Form 8-K XPEL, Inc. For: May 26

INVESTOR PRESENTATION MAY 2022

2 FORWARD LOOKING STATEMENT This Presentation contains certain forward-looking statements in respect of various matters including upcoming events that involve known and unknown risks and uncertainties that are beyond the control of Management. Those risks and uncertainties include, among other things, risks related to: share prices, liquidity, credit worthiness, currency, insurance, dilution, ability to access capital markets, interest rates, dependence on key personnel and environmental matters. Management believes that the expectations reflected in forward- looking statements are based upon reasonable assumptions and information currently available; however, Management can give no assurance that actual results will be consistent with these forward-looking statements. Factors and assumptions that were applied in drawing conclusions and could cause actual results, performance, or achievements to differ materially from those expressed or implied by forward-looking statements, include, but are not limited to, general economic conditions, competition, availability of manufacturing supply or quality, availability and quality of raw materials, the Company’s ability to maintain key employees and other factors identified in the “Risk Factors” section of the Company’s Management’s Discussion and Analysis (MD&A) available at www.xpel.com/relations.

3 THE LEADER IN PROTECTIVE FILMS AUTOMOTIVE PAINT PROTECTION FILMS AUTOMOTIVE WINDOW TINT HOME & OFFICE WINDOW FILMS

4 A BRAND BUILT OVER 20 YEARS HEADQUARTERED IN SAN ANTONIO, TX FOUNDED IN 1997 NASDAQ: XPEL 750 FULL TIME EMPLOYEES GLOBAL OPERATIONS

5 HISTORY THAT CONTINUES TO SET THE STANDARDS

6 KEY INVESTMENTS HIGHLIGHTS Strong Recognition as Premium Brand Significant Domestic and International Market Opportunity Robust Growth, Profitability and Strong Balance Sheet

7 AUTOMOTIVE PRODUCTS Invisible, Cut-To-Fit Protection Film Protects from Rock Chips, Bug Acids, and Road Debris Damage Professionally Installed New-Car Product Film for Heat Rejection, Security and Appearance 4 Core Lines of Film, Something For Everyone High-End Products for Margin, Differentiation Hydrophobic Coating Applied to PPF and Painted Surfaces Allows for Easy Finished Maintenance and Cleaning Opportunity for More Revenue Per Car

8 COMPLETE PROTECTION BUMPER HOOD HEADLIGHTS & FOG LIGHTS FENDER MIRRORS A-PILLARS & ROOFLINE DOORSILLS DOOR CUPS & DOOR EDGES ROCKER PANELS & REAR WHEEL IMPACT AREA LUGGAGE STRIP COVERAGE

9 END CUSTOMER PPF ECONOMICS COVERAGE – FULL CAR COVERAGE – FULL FRONT COVERAGE – PARTIAL HOOD Covers entire car. $4000-$6000 Covers entire painted front bumper, hood, fenders, headlights, and backs of painted mirrors. $1800-$2500 Covers 6” - 12” of leading of hood. $100-200 FACTORS INFLUENCING PRICING Coverage Retail vs Wholesale Regional Variation

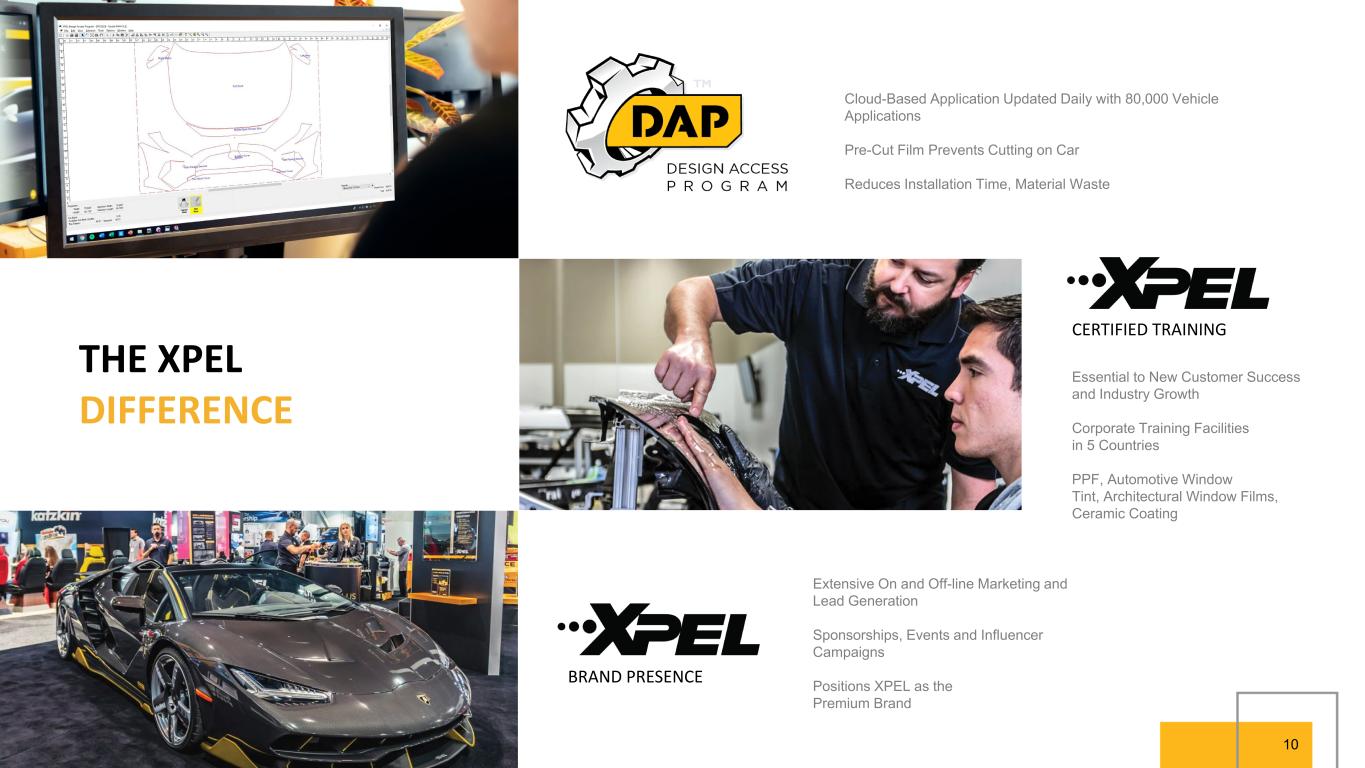

10 Cloud-Based Application Updated Daily with 80,000 Vehicle Applications Pre-Cut Film Prevents Cutting on Car Reduces Installation Time, Material Waste CERTIFIED TRAINING BRAND PRESENCE Essential to New Customer Success and Industry Growth Corporate Training Facilities in 5 Countries PPF, Automotive Window Tint, Architectural Window Films, Ceramic Coating Extensive On and Off-line Marketing and Lead Generation Sponsorships, Events and Influencer Campaigns Positions XPEL as the Premium Brand THE XPEL DIFFERENCE

11 DEALERSHIP SEVICES Acquired 2 Dealership Service Businesses In 2021 Unique Business Model - Serves only automotive dealership customers - Primarily window film installation today - Products are pre-loaded on vehicles prior to sale - Our labor is housed within the dealership Opportunity To Penetrate Down Market Opportunity To Introduce Paint Protection To Dealership Dealership Services More Impacted By Low Inventories Than Legacy XPEL Business

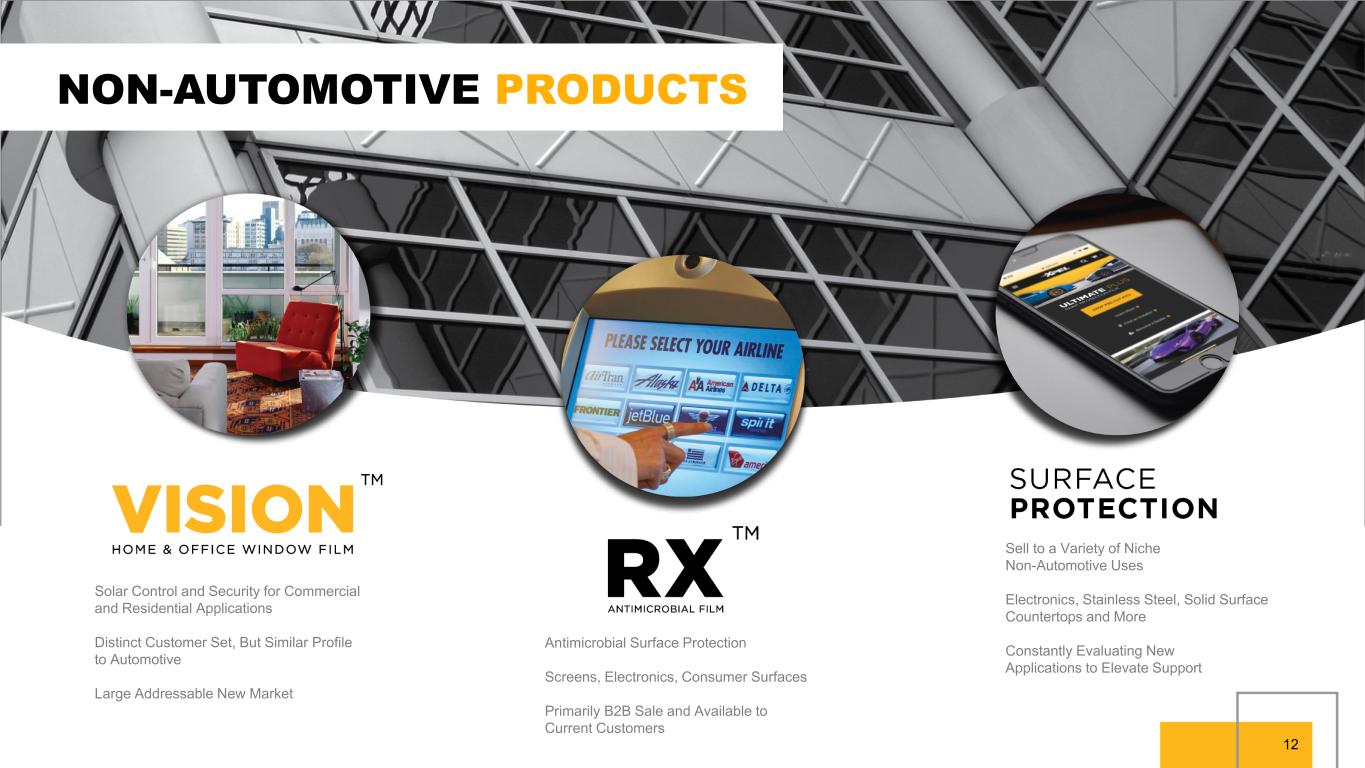

12 NON-AUTOMOTIVE PRODUCTS Solar Control and Security for Commercial and Residential Applications Distinct Customer Set, But Similar Profile to Automotive Large Addressable New Market Antimicrobial Surface Protection Screens, Electronics, Consumer Surfaces Primarily B2B Sale and Available to Current Customers Sell to a Variety of Niche Non-Automotive Uses Electronics, Stainless Steel, Solid Surface Countertops and More Constantly Evaluating New Applications to Elevate Support

13 XPEL REVENUE ECOSYSTEM PRODUCT REVENUE 85% $150 - $375 / CAR $600 - $1500 / CAR $800 - $2500 / CAR DIRECT - 65% INDIRECT - 35% INTERNATIONAL DISTRIBUTORS INDEPENDENT INSTALLERS NEW CAR DEALERSHIPS END CONSUMER END CONSUMER NEW CAR DEALERSHIP PRELOAD $60 - $200 / CAR DEALERSHIP SERVICES INSTALLATION CENTER US 7 UK 1 CANADA 3 OEM INSTALLATION SERVICE REVENUE 15%

14 CONTINUE GLOBAL EXPANSION Operations in 9 Countries Build Out Sales Team In Under-penetrated Geographies STRATEGIC INITIATIVES DRIVE GLOBAL BRAND AWARENESS High Visibility At Premium Events Advertising Placement In Media Consumed By Car Enthusiasts EXPAND NON-AUTOMOTIVE PRODUCT PORTFOLIO Find Opportunities That Leverage The Channel and Brand Find Opportunities That Leverage Existing Products & Technology CHANNEL EXPANSION VIA ACQUISITION Acquire Select Installation Facilities in Key Markets Acquire International Partners for Global Reach

15 REVENUE TREND IN MILLIONS

16 2022 SALES MIX BY REGION CANADA 10.9% UNITED STATES 57.9% LATIN AMERICA 1.7% MIDDLE EAST/ AFRICA 2.9% ASIA PACIFIC 2.8% CHINA 12.3% UK 3.4% CONTINETAL EUROPE 7.9% OTHER 0.2%

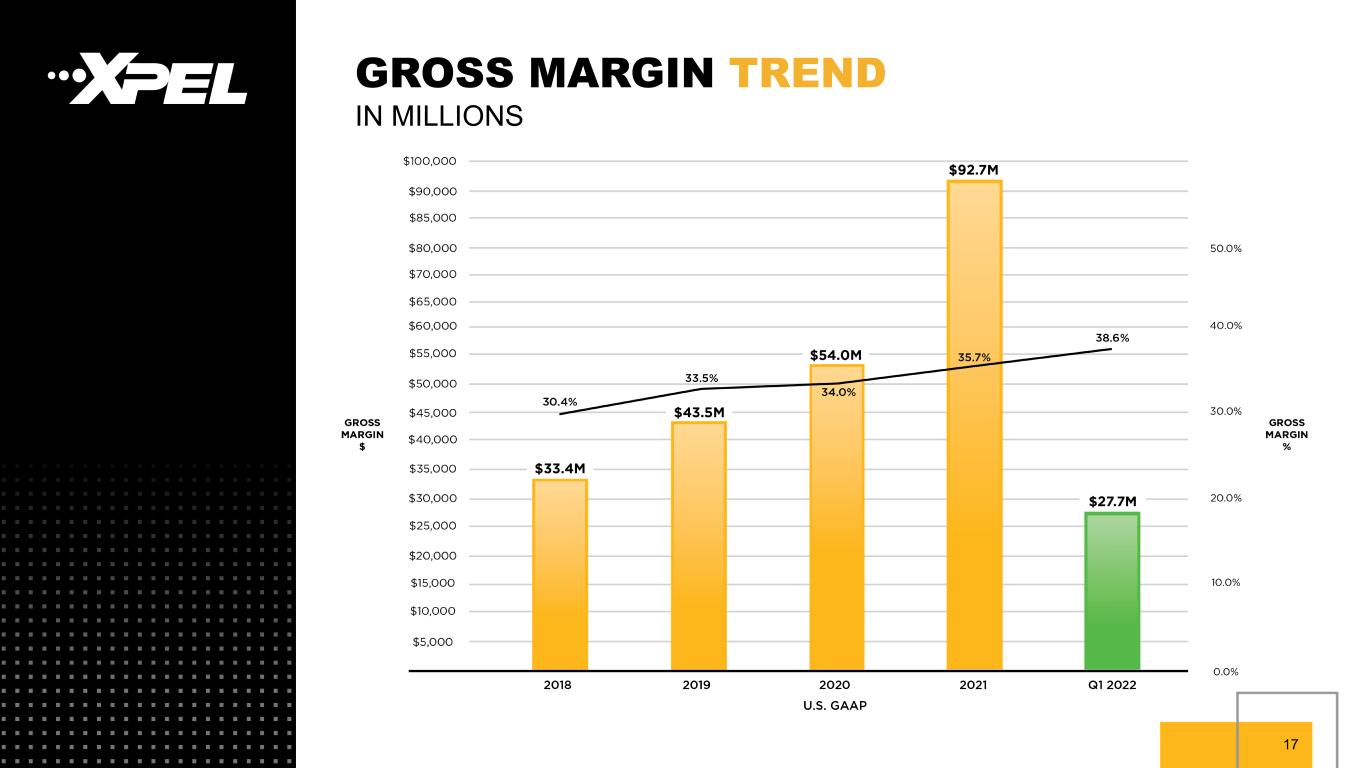

17 GROSS MARGIN TREND IN MILLIONS

18 EBITDA PROFILE IN MILLIONS

19 NET INCOME TREND IN MILLIONS

20 STRONG FINANCIAL POSITION IN MILLIONS CASH • CASH EQUIVALENTS NET WORKING CAPITAL ACOUNTS RECEIVABLEACOUNTS R EIVABLE TOTAL INVENTORY TOTAL ASSETS TOTAL DEBT (EXCLUDES LEASE OBLIGATIONS) CASH FLOW FROM OPS Q1 20222021 $9.6M $42.8M $13.2M $51.9M $161.0M $25.5M $18.3M $10.6M $56.9M $15.2M $74.5M $188.3M $33.4M ($4.3M) 2020 $29.0M $41.6M $9.9M $22.4M $83.8M $6.1M $18.5M

21 MACRO GROWTH OPPORTUNITIES Rock Chips Are Top Consumer Complaint Paint Protection Film Low Penetration to New Cars Sold Fragmented Market Provides Opportunity Ripe for Consolidation Dealerships Need Tangible, Profitable Products Equivalent Opportunities Domestically & Internationally Down Market Penetration Opportunity With Dealership Services Business

APPENDIX

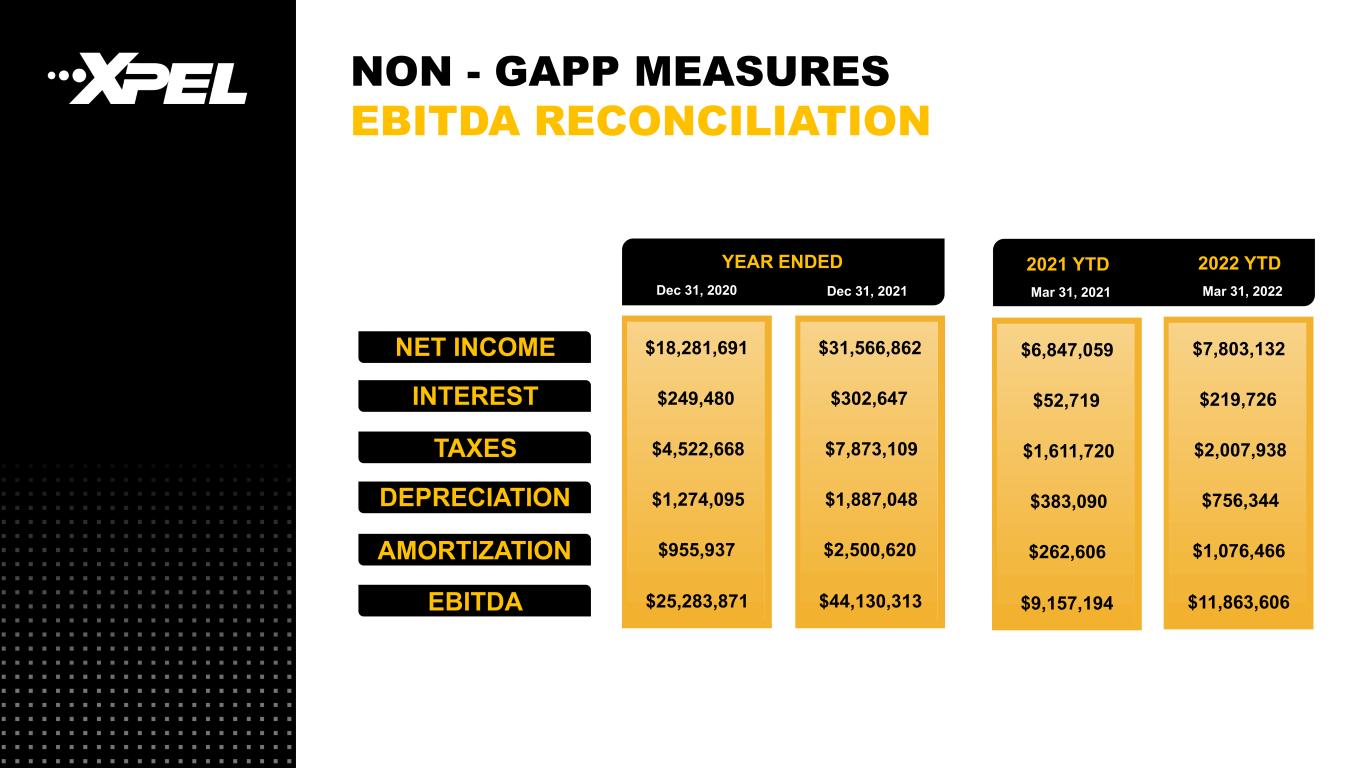

NON - GAPP MEASURES EBITDA RECONCILIATION NET INCOME INTEREST TAXES DEPRECIATION AMORTIZATION EBITDA $18,281,691 $249,480 $4,522,668 $1,274,095 $955,937 $25,283,871 YEAR ENDED Dec 31, 2020 $31,566,862 $302,647 $7,873,109 $1,887,048 $2,500,620 $44,130,313 Dec 31, 2021 $7,803,132 $219,726 $2,007,938 $756,344 $1,076,466 $11,863,606 Mar 31, 2022 2022 YTD $6,847,059 $52,719 $1,611,720 $383,090 $262,606 $9,157,194 Mar 31, 2021 2021 YTD

COMPLETE PROTECTION, UNSEEN. San Antonio, TX. USA +1210-678-3700. XPEL.COM

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- XPEL, Inc. to Host Conference Call to Discuss First Quarter 2024 Results

- Positive 11 Month Topline Efficacy Data Showing Significant Clinical Improvement from enVVeno Medical's VenoValve(R) Pivotal Trial to be Presented Today at the 46th Annual Charing Cross Symposium

- NiSource to release financial results and host conference call on May 8

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share