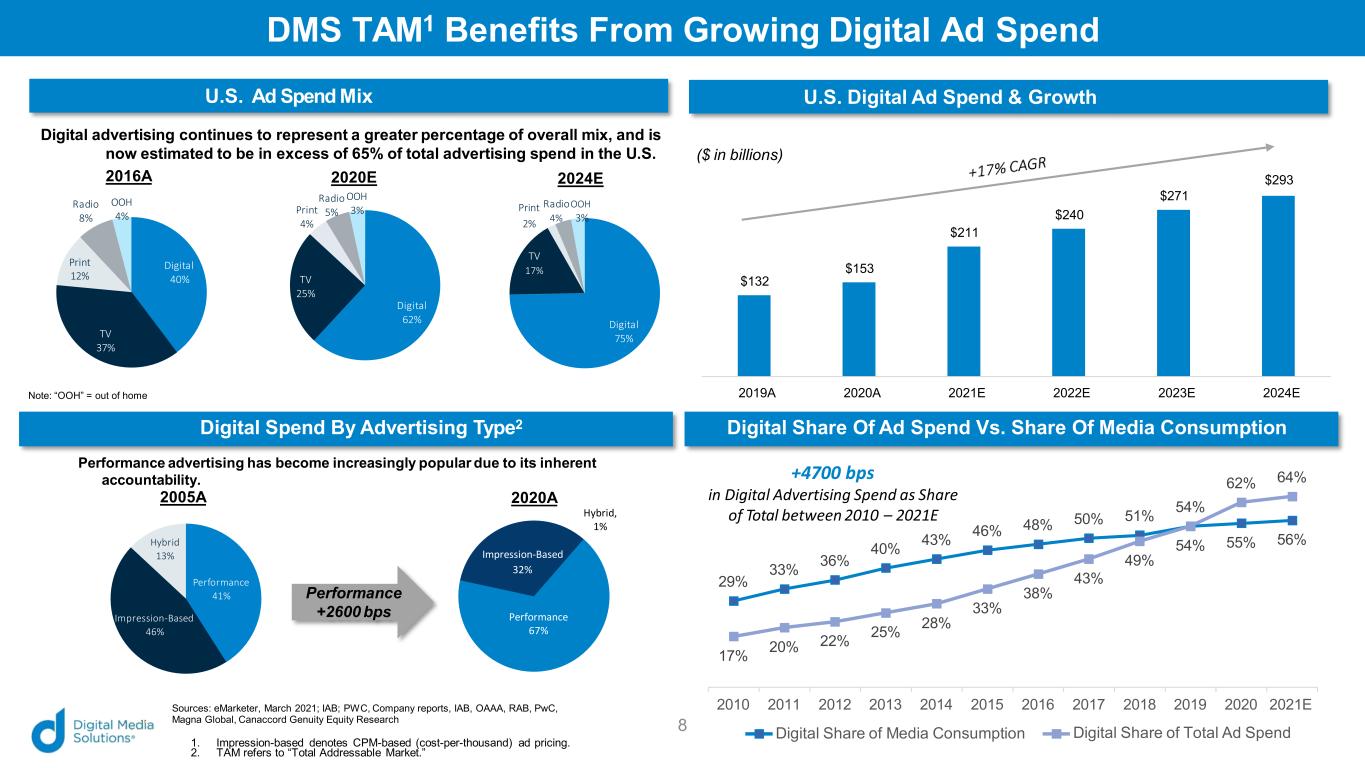

Performance 67% Impression-Based 32% Hybrid, 1% $132 $153 $211 $240 $271 $293 DMS TAM1 Benefits From Growing Digital Ad Spend Sources: eMarketer, March 2021; IAB; PWC, Company reports, IAB, OAAA, RAB, PwC, Magna Global, Canaccord Genuity Equity Research U.S. Ad Spend Mix Digital 40% TV 37% Print 12% Radio 8% OOH 4% TV 25% Digital 75% TV 17% 2% Print 4% RadioOOH 3% 2016A 2024E Digital advertising continues to represent a greater percentage of overall mix, and is now estimated to be in excess of 65% of total advertising spend in the U.S. Note: “OOH” = out of home 2005A 2020A Performance 41% Impression-Based 46% Hybrid 13% Performance +2600 bps Performance advertising has become increasingly popular due to its inherent accountability. U.S. Digital Ad Spend & Growth ($ in billions) 2019A 2020A 2021E 2022E 2023E 2024E +4700 bps in Digital Advertising Spend as Share of Total between 2010 – 2021E 29% 33% 36% 40% 43% 46% 48% 50% 51% 54% 55% 56% 17% 20% 22% 25% 28% 33% 38% 43% 49% 54% 62% 64% Digital Share of Media Consumption 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021E Digital Share of Total Ad Spend Digital 62% TV 25% Print 4% Radio 5% OOH 3% 2020E 8 1. Impression-based denotes CPM-based (cost-per-thousand) ad pricing. 2. TAM refers to “Total Addressable Market.” Digital Spend By Advertising Type2 Digital Share Of Ad Spend Vs. Share Of Media Consumption

7 DMS Growth Momentum Dynamic DiversificationScaled SpendData Flywheel Part Of Industry-Leading Toolset Reliable ROI Drives Growth Of Client Spend Vertical-Agnostic & Channel-Agnostic NYSE: DMS9

10 Interest Awareness CPM (Cost per thousand) CPL & CPT (Cost per lead) (Cost per transfer) CPE (Cost per engagement) CPC (Cost per click) CPS (Cost per sale or % of transaction value) Near Customers Intent Customers Purchase Most Value To Advertisers Least Value To Advertisers DMS De-Risks Advertising Spend Unlike traditional advertising, digital performance advertising enables advertisers to pay only for qualified intent and outcomes. Branding Unregistered View/Click Unqualified Browsing Performance Advertising Registered Lead/Purchase Qualified Researching Transactions C ( t r t ) CPL & CPT (Cost per lead) (Cost per transfer) CPE (Cost per engagement) CPC (Cost per click) CPS (Cost per sale) CPA (Cost per action)

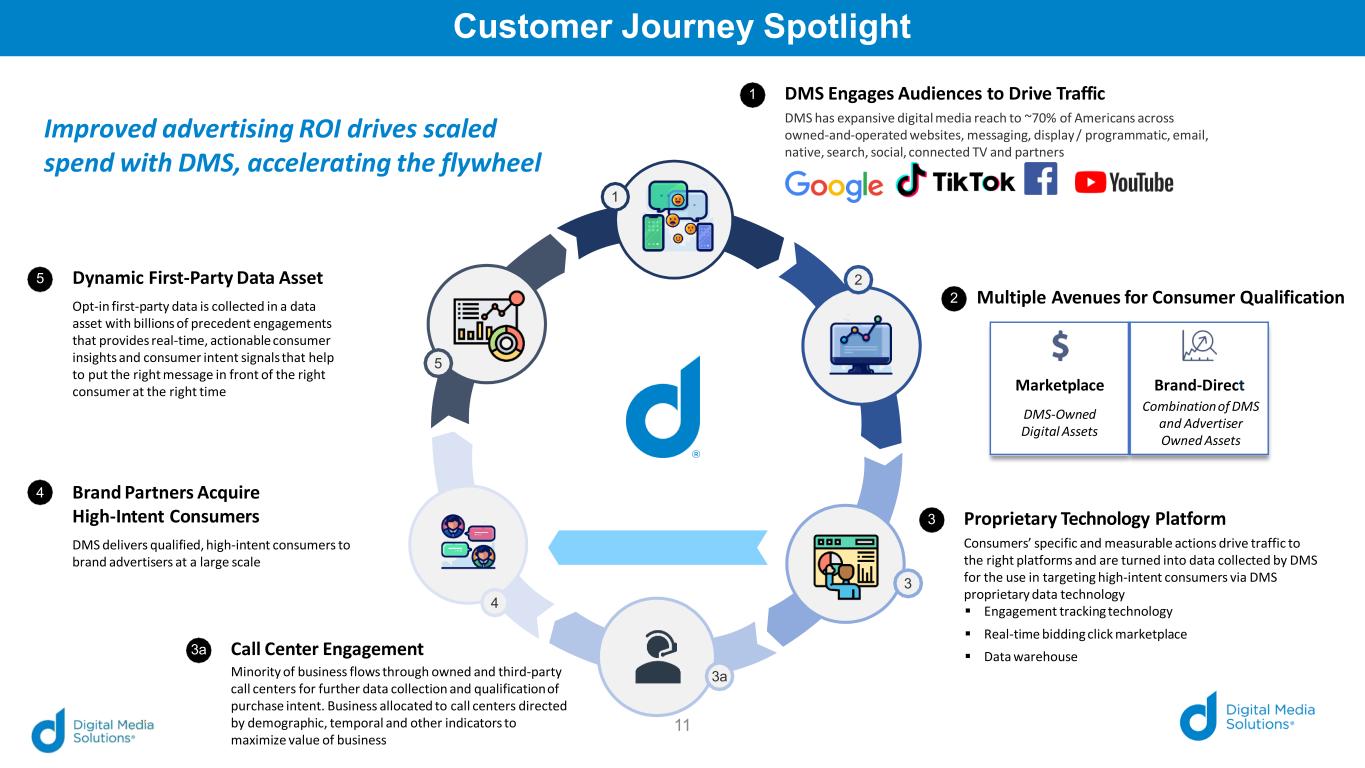

Customer Journey Spotlight 1 3a 4 5 2 1 DMS Engages Audiences to Drive Traffic DMS has expansive digital media reach to ~70% of Americans across owned-and-operated websites, messaging, display / programmatic, email, native, search, social, connected TV and partners 2 Multiple Avenues for Consumer Qualification Marketplace Brand-Direct DMS-Owned Digital Assets Combinationof DMS and Advertiser Owned Assets 3 Proprietary Technology Platform Consumers’ specific and measurable actions drive traffic to the right platforms and are turned into data collected by DMS for the use in targeting high-intent consumers via DMS proprietary data technology Engagement tracking technology Real-time bidding click marketplace Data warehouse Brand Partners Acquire High-Intent Consumers DMS delivers qualified, high-intent consumers to brand advertisers at a large scale 4 5 Dynamic First-Party Data Asset Opt-in first-party data is collected in a data asset with billions of precedent engagements that provides real-time, actionable consumer insights and consumer intent signals that help to put the right message in front of the right consumer at the right time Improved advertising ROI drives scaled spend with DMS, accelerating the flywheel 3 3a Call Center Engagement Minority of business flows through owned and third-party call centers for further data collection and qualificationof purchase intent. Business allocated to call centers directed by demographic, temporal and other indicators to maximize value of business 11

DMS Provides Value To Consumers & Advertisers + FIRST-PARTY DATA ASSET PROPRIETARY TECH + EXPANSIVE DIGITAL MEDIA REACH = 4Rs RIGHT PERSON RIGHT OFFER RIGHT PLACE RIGHT TIME For Consumers Options SavingsPromotions easier access to: For DMS Advertiser Clients easier access to: Transactions Customers & Near Customers 12

11 DMS Delivers Reliable Advertising ROI The Flywheel Creates Growth & Consistency Among Top 20 Advertisers INSURANCE: 10 of the largest U.S. insurance firms across auto, home, life & health ECOMMERCE: Leading top consumer brands across ecommerce, DTC, food, retail and more CONSUMER FINANCE: Top 3 mortgage lenders + top 3 consumer reporting companies CAREER & EDUCATION: Top-tier large universities + large learning software providers HOME SERVICES: 2 of the leading home security companies in the U.S. NYSE: DMS13 100% Retention: Top 20 advertiser clients Top 20 insurance clients 2020 to 2021 Significant And Growing Brand Name Roster Of Blue-Chip Clients Across

12 Dynamic Diversification – Advertiser Demand NYSE: DMS LTM1 Insurance Gross Revenue By Insurance VerticalLTM1 Gross Revenue By Vertical Auto 55% Health 34% Home 4% Life 7%Ecommerce 15% Consumer Finance 10% Education 11% Insurance 59% Other 5% 14 1. LTM is defined as the twelve months ending June 30, 2022.

DMS targets audiences where they spend their time and engages high-intent consumers when they are ready to take action • Nearly 100% digital channels • Deep digital media buying experience • Media distribution to every American consumer segment; reaching ~70% of U.S. adults • SaaS offering includes online real-time management of advertising activities and KPIs, such as channel performance and attribution • Aimtell / PushPros added powerful,AI- powered SaaS push technology to enhance consumer engagement with hyper-targeted messaging, leveraging advanced machine learning and customization features, to boost conversion rates and advertiser client ROI • As legacy methods of targeting are retired (e.g. Google third-party cookies), advertisers will place increasing value on first-party data and DMS solutions • No SEO exposure to algorithm risk Commentary NM 8.5% 10.7% 13.8% 23.2%3.6% 8.6% 18.7% Messaging capabilities enhancedwith Digital streaming platforms are a future growth driver for DMS Note: Other channels represent 12.9% of media spend. Dynamic Diversification – Traffic & Media 15

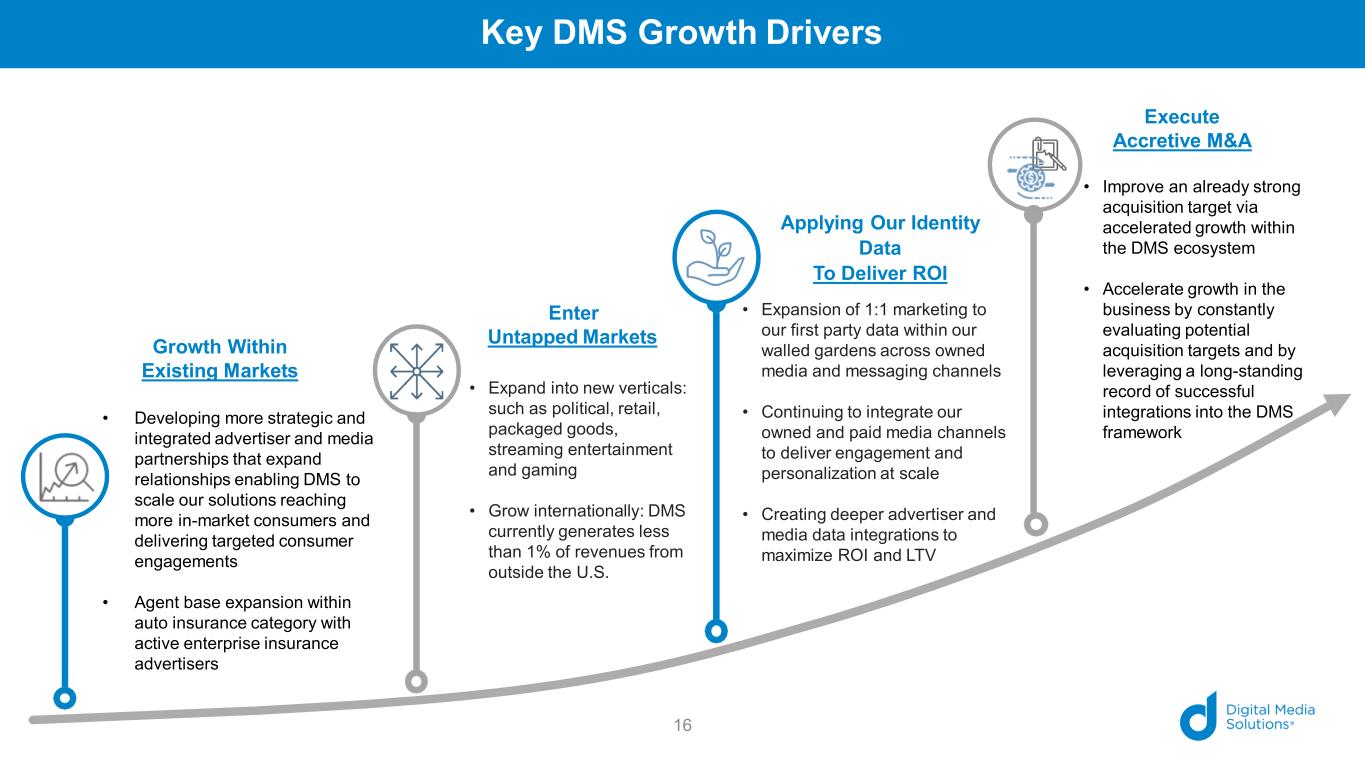

Key DMS Growth Drivers • Expand into new verticals: such as political, retail, packaged goods, streaming entertainment and gaming • Grow internationally: DMS currently generates less than 1% of revenues from outside the U.S. Growth Within Existing Markets • Developing more strategic and integrated advertiser and media partnerships that expand relationships enabling DMS to scale our solutions reaching more in-market consumers and delivering targeted consumer engagements • Agent base expansion within auto insurance category with active enterprise insurance advertisers Enter Untapped Markets • Expansion of 1:1 marketing to our first party data within our walled gardens across owned media and messaging channels • Continuing to integrate our owned and paid media channels to deliver engagement and personalization at scale • Creating deeper advertiser and media data integrations to maximize ROI and LTV Execute Accretive M&A • Improve an already strong acquisition target via accelerated growth within the DMS ecosystem • Accelerate growth in the business by constantly evaluating potential acquisition targets and by leveraging a long-standing record of successful integrations into the DMS framework 16 Applying Our Identity Data To Deliver ROI

Brand-Direct Solutions (49% LTM1 Revenue) Marketplace Solutions (46% LTM1 Revenue) Technology Solutions (5% LTM1 Revenue) Deliver customers + near customers at or below transparent, identified cost threshold de-risking ad spend Filter leads through first-person database using proprietary technology Place advertising on behalf of clients across channels (e.g. search, social, email, etc.) Attract consumers to O&O websites relevant to clients served License proprietary technology to clients to manage, track and optimize campaigns 1 2 Brand-Direct Solutions 49% Top 3 U.S. Mortgage Lender Top 3 U.S. Auto Insurer Leading Home Security Company Top 100 U.S. University Fortune 50 Beverage Brand Leading U.S. Auto Insurer Top U.S. Home Services Company Numerous Ecommerce Brands Marketplace Solutions 46% Technology Solutions 5% DMS Key Comparables DMS Key Customers DMS Business Model & Mix 3 2-way feedback loop 15 NYSE: DMS End-To-End Platform Optimizes Customer Acquisition At Attractive ROI DMS Business Mix (% Of Revenue) 17 1. LTM is defined as the twelve months ending June 30, 2022.

14 Successful Acquisitions DMS Playbook Strong Track Record Of M&A Core M&A Criteria Add new verticals or strengthen existing verticals Enhance distribution capabilities 1 Management collaborated with third-party consultancy to streamline professionalized approach to M&A 2 Dedicated and experienced team manages M&A process 3 Maintain and evaluate pipeline of opportunities 4 Form internal SteerCo (key management plus associates with relevant expertise) to drive deal diligence, execution and integration 5 Post-closing, the target is integrated and fully harmonized into DMS within ~12 months • HR onboarding for new FTEs • Integration of IT systems, product management and sales 18 Strong M&A Track Record Strengthen technology platform

Growing Insurance Market Digital Insurance Ad Spend Customer Acquisition & Industry Ad Spend • While investments in digital ad spend have accelerated, the insurance market remains underpenetrated relative to other sectors • COVID-19 advanced the digital transition, driving insurance carriers to evolve through increasing digital spend • Consumers are increasingly researching and purchasing insurance policies online • Digital channels are producing a disproportionate amount of growth in gross written periods, with expectations of current trends continuing through 2025 Commentary 20-25% % of budget allocated to customer acquisition in 2019 $16b 2025 est. insurance industry digital spend 31% Estimated % of budget allocated to customer acquisition in 2025 ($ in billions) 2.2 3.8 6.1 9.1 1.7 2.5 3.5 4.7 $4.3 0.4 0.9 1.3 1.8 $7.2 $10.9 $15.6 2019 2021 2023 2025 Property & Casualty Medicare Life CAGR 24% 29% 19% 27% Expanding Medicare Brokerage Opportunities 19M 20M 22M 24M 26M 38M 2017 2018 2019 2020 2021 2025 Medicare Advantage Enrollment 10% 20% 30% 2008A 2016A 2022E Market Penetration Of Independent Digital / Telesales Distribution Sources: S&P Global Market Intelligence, CMS, eHealth, Kaiser Family Foundation, America’s Health Insurance Plans, KFF, Wall Street Research. 19

$11 $14 $18 $20 $24 2017 2018 2019 2020 2021 US Channel Consumer Finance Advertising Spending DMS Serves Verticals Well-Positioned For Growth Sources: eMarketer, Statista, Coursera, The CMO Survey Ecommerce Consumer Finance Career & Education Due to the pandemic, 73% of US consumers shifted to digital banking and digital payments Due to the change in consumer behavior, banks and other financial services providers are focusing on improving the customer experience of their digital properties Financial services businesses will continue to use digital advertising to gain customers and boost brand reputation ($ in billions) Ecommerce had been expected to double to $4.5 trillion in 2021 from $2.3 trillion in 2017 Ecommerce sales are projected to be 22% of all retail sales by 2025, up from 14% in 2020 $13 $19 $24 $30 $36 $41 2019 2020 2021 2022 2023 2024 US Ecommerce Channel Digital Advertising Spending ($ in billions) 20 Strong Customer Acquisition Spending Across Verticals Demand for online education is growing Digital marketing is more impactful toward business performance in the education sector compared to any other sector according to CMOs in 2021, according to The CMO Survey Continued digital transformation is expected to drive digital advertising spending increase in the education sector $26 $43 $59 $76 $143 $189 0 100 200 2016 2017 2018 2019 2020 2021 Total number of enrollments ($ in millions)

3Q’22 & FY’22 FINANCIAL OUTLOOK NYSE: DMS

Q3 + 2022 Full Year Guidance 221. This is a non-GAAP financial measure. Refer to appendix for additional detail. 3Q22 ($ in millions) FY22 ($ in millions) GAAP Revenue $87 - $90 $390 - $400 Adjusted EBITDA1 $4 - $6 $30 - $35 Gross Margin1 28% - 31% 28% - 31% Variable Marketing Margin1 32% - 36% 32% - 36%

Investment Highlights NYSE: DMS

1. A leading provider of diversified performance advertising solutions 2. Unique first-party data asset and proprietary technology platform optimize ROI and increase client retention 3. Serves a diverse range of strong, growing end markets 4. Strong retention rates with increasing spend from blue-chip customer base 7. History of accretive M&A with significant pipeline of opportunities 9. Strong organic growth with in-flight initiatives to drive continued success 8. Founder-led management team with strong track record and significant ownership 6. Positioned for ongoing shift toward digital customer acquisition and increasing advertiser ROI focus Investment Highlights 5. Diverse and stable customer and supplier mix 10. Highly profitable with significant cash flow generation 24

Large & Powerful Data Asset Proprietary, opt-in database with over 7bn quarterly impressions to leverage spanning ~70% of the adult population in the U.S. Continuous investment of DMS advertising spend on behalf of its clients since 2012 Highly scalable, as ad spend perpetuates regularly optimized results and creates significant barriers to entry Engage high-intent audiences with the right messaging at the right time Meet ROI goals by delivering customers and near customers to brands looking to grow their businesses Provide differentiated consumer intelligence & signals to understand in- market audiences: where they are, what they want, when they engage, when they are ready to buy Drive efficiency as audiences are targeted based on billions of precedent interactions Analyze aggregated data to target based on knowledge of consumer habits Recalibrate and optimize based on consumer interactions in order to make the most efficient media buying decisions for the next cycle 25

Dynamic First-Party Data Asset Proprietary Technology To Deliver Customers And Leads Pay-For-Performance Model Vertical & Channel Agnostic Model Of Scale 26 DMS Provides Solutions Digital Advertising Solution • Difficulty scaling campaigns in highly competitive media channels • 1:1 campaign targeting without cookies Common Advertiser Problems • Audience insight & targeting challenges • Personalized 1:1 advertising at scale • Media “waste” while scaling campaigns • Inability to track ROI • Transparent pricing that delivers leads and customers at or below target customer acquisition cost (CAC) • DMS provides linear connection between ad spend and results • DMS is an end-to-end digital customer acquisition solution provider capturing growth across verticals & media channels • DMS helps advertisers launch, edit and optimize campaigns quickly • Multiple partners to achieve one advertising objective • Static campaigns that don’t scale • Leverage first-party database of consented, known consumers • Insights and signals put the right message in front of the right consumer at the right time • Integrated technology stack tracks all user interactions, indexes & stores data, manages click & lead routing + more • Capabilities include already implemented & tested cookie-less targeting The DMS Difference NYSE: DMS26

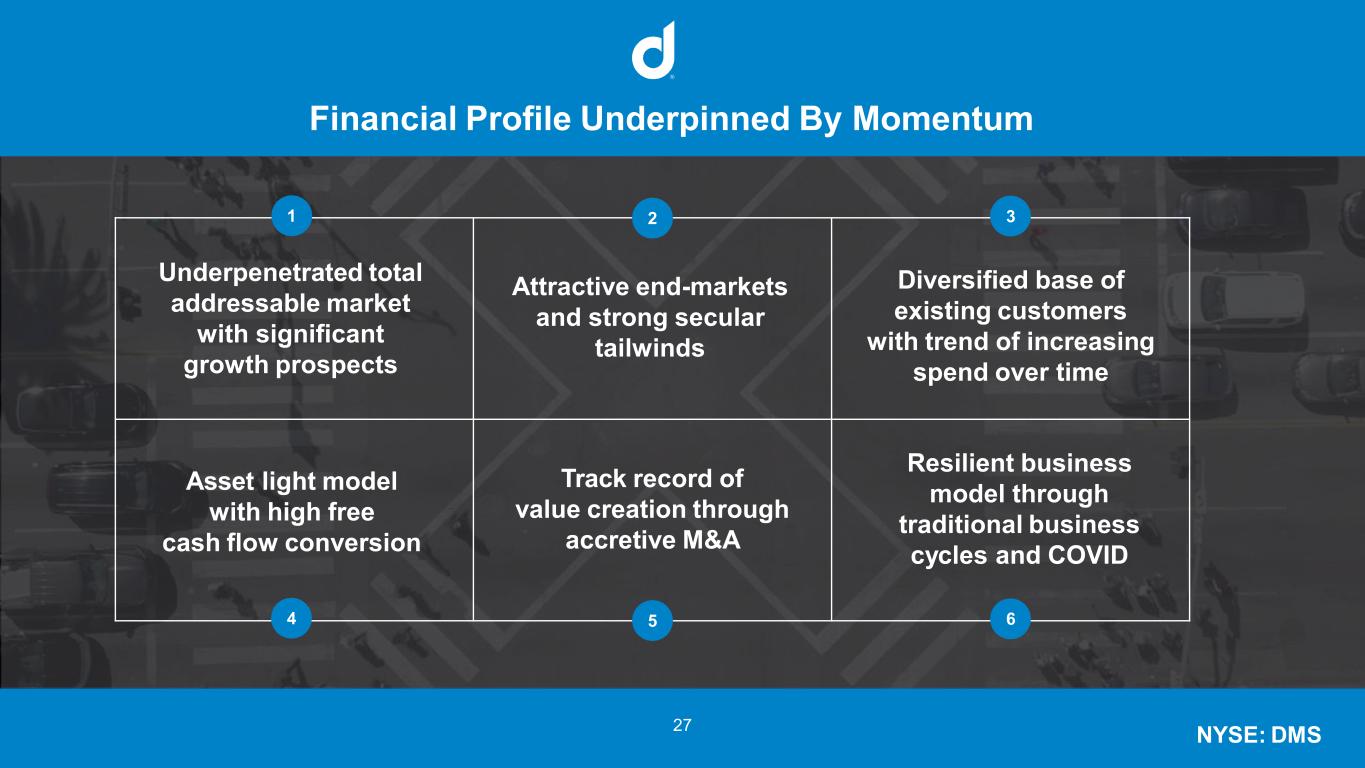

Financial Profile Underpinned By Momentum 1 Underpenetrated total addressable market with significant growth prospects Attractive end-markets and strong secular tailwinds 2 3 Diversified base of existing customers with trend of increasing spend over time 4 5 6 Asset light model with high free cash flow conversion Track record of value creation through accretive M&A Resilient business model through traditional business cycles and COVID NYSE: DMS27

Founder-Led Management With Proven Track Record Joe Marinucci Chief Executive Officer Co-Founder • EY 2019 Entrepreneur of the Year • Prior President and Co-Founder of Interactive Marketing Solutions • Served as a Board Member of LeadsCouncil Fernando Borghese Chief Operations Officer Co-Founder • Successful track record of building high-performing teams that deliver measurable impact • Previously Executive Vice President at DMi Partners, focused on developing performance-based solutions for clients • Current Board Member of Professional Association of Customer Engagement (PACE) 28 Richard Rodick Chief Financial Officer • Nearly two decades of CFO and executive-level expertise from his time with multimillion and billion-dollar companies across a number of verticals • Expertise includes financial reporting, financial planning and analysis, investor relations and acquisition valuation

Appendix NYSE: DMS

Non-GAAP Financial Measures Variable Marketing Margin Variable Marketing Margin is a measure of the efficiency of the Company’s revenue generation efforts, measuring revenue after subtracting the variable marketing and direct media costs that are directly associated with revenue generation. Variable Marketing Margin and Variable Marketing Margin % of revenue are key reporting metrics by which the Company measures the efficacy of its marketing and media acquisition efforts. Variable Marketing Margin is defined as revenue less variable marketing expense. Variable marketing expense is defined as the expense attributable to variable costs paid for direct marketing and media acquisition costs, and includes only the portion of cost of revenue attributable to costs paid for this direct marketing activity and advertising acquired for resale to the Company’s customers, and excludes overhead, fixed costs and personnel-related expenses. The majority of these variable advertising costs are expressly intended to drive traffic to our websites and to our customers’ websites, and these variable advertising costs are included in cost of revenue on the company's consolidated statements of operations. 30 Adjusted EBITDA, Adjusted EBITDA Margin, Unlevered Free Cash Flow and Unlevered Free Cash Flow Conversion We use the non-GAAP measures of adjusted EBITDA and unlevered free cash flow to assess operating performance. Management believes that these measures provide useful information to investors regarding DMS’s operating performance and its capacity to incur and service debt and fund capital expenditures. DMS believes that these measures are used by many investors, analysts and rating agencies as a measure of performance. By reporting these measures, DMS provides a basis for comparison of our business operations between current, past and future periods by excluding items that DMS does not believe are indicative of our core operating performance. Financial measures that are non-GAAP should not be considered as alternatives to operating income, cash flows from operating activities or any other performance measures derived in accordance with GAAP as measures of operating performance, or cash flows as measures of liquidity. These measures have limitations as analytical tools, and you should not consider them in isolation or as a substitute for analysis of our results as reported under GAAP. Because of these limitations, DMS relies primarily on its GAAP results and uses adjusted EBITDA and unlevered free cash flow only as a supplement. Adjusted EBITDA is defined as net income (loss), excluding (a) interest expense, (b) income tax expense, (c) depreciation and amortization, (d) change in fair value of warrant liabilities, (e) debt extinguishment, (f) stock-based compensation, (g) change in tax receivable agreement liability, (h) restructuring costs, (i) acquisition costs and, (j) other expense. Adjusted EBITDA Margin is defined as adjusted EBITDA divided by Net Revenue. In addition, we adjust to take into account estimated cost synergies related to our acquisitions. These adjustments are estimated based on cost-savings that are expected to be realized within our acquisitions over time as these acquisitions are fully integrated into DMS. These cost-savings result from the removal of cost and or service redundancies that already exist within DMS, technology synergies as systems are consolidated and centralized, headcount reductions based on redundancies, right-sized cost structure of media and service costs utilizing the most beneficial contracts within DMS and the acquired companies with external media and service providers. We believe that these non-synergized costs tend to overstate our expenses during the periods in which such synergies are still being realized. Furthermore, in order to review the performance of the combined business over periods that extend prior to our ownership of the acquired businesses, we include the pre-acquisition performance of the businesses acquired. Management believes that doing so helps to understand the combined operating performance and potential of the business as a whole and makes it easier to compare performance of the combined business over different periods. Unlevered free cash flow is defined as adjusted EBITDA, less capital expenditures, and unlevered free cash flow conversion is defined as unlevered free cash flow divided by adjusted EBITDA.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- The First Bancshares, Inc. Reports Results for First Quarter ended March 31, 2024

- Nepra Foods Announces Loan to Its Subsidiary, Nepra Foods Ltd.

- Alberto Castillo Injured in Truck Accident on Veterans Memorial Drive in Northwest Houston

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share