Form 8-K Superior Drilling Produc For: May 12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

Current Report

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED):

May 12, 2021

SUPERIOR DRILLING PRODUCTS, INC.

(Exact name of registrant as specified in its charter)

| Utah | 46-4341605 | |

(State of Incorporation) |

(I.R.S. Employer Identification No.) |

1583 South 1700 East Vernal, Utah |

84078 | |

| (Address of principal executive offices) | (Zip code) |

Commission File Number: 001-36453

Registrant’s telephone number, including area code: (435) 789-0594

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| [ ] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| [ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| [ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| [ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities Registered Pursuant to Section 12(b) of the Exchange Act:

| Title of each class: | Trading Symbol(s) | Name of each exchange on which registered: | ||

| Common Stock, $0.001 par value | SDPI | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item 2.02. Results of Operations and Financial Condition.

On May 12, 2021, Superior Drilling Products, Inc. (the “Company”) issued a press release announcing its financial results for the quarter ending March 31, 2021. A copy of the press release is furnished as Exhibit 99.1 to this report and is incorporated herein by reference. The webcast and slide presentation for the earnings call are available on the Investors page of the Company’s website at www.sdpi.com. Information on the Company’s website is not deemed to be incorporated herein by reference. The slide presentation is furnished herewith as Exhibit 99.2.

In accordance with General Instruction B.2 of Form 8-K, the information set forth in this Item 2.02 and in the attached Exhibits 99.1 and 99.2 shall be deemed to be “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended.

Item 9.01 Financial Statements and Exhibits.

| Exhibit Number | Description | |

| 99.1 | Press release dated May 12, 2021 regarding first quarter 2021 earnings.* | |

| 99.2 | Slide presentation accompanying earnings call.* |

*Furnished herewith.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: May 12, 2021

| SUPERIOR DRILLING PRODUCTS, INC. | |

| /s/ Christopher D. Cashion | |

| Christopher D. Cashion | |

| Chief Financial Officer |

Exhibit 99.1

|

NEWS RELEASE |

1583 S. 1700 E. ● Vernal, UT 84078 ● (435)789-0594

FOR IMMEDIATE RELEASE

Superior Drilling Products, Inc. Revenue Increased 57% Sequentially to $2.4 million in First Quarter 2021

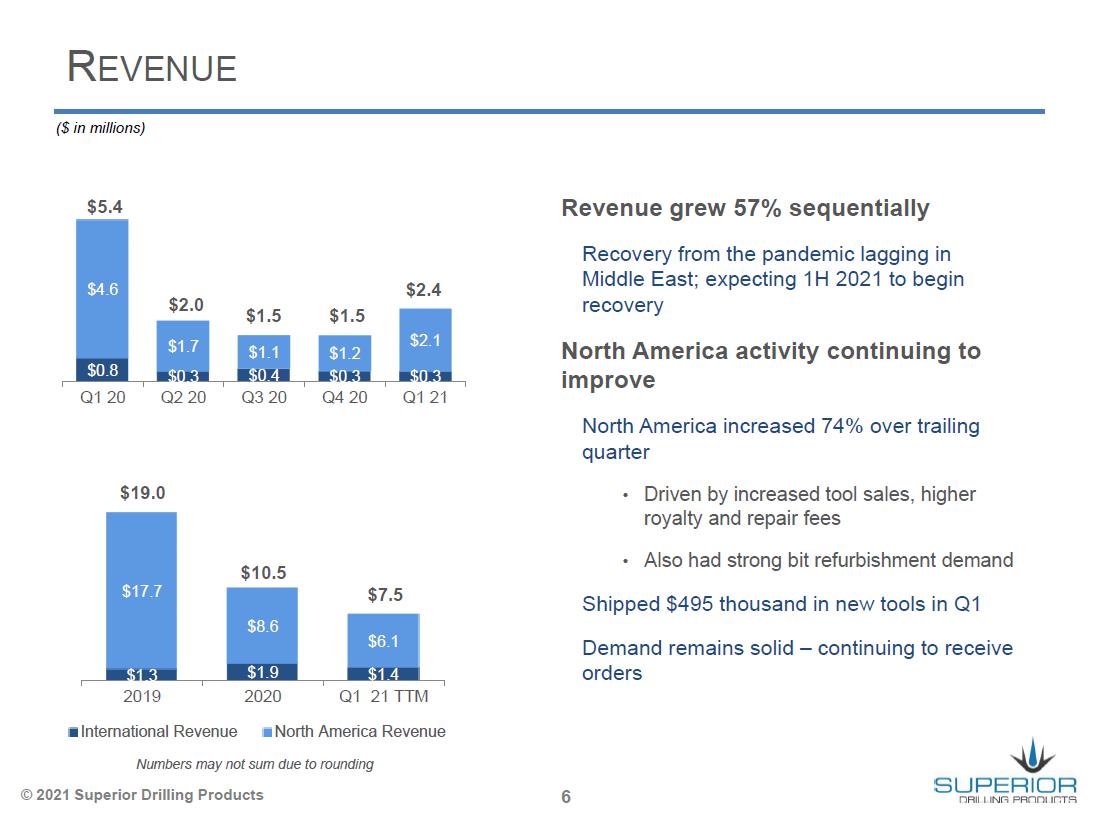

| ● | First quarter revenue grew $0.9 million to $2.4 million over trailing fourth quarter as market steadily improves | |

| ● | U.S. market conditions strengthening and market share expanding driving revenue in North America up 74% over trailing quarter | |

| ● | Tool revenue grew 84% over the trailing quarter while Contract Services revenue was up 19% | |

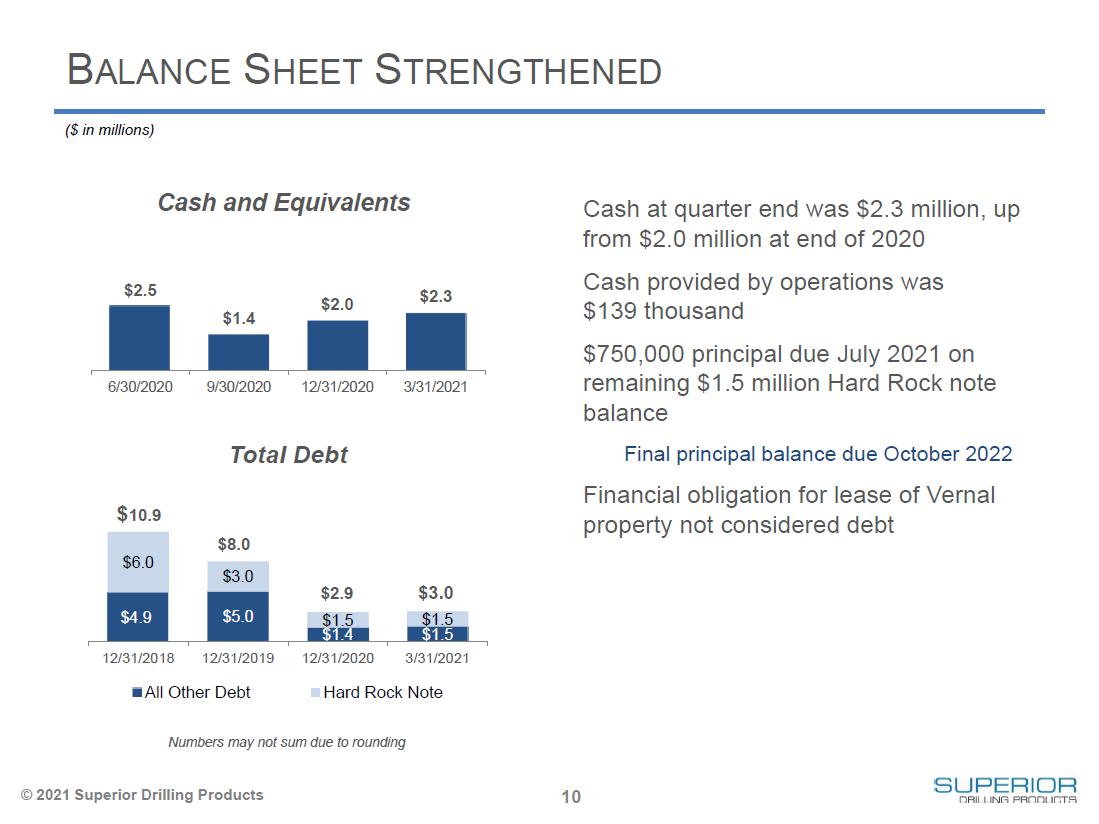

| ● | Cost savings efforts and improved revenue resulted in positive cash generation from operations; ended quarter with $2.3 million of cash on hand | |

| ● | Restructured international team to build market opportunity while expanding relationships with major oil field service companies to deepen market reach |

VERNAL, UT, May 12, 2021 — Superior Drilling Products, Inc. (NYSE American: SDPI) (“SDP” or the “Company”), a designer and manufacturer of drilling tool technologies, today reported financial results for the first quarter of 2021 ended March 31, 2021.

Troy Meier, Chairman and CEO, commented, “The pace of activity is encouraging as markets begin to recover. Demand for new Drill-N-Ream® well bore conditioning tools in North America continued through April as market conditions strengthen. We believe we are also continuing to gain market share in this depressed environment as more operators recognize both the production efficiencies gained and costs saved when using the DNR for their drilling operations. Drill bit refurbishment activity has increased as well during the quarter, with the growing number of drill rigs operating in the U.S.”

He added, “We are bringing back fabricators, advancing new drill bit development and we are making progress on broader marketing and servicing agreements with much larger entities that have the breadth to extend and deepen our market reach. While we are not expecting the market in the U.S. to return to pre-COVID levels, we believe that there is still plenty of room for improvement and more market penetration potential for the DNR. We have also restructured our international development team to improve returns on our investments in those markets while also advancing the agreements needed to gain market share.”

Mr. Meier concluded, “We are optimistic about the recovery supporting growth through 2021. More significantly, we are excited about the changes we are making in the organization and the relationships we are building that we expect to drive significant growth for the Company in the long-term.”

- MORE -

Superior Drilling Products, Inc. Reports First Quarter 2021 Results

May 12, 2021

Page 2 of 8

First Quarter 2021 Review ($ in thousands, except per share amounts) (See at “Definitions” the composition of product/service revenue categories.)

| ($ in thousands, except per share amounts) | March 31, 2021 | December 31, 2020 | March 31, 2020 | Change Sequential | Change Year/Year | |||||||||||||||

| North America | 2,092 | 1,203 | 4,581 | 73.9 | % | (54.3 | )% | |||||||||||||

| International | 332 | 338 | 777 | (1.7 | )% | (57.2 | )% | |||||||||||||

| Total Revenue | $ | 2,425 | $ | 1,541 | $ | 5,358 | 57.3 | % | (54.7 | )% | ||||||||||

| Tool Sales/Rental | $ | 831 | $ | 342 | $ | 1,768 | 143.0 | % | (53.0 | )% | ||||||||||

| Other Related Tool Revenue | 832 | 561 | 1,845 | 48.3 | % | (54.9 | )% | |||||||||||||

| Tool Revenue | 1,664 | 903 | 3,613 | 84.2 | % | (54.0 | )% | |||||||||||||

| Contract Services | 761 | 638 | 1,745 | 19.3 | % | (56.4 | )% | |||||||||||||

| Total Revenue | $ | 2,425 | $ | 1,541 | $ | 5,358 | 57.3 | % | (54.7 | )% | ||||||||||

Revenue increased sequentially $884 thousand, or 57%, over the trailing fourth quarter as market share and market conditions improved. The year-over-year comparison reflects the impact of the global pandemic on the oil & gas production industry. The market in North America is improving more rapidly than international markets. Revenue in North America increased 74% from increased tool sales, as well as higher royalty and repair fees. Contract Services revenue also improved sequentially reflecting increased drill bit refurbishment. International revenue was relatively unchanged from the trailing fourth quarter as the market recovery is lagging similar to the lag in decline this market had through 2020.

First Quarter 2021 Operating Costs

| ($ in thousands,except per share amounts) | March 31, 2021 | December 31, 2020 | March 31, 2020 | Change Sequential | Change Year/Year | |||||||||||||||

| Cost of revenue | $ | 1,176 | $ | 821 | $ | 2,315 | 43.2 | % | (49.2 | )% | ||||||||||

| As a percent of sales | 48.5 | % | 53.3 | % | 43.2 | % | ||||||||||||||

| Selling, general & administrative | $ | 1,516 | $ | 1,483 | $ | 2,018 | 2.2 | % | (24.9 | )% | ||||||||||

| As a percent of sales | 62.5 | % | 96.2 | % | 37.7 | % | ||||||||||||||

| Depreciation & amortization | $ | 690 | $ | 682 | $ | 761 | 1.2 | % | (9.3 | )% | ||||||||||

| Total operating expenses | $ | 3,381 | $ | 2,986 | $ | 5,093 | 13.2 | % | (33.6 | )% | ||||||||||

| Operating Income (loss) | $ | (957 | ) | $ | (1,445 | ) | $ | 265 | NM | NM | ||||||||||

| As a % of sales | (39.5 | )% | (93.8 | )% | 4.9 | % | ||||||||||||||

| Other

(expense) income including income tax (expense) | $ | (145 | ) | $ | 790 | $ | (67 | ) | NM | NM | ||||||||||

| Net income (loss) | $ | (1,102 | ) | $ | (655 | ) | $ | 198 | NM | NM | ||||||||||

| Diluted earnings (loss) per share | $ | (0.04 | ) | $ | (0.03 | ) | $ | 0.01 | NM | NM | ||||||||||

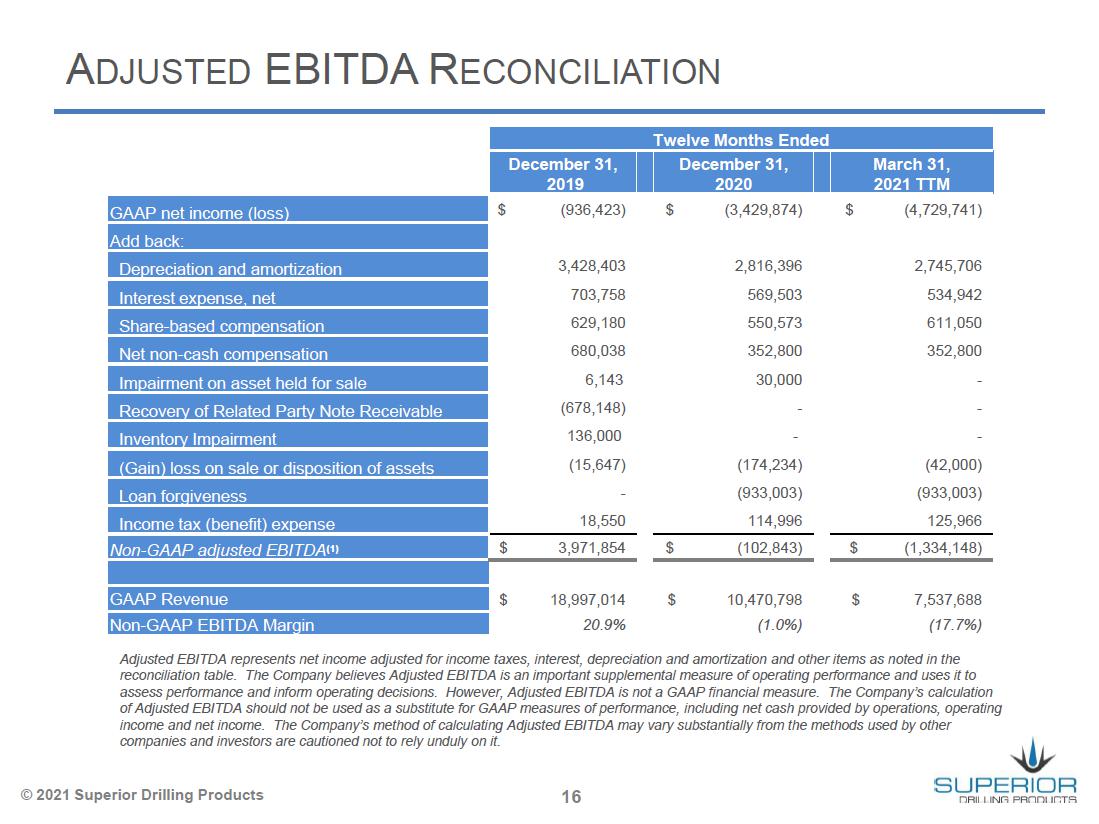

| Adjusted EBITDA(1) | $ | (11 | ) | $ | (494 | ) | $ | 1,221 | NM | NM | ||||||||||

(1) Adjusted EBITDA is a non-GAAP measure defined as earnings before interest, taxes, depreciation and amortization, non-cash stock compensation expense and unusual items. See the attached tables for important disclosures regarding SDP’s use of Adjusted EBITDA, as well as a reconciliation of net loss to Adjusted EBITDA.

Total operating expenses increased 13% over the trailing fourth quarter, while revenue increased 57% demonstrating the effect of cost reduction efforts and the operating leverage gained from higher volume.

Superior Drilling Products, Inc. Reports First Quarter 2021 Results

May 12, 2021

Page 3 of 8

Net loss for the quarter was $1.1 million compared with $0.7 million in the trailing fourth quarter which included a $0.9 million benefit from the government forgiveness of SBA debt. Compared with the trailing fourth quarter, Adjusted EBITDA(1) improved sequentially as a result of increased sales and operating leverage gained from higher volume.

The Company believes that when used in conjunction with measures prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), Adjusted EBITDA, which is a non-GAAP measure, helps in the understanding of its operating performance.

Balance Sheet and Liquidity

Cash at the end of the quarter was $2.3 million, up from $2.0 million at the end of 2020. Cash provided by operations in the first quarter of 2021 was $139 thousand. Long-term debt, including the current portion at March 31, 2021, was $3.0 million. The $4.2 million long-term financial obligation is related to the future minimum lease payments under the 15-year lease of the Company’s Vernal, Utah property.

Definitions and Composition of Product/Service Revenue:

Contract Services Revenue is comprised of drill bit and other repair and manufacturing services.

Other Related Tool Revenue is comprised of royalties and fleet maintenance fees.

Tool Sales/Rental revenue is comprised of revenue from either the sale of tools or tools rented to customers.

Tool Revenue is the sum of Other Related Tool Revenue and Tool Sales/Rental revenue.

Webcast and Conference Call

The Company will host a conference call and live webcast today at 10:00 am MT (12:00 pm ET) to review the results of the quarter and full year and discuss its corporate strategy and outlook. The discussion will be accompanied by a slide presentation that will be made available prior to the conference call on SDP’s website at www.sdpi.com/events. A question-and-answer session will follow the formal presentation.

The conference call can be accessed by calling (201) 689-8470. Alternatively, the webcast can be monitored at www.sdpi.com/events. A telephonic replay will be available from 1:00 p.m. MT (3:00 p.m. ET) the day of the teleconference until Wednesday, May 19, 2021. To listen to the archived call, please call (412) 317-6671 and enter conference ID number 13718357, or access the webcast replay at www.sdpi.com, where a transcript will be posted once available.

About Superior Drilling Products, Inc.

Superior Drilling Products, Inc. is an innovative, cutting-edge drilling tool technology company providing cost saving solutions that drive production efficiencies for the oil and natural gas drilling industry. The Company designs, manufactures, repairs and sells drilling tools. SDP drilling solutions include the patented Drill-N-Ream® well bore conditioning tool and the patented Strider™ oscillation system technology. In addition, SDP is a manufacturer and refurbisher of PDC (polycrystalline diamond compact) drill bits for a leading oil field service company. SDP operates a state-of-the-art drill tool fabrication facility, where it manufactures its solutions for the drilling industry, as well as customers’ custom products. The Company’s strategy for growth is to leverage its expertise in drill tool technology and innovative, precision machining in order to broaden its product offerings and solutions for the oil and gas industry.

Additional information about the Company can be found at: www.sdpi.com.

Safe Harbor Regarding Forward Looking Statements

This news release contains forward-looking statements and information that are subject to a number of risks and uncertainties, many of which are beyond our control. All statements, other than statements of historical fact included in this release, including, without limitations, the continued impact of COVID-19 on the business, the Company’s strategy, future operations, success at developing future tools, the Company’s effectiveness at executing its business strategy and plans, financial position, estimated revenue and losses, projected costs, prospects, plans and objectives of management, and ability to outperform are forward-looking statements. The use of words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “may,” “continue,” “predict,” “potential,” “project”, “forecast,” “should” or “plan, and similar expressions are intended to identify forward-looking statements, although not all forward -looking statements contain such identifying words. These statements reflect the beliefs and expectations of the Company and are subject to risks and uncertainties that may cause actual results to differ materially. These risks and uncertainties include, among other factors, the duration of the COVID-19 pandemic and related impact on the oil and natural gas industry, the effectiveness of success at expansion in the Middle East, options available for market channels in North America, the deferral of the commercialization of the Strider technology, the success of the Company’s business strategy and prospects for growth; the market success of the Company’s specialized tools, effectiveness of its sales efforts, its cash flow and liquidity; financial projections and actual operating results; the amount, nature and timing of capital expenditures; the availability and terms of capital; competition and government regulations; and general economic conditions. These and other factors could adversely affect the outcome and financial effects of the Company’s plans and described herein. The Company undertakes no obligation to revise or update any forward-looking statements to reflect events or circumstances after the date hereof

For more information, contact investor relations:

Deborah K. Pawlowski, Kei Advisors LLC

(716) 843-3908, [email protected]

FINANCIAL TABLES FOLLOW.

Superior Drilling Products, Inc. Reports First Quarter 2021 Results

May 12, 2021

Page 4 of 8

Superior Drilling Products, Inc.

Consolidated Condensed Statements of Operations

(unaudited)

| For the Three Months | ||||||||

| Ended March 31, | ||||||||

| 2021 | 2020 | |||||||

| Revenue | ||||||||

| North America | $ | 2,092,200 | $ | 4,580,510 | ||||

| International | 332,453 | 777,253 | ||||||

| Total revenue | $ | 2,424,653 | $ | 5,357,763 | ||||

| Operating cost and expenses | ||||||||

| Cost of revenue | 1,175,593 | 2,314,508 | ||||||

| Selling, general, and administrative expenses | 1,515,590 | 2,017,899 | ||||||

| Depreciation and amortization expense | 690,074 | 760,764 | ||||||

| Total operating costs and expenses | 3,381,257 | 5,093,171 | ||||||

| Operating Income (loss) | (956,604 | ) | 264,592 | |||||

| Other income (expense) | ||||||||

| Interest income | 48 | 4,688 | ||||||

| Interest expense | (138,057 | ) | (177,258 | ) | ||||

| Loss on Fixed Asset Impairment | - | (30,000 | ) | |||||

| Gain (loss) on sale or disposition of assets | 10,000 | 142,234 | ||||||

| Total other expense | (128,009 | ) | (60,336 | ) | ||||

| Income (loss) Before Income Taxes | $ | (1,084,613 | ) | $ | 204,256 | |||

| Income tax expense | (800 | ) | (6,210 | ) | ||||

| Foreign Tax | (16,380 | ) | - | |||||

| Net Income (loss) | $ | (1,101,793 | ) | $ | 198,046 | |||

| Basic income (loss) earnings per common share | $ | (0.04 | ) | $ | 0.01 | |||

| Basic weighted average common shares outstanding | 25,762,342 | 25,418,126 | ||||||

| Diluted income (loss) per common Share | $ | (0.04 | ) | $ | 0.01 | |||

| Diluted weighted average common shares outstanding | 25,762,342 | 25,418,126 | ||||||

Superior Drilling Products, Inc. Reports First Quarter 2021 Results

May 12, 2021

Page 5 of 8

Superior Drilling Products, Inc.

Consolidated Condensed Balance Sheets

| March 31, 2021 | December 31, 2020 | |||||||

| (unaudited) | ||||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash | $ | 2,262,251 | $ | 1,961,441 | ||||

| Accounts receivable, net | 1,601,837 | 1,345,622 | ||||||

| Prepaid expenses | 109,354 | 90,269 | ||||||

| Inventories | 996,083 | 1,020,008 | ||||||

| Asset held for sale | - | 40,000 | ||||||

| Other current assets | 42,751 | 40,620 | ||||||

| Total current assets | 5,012,276 | 4,497,960 | ||||||

| Property, plant and equipment, net | 7,211,648 | 7,535,098 | ||||||

| Intangible assets, net | 527,778 | 819,444 | ||||||

| Right of use Asset (net of amortizaton) | $ | 65,624 | $ | 99,831 | ||||

| Other noncurrent assets | 84,115 | 87,490 | ||||||

| Total assets | $ | 12,901,441 | $ | 13,039,823 | ||||

| Liabilities and Owners’ Equity | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 741,727 | $ | 430,015 | ||||

| Accrued expenses | 1,468,257 | 1,091,518 | ||||||

| Accrued Income tax | 122,826 | 106,446 | ||||||

| Current portion of Operating Lease Liability | 54,063 | 79,313 | ||||||

| Current portion of Long-term Financial Obligation | 59,420 | 61,691 | ||||||

| Current portion of long-term debt, net of discounts | 1,651,283 | 1,397,337 | ||||||

| Total current liabilities | $ | 4,097,576 | $ | 3,166,320 | ||||

| Operating long term liability | 11,561 | 20,518 | ||||||

| Long-term Financial Obligation | 4,161,463 | 4,178,261 | ||||||

| Long-term debt, less current portion, net of discounts | 1,341,487 | 1,451,049 | ||||||

| Total liabilities | $ | 9,612,087 | $ | 8,816,148 | ||||

| Stockholders’ equity | ||||||||

| Common stock (25,418,126 and 25,418,126) | 25,762 | 25,762 | ||||||

| Additional paid-in-capital | 40,787,092 | 40,619,620 | ||||||

| Accumulated deficit | (37,523,500 | ) | (36,421,707 | ) | ||||

| Total stockholders’ equity | $ | 3,289,354 | $ | 4,223,675 | ||||

| Total liabilities and shareholders’ equity | $ | 12,901,441 | $ | 13,039,823 | ||||

Superior Drilling Products, Inc. Reports First Quarter 2021 Results

May 12, 2021

Page 6 of 8

Superior Drilling Products, Inc.

Consolidated Condensed Statement of Cash Flows

(Unaudited)

March 31, 2021 | March 31, 2020 | |||||||

| Cash Flows From Operating Activities | ||||||||

| Net Income (Loss) | $ | (1,101,793 | ) | $ | 198,046 | |||

| Adjustments to reconcile net loss to net cash provided by operating activities: | ||||||||

| Depreciation and amortization expense | 690,074 | 760,764 | ||||||

| Share-based compensation expense | 167,473 | 106,996 | ||||||

| Loss (Gain) on sale or disposition of assets | (10,000 | ) | (142,234 | ) | ||||

| Impairment on asset held for sale | - | 30,000 | ||||||

| Amortization of deferred loan cost | 4,631 | 4,631 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | (256,215 | ) | 625,419 | |||||

| Inventories | (41,795 | ) | (303,122 | ) | ||||

| Prepaid expenses and other noncurrent assets | (17,841 | ) | 296,392 | |||||

| Accounts payable and accrued expenses | 688,451 | 660,731 | ||||||

| Income Tax expense | 16,380 | 6,210 | ||||||

| Other long-term liabilities | - | (61,421 | ) | |||||

| Net Cash Provided By Operating Activities | 139,364 | 2,182,412 | ||||||

| Cash Flows From Investing Activities | ||||||||

| Purchases of property, plant and equipment | (9,237 | ) | (37,850 | ) | ||||

| Proceeds from sale of fixed assets | 50,000 | 117,833 | ||||||

| Net Cash Provided By Investing Activities | 40,763 | 79,983 | ||||||

| Cash Flows From Financing Activities | ||||||||

| Principal payments on debt | (135,403 | ) | (975,440 | ) | ||||

| Proceeds received from debt borrowings | - | 72,520 | ||||||

| Payments on Revolving Loan | (280,245 | ) | (39,461 | ) | ||||

| Proceeds received from Revolving Loan | 536,331 | 812,224 | ||||||

| Debt issuance Costs | - | - | ||||||

| Net Cash Provided By (Used In) Financing Activities | 120,683 | (130,157 | ) | |||||

| Net change in Cash | 300,810 | 2,132,238 | ||||||

| Cash at Beginning of Period | 1,961,441 | 1,217,014 | ||||||

| Cash at End of Period | $ | 2,262,251 | $ | 3,349,252 | ||||

| Supplemental information: | ||||||||

| Cash paid for interest | $ | 130,363 | $ | 182,369 | ||||

| Non-cash payment of other liabilities by offsetting recovery of related-party note receivable | $ | - | $ | - | ||||

| Inventory converted to property, plant and equipment | $ | 65,720 | $ | 47,907 | ||||

| Long term debt paid with Sale of Plane | $ | - | $ | 211,667 | ||||

Superior Drilling Products, Inc. Reports Fourth Quarter and Full

Year 2020 Results

March 11, 2021

Page 7 of 7

Superior Drilling Products, Inc.

Adjusted EBITDA(1) Reconciliation

(unaudited)

($, in thousands)

| Three Months Ended | ||||||||||||

| March 31, 2021 | March 31, 2020 | December 31, 2020 | ||||||||||

| GAAP net income | $ | (1,101,793 | ) | $ | 198,046 | $ | (655,142 | ) | ||||

| Add back: | ||||||||||||

| Depreciation and amortization | 690,074 | 760,764 | 681,998 | |||||||||

| Interest expense, net | 138,009 | 172,570 | 125,068 | |||||||||

| Share-based compensation | 167,473 | 106,996 | 180,730 | |||||||||

| Net non-cash compensation | 88,200 | 88,200 | 88,200 | |||||||||

| Income tax expense | 17,180 | 6,210 | 8,582 | |||||||||

| (Gain) Loss on disposition of assets | (10,000 | ) | (112,234 | ) | (891,600 | ) | ||||||

| Recovery of Related Party Note Receivable | - | - | - | |||||||||

| Non-GAAP adjusted EBITDA(1) | $ | (10,858 | ) | $ | 1,220,552 | $ | (494,164 | ) | ||||

| GAAP Revenue | $ | 2,424,653 | $ | 5,357,763 | $ | 1,541,205 | ||||||

| Non-GAAP Adjusted EBITDA Margin | (0.4 | )% | 22.8 | % | (32.1 | )% | ||||||

(1) Adjusted EBITDA represents net income adjusted for income taxes, interest, depreciation and amortization and other items as noted in the reconciliation table. The Company believes Adjusted EBITDA is an important supplemental measure of operating performance and uses it to assess performance and inform operating decisions. However, Adjusted EBITDA is not a GAAP financial measure. The Company’s calculation of Adjusted EBITDA should not be used as a substitute for GAAP measures of performance, including net cash provided by operations, operating income and net income. The Company’s method of calculating Adjusted EBITDA may vary substantially from the methods used by other companies and investors are cautioned not to rely unduly on it.

- END -

Exhibit 99.2

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- GXO Announces Pricing of $1.1 Billion Notes Offering

- Aterian Sets Date for First Quarter 2024 Earnings Announcement & Investor Conference Call

- Stockholder Alert: Robbins LLP Informs Investors of the Class Action Filed Against Compass Minerals International, Inc. (CMP)

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share