Form 8-K TRANSATLANTIC PETROLEUM For: Dec 17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 17, 2020

|

TAT MERGER SUB LLC |

|

(Exact name of registrant as specified in its charter) |

|

Texas |

001-34574 |

85-2238435 |

||

|

(State or other jurisdiction of |

(Commission File Number) |

(IRS Employer |

||

|

incorporation) |

|

Identification No.) |

||

|

16803 Dallas Parkway Addison, Texas |

|

75001 |

||

|

(Address of principal executive offices) |

|

(Zip Code) |

||

Registrant’s telephone number, including area code: (214) 220-4323

TransAtlantic Petroleum Ltd.

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

|

|

|

|

|

|

Ticker Symbol |

|

|

|

|

|

|

|

Name of each exchange on which registered |

|

Common shares, par value $0.10 |

|

|

|

|

|

|

|

TAT |

|

|

|

|

|

|

|

NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

- 2 -

Introductory Note

On December 18, 2020, pursuant to the Agreement and Plan of Merger (the “Merger Agreement”), by and among TransAtlantic Petroleum, Ltd. (the “Company”), TAT Holdco LLC, a Texas limited liability company (“Parent”), and TAT Merger Sub LLC, a Texas limited liability company and wholly-owned subsidiary of Parent (“Merger Sub”), the Company merged with and into Merger Sub (the “Merger”), with Merger Sub continuing as the surviving company and as a wholly owned subsidiary of Parent.

The foregoing description of the Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Merger Agreement filed as Exhibit 2.1 to the Company’s Current Report on Form 8-K dated as of August 7, 2020, which is incorporated herein by reference.

Item 2.01Completion of Acquisition or Disposition of Assets

The effective time of the Merger was 12:01 am Central time on December 18, 2020 (the “Effective Time”). Pursuant to the Merger Agreement, at the Effective Time, each share of the Company’s issued and outstanding common shares, par value $0.10 per share (“Common Shares”) (other than the Excluded Shares (as defined below)), was canceled and converted automatically into the right to receive $0.13 in cash, without interest (subject to any applicable withholding tax) (the “Merger Consideration”).

Each (i) Common Share owned by the Company or any of its wholly-owned subsidiaries immediately prior to the Effective Time and (ii) 12.0% Series A Convertible Redeemable Preferred Share (a “Series A Preferred Share”) owned, directly or indirectly, by Parent, the equity holders of the Parent or any of Parent’s wholly-owned subsidiaries (including Merger Sub) immediately prior to the Effective Time ((i) and (ii) collectively, the “Excluded Shares”) was canceled automatically and ceased to exist, and no consideration was paid for those Excluded Shares.

Item 3.01Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

As a result of the Merger, each Common Share was cancelled and converted into the right to receive the Merger Consideration. The Common Shares were suspended from trading on the NYSE American effective as of the opening of trading on December 18, 2020. The NYSE American has filed a Notification of Removal from Listing and/or Registration on Form 25 to delist the Common Shares and terminate the registration of such shares under Section 12(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Merger Sub intends to file a Form 15 with the Securities and Exchange Commission (the “SEC”) to terminate the registration of the Common Shares under the Exchange Act and suspend its reporting obligations under Section 13 and Section 15(d) of the Exchange Act. The information set forth in the Introductory Note and Item 2.01 and Item 5.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.01.

Item 3.03Material Modification to Rights of Securityholders.

At the Effective Time, each holder of Common Shares issued and outstanding immediately prior to the Effective Time ceased to have any rights as a shareholder of the Company (other than the rights of shareholders of the Company (other than holders of Excluded Shares) to receive the Merger Consideration). The information set forth in the Introductory Note and Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.03.

- 3 -

Item 5.01Changes in Control of Registrant.

In exchange for the aggregate Merger Consideration, the Company merged with and into Merger Sub, with Merger Sub continuing as the surviving company and a wholly-owned subsidiary of Parent. The information set forth in the Introductory Note and Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 5.01.

Item 5.02Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

In connection with the Merger, at the Effective Time, N. Malone Mitchell 3rd, Charles J. Campise, Gregory K. Renwick, H. Lee Muncy, Jonathan Fite, K. Kirk Krist, and Randall Rochman resigned from the Company’s board of directors. None of these resignations were a result of any disagreement with the Company, its management or its board of directors. In addition, N. Malone Mitchell 3rd, Todd Dutton, Selami Erdem Uras, Michael Hill, David Mitchell, and Tabitha Bailey resigned as executive officers of the Company. As of the Effective Time, the sole member and manager of Merger Sub, as the surviving company of the Merger, was Parent.

Item 5.03Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

In accordance with the Merger Agreement, at the Effective Time, (i) the certificate of formation of Merger Sub, as in effect immediately prior to the Effective Time, became the certificate of formation of the surviving company and (ii) the limited liability company agreement of Merger Sub, as in effect immediately prior to the Effective Time, became the limited liability company agreement of the surviving company. Copies of the certificate of formation and limited liability company agreement of the surviving company are attached as Exhibit 3.1 and Exhibit 3.2, respectively, to this Current Report on Form 8-K and are incorporated by reference into this Item 5.03.

Item 5.07Submission of Matters to a Vote of Security Holders.

The Company held its special meeting of shareholders (the “Special Meeting”) on December 17, 2020 to (i) adopt and approve the Merger Agreement, the related form of statutory merger agreement required in accordance with Section 105 of the Companies Act 1981 of Bermuda, as amended, and the transactions contemplated thereby, including the Merger (“Proposal 1”) and (ii) adjourn the Special Meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the Special Meeting to adopt and approve Proposal 1 (“Proposal 2”). For more information about the foregoing proposals, see the Company’s definitive proxy statement, filed with the SEC on November 4, 2020. The table below shows the final results of the voting at the Special Meeting:

|

|

For |

Against |

Abstain |

|

Proposal 1 |

56,409,069 |

518,143 |

56,795 |

|

|

|

|

|

|

Proposal 2 |

56,367,931 |

544,227 |

71,849 |

- 4 -

Item 9.01Financial Statements and Exhibits.

(d)Exhibits.

|

Exhibit No. |

Description of Exhibit |

|

2.1 |

|

|

3.1 |

|

|

3.2 |

|

|

99.1 |

Press release, dated December 18, 2020, issued by TransAtlantic Petroleum Ltd. |

- 5 -

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: |

December 18, 2020 |

|

|

|

|

|

|

|

|

|

|

TAT MERGER SUB, LLC

|

|

|

|

|

|

|

|

|

|

By: |

/s/ N. Malone Mitchell 3rd |

|

|

|

|

N. Malone Mitchell 3rd |

|

|

|

|

Manager of TAT Holdco LLC Sole Member and Manager of TAT Merger Sub LLC |

- 6 -

Exhibit 3.1

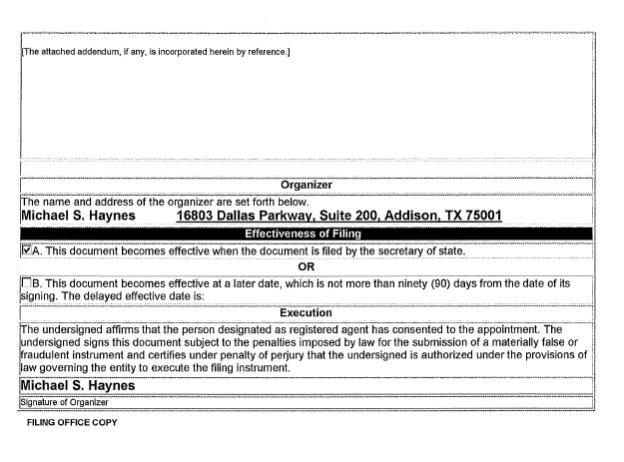

Secretary of State P.O. Box 13697 Austin, TX 78711-3697 FAX: 512/463-5709 Filing Fee: $300 Certificate of Formation Limited Liability Company Filed in the Office of the Secretary of State of Texas Filing #: 803697067 07/24/2020 Document#:985263620002 Image Generated Electronically for Web Filing Article 1 - Entity Name and Type The filing entity being formed is a limited liability company. The name of the entity is: TAT Merger Sub LLC Article 2 - Registered Agent and Registered Office A. The initial registered agent is an organization (cannot be company named above) by the name of: OR B. The initial registered agent is an individual resident of the state whose name is set forth below: Name: Michael S. Haynes C. The business address of the registered agent and the registered office address is: Street Address: 16803 Dallas Parkway Suite 200 Addison TX 75001 Consent of Registered Agent A. A copy of the consent of registered agent is attached. OR B. The consent of the registered agent is maintained by the entity. Article 3 - Governing Authority A. The limited liability company is to be managed by managers. OR B. The limited liability company will not have managers. Management of the company is reserved to the members. The names and addresses of the governing persons are set forth below: Manager 1: (Business Name) TAT Holdco LLC Address: PO Box 1989 Addison TX, USA 75001 Article 4 – Purpose The purpose for which the company is organized is for the transaction of any and all lawful business for which limited liability companies may be organized under the Texas Business Organizations Code. Supplemental Provisions / Information

[The attached addendum, if any, is incorporated herein by reference.] Organizer The name and address of the organizer are set forth below. Michael S. Haynes 16803 Dallas Parkway. Suite 200. Addison. TX 75001 Effectiveness of Filing A. This document becomes effective when the document is filed by the secretary of state. OR B. This document becomes effective at a later date, which is not more than ninety (90) days from the date of its signing. The delayed effective date is: Execution The undersigned affirms that the person designated as registered agent has consented to the appointment. The undersigned signs this document subject to the penalties imposed by law for the submission of a materially false or fraudulent instrument and certifies under penalty of perjury that the undersigned is authorized under the provisions of law governing the entity to execute the filing instrument. Michael S. Haynes Signature of Organizer FILING OFFICE COPY

Exhibit 3.2

LIMITED LIABILITY COMPANY AGREEMENT

OF

TAT MERGER SUB LLC

(A Texas Limited Liability Company)

THIS LIMITED LIABILITY COMPANY AGREEMENT (the “Agreement”) of TAT Merger Sub LLC, a Texas limited liability company (the “Company”) is made and entered into effective as of August 7, 2020, by and among the undersigned persons pursuant to the provisions of the Texas Business Organizations Code, as amended.

A.TransAtlantic Petroleum Ltd. (“TransAtlantic”) is a publicly-traded Bermuda exempted company. On July 23, 2020, TAT Holdco LLC (“Holdco”) was formed as a limited liability company in the State of Texas for the purpose of being the sole member and manager of the Company.

B.The Company was formed for the purpose of being the surviving entity in a merger of TransAtlantic with and into the Company (the “Merger”).

1.Formation. Holdco (the “Member”) agrees to become a member in the Company under the provisions of this Agreement and the Texas Business Organization Code, as amended from time to time (the “Code”). The Member shall be the sole Member of the Company. The Company shall be managed by the Manager, as provided in this Agreement.

2.Name. The name of the Company is TAT Merger Sub LLC.

3.Certificate of Formation. A certificate of formation was filed on July 24, 2020 as required by the Code. The Company and Member shall do all other things requisite to the organization and continuation of a sole member limited liability company under the Code.

4.Term. The term of the Company commenced upon the filing of the certificate of formation with the Texas Secretary of State. The Company shall have perpetual existence.

5.Business of the Company. The nature of the business and the purpose of the Company shall be to engage in any lawful act or activity for which limited liability companies may be organized under the Code.

6.Place of Business. The principal place of business of the Company shall be 16803 Dallas Parkway, Addison, Texas 75001, or such other place as the Member may from time to time determine. At the principal place of business, the Company shall keep such documents and information as may be required under the Code to be maintained at such office.

7.Registered Agent. The name and street address of the Company’s registered agent are Michael S. Haynes, 16803 Dallas Parkway, Addison, TX 75001.

8.Liability of the Member. Except as otherwise required by the Code, the debts, obligations, and liabilities of the Company, whether arising in contract, tort, or otherwise, shall be

solely the debts, expenses, obligations, and liabilities of the Company, and the Member shall not be obligated personally for any such debt, expense, obligation, or liability of the Company solely by reason of being the Member. The Member shall not be liable to the Company for monetary damages for any losses, claims, damages, or liabilities arising out of or in connection with this Agreement or the Company’s business or affairs, except for any such loss, claim, damage, or liability attributable to the Member’s gross negligence, willful misconduct, or fraud. All Persons dealing with the Company shall have recourse solely to the assets of the Company for the payment of the debts, obligations, or liabilities of the Company.

9.Manager. The business and affairs of the Company shall be managed by the manager (“Manager”). The Manager shall direct, manage, and control the business of the Company and shall have full and complete authority and discretion to make any and all decisions relating to the Company. The initial Manager shall be Holdco. The Member may remove and replace the Manager at any time.

10.Authority of Manager. The Manager shall exercise control over all aspects of Company business and shall have complete charge of the operations of the Company. The Manager shall, subject to the provisions of this Agreement, have full authority to oversee the operations of the company and to execute and deliver all agreements relating to the affairs of the Company. The Manager shall be authorized to: (a) purchase, manage and dispose of assets, including real and personal property and oil and gas assets; (b) vote all stock owned by the Company; (c) borrow money, and execute promissory notes, security agreements, and other instruments of indebtedness of the Company for borrowed funds; (d) pledge, mortgage and hypothecate, sell or dispose of all or any part of the assets and properties of the Company; (e) invest Company funds in stock and securities of all sorts, including limited liability companies, and general and limited interests in partnerships or joint ventures; (f) retain investment counselors and delegate to them discretionary authority to invest and manage Company funds; (g) execute instruments of transfer of Company property; and (h) enter into and execute all other agreements, documents and instruments of any character relating to the affairs of the Company.

11.Restrictions on Authority. Without first obtaining the consent or approval of the Member, the Manager shall not: (a) do any act in contravention of this Agreement; (b) execute or deliver any assignment for the benefit of creditors of the Company; (c) confess a judgment against the Company; (d) do any act which would make it impossible to carry on the ordinary business of the Company; or (e) admit a new Member or Members. Notwithstanding the foregoing, in no event will the Member or Manager do any act in contravention of the terms of the Limited Liability Company Agreement of Holdco.

12.Management Duties. The Manager shall manage the Company’s affairs in a prudent and businesslike manner to carry out the purposes of the Company. The Manager shall: (a) maintain proper books and records relating to the business of the Company; (b) furnish the Member (i) annual financial reports of the Company and the companies in which it owns any material interest within 90 days after the end of each calendar year and (ii) other financial information as may be reasonably necessary to keep the Member apprised of the Company’s business, its financial condition and the financial condition of the companies in which the Company owns an interest; (c) comply with all legal requirements relating to the formation and

operation of a limited liability company; and (d) arrange to prosecute, defend, settle or compromise actions and legal proceedings as may be necessary to enforce and protect the Company’s rights and interests.

13.Action by Written Consent. Any action permitted or required by the Code, the certificate of formation, or this Agreement to be taken at a meeting of the Member may be taken without a meeting if a consent in writing, setting forth the action to be taken, is signed by the Member. Such consent shall have the same force and effect as a vote at a meeting and may be stated as such in any document or instrument filed with the Texas Secretary of State, and the execution of such consent shall constitute attendance or presence in person at a meeting of the Member.

14.Insurance. The Company shall maintain insurance on the assets of the Company of such types as is consistent with insurance customarily maintained on similar assets, as determined by the Manager. Insurance maintained by the Company may name the Member and the Member’s managers as an additional named insureds (and, if provided, shall identify its status as a member of the Company) and shall require that at least 30 days prior notice of changes in such insurance be provided to the Member.

15.Time Devoted to Business. The Manager shall devote such part of his time as is reasonably needed to manage the Company’s business. This section is not intended, nor shall it be construed, to prohibit a Manager from delegating or performing services for any other party for compensation.

16.Membership Interests. The membership interests in the Company shall be deemed to be securities governed by Article 8 of the Uniform Commercial Code as in effect in the State of Texas (“UCC”) and within the meaning of Section 8-102(a)(15) of the UCC, including for purposes of the grant, pledge, attachment or perfection of a security interest in the certificated membership interests. The law of the State of Texas is hereby designated as the issuer’s jurisdiction within the meaning of section 8-110(d) of the UCC for purposes of the matters specified herein.

17.Compensation. No salary or other fee shall be payable to a Manager in his, her or its capacity as a Manager with respect to services rendered to the Company.

18.Costs of Operation. All costs and expenses of the Company, including debt service, taxes, legal and accounting fees, insurance premiums and every other cost or expense incurred after formation of the Company shall be paid from Company funds.

19.Initial Contributions to Company Capital. The Member’s contribution of capital to the Company is comprised of the property and cash as reflected on Exhibit A attached hereto.

20.Payment of Operating Costs. If the Company incurs operating costs in excess of revenues in its operations, the Member may advance funds to the Company in the form of loans.

21.Additional Voluntary Capital Contributions. The Manager shall, from time to time, determine the amounts of cash required by the Company. If additional cash is required, the Manager may request additional capital from the Member. The Manager shall give written notice to the Member of the reason for and the amount of the additional voluntary capital contribution requested, and the Member may contribute such amount. No person other than the Manager may make such a request or attempt to enforce this provision, and any decision to contribute additional capital shall be solely within the discretion of the Member as a voluntary additional capital contribution.

22.Dissolution. Provided that the Credit Facility is not outstanding, the Company may be dissolved and terminated at any time at the election of the Member.

23.Right to Rely Upon the Authority of Manager. No person dealing with the Manager shall be required to determine the authority of the Manager to make any commitment or undertaking on behalf of the Company, nor to determine any fact or circumstance bearing upon the existence of such authority. In addition, no purchaser of any property or interest owned by the Company shall be required to determine the authority of the Manager to sign and deliver on behalf of the Company any instrument of transfer, or to see to the application or distribution of revenues or proceeds paid or credited in connection therewith.

24.Applicable Law. This Agreement shall be governed by and construed in accordance with Texas law and shall constitute the Company Agreement of the Company as provided in the Code.

[Signature Page to Follow]

The Member has executed this Agreement to be effective as of the date set forth above.

SOLE MEMBER:

TAT HOLDCO LLC, a Texas limited liability company

By: /s/ N. Malone Mitchell 3rd

N. Malone Mitchell 3rd, Manager

By: /s/ Noah M. Mitchell 4th

Noah M. Mitchell 4th, Manager

By: /s/ Stevenson Briggs Mitchell

Stevenson Briggs Mitchell, Manager

By: /s/ Jonathon Troy Fite

Jonathon Troy Fite, Manager

By: /s/ Randall I. Rochman

Randall I. Rochman, Manager

Signature Page to Limited Liability Company Agreement of TAT Merger Sub LLC

ACCEPTANCE AND ACKNOWLEDGEMENT

The undersigned accepts the appointment as Manager of the Company and acknowledges the limitations on its authority as Manager contained in this Agreement.

TAT HOLDCO LLC

by:

/s/ N. Malone Mitchell 3rd

N. Malone Mitchell 3rd, Manager

/s/ Noah M. Mitchell 4th

Noah M. Mitchell 4th, Manager

/s/ Stevenson Briggs Mitchell

Stevenson Briggs Mitchell, Manager

/s/ Jonathon Troy Fite

Jonathon Troy Fite, Manager

/s/ Randall I. Rochman

Randall I. Rochman, Manager

Signature Page to Limited Liability Company Agreement of TAT Merger Sub LLC

EXHIBIT A

SCHEDULE OF CAPITAL CONTRIBUTIONS

|

Name of Member |

Cash and Value of Property Contributed |

|

|

|

|

TAT Holdco LLC |

$100,000.00 |

|

|

|

|

Totals |

$100,000.00 |

Exhibit A to Limited Liability Company Agreement of TAT Merger Sub LLC

Exhibit 99.1

TransAtlantic Petroleum Approval of

Agreement and Plan of Merger

Hamilton, Bermuda (December 18, 2020) -- TransAtlantic Petroleum Ltd. (TSX: TNP) (NYSE American: TAT) (the “Company” or “TransAtlantic”) today announced that the Company’s shareholders have approved the Agreement and Plan of Merger (the “Merger Agreement”), by and among the Company, TAT Holdco LLC, a Texas limited liability company (“Parent”), and TAT Merger Sub LLC, a Texas limited liability company and wholly-owned subsidiary of Parent (“Merger Sub”). Under the Merger Agreement and the Companies Act 1981 of Bermuda (the “Companies Act”), the approval and adoption of the merger proposal required the affirmative vote of 75% of the votes cast by holders of common shares as of the close of business on the record date at a duly convened meeting of the common shareholders of the Company at which a quorum is present. At the meeting, the holders of 56,984,007 Common Shares were represented in person or by proxy, constituting a quorum. Final vote totals indicate that 99.10% of the total votes cast were in favor of the Merger. Of the votes cast by shareholders not affiliated with the Acquiring Group, 86.60% were cast in favor of the Merger.

Pursuant to the Merger Agreement, Company has merged with and into Merger Sub and each of the Company’s issued and outstanding common shares, par value $0.10 per share (“Common Shares”), (other than the Excluded Shares (as defined in the Merger Agreement)) was canceled and was converted automatically into the right to receive $0.13 in cash.

The Company closed the transactions contemplated by the Merger Agreement effective at 12:01 am Central Time on December 18, 2020 and the Company’s Common Shares were suspended from trading on the NYSE American effective as of the opening of trading on December 18, 2020. The Company expects to be delisted from the NYSE American and Toronto Stock Exchange as soon as practicable.

About TransAtlantic

The Company is an international oil and natural gas company engaged in the acquisition, exploration, development, and production of oil and natural gas. The Company holds interests in developed and undeveloped properties in Turkey and Bulgaria.

(NO STOCK EXCHANGE, SECURITIES COMMISSION, OR OTHER REGULATORY AUTHORITY HAS APPROVED OR DISAPPROVED THE INFORMATION CONTAINED HEREIN.)

Forward-Looking Statements

Certain statements in this press release constitute “forward-looking statements” under the federal securities laws. These forward-looking statements are intended to be covered by the safe harbors created by the Private Securities Litigation Reform Act of 1995. The statements in this report speak only as of the date of hereof, and the Company undertakes no obligation to update or revise any forward-looking statement, whether as a result of new information, future developments, or otherwise, except as may be required by law.

Contacts:

Christine Stroud

Counsel

214-265-4763

TransAtlantic Petroleum Ltd.

16803 Dallas Parkway

Addison, Texas 75001

http://www.transatlanticpetroleum.com

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Lululemon to shutter Washington distribution center, lay off 128 employees

- University of Phoenix College of Nursing Faculty Leadership Selected for Prestigious Fellows of the American Association of Nurse Practitioners® Program

- Vision Sensing Acquisition Corp. Receives Positive Ruling from Nasdaq Hearings Panel

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share