Form 8-K Tivic Health Systems, For: May 16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 16, 2022

TIVIC HEALTH SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-41052 | 81-4016391 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

25821 Industrial Blvd., Suite 100

Hayward, CA 94545

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (888) 276-6888

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||

| Common Stock, par value $0.0001 per share | TIVC | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 | Results of Operations and Financial Condition |

The information provided below in “Item 7.01 - Regulation FD Disclosure” of this Current Report on Form 8-K is incorporated by reference into this Item 2.02.

| Item 7.01 | Regulation FD Disclosure |

On May 16, 2022, Tivic Health Systems, Inc. (the “Company”) issued a press release regarding the Company’s financial results for its fiscal quarter ended March 31, 2022. A copy of that press release is furnished as Exhibit 99.1 hereto and incorporated herein by reference.

In addition, on May 16, 2022, the Compnay began using a new corporate presentation. A copy of that corporate presentation is furnished as Exhibit 99.2 hereto and incorporated herein by reference. A copy of the presentation is also available on the Company’s website located at https://tivichealth.com/investor/.

The information set forth under Item 7.01 of this Current Report on Form 8-K (“Current Report”), including Exhibits 99.1 and 99.2 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section. The information in Item 7.01 of this Current Report, including Exhibits 99.1 and 99.2, shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any incorporation by reference language in any such filing, except as expressly set forth by specific reference in such a filing. This Current Report will not be deemed an admission as to the materiality of any information in this Current Report that is required to be disclosed solely by Regulation FD.

Forward-Looking Statements

This Current Report, including Exhibits 99.1 and 99.2 attached hereto, contains certain forward-looking statements that involve substantial risks and uncertainties. When used herein, the terms “anticipates,” “expects,” “estimates,” “believes,” “will” and similar expressions, as they relate to us or our management, are intended to identify such forward-looking statements.

Forward-looking statements in this Current Report, including Exhibits 99.1 and 99.2 attached hereto, or hereafter, including in other publicly available documents filed with the Securities and Exchange Commission, reports to the stockholders of the Company and other publicly available statements issued or released by us involve known and unknown risks, uncertainties and other factors which could cause our actual results, performance (financial or operating) or achievements to differ from the future results, performance (financial or operating) or achievements expressed or implied by such forward-looking statements. Such future results are based upon management’s best estimates based upon current conditions and the most recent results of operations. These risks include, but are not limited to, the risks set forth herein and in such other documents filed with the Securities and Exchange Commission, each of which could adversely affect our business and the accuracy of the forward-looking statements contained herein. Our actual results, performance or achievements may differ materially from those expressed or implied by such forward-looking statements.

| Item 9.01 | Financial Statements and Exhibits. |

| (d) | Exhibits. |

| Exhibit No. |

Description | |

| 99.1 | Press Release, dated May 16, 2022. | |

| 99.2 | Corporate Presentation, dated May 2022 | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: May 16, 2022

| TIVIC HEALTH SYSTEMS, INC. | ||

| By: | /s/ Veronica Cai | |

| Name: Veronica Cai | ||

| Title: Chief Financial Officer | ||

Exhibit 99.1

Tivic Health Reports First Quarter 2022 Financial Results

77% year-over-year growth in unit sales direct-to-consumer; 219% increase in gross profit.

SAN FRANCISCO, CA — May 16, 2022 – Tivic Health® Systems, Inc. (“Tivic Health”, Nasdaq: TIVC), a commercial-phase health technology company that develops and commercializes bioelectronic medicine, today announced its financial results for the quarter ended March 31, 2022.

“I am pleased that our strategy to grow direct-to-consumer sales is driving both our revenue growth and increased gross margins. Increasing sales through direct-to-consumer channels is the first cornerstone in the strategic plan laid out by the company as part of its IPO last November,” commented Jennifer Ernst, Tivic Health’s CEO. “With a growing volume of unit sales and strong customer reviews, we believe we are building confidence among consumers and health care professionals for our bioelectronic platform used in the treatment of sinus pain and congestion.”

First Quarter 2022 Financial Highlights Compared to First Quarter 2021

| · | 33% increase in net revenue | |

| · | 219% increase in gross profit on 28% growth in overall unit sales | |

| · | 77% growth in unit sales through direct-to-consumer channels |

| · | Tivic Health featured in the ABC News Report: “New Bioelectronic Technologies Could Signal the Future of Medicine.” |

| · | ClearUP Sinus Pain Relief named best sinus pain relief solution of 2021 by Global Health & Pharma Magazine. |

First Quarter 2022 Financial Review

Net revenue for the first quarter 2022 was $428 thousand, an increase of $105 thousand (or 33%) compared to $323 thousand in the same period 2021, primarily due to increased unit sales of 28% and termination of less profitable retail distribution arrangements.

Cost of sales for the first quarter 2022 was $358 thousand, an increase of $57 thousand (or 19%) compared to $301 thousand in the same period 2021. The period over period increase was primarily due to the increase in unit sales of 28%.

Gross profit for the first quarter 2022 was $70 thousand, an increase of $48 thousand (or 219%) compared to $22 thousand in the same period 2021. The increase was primarily due to a higher percentage of sales through distribution channels with higher margins, and termination of low-margin “product discovery” contracts entered into in 2020. The increase was partially offset by the effect of the ongoing global supply chain concerns impacting component, materials and shipping costs.

Sales and marketing expenses were $684 thousand for the first quarter 2022, compared to $300 thousand in the same period 2021. The increase of $384 thousand was due primarily to expansion of our sales and marketing efforts, including (i) expanding advertising reach; (ii) growing our social media presence; (iii) upgrading and optimizing e-commerce infrastructure; and (iv) other marketing initiatives.

Research and development expenses were $401 thousand for the first quarter 2022, a $203 thousand increase from $198 thousand for the same period in 2021. The increase was primarily related to activities in the migraine treatment area and initiation of double-blind randomized controlled trial for post-operative pain relief following sinus surgery.

General and administrative expenses were $1.2 million for the first quarter 2022, compared to $581 thousand in the same period 2021. The increase of $645 thousand was primarily attributable to D&O insurance, audit fees, consulting fees and other professional services to upgrade the corporate and finance functions to public company standards.

As of March 31, 2022, the company had cash and cash equivalents of approximately $10.8 million compared to approximately $13.0 million on December 31, 2021.

Conference Call:

Management will host a conference call on Monday, May 16, 2022, at 4:30 p.m. Eastern Time to discuss the company’s first quarter 2022 financial results and provide a business update.

The conference call will be available via telephone by dialing toll free 888-506-0062 for local callers; or 973-528-0011 for international callers and using entry code 535202.

The conference call will also be available via Webcast link:

https://www.webcaster4.com/Webcast/Page/2865/45466.

An audio replay of the call will be available from the “Recent Press” page on the Tivic Health website at

https://tivichealth.com/investor/.

About Tivic Health

Tivic Health Systems, Inc. is a commercial-phase health technology company delivering non-invasive bioelectronic treatments that provide consumers a choice in the treatment of inflammation and related conditions. For more information visit https://tivichealth.com @TivicHealth.

Forward-Looking Statements

This press release may contain “forward-looking statements” that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained in this press release are forward-looking statements. Forward-looking statements contained in this press release may be identified by the use of words such as “anticipate,” “believe,” “contemplate,” “could,” “estimate,” “expect,” “intend,” “seek,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “target,” “aim,” “should,” “will” “would,” or the negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking statements are based on Tivic Health Systems, Inc.’s current expectations and are subject to inherent uncertainties, risks, and assumptions that are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. Additional information concerning Tivic Health and its business, including a discussion of factors that could materially affect the company operating results, is contained in the company’s Annual Report on Form 10-K for the year ended December 31, 2021, filed with the Securities and Exchange Commission on March 31, 2022, under the heading “Risk Factors,” as well as the company’s subsequent filings with the Securities and Exchange Commission. Forward-looking statements contained in this press release are made as of this date, and Tivic Health Systems, Inc. undertakes no duty to update such information except as required by applicable law.

Media Contact:

Cheryl Delgreco

617-429-6749

Investor Contact:

Tivic Health Systems, Inc.

Condensed Balance Sheets (Unaudited)

March 31, 2022 and December 31, 2021

(in thousands, except share and per share data)

| March 31, | December 31, | |||||||

| 2022 | 2021 | |||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 10,801 | $ | 12,975 | ||||

| Accounts receivable, net | 117 | 92 | ||||||

| Inventory, net | 447 | 429 | ||||||

| Prepaid expenses and other current assets | 633 | 793 | ||||||

| Total current assets | 11,998 | 14,289 | ||||||

| Property and equipment, net | 16 | 11 | ||||||

| Right-of-use assets, operating lease | 647 | 687 | ||||||

| Other assets | 33 | 49 | ||||||

| Total assets | $ | 12,694 | $ | 15,036 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities | ||||||||

| Accounts payable | $ | 625 | $ | 789 | ||||

| Other accrued expenses | 304 | 267 | ||||||

| Operating lease liability, current | 168 | 163 | ||||||

| Total current liabilities | 1,097 | 1,219 | ||||||

| Operating lease liability | 504 | 545 | ||||||

| Total liabilities | 1,601 | 1,764 | ||||||

| Commitments and contingencies | ||||||||

| Stockholders’ equity | ||||||||

| Preferred stock, $0.0001 par value, 10,000,000 shares authorized; no shares issued and outstanding at March 31, 2022 and December 31, 2021 | — | — | ||||||

| Common stock, $0.0001 par value, 200,000,000 shares authorized; 9,715,234 shares issued and outstanding at March 31, 2022 and December 31, 2020, respectively | 1 | 1 | ||||||

| Additional paid in capital | 32,878 | 32,817 | ||||||

| Accumulated deficit | (21,786 | ) | (19,546 | ) | ||||

| Total stockholders’ equity | 11,093 | 13,272 | ||||||

| Total liabilities and stockholders’ equity | $ | 12,694 | $ | 15,036 | ||||

Tivic Health Systems, Inc.

Condensed Statements of Operations (Unaudited)

Three Months Ended March 31, 2022 and 2021

(in thousands, except share and per share data)

| Three Months Ended | ||||||||

| March 31, | ||||||||

| 2022 | 2021 | |||||||

| Revenue | $ | 428 | $ | 323 | ||||

| Cost of sales | 358 | 301 | ||||||

| Gross profit | 70 | 22 | ||||||

| Operating expenses: | ||||||||

| Research and development | 401 | 198 | ||||||

| Sales and marketing | 684 | 300 | ||||||

| General and administrative | 1,226 | 581 | ||||||

| Total operating expenses | 2,311 | 1,079 | ||||||

| Loss from operations | (2,241 | ) | (1,057 | ) | ||||

| Other income (expense): | ||||||||

| Interest expense | — | (274 | ) | |||||

| Change in fair value of derivative liabilities | — | (27 | ) | |||||

| Other income | 1 | 2 | ||||||

| Total other income (expense) | 1 | (299 | ) | |||||

| Loss before provision for income taxes | (2,240 | ) | (1,356 | ) | ||||

| Net loss and comprehensive loss | $ | (2,240 | ) | $ | (1,356 | ) | ||

| Net loss per share - basic and diluted | $ | (0.23 | ) | $ | (0.58 | ) | ||

| Weighted-average number of shares - basic and diluted | 9,715,234 | 2,334,479 | ||||||

Exhibit 99.2

2022 May INVESTOR PRESENTATION NASDAQ: TIVC

2 This presentation contains forward - looking statements . All statements other than statements of historical facts contained in this presentation may be forward - looking statements . Statements regarding our future results of operations and financial position, economic performance, business strategy and plans and objectives of management for future operations, including, among others, statements regarding our expected growth, acquisition strategies, investments, and future capital expenditures are all forward looking statements . Without limiting the generality of the foregoing, words such as “may,” “will,” “should,” “expect,” “believe,” “anticipate,” “intend,” “could,” “estimate,” “target,” “project,” “might,” “plan,” “predict” or “continue” or the negative or other variations thereof or comparable terminology are intended to identify forward - looking statements . We caution you that any such forward - looking statements are not guarantees of future performance, and are subject to risks, assumptions and uncertainties that are difficult to predict and beyond our ability and control . Although we believe that the expectations reflected in these forward - looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward - looking statements . Any differences could be caused by a number of factors, including but not limited to : our anticipated needs for working capital ; our ability to secure additional financing ; regulatory or legal developments in the United States and other countries ; our expectation regarding timing, costs, conduct and development of our product candidates ; supply chain constraints ; and our efforts to expand our products and business . Many of the important factors that will determine these results are beyond our ability to control or predict . Accordingly, you should not place undue reliance on any such forward - looking statements . Any forward - looking statement speaks only as of the date on which it is made, and, except as otherwise required by law, we do not undertake any obligation to publicly update or review any forward - looking statement, whether as a result of new information, future developments or otherwise . New factors emerge from time to time, and it is not possible for us to predict which will arise . We cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward - looking statements . In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject . These statements are based upon information available to us as of the date made, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information . These statements are inherently uncertain, and you are cautioned not to place undue reliance upon these statements . Unless otherwise indicated, information contained in this presentation concerning our industry, competitive position and the markets in which we operate is based on information from independent industry and research organizations, other third - party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data, and our experience in, and knowledge of, such industry and markets, which we believe to be reasonable . In addition, projections, assumptions and estimates of the future performance of the industry in which we operate, and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, which could cause results to differ materially from those expressed in the estimates made by the independent parties and by us . This presentation shall not constitute an offer to sell or the solicitation of an offer to buy our securities . FORWARD LOOKING STATEMENTS

3 Investment Highlights TIVIC HEALTH: FOUNDED 2016 30,000 Units Sold 2 FDA Clearances + CE Mark Over 2 3 5 18 500 + IPO PEER - REVIEWED PUBLICATIONS REGULATORY CLEARANCES ISSUED PATENTS PATENTS PENDING 4 - AND 5 - STAR PRODUCT REVIEWS NOVEMBER 2021 Growth company in the emerging area of noninvasive bioelectronic medicine Strong science backing FDA Approved / CE marked, award - winning product for sinus pain, pressure & congestion Extensible platform with potential applications in migraine and other indications ClearUP is the first commercial product, demonstrated management's scientific and commercial capabilities, delivering product from founding to launch in 3 years Direct consumer engagement accelerating sales traction Non - invasive bioelectronic platform offers effective therapeutic solutions with high safety profile, low - risk, and broad application 77% Year - over - year DTC unit growth

4 THE BIG IDEA The body is an electro chemical system. Electrons can be used as medicine. Bioelectronic medicine treats disease by tuning the electrical signals carried along the neural (nerve) pathways. 4 Bioelectronic medicine “represents a multibillion dollar opportunity, … [and has the] potential to become a pillar of medical treatment.” Bioelectronics ‘jump - start the next wave of device therapeutics. October 2019

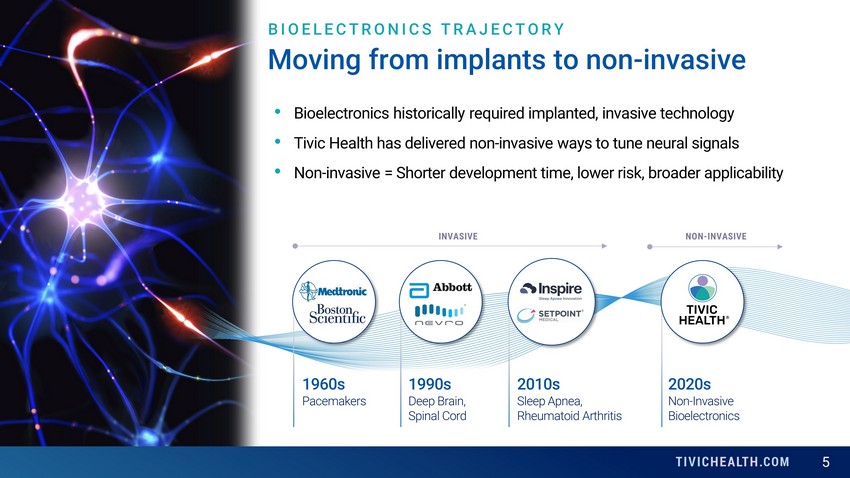

5 Moving from implants to non - invasive 1960s Pacemakers 2010s Sleep Apnea, Rheumatoid Arthritis 1990s Deep Brain, Spinal Cord 2020s Non - Invasive Bioelectronics • Bioelectronics historically required implanted, invasive technology • Tivic Health has delivered non - invasive ways to tune neural signals • Non - invasive = Shorter development time, lower risk, broader applicability INVASIVE NON - INVASIVE BIOELECTRONICS TRAJECTORY

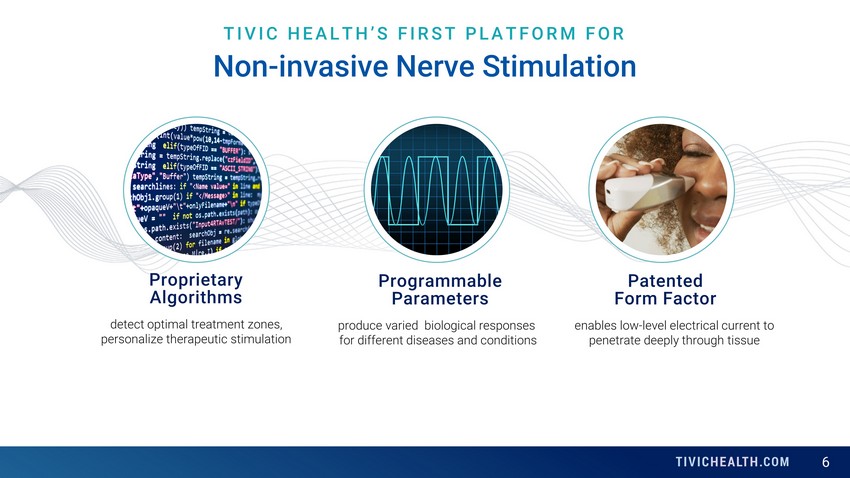

6 TIVIC HEALTH’S FIRST PLATFORM FOR Non - invasive Nerve Stimulation Programmable Parameters produce varied biological responses for different diseases and conditions Patented Form Factor enables low - level electrical current to penetrate deeply through tissue Proprietary Algorithms detect optimal treatment zones, personalize therapeutic stimulation

7 K182025 CE 704687 DEN200006 ISSUED PATENTS almost 100 claims, issued in 2020 & 2021 5 PATENTS PENDING 18 STRONG INTELLECTUAL PROPERTY THREE REGULATORY CLEARANCES PEER - REVIEWED PUBLICATIONS Open - label study. Continuous reduction in pain and congestion over 4 - weeks of at - home use. Published: Bioelectronic Medicine Double - blind, sham - controlled, randomized trial. Reductions in pain and congestion vs. sham 10 minutes after treatment. Published: International Forum of Allergy & Rhinology ROBUST FOUNDATIONS

8 PRODUCT & PIPELINE Other Potential Use Cases Postoperative Pain following sinus surgery 600,000 FESS (sinus) surgeries annually in US, alternative to opioids Temporomandibular Joint Disorder (TMJ) Tinnitus Trigeminal Neuralgia Otitis Media / Ear Infection Migraine Headache 39M people in US, 1B people w orldwide Approved product in market PRODUCT / PRODUCT LINE THERAPEUTIC AREA DISCOVERY /R&D CLINICAL FEASIBILITY PIVOTAL STUDY REGULATORY CLEARANCE COMMERCIAL DISTRIBUTION CONTENT PARTNERS ClearUP Ʀ Sinus Pain and Congestion npdPP Post - Operative Pain npdMI Migraine Sinus Pain and Congestion (ClearUP) $8B estimated US market, global opportunity (1) Extensible platform (1) Market research study of 600 people with recurring sinus conditions. Company - sponsored research conducted by Research America. PIPELINE

9 Clears congestion, stops sinus pain, non - invasively. ClearUP ® • User glides tip along facial skin around cheek, nose, brow (sinus regions) for 5 minutes, twice daily and as needed • Low - level pulsed current flows from tip, through sinus passages • Launched late 2019, winner of numerous innovation awards • Available through Tier 1 online retailers, average 4+ star ratings • $149 list price FIRST COMMERCIAL PRODUCT IN MARKET Featured on … … and more “ Changed my life! “Unbelievable” “Godsend” “Amazing!”

10 2019 Sinus Pain from allergies 2021 Moderate to Severe Congestion from any cause 50M monthly allergy sufferers. 1 90% experience sinus pain from allergic rhinitis. 2 27% would consider purchase @ $149. 2 = $1.8B US Market 2 200M US adults experience at least monthly. 1 27% would consider purchase @ $149. 2 = $8.0B US Market 2 Large Markets, Significant Growth Opportunity MARKET SIZE CE Mark Secured for International Growth Sinus Pain, Pressure & Congestion from any cause Global problem. Future growth opportunity secured by existing regulatory clearance. ClearUP is indicated for use for temporary relief of sinus pain from allergic rhinitis (US FDA), for temporary relief of moderate to severe congestion (US FDA), and for temporary relief of sinus pain, pressure and congestion (CE Mark). (1) Data from publicly available information that has not been independently verified by the Company. (2) Market research study of 600 people with recurring sinus conditions. Company sponsored research conducted by Research America .

11 Oral & Intranasal Decongestants Antihistamines • Treat itchiness • Not effective for congestion and pain • Headache, sleepiness, fatigue, dry mouth, and sore throat • Insomnia, nervousness, heart palpitations, headache, sweating, nausea, trembling, weakness, rebound Saline Irrigation • Messy / impractical • Not portable • $706M US market OTC Drugs Dominate Sinus Care … but 90% of sufferers interested in treatments that decrease use of drugs 1 (1) Market research study of 600 people with recurring sinus conditions. Company - sponsored research conducted by Research America. COMPETITIVE LANDSCAPE Intranasal Steroids • Powerful drug • Burning, stinging, nose bleeds, headache, nausea, vomiting, diarrhea, sore throat, dizziness, cough

12 82% preferred ClearUP to existing treatments 1 STRONG CONSUMER PREFERENCE • No pills, no sprays, nothing in the nose • No drugs, no significant side effects reported 2 • Use any time, anywhere, whenever and as often as needed (2) Most common side effect: 0.02% reported mild skin irritation in clinical studies and post - market surveillance. (1) Data from a 71 - person double - blind, randomized, controlled clinical study conducted by Stanford Medicine.

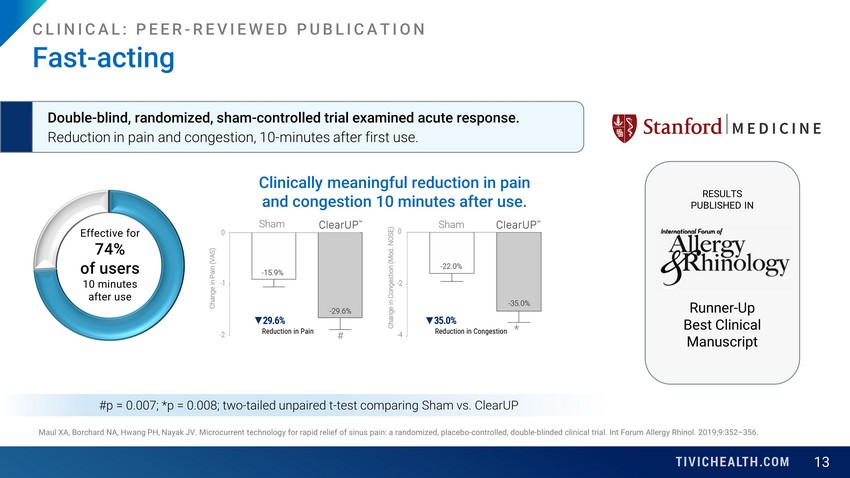

13 Maul XA, Borchard NA, Hwang PH, Nayak JV. Microcurrent technology for rapid relief of sinus pain: a randomized, placebo-controll ed, double-blinded clinical trial. Int Forum Allergy Rhinol. 2019;9:352 – 356. Fast - acting Double - blind, randomized, sham - controlled trial examined acute response. Reduction in pain and congestion, 10 - minutes after first use. #p = 0.007; *p = 0.008; two - tailed unpaired t - test comparing Sham vs. ClearUP RESULTS PUBLISHED IN CLINICAL: PEER - REVIEWED PUBLICATION Runner - Up Best Clinical Manuscript Effective for 74% of users 10 minutes after use Clinically meaningful reduction in pain and congestion 10 minutes after use.

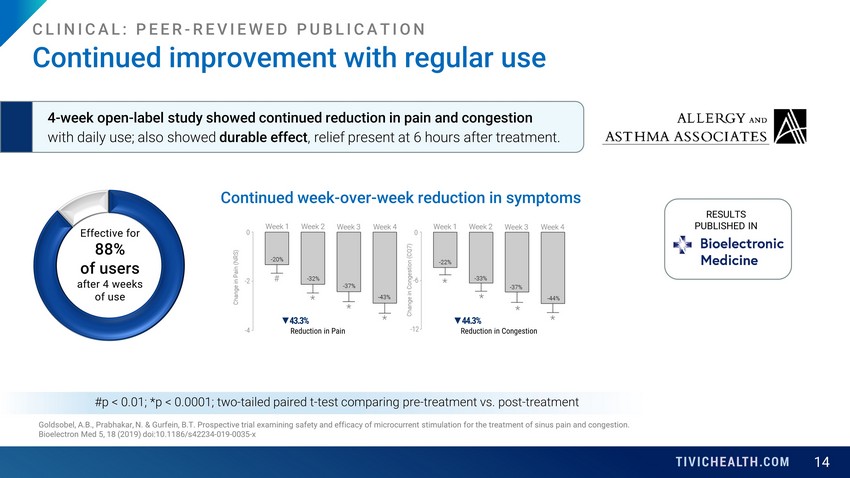

14 Goldsobel, A.B., Prabhakar, N. & Gurfein, B.T. Prospective trial examining safety and efficacy of microcurrent stimulation fo r t he treatment of sinus pain and congestion. Bioelectron Med 5, 18 (2019) doi:10.1186/s42234 - 019 - 0035 - x #p < 0.01; *p < 0.0001; two - tailed paired t - test comparing pre - treatment vs. post - treatment Continued improvement with regular use CLINICAL: PEER - REVIEWED PUBLICATION 4 - week open - label study showed continued reduction in pain and congestion with daily use; also showed durable effect , relief present at 6 hours after treatment. Continued week - over - week reduction in symptoms ▼ 43.3% Reduction in Pain ▼ 44.3% Reduction in Congestion RESULTS PUBLISHED IN Effective for 88% of users after 4 weeks of use

15 Multiple pathways relieve multiple symptoms 1 . Maul, Ximena A . , et al . "Microcurrent technology for rapid relief of sinus pain : a randomized, placebo-controlled, double-blinded clinical trial . " International forum of allergy & rhinology . Vol . 9 . No . 4 . 2019 . Trigeminal nerve activation mediates pain CLINICAL: MECHANISM OF ACTION Pain Low - level current applied to sensory trigeminal nerves markedly reduces pain 1 2 . Mandel, Yossi, et al . "Vasoconstriction by electrical stimulation : new approach to control of non - compressible hemorrhage . " Scientific reports 3 . 1 ( 2013 ) : 1 - 7 . 3 . Franco, O . S . , et al . “Effects of different frequencies of transcutaneous electrical nerve stimulation on venous vascular reactivity . ” Brazilian Journal of Medical and Biological Research 47 . 5 ( 2014 ) : 411 - 418 . 4 . Malm, L . “Stimulation of sympathetic nerve fibres to the nose in cats . ” Acta otolaryngologica 75 . 2 - 6 ( 1973 ) ; 519 - 526 . 5 . Fischer, Laurent, et al . “Adrenergic and non - adrenergic vasoconstrictor mechanisms in the human nasal mucosa . ” Rhinology 31 . 1 ( 1993 ) : 11 - 15 . Congestion Activation of sympathetic nerve fibers promotes rapid release of norepinephrine and vasoconstriction. 2 - 4 Vasoconstriction reduces swelling, increases air flow, and decreases congestion. 5 The mechanism described has been reviewed by the FDA in conjunction with FDA Clearances. The exact mechanism of action for ClearUP has not been definitively proven. Sympathetic nerve activation relieves congestion. Trigeminal nerve activation mediates pain Sympathetic nerve activation relieves congestion.

16 Tried - and - true omnichannel, multi - touchpoint approach DEMAND GENERATION BUILD CREDIBILITY / RETARGETTING 4 - & 5 - star reviews, clinical publications, value - added content (video content, blogs) DRIVE PURCHASE On - site advertising, co - operative marketing, seasonal promotions GENERATE AWARENESS Digital, cable, and CTV video advertising, social media, SEO, content marketing Currently available at … and others Buy Now • Proven model in consumer marketing • Focus for 2022 scaling • Consumer engagement part of our DNA • Contributes to success of both OTC and potential prescription products

17 2023+: Additional Channel Growth Opportunity 2022: Optimize and scale highest margin channels MARKET DEVELOPMENT Early Traction Expedited Development Sept 2016 – Sept 2019 2020 - 2021 2022+ • Optimizing website and D2C channels • Scaling - up advertising to drive sales, capture market share • Expanding social media, content marketing x Tier 1 sales relationships in place x Over 23,000 units sold x 500+ 4 - and 5 - star ratings x 3 years from founding to product sales of FDA - cleared medical device Early traction shows high - growth opportunities in D2C 2023+ 74% of target customers expect to purchase on - line, 65% from manufacturer’s website 1 o Healthcare professional (HCP) referrals o In - store o International (1) Market research study of 600 people with recurring sinus conditions. Company sponsored research conducted by Research America .

18 FINANCIALS Operating results • ClearUP revenue increased 33% year over year on 28% increase in unit sales • Variable cost of sales increased 32% year over year primarily due to higher volume and product mix • Fixed cost of sales decreased 27% due to refinement of processes and increase in volume Three Months Ended March 31, ($ in thousands) 2022 2021 Revenues $ 428 $ 323 Direct to consumer 363 219 Retail 105 134 Returns & Warranty Reserves (40) (30) Cost of Sales 358 301 Variable 310 235 Fixed 48 66 Gross Profit 70 22 Operating Profit (Loss) $ (2,241) $ (1,057)

19 Common Stock as of May 10, 2022 9,621,484 Options and warrants 1,323,649 Fully Diluted Shares 10,945,133 Single class of shares FINANCIALS • $10.8M cash at the end of Q1 2022 • No debt • IPO in November 2021 to broaden investor reach, build consumer engagement and sales infrastructure and broaden product pipeline

20 2022 Directions INVESTING FOR GROWTH Broaden ClearUP market penetration • Upgrade ecommerce infrastructure, online website design and branding • Optimize and expand advertising and public relations • Increase support for social media and digital Improve ClearUP gross margin • Increase % of sales through direct channels • Launch second generation with improved cost structure, lower cost manufacturing • Higher volume absorbing fixed & allocated costs Expand product pipeline • Clinical research to validate migraine and post - operative pain management opportunities • Evaluation of potential merger, acquisition & licensing opportunities Build Tivic as trusted brand for non - invasive bioelectronic medicine

21 Experienced, Execution - oriented Leadership LEADERSHIP TEAM Jennifer Ernst Chief Executive Officer, Co - founder, MBA Built Tivic Health from founding to IPO in 5 years. Took prior company (Thin Film Electronics) from 8 - person R&D team to $480MM market cap in < 5 years, as CEO of US subsidiary. Blake Gurfein Chief Scientific Officer, Ph.D. Neuroscientist, Asst. Prof. of Medicine, UCSF. Pfizer, EMD Serono. Named to 40 under 40, Silicon Valley Business Journal. Four prior neuromodulation products. Veronica Cai Chief Financial Officer, CPA 25 years broad - based public and private company finance and accounting leadership for high - growth medical and life science companies. Prior experience at RefleXion Medical, Catalyst Bioscience, Zogenix . Previously served at Ernst & Young and at the PCAOB. Ryan Sabia Chief Operations Officer Global sales, marketing, and operations for omnichannel and ecommerce growth companies. Background in both health and consumer products. 2021 Female Founders 100 Top 25 Women in Consumer Healthtech.

22 Experienced Board of Directors Dean Zikria Global Strategy, J&J, Pfizer, Allergy/Asthma Chief Commercial Officer, Intuity Medical. Commercial leadership Pfizer, J&J. Healthcare Strategy at Accenture, Deloitte. Growth leadership in Asthma & Allergy. MBA, Rutgers. BS, Biology, Rutgers. Karen Drexler Public Board Member, Compensation Chair, Nominating & Governance Chair Board of ResMed (NYSE: RSMD), OutSet Medical (NASDAQ: OM) and VIDA Diagnostics. Sale of companies to Roche, J&J. MBA, Stanford; BSE Princeton University. Sheryle Bolton Hult Faculty, Board Chair, Audit Committee Chair Experienced public company CEO. International Board Member and serial entrepreneur. Prior leadership of successful neuroscience IPO. Merrill Lynch Capital Markets. MBA, Harvard Business School. INDEPENDENT DIRECTORS

23 Summary TIVIC HEALTH FDA - cleared product in high - growth sector. Established Tier 1 channels growing. Large available market. Clinical validation with leading institutions, peer - reviewed publications. Regulatory clearances for both US and international sales. Robust IP portfolio, recently issued patents. Extensible platform with multiple product opportunities. Growth strategy built for 21 st century. Experienced leadership , with public company growth experience.

24 24 Jennifer Ernst CEO, Tivic Health [email protected]

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Form 8.5 (EPT/RI) - musicMagpie Plc

- Strifor Announces Strategic Move to Marshall Islands, Joins the Financial Commission

- Defence's AccuTOX Anti-Cancer ARM-002 Vaccine Exhibits Potent Antigen Presentation

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share