Form 8-K THOR INDUSTRIES INC For: Dec 08

Exhibit 99.1

THOR Industries Reports Record Net Sales Of $3.96 Billion And Earnings Per Share Of $4.34 For The First Quarter Of Fiscal 2022 And Reaffirms Positive Outlook

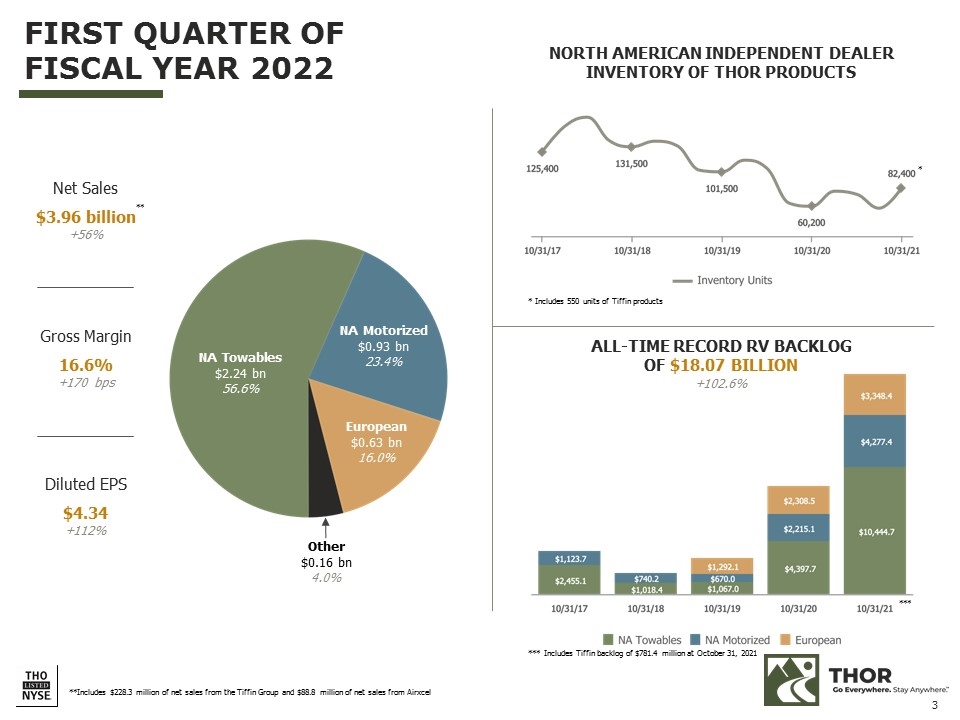

- Net sales for the first quarter were $3.96 billion, an increase of 56.0% as compared to the first quarter of the prior fiscal year.

- Consolidated gross profit margin for the first quarter was 16.6%, a 170 basis-point improvement over the comparable prior-year period.

- Earnings per share for the first quarter were $4.34 per diluted share, an increase of 111.7% as compared to $2.05 per diluted share in the same period of the prior fiscal year.

- Consolidated RV backlog as of October 31, 2021 was $18.07 billion, an increase of over 100% as compared to RV backlog as of October 31, 2020.

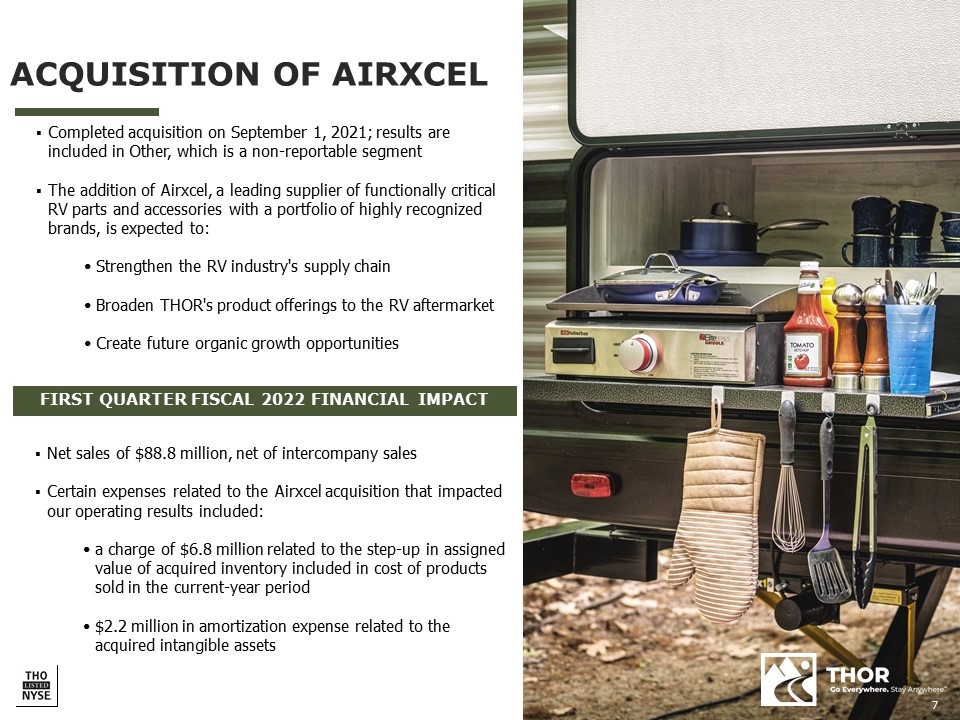

- During the first quarter, THOR acquired Airxcel, a significant supplier to the North American RV industry.

- For our complete set of investor relations materials, please visit: http://ir.thorindustries.com

ELKHART, Ind., Dec. 8, 2021 /PRNewswire/ -- THOR Industries, Inc. (NYSE: THO) today announced record results for its first fiscal quarter ended October 31, 2021.

"Building on our record-setting fiscal 2021, THOR delivered yet another quarter of strong financial results to begin our 2022 fiscal year. It seems the market focuses on the supply chain and labor challenges that our industry is facing right now more than it does our performance in the face of those challenges, but our performance has been consistent despite those challenges. Through outstanding operational execution, our teams continue to successfully navigate through these challenges at record levels. In the quarter, we delivered over 88,100 units, outpacing the RV industry's growth rate of shipments. Our first quarter performance, which marks a third consecutive quarter of record net sales and diluted earnings per share, is a testament to the experience, flexibility and agility of our operating teams and their drive to meet the needs of our customers in a difficult and dynamic business environment," said Bob Martin, President and CEO of THOR Industries.

"Independent dealer sentiment remains positive and consumer demand for our RV products remains strong. In the first quarter, our global order backlog increased to more than $18 billion, reaffirming our view that the dealer restocking process will still take a number of quarters to complete and could possibly extend into calendar 2023," said Martin.

"The strategic course we have set gives us many reasons to remain confident and optimistic about our future performance as well. Our acquisition of Airxcel in the first quarter is a manifestation of our bullish outlook for our industry and for THOR in particular. This acquisition is a key piece to our strategic positioning of the Company as we seek to strengthen our supply chain. The Airxcel integration has gone exceedingly well, and we continue to see a great opportunity for growth through innovation, additional product offerings and the aftermarket business," added Martin.

First-Quarter Financial Results

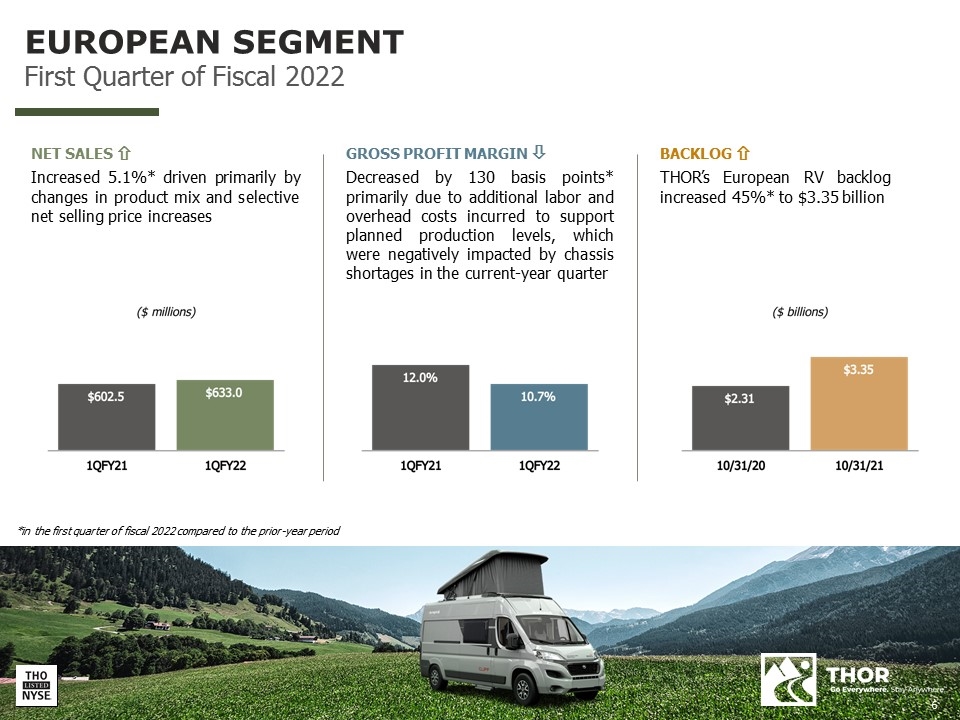

Consolidated net sales were $3.96 billion in the first quarter of fiscal 2022, compared to $2.54 billion in the first quarter of fiscal 2021. This year's first quarter net sales include $2.24 billion for the North American Towable RV segment compared to $1.39 billion in the first quarter of fiscal 2021, $925.0 million for the North American Motorized RV segment compared to $493.9 million in the first quarter of fiscal 2021, and $633.0 million for the European RV segment compared to $602.5 million in the first quarter of fiscal 2021. The increase in consolidated net sales is primarily due to the continuing demand for RVs and our recent acquisitions. The addition of the Tiffin Group, acquired in December of 2020, accounted for $228.3 million of the increase in net sales for the first quarter of fiscal 2022, while the addition of Airxcel, acquired in September of 2021, accounted for $88.8 million of the increase in net sales for the first quarter of fiscal 2022, net of intercompany sales.

Consolidated gross profit margin increased 170 basis points to 16.6% for the first quarter of fiscal 2022, compared to 14.9% in the corresponding period a year ago. The increase in the consolidated gross profit percentage was primarily driven by the increase in net sales, a reduction in sales discounts since the prior-year period and selective net selling price increases to cover known and anticipated material cost increases.

Net income attributable to THOR Industries and diluted earnings per share for the first quarter of fiscal 2022 were $242.2 million and $4.34, respectively, compared to $113.8 million and $2.05, respectively, in the prior-year period.

Segment Results

North American Towable RVs | ||||||||||

|

| ||||||||||

($ in thousands) | Three Months Ended October 31, |

| % Change | |||||||

|

| 2021 |

| 2020 |

| ||||||

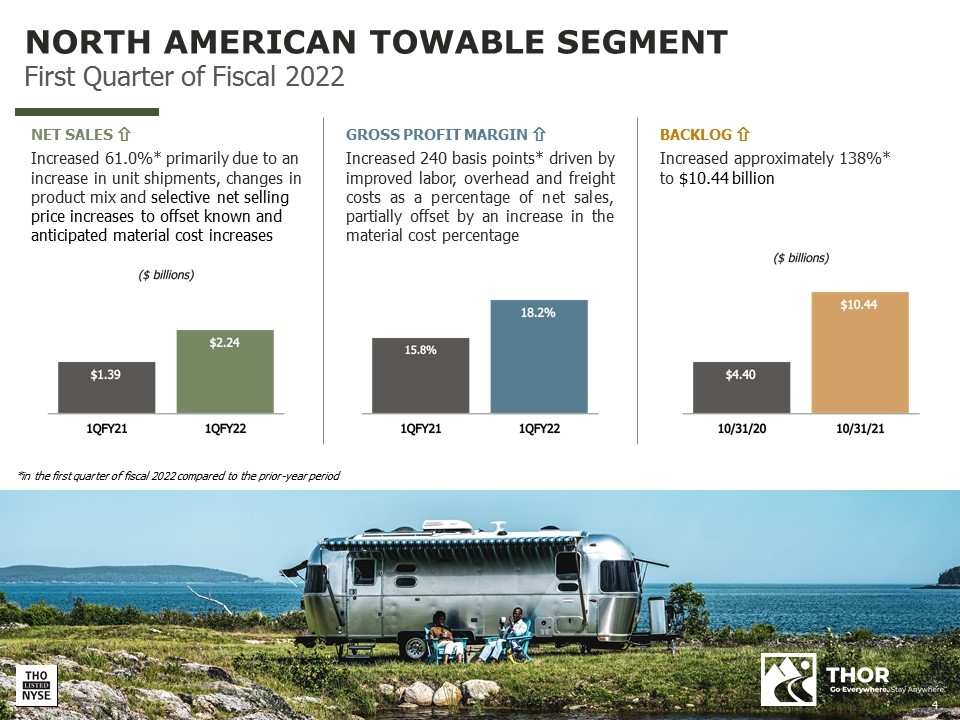

Net Sales | $ | 2,240,834 |

|

| $ | 1,392,044 |

|

| 61.0 |

|

Gross Profit | $ | 408,539 |

|

| $ | 219,848 |

|

| 85.8 |

|

Gross Profit Margin % | 18.2 |

|

| 15.8 |

|

|

| |||

Income Before Income Taxes | $ | 266,282 |

|

| $ | 141,179 |

|

| 88.6 |

|

|

| ||||||||||

|

| ||||||||||

|

| As of October 31, |

| % Change | |||||||

($ in thousands) | 2021 |

| 2020 |

| ||||||

Order Backlog | $ | 10,444,698 |

|

| $ | 4,397,713 |

|

| 137.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

North American Motorized RVs | ||||||||||

|

| ||||||||||

($ in thousands) | Three Months Ended October 31, |

| % Change | |||||||

|

| 2021 |

| 2020 |

| ||||||

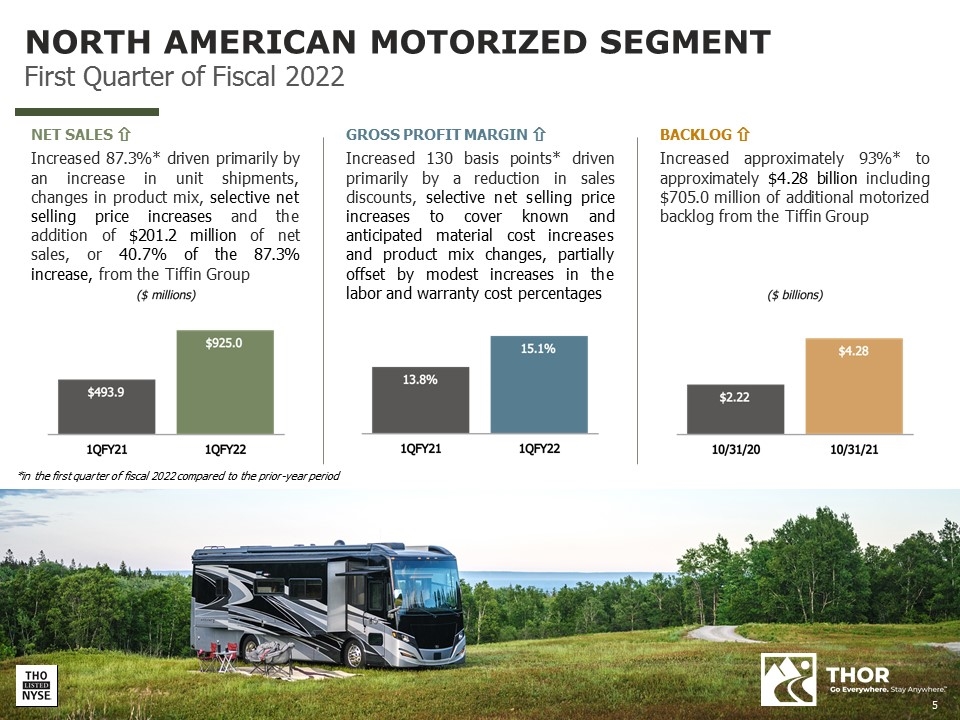

Net Sales | $ | 925,028 |

|

| $ | 493,855 |

|

| 87.3 |

|

Gross Profit | $ | 139,721 |

|

| $ | 68,102 |

|

| 105.2 |

|

Gross Profit Margin % | 15.1 |

|

| 13.8 |

|

|

| |||

Income Before Income Taxes | $ | 88,898 |

|

| $ | 41,567 |

|

| 113.9 |

|

|

| ||||||||||

|

| ||||||||||

|

| As of October 31, |

| % Change | |||||||

($ in thousands) | 2021 |

| 2020 |

| ||||||

Order Backlog | $ | 4,277,378 |

|

| $ | 2,215,069 |

|

| 93.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

The addition of the Tiffin Group, acquired on December 18, 2020, accounted for $201.2 million of the $431.2 million increase in North American Motorized RV net sales.

European RVs | ||||||||||

|

| ||||||||||

($ in thousands) | Three Months Ended October 31, |

| % Change | |||||||

|

| 2021 |

| 2020 |

| ||||||

Net Sales | $ | 632,997 |

|

| $ | 602,488 |

|

| 5.1 |

|

Gross Profit | $ | 67,444 |

|

| $ | 72,381 |

|

| (6.8) |

|

Gross Profit Margin % | 10.7 |

|

| 12.0 |

|

|

| |||

(Loss) Before Income Taxes | $ | (17,976) |

|

| $ | (5,506) |

|

| (226.5) |

|

|

| ||||||||||

|

| ||||||||||

|

| As of October 31, |

| % Change | |||||||

($ in thousands) | 2021 |

| 2020 |

| ||||||

Order Backlog | $ | 3,348,355 |

|

| $ | 2,308,472 |

|

| 45.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Management Commentary

"In our first fiscal quarter of 2022, we delivered another record consolidated financial performance, reflecting the strong and ongoing demand for our RV products as we continue to demonstrate our ability to excel in challenging operating environments. THOR is strategically structured to enable it to excel during times of favorable market conditions and to outperform when the industry faces challenges like the supply and labor constraints the industry faces today. We are very pleased with our first quarter gross profit margin performance of 16.6% which is an improvement of 170 basis points from the first quarter of fiscal 2021. This increase in consolidated gross profit margin reflects our operating excellence initiatives, an increased mix of higher margin North American sales versus European sales this quarter and our decision to take price adjustments ahead of anticipated increases in our material costs. We do expect our consolidated gross margins to see some downward pressure as global revenue mix normalizes and cost increases continue to occur in future quarters of fiscal 2022," said Colleen Zuhl, THOR Industries' Senior Vice President and Chief Financial Officer.

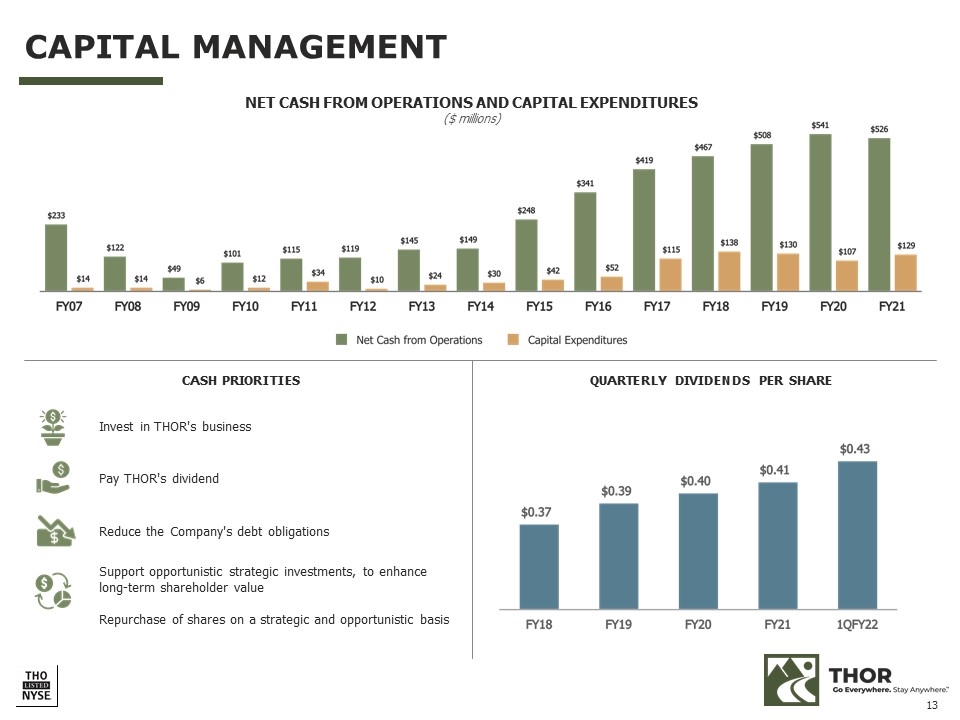

"During the first quarter of fiscal 2022, we issued $500 million of senior unsecured notes and expanded our ABL borrowing capacity to $1 billion. These transactions not only enhanced our liquidity and extended our debt maturities, but also secured access to long-term financing at attractive rates and provided funding for our acquisition of Airxcel. At the end of the first fiscal quarter, we had liquidity of over $1 billion, including approximately $336 million in cash on hand and approximately $810 million available under our ABL, providing significant financial flexibility moving forward as we continue to execute our long-term strategic plan through prudent and thoughtful capital deployment," concluded Zuhl.

Outlook

"Our first quarter financial and operational performance was a phenomenal start to our fiscal 2022 year. As we look ahead, we expect continued supply chain constraints, logistical challenges and cost pressures. However, as we have consistently demonstrated, we also expect to continue to excel at our top and bottom lines. We remain steadfastly focused on the execution of our strategic plan while we continue our realization of operational excellence as we strive to meet the strong consumer demand for our products. Through continued strategic operational execution, the integration of our recent acquisitions, our positive outlook for the RV industry and with record backlog levels providing visibility beyond this fiscal year, we are confident that fiscal year 2022 will be another year of meaningful growth for THOR," said Martin.

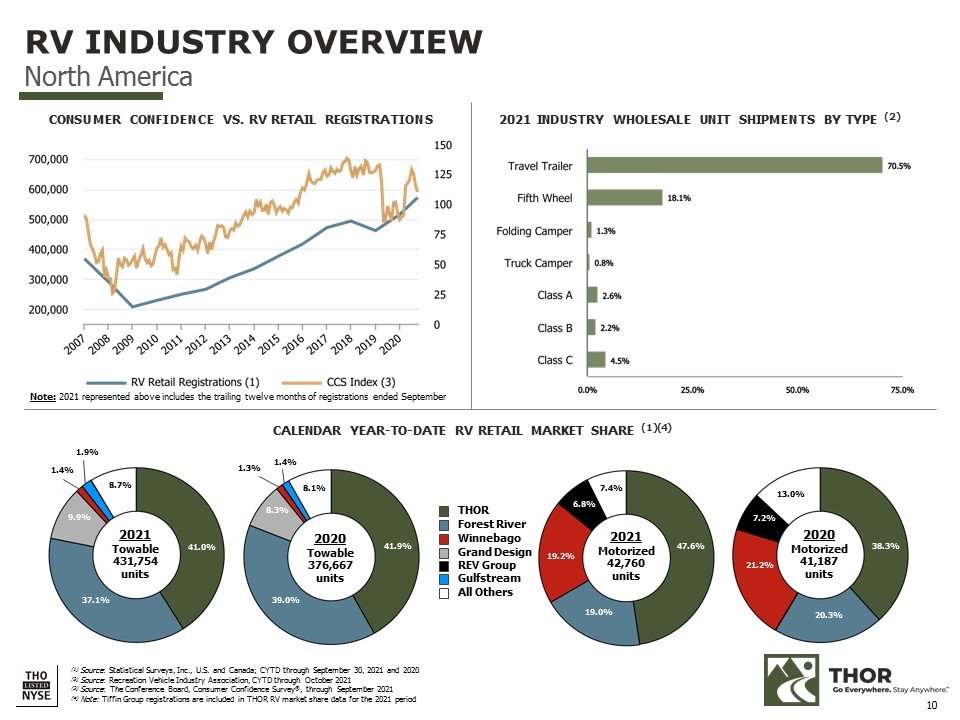

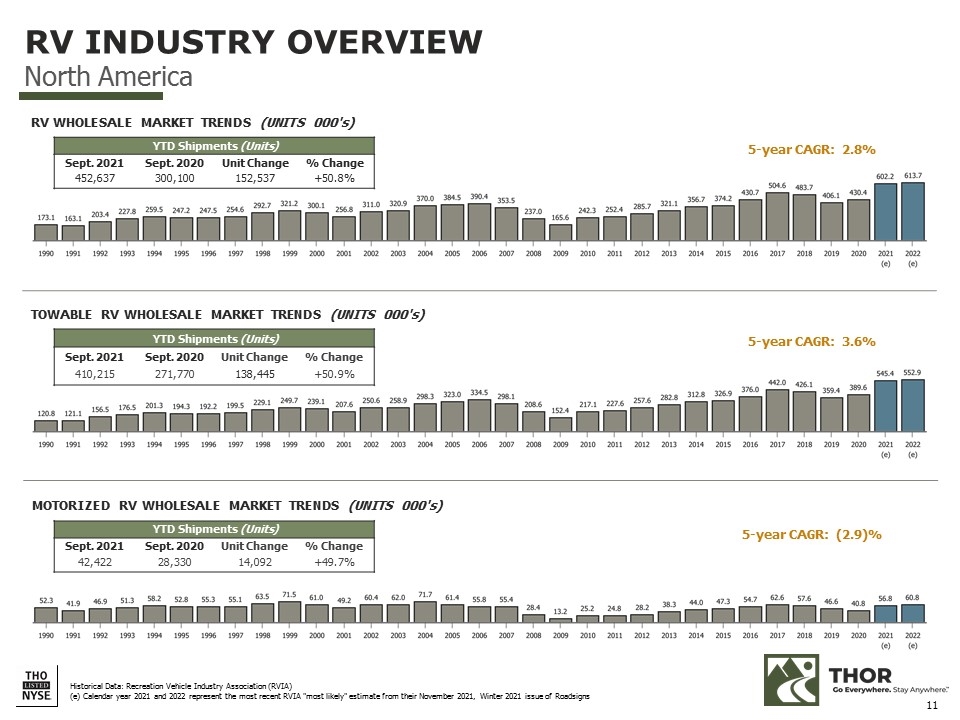

"Additionally, RVIA has recently increased its wholesale shipment forecast for calendar year 2021 to more than 602,000 units, and to over 613,000 for calendar year 2022, a projected increase of approximately 2% for next year. We agree with this outlook and expect THOR to continue to outperform the market and to grow at a higher rate than RVIA projects for the industry as whole," added Martin.

"We are pleased with the excellent progress we have made toward achieving our 2025 financial goals that we introduced in October 2019, and we look forward to seeing everyone at the 2022 Florida RV Supershow in January," concluded Martin.

Supplemental Earnings Release Materials

THOR Industries has provided a comprehensive question and answer document, as well as a PowerPoint presentation, relating to its quarterly results and other topics.

To view these materials, go to http://ir.thorindustries.com.

About THOR Industries, Inc.

THOR Industries is the sole owner of operating subsidiaries that, combined, represent the world's largest manufacturer of recreational vehicles.

For more information on the Company and its products, please go to www.thorindustries.com.

Forward-Looking Statements

This release includes certain statements that are "forward-looking" statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are made based on management's current expectations and beliefs regarding future and anticipated developments and their effects upon THOR, and inherently involve uncertainties and risks. These forward-looking statements are not a guarantee of future performance. We cannot assure you that actual results will not differ materially from our expectations. Factors which could cause materially different results include, among others: the extent and impact from the continuation of the COVID-19 pandemic, along with the responses to contain the spread of the virus, or its variants, by various governmental entities or other actors, which may have negative effects on retail customer demand, our independent dealers, our supply chain, our labor force, our production or other aspects of our business; the ability to ramp production up or down quickly in response to rapid changes in demand while also managing costs and market share; the effect of raw material and commodity price fluctuations, and/or raw material, commodity or chassis supply constraints; the dependence on a small group of suppliers for certain components used in production; the level and magnitude of warranty and recall claims incurred; the ability of our suppliers to financially support any defects in their products; legislative, regulatory and tax law and/or policy developments including their potential impact on our dealers and their retail customers or on our suppliers; the costs of compliance with governmental regulation; public perception of and the costs related to environmental, social and governance matters; legal and compliance issues including those that may arise in conjunction with recently completed transactions; lower consumer confidence and the level of discretionary consumer spending; interest rate fluctuations and their potential impact on the general economy and, specifically, on our dealers and consumers; the impact of exchange rate fluctuations; restrictive lending practices which could negatively impact our independent dealers and/or retail consumers; management changes; the success of new and existing products and services; the ability to maintain strong brands and develop innovative products that meet consumer demands; the ability to efficiently utilize existing production facilities; changes in consumer preferences; the risks associated with acquisitions, including: the pace and successful closing of an acquisition, the integration and financial impact thereof, the level of achievement of anticipated operating synergies from acquisitions, the potential for unknown or understated liabilities related to acquisitions, the potential loss of existing customers of acquisitions and our ability to retain key management personnel of acquired companies; a shortage of necessary personnel for production and increasing labor costs to attract production personnel in times of high demand; the loss or reduction of sales to key dealers; disruption of the delivery of units to dealers; increasing costs for freight and transportation; asset impairment charges; competition; the impact of potential losses under repurchase agreements; the potential impact of the strength of the U.S. dollar on international demand for products priced in U.S. dollars; general economic, market and political conditions in the various countries in which our products are produced and/or sold; the impact of changing emissions and other related climate change regulations in the various jurisdictions in which our products are produced, used and/or sold; changes to our investment and capital allocation strategies or other facets of our strategic plan; and changes in market liquidity conditions, credit ratings and other factors that may impact our access to future funding and the cost of debt.

These and other risks and uncertainties are discussed more fully in our Quarterly Report on Form 10-Q for the quarter ended October 31, 2021 and in Item 1A of our Annual Report on Form 10-K for the year ended July 31, 2021.

We disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained in this release or to reflect any change in our expectations after the date hereof or any change in events, conditions or circumstances on which any statement is based, except as required by law.

THOR INDUSTRIES, INC. | ||||||||||

CONDENSED CONSOLIDATED STATEMENTS OF INCOME | ||||||||||

FOR THE THREE MONTHS ENDED OCTOBER 31, 2021 AND 2020 | ||||||||||

($000's except share and per share data) | ||||||||||

|

|

|

|

|

|

|

| ||||

|

|

| Three Months Ended October 31, (Unaudited) | ||||||||

|

|

| 2021 | % Net Sales (1) |

| 2020 | % Net Sales (1) | ||||

|

|

|

|

|

|

|

| ||||

Net sales |

| $ | 3,958,224 |

|

|

| $ | 2,537,360 |

|

|

|

|

|

|

|

|

|

| ||||

Gross profit |

| $ | 655,424 |

| 16.6% |

| $ | 378,852 |

| 14.9% |

|

|

|

|

|

|

|

| ||||

Selling, general and administrative expenses |

| 295,883 |

| 7.5% |

| 181,763 |

| 7.2% | ||

|

|

|

|

|

|

|

| ||||

Amortization of intangible assets |

| 33,214 |

| 0.8% |

| 27,427 |

| 1.1% | ||

|

|

|

|

|

|

|

| ||||

Interest expense, net |

| 20,720 |

| 0.5% |

| 23,958 |

| 0.9% | ||

|

|

|

|

|

|

|

| ||||

Other income, net |

| 7,235 |

| 0.2% |

| 615 |

| —% | ||

|

|

|

|

|

|

|

| ||||

Income before income taxes |

| 312,842 |

| 7.9% |

| 146,319 |

| 5.8% | ||

|

|

|

|

|

|

|

| ||||

Income taxes |

| 68,039 |

| 1.7% |

| 30,680 |

| 1.2% | ||

|

|

|

|

|

|

|

| ||||

Net income |

| 244,803 |

| 6.2% |

| 115,639 |

| 4.6% | ||

|

|

|

|

|

|

|

| ||||

Less: net income attributable to non-controlling interests |

| 2,561 |

| 0.1% |

| 1,882 |

| 0.1% | ||

|

|

|

|

|

|

|

| ||||

Net income attributable to THOR Industries, Inc. |

| $ | 242,242 |

| 6.1% |

| $ | 113,757 |

| 4.5% |

|

|

|

|

|

|

|

| ||||

Earnings per common share |

|

|

|

|

|

| ||||

Basic |

| $ | 4.37 |

|

|

| $ | 2.06 |

|

|

Diluted |

| $ | 4.34 |

|

|

| $ | 2.05 |

|

|

|

|

|

|

|

|

|

| ||||

Weighted-avg. common shares outstanding – basic |

| 55,422,854 |

|

|

| 55,238,164 |

|

| ||

Weighted-avg. common shares outstanding – diluted |

| 55,790,712 |

|

|

| 55,554,682 |

|

| ||

|

|

|

|

|

|

|

| ||||

(1) Percentages may not add due to rounding differences | ||||||||||

SUMMARY CONDENSED CONSOLIDATED BALANCE SHEETS ($000's) (Unaudited) | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

|

| October 31, 2021 |

| July 31,

|

|

|

| October 31, 2021 |

| July 31,

| ||||||||

Cash and equivalents |

| $ | 339,297 |

|

| $ | 448,706 |

|

| Current liabilities |

| $ | 2,036,742 |

|

| $ | 1,794,785 |

|

Accounts receivable, net |

| 1,166,373 |

|

| 949,932 |

|

| Long-term debt |

| 2,232,266 |

|

| 1,594,821 |

| ||||

Inventories, net |

| 1,671,847 |

|

| 1,369,384 |

|

| Other long-term liabilities |

| 367,521 |

|

| 316,376 |

| ||||

Prepaid income taxes, expenses and other |

| 36,194 |

|

| 35,501 |

|

| Stockholders' equity |

| 3,132,242 |

|

| 2,948,106 |

| ||||

Total current assets |

| 3,213,711 |

|

| 2,803,523 |

|

|

|

|

|

|

| ||||||

Property, plant & equipment, net |

| 1,218,023 |

|

| 1,185,131 |

|

|

|

|

|

|

| ||||||

Goodwill |

| 1,915,388 |

|

| 1,563,255 |

|

|

|

|

|

|

| ||||||

Amortizable intangible assets, net |

| 1,298,289 |

|

| 937,171 |

|

|

|

|

|

|

| ||||||

Deferred income taxes and other, net |

| 123,360 |

|

| 165,008 |

|

|

|

|

|

|

| ||||||

Total |

| $ | 7,768,771 |

|

| $ | 6,654,088 |

|

|

|

| $ | 7,768,771 |

|

| $ | 6,654,088 |

|

Contact

Mark Trinske, Vice President of Investor Relations

[email protected]

(574) 970-7912

FIRST QUARTER OF FISCAL 2022 FINANCIAL RESULTS Exhibit 99.2

FORWARD-LOOKING STATEMENTS This presentation includes certain statements that are “forward-looking” statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are made based on management’s current expectations and beliefs regarding future and anticipated developments and their effects upon THOR, and inherently involve uncertainties and risks. These forward-looking statements are not a guarantee of future performance. We cannot assure you that actual results will not differ materially from our expectations. Factors which could cause materially different results include, among others: the extent and impact from the continuation of the COVID-19 pandemic, along with the responses to contain the spread of the virus, or its variants, by various governmental entities or other actors, which may have negative effects on retail customer demand, our independent dealers, our supply chain, our labor force, our production or other aspects of our business; the ability to ramp production up or down quickly in response to rapid changes in demand while also managing costs and market share; the effect of raw material and commodity price fluctuations, and/or raw material, commodity or chassis supply constraints; the dependence on a small group of suppliers for certain components used in production; the level and magnitude of warranty and recall claims incurred; the ability of our suppliers to financially support any defects in their products; legislative, regulatory and tax law and/or policy developments including their potential impact on our dealers and their retail customers or on our suppliers; the costs of compliance with governmental regulation; public perception of and the costs related to environmental, social and governance matters; legal and compliance issues including those that may arise in conjunction with recently completed transactions; lower consumer confidence and the level of discretionary consumer spending; interest rate fluctuations and their potential impact on the general economy and, specifically, on our dealers and consumers; the impact of exchange rate fluctuations; restrictive lending practices which could negatively impact our independent dealers and/or retail consumers; management changes; the success of new and existing products and services; the ability to maintain strong brands and develop innovative products that meet consumer demands; the ability to efficiently utilize existing production facilities; changes in consumer preferences; the risks associated with acquisitions, including: the pace and successful closing of an acquisition, the integration and financial impact thereof, the level of achievement of anticipated operating synergies from acquisitions, the potential for unknown or understated liabilities related to acquisitions, the potential loss of existing customers of acquisitions and our ability to retain key management personnel of acquired companies; a shortage of necessary personnel for production and increasing labor costs to attract production personnel in times of high demand; the loss or reduction of sales to key dealers; disruption of the delivery of units to dealers; increasing costs for freight and transportation; asset impairment charges; competition; the impact of potential losses under repurchase agreements; the potential impact of the strength of the U.S. dollar on international demand for products priced in U.S. dollars; general economic, market and political conditions in the various countries in which our products are produced and/or sold; the impact of changing emissions and other related climate change regulations in the various jurisdictions in which our products are produced, used and/or sold; changes to our investment and capital allocation strategies or other facets of our strategic plan; and changes in market liquidity conditions, credit ratings and other factors that may impact our access to future funding and the cost of debt. These and other risks and uncertainties are discussed more fully in our Quarterly Report on Form 10-Q for the quarter ended October 31, 2021 and in Item 1A of our Annual Report on Form 10-K for the year ended July 31, 2021. We disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained in this presentation or to reflect any change in our expectations after the date hereof or any change in events, conditions or circumstances on which any statement is based, except as required by law.

European $0.63 bn 16.0% NA Motorized $0.93 bn 23.4% NA Towables $2.24 bn 56.6% Other $0.16 bn 4.0% NORTH AMERICAN INDEPENDENT DEALER INVENTORY OF THOR PRODUCTS ALL-TIME RECORD RV BACKLOG OF $18.07 BILLION +102.6% * * Includes 550 units of Tiffin products *** *** Includes Tiffin backlog of $781.4 million at October 31, 2021 **Includes $228.3 million of net sales from the Tiffin Group and $88.8 million of net sales from Airxcel FIRST QUARTER OF FISCAL YEAR 2022 Gross Margin 16.6% +170 bps Diluted EPS $4.34 +112% Net Sales $3.96 billion +56% **

NET SALES ñ Increased 61.0%* primarily due to an increase in unit shipments, changes in product mix and selective net selling price increases to offset known and anticipated material cost increases GROSS PROFIT MARGIN ñ Increased 240 basis points* driven by improved labor, overhead and freight costs as a percentage of net sales, partially offset by an increase in the material cost percentage BACKLOG ñ Increased approximately 138%* to $10.44 billion NORTH AMERICAN TOWABLE SEGMENT First Quarter of Fiscal 2022 *in the first quarter of fiscal 2022 compared to the prior-year period

NET SALES ñ Increased 87.3%* driven primarily by an increase in unit shipments, changes in product mix, selective net selling price increases and the addition of $201.2 million of net sales, or 40.7% of the 87.3% increase, from the Tiffin Group GROSS PROFIT MARGIN ñ Increased 130 basis points* driven primarily by a reduction in sales discounts, selective net selling price increases to cover known and anticipated material cost increases and product mix changes, partially offset by modest increases in the labor and warranty cost percentages BACKLOG ñ Increased approximately 93%* to approximately $4.28 billion including $705.0 million of additional motorized backlog from the Tiffin Group NORTH AMERICAN MOTORIZED SEGMENT First Quarter of Fiscal 2022 *in the first quarter of fiscal 2022 compared to the prior-year period

NET SALES ñ Increased 5.1%* driven primarily by changes in product mix and selective net selling price increases GROSS PROFIT MARGIN ò Decreased by 130 basis points* primarily due to additional labor and overhead costs incurred to support planned production levels, which were negatively impacted by chassis shortages in the current-year quarter BACKLOG ñ THOR’s European RV backlog increased 45%* to $3.35 billion EUROPEAN SEGMENT First Quarter of Fiscal 2022 *in the first quarter of fiscal 2022 compared to the prior-year period

ACQUISITION OF AIRXCEL TOWABLE EUROPEAN MOTORIZED OTHER NORTH AMERICAN Completed acquisition on September 1, 2021; results are included in Other, which is a non-reportable segment The addition of Airxcel, a leading supplier of functionally critical RV parts and accessories with a portfolio of highly recognized brands, is expected to: Strengthen the RV industry's supply chain Broaden THOR's product offerings to the RV aftermarket Create future organic growth opportunities FIRST QUARTER FISCAL 2022 FINANCIAL IMPACT Net sales of $88.8 million, net of intercompany sales Certain expenses related to the Airxcel acquisition that impacted our operating results included: a charge of $6.8 million related to the step-up in assigned value of acquired inventory included in cost of products sold in the current-year period $2.2 million in amortization expense related to the acquired intangible assets

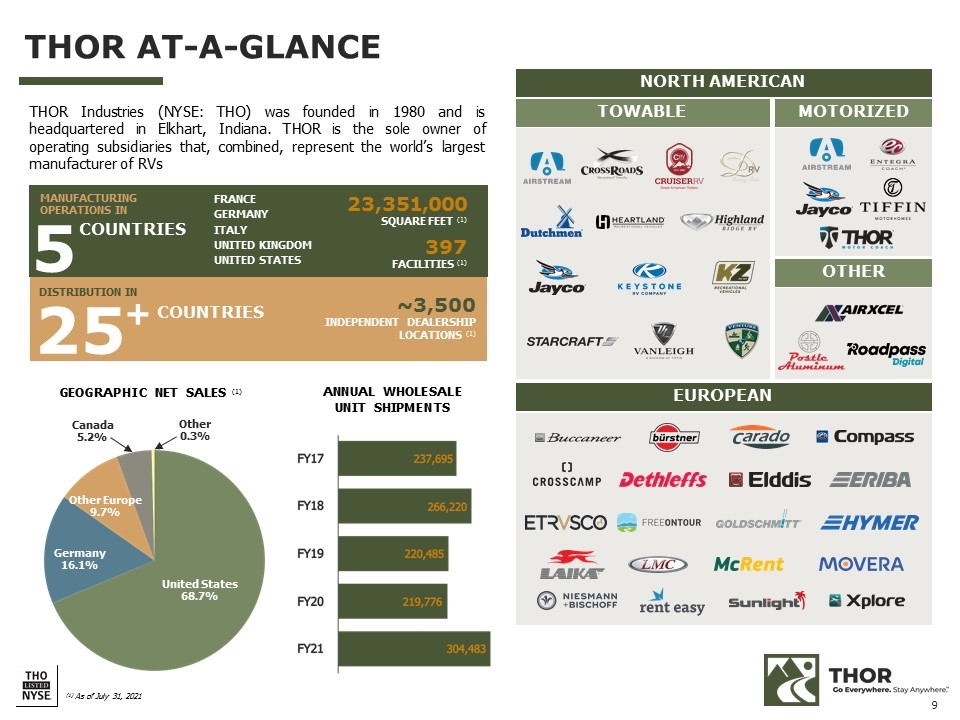

APPENDIX

THOR AT-A-GLANCE COUNTRIES 25 5 COUNTRIES + MANUFACTURING OPERATIONS IN DISTRIBUTION IN (1) As of July 31, 2021 GEOGRAPHIC NET SALES (1) THOR Industries (NYSE: THO) was founded in 1980 and is headquartered in Elkhart, Indiana. THOR is the sole owner of operating subsidiaries that, combined, represent the world’s largest manufacturer of RVs United States 68.7% Germany 16.1% Other Europe 9.7% Canada 5.2% Other 0.3% ANNUAL WHOLESALE UNIT SHIPMENTS FRANCE GERMANY ITALY UNITED KINGDOM UNITED STATES 23,351,000 SQUARE FEET (1) 397 FACILITIES (1) ~3,500 INDEPENDENT DEALERSHIP LOCATIONS (1) TOWABLE EUROPEAN MOTORIZED OTHER NORTH AMERICAN

RV INDUSTRY OVERVIEW North America (1) Source: Statistical Surveys, Inc., U.S. and Canada; CYTD through September 30, 2021 and 2020 (2) Source: Recreation Vehicle Industry Association, CYTD through October 2021 (3) Source: The Conference Board, Consumer Confidence Survey®, through September 2021 (4) Note: Tiffin Group registrations are included in THOR RV market share data for the 2021 period 2021 INDUSTRY WHOLESALE UNIT SHIPMENTS BY TYPE (2) CONSUMER CONFIDENCE VS. RV RETAIL REGISTRATIONS CALENDAR YEAR-TO-DATE RV RETAIL MARKET SHARE (1)(4) THOR Forest River Winnebago Grand Design REV Group Gulfstream All Others 2021 Towable 431,754 units 2021 Motorized 42,760 units 2020 Motorized 41,187 units 2020 Towable 376,667 units 47.6% 41.0% 38.3% 41.9% 37.1% 19.0% 9.9% 1.4% 8.7% 1.9% 19.2% 6.8% 7.4% 8.1% 8.3% 39.0% 1.4% 1.3% 13.0% 20.3% 21.2% 7.2% Note: 2021 represented above includes the trailing twelve months of registrations ended September

TOWABLE RV WHOLESALE MARKET TRENDS (UNITS 000's) YTD Shipments (Units) Sept. 2021 Sept. 2020 Unit Change % Change 452,637 300,100 152,537 +50.8% YTD Shipments (Units) Sept. 2021 Sept. 2020 Unit Change % Change 410,215 271,770 138,445 +50.9% YTD Shipments (Units) Sept. 2021 Sept. 2020 Unit Change % Change 42,422 28,330 14,092 +49.7% Historical Data: Recreation Vehicle Industry Association (RVIA) (e) Calendar year 2021 and 2022 represent the most recent RVIA "most likely" estimate from their November 2021, Winter 2021 issue of Roadsigns 5-year CAGR: 2.8% 5-year CAGR: 3.6% 5-year CAGR: (2.9)% RV INDUSTRY OVERVIEW North America RV WHOLESALE MARKET TRENDS (UNITS 000's) MOTORIZED RV WHOLESALE MARKET TRENDS (UNITS 000's)

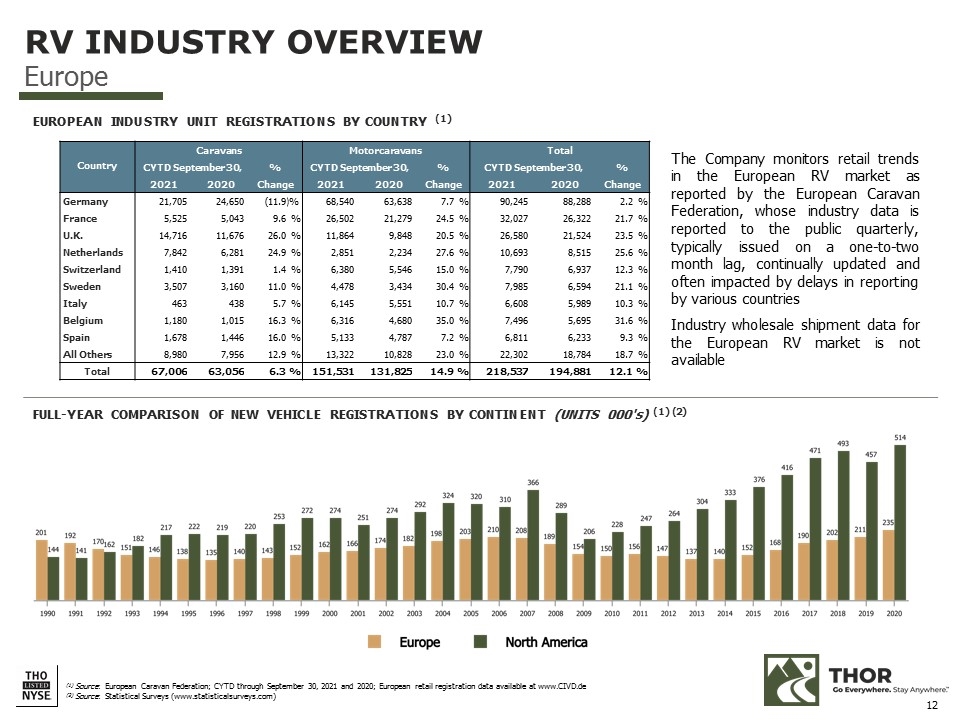

(1) Source: European Caravan Federation; CYTD through September 30, 2021 and 2020; European retail registration data available at www.CIVD.de (2) Source: Statistical Surveys (www.statisticalsurveys.com) Country Caravans Motorcaravans Total CYTD September 30, % CYTD September 30, % CYTD September 30, % 2021 2020 Change 2021 2020 Change 2021 2020 Change Germany 21,705 24,650 (11.9 )% 68,540 63,638 7.7 % 90,245 88,288 2.2 % France 5,525 5,043 9.6 % 26,502 21,279 24.5 % 32,027 26,322 21.7 % U.K. 14,716 11,676 26.0 % 11,864 9,848 20.5 % 26,580 21,524 23.5 % Netherlands 7,842 6,281 24.9 % 2,851 2,234 27.6 % 10,693 8,515 25.6 % Switzerland 1,410 1,391 1.4 % 6,380 5,546 15.0 % 7,790 6,937 12.3 % Sweden 3,507 3,160 11.0 % 4,478 3,434 30.4 % 7,985 6,594 21.1 % Italy 463 438 5.7 % 6,145 5,551 10.7 % 6,608 5,989 10.3 % Belgium 1,180 1,015 16.3 % 6,316 4,680 35.0 % 7,496 5,695 31.6 % Spain 1,678 1,446 16.0 % 5,133 4,787 7.2 % 6,811 6,233 9.3 % All Others 8,980 7,956 12.9 % 13,322 10,828 23.0 % 22,302 18,784 18.7 % Total 67,006 63,056 6.3 % 151,531 131,825 14.9 % 218,537 194,881 12.1 % EUROPEAN INDUSTRY UNIT REGISTRATIONS BY COUNTRY (1) The Company monitors retail trends in the European RV market as reported by the European Caravan Federation, whose industry data is reported to the public quarterly, typically issued on a one-to-two month lag, continually updated and often impacted by delays in reporting by various countries Industry wholesale shipment data for the European RV market is not available FULL-YEAR COMPARISON OF NEW VEHICLE REGISTRATIONS BY CONTINENT (UNITS 000's) (1) (2) RV INDUSTRY OVERVIEW Europe

CAPITAL MANAGEMENT CASH PRIORITIES Invest in THOR's business Pay THOR's dividend Reduce the Company's debt obligations Support opportunistic strategic investments, to enhance long-term shareholder value Repurchase of shares on a strategic and opportunistic basis NET CASH FROM OPERATIONS AND CAPITAL EXPENDITURES ($ millions) QUARTERLY DIVIDENDS PER SHARE

INVESTOR RELATIONS CONTACT Mark Trinske Vice President of Investor Relations [email protected] (574) 970-7912

Exhibit 99.3

FIRST QUARTER OF FISCAL 2022

INVESTOR QUESTIONS & ANSWERS

December 8, 2021

Forward-Looking Statements

Reference is made to the forward-looking statements disclosure provided at the end of this document.

Executive Overview

|

|

• |

Net sales for the first quarter were $3.96 billion, an increase of 56.0% as compared to the first quarter of the prior fiscal year. |

|

|

• |

Consolidated gross profit margin for the first quarter was 16.6%, a 170 basis-point improvement over the comparable prior-year period. |

|

|

• |

Earnings per share for the first quarter were $4.34 per diluted share, an increase of 111.7% as compared to $2.05 per diluted share in the same period of the prior fiscal year. |

|

|

• |

Consolidated RV backlog as of October 31, 2021 was $18.07 billion, an increase of over 100% as compared to RV backlog as of October 31, 2020. |

|

|

• |

During the first quarter, THOR acquired Airxcel, a significant supplier to the North American RV industry. |

|

|

• |

For our complete set of investor relations materials, please visit: http://ir.thorindustries.com |

Quick Reference to Contents

|

Current Market Conditions and Outlook Assumptions |

2 |

||

|

|

|

|

|

|

Q&A |

|

||

|

|

|

Operations Update |

|

|

|

|

Market Update |

4 |

|

|

|

Financial Operating Results |

6 |

|

|

|

|

|

|

Segment Data |

|

||

|

|

|

Summary of Key Quarterly Segment Data – North American Towable RVs |

9 |

|

|

|

Summary of Key Quarterly Segment Data – North American Motorized RVs |

10 |

|

|

|

Summary of Key Quarterly Segment Data – European RVs |

11 |

|

|

|

|

|

|

Forward-Looking Statements |

12 |

||

Current Market Conditions and Outlook Assumptions

|

|

• |

Market demand conditions in North America. |

Demand in the North American RV market remains very high. Deliveries to independent dealers are being retail sold quickly and dealer inventories remain at low levels in North America. We believe the restocking cycle will still take a number of quarters to complete and could possibly extend into calendar 2023. In the longer-term, which we define as calendar 2023 and beyond, we expect dealers will get back to a more historical ordering cycle where dealers order to replenish sold stock. We anticipate that consumer demand will continue to exceed historical norms even after dealer inventories are restocked.

The Recreational Vehicle Industry Association (“RVIA”) recently issued its updated wholesale unit shipments forecast for calendar years 2021 and 2022. The RVIA now estimates total North American wholesale shipments in calendar year 2021 to be approximately 602,200 units, an increase of approximately 40% over calendar year 2020 wholesale shipments. Towable RV shipments are anticipated to reach 545,400 units, while motorized shipments are projected to reach 56,800 units in calendar year 2021. Towable and motorized wholesale unit shipments are projected to reach a combined total of 613,700 units in calendar 2022, an increase of 1.9% over the anticipated calendar year 2021 shipments of 602,200. We believe these recent RVIA most-likely estimates for wholesale shipments in calendar 2021 and calendar 2022 are reasonable.

|

|

• |

Market demand conditions in Europe. |

Demand in the European RV market also remains strong. According to the European Caravan Foundation (“ECF”), total retail registrations in Europe for the first nine months of calendar year 2021 increased 12% compared to the same time period in 2020. Caravan registrations in Europe for the first nine months of calendar year 2021 increased 6% compared to the same time period in 2020. Motorcaravan retail registrations in Europe for the first nine months of calendar 2021 increased 15% compared to the same time period in 2020. The increase in retail registrations was realized despite the impact of COVID-19 restrictions which, at various times in various regions, created significant impediments to dealers and retail customers.

Independent RV dealer inventory levels of our European RV products are generally below prior-year levels in the various countries in which we serve. Within Germany, which accounts for approximately 60% of our European product sales, dealer inventories are significantly below normal stocking levels.

|

|

• |

Order backlogs for both North America and Europe are at all-time record levels. |

North American RV backlog was $14.72 billion as of October 31, 2021, an increase of 122.6% compared to $6.61 billion as of October 31, 2020. European RV backlog was $3.35 billion as of October 31, 2021, an increase of 45.0% compared to $2.31 billion as of October 31, 2020

|

|

• |

Supply chain constraints in North America and Europe. |

During the first quarter of fiscal 2022, we continued to face a number of supply constraints. Despite the constraints, our management and procurement teams successfully managed the various challenges to support our record quarterly consolidated results. The current supply chain constraints, including chassis shortages, continue to be a limiting factor on our ability to further ramp up production in the near term. We will, however, continue to actively and aggressively manage through the supply chain issues, and minimize their impact to our business.

|

|

• |

Positive long-term RV industry outlook in both North America and Europe. |

Our confident outlook is supported by favorable demographics, strong RV retail sales, adequate current availability of RV dealer and consumer credit at historically low rates in both North America and Europe and favorable perception of RVing as promoting a safe, socially distanced and healthy lifestyle. In addition, many independent dealers, particularly larger dealers in North America, continue to invest heavily in their businesses through acquisitions, new or expanded locations, added service facilities and other amenities to serve RV consumers while local, state and federal governments invest in improving and expanding outdoor recreation spaces. We believe these actions will enhance the experience of current RVers and encourage new buyers to enter the lifestyle.

2

|

|

1. |

First quarter North American unit shipments represented record quarterly output. How were you able to achieve these levels given the supply chain constraints? |

|

|

a. |

The supply chain challenges faced by our industry are well documented, and the context of those challenges should not be misunderstood. RV retail and wholesale sales are at record levels. This demand naturally stresses our supply chain as the industry pushes to higher levels of production. For example, calendar year 2021 will mark the first time that the industry surpasses 600,000 wholesale units. |

Despite the supply chain challenges in our industry, THOR has outperformed the market and gained wholesale shipment share by implementing a number of specific strategies. As the market surged after the pandemic shutdown, we aggressively retrofitted a number of existing facilities, adding new production lines to increase our capacity. Additionally, THOR executed upon a supply chain management strategy that better positioned the THOR companies to maximize output. That strategy included efficiently managing supply between companies, utilizing THOR’s purchasing leverage, and introducing new suppliers. As we have consistently demonstrated, our operating model enables us to flex our operations up or down to meet demand.

As a consequence of the success of our supply chain management actions and the strong demand for our brands, our first quarter North American Towables and North American Motorized wholesale unit shipments increased 36% and 42% year-over-year, respectively, outpacing RVIA-reported industry wholesale shipment growth of 30% and 20% year-over-year, respectively, during our first fiscal quarter time period. As a result, our Towable segment wholesale shipment share increased to approximately 45% in the first quarter of fiscal 2022, while our Motorized segment wholesale shipment share increased to approximately 51% in the first quarter of fiscal 2022.

|

|

2. |

Can you comment on THOR Industries’ approach to North American retail market share? |

|

|

a. |

THOR Industries is focused on a balanced approach between growth in retail market share and overall profitability as we continue to make progress on our strategic plan. In the current operating environment, we are pursuing this balanced approach through increased production capacity and throughput, product offerings focused on the needs and desires of end consumers and continued operational excellence. |

One key piece of our strategic plan is to grow within the Class B segment, which is the fastest growing segment of the RV market. During the 2021 calendar year, we significantly expanded our Class B product offerings and added production capacity, which have resulted in significant calendar year-over-year retail market share gains. As a result of our actions, our Class B retail market share grew to 27.2% in the first nine months of calendar year ended September 30, 2021 from 12.0% in the first nine months of calendar year 2020. While competitors can gain temporary market share by making imprudent sacrifices of their margin, our focus remains on a balanced approach.

3

|

|

a. |

As described above, record industry demand has naturally stressed our supply chain. In addition, due to the ongoing semiconductor shortage that has hampered automobile production around the world, our chassis supply has been constrained. Despite these issues, our management and procurement teams successfully managed the various challenges to support our record results for the quarter, and we fully expect the teams to be successful in managing these constraints moving forward. Given our longstanding supplier relationships, future production visibility and scale of operations, we are proactively working with our supply chain partners to manage production and delivery of the components we need and, where necessary, seeking alternative supply solutions. We remain confident in our ability to continue to provide product to our end consumers in the face of the supply chain challenges. |

|

|

4. |

What is your expected level of capital expenditures for fiscal 2022? |

|

|

a. |

Our current estimate of committed and internally approved capital spend for fiscal 2022 is $275 million, of which approximately two-thirds will be spent in North America and one-third in Europe. We spent $43 million for capital expenditures during the first quarter of fiscal 2022, and we anticipate that during the remainder of the fiscal year we will incur higher levels of capital spending as we address the capital needs of our recent acquisitions and certain delayed projects, focus on automation and other projects directly related to enhancing the quality of our products, and implement various capacity enhancement initiatives. |

Our planned spend on innovation is also expected to accelerate as key strategic initiatives advance beyond initial exploratory phases. Other planned capital expenditure projects will benefit customer services, technology enhancements, energy efficiency initiatives and general equipment replacements. Included within the capacity enhancement initiatives is a recently announced expansion of approximately $36 million by our Heartland subsidiary for a new regional complex in southern Michigan, which is expected to be completed in late fiscal 2022.

|

|

1. |

During the quarter, North American dealer inventory levels of THOR products increased from 58,300 units at July 31, 2021 to 82,400 units at October 31, 2021. Are you concerned with increasing dealer inventory levels? Does this represent a slowdown in demand? |

|

|

a. |

While dealer inventory levels increased quarter over quarter, dealer inventory levels remain significantly below historical levels. Both our own and independent dealer channel checks firmly establish that dealers continue to view their inventory levels as significantly low, particularly given their continued optimism on the retail market. Dealer inventory levels typically increase during the fall and winter months ahead of the spring selling season, and the 82,400 units of North American RV products in dealer inventory as of October 31, 2021 remain well below the pre-pandemic levels of 101,500 units in dealer inventory as of October 31, 2019. Given the historically low dealer inventory levels entering this fall, ongoing strong retail demand for our products and positive dealer sentiment, we are not concerned by the increase in dealer inventory at this time of the year. Instead, we are focused on increasing production to meet demand and refill dealer inventory levels during the fall and winter months. |

4

We continue to see strong demand in both the North American and European markets as both first-time and repeat buyers pursue the RV lifestyle. As we cited in previous quarters, there are a number of favorable trends that support the continued near- and long-term growth of the RV industry, including work from anywhere, a growing interest in camping, the rise of alternative RVing and camping resources, campground investments, federal funding and favorable demographics including reaching a younger buyer.

More recently, according to a survey from the RVIA, 72 million Americans plan on taking an RV trip in the next year, up from 61 million in a survey conducted one year ago. In addition, the Kampgrounds of America (“KOA”) estimates that 56 million households will have camped in 2021, representing a 16% increase versus 2020. Looking ahead, camping participation is also showing no signs of slowing down as KOA advance deposits for 2022 are up 50% versus 2021 levels. Finally, there were an estimated 14 million households that were new to camping in calendar 2020 and 2021. As the industry has observed a historical correlation between campers and eventual RV owners, these data points reaffirm our belief that strong demand for THOR products is sustainable over the coming years.

|

|

2. |

Backlog value is now at an all-time high of over $18 billion. How firm is the backlog? |

|

|

a. |

We are confident the backlog is firm since consumer demand remains strong and a significant number of units within our existing backlog are already retail-sold. Additionally, even though we have significantly increased production over the past 18 months to meet this surging demand for our products, dealer inventory levels remain below historical levels. We are confident that our backlog represents future sales, taking us well into calendar year 2022 and possibly beyond. |

|

|

3. |

How do used RV sales impact RV wholesale sales? Are you concerned that “new” RV consumer buyers from 2020 and 2021 might exit the RV lifestyle and sell their units post-COVID-19, increasing used unit availability and potentially impacting new RV unit sales? |

|

|

a. |

Due to the high interest in the RV lifestyle, which was growing even before the pandemic started and has accelerated since then, we do not believe the new units sold in 2020 and 2021, or those being sold today, will result in an overabundance of used units in the near future. We believe the interest in the RV lifestyle will continue to draw new buyers and having a robust used RV inventory allows dealers the ability to offer a wider variety of options for the first-time RV buyer. |

Additionally, used inventory is currently very limited, and we believe any change in used inventory in the marketspace would not materially impact our sales, as dealers are in need of inventory - both new and used.

History has shown that used RV sales are complementary to the new RV market. Generally, much of a dealer’s used RV inventory is a result of a trade-in for a new unit. In addition, the used-RV buyer generally follows the same historical 3 to 5 year trade-in, trade-up cycle, adding to potential new RV sales in the long-term. We do anticipate, and history has shown, that many used RV buyers will purchase a new unit at some point in the future.

5

|

|

1. |

THOR’s consolidated gross profit margin increased 170 basis points in the first fiscal quarter on a year-over-year basis. What drove this improvement? Is this gross margin sustainable for the second quarter of fiscal 2022 and beyond? |

|

|

a. |

THOR’s consolidated gross profit margin improved 170 basis points to 16.6% in the first quarter of fiscal 2022, compared to gross profit margin of 14.9% in the first quarter of fiscal 2021. The year-over-year improvement in consolidated gross profit margin was primarily driven by the increase in net sales, a reduction in sales discounts since the prior-year period, product mix and selective net selling price increases to cover known and anticipated material cost increases. Our strong fiscal 2022 first quarter gross profit margin also reflects our operating excellence initiatives and an increased mix of higher margin North American versus European sales this quarter. |

Looking ahead to the second quarter of fiscal 2022, our teams will be taking extended holiday shutdown time to give our employees a well-deserved break and to reduce the stress on the supply chain. The holiday break will result in lower second quarter unit production, when compared to the first quarter of fiscal 2022. In addition, we expect to see a continuation of material cost pressures in future quarters of fiscal 2022, including the second quarter, as a result of higher commodity prices, higher transportation costs, labor shortages and other ongoing supply chain constraints.

Over the long term, we remain committed to our goal of achieving a sustainable gross profit margin of 16% by fiscal 2025.

|

|

2. |

What were some of the key factors that affected SG&A expenses during the quarter? |

|

|

a. |

Selling, general and administrative expenses are primarily variable in nature and fluctuate with the level of sales. In dollar terms, the impact of higher net sales caused related commissions, incentive and other compensation to increase during the first quarter of fiscal 2022. |

Within our North American Towable segment specifically, we recorded an expense of $22 million in the first quarter of fiscal 2022 due to collection uncertainty from applicable vendor suppliers for potential costs related to a recent product recall issue on certain purchased parts utilized in certain of our North American towable products.

As a percentage of net sales for the first quarter, THOR’s consolidated SG&A expense were up compared to the prior year, at 7.5% compared to 7.2% last year with the aforementioned $22 million expense being the primary cause for the year-over-year percentage increase.

|

|

3. |

Can you comment on the first quarter results of THOR Industries’ European segment? |

|

|

a. |

The month of August is when most Europeans take their annual vacation, and consistent with prior years, our European segment’s first quarter was impacted by the resulting reduced fixed cost absorption from seasonally lower first quarter production and net sales levels. While demand remains very strong, the combination of seasonal factors and supply chain challenges, particularly with chassis, limited our production levels in the first quarter of fiscal 2022 causing labor costs to increase as a percentage of net sales. As a result, and consistent with prior fiscal first quarters and our expectations for the quarter, we realized a loss before income taxes in our European segment. |

As we look forward, demand for our European products continues to outpace supply as evidenced by our European segment backlog value of $3.35 billion as of October 31, 2021, which is up 45.0% over the prior year backlog.

6

We continue to hold strong optimism for our future performance in Europe given the continued strong market and our demonstrated ability to manage through the supply chain challenges. Importantly, both our European and North American operations have benefited from THOR’s global footprint as we navigate supply chain pressures on both continents.

|

|

4. |

What was the impact on THOR's first quarter results from the Airxcel acquisition? |

|

|

a. |

First quarter fiscal 2022 results include two months of operations of Airxcel, which was acquired on September 1, 2021. For the quarter, Airxcel recorded net sales of $88.8 million, net of intercompany sales. Net income before income taxes, net of intercompany profit elimination, was not material for the three months ended October 31, 2021. |

Net income before income taxes included a charge of $6.8 million related to the step-up in assigned value of acquired Airxcel inventory that was included in cost of products sold in the current period, and also includes $2.2 million in amortization expense related to the acquired intangible assets.

Please see Note 8 to the Condensed Consolidated Financial Statements in our Form 10-Q for our estimate of future annual consolidated amortization expense, which now includes estimated amortization expense associated with the Airxcel acquisition.

The integration of Airxcel into THOR has been very smooth. We continue to see Airxcel as an integral part of our future growth plans through innovation, additional product offerings and the aftermarket business.

|

|

5. |

Can you comment on operating cash flow for the first quarter? Why did working capital increase? |

|

|

a. |

Historically, THOR’s cash flow from operations during the first fiscal quarter results in a use of cash from operating activities as we build inventory. During the first quarter of fiscal 2022, we generated $41.8 million in cash from operating activities despite an increase in net working capital. The change in net working capital resulted in the use of $271.8 million of operating cash during the first quarter of fiscal 2022, primarily due to an increase in inventory, as production levels have increased due to continued heightened consumer demand, and ongoing supply constraints have caused work in process and other inventory categories to increase. In addition, there was a typical seasonal increase in accounts receivable. These increases were partially offset by an increase in accounts payable primarily related to the inventory growth and an increase in accrued liabilities. A similar net working capital use of $264.2 million occurred in the first quarter of fiscal 2021. |

7

|

|

a. |

Although we do not generally disclose non-GAAP numbers, we recognize that many of the users of our financial statements find a measure of EBITDA adjusted for non-cash or non-routine items to be useful. Below are some items that might be helpful in considering this question: |

|

|

Three Months Ended October 31, 2021 |

|

|

Income Before Income Taxes (1) |

$ |

312.8 million |

|

Depreciation & Amortization Expense (2) |

65.0 million |

|

|

Net Interest Expense (1) |

20.7 million |

|

|

Stock-Based Compensation Expense (3) |

6.0 million |

|

|

Change in LIFO Reserve (4) |

3.4 million |

|

|

Inventory Step-Up - Negative Impact on Gross Profit (5) |

6.8 million |

|

|

Collection Uncertainty Expense Related to a Product Recall (6) |

22.0 million |

|

|

|

Three Months Ended October 31, 2020 |

|

|

Income Before Income Taxes (1) |

$ |

146.3 million |

|

Depreciation & Amortization Expense (2) |

54.2 million |

|

|

Net Interest Expense (1) |

24.0 million |

|

|

Stock-Based Compensation Expense (3) |

5.8 million |

|

|

Change in LIFO Reserve (4) |

1.0 million |

|

|

|

(1) From the Income Statement |

|

(2) From the Business Segments footnote |

|

|

|

(3) From the Statement of Cash Flows |

|

(4) From the Inventories footnote |

|

|

|

(5) From the Acquisitions footnote |

|

(6) From the Contingent Liabilities footnote |

|

8

Summary of Key Quarterly Segment Data – North American Towable RVs

Dollars are in thousands

|

|

|

|

|

|

|

|||||

|

NET SALES: |

Three Months Ended October 31, 2021 |

|

Three Months Ended October 31, 2020 |

|

% Change |

|||||

|

North American Towables |

|

|

|

|

|

|||||

|

Travel Trailers and Other |

$ |

1,409,624 |

|

|

$ |

837,900 |

|

|

68.2 |

% |

|

Fifth Wheels |

831,210 |

|

|

554,144 |

|

|

50.0 |

% |

||

|

Total North American Towables |

$ |

2,240,834 |

|

|

$ |

1,392,044 |

|

|

61.0 |

% |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

# OF UNITS: |

Three Months Ended October 31, 2021 |

|

Three Months Ended October 31, 2020 |

|

% Change |

|||||

|

North American Towables |

|

|

|

|

|

|||||

|

Travel Trailers and Other |

54,899 |

|

|

39,077 |

|

|

40.5 |

% |

||

|

Fifth Wheels |

13,538 |

|

|

11,264 |

|

|

20.2 |

% |

||

|

Total North American Towables |

68,437 |

|

|

50,341 |

|

|

35.9 |

% |

||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

ORDER BACKLOG |

As of October 31, 2021 |

|

As of October 31, 2020 |

|

% Change |

|||||

|

North American Towables |

$ |

10,444,698 |

|

|

$ |

4,397,713 |

|

|

137.5 |

% |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

TOWABLE RV MARKET SHARE SUMMARY (1)(2) |

Calendar Year to Date September 30, |

|

|

|||||||

|

|

2021 |

|

2020 |

|

|

|||||

|

U.S. Market |

40.5 |

% |

|

41.5 |

% |

|

|

|||

|

Canadian Market |

45.2 |

% |

|

45.8 |

% |

|

|

|||

|

Combined North American Market |

41.0 |

% |

|

41.9 |

% |

|

|

|||

(1) Source: Statistical Surveys, Inc. Calendar year to date September 30, 2021 and 2020.

(2) 2021 period includes Tiffin Group registrations.

Note: Data reported by Stat Surveys is based on official state and provincial records. This information is subject to adjustment, is continuously updated, and is often impacted by delays in reporting by various states or provinces. The COVID-19 pandemic has resulted in further delays in the submission of information reported by the various states or provinces beginning with calendar 2020 results, and may also be impacting the completeness of such information.

9

Summary of Key Quarterly Segment Data – North American Motorized RVs

Dollars are in thousands

|

|

|

|

|

|

|

|||||

|

NET SALES: |

Three Months Ended October 31, 2021 |

|

Three Months Ended October 31, 2020 |

|

% Change |

|||||

|

North American Motorized |

|

|

|

|

|

|||||

|

Class A |

$ |

409,499 |

|

|

$ |

158,555 |

|

|

158.3 |

% |

|

Class C |

360,006 |

|

|

275,399 |

|

|

30.7 |

% |

||

|

Class B |

155,523 |

|

|

59,901 |

|

|

159.6 |

% |

||

|

Total North American Motorized |

$ |

925,028 |

|

|

$ |

493,855 |

|

|

87.3 |

% |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

# OF UNITS: |

Three Months Ended October 31, 2021 |

|

Three Months Ended October 31, 2020 |

|

% Change |

|||||

|

North American Motorized |

|

|

|

|

|

|||||

|

Class A |

2,164 |

|

|

1,168 |

|

|

85.3 |

% |

||

|

Class C |

3,645 |

|

|

3,464 |

|

|

5.2 |

% |

||

|

Class B |

1,528 |

|

|

535 |

|

|

185.6 |

% |

||

|

Total North American Motorized |

7,337 |

|

|

5,167 |

|

|

42.0 |

% |

||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

ORDER BACKLOG |

As of October 31, 2021 |

|

As of October 31, 2020 |

|

% Change |

|||||

|

North American Motorized |

$ |

4,277,378 |

|

|

$ |

2,215,069 |

|

|

93.1 |

% |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

MOTORIZED RV MARKET SHARE SUMMARY (1)(2) |

Calendar Year to Date September 30, |

|

|

|||||||

|

|

2021 |

|

2020 |

|

|

|||||

|

U.S. Market |

47.7 |

% |

|

38.0 |

% |

|

|

|||

|

Canadian Market |

46.4 |

% |

|

43.6 |

% |

|

|

|||

|

Combined North American Market |

47.6 |

% |

|

38.3 |

% |

|

|

|||

(1) Source: Statistical Surveys, Inc. Calendar year to date September 30, 2021 and 2020.

(2) 2021 period includes Tiffin Group registrations.

Our North American market share includes 5.8% attributable to Tiffin Group (primarily Class As) for the nine months ended September 30, 2021.

Note: Data reported by Stat Surveys is based on official state and provincial records. This information is subject to adjustment, is continuously updated and is often impacted by delays in reporting by various states or provinces. The COVID-19 pandemic has resulted in further delays in the submission of information reported by the various states or provinces beginning with calendar 2020 results, and may also be impacting the completeness of such information.

10

Summary of Key Quarterly Segment Data – European RVs

Dollars are in thousands

|

|

|

|

|

|

|

|||||

|

NET SALES: |

Three Months Ended October 31, 2021 |

|

Three Months Ended October 31, 2020 |

|

% Change |

|||||

|

European |

|

|

|

|

|

|||||

|

Motorcaravan |

$ |

316,264 |

|

|

$ |

318,343 |

|

|

(0.7) |

% |

|

Campervan |

177,783 |

|

|

143,400 |

|

|

24.0 |

% |

||

|

Caravan |

60,680 |

|

|

55,195 |

|

|

9.9 |

% |

||

|

Other |

78,270 |

|

|

85,550 |

|

|

(8.5) |

% |

||

|

Total European |

$ |

632,997 |

|

|

$ |

602,488 |

|

|

5.1 |

% |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

# OF UNITS: |

Three Months Ended October 31, 2021 |

|

Three Months Ended October 31, 2020 |

|

% Change |

|||||

|

European |

|

|

|

|

|

|||||

|

Motorcaravan |

5,080 |

|

|

5,383 |

|

|

(5.6) |

% |

||

|

Campervan |

4,404 |

|

|

4,277 |

|

|

3.0 |

% |

||

|

Caravan |

2,843 |

|

|

2,566 |

|

|

10.8 |

% |

||

|

Total European |

12,327 |

|

|

12,226 |

|

|

0.8 |

% |

||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

ORDER BACKLOG |

As of October 31, 2021 |

|

As of October 31, 2020 |

|

% Change |

|||||

|

European |

$ |

3,348,355 |

|

|

$ |

2,308,472 |

|

|

45.0 |

% |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

EUROPEAN RV MARKET SHARE SUMMARY (1) |

Calendar Year to Date September 30, |

|

|

|||||||

|

|

2021 |

|

2020 |

|

|

|||||

|

Motorcaravan and Campervan (2) |

24.9 |

% |

|

26.2 |

% |

|

|

|||

|

Caravan |

18.1 |

% |

|

20.6 |

% |

|

|

|||

(1) Sources: Caravaning Industry Association e.V. (“CIVD”) and European Caravan Federation (“ECF”), Calendar year to date September 30, 2021 and 2020. Data from the ECF is subject to adjustment, continuously updated and is often impacted by delays in reporting by various countries (some countries, including the United Kingdom, do not report OEM-specific data and are thus excluded from the market share calculation).

(2) The CIVD and ECF report motorcaravans and campervans together.

Note: Industry wholesale shipment data for the European RV market is not available.

11

This release includes certain statements that are “forward-looking” statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are made based on management’s current expectations and beliefs regarding future and anticipated developments and their effects upon THOR, and inherently involve uncertainties and risks. These forward-looking statements are not a guarantee of future performance. We cannot assure you that actual results will not differ materially from our expectations. Factors which could cause materially different results include, among others: the extent and impact from the continuation of the COVID-19 pandemic, along with the responses to contain the spread of the virus, or its variants, by various governmental entities or other actors, which may have negative effects on retail customer demand, our independent dealers, our supply chain, our labor force, our production or other aspects of our business; the ability to ramp production up or down quickly in response to rapid changes in demand while also managing costs and market share; the effect of raw material and commodity price fluctuations, and/or raw material, commodity or chassis supply constraints; the dependence on a small group of suppliers for certain components used in production; the level and magnitude of warranty and recall claims incurred; the ability of our suppliers to financially support any defects in their products; legislative, regulatory and tax law and/or policy developments including their potential impact on our dealers and their retail customers or on our suppliers; the costs of compliance with governmental regulation; public perception of and the costs related to environmental, social and governance matters; legal and compliance issues including those that may arise in conjunction with recently completed transactions; lower consumer confidence and the level of discretionary consumer spending; interest rate fluctuations and their potential impact on the general economy and, specifically, on our dealers and consumers; the impact of exchange rate fluctuations; restrictive lending practices which could negatively impact our independent dealers and/or retail consumers; management changes; the success of new and existing products and services; the ability to maintain strong brands and develop innovative products that meet consumer demands; the ability to efficiently utilize existing production facilities; changes in consumer preferences; the risks associated with acquisitions, including: the pace and successful closing of an acquisition, the integration and financial impact thereof, the level of achievement of anticipated operating synergies from acquisitions, the potential for unknown or understated liabilities related to acquisitions, the potential loss of existing customers of acquisitions and our ability to retain key management personnel of acquired companies; a shortage of necessary personnel for production and increasing labor costs to attract production personnel in times of high demand; the loss or reduction of sales to key dealers; disruption of the delivery of units to dealers; increasing costs for freight and transportation; asset impairment charges; competition; the impact of potential losses under repurchase agreements; the potential impact of the strength of the U.S. dollar on international demand for products priced in U.S. dollars; general economic, market and political conditions in the various countries in which our products are produced and/or sold; the impact of changing emissions and other related climate change regulations in the various jurisdictions in which our products are produced, used and/or sold; changes to our investment and capital allocation strategies or other facets of our strategic plan; and changes in market liquidity conditions, credit ratings and other factors that may impact our access to future funding and the cost of debt.

These and other risks and uncertainties are discussed more fully in our Quarterly Report on Form 10-Q for the quarter ended October 31, 2021 and in Item 1A of our Annual Report on Form 10-K for the year ended July 31, 2021.

We disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained in this release or to reflect any change in our expectations after the date hereof or any change in events, conditions or circumstances on which any statement is based, except as required by law.

12

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Why Former CPAs are Leaving and What Existing CPAs Want: CPA Talent Retention Survey from the PICPA Sheds Light On Accounting’s Retention Challenges

- August Health Unveils Inaugural Members of New Advisory Board

- Oxurion Receives Transparency Notification from Atlas Special Opportunities LLC

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share